UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | | |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

LUMINAR TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

| | | | | | | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | |

| | |

| | |

| | |

| |

| |

| | |

| | |

| | |

| | |

May 6, 2022

To Our Stockholders:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders, or the Annual Meeting, of Luminar Technologies, Inc., on Tuesday, June 7, 2022 at 1:00 p.m. Eastern Time/10:00 a.m. Pacific Time. In order to support the health and well-being of our stockholders, business partners, employees and board of directors during the coronavirus (COVID-19) pandemic, expand access, facilitate stockholder attendance and participation and reduce costs, the Annual Meeting will be a completely virtual meeting, conducted only via live webcast on the internet at www.virtualshareholdermeeting.com/LAZR2022. There will be no physical location for the Annual Meeting. You will be able to attend and participate in the Annual Meeting online, submit questions during and prior to the meeting and vote your shares electronically. In addition, although the live webcast is available only to stockholders at the time of the meeting, following completion of the Annual Meeting, a webcast replay will be posted to the Investor Relations section of our website at https://investors.luminartech.com.

The matters expected to be acted upon at the Annual Meeting are described in the Notice of Annual Meeting of Stockholders and proxy statement. The Annual Meeting materials include the notice, the proxy statement, our annual report and the proxy card, each of which is enclosed.

Please use this opportunity to take part in our affairs by voting on the business to come before the Annual Meeting. Only stockholders of record at the close of business on April 13, 2022 may vote at the Annual Meeting and any postponements or adjournments of the meeting. All stockholders are cordially invited to participate in the Annual Meeting and any postponements or adjournments of the meeting. However, to ensure your representation at the Annual Meeting, please vote as soon as possible by using the internet or telephone, as instructed in the proxy card. Returning the paper proxy card or voting electronically does NOT deprive you of your right to participate in the virtual meeting and to vote your shares for the matters acted upon at the meeting.

Your vote is important. Whether or not you expect to attend and participate in the Annual Meeting, we encourage you to vote in advance of the Annual Meeting.

Sincerely,

| | | |

| /s/ Austin Russell |

| Austin Russell |

| Chairperson of the Board, President and Chief Executive Officer |

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 7, 2022: THE PROXY MATERIALS, INCLUDING THE PROXY STATEMENT AND ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021 ARE AVAILABLE FREE OF CHARGE AT www.proxyvote.com. |

LUMINAR TECHNOLOGIES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 6, 2022

| | | | | | | | | | | |

Time and Date: | June 7, 2022 at 1:00 p.m. Eastern Time/10:00 a.m. Pacific Time. |

| |

Place: | Via live webcast on the internet at www.virtualshareholdermeeting.com/LAZR2022. |

| |

Items of Business: | 1. | Election of Class II directors. |

| | |

| 2. | Ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of Luminar Technologies, Inc. for the fiscal year ending December 31, 2022. |

| | |

| 3. | Advisory (non-binding) vote to approve the compensation of our named executive officers. |

| | |

| 4. | Advisory (non-binding) vote on the frequency of future advisory votes on executive compensation. |

| | |

| 5. | Approve the amendment and restatement of the Luminar Technologies, Inc. 2020 Equity Incentive Plan to increase the authorized share reserve and add an automatic annual share reserve increase provision. |

| | |

| 6. | Transact any other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

| |

Record Date: | Only stockholders of record at the close of business on April 13, 2022 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof. |

| |

Proxy Voting: | Holders of our Class A common stock are entitled to one vote for each share held as of the above record date. Holders of our Class B common stock are entitled to ten votes for each share held as of the above record date. Holders of our Class A common stock and Class B common stock will vote together as a single class on all matters described in this proxy statement. Our Class A common stock and Class B common stock are sometimes collectively referred to in this proxy statement as our “common stock.” |

| |

| For questions regarding your stock ownership, you may contact us through our Investor Relations section of our website at https://investors.luminartech.com/ir-resources/contact-ir or, if you are a registered holder, contact our transfer agent, American Stock Transfer & Trust Company, LLC, through its website at https://www.astfinancial.com/ or by phone at (800) 937-5449 or (718) 921-8124. |

| | |

| By Order of the Board of Directors, |

| | | |

| Austin Russell Chairperson of the Board, President and Chief Executive Officer |

LUMINAR TECHNOLOGIES, INC.

PROXY STATEMENT FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, JUNE 7, 2022

May 6, 2022

INFORMATION ABOUT SOLICITATION AND VOTING

A proxy is solicited on behalf of our board of directors of Luminar Technologies, Inc. (“Luminar”), for use at Luminar’s 2022 Annual Meeting of Stockholders (the "Annual Meeting" or “meeting”) to be held on Tuesday, June 7, 2022 at 1:00 p.m. Eastern Time/10:00 a.m. Pacific Time via live webcast on the internet at www.virtualshareholdermeeting.com/LAZR2022. References in this proxy statement (the “Proxy Statement”) to “we,” “us,” “our,” “the Company” or “Luminar” refer to Luminar Technologies, Inc.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS

We mailed, on or about May 6, 2022, copies of the proxy materials, which include this Proxy Statement, a proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “2021 Annual Report”), to our stockholders of record and beneficial owners as of the close of business on April 13, 2022.

The proxy materials, including the Proxy Statement and the 2021 Annual Report, are available free of charge at www.proxyvote.com.

QUESTIONS AND ANSWERS ABOUT THE MEETING

Q: What is the purpose of the meeting?

A: At the meeting, stockholders will act upon the proposals described in this Proxy Statement. In addition, following the formal portion of the meeting, management will be available to respond to questions from stockholders.

Q: What proposals are scheduled to be voted on at the meeting?

A: Stockholders will be asked to vote on the following proposals at the meeting:

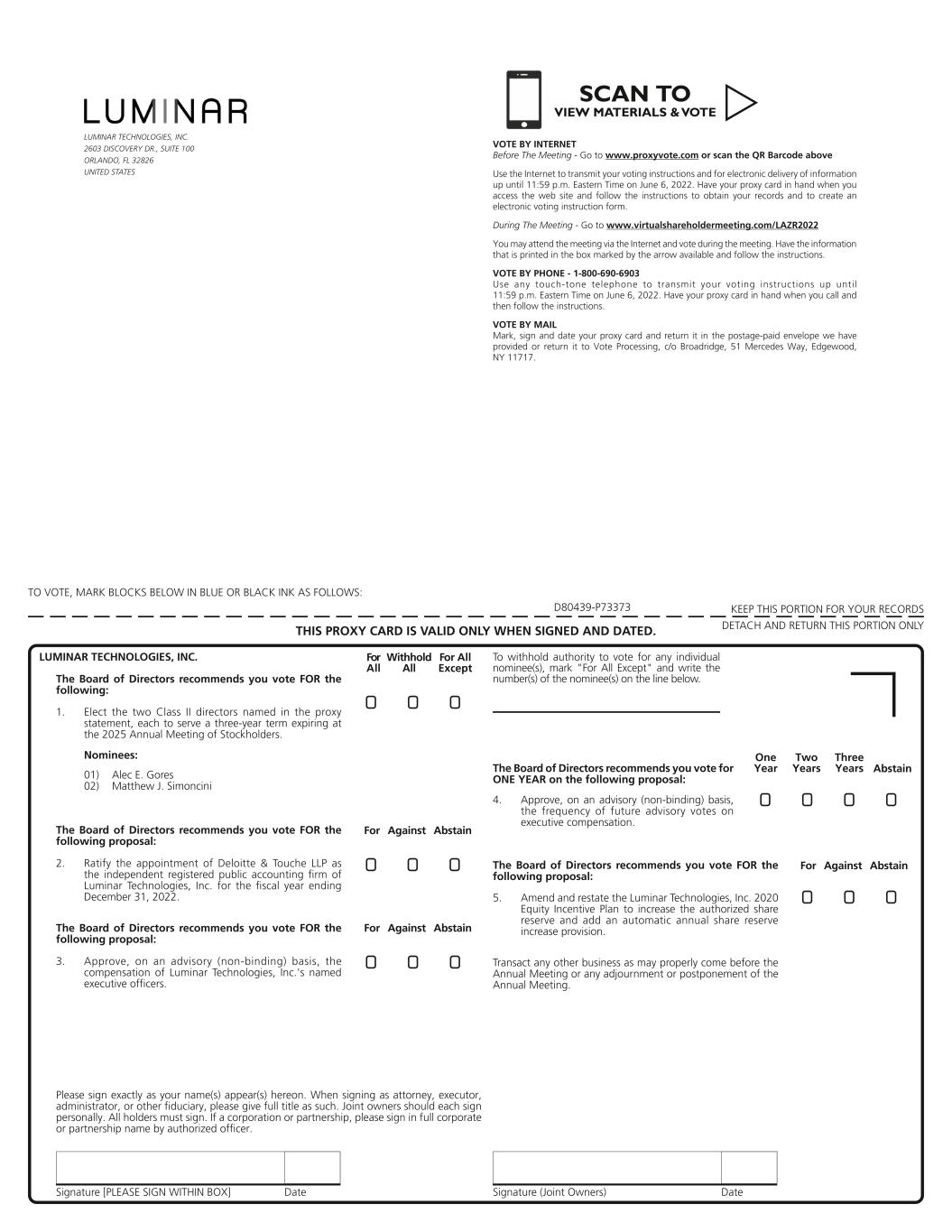

1.To elect Alec E. Gores and Matthew J. Simoncini as Class II directors to serve for a term of three years or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal (“Proposal One”);

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (“Proposal Two”);

3.To vote on a non-binding advisory resolution to approve the compensation of our named executive officers (“Proposal Three”);

4.To vote on a non-binding advisory resolution to approve the frequency of future advisory votes on executive compensation (“Proposal Four”); and

5.To approve the amendment and restatement of the Luminar Technologies, Inc. 2020 Equity Incentive Plan to increase the authorized share reserve and add an automatic annual share reserve increase provision (“Proposal Five”).

Q: Could matters other than Proposal One, Two, Three, Four and Five be decided at the meeting?

A: Our bylaws require that we receive advance notice of any proposal to be brought before the meeting by stockholders of Luminar, and we have not received notice of any such proposals. If any other matter were to come before the meeting, the proxy holders appointed by our board of directors will have the discretion to vote on those matters for you.

Q: How does the board of directors recommend I vote on these proposals?

A: Our board of directors recommends that you vote your shares:

•“FOR ALL” the nominees to the board of directors (Proposal One);

•“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal Two);

•“FOR” the approval of the compensation of our named executive officers (Proposal Three);

•“ONE YEAR” for the frequency of future advisory votes on executive compensation (Proposal Four); and

•“FOR” the approval of the amendment and restatement of the Luminar Technologies, Inc. 2020 Equity Incentive Plan to increase the authorized share reserve and add an automatic annual share reserve increase provision (Proposal Five).

Q: Who may vote at the Annual Meeting?

A: Stockholders of record as of the close of business on April 13, 2022, or the Record Date, are entitled to receive notice of, to attend and participate, and to vote at the Annual Meeting. At the close of business on the Record Date, there were 254,411,153 shares of Class A common stock and 97,088,670 shares of Class B common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the stockholder of record with respect to those shares, and the proxy materials were sent directly to you.

Beneficial Owner of Shares Held in Street Name: Shares Registered in the Name of a Broker or Nominee

If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and the proxy materials were forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting. Beneficial owners must obtain a valid proxy from the organization that holds their shares and present it to American Stock

Transfer & Trust Company, LLC, at least three business (3) days in advance of the Annual Meeting.

Q: How do I vote?

A. You may vote by mail or follow any alternative voting procedure (such as telephone or internet voting) described on your proxy card. To use an alternative voting procedure, follow the instructions on the proxy card that you receive. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may:

•Vote by telephone or through the internet - in order to do so, please follow the instructions shown on your proxy card;

•Vote by mail - if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and return it before the meeting in the pre-paid envelope provided; or

•Vote in person at the virtual Annual Meeting - you may virtually attend and participate in the Annual Meeting online at www.virtualshareholdermeeting.com/LAZR2022 and vote your shares electronically before the polls close during the Annual Meeting. To participate and vote in the Annual Meeting, you will need the control number included on your proxy card.

Votes submitted by telephone or through the internet must be received by 11:59 p.m. Eastern Time, on June 6, 2022. Submitting your proxy, whether by telephone, through the internet or by mail if you request or received a paper proxy card, will not affect your right to vote in person should you decide to attend and participate in the meeting virtually.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares. Your vote is important. To ensure that your vote is counted, complete and mail the voting instruction card provided by your brokerage firm, bank, or other nominee as directed by your nominee. To electronically vote in person at the meeting online, you must obtain a legal proxy from your nominee. Follow the instructions from your nominee included with our proxy materials or contact your nominee to request a proxy form.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

Q: How do I vote by internet or telephone?

A. If you wish to vote by internet or telephone, you may do so by following the voting instructions included on your proxy card. Please have the proxy card you received in hand when you vote over the internet or by telephone as you will need information specified therein to submit your vote. The giving of such a telephonic or internet proxy will not affect your right to vote in person (as detailed above) should you decide to attend the meeting.

The telephone and internet voting procedures are designed to authenticate stockholders' identities, to allow stockholders to give their voting instructions and to confirm that stockholders' instructions have been recorded properly.

Q: What shares can I vote?

A: Each share of Class A common stock and Class B common stock issued and outstanding as of the close of business on April 13, 2022 is entitled to vote on all items being voted on at the meeting. You may vote all shares owned by you as of April 13, 2022, including (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

Q: How many votes am I entitled to per share?

A: Each holder of shares of (i) Class A common stock is entitled to one vote for each share of Class A common stock held as the Record Date and (ii) Class B common stock is entitled to ten votes for each share of Class B common stock held as of the Record Date.

Q: What is the quorum requirement for the meeting?

A: The holders of a majority of the voting power of the shares of our Class A common stock and Class B common stock (voting together as a single class) entitled to vote at the Annual Meeting as of the Record Date must be present in person or represented by proxy at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or if you have properly submitted a proxy.

Q: How are abstentions and broker non-votes treated?

A: Abstentions (i.e., shares present at the Annual Meeting and marked “abstain”) are deemed to be shares present or represented by proxy and entitled to vote, and are counted for purposes of determining whether a quorum is present. Abstentions have no effect on Proposal One, Two, Three, Four or Five.

A broker non-vote occurs when the beneficial owner of shares fails to provide the broker, bank or other nominee that holds the shares with specific instructions on how to vote on any "non-routine" matters brought to a vote at the stockholders meeting. In this situation, the broker, bank or other nominee will not vote on the “non-routine” matter. Broker non-votes are counted for purposes of determining whether a quorum is present and have no effect on the outcome of the matters voted upon.

Note that if you are a beneficial holder, brokers and other nominees will be entitled to vote your shares on “routine” matters without instructions from you. The only proposal that would be considered “routine” in such event is the proposal for the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal Two). A broker or other nominee will not be entitled to vote your shares on any “non-routine” matters, absent instructions from you. This year, “non-routine” matters include all proposals other than Proposal Two, including the election of directors Accordingly, we encourage you to provide voting instructions to your broker or other nominee whether or not you plan to attend the meeting.

Q: What is the vote required for each proposal?

A: The votes required to approve each proposal are as follows:

•Proposal One: Each director elected shall be elected by a plurality of the votes of the shares of our Class A common stock and Class B common stock (voting together as a single class) present in person or represented by proxy at the meeting and entitled to vote on the election of directors, meaning that the two individuals nominated for election to our board of directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected.

•Proposal Two: Approval will be obtained if the number of votes of our Class A common stock and Class B common stock (voting together as a single class) cast “FOR” the proposal at the Annual Meeting exceeds the number of votes “AGAINST” the proposal.

•Proposal Three: Approval will be obtained if the number of votes of our Class A common stock and Class B common stock (voting together as a single class) cast “FOR” the proposal at the Annual Meeting exceeds the number of votes “AGAINST” the proposal.

•Proposal Four: The frequency receiving the votes of the holders of a majority of the voting power of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting voting for or against the choices will be deemed to be the frequency preferred by the stockholders. In the event that no option receives a majority of the votes as described in the immediately preceding sentence, the Company will consider the option that receives the most votes cast to be the frequency preferred by our stockholders.

•Proposal Five: Approval will be obtained if the number of votes of our Class A common stock and Class B common stock (voting together as a single class) cast “FOR” the proposal at the Annual Meeting exceeds the number of votes “AGAINST” the proposal.

Q: If I submit a proxy, how will it be voted?

A: When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described below under “Can I change my vote or revoke my proxy?”

Q: What should I do if I get more than one proxy or voting instruction card?

A: Stockholders may receive more than one set of voting materials, including multiple copies of the proxy materials, proxy cards or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials. You should vote in accordance with all of the proxy cards and voting instruction cards you receive relating to our Annual Meeting to ensure that all of your shares are voted and counted.

Q: Can I change my vote or revoke my proxy?

A: You may change your vote or revoke your proxy at any time prior to the taking of the vote or the polls closing at the Annual Meeting.

If you are the stockholder of record, you may change your vote by:

•granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method);

•providing a written notice of revocation to Luminar’s Secretary at Luminar Technologies, Inc., 2603 Discovery Drive, Suite 100, Orlando, Florida 32826, prior to your shares being voted; or

•participating in the Annual Meeting and voting electronically online at www.virtualshareholdermeeting.com/LAZR2022. Participation alone at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically vote during the meeting online at www.virtualshareholdermeeting.com/LAZR2022.

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Q: How can I attend the Annual Meeting in person?

A: There is no physical location for the Annual Meeting. You are invited to attend the Annual Meeting by participating online if you are a stockholder of record or a street name stockholder as of April 13, 2022, the Record Date. See, “How can I participate in the Annual Meeting?” below for more details. Please be aware that participating in the Annual Meeting will not, by itself, revoke a proxy. See, “Can I change my vote or revoke my proxy?” above for more details.

Q. How can I participate in the Annual Meeting?

A: The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend and participate in the Annual Meeting online and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/LAZR2022. You will also be able to vote your shares electronically at the Annual Meeting. To participate and vote in the Annual Meeting, you will need the control number included on your proxy card.

Q: Can I submit questions prior to the meeting?

A: Yes, following the meeting, there will be an informal Question and Answer period as time permits. As a stockholder, you may submit questions to the Company in writing by visiting the website www.proxyvote.com, and following the instructions provided. Stockholders may also submit questions live during the meeting on www.virtualshareholdermeeting.com/LAZR2022.

Q: What if during the check-in time or during the meeting I have technical difficulties or trouble accessing the virtual meeting website?

A: If you encounter any technical difficulties accessing the virtual meeting during the check in or meeting time, please call the technical support number posted at www.virtualshareholdermeeting.com/LAZR2022. Technical support will be available starting at 12:45 p.m. Eastern Time/9:45 a.m., Pacific Time on June 7, 2022.

Q: Why is the Annual Meeting being held only online?

A: We believe that hosting a virtual meeting will not only support the health and well-being of our stockholders, business partners, employees and board of directors during the coronavirus (COVID-19) pandemic, but it will also expand access, facilitate stockholder attendance and participation and reduce costs. We have designed the virtual annual meeting to provide the same rights and opportunities to participate as stockholders would have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform.

Q. How can I get electronic access to the proxy materials?

A: This Proxy Statement and our 2021 Annual Report are available at www.proxyvote.com. To instruct us to send our future proxy materials to you electronically by email, please go to www.proxyvote.com.

If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Q: Is there a list of stockholders entitled to vote at the Annual Meeting?

A: The names of stockholders of record entitled to vote will be available for inspection by stockholders of record for 10 days prior to the meeting. If you are a stockholder of record and want to inspect the stockholder list, please send a written request to our Secretary at Luminar Technologies, Inc., 2603 Discovery Drive, Suite 100, Orlando, Florida 32826 or by e-mail at investors@luminartech.com to arrange for access to the stockholder list. During the Annual Meeting, any stockholder attending the meeting may access the names of stockholders of record entitled to vote at the Annual Meeting at www.virtualshareholdermeeting.com/LAZR2022.

Q: Who will tabulate the votes?

A: A representative of Broadridge Financial Solutions, Inc. will serve as the Inspector of Elections and will tabulate the votes at the Annual Meeting.

Q: Where can I find the voting results of the Annual Meeting?

A: We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

Q: I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

A: The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more

stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process is commonly referred to as “householding.”

Brokers with account holders who are Luminar stockholders may be householding our proxy materials. A single set of proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you notify your broker or Luminar that you no longer wish to participate in householding.

If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, you may (1) notify your broker, (2) direct your written request to: Investor Relations, Luminar Technologies, Inc., 2603 Discovery Drive, Suite 100, Orlando, Florida 32826 or (3) contact our Investor Relations department by email at investors@luminartech.com. Stockholders who receive multiple copies of the proxy statement or annual report at their address and would like to request householding of their communications should contact their broker. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

Q: What if I have questions about my Luminar shares or need to change my mailing address?

A: If you are a stockholder of record, you may contact our transfer agent, American Stock Transfer & Trust Company, LLC, by telephone at (800) 937-5449 or (718) 921-8124, through its website at https://www.astfinancial.com/ or by U.S. mail at 6201 15th Ave, Brooklyn, NY 11219, if you have questions about your Luminar shares or need to change your mailing address.

Q: Who is soliciting my proxy and paying for the expense of solicitation?

A: The proxy for the Annual Meeting is being solicited on behalf of our board of directors. We will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may, on request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by telephone or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we may reimburse these individuals for their reasonable out-of-pocket expenses. We do not expect to, but have the option to, retain a proxy solicitor. If you choose to access the proxy materials or vote via the Internet or by phone, you are responsible for any Internet access or phone charges you may incur.

Q: What are the requirements to propose actions to be included in our proxy materials for next year’s annual meeting of stockholders, or our 2023 Annual Meeting, or for consideration at our 2023 Annual Meeting?

A: Requirements for Stockholder Proposals to be considered for inclusion in our proxy materials for our 2023 Annual Meeting:

Our amended and restated bylaws provide that stockholders may present proposals for inclusion in our proxy statement by submitting their proposals in writing to the attention of our Secretary at our principal executive office. Our current principal executive office is located at 2603 Discovery Drive, Suite 100, Orlando, Florida 32826. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and related SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. In order to be included in the proxy

statement for our 2023 Annual Meeting, stockholder proposals must be received by our Secretary no later than December 29, 2022 and must otherwise comply with the requirements of Rule 14a-8 of the Exchange Act.

Requirements for Stockholder Proposals to be presented at our 2023 Annual Meeting:

Our amended and restated bylaws provide that stockholders may present proposals to be considered at an annual meeting by providing timely notice to our Secretary at our principal executive office. To be timely for our 2023 Annual Meeting, our Secretary must receive the written notice at our principal executive office:

•not earlier than the close of business on February 7, 2023, and

•not later than the close of business on March 9, 2023.

If we hold our 2023 annual meeting of stockholders more than 30 days before or more than 60 days after June 7, 2023 (the one-year anniversary date of the Annual Meeting), then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received by our Secretary at our principal executive office:

•not earlier than the close of business on the 120th day prior to such annual meeting, and

•not later than the close of business on the later of (i) the 90th day prior to such annual meeting, or (ii) the tenth day following the day on which public announcement of the date of such annual meeting is first made.

A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting the information required by our amended and restated bylaws. If a stockholder who has notified Luminar of such stockholder’s intention to present a proposal at an annual meeting does not appear to present such stockholder’s proposal at such meeting, Luminar does not need to present the proposal for vote at such meeting.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our board of directors currently consists of seven directors and is divided into three classes, with staggered three-year terms, pursuant to our amended and restated certificate of incorporation and our amended and restated bylaws. Our board of directors consists of three Class I directors, Dr. Maguire, Mr. Heng, and Ms. Martin, two Class II directors, Messrs. Gores and Simoncini, and two Class III directors, Dr. Jepsen and Mr. Russell.

We have a strong commitment to good corporate governance practices. These practices provide an important framework within which our board of directors, its committees and our management can pursue our strategic objectives in order to promote the interests of our stockholders.

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions and other policies for the governance of our Company. Our Corporate Governance Guidelines are available on the Investor Relations section of our website, which is located at https://investors.luminartech.com by clicking on “Governance Documents” in the “Governance” section of our website. Our Corporate Governance Guidelines are subject to modification from time to time by our board of directors pursuant to the recommendations of our nominating and ESG committee.

The board of directors is committed to governance practices that promote long-term stockholder value and strengthen board and management accountability to our stockholders, clients and other stakeholders. The following table highlights many of our key governance practices.

| | | | | | | | |

•Six of our seven directors are independent | | •Strong focus on pay-for-performance |

| | |

•Independent standing board committees | | •Clawback policy on executive compensation |

| | |

•Annual board and committee self-assessment process | • | •Programs, policies and practices relating to environmental and social issues and impacts are overseen by the nominating and ESG committee |

| | |

•Regular meetings of our independent directors without management present | | •Two of our seven directors are female |

| | |

Board Leadership Structure

The board of directors does not anticipate having a policy requiring the positions of the Chairperson of the Board and Chief Executive Officer to be separate or held by the same individual. The board of directors believes that this determination should be based on circumstances existing from time to time, based on criteria that are in Luminar’s best interests and the best interests of its stockholders, including the composition, skills and experience of the board of directors and its members, specific challenges faced by Luminar or the industry in which it operates and governance efficiency. We adopted Corporate Governance Guidelines, effective as of the consummation of our business combination pursuant to that certain Agreement and Plan of Merger dated August 24, 2020 with the pre-Business Combination Luminar Technologies, Inc. (“Legacy Luminar”) (the “Business Combination”), which provide for the appointment of a lead independent director at any time when the Chairperson is not independent. The board of directors elected Mr. Russell as Chairperson of the board because it believes that Mr. Russell’s strategic vision for the business, his in-depth knowledge of the Company’s operations, and his

experience serving as the Chief Executive Officer since Legacy Luminar’s inception make him well qualified to serve as both Chairperson of the board and Chief Executive Officer. The board of directors has considered whether to select a lead independent director to help reinforce the independence of the board as a whole, and at this time has determined the Company has sufficient governance without having a lead independent director.

Our Board of Directors’ Role in Risk Oversight

One of the key functions of the board of directors is informed oversight of our risk management process. The board of directors does not have a standing risk management committee, but rather administers this oversight function directly through the board as a whole, as well as through various standing committees of the board of directors that address risks inherent in their respective areas of oversight. In particular, the board of directors is responsible for monitoring and assessing strategic risk exposure and our audit committee has the responsibility to consider and discuss our major financial risk exposures, operational risk management, and the steps our management will take to monitor and control such exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements and risks related to cybersecurity. The compensation & human capital management committee also assesses and monitors whether our compensation plans, policies and programs comply with applicable legal and regulatory requirements. The nominating and ESG committee monitors the effectiveness of our governance guidelines and oversees programs, policies and practices relating to environmental and social issues and impacts to support the sustainable growth of the company’s businesses.

We believe this division of responsibilities is an effective approach for addressing the risks we face and that our board leadership structure supports this approach.

Independence of Directors; Controlled Company Exemption

Our board of directors has determined that none of the members of our board of directors other than Austin Russell has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of Matthew J. Simoncini, Jun Hong Heng, Shaun Maguire, PhD, Katharine A. Martin, Mary Lou Jepsen, PhD and Alec E. Gores is “independent” as that term is defined under the rules of the Nasdaq Stock Market, or Nasdaq. In making this determination, our board of directors considered that the law firm of Wilson Sonsini Goodrich & Rosati PC (“WSGR”), of which Ms. Martin is the Chairperson, had provided minimal legal services to us and Austin Russell, which ceased before Ms. Martin joined the board of directors in 2021. All services by WSGR terminated prior to Ms. Martin joining the board of directors and will not continue.

Austin Russell controls a majority of the voting power of our outstanding capital stock. As a result, we are a “controlled company” under Nasdaq rules. As a controlled company, we are exempt from certain Nasdaq corporate governance requirements, including those that would otherwise require the board of directors to have a majority of independent directors and require that we establish a compensation committee comprised entirely of independent directors, or otherwise ensure that the compensation of our executive officers and nominees for directors are determined or recommended to the board of directors by the independent members of the board of directors. While we do not currently intend to rely on any of these exemptions, we will be entitled to do so for as long as we are considered a “controlled company,” and to the extent we rely on one or more of these exemptions, holders of our capital stock will not have the same protections afforded to stockholders of companies that are subject to all of the Nasdaq corporate governance requirements.

In addition, audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in such member’s capacity as a

member of the audit committee, the board of directors or any other board committee (i) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its subsidiaries. Based on information requested from and provided by each director concerning his or her background, employment and affiliations, our Board has determined that each member of our audit committee satisfies the independence requirements of the SEC rules.

In order to be considered independent for purposes of Rule 5605(d)(2)(A) of the Nasdaq Rules, a member of a compensation committee of a listed company may not, other than in his or her capacity as a member of the compensation committee, the board or any other board committee: (1) accept any consulting, advisory, or other compensatory fee from the listed company, other than for board service; or (2) be an affiliated person of the listed company. Based on information requested from and provided by each director concerning his or her background, employment and affiliations, our Board has determined that each member of our compensation & human capital management committee satisfies the independence requirements of the Nasdaq Rules.

Committees of Our Board of Directors

Our board of directors has established an audit committee, a compensation & human capital management committee and a nominating and ESG committee. The composition and responsibilities of each committee are described below. Each of these committees has a written charter approved by our board of directors. Copies of the charters for each committee are available on the Investor Relations section of our website, which is located at https://investors.luminartech.com by clicking on “Governance Documents” in the “Governance” section of our website. Members serve on these committees until (i) they resign from their respective committee, (ii) they no longer serve as a director or (iii) as otherwise determined by our board of directors.

Audit Committee

Our audit committee currently consists of Matthew J. Simoncini, Jun Hong Heng and Shaun Maguire, PhD. The board of directors determined that each of Messrs. Simoncini, Heng and Dr. Maguire meets the requirements for independence and financial literacy under the current Nasdaq listing standards and SEC rules and regulations, including Rule 10A-3. Mr. Simoncini will continue to serve as the chair of the audit committee. In addition, Mr. Simoncini is an “audit committee financial expert” within the meaning of Item 407(d) of Regulation S-K promulgated under the Securities Act. This designation does not impose any duties, obligations, or liabilities that are greater than are generally imposed on members of the audit committee and the board of directors. The audit committee is responsible for, among other things:

•selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

•helping to ensure the independence and overseeing the performance of the independent registered public accounting firm;

•reviewing and discussing the results of the audit with the independent registered public accounting firm and reviewing, with management and that firm, our interim and year-end operating results;

•reviewing our financial statements and critical accounting policies and estimates;

•reviewing the adequacy and effectiveness of our internal controls;

•developing procedures for employees to submit concerns anonymously about questionable accounting, internal accounting controls, or audit matters;

•overseeing and reviewing our policies on risk assessment and risk management;

•overseeing compliance with our code of business conduct and ethics;

•reviewing related party transactions;

•overseeing cybersecurity, data privacy and other risks relevant to the our computerized information system controls and security, the steps we have taken to monitor or mitigate such exposures, and our information governance policies and programs;

•unless delegated to a separate committee of the board: (i) periodically receiving reports from management to help fulfill the committee’s duties to oversee the principal risk exposures facing the company and the company’s mitigation efforts in respect of such risks; and (ii) reviewing the company’s risk management framework and programs, the company’s adherence to risk limits and its established risk appetite, and the framework by which management discusses the company’s risk profile and risk exposures with the board and its committees and annually recommending to the board the articulation and establishment of the company’s risk appetite;

•overseeing our business continuity and disaster preparedness planning; and

•approving or, as permitted, pre-approving all audit and all permissible non-audit services to be performed by the independent registered public accounting firm.

The audit committee operates under a written charter, which satisfies the applicable rules of the SEC and the listing standards of Nasdaq, and which is available on our website. All audit services provided to us and all permissible non-audit services, provided to us by our independent registered public accounting firm are approved in advance by the audit committee.

Compensation & Human Capital Management Committee

Our compensation committee & human capital management committee, or compensation committee, consists of Katharine A. Martin, Mary Lou Jepsen, PhD and Matthew J. Simoncini, with Ms. Martin serving as the chair of the compensation committee. Mr. Simoncini previously served as the chair of the compensation committee from December 2, 2020 to February 8, 2021. The board of directors has determined that each of Ms. Martin, Dr. Jepsen and Mr. Simoncini meets the requirements for independence under the current Nasdaq listing standards and SEC rules and regulations. Each member of the compensation committee is a non-employee director, as defined in Rule16b-3 promulgated under the Exchange Act. The compensation committee is responsible for, among other things:

•reviewing, approving and determining, or making recommendations to the board of directors regarding, the compensation of our executive officers, including the Chief Executive Officer;

•making recommendations regarding non-employee director compensation to our board of directors;

•administering our equity compensation plans and agreements with our executive officers;

•reviewing, approving and administering incentive compensation and equity compensation plans;

•reviewing with management annually risks arising from the company’s compensation policies and practices applicable to employees;

•overseeing the development, implementation and effectiveness of the company’s practices, policies and strategies relating to human capital; and

•reviewing and approving our overall compensation philosophy.

The compensation committee operates under a written charter, which satisfies the applicable rules of the SEC and Nasdaq listing standards, and is available on our website. The charter allows the compensation committee to delegate its responsibilities to a subcommittee of the compensation committee, as may be necessary or appropriate, and within certain limits. In addition, to the extent permitted by applicable law, the compensation committee may delegate to one or more officers of the Company (or other appropriate supervisory personnel) the authority to grant stock options and other stock awards to employees (who are not executive officers or members of the Board) of the Company or of any subsidiary of the Company.

Nominating and ESG Committee

Our nominating and ESG committee consists of Mary Lou Jepsen, PhD, Jun Hong Heng and Katharine A. Martin. Dr. Jepsen serves as the chair of the nominating and ESG committee. The Board has determined that Dr. Jepsen, Mr. Heng and Ms. Martin meet the requirements for independence under the current Nasdaq listing standards and SEC rules and regulations. The nominating and ESG committee is responsible for, among other things:

•recommending to the board for determination the desired qualifications, expertise and characteristics of Board members, with the goal of developing a diverse, experienced and highly qualified board;

•identifying, evaluating and individuals qualified to serve as members of the board, consistent with criteria approved by the board, and making recommendations to the board of directors regarding nominees for election to the board and its committees;

•considering and making recommendations to the board of directors regarding the composition of the board and its committees;

•overseeing corporate governance and related matters;

•developing and making recommendations to the board of directors regarding corporate governance guidelines and ESG matters;

•overseeing the company’s ESG programs, policies and practices;

•overseeing an annual evaluation of the board and its committees;

•reviewing and monitoring key public policy trends, issues, regulatory matters and other concerns that may affect our business, strategies, operations, performance or reputation, and overseeing our engagement in the public policy process; and

•contributing to succession planning.

The nominating and ESG committee operates under a written charter, which satisfies the applicable rules of the SEC and the Nasdaq listing standards and is available on our website.

Board Assessment

Our Corporate Governance Guidelines provide that the nominating and ESG committee is responsible for overseeing an annual self-evaluation of the board of directors as a whole and its committees. Such evaluations were conducted in 2022 by the board and each of the committees.

The evaluation topics for 2021 included (i) the composition and board and committee structure, (ii) access to and review of information from management and (iii) culture with respect to promoting candid communication and rigorous decision making.

Our board and committee evaluation process for 2021 included the following steps: | | | | | |

Board

Evaluation | Our Board responded to tailored questionnaires, meant to enhance the Board’s overall effectiveness by identifying the best practices of a highly effective board and identifying suggested ways to implement these best practices. |

| |

Committee

Evaluations | The directors also responded a tailored set of questions for each of their committee assignments and identified committee strengths and accomplishments in 2021 together with recommended changes in committee practices for 2022. |

| |

Third-Party

Facilitator Report | To protect anonymity and the integrity of our Board and Committee evaluation process, the company’s outside counsel compiled responses to Board and Committee evaluations into a report for the Board of Directors. |

| |

Discussion

of Results | The results of the Board and Committee evaluations process were presented to the Board of Directors which discussed the evaluations and determined if any follow-up actions were appropriate. |

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee is or has been at any time one of our officers or employees. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board or compensation committee (or other board of directors committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of

any entity that has one or more executive officers serving as a member of the board or compensation committee.

Board and Committee Meetings and Attendance

Our board of directors and its committees meet regularly throughout the year, and also hold special meetings and act by written consent from time to time. The board of directors met 11 times during the fiscal year ended December 31, 2021. The audit committee met 13 times during the fiscal year ended December 31, 2021 and the compensation & human capital management committee met 8 times during the fiscal year ended December 31, 2021. The nominating and ESG committee met 5 times during the year ended December 31, 2021.

During 2021, each member of our board of directors attended at least 75% of the aggregate of all meetings of our board of directors and of all meetings of committees of our board of directors on which such member served that were held during the period in which such director served.

Board Attendance at Annual Meeting of Stockholders

Our policy is to invite and encourage each member of our board of directors to be present at our annual meetings of stockholders. All five continuing directors attended the last annual meeting of stockholders of the Company.

Communication with Directors

Stockholders and interested parties who wish to communicate with our board of directors, non-management members of our board of directors as a group, a committee of our board of directors or a specific member of our board of directors (including our Chairperson) may do so by letters addressed to the attention of our Chief Financial Officer.

All communications are reviewed by the Chief Financial officer and provided to the members of our board of directors as appropriate. Unsolicited items, sales materials, abusive, threatening or otherwise inappropriate materials and other routine items and items unrelated to the duties and responsibilities of our board of directors will not be provided to directors.

The address for these communications is:

Luminar Technologies, Inc.

2603 Discovery Drive, Suite 100

Orlando, Florida 32826

Attn: Chief Financial Officer

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of the members of our board of directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. Our Code of Business Conduct and Ethics is posted on the Investor Relations section of our website, which is located at https://investors.luminartech.com by clicking on “Governance Documents” in the “Governance” section of our website. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding

amendment to, or waiver from, a provision of our Code of Business Conduct and Ethics by posting such information on our website at the location specified above.

Policy Against Hedging

We have adopted a policy that prohibits members of our Board and all employees, including “officers” under Section 16 of the Exchange Act, from purchasing any financial instruments (such as prepaid variable forward contracts, equity swaps, collars or exchange funds) or otherwise engaging in any transactions that hedge the risk of Company stock ownership.

Director Compensation

In March 2021, the compensation & human capital management committee, comprised solely of independent directors, recommended to the board for approval a compensation policy for non-employee directors (the “Director Compensation Policy”) after consideration of market data and based on the recommendation of its independent compensation consultant. Our Board approved the Director Compensation Policy. The Director Compensation Policy consists of the following:

Cash Compensation. Each of our directors, with the exception of Mr. Russell, will receive $12,500 per quarter to serve as a member of our board, and any future lead independent director of our board will receive an additional $7,500 per quarter to serve in such capacity. Our non-employee directors do not receive per meeting fees.

In addition, each chair of our audit committee, compensation & human capital management committee and nominating and ESG committee, will receive $6,250, $5,000 and $2,500 per quarter, respectively, for serving as chair of these committees. The members of our audit committee, compensation & human capital management committee and nominating and ESG committee who are not the chair of the respective committee, will receive $3,125, $2,500 and $1,250 per quarter, respectively, to serve on these committees.

Non-employee directors are reimbursed for all reasonable travel and related expenses incurred in connection with attending board and committee meetings.

Equity Awards. Additionally, directors who are not our employees each receive equity compensation.

The following table sets forth information concerning the compensation of our non-employee directors during the year ended December 31, 2021.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees

Earned or

Paid in

Cash

($)(1) | | Stock Awards ($)(2) | | Total

($) |

| Alec Gores | | $ | 54,056 | | | $ | 222,460 | | (6) | | $ | 276,516 | |

| Matthew Simoncini | | 65,639 | | | 222,460 | | (6) | | 288,099 | |

| Dr. Mary Lou Jepsen (3) | | 42,472 | | | 578,042 | | (7) | | 620,514 | |

| Katharine A. Martin (3) | | 57,917 | | | 578,042 | | (7) | | 635,959 | |

| Jun Hong Heng (4) | | 35,027 | | | 430,687 | | (8) | | 465,714 | |

| Dr. Shaun Maguire (4) | | 35,027 | | | 430,687 | | (8) | | 465,714 | |

| Scott A. McGregor (5) | | 13,236 | | | — | | | | 13,236 | |

| Benjamin J. Kortlang (5) | | 13,236 | | | — | | | | 13,236 | |

(1)The following directors elected to receive payment in stock in lieu of cash pursuant to the Director Compensation Policy: Mr. Gores (3,586 shares), Mr. Simoncini (4,355 shares), Ms. Martin (3,843 shares), Dr. Jepsen (2,818 shares), and Dr. Maguire (2,324 shares). With respect to each such director, the underlying shares were issued based on the closing price of our common stock on the Nasdaq on December 15, 2021 ($15.07).

(2)Stock awards and option awards are reported at aggregate grant date fair value in the year granted, as determined in accordance with the provisions of FASB ASC Topic 718. For the assumptions used in valuing these awards for purposes of computing this expense, please see Note 14 of the Company’s consolidated financial statements for the year ended December 31, 2021.

(3)Commenced service as a Director on February 8, 2021.

(4)Commenced service as a Director on June 9, 2021.

(5)Ceased service as a Director on June 9, 2021.

(6)Represents 9,106 RSUs granted on June 9, 2021, and scheduled to vest on the earlier of June 9, 2022 or the date of our 2022 Annual Meeting of Stockholders, subject to the continuous service of the RSU holder on the vesting date. As of December 31, 2021, each of Messrs. Gores and Simoncini held 9,106 RSUs with an aggregate value of $153,982, based on the closing price of our common stock on the Nasdaq on December 31, 2021 ($16.91), and Mr. Simoncini held an aggregate 340,773 stock options in the Company, of which 134,889 were vested as of December 31, 2021.

(7)Represents (i) 14,627 RSUs granted on March 31, 2021, and scheduled to vest in three equal annual installments on the first, second and third anniversaries of February 8, 2021, subject to the RSU holder’s continued service as a member of the board of directors through each vesting date; and (ii) 9,106 RSUs granted on June 9, 2021, and scheduled to vest on the earlier of June 9, 2022 or the date of our 2022 Annual Meeting of Stockholders, subject to the continuous service of Dr. Jepsen and Ms. Martin on the vesting date. As of December 31, 2021, each of Dr. Jepsen and Ms. Martin held 23,733 RSUs with an aggregate value of $401,325, based on the closing price of our common stock on the Nasdaq on December 31, 2021 ($16.91).

(8)Represents 18,234 RSUs granted on June 10, 2021, and scheduled to vest in three equal annual installments on the first, second and third anniversaries of June 10, 2021, subject to the RSU holder’s continued service as a member of the board of directors through each vesting date. As of December 31, 2021, each of Mr. Heng and Dr. Maguire held 18,234 RSUs with an aggregate value of $308,337, based on the closing price of our common stock on the Nasdaq on December 31, 2021 ($16.91).

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

Candidates for nomination to our board of directors are selected by our board of directors based on the recommendation of our nominating and ESG committee in accordance with its charter, our amended and restated certificate of incorporation and amended and restated bylaws, our Corporate Governance Guidelines and the criteria approved by our board regarding director candidate qualifications. In recommending candidates for nomination, our nominating and ESG committee considers candidates recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates.

Additional information regarding the process for properly submitting stockholder nominations for candidates for nomination to our board of directors is set forth above under “Requirements for Stockholder Proposals to be considered for inclusion in our proxy materials for our 2023 Annual Meeting” and “Requirements for Stockholder Proposals to be presented at our 2023 Annual Meeting.”

Director Qualifications

With the goal of developing a diverse, experienced and highly qualified board of directors, our nominating and ESG committee is responsible for developing and recommending to our board the desired qualifications, expertise and characteristics of members of our board, including any specific minimum qualifications that the committee believes must be met by a committee-recommended nominee for membership on our board and any specific qualities or skills that the committee believes are necessary for one or more of the members of our board to possess.

Because the identification, evaluation and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, and will be significantly influenced by the particular needs of our board of directors from time to time, our board has not adopted a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory and Nasdaq listing requirements and the provisions of our amended and restated certificate of incorporation and amended and restated bylaws, our Corporate Governance Guidelines and the charters of the committees of our board of directors. When considering nominees, our nominating and ESG committee may take into consideration many factors including, among other things, a candidate’s independence, integrity, skills, financial and other expertise, breadth of experience, knowledge about our business or industry, willingness and ability to devote adequate time and effort to board responsibilities in the context of the existing composition, other areas that are expected to contribute to the board’s overall effectiveness and needs of the board and its committees. Our board of directors affirms the value placed on diversity within our company. Through the nomination process, our nominating and ESG committee seeks to promote board membership that reflects a diversity of talents, skills, background, including with respect to age, gender, national origin, sexual orientation and identification, race, ethnicity and culture and expertise necessary to provide sound and prudent oversight with respect to the operations and interests of the business and has approved a requirement to have diverse candidates in its candidate pool of nominees. Further, our board of directors is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool from which new candidates are selected. The brief biographical description of each director set forth in “Proposal One: Election of Directors” below includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of our board of directors at this time.

The following table provides information on the diversity of the current members of our board of directors as of April 13, 2022.

Board Diversity

| | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (As of April 13, 2022) |

| Total Number of Directors | | 7 |

| | Female | | Male | | Did Not Disclose Gender |

| Part I: Gender Identity | | | | | | |

| Directors | | 2 | | 3 | | 2 |

| Part II: Demographic Background | | | | | | |

| African American or Black | | -- | | -- | | -- |

| Alaskan Native or Native American | | -- | -- | | -- |

| Asian | | -- | | 1 | | -- |

| Hispanic or Latino | | -- | | -- | | -- |

| Native Hawaiian or Pacific Islander | | -- | | -- | | -- |

| White | | 2 | | 2 | | -- |

| Two or More Races or Ethnicities | | -- | | -- | | -- |

| LGBTQ+ | -- |

| Did Not Disclose Demographic Background | 2 |

PROPOSAL ONE: ELECTION OF CLASS II DIRECTORS

The current Class I and Class III directors will serve until our annual meetings of stockholders to be held in 2024 and 2023, respectively, or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

Upon the recommendation of the nominating and ESG committee, our board of directors has nominated Messrs. Gores and Simoncini to be elected as Class II directors at the Annual Meeting, each to serve a three-year term expiring at our annual meeting of stockholders to be held in 2025 or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. Messrs. Gores and Simoncini who are both current Class II directors are standing for re-election at the Annual Meeting.

Shares represented by proxies will be voted “FOR” the election of each of the two nominees named below, unless the proxy is marked to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder might determine. Each nominee has consented to being named in this Proxy Statement and to serve if elected. Proxies may not be voted for more than two directors. Stockholders may not cumulate votes for the election of directors.

Nominees to Our Board of Directors

The nominees and their ages, occupations and lengths of service on our board of directors as of April 13, 2022 are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Alec E. Gores | | 68 | | Director nominee |

Matthew J. Simoncini(1)(2) | | 61 | | Director nominee |

____________

(1) Member of the audit committee.

(2) Member of the compensation & human capital management committee.

Alec E. Gores, has served as a member of our board of directors since December 2020. Mr. Gores is the Founder, Chairman and Chief Executive Officer of The Gores Group, a global investment firm focused on acquiring businesses that can benefit from the firm’s operating expertise. Mr. Gores implemented an operational approach to private equity investing when he founded The Gores Group in 1987 by operating businesses alongside management, or in some cases in lieu of management, to build value in those entities. Since then, the firm has acquired more than 120 businesses including a current portfolio of more 8 active companies worldwide. Mr. Gores began his career as a self-made entrepreneur and operating executive. In 1978, he self-funded and founded Executive Business Systems (EBS), a developer and distributor of vertical business software systems. Within seven years, EBS had become a leading value-added reseller in Michigan and employed over 200 people. In 1986, CONTEL purchased EBS, and Mr. Gores subsequently began acquiring and operating non-core businesses from major corporations and building value in those entities, a decision that ultimately led to the founding of what has evolved into The Gores Group today. Under his leadership, The Gores Group has continued to acquire businesses in need of operational and financial resources, while creating value and working with management teams to establish an entrepreneurial environment as a foundation for sustainable growth. This philosophy has served the firm well. Mr. Gores served as the Chairman of the Board of Directors of Gores Holdings I from its inception in June 2015 until completion of the Hostess acquisition in November 2016, as the Chairman of the Board of Directors of Gores Holdings II since its inception in August 2016 until completion of the Verra acquisition in October 2018 and as the Chairman of the Board of Directors of

Gores Holdings III since its inception in October 2017 until the completion of the PAE acquisition in February 2020, as the Chairman of the Board of Directors of Gores Holdings IV from June 2019 until the completion of the UWM acquisition in January 2021, as the Chairman of the Board of Directors of Gores Holdings V from June 2020 until the completion of the AMP acquisition in August 2021, as the Chairman of the Board of Directors of Gores Holdings from June 2020 until the completion of the Matterport acquisition in July 2021. Mr. Gores has served as the Chairman of the board of directors of Gores Holdings VII since September 2020, Gores Holdings VIII since September 2020, Gores Technology since December 2020, Gores Technology II since December 2020, Gores Guggenheim since December 2020 and Gores Holdings IX since January 2021 and Gores Holdings X since January 2021. Mr. Gores has also served as the Chief Executive Officer and a director of Gores Metropoulos II since July 2020. Mr. Gores holds a degree in Computer Science from Western Michigan University. Mr. Gores’ significant investment and financial expertise make him well qualified to serve as a member of our board of directors.

We believe Mr. Gores is qualified to serve on our board of directors based on his significant investment and financial expertise.

Matthew J. Simoncini has served as a member of our board of directors since December 2020 and previously served on Legacy Luminar’s board of directors since June 2020. Mr. Simoncini has served on the board of directors of Kensington Capital Acquisition Corp., a special purpose acquisition company focused on companies in the automotive sector, since June 2020. He previously served on the board of directors of Cooper-Standard Holdings Inc., a leading global supplier of systems and components for the automotive industry, from August 2018 to May 2020. From September 2011 until his retirement in February 2018, Mr. Simoncini served as President and Chief Executive Officer and as a member of the board of directors of Lear Corporation (“Lear”), a global automotive technology company, and he served as Chief Financial Officer of Lear from September 2007 to September 2011. Mr. Simoncini joined Lear in May 1999 after Lear acquired UT Automotive, a supplier of electronic and interior products for the auto industry, where he served as Director of Global Financial Planning & Analysis from April 1996 to May 1999. Mr. Simoncini holds a B.A. in business administration and an Honorary Doctorate of Law from Wayne State University.

We believe Mr. Simoncini is qualified to serve on our board of directors based on his extensive executive leadership and management experience and his significant strategic and financial expertise in the automotive and automotive-related industries.

Continuing Directors

The directors who are serving for terms that end following the Annual Meeting and their ages, occupations and lengths of service on our board of directors as of April 13, 2022 are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Austin Russell | | 27 | | Chairperson, Director, President and Chief Executive Officer |

Jun Hong Heng(1) (3) | | 40 | | Director |

Mary Lou Jepsen, PhD(2)(3) | | 57 | | Director |

Shaun Maguire, PhD(1) | | 36 | | Director |

Katharine A. Martin (2)(3) | | 59 | | Director |

___________

(1) Member of the audit committee.

(2) Member of the compensation & human capital management committee.

(3) Member of the nominating and ESG committee.

Austin Russell has served as our President and Chief Executive Officer and as Chairperson and member of our board of directors since December 2020 and prior to this, served as President and Chief Executive Officer of Legacy Luminar and as a member of its board of directors since founding Legacy Luminar. Mr. Russell developed his first visioning system at age eleven by building prototype supercomputers and optoelectronic systems with real-world applications in mind. He wrote his first patent application at 12, and over the next four years worked on a host of photonics and imaging related technologies before he later became an independent researcher at the Beckman Laser Institute. After being recruited to Stanford for Applied Physics, he was awarded the Thiel Fellowship at 17 to pursue Legacy Luminar full-time with a vision to develop a new kind of sensing technology to make autonomous vehicles both safe and ubiquitous.

We believe that Mr. Russell is qualified to serve on our board of directors because he is our founder, our largest stockholder and has the long-term vision for Luminar and due to his operational and historical expertise gained from serving as Legacy Luminar’s President and Chief Executive Officer since Legacy Luminar’s inception.

Jun Hong Heng has served as a member of our board of directors since June 2021 and is the Founder and the Chief Investment Officer of Crescent Cove Advisors, LP (“Crescent Cove”) since August 2018. Since Feb 2021, Mr. Heng is also the Chairman and Chief Executive Officer of COVA Acquisition Corp. Mr. Heng is also the Founder of Crescent Cove Capital Management LLC and has served as its Chief Investment Officer since February 2016. Prior to Crescent Cove Capital Management LLC, Mr. Heng served as Principal of Myriad Asset Management, an investment firm, from August 2011 to January 2015, where he focused on Asian credit and equity, including special situations. From June 2008 to June 2011, he served as Vice President of Argyle Street Management, a spin-off from Goldman Sachs Asian Special Situations Group. Previously, Mr. Heng served as an analyst at Morgan Stanley, where he focused on Asia, and as an analyst at Bear, Stearns & Co., where he served in a multi-disciplinary role across technology, media and telecommunications, mergers and acquisitions, and equity and debt capital markets. Mr. Heng holds a B.B.A. in Finance and Accounting from the Stephen M. Ross School of Business at the University of Michigan.

We believe Mr. Heng is qualified to serve as a director based on his extensive investment and financial expertise.

Mary Lou Jepsen, PhD has served as a member of our board of directors since February 2021. Dr. Jepsen is the CEO, Founder and Chairperson of the board of directors of Openwater, a San Francisco-based medical laser imaging device technology company. Previously, Dr. Jepsen served as the Executive Director of Engineering at Facebook, Inc. and Head of Display Technologies at Oculus, and before that served a similar role at Google, Inc. and X (formerly Google X). She also co-founded and served as the Chief Technology Officer of One Laptop per Child, a nonprofit organization, of which she was the lead architect designing $100 laptops that were shipped to millions of children in the developing world. Dr. Jepsen has served on the board of directors of Lear Corporation (“Lear”), a leading, global tier-1 automotive components supplier, since March 2016. Dr. Jepsen holds a Ph.D. degree from Brown University in Optical Sciences, an M.S. from Massachusetts Institute of Technology in Visual Studies and a Sc.B. from Brown University in Electrical Engineering and Studio Art.

We believe Dr. Jepsen is qualified to serve on our board of directors based on her exceptional track record of leadership and innovation including her senior management experience in the technology industry and as a board member of a publicly traded company.

Shaun Maguire, PhD has served as a member of our board of directors since June 2021 and is currently a General Partner at Sequoia Capital. Prior to joining Sequoia Capital in 2019, Dr. Maguire served as Co-Founder and Chairman of Expanse (formerly known as Qadium) from May 2012 to December 2020, when Expanse was acquired by Palo Alto Networks. Dr. Maguire also served as Partner of GV from 2016 to 2019, Co-Founder of Escape Dynamics, Inc. from 2010 to 2015, Consultant at the