UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________________

FORM 10-Q

_______________________________________________________________

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2022 |

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number: 333-254931

_______________________________________________________________

Invesco Real Estate Income Trust Inc.

(Exact name of Registrant as specified in its charter)

_______________________________________________________________

| | | | | | | | |

| Maryland | | 83-2188696 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

2001 Ross Avenue Suite 3400 Dallas, Texas (address of principal executive office) | | 75201 (Zip Code) |

| Registrant’s telephone number, including area code: (972)715-7400 |

_______________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: None

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | | Accelerated filer | ¨ |

| Non-accelerated filer | x | | Smaller reporting company | x |

| | | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes x No ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No x

As of August 11, 2022, the issuer had the following shares outstanding: 357,834 shares of Class T common stock, 351,856 shares of Class S common stock, 458,695 shares of Class D common stock, 2,858,020 shares of Class I common stock, 2,261,342 shares of Class E common stock and 10,020,129 shares of Class N common stock.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Invesco Real Estate Income Trust Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| $ in thousands except share amounts | June 30, 2022 | | December 31, 2021 |

| | | |

| ASSETS | | | |

| Investments in real estate, net | $ | 746,317 | | | $ | 434,373 | |

| Investments in unconsolidated entities | 121,300 | | | 115,285 | |

| Investments in real estate-related securities, at fair value | 25,333 | | | 12,685 | |

| Intangible assets, net | 33,519 | | | 21,977 | |

| Cash and cash equivalents | 16,144 | | | 13,754 | |

| Restricted cash | 9,227 | | | 1,745 | |

| Other assets | 16,768 | | | 12,558 | |

| Total assets | $ | 968,608 | | | $ | 612,377 | |

| | | |

| LIABILITIES | | | |

| Revolving credit facility | $ | 62,100 | | | $ | 75,500 | |

| Mortgage notes payable, net | 374,045 | | | 161,653 | |

| Financing obligation, net | 53,752 | | | 53,619 | |

| | | |

| | | |

| Due to affiliates | 21,241 | | | 16,930 | |

| Accounts payable, accrued expenses and other liabilities | 16,446 | | | 5,907 | |

| Total liabilities | 527,584 | | | 313,609 | |

| | | |

| Commitments and contingencies (See Note 15) | — | | | — | |

| | | |

| Class N redeemable common stock, $0.01 par value per share, 10,020,128 and 7,372,812 shares issued and outstanding, respectively | 327,340 | | | 224,667 | |

| Redeemable non-controlling interest in INREIT OP | 3,173 | | | — | |

| | | |

| EQUITY | | | |

| Preferred stock, $0.01 par value per share, 100,000,000 shares authorized; 125 shares issued and outstanding ($500.00 per share liquidation preference) | 41 | | | 41 | |

| Common stock, Class T shares, $0.01 par value per share, 600,000,000 shares authorized; 352,694 and 186,821 shares issued and outstanding, respectively | 4 | | | 2 | |

| Common stock, Class S shares, $0.01 par value per share, 600,000,000 shares authorized; 351,856 and 186,821 shares issued and outstanding, respectively | 4 | | | 2 | |

| Common stock, Class D shares, $0.01 par value per share, 600,000,000 shares authorized; 376,242 and 186,821 shares issued and outstanding, respectively | 4 | | | 2 | |

| Common stock, Class I shares, $0.01 par value per share, 600,000,000 shares authorized; 2,603,350 and 186,715 shares issued and outstanding, respectively | 26 | | | 2 | |

| Common stock, Class E shares, $0.01 par value per share, 600,000,000 shares authorized; 2,255,757 and 2,244,581 shares issued and outstanding, respectively | 22 | | | 22 | |

Common stock, Class N shares, $0.01 par value per share, 600,000,000 shares authorized; 0 and 1,183,697 shares issued and outstanding, respectively | — | | | 12 | |

| Additional paid-in capital | 125,789 | | | 94,097 | |

| Accumulated deficit and cumulative distributions | (46,207) | | | (24,150) | |

| Total stockholders' equity | 79,683 | | | 70,030 | |

| Non-controlling interests in consolidated joint ventures | 30,828 | | | 4,071 | |

| Total equity | 110,511 | | | 74,101 | |

| Total liabilities, redeemable equity instruments and equity | $ | 968,608 | | | $ | 612,377 | |

See accompanying notes to condensed consolidated financial statements.

Invesco Real Estate Income Trust Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| $ in thousands except share amounts | 2022 | | 2021 | | 2022 | | 2021 |

| Revenues | | | | | | | |

| Rental revenue | $ | 13,264 | | | $ | 2,452 | | | $ | 22,927 | | | $ | 4,567 | |

| Other revenue | 643 | | | 117 | | | 1,226 | | | 180 | |

| Total revenues | 13,907 | | | 2,569 | | | 24,153 | | | 4,747 | |

| Expenses | | | | | | | |

| Rental property operating | 4,925 | | | 599 | | | 8,143 | | | 1,111 | |

| | | | | | | |

| General and administrative | 1,289 | | | 979 | | | 2,912 | | | 2,140 | |

| Management fee - related party | 187 | | | — | | | 301 | | | — | |

| Performance participation interest - related party | 2,273 | | | 609 | | | 4,394 | | | 791 | |

| Depreciation and amortization | 11,710 | | | 2,037 | | | 20,488 | | | 3,562 | |

| Total expenses | 20,384 | | | 4,224 | | | 36,238 | | | 7,604 | |

| Other income (expense), net | | | | | | | |

| Income (loss) from unconsolidated entities, net | 1,728 | | | (228) | | | 5,707 | | | 1,503 | |

| Income (loss) from real estate-related securities | (1,123) | | | 55 | | | (1,095) | | | 64 | |

| Unrealized gain on derivative instruments | 954 | | | — | | | 2,470 | | | — | |

| Interest expense | (3,238) | | | (580) | | | (5,275) | | | (1,082) | |

| Other expense | (9) | | | — | | | (84) | | | — | |

| Total other income (expense), net | (1,688) | | | (753) | | | 1,723 | | | 485 | |

| Net loss attributable to Invesco Real Estate Income Trust Inc. | $ | (8,165) | | | $ | (2,408) | | | $ | (10,362) | | | $ | (2,372) | |

| Dividends to preferred stockholders | $ | (2) | | | $ | (2) | | | $ | (4) | | | $ | (4) | |

| Net loss attributable to non-controlling interests in consolidated joint ventures | 430 | | | — | | | 444 | | | — | |

| Net loss attributable to non-controlling interest in INREIT OP | 38 | | | — | | | 299 | | | — | |

| Net loss attributable to common stockholders | $ | (7,699) | | | $ | (2,410) | | | $ | (9,623) | | | $ | (2,376) | |

| | | | | | | |

| Loss per share: | | | | | | | |

| Net loss per share of common stock, basic and diluted | $ | (0.49) | | | $ | (0.39) | | | $ | (0.66) | | | $ | (0.40) | |

| Weighted average shares of common stock outstanding, basic and diluted | 15,647,218 | | | 6,246,332 | | | 14,671,363 | | | 5,879,503 | |

See accompanying notes to condensed consolidated financial statements.

Invesco Real Estate Income Trust Inc.

Condensed Consolidated Statements of Changes in Equity and Redeemable Equity Instruments

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | Series A

Preferred Stock | | Class T

Common Stock | | Class S

Common Stock | | Class D

Common Stock | | Class I

Common Stock | | Class E

Common Stock | | Class N

Common Stock | | Additional Paid-in Capital | | Accumulated

Deficit and Cumulative Distributions | | Total Stockholders'

Equity | | Non-controlling Interests in Consolidated Joint Ventures | | Total

Equity | | | Class N Redeemable Common Stock | | Redeemable Non-controlling Interest in INREIT OP |

| Balance at December 31, 2021 | $ | 41 | | | $ | 2 | | | $ | 2 | | | $ | 2 | | | $ | 2 | | | $ | 22 | | | $ | 12 | | | $ | 94,097 | | | $ | (24,150) | | | $ | 70,030 | | | $ | 4,071 | | | $ | 74,101 | | | | $ | 224,667 | | | $ | — | |

| Proceeds from issuance of common stock, net of offering costs | — | | | 2 | | | 2 | | | 2 | | | 3 | | | — | | | 8 | | | 48,141 | | | — | | | 48,158 | | | — | | | 48,158 | | | | 42,990 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distribution reinvestment | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 80 | | | — | | | 80 | | | — | | | 80 | | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 19 | | | — | | | 19 | | | — | | | 19 | | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,922) | | | (1,922) | | | (14) | | | (1,936) | | | | — | | | (261) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred stock dividends | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2) | | | (2) | | | — | | | (2) | | | | — | | | — | |

| Common stock distributions | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (5,876) | | | (5,876) | | | — | | | (5,876) | | | | — | | | — | |

| Acquired non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2,025 | | | 2,025 | | | | — | | | — | |

| Issuance of Class E OP Units to non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | — | | | 3,280 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (80) | | | (80) | | | | — | | | (30) | |

| Adjustment to carrying value of redeemable equity instruments | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (10,182) | | | — | | | (10,182) | | | — | | | (10,182) | | | | 10,044 | | | 138 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at March 31, 2022 | $ | 41 | | | $ | 4 | | | $ | 4 | | | $ | 4 | | | $ | 5 | | | $ | 22 | | | $ | 20 | | | $ | 132,155 | | | $ | (31,950) | | | $ | 100,305 | | | $ | 6,002 | | | $ | 106,307 | | | | $ | 277,701 | | | $ | 3,127 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from issuance of common stock, net of offering costs | — | | — | | — | | — | | 4 | | — | | — | | 13,057 | | | — | | 13,061 | | | — | | | 13,061 | | | | 44,188 | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distribution reinvestment | — | | — | | — | | — | | — | | — | | — | | 129 | | — | | 129 | | — | | 129 | | | — | | — |

| Common stock repurchased | — | | — | | — | | — | | (3) | | | — | | — | | (9,197) | | | — | | (9,200) | | | — | | (9,200) | | | | (4,795) | | | — |

| Share-based compensation | — | | — | | — | | — | | — | | — | | — | | 19 | | — | | 19 | | — | | | 19 | | | | — | | — | |

| Net loss | — | | — | | — | | — | | — | | — | | — | | — | | (7,697) | | | (7,697) | | | (430) | | | (8,127) | | | | — | | (38) | |

| Exchange of common stock | — | | — | | — | | — | | 20 | | — | | | (20) | | | — | | — | | — | | — | | | — | | | | — | | — | |

| Preferred stock dividends | — | | — | | — | | — | | — | | — | | — | | — | | (2) | | | (2) | | | — | | | (2) | | | | — | | — | |

| Common stock distributions | — | | — | | — | | — | | — | | — | | — | | — | | (6,558) | | | (6,558) | | | — | | | (6,558) | | | | — | | — | |

| Acquired non-controlling interests | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 25,400 | | 25,400 | | | | — | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (144) | | | (144) | | | | — | | (44) | |

| Adjustment to carrying value of redeemable equity instruments | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (10,374) | | | — | | | (10,374) | | | — | | | (10,374) | | | | 10,246 | | | 128 | |

| Balance at June 30, 2022 | $ | 41 | | | $ | 4 | | | $ | 4 | | | $ | 4 | | | $ | 26 | | | $ | 22 | | | $ | — | | | $ | 125,789 | | | $ | (46,207) | | | $ | 79,683 | | | $ | 30,828 | | | $ | 110,511 | | | | $ | 327,340 | | | $ | 3,173 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

Invesco Real Estate Income Trust Inc.

Condensed Consolidated Statements of Changes in Equity and Redeemable Equity Instruments

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | Series A

Preferred Stock | | Class T

Common Stock | | Class S

Common Stock | | Class D

Common Stock | | Class I

Common Stock | | Class E

Common Stock | | Class N

Common Stock | | Additional Paid-in Capital | | Accumulated

Deficit and Cumulative Distributions | | Total Stockholders'

Equity | | Non-controlling Interests in Consolidated Joint Ventures | | Total

Equity | | | Class N Redeemable Common Stock | | Redeemable Non-controlling Interest in INREIT OP |

| Balance at December 31, 2020 | $ | 41 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 4 | | | $ | 9,276 | | | $ | (4,089) | | | $ | 5,232 | | | $ | — | | | $ | 5,232 | | | | $ | 83,194 | | | $ | — | |

| Proceeds from issuance of preferred stock, net of offering costs | — | | | — | | | — | | | — | | | — | | | — | | | 3 | | | 9,315 | | | — | | | 9,318 | | | — | | | 9,318 | | | | 61,726 | | | — | |

| Distribution reinvestment | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1 | | | — | | | 1 | | | — | | | 1 | | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 19 | | | — | | | 19 | | | — | | | 19 | | | | — | | | — | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 36 | | | 36 | | | — | | | 36 | | | | — | | | — | |

| Preferred stock dividends | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2) | | | (2) | | | — | | | (2) | | | | — | | | — | |

| Common stock distributions | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,378) | | | (2,378) | | | — | | | (2,378) | | | | — | | | — | |

| Balance at March 31, 2021 | $ | 41 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 7 | | | $ | 18,611 | | | $ | (6,433) | | | $ | 12,226 | | | $ | — | | | $ | 12,226 | | | | $ | 144,920 | | | $ | — | |

| Proceeds from issuance of common stock, net of offering costs | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6) | | | — | | | (6) | | | — | | | (6) | | | | — | | | — | |

| Distribution reinvestment | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 26 | | | — | | | 26 | | | — | | | 26 | | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 19 | | | — | | | 19 | | | — | | | 19 | | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,408) | | | (2,408) | | | — | | | (2,408) | | | | — | | | — | |

| Exchange of common stock | — | | | — | | | — | | | — | | | — | | | 2 | | | (2) | | | — | | | — | | | — | | | — | | | — | | | | — | | | — | |

| Preferred stock dividends | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2) | | | (2) | | | — | | | (2) | | | | — | | | — | |

| Common stock distributions | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,659) | | | (2,659) | | | — | | | (2,659) | | | | — | | | — | |

| Adjustment to carrying value of redeemable equity instruments | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (10,249) | | | — | | | (10,249) | | | — | | | (10,249) | | | | 10,249 | | | — | |

| Balance at June 30, 2021 | $ | 41 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 2 | | | $ | 5 | | | $ | 8,401 | | | $ | (11,502) | | | $ | (3,053) | | | $ | — | | | $ | (3,053) | | | | $ | 155,169 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

Invesco Real Estate Income Trust Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) | | | | | | | | | | | |

| Six Months Ended June 30, |

| $ in thousands | 2022 | | 2021 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (10,362) | | | $ | (2,372) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Management fee - related party | 301 | | | — | |

| Performance participation interest - related party | 4,394 | | | 791 | |

| Income from unconsolidated entities, net | (5,707) | | | (1,503) | |

| Depreciation and amortization | 20,488 | | | 3,562 | |

| Share-based compensation | 38 | | | 39 | |

| Straight-line rents | (719) | | | (310) | |

| Amortization of below-market lease intangibles | (50) | | | (98) | |

| Amortization of above-market lease intangibles | 77 | | | — | |

| Amortization of deferred financing costs | 645 | | | 318 | |

| Unrealized loss on real estate-related securities, net | 1,554 | | | (13) | |

| Unrealized gain on derivative instruments | (2,470) | | | — | |

| Distributions of earnings from investments in unconsolidated entities | 3,413 | | | 780 | |

| Other operating activities | 392 | | | 31 | |

| Change in assets and liabilities, net of assets and liabilities acquired in acquisitions: | | | |

| Decrease (increase) in other assets | 2,525 | | | (583) | |

| Increase in due to affiliates | 1,574 | | | 2,720 | |

| Increase in accounts payable, accrued expenses and other liabilities | 1,136 | | | 285 | |

| Net cash provided by operating activities | 17,229 | | | 3,647 | |

| Cash flows from investing activities: | | | |

| Investments in unconsolidated entities | (3,720) | | | (11,096) | |

| Acquisitions of real estate | (342,453) | | | (71,015) | |

| Pre-acquisition deposits | (480) | | | — | |

| Capital improvements to real estate | (223) | | | (24) | |

| Purchase of real estate-related securities | (14,235) | | | (4,452) | |

| Proceeds from sale of real estate-related securities | — | | | 564 | |

| Distributions of capital from investments in unconsolidated entities | — | | | 2,512 | |

| | | |

| Net cash used in investing activities | (361,111) | | | (83,511) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of redeemable common stock | 87,202 | | | 61,726 | |

| | | |

| Proceeds from issuance of common stock | 61,833 | | | 9,351 | |

| Repurchase of common stock | (13,995) | | | — | |

| Subscriptions received in advance | 6,328 | | | — | |

| | | |

| Proceeds from revolving credit facility | 123,400 | | | 80,900 | |

| Repayment of revolving credit facility | (136,800) | | | (111,700) | |

| Borrowings from mortgages payable | 214,925 | | | 45,000 | |

| | | |

| Purchase of derivative instruments | (1,808) | | | — | |

| | | |

| | | |

| | | |

| | | |

| Payment of deferred financing costs | (2,987) | | | (1,457) | |

| | | |

| Common stock distributions | (11,482) | | | (4,688) | |

| Preferred stock dividends | (4) | | | (4) | |

| Sale of interest to non-controlling interest | 22,462 | | | — | |

| Contributions from non-controlling interests | 4,963 | | | — | |

| Distributions to non-controlling interests | (283) | | | — | |

| Net cash provided by financing activities | 353,754 | | | 79,128 | |

| Net change in cash and cash equivalents and restricted cash | 9,872 | | | (736) | |

| Cash and cash equivalents and restricted cash, beginning of period | 15,499 | | | 3,718 | |

| Cash and cash equivalents and restricted cash, end of period | $ | 25,371 | | | $ | 2,982 | |

| | | | | | | | | | | |

| Reconciliation of cash and cash equivalents and restricted cash to the condensed consolidated balance sheets: | | | |

| Cash and cash equivalents | $ | 16,144 | | | $ | 2,123 | |

| Restricted cash | 9,227 | | | 859 | |

| Total cash and cash equivalents and restricted cash | $ | 25,371 | | | $ | 2,982 | |

| Supplemental disclosures: | | | |

| Interest paid | $ | 4,128 | | | $ | 736 | |

| Non-cash investing and financing activities: | | | |

| | | |

| Assumption of assets and liabilities in conjunction with acquisitions of real estate, net | $ | 1,331 | | | $ | 68 | |

| Issuance of Class E OP Units to non-controlling interests | $ | 3,280 | | | $ | — | |

| Issuance of Class E shares for payment of management fees | $ | 157 | | | $ | — | |

| | | |

| | | |

| Accrued capital expenditures | $ | 508 | | | $ | 1,438 | |

| | | |

| | | |

| Distributions payable | $ | 2,198 | | | $ | 825 | |

| Distribution reinvestment | $ | 209 | | | $ | 27 | |

| Accrued offering costs due to affiliates | $ | 795 | | | $ | 2,922 | |

| | | |

| Adjustment to carrying value of redeemable equity instruments | $ | 20,556 | | | $ | 10,249 | |

| | | |

| | | |

See accompanying notes to condensed consolidated financial statements.

Invesco Real Estate Income Trust Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1.Organization and Business Purpose

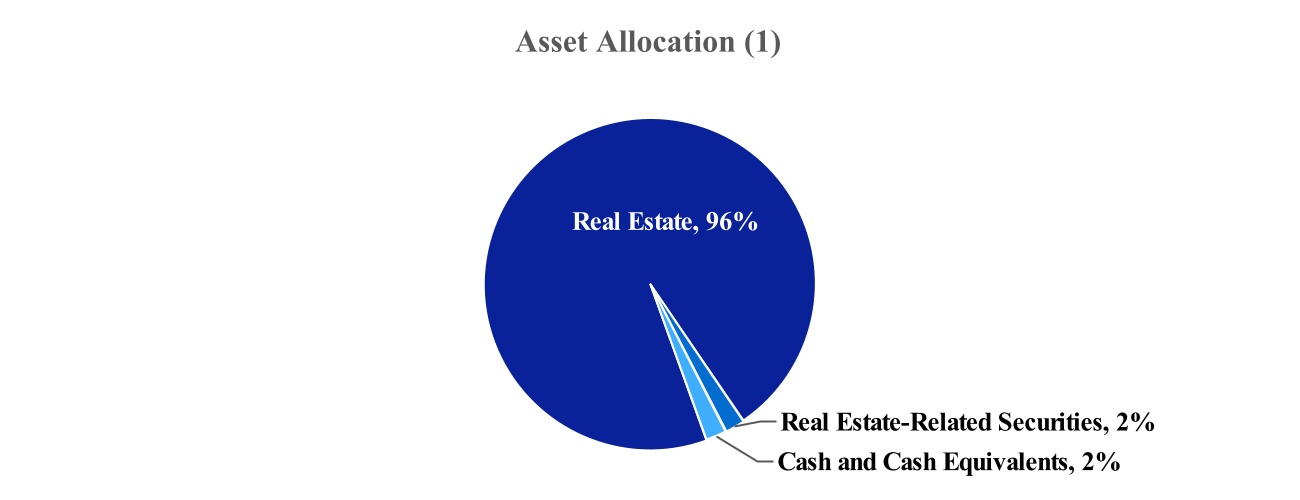

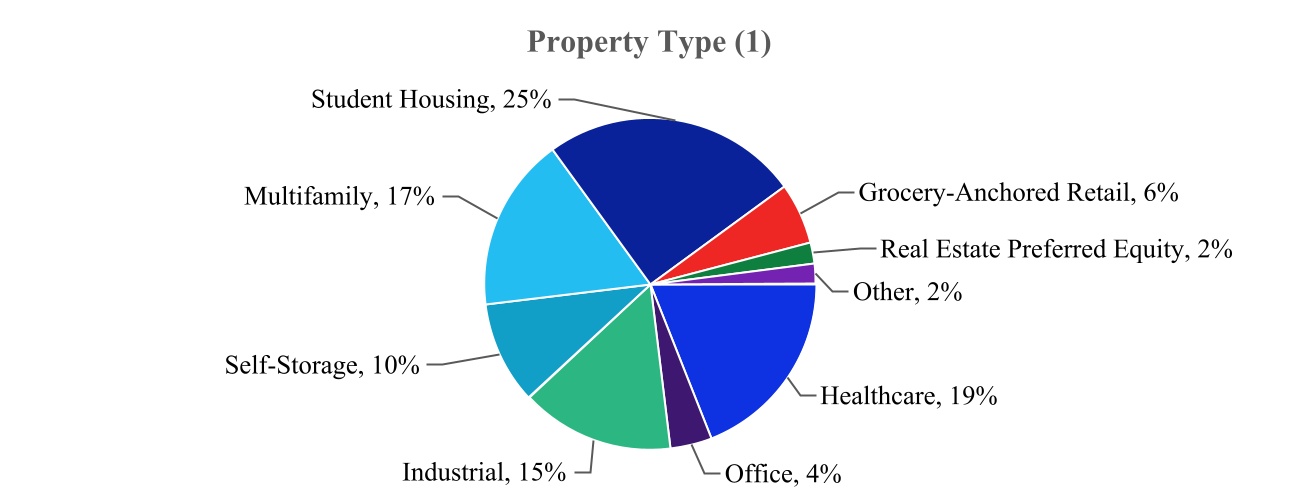

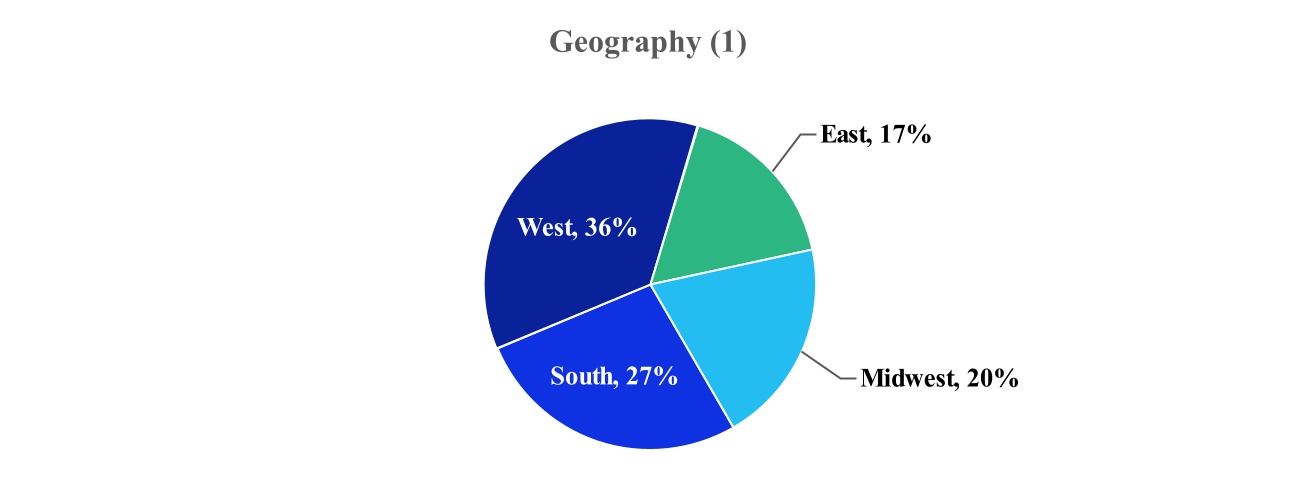

Invesco Real Estate Income Trust Inc. (the “Company” or “we”) is focused on investing in stabilized, income-oriented commercial real estate in the United States. To a lesser extent, we also originate and acquire private real estate debt and invest in real estate-related securities. We own, and expect to continue to own, all or substantially all of our assets through Invesco REIT Operating Partnership L.P. (the “Operating Partnership” or “INREIT OP”), of which we are the sole general partner.

We were incorporated in October 2018 as a Maryland corporation and commenced real estate operations in September 2020. We qualified as a real estate investment trust (“REIT”) for U.S. federal income tax purposes beginning with the taxable year ended December 31, 2020. We are externally managed by Invesco Advisers, Inc. (the “Adviser”), a registered investment adviser and an indirect, wholly-owned subsidiary of Invesco Ltd. (“Invesco”), a leading independent global investment management firm.

We have registered with the Securities and Exchange Commission (“SEC”) a public offering of up to $3.0 billion in shares of common stock, consisting of up to $2.4 billion in shares in our primary offering (the “Primary Offering”) and up to $600 million in shares under our distribution reinvestment plan (collectively, the “Offering”). We are offering to sell any combination of 5 classes of shares of our common stock in the Offering: Class T shares, Class S shares, Class D shares, Class I shares and Class E shares, with a dollar value up to the maximum offering amount. The share classes have different upfront selling commissions and dealer manager fees and different ongoing stockholder servicing fees.

We are also conducting private offerings of up to $1.0 billion in shares of our Class N common stock (the “Class N Private Offering”) and up to $20.0 million in shares of our Class E common stock (the “Class E Private Offering”) (collectively, the “Private Offerings”).

2.Summary of Significant Accounting Policies

Basis of Presentation

Certain disclosures included in our Annual Report on Form 10-K are not required to be included on an interim basis in our quarterly reports on Form 10-Q. We have condensed or omitted these disclosures. Therefore, this Quarterly Report on Form 10-Q should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2021.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and consolidate the financial statements of the Company and its controlled subsidiaries. All significant intercompany transactions, balances, revenues and expenses are eliminated upon consolidation. In the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments, consisting of normal recurring accruals, which are necessary for a fair statement of our financial condition and results of operations for the periods presented.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results may differ from those estimates.

Significant Accounting Policies

There have been no changes to our accounting policies included in Note 2 — “Summary of Significant Accounting Policies” to the consolidated financial statements of our Annual Report on Form 10-K for the year ended December 31, 2021 other than as discussed below.

Consolidation

We consolidate entities in which we have a controlling financial interest. In determining whether we have a controlling financial interest in a partially owned entity, we consider whether the entity is a variable interest entity (“VIE”) and whether we are the primary beneficiary. We are the primary beneficiary of a VIE when we have both the power to direct the most significant activities impacting the economic performance of the VIE and the obligation to absorb losses or receive benefits significant to the VIE.

For consolidated joint ventures, the non-controlling partner’s share of the assets, liabilities and operations of each joint venture is included in non-controlling interests in consolidated joint ventures and reported as equity of the Company on our consolidated balance sheets. The non-controlling partner’s interest is generally calculated as the joint venture partner’s ownership percentage. Certain of the joint ventures formed by the Company provide the joint venture partner a profits interest based on certain internal rate of return hurdles being achieved. Any profits interest due to the joint venture partner is reported within non-controlling interests.

We apply the equity method of accounting if we have significant influence over an entity, typically when we hold 20% or more of the voting common stock (or equivalent) of an investee but do not have a controlling financial interest. In certain circumstances, such as with investments in limited liability companies or limited partnerships, we apply the equity method of accounting when we own as little as three to five percent. See Note 4 — “Investments in Unconsolidated Entities” for further information about our investments in partially owned entities.

Derivative Financial Instruments

We use derivative financial instruments such as interest rate caps to manage risks from increases in interest rates. We record all derivatives at fair value on our condensed consolidated balance sheets. At the inception of a derivative contract, we determine whether the instrument will be part of a qualifying hedge accounting relationship or whether we will account for the contract as a trading instrument. We have elected not to apply hedge accounting to all derivative contracts. Changes in the fair value of our derivatives are recorded in unrealized gain on derivative instruments in our condensed consolidated statements of operations. Derivative financial instruments are recorded as a component of other assets on our condensed consolidated balance sheets at fair value. We have elected to classify our interest rate caps as financing activities on our condensed consolidated statements of cash flows in the same category as the cash flow from the instrument for which the interest rate caps provide an economic hedge.

Income Taxes

For the three and six months ended June 30, 2022, we recorded a net tax expense of approximately $9,000 and $84,000, respectively, located within other expense on our consolidated statements of operations. For the three and six months ended June 30, 2021, our taxable REIT subsidiaries did not have a tax expense. As of June 30, 2022 and December 31, 2021, we recorded a deferred tax asset of approximately $73,000 and a deferred tax liability of approximately $9,000, respectively. These were recorded within other assets and other liabilities, respectively, on our condensed consolidated balance sheets. As of June 30, 2022, our tax years 2019 through 2021 remain subject to examination by the United States tax authorities.

Redeemable Equity Instruments

Certain shares of our Class N common stock are classified as Class N redeemable common stock on our condensed consolidated balance sheets because the holder of these shares, Massachusetts Mutual Life Insurance Company (“MassMutual”), has the contractual right to redeem the shares under certain circumstances as described in Note 10 — “Class N Redeemable Common Stock.”

Our Class E units in INREIT OP are classified as redeemable non-controlling interest in INREIT OP on our condensed consolidated balance sheets because the holder of these units, Invesco REIT Special Limited Partner L.L.C. (the “Special Limited Partner”), a wholly-owned subsidiary of Invesco, has the contractual right to redeem the units under certain circumstances as described in Note 11— “Equity and Redeemable Non-controlling Interest .”

We report our Class N redeemable common stock and redeemable non-controlling interest in INREIT OP on our condensed consolidated balance sheets at redemption value. The redemption value is determined as of our balance sheet date based on our net asset value (“NAV”) per share of Class N common stock or per unit of Class E units, as applicable. NAV is equivalent to GAAP stockholders’ equity adjusted for the redemption value of our redeemable common stock; certain organization and offering costs and certain operating expenses; unrealized real estate appreciation; accumulated depreciation and amortization; straight-line rent receivable and other assets. For purposes of determining our NAV, the fair value of our investments in real estate is determined based on third party valuations prepared by licensed appraisers in accordance with standard industry practice.

Earnings (Loss) per Share

We calculate basic earnings (loss) per share by dividing net earnings (loss) attributable to common stockholders for the period by the weighted average number of common shares outstanding during the period, including redeemable common stock. All classes of common stock are allocated net earnings (loss) at the same rate per share and receive the same gross distribution per share. We calculate diluted net earnings (loss) per share by dividing net income (loss) attributable to common stockholders for the period by the weighted average number of common shares and common share equivalents outstanding (unless their effect is antidilutive) for the period.

As of June 30, 2022 and 2021, there are no common share equivalents outstanding that would have a dilutive effect as a result of our net income, and accordingly, the weighted average number of common shares outstanding is identical for the period for both basic and diluted shares.

3.Investments in Real Estate, net

Investments in real estate, net consist of:

| | | | | | | | | | | | | | | | |

| $ in thousands | | June 30, 2022 | | December 31, 2021 | | |

| Building and improvements | | $ | 593,944 | | | $ | 365,687 | | | |

| Land and land improvements | | 153,429 | | | 64,127 | | | |

| Furniture, fixtures and equipment | | 11,060 | | | 8,690 | | | |

| Total | | 758,433 | | | 438,504 | | | |

| Accumulated depreciation | | (12,116) | | | (4,131) | | | |

| Investments in real estate, net | | $ | 746,317 | | | $ | 434,373 | | | |

The following table details the properties acquired during the six months ended June 30, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | | | | | | | | | | |

| Property Name | | Ownership Interest | | Number of

Properties | | Segment | | Acquisition Date | | Purchase Price(1) |

| Grove City Industrial | | 95% | | 1 | | Industrial | | January 2022 | | $ | 28,030 | |

| Cortlandt Crossing | | 100% | | 1 | | Grocery-Anchored Retail | | February 2022 | | 65,553 | |

| 3101 Agler Road | | 95% | | 1 | | Industrial | | March 2022 | | 20,503 | |

| Earth City Industrial | | 95% | | 1 | | Industrial | | March 2022 | | 37,418 | |

| Winston-Salem Self-Storage | | 100% | | 1 | | Self-Storage | | April 2022 | | 12,154 | |

Everly Roseland Apartments(2) | | 57% | | 1 | | Multifamily | | April 2022 | | 162,023 | |

| Bend Self-Storage | | 100% | | 2 | | Self-Storage | | June 2022 | | 18,078 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | 8 | | | | | | $ | 343,759 | |

(1)Purchase price is inclusive of acquisition-related costs.

(2)In April 2022, we acquired a 95% consolidated interest in the Everly Roseland Apartments property. In May 2022, we sold 40% of our 95% interest in the Everly Roseland Apartments to an affiliate of Invesco. We continue to consolidate the property subsequent to the sale due to our controlling financial interest.

The following table summarizes the allocation of the total cost for the properties acquired during the six months ended June 30, 2022:

| | | | | |

| $ in thousands | Amount |

| Building and building improvements | $ | 227,662 | |

| Land and land improvements | 89,289 | |

Lease intangibles(1) | 23,478 | |

Capitalized tax abatement(2) | 1,666 | |

| Furniture, fixtures and equipment | 2,263 | |

| Above-market lease intangibles | 629 | |

| Below-market lease intangibles | (1,228) | |

Total purchase price(3) | $ | 343,759 | |

| |

| |

(1)Lease intangibles consist of in-place leases and leasing commissions.

(2)We obtained a tax abatement in conjunction with our purchase of the 3101 Agler Road property with an expiration date of December 31, 2031 and are amortizing the tax abatement over its remaining useful life. See Note 7 — “Other Assets” for additional information on the capitalized tax abatement.

(3)Includes acquisition-related costs.

The weighted-average amortization periods for intangible assets and liabilities acquired in connection with our acquisitions during the six months ended June 30, 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | In-place lease intangibles | | Leasing commissions | | Above-market lease intangibles | | Below-market lease intangibles |

| Weighted-average amortization periods (in years) | | 8.76 | | 13.39 | | 7.58 | | 9.86 |

We did not record any impairment losses on investments in real estate for the three and six months ended June 30, 2022.

4.Investments in Unconsolidated Entities

As of June 30, 2022, we held 4 investments in unconsolidated entities for an aggregate investment balance of $121.3 million that are accounted for using the equity method of accounting. The amounts reflected in the following tables (except for our share of equity and income) are based on the historical financial information of the individual unconsolidated entities. We do not record operating losses of an unconsolidated entity in excess of its investment balance unless we are liable for the obligations of the entity or are otherwise committed to provide financial support to the entity.

Our investments in unconsolidated entities as of June 30, 2022 and December 31, 2021 were as follows:

| | | | | | | | | | | | | | | | | | | | |

| $ in thousands | | | | Carrying Amount |

| Entity | | Ownership Percentage(1) | | June 30, 2022 | | December 31, 2021 |

Vida JV LLC(2) | | 42.5 | % | | $ | 81,760 | | | $ | 80,455 | |

San Simeon Holdings(3) | | — | | | 23,608 | | | 21,088 | |

PTCR Holdco, LLC(4) | | — | | | 7,958 | | | 7,749 | |

Retail GP Fund(5) | | 6.8% to 9.0% | | 7,974 | | | 5,993 | |

| Total | | | | $ | 121,300 | | | $ | 115,285 | |

(1)Ownership percentage represents our entitlement to residual distributions after payments of priority returns, where applicable. Preferred equity investment ownership percentages are not presented.

(2)We formed a joint venture with Invesco U.S. Income Fund L.P., an affiliate of Invesco, (the “Invesco JV”) to acquire an interest in a portfolio of medical office buildings located throughout the United States (the “Sunbelt Medical Office Portfolio”). As of June 30, 2022, the Invesco JV owned an 85% interest in a joint venture (“Vida JV LLC”) with an unaffiliated third party. As of June 30, 2022, Vida JV LLC owned a portfolio of 20 medical office buildings.

(3)We own a preferred membership interest in San Simeon Holdings LLC (“San Simeon Holdings”), a limited liability company that owns a multifamily property. Our preferred membership interest is mandatorily redeemable on December 15, 2023, although there are certain conditions that may accelerate the redemption date. The common member of San Simeon Holdings has two one-year options that may extend the mandatory redemption date of our preferred membership interest to December 15, 2025. The investment yields a current pay rate of 6.50%, increasing 0.50% annually on the anniversary of the investment during the initial term and 0.25% during each extension term, as well as a preferred accrued return of 4.00% due upon redemption. See Note 15 — “Commitments and Contingencies” for additional information regarding our future capital commitment to San Simeon Holdings.

(4)We hold an 85% ownership interest in a consolidated joint venture, ITP Investments LLC (“ITP LLC”). ITP LLC holds a preferred equity investment in PTCR Holdco, LLC, a fully integrated retail platform operating company.

(5)ITP LLC has a 90% interest in PT Co-GP Fund, LLC (“Retail GP Fund”), which was formed to invest in retail properties through non-controlling general partner interests. ITP LLC holds non-controlling general partner interests through its interest in the Retail GP Fund ranging from 6.8% to 9.0% in 7 retail properties.

Our share of the unconsolidated entities’ income (loss) for the three and six months ended June 30, 2022 and 2021 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | | | | Company’s Share of Unconsolidated Entities Income (Loss) |

| | | | Three Months Ended June 30, | | Six Months Ended June 30, |

| Entity | | | | 2022 | | 2021 | | 2022 | | 2021 |

| Vida JV LLC | | | | $ | 447 | | | $ | (699) | | | $ | 3,599 | | | $ | 585 | |

| San Simeon Holdings | | | | 640 | | | 471 | | | 1,247 | | | 918 | |

| PTCR Holdco, LLC | | | | 361 | | | — | | | 535 | | | — | |

| Retail GP Fund | | | | 280 | | | — | | | 326 | | | — | |

| Total | | | | $ | 1,728 | | | $ | (228) | | | $ | 5,707 | | | $ | 1,503 | |

The following tables provide summarized balance sheets of our investments in unconsolidated entities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2022 | | December 31, 2021 |

| $ in thousands | Vida JV LLC | | San Simeon Holdings | | Other | | Total | | Vida JV LLC | | San Simeon Holdings | | Other | | Total |

| Total assets | $ | 413,623 | | | $ | 118,305 | | | $ | 293,533 | | | $ | 825,461 | | | $ | 407,574 | | | $ | 122,661 | | | $ | 234,015 | | | $ | 764,250 | |

| Total liabilities | (221,818) | | | (75,323) | | | (150,480) | | | (447,621) | | | (218,845) | | | (79,237) | | | (94,373) | | | (392,455) | |

| Total equity | $ | 191,805 | | | $ | 42,982 | | | $ | 143,053 | | | $ | 377,840 | | | $ | 188,729 | | | $ | 43,424 | | | $ | 139,642 | | | $ | 371,795 | |

The following tables provide summarized operating data of our investments in unconsolidated entities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2022 | | Three Months Ended June 30, 2021 |

| $ in thousands | Vida JV LLC | | San Simeon Holdings | | Other | | Total | | Vida JV LLC | | San Simeon Holdings | | Other | | Total |

| Total revenue | $ | 9,241 | | | $ | 2,528 | | | $ | 16,326 | | | $ | 28,095 | | | $ | 9,251 | | | $ | 2,123 | | | $ | — | | | $ | 11,374 | |

| Net income (loss) | $ | 1,056 | | | $ | 609 | | | $ | 5,888 | | | $ | 7,553 | | | $ | (1,643) | | | $ | (495) | | | $ | — | | | $ | (2,138) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2022 | | Six Months Ended June 30, 2021 |

| $ in thousands | Vida JV LLC | | San Simeon Holdings | | Other | | Total | | Vida JV LLC | | San Simeon Holdings | | Other | | Total |

| Total revenue | $ | 18,296 | | | $ | 4,992 | | | $ | 23,649 | | | $ | 46,937 | | | $ | 17,840 | | | $ | 4,379 | | | $ | — | | | $ | 22,219 | |

| Net income (loss) | $ | 8,477 | | | $ | 1,329 | | | $ | 6,658 | | | $ | 16,464 | | | $ | 1,388 | | | $ | (719) | | | $ | — | | | $ | 669 | |

We did not record any impairment losses on our investments in unconsolidated entities for the three and six months ended June 30, 2022.

5.Investments in Real Estate-Related Securities

The following tables summarize our investments in real estate-related securities by asset type:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2022 |

| $ in thousands | | Principal Balance | | Unamortized Premium (Discount) | | Amortized Cost / Cost(1) | | Unrealized Gain (Loss), Net | | Fair Value | | Period-end Weighted Average Yield | | Weighted-Average Maturity Date |

| Non-agency CMBS | | $ | 14,246 | | | $ | (303) | | | $ | 13,943 | | | $ | (1,133) | | | $ | 12,810 | | | 5.40 | % | | 7/21/2042 |

| Corporate debt | | 5,228 | | | 196 | | | 5,424 | | | (544) | | | 4,880 | | | 3.97 | % | | 3/3/2026 |

| Preferred stock of REITs | | N/A | | N/A | | 3,651 | | | (90) | | | 3,561 | | | 3.54 | % | | N/A |

| Common stock of REITs | | N/A | | N/A | | 4,034 | | | 48 | | | 4,082 | | | 6.40 | % | | N/A |

| Total | | $ | 19,474 | | | $ | (107) | | | $ | 27,052 | | | $ | (1,719) | | | $ | 25,333 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2021 |

| $ in thousands | | Principal Balance | | Unamortized Premium (Discount) | | Amortized Cost / Cost(1) | | Unrealized Gain (Loss), Net | | Fair Value | | Period-end Weighted Average Yield | | Weighted-Average Maturity Date |

| Non-agency CMBS | | $ | 7,171 | | | $ | (83) | | | $ | 7,088 | | | $ | (154) | | | $ | 6,934 | | | 3.60 | % | | 8/11/2042 |

| Corporate debt | | 5,125 | | | 226 | | | 5,351 | | | (7) | | | 5,344 | | | 3.58 | % | | 3/29/2026 |

| Preferred stock of REITs | | N/A | | N/A | | 411 | | | (4) | | | 407 | | | 6.78 | % | | N/A |

| | | | | | | | | | | | | | |

| Total | | $ | 12,296 | | | $ | 143 | | | $ | 12,850 | | | $ | (165) | | | $ | 12,685 | | | | | |

(1)For non-agency CMBS and corporate debt, the amount presented represents amortized cost. For preferred and common stock of REITs, the amount presented represents cost.

6.Intangibles

The gross carrying amount and accumulated amortization of our intangible assets and liabilities are:

| | | | | | | | | | | | | | | | | |

| June 30, 2022 |

| $ in thousands | Total Cost | | Accumulated Amortization | | Intangible Assets, net |

| Intangible assets, net: | | | | | |

| In-place lease intangibles | $ | 44,756 | | | $ | (18,343) | | | $ | 26,413 | |

| Leasing commissions | 5,774 | | | (516) | | | 5,258 | |

| Above-market lease intangibles | 1,951 | | | (103) | | | 1,848 | |

| Total intangible assets, net | $ | 52,481 | | | $ | (18,962) | | | $ | 33,519 | |

| | | | | |

| Total Cost | | Accumulated Amortization | | Intangible Liabilities, net |

| Intangible liabilities, net: | | | | | |

| Below-market lease intangibles | $ | 2,904 | | | $ | (244) | | | $ | 2,660 | |

| Total intangible liabilities, net | $ | 2,904 | | | $ | (244) | | | $ | 2,660 | |

| | | | | | | | | | | | | | | | | |

| December 31, 2021 |

| $ in thousands | Total Cost | | Accumulated Amortization | | Intangible Assets, net |

| Intangible assets, net: | | | | | |

| In-place lease intangibles | $ | 24,094 | | | $ | (6,115) | | | $ | 17,979 | |

| Leasing commissions | 2,932 | | | (230) | | | 2,702 | |

| Above-market lease intangibles | 1,322 | | | (26) | | | 1,296 | |

| Total intangible assets, net | $ | 28,348 | | | $ | (6,371) | | | $ | 21,977 | |

| | | | | |

| Total Cost | | Accumulated Amortization | | Intangible Liabilities, net |

| Intangible liabilities, net: | | | | | |

| Below-market lease intangibles | $ | 1,677 | | | $ | (195) | | | $ | 1,482 | |

| Total intangible liabilities, net | $ | 1,677 | | | $ | (195) | | | $ | 1,482 | |

The estimated future amortization of our intangibles for each of the next five years and thereafter as of June 30, 2022 is:

| | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | In-place Lease

Intangibles | | Leasing Commissions | | Above-market Lease Intangibles | | Below-market

Lease Intangibles |

| 2022 (remainder) | $ | 6,675 | | | $ | 309 | | | $ | 88 | | | $ | (273) | |

| 2023 | 3,596 | | | 616 | | | 176 | | | (402) | |

| 2024 | 2,192 | | | 616 | | | 176 | | | (402) | |

| 2025 | 2,192 | | | 616 | | | 176 | | | (402) | |

| 2026 | 2,192 | | | 614 | | | 176 | | | (402) | |

| 2027 | 1,968 | | | 552 | | | 176 | | | (315) | |

| Thereafter | 7,598 | | | 1,935 | | | 880 | | | (464) | |

| $ | 26,413 | | | $ | 5,258 | | | $ | 1,848 | | | $ | (2,660) | |

7.Other Assets

The following table summarizes the components of other assets:

| | | | | | | | | | | |

| $ in thousands | June 30, 2022 | | December 31, 2021 |

Capitalized tax abatement, net(1) | $ | 8,456 | | | $ | 7,049 | |

| Derivative instruments | 4,278 | | | — | |

| Prepaid expenses | 1,383 | | | 460 | |

| Deferred rent | 1,247 | | | 528 | |

| Deferred financing costs, net | 637 | | | 818 | |

| Deposits | 587 | | | 3,460 | |

| Other | 180 | | | 243 | |

| Total | $ | 16,768 | | | $ | 12,558 | |

(1)We obtained tax abatements in conjunction with our purchases of the Cortona Apartments and 3101 Agler Road properties with expiration dates of December 31, 2038 and December 31, 2031, respectively. We are amortizing the tax abatements over their remaining useful life as a component of property operating expenses in the condensed consolidated statements of operations. As of June 30, 2022, accumulated amortization of the capitalized tax abatements was $0.6 million, and the estimated annual amortization is $0.6 million.

Derivative Instruments

We are exposed to certain risks arising from both our business operations and economic conditions. We principally manage our exposures to a wide variety of business and operational risks through management of our core business activities. We manage economic risks, including interest rate risk, primarily by managing the amount, sources, and duration of our investments, borrowings, and the use of derivative financial instruments. Specifically, we use derivative financial instruments to manage exposures that arise from business activities that result in the payment of future known and uncertain cash amounts, the value of which are determined by interest rates. Our derivative financial instruments are used to manage differences in the amount, timing, and duration of our known or expected cash payments principally related to our borrowings.

We have not designated any of our derivative financial instruments as hedges. Derivatives not designated as hedges are not speculative and are used to manage our exposure to increases in interest rates.

During the six months ended June 30, 2022, we entered into 2 interest rate cap transactions. The following table summarizes the notional amount and other information related to these instruments as of June 30, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | | Number of Instruments | | Notional Amount(1) | | | | Fixed Amount | | Fair Value(2) | | Strike Rate | | Weighted Average Remaining Term In Years |

| Interest Rate Caps | | 2 | | $ | 118,500 | | | | | $ | 1,808 | | | $ | 4,278 | | | 1.0 | % | | 2.62 |

(1)The notional amount represents the amount of the borrowings that we are hedging, but does not represent exposure to credit, interest rate or market risks.

(2)The fair value of the interest rate caps is included in other assets on our condensed consolidated balance sheets. For the three and six months ended June 30, 2022, the changes in fair value of $1.0 million and $2.5 million, respectively, are included in unrealized gain on derivative instruments in our condensed consolidated statements of operations.

8.Borrowings

Revolving Credit Facility

The following is a summary of the revolving credit facility:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | | | | | | Maximum Facility Size(2) | | Principal Outstanding Balance |

| Indebtedness | | Interest Rate | | Maturity Date | | June 30, 2022 | | December 31, 2021 | | June 30, 2022 | | December 31, 2021 |

| Revolving Credit Facility | | S + applicable margin(1) | | 1/22/2024 | | $ | 150,000 | | | $ | 100,000 | | | $ | 62,100 | | | $ | 75,500 | |

(1)The term “S” refers to the Secured Overnight Financing Rate (“SOFR”) benchmark interest rate. Borrowings under the Revolving Credit Facility carry interest at a rate equal to (i) Daily Simple SOFR, (ii) Term SOFR with an interest period of one, three or six-months, or (iii) a Base Rate, where the base rate is the highest of (1) federal funds rate plus 0.5%, (2) the rate of interest as publicly announced by Bank of America N.A. as its “prime rate”, (3) Term SOFR with an interest period of one month plus 1.0%, or (4) 1.0%, in each case, plus an applicable margin that is based on our leverage ratio. The weighted-average interest rate for the three and six months ended June 30, 2022 was 2.41% and 2.22%, respectively.

(2)As of June 30, 2022, the borrowing capacity on the Revolving Credit Facility was $32.1 million. The borrowing capacity is less than the difference between the maximum facility size and the current principal outstanding balance as the calculation of borrowing capacity is limited by the aggregate fair value and cash flows of our unencumbered properties.

As of June 30, 2022, we were in compliance with all loan covenants in our revolving credit facility agreement.

Mortgage Notes Payable, Net

The following table summarize certain characteristics of our mortgage notes that are secured by the Company’s properties:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | | | | | | | | Principal Balance Outstanding |

| Indebtedness | | Interest Rate(1) | | Maturity Date | | Maximum Principal Amount | | June 30, 2022 | | December 31, 2021 |

| Cortona Apartments | | L + applicable margin(2) | | 6/1/2028 | | $ | 45,000 | | | $ | 45,000 | | | $ | 45,000 | |

| Bixby Kennesaw | | L + applicable margin(3) | | 9/24/2026 | | $ | 53,000 | | | 53,000 | | | 53,000 | |

| Tempe Student Housing | | S + applicable margin(4) | | 1/1/2025 | | $ | 65,500 | | | 65,500 | | | 65,500 | |

| Cortlandt Crossing | | 3.13% | | 3/1/2027 | | $ | 39,660 | | | 39,660 | | | — | |

| Everly Roseland Apartments | | S + applicable margin(5) | | 4/28/2027 | | $ | 113,500 | | | 105,265 | | | — | |

| Midwest Industrial Portfolio | | 4.44% and S + applicable margin(6) | | 7/5/2027 | | $ | 70,000 | | | 70,000 | | | — | |

| | | | | | | | | | |

| Total mortgages payable | | | | | | | | 378,425 | | | 163,500 | |

| Deferred financing costs, net | | | | | | | | (4,380) | | | (1,847) | |

| Mortgage notes payable, net | | | | | | | | $ | 374,045 | | | $ | 161,653 | |

(1)The terms “L” and “S” refer to the relevant floating benchmark rates, USD LIBOR and SOFR, respectively, as applicable to each loan. The mortgage agreements that utilize LIBOR contain LIBOR replacement language.

(2)The mortgage note secured by the Cortona Apartments bears interest at the greater of (a) 2.65% or (b) the sum of 2.40% plus one-month LIBOR. The weighted-average interest rate for the three and six months ended June 30, 2022 was 2.90% and 2.78%, respectively.

(3)The mortgage note secured by Bixby Kennesaw bears interest at the sum of 1.60% plus one-month LIBOR. The weighted-average interest rate for the three and six months ended June 30, 2022 was 2.37% and 2.06%, respectively.

(4)The mortgage note secured by Tempe Student Housing bears interest at 1.75% plus SOFR. The weighted-average interest rate for the three and six months ended June 30, 2022 was 2.11% and 1.96%, respectively.

(5)The mortgage note secured by Everly Roseland Apartments bears interest at 1.45% plus SOFR. The weighted-average interest rate for both the three and six months ended June 30, 2022 was 2.33%.

(6)The mortgage note secured by Meridian Business 940, Grove City Industrial, 3101 Agler Road and Earth City Industrial (collectively the “Midwest Industrial Portfolio”) bears interest at two rates. Of the $70.0 million principal balance, $35.0 million bears interest at a fixed rate of 4.44%, and $35.0 million bears interest at a floating rate of the greater of (a) 2.20% or (b) the sum of 1.70% plus SOFR. The weighted-average interest rate for both the three and six months ended June 30, 2022 was 3.84%.

As of June 30, 2022, we were in compliance with all loan covenants in our mortgage notes agreements.

Financing Obligation, Net

In connection with the Tempe Student Housing property, as of June 30, 2022 we hold a financing obligation on our condensed consolidated balance sheets of $53.8 million, net of debt issuance costs.

The following table presents the future principal payments due under our outstanding borrowings as of June 30, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ($ in thousands) | | Revolving Credit Facility | | Mortgages Payable | | Financing Obligation | | Total |

| 2022 (remaining) | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| 2023 | | — | | | — | | | 3 | | | 3 | |

| 2024 | | 62,100 | | | — | | | 6 | | | 62,106 | |

| 2025 | | — | | | 65,500 | | | 9 | | | 65,509 | |

| 2026 | | — | | | 53,000 | | | 12 | | | 53,012 | |

| 2027 | | — | | | 214,925 | | | 15 | | | 214,940 | |

| Thereafter | | — | | | 45,000 | | | 36,309 | | | 81,309 | |

| Total | | $ | 62,100 | | | $ | 378,425 | | | $ | 36,354 | | | $ | 476,879 | |

9.Accounts Payable, Accrued Expenses and Other Liabilities

The following table summarizes the components of accounts payable, accrued expenses and other liabilities:

| | | | | | | | | | | |

| $ in thousands | June 30, 2022 | | December 31, 2021 |

| Subscriptions received in advance | $ | 6,328 | | | $ | 250 | |

| Intangible liabilities, net | 2,660 | | | 1,482 | |

| Accounts payable and accrued expenses | 2,117 | | | 1,237 | |

| Real estate taxes payable | 1,588 | | | 743 | |

| Prepaid rental income | 1,428 | | | 274 | |

| Tenant security deposits | 1,275 | | | 409 | |

| Accrued interest expense | 1,050 | | | 608 | |

| | | |

| Unsettled trade payable | — | | | 904 | |

| Total | $ | 16,446 | | | $ | 5,907 | |

10.Class N Redeemable Common Stock

The following table details our Class N redeemable common stock activity with MassMutual:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | | As of June 30, 2022 | | As of December 31, 2021 |

| | Shares | | Amount | | Shares | | Amount |

| Class N Redeemable Common Stock issued | | 12,557,919 | | | $ | 358,726 | | | 9,760,987 | | | $ | 271,526 | |

| Class N Redeemable Common Stock repurchased | | 2,537,790 | | | $ | 74,795 | | | 2,388,175 | | | $ | 70,000 | |

For the three and six months ended June 30, 2022, we recorded an increase to Class N redeemable common stock and a decrease to additional paid-in capital of $10.2 million and $20.3 million, respectively, to adjust the value of the MassMutual shares to our June 30, 2022 NAV per Class N share. For the three and six months ended June 30, 2021, we recorded an increase to Class N redeemable common stock and a decrease to additional paid-in capital of $10.2 million for both periods to adjust the value of the MassMutual shares to our June 30, 2021 NAV per Class N share. We will limit any adjustment to the carrying amount of the Class N redeemable common stock so as to not reduce the carrying amount below the initial amount reported as Class N redeemable common stock. The change in the redemption value does not affect income available to common stockholders. MassMutual has committed to purchase an additional $41.3 million of Class N common stock at our request prior to January 20, 2023.

We have entered into an exchange rights and registration agreement with MassMutual (the “Registration Rights Agreement”). After September 28, 2025, MassMutual may require us to exchange all or a portion of its Class N shares for any class of shares of our common stock being sold in the Primary Offering and file and maintain an effective registration statement with the SEC (for no longer than three years) registering the offer and sale of the new shares issued in the exchange. MassMutual's rights under the Registration Rights Agreement will terminate when its shares of our common stock have an aggregate NAV of less than $20.0 million.

11.Equity and Redeemable Non-controlling Interest

Preferred Stock

As of June 30, 2022 and December 31, 2021, 125 shares of preferred stock are issued and outstanding. Holders of our Series A Preferred Stock are entitled to receive dividends at an annual rate of 12.5% of the liquidation preference of $500.00 per share, or $62.50 per share per annum. Dividends are cumulative and payable semi-annually. We have the option to redeem shares of our Series A Preferred Stock in whole or in part at any time for the price of $500.00 per share, plus any accrued and unpaid dividends through the date of redemption. If a redemption occurs on or before December 31, 2022, we will pay an additional $50.00 per share redemption premium.

Common Stock

The following tables detail the movement in the Company’s outstanding shares of common stock:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2022 |

| | Class T

Shares | | Class S

Shares | | Class D

Shares | | Class I

Shares | | Class E

Shares | | Class N

Shares | | Total |

| Balance at December 31, 2021 | | 186,821 | | | 186,821 | | | 186,821 | | | 186,715 | | | 2,244,581 | | | 8,556,509 | | | 11,548,268 | |

| Issuance of common stock | | 165,035 | | | 165,035 | | | 165,035 | | | 279,643 | | | 1,814 | | | 2,213,413 | | | 2,989,975 | |

| Distribution reinvestment | | — | | | — | | | — | | | 458 | | | 2,133 | | | — | | | 2,591 | |

| Balance at March 31, 2022 | | 351,856 | | | 351,856 | | | 351,856 | | | 466,816 | | | 2,248,528 | | | 10,769,922 | | | 14,540,834 | |

| Issuance of common stock | | 838 | | | — | | | 24,365 | | | 398,375 | | | 5,099 | | | 1,392,047 | | | 1,820,724 | |

Common stock repurchased(1) | | — | | | — | | | — | | | (291,818) | | | — | | | (149,616) | | | (441,434) | |

Exchange of common stock(2) | | — | | | — | | | — | | | 2,028,085 | | | — | | | (1,992,225) | | | 35,860 | |

| Distribution reinvestment | | — | | | — | | | 21 | | | 1,892 | | | 2,130 | | | — | | | 4,043 | |

| Balance at June 30, 2022 | | 352,694 | | | 351,856 | | | 376,242 | | | 2,603,350 | | | 2,255,757 | | | 10,020,128 | | | 15,960,027 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2021 |

| | Class T

Shares | | Class S

Shares | | Class D

Shares | | Class I

Shares | | Class E

Shares | | Class N

Shares | | Total |

| Balance at December 31, 2020 | | — | | | — | | | — | | | — | | | — | | | 3,608,830 | | | 3,608,830 | |

| Issuance of common stock | | — | | | — | | | — | | | — | | | — | | | 2,636,645 | | | 2,636,645 | |

| Distribution reinvestment | | — | | | — | | | — | | | — | | | — | | | 32 | | | 32 | |

| Balance at March 31, 2021 | | — | | | — | | | — | | | — | | | — | | | 6,245,507 | | | 6,245,507 | |

| Issuance of common stock | | 91 | | | 91 | | | 91 | | | — | | | — | | | 1,154 | | | 1,427 | |

Exchange of common stock(3) | | — | | | — | | | — | | | — | | | 156,066 | | | (156,066) | | | — | |

| Distribution reinvestment | | — | | | — | | | — | | | 492 | | | — | | | — | | | 492 | |

| Balance at June 30, 2021 | | 91 | | | 91 | | | 91 | | | 492 | | | 156,066 | | | 6,090,595 | | | 6,247,426 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

(1)We repurchased 149,615 Class N shares under MassMutual’s subscription agreement and 291,818 Class I shares as permitted under Invesco Reality, Inc.’s subscription agreement.

(2)On June 29, 2022, we issued 2,028,085 unregistered Class I shares of common stock to an affiliate of our Adviser in exchange for 1,992,225 of Class N shares with an equivalent aggregate NAV based on the NAV per share of Class I shares and Class N shares as of May 31, 2022.

(3)On May 14, 2021, we exchanged 156,066 Class N shares of our common stock held by our directors and employees of the Adviser and its affiliates, for no additional consideration, on a one-for-one basis for Class E shares of our common stock.

As of June 30, 2022 and December 31, 2021, 10,020,128 and 7,372,812, respectively, of our Class N shares have been classified as redeemable common stock because the stockholder, MassMutual, has the contractual right to redeem the shares under certain circumstances. As of June 30, 2022 all outstanding Class N shares were classified as redeemable common stock. As of December 31, 2021, of the 8,556,509 outstanding Class N shares, 1,183,697 have been recorded as common stock.

As of June 30, 2022, MassMutual has committed to purchase an additional $41.3 million of Class N common stock, as discussed in Note 10 — “Class N Redeemable Common Stock.” We also have a $30.0 million commitment from Invesco Realty, Inc. that collateralizes our Revolving Credit Facility. We may be required to call capital under this commitment to repay outstanding obligations under our Revolving Credit Facility in the event of default, however this commitment is not available to fund our operating or investing activities.

Distributions

We intend to distribute substantially all of our taxable income to our stockholders each year to comply with the REIT provisions of the Internal Revenue Code. Taxable income does not necessarily equal net income as calculated in accordance with GAAP.

For the three and six months ended June 30, 2022, we declared distributions of $6.6 million and $12.5 million, respectively. For the three and six months ended June 30, 2021, we declared distributions of $2.7 million and $5.0 million, respectively. We accrued $2.1 million and $1.4 million for distributions payable to related parties as a component of due to affiliates in our condensed consolidated balance sheets as of June 30, 2022 and December 31, 2021, respectively. Additionally, we accrued approximately $74,000 for distributions payable to third parties as a component of accounts payable and accrued expenses in our condensed consolidated balance sheets as of June 30, 2022. As of December 31, 2021, we did not accrue any distributions payable to third parties.

The following tables detail the aggregate distributions declared per share for each applicable class of stock for the three and six months ended June 30, 2022 and 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2022 |

| | Series A

Preferred Stock | | Class T

Common Stock | | Class S

Common Stock | | Class D

Common Stock | | Class I

Common Stock | | Class E

Common Stock | | Class N

Common Stock |

| Aggregate distributions declared per share | | $ | 31.2500 | | | $ | 0.4215 | | | $ | 0.4215 | | | $ | 0.4215 | | | $ | 0.4215 | | | $ | 0.4215 | | | $ | 0.4215 | |

Stockholder servicing fee per share(1)(2) | | — | | | 0.0754 | | | 0.0758 | | | 0.0216 | | | — | | | — | | | — | |

| Net distributions declared per share | | $ | 31.2500 | | | $ | 0.4969 | | | $ | 0.4973 | | | $ | 0.4431 | | | $ | 0.4215 | | | $ | 0.4215 | | | $ | 0.4215 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2021 |

| | Series A

Preferred Stock | | Class T

Common Stock | | Class S

Common Stock | | Class D

Common Stock | | Class I

Common Stock | | Class E

Common Stock | | Class N

Common Stock |

| Aggregate distributions declared per share | | $ | 31.2500 | | | $ | 0.1320 | | | $ | 0.1320 | | | $ | 0.1320 | | | $ | 0.2622 | | | $ | 0.2622 | | | $ | 0.4242 | |

Stockholder servicing fee per share(1) | | — | | | (0.0195) | | | (0.0195) | | | (0.0057) | | | — | | | — | | | — | |

| Net distributions declared per share | | $ | 31.2500 | | | $ | 0.1125 | | | $ | 0.1125 | | | $ | 0.1263 | | | $ | 0.2622 | | | $ | 0.2622 | | | $ | 0.4242 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2022 |

| | Series A

Preferred Stock | | Class T

Common Stock | | Class S

Common Stock | | Class D

Common Stock | | Class I

Common Stock | | Class E

Common Stock | | Class N

Common Stock |

| Aggregate distributions declared per share | | $ | 31.2500 | | | $ | 0.8467 | | | $ | 0.8467 | | | $ | 0.8467 | | | $ | 0.8467 | | | $ | 0.8467 | | | $ | 0.8467 | |

Stockholder servicing fee per share(1)(2) | | — | | | 0.0111 | | | 0.0115 | | | 0.0027 | | | — | | | — | | | — | |

| Net distributions declared per share | | $ | 31.2500 | | | $ | 0.8578 | | | $ | 0.8582 | | | $ | 0.8494 | | | $ | 0.8467 | | | $ | 0.8467 | | | $ | 0.8467 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2021 |

| | Series A

Preferred Stock | | Class T

Common Stock | | Class S

Common Stock | | Class D

Common Stock | | Class I

Common Stock | | Class E

Common Stock | | Class N

Common Stock |

| Aggregate distributions declared per share | | $ | 31.2500 | | | $ | 0.1320 | | | $ | 0.1320 | | | $ | 0.1320 | | | $ | 0.2622 | | | $ | 0.2622 | | | $ | 0.8522 | |

Stockholder servicing fee per share(1) | | — | | | (0.0195) | | | (0.0195) | | | (0.0057) | | | — | | | — | | | — | |

| Net distributions declared per share | | $ | 31.2500 | | | $ | 0.1125 | | | $ | 0.1125 | | | $ | 0.1263 | | | $ | 0.2622 | | | $ | 0.2622 | | | $ | 0.8522 | |

(1)See Note 13 — “Related Party Transactions” for a discussion of the stockholder servicing fees.

(2)For Class T, Class S and Class D Common Stock, the stockholder servicing fee in the distribution above results in a net distribution higher than the gross distribution because it includes an adjustment for stockholder servicing fees deducted from prior monthly distributions.

Redeemable Non-controlling Interest in INREIT OP

In connection with its performance participation interest, the Special Limited Partner holds Class E units in INREIT OP. See Note 13 — “Related Party Transactions” for further details of the Special Limited Partner’s performance participation interest. Because the Special Limited Partner has the ability to redeem its Class E units for cash, at its election, we have classified these Class E units as redeemable non-controlling interest in INREIT OP on our condensed consolidated balance sheets. The redeemable non-controlling interest in INREIT OP is recorded at the greater of the carrying amount, adjusted for its share of the allocation of income or loss and dividends, or the redemption value, which is equivalent to fair value, of such units at the end of each measurement period. See Note 2 — “Summary of Significant Accounting Policies” for additional information on the redemption value. As the redemption value was greater than the adjusted carrying value at June 30, 2022, we recorded an allocation adjustment of $0.1 million between additional paid-in capital and redeemable non-controlling interest in INREIT OP on our condensed consolidated balance sheets.

The following table details the non-controlling interest activity related to the Special Limited Partner: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | Six Months Ended June 30, |

| $ in thousands | | 2022 | | 2021 | 2022 | | 2021 |

| Net loss allocated | | $ | (38) | | | $ | — | | $ | (299) | | | $ | — | |

| Distributions | | $ | 44 | | | $ | — | | $ | 74 | | | $ | — | |

| Adjustment to carrying value | | $ | 128 | | | $ | — | | $ | 128 | | | $ | — | |

As of June 30, 2022, distributions payable to the Special Limited Partner were approximately $15,000. As the Special Limited Partner did not receive Class E INREIT OP units until February 2022, there was no distribution payable to the Special Limited Partner as of December 31, 2021.

Distribution Reinvestment Plan

We have adopted a distribution reinvestment plan whereby stockholders (other than stockholders residing in certain states, as discussed below) will have their cash distributions automatically reinvested in additional shares of common stock unless they elect to receive their distributions in cash. Stockholders residing in Alabama, Idaho, Kansas, Kentucky, Maryland, Massachusetts, Nebraska, New Jersey, North Carolina, Ohio, Oregon, Vermont and Washington will automatically receive their distributions in cash unless they elect to have their cash distributions reinvested in additional shares of common stock. The per share purchase price for shares purchased under the distribution reinvestment plan will be equal to the offering price before upfront selling commissions and dealer manager fees (the “transaction price”) at the time the distribution is payable. The transaction price will generally be equal to our prior month’s NAV per share for that share class. Stockholders will not pay upfront selling commissions or dealer manager fees when purchasing shares under the distribution reinvestment plan. The stockholder servicing fees for shares of our Class T shares, Class S shares and Class D shares are calculated based on the NAV for those shares and may reduce the NAV or, alternatively, the distributions payable with respect to shares of each such class, including shares issued in respect of distributions on such shares under the distribution reinvestment plan.

Share Repurchase Plan

We have adopted a share repurchase plan. On a monthly basis, our stockholders may request that we repurchase all or any portion of their shares. We may choose, in our discretion, to repurchase all, some or none of the shares that have been requested to be repurchased at the end of any month, subject to any limitations in the share repurchase plan. For the three and six months ended June 30, 2022, we did not repurchase any shares under the share repurchase plan as no repurchase requests were made.

Share-Based Compensation Plan

For the three and six months ended June 30, 2022, we awarded independent members of our board of directors 602 and 1,230 Class E shares, respectively, under our 2019 Equity Incentive Plan (the “Incentive Plan”) and recognized approximately $19,000 and $38,000, respectively, of compensation expense related to these awards. For the three and six months ended June 30, 2021, we awarded independent members of our board of directors 703 and 1,422 Class N shares, respectively, under the Incentive Plan and recognized approximately $19,000 and $39,000, respectively, of compensation expense related to these awards. As of June 30, 2022, 190,890 shares of common stock remain available for future issuance under the Incentive Plan.

12.Fair Value of Financial Instruments

A three-level valuation hierarchy exists for disclosure of fair value measurements based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs reflect our market assumptions. The three levels are defined as follows:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. We do not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.