PRELIMINARY OFFERING CIRCULAR DATED MAY 18, 2019 PURSUANT TO

REGULATION A OF THE SECURITIES ACT OF 1933

FORM 1-A: PART II – OFFERING CIRCULAR FORMAT

EmpireBIT, Inc. (A Delaware Corporation)

36 Christopher Columbus Blvd., Jackson, NJ 08527

732-654-2600 www.EmpireBIT.com

5,000,000 Shares of Class A Common Stock at $10.00 per Share convertible into Shares

Minimum Investment: 25 Shares of Class A Common Stock ($250.00)

Maximum Offering: $50,000,000.00

See The Offering – Page 19 and Securities Being Offered – Page 92 For Further Details of the terms of the Offering and a full description of the securities being offering. None of the securities offered are being sold by present security holders. The securities offered have no voting rights other than those reserved under Delaware law. See Page 93 for further details. The Company will accept Bitcoin and Ether as payment for the Shares, subject to the procedures and limitations set out below. See Page 114 for further details.

This Offering Will Commence Upon Qualification Of This Offering By The Securities And Exchange Commission And Will Terminate 180 Days From Commencement, Unless Extended Or Terminated Earlier By The Company.

| Price To Public | Commissions (1) | Proceeds To Company | Proceeds To Other Persons |

Price Per Share | $10.00 | $0.50 | $9.50 | None |

Minimum Investment | $250.00 | $12.50 | $237.50 | None |

Maximum Offering | $50,000,000.00 | $2,500,000.00 | $47,500,000.00 | None |

(1) Commissions to be paid to Cuttone & Co., LLC, a FINRA licensed broker-dealer. In addition to a FINRA 5110 filing fee and a due diligence fee paid by the Company, the Company is obligated to pay Cuttone & Co., LLC up to $10,000.00 of out of pocket expenses, if incurred. See “Plan of Distribution” for details.

PLEASE REVIEW ALL RISK FACTORS ON PAGE 22 THROUGH PAGE 58 BEFORE MAKING AN INVESTMENT IN THIS COMPANY.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

TABLE OF CONTENTS

PRELIMINARY INFORMATION, DISCLOSURES AND LEGENDS | 5 |

OFFERING SUMMARY AND RISK FACTORS | 18 |

OFFERING SUMMARY | 18 |

The Offering | 19 |

Summary of Risk Factors | 20 |

Investment Analysis | 21 |

RISK FACTORS | 22 |

DILUTION | 59 |

PLAN OF DISTRIBUTION | 62 |

USE OF PROCEEDS | 66 |

USE OF PROCEEDS TABLE | 67 |

DESCRIPTION OF THE BUSINESS | 68 |

General | 68 |

Where It All Began: The Story of Michael and Evan Almeida and Their “Empire” | 70 |

The Existing Marketplace And The Opportunity To Bring Cryptocurrency Mainstream | 72 |

The EmpireBIT Solution | 73 |

The Company's Competitive Advantage | 74 |

EmpireBIT Crypto ATMs | 75 |

Software Platform for Crypto ATMs | 76 |

Online Marketplace | 76 |

The Investment Offered: EmpireBIT, Inc. Offers Only Shares Convertible Into Security Tokens | 76 |

The EmpireBIT Security Token | 77 |

The Company’s Cryptocurrency: The EmpireBIT Coin | 78 |

The Company’s Wallet | 78 |

The Company’s Native Blockchain | 79 |

Master Node Capability | 80 |

Proof of Stake | 80 |

Proof of Work | 80 |

Dedicated Operating System | 80 |

EmpireBIT Cryptocurrency ATMs | 81 |

Point of Sale System | 81 |

The EmpireBIT Ecosystem and Community | 82 |

Proposed Acquisitions | 83 |

DESCRIPTION OF PROPERTY | 83 |

LITIGATION | 83 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 83 |

BUSINESS | 84 |

Overview | 84 |

Results of Operations | 84 |

Liquidity and Capital Resources | 85 |

Plan of Operations | 85 |

Trend Information | 86 |

Off-Balance Sheet Arrangements | 86 |

Critical Accounting Policies | 86 |

Revenue Recognition | 87 |

Additional Company Matters | 87 |

DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES | 88 |

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS | 89 |

Executive Compensation | 89 |

Employment Agreements | 89 |

Equity Incentive Plan | 89 |

Board of Directors | 90 |

Committees of the Board of Directors | 90 |

Director Compensation | 90 |

Limitation of Liability and Indemnification of Officers and Directors | 90 |

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS | 91 |

CAPITALIZATION TABLE | 91 |

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN RELATED-PARTY TRANSACTIONS AND AGREEMENTS | 92 |

SECURITIES BEING OFFERED | 92 |

Subscription Price | 93 |

Voting Rights | 93 |

Dividends | 94 |

Indemnification Clause In Subscription Agreement | 95 |

Jurisdiction of Disputes | 95 |

Revenue Share | 95 |

Liquidation Rights | 96 |

Conversion Rights | 96 |

Right of First Refusal | 97 |

Additional Matters | 97 |

PERKS | 98 |

TOKENIZATION OF SHARES | 99 |

General | 100 |

ERC-20 Standard | 100 |

Smart Contracts, Wallets and Whitelists | 101 |

How The Security Tokens Are Created | 102 |

How The Security Tokens Are Issued | 104 |

How The Shares Are Cleared By The Broker-Dealer, Before Being Issued | 105 |

The Distributed Ledger | 105 |

The Smart Contracts | 106 |

How the Security Tokens and Transactions on the Ethereum Blockchain Will Be Validated | 107 |

Subsequent Token Transfers | 107 |

DISQUALIFYING EVENTS DISCLOSURE | 109 |

ERISA CONSIDERATIONS | 110 |

INVESTOR ELIGIBILITY STANDARDS | 112 |

HOW TO INVEST USING CRYPTOCURRENCY | 114 |

TAXATION ISSUES | 118 |

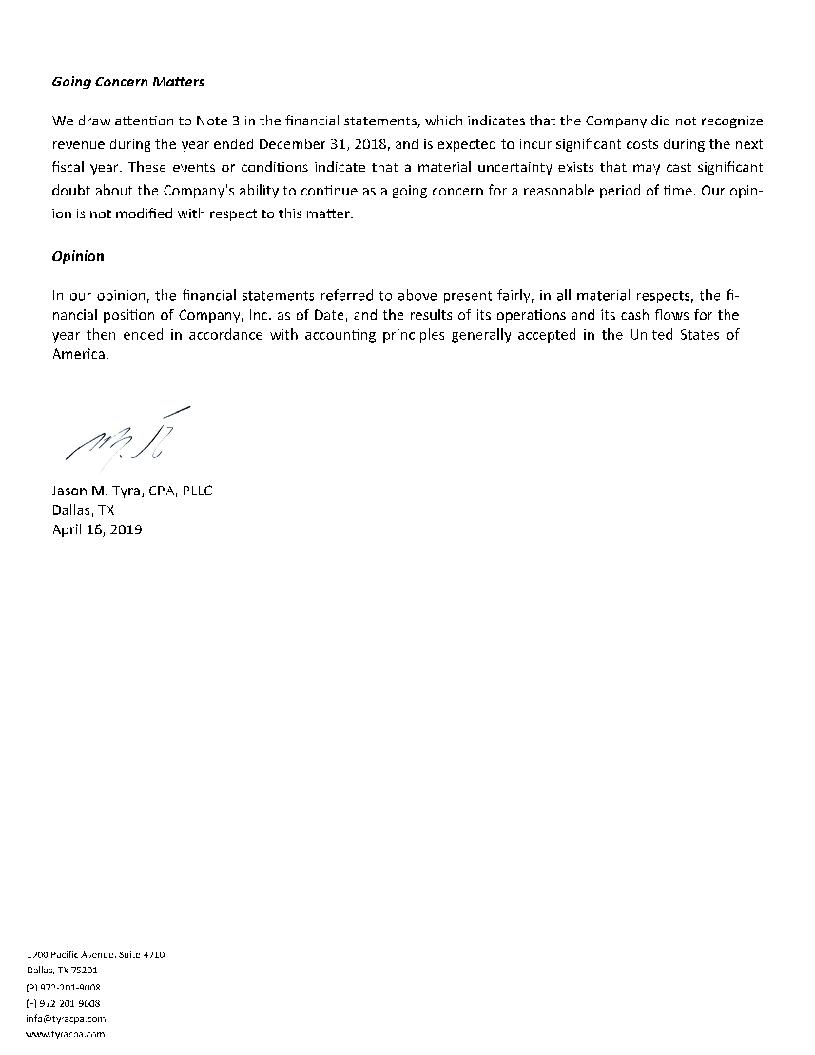

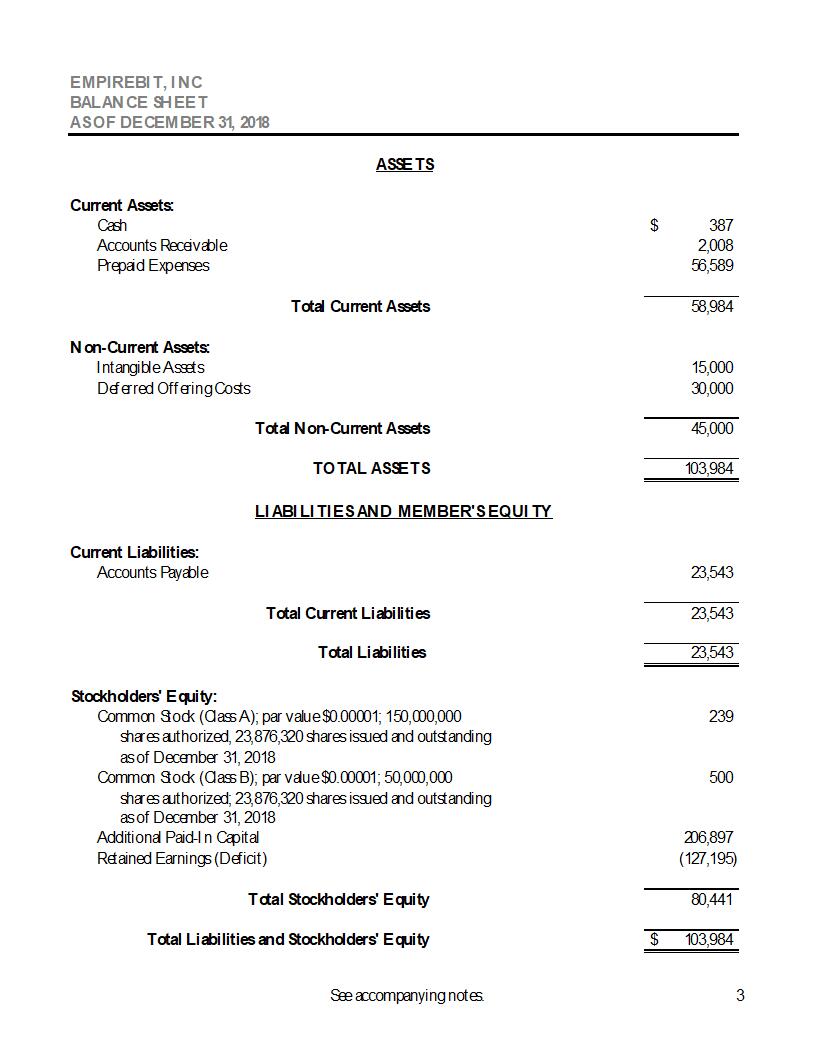

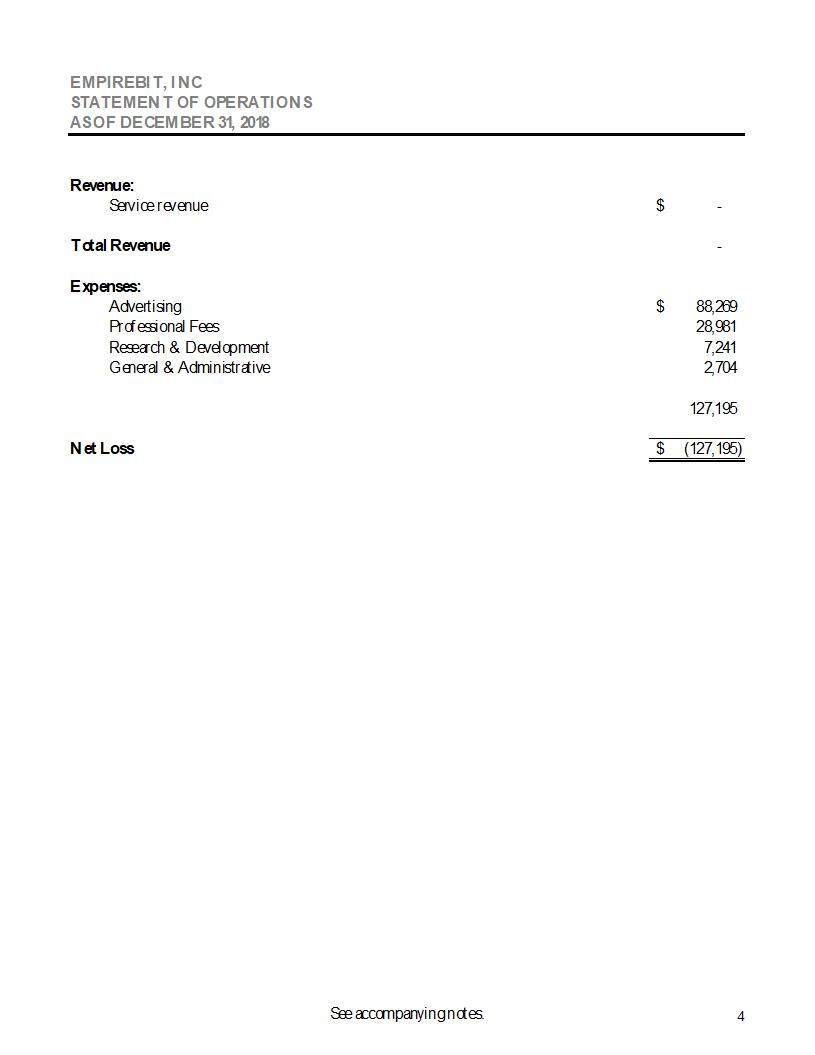

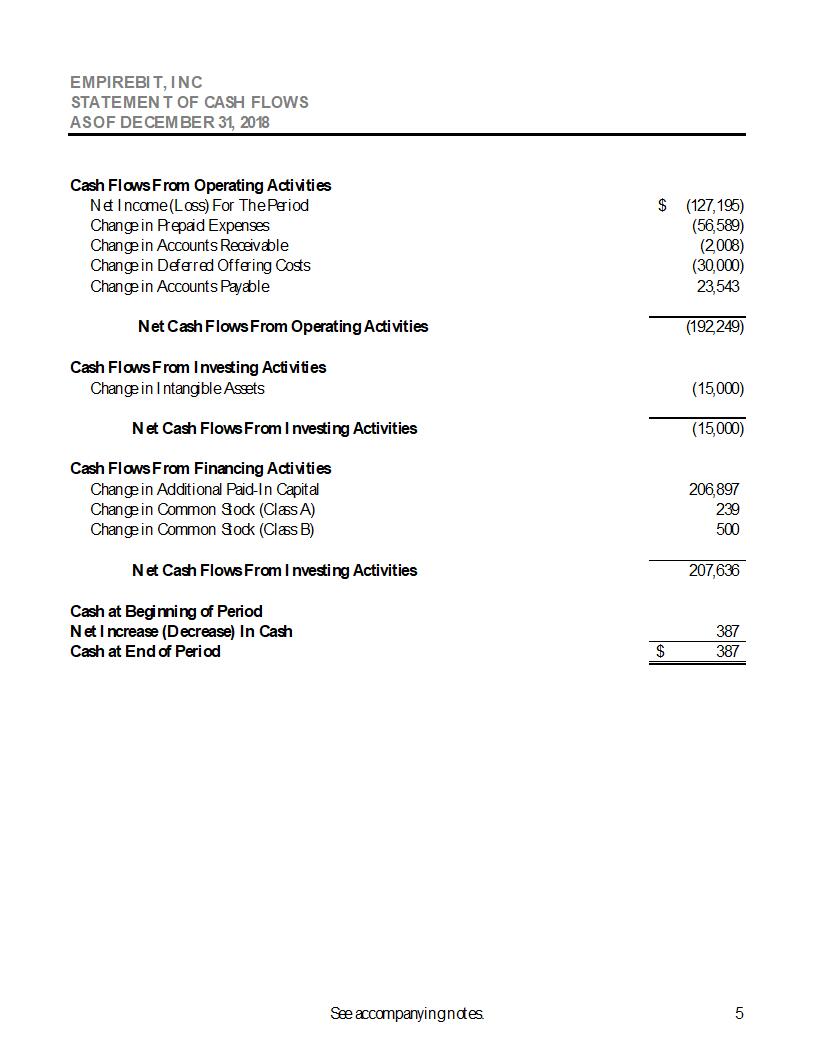

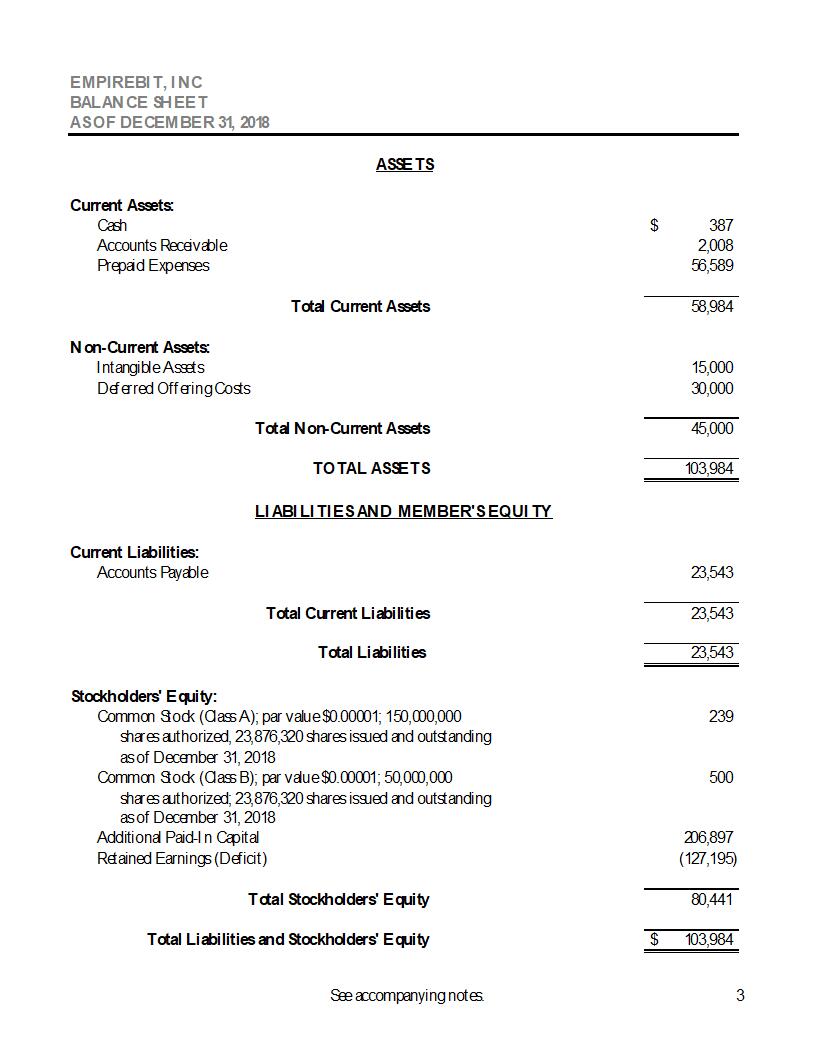

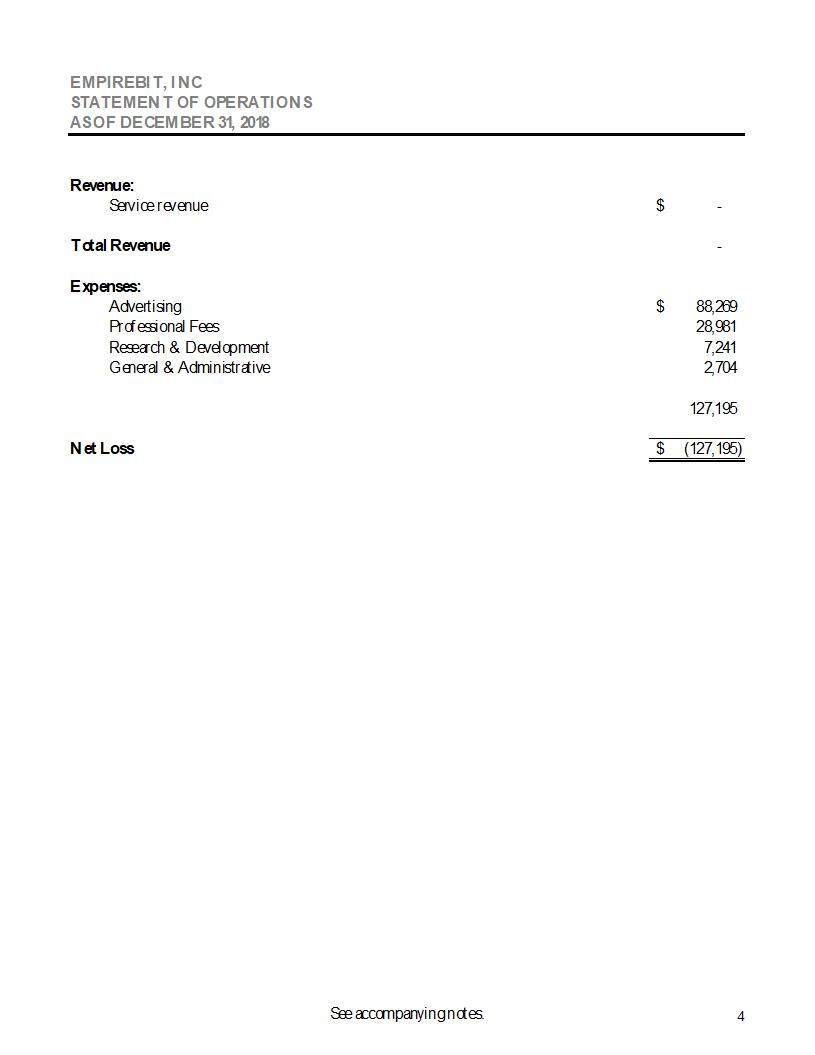

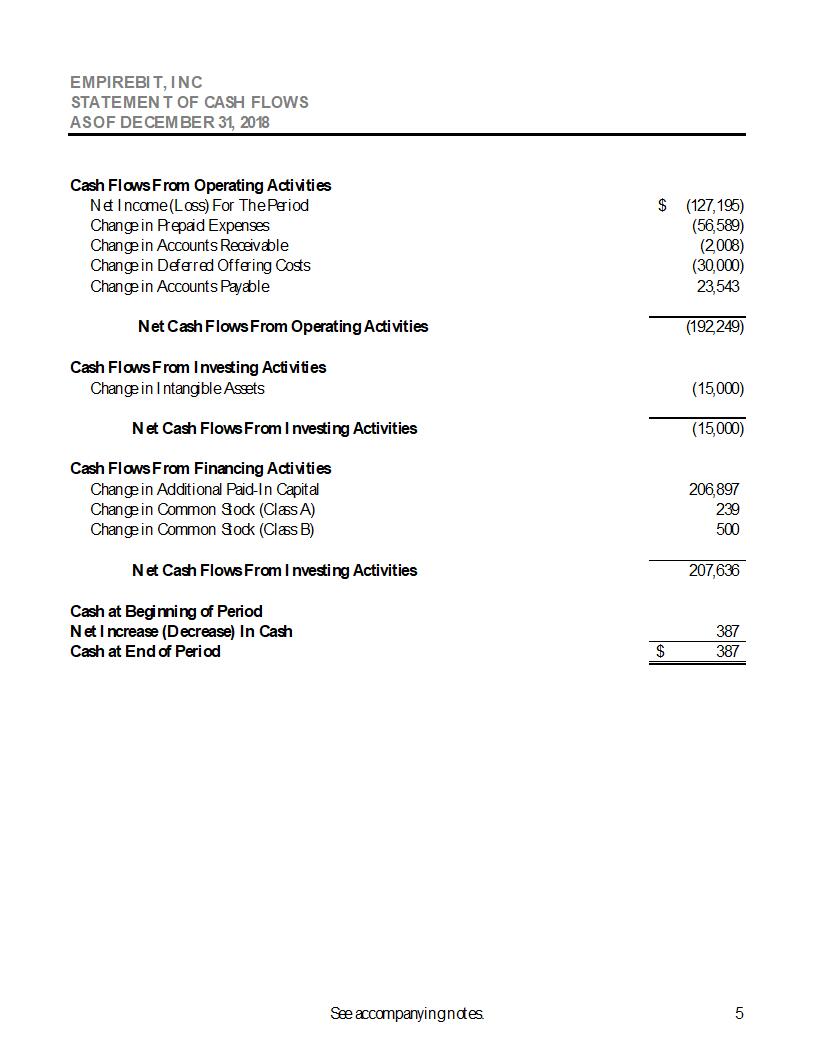

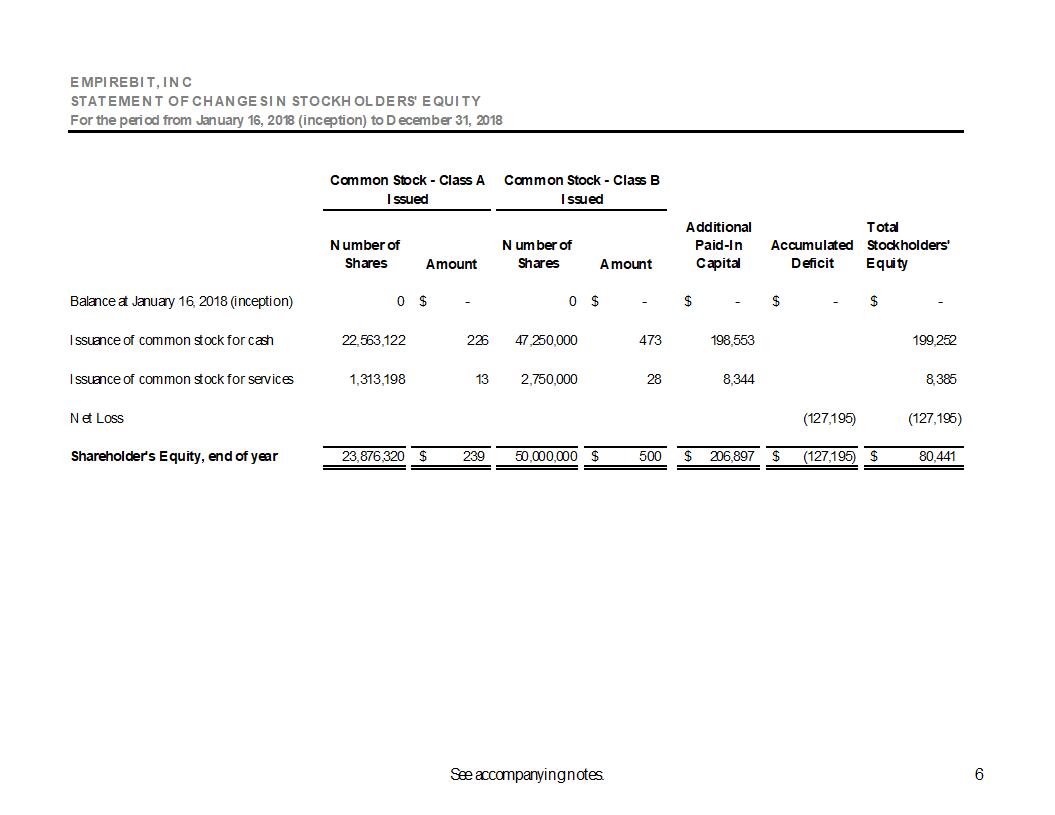

SECTION F/S: FINANCIAL STATEMENTS | 120 |

SIGNATURES | 136 |

ACKNOWLEDGEMENT ADOPTING TYPED SIGNATURES | 137 |

PART III EXHIBITS: Index to Exhibits | 138 |

1

PRELIMINARY INFORMATION, DISCLOSURES AND LEGENDS

OFFERING CIRCULAR PURSUANT TO

REGULATION A OF THE SECURITIES ACT OF 1933

FORM 1-A: PART II –OFFERING CIRCULAR FORMAT

Dated: May 18, 2019

EmpireBIT, Inc. (A Delaware Corporation)

36 Christopher Columbus Blvd

Jackson, NJ 08527

732-654-2600

www.EmpireBIT.com

5,000,000 Shares of Class A Common Stock at $10.00 Per Share

Convertible Into Security Tokens

Minimum Investment: 25 Shares of Class A Common Stock ($250.00)

Maximum Offering: $50,000,000.00

6199 | | 82-4794548 |

(Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

This Preliminary Offering Circular shall only be qualified upon order of the Commission, unless a subsequent amendment is filed indicating the intention to become qualified by operation of the terms of Regulation A.

PLEASE REVIEW ALL RISK FACTORS ON PAGES PAGE 22 THROUGH PAGE 58 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE IF YOU ARE CAPABLE OF EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE LOSS OF YOUR INVESTMENT, SHOULD THAT OCCUR.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

Because these securities are being offered on a “best efforts” basis, the following disclosures are hereby made:

| Price to Public | Commissions (1) | Proceeds to Company (2) | Proceeds to Other Persons (3) |

Per Share | $10.00 | $0.50 | $9.50 | None |

Minimum Investment | $250.00 | $12.50 | $237.50 | None |

Maximum Offering | $50,000,000.00 | $2,500,000.00 | $47,500,000.00 | None |

(1) The Company shall pay Cuttone & Co. LLC (“Cuttone”) a cash success fee equivalent to 5% of the gross proceeds raised in the Offering. In addition to the fees above, the Company shall grant to Cuttone (or its designees and assignees) cashless warrants equivalent to 3% of the gross proceeds raised in the Offering. The cashless warrants will be valued at the same $5.00 per share price to the public for the purpose of determining how many securities Cuttone will be issued. Fees in the chart above only reflect the cash fee (5%), and do not reflect the warrants, which are also not represented in the capitalization table herein. Cuttone may engage the services of additional FINRA member broker-dealers as part of a selling group, and those additional broker-dealers may be paid additional fees to those disclosed herein. Should such additional broker-dealers be engaged, an amendment to this Offering Circular will be filed disclosing the additional fees. Cuttone is not an underwriter and will not be paid underwriting fees, but will be paid service fees. See “Plan of Distribution.”

(2) Does not reflect payment of expenses of this Offering, which are estimated to not exceed $500,000.00 and which include, among other things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, broker-dealer retainer and advisory fees, broker-dealer out-of-pocket expenses, administrative services, other costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Shares of Class A Common Stock, but which do not include success fees or commissions paid to Cuttone. If the Company engages the services of additional broker-dealers in connection with the Offering, their commissions will be an additional expense of the Offering. See the “Plan of Distribution” for details regarding the compensation payable in connection with this Offering. This amount represents the proceeds of the Offering to the Company, which will be used as set out in “Use of Proceeds.”

(3) There are no finder’s fees or other fees being paid to third parties from the proceeds, other than those disclosed above. See "Plan of Distribution."

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

This offering consists of Shares of Class A Common Stock (the “Shares” or individually, each a “Share”) that are convertible, at the option of each shareholder, at a later date to be determined in the Company’s sole discretion, on a one-to-one basis into Security Tokens of the same class and with the same rights, preferences and privileges as the Class A Common Stock (the “Security Tokens” or individually, each a “Security Token”) that are being offered on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold. The term “Offering” refers to the offer of Shares of Class A Common Stock pursuant to this Offering Circular. The Shares are being offered and sold by EmpireBIT, Inc., a Delaware Corporation (“EmpireBIT”, “we”, “our” or the “Company”). The Shares referred to in this Offering Circular are 5,000,000 Class A Common Stock that may later, at the option of each shareholder, be “tokenized” into non-certificated, book-entry digital securities as set out herein. The “Security Tokens” as used in this Offering Circular do not presently exist, but will be tokenized Shares of Class A Common Stock of the Company, for investors who choose to tokenize their Shares when the Company offers this option at a presently-undetermined later date.

The Shares of Class A Common Stock are being offered at a price of $10.00 per Share with a minimum purchase of twenty-five (25) Shares per investor. The Shares are being offered on a best efforts basis to an unlimited number of accredited investors and an unlimited number of non-accredited investors only by the Company and through Cuttone & Co., LLC (“Cuttone”), a broker/dealer registered with the Securities and Exchange Commission (the “SEC”) and a member of the Financial Industry Regulatory Authority (“FINRA”). The maximum aggregate amount of the Shares of Class A Common Stock offered is $50,000,000.00 (the “Maximum Offering”). There is no minimum number of Shares that needs to be sold in order for funds to be released to the Company and for this Offering to hold its first closing.

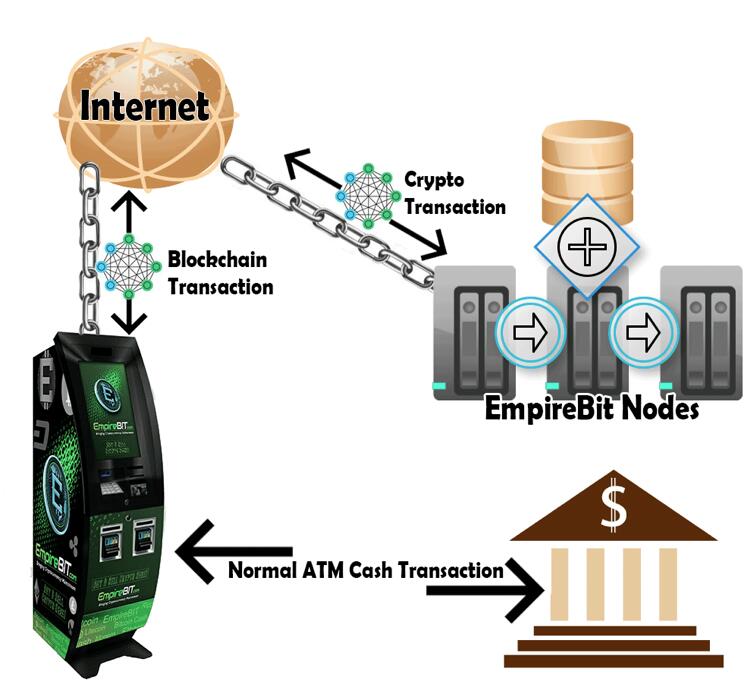

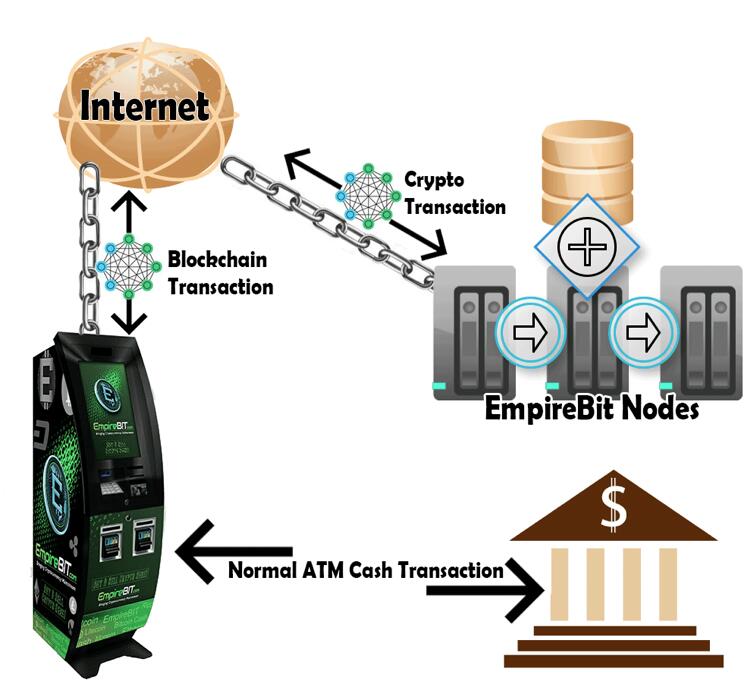

The Company was originally formed as EmpireBIT LLC, a Delaware limited liability company, on or about January 16, 2018 and was converted into a Delaware corporation on or about August 3, 2018. The Company was formed for the general purpose of developing a network of cryptocurrency automatic teller machines and a blockchain ecosystem for the Company’s cryptocurrency, should one be created in the future.

The Shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offerings. The Shares will only be issued to purchasers who satisfy the requirements set forth in Regulation A. This Offering will commence after qualification by the Commission and is expected to expire on the first of: (i) all of the Shares offered are sold; or (ii) the close of business 180 days from the date of qualification by the Commission, unless sooner terminated or extended by the Company’s CEO, or (iii) the date upon which a determination is made by the Company to terminate the Offering in the Company’s sole and absolute discretion. Pending each closing, payments for the Shares will be deposited in a bank account to be held for the Company. Funds will be promptly refunded without interest, for sales that are not consummated. All funds received shall be held only in a non-interest-bearing bank account. Upon each closing under the terms as set out in this Offering Circular, funds will be immediately transferred to the Company where they will be available for use in the operations of the Company’s business in a manner consistent with the “Use Of Proceeds” in this Offering Circular.

The Company’s website and white paper are not incorporated into this Offering Circular. If you review the Company’s white paper, please be aware that the white paper is summary in nature and subject to the legal disclaimers provided therein as well as the Risk Factors in this Offering Circular and all disclaimers in this Offering Circular. The photographs, drawings and graphics in the white paper are for illustrative purposes only, and may not be accurate representations of the crypto ATM units and other matters or items depicted, when they are ultimately created and deployed by the Company.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

_____________________________________

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE.

_____________________________________

BEFORE INVESTING IN THIS OFFERING, PLEASE REVIEW ALL DOCUMENTS CAREFULLY, ASK ANY QUESTIONS OF THE COMPANY’S MANAGEMENT THAT YOU WOULD LIKE ANSWERED AND CONSULT YOUR OWN COUNSEL, ACCOUNTANT AND OTHER PROFESSIONAL ADVISORS AS TO LEGAL, TAX AND OTHER RELATED MATTERS CONCERNING THIS INVESTMENT.

_____________________________________

THERE IS NO PUBLIC MARKET FOR THE SHARES OF CLASS A COMMON STOCK CONVERTIBLE INTO CLASS A SECURITY TOKENS OR ANY OTHER SECURITIES OF THIS COMPANY, NOR WILL ANY SUCH MARKET DEVELOP AS A RESULT OF THIS OFFERING. A LEGALLY COMPLIANT TRADING MARKET FOR THE SHARES OF CLASS A COMMON STOCK CONVERTIBLE INTO CLASS B SECURITY TOKENS MAY NEVER BE DEVELOPED AND PEER-TO-PEER TRADING OF SHARES OF CLASS A COMMON STOCK CONVERTIBLE INTO CLASS A SECURITY TOKENS WILL NOT BE PERMITTED UNLESS AND UNTIL SECURITY TOKENHOLDERS ARE NOTIFIED OTHERWISE BY THE COMPANY, WHICH MAY REQUIRE HOLDERS TO HOLD THEIR SECURITY TOKENS INDEFINITELY. AN INVESTMENT IN THIS OFFERING IS HIGHLY SPECULATIVE, AND YOU SHOULD ONLY INVEST IF YOU ARE PREPARED TO LOSE YOUR ENTIRE INVESTMENT.

_____________________________________

THE SHARES ARE OFFERED BY THE COMPANY SUBJECT TO THE COMPANY’S RIGHT TO REJECT ANY TENDERED SUBSCRIPTION, IN ITS ABSOLUTE DISCRETION, AT ANY TIME PRIOR TO THE ISSUANCE OF THE SHARES. THE COMPANY MAY REJECT ANY OFFER AND NEED NOT ACCEPT OFFERS IN THE ORDER RECEIVED.

_____________________________________

INVESTORS WILL BE REQUIRED TO REPRESENT THAT THEY ARE ABLE TO BEAR THE ECONOMIC RISK OF THEIR INVESTMENT AND THAT THEY (OR THEIR PURCHASER REPRESENTATIVES) ARE FAMILIAR WITH AND UNDERSTAND THE TERMS AND RISKS OF THIS OFFERING. THE CONTENTS OF THIS OFFERING CIRCULAR ARE NOT TO BE CONSTRUED AS LEGAL OR TAX ADVICE. EACH INVESTOR SHOULD CONSULT HIS OR HER OWN ATTORNEY, ACCOUNTANT OR BUSINESS ADVISOR AS TO LEGAL, TAX AND RELATED MATTERS CONCERNING THIS INVESTMENT. ALL FINAL DECISIONS IN RESPECT TO SALES OF SECURITIES WILL BE MADE BY THE COMPANY, WHICH RESERVES THE RIGHT TO REVOKE THE OFFER AND TO REFUSE TO SELL TO ANY PROSPECTIVE INVESTOR.

_____________________________________

NO PERSONS, EXCEPT THE COMPANY OR ITS AGENTS AND SUCH REGISTERED BROKER-DEALERS AS THE COMPANY MAY ELECT TO UTILIZE, HAVE BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS OFFERING CIRCULAR AND IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY. NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE HEREUNDER SHALL UNDER ANY CIRCUMSTANCES CREATE THE IMPLICATION THERE HAS BEEN NO CHANGE IN THE INFORMATION CONTAINED HEREIN SUBSEQUENT TO THE DATE HEREOF.

_____________________________________

THE INVESTMENT DESCRIBED IN THIS OFFERING CIRCULAR INVOLVES RISK AND IS OFFERED ONLY TO INDIVIDUALS WHO CAN AFFORD TO ASSUME SUCH RISKS FOR AN INDEFINITE PERIOD OF TIME AND WHO AGREE TO PURCHASE THE SECURITIES THAT ARE BEING OFFERED HEREUNDER ONLY FOR INVESTMENT PURPOSES AND NOT WITH A VIEW TOWARDS A TRANSFER, RESALE, EXCHANGE OR FURTHER DISTRIBUTION OF SUCH. FEDERAL LAW AND STATE SECURITIES LAWS LIMIT THE RESALE OF SUCH SECURITIES AND IT IS THEREFORE URGED THAT EACH POTENTIAL INVESTOR SEEK COUNSEL CONCERNING SUCH LIMITATIONS.

_____________________________________

THE COMPANY AS DESCRIBED IN THIS OFFERING CIRCULAR HAS ARBITRARILY DETERMINED THE PRICE OF SECURITIES, AND EACH PROSPECTIVE INVESTOR SHOULD MAKE AN INDEPENDENT EVALUATION OF THE FAIRNESS OF SUCH PRICE UNDER ALL THE CIRCUMSTANCES AS DESCRIBED IN THIS OFFERING CIRCULAR.

_____________________________________

THIS OFFERING CIRCULAR DOES NOT KNOWINGLY CONTAIN ANY UNTRUE STATEMENT OF A MATERIAL FACT OR OMIT A MATERIAL FACT, AND ANY SUCH MISSTATEMENT OR OMISSION IS DONE WITHOUT THE KNOWLEDGE OF THE PREPARERS OF THIS DOCUMENT OR THE COMPANY. AS SUCH, THE COMPANY BELIEVES THAT THIS OFFERING CIRCULAR CONTAINS ALL MATTERS, DOCUMENTS AND CIRCUMSTANCES MATERIAL TO THIS OFFERING.

_____________________________________

PROSPECTIVE INVESTORS WHO HAVE QUESTIONS CONCERNING THE TERMS AND CONDITIONS OF THE OFFERING OR WHO DESIRE ADDITIONAL INFORMATION OR DOCUMENTATION TO VERIFY THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR SHOULD CONTACT THE CHIEF EXECUTIVE OFFICER OF THE COMPANY. ANY PROJECTIONS CONTAINED HEREIN OR OTHERWISE PROVIDED TO A POTENTIAL INVESTOR MUST BE VIEWED ONLY AS ESTIMATES. ALTHOUGH ANY PROJECTIONS ARE BASED UPON ASSUMPTIONS, WHICH THE COMPANY BELIEVES TO BE REASONABLE, THE ACTUAL PERFORMANCE OF THE COMPANY WILL DEPEND UPON FACTORS BEYOND THE CONTROL OF THE COMPANY. NO ASSURANCE CAN BE GIVEN THAT THE COMPANY’S ACTUAL PERFORMANCE WILL MATCH THE PROJECTIONS.

_____________________________________

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE.

_____________________________________

BEFORE INVESTING IN THIS OFFERING, PLEASE REVIEW ALL DOCUMENTS CAREFULLY, ASK ANY QUESTIONS OF THE COMPANY’S MANAGEMENT THAT YOU WOULD LIKE ANSWERED ANDEACH PROSPECTIVE INVESTOR SHOULD CONSULT WITH HIS OR HER OWN PROFESSIONAL TAX, LEGAL AND INVESTMENT ADVISORS TO ASCERTAIN THE MERITS AND RISKS OF INVESTING IN THE SHARES DESCRIBED IN THIS OFFERING CIRCULAR PRIOR TO SUBSCRIBING TO SECURITIES OF THE COMPANY.

NASAA UNIFORM LEGEND

FOR RESIDENTS OF ALL STATES: THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED "BLUE SKY" LAWS).

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE ACT, AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME.

_____________________________________

NOTICE TO FOREIGN INVESTORS

IF THE PURCHASER LIVES OUTSIDE THE UNITED STATES, IT IS THE PURCHASER'S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES BY ANY FOREIGN PURCHASER.

NOTICE TO PROSPECTIVE PURCHASERS IN AUSTRALIA:

Neither this Offering Circular, nor any other disclosure document in relation to the Securities, has been, will be, or needs to be, lodged with the Australian Securities & Investments Commission. This Offering Circular is not a product disclosure statement under Division 2 of Part 7.9 of the Corporations Act 2001 (CTH) (the “Australia Act”) nor is it a prospectus under Chapter 6D of the Australia Act, and the Securities have not been, and will not be, registered as a managed investment scheme under the Australia Act.

An offer of the Shares is made in Australia only to “wholesale clients” as defined by the Australia Act (“Wholesale Clients”), and can only be accepted by a recipient if they are a Wholesale Client. No Shares will be issued or arranged to be issued, and no recommendations to acquire Shares will be made, which would require the provision of a product disclosure statement under Division 2 of Part 7.9 of the Australia Act or the provision of a financial services guide or a statement of advice under Division 2 or 3 of Part 7.7 of the Australia Act.

Neither this Offering Circular, the offer contained herein nor any other disclosure document in relation to the Shares can be partially or wholly distributed, published, reproduced, transmitted or otherwise made available or disclosed by recipients to any other person in Australia.

NOTICE TO PROSPECTIVE PURCHASERS IN THE EUROPEAN ECONOMIC AREA:

In relation to each Member State of the European Economic Area (each a “Member State”), which has implemented the Prospectus Directive, the Company has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Member State it has not made and will not make an offer of the Shares to the public in a Member State, except that it may, with effect from and including such date, make an offer of Shares in a Member State at any time under the following exemptions as provided by the Prospectus Directive:

(a)to legal entities which are qualified investors, as defined in the Prospectus Directive;

(b)to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospective Directive;

(c)in any other circumstances falling within the scope of Article 3(2) of the Prospectus Directive.

For the purposes of the above, (i) the expression an “offer of the Securities to the public” in relation to any Shares in any Member State means the communication in any form and by any means of sufficient information on the terms of the Offering and the Shares to be offered so as to enable an investor to decide to purchase or subscribe the Shares, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State and (ii) the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including Directive 2010/73/EU), and includes any relevant implementing measure in each Member State.

NOTICE TO PURCHASERS IN FRANCE:

The Offering is not being made, directly or indirectly, to the public in the Republic of France ("France"). Neither this Offering Circular nor any other documents or materials relating to the Offering have been or will be distributed to the public in France and only (i) providers of investment services relating to portfolio management for the account of third parties (personnes fournissant le service d'investissement de gestion de portefeuille pour compte de tiers) and/or (ii) qualified investors (investisseurs qualifiés) acting for their own account (other than individuals), and all as defined in, and in accordance with, Articles L.411-1, L.411-2, D.411-1 and D.411-4, D.734-1, D.744-1, D.754-1 and D.764-1 of the French Code Monétaire et Financier, are eligible to participate in the Offering. Neither this Offering Circular nor any other documents or materials relating to the Offering have been or will be submitted for clearance to or approved by the Autorité des marchés financiers. The direct or indirect distribution to the public in France of any so acquired Shares may be made only as provided by Articles L.411-1, L.411-2, L. 412-1 and L.621-8 to L.621-8-3 of the French Code Monétaire et financier and applicable regulations thereunder.

This Offering Circular, and any related document or material, shall not be considered, nor construed, as any form of financial investment advice, solicitation or advertisement.

NOTICE TO PROSPECTIVE PURCHASERS IN HONG KONG:

The Shares have not been offered or sold and will not be offered or sold in Hong Kong, by means of any document, other than to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “SFO”) and any rules made thereunder, or in circumstances which do not result in the document being a “prospectus” as defined in the Companies (Winding up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of the Companies Ordinance (Cap. 622) of Hong Kong.

No person has issued or had in its possession for the purposes of issue, or will issue or have in its possession of the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to the Shares, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the Shares which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” within the meaning of the SFO and any rules made thereunder.

NOTICE TO PROSPECT INVESTORS IN ISRAEL:

This Offering Circular does not constitute a prospectus under the Israeli Securities Law, 5728-1968, and has not been filed with or approved by the Israel Securities Authority. In Israel, this Offering Circular is being distributed only to, and is directed only at, investors listed in the first addendum, or the Addendum, to the Israeli Securities Law, consisting primarily of joint investment in trust funds, provident funds, insurance companies, banks, portfolio managers, investment advisors, members of the Tel Aviv Stock Exchange, underwriters purchasing for their own account, venture capital funds, and entities with shareholders’ equity in excess of NIS 250 million, each as defined in the Addendum (as it may be amended from time to time, collectively referred to as institutional investors). Institutional investors may be required to submit written confirmation that they fall within the scope of the Addendum.

NOTICE TO PROSPECTIVE PURCHASERS IN SINGAPORE:

Each investor has acknowledged that this Offering Circular has not been and will not be registered as a prospectus with the Monetary Authority of Singapore (the “MAS”). Accordingly, this Offering Circular and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the Shares, may not be circulated or distributed, nor may the Shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to any person in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act (Chapter 289 of Singapore) (the “SFA”)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1) of the SFA, or any person pursuant to Section 275(1A) of the SFA, and in accordance with the conditions, specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provisions of the SFA.

Where the Shares are subscribed or purchased under Section 275 of the SFA by a relevant person which is:

(a)a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b)a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor,

Securities (as defined in Section 239(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the units, as the case may be, pursuant to an offer made under Section 275 of the SFA except:

(1)to an institutional investor pursuant to Section 274 of the SFA or to a relevant person pursuant to Section 275(1) of the SFA, or to any person pursuant arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the SFA;

(2)where no consideration is or will be given for the transfer;

(3)where the transfer is by operation of law;

(4)as specified in Section 276(7) of the SFA; and/or

(5)as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations 2005 of Singapore.

By accepting receipt of this Offering Circular, any person in Singapore represents and warrants that he is entitled to receive such Offering Circular in accordance with the restrictions set forth above and agrees to be bound by the limitations contained herein.

NOTICE TO PROSPECTIVE PURCHASERS IN THE NETHERLANDS:

The Shares may not be offered or sold in The Netherlands to any persons other than qualified investors within the meaning of the Prospectus Directive. For purposes of the above, the expression “Prospectus Directive” shall have the meaning given to it in the paragraph “Notice to Prospective Purchasers in the European Economic Area” above.

NOTICE TO PROSPECTIVE PURCHASERS IN THE UNITED KINGDOM:

With respect to offers and sales of the Shares that are the subject of this Offering Circular, offers or sales of any of such Shares to persons in the United Kingdom are prohibited in circumstances which have resulted in or will result in such Shares being or becoming the subject of an offer of transferable securities to the public as defined in Section 102B of the Financial Services and Markets Act 2000 (as amended) (the “FSMA”) and all applicable provisions of the FSMA must be complied with, with respect to anything done in relation to such Shares in, from or otherwise involving the United Kingdom.

To the extent this Offering Circular is distributed in the United Kingdom, it will only be distributed to and directed at: (i) persons who have professional experience in matters relating to investments falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) (the "FPO"); (ii) high net worth entities and other persons to whom it may otherwise lawfully be communicated falling within Article 49 of the FPO; (iii) certified sophisticated investors falling within Article 50 of the FPO; or (iv) other persons to whom it may lawfully be directed under an exemption contained in the FPO (the persons specified in (i), (ii), (iii) and (iv) above are, together, referred to as “relevant persons”). Persons who are not relevant persons must not act on or rely on this Offering Circular or any of its contents. Any investment or investment activity to which this Offering Circular relates is available only to relevant persons and will be engaged in only with relevant persons. Relevant persons in receipt of this Offering Circular must not distribute, publish, reproduce, or disclose this Offering Circular (in whole or in part) to any person who is not a relevant person.

In addition, any invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) received in connection with the issue or sale of such Shares will only be communicated, or be caused to be communicated, in circumstances in which Section 21(1) of the FSMA does not apply to the Company.

_____________________________________

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Form 1-A and Offering Circular and any documents incorporated by reference herein or therein contain “forward-looking statements.” As used in this Form 1-A and Offering Circular, the term “forward-looking statements” include statements containing a projection of revenues, income (including income loss), earnings (including earnings loss) per share, capital expenditures, dividends, capital structure, or other financial items; statements of the plans and objectives of management for future operations, including plans or objectives relating to the products or services of the Company; statements of future economic performance, including any such statement contained in a discussion and analysis of financial condition by the management or in the results of operations included in this Form 1-A and Offering Circular; and any statements of the assumptions underlying or relating to any statements in this paragraph.

The forward-looking statements appear in a number of places in this Offering Circular and any documents incorporated by reference and include statements regarding the intent, belief or current expectations of the Company with respect to, among others things: (i) the development of the Company and its products; (ii) the targeting of markets; (iii) trends affecting the Company’s financial condition or results of operation; (iv) the Company’s business plan and growth strategies; (v) the industries in which the Company participates; and (vi) the ability of the Company to generate sufficient cash from operations to meet its operating needs and pay off its existing indebtedness, all of which are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this Offering Circular, and any documents incorporated by reference are forward-looking statements. Forward-looking statements give the Company's current reasonable expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “may,” “could,” “will,” “should,” “can have,” “likely,” “assume,” “expect,” “anticipate,” “plan,” “intend,” “believe,” “predict,” “project,” “estimate,” “forecast,” “outlook,” “potential,” or “continue,” or the negative of these terms, and other comparable terminology and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected, expressed or implied, in the forward-looking statements as a result of various factors. They involve risks, uncertainties (many of which are beyond the Company's control) and assumptions. are based on reasonable assumptions, you should be aware that many factors could affect its actual operating and financial performance and cause its performance to differ materially from the performance anticipated in the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect or change, the Company's actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements.

The Company discloses important factors that could cause its actual results to differ materially from its expectations under the caption “Risk Factors” below. These cautionary statements qualify all forward-looking statements attributable to the Company or persons acting on its behalf. The Company has based its forward-looking statements on its current expectations about future events. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Although the Company believes its forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect its actual operating and financial performance and cause its performance to differ materially from the performance anticipated in the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect or change, the Company's actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements

Any forward-looking statement made by the Company in this Offering Circular or any documents incorporated by reference herein speak only as of the date of this Offering Circular or any documents incorporated by reference herein. Factors or events that could cause the Company’s actual operating and financial performance to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company disclaims any obligation, and undertakes no obligation, to update or alter any forward-looking statement, whether as a result of new information, future events/developments or otherwise or to conform these statements to actual results. whether as a result of new information, future events or otherwise. You should not place undue reliance on forward-looking statements. The Company urges you to carefully consider these matters, and the risk factors described in this Offering Circular, prior to making an investment in its Shares.

_____________________________________

About This Form 1-A and Offering Circular

In making an investment decision, you should rely only on the information contained in this Form 1-A and Offering Circular. The Company has not authorized anyone to provide you with information different from that contained in this Form 1-A and Offering Circular. The Company are offering to sell, and seeking offers to buy the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this Form 1-A and Offering Circular is accurate only as of the date of this Form 1-A and Offering Circular, regardless of the time of delivery of this Form 1-A and Offering Circular. Our business, financial condition, results of operations, and prospects may have changed since that date. Statements contained herein as to the content of any agreements or other documents are summaries and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents. The Company will provide the opportunity to ask questions of and receive answers from the Company's management concerning terms and conditions of the Offering, the Company or any other relevant matters and any additional reasonable information to any prospective investor prior to the consummation of the sale of the Shares. This Form 1-A and Offering Circular do not purport to contain all of the information that may be required to evaluate the Offering and any recipient hereof should conduct its own independent analysis. The statements of the Company contained herein are based on information believed to be reliable. No warranty can be made that circumstances have not changed since the date of this Form 1-A and Offering Circular. The Company does not expect to update or otherwise revise this Form 1-A, Offering Circular or other materials supplied herewith. The delivery of this Form 1-A and Offering Circular at any time does not imply that the information contained herein is correct as of any time subsequent to the date of this Form 1-A and Offering Circular. This Form 1-A and Offering Circular are submitted in connection with the Offering described herein and may not be reproduced or used for any other purpose.

______________________________________________________________________________

OFFERING SUMMARY AND RISK FACTORS

OFFERING SUMMARY

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offering Circular and/or incorporated by reference in this Offering Circular. For full offering details, please (1) thoroughly review this Form 1-A filed with the Securities and Exchange Commission (2) thoroughly review this Offering Circular and (3) thoroughly review any attached documents to or documents referenced in, this Form 1-A and Offering Circular.

Issuer: | EmpireBIT, Inc. |

Type of Offering: | Shares of Class A Common Stock convertible into Class B Security Tokens. |

Price Per Share: | $10.00 per Share (5,000,000 Shares) |

Minimum Investment: | $250.00 per investor |

Maximum Offering: | $50,000,000.00 The Company will not accept investments greater than the Maximum Offering amount. |

Maximum Shares Offered: | 5,000,000 Shares |

Purchasers: | Purchasers may be accredited investors or non-accredited investors. Non-accredited investors are limited in the number of Shares they may purchase. |

Use of Proceeds: | See the description in section entitled “Use of Proceeds” on page 66 herein. |

Revenue Share: | As a class, the Shares of Class A Common Stock are entitled to 10% of all Transaction Fees (as defined below in “Securities Being Offered.” Please carefully review “Securities Being Offered” for details of the revenues to be shared. |

Voting Rights: | The Shares have no voting rights other than those reserved under Delaware law. See “Voting Rights” section of “Securities Being Offered” below for details. |

Length of Offering: | Shares will be offered on a continuous basis until either (a) the date upon which the Company confirms that it has received in the TD Bank account gross proceeds of $50,000,000.00 in deposited funds; (b) the expiration of 180 days from the date of this Offering Circular unless extended in its sole discretion by the Company; or (c) the date upon which a determination is made by the Company to terminate the Offering in its sole discretion. |

The Offering

Class A Non-Voting Common Stock Outstanding | 23,876,318 Shares |

Class B Common Stock Outstanding | 50,000,000 Shares |

Class A Non-Voting Common Stock in this Offering (1) | 5,000,000 Shares |

Class B Common Stock in this Offering | 0 Shares |

Total Common Stock to be outstanding after the Offering (2) | 78,876,318 Shares |

Class A Security Tokens Outstanding (3) | 0 Security Tokens |

Class B Security Tokens Outstanding (3) | 0 Security Tokens |

Class A Security Tokens in this Offering (3) | 0 Security Tokens |

Class B Security Tokens in this Offering (3) | 0 Security Tokens |

Total Security Tokens to be outstanding after the Offering (3) | 0 Security Tokens |

(1) There are two classes of Common Stock issued by the Company. For a full description of the rights of the classes of Common Stock, please see the section of this Offering Circular entitled “Securities Being Offered” below. The total number of Shares of Shares of Class A Common Stock (5,000,000) in the chart assumes that the maximum number of Shares of Class A Common Stock are sold in this Offering.

(2) The number of Shares to be outstanding after the Offering assumes that the Offering is fully subscribed, and this number will be less if the Offering is not fully subscribed. Shares outstanding after the Offering does not include a number of Shares equivalent to 3% of the gross proceeds raised in the Offering, which will be exercisable by the broker-dealer or their assigns via warrants in the future based on the terms of said warrants.

(3) As noted herein, at present, the authorized and outstanding equity of the Company is in Common Stock, not Security Tokens. The Company plans at a later date to be determined in the Company’s absolute discretion, as set out herein, to allow each Shareholder convert some or all of its Common Stock on a one-for-one basis into Security Tokens, with the Security Tokens having the same classes, rights, preferences and privileges as the corresponding classes of Common Stock. However, as of the date of this Offering Circular, no Security Tokens have been issued, and no Common Stock has been converted into Security Tokens.

The Company may not be able to sell the Maximum Offering amount. The Company will conduct one or more closings on a rolling basis as funds are received from investors. Funds tendered by investors will be kept in a bank account at TD Bank until the next closing after they are received by the bank. At each closing, with respect to subscriptions accepted by the Company, funds held in the bank account will be distributed to the Company, entitling the investor to receive the Shares when they are later issued as set out herein. Investors may not withdraw their funds tendered from the bank account unless the Offering is terminated without a closing having occurred. Investors are not entitled to any refund of funds transmitted by any means to the Company, or to the bank account, for any reason, unless the Investor does not clear compliance by the broker-dealers involved.

While the Company's Shares are not presently listed on any trading market, Alternative Trading System ("ATS") or national exchange, it is the Company's intent for the Shares, if they are converted into Security Tokens, to become eligible for trading on an SEC-registered ATS to provide a secondary market for the Security Tokens at some point in the future, in order to provide some level of liquidity for investors and Security Tokenholders. If and when such a listing will occur is uncertain at this time, because as of the date of this Offering Circular, there is no currently SEC-approved or SEC-registered third-party platform or ATS that can support the secondary trading of security tokens.

In this regard, the Company has entered into a non-binding Letter of Intent with Pro Securities LLC to potentially qualify the Company's Security Tokens, if the Shares are converted, for trading on the ProSecurities ATS, an SEC-registered alternative trading system powered by technology owned and licensed from Pro Securities LLC's parent, tZERO Group, Inc. This Letter of Intent merely constitutes an outline of tentative terms and conditions of a definitive service agreement that has not been entered into by the Company. The Letter of Intent does not guarantee that the Shares will qualify for trading on the ATS or that any broker-dealer or other subscriber to the ATS will make a market or otherwise facilitate secondary trading of the Company's Security Tokens, if the Shares are converted, on the ATS. No investor should rely upon this Letter of Intent as evidence that a secondary market or any liquidity for the Shares, or the Security Tokens if conversion occurs, will exist.

Summary of Risk Factors

This Offering involves significant risks and you should consider the Shares highly speculative. The following important factors, and those important factors described elsewhere in this Offering Circular, including the matters set forth under the section entitled “Risk Factors,” could affect (and in some cases have affected) the Company’s actual results and could cause such results to differ materially from estimates or expectations reflected in this Offering Circular and in any forward-looking statements made herein or by the Company. These important risk factors include, but are not limited to:

The Company is a relatively newly formed entity with limited tangible assets and its continued operation requires substantial additional funding.

The Company has a very short operating history and there is no assurance that the business plan can be executed, or that the Company will generate revenues or profits.

Investors in this Offering risk the loss of their entire investment. The industry in which the Company is participating is highly speculative and extremely risky.

There is no minimum number of Shares that needs to be sold in order for funds to be released to the Company and for this Offering to close; therefore, there is no assurance the Company will receive funds sufficient to further its business plan.

If you invest and purchase the Shares, you will be acquiring a minority interest in the Company and will have little to no effective control over, or input into, the management or decisions of the Company, primarily because the Shares have no voting rights other than those reserved under Delaware law.

There is no market for the Company’s Shares at present and there is no assurance such a market will develop subsequent to this Offering. The Shares are illiquid and should be considered a long-term investment.

There are substantial restrictions on the transferability of the Shares and in all likelihood, you will not be able to liquidate some or all of your investment in the immediate future.

The Company has broad discretion in its use of proceeds and, as an investor, you are relying on management’s judgment.

The price of the Shares is arbitrary and may not be indicative of the value of the Shares or the Company.

The Company is entering into a relatively new industry where there is great uncertainty, little regulatory or legal guidance or precedent, and numerous and substantial risks that are known, as well as many that will likely arise that are unknown at this time, that could negatively affect the Company and your investment.

The Company is selling Shares, and plans to later develop what they believe to be a cryptocurrency, and will be basing portions of their business on blockchain technology, all of which are relatively new, and are fraught with great uncertainty. There is little to no regulatory or legal guidance or precedent, and numerous and substantial risks that are known, as well as many that will likely arise that are unknown at this time that could negatively affect the Company and your investment.

The tax treatment of the Shares, if converted into Security Tokens, is uncertain.

If the Shares are converted into Security Tokens, security token transactions may be irreversible and losses due to fraudulent or accidental transactions may not be recoverable.

The Company does not expect there to be any market makers to develop a trading market in the Shares.

Some market participants may oppose the development of distributed ledger or blockchain-based systems.

The prices of blockchain assets are extremely volatile and fluctuations in the price of digital assets could materially and adversely affect the Company’s business, and the Security Tokens may also be subject to significant price volatility, if they are eventually listed on an exchange or ATS.

The popularity of cryptocurrencies and tokenized security offerings may decrease in the future, which could have a material impact on the Company’s operations and financial conditions.

For a more detailed discussion of these and other significant risks, please thoroughly review and understand “Risk Factors” in the main body of this Offering Circular. Potential investors will be given an opportunity, if the potential investor requests to do so, to review the current status of all material contracts and make appropriate questions of management prior to subscribing to this Offering.

Investment Analysis

The Company believes that it has strong economic prospects by virtue of the following dynamics of the industry, the success of its founders in their related business endeavors, and other reasons:

1.Management believes that the trends for growth in the crypto ATM industry in the United States are favorable.

2.The demand for cryptocurrency in the United States is expected to grow, creating an opportunity for the Company as it is already ahead of many competitors because of its ability to use the footprint of Empire ATM Group to establish crypto ATMs in many locations.

3.Management believes that its experience in the traditional ATM market will position EmpireBIT, Inc. for profitable operations and will create new market opportunities in the United States.

Despite Management’s beliefs, there is no assurance that EmpireBIT, Inc. will be profitable, or that management’s opinion of the industry’s favorable dynamics will not be outweighed in the future by unanticipated losses, adverse regulatory developments and other risks. Investors should carefully consider the various risk factors below before investing in the Shares.

RISK FACTORS

The purchase of the Company’s Shares involves substantial risks. You should carefully consider the following risk factors in addition to any other risks associated with this investment. The Shares offered by the Company constitute a highly speculative investment and you should be in an economic position to lose your entire investment. The risks listed do not necessarily comprise all those associated with an investment in the Shares and are not set out in any particular order of priority. Additional risks and uncertainties may also have an adverse effect on the Company’s business and your investment in the Shares. An investment in the Company may not be suitable for all recipients of this Offering Circular. You are advised to consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to invest. You should consider carefully whether an investment in the Company is suitable in the light of your personal circumstances and the financial resources available to you.

The Company is, in addition to the risks set out below, subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, early-stage companies inherently involve greater risk than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Before investing, you should carefully read and carefully consider the following:

Risks Relating to The Company

The Company Has Limited Operating History

The Company has a limited operating history and there can be no assurance that the Company's proposed plan of business can be realized in the manner contemplated and, if it cannot be, Shareholders may lose all or a substantial part of their investment. There is no guarantee that the Company will ever realize any significant operating revenues or that its operations will ever be profitable.

The Company Has Incurred Operating Losses In The Past, Expects To Incur Operating Losses In The Future And May Never Achieve Or Maintain Profitability.

Since the Company’s inception, it has experienced net losses and negative cash flows from operations. The Company expects its operating expenses to increase in the future as it expands its operations. If the Company’s revenue does not grow at a greater rate than its operating expenses, the Company will not be able to achieve and maintain profitability. The Company expects to incur significant losses in the future for a number of reasons, including without limitation the other risks and uncertainties described herein. Additionally, the Company may encounter unforeseen operating or legal expenses, difficulties, complications, delays and other factors that may result in losses in future periods. If the Company’s expenses exceed its revenue, the Company may never achieve or maintain profitability and the Company’s business may be harmed.

The Company Is Dependent Upon Its Management, Key Personnel and Consultants to Execute the Business Plan, And Some of Them Will Have Concurrent Responsibilities at Other Businesses

The Company's success is heavily dependent upon the continued active participation of the Company's current executive officers as well as other key personnel and consultants. Many of them will have concurrent responsibilities at other entities such as at Empire ATM Group (an affiliated company as discussed below). Loss of the services of one or more of these individuals could have a material adverse effect upon the Company's business, financial condition or results of operations. Further, the Company's success and achievement of the Company's growth plans depend on the Company's ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among companies in industries that the Company is participating in is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the expansion of the Company's activities, could have a materially adverse effect on it. The inability to attract and retain the necessary personnel, consultants and advisors could have a material adverse effect on the Company's business, financial condition or results of operations.

Although Dependent Upon Certain Key Personnel, The Company Does Not Have Any Key Man Life Insurance Policies on Any Such People

The Company is dependent upon management in order to conduct its operations and execute its business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, should any of these key personnel, management or consultants die or become disabled, the Company will not receive any compensation that would assist with such person's absence. The loss of such person could negatively affect the Company and its operations.

The Company Is Subject to Income Taxes as Well As Non-Income Based Taxes, Which May Include Payroll, Sales, Use, Value-Added, Net Worth, Property and Goods and Services Taxes.

Significant judgment is required in determining the Company’s provision for income taxes and other tax liabilities. In the ordinary course of the Company’s business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although the Company believes that the Company’s tax estimates will be reasonable: (i) there is no assurance that the final determination of tax audits or tax disputes will not be different from what is reflected in the Company’s income tax provisions, expense amounts for non-income based taxes and accruals and (ii) any material differences could have an adverse effect on the Company’s financial position and results of operations in the period or periods for which determination is made.

The Company Is Not Subject to Sarbanes-Oxley Regulations and Lack the Financial Controls and Safeguards Required of Public Companies.

The Company does not have the internal infrastructure necessary, and is not required, to complete an attestation about the Company’s financial controls that would be required under the Sarbanes-Oxley Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of the Company’s financial controls.

The Company Has Engaged in Certain Transactions with Related Persons or Entities.

The Company has, and will continue to engage in transactions with related parties and/or entities, such as Empire ATM Group and United Armor. While the Company believes the terms of such transactions are fair and equitable, these other parties and/or entities are under the control of, and are majority owned by, Michael and Evan Almeida, the Company’s founders, directors, officers and majority shareholders, so the transactions have not been, and will not in the future be, at arm’s length. Please see the section of this Offering Circular entitled “Interest of Management and Others in Certain Related-Party Transactions and Agreements” for further details. If you have concerns about these transactions in the past or in the future, you may ask questions of the Company’s management. However, if you choose to invest in the Company, you will do so knowing and understanding that these transactions have occurred and will continue to occur in the future.

Changes in Employment Laws or Regulation Could Harm the Company’s Performance.

Various federal and state labor laws govern the Company’s relationship with the Company’s employees and contractors and affect the Company’s operating costs. These laws may include minimum wage requirements, overtime pay, healthcare reform and the implementation of various federal and state healthcare laws, unemployment tax rates, workers' compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect the Company’s operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

The Company’s Bank Accounts Will Not Be Fully Insured

The Company’s regular bank accounts and the TD Bank account for this Offering each have federal insurance that is limited to a certain amount of coverage. It is anticipated that the account balances in each account may exceed those limits at times. In the event that any of Company’s banks should fail, the Company may not be able to recover all amounts deposited in these bank accounts.

The Company’s Business Plan Is Speculative

The Company’s present business and planned business are speculative and subject to numerous risks and uncertainties. There is no assurance that the Company will generate significant revenues or profits. An investment in the Company’s Shares is speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

The Company Will Likely Incur Debt

The Company will likely incur debt (including secured debt) in the future and in the continuing operations of its business. Complying with obligations under such indebtedness may have a material adverse effect on the Company and on your investment.

The Company’s Expenses Could Increase Without a Corresponding Increase in Revenues

The Company’s operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on the Company’s financial results and on your investment. Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory charges, (3) changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations or policies, (4) significant increases in insurance premiums, (5) increases in borrowing costs, and (5) unexpected increases in costs of supplies, goods, materials, construction, equipment or distribution.

Computer, Website or Information System Breakdown Could Affect the Company’s Business

Computer, website and/or information system breakdowns as well as cyber security attacks could impair the Company’s ability to service its customers leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on the Company’s financial results as well as your investment.

Changes in The Economy Could Have a Detrimental Impact

Changes in the general economic climate, both in the United States and internationally, could have a detrimental impact on consumer expenditure and therefore on the Company’s revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases) may decrease the disposable income that customers have available to spend on products and services like those of the Company and may adversely affect customers’ confidence and willingness to spend. Any of such events or occurrences could have a material adverse effect on the Company’s financial results and on your investment.

The Amount of Capital the Company Is Attempting to Raise in This Offering Is Not Enough to Sustain the Company's Current Business Plan

In order to achieve the Company's near and long-term goals, the Company will need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If the Company is not able to raise sufficient capital in the future, the Company will not be able to execute the Company’s business plan, the Company’s continued operations will be in jeopardy and the Company may be forced to cease operations and sell or otherwise transfer all or substantially all of the Company’s remaining assets, which could cause you to lose all or a portion of your investment.

Additional Financing May Be Necessary for The Implementation of The Company's Growth Strategy

Whether the Company is successful in selling the maximum number of Shares in this Offering or not, the Company may require additional debt, equity or security token financing to pursue the Company’s growth and business strategies. These growth and business strategies include, but are not limited to enhancing the Company’s operating infrastructure and otherwise responding to competitive pressures. Given the Company’s limited operating history and existing losses, there can be no assurance that additional financing will be available, or, if available, that the terms will be acceptable to the Company. Lack of additional funding could force the Company to curtail substantially the Company’s growth plans. Furthermore, the issuance by the Company of any additional securities pursuant to any future fundraising activities undertaken by the Company or could result in an issuance of securities or tokens whose rights, preferences and privileges are senior to those of existing Shareholders including you, and could dilute the ownership or benefits of ownership of existing Shareholders including, but not limited to reducing the value of Shares subscribed for under this Offering.

The Company's Executive Officers, Directors and Affiliate Token Holders Beneficially Own or Control a Substantial Portion of Its Outstanding Shares

The Company's executive officers, directors and affiliates beneficially own or control a substantial portion of the Company’s outstanding Shares which may limit your ability and the ability of the Company’s other Shareholders, whether acting alone or together, to propose or direct the management or overall direction of the Company. Additionally, this concentration of ownership could discourage or prevent a potential merger or acquisition of the Company that might otherwise result in an investor receiving a premium over the market price for his or her Shares. Accordingly, the Company’s employees, directors, executive officers and affiliate Shareholders may have the power to control the election of the Company’s directors and the approval of actions for which the approval of the Company’s Shareholders is required. If you acquire the Company’s Shares, you will have no effective voice in the management of the Company. Such concentrated control of the Company may adversely affect the value of the Company’s Shares and could also limit the price that investors might be willing to pay in the future for the Company’s Shares.

The Company’s Operating Plan Relies in Large Part Upon Assumptions and Analyses Developed by The Company. If These Assumptions or Analyses Prove to Be Incorrect, The Company’s Actual Operating Results May Be Materially Different from The Company’s Forecasted Results

Whether actual operating results and business developments will be consistent with the Company’s expectations and assumptions as reflected in its forecasts depend on a number of factors, many of which are outside the Company’s control, including, but not limited to:

whether the Company can obtain sufficient capital to sustain and grow its business

the Company’s ability to manage its growth

whether the Company can manage relationships with key vendors and third parties

demand for the Company’s products and services

the timing and costs of new and existing marketing and promotional efforts

competition

the Company’s ability to retain existing key management, to integrate recent hires and to attract, retain and motivate qualified personnel

the overall strength and stability of domestic and international economies

consumer habits

Unfavorable changes in any of these or other factors, most of which are beyond the Company’s control, could materially and adversely affect its business, results of operations and financial condition.

To Date, The Company Has Had Operating Losses and Does Not Expect to Be Initially Profitable For At Least The Foreseeable Future, And Cannot Accurately Predict When It Might Become Profitable

The Company has been operating at a loss since the Company's inception, and the Company expects to continue to incur losses for the foreseeable future. Further, the Company may not be able to generate significant revenues in the future. In addition, the Company expects to incur substantial operating expenses in order to fund the expansion of the Company's business. As a result, The Company expects to continue to experience substantial negative cash flow for at least the foreseeable future and cannot predict when, or even if, the Company might become profitable.

The Company May Be Unable to Manage Their Growth or Implement Their Expansion Strategy

The Company may not be able to expand the Company's product and service offerings, the Company's markets, or implement the other features of the Company's business strategy at the rate or to the extent presently planned. The Company's projected growth will place a significant strain on the Company's administrative, operational and financial resources. If the Company is unable to successfully manage the Company's future growth, establish and continue to upgrade the Company's operating and financial control systems, recruit and hire necessary personnel or effectively manage unexpected expansion difficulties, the Company's financial condition and results of operations could be materially and adversely affected.

If The Company Is Unable to Effectively Protect Its Intellectual Property and Trade Secrets, It May Impair The Company’s Ability to Compete

The Company’s success will depend on its ability to obtain and maintain meaningful intellectual property protection for any Company intellectual property. The names and/or logos of Company brands may be challenged by holders of trademarks who file opposition notices, or otherwise contest, trademark applications by the Company for its brands. Similarly, domains owned and used by the Company may be challenged by others who contest the ability of the Company to use the domain name or URL. Patents, trademarks and copyrights that have been or may be obtained by the Company may be challenged by others, or enforcement of the patents, trademarks and copyrights may be required. The Company also relies upon, and will rely upon in the future, trade secrets. While the Company uses reasonable efforts to protect these trade secrets, the Company cannot assure that its employees, consultants, contractors or advisors will not, unintentionally or willfully, disclose the Company's trade secrets to competitors or other third parties. In addition, courts outside the United States are sometimes less willing to protect trade secrets. Moreover, the Company's competitors may independently develop equivalent knowledge, methods and know-how. If the Company is unable to defend the Company's trade secrets from others use, or if the Company's competitors develop equivalent knowledge, it could have a material adverse effect on the Company's business.