EQUINOX GOLD CORP.

Technical Report on the Fazenda Gold Mine

Bahia State, Brazil

| QUALIFIED PERSONS: | EFFECTIVE DATE: June 30, 2024 |

| | |

| David Warren, P.Eng. | REPORT DATE: January 31, 2025 |

| | |

| Dominic Claridge, P.Eng. | |

| | |

| João Paulo Santos, MAusIMM | |

| | |

| Gabriel Freire, FAusIMM | |

| | |

| Benoit Poupeau, FAusIMM | |

| | |

| Mo Molavi, P.Eng. | |

| | |

| Paul Sterling, P.Eng. | |

| | |

| Kelly Boychuk, P.Eng. | |

FORWARD-LOOKING INFORMATION

This Technical Report contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation and may include future-oriented financial information (collectively, forward-looking Information). Forward-looking information in this Technical Report includes, but is not limited to, statements regarding: plans and expectations for the Fazenda Gold Mine, including estimated mine life, mining costs and production rates; estimates of Mineral Resources and the conversation of Mineral Resources to Mineral Reserves; projected metallurgical recoveries; and anticipated environmental liabilities. Forward-looking information can be identified by the use of words such as "will," "expect," "achieve," "strategy," "increase," "plan," "potential," "intend," "anticipate," "expect," "estimate," "target," "objective" and similar expressions and phrases or statements that certain actions, events or results "may," "could," or "should" occur, or the negative connotation of such terms. The material factors or assumptions regarding forward-looking information contained in this Technical Report are discussed in this report, where applicable.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking information. Relevant risks and other factors include, without limitation: fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services; fluctuations in currency markets; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, geotechnical incidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding, fire and severe weather); inadequate insurance, or inability to obtain insurance to cover these risks and hazards; employee relations; relationships with, and claims by, local communities and indigenous populations; the ability to maintain existing or obtain all necessary permits, licenses and regulatory approvals in a timely manner or at all; changes in laws, regulations and government practices, including environmental and export and import laws and regulations; legal restrictions relating to mining; and risks relating to expropriation; increased competition in the mining industry. Forward-looking information is designed to help readers understand views as of that time with respect to future events and speaks only as of the date it is made.

All the forward-looking information in this Technical Report is qualified by these cautionary statements. Except as required by applicable law, Equinox Gold Corp. and the Qualified Persons who authored this Technical Report assume no obligation to update publicly or otherwise revise any forward-looking information in this Technical Report, whether because of new information or future events or otherwise.

Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources

Disclosure regarding Equinox Gold Corp.'s mineral properties, including with respect to Mineral Reserve and Mineral Resource estimates included in this Technical Report, was prepared in accordance with National Instrument 43-101-Standards of Disclosure for Mineral Projects (NI 43-101). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (SEC) generally applicable to U.S. companies. Accordingly, information contained in this Technical Report is not comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Contents

| 1 SUMMARY | 1-1 |

| | |

| 1.1 Executive Summary | 1-1 |

| 1.2 Technical Summary | 1-3 |

| 1.2.1 Property Description and Location | 1-3 |

| 1.2.2 Land Tenure | 1-3 |

| 1.2.3 History | 1-4 |

| 1.2.4 Geology and Mineralization | 1-4 |

| 1.2.5 Exploration Status | 1-4 |

| 1.2.6 Metallurgical Testing | 1-5 |

| 1.2.7 Mineral Resources | 1-5 |

| 1.2.8 Mineral Reserves | 1-6 |

| 1.2.9 Mining Methods | 1-6 |

| 1.2.10 Life-of-Mine Production Schedule | 1-7 |

| 1.2.11 Mineral Processing | 1-8 |

| 1.2.12 Project Infrastructure | 1-8 |

| 1.2.13 Market Studies | 1-9 |

| 1.2.14 Environmental, Permitting, and Social Considerations | 1-9 |

| 1.2.15 Capital and Operating Cost Estimates | 1-9 |

| 1.3 Economic Analysis | 1-10 |

| 1.4 Conclusions | 1-10 |

| 1.4.1 Geology and Mineral Resources | 1-10 |

| 1.4.2 Mining and Mineral Reserves | 1-11 |

| 1.4.3 Metallurgical Testing and Processing | 1-11 |

| 1.4.4 Infrastructure | 1-12 |

| 1.4.5 Environmental, Social, and Permitting Considerations | 1-12 |

| 1.4.6 Capital and Operating Costs | 1-12 |

| 1.5 Recommendations | 1-12 |

| 1.5.1 Geology and Mineral Resources | 1-12 |

| 1.5.2 Mining and Mineral Reserves | 1-13 |

| 1.5.3 Metallurgical Testing and Processing | 1-14 |

| 1.5.4 Infrastructure | 1-14 |

| 1.5.5 Environmental, Social, and Permitting Considerations | 1-15 |

| 1.5.6 Capital and Operating Costs | 1-15 |

| | |

| 2 INTRODUCTION | 2-1 |

| 2.1 Sources of Information | 2-1 |

| 2.2 Responsibility | 2-1 |

| 2.3 Qualified Persons Site Visits | 2-2 |

| 2.4 Abbreviations, Acronyms, and Units of Measure | 2-2 |

| | |

| 3 RELIANCE ON OTHER EXPERTS | 3-1 |

| | |

| 4 PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| 4.1 Property Location | 4-1 |

| 4.2 Mineral and Surface Rights in Brazil | 4-1 |

| 4.3 Land Tenure | 4-3 |

| 4.4 Royalties | 4-6 |

| | |

| 5 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 5-1 |

| 5.1 Accessibility | 5-1 |

| 5.2 Climate | 5-1 |

| 5.3 Local Resources | 5-1 |

| 5.4 Infrastructure | 5-1 |

| 5.5 Physiography | 5-2 |

| | |

| 6 HISTORY | 6-1 |

| 6.1 Prior Ownership and Exploration History | 6-1 |

| 6.2 Historical Resource Estimates | 6-1 |

| 6.3 Past Production | 6-2 |

| | |

| 7 GEOLOGICAL SETTING AND MINERALIZATION | 7-1 |

| 7.1 Regional Geology | 7-1 |

| 7.2 Local Geology | 7-3 |

| 7.2.1 Lithology | 7-3 |

| 7.2.2 Riacho do Inco Unit | 7-4 |

| 7.2.3 Fazenda Brasileiro Unit | 7-4 |

| 7.2.4 Canto Unit | 7-5 |

| 7.2.5 Structure | 7-9 |

| 7.2.6 D1 Deformation Event | 7-9 |

| 7.2.7 D2 Deformation Event | 7-9 |

| 7.2.8 D3 Deformation Event | 7-10 |

| 7.2.9 D4 Deformation Event | 7-10 |

| 7.3 Mineralization | 7-10 |

| | |

| 8 DEPOSIT TYPES | 8-1 |

| | |

| 9 EXPLORATION | 9-1 |

| 9.1 Exploration Potential | 9-1 |

| | |

| 10 DRILLING | 10-1 |

| 10.1 Sampling Method and Approach | 10-3 |

| | |

| 11 SAMPLE PREPARATION, ANALYSES, AND SECURITY | 11-1 |

| 11.1 Sample Preparation and Analytical Procedures | 11-1 |

| 11.1.1 Fazenda Laboratory | 11-1 |

| 11.1.2 ALS Laboratory | 11-1 |

| 11.1.3 SGS Laboratory | 11-2 |

| 11.2 Quality Assurance and Quality Control | 11-2 |

| 11.2.1 QA/QC Sample Insert Definitions | 11-2 |

| 11.2.2 QA/QC Sample Insertion Frequency | 11-3 |

| 11.2.3 QA/QC Summary Results | 11-4 |

| 11.2.4 Fazenda QC Review and Laboratory Audit | 11-13 |

| 11.3 Sample Security | 11-14 |

| 11.4 Author Opinion | 11-14 |

| | |

| 12 DATA VERIFICATION | 12-1 |

| 12.1 Site Visit and Core Inspection | 12-1 |

| 12.2 Database Validation | 12-1 |

| 12.3 Independent Verification and Check Assays | 12-2 |

| 12.4 Conclusion | 12-2 |

| | |

| 13 MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 |

| 13.1 Metallurgical Testing | 13-1 |

| 13.1.1 Exploration Technological Characterization Testwork (SGS GEOSOL, 2024) | 13-1 |

| 13.2 Operational Improvements | 13-2 |

| 13.2.1 Process Changes for Different Plant Feed Ore | 13-2 |

| 13.2.2 Daily Geometallurgical Testwork | 13-2 |

| 13.2.3 Kerosene Addition to the Leaching Circuit (August 2019 Onwards) | 13-2 |

| 13.2.4 Lead Nitrate Addition to the Leaching Circuit (May 2020 Onwards) | 13-3 |

| 13.2.5 Optimized Leaching Particle Size (December 2020 Onwards) | 13-3 |

| 13.2.6 pH Optimization | 13-4 |

| 13.2.7 Elution Recovery Optimization | 13-4 |

| 13.2.8 Installation of Regeneration Kiln | 13-4 |

| 13.3 Necessary Structural Refurbishment | 13-4 |

| 13.4 Next Steps | 13-4 |

| | |

| 14 MINERAL RESOURCE ESTIMATES | 14-1 |

| 14.1 Summary of Mineral Resource Estimate | 14-1 |

| 14.2 Method and Data Sources | 14-4 |

| 14.2.1 Software | 14-4 |

| 14.2.2 Drill-Hole Databases | 14-4 |

| 14.2.3 Data Handling | 14-4 |

| 14.2.4 Editing of the Block Models | 14-5 |

| 14.3 Mineral Reserves | 14-7 |

| 14.4 Limitations on Data | 14-7 |

| 14.5 Independent Data Verification | 14-8 |

| 14.6 Geological Models | 14-8 |

| 14.6.1 Regolith Models | 14-8 |

| 14.6.2 Geological Models | 14-8 |

| 14.6.3 PPQ, F&G, CLX, Canto, and PR Deposits | 14-9 |

| 14.6.4 Barrocas and Barrocas SW Deposits | 14-10 |

| 14.6.5 Lagoa do Gato | 14-11 |

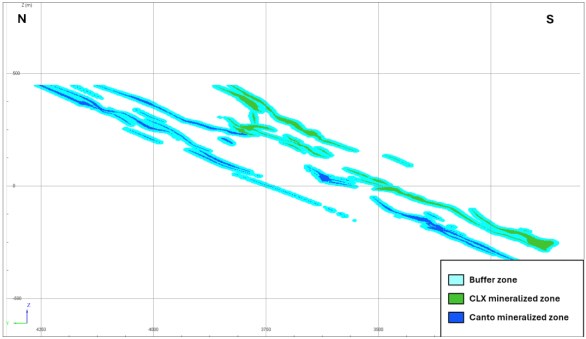

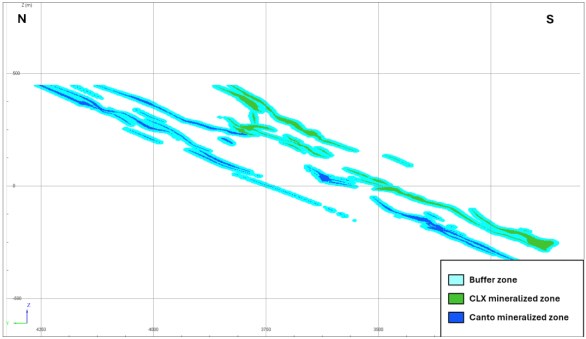

| 14.6.6 Buffer Zone | 14-11 |

| 14.7 Exploratory Data Analysis | 14-12 |

| 14.7.1 Grade Capping | 14-12 |

| 14.7.2 Compositing | 14-15 |

| 14.7.3 Declustering | 14-15 |

| 14.7.4 Boundary Analysis | 14-15 |

| 14.8 Variography | 14-16 |

| 14.9 Estimation | 14-17 |

| 14.10 Validation of Gold Grade Estimates | 14-19 |

| 14.10.1 Visual Inspections | 14-20 |

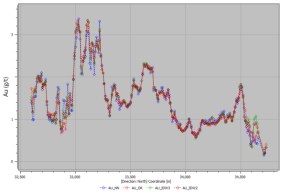

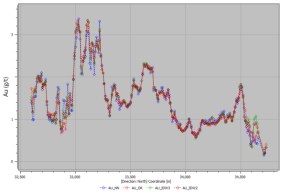

| 14.10.2 Swath Plots | 14-31 |

| 14.10.3 Comparison of Estimation Techniques | 14-31 |

| 14.10.4 Reconciliation to Past Production from CLX Open Pit and Underground | 14-32 |

| 14.11 Mineral Resource Classification | 14-32 |

| 14.12 Reasonable Prospects of Eventual Economic Extraction | 14-32 |

| 14.13 Mineral Resource Statement | 14-34 |

| 14.13.1 Qualified Person's Statement on Adequacy of Data | 14-36 |

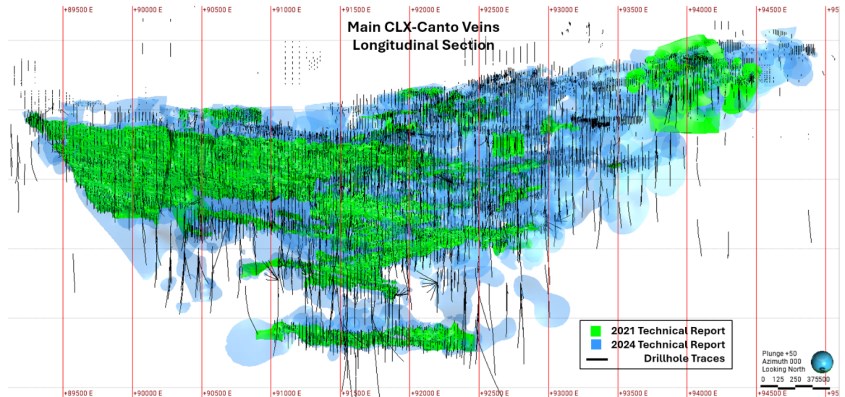

| 14.14 Comparison with the Previous Mineral Resource Estimate | 14-37 |

| | |

| 15 MINERAL RESERVE ESTIMATES | 15-1 |

| 15.1 Mineral Reserves | 15-1 |

| 15.2 Open Pit | 15-4 |

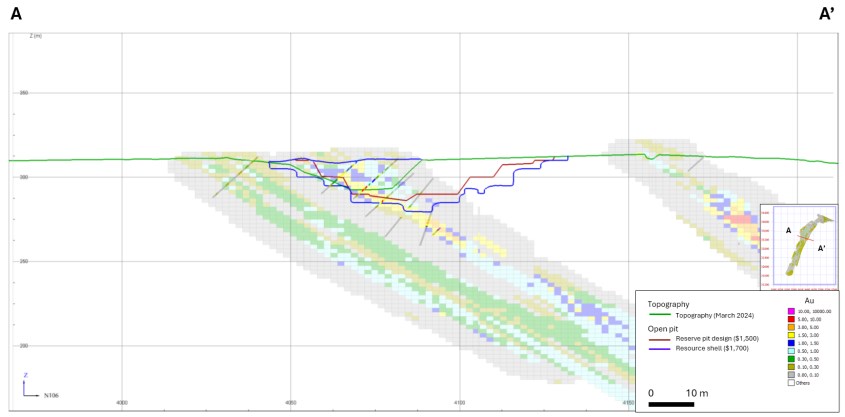

| 15.2.1 Resource Block Models | 15-4 |

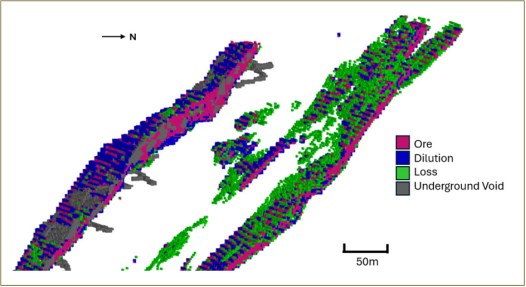

| 15.2.2 Dilution and Extraction | 15-4 |

| 15.2.3 Cut-Off Grade | 15-5 |

| 15.2.4 Open Pit Optimization Inputs | 15-7 |

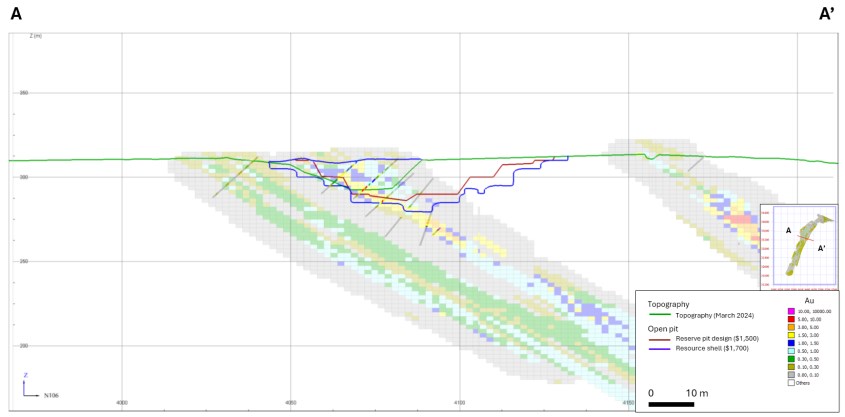

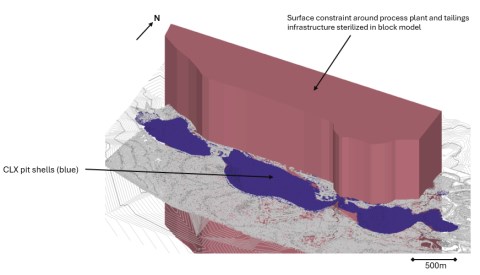

| 15.2.5 Open Pit Optimization Results | 15-9 |

| 15.2.6 Open Pit Design | 15-17 |

| 15.2.7 Open Pit Mineral Reserve Comparison 2020 vs. 2024 | 15-17 |

| 15.3 Underground | 15-17 |

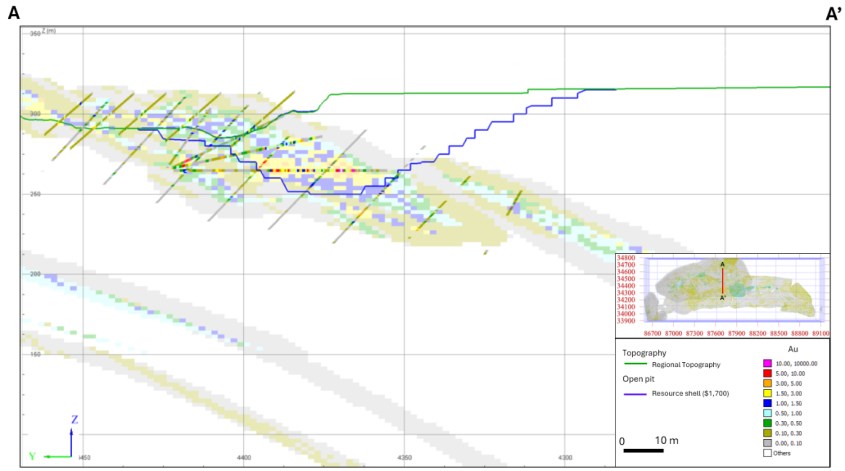

| 15.3.1 Mineral Resource Block Models | 15-17 |

| 15.3.2 Dilution and Extraction | 15-18 |

| 15.3.3 Cut-Off Grade | 15-18 |

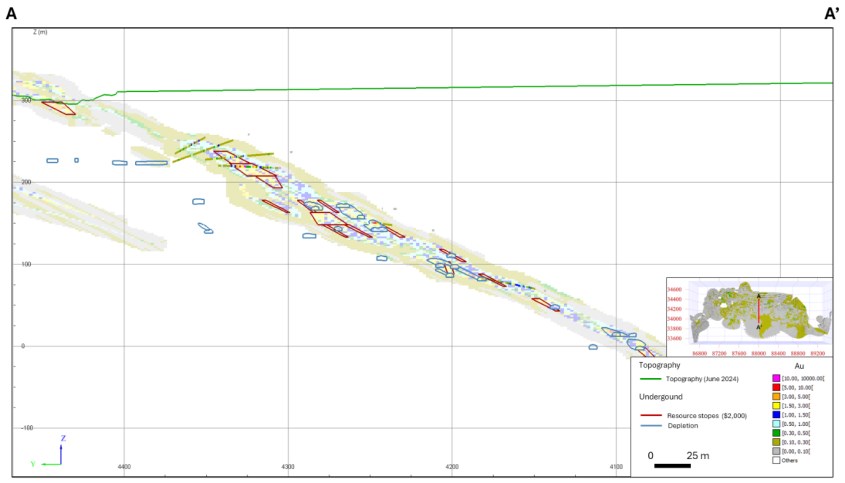

| 15.3.4 Underground Mineral Reserves Estimate | 15-19 |

| 15.3.5 Underground Mineral Reserve Comparison 2020 vs. 2024 | 15-21 |

| | |

| 16 MINING METHODS | 16-1 |

| 16.1 Open Pit Mining | 16-1 |

| 16.1.1 Open Pit Design | 16-1 |

| 16.1.2 Waste Dump and Stockpile Design | 16-8 |

| 16.1.3 Mine Equipment | 16-12 |

| 16.1.4 Geotechnical Evaluation | 16-12 |

| 16.1.5 Labour Force | 16-18 |

| 16.2 Underground Mining | 16-20 |

| 16.2.1 Geotechnical Considerations | 16-24 |

| 16.2.2 Mining Method and Mine Design Considerations | 16-26 |

| 16.2.3 Mine Design | 16-31 |

| 16.2.4 Underground Access | 16-32 |

| 16.2.5 Material Handling | 16-32 |

| 16.2.6 Personnel | 16-32 |

| 16.2.7 Underground Mining Fleet | 16-32 |

| 16.2.8 Underground Mine Equipment | 16-32 |

| 16.2.9 Ventilation | 16-33 |

| 16.2.10 Ground Support | 16-34 |

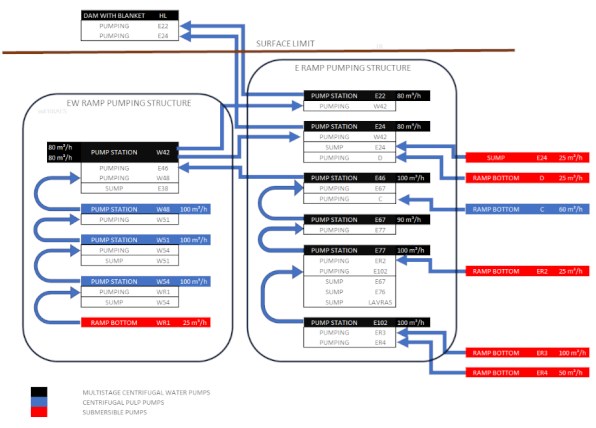

| 16.2.11 Mine Dewatering | 16-34 |

| 16.2.12 Explosives Magazine | 16-35 |

| 16.2.13 Development Sections Drill and Blast | 16-36 |

| 16.2.14 Other Services | 16-36 |

| 16.3 Production Schedule | 16-37 |

| | |

| 17 RECOVERY METHODS | 17-1 |

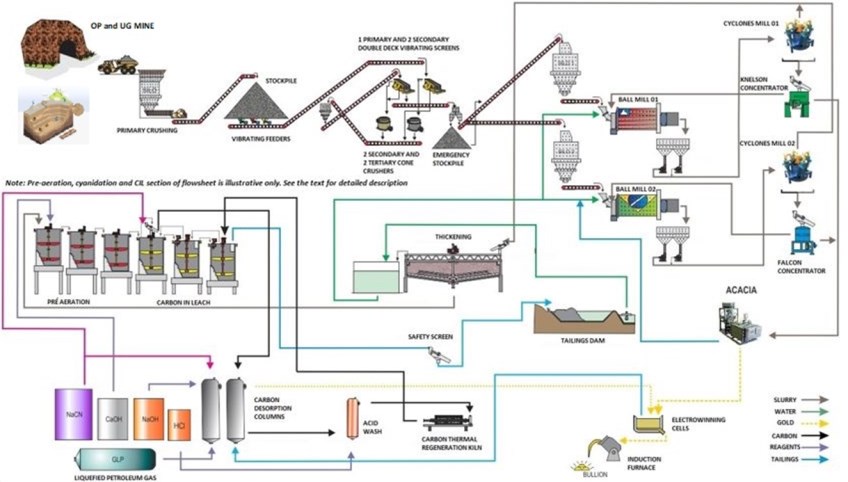

| 17.1 Process Description | 17-1 |

| 17.1.1 Historical Production (1984 to 2024) | 17-3 |

| 17.1.2 Ore Sources and Characteristics | 17-3 |

| 17.1.3 Ore Delivery from the Mine | 17-4 |

| 17.1.4 Crushing | 17-4 |

| 17.1.5 Grinding | 17-4 |

| 17.1.6 Gravity Concentration | 17-5 |

| 17.1.7 Intensive Leaching-Acacia | 17-5 |

| 17.1.8 Thickening | 17-5 |

| 17.1.9 Carbon-in-Leaching | 17-5 |

| 17.1.10 Elution | 17-6 |

| 17.1.11 Carbon Regeneration | 17-7 |

| 17.1.12 Electrowinning and Doré Smelting | 17-7 |

| 17.1.13 Tailings | 17-7 |

| 17.2 Production Historical Data | 17-7 |

| | |

| 18 PROJECT INFRASTRUCTURE | 18-1 |

| 18.1 Access Roads | 18-1 |

| 18.2 Electrical Power Supply | 18-5 |

| 18.3 Water Supply | 18-5 |

| 18.4 Site Facilities | 18-5 |

| 18.5 Workforce Accommodation | 18-6 |

| 18.6 Security | 18-6 |

| 18.7 Occupational Health and Safety | 18-6 |

| 18.7.1 Hygiene, Medicine, and Occupational Safety | 18-6 |

| 18.7.2 Emergency Response Plan | 18-7 |

| 18.7.3 Emergency Organization | 18-7 |

| 18.7.4 Procedures and Responsibilities | 18-7 |

| 18.7.5 Additional Provisions | 18-7 |

| 18.8 Tailings Storage Facilities | 18-7 |

| 18.9 Explosives Magazine Facilities | 18-8 |

| | |

| 19 MARKET STUDIES AND CONTRACTS | 19-1 |

| 19.1 Markets | 19-1 |

| 19.2 Contracts | 19-1 |

| 19.2.1 Contractor Mining Agreement | 19-1 |

| 19.2.2 Electrical Energy Supply Agreement | 19-1 |

| 19.2.3 Diesel Fuel Supply Agreement | 19-1 |

| 19.2.4 Explosives Supply Agreement | 19-1 |

| 19.2.5 Cyanide Supply Agreement | 19-1 |

| | |

| 20 ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | 20-1 |

| 20.1 Environmental Licensing | 20-1 |

| 20.1.1 Land Use | 20-1 |

| 20.1.2 Environmental Impacts and Mitigation Actions | 20-4 |

| 20.2 Socioeconomics | 20-4 |

| 20.3 Acid Rock Drainage Evaluation | 20-5 |

| 20.4 Mine Closure Requirements | 20-6 |

| | |

| 21 CAPITAL AND OPERATING COSTS | 21-1 |

| 21.1 Capital Costs | 21-1 |

| 21.2 Operating Costs | 21-2 |

| 21.3 Workforce | 21-3 |

| 22 ECONOMIC ANALYSIS | 22-1 |

| | |

| 23 ADJACENT PROPERTIES | 23-1 |

| | |

| 24 OTHER RELEVANT DATA AND INFORMATION | 24-1 |

| | |

| 25 INTERPRETATION AND CONCLUSIONS | 25-1 |

| 25.1 Geology and Mineral Resources | 25-1 |

| 25.2 Mining and Mineral Reserves | 25-1 |

| 25.3 Metallurgical Testing and Processing | 25-2 |

| 25.4 Infrastructure | 25-3 |

| 25.5 Environmental, Social, and Permitting Considerations | 25-3 |

| 25.6 Capital and Operating Costs | 25-4 |

| | |

| 26 RECOMMENDATIONS | 26-1 |

| 26.1 Mineral Resource Estimate | 26-1 |

| 26.2 Mining and Mineral Reserves | 26-1 |

| 26.3 Metallurgical Testwork and Mineral Processing | 26-2 |

| 26.4 Infrastructure | 26-3 |

| 26.5 Environmental, Social, and Permitting Considerations | 26-3 |

| 26.6 Capital and Operating Costs | 26-3 |

| | |

| 27 REFERENCES | 27-1 |

| | |

| 28 DATE AND SIGNATURE PAGE | 28-1 |

| | |

| 29 CERTIFICATE OF QUALIFIED PERSON | 29-1 |

| 29.1 David Warren, P.Eng. | 29-1 |

| 29.2 Dominic Claridge, FAusIMM | 29-2 |

| 29.3 João Paulo Santos, FAusIMM | 29-3 |

| 29.4 Gabriel Freire, FAusIMM | 29-4 |

| 29.5 Benoit Poupeau, FAusIMM | 29-5 |

| 29.6 Mo Molavi, P.Eng. | 29-6 |

| 29.7 Paul Sterling, P.Eng. | 29-7 |

| 29.8 Kelly Boychuk, P.Eng. | 29-8 |

Tables

| Table 1-1: Mineral Resources Summary (Exclusive of Reserves) as at June 30, 2024 | 1-2 |

| Table 1-2: Mineral Reserves Summary as at June 30, 2024 | 1-3 |

| Table 1-3: Life-of-Mine Production Schedule (2024 to 2033) | 1-7 |

| Table 1-4: Life-of-Mine Projected Capital Costs | 1-9 |

| Table 1-5: Life-of-Mine Projected Unit Operating Costs | 1-10 |

| Table 2-1: Qualified Persons and their Respective Sections of Responsibility | 2-2 |

| Table 4-1: Summary of Fazenda Tenure Held by FBDM | 4-5 |

| Table 6-1: Exploration History | 6-1 |

| Table 6-2: Fazenda Historical Production 1984 to 2023 | 6-3 |

| Table 7-1: Fazenda Mine Area Stratigraphic Column (2023) | 7-6 |

| Table 10-1: Drilling Completed as of December 31, 2023 | 10-1 |

| Table 11-1: Fazenda Drilling QA/QC Protocols | 11-3 |

| Table 11-2: QA/QC Sample Insertion Summary | 11-4 |

| Table 11-3: List of Certified Reference Materials used and Performance Summary | 11-5 |

| Table 13-1: Summary of Test Results-GRG Knelson + CIL Kinects (24 h) | 13-1 |

| Table 14-1: Codes and Descriptions for Each Deposit | 14-1 |

| Table 14-2: Summary of Databases Informing Mineral Resource Estimates | 14-4 |

| Table 14-3: Summary of Topographic Surveys Used for the Mineral Resource Estimate | 14-5 |

| Table 14-4: Summary of Wireframes and Codes Used for the Mineral Resource Estimate | 14-5 |

| Table 14-5: Summary of Average Density Values for Fazenda Deposits | 14-7 |

| Table 14-6: Summary of Capping Values for Gold by Deposit | 14-13 |

| Table 14-7: Summary of Capping Values for Sulphur by Deposit | 14-14 |

| Table 14-8: Summary of Capping Values for Total Organic Carbon by Deposit | 14-14 |

| Table 14-9: Composite Summary | 14-15 |

| Table 14-10: Variogram Model Parameters by Deposit | 14-16 |

| Table 14-11: Open Pit Block and Underground Model Definitions by Deposit | 14-17 |

| Table 14-12: Search Interpolation Parameters by Deposit | 14-18 |

| Table 14-13: Estimator Comparison Results-CLX Underground | 14-32 |

| Table 14-14: Open Pit Optimization Parameters for Mineral Resources | 14-33 |

| Table 14-15: Underground Mining Stope Optimization Parameters for Mineral Resources | 14-33 |

| Table 14-16: Mineral Resources Inclusive of Mineral Reserves for the Fazenda Mine | 14-34 |

| Table 14-17: Mineral Resources Exclusive of Mineral Reserves for the Fazenda Mine | 14-35 |

| Table 14-18: Comparison between 2021 MRE and 2024 MRE, including Mineral Reserves | 14-37 |

| Table 15-1: Mineral Reserve Estimate Summary by Mine Area-June 30, 2024 | 15-1 |

| Table 15-2: Mineral Reserve Estimate Summary-June 30, 2024 | 15-3 |

| Table 15-3: Open Pit Dilution and Losses by Mining Area | 15-5 |

| Table 15-4: Open Pit Cut-Off Grade Estimation for CLX, Canto 1, and Canto 2 | 15-6 |

| Table 15-5: Open Pit Cut-Off Grade Estimation for LG, PPQ, and G | 15-6 |

| Table 15-6: Open Pit Optimization Inputs for CLX, Canto 1, and Canto 2 | 15-7 |

| Table 15-7: Open Pit Optimization Inputs for LG, PPQ, and G | 15-8 |

| Table 15-8: Geotechnical Inputs by Pit | 15-9 |

| Table 15-9: Open Pit Optimization Results-CLX | 15-11 |

| Table 15-10: Open Pit Optimization Results-Canto 1 | 15-12 |

| Table 15-11: Open Pit Optimization Results-Canto 2 | 15-13 |

| Table 15-12: Open Pit Optimization Results-LG | 15-14 |

| Table 15-13: Open Pit Optimization Results-G | 15-15 |

| Table 15-14: Open Pit Optimization Results-PPQ | 15-16 |

| Table 15-15: Open Pit Mineral Reserve Comparison 2020 vs. 2024 | 15-17 |

| Table 15-16: Underground Dilution and Losses by Mining Area | 15-18 |

| Table 15-17: Underground Cut-Off Grade and Supporting Parameters | 15-18 |

| Table 15-18: Underground Mineral Reserve Comparison 2020 vs. 2024 | 15-21 |

| Table 16-1: Open Pit Design Parameters | 16-1 |

| Table 16-2: Waste Dump and Stockpile Volumes and Design Parameters | 16-9 |

| Table 16-3: Current Mining Contractor Equipment Type and Size | 16-12 |

| Table 16-4: Summary of the Critical Stress Reduction Factors | 16-14 |

| Table 16-5: Current Mining Contractor Labour Force-Open Pit | 16-19 |

| Table 16-6: Summary of Underground Support | 16-25 |

| Table 16-7: Geotechnical Design Parameters | 16-26 |

| Table 16-8: Primary Production Equipment | 16-33 |

| Table 16-9: Fazenda Mine Production-2021 to 2023 | 16-37 |

| Table 16-10: Open Pit Mine Fleet Productivity Assumptions | 16-39 |

| Table 16-11: Underground Fleet Productivity Assumptions | 16-39 |

| Table 16-12: Life-of-Mine Production Schedule | 16-40 |

| Table 16-13: Life-of-Mine Ore Production by Area | 16-41 |

| Table 17-1: Historical Production Data 1984-2024 | 17-3 |

| Table 17-2: Processing Operating Parameters (January 2023 through June 2024) | 17-8 |

| Table 20-1: Environmental Permit Status | 20-2 |

| Table 20-2: Socioeconomic Impacts Associated with Mine Closure | 20-4 |

| Table 20-3: Estimated Mine Closure Costs | 20-6 |

| Table 21-1: Actual Sustaining Capital Costs-2021 to 2023 | 21-1 |

| Table 21-2: LOM Projected Capital Costs | 21-1 |

| Table 21-3: Actual Operating Costs-2021 to 2023 | 21-2 |

| Table 21-4: Actual Unit Operating Costs-2021 to 2023 | 21-2 |

| Table 21-5: LOM Projected Total Operating Costs | 21-3 |

| Table 21-6: LOM Projected Unit Operating Costs | 21-3 |

Figures

| Figure 1-1: Total Material Mined by Year (2024 to 2033) | 1-8 |

| Figure 4-1: Project Location | 4-2 |

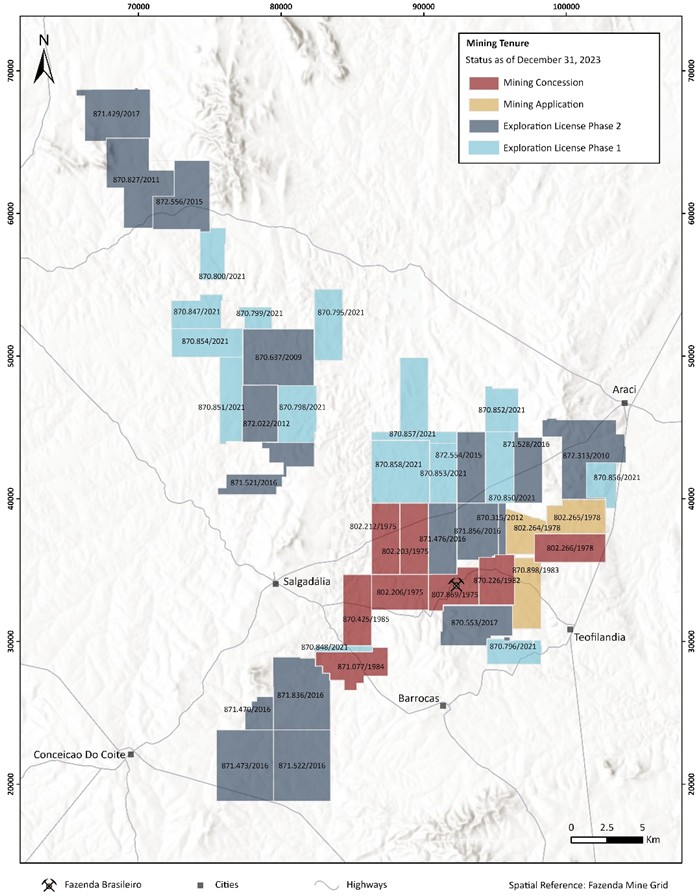

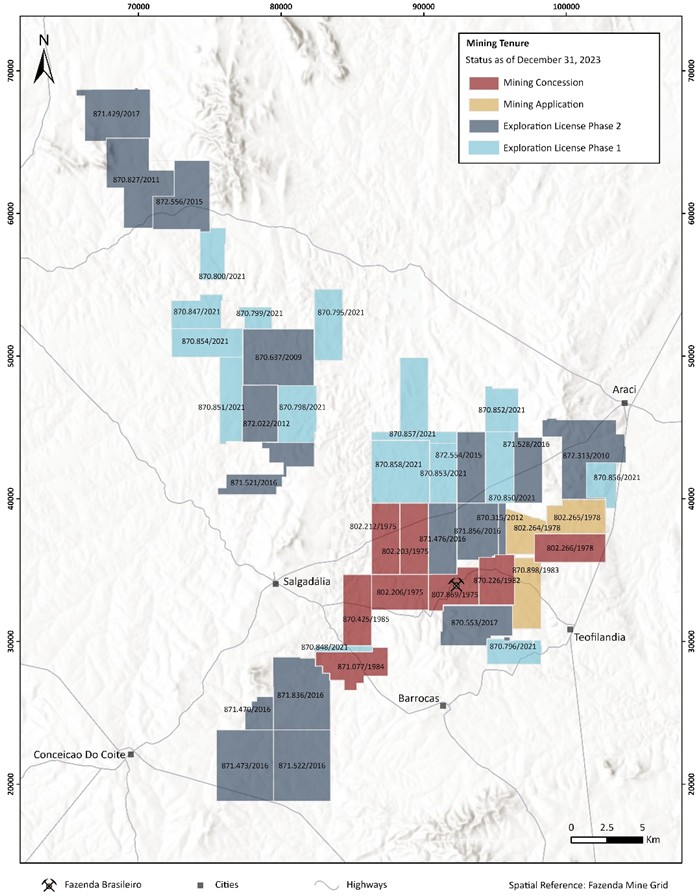

| Figure 4-2: Land Tenure Status | 4-4 |

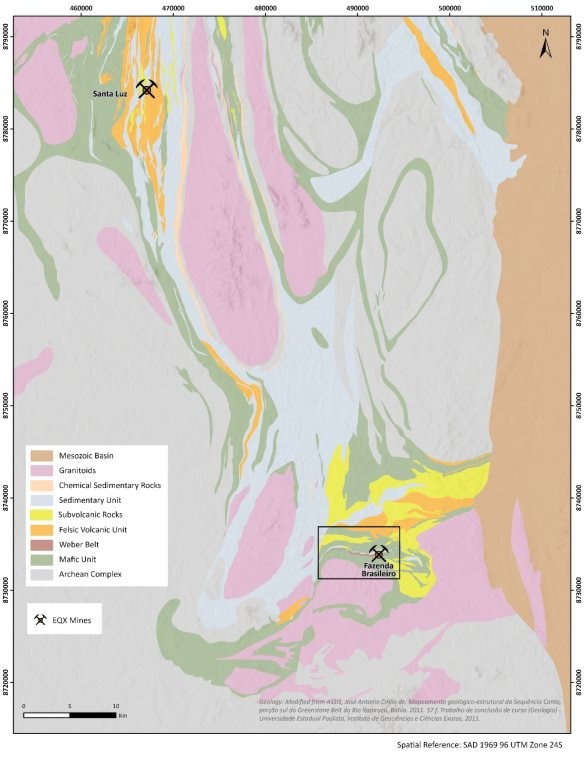

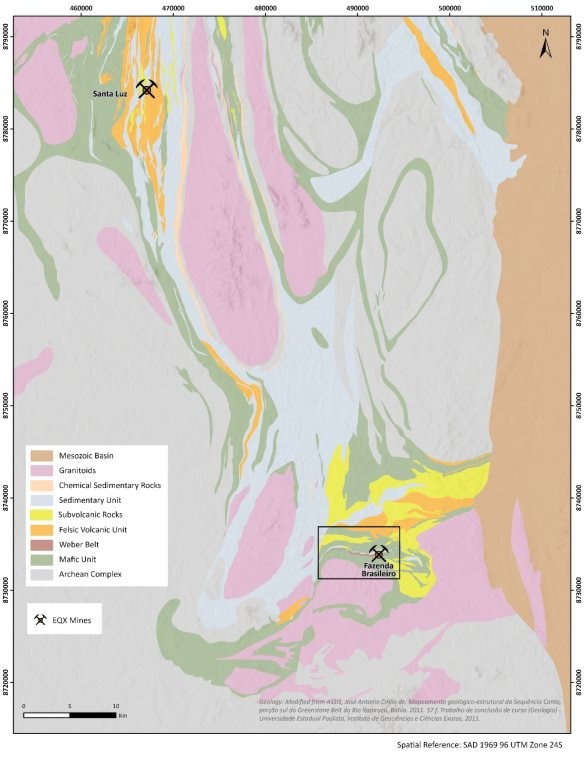

| Figure 7-1: Regional Geology | 7-2 |

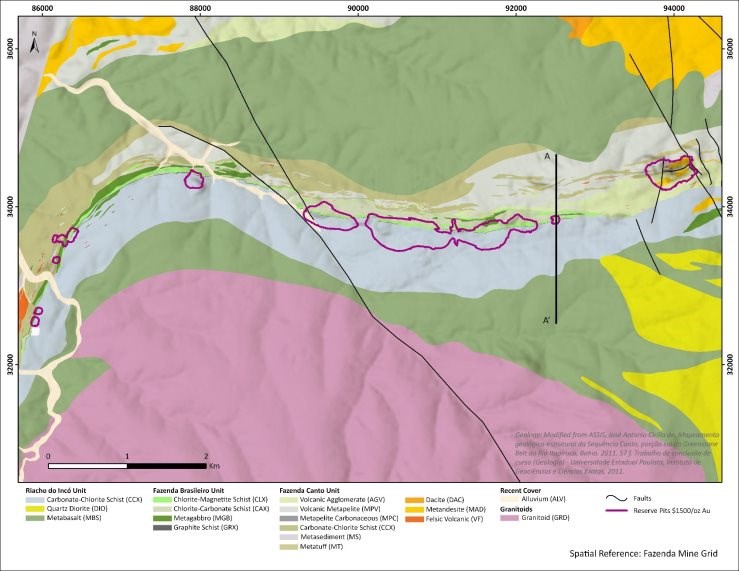

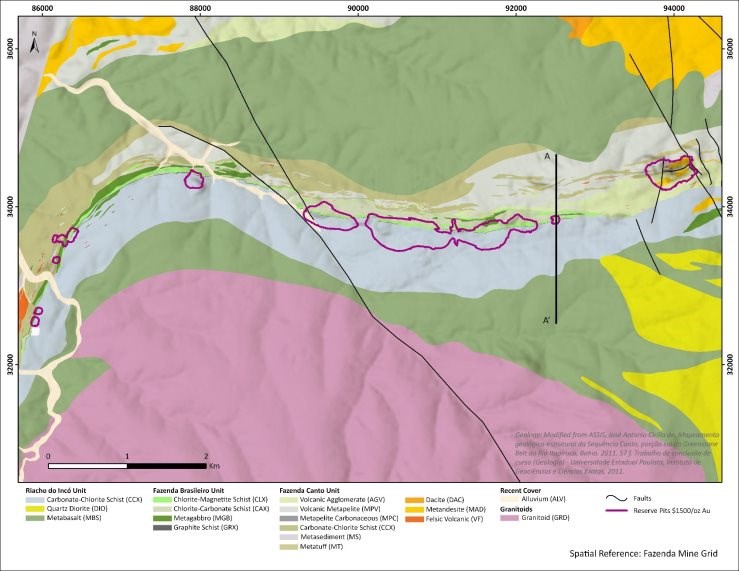

| Figure 7-2: Weber Belt Surface Geology | 7-7 |

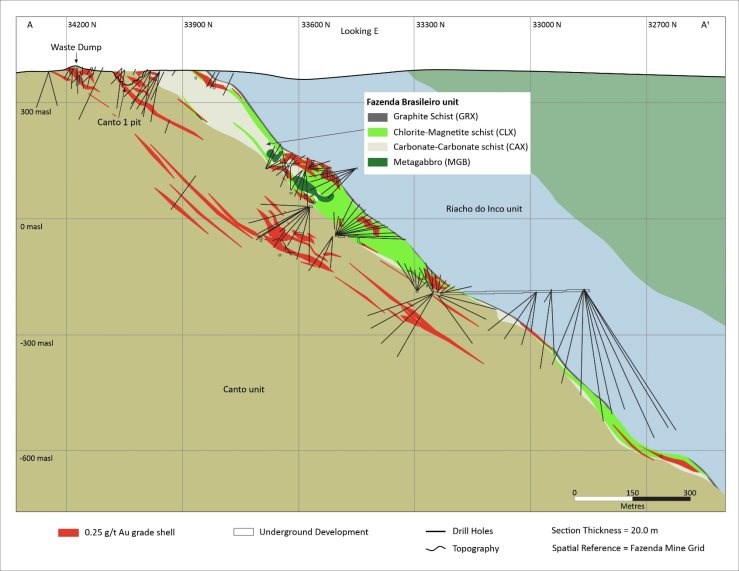

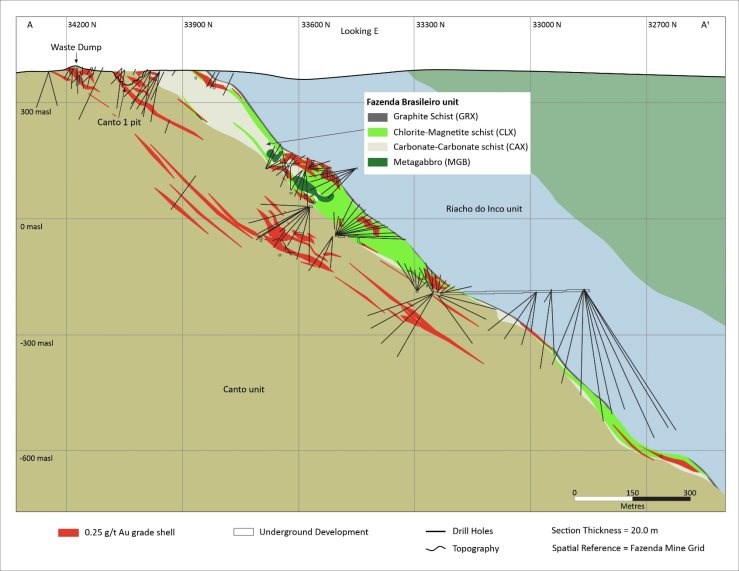

| Figure 7-3: Schematic Geologic Cross-Section | 7-8 |

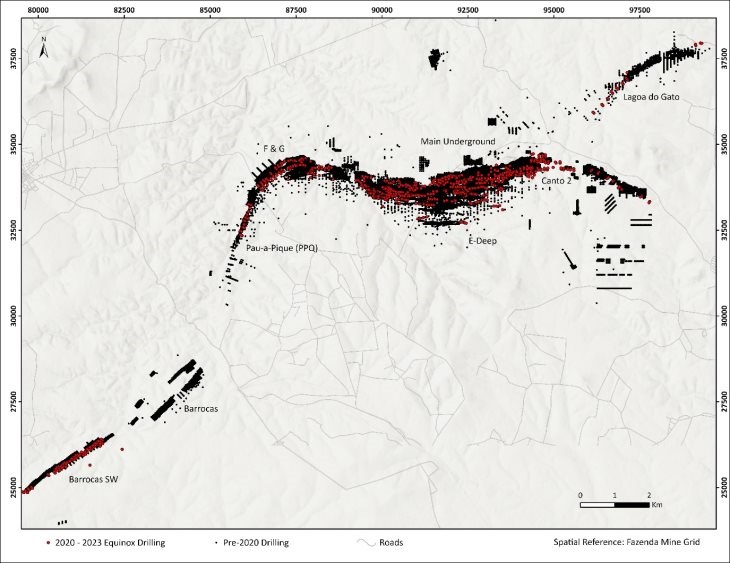

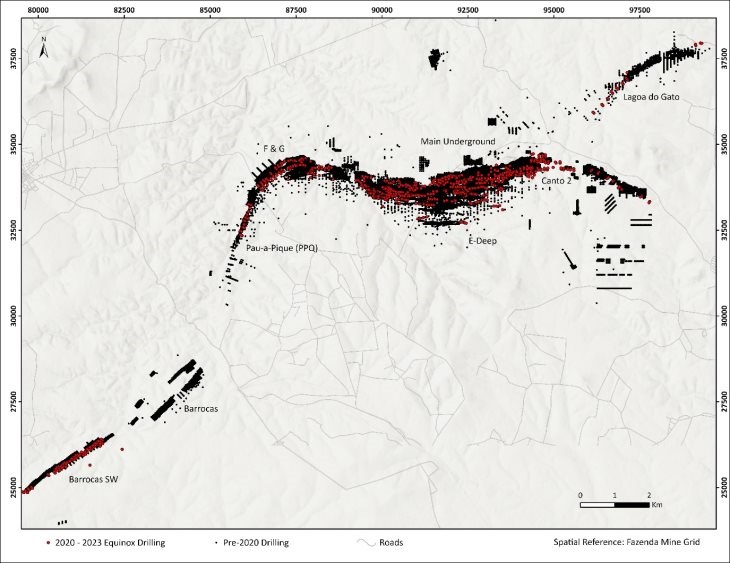

| Figure 10-1: Drilling Plan View | 10-2 |

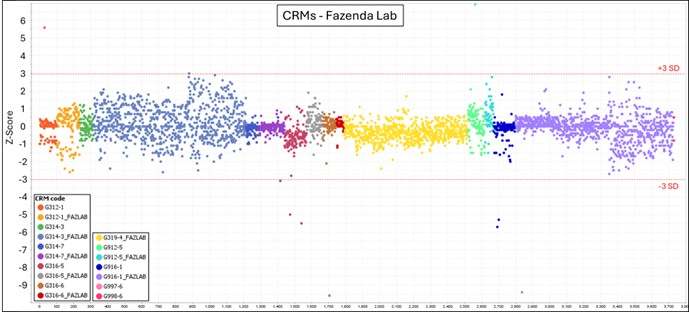

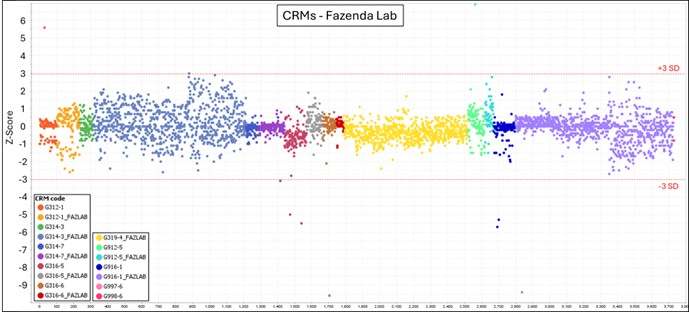

| Figure 11-1: Z-Score Charts of CRM Results | 11-6 |

| Figure 11-2: Blank Assay Results-Fazenda Lab | 11-7 |

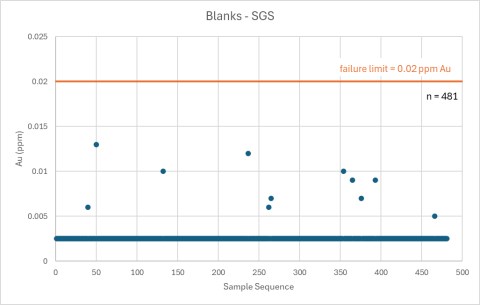

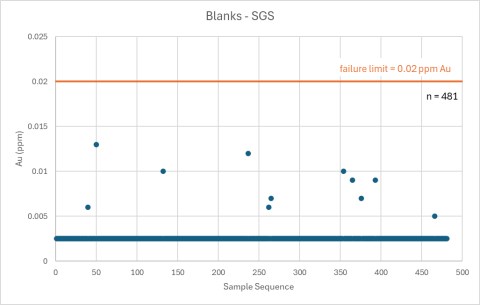

| Figure 11-3: Blank Assay Results-SGS | 11-7 |

| Figure 11-4: Blank Assay Results-ALS | 11-8 |

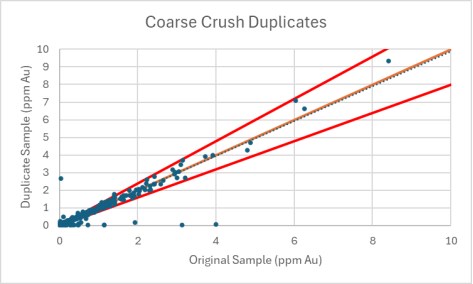

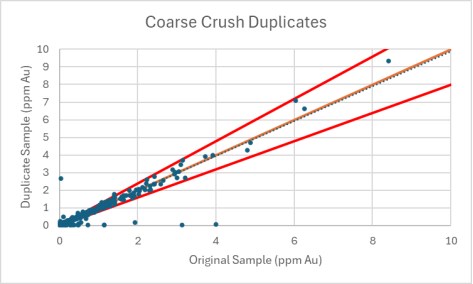

| Figure 11-5: Scatterplot of Coarse Crush Duplicate Sample Results | 11-8 |

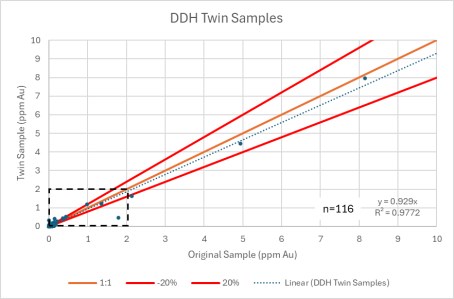

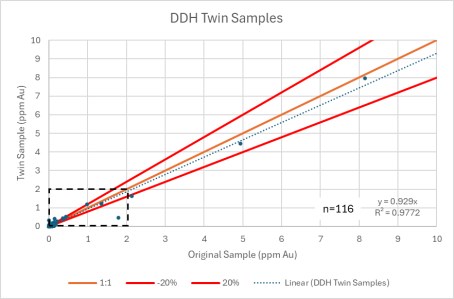

| Figure 11-6: Scatterplot of DDH Twin Sample Results | 11-9 |

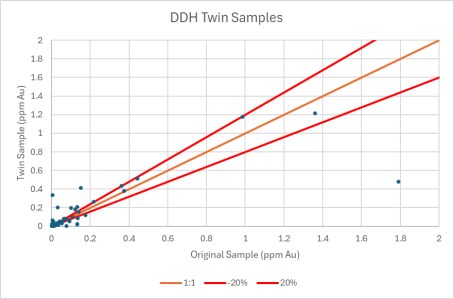

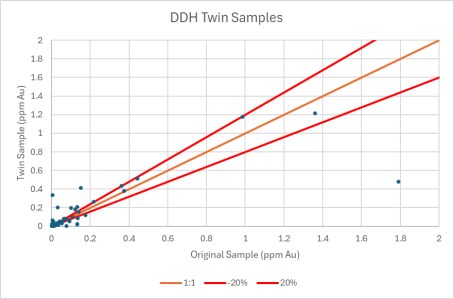

| Figure 11-7: Scatterplot of the Same Data as Figure 11-6 with Results ≤2 ppm Au | 11-9 |

| Figure 11-8: Scatterplot of Lab Check Results (Fazenda Lab and ALS) | 11-10 |

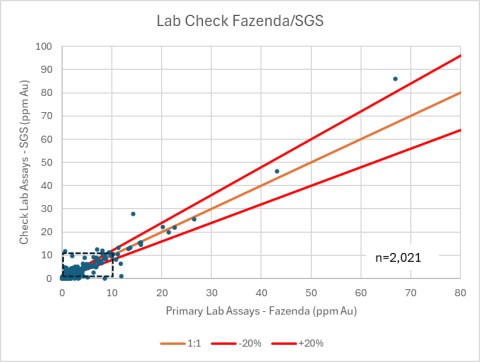

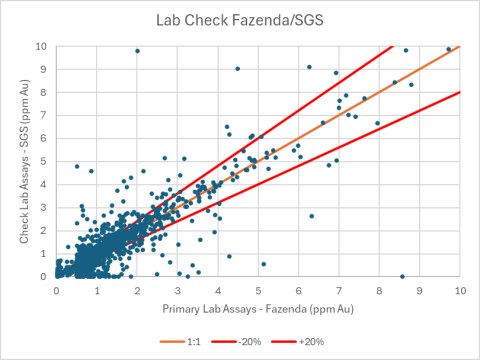

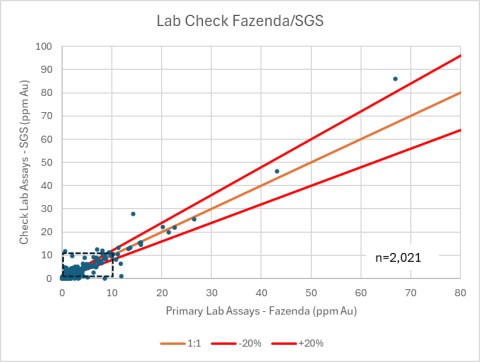

| Figure 11-9: Scatterplot of Lab Check Results (Fazenda Lab and SGS) | 11-11 |

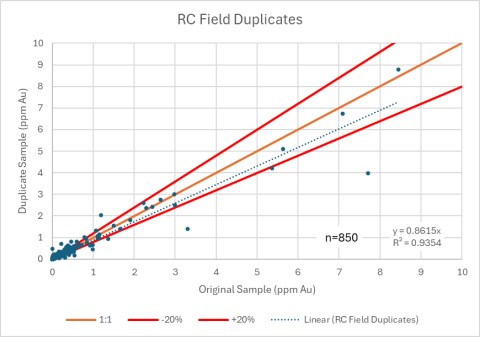

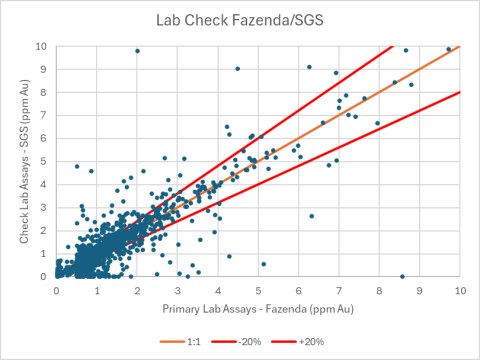

| Figure 11-10: Scatterplot of the Same Data as Figure 11-5b with Results ≤10 ppm Au | 11-11 |

| Figure 11-11 :Scatterplot of Lab Check Results with ALS as the Primary Lab and SGS as the Check Lab | 11-12 |

| Figure 11-12: Scatterplot of Lab Check Results with SGS as the Primary Lab and ALS as the Check Lab | 11-12 |

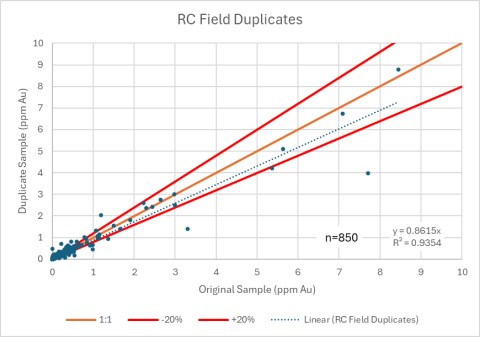

| Figure 11-13: Scatterplot of RC Field Duplicate Sample Results | 11-13 |

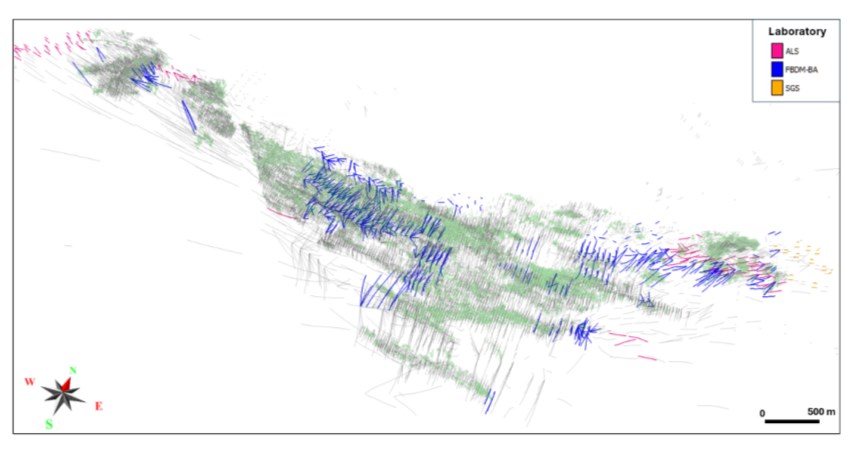

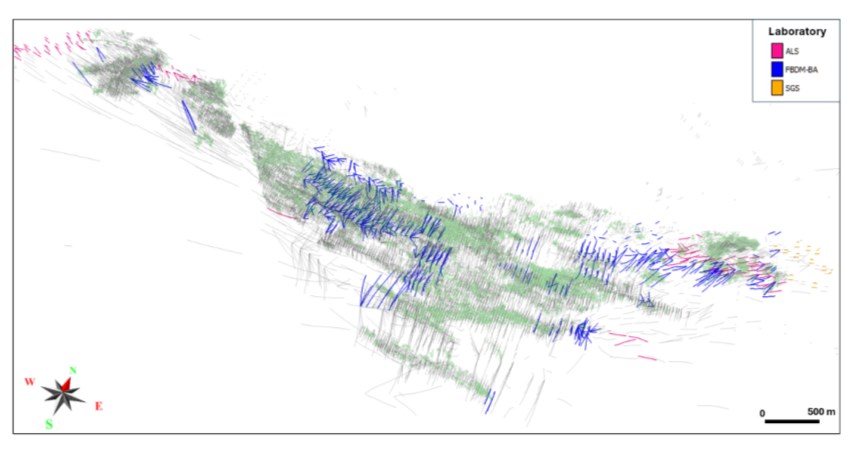

| Figure 12-1: Drill Holes Assayed between 2021 and 2023-Current Drilling Definition (in Light Grey), Resource Stopes (in Green) at $2,000/oz | 12-3 |

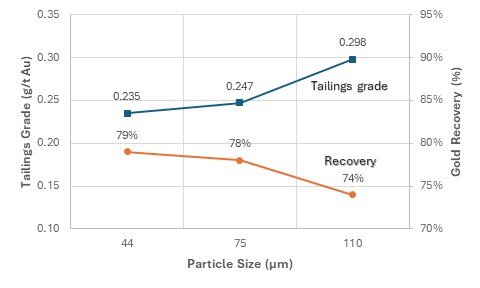

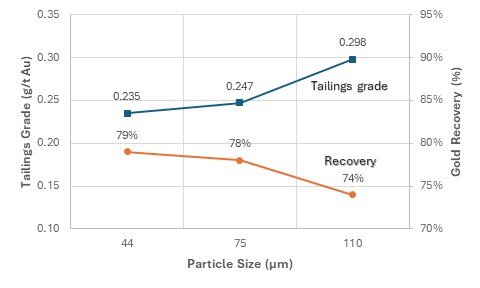

| Figure 13-1: Influence of Grind Size (P80) on Gold Recovery | 13-3 |

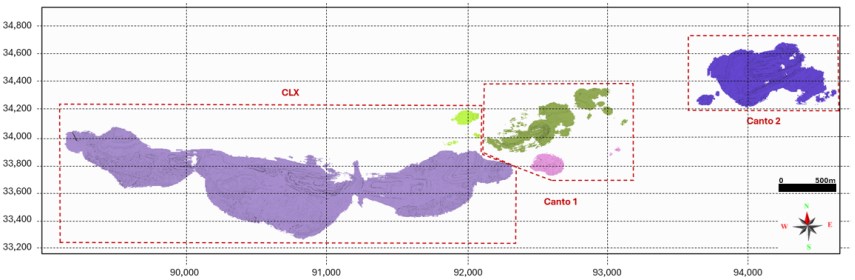

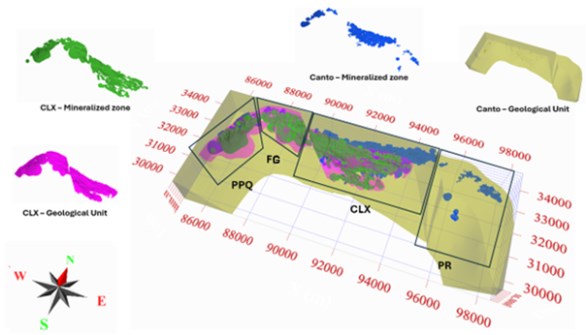

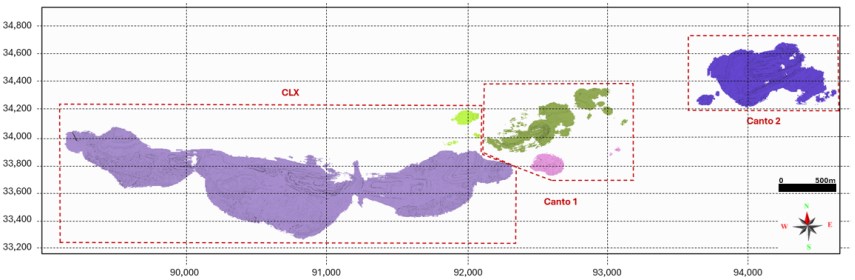

| Figure 14-1: Fazenda Deposit Block Model Locations | 14-2 |

| Figure 14-2: Deposits in the CL Block Model Area | 14-3 |

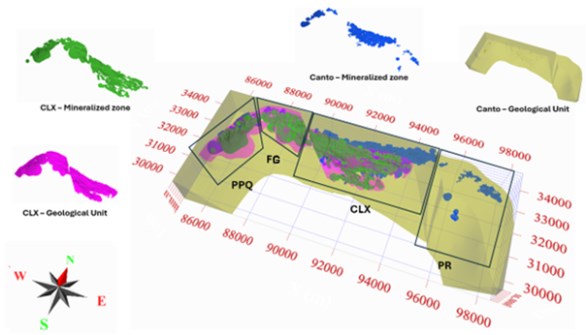

| Figure 14-3: Geological Model of PPQ, F&G, CLX, and PR Deposits | 14-9 |

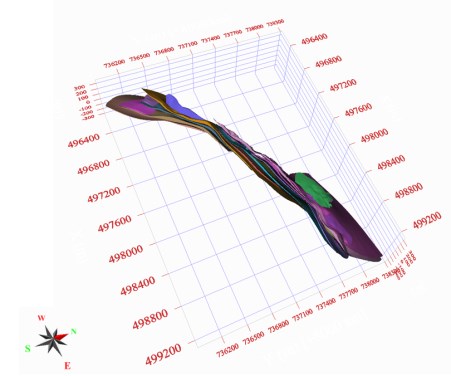

| Figure 14-4: CLX and Canto Mineralized Zones, Showing the Location of the PPQ, F&G, CLX, and PR Deposits | 14-10 |

| Figure 14-5: Mineralized Zones in Barrocas SW and Barrocas Deposits | 14-10 |

| Figure 14-6: Mineralized Zones-Lagoa Do Gato | 14-11 |

| Figure 14-7: Buffer Zone Around the Mineralized Zones-CLX Deposit (Section: X=91,992 m) | 14-12 |

| Figure 14-8: Cross-Section of the Lago Do Gato (LG) Block Model | 14-21 |

| Figure 14-9: Cross-Section of the Barrocas (BR) Block Model | 14-22 |

| Figure 14-10: Cross-Section of the Barrocas SW (BS) Block Model | 14-23 |

| Figure 14-11: Cross-Section of the Papagaio & Raminhos (PR) Block Model | 14-24 |

| Figure 14-12: Cross-Section of the Pau-a-Pique (PP) Open Pit Block Model | 14-25 |

| Figure 14-13: Cross-Section of the Pau-a-Pique (PP) Underground Block Model | 14-26 |

| Figure 14-14: Cross-Section of the F&G (FG) Open pit Block Model | 14-27 |

| Figure 14-15: Cross-Section of the F&G (FG) Underground Block Model | 14-28 |

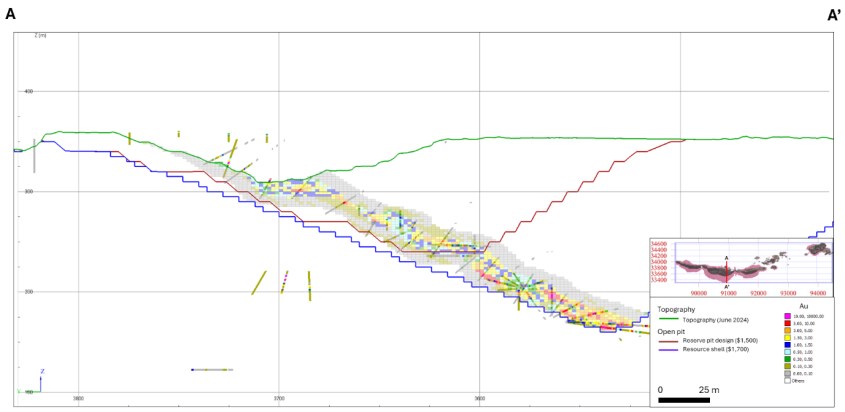

| Figure 14-16: Cross-Section of the CLX (CL) Open Pit Block Model | 14-29 |

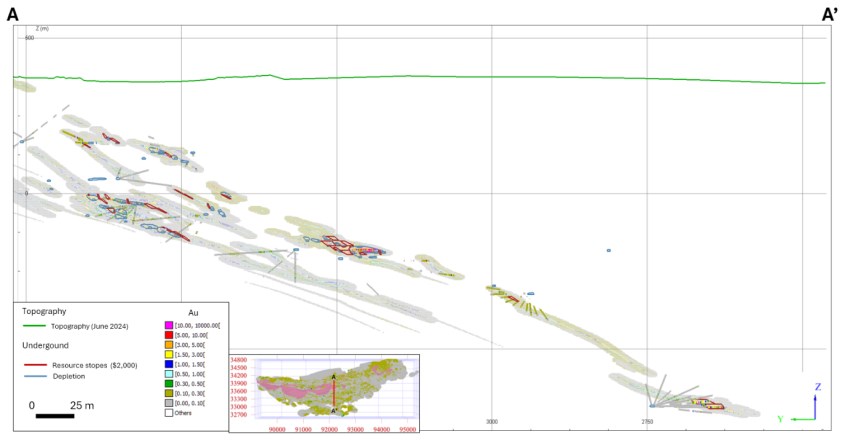

| Figure 14-17: Cross-Section of the CLX (CL) Underground Block Model | 14-30 |

| Figure 14-18: An Example of Swath Plots-CLX Underground Model | 14-31 |

| Figure 14-19: Waterfall Showing an Increase of Ounces Between 2021 MRE and 2024 MRE (Measured and Indicated) | 14-38 |

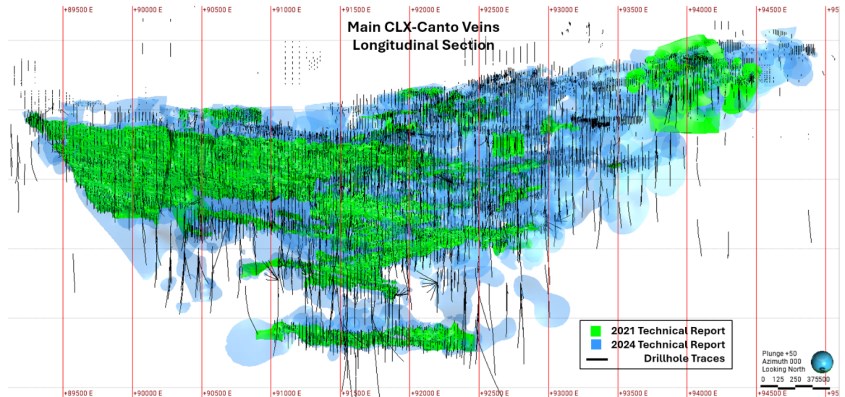

| Figure 14-20: Comparison of Mineralized Wireframes used for the 2021 and 2024 Technical Reports | 14-39 |

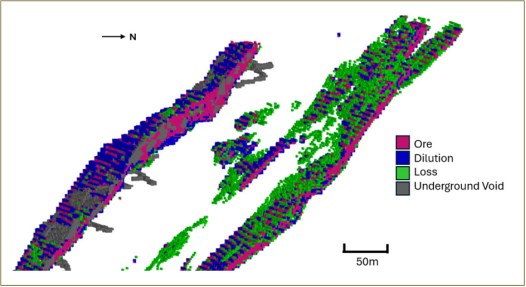

| Figure 15-1: Cross-Section View of Regularized Open Pit Block Model Showing Dilution and Losses | 15-5 |

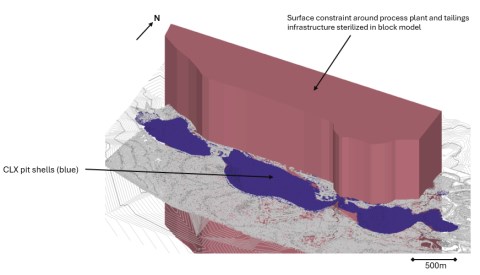

| Figure 15-2: Isometric View of Plant and Tailings Surface Infrastructure Constraint on CLX Pit Optimization | 15-9 |

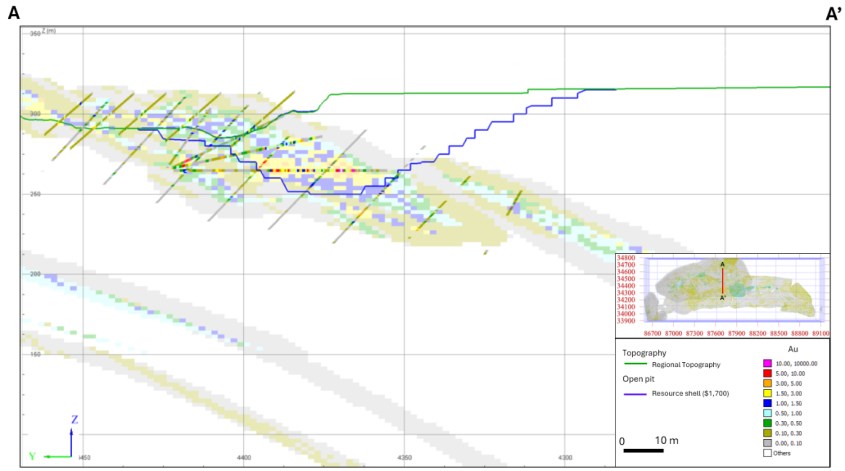

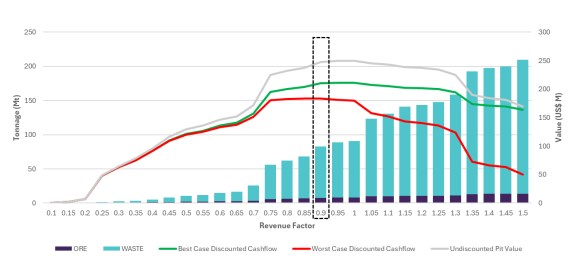

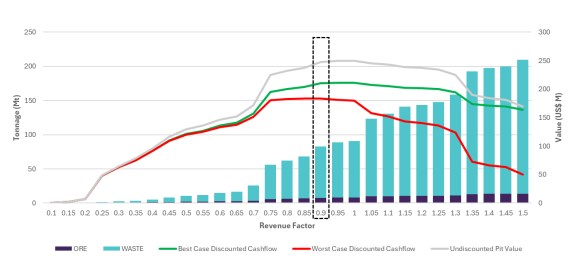

| Figure 15-3: CLX Open Pit Optimization Results | 15-10 |

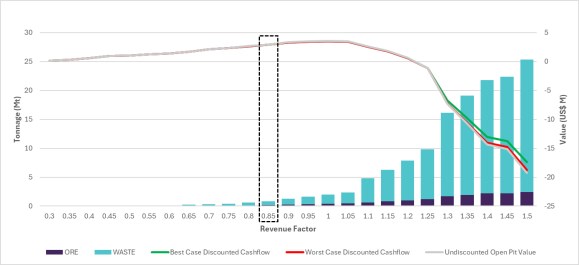

| Figure 15-4: Canto 1 Open Pit Optimization Results | 15-11 |

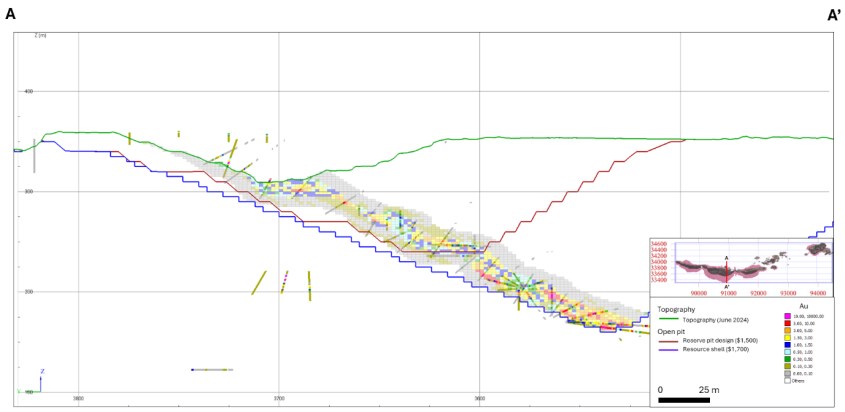

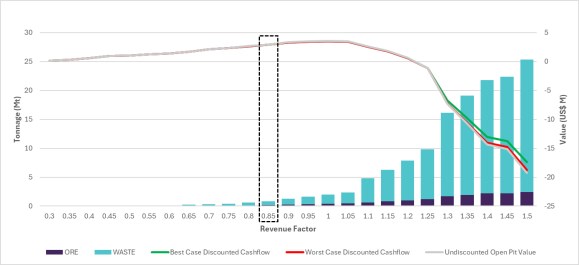

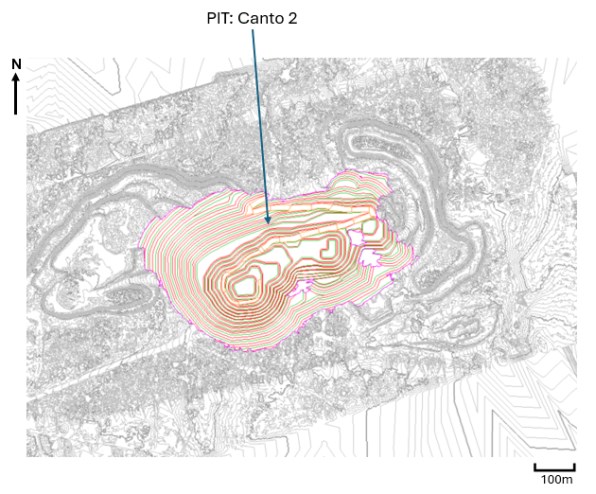

| Figure 15-5: Canto 2 Open Pit Optimization Results | 15-12 |

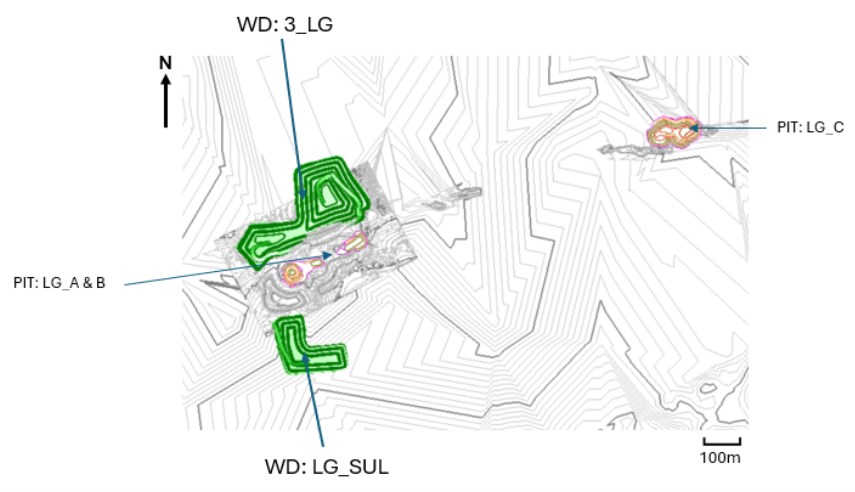

| Figure 15-6: LG Open Pit Optimization Results | 15-13 |

| Figure 15-7: G Open Pit Optimization Results | 15-14 |

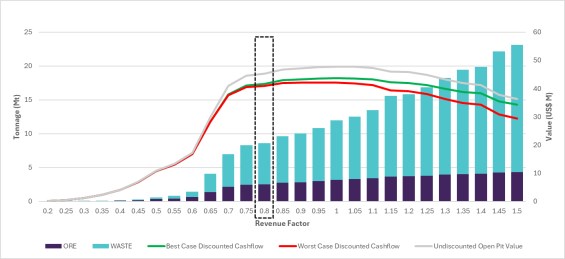

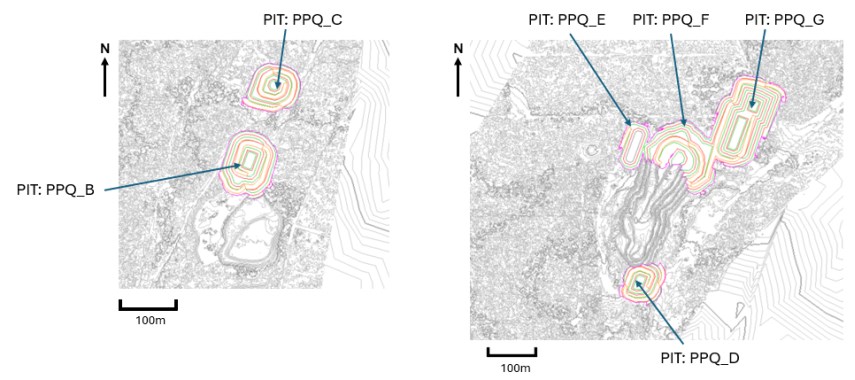

| Figure 15-8: PPQ Open Pit Optimization Results | 15-16 |

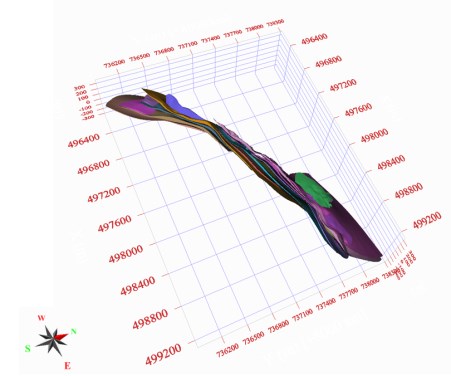

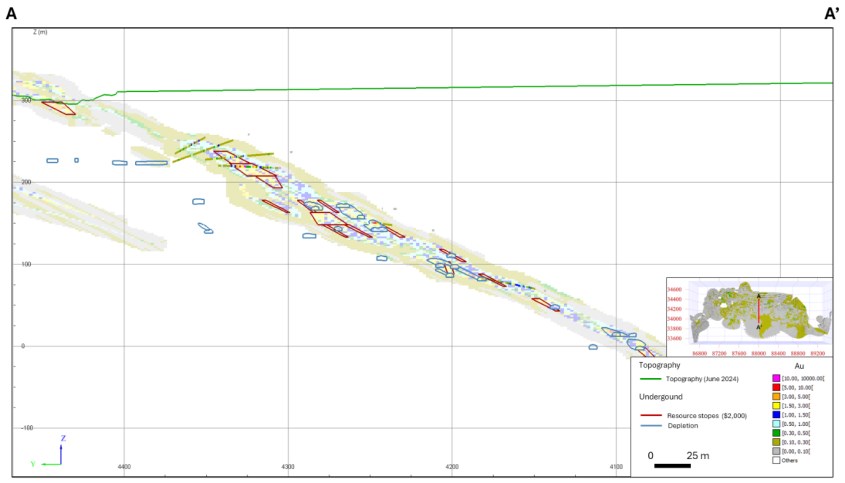

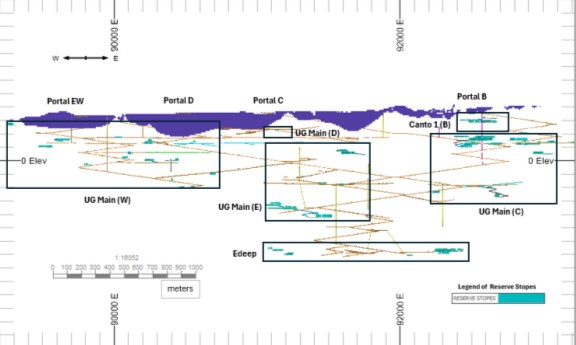

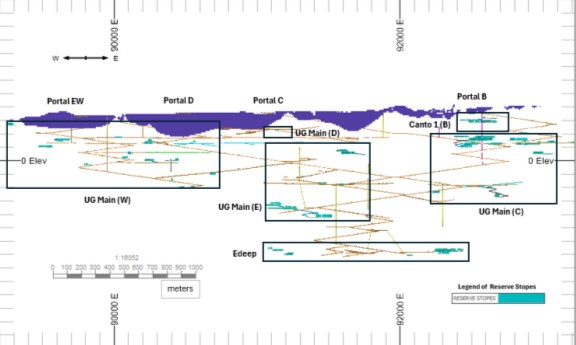

| Figure 15-9: Underground Mineral Reserves for Main, Edeep, and Canto 1 | 15-19 |

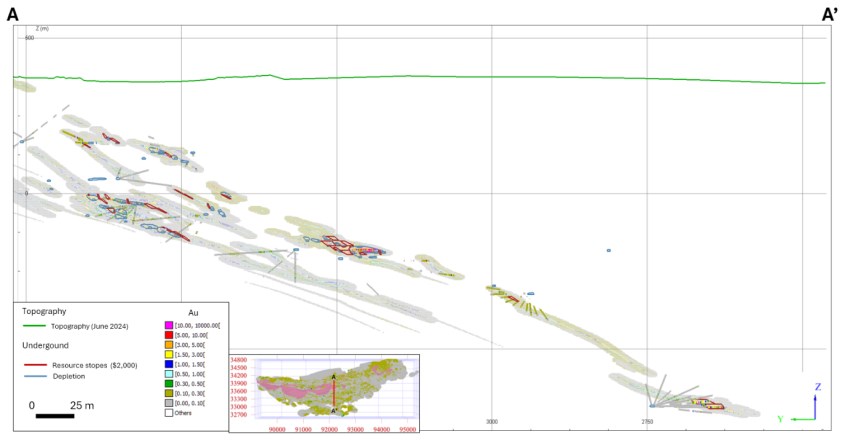

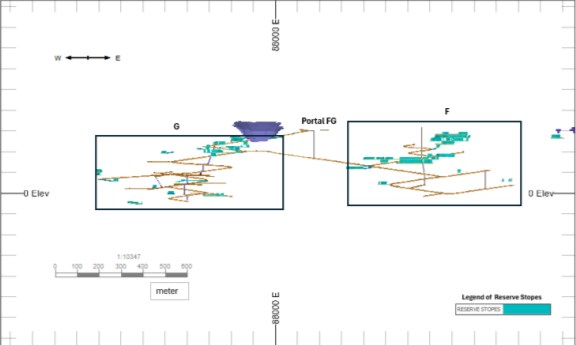

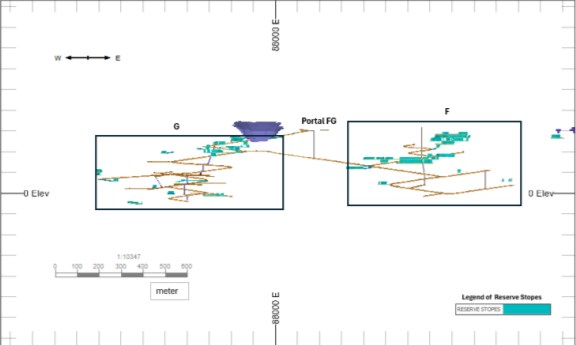

| Figure 15-10: Underground Mineral Reserves for F and G | 15-20 |

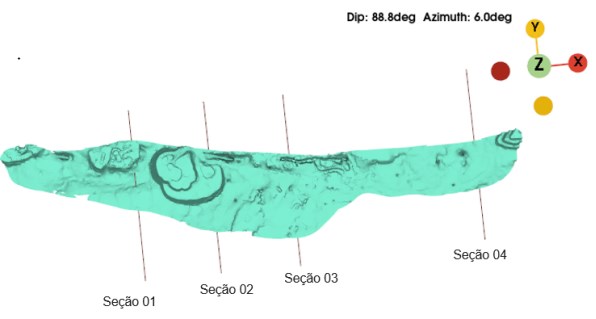

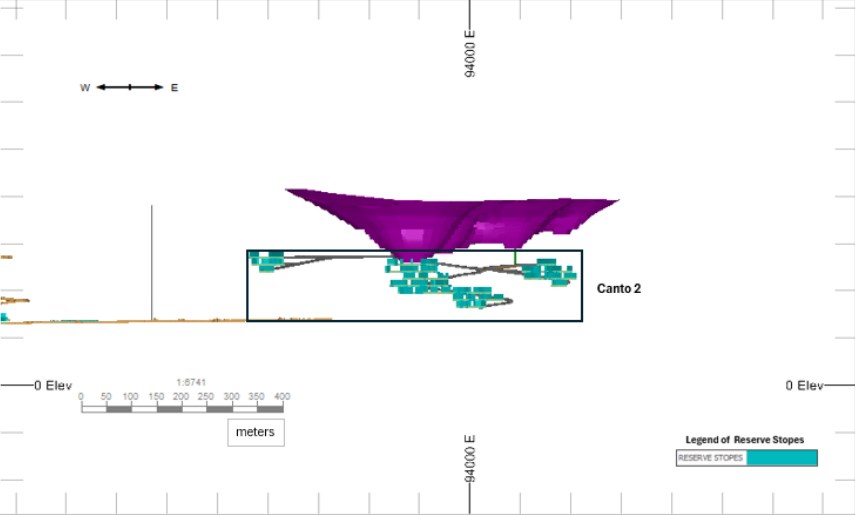

| Figure 15-11: Underground Mineral Reserves for Canto 2 | 15-20 |

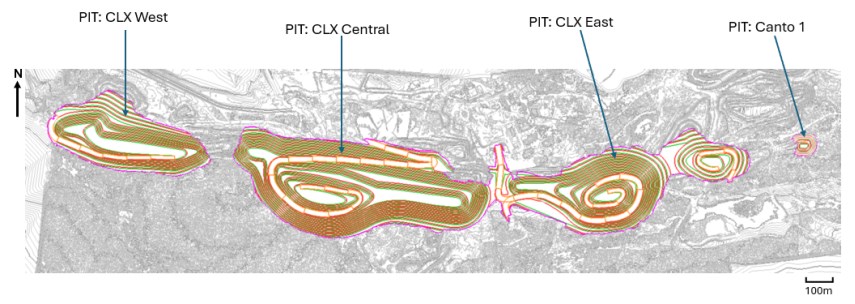

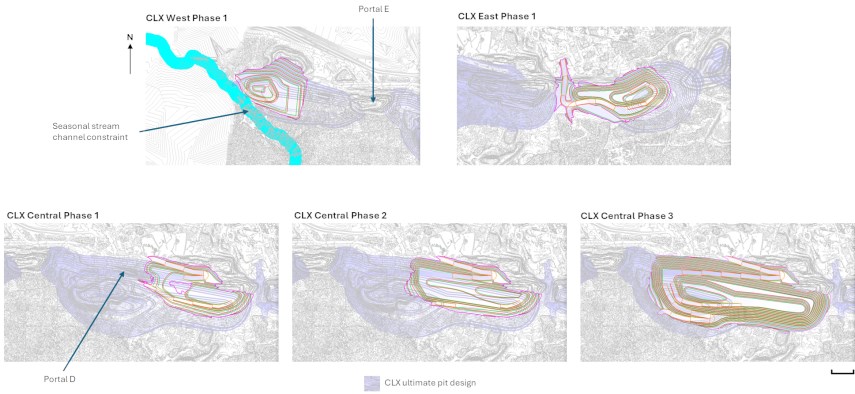

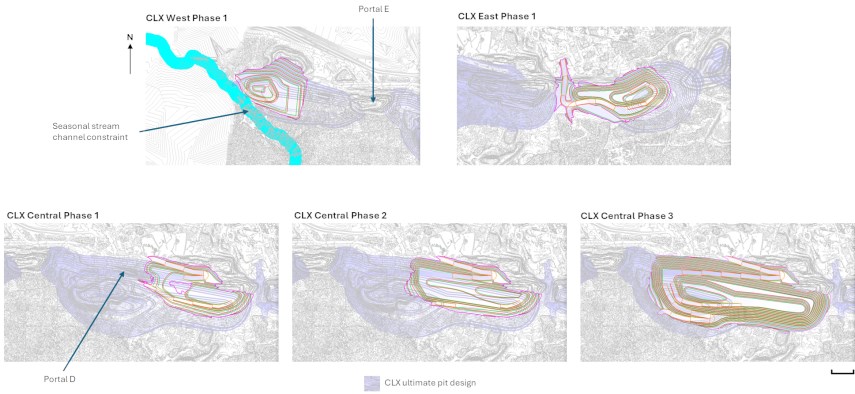

| Figure 16-1: CLX and Canto 1 Pit Designs | 16-2 |

| Figure 16-2: CLX Pit Intermediate Phase Designs | 16-3 |

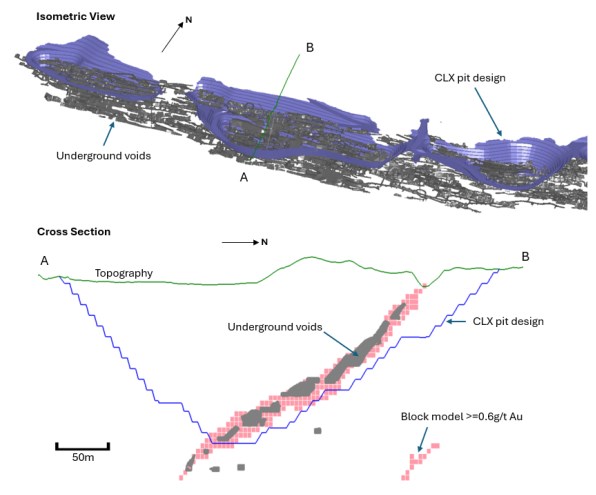

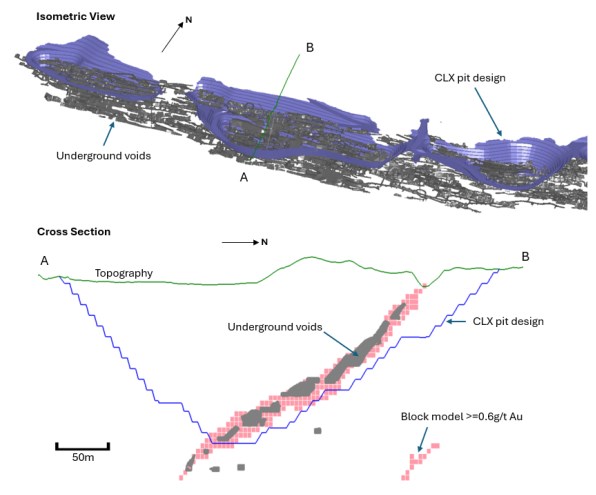

| Figure 16-3: CLX Open Pit-Underground Interaction | 16-4 |

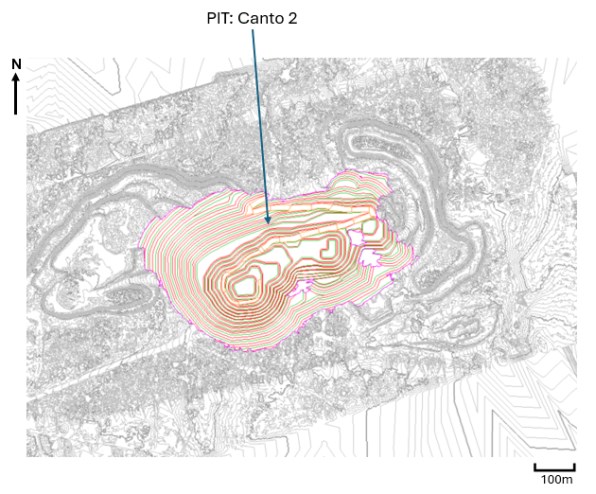

| Figure 16-4: Canto 2 Pit Design | 16-5 |

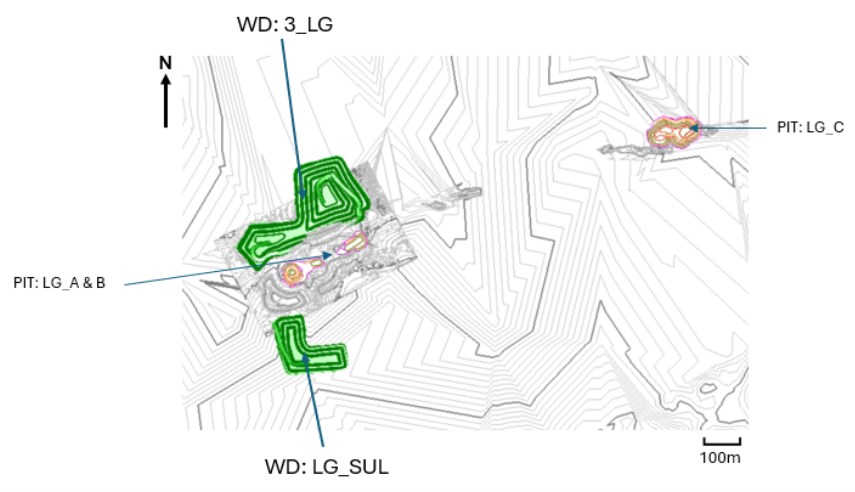

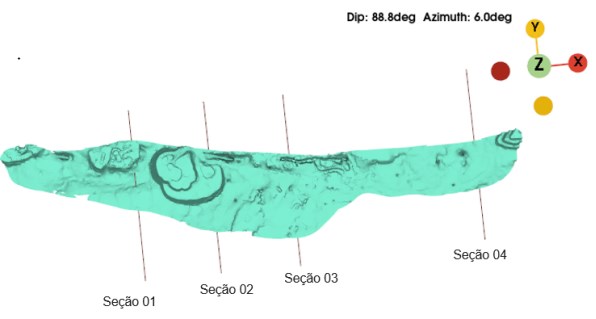

| Figure 16-5: LG Pit Designs | 16-6 |

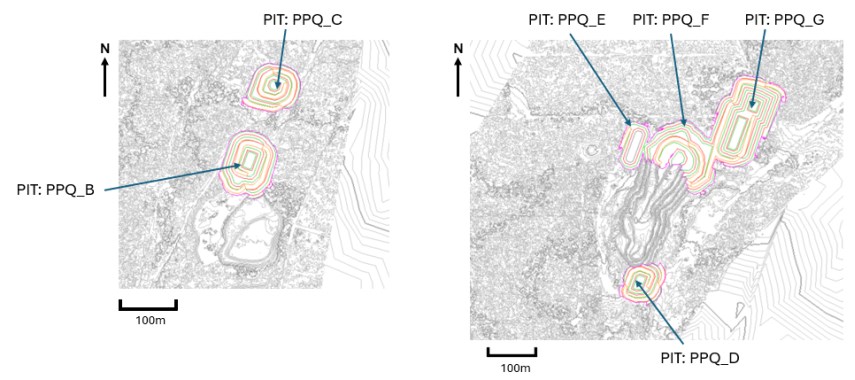

| Figure 16-6: PPQ Pit Designs | 16-7 |

| Figure 16-7: G Pit Designs | 16-8 |

| Figure 16-8: Waste Dump Locations (Main Project Area) | 16-10 |

| Figure 16-9: Waste Dump Locations (LG) | 16-11 |

| Figure 16-10: CLX Pit and Critical Geotechnical Sections | 16-14 |

| Figure 16-11: CLX Pit and Local Infrastructure | 16-15 |

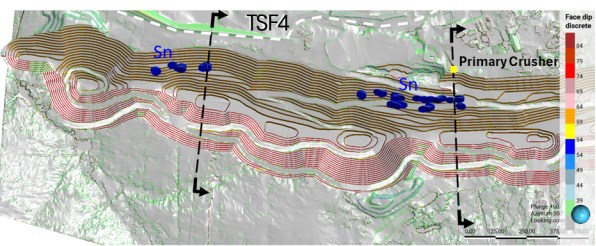

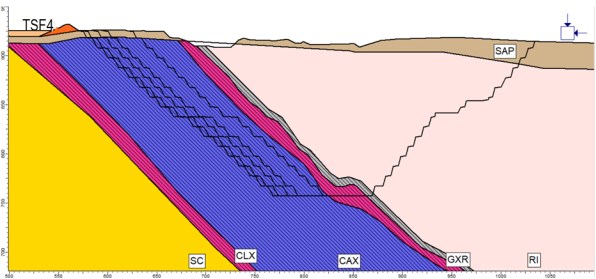

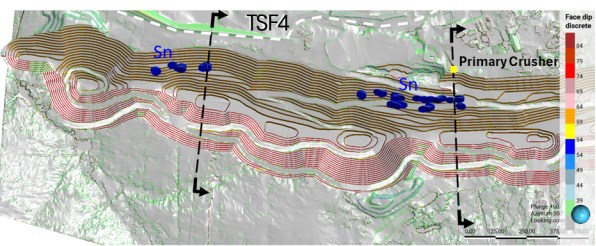

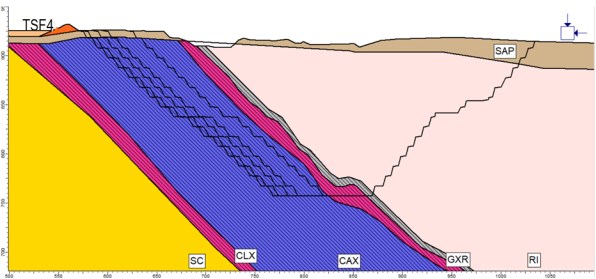

| Figure 16-12: TSF 4 and CLX Pit Section | 16-15 |

| Figure 16-13: Primary Crusher and CLX Pit Section | 16-16 |

| Figure 16-14: CLX Pit and TSF 4 Numerical Analysis with SSR Method | 16-17 |

| Figure 16-15: CLX Pit and Primary Crusher Numerical Analysis with SSR Method | 16-18 |

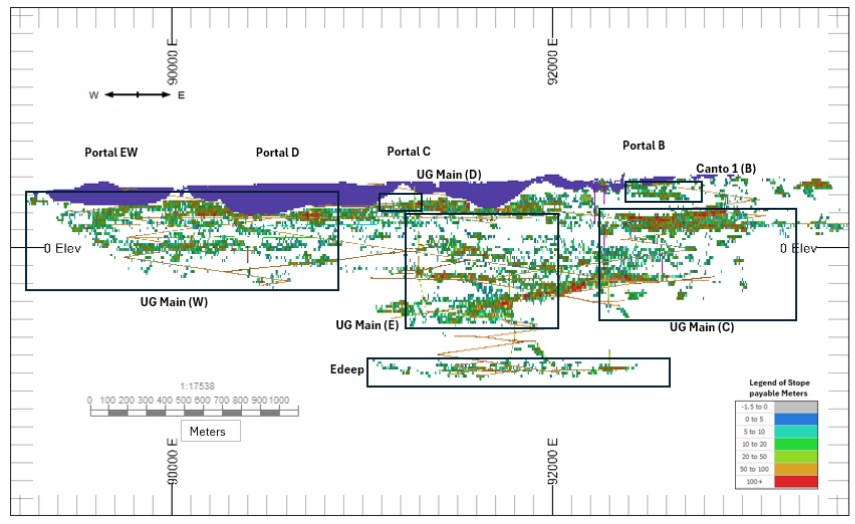

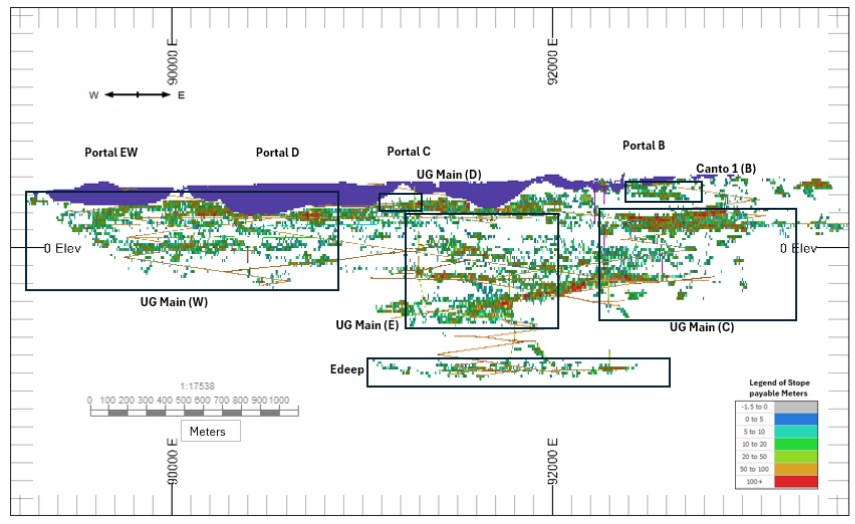

| Figure 16-16: Fazenda Deswik SO Blocks at UG Main, EDEEP and Canto 1 Mining Areas Prior to Depletion and Manual Analysis | 16-21 |

| Figure 16-17: Fazenda Deswik SO Blocks at F and G Mining Areas Prior to Depletion and Manual Analysis | 16-22 |

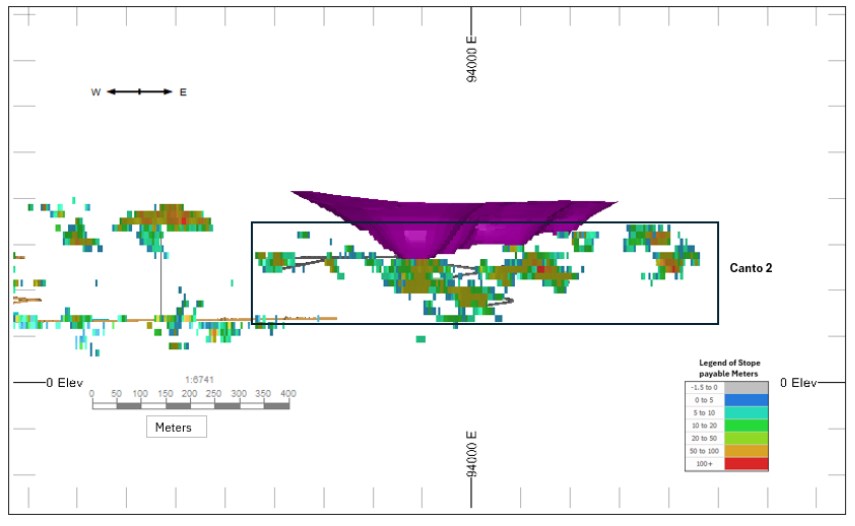

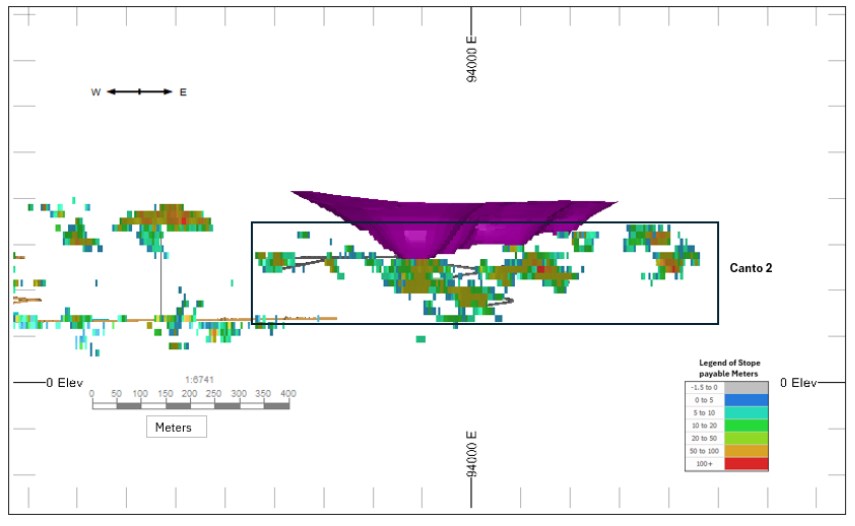

| Figure 16-18: Fazenda Deswik SO Blocks at Canto 2 Prior to Depletion and Manual Analysis | 16-23 |

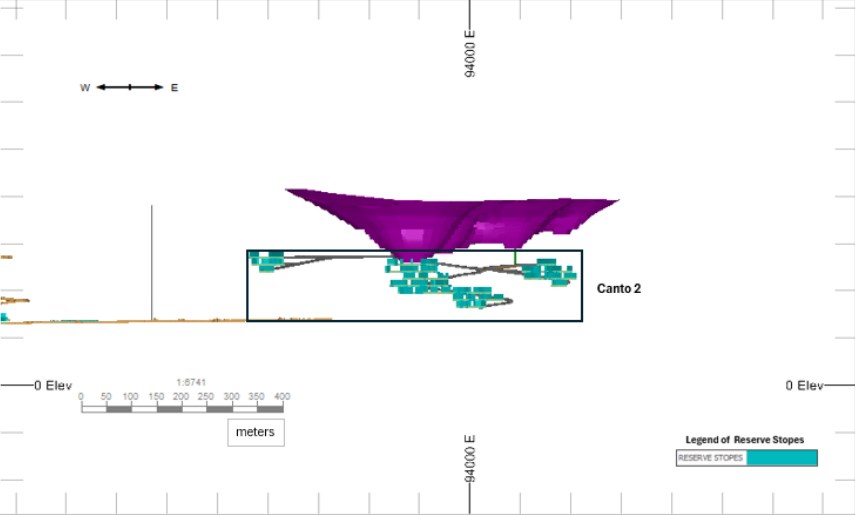

| Figure 16-19: Reserve Blocks for UG Main, Canto 1 and EDEEP Following Depletion Analysis | 16-28 |

| Figure 16-20: Reserve Blocks for F and G Following Depletion Analysis | 16-29 |

| Figure 16-21: Reserve Blocks for Canto 2 Following Depletion Analysis | 16-30 |

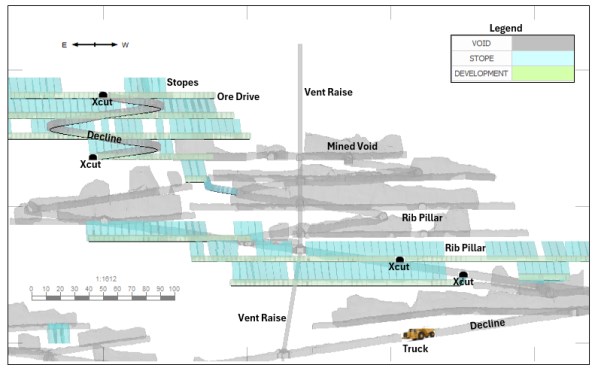

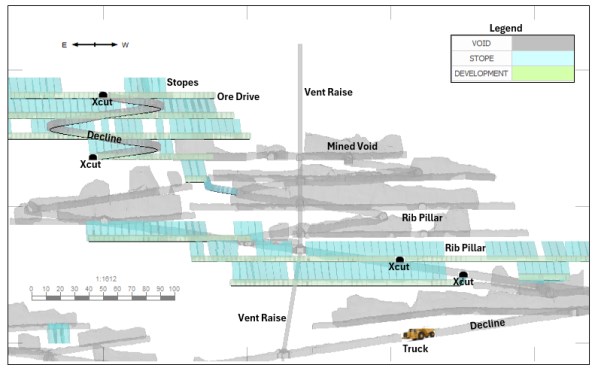

| Figure 16-22: Fazenda FG Underground Development and Stope Mining | 16-31 |

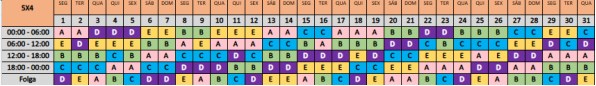

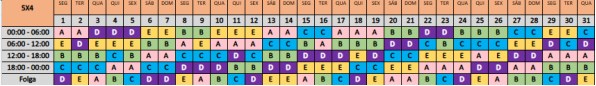

| Figure 16-23: Underground Operators Shift Roster | 16-32 |

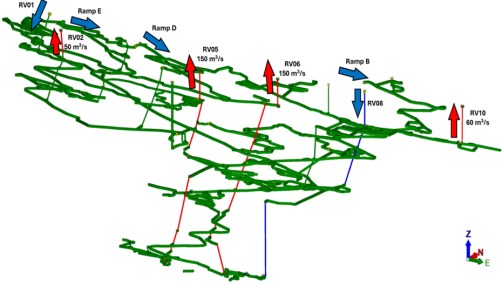

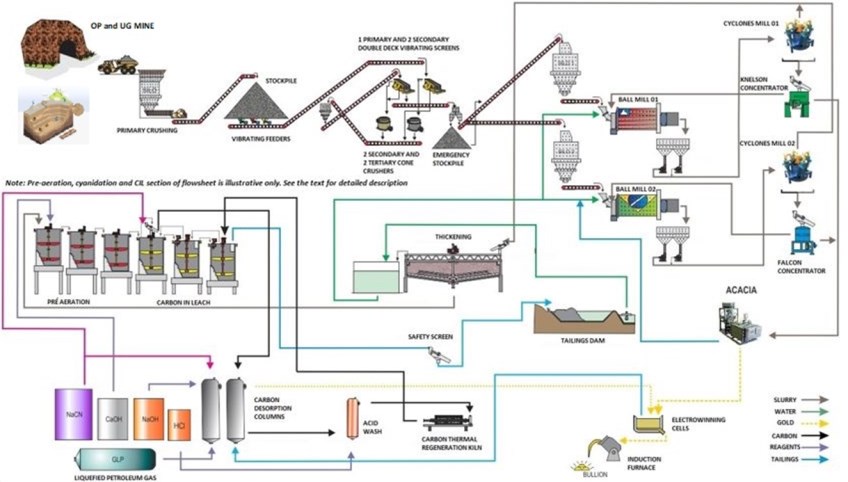

| Figure 16-24: Underground Ventilation Circuit | 16-34 |

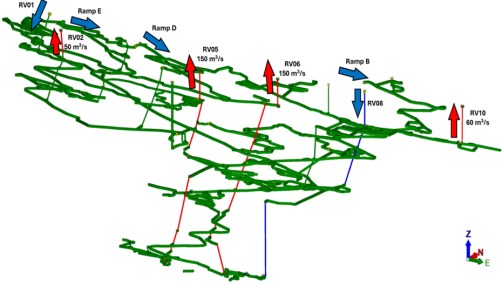

| Figure 16-25: Underground Dewatering Flowchart | 16-35 |

| Figure 16-26: Underground Explosives Magazine | 16-36 |

| Figure 16-27: Typical Development Headings Drill and Blast Pattern | 16-36 |

| Figure 16-28: Total Material Mined by Year | 16-41 |

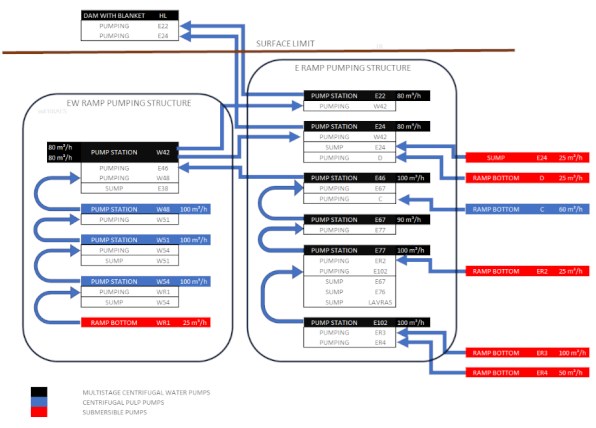

| Figure 17-1: Process Flowsheet | 17-2 |

| Figure 17-2: Mill Production, Budgeted vs. Actual, in 2023 through June 2024 | 17-9 |

| Figure 17-3: Gold Recovery and Gold Grade in 2023 through June 2024 | 17-9 |

| Figure 17-4: Reagent and Grinding Media Consumptions in 2023 through June 2024 | 17-10 |

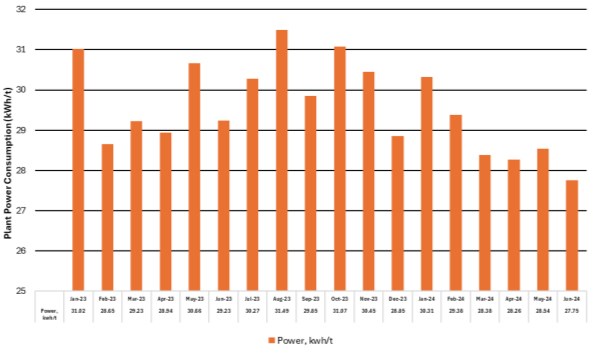

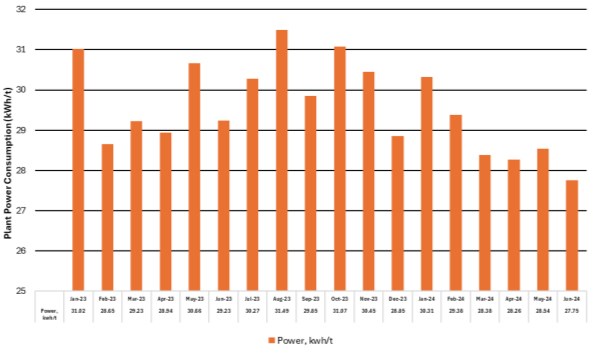

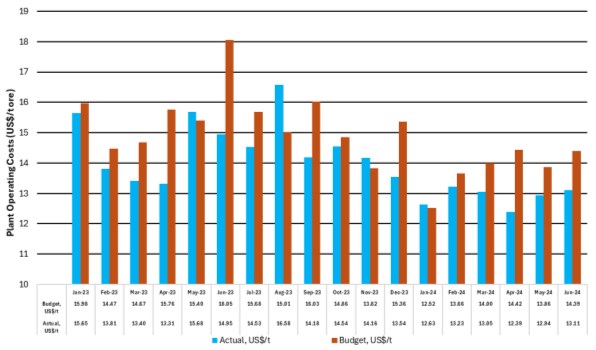

| Figure 17-5: Process Plant Power Consumption from January 2023 through June 2024 | 17-11 |

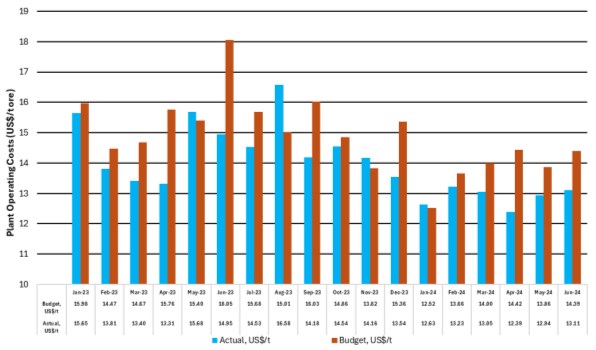

| Figure 17-6: Process Plant Unit Operating Costs from January 2023 through June 2024 | 17-11 |

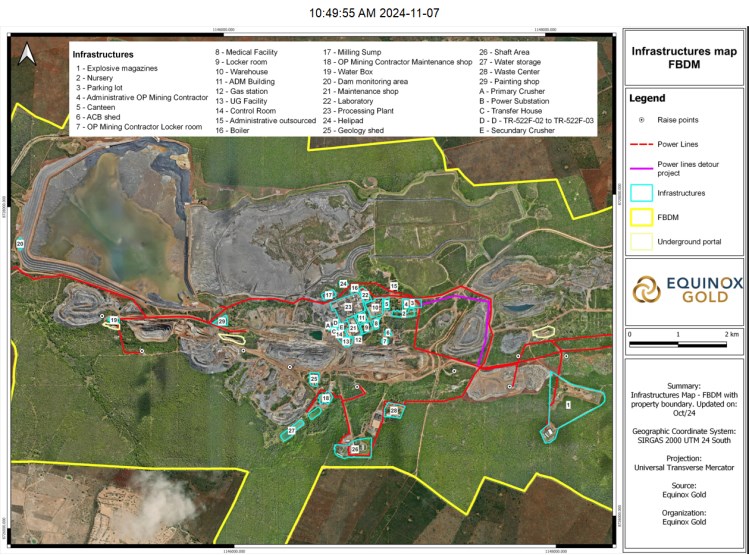

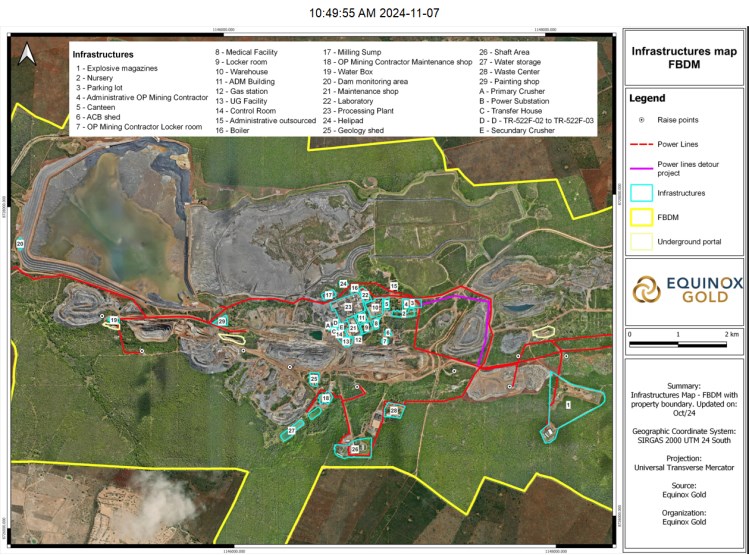

| Figure 18-1: Site Plan and Infrastructure | 18-2 |

| Figure 18-2: Site Photo of Facilities Layout and Infrastructure | 18-3 |

| Figure 18-3: Site Access Roads-Proposed Future Alignments | 18-4 |

| Figure 18-4: Monthly Power Consumption | 18-5 |

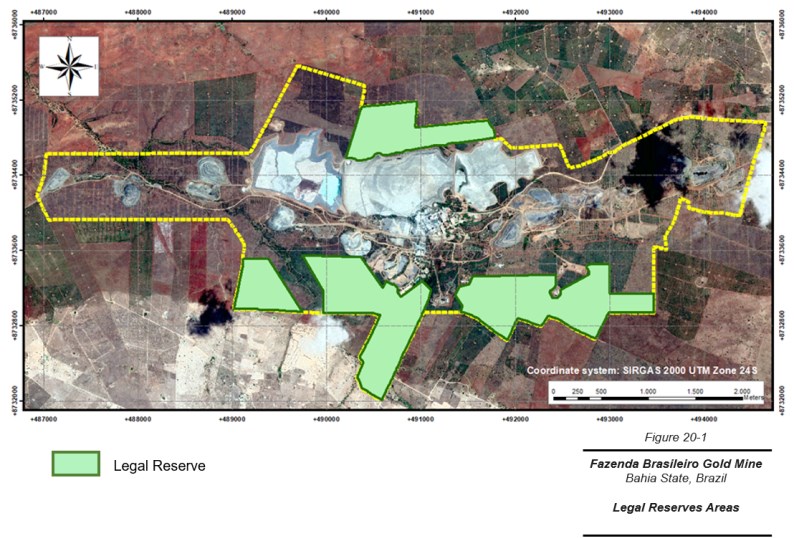

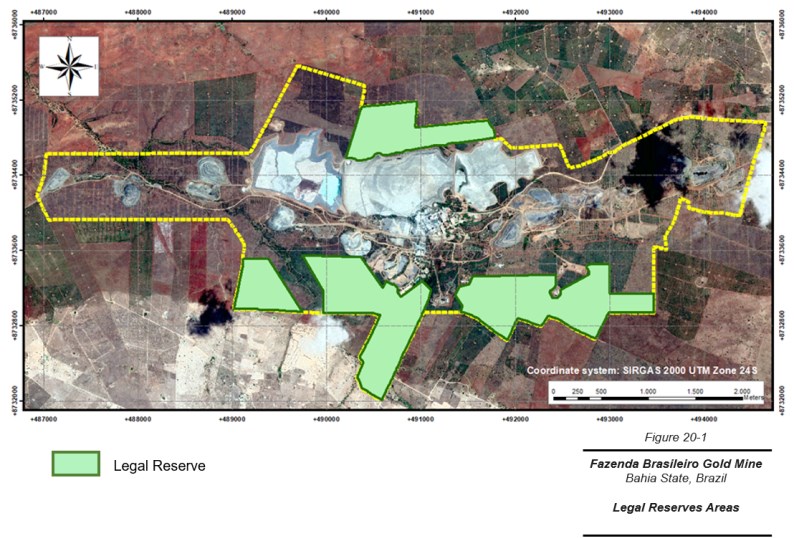

| Figure 20-1: Legal Reserve Areas | 20-3 |

| Figure 20-2: Acid-Base Accounting Characterization | 20-5 |

Abbreviations, Acronyms, and Units of Measure

Abbreviations and Acronyms

| 3-D | Three-dimensional |

| AA | Atomic absorption |

| Ag | Silver |

| ALS | ALS Global |

| AMC | AMC Mining Consultants Canada Ltd. |

| ANM | Agência Nacional de Mineração (Brazilian National Mining Agency) |

| ARD | Acid Rock Drainage |

| Au | Gold |

| BH | Blasthole |

| BR | Barrocas |

| BRSW | Barrocas SW |

| BWi | Ball Mill Work Index |

| CAX | Sericite-chlorite-carbonate schist (also chlorite-carbonate schist) |

| CCTV | Closed circuit television |

| CCX | Carbonate-chlorite schist |

| CIL | Carbon-in-leach |

| CIM | Canadian Institute of Mining, Metallurgy & Petroleum |

| CIM Definitions Standards | CIM Definition Standards for Mineral Resources and Mineral Reserves |

| CIP | Carbon-in-pulp |

| CLX | chlorite-magnetite schist (also magnetic quartz-chlorite schist; also quartz-chlorite schist) |

| CLX1 | Uppermost chlorite-magnetite schist |

| CLX2 | structurally lower chlorite-magnetite schist |

| COG | Cut-off grade |

| CRM | Certified reference material |

| CVRD | Companhia Vale do Rio Doce |

| D1 | First deformation event |

| D2 | Second deformation event |

| D3 | Third deformation event |

| D4 | Fourth deformation event |

| DD | Diamond drilling |

| DDH | Diamond drill-hole |

| DTEM | Digital terrain elevation model |

| EL | Exploration License |

| Equinox Gold | Equinox Gold Corp. |

| F2 | large-scale, asymmetric, tight to open folds |

| FBDM | Fazenda Brasileiro Desenvolvimento Mineral |

| FVU | Felsic volcanic unit |

| FW | Footwall |

| GPS | Global Positioning System |

| GRG | Gravity-recoverable gold |

| GRX | Graphitic schist hanging-wall marker horizon |

| HDPE | High-density polyethylene |

| HW | Hanging wall |

| IDW2 | Inverse distance weighting to the second power |

| IDW3 | Inverse distance weighting to the third power |

| Inco | Riacho do Inco unit |

| INEMA | Institute of Environment and Water Resources |

| LG | Lagoa do Gato |

| LHD | Load-haul-dump |

| LIMS | Laboratory information management system |

| LOM | Life-of-Mine |

| LUC | Local uniform conditioning |

| LVA | Locally varying anisotropy |

| M1 | Early oceanic sea-floor hydrothermal alteration metamorphism event |

| M2 | Regional metamorphism event |

| M3 | Local metamorphism event |

| MCP | Mine Closure Plan |

| Mine Lab(oratory) | Fazenda mine in-house laboratory |

| MRE | Mineral Resource estimate |

| MVU | mafic volcanic unit |

| NI 43-101 | National Instrument 43-101-Canadian Standards of Disclosure for Mineral Projects |

| NN | Nearest neighbour |

| OCH | Outcrop channel |

| OK | Ordinary kriging |

| PPE | Personal protective equipment |

| PR | Papagaio & Raminhos |

| PVC | Polyvinyl chloride |

| QA/QC | Quality assurance/quality control |

| QP | Qualified Person |

| RAB | Rotary air blast |

| RC | Reverse circulation |

| RF | Revenue factor |

| RIGB | Rio Itapicuru Greenstone Belt |

| RPA | Roscoe Postle Associates Inc. |

| S | Sulfur |

| SD | Standard deviation |

| SG | Specific gravity |

| SRF | Stress reduction factor |

| SSR | Shear-strength reduction |

| Technical Report | Technical Report on the Fazenda Gold Mine, Bahia State, Brazil |

| TOC | Total organic carbon |

| TR | Trench |

| TSF | Tailings storage facility |

| UTM | Universal Transverse Mercator |

| WGM | Watts, Griffis and McQuat Limited |

| Wi | Hardness |

| Yamana | Yamana Gold Inc. |

Units of Measure

| ɸ | Friction angle |

| µm | Micron (10−6 metre) |

| ′ | Minute |

| ″ | Inch |

| $ | U.S. dollar |

| $ M | Million dollars |

| $/oz | Dollars per troy ounce |

| $/t | Dollars per tonne |

| $/10 m | Dollars per 10 metres |

| ° | Degree |

| °C | Degree Celsius |

| cm | Centimetre |

| g | Gram |

| g/cm3 | Gram per cubic centimetre |

| g/L | Grams per litre |

| g/t Au | Grams of gold per tonne |

| g/t | Grams per tonne |

| Ga | Billion years |

| h | Hour |

| h/d | Hours per day |

| ha | Hectare |

| k | Thousand (kilo) |

| kg | Kilogram |

| kg/h | Kilograms per hour |

| kg/t | Kilograms per tonne |

| km | Kilometre |

| km2 | Square kilometre |

| koz | Thousands of troy ounces |

| kPa | Kilopascal |

| kt | Kilotonne |

| kt/a | Kilotonnes per annum |

| kV | Kilovolts |

| kW | Kilowatt |

| kWh | Kilowatt hour |

| kWh/t | Kilowatt hour per tonne |

| L | Litre |

| m | Metre |

| m2 | Square metre |

| m3 | Cubic metre |

| m³/h | Cubic metre per hour |

| masl | Metres above sea level |

| mg/L | Milligram per litre |

| mm | Millimetre |

| M | Million |

| Mm3 | Million cubic metres |

| Moz | Million troy ounces |

| Mt | Million tonnes |

| Mt/a | Million tonnes per annum |

| MW | Megawatt |

| oz | Troy ounce (31.10348 grams) |

| P80 | 80% passing |

| ppm | Parts per million |

| t | Tonne (1,000 kg) (metric ton) |

| t/d | Tonnes per day |

| t/m3 | Tonnes per cubic metre |

| ton | Short ton |

| V | Volt |

| w:o | Ratio of waste to ore |

1 Summary

1.1 Executive Summary

Equinox Gold Corp. (Equinox Gold) has prepared this report titled Technical Report on the Fazenda Gold Mine, Bahia State, Brazil (Technical Report), dated January 31, 2025, and with an effective date of June 30, 2024, under the guidance and supervision of several internal and independent Qualified Persons (QP).

The Technical Report provides an update on the Mineral Resources (reported both inclusive and exclusive of Mineral Reserves) and Mineral Reserves as of June 30, 2024. This Technical Report conforms to National Instrument 43‐101 Standards of Disclosure for Mineral Projects (NI 43-101), effective June 09, 2023. QPs carried out site visits between October 2023 and April 2024.

This Technical Report also supersedes the previous technical report that Equinox Gold prepared, titled NI 43-101 Technical Report on the Fazenda Brasileiro Gold Mine, Bahia State, Brazil, with an effective date of December 31, 2020, and a published date of October 22, 2021.

The Fazenda mine is operated by Fazenda Brasileiro Desenvolvimento Mineral (FBDM), a wholly owned Brazilian-domiciled subsidiary of Equinox Gold. Equinox Gold is a publicly listed Canadian mining company with significant gold-producing, development, and exploration-stage properties in Canada, U.S.A., Brazil, and Mexico. Gold production in 2023 totalled approximately 564 koz.

Fazenda has been operational since 1984, starting as a heap leaching operation. Carbon-in-pulp (CIP) milling facilities were added in 1988, and the process plant was subsequently converted to use pre-aeration with carbon-in-leach (CIL). Historically, it was primarily an underground mine with supplementary small open pits; however, it is now transitioning to primarily open pit operations following successful shallow exploration and a higher gold price environment. For the future mine life, 82% of the total 13.1 Mt of ore will be sourced from open pits, and 18% from underground over 9.5 years (mid-2024 to 2033). In 2023, 1.43 Mt of ore were processed, producing 66 koz Au, with 61% of the ore sourced from the underground mine and 39% from open pits.

The plant is scheduled to process approximately 3,945 t/d (1.44 Mt/a) and will recover 683 koz Au over the remaining mine life, which extends to 2033. Fazenda's gold production from 1984 through the end of June 2024 has totalled 3.58 Moz Au.

All currency in this report is given in United States dollars ($) unless otherwise noted.

Table 1-1 summarizes the Mineral Resource estimate exclusive of Mineral Reserves, as of June 20, 2024. Table 1-2 summarizes the updated Mineral Reserve estimates as of June 30, 2024. The Mineral Resource and Mineral Reserve estimates conform to Canadian Institute of Mining, Metallurgy and Petroleum (CIM) CIM Definition Standards for Mineral Resources & Mineral Reserves (CIM Definition Standards), dated May 10, 2014 (CIM, 2014).

Table 1-1: Mineral Resources Summary (Exclusive of Reserves) as at June 30, 2024

Category | Tonnage

(kt) | Gold Grade

(g/t) | Contained Gold

(koz) |

Measured | | | |

Underground | 12,646 | 2.49 | 1,014 |

Open Pit | 5,772 | 1.80 | 334 |

Total Measured | 18,418 | 2.28 | 1,348 |

Indicated | | | |

Underground | 2,302 | 2.01 | 149 |

Open Pit | 698 | 1.23 | 28 |

Total Indicated | 3,000 | 1.83 | 176 |

Measured + Indicated | | | |

Underground | 14,948 | 2.42 | 1,163 |

Open Pit | 6,470 | 1.74 | 361 |

Total Measured + Indicated | 21,418 | 2.21 | 1,524 |

Inferred | | | |

Inferred-Underground | 2,088 | 2.29 | 154 |

Inferred-Open Pit | 2,593 | 1.35 | 113 |

Total Inferred | 4,681 | 1.77 | 266 |

Notes:

- The CIM Definition Standards (CIM, 2014) were followed for the classification of Mineral Resources.

- Mineral Resources are reported exclusive of Mineral Reserves.

- Open pit Mineral Resources are reported within conceptual pit shells at a cut-off grade of 0.5 g/t Au, based on a gold price of $1,700/oz, mining cost of $1.79/t to $2.70/t, processing cost of $14.60/t, G&A cost of $4.69/t, recovery of 75% to 90%, and an exchange rate of R$4.80:US$1.00

- Underground Mineral Resources are reported within conceptual stope shapes based on a gold price of $2,000/oz, mining cost of $36.20/t, processing cost of $14.60/t, G&A cost of $4.69/t, recovery of 86% to 90%, a cut-off grade of 1.0 g/t Au, and an exchange rate of R$4.80:US$1.00.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Benoit Poupeau, FAusIMM (CP), a QP as defined by NI 43-101, who is independent of Equinox Gold, prepared this Mineral Resource estimate (MRE).

- Totals may not sum precisely due to rounding.

Table 1-2: Mineral Reserves Summary as at June 30, 2024

Category | Tonnage

(kt) | Gold Grade

(g/t) | Contained Gold

(koz) |

Proven | | | |

Underground | 1,935 | 1.99 | 124 |

Open Pit | 10,358 | 1.79 | 595 |

Subtotal Proven | 12,293 | 1.82 | 719 |

Probable | | | |

Underground | 462 | 1.90 | 28 |

Open Pit | 386 | 1.27 | 16 |

Stockpile | 20 | 0.99 | 1 |

Subtotal Probable | 868 | 1.60 | 45 |

Total Proven & Probable | 13,161 | 1.80 | 763 |

Notes:

- CIM Definition Standards (CIM, 2014) were followed for Mineral Reserves.

- Mineral Reserves are reported at a cut-off grade of 1.36 g/t Au for underground stoping and 0.43 g/t Au for underground development, at a cut-off grade between 0.54 and 0.66 g/t Au for open pits.

- Mineral Reserves are estimated using an average long-term gold price of $1,500/oz for open pits and $1,800/oz for underground, and an exchange rate of R$4.80:US$1.00.

- A minimum mining width of 2.0 m was used for underground Mineral Reserves.

- The QP for open pit is David Warren, P.Eng., of AMC Mining Consultants (Canada) Ltd.

- The QP for underground is Dominic Claridge, FAusIMM, of AMC Consultants (UK) Limited.

- Mineral Reserves include dilution and mining recovery.

- Numbers may not sum precisely due to rounding.

1.2 Technical Summary

1.2.1 Property Description and Location

The Fazenda mine is located in the eastern part of Bahia State in east-central Brazil, approximately 180 km northwest of the state capital, Salvador. Topographic coordinates of the mine area are 11° 27' south latitude and 39° 05' west longitude.

1.2.2 Land Tenure

The Fazenda property covers an area totalling approximately 58,651 ha, including:

28 Exploration Licenses (EL) covering approximately 33,522 ha

15 Exploration Applications covering approximately 12,909 ha

8 mining permits covering approximately 7,732 ha

3 mining permits in application covering approximately 2,556 ha

- 1 EL with a Final Positive Exploration Report submitted, covering approximately 1,932 ha.

Equinox Gold is not aware of any environmental liabilities on the property. Equinox Gold has all required permits to conduct the proposed work on the property. Equinox Gold is not aware of any other significant factors or risks that may affect access, title, or the right or ability to perform the work program on the property.

1.2.3 History

Companhia Vale do Rio Doce's (CVRD) exploration division, DOCEGEO, has explored the Weber Belt since the late 1960s. Mineralization at Fazenda was discovered in the late 1970s, and the mine entered production in 1984. Leagold Mining Corporation (Leagold) operated the mine from 2018 to 2020, and on March 10, 2020, Equinox Gold acquired Leagold.

1.2.4 Geology and Mineralization

Fazenda is within the Rio Itapicuru Greenstone Belt (RIGB), a 100 km-long, 60 km-wide, north-south-trending volcano-sedimentary belt within the São Francisco Craton. The structural history of the area is complex, with at least three phases of ductile and ductile-brittle deformation followed by late brittle faulting.

Fazenda is an epigenetic, structurally controlled, and hydrothermally altered Precambrian quartz-vein-hosted lode-gold deposit that has been subjected to greenschist facies metamorphism. The main gold mineralization is sulphide-bearing quartz veining associated with multiple deformation events. These vein systems vary in true width from 1.5 to 40 m, and horizontal s widths vary from 3 to 40 m. The regional strike of mineralization is north-south, while locally the veins are generally arcuate in an east-west trend, and south dipping at 40° to 70°, with a shallow-to-moderate east plunge. However, the plunge is quite variable, with some zones plunging westerly.

1.2.5 Exploration Status

The district has seen approximately 60 years of geological exploration along the mine trend, which has consistently identified new underground and open pit Mineral Resources. Exploration potential still exists along strike, at depth, and between historical open pits and stopes. Recent exploration at Fazenda has been focused on diamond and RC drilling to replace depleted Mineral Reserves and addition of new Mineral Resources. Drilling was carried out from both the surface and underground and targeted areas between historical open pits, along strike of high-grade underground ore shoots, extending open mineralization, and infill drilling of areas with lower gold grades that are now potentially economic.

Several regional concessions have seen early- to intermediate-stage exploration activity including geologic mapping, outcrop sampling, geophysical surveys, geochemical surveys, and exploration drilling. Both regional and near-mine exploration, including all the above-mentioned activities, continues.

The Fazenda geologic model and mineralization wireframes were rebuilt between 2022 and 2024 with a focus on geological continuity, shear zone architecture, and exploration potential. These new models have allowed for better exploration drill targeting outside of known Mineral Resources.

An aggressive exploration program for 2025, based on the revised geological model and new resource estimate, has been approved that includes a high-resolution aeromagnetic survey, geologic mapping, soil sampling at several prospects, and approximately 65,000 m of near-mine diamond drilling from both underground and surface.

1.2.6 Metallurgical Testing

Gold-bearing ore is processed at an average grind size of P80 75 µm and at an average recovery rate of 90.6%. A series of process improvements was implemented in 2019, 2020, and 2021 to improve the gold extraction efficiency as the feed grade decreased each year.

To reduce gold-recovery losses with more carbonaceous ore in the blend, kerosene is now used, which enables a gold-recovery increase of approximately 2%. A pre-aeration tank was transformed into a pre-lime tank and, at a dosage of pH 10.2, increased the effectiveness of lead nitrate addition. This change resulted in an approximately 10% reduction in cyanide consumption and an approximately 2% increase in gold recovery.

A grind size of P80 75 µm is targeted to enhance gold recovery; hence, the following process modifications have been carried out:

- Reducing the hydrocyclones apexes from 110 to 100 mm.

FBDM investigated an increase of the dissolved oxygen in the pre-aeration tanks to improve gold dissolution and thereby increase gold recovery. The testwork entailed dosing hydrogen peroxide in the pre-aeration tanks at 200 g/t.

The current first step of the elution process is desorption; the second step is acid washing, which removes base metals and scaling compounds such as calcium carbonate and sodium silicate from the carbon after elution. The current elution recovery is approximately 90%.

A new 500 kg/h capacity regeneration kiln was installed in 2021 to more efficiently regenerate the carbon.

Structural refurbishments within the processing area continue to replace support pillars and platforms for the leaching tanks; tanks and channels within the leaching area; and support beams for the desorption and mill buildings.

1.2.7 Mineral Resources

Dr. Benoit Poupeau (independent QP) prepared the Mineral Resource estimate as of June 30, 2024. The QP constructed a three-dimensional (3-D) block model to estimate the Mineral Resources, incorporating data from recent grade-control and exploration drilling Equinox Gold has conducted since 2021. The QP has compiled the Mineral Resources using the topographic surface as of June 30, 2024, summarized in Table 1-1. The Mineral Resources reported in Table 1-1 are exclusive of the Mineral Reserves.

The Mineral Resources for the open pits are reported within conceptual pit shells at a cut-off grade of 0.5 g/t Au and a gold price of $1,700/oz; the Mineral Resources for the underground are reported within conceptual stope shapes based on a cut-off grade of 1.0 g/t Au and a gold price of $2,000/oz.

1.2.8 Mineral Reserves

AMC prepared the Mineral Reserve estimate as of June 30, 2024.

The Mineral Reserves summarized in Table 1-2 were estimated using a cut-off grade of 0.54 to 0.66 g/t Au for open pit operations, with a gold price of $1,500/oz. The underground operations used a cut-off grade of 1.36 g/t Au, with a gold price of $1,800/oz Au.

After considering and applying appropriate modifying factors, the QPs believe that the resulting Measured and Indicated Mineral Resources within the final pits and underground stope designs may be classified as Proven and Probable Mineral Reserves, respectively; moreover, the QPs are not aware of any mining, metallurgical, infrastructure, permitting, or other relevant factors that could materially affect the Mineral Reserve estimate.

1.2.9 Mining Methods

Open Pit

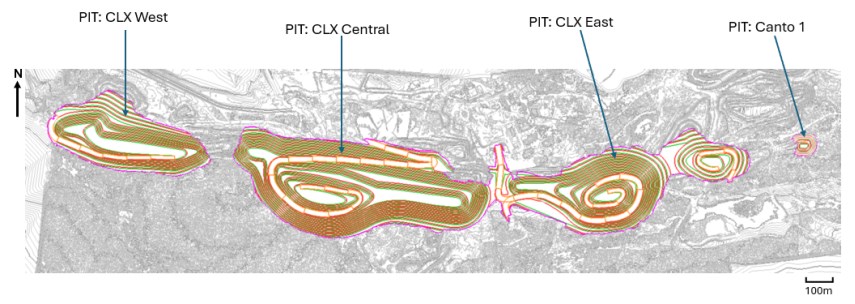

Over the course of the operation's history, several shallow open pits have been excavated to extract near-surface portions of the mineral deposits. Currently, several small open pits are in operation in the CLX area, and initial work has commenced on expanding shallow open pits to include excavating the remaining underground crown pillars. CLX Central, East and West will be the major pits, with Canto 1, Canto 2, PPQ, LG and G to be minor pits. Contractors mine the open pits.

The small pits are being developed using air-track drills and backhoe excavators for mining, and highway-type trucks for haulage to the mill. From 2027 onwards, a larger contractor fleet consisting of 100-ton trucks (i.e., CAT 777 or similar) and appropriately matched loading units (i.e., Hitachi EX2500 for waste and Komatsu EX1250 for ore, or similar) is anticipated for the larger CLX pit. The CLX ultimate pit and phases have been designed appropriately to accommodate the larger fleet size.

Underground

The underground mining method is longhole open stoping (LHOS) from levels accessed via decline development in the mineralization footwall. The stoping areas are accessed via 5 m-wide by 5.5 m-high main haulage ramps developed at a 15% gradient, which lead to primary development crosscuts that are 4.5 m wide by 4.9 m high, and secondary development drifts. Levels are spaced at 20 m vertical intervals. Mined out stopes are not backfilled.

Active underground mining is being undertaken within areas known as Canto 1, UG Main, F, and G. A new underground mine, Canto 2, is planned to be developed following completion of the Canto 2 open pit. Mining operations have a planned dilution of between 15% and 20%. Planned mining recovery is estimated to be 90% for all areas.

From each level, access drifts are developed into the stoping areas. Blastholes are fan-drilled into the mineralization to further define its boundaries and facilitate design of ultimate blast patterns. After blasting, remote-controlled, 10-tonne-capacity load-haul-dump (LHD) machines are used to load and haul the ore from the stoping areas to 38-tonne-capacity haulage trucks at loading points in the sublevels.

Waste rock is generally hauled to surface and deposited in waste rock storage areas but is dumped into empty voids where practicable.

1.2.10 Life-of-Mine Production Schedule

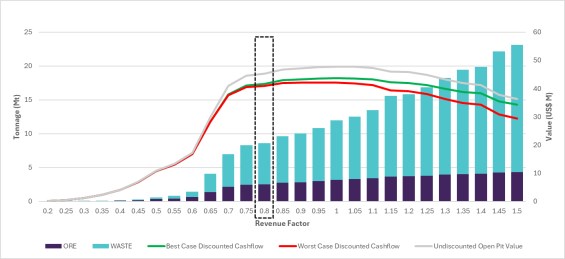

The life-of-mine (LOM) production schedule is presented in Table 1-3. Total ore and waste mined from open pit and underground is shown in Figure 1-1. The plan is reasonable and achievable based on actual recent performance and LOM provisions for equipment and personnel.

Table 1-3: Life-of-Mine Production Schedule (2024 to 2033)

| Unit | Total | Years |

2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

Ore Mined | | | | | | | | | | | | |

Underground | kt | 2,396 | 396 | 772 | 653 | 445 | 131 | - | - | - | - | - |

g/t Au | 1.97 | 2.02 | 2.01 | 2.00 | 1.89 | 1.73 | - | - | - | - | - |

koz Au | 152 | 26 | 50 | 42 | 27 | 7 | - | - | - | - | - |

Open Pit | kt | 10,744 | 132 | 759 | 825 | 995 | 1,297 | 1,440 | 1,442 | 1,314 | 1,427 | 1,113 |

g/t Au | 1.77 | 1.94 | 1.26 | 1.94 | 2.00 | 1.95 | 1.78 | 1.88 | 1.78 | 1.73 | 1.43 |

koz Au | 611 | 8 | 31 | 52 | 64 | 81 | 82 | 87 | 75 | 79 | 51 |

Total Ore Mined | kt | 13,140 | 527 | 1,531 | 1,478 | 1,440 | 1,428 | 1,440 | 1,442 | 1,314 | 1,427 | 1,113 |

g/t Au | 1.81 | 2.00 | 1.64 | 1.97 | 1.97 | 1.93 | 1.78 | 1.88 | 1.78 | 1.73 | 1.43 |

koz Au | 763 | 34 | 81 | 93 | 91 | 88 | 82 | 87 | 75 | 79 | 51 |

Stockpile Balance | | | | | | | | | | | | |

Stockpile | kt | 20 | 20 | 111 | 148 | 148 | 136 | 136 | 138 | 13 | - | - |

g/t Au | 0.99 | 0.87 | 0.84 | 0.84 | 0.80 | 0.80 | 0.80 | 0.80 | 0.00 | - | - |

Processed | | | | | | | | | | | | |

Total Ore Processed | kt | 13,160 | 527 | 1,440 | 1,440 | 1,440 | 1,440 | 1,440 | 1,440 | 1,440 | 1,440 | 1,113 |

g/t Au | 1.80 | 2.00 | 1.69 | 2.00 | 1.97 | 1.92 | 1.78 | 1.88 | 1.69 | 1.72 | 1.43 |

Recovery | % | 90 | 90 | 89 | 90 | 89 | 90 | 90 | 89 | 90 | 89 | 86 |

Recovered Gold | koz Au | 683 | 31 | 70 | 83 | 82 | 80 | 74 | 78 | 70 | 71 | 44 |

Waste Mined | | | | | | | | | | | | |

Underground | kt | 455 | 84 | 170 | 63 | 130 | 8 | - | - | - | - | - |

Open Pit | kt | 93,880 | 3,784 | 8,751 | 13,113 | 15,005 | 14,222 | 13,560 | 13,058 | 7,018 | 4,024 | 1,346 |

Total Waste Mined | kt | 94,335 | 3,868 | 8,921 | 13,175 | 15,134 | 14,230 | 13,560 | 13,058 | 7,018 | 4,024 | 1,346 |

Open Pit Strip Ratio | | 8.7 | 28.8 | 11.5 | 15.9 | 15.1 | 11.0 | 9.4 | 9.1 | 5.3 | 2.8 | 1.2 |

Note: Totals may not sum precisely due to rounding.

Year 2024 is for six months only, from July 1.

Figure 1-1: Total Material Mined by Year (2024 to 2033)

1.2.11 Mineral Processing

The plant is scheduled to process approximately 3,945 t/d (1.44 Mt/a). The overall process flowsheet consists of:

Three-stage crushing circuit

Two grinding ball mills, closed circuit with hydrocyclones

Thickener to produce a leach feed of 50% solids

Cyanide leaching circuit

Zadra pressure-stripping of the carbon

Electrowinning of the carbon eluent

- Casting of gold doré bars in an induction furnace.

1.2.12 Project Infrastructure

All necessary infrastructure for the operation is in place, which includes, but is not limited to: a 470 m vertical shaft; a series of underground ramps; underground ventilation and dewatering facilities; explosives magazines; power supply system; CIL milling and processing facility; associated process equipment from a previous heap leach operation; geomembrane-lined tailings storage facilities (TSF); waste rock storage facilities; warehouse; maintenance shops; drill core logging, splitting, and storage facilities; assay laboratory; cafeteria; helipad for emergency use and shipment of gold doré bars; office complexes; water supply system; and a fuel station.

1.2.13 Market Studies

The principal commodity the Fazenda mine produces is gold, which is freely traded, at prices that are widely known, so that prospect for sale of any production is virtually assured.

1.2.14 Environmental, Permitting, and Social Considerations

All required environmental licences and permits to conduct the proposed work on the property are in good standing or are in the process of being renewed. As of the date of this Technical Report, Equinox Gold has advised that all licences and permits are in good standing.

FBDM has developed a comprehensive environmental policy that has been developed in line with the Mine Closure Plan (MCP), as required by the Brazilian National Mining Agency (Agência Nacional de Mineração [ANM]). The environmental authorities in Brazil use the MCP as a commitment to complete the rehabilitation required for mine closure. The guidelines primarily involve revegetating the areas with native species; covering the pits or converting the pits to store water; along with stabilizing and rehabilitating waste dumps and TSFs. The estimated mine closure cost is $19.60 million.

1.2.15 Capital and Operating Cost Estimates

The LOM plan capital cost estimate includes sustaining capital cost, non-sustaining capital cost, and closure and reclamation cost. The capital cost of these activities is estimated to total $199 million as shown in Table 1-4.

Table 1-4: Life-of-Mine Projected Capital Costs

Description | 2024

($ M) | 2025

($ M) | 2026

($ M) | 2027

($ M) | 2028 & Beyond

($ M) | Total

($ M) |

Sustaining Capital | | | | | | |

Buildings & Infrastructure | 0.566 | 1.834 | 0.901 | 0.819 | 1.730 | 5.849 |

Hardware, Software & Automation | 0.073 | 0.780 | 0.278 | 0.160 | 0.000 | 1.291 |

Capitalized Underground + Open Pit | 9.691 | 19.228 | 12.696 | 16.389 | 2.495 | 60.499 |

Underground Mine Development | 2.635 | 7.895 | 0.397 | 1.383 | 0.298 | 12.609 |

Open Pit Mine Development | 7.056 | 11.332 | 12.299 | 15.005 | 2.197 | 47.890 |

Land Acquisition | - | 0.720 | - | - | - | 0.720 |

Machinery & Equipment | 3.968 | 8.116 | 8.254 | 6.061 | 2.944 | 29.342 |

Furniture & Fixture | 0.023 | 0.096 | 0.062 | 0.048 | 0.041 | 0.268 |

Tailings Dam Sustaining | - | - | 7.023 | - | 8.037 | 15.060 |

Subtotal Sustaining | 14.321 | 30.773 | 29.213 | 23.476 | 15.247 | 113.029 |

Non-Sustaining | | | | | | |

Underground Mine Development | 0.837 | 0.650 | 2.269 | 4.425 | 0.080 | 8.261 |

Capacity Increases | - | - | 0.889 | 0.889 | - | 1.777 |

Exploration | 2.288 | 4.919 | 4.919 | 4.919 | - | 17.047 |

Subtotal Non-Sustaining | 3.125 | 5.569 | 8.077 | 10.233 | 0.080 | 27.085 |

Closure & Reclamation | 0.346 | 1.912 | 0.083 | 0.232 | 16.568 | 19.141 |

Contingency | 4.448 | 9.563 | 9.343 | 8.485 | 7.974 | 39.814 |

Total | 22.240 | 47.817 | 46.717 | 42.426 | 39.868 | 199.068 |

Notes: Totals may not sum precisely due to rounding.

2024 represents only 6 months (July to December).

Projected unit operating costs for the envisaged mill feed are shown in Table 1-5. The LOM plan's estimated unit operating cost averages $55.15/t milled. Operating cost estimates are based on planned operating metrics and recent actual results.

Table 1-5: Life-of-Mine Projected Unit Operating Costs

Activity | 2024

($/t milled) | 2025

($/t milled) | 2026

($/t milled) | 2027

($/t milled) | 2028 & Beyond

($/t milled) | Average

($/t milled) |

Open Pit Mining | 12.21 | 13.21 | 22.42 | 19.13 | 20.13 | 19.20 |

Underground Mining | 39.79 | 28.41 | 24.03 | 16.38 | 0.83 | 9.65 |

Milling | 15.60 | 15.60 | 15.60 | 15.60 | 15.60 | 15.60 |

G&A | 10.70 | 10.70 | 10.70 | 10.70 | 10.70 | 10.70 |

Total | 78.30 | 67.92 | 72.75 | 61.81 | 47.26 | 55.15 |

Notes: Totals may not sum precisely due to rounding.

2024 represents only 6 months (July to December).

For both capital and operating LOM cost projections, the exchange rate used was R$5.00:$1.00 in 2024 and 2025, and R$4.80:$1.00 for the remaining mine life.

1.3 Economic Analysis

An economic analysis of the Fazenda LOM was performed using the estimates presented in this Technical Report and confirms that the outcome is a positive cash flow that supports the statement of Mineral Reserves.

1.4 Conclusions

Based on review of the available documentation, and from discussions with FBDM personnel, the QPs make the following conclusions.

1.4.1 Geology and Mineral Resources

Mineral Resources were prepared following CIM Definition Standards (2014).

The geological model generated by Equinox Gold geologists is reasonably well understood and is well supported by field observations in outcrops, mine faces, and drill intersections.

Interpretations of the geology and the 3-D wireframes of the estimation domains derived from these interpretations are reasonable.

Sampling and assaying have been carried out following standard industry quality assurance and quality control (QA/QC) practices.

The Mineral Resource model has been prepared using appropriate methodology and assumptions.

The block model has been validated using a reasonable level of rigour consistent with common industry practice.

- Mineral Resources for Fazenda comply with all disclosure requirements for Mineral Resources, as set out in NI 43-101.

1.4.2 Mining and Mineral Reserves

The mining methods used at Fazenda include both conventional open pit mining and underground mechanized open stoping. These methods are appropriate for the deposit.

Proven and Probable Mineral Reserves for the Fazenda mine as of June 30, 2024, total 13.2 Mt grading 1.80 g/t Au, containing 763 koz Au, including stockpile.

The mill feed is projected to be 18% from underground and 82% from open pits over the LOM.

Four separate declines originate on surface and access the various underground orebodies over a strike length of several kilometres.

The underground workings have good ground conditions that do not require any special support or backfill to ensure stable openings.

The LOM mining and processing schedules are based on Mineral Reserves only.

The main outcomes of the LOM schedule are presented below:

- Mining operations and processing LOM is 9.5 years.

- Underground operations finish in Year 2028. Open pit operations finish in Year 2033.

- Total annual ex-pit material movement peaks at approximately 16.5 Mt/a.

- Gold metal recovered averages approximately 75 koz/a over the LOM.

- Long-term stockpile capacity is 140 kt. The majority of this stockpile comprises the lowest-grade material and is fed to the process plant at the end of the mine life.

The Mineral Reserve estimates have been prepared using appropriate methodology and assumptions.

Mineral Reserves have been estimated in an appropriate manner using current mining software, procedures consistent with reasonable practice, and in accordance with CIM Definition Standards (CIM, 2014).

1.4.3 Metallurgical Testing and Processing

One of the main production constraints on Fazenda has been frequent power outages from the power grid supplier, COELBA; this circumstance has made it necessary to install diesel generator sets as a back-up to keep the agitators operating to avoid settling inside the leaching tanks.

Following a series of process improvements implemented in 2019, 2020, and 2021, Fazenda operates at P80 75 µm, at a feed rate of 168 t/h, recovering around 90% on average. The process had been improved every year to maximize the extraction and recovery efficiencies as the feed grade decreases each year with lower-grade open pit contribution increasing compared to the underground contribution.

The old CVRD heap leaching waste dumps show a potential for mining in the future, with an estimated 3 Mt of oxidized material at an estimated average grade of 0.6 g/t Au. Testwork was carried out, with gold recovery higher than 70%.

The plant facility requires refurbishments as well as normal maintenance. The structural steel in the grinding, leaching, and acid-wash circuits is showing significant deterioration due to corrosion. Maintenance work includes replacing the structural steel on a periodic basis, and over a span of several years during ongoing operations.

1.4.4 Infrastructure

Fazenda has been operational for 40 years and has all the necessary roads, power lines, access, and medical facilities; surrounding communities provide workers and services that one would expect to find for one of the state's major employers.

Water is supplied by a series of wellfields, with a total production capacity of 310 m3/h.

- The power requirement for Fazenda and site facilities is approximately 9.95 MW, which is supplied by the local grid. Emergency backup power has been established in the form of diesel generators.

1.4.5 Environmental, Social, and Permitting Considerations

Fazenda is an established gold mine with 40 years of history and in good corporate standing with the Brazilian and Bahia State government regulatory agencies.

A detailed acid rock-drainage (ARD) evaluation of the Fazenda tailings was carried out in 2012. The results showed that almost 100% of samples presented a neutralization potential two times higher than the acid-generating potential.

The arsenopyrite and pyrrhotite in the TSFs have low potential to become future ARD generators, as the proportion of carbonates is well in excess of the amount of the sulphides.

FBDM staff has developed an exemplary and credible program for social and community involvement in the area of the mine's operations, which should be maintained for the LOM.

- Fazenda has a comprehensive environmental policy developed according to the MCP, which the environmental authorities in Brazil use as a commitment to complete the rehabilitation required for mine closure.

1.4.6 Capital and Operating Costs

- The LOM plan capital cost estimate includes sustaining capital cost, non-sustaining capital cost, and closure and reclamation cost. The capital cost of these activities is estimated to total $199 million and is based on an exchange rate of R$5.00:USI$1.00 in 2024 and 2025, and R$4.80:US$1.00 for the remaining LOM.

- LOM plan operating costs are estimated to total $726 million, which averages $55.15/t milled.

1.5 Recommendations

The QPs make the following recommendations. The costs of all recommendations are anticipated to be covered as part of normal operating at Fazenda.

1.5.1 Geology and Mineral Resources

- Based on the distribution and grade of the Mineral Resources and on the geological continuity, significant exploration potential exists, which includes both open pit and underground near-mine conversion of Mineral Resources to Mineral Reserves, and addition of new Mineral Resources. Infill and step-out drill programs should be performed.

Refine the mineralized wireframes: enhance the quality of the mineralized wireframes for the Canto and CLX zones by subdividing these zones into stationary sub-domains. This approach will help to better capture the geological variability within each mineralized zone and improve the overall accuracy of the Mineral Resource model.

Improve wireframe definition: refine the wireframes by separating the roof and ceiling of each mineralized domain. This separation is essential for accurately computing a locally varying anisotropy field, allowing for a more precise modelling of the mineralization's spatial distribution and directional variability.

Enhance high-grade zone modelling: focus on improving the modelling of high-grade zones to better constrain the influence of high-grade assays. This will help to reduce smoothing effects and improve the definition of high-grade domains, ensuring that the Mineral Resource estimate better reflects the localized variations in grade.

Apply non-linear geostatistics: implement non-linear geostatistical methods such as local uniform conditioning (LUC) to capture fine-scale grade variability. LUC is particularly useful in regions with sparse drilling data, where traditional kriging methods may overlook local variability. This approach will provide more accurate Mineral Resource estimates, especially for smaller blocks, by conditioning the model to the local data distribution.

Implement QA/QC for density analyses: develop and implement a robust QA/QC process for density analysis to ensure the accuracy and consistency of density measurements used in the Mineral Resource estimation, which is critical for accurate tonnage calculations.

- Enhance QA/QC procedures for assay data: strengthen the current QA/QC procedures for internal and external laboratories involved in assay analysis. This will entail refining protocols for sample handling, analysis, and data validation, improving the reliability of assay results and minimizing analytical errors.

1.5.2 Mining and Mineral Reserves

FBDM should consider the opportunities for and potential impact of expanding the open pit extents. The Technical Report used a $1,500/oz gold price for open pit Mineral Reserves, while recent price levels have been much higher; the prevailing price at the time of this Technical Report is approximately $2,600/oz. The Whittle optimal pit analysis shows that the pit size is very susceptible to metal price. Current price levels would support pits more than twice as large as those used in the Technical Report. Additionally, placing infrastructure in the footprint of potential pit expansions should be carefully assessed.

FBDM should consider the potential impact of increasing the gold price used for Mineral Reserve calculation. Some Mineral Resources are prevented from converting to Mineral Reserves due to the distance from existing underground infrastructure and the associated cost of development. The Technical Report used a $1,800/oz gold price for underground Mineral Reserves, however; the prevailing price at the time of this Technical Report is approximately $2,600/oz. Increasing the gold price for Mineral Reserves may allow for conversion of Mineral Resources to Mineral Reserves.

Pit designs are preliminary, and further detailing is recommended to obtain optimal and most-practically viable designs.

Scheduling has been done to an annual level. Further refinements are recommended to obtain more comprehensive and accurate mine plans. Greater detail on equipment, labour requirements, and productivities would enhance accuracy and assurance on the study estimates.

The ongoing geotechnical program should be continued to collect additional data for pit-wall angle-stability analysis in open pits P&R, FW, and BRSW.

Further investigation should be undertaken on how to best deal with extensive underground voids: e.g., advance pilot drilling to delineate voids and potential backfill of areas. The assessment should also reference and review working procedures to minimize any operational or safety risk associated with interaction between open pit and underground workings.

A hydrogeological drilling program is recommended to confirm hydraulic properties and investigate drill targets, and to facilitate groundwater modelling to assess and optimize the location and timing of dewatering bores and horizontal drain holes.

Continue evaluating areas that were excluded from Mineral Reserves due to restricted access, proximity to infrastructure, and economic considerations.

- The suitability of applying paste backfill with cement to recover the pillars in high-grade zones should be investigated.

1.5.3 Metallurgical Testing and Processing

Undertake a long-term geometallurgical study to develop a process route to mitigate the impact of high-total organic carbon and high-sulphide ores in the plant recovery.

Carry out work-index testwork to arrive at necessary changes in the grinding circuit to maintain plant throughput and optimum gold recovery.

Analyze sulphur and arsenic chemistry of the leaching feed samples to better predict the necessary process changes for reagent additions.

Analyze the particle-size distribution of the blasted ore to improve the crushing-circuit product, which impacts the comminution-circuit final product reporting to the leaching circuit.

- Continue maintenance work at the plant, including refurbishing equipment and structures.

1.5.4 Infrastructure

In respect of providing services, ensure that interactions between the open pit and the continuation of the underground mining activities are effectively monitored and managed, as some of the portals will be taken out of service.

Regarding underground mine ventilation, re-evaluate the circuit and the Ventsim model to determine which entries will be lost when the pit breaks into underground openings, where stoppings need to be installed, and any other measures that may be required to maintain an appropriate and regulatory-compliant ventilation circuit underground, and avoid uncontrolled air gains or losses.

With CLX pits impacting Portals C and D, and breaking into the declines, stopes, and access drifts, changes to the mine's emergency warning system will be needed to mitigate the impact of any inrush of water during a major rainfall. Re-evaluating the current emergency procedures and introducing an advance-warning system to alert of any impending meteorological event in the mine vicinity.

A study is needed to determine requirements for installing water-control barriers with drainage holes to prevent a sudden inundation of the workings during a major rain event. A key aspect of the study would be determining which entries will be lost, and where stoppings need to be installed to offset risk of injury to workers and flooding of the underground openings.

Perform a trade-off study to compare the costs and scheduling of future expansions (dam raises) of TSF4 to store the LOM tailings as compared to building a new TSF downstream of TSF4.

1.5.5 Environmental, Social, and Permitting Considerations

- Complete studies and update the MCP for TSF1 and TSF2, as well as acid drainage studies, in accordance with the new LOM and to meet ANM requirements.

1.5.6 Capital and Operating Costs

- Collect quotes from multiple Brazilian mining contractors to firm up the mining cost estimates for the open pit operations in CLX, which anticipate using larger-scale equipment from 2027 onwards. Equinox Gold should acquire binding quotes from the primary mining contractor to achieve a higher level of estimation accuracy.

2 Introduction

In operation since 1984, the Fazenda mine has historically been an underground mine with supplementary small open pits and has been operated by Fazenda Desenvolvimento Mineral (FBDM). Fazenda started as a heap leaching operation, and carbon-in-pulp (CIP) milling facilities were added in 1988 to complement the heap leaching operation. The process plant was subsequently converted to use pre-aeration with carbon-in-leach (CIL), and heap leaching operations have since ceased. Open pit mining has increased in recent years as the underground operation has declined.

Equinox Gold Corp. (Equinox Gold) has prepared this Technical Report for the Fazenda mine, located in eastern Bahia State. The scope of this report, titled Technical Report on the Fazenda Gold Mine, Bahia State, Brazil (Technical Report), has an effective date of June 30, 2024, and includes updates to the geology, Mineral Resources, and Mineral Reserves. This Technical Report supersedes the previous Technical Report, titled NI 43-101 Technical Report on the Fazenda Gold Mine, with an effective date of December 31, 2020, and a published date of October 22, 2021.

Several engineering consulting firms have contributed to this Technical Report and project update as follows:

AMC Mining Consultants Canada Ltd. (AMC): estimate of Mineral Reserves; review and update of mining methods, economic analysis, operating costs pertaining to mining, processing, and G&A and review of capital costs.

SAFF Engenharia: validation of open pit geotechnical design parameters for the CLX open pit, including an assessment of the impact of the final open pit on the tailings storage facility (TSF) and processing plant.

- GEOTECH Consultoria e Projetos: review and analysis of underground geotechnical engineering and rock mechanics.

2.1 Sources of Information

This Technical Report is based on published and unpublished materials, and professional opinions formed by Equinox Gold and its consultants. Other sources of information include geological reports, drill-hole information, field observations, block models, geotechnical reports, mine plans, cost estimates, historical costs, productivity information, and economic models.

Any previous technical reports or literature used in the compilation of this Technical Report are referenced in the text, as necessary.

2.2 Responsibility

Table 2-1 provides a list of Qualified Persons (QP) and their responsibility for sections of this Technical Report. The QP certificates are included in Section 29.

Table 2-1: Qualified Persons and their Respective Sections of Responsibility

Qualified Persons | Company | Sections |

David Warren, P.Eng. | AMC Mining Consultants (Canada) Ltd. | 15.1, 15.2 (except 15.2.1), 16.1.1 to 16.1.3, 16.1.5, 16.3, 21 (open pit aspects), and corresponding portions of 1, 24, 25, 26, and 27 |

Dominic Claridge, FAusIMM. | AMC Mining Consultants (UK) Ltd. | 15.1, 15.3 (except 15.3.1), 16.2.2 to 16.2.8, 16.2.10, and corresponding portions of 1, 24, 25, 26, and 27 |

João Paulo Santos, MAusIMM | SAFF Engenharia | 16.1.4, and corresponding portions of 1, 24, 25, 26, and 27 |

Gabriel Freire, FAusIMM | GEOTECH Consultoria e Projetos | 16.2.1 and corresponding portions of 1, 24, 25, 26, and 27 |

Benoit Poupeau, FAusIMM | Trust Mineral Resources | 4, 5, 6, 7, 8, 9, 10, 11, 12, 14, 15.2.1, 15.3.1, 23, and corresponding portions of 1, 24, 25, 26, and 27 |

Mo Molavi, P.Eng. | AMC Mining Consultants (Canada) Ltd. | 16.2.9, 16.2.11 to 16.2.14 and 18 (except 18.8), and corresponding portions of 1, 24, 25, 26, and 27 |

Paul Sterling, P.Eng. | Equinox Gold Corp. | 13, 17, and corresponding portions of 1, 24, 25, 26, and 27 |

Kelly Boychuk, P.Eng. | Equinox Gold Corp. | 2, 3, 18.8, 19, 20, 21.2.6 to 21.2.8, 22, 23, 24, 25, 26, and 27, and corresponding portions of 1, 24, 25, 26, and 27 |

2.3 Qualified Persons Site Visits

The QPs visited the Fazenda mine on the following dates:

David Warren, P.Eng., AMC Consulting, April 24 to 26, 2024

Dominic Claridge, FAusIMM., AMC Consulting, April 24 to 26, 2024

João Paulo Santos, MAusIMM, SAFF Engenharia, April 24 to 26, 2024

Gabriel Freire, FAusIMM, GEOTECH Consultoria e Projetos, April 24 to 26, 2024

Benoit Poupeau, FAusIMM, Trust Mineral Resources, November 13 to 16, 2023

Paul Sterling, P.Eng., Equinox Gold Corp., April 24 to 26, 2024

- Kelly Boychuk, P.Eng., Equinox Gold Corp., October 4 to 5, 2023.

Mr. Mo Molavi, P.Eng., has not conducted a site visit and has relied on information provided by other QPs.

2.4 Abbreviations, Acronyms, and Units of Measure

Unless otherwise noted, the Technical Report uses the International System of Units (metric system). A list of the main symbols, units of measure, abbreviations, acronyms, and initialisms used in this Technical Report are presented below the table of contents. All currency in this Technical Report is expressed in United States dollars ($) or as otherwise stated.

3 Reliance on Other Experts