CONSOLIDATED FINANCIAL STATEMENTS Vida JV LLC & Subsidiaries (A Limited Liability Company) For the Year Ended December 31, 2021 and for the Period From September 29, 2020 (inception) to December 31, 2020 With Report of Independent Auditors

Vida JV LLC & Subsidiaries Consolidated Financial Statements For the Year Ended December 31, 2021 and for the Period From September 29, 2020 (inception) to December 31, 2020 Table of Contents Report of Independent Auditors ........................................................................................... 2 Consolidated Financial Statements Consolidated Balance Sheets ................................................................................................ 4 Consolidated Statements of Operations ............................................................................... 5 Consolidated Statements of Changes in Members' Equity ................................................... 6 Consolidated Statements of Cash Flows ............................................................................... 7 Notes to Consolidated Financial Statements ........................................................................ 8 Supplemental Information: Schedule III - Real Estate and Accumulated Depreciation ....... 21 1

Report of Independent Auditors To the Members of Vida JV LLC Opinion We have audited the accompanying consolidated financial statements of Vida JV LLC and its subsidiaries (the "Company"), which comprise the consolidated balance sheets as of December 31, 2021 and 2020, and the related consolidated statements of operations, of members' equity and of cash flows for the year ended December 31, 2021 and for the period from September 29, 2020 (inception) to December 31, 2020, including the related notes (collectively referred to as the "consolidated financial statements"). In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2021 and 2020, and the results of its operations and its cash flows for the year ended December 31, 2021 and for the period from September 29, 2020 (inception) to December 31, 2020 in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors' Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for one year after the date the financial statements are available to be issued. Auditors' Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors' report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. 2

In performing an audit in accordance with US GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. Supplemental Information Our audit was conducted for the purpose of forming an opinion on the consolidated financial statements taken as a whole. The accompanying Schedule III - Real Estate and Accumulated Depreciation as of December 31, 2021 is presented for purposes of additional analysis and is not a required part of the consolidated financial statements. The Schedule III – Real Estate and Accumulated Depreciation is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the consolidated financial statements. The information has been subjected to the auditing procedures applied in the audit of the consolidated financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the consolidated financial statements or to the consolidated financial statements themselves and other additional procedures, in accordance with auditing standards generally accepted in the United States of America. In our opinion, the Schedule III – Real Estate and Accumulated Depreciation is fairly stated, in all material respects, in relation to the consolidated financial statements taken as a whole. /s/ PricewaterhouseCoopers LLP Dallas, Texas March 16, 2022 3

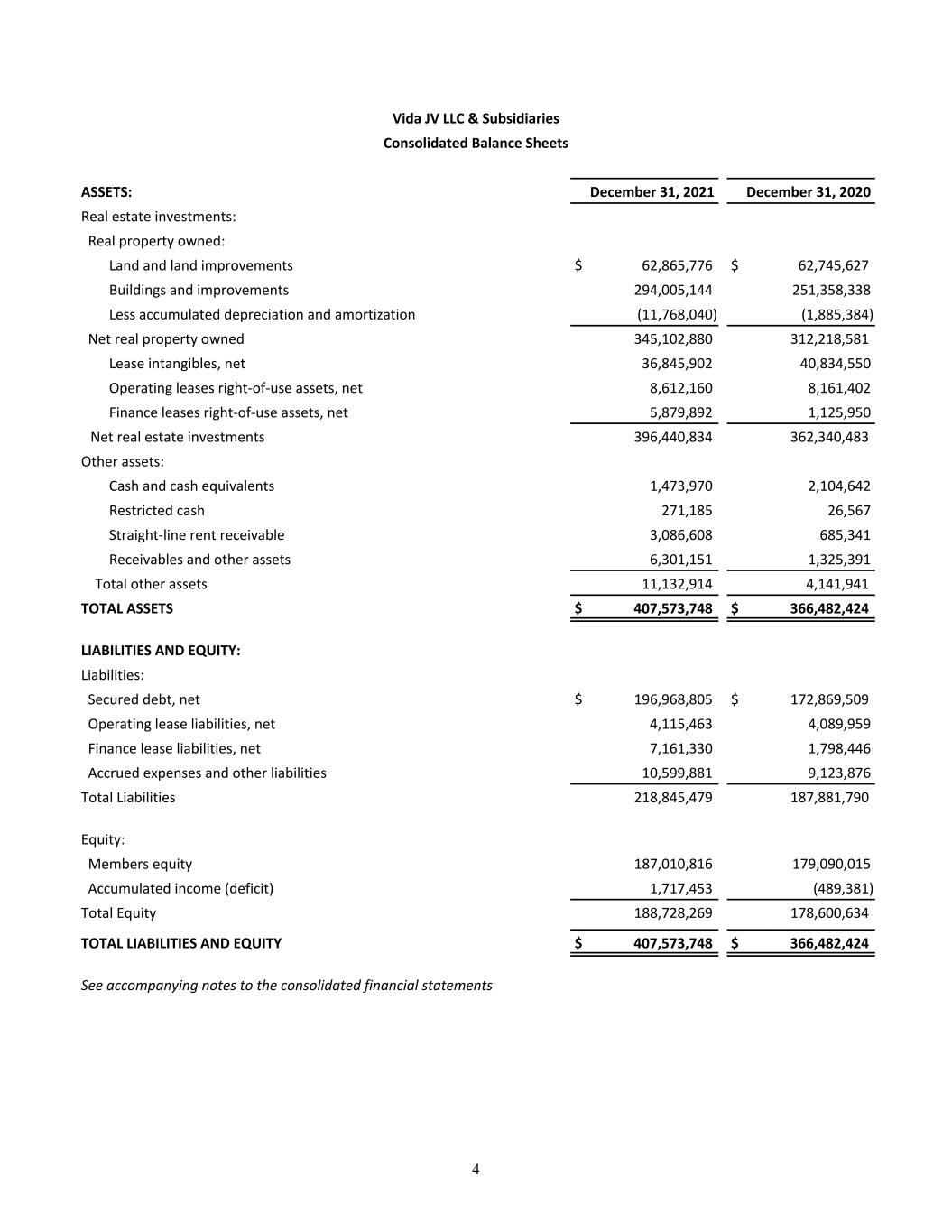

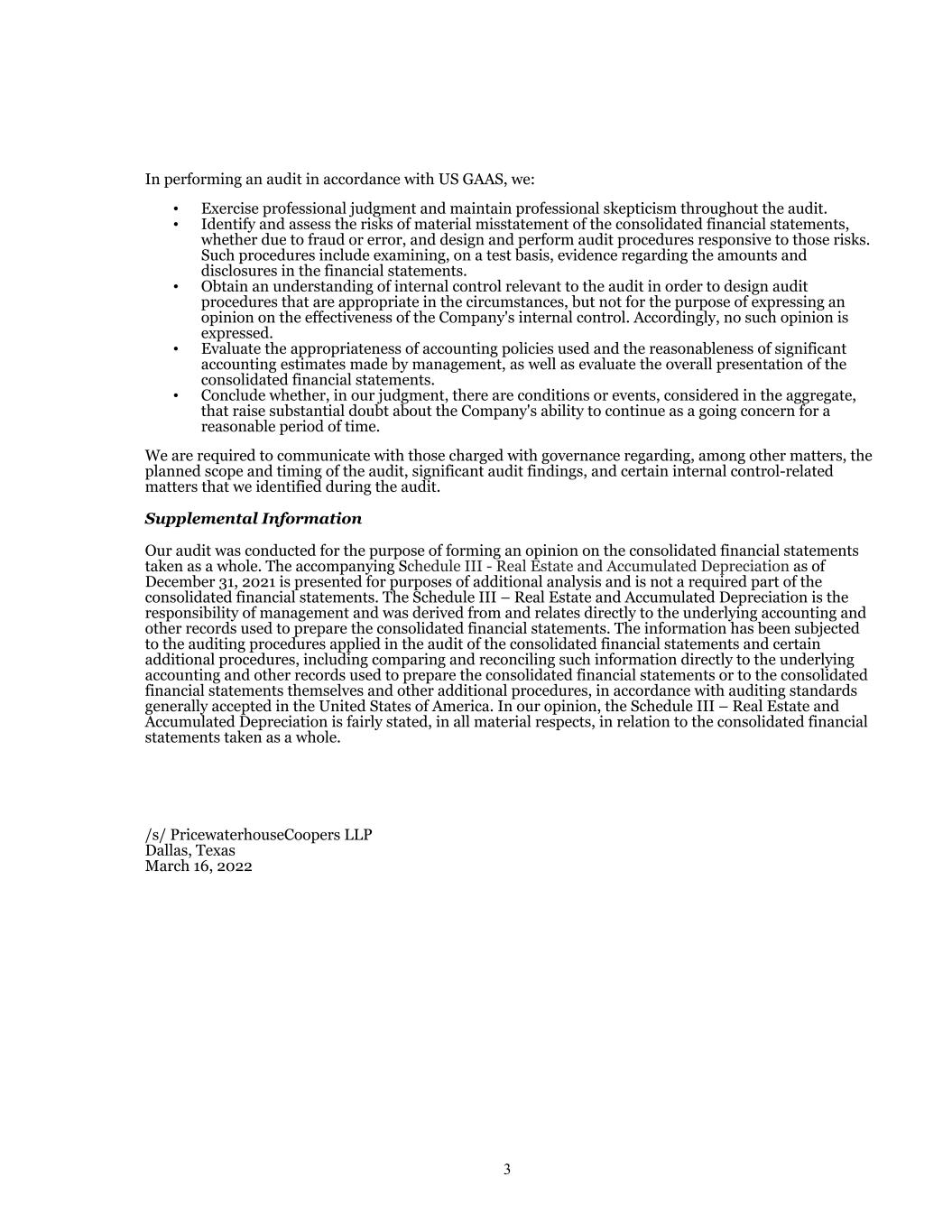

Vida JV LLC & Subsidiaries Consolidated Balance Sheets ASSETS: December 31, 2021 December 31, 2020 Real estate investments: Real property owned: Land and land improvements $ 62,865,776 $ 62,745,627 Buildings and improvements 294,005,144 251,358,338 Less accumulated depreciation and amortization (11,768,040) (1,885,384) Net real property owned 345,102,880 312,218,581 Lease intangibles, net 36,845,902 40,834,550 Operating leases right-of-use assets, net 8,612,160 8,161,402 Finance leases right-of-use assets, net 5,879,892 1,125,950 Net real estate investments 396,440,834 362,340,483 Other assets: Cash and cash equivalents 1,473,970 2,104,642 Restricted cash 271,185 26,567 Straight-line rent receivable 3,086,608 685,341 Receivables and other assets 6,301,151 1,325,391 Total other assets 11,132,914 4,141,941 TOTAL ASSETS $ 407,573,748 $ 366,482,424 LIABILITIES AND EQUITY: Liabilities: Secured debt, net $ 196,968,805 $ 172,869,509 Operating lease liabilities, net 4,115,463 4,089,959 Finance lease liabilities, net 7,161,330 1,798,446 Accrued expenses and other liabilities 10,599,881 9,123,876 Total Liabilities 218,845,479 187,881,790 Equity: Members equity 187,010,816 179,090,015 Accumulated income (deficit) 1,717,453 (489,381) Total Equity 188,728,269 178,600,634 TOTAL LIABILITIES AND EQUITY $ 407,573,748 $ 366,482,424 See accompanying notes to the consolidated financial statements 4

Vida JV LLC & Subsidiaries Consolidated Statements of Operations For the Year Ended December 31, 2021 For the Period From September 29, 2020 (inception) To December 31, 2020 REVENUES: Rental income $ 36,100,040 $ 5,716,087 Total revenues 36,100,040 5,716,087 EXPENSES: Property operating expenses 11,606,551 1,524,222 Interest expense 6,886,889 1,153,877 Gain on derivative instrument (5,318,602) (174,767) Depreciation and amortization 20,113,197 3,449,345 General and administrative expenses 558,635 248,055 Total expenses 33,846,670 6,200,732 Income (Loss) from operations before income taxes 2,253,370 (484,645) Income tax expense (46,536) (4,736) NET INCOME (LOSS) $ 2,206,834 $ (489,381) See accompanying notes to the consolidated financial statements 5

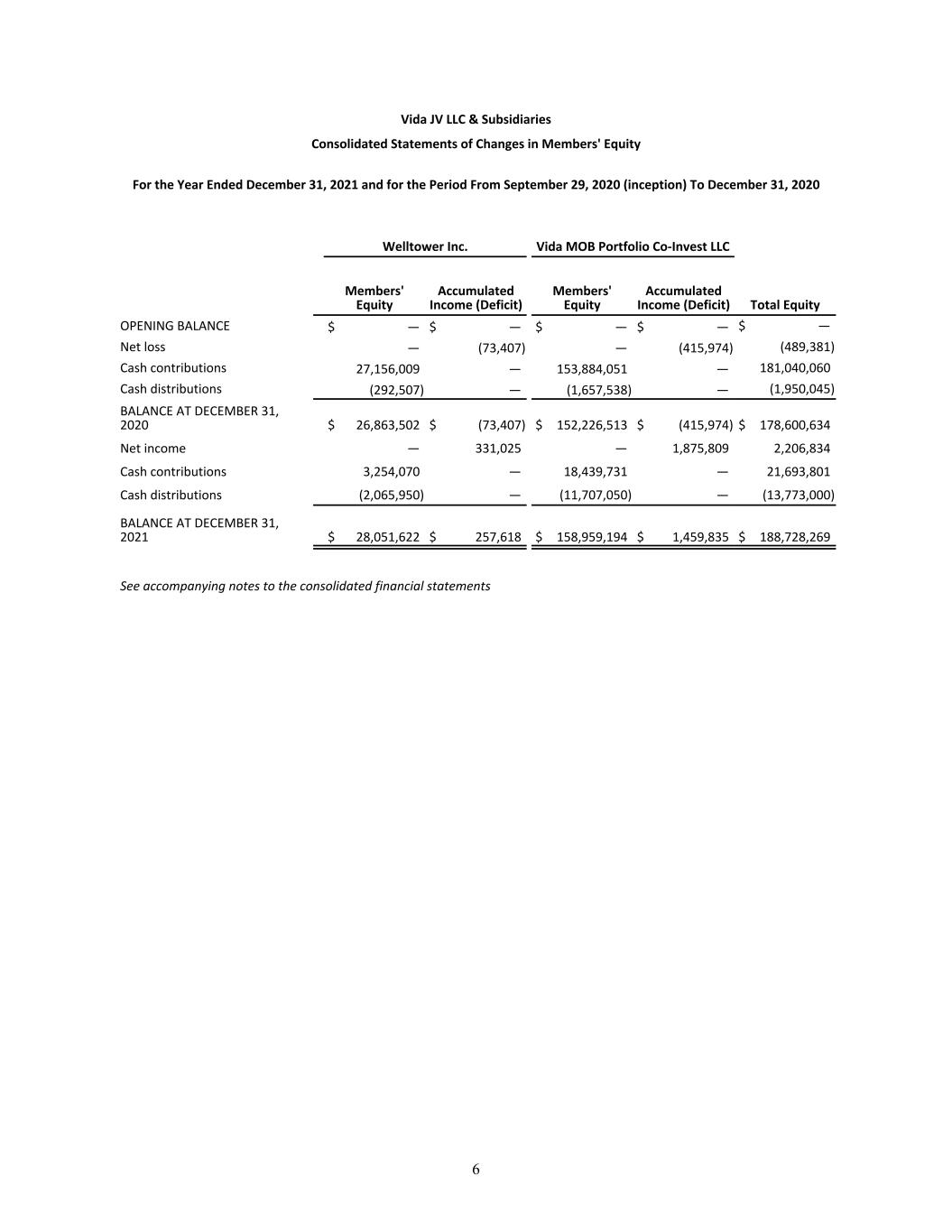

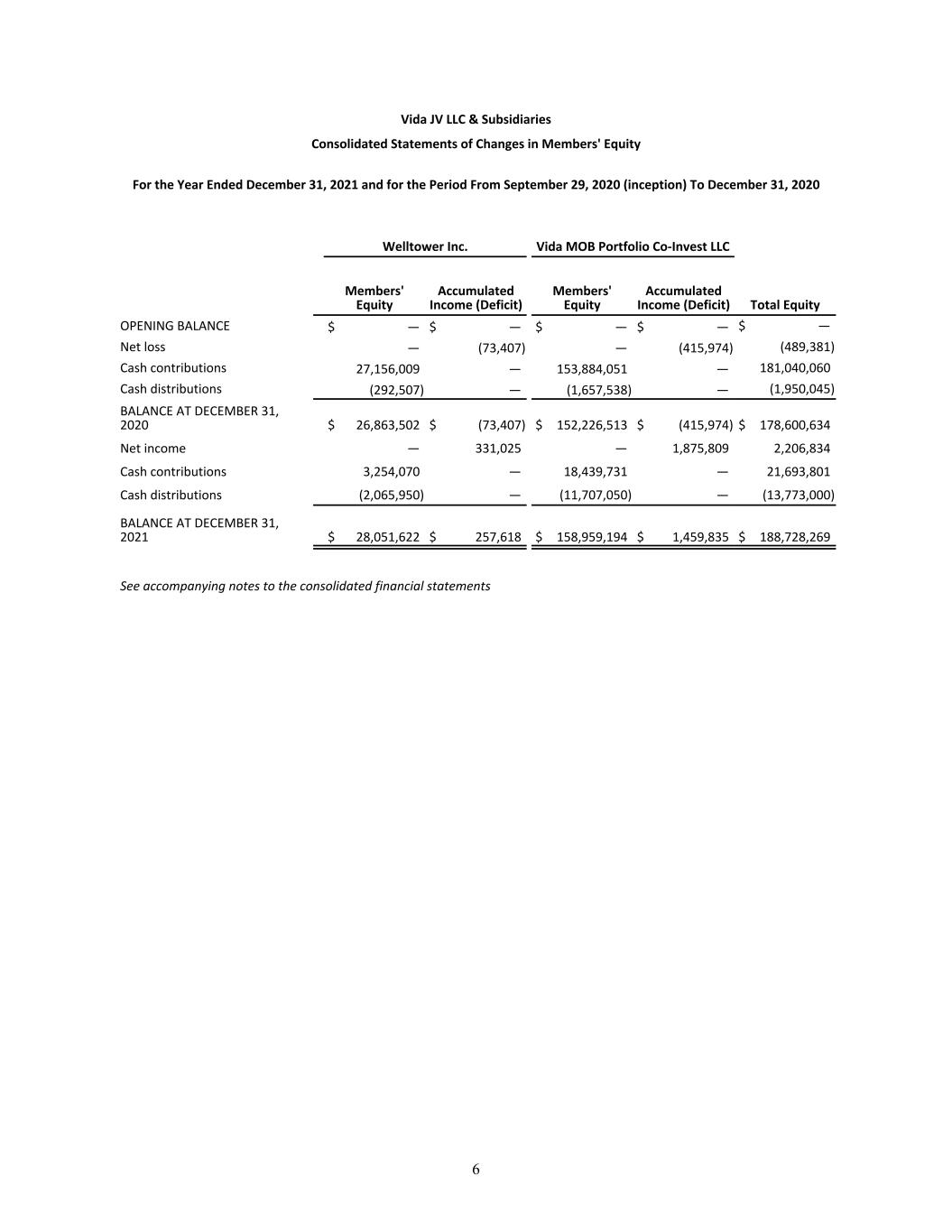

Vida JV LLC & Subsidiaries Consolidated Statements of Changes in Members' Equity For the Year Ended December 31, 2021 and for the Period From September 29, 2020 (inception) To December 31, 2020 Welltower Inc. Vida MOB Portfolio Co-Invest LLC Members' Equity Accumulated Income (Deficit) Members' Equity Accumulated Income (Deficit) Total Equity OPENING BALANCE $ — $ — $ — $ — $ — Net loss — (73,407) — (415,974) (489,381) Cash contributions 27,156,009 — 153,884,051 — 181,040,060 Cash distributions (292,507) — (1,657,538) — (1,950,045) BALANCE AT DECEMBER 31, 2020 $ 26,863,502 $ (73,407) $ 152,226,513 $ (415,974) $ 178,600,634 Net income — 331,025 — 1,875,809 2,206,834 Cash contributions 3,254,070 — 18,439,731 — 21,693,801 Cash distributions (2,065,950) — (11,707,050) — (13,773,000) BALANCE AT DECEMBER 31, 2021 $ 28,051,622 $ 257,618 $ 158,959,194 $ 1,459,835 $ 188,728,269 See accompanying notes to the consolidated financial statements 6

Vida JV LLC & Subsidiaries Consolidated Statements of Cash Flows CASH FLOWS PROVIDED FROM (USED IN) OPERATING ACTIVITIES: For the Year Ended December 31, 2021 For the Period From September 29, 2020 (inception) To December 31, 2020 Net Income (loss) $ 2,206,834 $ (489,381) Adjustments to reconcile net income (loss) to net cash provided from (used in) operating activities: Depreciation and amortization expense 20,005,480 3,449,345 Amortization of deferred financing costs 933,184 166,434 Amortization related to above (below) market leases, net 32,083 80,997 Rental income in excess of cash received (2,401,267) (685,341) Change in fair values of derivatives, net (5,318,602) (174,767) Amortization of right-of-use assets 260,599 12,898 Accrued interest on lease liabilities 82,890 — (Increase) Decrease in receivables and other assets 355,441 (240,636) Increase in accrued expenses and other liabilities 2,162,739 1,459,973 Net cash provided from operating activities 18,319,381 3,579,522 CASH FLOWS PROVIDED FROM (USED IN) INVESTING ACTIVITIES: Cash disbursed for acquisition of properties (45,708,110) (352,983,188) Capital expenditures on properties (4,084,238) (258,215) Net cash used in investing activities (49,792,348) (353,241,403) CASH FLOWS PROVIDED FROM (USED IN) FINANCING ACTIVITIES: Deferred financing costs (455,358) (4,204,455) Secured debt issuance 23,621,470 176,907,530 Cash contributions from Welltower Inc. 3,254,070 27,156,009 Cash contributions from Vida MOB Portfolio Co-Invest LLC 18,439,731 153,884,051 Cash distributions to Welltower Inc. (2,065,950) (292,507) Cash distributions to Vida MOB Portfolio Co-Invest LLC (11,707,050) (1,657,538) Net cash provided from financing activities 31,086,913 351,793,090 (DECREASE) / INCREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH (386,054) 2,131,209 CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD 2,131,209 — CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD $ 1,745,155 $ 2,131,209 Reconciliation of cash and cash equivalents and restricted cash to the consolidated balance sheet: Cash and cash equivalents 1,473,970 2,104,642.00 Restricted cash 271,185 26,567.00 Total cash and cash equivalents and restricted cash $ 1,745,155 $ 2,131,209 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION Interest paid $ 5,534,693 $ 637,687 Accrued capital expenditures $ 674,699 $ 1,002,091 See accompanying notes to the consolidated financial statements 7

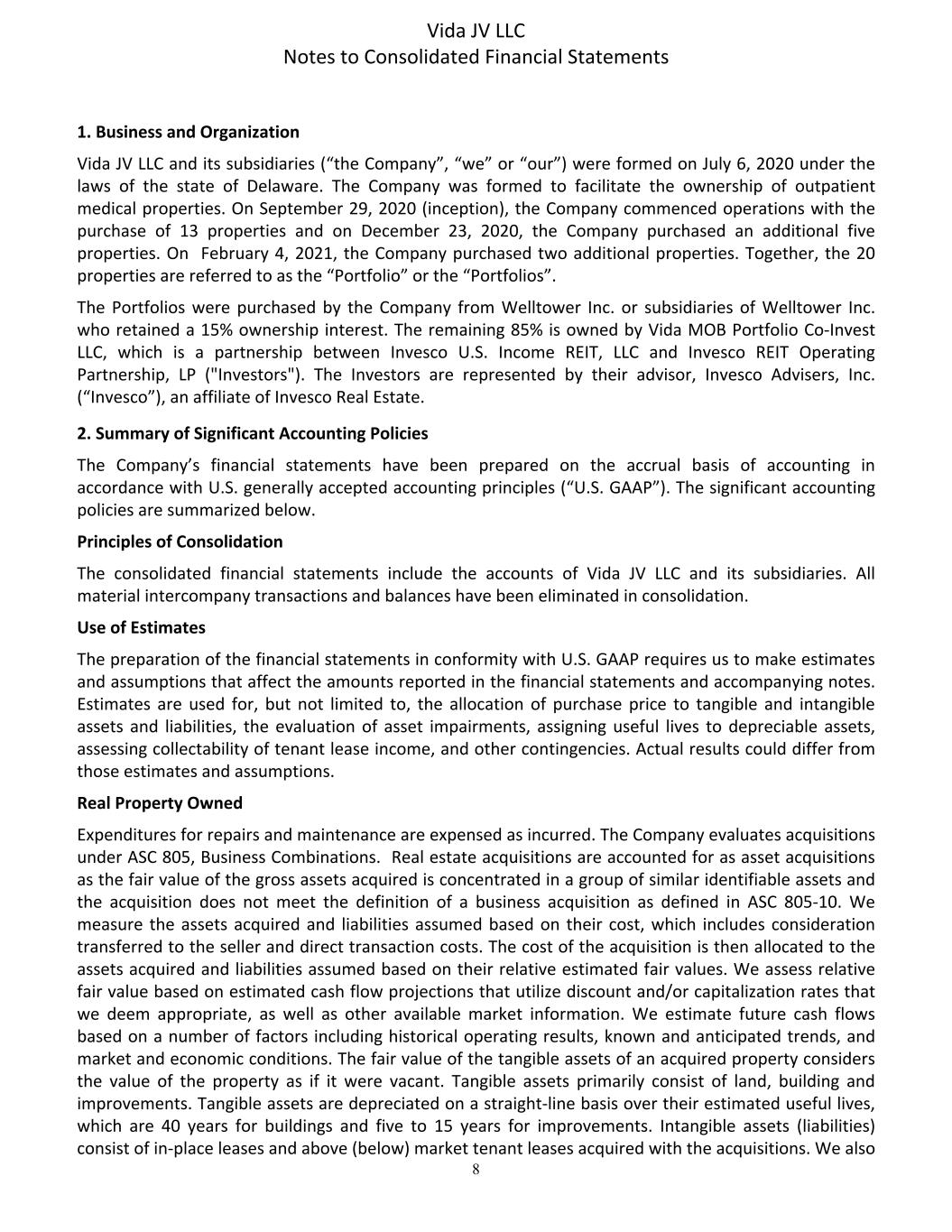

1. Business and Organization Vida JV LLC and its subsidiaries (“the Company”, “we” or “our”) were formed on July 6, 2020 under the laws of the state of Delaware. The Company was formed to facilitate the ownership of outpatient medical properties. On September 29, 2020 (inception), the Company commenced operations with the purchase of 13 properties and on December 23, 2020, the Company purchased an additional five properties. On February 4, 2021, the Company purchased two additional properties. Together, the 20 properties are referred to as the “Portfolio” or the “Portfolios”. The Portfolios were purchased by the Company from Welltower Inc. or subsidiaries of Welltower Inc. who retained a 15% ownership interest. The remaining 85% is owned by Vida MOB Portfolio Co-Invest LLC, which is a partnership between Invesco U.S. Income REIT, LLC and Invesco REIT Operating Partnership, LP ("Investors"). The Investors are represented by their advisor, Invesco Advisers, Inc. (“Invesco”), an affiliate of Invesco Real Estate. 2. Summary of Significant Accounting Policies The Company’s financial statements have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The significant accounting policies are summarized below. Principles of Consolidation The consolidated financial statements include the accounts of Vida JV LLC and its subsidiaries. All material intercompany transactions and balances have been eliminated in consolidation. Use of Estimates The preparation of the financial statements in conformity with U.S. GAAP requires us to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Estimates are used for, but not limited to, the allocation of purchase price to tangible and intangible assets and liabilities, the evaluation of asset impairments, assigning useful lives to depreciable assets, assessing collectability of tenant lease income, and other contingencies. Actual results could differ from those estimates and assumptions. Real Property Owned Expenditures for repairs and maintenance are expensed as incurred. The Company evaluates acquisitions under ASC 805, Business Combinations. Real estate acquisitions are accounted for as asset acquisitions as the fair value of the gross assets acquired is concentrated in a group of similar identifiable assets and the acquisition does not meet the definition of a business acquisition as defined in ASC 805-10. We measure the assets acquired and liabilities assumed based on their cost, which includes consideration transferred to the seller and direct transaction costs. The cost of the acquisition is then allocated to the assets acquired and liabilities assumed based on their relative estimated fair values. We assess relative fair value based on estimated cash flow projections that utilize discount and/or capitalization rates that we deem appropriate, as well as other available market information. We estimate future cash flows based on a number of factors including historical operating results, known and anticipated trends, and market and economic conditions. The fair value of the tangible assets of an acquired property considers the value of the property as if it were vacant. Tangible assets primarily consist of land, building and improvements. Tangible assets are depreciated on a straight-line basis over their estimated useful lives, which are 40 years for buildings and five to 15 years for improvements. Intangible assets (liabilities) consist of in-place leases and above (below) market tenant leases acquired with the acquisitions. We also Vida JV LLC Notes to Consolidated Financial Statements 8

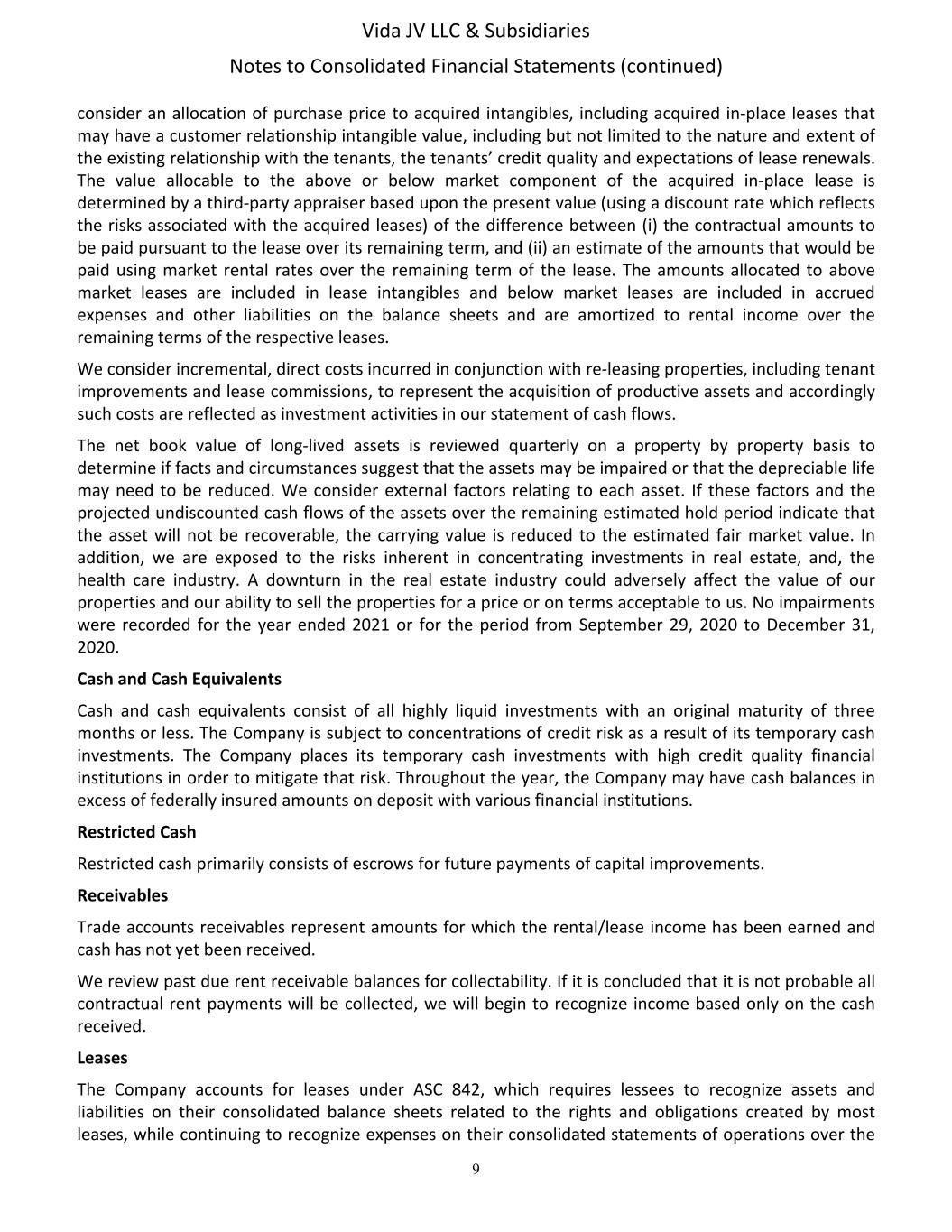

consider an allocation of purchase price to acquired intangibles, including acquired in-place leases that may have a customer relationship intangible value, including but not limited to the nature and extent of the existing relationship with the tenants, the tenants’ credit quality and expectations of lease renewals. The value allocable to the above or below market component of the acquired in-place lease is determined by a third-party appraiser based upon the present value (using a discount rate which reflects the risks associated with the acquired leases) of the difference between (i) the contractual amounts to be paid pursuant to the lease over its remaining term, and (ii) an estimate of the amounts that would be paid using market rental rates over the remaining term of the lease. The amounts allocated to above market leases are included in lease intangibles and below market leases are included in accrued expenses and other liabilities on the balance sheets and are amortized to rental income over the remaining terms of the respective leases. We consider incremental, direct costs incurred in conjunction with re-leasing properties, including tenant improvements and lease commissions, to represent the acquisition of productive assets and accordingly such costs are reflected as investment activities in our statement of cash flows. The net book value of long-lived assets is reviewed quarterly on a property by property basis to determine if facts and circumstances suggest that the assets may be impaired or that the depreciable life may need to be reduced. We consider external factors relating to each asset. If these factors and the projected undiscounted cash flows of the assets over the remaining estimated hold period indicate that the asset will not be recoverable, the carrying value is reduced to the estimated fair market value. In addition, we are exposed to the risks inherent in concentrating investments in real estate, and, the health care industry. A downturn in the real estate industry could adversely affect the value of our properties and our ability to sell the properties for a price or on terms acceptable to us. No impairments were recorded for the year ended 2021 or for the period from September 29, 2020 to December 31, 2020. Cash and Cash Equivalents Cash and cash equivalents consist of all highly liquid investments with an original maturity of three months or less. The Company is subject to concentrations of credit risk as a result of its temporary cash investments. The Company places its temporary cash investments with high credit quality financial institutions in order to mitigate that risk. Throughout the year, the Company may have cash balances in excess of federally insured amounts on deposit with various financial institutions. Restricted Cash Restricted cash primarily consists of escrows for future payments of capital improvements. Receivables Trade accounts receivables represent amounts for which the rental/lease income has been earned and cash has not yet been received. We review past due rent receivable balances for collectability. If it is concluded that it is not probable all contractual rent payments will be collected, we will begin to recognize income based only on the cash received. Leases The Company accounts for leases under ASC 842, which requires lessees to recognize assets and liabilities on their consolidated balance sheets related to the rights and obligations created by most leases, while continuing to recognize expenses on their consolidated statements of operations over the Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 9

lease term. The Company determined that the lease component is the primary component for leases in which it is the lessor and thus variable lease payments (primarily common area maintenance reimbursements) are recognized as part of the lease payment in accordance with ASC 842. Additionally, when the Company is the lessee, the Company has made the policy election to keep short-term leases less than twelve months off the balance sheet for all classes of underlying assets. Income Allocation For financial reporting purposes, income, gain, loss, credits and deductions are allocated as outlined in the Limited Liability Company Agreement (“LLC Agreement”). Operating cash flow is distributed to the members in proportion to their respective ownership percentages. Cash proceeds resulting from a material capital transaction such as a refinance, insurance proceeds, or sale of a property are distributed in the following manner: 1. First, to the members on a proportionate basis until their capital accounts are reduced to zero. 2. Second, to the members on a proportionate basis until Vida MOB Portfolio Co-Invest LLC has achieved a rate of return equal to 12%. 3. Third, 80% of the remaining amount to the members on a proportionate basis and 20% of the remaining amount to Welltower Inc. Cash proceeds resulting from the liquidation of the Company are also distributed as outlined as above, after the payment of any loans or other liabilities of the Company. Deferred Financing Costs Deferred financing costs are fees incurred by the Company in connection with the issuance, assumption and amendments of debt arrangements. Deferred financing costs related to debt instruments are recorded as a reduction of the related debt liability. We amortize these costs over the term of the debt using the straight-line method, which approximates the effective interest method. Revenue Recognition Substantially all of our revenue is generated through operating lease arrangements which contain escalating rent structures. Leases with fixed annual rental escalators are generally recognized on a straight-line basis over the initial lease period, subject to a collectability assessment. Rental income related to leases with contingent rental escalators is generally recorded based on the contractual cash rental payments due for the period. Our leases typically include some form of operating expense reimbursement by the tenant. If collection of the operating lease payments are deemed to no longer be probable (either at lease commencement or after the commencement date), we record rental income for the amount of cash collected and write off the accrued balances deemed to be uncollectible. Income Taxes The Company is a limited liability company treated as a partnership for federal income tax purposes with all income tax liabilities or benefits of the Company being passed through to the members. As such, no recognition of federal income taxes for the Company or its subsidiaries that are organized as limited liability companies has been provided for in the accompanying consolidated financial statements. Income tax expense represents state and local taxes. The Company is subject to gross margin taxes in the State of Texas where some of the properties are located. This expense is included in income tax expense on the Consolidated Statement of Operations. The Company remains subject to examination by U.S. federal, state, and local jurisdictions for tax years since commencement in 2020 and upon completion of Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 10

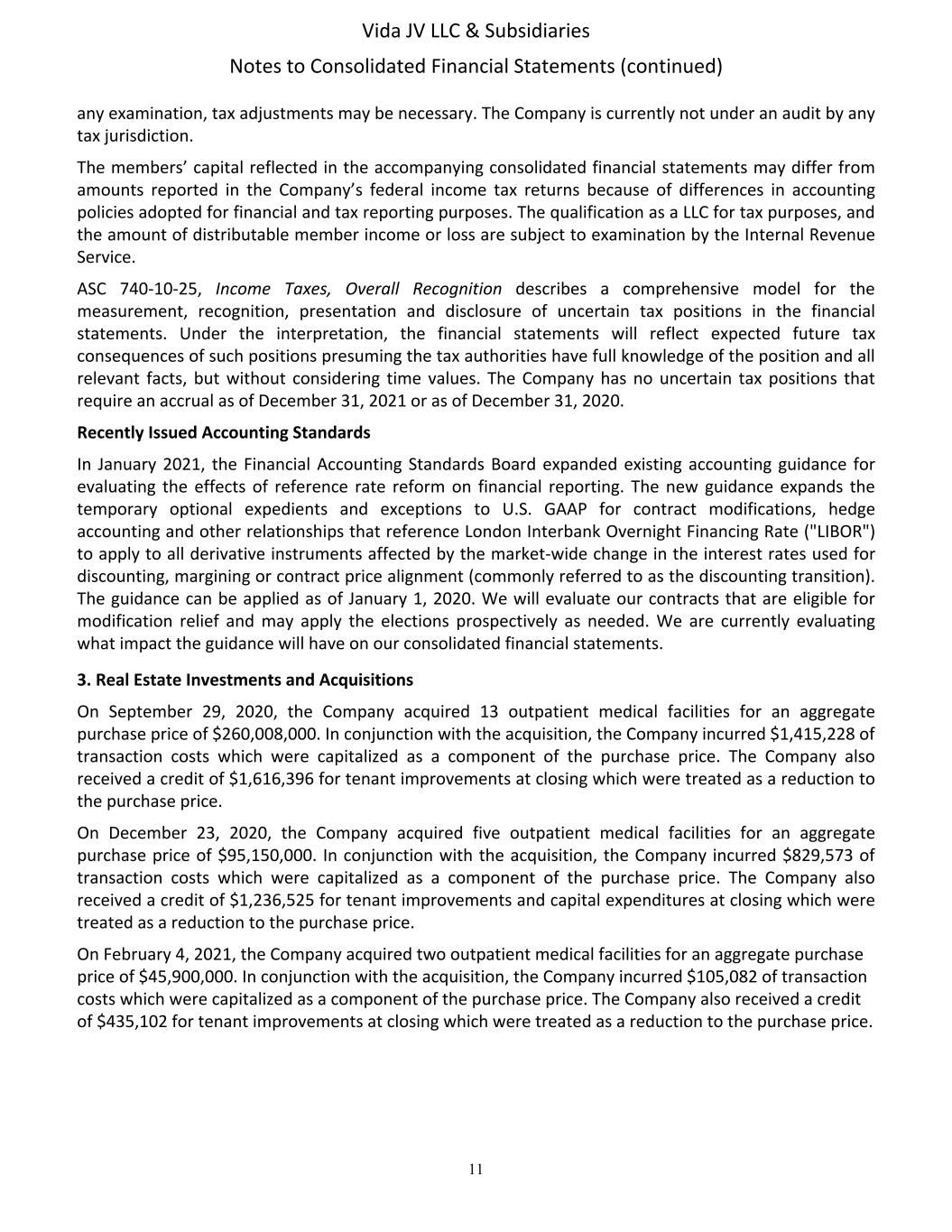

any examination, tax adjustments may be necessary. The Company is currently not under an audit by any tax jurisdiction. The members’ capital reflected in the accompanying consolidated financial statements may differ from amounts reported in the Company’s federal income tax returns because of differences in accounting policies adopted for financial and tax reporting purposes. The qualification as a LLC for tax purposes, and the amount of distributable member income or loss are subject to examination by the Internal Revenue Service. ASC 740-10-25, Income Taxes, Overall Recognition describes a comprehensive model for the measurement, recognition, presentation and disclosure of uncertain tax positions in the financial statements. Under the interpretation, the financial statements will reflect expected future tax consequences of such positions presuming the tax authorities have full knowledge of the position and all relevant facts, but without considering time values. The Company has no uncertain tax positions that require an accrual as of December 31, 2021 or as of December 31, 2020. Recently Issued Accounting Standards In January 2021, the Financial Accounting Standards Board expanded existing accounting guidance for evaluating the effects of reference rate reform on financial reporting. The new guidance expands the temporary optional expedients and exceptions to U.S. GAAP for contract modifications, hedge accounting and other relationships that reference London Interbank Overnight Financing Rate ("LIBOR") to apply to all derivative instruments affected by the market-wide change in the interest rates used for discounting, margining or contract price alignment (commonly referred to as the discounting transition). The guidance can be applied as of January 1, 2020. We will evaluate our contracts that are eligible for modification relief and may apply the elections prospectively as needed. We are currently evaluating what impact the guidance will have on our consolidated financial statements. 3. Real Estate Investments and Acquisitions On September 29, 2020, the Company acquired 13 outpatient medical facilities for an aggregate purchase price of $260,008,000. In conjunction with the acquisition, the Company incurred $1,415,228 of transaction costs which were capitalized as a component of the purchase price. The Company also received a credit of $1,616,396 for tenant improvements at closing which were treated as a reduction to the purchase price. On December 23, 2020, the Company acquired five outpatient medical facilities for an aggregate purchase price of $95,150,000. In conjunction with the acquisition, the Company incurred $829,573 of transaction costs which were capitalized as a component of the purchase price. The Company also received a credit of $1,236,525 for tenant improvements and capital expenditures at closing which were treated as a reduction to the purchase price. On February 4, 2021, the Company acquired two outpatient medical facilities for an aggregate purchase price of $45,900,000. In conjunction with the acquisition, the Company incurred $105,082 of transaction costs which were capitalized as a component of the purchase price. The Company also received a credit of $435,102 for tenant improvements at closing which were treated as a reduction to the purchase price. Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 11

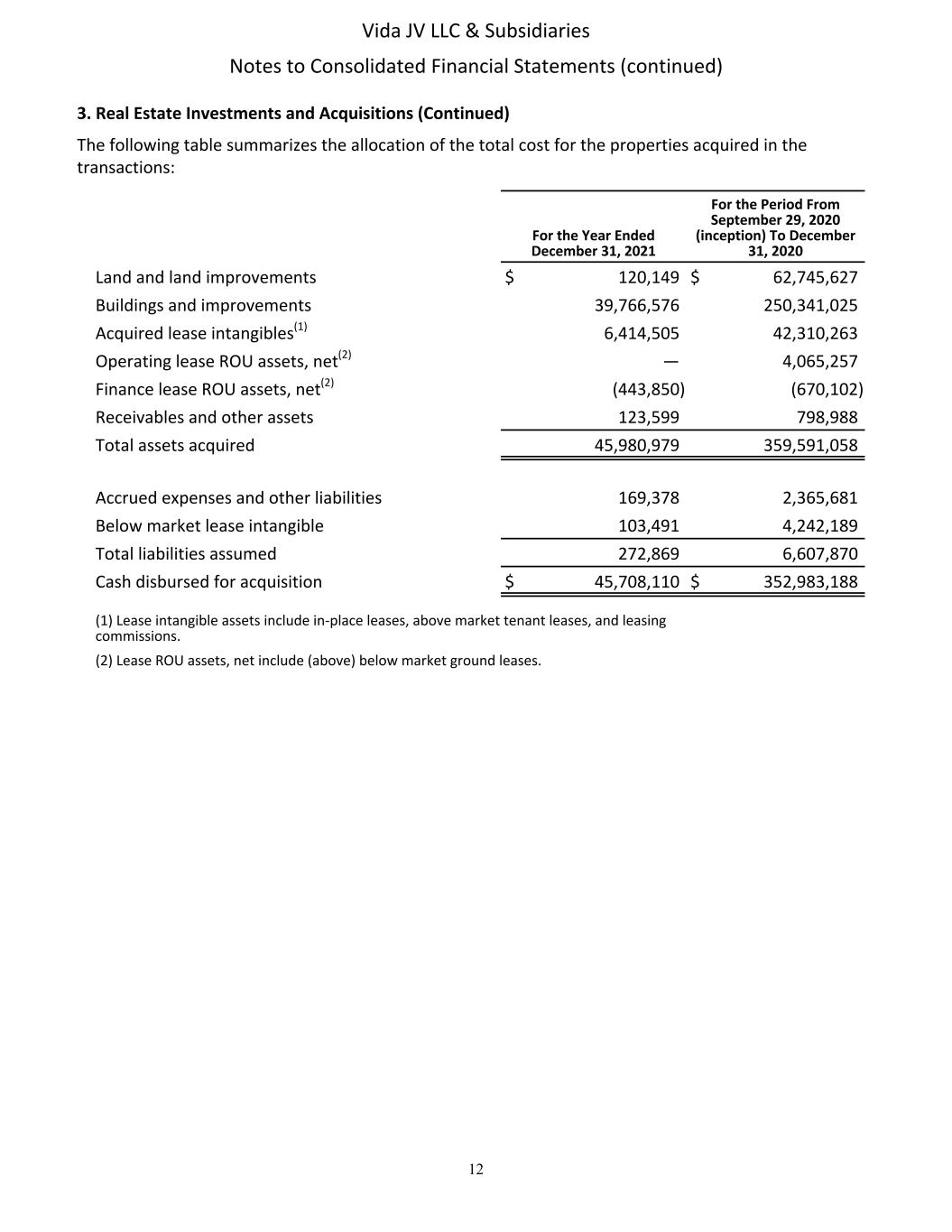

3. Real Estate Investments and Acquisitions (Continued) The following table summarizes the allocation of the total cost for the properties acquired in the transactions: For the Year Ended December 31, 2021 For the Period From September 29, 2020 (inception) To December 31, 2020 Land and land improvements $ 120,149 $ 62,745,627 Buildings and improvements 39,766,576 250,341,025 Acquired lease intangibles(1) 6,414,505 42,310,263 Operating lease ROU assets, net(2) — 4,065,257 Finance lease ROU assets, net(2) (443,850) (670,102) Receivables and other assets 123,599 798,988 Total assets acquired 45,980,979 359,591,058 Accrued expenses and other liabilities 169,378 2,365,681 Below market lease intangible 103,491 4,242,189 Total liabilities assumed 272,869 6,607,870 Cash disbursed for acquisition $ 45,708,110 $ 352,983,188 (1) Lease intangible assets include in-place leases, above market tenant leases, and leasing commissions. (2) Lease ROU assets, net include (above) below market ground leases. Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 12

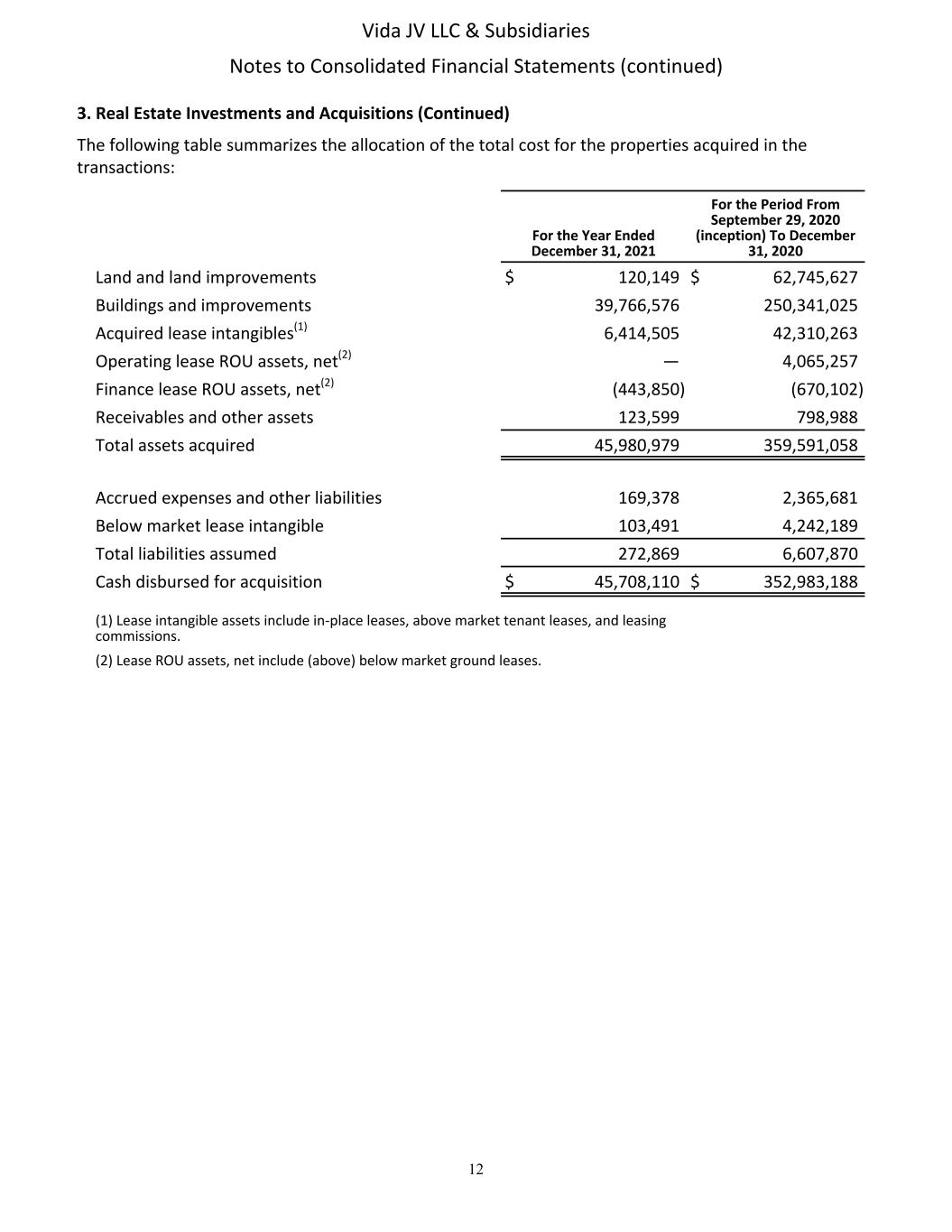

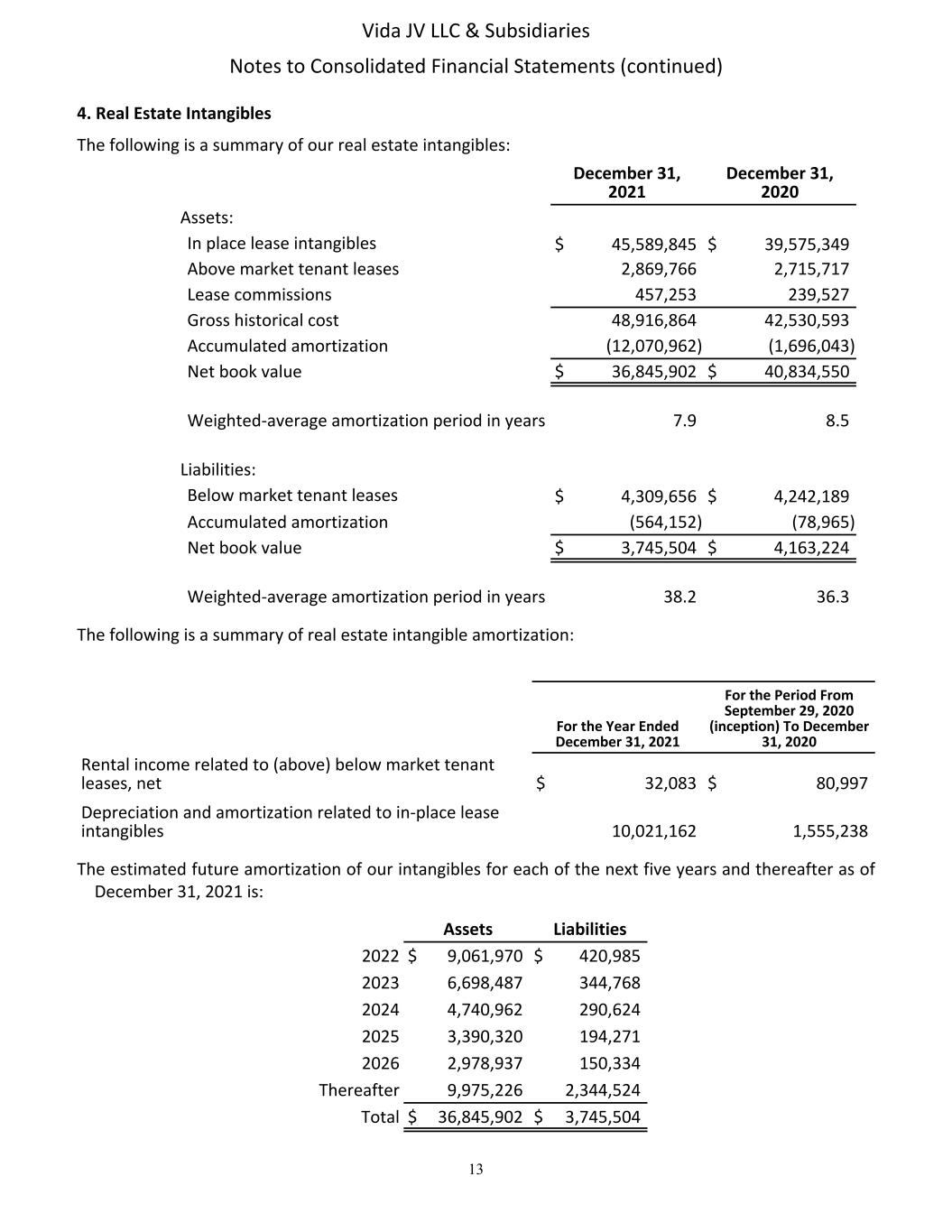

4. Real Estate Intangibles The following is a summary of our real estate intangibles: December 31, 2021 December 31, 2020 Assets: In place lease intangibles $ 45,589,845 $ 39,575,349 Above market tenant leases 2,869,766 2,715,717 Lease commissions 457,253 239,527 Gross historical cost 48,916,864 42,530,593 Accumulated amortization (12,070,962) (1,696,043) Net book value $ 36,845,902 $ 40,834,550 Weighted-average amortization period in years 7.9 8.5 Liabilities: Below market tenant leases $ 4,309,656 $ 4,242,189 Accumulated amortization (564,152) (78,965) Net book value $ 3,745,504 $ 4,163,224 Weighted-average amortization period in years 38.2 36.3 The following is a summary of real estate intangible amortization: For the Year Ended December 31, 2021 For the Period From September 29, 2020 (inception) To December 31, 2020 Rental income related to (above) below market tenant leases, net $ 32,083 $ 80,997 Depreciation and amortization related to in-place lease intangibles 10,021,162 1,555,238 The estimated future amortization of our intangibles for each of the next five years and thereafter as of December 31, 2021 is: Assets Liabilities 2022 $ 9,061,970 $ 420,985 2023 6,698,487 344,768 2024 4,740,962 290,624 2025 3,390,320 194,271 2026 2,978,937 150,334 Thereafter 9,975,226 2,344,524 Total $ 36,845,902 $ 3,745,504 Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 13

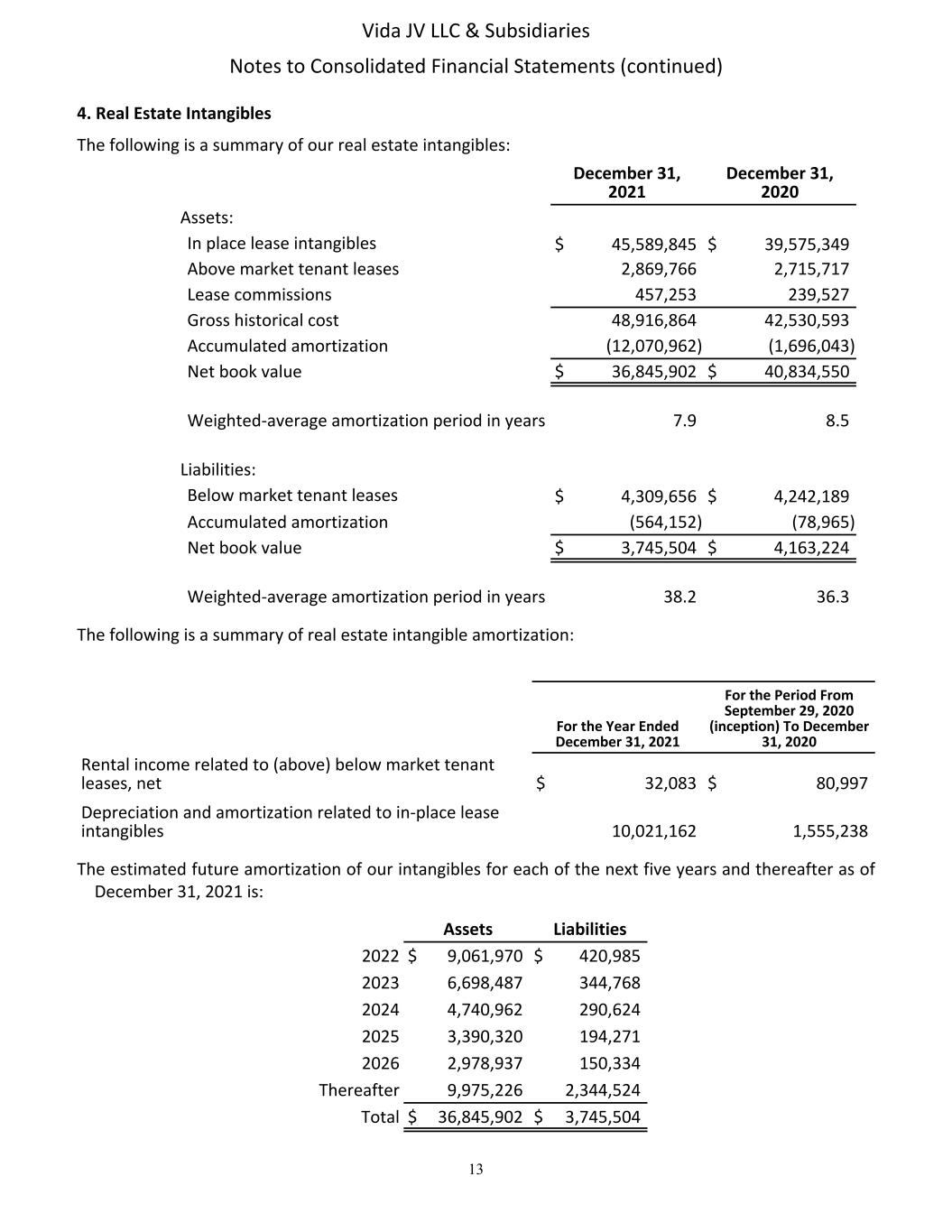

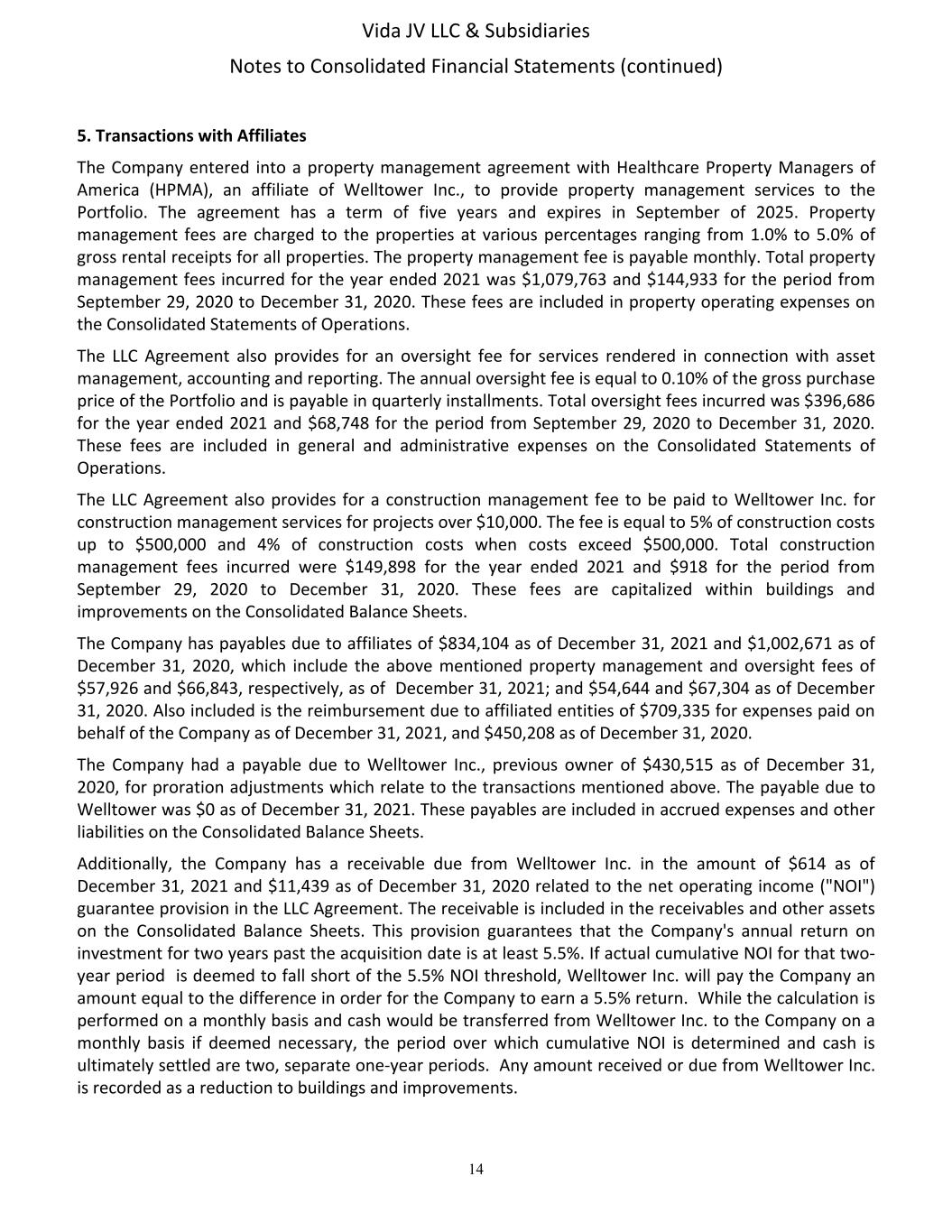

5. Transactions with Affiliates The Company entered into a property management agreement with Healthcare Property Managers of America (HPMA), an affiliate of Welltower Inc., to provide property management services to the Portfolio. The agreement has a term of five years and expires in September of 2025. Property management fees are charged to the properties at various percentages ranging from 1.0% to 5.0% of gross rental receipts for all properties. The property management fee is payable monthly. Total property management fees incurred for the year ended 2021 was $1,079,763 and $144,933 for the period from September 29, 2020 to December 31, 2020. These fees are included in property operating expenses on the Consolidated Statements of Operations. The LLC Agreement also provides for an oversight fee for services rendered in connection with asset management, accounting and reporting. The annual oversight fee is equal to 0.10% of the gross purchase price of the Portfolio and is payable in quarterly installments. Total oversight fees incurred was $396,686 for the year ended 2021 and $68,748 for the period from September 29, 2020 to December 31, 2020. These fees are included in general and administrative expenses on the Consolidated Statements of Operations. The LLC Agreement also provides for a construction management fee to be paid to Welltower Inc. for construction management services for projects over $10,000. The fee is equal to 5% of construction costs up to $500,000 and 4% of construction costs when costs exceed $500,000. Total construction management fees incurred were $149,898 for the year ended 2021 and $918 for the period from September 29, 2020 to December 31, 2020. These fees are capitalized within buildings and improvements on the Consolidated Balance Sheets. The Company has payables due to affiliates of $834,104 as of December 31, 2021 and $1,002,671 as of December 31, 2020, which include the above mentioned property management and oversight fees of $57,926 and $66,843, respectively, as of December 31, 2021; and $54,644 and $67,304 as of December 31, 2020. Also included is the reimbursement due to affiliated entities of $709,335 for expenses paid on behalf of the Company as of December 31, 2021, and $450,208 as of December 31, 2020. The Company had a payable due to Welltower Inc., previous owner of $430,515 as of December 31, 2020, for proration adjustments which relate to the transactions mentioned above. The payable due to Welltower was $0 as of December 31, 2021. These payables are included in accrued expenses and other liabilities on the Consolidated Balance Sheets. Additionally, the Company has a receivable due from Welltower Inc. in the amount of $614 as of December 31, 2021 and $11,439 as of December 31, 2020 related to the net operating income ("NOI") guarantee provision in the LLC Agreement. The receivable is included in the receivables and other assets on the Consolidated Balance Sheets. This provision guarantees that the Company's annual return on investment for two years past the acquisition date is at least 5.5%. If actual cumulative NOI for that two- year period is deemed to fall short of the 5.5% NOI threshold, Welltower Inc. will pay the Company an amount equal to the difference in order for the Company to earn a 5.5% return. While the calculation is performed on a monthly basis and cash would be transferred from Welltower Inc. to the Company on a monthly basis if deemed necessary, the period over which cumulative NOI is determined and cash is ultimately settled are two, separate one-year periods. Any amount received or due from Welltower Inc. is recorded as a reduction to buildings and improvements. Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 14

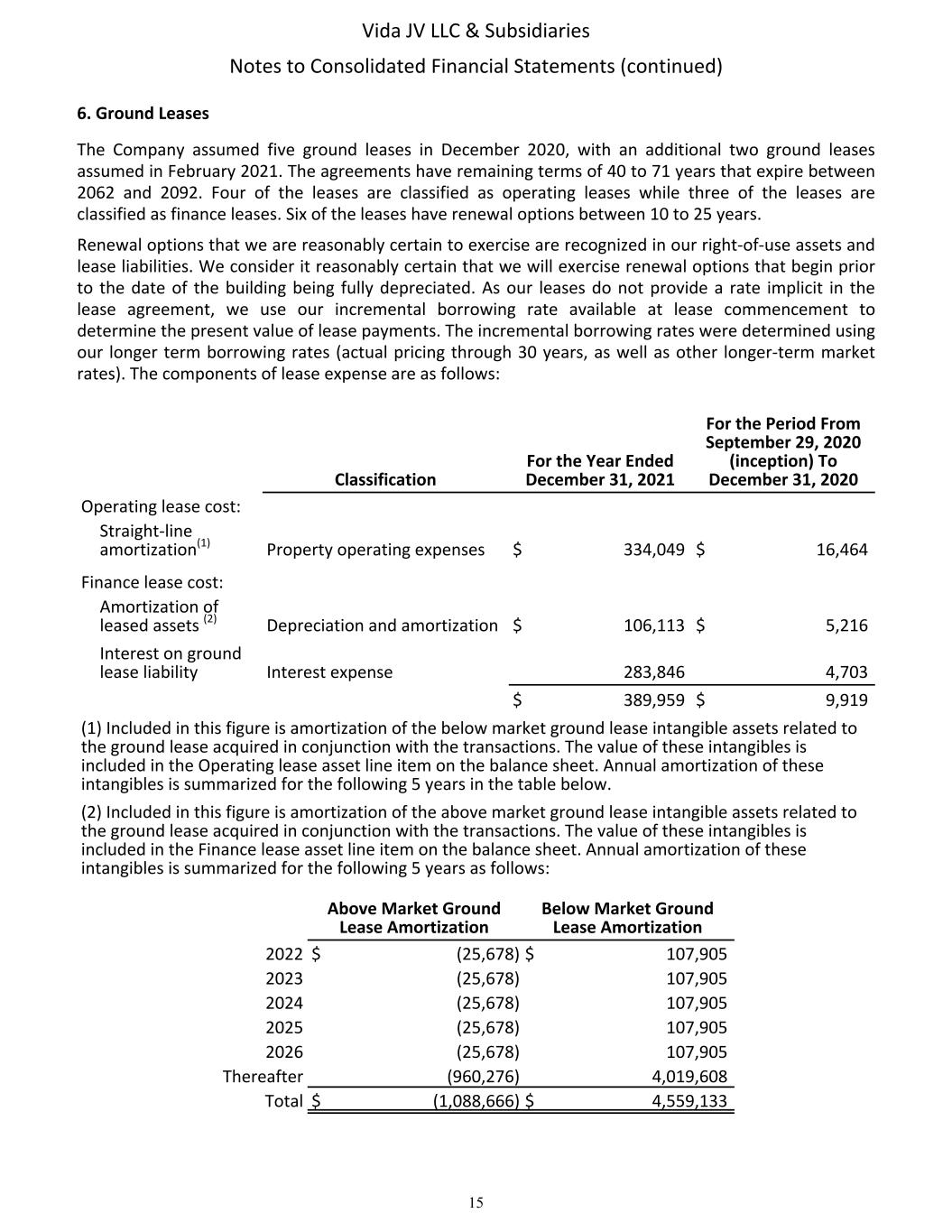

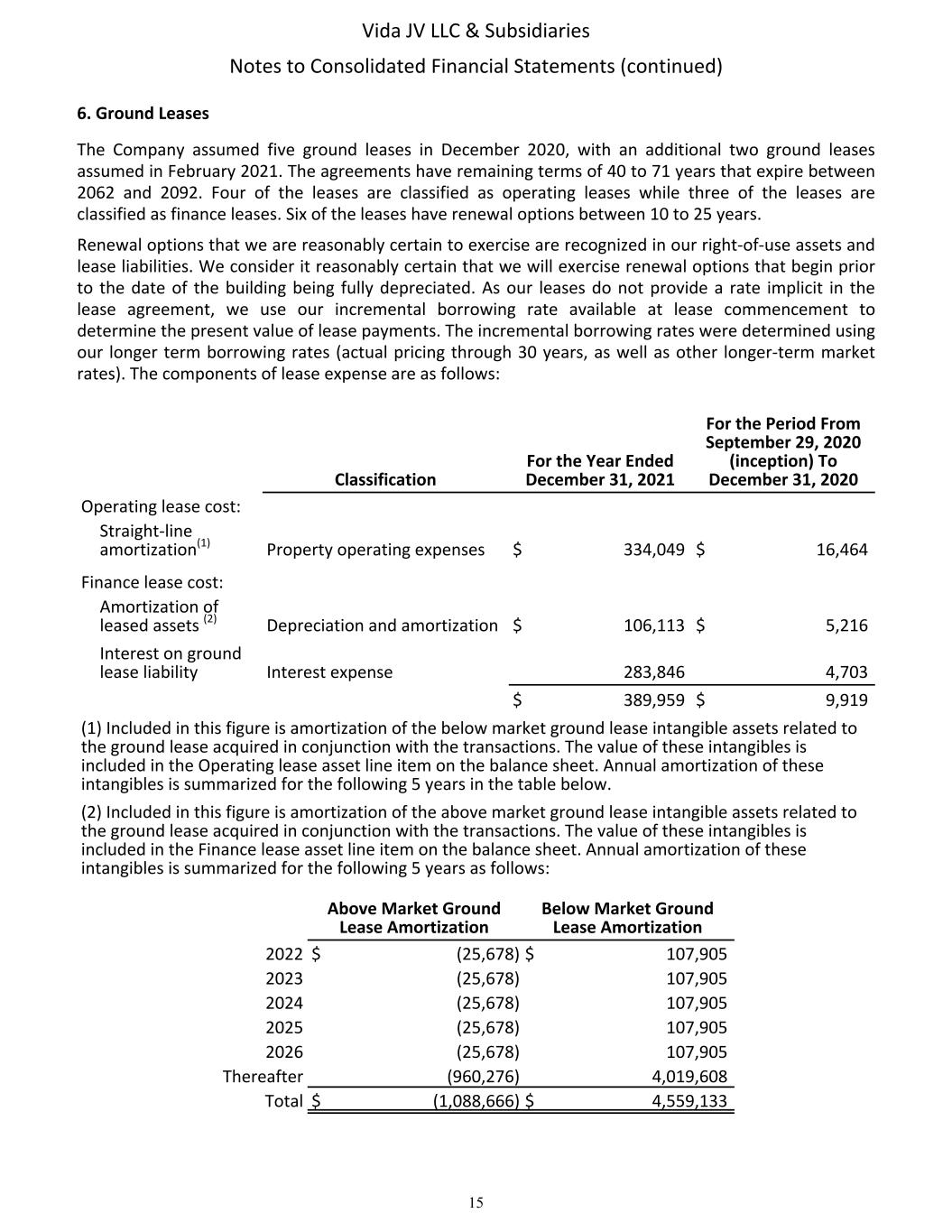

6. Ground Leases The Company assumed five ground leases in December 2020, with an additional two ground leases assumed in February 2021. The agreements have remaining terms of 40 to 71 years that expire between 2062 and 2092. Four of the leases are classified as operating leases while three of the leases are classified as finance leases. Six of the leases have renewal options between 10 to 25 years. Renewal options that we are reasonably certain to exercise are recognized in our right-of-use assets and lease liabilities. We consider it reasonably certain that we will exercise renewal options that begin prior to the date of the building being fully depreciated. As our leases do not provide a rate implicit in the lease agreement, we use our incremental borrowing rate available at lease commencement to determine the present value of lease payments. The incremental borrowing rates were determined using our longer term borrowing rates (actual pricing through 30 years, as well as other longer-term market rates). The components of lease expense are as follows: For the Year Ended December 31, 2021 For the Period From September 29, 2020 (inception) To December 31, 2020Classification Operating lease cost: Straight-line amortization(1) Property operating expenses $ 334,049 $ 16,464 Finance lease cost: Amortization of leased assets (2) Depreciation and amortization $ 106,113 $ 5,216 Interest on ground lease liability Interest expense 283,846 4,703 $ 389,959 $ 9,919 (1) Included in this figure is amortization of the below market ground lease intangible assets related to the ground lease acquired in conjunction with the transactions. The value of these intangibles is included in the Operating lease asset line item on the balance sheet. Annual amortization of these intangibles is summarized for the following 5 years in the table below. (2) Included in this figure is amortization of the above market ground lease intangible assets related to the ground lease acquired in conjunction with the transactions. The value of these intangibles is included in the Finance lease asset line item on the balance sheet. Annual amortization of these intangibles is summarized for the following 5 years as follows: Above Market Ground Lease Amortization Below Market Ground Lease Amortization 2022 $ (25,678) $ 107,905 2023 (25,678) 107,905 2024 (25,678) 107,905 2025 (25,678) 107,905 2026 (25,678) 107,905 Thereafter (960,276) 4,019,608 Total $ (1,088,666) $ 4,559,133 Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 15

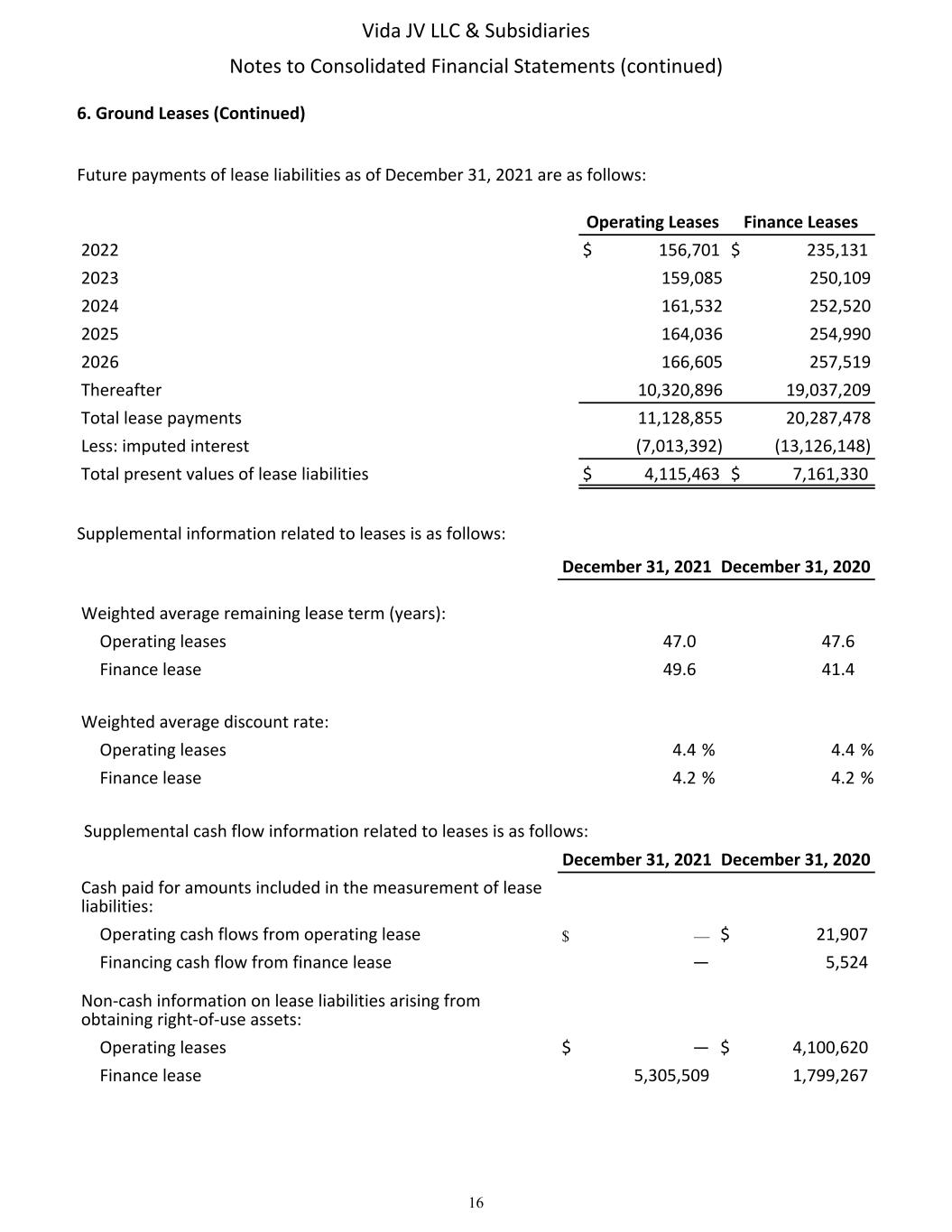

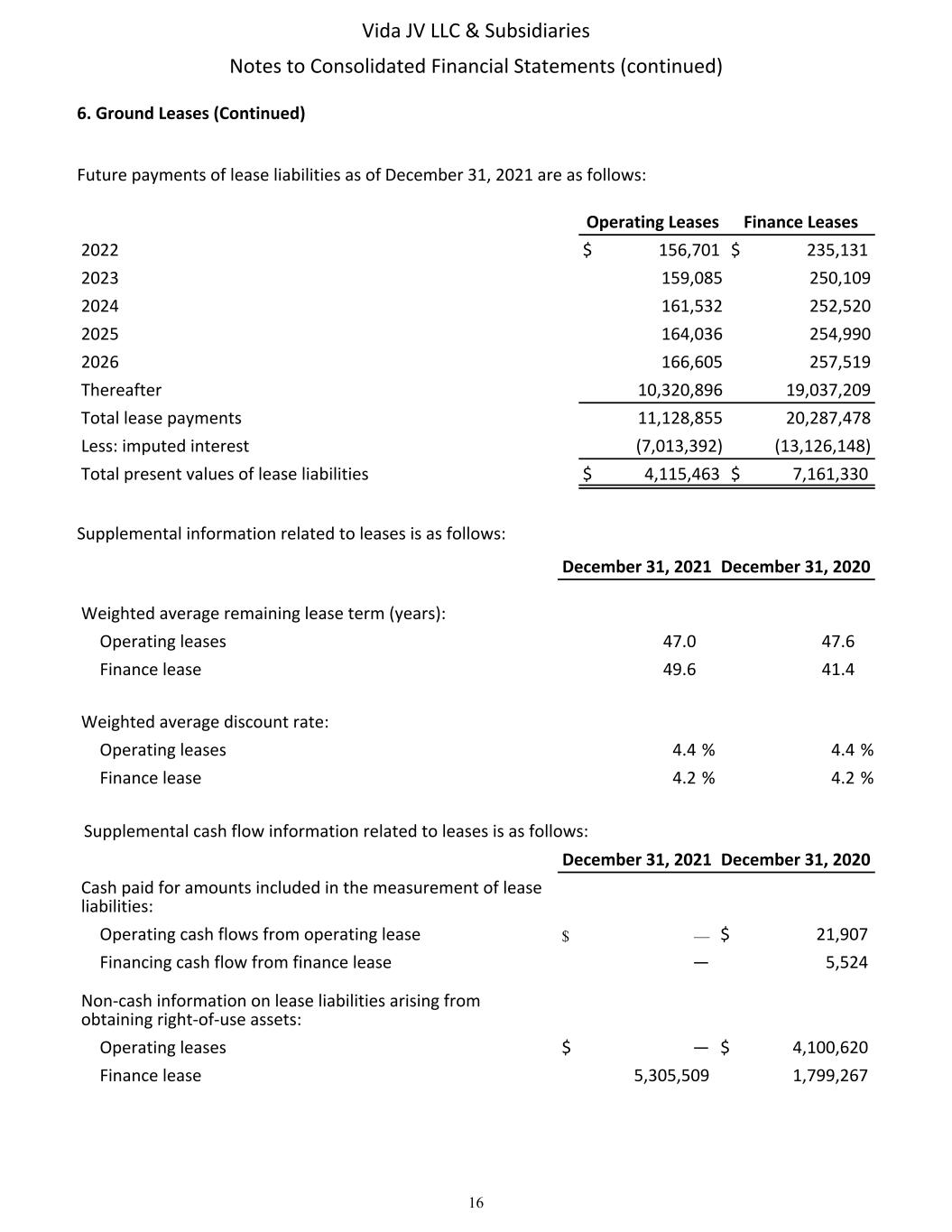

6. Ground Leases (Continued) Future payments of lease liabilities as of December 31, 2021 are as follows: Operating Leases Finance Leases 2022 $ 156,701 $ 235,131 2023 159,085 250,109 2024 161,532 252,520 2025 164,036 254,990 2026 166,605 257,519 Thereafter 10,320,896 19,037,209 Total lease payments 11,128,855 20,287,478 Less: imputed interest (7,013,392) (13,126,148) Total present values of lease liabilities $ 4,115,463 $ 7,161,330 Supplemental information related to leases is as follows: December 31, 2021 December 31, 2020 Weighted average remaining lease term (years): Operating leases 47.0 47.6 Finance lease 49.6 41.4 Weighted average discount rate: Operating leases 4.4 % 4.4 % Finance lease 4.2 % 4.2 % Supplemental cash flow information related to leases is as follows: December 31, 2021 December 31, 2020 Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows from operating lease $ — $ 21,907 Financing cash flow from finance lease — 5,524 Non-cash information on lease liabilities arising from obtaining right-of-use assets: Operating leases $ — $ 4,100,620 Finance lease 5,305,509 1,799,267 Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 16

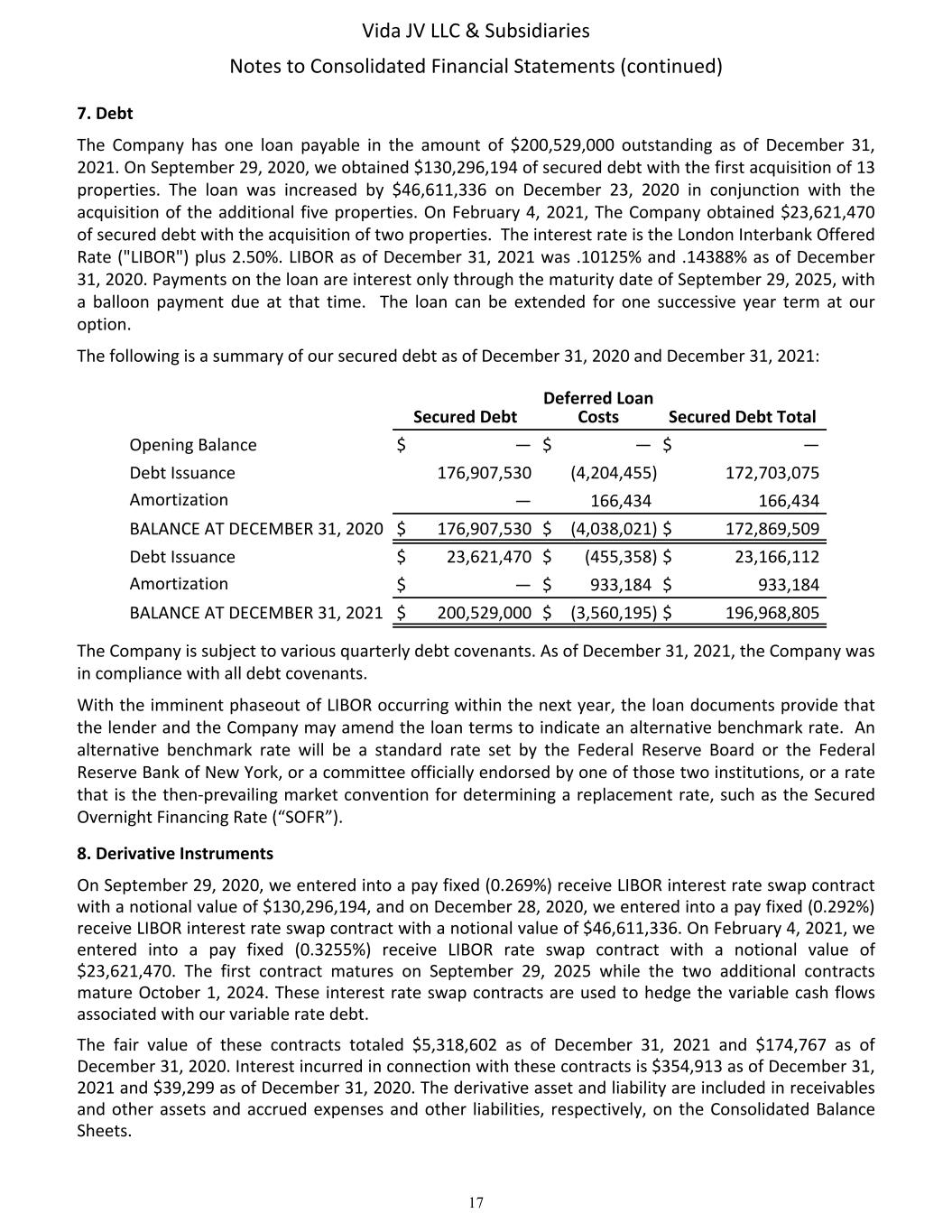

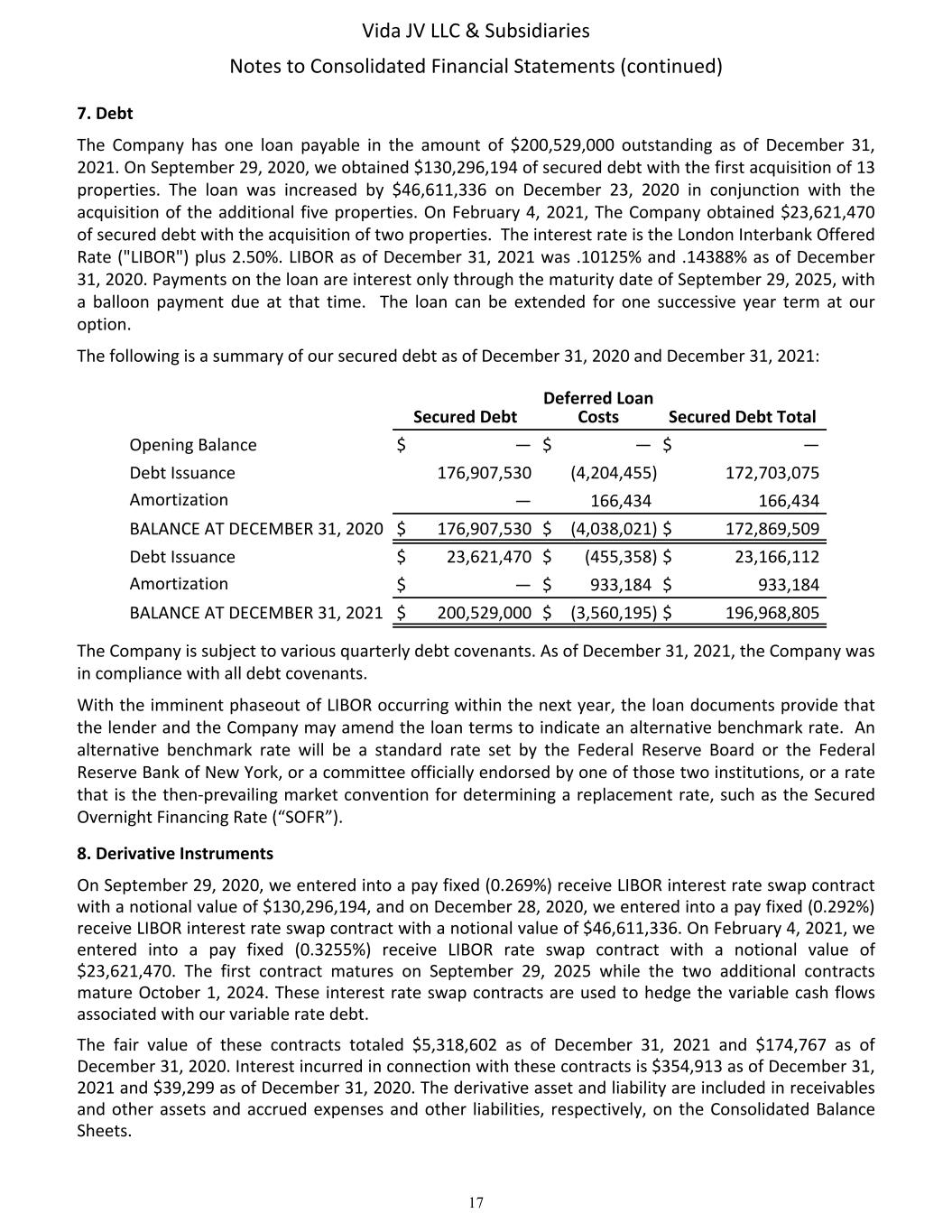

7. Debt The Company has one loan payable in the amount of $200,529,000 outstanding as of December 31, 2021. On September 29, 2020, we obtained $130,296,194 of secured debt with the first acquisition of 13 properties. The loan was increased by $46,611,336 on December 23, 2020 in conjunction with the acquisition of the additional five properties. On February 4, 2021, The Company obtained $23,621,470 of secured debt with the acquisition of two properties. The interest rate is the London Interbank Offered Rate ("LIBOR") plus 2.50%. LIBOR as of December 31, 2021 was .10125% and .14388% as of December 31, 2020. Payments on the loan are interest only through the maturity date of September 29, 2025, with a balloon payment due at that time. The loan can be extended for one successive year term at our option. The following is a summary of our secured debt as of December 31, 2020 and December 31, 2021: Secured Debt Deferred Loan Costs Secured Debt Total Opening Balance $ — $ — $ — Debt Issuance 176,907,530 (4,204,455) 172,703,075 Amortization — 166,434 166,434 BALANCE AT DECEMBER 31, 2020 $ 176,907,530 $ (4,038,021) $ 172,869,509 Debt Issuance $ 23,621,470 $ (455,358) $ 23,166,112 Amortization $ — $ 933,184 $ 933,184 BALANCE AT DECEMBER 31, 2021 $ 200,529,000 $ (3,560,195) $ 196,968,805 The Company is subject to various quarterly debt covenants. As of December 31, 2021, the Company was in compliance with all debt covenants. With the imminent phaseout of LIBOR occurring within the next year, the loan documents provide that the lender and the Company may amend the loan terms to indicate an alternative benchmark rate. An alternative benchmark rate will be a standard rate set by the Federal Reserve Board or the Federal Reserve Bank of New York, or a committee officially endorsed by one of those two institutions, or a rate that is the then-prevailing market convention for determining a replacement rate, such as the Secured Overnight Financing Rate (“SOFR”). 8. Derivative Instruments On September 29, 2020, we entered into a pay fixed (0.269%) receive LIBOR interest rate swap contract with a notional value of $130,296,194, and on December 28, 2020, we entered into a pay fixed (0.292%) receive LIBOR interest rate swap contract with a notional value of $46,611,336. On February 4, 2021, we entered into a pay fixed (0.3255%) receive LIBOR rate swap contract with a notional value of $23,621,470. The first contract matures on September 29, 2025 while the two additional contracts mature October 1, 2024. These interest rate swap contracts are used to hedge the variable cash flows associated with our variable rate debt. The fair value of these contracts totaled $5,318,602 as of December 31, 2021 and $174,767 as of December 31, 2020. Interest incurred in connection with these contracts is $354,913 as of December 31, 2021 and $39,299 as of December 31, 2020. The derivative asset and liability are included in receivables and other assets and accrued expenses and other liabilities, respectively, on the Consolidated Balance Sheets. Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 17

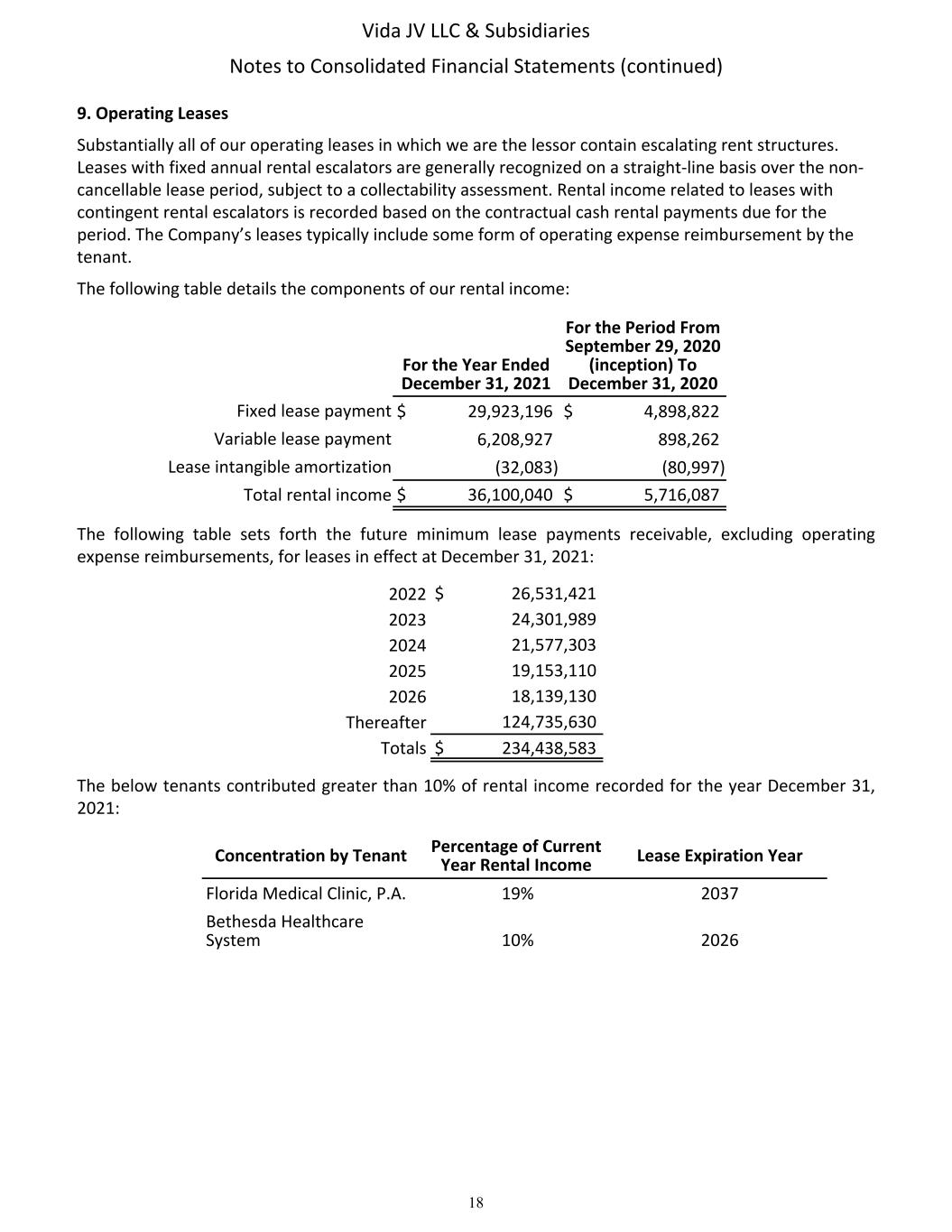

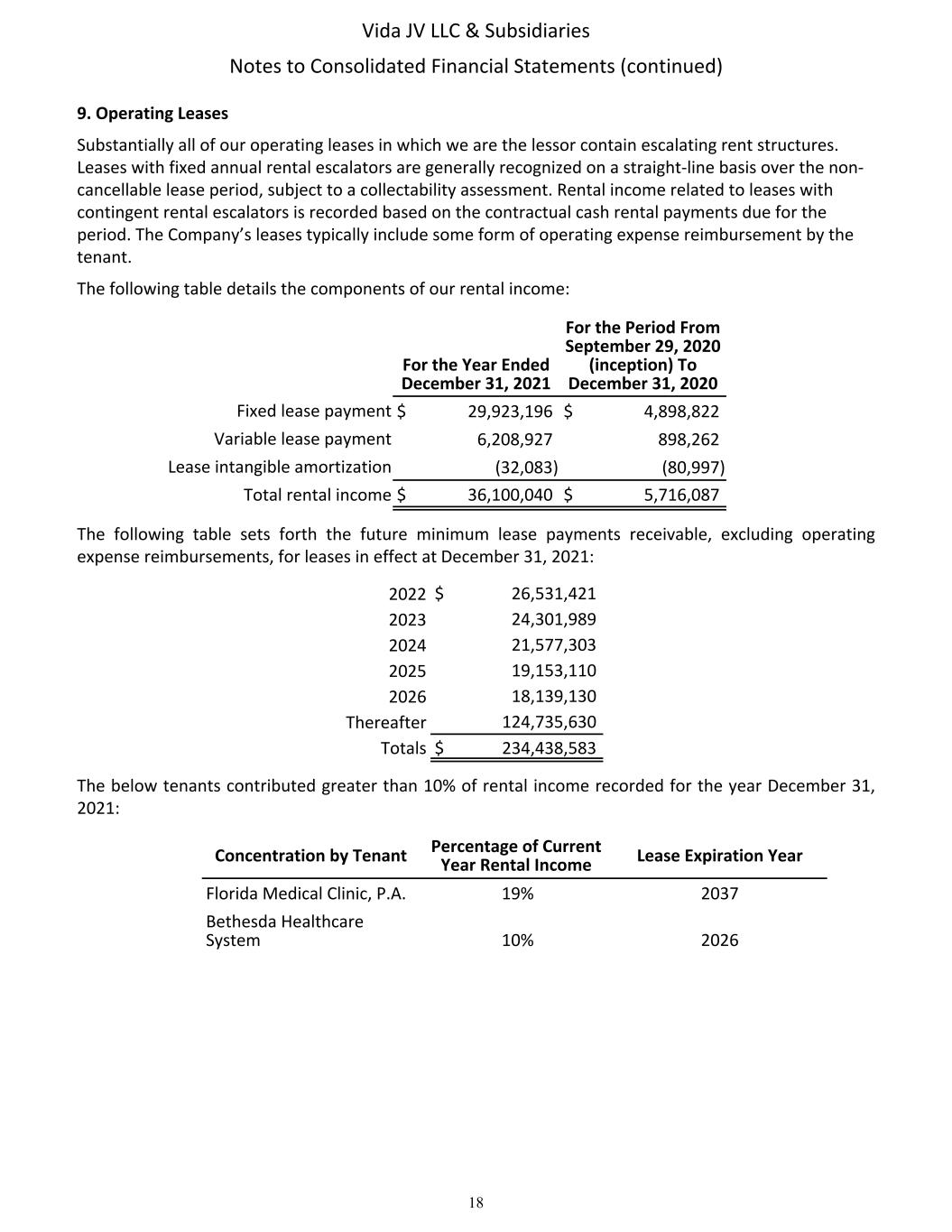

9. Operating Leases Substantially all of our operating leases in which we are the lessor contain escalating rent structures. Leases with fixed annual rental escalators are generally recognized on a straight-line basis over the non- cancellable lease period, subject to a collectability assessment. Rental income related to leases with contingent rental escalators is recorded based on the contractual cash rental payments due for the period. The Company’s leases typically include some form of operating expense reimbursement by the tenant. The following table details the components of our rental income: For the Year Ended December 31, 2021 For the Period From September 29, 2020 (inception) To December 31, 2020 Fixed lease payment $ 29,923,196 $ 4,898,822 Variable lease payment 6,208,927 898,262 Lease intangible amortization (32,083) (80,997) Total rental income $ 36,100,040 $ 5,716,087 The following table sets forth the future minimum lease payments receivable, excluding operating expense reimbursements, for leases in effect at December 31, 2021: 2022 $ 26,531,421 2023 24,301,989 2024 21,577,303 2025 19,153,110 2026 18,139,130 Thereafter 124,735,630 Totals $ 234,438,583 The below tenants contributed greater than 10% of rental income recorded for the year December 31, 2021: Concentration by Tenant Percentage of Current Year Rental Income Lease Expiration Year Florida Medical Clinic, P.A. 19% 2037 Bethesda Healthcare System 10% 2026 Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 18

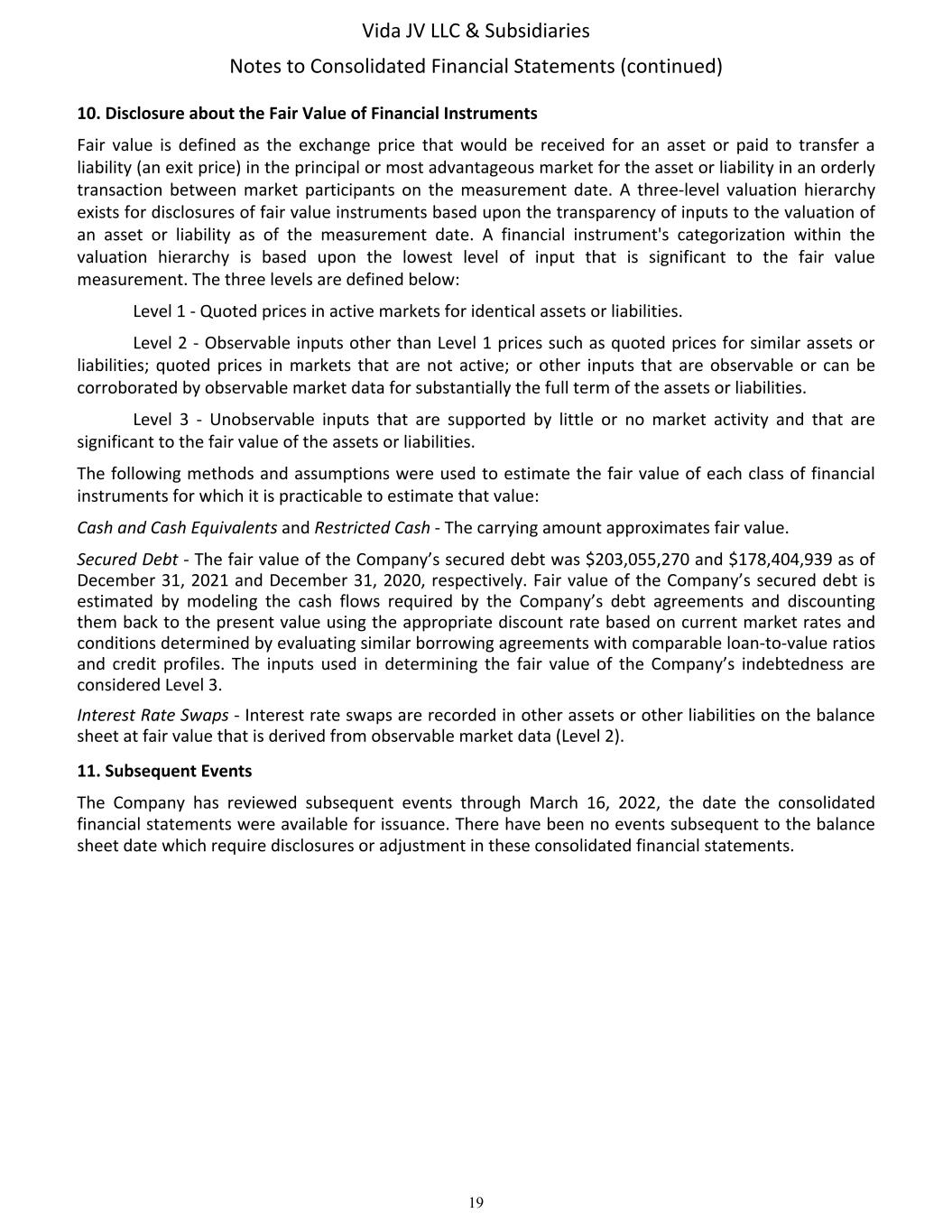

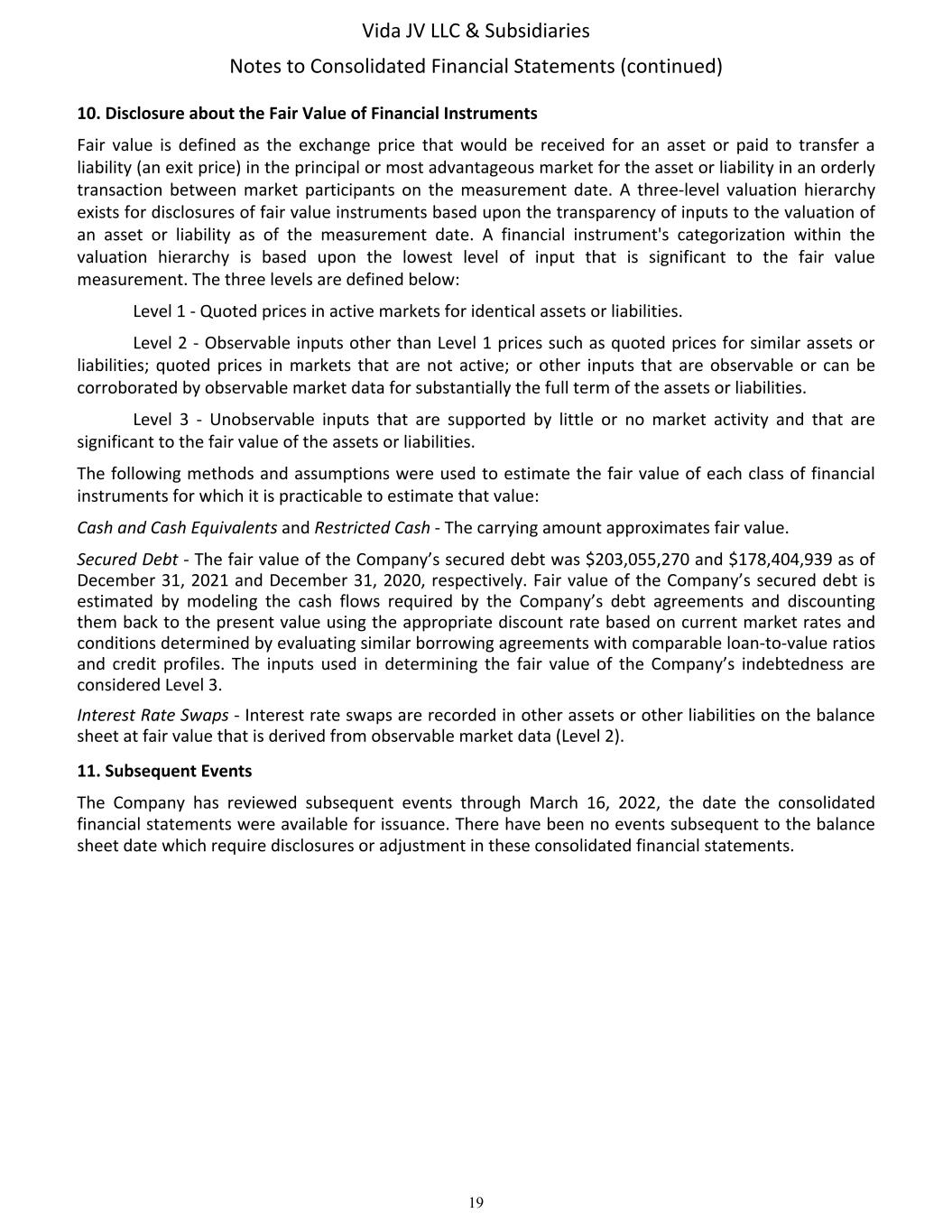

10. Disclosure about the Fair Value of Financial Instruments Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. A three-level valuation hierarchy exists for disclosures of fair value instruments based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. A financial instrument's categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement. The three levels are defined below: Level 1 - Quoted prices in active markets for identical assets or liabilities. Level 2 - Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. The following methods and assumptions were used to estimate the fair value of each class of financial instruments for which it is practicable to estimate that value: Cash and Cash Equivalents and Restricted Cash - The carrying amount approximates fair value. Secured Debt - The fair value of the Company’s secured debt was $203,055,270 and $178,404,939 as of December 31, 2021 and December 31, 2020, respectively. Fair value of the Company’s secured debt is estimated by modeling the cash flows required by the Company’s debt agreements and discounting them back to the present value using the appropriate discount rate based on current market rates and conditions determined by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. The inputs used in determining the fair value of the Company’s indebtedness are considered Level 3. Interest Rate Swaps - Interest rate swaps are recorded in other assets or other liabilities on the balance sheet at fair value that is derived from observable market data (Level 2). 11. Subsequent Events The Company has reviewed subsequent events through March 16, 2022, the date the consolidated financial statements were available for issuance. There have been no events subsequent to the balance sheet date which require disclosures or adjustment in these consolidated financial statements. Vida JV LLC & Subsidiaries Notes to Consolidated Financial Statements (continued) 19

Vida JV LLC & Subsidiaries Supplemental Information 20

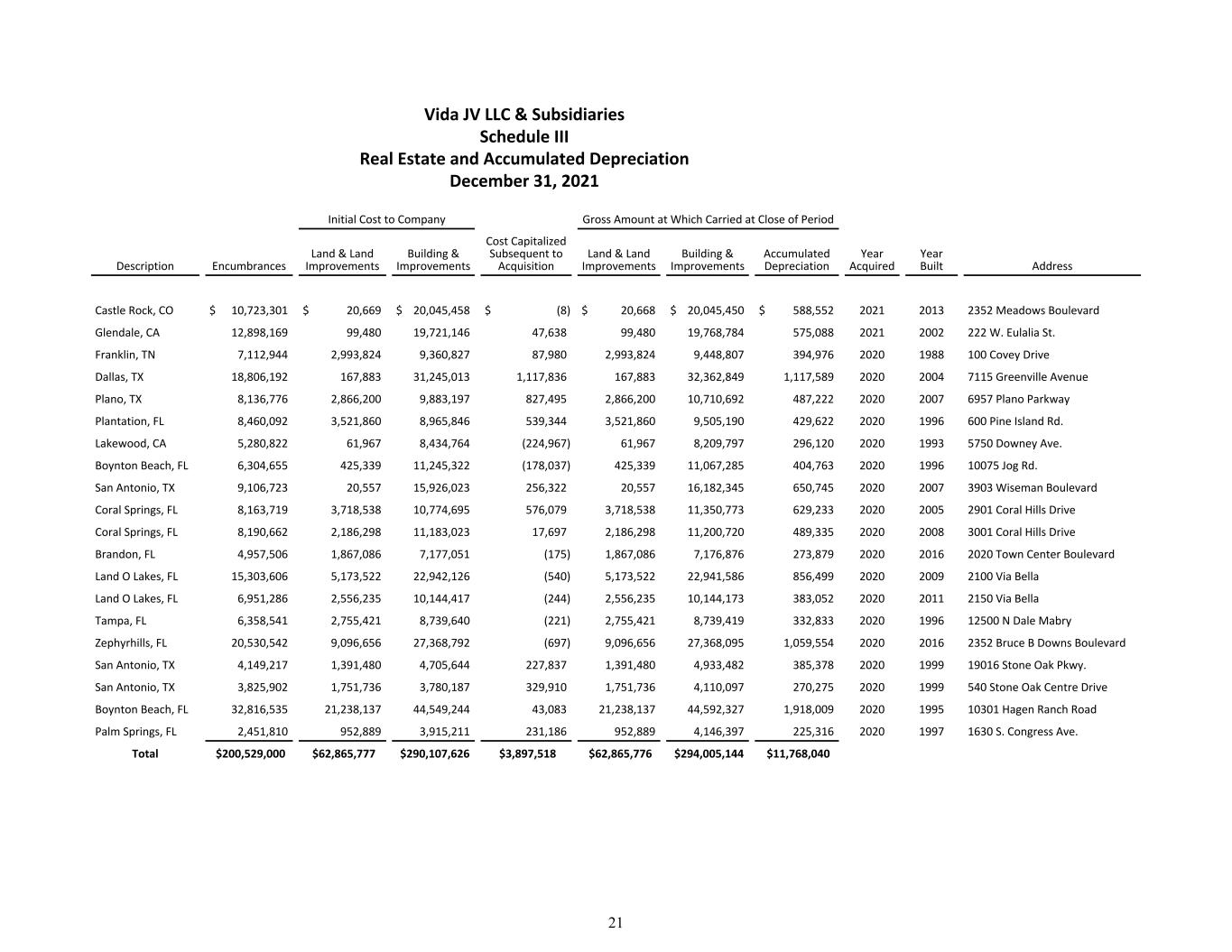

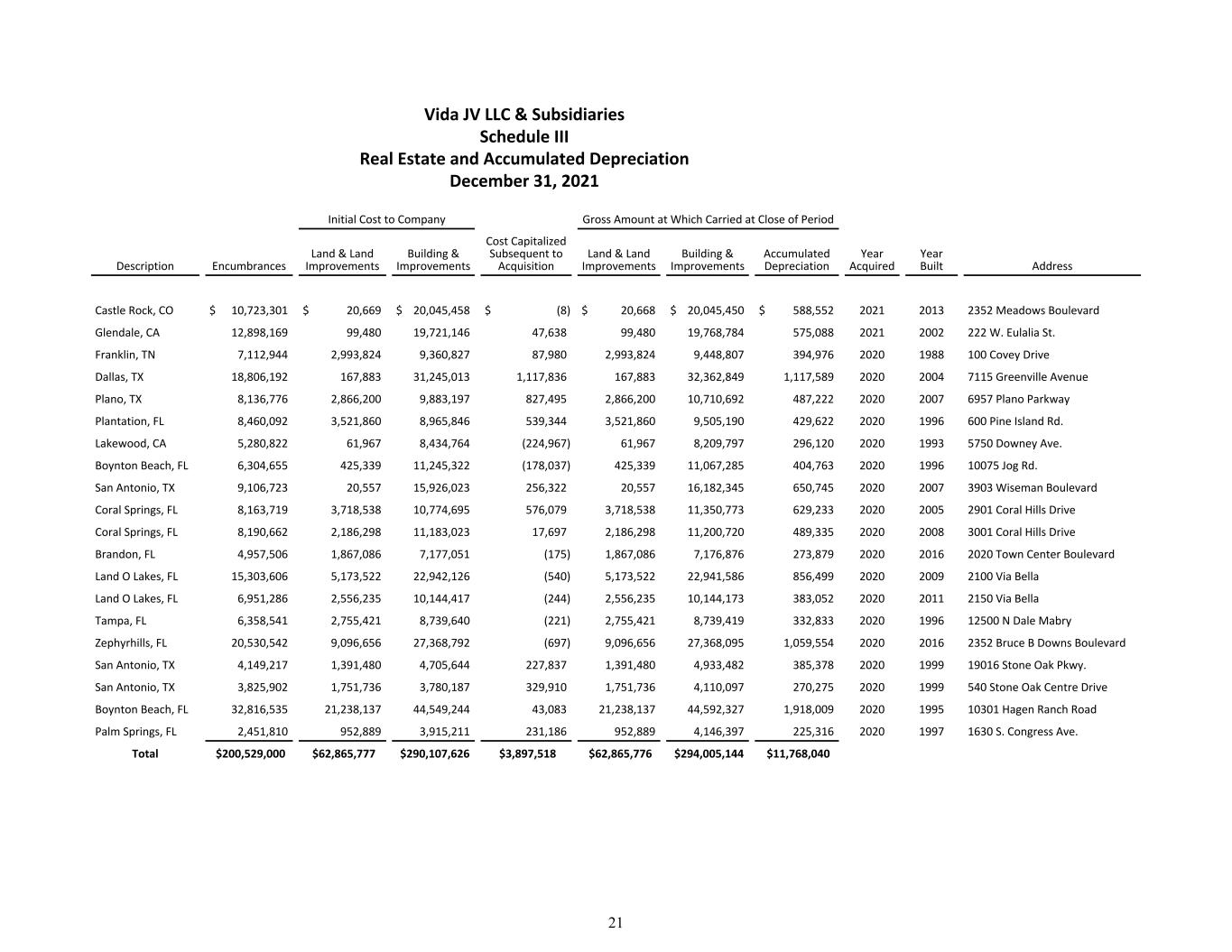

Vida JV LLC & Subsidiaries Schedule III Real Estate and Accumulated Depreciation December 31, 2021 Initial Cost to Company Gross Amount at Which Carried at Close of Period Description Encumbrances Land & Land Improvements Building & Improvements Cost Capitalized Subsequent to Acquisition Land & Land Improvements Building & Improvements Accumulated Depreciation Year Acquired Year Built Address Castle Rock, CO $ 10,723,301 $ 20,669 $ 20,045,458 $ (8) $ 20,668 $ 20,045,450 $ 588,552 2021 2013 2352 Meadows Boulevard Glendale, CA 12,898,169 99,480 19,721,146 47,638 99,480 19,768,784 575,088 2021 2002 222 W. Eulalia St. Franklin, TN 7,112,944 2,993,824 9,360,827 87,980 2,993,824 9,448,807 394,976 2020 1988 100 Covey Drive Dallas, TX 18,806,192 167,883 31,245,013 1,117,836 167,883 32,362,849 1,117,589 2020 2004 7115 Greenville Avenue Plano, TX 8,136,776 2,866,200 9,883,197 827,495 2,866,200 10,710,692 487,222 2020 2007 6957 Plano Parkway Plantation, FL 8,460,092 3,521,860 8,965,846 539,344 3,521,860 9,505,190 429,622 2020 1996 600 Pine Island Rd. Lakewood, CA 5,280,822 61,967 8,434,764 (224,967) 61,967 8,209,797 296,120 2020 1993 5750 Downey Ave. Boynton Beach, FL 6,304,655 425,339 11,245,322 (178,037) 425,339 11,067,285 404,763 2020 1996 10075 Jog Rd. San Antonio, TX 9,106,723 20,557 15,926,023 256,322 20,557 16,182,345 650,745 2020 2007 3903 Wiseman Boulevard Coral Springs, FL 8,163,719 3,718,538 10,774,695 576,079 3,718,538 11,350,773 629,233 2020 2005 2901 Coral Hills Drive Coral Springs, FL 8,190,662 2,186,298 11,183,023 17,697 2,186,298 11,200,720 489,335 2020 2008 3001 Coral Hills Drive Brandon, FL 4,957,506 1,867,086 7,177,051 (175) 1,867,086 7,176,876 273,879 2020 2016 2020 Town Center Boulevard Land O Lakes, FL 15,303,606 5,173,522 22,942,126 (540) 5,173,522 22,941,586 856,499 2020 2009 2100 Via Bella Land O Lakes, FL 6,951,286 2,556,235 10,144,417 (244) 2,556,235 10,144,173 383,052 2020 2011 2150 Via Bella Tampa, FL 6,358,541 2,755,421 8,739,640 (221) 2,755,421 8,739,419 332,833 2020 1996 12500 N Dale Mabry Zephyrhills, FL 20,530,542 9,096,656 27,368,792 (697) 9,096,656 27,368,095 1,059,554 2020 2016 2352 Bruce B Downs Boulevard San Antonio, TX 4,149,217 1,391,480 4,705,644 227,837 1,391,480 4,933,482 385,378 2020 1999 19016 Stone Oak Pkwy. San Antonio, TX 3,825,902 1,751,736 3,780,187 329,910 1,751,736 4,110,097 270,275 2020 1999 540 Stone Oak Centre Drive Boynton Beach, FL 32,816,535 21,238,137 44,549,244 43,083 21,238,137 44,592,327 1,918,009 2020 1995 10301 Hagen Ranch Road Palm Springs, FL 2,451,810 952,889 3,915,211 231,186 952,889 4,146,397 225,316 2020 1997 1630 S. Congress Ave. Total $200,529,000 $62,865,777 $290,107,626 $3,897,518 $62,865,776 $294,005,144 $11,768,040 21

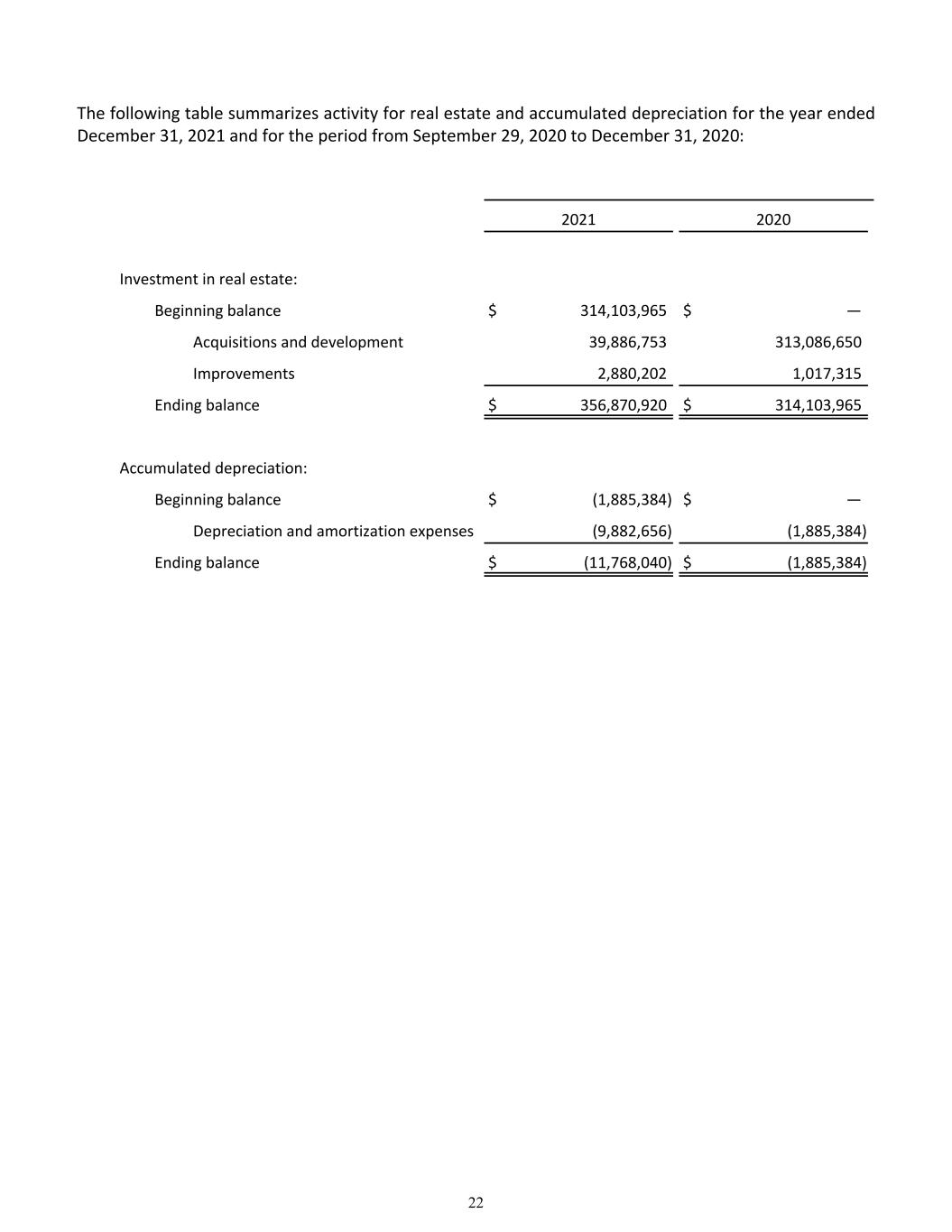

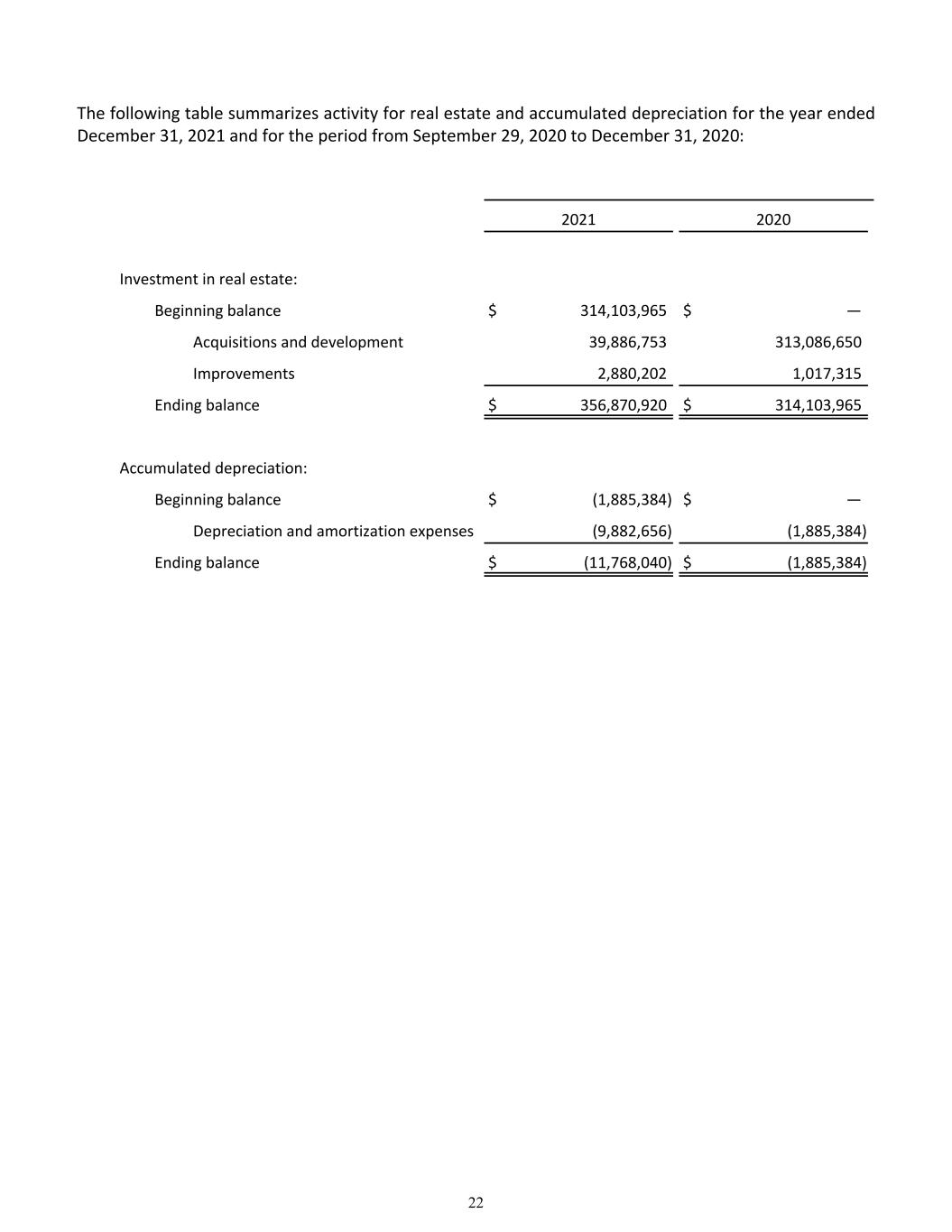

The following table summarizes activity for real estate and accumulated depreciation for the year ended December 31, 2021 and for the period from September 29, 2020 to December 31, 2020: 2021 2020 Investment in real estate: Beginning balance $ 314,103,965 $ — Acquisitions and development 39,886,753 313,086,650 Improvements 2,880,202 1,017,315 Ending balance $ 356,870,920 $ 314,103,965 Accumulated depreciation: Beginning balance $ (1,885,384) $ — Depreciation and amortization expenses (9,882,656) (1,885,384) Ending balance $ (11,768,040) $ (1,885,384) 22