- STE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

STERIS (STE) DEF 14ADefinitive proxy

Filed: 7 Jun 23, 4:31pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only |

as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and0-11. |

Proxy Statement Notice of Annual Meeting of Shareholders Thursday, July 27, 2023 STERIS

STERIS plc

A public limited company incorporated in Ireland with company number 595593

Registered office: 70 Sir John Rogerson’s Quay

Dublin 2, Ireland

Directors: Dr. Esther M. Alegria (U.S.), Richard C. Breeden (U.S.), Daniel A. Carestio (U.S.), Cynthia L. Feldmann (U.S.), Christopher S. Holland (U.S.), Dr. Jacqueline B. Kosecoff (U.S.),

Paul E. Martin (U.S.), Dr. Nirav R. Shah (U.S.), Dr. Mohsen M. Sohi (U.S.) and Dr. Richard M. Steeves (British & Canadian)

To Our Shareholders:

The 2023 Annual General Meeting (“Annual Meeting”) of Shareholders of STERIS plc will be held at 9:00 a.m. Dublin Time (4:00 a.m. Eastern Daylight Saving Time), on Thursday, July 27, 2023 at 70 Sir John Rogerson’s Quay, Dublin 2, Ireland.

Should we determine that alternate Annual Meeting arrangements may be advisable or required, such as changing the date, time or location of the Annual Meeting, we will announce our decision by press release, post additional information at steris-ir.com, and make a public filing with the U.S. Securities and Exchange Commission (“SEC”). Regardless of whether you plan to attend in person, we also encourage shareholders to cast their votes prior to the Annual Meeting by one of the methods described in this Proxy Statement.

At the Annual Meeting, shareholders will be asked to vote on a number of matters described in the Notice of 2023 Annual Meeting of Shareholders, including the re-election of directors for terms expiring at the 2024 annual general meeting. We urge our shareholders to vote “FOR” for proposals 1 through 5 and 7 through 8, and every “ONE YEAR” for proposal 6, each as presented to shareholders and described in the Notice of 2023 Annual Meeting of Shareholders.

The formal Notice of 2023 Annual Meeting of Shareholders and the Proxy Statement containing information relative to the Annual Meeting follow this letter. We urge you to read the Proxy Statement carefully and use one of the specified alternative methods of voting to ensure that your shares will be voted at the 2023 Annual Meeting.

Please note that if you are a shareholder of record voting by proxy, your vote may not be counted unless it is received no later than 4:59 a.m. Dublin Time on Wednesday, July 26, 2023 (11:59 p.m. Eastern Daylight Saving Time on Tuesday, July 25, 2023).

Sincerely,

|  | |

| DANIEL A. CARESTIO | DR. MOHSEN M. SOHI | |

| President and Chief Executive Officer | Chairman of the Board |

STERIS plc

(A public limited company incorporated in Ireland with company number 595593)

NOTICE OF 2023 ANNUAL GENERAL MEETING OF SHAREHOLDERS

To the Holders of Ordinary Shares of STERIS plc:

The 2023 Annual General Meeting (the “Annual Meeting”) of shareholders of STERIS plc (the “Company,” “we,” “us,” or “our”) will be held on Thursday, July 27, 2023 at 9:00 a.m. Dublin Time (4:00 a.m. Eastern Daylight Saving Time) at 70 Sir John Rogerson’s Quay, Dublin 2, Ireland. Should we determine that alternative Annual Meeting arrangements may be advisable or required, such as changing the date, time or location of the Annual Meeting, we will announce our decision by press release, post additional information at steris-ir.com, and make a public filing with the U.S. Securities and Exchange Commission (“SEC”).

You are being asked to consider and vote on the resolutions described below at the Annual Meeting.

Shareholders of the Company will be asked to consider certain proposals that may not be familiar to them because, unlike many companies with shares traded on the New York Stock Exchange, we are incorporated under the laws of Ireland. The Irish Companies Act 2014, as amended (the “Irish Companies Act”) obligates us to propose certain matters to shareholders for approval that would generally not be subject to periodic approval by shareholders of companies incorporated in the United States but are considered routine items for approval by shareholders of companies incorporated in Ireland. Each proposal to be presented at the Annual Meeting is described more fully below.

Proposal 1—Ordinary resolutions to elect directors of the Company:

| a) | To re-elect Dr. Esther M. Alegria as a director of the Company. |

| b) | To re-elect Richard C. Breeden as a director of the Company. |

| c) | To re-elect Daniel A. Carestio as a director of the Company. |

| d) | To re-elect Cynthia L. Feldmann as a director of the Company. |

| e) | To re-elect Christopher S. Holland as a director of the Company. |

| f) | To re-elect Dr. Jacqueline B. Kosecoff as a director of the Company. |

| g) | To re-elect Paul E. Martin as a director of the Company. |

| h) | To re-elect Dr. Nirav R. Shah as a director of the Company. |

| i) | To re-elect Dr. Mohsen M. Sohi as a director of the Company. |

| j) | To re-elect Dr. Richard M. Steeves as a director of the Company. |

Proposal 2—Ordinary resolution regarding ratification of independent registered public accounting firm:

| 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending March 31, 2024. |

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

Proposal 3—Ordinary resolution to appoint Ernst & Young Chartered Accountants as our Irish statutory auditor:

| 3. | To appoint Ernst & Young Chartered Accountants as the Company’s statutory auditor under Irish law to hold office until the conclusion of the Company’s next annual general meeting. |

Proposal 4—Ordinary resolution regarding our Irish statutory auditor’s remuneration:

| 4. | To authorize the Board of Directors of the Company (the “Board”) or the Audit Committee of the Board to determine the remuneration of Ernst & Young Chartered Accountants as the Company’s statutory auditor under Irish law. |

Proposal 5—Advisory resolution (to be proposed as an ordinary resolution) on named executive officer compensation:

| 5. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed pursuant to the disclosure rules of the SEC, including the Compensation Discussion and Analysis and the tabular and narrative disclosure contained in the Company’s Proxy Statement dated June 7, 2023. |

Proposal 6—Advisory resolution (to be proposed as an ordinary resolution) on the frequency of the shareholder advisory vote on named executive officer compensation:

| 6. | To approve, on a non-binding advisory basis, whether the non-binding advisory vote on named executive officer compensation should be held every one, two, or three years. |

Proposal 7—Ordinary resolution regarding the renewal of the Board’s authority to issue shares under Irish law:

| 7. | To approve the renewal of the Board’s authority to issue authorized but unissued shares under Irish law (i) in an amount of up to 20% of the existing issued ordinary share capital of STERIS (calculated as of May 30, 2023) and (ii) until the earlier of the next annual general meeting of shareholders or the expiration of 15 months from the Annual Meeting. |

Proposal 8— Special resolution regarding the renewal of the Board’s authority to opt-out of statutory pre-emption rights under Irish law:

| 8. | To approve the renewal of the Board’s authority to opt-out of statutory pre-emption rights under Irish law regarding the issuance of shares for cash (i) in respect of up to 20% of the existing issued ordinary share capital of STERIS (calculated as of May 30, 2023), provided that, insofar as it relates to shares which represent greater than 10% in number of STERIS’s issued ordinary share capital (calculated as of May 30, 2023), such authority be used only for purposes of an acquisition or a specified capital investment, and (ii) until the earlier of the next annual general meeting of shareholders or the expiration of 15 months from the Annual Meeting. |

Proposal 9—Other business:

| 9. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Proposals 3, 4, 7 and 8 are items required to be approved by shareholders under the Irish Companies Act and generally do not have an analogous requirement under United States law.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

OUR BOARD OF DIRECTORS HAS DETERMINED THAT RESOLUTIONS FOR PROPOSALS 1, 2, 3, 4, 5, 7 AND 8 AND FOR EVERY “ONE YEAR” FOR THE RESOLUTION FOR PROPOSAL 6 TO BE VOTED UPON AT THE MEETING ARE IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS AS A WHOLE. OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” FOR ALL RESOLUTIONS FOR PROPOSALS 1, 2, 3, 4, 5, 7 AND 8 AND FOR EVERY “ONE YEAR” FOR THE RESOLUTION FOR PROPOSAL 6.

In accordance with our articles of association (the “Articles”), all resolutions will be taken on a poll. Voting on a poll means that each share represented in person or by proxy will be counted in the vote.

Proposals 1, 2, 3, 4, 5, 6, and 7 will be proposed as ordinary resolutions under Irish law. In each case, provided that a quorum is present, the relevant resolution must be passed by a simple majority of the votes cast for or against such resolution, whether in person or by proxy, in order to be approved. Proposal 8 will be proposed as a special resolution under Irish law. Provided that a quorum is present, Proposal 8 must be passed by 75% of the votes cast for or against such resolution, whether in person or by proxy, in order to be approved. Abstentions and broker non-votes will not affect the voting results for a resolution. In the case of joint holders, the vote of the senior holder who tenders a vote shall be accepted to the exclusion of the votes of the other joint holders (with seniority being determined by the order that the names of the joint holders appear in the Company’s share register). Explanatory notes regarding each of the proposals (and related resolutions) are set out in the relevant sections of the accompanying Proxy Statement relating to such proposals. Only shareholders of record of ordinary shares, par value $0.001 per share, of the Company (“Ordinary Shares”) at the close of business in New York on May 30, 2023 are entitled to notice of, and to attend, speak, ask questions and vote at the Annual Meeting and any adjournment thereof. In accordance with the provisions of the Irish Companies Act and in accordance with our Articles, a shareholder of record is entitled to appoint another person as his or her proxy (or, in the case of a corporation which is a shareholder of record, a corporate representative) to exercise all or any of their rights to attend and to speak and vote at the Annual Meeting. A shareholder of record may appoint more than one proxy in relation to the Annual Meeting (provided that each proxy is appointed to exercise the rights attached to a different share or shares). A proxy need not be a shareholder of record. When you vote by telephone, through the Internet or by returning a completed proxy card, this proxy will be given to certain Directors and executive officers of the Company.

Pursuant to the rules of the SEC, we provide access to our proxy materials through the Internet. As a result, prior to June 16, 2023, a Notice of Internet Availability of Proxy Materials will be mailed to certain shareholders as of the close of business in New York on May 30, 2023. On the date of mailing of the Notice of Internet Availability of Proxy Materials, shareholders will be able to access the proxy materials on a website referred to and at the URL address included in the Notice of Internet Availability of Proxy Materials and in the Proxy Statement. These proxy materials will be available free of charge. In addition, on or before June 30, 2023, we will also mail paper copies of the proxy materials to those shareholders as of the close of business on May 30, 2023 who have not consented to alternative delivery under Irish law or who have previously requested paper copies of the proxy materials.

Please note that if you are a shareholder of record voting by proxy, your vote may not be counted unless it is received no later than 4:59 a.m. Dublin Time on Wednesday, July 26, 2023 (11:59 p.m. Eastern Daylight Saving Time on Tuesday, July 25, 2023).

The results of the polls taken on the resolutions at the Annual Meeting and any other information required by the Irish Companies Act will be made available on the Company’s website as soon as reasonably practicable following the Annual Meeting and for a period of two years thereafter and filed with the SEC on a Form 8-K within four business days of the Annual Meeting.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

During the Annual Meeting, management will present, for consideration at the meeting, the Company’s statutory financial statements under Irish law for the fiscal year ended March 31, 2023 (and the report of the directors and the Irish statutory auditor thereon) together with a review of the Company’s affairs. There also will be an opportunity for questions and answers immediately following the formal portion of the Annual Meeting.

By Order of the Board of Directors,

J. Adam Zangerle

Company Secretary

The Company’s registered office is at 70 Sir John Rogerson’s Quay, Dublin 2, Ireland.

June 7, 2023

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on July 27, 2023. Our Proxy Statement for the Annual Meeting (which includes the notice of the Annual Meeting), the Annual Report to Shareholders (including the Company’s Annual Report on Form 10-K) for the fiscal year ended March 31, 2023 and the Company’s Directors’ Report and Consolidated Financial Statements under Irish law for the fiscal year ended March 31, 2023 (the “Irish Statutory Accounts”) are available at www.proxyvote.com if you are a shareholder of record and are collectively referred to as the “Proxy Materials.” You can also view these materials in the “Online IR Kit” in the “Shareholder Resources” section of steris-ir.com.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we encourage you to vote as promptly as possible by telephone, through the Internet or by requesting a paper proxy card to complete, sign and return by mail. Details of the deadlines for when your vote(s) must be submitted are described subsequently. If you attend the Annual Meeting in person, you may revoke your proxy and vote your shares in person.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

| STERIS plc | 70 Sir John Rogerson’s Quay Dublin 2, Ireland www.steris.com |

Annual General Meeting of Shareholders of the Company

July 27, 2023—9:00 a.m. Dublin Time (4:00 a.m. Eastern Daylight Saving Time)

PROXY STATEMENT

TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

PROPOSAL 5—ADVISORY RESOLUTION ON NAMED EXECUTIVE OFFICER COMPENSATION | 21 | |||

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement i

| Table of Contents |

| 86 | ||||

| 86 | ||||

| 87 | ||||

| 88 | ||||

| 89 | ||||

| 89 | ||||

| 90 | ||||

| 91 | ||||

| 92 | ||||

| 95 | ||||

| 97 | ||||

| 98 | ||||

| A-1 | ||||

ii Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

PROXY SUMMARY

|

This summary highlights certain information contained elsewhere in this Proxy Statement or in the other documents being distributed or made available to shareholders in conjunction with this Proxy Statement, but does not contain all the information you should consider prior to casting your vote. Therefore, you should read this entire Proxy Statement carefully before voting.

General Information

Meeting Date: | July 27, 2023 | |

Meeting Time: | 9:00 a.m. Dublin Time (4:00 a.m. Eastern Daylight Saving Time) | |

Meeting Location: | 70 Sir John Rogerson’s Quay Dublin 2, Ireland | |

Record Date: | Close of business in New York May 30, 2023 | |

Stock Symbol: | STE | |

Exchange: | New York Stock Exchange | |

Shares Outstanding on Record Date: | 98,650,991 Ordinary Shares | |

Registrar and Transfer Agent: | Computershare | |

Jurisdiction of Formation: | Ireland | |

Year of Incorporation: | 2016 (Predecessors, 2014 and 1985, respectively) | |

Public Company Since: | 2019 (Predecessors, 2015 and 1992, respectively) | |

Corporate Website: | www.steris.com | |

Date Proxy Materials First Furnished to Shareholders: | On or about June 9, 2023 | |

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 1

| Proxy Summary: Financial and Operating Highlights |

Financial and Operating Highlights

Fiscal 2023 was another year of growth for STERIS. Despite macro challenges, we ended our year strong and grew revenue 8%. We are cautiously optimistic that the past year’s supply chain challenges have eased in a meaningful way and surgical procedure rates are improving. Our fourth quarter and full year are reflective of that, as well as our expectations for the new fiscal year.

Due to the strength of our balance sheet and cost management, we were able to continue to invest in new product development, and also invest in expansion through acquisition.

• As reported full year revenues increased 8.1% to $4,957.8 million, compared with $4,585.1 million in fiscal 2022. |

• As reported full year net income declined to $107.0 million, or $1.07 per diluted share, compared with $243.9 million, or $2.48 per diluted share, in the prior year. Net income was negatively impacted by a $490.6 pre-tax, non-cash impairment charge related to the goodwill associated with the Dental segment purchased from Cantel Medical. |

• Full year adjusted net income (see Appendix A) increased 5.6% to $822.2 million, or $8.20 per diluted share, compared with $778.9 million, or $7.92 per diluted share, in fiscal 2022.(1) |

• Cash flows provided by operations for fiscal 2023 increased 10.5% to $756.9 million, compared with $684.8 million in fiscal 2022. |

• Free cash flow (see Appendix A) for fiscal 2023 increased 2.7% to $409.6 million, compared with $399.0 million in the prior year.(1) |

• We increased our dividend for the 17th consecutive year in the second quarter of fiscal 2023. |

| (1) | Adjusted Net Income and Free Cash Flow, which are referenced in this Proxy Summary, are financial measures not prepared in accordance with Accounting Principles Generally Accepted in the United States (“GAAP”). For a discussion of these non-GAAP financial measures refer to Appendix A for definitions and the reconciliation to the most directly comparable GAAP measures. |

2 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

| Proxy Summary: Director Nominee Highlights |

Director Nominee Highlights

Each of the ten director nominees is elected annually by a majority of votes cast. Select information regarding each director is specified below. For more information about our nominees, see pages 13 through 17 of this Proxy Statement.

| Board Committee Memberships at 3/31/23 | ||||||||||||||||||

| Name | Age | Director Since | Independent | Audit | Compensation and Organization Development | Nominating and Governance | Compliance and Technology | Other Public Company Boards | Diversity | |||||||||

Dr. Esther M. Alegria Founder and Chief Executive Officer of APIE Therapeutics, Inc. | 64 | 2023 | ✓ | 1 | ✓ | |||||||||||||

Richard C. Breeden Chairman & CEO Breeden Capital Management | 73 | 2008 | ✓ |

| ✓ | — | ||||||||||||

Daniel A. Carestio President and CEO STERIS | 50 | 2021 | ✓ | — | ||||||||||||||

Cynthia L. Feldmann Former President & Founder Jetty Lane Associates | 70 | 2005 | ✓ | ✓ |

| 3 | ✓ | |||||||||||

Christopher S. Holland Former Senior VP & CFO C.R. Bard | 56 | 2020 | ✓ | ✓ | ✓ | 1 | ||||||||||||

Dr. Jacqueline B. Kosecoff Managing Partner, Moriah Partners, LLC | 73 | 2003 | ✓ |

| ✓ | 4(1) | ✓ | |||||||||||

Paul E. Martin Former Senior V.P. & CIO Baxter International | 65 | 2021 | ✓ | ✓ | ✓ | 3 | ✓ | |||||||||||

Dr. Nirav R. Shah Member of Stanford University Faculty | 51 | 2018 | ✓ | ✓ | ✓ | — | ✓ | |||||||||||

Dr. Mohsen M. Sohi CEO of Freudenberg SE | 64 | 2005 | ✓ | 1 | ||||||||||||||

Dr. Richard M. Steeves Former CEO and Director of Synergy Health | 61 | 2015 | ✓ | ✓ |

| — | ||||||||||||

= Chairperson

= Chairperson

| (1) | Dr. Kosecoff has resigned from the Board of GoodRx Holdings effective June 30, 2023. |

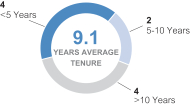

Tenure Balance

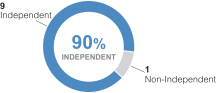

| Independence

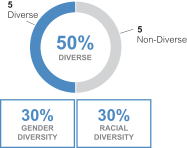

| Diversity

| ||

|  |  |

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 3

| Proxy Summary: Director Skills Matrix |

Director Skills Matrix

Our Nominating and Governance Committee and our Board are focused on ensuring that a wide range of backgrounds, attributes, viewpoints and experiences are represented on our Board. The chart below highlights the diverse and balanced mix of attributes and experiences of the Board as a whole. While the matrix is useful for determining the collective skills of the Board as a whole, it is not a comparative measure of the value of any director. Each mark ● indicates an experiential strength that was self-selected by each director.

Capital Markets and Investment

| ● ● ● ● ● ● 〇 〇 〇 〇 | 60% | ||

Corporate Governance

| ● ● ● ● ● ● ● ● 〇 〇 | 80% | ||

Executive Leadership

| ● ● ● ● ● ● ● ● ● ● | 100% | ||

Financial Literacy

| ● ● ● ● ● ● 〇 〇 〇 〇 | 60% | ||

Global Experience

| ● ● ● ● ● ● ● ● 〇 〇 | 80% | ||

Human Capital Management

| ● ● ● ● ● ● 〇 〇 〇 〇 | 60% | ||

Industry & Operations

| ● ● ● ● ● ● ● ● ● 〇 | 90% | ||

Mergers & Acquisition

| ● ● ● ● ● ● ● 〇 〇 〇 | 70% | ||

Public Company Board Experience

| ● ● ● ● ● ● ● ● 〇 〇 | 80% | ||

Regulatory Compliance and Public Policy

| ● ● ● ● ● ● ● ● ● 〇 | 90% | ||

Sustainability/ESG

| ● ● ● ● ● ● ● 〇 〇 〇 | 70% | ||

Technology Management & Cybersecurity

| ● ● ● ● ● ● ● 〇 〇 〇 | 70% |

4 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

| Proxy Summary: Governance Highlights |

Governance Highlights

• Strong Board independence (all but one of our director nominees are independent); |

• All members of the Audit, Compensation and Organization Development and Nominating and Governance Committees are independent; |

• Annual election of directors; |

• Board conducts annual self-evaluation; |

• Independent non-employee Chairman of the Board; if the Company does not have an independent Chairman, a lead independent director will preside over executive sessions of independent directors (which will occur at least every other regularly scheduled Board meeting); |

• Robust stock ownership guidelines for non-employee directors and officers and other key managers; |

• Clawback policies applicable in specified situations to incentive compensation and equity awards; |

• No hedging or pledging or short sales of our shares is permitted by our directors, officers or employees; |

• Annual compensation risk assessment; |

• Incentive-based compensation programs linked to performance; and |

• No shareholder rights plan (Poison Pill). |

Chief Executive Officer Compensation Highlights

Our Fiscal 2023 Compensation Programs Reward the Performance of Daniel Carestio, our President and Chief Executive Officer (“CEO”). Our 2023 compensation programs were intended to reward our CEO for generating value for our shareholders, as demonstrated by the following:

• 87.5% of total compensation delivered to our CEO was variable; |

• 100% of annual incentive compensation delivered to our CEO was tied to annual financial performance measures based on EBIT and Free Cash Flow paying out an aggregate amount of $602,884 at 50% of target for fiscal 2023 with no adjustments based upon personal achievement; |

• 65% of variable Long Term Incentive Plan (“LTIP”) opportunity was delivered to our CEO in the form of premium-price stock options, subject to an exercise price equal to 110% of the closing price per share of our Ordinary Shares on the grant date and pro-rata four-year vesting conditions; and |

• 35% of variable LTIP opportunity was delivered to our CEO in the form of restricted stock, subject to pro-rata four-year vesting conditions. |

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 5

| Proxy Summary: Summary of Voting Proposals and Board Recommendations |

Summary of Voting Proposals and Board Recommendations

Proposal Number | Proposal | Board Voting Recommendation | ||||

| No. 1 | By separate resolutions, to elect as directors the 10 nominees named in the Proxy Statement. | | FOR EACH | | ||

All of the directors nominated by the Board to stand for election as directors of the Company are incumbent directors. Each nominee, if elected, will serve as a director for a term expiring at the next annual general meeting of shareholders and until his or her successor is duly elected and qualified.

|

| |||||

No. 2 |

To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending March 31, 2024. | FOR | ||||

Our Audit Committee has appointed Ernst & Young LLP as the independent registered public accounting firm to audit our books and records for the year ending March 31, 2024. Ernst & Young LLP has acted as auditor for our predecessor since our predecessor was re-registered as a public limited company under the laws of England and Wales in November 2015 and previously served as auditor of STERIS Corporation for many years. We are offering shareholders the opportunity to ratify the appointment of our independent registered public accounting firm as a matter of good corporate governance practice.

|

| |||||

No. 3 |

To appoint Ernst & Young Chartered Accountants as the Company’s Irish statutory auditor to hold office until the conclusion of the Company’s next annual general meeting. | FOR | ||||

The Irish Companies Act requires that statutory auditor(s) be appointed at each annual general meeting of shareholders, to hold office from the conclusion of the annual general meeting until the conclusion of the next annual general meeting. Our Audit Committee has recommended that Ernst & Young Chartered Accountants be appointed as our Irish statutory auditor to hold office from the conclusion of the Annual Meeting of the shareholders of the Company until the conclusion of the next annual general meeting of the shareholders of the Company. Ernst & Young Chartered Accountants are based in Dublin and are affiliated with Ernst & Young LLP, who served as our predecessor’s U.K. statutory auditor from 2015 to 2019. If this proposal is not approved by the shareholders, the Board may appoint the Irish statutory auditor.

|

| |||||

No. 4 |

To authorize the Board of Directors of the Company or the Audit Committee of the Board to determine the remuneration of Ernst & Young Chartered Accountants as the Company’s Irish statutory auditor. | FOR | ||||

Under the Irish Companies Act, the remuneration of the Irish statutory auditor must be fixed by the shareholders at a general meeting or in such other manner as the shareholders may determine thereat. This resolution authorizes our Board or the Audit Committee of our Board to determine the remuneration of Ernst & Young Chartered Accountants as the Company’s Irish statutory auditors.

|

| |||||

6 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

| Proxy Summary: Summary of Voting Proposals and Board Recommendations |

Proposal Number | Proposal | Board Voting Recommendation | ||||

| No. 5 | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed pursuant to the disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis and the tabular and narrative disclosure contained in the Company’s Proxy Statement dated June 7, 2023. | FOR | ||||

U.S. law requires that the shareholders periodically vote on a non-binding advisory basis on the compensation of our “named executive officers” as disclosed herein. Our shareholders have determined on a non-binding advisory basis that we should hold this vote every year, and our Board has concurred with this vote as a matter of good corporate governance practice.

|

| |||||

No. 6 |

To approve, on a non-binding advisory basis, the frequency of future votes on the compensation of named executive officers. | | ONE YEAR | | ||

U.S. law requires that the shareholders vote at least every six years on a non-binding advisory basis on the frequency of future non-binding advisory votes on the compensation of our named executive officers.

|

| |||||

No. 7 |

To approve the renewal of the Board’s authority to issue shares under Irish law | FOR | ||||

The Directors currently have authority under Irish law to issue shares and to grant rights to acquire shares (e.g., pursuant to options, warrants and other convertible securities), including shares that are part of STERIS’s authorized but unissued share capital. This resolution, which requires shareholder approval, authorizes the renewal of the Board’s authority to issue authorized but unissued shares under Irish law (i) in an amount of up to 20% of the existing issued ordinary share capital of STERIS (calculated as of May 30, 2023) and (ii) until the earlier of the next annual general meeting or the expiration of 15 months.

|

| |||||

No. 8 |

To approve the renewal of the Board’s authority to opt-out of statutory pre-emption rights under Irish law | FOR | ||||

The Directors currently have authority under Irish law to opt-out of statutory pre-emption rights pursuant to the Articles. Under Irish law, unless its directors are otherwise authorized and empowered to opt-out, when an Irish public limited company proposes to issue, or grant rights to acquire, shares for cash, the company is required to first offer those shares or rights on the same or more favorable terms to existing shareholders of the company on a pro-rata basis (commonly referred to as statutory pre-emption rights). This resolution authorizes the renewal of the Board’s authority to opt-out of statutory pre-emption rights under Irish law in respect of the issuance of shares for cash (i) in respect of up to 20% of the existing issued ordinary share capital of STERIS (calculated as of May 30, 2023), provided that, insofar as it relates to shares which represent greater than 10% in number of STERIS’s issued ordinary share capital (calculated as of May 30, 2023), such authority be used only for purposes of an acquisition or a specified capital investment, and (ii) until the earlier of the next annual general meeting or the expiration of 15 months.

|

| |||||

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 7

| Proxy Summary: Summary of Voting Proposals and Board Recommendations |

Proposal Number | Proposal | Board Voting Recommendation | ||||

No. 9 |

To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. | FOR | ||||

We are not aware of any other proposals that may come before the Annual Meeting. This proposal authorizes the proxy holders to vote on any other business that may properly come before that meeting in their best judgment and to the extent permitted by applicable law with respect to such matters in their discretion.

|

| |||||

8 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

GENERAL INFORMATION

|

Proxy Voting and Solicitation of Proxies

This Proxy Statement was furnished beginning on or about June 9, 2023, to the shareholders of STERIS plc (“STERIS,” the “Company,” “we,” “us,” or “our”) of record as of the close of the stock transfer books on May 30, 2023. This Proxy Statement is provided in connection with the solicitation by the Board of Directors of proxies for the 2023 Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held at 9:00 a.m. Dublin Time (4:00 a.m. Eastern Daylight Saving Time), on Thursday, July 27, 2023, at 70 Sir Rogerson’s Quay, Dublin 2, Ireland. The cost of soliciting the proxies will be borne by the Company. Directors, officers, and designated employees of the Company and affiliates may solicit proxies in person, by mail, by telephone, fax, or email. They will not receive any additional compensation for these activities. STERIS has engaged a professional proxy solicitation firm, Georgeson LLC (“Georgeson”), to assist in tracking voting with brokers, banks and other institutional holders. The Company will pay Georgeson a fee of approximately $16,500 for these services. Additional shareholder meeting services may be provided for additional fees.

As permitted by rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we are making this Proxy Statement, and our 2023 Annual Report to shareholders, which includes STERIS’s Annual Report on Form 10-K (the “Annual Report”), and the Irish Statutory Accounts available at www.proxyvote.com. If you received a Notice of Internet Availability (“Notice of Internet Availability”) regarding this availability, the Notice of Internet Availability instructs you how to access and review the Proxy Statement, the Annual Report and our Irish Statutory Accounts, as well as the alternative methods to vote your shares—over the Internet, by telephone, or by mailing a completed form of proxy (if requested). If you received a Notice of Internet Availability and would like to receive a printed copy of the Proxy Materials, you should follow the instructions in the Notice of Internet Availability for requesting such materials.

If you received a printed copy of the Proxy Materials, the Company offers the opportunity to electronically receive future proxy statements and annual reports over the Internet. By using this service, you are not only able to access these materials more quickly, but you are also helping STERIS save resources and reduce printing and postage costs.

Voting and Annual Meeting Attendance

As of the record date set by the Board of Directors (May 30, 2023), the Company had 98,650,991 Ordinary Shares outstanding and entitled to notice of, and to attend, speak, ask questions and vote at the Annual Meeting, each of which is entitled to one vote.

We encourage you to vote by proxy in advance of the Annual Meeting, even if you plan on attending in person.

To attend the meeting in person, you must present valid photo identification, such as a driver’s license or passport. If you are a beneficial owner and not a shareholder of record, you also must present a letter from your broker or other nominee showing that you were the beneficial owner of the shares on the record date together with a legal proxy from your broker or other nominee to vote your shares in person at the Annual Meeting.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 9

| General Information: Redomiciliation and Combination |

If you are a shareholder of record, you may appoint a proxy to attend, speak, ask questions and vote on your behalf using any of the following methods:

| • | through the Internet, as instructed on the proxy card or the Notice of Internet Availability; |

| • | by telephone using the toll-free telephone number shown on the proxy card or the Notice of Internet Availability; or |

| • | if you received the Proxy Materials by mail or if you request a paper proxy card by telephone or through the Internet, you may elect to vote by mail by completing and signing the proxy card and returning it in the prepaid envelope provided to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, United States of America (which will, upon receipt, be forwarded to the Company’s registered office in Ireland electronically) or otherwise depositing it at the Company’s registered office in Ireland. |

To be valid, a proxy must be received using one of such procedures by no later than 4:59 a.m. Dublin Time on Wednesday, July 26, 2023 (11:59 p.m. Eastern Daylight Saving Time on Tuesday, July 25, 2023) (or in the case of any adjournment thereof, such later time as may be announced by the Company, not being greater than 48 hours before the adjourned meeting).

We have retained Broadridge Financial Solutions (“Broadridge”) to distribute, receive, count and tabulate proxies.

Redomiciliation and Combination

The Company is a public limited company incorporated under the laws of Ireland. On March 28, 2019, upon the consummation of a scheme of arrangement under the laws of the United Kingdom (“the Redomiciliation”), the Company became the owner of the entire issued ordinary share capital of STERIS plc, a company organized under the laws of the United Kingdom and since renamed “STERIS Limited” (“Old STERIS”). Previously, on November 2, 2015, pursuant to a combination under U.K. law (the “Combination”), STERIS Corporation became a wholly-owned indirect subsidiary of Old STERIS and Synergy Health plc became a wholly-owned direct subsidiary of Old STERIS.

References in this Proxy Statement to the actions of “the Company,” “us,” “we” or “STERIS” (or its Board of Directors, Committees of its Board of Directors, or its Directors and/or officers) or any similar references relating to periods from and after the consummation of the Redomiciliation should be construed as references to the actions of the Company (or where appropriate, its Board of Directors, Committees of its Board or its Directors and/or officers) unless the context requires otherwise, and references in this Proxy Statement to the actions of “the Company,” “us,” “we” or “STERIS” (or its Board of Directors, Committees of its Board of Directors, or any of its Directors and/or officers) or any similar references relating to periods before the consummation of the Redomiciliation should be construed as references to the actions of Old STERIS or STERIS Corporation, as applicable (or, where appropriate, their respective Boards of Directors, Committees of their respective Board of Directors, or their respective Directors and/or officers) unless the context requires otherwise.

STERIS’s Annual Report to Shareholders, which includes STERIS’s Annual Report on Form 10-K, including consolidated financial statements for the year ended March 31, 2023, but excluding exhibits, and STERIS’s Irish Statutory Accounts accompany this Proxy Statement. Requests for copies of exhibits to STERIS’s Annual Report on Form 10-K should be submitted to the Office of the Company Secretary, STERIS plc, 70 Sir John Rogerson’s Quay, Dublin 2, Ireland. A nominal fee may be charged for Exhibits (which fee will be limited to the expenses

10 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

| General Information: Votes Required to Adopt Proposals |

we incur in providing you with the requested exhibits). STERIS’s Annual Report on Form 10-K, including exhibits, and STERIS’s Irish Statutory Accounts are also available free of charge through our website in the “Online IR Kit” in the “Shareholder Resources” section of steris-ir.com. Nothing contained on or accessible through that website shall be deemed to be part of this Proxy Statement.

Votes Required to Adopt Proposals

Ordinary Shares represented by properly executed proxies will be voted in accordance with the specifications made thereon. If no specification is made, proxies will be voted “FOR” proposals 1 through 5 and 7 through 8, and for every “ONE YEAR” for proposal 6 contained in the foregoing Notice of 2023 Annual Meeting of Shareholders.

The proposal to elect directors is presented as separate ordinary resolutions. Each Director nominee will be elected, assuming a quorum is present, if a majority of the votes cast are in favor of his or her election. Proposals 2, 3, 4, 5, 6, and 7 will be proposed as ordinary resolutions under Irish law. In each case, provided that a quorum is present, the relevant resolution must be passed by a simple majority of the votes cast for or against such resolution, whether in person or by proxy, in order to be approved. Proposal 8 will be proposed as a special resolution under Irish law. Provided that a quorum is present, Proposal 8 must be passed by 75% of the votes cast for or against such resolution, whether in person or by proxy, in order to be approved.

Abstentions and broker non-votes are tabulated in determining the votes present at a meeting for purposes of determining a quorum. An abstention or broker non-vote also will have no effect on the passage of any of these proposals as the abstention or broker non-vote will not be counted in determining the number of votes cast.

Shareholder votes will be tabulated by a representative of Broadridge, our independent inspector of elections for the Annual Meeting.

Purposes of Annual Meeting

The Annual Meeting has been called for the purposes set forth in the foregoing notice of Annual Meeting. The persons named in the accompanying proxy form have been selected by the Board of Directors and will vote shares represented by valid proxies. They have indicated that, unless otherwise specified in the proxy, they intend to vote “FOR” for proposals 1 through 5 and 7 through 8, and for every “ONE YEAR” for proposal 6.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 11

PROPOSAL 1—RESOLUTIONS REGARDING THE ELECTION OF DIRECTORS

|

All ten of the current members of our Board of Directors (the “Board” or “Board of Directors”) have been nominated for and are standing for re-election at the Annual Meeting. The Nominating and Governance Committee recommended the ten nominees to serve on the Board for an additional term. All nominees for Director have consented to be named and have agreed to serve as Directors, if re-elected. We have no reason to believe that any of the nominees will not be available to serve as a Director. However, if any nominee should become unavailable to serve for any reason, the proxies will be voted for such substitute nominees as may be designated by the Board.

The term of each re-elected Director will expire at the next annual general meeting of shareholders, and each Director will continue in office until the election and qualification of his or her respective successor or until his or her earlier death, removal or resignation. Under the terms of the Company’s current Articles, the Board shall consist of such number of Directors as the Board may determine from time to time (subject to a maximum of fifteen and a minimum of seven). The size of the Board is currently set at ten members. Proxies cannot be voted for a greater number of directors than the ten nominees as identified in this Proxy Statement.

Each of the ten nominees for Director will be elected by the vote of a majority of the votes cast with respect to such nominee, which means that the number of votes cast for a nominee must exceed the number of votes cast against that nominee. A shareholder may: (i) vote for the election of a nominee; (ii) vote against the election of a nominee; or (iii) abstain from voting for a nominee. For purposes of determining the outcome of the vote, abstentions will not be considered “votes cast.”

Unless a proxy contains instructions to the contrary, it is assumed that the proxy will be voted FOR the re-election of each nominee for Director named on the following pages.

STERIS values a number of attributes and criteria when identifying nominees to serve as a Director, including professional background, expertise, reputation for integrity, business, financial and management experience, leadership capabilities, time availability, and diversity. In addition to the specific experience and qualifications set forth below, we believe all of the nominees are individuals with a reputation for integrity, demonstrate strong leadership capabilities, and are able to work collaboratively to make contributions to the Board and Company.

12 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

| Proposal 1: Nominees for Election as Directors |

Nominees for Election as Directors

Biographical and other background information concerning each nominee for Director is set forth below. This information includes each nominee’s principal occupation as well as a discussion of the specific experience, qualifications, attributes, and skills of each nominee that led to the Board’s conclusion that such nominee should serve as a Director. Ages and other biographical information provided for all Directors are as of June 7, 2023. In addition, set forth below is the period during which each nominee has served as a Director of STERIS. For those persons who served as Directors or executives of Old STERIS immediately prior to the Redomiciliation and STERIS Corporation immediately prior to the Combination, the specified period includes their periods of service as Directors or executives of Old STERIS or STERIS Corporation, as the case may be, as STERIS’s predecessors. The information presented below has been confirmed by each nominee for purposes of its inclusion in this Proxy Statement.

| Dr. Esther M. Alegria

Dr. Alegria has served as the Founder and Chief Executive Officer of APIE Therapeutics, a preclinical stage pharmaceutical company, since 2020. Dr. Alegria was recommended to the Nominating and Governance Committee for her initial election to the Company’s Board by a third-party search firm. From 2016 to 2020, Dr. Alegria served as the President and Senior Executive Advisor at Catalyst Excel & Advance, an advisory firm providing operational guidance to senior executives working to launch new pharmaceutical and biopharmaceutical companies. From 2005 to 2015, Dr. Alegria held positions of increasing responsibility at Biogen, Inc., most recently as Senior Vice President, Global Manufacturing, where she was responsible for the company’s successful manufacturing operations in Denmark, Massachusetts and North Carolina. Prior to 2005, Dr. Alegria held positions at Banner Pharmacaps, Inc. and Wyeth LLC. Since 2021, Dr. Alegria has served as a director and member of the Audit and Corporate Governance committees of AVID Bioservices, Inc.

Qualifications. Dr. Alegria’s extensive operational and leadership experience in the biopharmaceutical industry provides our Board insight regarding the operational and strategic challenges facing STERIS’s Life Sciences and Applied Sterilization Technologies segments. | |

Founder and Chief Executive

Director since: 2023

Age: 64

Committees:

None

|

| Richard C. Breeden

Mr. Breeden has served as Chairman and Chief Executive Officer of Breeden Capital Management LLC since 2005. Since 1996 he has also been Chairman of Richard C. Breeden & Co., LLC, a professional services firm providing consulting services. Mr. Breeden also leads RCB Fund Services LLC, a firm providing claims management services to U.S. government agencies. Mr. Breeden has previously handled asset distributions to victims of unlawful conduct at WorldCom, Enron, Adelphia, Royal Dutch Shell, British Petroleum, JPMorgan Chase, and other companies. Mr. Breeden served as Chairman of the SEC from 1989 to 1993.

Qualifications. Mr. Breeden’s experience as Chairman of the SEC, CEO of an investment advisory firm, and a director of several public companies provides our Board with extensive managerial, governance and regulatory insights regarding issues facing public companies. As an investor, Mr. Breeden also provides valuable insight on issues such as shareholder return, executive compensation programs, and capital structure. | |

Chairman and Chief Executive Officer of Breeden Capital Management LLC

Director since: 2008

Age: 73

Committees:

Audit Committee (Chair) Nominating and Governance Committee |

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 13

| Proposal 1: Nominees for Election as Directors |

| Daniel A. Carestio

Mr. Carestio has served as President and CEO of the Company since July 2021. He served as Senior Vice President and Chief Operating Officer from August 2018 to July 2021. He served as Senior Vice President, Sterilization and Disinfection from February 2018 to July 2018 and as Senior Vice President, STERIS Applied Sterilization Technologies and Life Sciences from August 2015 to February 2018.

Qualifications. Mr. Carestio’s many years of experience in all operating aspects of STERIS’s business and familiarity with healthcare and related industries and the Company’s Customers. Mr. Carestio leads the management team, assists the Board in its oversight of the Company, and provides unique perspectives into healthcare and related industries and our operations, direction and strategies. | |

President and Chief Executive Officer of STERIS plc

Director since: 2021

Age: 50

Committees:

Compliance and Technology Committee |

| Cynthia L. Feldmann

Ms. Feldmann is a retired certified public accountant with a Bachelor of Science in Accounting from Boston College and 27 years of experience in two large global accounting firms. From 2003 to 2005, Ms. Feldmann served as the Life Sciences Business Development Officer for the Boston law firm Palmer & Dodge, LLP. From 1994 to 2002, Ms. Feldmann was a partner with KPMG LLP, primarily serving as Partner-in-Charge of its National Medical Technologies Practice. From 1975 to 1994, Ms. Feldmann was employed by Coopers & Lybrand (now PricewaterhouseCoopers LLP), and during that time was named Partner-in-Charge of its life sciences practice. Ms. Feldmann served as a director of Hanger, Inc. until January 2018. Ms. Feldmann is a director of, and a member of the Nominating Committee and chairs the Audit Committee of UFP Technologies, Inc. and is a director of and chair of the Audit Committee of Frequency Therapeutics, and is a director of and serves on the Science, Agtech and & Technology Committee of Alexandria Real Estate Equities, Inc.

Qualifications. Ms. Feldmann’s experience as Partner-in-Charge of a national medical technologies practice and Life Sciences practice for leading public accounting firms and director of publicly traded companies. Ms. Feldmann’s overall experience and financial expertise supports the Board’s oversight of critical financial policy, reporting, and risk matters encountered by public companies. | |

Retired, Former President and Founder of Jetty Lane Associates

Director since: 2005

Age: 70

Committees:

Audit Committee Nominating and Governance Committee (Chair) |

14 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

| Proposal 1: Nominees for Election as Directors |

| Christopher S. Holland

Mr. Holland is former Senior Vice President and Chief Financial Officer of C.R. Bard, a developer, manufacturer, and marketer of medical technologies, from May 2012 until its December 2017 acquisition by Becton, Dickinson and Company. From 2015 through 2017, Mr. Holland’s responsibilities also included business development, corporate marketing, reimbursement, healthcare economics and strategy. From 2013 through 2015, he also had operating responsibility for Bard Medical Division. Earlier, Mr. Holland was Senior VP, Finance, and Treasurer of Aramark Corporation, a global provider of food, facilities and uniform services, from 2006 through 2012, and Vice President and Treasurer from 2003 to 2006. Prior to joining Aramark, he served as Vice President and medical device sector head at J.P. Morgan and Company, Inc. from 1999 to 2003. Prior to that, Mr. Holland held various positions of increasing responsibility at J.P. Morgan. He also has served as a director of Jabil Inc. since January 2018 and is Chair of the Audit Committee and a member of the Cybersecurity Committee of Jabil Inc.

Qualifications. Mr. Holland’s thirty plus years of combined professional experience as a finance executive and investment banker, including experience as the CFO of a publicly traded medical technologies company. Mr. Holland’s extensive financial experience and experience relating to the healthcare industry, medical devices and technology, provide our Board with invaluable experience and expertise relative to those matters. | |

Retired, Former Senior Vice President and Chief Financial Officer of C.R. Bard

Director since: 2020

Age: 56

Committees:

Audit Committee Compensation and Organization Development Committee

|

| Dr. Jacqueline B. Kosecoff

Dr. Kosecoff is Managing Partner of Moriah Partners, LLC, a private equity firm focused on health services and technology since 2012, and Senior Advisor to Warburg Pincus LLC, a private equity fund. She also has served as a member of the Executive Advisory Board of SAP America, Inc., a software and enterprise applications provider, from November 2010 through May 2017. From October 2007 to November 2011, Dr. Kosecoff served as Chief Executive Officer of OptumRx (formerly named Prescriptions Solutions), a pharmacy benefits management company and subsidiary of UnitedHealth Group, and continued to serve as a senior advisor to OptumRx from December 2011 to February 2012. Dr. Kosecoff served as Chief Executive Officer of Ovations Pharmacy Solutions, a UnitedHealth Group company, from December 2005 to October 2007. From July 2002 to December 2005, Dr. Kosecoff served as Executive Vice President, Specialty Companies, of PacifiCare Health Systems, Inc., one of the nation’s largest consumer health organizations. From 1998 to 2002, Dr. Kosecoff was President and Founder of Protocare, Inc., a firm involved in the development and testing of drugs, devices, biopharmaceutical and nutritional products, and consulting and analytic services. Dr. Kosecoff is currently a director of Houlihan Lokey, TriNet Group, Inc. and Alignment Healthcare. Dr. Kosecoff has resigned from the Board of GoodRx Holdings effective June 30, 2023. Dr. Kosecoff previously served as a director of athenahealth, Inc. until February 2019 and of Sealed Air Corporation until May 2021.

Qualifications. Dr. Kosecoff’s experience as Chief Executive Officer for a number of large healthcare organizations and a director of publicly traded companies. Dr. Kosecoff’s background provides our Board with extensive managerial, government and regulatory experiences, and insight in the healthcare industry. | |

Managing Partner of Moriah Partners, LLC

Director since: 2003

Age: 73

Committees:

Compensation and Organization Development Committee (Chair) Nominating and Governance Committee

|

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 15

| Proposal 1: Nominees for Election as Directors |

| Paul E. Martin

Mr. Martin is former Senior Vice President & Chief Information Officer of Baxter International, a multinational health care company, from January 2011 to October 2020. Mr. Martin serves as director of Unisys Corporation, is a member of its Audit and Finance Committee and Chair of its Security and Risk Committee. Mr. Martin also serves as director of Owens Corning and is a member of the Audit and Finance Committees. From January 2021 to October 2022, Mr. Martin served as a member of the board of directors of Ping Identity Holding Corp.

Qualifications. Mr. Martin’s extensive professional management experience as an information technology executive, his technology and security risk experience and his financial experience. Mr. Martin’s IT experience as well as international experience and life sciences and healthcare experience provide the Company with invaluable resources and strengthen our Board’s oversight of information security and healthcare matters. | |

Retired, Former Senior Vice President & Chief Information Officer of Baxter International

Director since: 2021

Age: 65

Committees:

Compensation and Organization Development Committee Compliance and Technology Committee |

| Dr. Nirav R. Shah

Dr. Shah has served on the faculty of Stanford University since August 2018 and as Chief Medical Officer of American Health Associates since March 2022. Previously, Dr. Shah served from July 2020 through March 2022 as Chief Medical Officer of doc.ai, inc., and its successor, Sharecare Inc., a digital healthcare platform company. Dr. Shah also served as Commissioner of Health of the State of New York from January 2011 to May 2014 and as Senior Vice President and Chief Operating Officer for Clinical Operations for Kaiser Permanente Southern California from May 2014 to October 2017. Dr. Shah is a graduate of Harvard College and Yale School of Medicine and is Board Certified in Internal Medicine.

Qualifications. Dr. Shah’s experience at one of the nation’s leading public health agencies and service as COO for Clinical Operations of one of America’s leading health care providers and not-for-profit health plans. Dr. Shah provides the Board with years of policy and regulatory experience, management experience in our industry and experience as a practicing physician, as well as a new area of focus in innovative models in healthcare. | |

Professor at Stanford University and Chief Medical Officer of American Health Associates

Director since: 2018

Age: 51

Committees:

Compensation and Organization Development Committee Compliance and Technology Committee |

16 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

| Proposal 1: Nominees for Election as Directors |

Chief Executive Officer at Freudenberg SE

Director since: 2005

Age: 64

Committees:

None | Dr. Mohsen M. Sohi

Since July 2012, Dr. Sohi has served as Chief Executive Officer of Freudenberg SE, a general multi-industry company serving industries that include automotive, medical, aerospace, oil and gas, and power generation and transmission. From July 2010 to June 2012, Dr. Sohi served as Managing Partner of Freudenberg and Co. From March 2003 through June 2010, Dr. Sohi served as President and Chief Executive Officer of Freudenberg-NOK, a privately-held joint venture partnership between Freudenberg and NOK Corp. of Japan, one of the world’s largest producers of elastomeric seals and custom molded products for automotive and other applications. From January 2001 to March 2003, Dr. Sohi was with NCR Corporation, a leading global technology company, most recently as the Senior Vice President, Retail Solutions Division. Prior to NCR, Dr. Sohi was with Honeywell International Inc. and its pre-merger constituent, Allied Signal, Inc., providers of aerospace, automation and control solutions, specialty materials, and transportation systems, for 14 years, serving from July 2000 to January 2001 as President, Honeywell Electronic Materials. Dr. Sohi previously served as a director of Aviat Networks, Inc. (formerly known as Harris Stratex Networks, Inc.) from 2007 until January 2015 and Hayes Lemmerz International from 2004 until 2009. Dr. Sohi previously served as a member of the Supervisory Board of ZF AG from 2018 until March 2023 and of the Board of Tetra Laval Group. Since 2021, Dr. Sohi has served as a director and member of the Audit Committee and Human Capital and Compensation Committee of Baker Hughes Company.

Qualifications. Dr. Sohi’s experience as President and Chief Executive Officer of international industrial companies and international operating experience. Dr. Sohi provides our Board with substantial strategic planning, manufacturing, operational excellence, executive development, succession planning, and international experience, which are important factors for the Board’s oversight and the Company’s strategies. | |

| Dr. Richard M. Steeves

Dr. Steeves served as Chief Executive Officer and director of Synergy Health plc, a provider of specialty outsourced services to the healthcare and related industries, from 1992 until 2015, and founded the Company in 1991. Dr. Steeves served as a director of Gama Aviation plc from January 2018 to February 2019. Dr. Steeves has served since July 2017 as Executive Chairman of Advanced Research Cryptography Ltd. and, since October 2017 as Chairman of TrustFlight Ltd.

Qualifications. Dr. Steeves’s previous role as founder and former Chief Executive Officer of Synergy Health plc. Dr. Steeves provides the Board with extensive legacy business knowledge, as well as a strong technical and science background and knowledge of issues facing healthcare and medical device companies, particularly in the U.K. and Europe. | |

Retired, Former Chief Executive Officer of Synergy Health plc

Director since: 2015

Age: 61

Committees:

Audit Committee Compliance and Technology Committee (Chair) |

THE MEMBERS OF OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND A VOTE FOR THE ELECTION OF EACH OF DR. ESTHER M. ALEGRIA, RICHARD C. BREEDEN, DANIEL A. CARESTIO, CYNTHIA L. FELDMANN, CHRISTOPHER S. HOLLAND, DR. JACQUELINE B. KOSECOFF, PAUL E. MARTIN, DR. NIRAV R. SHAH, DR. MOHSEN M. SOHI, AND DR. RICHARD M. STEEVES AS DIRECTORS OF THE COMPANY.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 17

PROPOSAL 2—RESOLUTION REGARDING RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

The Audit Committee has appointed Ernst & Young LLP as STERIS’s independent registered public accounting firm for the fiscal year ending March 31, 2024. Ernst & Young LLP was retained in 2015 as the independent registered public accounting firm of our predecessor entity, Old STERIS, and was first retained in 1989 as the independent registered public accounting firm of Old STERIS’s predecessor entity, STERIS Corporation, and served in that capacity continuously through the Combination and the Redomiciliation. The appointment was based upon the considerations described in the Section “Independent Registered Public Accounting Firm” that begins on page 41 including the evaluation described therein.

Although the ratification of this appointment is not required to be submitted to a vote of the shareholders, the Board and Audit Committee believe it appropriate as a matter of corporate governance policy to request that the shareholders ratify the appointment of the independent registered public accounting firm for the fiscal year ending March 31, 2024. If this proposal does not receive the affirmative vote of the holders of a majority of the shares entitled to vote and present in person or represented by proxy at the Annual Meeting, the Audit Committee will reconsider the appointment.

We anticipate that the lead audit partner from Ernst & Young LLP will be present at the Annual Meeting. The lead audit partner (or other attending representative) will be given the opportunity to make a statement if he or she desires to do so, and is expected to be available to respond to any appropriate questions that may be submitted by shareholders at the Annual Meeting.

OUR BOARD OF DIRECTORS AND AUDIT COMMITTEE UNANIMOUSLY RECOMMEND THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING MARCH 31, 2024.

18 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

PROPOSAL 3—RESOLUTION APPOINTING ERNST & YOUNG CHARTERED ACCOUNTANTS AS THE COMPANY’S IRISH STATUTORY AUDITOR

|

The Irish Companies Act requires that our statutory auditors be appointed at each annual general meeting of shareholders, to hold office from the conclusion of the annual general meeting until the conclusion of the next annual general meeting. Ernst & Young Chartered Accountants has served as our Irish statutory auditor since the Redomiciliation and is affiliated with Ernst & Young LLP, who served as the U.K. statutory auditor of Old STERIS prior to the Redomiciliation from 2015 to 2019. Our Audit Committee has recommended that Ernst & Young Chartered Accountants be appointed as our Irish statutory auditor. If this resolution does not receive the affirmative vote of the holders of a majority of the shares cast in person or by proxy at the Annual Meeting, the Board may appoint a person or firm to fill the vacancy.

OUR BOARD OF DIRECTORS AND AUDIT COMMITTEE UNANIMOUSLY RECOMMEND THAT YOU VOTE “FOR” THE APPOINTMENT OF ERNST & YOUNG CHARTERED ACCOUNTANTS AS OUR IRISH STATUTORY AUDITOR TO HOLD OFFICE FROM THE CONCLUSION OF THE ANNUAL MEETING UNTIL THE CONCLUSION OF THE NEXT ANNUAL GENERAL MEETING OF THE COMPANY.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 19

PROPOSAL 4—RESOLUTION TO AUTHORIZE THE BOARD OF DIRECTORS OR THE AUDIT COMMITTEE OF THE BOARD TO DETERMINE THE REMUNERATION OF ERNST & YOUNG CHARTERED ACCOUNTANTS AS THE COMPANY’S IRISH STATUTORY AUDITOR

|

Under the Irish Companies Act, the remuneration of our Ireland statutory auditor must be fixed by the shareholders in a general meeting or in such other manner as the shareholders may determine. We are asking our shareholders to authorize our Board or the Audit Committee to determine Ernst & Young Chartered Accountant’s remuneration as our Irish statutory auditor. It is expected that the Board would delegate the authority to determine the remuneration of the Irish statutory auditor for the Company’s fiscal year ending March 31, 2024 to the Audit Committee in accordance with the Board’s procedures and applicable law.

OUR BOARD OF DIRECTORS AND AUDIT COMMITTEE UNANIMOUSLY RECOMMEND THAT YOU VOTE “FOR” THE AUTHORIZATION OF THE BOARD OF DIRECTORS OR AUDIT COMMITTEE TO DETERMINE OUR IRISH STATUTORY AUDITOR’S REMUNERATION.

20 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

PROPOSAL 5—ADVISORY RESOLUTION ON NAMED EXECUTIVE OFFICER COMPENSATION

|

We believe that our compensation policies and procedures are based on a pay-for-performance philosophy and are aligned with the long-term interests of our shareholders. However, to obtain the specific input of shareholders with respect to these policies and procedures in accordance with the provisions of the United States Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) and Section 14A of the United States Securities Exchange Act of 1934 (“Exchange Act”), the proposal described below provides shareholders with the opportunity to approve, on a non-binding advisory basis, the compensation of our named executive officers.

This proposal, commonly known as a “Say on Pay” proposal, gives shareholders the opportunity to provide input to endorse or not endorse the compensation of the Company’s named executive officers. The Company’s predecessors, STERIS Corporation and Old STERIS, conducted say on pay votes every year beginning in 2010 and continuing through 2018. We have held annual say on pay votes since 2019 and expect to continue to hold our say on pay votes on an annual basis. We expect to hold our next say on pay vote at our 2024 annual general meeting of shareholders. We strongly encourage you to carefully review the Compensation Discussion and Analysis and compensation tables and narrative discussions and related material beginning on page 44 of this Proxy Statement. Thereafter, we request your input on the compensation of the Company’s named executive officers through your vote on the following resolution:

“Resolved, that the shareholders approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to the disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis and the tabular and narrative disclosures contained in the Company’s Proxy Statement dated June 7, 2023.”

The non-binding resolution to approve the compensation of our named executive officers will be considered adopted if approved by the affirmative vote of the holders of a majority of the votes cast by shareholders represented in person or by proxy and entitled to vote thereon. Because your vote is advisory, it will not be binding upon the Board or the Compensation and Organization Development Committee. However, the Compensation and Organization Development Committee will take into account the outcome of the vote when considering future executive compensation decisions.

OUR BOARD OF DIRECTORS AND COMPENSATION AND ORGANIZATION DEVELOPMENT COMMITTEE UNANIMOUSLY RECOMMEND THAT YOU VOTE “FOR” THE APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 21

PROPOSAL 6—ADVISORY RESOLUTION ON THE FREQUENCY OF THE SHAREHOLDER ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

|

The Dodd-Frank Act also requires us to provide our shareholders every six years the opportunity to indicate how frequently we should seek a non-binding advisory vote regarding the compensation of our named executive officers (such as the one provided in proposal 5 included on page 21 of this Proxy Statement). By voting on this proposal 6, shareholders may indicate whether they would prefer a non-binding advisory vote on named executive officer compensation once every one, two, or three years.

A shareholder advisory vote on this issue was last taken in August 2017 by the shareholders of Old STERIS. At that time the STERIS board recommended that the shareholders approve, and the shareholder advisory vote approved, a frequency of every year.

After consideration of this proposal, our Board continues to believe that an annual advisory vote on named executive officer compensation is the most appropriate frequency alternative for STERIS, and therefore our Board recommends that you vote for an advisory vote on the executive compensation of our named executive officers to be held every year.

In formulating its recommendation, our Board considered that an annual advisory vote on executive compensation will allow our shareholders to provide us with their direct input on our compensation philosophy, policies, and practices as disclosed in the Proxy Statement on a regular and frequent basis. Additionally, an annual non-binding advisory vote on executive compensation is consistent with our policy of seeking input from, and engaging in discussions with, our shareholders on corporate governance matters and our executive compensation philosophy, policies, and practices.

We understand that our shareholders may have different views as to what is the best approach for STERIS, and we look forward to hearing from our shareholders on this proposal. We request your input on your preferred voting frequency regarding named executive compensation by choosing the option of every one year, two years, or three years.

The accompanying proxy card allows shareholders to vote for the advisory vote on executive compensation to occur every 1, 2 or 3 years, or to abstain from voting on this matter. Because this vote is advisory it will not be binding upon the Board or the Compensation and Organization Development Committee. However the Compensation and Organization Development Committee will take into account the outcome of the vote when considering when to hold the next shareholder advisory vote on executive compensation.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF EVERY “ONE YEAR” FOR THE FREQUENCY OF THE ADVISORY VOTE ON COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

22 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement

PROPOSAL 7—RENEWAL OF THE BOARD’S AUTHORITY TO ISSUE SHARES UNDER IRISH LAW

|

Under Irish law, the directors of an Irish public limited company must have authority from the company’s shareholders to issue shares and to grant rights to acquire shares (e.g., pursuant to options, warrants and other convertible securities), including shares that are part of the company’s authorized but unissued share capital.

This requirement does not apply to the issue of shares and the grant of rights to acquire shares to employees or former employees under an employees’ share scheme.

Under the Board’s current authority, which is included in STERIS’s Articles, the Board is authorized to issue shares and to grant rights to acquire shares up to the full amount of STERIS’s authorized but unissued share capital. This authority will expire on March 27, 2024.

We are presenting this proposal to renew the Board’s authority to issue authorized but unissued shares and to grant rights to acquire such shares on the terms set forth below. This proposal is in line with customary practice and governance standards applicable to public companies incorporated in Ireland and listed on U.S. markets. The proposed authority is more limited than the Board’s current authority. If this proposal is not passed, STERIS will have a limited ability to issue new Ordinary Shares after March 27, 2024.

In line with customary practice and applicable governance standards, we are seeking authority from our shareholders at the Annual Meeting for the Board to issue, and/or grant rights to acquire, shares up to a maximum number which is equal to approximately 20% of our issued ordinary share capital as of May 30, 2023 (the latest practicable date before this Proxy Statement). The proposed authority is for a period expiring on the earlier of (i) the date of our next annual general meeting and (ii) the date which is 15 months from the date of our Annual Meeting, unless otherwise varied, revoked or renewed. The Board expects to propose renewals of this authority on a regular basis at our annual general meetings in subsequent years.

Granting the Board authority to issue shares is a routine matter for public companies incorporated in Ireland and is consistent with Irish market practice. This renewal of authority, which is more limited than the Board’s current authority, is fundamental to our business and enables us to issue shares (and/or rights to acquire shares), including, if applicable, in connection with funding acquisitions and raising capital. We are not asking you to approve an increase in our authorized share capital or to approve a specific issue of shares. Instead, approval of this proposal will only grant the Board the authority to issue, and grant rights to acquire, shares that are already included in our authorized share capital under our articles of association.

In addition, because we are a NYSE-listed company, our shareholders continue to benefit from the protections afforded to them under the rules and regulations of the NYSE and the SEC, including those rules that limit our ability to issue shares in specified circumstances without obtaining shareholder approval. This authority is required as a matter of Irish law and is not otherwise required for other companies listed on the NYSE. Accordingly, approval of this resolution would merely place us on equal footing with other NYSE-listed companies.

Notice of Annual Meeting of Shareholders and 2023 Proxy Statement 23

| Proposal 7: Renewal of the Board’s Authority to Issue Shares Under Irish Law |

Accordingly, the following resolution will be submitted to our shareholders for approval, as an ordinary resolution, at the Annual Meeting:

“Resolved, that the directors be and they are, with effect from the passing of this resolution, hereby generally and unconditionally authorized to exercise all powers of the Company to allot and issue relevant securities (within the meaning of section 1021 of the Companies Act 2014, as amended) up to an aggregate nominal value of US$19,730 (which represents 19,730,000 shares) (being equivalent to approximately 20% of the aggregate nominal value and number of the issued ordinary shares in the capital of the Company as of May 30, 2023 (the last practicable date before this proxy statement)) and the authority conferred by this resolution shall expire on the earlier of (i) the date of the Company’s next annual general meeting and (ii) the date that is 15 months from the passing of this resolution, unless previously renewed, varied or revoked by the Company, provided that the Company may, before such expiry, make an offer or agreement which would, or might, require relevant securities to be allotted and issued after such expiry and, in that case, the directors may allot and issue relevant securities in pursuance of any such offer or agreement as if the authority conferred by this resolution had not expired.”

This resolution to authorize the Board to issue shares under Irish law will be considered adopted as an ordinary resolution if approved by the affirmative vote of the holders of a majority of the votes cast by shareholders represented in person or by proxy at the Annual Meeting and entitled to vote thereon.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RENEWAL OF THE BOARD’S AUTHORITY TO ISSUE SHARES UNDER IRISH LAW.

24 Notice of Annual Meeting of Shareholders and 2023 Proxy Statement