CHANGE IN ACCOUNTANTS

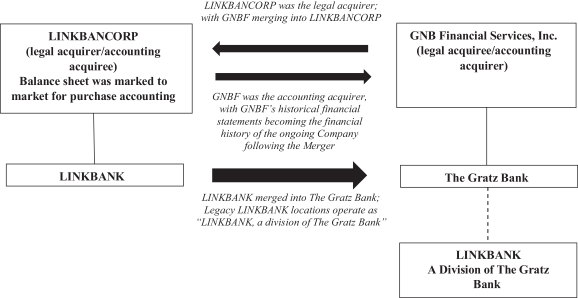

Effective on September 18, 2021, the Company completed its Merger with GNBF. The Merger was treated as a “reverse merger” for accounting purposes with GNBF as the accounting acquirer and the Company as the legal acquirer. The Securities and Exchange Commission has released guidance that, in the case of a reverse merger, unless the same independent accountant reported on the most recent financial statements of both the accounting acquirer and the legal acquirer, a change in accountants will occur. Prior to the completion of the Merger, GNBF’s independent accountant was Hacker, Johnson & Smith PA and the Company’s independent accountant was S.R. Snodgrass, P.C. In addition, S.R. Snodgrass, P.C. had previously served as the independent accountant for GNBF for the year ended December 31, 2019.

On September 17, 2021, Hacker, Johnson & Smith PA resigned as principal accountant of the Company as a result of the completion of the Merger.

The audit report of Hacker, Johnson & Smith PA on GNBF’s consolidated financial statements as of and for the year ended December 31, 2020 did not contain an adverse opinion or a disclaimer of opinion, and was not qualified or modified as to uncertainty, audit scope or accounting principles. During the year ended December 31, 2020 and the subsequent interim period through September 17, 2021, there were no: (1) disagreements with Hacker, Johnson & Smith PA on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which disagreements, if not resolved to the satisfaction of Hacker, Johnson & Smith PA, would have caused Hacker, Johnson & Smith PA to make reference to the subject matter of the disagreements in connection with its audit report, or (2) reportable events under Item 304(a)(1)(v) of SEC Regulation S-K.

The audit report of S.R. Snodgrass, P.C. on GNBF’s consolidated financial statements as of and for the year ended December 31, 2019 did not contain an adverse opinion or a disclaimer of opinion, and was not qualified or modified as to uncertainty, audit scope or accounting principles. During the year ended December 31, 2019, there were no: (1) disagreements with S.R. Snodgrass, P.C. on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which disagreements, if not resolved to the satisfaction of S.R. Snodgrass, P.C., would have caused S.R. Snodgrass, P.C. to make reference to the subject matter of the disagreements in connection with its audit report, or (2) reportable events under Item 304(a)(1)(v) of SEC Regulation S-K.

The Company provided Hacker, Johnson & Smith PA with a copy of this disclosure contained in a Current Report on Form 8-K prior to filing with the Securities and Exchange Commission. The Company requested that Hacker, Johnson & Smith PA issue a letter stating whether or not it agreed with the above statements. The letter from Hacker, Johnson & Smith PA to the Securities and Exchange Commission is filed as Exhibit 16.1 to this registration statement.

The Company has provided S.R. Snodgrass, P.C. with a copy of this disclosure contained in a Current Report on Form 8-K prior to filing with the Securities and Exchange Commission. The Company requested that S.R. Snodgrass, P.C. issue a letter stating whether or not it agreed with the above and below statements. The letter from S.R. Snodgrass, P.C. to the Securities and Exchange Commission is attached as Exhibit 16.2 to this registration statement.

Concurrent with the Merger, the Audit Committee of the Company engaged S.R. Snodgrass, P.C. as the Company’s new principal accountant for the year ending December 31, 2021. During the years ended December 31, 2020 and 2019 and the subsequent interim period prior to engaging S.R. Snodgrass, P.C., the Company did not consult with S.R. Snodgrass, P.C. regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company that S.R. Snodgrass, P.C. concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a disagreement or a reportable event, each as defined in Regulation S-K Item 304(a)(1)(v), respectively.

150