- LNKB Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

LINKBANCORP (LNKB) S-1IPO registration

Filed: 7 Sep 22, 8:47am

Pennsylvania | 6022 | 82-5130531 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Copies to: | ||

Benjamin M. Azoff, Esq. Gregory M. Sobczak, Esq. Luse Gorman, PC 5335 Wisconsin Avenue, N.W., Suite 780 Washington, D.C. 20015 (202) 274-2000 | James J. Barresi, Esq. Aaron A. Seamon, Esq. Squire Patton Boggs (US) LLP 221 E. Fourth Street, Suite 2900 Cincinnati, Ohio 45202 Telephone: (513) 361-1260 | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

Per Share | Total | |||||||

Public offering price | ||||||||

Underwriting discounts and commissions(1) | ||||||||

Proceeds to us, before expenses | ||||||||

| (1) | The offering of our common stock will be conducted on a firm commitment basis. See “Underwriting” for a description of all underwriting compensation payable and expense reimbursement in connection with this offering. |

|  |

| 1 | ||||

| 33 | ||||

| 55 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 61 | ||||

| 63 | ||||

| 64 | ||||

| 91 | ||||

| 109 | ||||

| 118 | ||||

| 124 | ||||

| 132 | ||||

| 134 | ||||

| 137 | ||||

| 140 | ||||

| 142 | ||||

| 146 | ||||

| 151 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| F-1 |

| • | we may present as few as two years of audited financial statements and two years of related management discussion and analysis of financial condition and results of operations; |

| • | we are exempt from the requirement to obtain an attestation and report from our auditors on management’s assessment of our internal control over financial reporting under the Sarbanes-Oxley Act of 2002; |

| • | we are permitted to provide reduced disclosure regarding our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means we do not have to include a compensation discussion and analysis and certain other disclosures regarding our executive compensation; and |

| • | we are not required to hold non-binding advisory votes on executive compensation or golden parachute arrangements. |

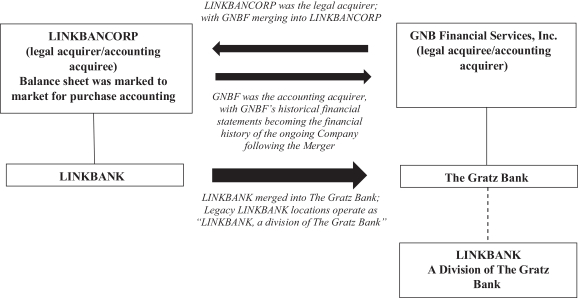

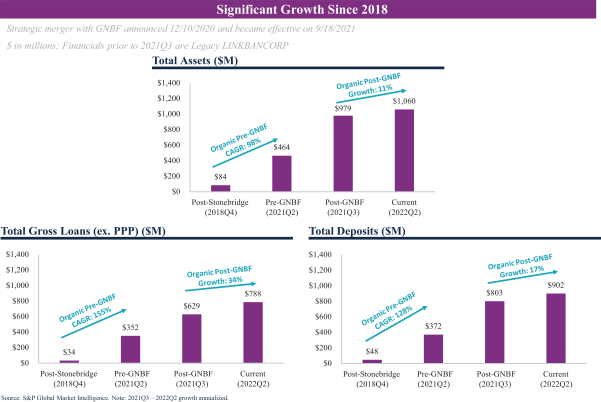

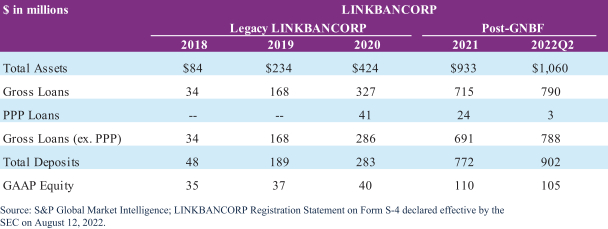

| LINKBANCORP was organized in 2018 with a mission to positively impact lives through community banking. Members of the founding management team and board of directors had worked together with multiple financial institutions of various sizes, primarily focused in Central and Southeastern Pennsylvania, over a period of more than 20 years. Informed by these experiences, the founders sought to establish an entrepreneurial and growth-oriented community bank that would leverage talented relationship bankers, coupled with emerging innovations in technology, to meet the needs of the local community. Rather than organize a de novo bank to facilitate these objectives, in October 2018 LINKBANCORP acquired and recapitalized Stonebridge Bank, a community bank primarily serving Chester County, Pennsylvania, in a transaction conducted under the U.S. Bankruptcy Code, funded with proceeds from a private placement of common stock to friends and family. At the time of the acquisition of Stonebridge Bank, it had $55.2 million in total assets and one branch office. Stonebridge Bank had been party to a consent order with the FDIC and the PADOBS at the time of the acquisition, which was successfully resolved by the Company’s management team, with the consent order terminated in February 2019. |

| • | October 2018: |

| • | December 2018: |

| • | January 2019: |

| • | May – June 2019: |

| • | April – July 2020: |

| • | June 2020: |

| • | September – October 2020: |

| • | December 2020: |

| • | December 2020: |

| • | September 2021: |

| • | Executive management roles continue to be filled by the Legacy LINKBANCORP officers, including Andrew Samuel - CEO; Carl Lundblad - President; Brent Smith, President of The Gratz Bank; Kristofer Paul - CFO; and Tiffanie Horton - Chief Credit Officer. |

| • | Achieves critical mass in the Central Pennsylvania market. |

| • | Doubles the Company’s asset size and provides opportunity to capture economies of scale on both the revenue and cost sides. |

| • | Diversifies the loan portfolio and provides low cost, stable and highly granular retail deposits. |

| • | GNBF’s relatively low loan-to-deposit ratio prior to the Merger provides additional liquidity to fuel LINKBANCORP’s strong loan generation capabilities. |

| • | Significantly enhances the loan-to-one borrower limit with a doubling of regulatory capital. |

| • | December 2021: |

| • | January 2022: |

| • | January 2022: |

| • | February 2022: |

| • | April 2022: |

| • | April 2022 |

| • | May 2022 |

| • | June 2022: |

| • | Hire talented, entrepreneurial bankers with demonstrated track records. |

| • | Focus on profitable customer relationships and taking wallet share. |

| • | Operate with a branch-lite footprint. |

| • | �� | Leverage technology, digital banking and information systems. |

| • | Achieve economies of scale and increase operating leverage as we grow. |

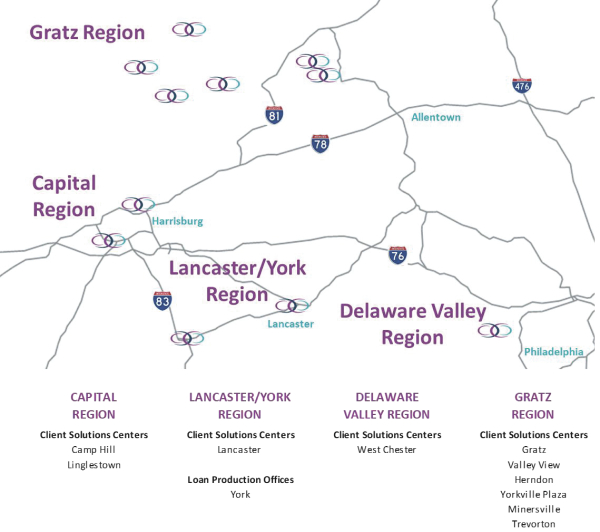

| • | Personal Banking: Strategically placed client solutions centers leveraging our strong local community identity and complemented with digital banking solutions. |

| • | Business Banking: Focused on family-owned businesses with under $100 million in annual revenue. |

| • | Nonprofit Banking: Bank of choice for nonprofits, with strong individual and organizational engagement in the communities we serve. |

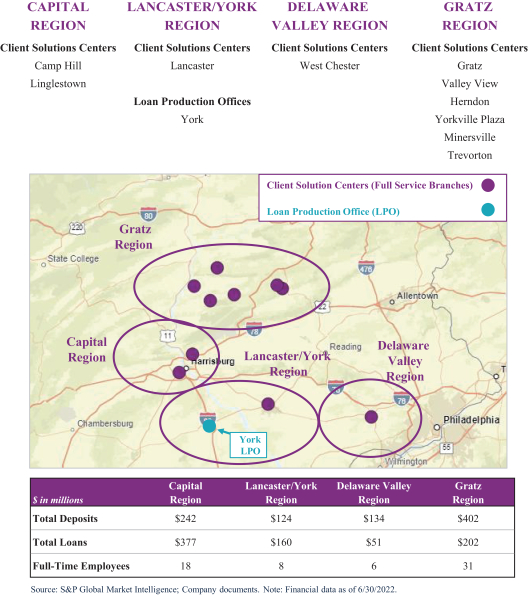

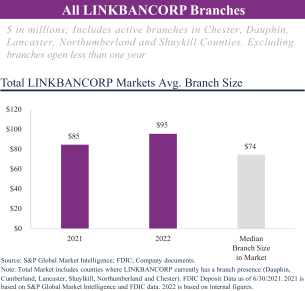

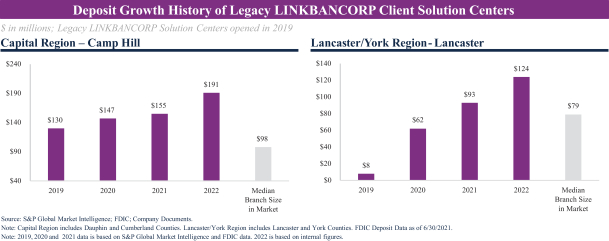

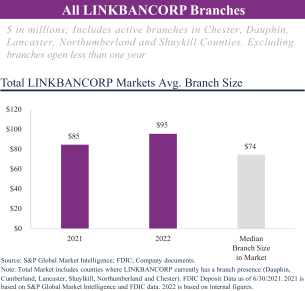

Through the GNBF Merger we inherited six branch offices, all of which remain open. The strategy for these legacy GNBF offices are different than our legacy LINKBANK client solutions centers, although we believe they provide a strong core funding base for our organic loan growth. As of June 30, 2022, our overall average branch size for offices open more than one year, was $94.6 million. While industry wide data for 2022 is not publicly available, we believe our average branch size of $85 million as of June 30, 2021 compares favorably to the $74 million average branch size in our markets of operation at June 30, 2021. |  |

| • | First Commonwealth Corporation / Centric Financial Corporation |

| • | Fulton Financial Corporation / Prudential Bancorp, Inc. |

| • | Mid Penn Bancorp, Inc. / Riverview Financial Corporation |

| • | WSFS Financial Corporation / Bryn Mawr Bank Corporation |

| • | Citizens & Northern Corporation / Covenant Financial Inc. |

| • | S&T Bancorp, Inc. / DNB Financial Corporation |

| • | Citizens & Northern Corporation / Monument Bancorp, Inc. |

| • | WSFS Financial Corporation / Beneficial Bancorp, Inc. |

| • | Northwest Bancshares, Inc. / Donegal Financial Services Corp. |

|  |

| • | Focus on relationship lending, in many cases with clients that our relationship managers and executive management team have known for decades; |

| • | Development of underwriting and credit risk management processes tailored to each of our products and regions; |

| • | Centralized credit oversight and segregated reporting of credit and lending teams; |

| • | Utilization of regional credit officers with specific lending authority, allowing for localized analysis and decision making and faster turnaround time; |

| • | Commitment to maintaining a diverse portfolio; |

| • | Sophisticated monitoring and analysis of our portfolio and establishment of sub-portfolio limits that we review regularly and adjust in response to changes in our lending strategy and market conditions; and |

| • | Proactive problem asset management. |

| • | Changes in economic conditions, in particular an economic slowdown in Pennsylvania, could materially and negatively affect our business. |

| • | A significant portion of our loan portfolio is secured by real estate, and events that negatively impact the real estate market could hurt our business. |

| • | Inflation can have an adverse impact on our business and on our customers. |

| • | The economic impact of the COVID-19 outbreak could continue to affect our financial condition and results of operations. |

| • | Changes in prevailing interest rates may reduce our profitability, and we may not be able to adequately anticipate and respond to changes in market interest rates. |

| • | Our commercial real estate loans may increase our exposure to credit risk. |

| • | Repayment of commercial business loans is often dependent on the cash flows of the borrower, which may be unpredictable, and the collateral securing these loans may fluctuate in value. |

| • | Our decisions regarding allowance for loan losses and credit risk may materially and adversely affect our business. If the allowance for loan losses is not sufficient to cover actual loan losses, our earnings could decrease. |

| • | If our non-performing assets increase, our earnings will be adversely affected. |

| • | A portion of our loan portfolio consists of loan participations. Loan participations may have a higher risk of loss than loans we originate because we are not the lead lender, and we have limited control over credit monitoring. |

| • | The implementation of the current expected credit loss accounting standard could require us to increase our allowance for loan losses and may have a material adverse effect on our financial condition and results of operations. |

| • | We may be unable to effectively manage our growth. |

| • | We may encounter significant difficulties in integrating with GNBF and may fail to realize the anticipated benefits of the Merger, or those benefits may take longer to realize than expected. |

| • | Future acquisitions could disrupt our business and adversely affect our results of operations, financial condition and cash flows. |

| • | We rely heavily on technology, and our information systems may experience an interruption or breach in security. |

| • | We rely on third party vendors, which could expose us to additional cybersecurity risks. |

| • | Liquidity needs could adversely affect our financial condition and results of operation. |

| • | We rely heavily on our senior management team and the unexpected loss of any of those personnel could adversely affect our operations. |

| • | Competition with other financial institutions may have an adverse effect on our ability to retain and grow our client base, which could have a negative effect on our financial condition or results of operations. |

| • | We are subject to extensive government regulation and supervision that could interfere with our ability to conduct our business and may negatively impact our financial results, restrict our activities, have an adverse impact on our operations, and impose financial requirements or limitations on the conduct of our business. |

| • | The Bank is subject to federal and state fair lending laws, and failure to comply with these laws could lead to material penalties. |

| • | The Bank faces a risk of noncompliance and enforcement action with the Bank Secrecy Act and other anti-money laundering statutes and regulations. |

| • | Regulations relating to privacy, information security and data protection could increase our costs, affect or limit how they collect and use personal information and adversely affect their business opportunities. |

| • | The trading history of our common stock is characterized by low trading volume. An active, liquid trading market for our common stock may not develop, and you may not be able to sell your common stock at or above the public offering price, or at all. |

| • | You will incur immediate dilution as a result of this offering. |

| • | The price of our common stock could be volatile following this offering. |

| • | Our management will have broad discretion as to the use of proceeds from this offering, and we may not use the proceeds effectively. |

| • | Our directors and executive officers beneficially own a significant portion of our common stock and have substantial influence over us. |

| • | Our Articles of Incorporation and Bylaws, and certain banking laws applicable to us, could have an anti-takeover effect that decreases our chances of being acquired, even if our acquisition is in our shareholders’ best interests. |

Common stock offered by us | 4,575,000 shares |

Underwriters’ purchase option | 686,250 shares from us |

Common stock outstanding after completion of this offering | 14,413,435 shares (or 15,099,685 shares if the underwriters exercise their option to purchase additional shares in full). |

Use of proceeds | We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and estimated offering expenses, will be approximately $36.2 million (or approximately $41.8 million if the underwriters exercise their option to purchase additional shares in full), based on an assumed public offering price of $8.75 per share, which is the midpoint of the price range set forth on the cover of this prospectus. We intend to use the net proceeds of the offering to support the growth of The Gratz Bank, including providing capital to The Gratz Bank to support growth of its operations, including, without limitation, expansion of its lending activities, financing strategic acquisitions that may from time to time arise and for other general corporate purposes. See “Use of Proceeds.” |

Dividend policy | Through the second quarter of 2022, we paid total dividends of $0.15 per share, or an annualized yield of 3.43%, based on an assumed market price of $8.75 per share. The Merger Agreement with GNBF provides that, for three years following the effective time of the Merger, the Company will pay a quarterly cash dividend in an amount equal to or greater than $0.30 per share per year, provided sufficient funds are legally available and that the Company and the Bank remain “well-capitalized” in accordance with applicable regulatory guidelines. Subject to the approval of our board of directors and regulatory restrictions, the Company anticipates that it will continue to pay cash dividends on a quarterly basis in an amount equal to or greater than $0.30 per share per year. Our board of directors will make any determination whether or not to pay dividends based upon our financial condition, results of operations, capital and regulatory restrictions and other relevant factors. See “Dividend Policy.” |

Listing and trading symbol | We have applied to list our common stock on the Nasdaq Capital Market under the symbol “LNKB.” |

Directed Share Program | At our request, the underwriters have reserved up to 5% of the shares of our common stock offered by this prospectus for sale, at the initial public offering price, to our directors, officers, principal shareholders, employees, business associates, and related persons who have expressed an interest in purchasing our common stock in this offering. We will offer these shares to the extent permitted under applicable regulations in the United States through a directed share program. See the section entitled “Underwriting—Directed Share Program.” |

Risk factors | Investing in our common stock involves certain risks. See “Risk Factors,” beginning on page 33 of this prospectus, for a discussion of factors that you should carefully consider before investing in our common stock. |

| • | assumes no exercise of the underwriters’ option to purchase up to 686,250 additional shares of common stock from us; |

| • | excludes 403,900 shares of our common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $10.86 per share (195,700 options of which are exercisable) as of June 30, 2022; |

| • | excludes 1,537,484 shares of our common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $10.00 per share (all which are exercisable) as of June 30, 2022; and |

| • | does not attribute to any director, officer, principal shareholder or related person any purchases of shares of our common stock in this offering, including through the directed share program described in the section entitled “Underwriting — Directed Share Program.” |

At June 30, 2022 | At December 31, | |||||||||||||||

2021 | 2020 | 2019 | ||||||||||||||

(In thousands) | ||||||||||||||||

Selected Balance Sheet Data: | ||||||||||||||||

Total assets | $ | 1,059,885 | $ | 932,763 | $ | 429,544 | $ | 383,366 | ||||||||

Cash and cash equivalents | 62,996 | 22,590 | 33,162 | 27,708 | ||||||||||||

Certificates of deposit with other banks | 11,088 | 12,828 | 17,051 | 18,794 | ||||||||||||

Securities available for sale | 85,756 | 103,783 | 125,447 | 84,916 | ||||||||||||

Securities held to maturity | 28,816 | — | — | — | ||||||||||||

Loans receivable, net | 786,516 | 711,665 | 233,795 | 235,083 | ||||||||||||

Goodwill and other intangible assets | 37,020 | 37,152 | 2,509 | 2,575 | ||||||||||||

Deposits | 902,373 | 771,665 | 375,124 | 330,907 | ||||||||||||

Other borrowings | 1,639 | 19,814 | 1,120 | 2,759 | ||||||||||||

Subordinated debt | 40,585 | 20,696 | — | — | ||||||||||||

Total shareholders’ equity | 104,771 | 109,623 | 50,674 | 45,706 | ||||||||||||

For the Six Months Ended June 30, | For the Years Ended December 31, | |||||||||||||||||||

2022 | 2021 | 2021 | 2020 | 2019 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Selected Operating Data: | ||||||||||||||||||||

Interest and dividend income | $ | 17,478 | $ | 6,657 | $ | 18,496 | $ | 14,291 | $ | 14,811 | ||||||||||

Interest expense | 2,148 | 977 | 2,390 | 2,717 | 3,007 | |||||||||||||||

Net interest income | 15,330 | 5,680 | 16,106 | 11,574 | 11,804 | |||||||||||||||

Provision for loan losses | 675 | 91 | 648 | 184 | 416 | |||||||||||||||

Noninterest income | 1,408 | 1,214 | 2,139 | 1,754 | 1,163 | |||||||||||||||

Noninterest expense | 12,342 | 4,130 | 17,497 | 8,306 | 7,788 | |||||||||||||||

Income before income tax (benefit) expense | 3,721 | 2,673 | 100 | 4,838 | 4,763 | |||||||||||||||

Income tax (benefit) expense | 591 | 375 | (189 | ) | 645 | 757 | ||||||||||||||

Net income | $ | 3,130 | $ | 2,298 | $ | 289 | $ | 4,193 | $ | 4,006 | ||||||||||

At or For the Six Months Ended June 30, | At or For the Years Ended December 31, | |||||||||||||||||||

2022 | 2021 | 2021 | 2020 | 2019 | ||||||||||||||||

Performance Ratios (1): | ||||||||||||||||||||

Return on average assets | 0.63 | % | 1.05 | % | 0.05 | % | 1.02 | % | 1.12 | % | ||||||||||

Adjusted return on average assets (2) | 0.63 | % | 1.05 | % | 0.68 | % | 1.00 | % | 1.12 | % | ||||||||||

Return on average equity | 5.91 | % | 9.14 | % | 0.56 | % | 8.79 | % | 9.13 | % | ||||||||||

Adjusted return on average equity (2) | 5.89 | % | 9.14 | % | 7.52 | % | 8.61 | % | 9.11 | % | ||||||||||

Return on average tangible equity (2) | 9.06 | % | 9.61 | % | 0.74 | % | 9.28 | % | 9.66 | % | ||||||||||

Adjusted return on average tangible equity (2) | 9.03 | % | 9.61 | % | 9.92 | % | 9.09 | % | 9.63 | % | ||||||||||

Interest rate spread (3) | 3.31 | % | 2.64 | % | 3.01 | % | 2.84 | % | 3.09 | % | ||||||||||

Net interest margin (4) | 3.39 | % | 2.73 | % | 3.07 | % | 2.97 | % | 3.48 | % | ||||||||||

Efficiency ratio (5) | 73.7 | % | 59.9 | % | 96 | % | 62 | % | 60 | % | ||||||||||

Efficiency ratio, as adjusted (6) | 73.8 | % | 59.9 | % | 71 | % | 63 | % | 60 | % | ||||||||||

Noninterest income to average total assets | 0.28 | % | 0.56 | % | 0.37 | % | 0.43 | % | 0.33 | % | ||||||||||

Noninterest income to total revenue (7) | 8.35 | % | 17.61 | % | 12.82 | % | 13.16 | % | 8.98 | % | ||||||||||

Noninterest expense to average total assets | 2.49 | % | 1.89 | % | 3.07 | % | 2.02 | % | 2.12 | % | ||||||||||

Average interest-earning assets to average interest-bearing liabilities | 123.14 | % | 134.98 | % | 126.69 | % | 130.78 | % | 130.21 | % | ||||||||||

Average equity to average total assets | 10.68 | % | 11.54 | % | 8.99 | % | 11.61 | % | 12.27 | % | ||||||||||

Share and Per Share Data: | ||||||||||||||||||||

Basic earnings | $ | 0.32 | $ | 0.40 | $ | 0.04 | $ | 0.74 | $ | 0.70 | ||||||||||

Diluted earnings | $ | 0.31 | $ | 0.40 | $ | 0.04 | $ | 0.74 | $ | 0.70 | ||||||||||

Book value | $ | 10.65 | $ | 9.15 | $ | 11.16 | $ | 8.90 | $ | 8.03 | ||||||||||

Tangible book value (8) | $ | 6.89 | $ | 8.71 | $ | 7.38 | $ | 8.46 | $ | 7.58 | ||||||||||

Dividend payout ratio (9) | 47.12 | % | 21.05 | % | 505.9 | % | 34.2 | % | 30.1 | % | ||||||||||

Number of shares outstanding | 9,838,435 | 5,691,685 | 9,826,435 | 5,691,686 | 5,691,686 | |||||||||||||||

Weighted average number of shares Outstanding—diluted | 9,983,742 | 5,691,686 | 7,250,463 | 5,691,686 | 5,686,323 | |||||||||||||||

Capital Ratios: | ||||||||||||||||||||

Tangible common equity to tangible assets (10) | 6.62 | % | 11.54 | % | 8.09 | % | 11.28 | % | 11.33 | % | ||||||||||

Common equity tier 1 capital to risk weighted assets (11) | 11.94 | % | 13.35 | % | 11.02 | % | 13.22 | % | 12.99 | % | ||||||||||

Tier 1 capital to average assets (11) | 10.10 | % | 8.33 | % | 8.85 | % | 7.90 | % | 8.50 | % | ||||||||||

Tier 1 capital to risk weighted assets (11) | 11.94 | % | 13.35 | % | 11.02 | % | 13.22 | % | 12.99 | % | ||||||||||

Total capital to risk weighted assets (11) | 12.42 | % | 14.45 | % | 11.50 | % | 14.33 | % | 14.14 | % | ||||||||||

Asset Quality Ratios: | ||||||||||||||||||||

Non-performing assets to total assets | 0.14 | % | 0.12 | % | 0.15 | % | 0.14 | % | 0.23 | % | ||||||||||

Non-performing loans to total loans | 0.19 | % | 0.21 | % | 0.20 | % | 0.26 | % | 0.38 | % | ||||||||||

Allowance for loan losses to non-performing loans | 260.37 | % | 538.76 | % | 225.79 | % | 452.76 | % | 301.90 | % | ||||||||||

Allowance for loan losses to total loans | 0.49 | % | 1.16 | % | 0.44 | % | 1.18 | % | 1.14 | % | ||||||||||

Net charge-offs (recoveries) to average outstanding loans during the period | (0.02 | )% | 0.00 | % | 0.08 | % | 0.04 | % | (0.01 | )% | ||||||||||

Other: | ||||||||||||||||||||

Number of offices | 10 | 6 | 10 | 6 | 6 | |||||||||||||||

Number of full-time equivalent employees | 135 | 47 | 106 | 48 | 54 | |||||||||||||||

| (1) | Annualized for the six-month periods ended June 30, 2022 and 2021. |

| (2) | This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “Summary Historical Consolidated Financial Data of the Company—Non-GAAP Financial Measure Reconciliation.” |

| (3) | Represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities for the periods. |

| (4) | The net interest margin represents net interest income as a percent of average interest-earning assets for the periods. |

| (5) | The efficiency ratio represents noninterest expense divided by the sum of net interest income and noninterest income. |

| (6) | The efficiency ratio, as adjusted represents noninterest expense divided by the sum of net interest income and noninterest income, excluding gains or losses from securities sales and Merger expenses. This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measure Reconciliation.” |

| (7) | We calculate revenue as net interest income plus noninterest income, excluding gains or losses from securities sales, before provision for loan losses for the relevant periods. This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measure Reconciliation.” |

| (8) | We calculate tangible book value per common share as total shareholders’ equity less goodwill and other intangibles, divided by the outstanding number of shares of our common stock at the end of the relevant period. Tangible book value per common share is a non-GAAP financial measure, and, as we calculate tangible book value per common share, the most directly comparable GAAP financial measure is book value per common share. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measure Reconciliation.” |

| (9) | The dividend payout ratio represents dividends paid per share divided by net income per share. |

| (10) | We calculate tangible common equity as total shareholders’ equity less goodwill and other intangibles, and we calculate tangible assets as total assets less goodwill and other intangibles. This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measure Reconciliation.” |

| (11) | Ratios are only for The Gratz Bank. |

At June 30, | At December 31, | |||||||||||||||||||

2022 | 2021 | 2021 | 2020 | 2019 | ||||||||||||||||

(Dollars in thousands, except for share data) | ||||||||||||||||||||

Tangible Common Equity: | ||||||||||||||||||||

Total shareholders’ equity | $ | 104,771 | $ | 52,076 | $ | 109,623 | $ | 50,674 | $ | 45,706 | ||||||||||

Adjustments: | ||||||||||||||||||||

Goodwill | 35,842 | 2,333 | 35,842 | 2,333 | 2,333 | |||||||||||||||

Other intangible assets | 1,178 | 149 | 1,310 | 176 | 242 | |||||||||||||||

Tangible common equity | $ | 67,751 | $ | 49,594 | $ | 72,471 | $ | 48,165 | $ | 43,131 | ||||||||||

Common shares outstanding | 9,838,435 | 5,691,685 | 9,826,435 | 5,691,686 | 5,691,686 | |||||||||||||||

Book value per common share | $ | 10.65 | $ | 9.15 | $ | 11.16 | $ | 8.90 | $ | 8.03 | ||||||||||

Tangible book value per common share | $ | 6.89 | $ | 8.71 | $ | 7.38 | $ | 8.46 | $ | 7.58 | ||||||||||

Tangible Assets: | ||||||||||||||||||||

Total assets | $ | 1,059,885 | $ | 432,170 | $ | 932,763 | $ | 429,544 | $ | 383,366 | ||||||||||

Adjustments: | ||||||||||||||||||||

Goodwill | 35,842 | 2,333 | 35,842 | 2,333 | 2,333 | |||||||||||||||

Other intangible assets | 1,178 | 149 | 1,310 | 176 | 242 | |||||||||||||||

Tangible assets | $ | 1,022,865 | $ | 429,688 | $ | 895,611 | $ | 427,035 | $ | 380,791 | ||||||||||

Tangible common equity to tangible assets | 6.62 | % | 11.54 | % | 8.09 | % | 11.28 | % | 11.33 | % | ||||||||||

For the Six Months Ended June 30, | For the Years Ended December 31, | |||||||||||||||||||

2022 | 2021 | 2021 | 2020 | 2019 | ||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||

GAAP-based efficiency ratio | 73.7 | % | 59.9 | % | 96 | % | 62 | % | 60 | % | ||||||||||

Net interest income | $ | 15,330 | $ | 5,680 | $ | 16,106 | $ | 11,574 | $ | 11,804 | ||||||||||

Noninterest income | 1,408 | 1,214 | 2,139 | 1,754 | 1,163 | |||||||||||||||

Less: net gains on sales of securities | 13 | — | 74 | 110 | 13 | |||||||||||||||

Adjusted revenue | $ | 16,725 | $ | 6,894 | $ | 18,171 | $ | 13,218 | $ | 12,954 | ||||||||||

Total noninterest expense | 12,342 | 4,130 | 17,497 | 8,306 | 7,788 | |||||||||||||||

Less: merger expenses | — | — | 4,584 | — | — | |||||||||||||||

Adjusted noninterest expense | 12,342 | 4,130 | 12,913 | 8,306 | 7,788 | |||||||||||||||

Efficiency ratio, as adjusted | 73.8 | % | 59.9 | % | 71 | % | 63 | % | 60 | % | ||||||||||

For the Six Months Ended June 30, | For the Years Ended December 31, | |||||||||||||||||||

2022 | 2021 | 2021 | 2020 | 2019 | ||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||

Net income | $ | 3,130 | $ | 2,298 | $ | 289 | $ | 4,193 | $ | 4,006 | ||||||||||

Average assets | 999,378 | 439,548 | 570,422 | 411,008 | 357,560 | |||||||||||||||

Return on average assets(1) | 0.63 | % | 1.05 | % | 0.05 | % | 1.02 | % | 1.12 | % | ||||||||||

Net income | $ | 3,130 | $ | 2,298 | $ | 289 | $ | 4,193 | $ | 4,006 | ||||||||||

Net (gain) loss on sale of securities | (13 | ) | — | (74 | ) | (110 | ) | (13 | ) | |||||||||||

Tax effect at 21% | 3 | — | 16 | 23 | 3 | |||||||||||||||

Merger expenses | — | — | 4,584 | — | — | |||||||||||||||

Tax benefit at 21% | — | — | (963 | ) | — | — | ||||||||||||||

Adjusted net income | 3,120 | 2,298 | 3,852 | 4,106 | 3,996 | |||||||||||||||

Average assets | 999,378 | 439,548 | 570,422 | 411,008 | 357,560 | |||||||||||||||

Adjusted return on average assets(1) | 0.63 | % | 1.05 | % | 0.68 | % | 1.00 | % | 1.12 | % | ||||||||||

| (1) | Annualized for the six-month periods ended June 30, 2022 and 2021. |

For the Six Months Ended June 30, | For the Years Ended December 31, | |||||||||||||||||||

2022 | 2021 | 2021 | 2020 | 2019 | ||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||

Net income | $ | 3,130 | $ | 2,298 | $ | 289 | $ | 4,193 | $ | 4,006 | ||||||||||

Average shareholders’ equity | 106,767 | 50,725 | 51,257 | 47,711 | 43,864 | |||||||||||||||

Return on average shareholders’ equity(1) | 5.91 | % | 9.14 | % | 0.56 | % | 8.79 | % | 9.13 | % | ||||||||||

Net income | $ | 3,130 | $ | 2,298 | $ | 289 | $ | 4,193 | $ | 4,006 | ||||||||||

Net (gain) loss on sale of securities | (13 | ) | — | (74 | ) | (110 | ) | (13 | ) | |||||||||||

Tax effect at 21% | 3 | — | 16 | 23 | 3 | |||||||||||||||

Merger expenses | — | — | 4,584 | — | — | |||||||||||||||

Tax benefit at 21% | — | — | (963 | ) | — | — | ||||||||||||||

Adjusted net income | 3,120 | 2,298 | 3,852 | 4,106 | 3,996 | |||||||||||||||

Average shareholders’ equity | 106,767 | 50,725 | 51,257 | 47,711 | 43,864 | |||||||||||||||

Adjusted return on average shareholders’ equity(1) | 5.89 | % | 9.14 | % | 7.52 | % | 8.61 | % | 9.11 | % | ||||||||||

| (1) | Annualized for the six-month periods ended June 30, 2022 and 2021. |

For the Six Months Ended June 30, | For the Years Ended December 31, | |||||||||||||||||||

2022 | 2021 | 2021 | 2020 | 2019 | ||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||

Net income | $ | 3,130 | $ | 2,298 | $ | 289 | $ | 4,193 | $ | 4,006 | ||||||||||

Average shareholders’ equity | 106,767 | 50,725 | 51,257 | 47,711 | 43,864 | |||||||||||||||

Return on average shareholders’ equity(1) | 5.91 | % | 9.14 | % | 0.56 | % | 8.79 | % | 9.13 | % | ||||||||||

Average Tangible Common Equity: | ||||||||||||||||||||

Average total shareholders’ equity | $ | 106,767 | $ | 50,725 | $ | 51,257 | $ | 47,711 | $ | 43,864 | ||||||||||

Adjustments: | ||||||||||||||||||||

Average goodwill | (35,842 | ) | (2,333 | ) | (11,919 | ) | (2,333 | ) | (2,213 | ) | ||||||||||

Average other intangible assets | (1,254 | ) | (163 | ) | (506 | ) | (213 | ) | (163 | ) | ||||||||||

Average tangible common equity | $ | 69,671 | $ | 48,229 | $ | 38,832 | $ | 45,165 | $ | 41,488 | ||||||||||

Return on average tangible common shareholders’ equity | 9.06 | % | 9.61 | % | 0.74 | % | 9.28 | % | 9.66 | % | ||||||||||

Net income | $ | 3,130 | $ | 2,298 | $ | 289 | $ | 4,193 | $ | 4,006 | ||||||||||

Net (gain) loss on sale of securities | (13 | ) | — | (74 | ) | (110 | ) | (13 | ) | |||||||||||

Tax effect at 21% | 3 | — | 16 | 23 | 3 | |||||||||||||||

Merger expenses | — | — | 4,584 | — | — | |||||||||||||||

Tax benefit at 21% | — | — | (963 | ) | — | — | ||||||||||||||

Adjusted net income | 3,120 | 2,298 | 3,852 | 4,106 | 3,996 | |||||||||||||||

Average tangible common equity | $ | 69,671 | $ | 48,229 | $ | 38,832 | $ | 45,165 | $ | 41,488 | ||||||||||

Adjusted return on average tangible equity(1) | 9.03 | % | 9.61 | % | 9.92 | % | 9.09 | % | 9.63 | % | ||||||||||

| (1) | Annualized for the six-month periods ended June 30, 2022 and 2021. |

At June 30, 2021 | At December 31, | |||||||||||

2020 | 2019 | |||||||||||

(In thousands) | ||||||||||||

Selected Balance Sheet Data: | ||||||||||||

Total assets | $ | 464,430 | $ | 424,106 | $ | 233,500 | ||||||

Cash and cash equivalents | 31,449 | 9,002 | 11,210 | |||||||||

Securities available for sale | 3,398 | 79,205 | 46,975 | |||||||||

Loans receivable, net | 409,427 | 323,214 | 166,793 | |||||||||

Goodwill and other intangible assets | 1,357 | 1,371 | 1,402 | |||||||||

Deposits | 372,053 | 283,054 | 188,673 | |||||||||

Borrowings | 23,087 | 78,982 | 6,914 | |||||||||

Subordinated debt | 19,973 | 19,970 | — | |||||||||

Total shareholders’ equity | 43,477 | 40,334 | 36,873 | |||||||||

For the Six Months Ended June 30, 2021 | For the Years Ended December 31, | |||||||||||

2020 | 2019 | |||||||||||

(In thousands) | ||||||||||||

Selected Operating Data: | ||||||||||||

Interest and dividend income | $ | 8,163 | $ | 12,558 | $ | 5,714 | ||||||

Interest expense | 1,372 | 3,381 | 1,710 | |||||||||

Net interest income | 6,791 | 9,177 | 4,004 | |||||||||

Provision for loan losses | 617 | 2,470 | 1,605 | |||||||||

Noninterest income | 269 | 649 | 393 | |||||||||

Noninterest expense | 6,229 | 9,120 | 8,867 | |||||||||

Income (loss) before income tax (benefit) expense | 214 | (1,764 | ) | (6,075 | ) | |||||||

Income tax (benefit) expense | (2,953 | ) | — | — | ||||||||

Net income (loss) | $ | 3,167 | $ | (1,764 | ) | $ | (6,075 | ) | ||||

At or For the Six Months Ended June 30, 2021 | At or For the Years Ended December 31, | |||||||||||

2020 | 2019 | |||||||||||

Performance Ratios (1): | ||||||||||||

Return on average assets | 1.51 | % | (0.54 | )% | (4.27 | )% | ||||||

Adjusted return on average assets (2) | 0.33 | % | (0.54 | )% | (4.27 | )% | ||||||

Return on average equity | 14.96 | % | (4.86 | )% | (15.29 | )% | ||||||

Adjusted return on average equity (2) | 3.23 | % | (4.86 | )% | (15.29 | )% | ||||||

Return on average tangible equity (2) | 15.46 | % | (5.05 | )% | (15.85 | )% | ||||||

Adjusted return on average tangible equity (2) | 3.33 | % | (5.05 | )% | (15.85 | )% | ||||||

Interest rate spread (3) | 3.16 | % | 2.78 | % | 2.64 | % | ||||||

Net interest margin (4) | 3.35 | % | 2.89 | % | 3.03 | % | ||||||

Efficiency ratio (5) | 88 | % | 93 | % | 202 | % | ||||||

Noninterest income to average total assets | 0.13 | % | 0.20 | % | 0.28 | % | ||||||

Noninterest income to total revenue (6) | 3.81 | % | 6.60 | % | 8.94 | % | ||||||

Noninterest expense to average total assets | 2.98 | % | 2.80 | % | 6.24 | % | ||||||

Average interest-earning assets to average interest-bearing liabilities | 127.82 | % | 124.35 | % | 139.26 | % | ||||||

Average equity to average total assets | 10.12 | % | 11.14 | % | 27.95 | % | ||||||

Share and Per Share Data: | ||||||||||||

Basic earnings | $ | 0.64 | $ | (0.38 | ) | $ | (1.34 | ) | ||||

Diluted earnings | $ | 0.60 | $ | (0.38 | ) | $ | (1.34 | ) | ||||

Book value | $ | 8.75 | $ | 8.12 | $ | 8.11 | ||||||

Tangible book value (7) | $ | 8.48 | $ | 7.84 | $ | 7.80 | ||||||

Dividend payout ratio (8) | 0.00 | % | 0.00 | % | 0.00 | % | ||||||

Number of shares outstanding | 4,968,089 | 4,967,089 | 4,545,297 | |||||||||

Weighted average number of shares Outstanding—diluted | 5,212,236 | 4,627,274 | 4,545,297 | |||||||||

Capital Ratios: | ||||||||||||

Tangible common equity to tangible assets (9) | 9.10 | % | 9.22 | % | 15.28 | % | ||||||

Common equity tier 1 capital to risk weighted assets(10) | 12.38 | % | 14.61 | % | 17.34 | % | ||||||

Tier 1 capital to average assets(10) | 12.52 | % | 12.84 | % | 14.05 | % | ||||||

Tier 1 capital to risk weighted assets(10) | 12.38 | % | 14.61 | % | 17.34 | % | ||||||

Total capital to risk weighted assets(10) | 13.60 | % | 15.86 | % | 18.33 | % | ||||||

Asset Quality Ratios: | ||||||||||||

Non-performing assets to total assets | 0.11 | % | 0.05 | % | 0.39 | % | ||||||

Non-performing loans to total loans | 0.13 | % | 0.06 | % | 0.55 | % | ||||||

Allowance for loan losses to non-performing loans | 933.85 | % | 2088.50 | % | 183.79 | % | ||||||

Allowance for loan losses to total loans | 1.16 | % | 1.27 | % | 1.00 | % | ||||||

Net charge-offs (recoveries) to average outstanding loans during the period | 0.00 | % | (0.01 | )% | (0.04 | )% | ||||||

Other: | ||||||||||||

Number of offices | 3 | 3 | 3 | |||||||||

Number of full-time equivalent employees | 64 | 54 | 46 | |||||||||

| (1) | Annualized for the six-month period ended June 30, 2021. |

| (2) | This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measure Reconciliation for Legacy LINKBANCORP.” |

| (3) | Represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities for the periods. |

| (4) | The net interest margin represents net interest income as a percent of average interest-earning assets for the periods. |

| (5) | The efficiency ratio represents noninterest expense divided by the sum of net interest income and noninterest income. |

| (6) | We calculate revenue as net interest income plus noninterest income, excluding gains or losses from securities sales, before provision for loan losses for the relevant periods. This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measure Reconciliation for Legacy LINKBANCORP.” |

| (7) | We calculate tangible book value per common share as total shareholders’ equity less goodwill and other intangibles, divided by the outstanding number of shares of our common stock at the end of the relevant period. Tangible book value per common share is a non-GAAP financial measure, and, as we calculate tangible book value per common share, the most directly comparable GAAP financial measure is book value per common share. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measure Reconciliation for Legacy LINKBANCORP.” |

| (8) | The dividend payout ratio represents dividends paid per share divided by net income per share. |

| (9) | We calculate tangible common equity as total shareholders’ equity less goodwill and other intangibles, and we calculate tangible assets as total assets less goodwill and other intangibles. This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “—Non-GAAP Financial Measure Reconciliation for Legacy LINKBANCORP.” |

| (10) | Ratios are only for LINKBANK. |

At June 30, 2021 | At December 31, | |||||||||||

2020 | 2019 | |||||||||||

(Dollars in thousands, except for share data) | ||||||||||||

Tangible Common Equity: | ||||||||||||

Total shareholders’ equity | $ | 43,477 | $ | 40,334 | $ | 36,873 | ||||||

Adjustments: | ||||||||||||

Goodwill | 1,253 | 1,253 | 1,253 | |||||||||

Other intangible assets | 104 | 118 | 147 | |||||||||

Tangible common equity | $ | 42,120 | $ | 38,963 | $ | 35,473 | ||||||

Common shares outstanding | 4,968,089 | 4,967,089 | 4,545,297 | |||||||||

Book value per common share | $ | 8.75 | $ | 8.12 | $ | 8.11 | ||||||

Tangible book value per common share | $ | 8.48 | $ | 7.84 | $ | 7.80 | ||||||

Tangible Assets: | ||||||||||||

Total assets | $ | 464,430 | $ | 424,106 | $ | 233,500 | ||||||

Adjustments: | ||||||||||||

Goodwill | 1,253 | 1,253 | 1,253 | |||||||||

Other intangible assets | 104 | 118 | 147 | |||||||||

Tangible assets | $ | 463,073 | $ | 422,735 | $ | 232,100 | ||||||

Tangible common equity to tangible assets | 9.10 | % | 9.22 | % | 15.28 | % | ||||||

For the Six Months Ended June 30, 2021 | ||||

(Dollars in thousands) | ||||

Net income | $ | 3,167 | ||

Average assets | 421,950 | |||

Return on average assets(1) | 1.51 | % | ||

Net income | $ | 3,167 | ||

Merger related expenses | 560 | |||

Reversal of deferred tax asset valuation allowance | (3,044 | ) | ||

Adjusted net income | 683 | |||

Average assets | 421,950 | |||

Adjusted return on average assets(1) | 0.33 | % | ||

| (1) | Annualized for the six-month period ended June 30, 2021. |

For the Six Months Ended June 30, 2021 | ||||

(Dollars in thousands) | ||||

Net income | $ | 3,167 | ||

Average equity | 42,687 | |||

Return on average equity(1) | 14.96 | % | ||

Net income | $ | 3,167 | ||

Merger related expenses | 560 | |||

Reversal of deferred tax asset valuation allowance | (3,044 | ) | ||

Adjusted net income | 683 | |||

Average equity | 42,687 | |||

Adjusted return on average equity(1) | 3.23 | % | ||

| (1) | Annualized for the six-month period ended June 30, 2021. |

For the Six Months Ended June 30, 2021 | For the Years Ended December 31, | |||||||||||

2020 | 2019 | |||||||||||

(Dollars in thousands) | ||||||||||||

Net income | $ | 3,167 | $ | (1,764 | ) | $ | (6,075 | ) | ||||

Average equity | 42,687 | 36,325 | 39,721 | |||||||||

Return (loss) on average equity(1) | 14.96 | % | (4.86 | )% | (15.29 | )% | ||||||

Average Tangible Common Equity: | ||||||||||||

Average total shareholders’ equity | $ | 42,687 | $ | 36,325 | $ | 39,721 | ||||||

Adjustments: | ||||||||||||

Average goodwill | (1,253 | ) | (1,253 | ) | (1,253 | ) | ||||||

Average other intangible assets | (119 | ) | (134 | ) | (152 | ) | ||||||

Average tangible common equity | $ | 41,315 | $ | 34,938 | $ | 38,316 | ||||||

Return on average tangible common shareholders’ equity | 15.46 | % | (5.05 | )% | (15.85 | )% | ||||||

Net income | $ | 3,167 | $ | (1,764 | ) | $ | (6,075 | ) | ||||

Merger related expenses | 560 | — | — | |||||||||

Reversal of deferred tax asset valuation allowance | (3,044 | ) | — | — | ||||||||

Adjusted net income (loss) | 683 | (1,764 | ) | (6,075 | ) | |||||||

Average tangible common equity | $ | 41,315 | $ | 34,938 | $ | 38,316 | ||||||

Adjusted return (loss) on average tangible common shareholders’ equity(1) | 3.33 | % | (5.05 | )% | (15.85 | )% | ||||||

| (1) | Annualized for the six-month period ended June 30, 2021. |

LINKBANCORP, Inc. for the Twelve Months Ended December 31, 2021 | (Accounting Acquiree) LINKBANCORP, Inc. (1/1/2021 to 9/17/2021) | Transaction Accounting Adjustments | Pro Forma Combined for the Twelve Months Ended December 31, 2021 | |||||||||||||||||

INTEREST AND DIVIDEND INCOME | ||||||||||||||||||||

Loans, including fees | $ | 15,924 | $ | 11,546 | $ | 1,813 | (1 | ) | $ | 29,283 | ||||||||||

Other | 2,572 | 106 | (6 | ) | (2 | ) | 2,672 | |||||||||||||

Total interest and dividend income | 18,496 | 11,652 | 1,807 | 31,955 | ||||||||||||||||

INTEREST EXPENSE | ||||||||||||||||||||

Deposits | 2,091 | 1,077 | (165 | ) | (3 | ) | 3,003 | |||||||||||||

Borrowings | 50 | 10 | — | 60 | ||||||||||||||||

Subordinated debt | 249 | 1,177 | (130 | ) | (4 | ) | 1,296 | |||||||||||||

Total interest expense | 2,390 | 2,264 | (295 | ) | 4,359 | |||||||||||||||

NET INTEREST INCOME BEFORE | ||||||||||||||||||||

PROVISION FOR LOAN LOSSES | 16,106 | 9,388 | 2,102 | 27,596 | ||||||||||||||||

Provision for Loan Losses | 648 | 768 | — | 1,416 | ||||||||||||||||

NET INTEREST INCOME AFTER | ||||||||||||||||||||

PROVISION FOR LOAN LOSSES | 15,458 | 8,620 | 2,102 | 26,180 | ||||||||||||||||

NONINTEREST INCOME | ||||||||||||||||||||

Service charges on accounts | 733 | 99 | — | 832 | ||||||||||||||||

Bank owned life insurance | 253 | 96 | — | 349 | ||||||||||||||||

Gain on sale of secondary market mortgage loans | 316 | — | — | 316 | ||||||||||||||||

Other | 837 | 217 | — | 1,054 | ||||||||||||||||

T otal noninterest incom | 2,139 | 412 | — | 2,551 | ||||||||||||||||

NONINTEREST EXPENSE | ||||||||||||||||||||

Salaries and employee benefits | 6,999 | 5,586 | — | 12,585 | ||||||||||||||||

Occupancy | 913 | 627 | — | 1,540 | ||||||||||||||||

Equipment and data processing | 1,340 | 1,088 | — | 2,428 | ||||||||||||||||

Professional fees | 685 | 713 | — | 1,398 | ||||||||||||||||

FDIC insurance | 231 | 159 | — | 390 | ||||||||||||||||

Bank shares tax | 434 | 265 | — | 699 | ||||||||||||||||

Merger related expenses | 4,584 | 922 | (5,506 | ) | (5 | ) | — | |||||||||||||

Other | 2,311 | 1,163 | 122 | (6 | ) | 3,596 | ||||||||||||||

Total noninterest expenses | 17,497 | 10,523 | (5,384 | ) | 22,636 | |||||||||||||||

Income (loss) before income tax (benefit) expense | 100 | (1,491 | ) | 7,486 | 6,095 | |||||||||||||||

Income tax (benefit) expense | (189 | ) | (2,922 | ) | 1,425 | (7 | ) | (1,686 | ) | |||||||||||

NET INCOME | $ | 289 | $ | 1,431 | $ | 6,061 | $ | 7,781 | ||||||||||||

EARNINGS PER SHARE | ||||||||||||||||||||

EARNINGS PER SHARE, BASIC | $ | 0.04 | $ | 0.29 | $ | 0.79 | ||||||||||||||

EARNINGS PER SHARE, DILUTED | $ | 0.04 | $ | 0.27 | $ | 0.76 | ||||||||||||||

WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING | ||||||||||||||||||||

BASIC | 6,879,658 | 4,967,986 | (2,034,451 | ) | (8 | ) | 9,813,193 | |||||||||||||

DILUTED | 7,250,463 | 5,379,387 | (2,405,256 | ) | (8 | ) | 10,224,594 | |||||||||||||

| (1) | The ASC 310-20 loan interest rate fair value and general credit fair value adjustments and the ASC 310-30 accretable yield will be substantially recognized over the expected life of the loans and is expected to |

| increase pro forma pre-tax interest income by $1.8 million for the year ended December 31, 2021. No pro forma earnings impact was assumed from the ASC310-30 non-accretable discount or ASC 310-20 loan fee reversals and existing loan fair value balances. |

| (2) | An other interest income adjustment of $6 thousand for the year ended December 31, 2021, was made to reflect lost interest income related to the payment of cash consideration of $10.1 million at a rate of 0.08%, the average federal funds rate from January 1, 2021 through the Merger date. |

| (3) | Adjustment to reflect the amortization of certificate of deposit fair value adjustment which will be substantially recognized over the life of the deposits. These adjustments are expected to decrease pro forma pre-tax interest expense by $165 thousand for the year ended December 31, 2021. |

| (4) | Adjustment to reflect the amortization of subordinated debt fair value adjustment which will be substantially recognized over the period to the call date. This adjustment is expected to decrease pro forma pre-tax interest expense by $130 thousand for year ended December 31, 2021. |

| (5) | Adjustment to other noninterest expense to reflect the reversal of Merger-related expenses. For the year ended December 31, 2021, total Merger expenses were $5.5 million. |

| (6) | Adjustment to reflect the amortization of the new core deposit intangible based upon an expected life of 10 years using sum-of-the-years’ digits method and is expected to increase pro forma pre-tax expense by $122 thousand for the year ended December 31, 2021. |

| (7) | Provision for income taxes was applied on income statement adjustments using an effective tax rate of 21%. |

| (8) | Adjustment to eliminate GNBF’s average common shares outstanding and recognize the issuance of LINKBANCORP common stock based on the election of those GNBF shareholders that elected to receive LINKBANCORP common stock at an exchange ratio of 7.3064. Adjusted diluted shares outstanding include the effect of LINKBANCORP’s stock options and stock warrants. |

| • | the duration of the credit; |

| • | credit risks of a particular customer; |

| • | changes in economic and industry conditions; and |

| • | evaluation of economic conditions; |

| • | in the case of a collateralized loan, risks resulting from uncertainties about the future value of the collateral. |

| • | an ongoing review of the quality, mix, and size of our overall loan portfolio; |

| • | our historical loan loss experience; |

| • | evaluation of economic conditions; |

| • | regular reviews of loan delinquencies and loan portfolio quality; |

| • | ongoing review of financial information provided by borrowers; and |

| • | the amount and quality of collateral, including guarantees, securing the loans. |

| • | we record interest income only on the cash basis or cost-recovery method for nonaccrual loans and we do not record interest income for other real estate owned; |

| • | we must provide for probable loan losses through a current period charge to the provision for loan losses; |

| • | noninterest expense increases when we write down the value of properties in our other real estate owned portfolio to reflect changing market values; |

| • | there are legal fees associated with the resolution of problem assets, as well as carrying costs, such as taxes, insurance, and maintenance fees; and |

| • | the resolution of non-performing assets requires the active involvement of management, which can distract them from more profitable activity. |

| • | an acquisition may negatively affect our results of operations, financial condition or cash flows because it may require us to incur charges or assume substantial debt or other liabilities, may cause adverse tax consequences or unfavorable accounting treatment, may expose us to claims and disputes by third parties, or may not generate sufficient financial return to offset additional costs and expenses related to the acquisition; |

| • | we may encounter difficulties or unforeseen expenditures in integrating acquired operations, including the associated internal controls and regulatory functions, into our operations, particularly if key personnel of the acquired company decide not to work for us; |

| • | an acquisition may disrupt our ongoing business, divert resources, increase our expenses and distract our management; |

| • | an acquisition may involve the entry into geographic or business markets in which we have little or no prior experience or where competitors have stronger market positions; |

| • | if we incur debt to fund such acquisition, such debt may subject us to material restrictions on our ability to conduct our business as well as financial maintenance covenants; and |

| • | to the extent that we issue a significant amount of equity securities in connection with future acquisitions, existing shareholders may be diluted and earnings per share may decrease. |

| • | changes in general economic conditions and overall market fluctuations; |

| • | changes in interest rates; |

| • | actual or anticipated fluctuations in our quarterly or annual operating results; |

| • | changes in accounting standards, policies, guidance, interpretations or principles; |

| • | the public reaction to our press releases, our other public announcements and our filings with the SEC, or other news concerning our competitors or trends in our industry; |

| • | changes in financial estimates and recommendations by securities analysts following our stock, or the failure of securities analysts to cover our common stock after this offering; |

| • | changes in earnings estimates by securities analysts or our ability to meet those estimates; |

| • | the operating and stock price performance of other comparable companies; |

| • | the trading volume of our common stock; |

| • | new technology used, or services offered, by competitors; |

| • | changes in business, legal or regulatory conditions, or other developments affecting the financial services industry, participants in our industry; and |

| • | future sales of our common stock by us, directors, executives and significant shareholders, including the sale of our common stock by our existing shareholders who are not subject to the lock-up agreements described in “Underwriting.” |

| • | enable our board of directors to increase the size of the board and fill the vacancies created by the increase; |

| • | provide that directors may only be removed for cause and by a majority of the votes entitled to be cast; |

| • | enable our board of directors to amend our Bylaws without shareholder approval, subject, however, to any provision of the Articles of Incorporation, Bylaws, or the Pennsylvania Business Corporation Law that requires action to be taken by the shareholders and the general power of the shareholders to change such action in accordance with the Bylaws and Pennsylvania Business Corporation Law; |

| • | require advance notice for shareholder proposals and director nominations; |

| • | require a supermajority vote of the shareholders to approve a merger that has not been approved by the board of directors, and to amend certain provisions in the Articles of Incorporation and the Bylaws; and |

| • | require prior regulatory approval of any transaction involving control of our organization. |

| • | statements of our goals, intentions and expectations; |

| • | statements regarding our business plans, prospects, growth and operating strategies; |

| • | statements regarding the quality of our loan and investment portfolios; and |

| • | estimates of our risks and future costs and benefits. |

| • | general economic conditions, either nationally or in our market areas, that are worse than expected; |

| • | fluctuations in real estate values and both residential and commercial real estate market conditions; |

| • | demand for loans and deposits in our market area; |

| • | conditions relating to the COVID-19 pandemic, including the severity and duration of the associated economic slowdown either nationally or in our market areas and the effectiveness of vaccination programs, that are worse than expected; |

| • | changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses; |

| • | our ability to access cost-effective funding; |

| • | our ability to implement and change our business strategies; |

| • | competition among depository and other financial institutions; |

| • | inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; |

| • | the rate of delinquencies and amounts of loans charged-off; |

| • | adverse changes in the securities markets; |

| • | changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; |

| • | our ability to capitalize on strategic opportunities; |

| • | our ability to successfully introduce new products and services, enter new markets, and capitalize on growth opportunities; |

| • | our ability to successfully integrate into our operations any assets, liabilities, customers, systems and management personnel we may acquire and our ability to realize related revenue synergies and cost savings within expected time frames, and any goodwill charges related thereto; |

| • | our ability to retain our existing customers; |

| • | changes in consumer spending, borrowing and savings habits; |

| • | changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission or the Public Company Accounting Oversight Board; |

| • | changes in our organization, compensation and benefit plans; |

| • | changes in the quality or composition of our loan or investment portfolios; |

| • | a breach in security of our information systems, including the occurrence of a cyber incident or a deficiency in cyber security; |

| • | political instability or civil unrest; |

| • | acts of war or terrorism; |

| • | competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional providers, including retail businesses and technology companies; |

| • | the failure to attract and retain skilled people; |

| • | the fiscal and monetary policies of the federal government and its agencies; and |

| • | other economic, competitive, governmental, regulatory and operational factors affecting our operations, pricing, products and services described elsewhere in this prospectus. |

| • | on an actual basis; and |

| • | on a pro forma basis to give effect to the issuance and sale by us of 4,575,000 shares of common stock in this offering (assuming the underwriters do not exercise their option to purchase any additional shares to cover over-allotments, if any), and the receipt and application of the net proceeds from the sale of these shares at an initial public offering price of $8.75 per share after deducting underwriting discounts and commissions and the estimated offering expenses payable by us. |

At June 30, 2022 | ||||||||

Actual | As Adjusted | |||||||

(dollars in thousands except per share data) | ||||||||

(unaudited) | ||||||||

Short term debt | $ | 1,639 | $ | 1,639 | ||||

Long term debt | 40,585 | 40,585 | ||||||

Total debt | 42,224 | 42,224 | ||||||

Shareholders’ equity: | ||||||||

Common stock, par value $0.01 per share; authorized—25,000,000 shares; outstanding—9,838,435 shares actual and 14,413,435 shares as adjusted | $ | 99 | $ | 104 | ||||

Surplus | 83,070 | 119,288 | ||||||

Retained earnings | 26,491 | 26,491 | ||||||

Accumulated other comprehensive income (loss), net of taxes | (4,889 | ) | (4,889 | ) | ||||

Total shareholders’ equity | $ | 104,771 | $ | 140,994 | ||||

Total capitalization | $ | 146,995 | $ | 183,218 | ||||

Capital ratios | ||||||||

Tangible common equity to tangible assets(1) | 6.62 | % | 10.16 | % | ||||

Common equity tier 1 capital to risk-weighted assets(2) | 11.94 | % | 15.73 | % | ||||

Tier 1 capital to average assets(2) | 10.10 | % | 12.83 | % | ||||

Tier 1 capital to risk-weighted assets(2) | 11.94 | % | 15.73 | % | ||||

Total capital to risk-weighted assets(2) | 12.42 | % | 16.22 | % | ||||

Per share data | ||||||||

Book value per common share | $ | 10.66 | $ | 9.78 | ||||

Tangible book value per common share(1) | $ | 6.89 | $ | 7.22 | ||||

| (1) | Tangible book value represents the amount of our total tangible assets reduced by our total liabilities. Tangible assets are calculated by reducing total assets, as defined by GAAP, by $35.8 million in goodwill and $1.2 million in other intangible assets. Tangible book value at June 30, 2022 was $67.8 million “Actual” and $104.0 million “As Adjusted.” Tangible book value per common share represents our tangible book value divided by the number of shares of our common stock outstanding. |

| (2) | Ratios are for the Bank only. |

Assumed initial public offering price per share | $ | 8.75 | ||||||

Net tangible book value per share at June 30, 2022 | $ | 6.89 | ||||||

Increase in net tangible book value per share attributable to this offering | 0.33 | |||||||

As adjusted tangible book value per share after this offering | 7.22 | |||||||

Dilution in net tangible book value per share to new investors | $ | 1.53 | ||||||

Shares Purchased | Total Consideration | Average Price Per Share | ||||||||||||||||||

Number | Percentage | Amount | Percentage | |||||||||||||||||

Existing shareholders as of June 30, 2022 | 9,838,435 | 68.3% | $ | 83,169 | 67.5% | $8.45 | ||||||||||||||

New Investors | 4,575,000 | 31.7% | 40,031 | 32.5% | 8.75 | |||||||||||||||

Total | 14,413,435 | 100.0% | $ | 123,200 | 100.0% | 8.55 | ||||||||||||||

Quarterly Period | Amount Per Share | |||

June 30, 2022 | $ | 0.075 | ||

March 31, 2022 | $ | 0.075 | ||

December 31, 2021 | $ | 0.075 | ||

| • | our historical and projected financial condition, liquidity and results of operations; |

| • | our capital levels and requirements; |

| • | statutory and regulatory prohibitions and other limitations; |

| • | any contractual restriction on our ability to pay cash dividends, including pursuant to the terms of any of our credit agreements or other borrowing arrangements; |

| • | our business strategy; |

| • | tax considerations; |

| • | any acquisitions or potential acquisitions that we may examine; |

| • | general economic conditions; and |

| • | other factors deemed relevant by our board of directors. |

Fiscal Year Ending December 31, 2022 | High | Low | ||||||

Third Quarter through September 2, 2022 | $ | 9.50 | $ | 8.80 | ||||

Second Quarter | 11.21 | 9.20 | ||||||

First Quarter | 11.95 | 11.05 | ||||||

Fiscal Year Ending December 31, 2021 | ||||||||

Fourth Quarter | $ | 13.40 | $ | 11.50 | ||||

Third Quarter | 19.00 | 13.05 | ||||||

Second Quarter | 13.75 | 11.55 | ||||||

First Quarter | 12.00 | 11.25 | ||||||

Fiscal Year Ending December 31, 2020 | ||||||||

Fourth Quarter | $ | 12.09 | $ | 10.25 | ||||

Third Quarter | 11.00 | 9.99 | ||||||

Second Quarter | 12.00 | 9.05 | ||||||

First Quarter | 10.00 | 10.00 | ||||||

Change | ||||||||||||||||||||||||||||

As of June 30, 2022 | As of December 31, | June 30, 2022 vs. December 31, 2021 | December 31, 2021 vs. December 31, 2020 | |||||||||||||||||||||||||

2021 | 2020 | Amount | Percentage | Amount | Percentage | |||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||

Total assets | $ | 1,059,885 | $ | 932,763 | $ | 429,544 | $ | 127,092 | 13.6 | % | $ | 503,219 | 117.2 | % | ||||||||||||||

Cash and cash equivalents | 62,996 | 22,590 | 33,162 | 40,406 | 178.9 | % | (10,572 | ) | (31.9 | )% | ||||||||||||||||||

Loans receivable, net | 786,516 | 711,664 | 233,795 | 74,852 | 10.5 | % | 477,869 | 204.4 | % | |||||||||||||||||||

Securities available for sale | 85,756 | 103,783 | 125,447 | (18,027 | ) | (17.4 | )% | (21,664 | ) | (17.3 | )% | |||||||||||||||||

Securities held to maturity | 28,816 | — | — | 28,816 | 100.0 | % | — | — | ||||||||||||||||||||

Total deposits | 902,373 | 771,665 | 375,124 | 130,708 | 16.9 | % | 396,541 | 105.7 | % | |||||||||||||||||||

Other borrowings | 1,639 | 19,814 | 1,120 | (18,175 | ) | (91.7 | )% | 18,694 | 1669.1 | % | ||||||||||||||||||

Subordinated debt | 40,585 | 20,696 | — | 19,889 | 96.1 | % | 20,694 | N/A | % | |||||||||||||||||||

Shareholders’ Equity | 104,771 | 109,623 | 50,674 | (4,852 | ) | (4.4 | )% | 58,949 | 116.3 | % | ||||||||||||||||||

(amounts in thousands) | ||||

Cash and cash equivalents | $ | 49,962 | ||

Securities available for sale | 3,111 | |||

Loans | 415,905 | |||

Premises and equipment | 2,087 | |||

Right-of-use asset | 4,544 | |||

Intangible assets | 1,246 | |||

Goodwill | 33,508 | |||

Investment in bank owned life insurance | 4,784 | |||

Deferred taxes | 3,675 | |||

Other assets | 4,394 |

| • | Net increase in deposits of $130.7 million; |

| • | Cash received from investment securities (calls, maturities, and principal repayments) of $9.6 million; |

| • | Proceeds from the issuance of subordinated debt of $20.0 million; and |

| • | Cash provided by operating activities of $803 thousand. |

| • | Repayments of borrowings of $18.2 million; |

| • | Net increase in the funding of loans receivable of $70.6 million; |

| • | Purchase of investment securities held to maturity of $29.4 million; and |

| • | Payment of dividends of $1.5 million. |

| • | Cash provided by operating activities of $4.8 million; |

| • | Net cash acquired through the Merger of $39.9 million; |

| • | Net increase in deposits of $5.4 million; |

| • | Net cash from available for sale investment securities (sales, calls, maturities, and principal repayments less purchases) of $21.7 million; and |

| • | Net proceeds from redemption of certificates of deposits with other banks of $4.2 million. |

| • | Repayments of borrowings of $14.3 million; |

| • | Net increase in the funding of loans receivable of $66.5 million; |

| • | Payment of dividends of $1.5 million; and |

| • | Purchase of bank-owned life insurance of $5.0 million. |

June 30, 2022 | ||||||||||||||||

(In Thousands) | Amortized Cost | Gross Unrealized Gain | Gross Unrealized Losses | Fair Value | ||||||||||||

Available for Sale: | ||||||||||||||||

Small Business Administration loan pools | $ | 706 | $ | — | $ | (13 | ) | $ | 693 | |||||||

Obligations of state and political subdivisions | 44,389 | 50 | (3,446 | ) | 40,993 | |||||||||||

Mortgage-backed securities in government-sponsored entities | 46,847 | 3 | (2,780 | ) | 44,070 | |||||||||||

Total | $ | 91,942 | $ | 53 | $ | (6,239 | ) | $ | 85,756 | |||||||

June 30, 2022 | ||||||||||||||||

(In Thousands) | Amortized Cost | Gross Unrealized Gain | Gross Unrealized Losses | Fair Value | ||||||||||||

Held to Maturity: | ||||||||||||||||

Corporate debentures | $ | 9,993 | $ | — | $ | (241 | ) | $ | 9,752 | |||||||

Mortgage-backed securities in government-sponsored entities | 18,823 | — | (285 | ) | 18,538 | |||||||||||

Total | $ | 28,816 | $ | — | $ | (526 | ) | $ | 28,290 | |||||||

December 31, 2021 | ||||||||||||||||

(In Thousands) | Amortized Cost | Gross Unrealized Gain | Gross Unrealized Losses | Fair Value | ||||||||||||

Available for Sale: | ||||||||||||||||

Small Business Administration loan pools | $ | 1,099 | $ | — | $ | (15 | ) | $ | 1,084 | |||||||

Obligations of state and political subdivisions | 46,115 | 2,405 | (38 | ) | 48,482 | |||||||||||

Mortgage-backed securities in government-sponsored entities | 54,239 | 382 | (404 | ) | 54,217 | |||||||||||

Total | $ | 101,453 | $ | 2,787 | $ | (457 | ) | $ | 103,783 | |||||||

Available for Sale Securities | Held to Maturity Securities | |||||||||||||||

(In Thousands) | Amortized Cost | Fair Value | Amortized Cost | Fair Value | ||||||||||||

Due within one year | $ | 95 | $ | 95 | $ | — | $ | — | ||||||||

Due after one year through five years | 5,554 | 5,535 | 3,000 | 2,965 | ||||||||||||

Due after five years through ten years | 11,983 | 11,532 | 6,993 | 6,787 | ||||||||||||

Due after ten years | 29,872 | 26,757 | — | — | ||||||||||||

Mortgage-backed securities and collateralized mortgage obligations | 44,438 | 41,837 | 18,823 | 18,538 | ||||||||||||

| $ | 91,942 | $ | 85,756 | $ | 28,816 | $ | 28,290 | |||||||||

Change | ||||||||||||||||||||||||||||

As of June 30, | As of December 31, | June 30, 2022 vs. December 31, 2021 | December 31, 2021 vs. December 31, 2020 | |||||||||||||||||||||||||

2022 | 2021 | 2020 | Amount | Percentage | Amount | Percentage | ||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||

Agriculture loans | $ | 7,710 | $ | 9,341 | $ | 11,246 | $ | (1,631 | ) | (17.46 | )% | $ | (1,905 | ) | (16.94 | )% | ||||||||||||

Commercial business loans | 88,452 | 98,604 | 21,534 | (10,152 | ) | (10.30 | )% | 77,070 | 357.90 | % | ||||||||||||||||||

PPP loans | 2,527 | 23,774 | — | (21,247 | ) | (89.37 | )% | 23,774 | N/A | |||||||||||||||||||

Commercial real estate loans | 435,588 | 338,749 | 27,261 | 96,839 | 28.59 | % | 311,488 | 1142.61 | % | |||||||||||||||||||

Residential real estate loans(1) | 241,401 | 231,302 | 167,536 | 10,099 | 4.37 | % | 63,766 | 38.06 | % | |||||||||||||||||||

Consumer loans | 8,689 | 7,087 | 2,514 | 1,602 | 22.60 | % | 4,573 | 181.90 | % | |||||||||||||||||||

Municipal loans | 5,814 | 6,182 | 6,749 | (368 | ) | (5.95 | )% | (567 | ) | (8.40 | )% | |||||||||||||||||

Total Loans | 790,181 | 715,039 | 236,840 | 75,142 | 10.51 | % | 478,199 | 201.91 | % | |||||||||||||||||||

Deferred (fees) costs | 225 | (223 | ) | (256 | ) | 448 | 200.90 | % | 33 | (12.89 | )% | |||||||||||||||||

Allowance for loan losses | (3,890 | ) | (3,152 | ) | (2,789 | ) | 738 | 23.41 | % | (363 | ) | 13.02 | % | |||||||||||||||

Net Loans | $ | 786,516 | $ | 711,664 | $ | 233,795 | $ | 74,852 | 10.52 | % | $ | 477,869 | 204.40 | % | ||||||||||||||

| (1) | Residential real estate loans consist of one- to four-family residential, residential development, home equity and farmland loans. |

(In Thousands) | Due in One Year or Less | After One but Within Five Years | After Five but Within Fifteen Years | After Fifteen Years | Total due after One Year | Total | ||||||||||||||||||

Agriculture loans | $ | 1,317 | $ | 1,117 | $ | 806 | $ | 4,470 | $ | 6,393 | $ | 7,710 | ||||||||||||

Commercial business loans | 9,254 | 26,048 | 19,849 | 33,301 | 79,198 | 88,452 | ||||||||||||||||||

PPP loans | — | 2,527 | — | — | 2,527 | 2,527 | ||||||||||||||||||

Commercial real estate loans | 15,800 | 48,673 | 327,778 | 43,337 | 419,788 | 435,588 | ||||||||||||||||||

Residential real estate loans | 6,278 | 51,552 | 93,797 | 89,774 | 235,123 | 241,401 | ||||||||||||||||||

Consumer and other loans | 134 | 689 | 7,449 | 417 | 8,555 | 8,689 | ||||||||||||||||||

Municipal loans | 197 | 495 | 2,725 | 2,397 | 5,617 | 5,814 | ||||||||||||||||||

Total | $ | 32,980 | $ | 131,101 | $ | 452,404 | $ | 173,696 | $ | 757,201 | $ | 790,181 | ||||||||||||

Loans with fixed interest rates | ||||||||||||||||||||||||

Agriculture loans | $ | 139 | $ | 627 | $ | 166 | $ | — | $ | 793 | $ | 932 | ||||||||||||

Commercial business loans | 1,431 | 19,095 | 8,105 | 260 | 27,460 | 28,891 | ||||||||||||||||||

PPP loans | — | 2,527 | — | — | 2,527 | 2,527 | ||||||||||||||||||

Commercial real estate loans | 2,652 | 21,217 | 139,794 | 993 | 162,004 | 164,656 | ||||||||||||||||||

Residential real estate loans | 1,058 | 13,555 | 37,920 | 18,630 | 70,105 | 71,163 | ||||||||||||||||||

Consumer and other loans | 69 | 658 | 44 | 417 | 1,119 | 1,188 | ||||||||||||||||||

Municipal loans | 197 | 106 | 2,486 | 700 | 3,292 | 3,489 | ||||||||||||||||||

Total | $ | 5,546 | $ | 57,785 | $ | 188,515 | $ | 21,000 | $ | 267,300 | $ | 272,846 | ||||||||||||

Loans with floating interest rates | ||||||||||||||||||||||||

Agriculture loans | $ | 1,178 | $ | 490 | $ | 640 | $ | 4,470 | $ | 5,600 | $ | 6,778 | ||||||||||||

Commercial business loans | 7,823 | 6,953 | 11,744 | 33,041 | 51,738 | 59,561 | ||||||||||||||||||

PPP loans | — | — | — | — | — | — | ||||||||||||||||||

Commercial real estate loans | 13,148 | 27,456 | 187,984 | 42,344 | 257,784 | 270,932 | ||||||||||||||||||

Residential real estate loans | 5,220 | 37,997 | 55,877 | 71,144 | 165,018 | 170,238 | ||||||||||||||||||

Consumer and other loans | 65 | 31 | 7,405 | — | 7,436 | 7,501 | ||||||||||||||||||

Municipal loans | — | 389 | 239 | 1,697 | 2,325 | 2,325 | ||||||||||||||||||

Total | $ | 27,434 | $ | 73,316 | $ | 263,889 | $ | 152,696 | $ | 489,901 | $ | 517,335 | ||||||||||||

June 30, 2022 | December 31, 2021 | |||||||||||||||||||||||

Nonperforming Loans | Nonperforming Loans | |||||||||||||||||||||||

(In Thousands) | Total Loans | Amount | Percent of Loans in Category | Total Loans | Amount | Percent of Loans in Category | ||||||||||||||||||

Agriculture loans | $ | 7,710 | $ | — | — | $ | 9,341 | $ | — | — | ||||||||||||||

Commercial business loans | 88,452 | 36 | 0.04 | % | 98,604 | 39 | 0.04 | % | ||||||||||||||||

PPP loans | 2,527 | — | — | 23,774 | — | — | ||||||||||||||||||

Commercial real estate loans | 435,588 | 137 | 0.03 | % | 338,749 | 144 | 0.04 | % | ||||||||||||||||

Residential real estate loans | 241,401 | 1,321 | 0.55 | % | 231,302 | 1,211 | 0.52 | % | ||||||||||||||||

Consumer and other loans | 8,689 | — | — | 7,087 | 2 | 0.03 | % | |||||||||||||||||

Municipal loans | 5,814 | — | — | 6,182 | — | — | ||||||||||||||||||

Total | $ | 790,181 | $ | 1,494 | 0.19 | % | $ | 715,039 | $ | 1,396 | 0.20 | % | ||||||||||||

Excluding PPP loans | $ | 787,654 | $ | 1,494 | 0.19 | % | $ | 691,265 | $ | 1,396 | 0.20 | % | ||||||||||||

Allowance for loan losses | $ | 3,89 0 | $ | 3,152 | ||||||||||||||||||||

Ratio of allowance for loan losses to total loans | 0.49 | % | 0.44 | % | ||||||||||||||||||||

Ratio of nonperforming loans to total loans | 0.19 | % | 0.19 | % | ||||||||||||||||||||

Ratio of allowance for loan losses to nonperforming loans | 260.37 | % | 225.79 | % | ||||||||||||||||||||

December 31, 2020 | ||||||||||||

Nonperforming Loans | ||||||||||||

(In Thousands) | Total Loans | Amount | Percent of Loans in Category | |||||||||

Agriculture loans | $ | 11,246 | $ | — | — | |||||||

Commercial business loans | 21,534 | 48 | 0.22 | % | ||||||||

PPP loans | — | — | — | |||||||||

Commercial real estate loans | 27,261 | — | — | |||||||||

Residential real estate loans | 167,536 | 568 | 0.34 | % | ||||||||

Consumer and other loans | 2,514 | — | — | |||||||||

Municipal loans | 6,749 | — | — | |||||||||

Total | $ | 236,840 | $ | 616 | 0.26 | % | ||||||

Excluding PPP loans | $ | 236,840 | $ | 616 | 0.26 | % | ||||||

Allowance for loan losses | $ | 2,789 | ||||||||||

Ratio of allowance for loan losses to total loans | 1.18 | % | ||||||||||

Ratio of nonperforming loans to total loans | 0.26 | % | ||||||||||

Ratio of allowance for loan losses to nonperforming loans | 452.76 | % | ||||||||||

(In Thousands) | Amount of Allowance Allocated | Percent of Loans in Each Category to Total Loans | Total Loans | Ratio of Allowance Allocated to Loans in Each Category | ||||||||||||

June 30, 2022 | ||||||||||||||||

Agriculture loans | $ | 17 | 0.98 | % | $ | 7,710 | 0.22 | % | ||||||||

Commercial business loans | 506 | 11.19 | % | 88,452 | 0.57 | % | ||||||||||

PPP loans | — | 0.32 | % | 2,527 | 0.00 | % | ||||||||||

Commercial real estate loans | 1,786 | 55.13 | % | 435,588 | 0.41 | % | ||||||||||

Residential real estate loans | 1,547 | 30.55 | % | 241,401 | 0.64 | % | ||||||||||

Consumer and other loans | 21 | 1.10 | % | 8,689 | 0.24 | % | ||||||||||

Municipal loans | 13 | 0.73 | %�� | 5,814 | 0.22 | % | ||||||||||

Unallocated Allowance | — | — | — | — | ||||||||||||

Total | $ | 3,890 | 100.00 | % | $ | 790,181 | 0.49 | % | ||||||||

December 31, 2021 | ||||||||||||||||

Agriculture loans | $ | 23 | 1.31 | % | $ | 9,341 | 0.25 | % | ||||||||

Commercial business loans | 582 | 13.79 | % | 98,604 | 0.59 | % | ||||||||||

PPP loans | — | 3.32 | % | 23,774 | 0.00 | % | ||||||||||

Commercial real estate loans | 799 | 47.37 | % | 338,749 | 0.24 | % | ||||||||||

Residential real estate loans | 1,634 | 32.35 | % | 231,302 | 0.71 | % | ||||||||||

Consumer and other loans | 22 | 0.99 | % | 7,087 | 0.31 | % | ||||||||||

Municipal loans | 15 | 0.86 | % | 6,182 | 0.24 | % | ||||||||||

Unallocated Allowance | 77 | — | — | — | ||||||||||||

Total | $ | 3,152 | 100.00 | % | $ | 715,039 | 0.44 | % | ||||||||

December 31, 2020 | ||||||||||||||||

Agriculture loans | $ | 120 | 4.75 | % | $ | 11,246 | 1.07 | % | ||||||||

Commercial business loans | 290 | 9.09 | % | 21,534 | 1.35 | % | ||||||||||

Commercial real estate loans | 314 | 11.51 | % | 27,261 | 1.15 | % | ||||||||||

Residential real estate loans | 1,702 | 70.74 | % | 167,536 | 1.02 | % | ||||||||||

Consumer and other loans | 35 | 1.06 | % | 2,514 | 1.39 | % | ||||||||||

Municipal loans | 18 | 2.85 | % | 6,749 | 0.27 | % | ||||||||||

Unallocated Allowance | 310 | — | — | — | ||||||||||||

Total | $ | 2,789 | 100.00 | % | $ | 236,840 | 1.18 | % | ||||||||

(In Thousands) | ||||||||

Nature of Loan Adjustment | June 30, 2022 | December 31, 2021 | ||||||

To reflect a market interest rate | $ | (1,058 | ) | $ | (1,337 | ) | ||

To reflect additional credit risk | (6,071 | ) | (7,105 | ) | ||||

Total | $ | (7,128 | ) | $ | (8,442 | ) | ||

(In Thousands) | Provision Expense (Benefit) | Net (Charge- Offs) Recoveries | Average Loans | Ratio of Annualized Net (Charge-Offs) Recoveries to Average Loans | ||||||||||||

At June 30, 2022 | ||||||||||||||||

Agriculture loans | $ | (6 | ) | $ | — | $ | 8,153 | — | % | |||||||

Commercial business loans | (82 | ) | 6 | 96,073 | 0.01 | % | ||||||||||

PPP loans | — | — | 12,011 | — | % | |||||||||||

Commercial real estate loans | 988 | (1 | ) | 379,301 | (0.00 | )% | ||||||||||

Residential real estate loans | (143 | ) | 56 | 226,781 | 0.02 | % | ||||||||||

Consumer and other loans | (3 | ) | 2 | 6,878 | 0.03 | % | ||||||||||

Municipal loans | (2 | ) | — | 6,059 | — | % | ||||||||||

Unallocated | (77 | ) | — | — | — | % | ||||||||||