Participation of the Plan in the Exchange Offer.

The Exchange Offer applies to all McKesson shares, including the shares held under the Plan’s McKesson Stock Funds. As trustee of the Plan trust, Fidelity Management Trust Company (“Fidelity”) will arrange for the tender, if any, of McKesson shares held under the McKesson Stock Funds in response to the Exchange Offer.

Unless otherwise required by law, Fidelity will respond to the Exchange Offer by tendering McKesson shares attributable to participant accounts under the Plan in accordance with the directions received from Plan participants. Fidelity will not tender McKesson shares attributable to participant accounts for which it does not receive timely or complete directions, or for which timely and complete directions are received, but are timely withdrawn.

As a participant in the Plan, you have the right to instruct Fidelity as to whether or not to tender some or all of the McKesson shares attributable to your individual Plan account in the Exchange Offer. For details on how to provide your directions to Fidelity, please review the procedures set forth under the heading “Making an Election to Tender,” below.

Change Healthcare shares received by the McKesson Stock Funds in connection with the Exchange Offer (along with anyClean-upSpin-off) and the Merger will be transferred to a newly established Change Healthcare Stock Fund under the Plan, and the investment records for each account of a Plan participant who instructs Fidelity to tender shares in the Exchange Offer (or accounts of all Plan participants with accounts invested in the McKesson Stock Funds, with respect to aClean-upSpin-off) will be adjusted to reflect a reallocation of their investment in the McKesson Stock Funds to the Change Healthcare Stock Fund in proportion to the amount of this transfer attributable to their account.

Following this transfer, Change Healthcare shares held in the Change Healthcare Stock Fund will be subject to the terms and conditions described in this notice and the definitive documentation of such Change Healthcare Stock Fund that will be provided to participants of the Plan.

FIDELITY MAKES NO RECOMMENDATION REGARDING THE EXCHANGE OFFER. EACH PARTICIPANT MUST DECIDE WHETHER OR NOT TO INSTRUCT FIDELITY TO TENDER MCKESSON SHARES ATTRIBUTABLE TO HIS OR HER PLAN ACCOUNT IN THE EXCHANGE OFFER.

Exchange Offer Considerations.

A tender of McKesson shares attributable to your account may result in the loss of your ability to usenet unrealized appreciation tax treatment with respect to theMcKesson shares tendered. (See the discussion of net unrealized appreciation later in this letter under the heading “Net Unrealized Appreciation”.)

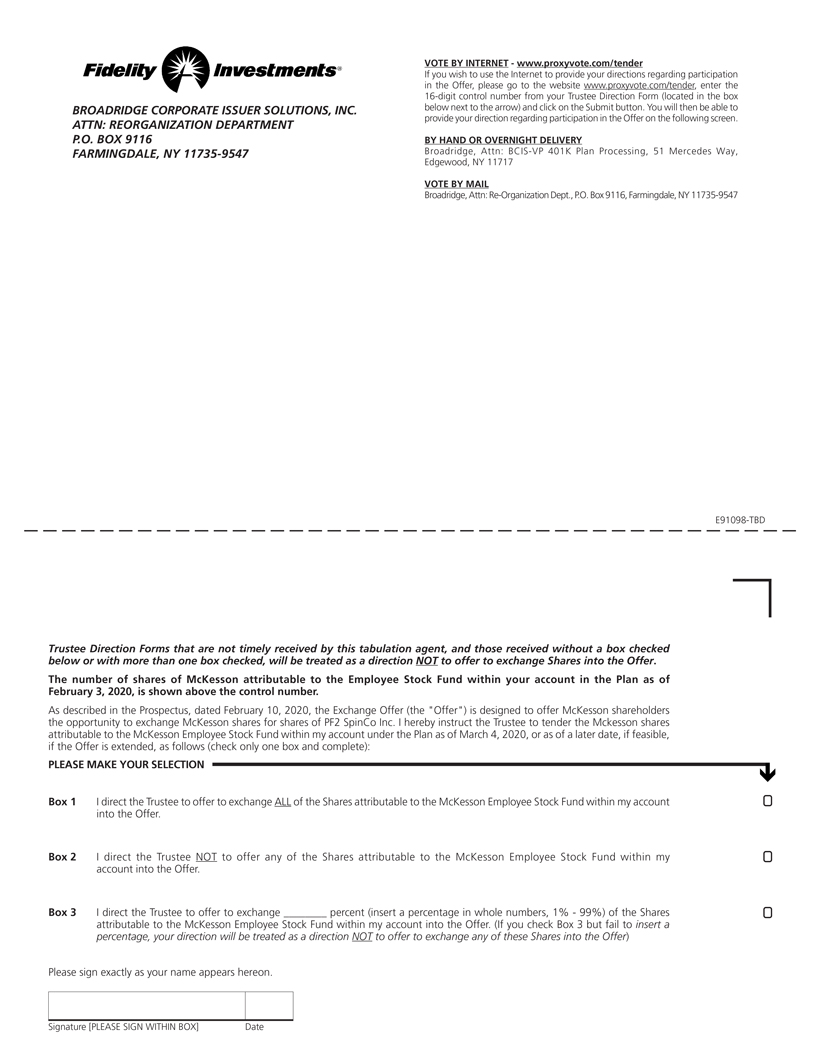

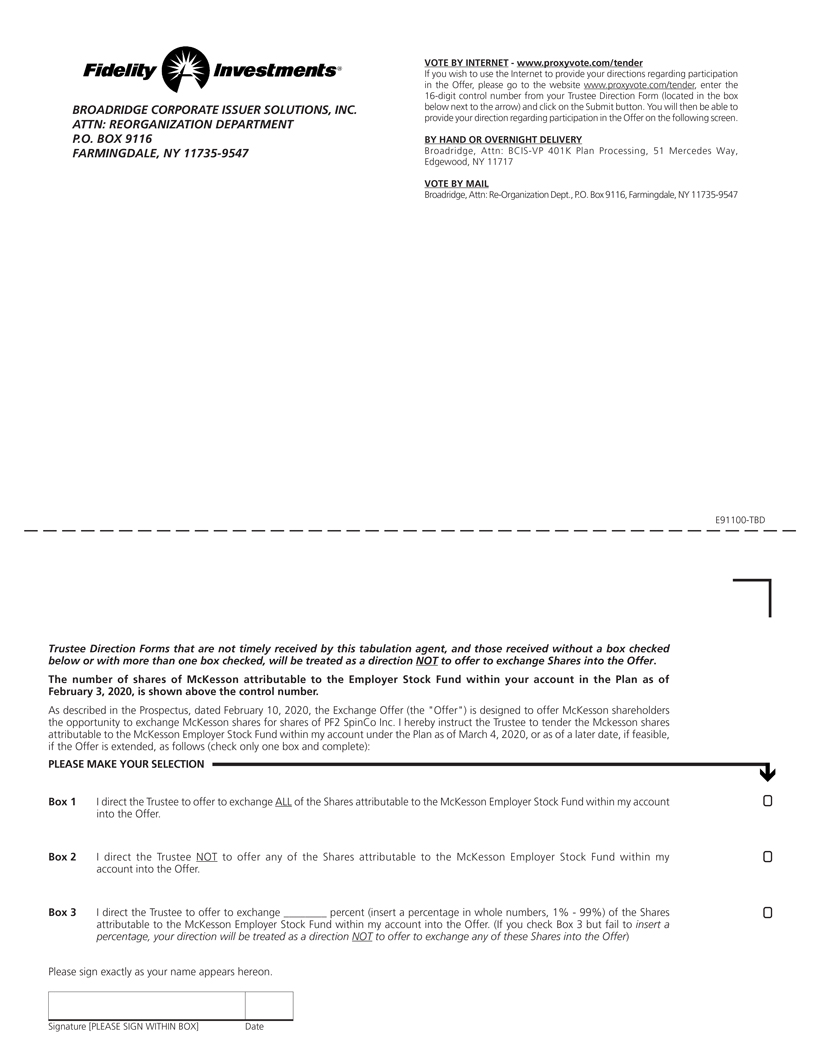

Enclosed please find a copy of the Prospectus and one Trustee Direction Form for each of the McKesson Stock Funds in which your individual Plan account is invested. These documents require your immediate attention. As described below, you have the right to instruct Fidelity Management Trust Company, as trustee, whether or not to tender McKesson shares attributable to your investment in the McKesson Stock Funds in response to the Exchange Offer.

Making an Election to Tender.

In order to participate in the Exchange Offer described in the Prospectus, and briefly summarized in this letter, with respect to the investment of your Plan account in the McKesson Stock Funds, you will need to complete the enclosed Trustee Direction Form(s) and return the form(s) to Broadridge Financial Services (“Broadridge”), Fidelity’s tabulation agent (the “Tabulation Agent”) in the return envelope provided so that the form(s) are RECEIVED by 4:00 p.m., New York City time, on March 3, 2020 (the “Due Date”), unless the Exchange Offer is extended and it is administratively feasible for Fidelity to extend the deadline.

2