Filed Pursuant to Rule 253(g)(2)

File No. 024-10927

FUNDRISE INCOME EREIT III, LLC

SUPPLEMENT NO. 6 DATED JUNE 1, 2020

TO THE OFFERING CIRCULAR DATED MARCH 11, 2020

This document supplements, and should be read in conjunction with, the offering circular of Fundrise Income eREIT III, LLC (the “Company”, “we”, “our” or “us”), dated March 11, 2020 and filed by us with the Securities and Exchange Commission (the “Commission”) on March 11, 2020 (the “Offering Circular”). Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the Offering Circular.

The purpose of this supplement is to:

| · | Revise various sections in the Offering Circular to provide updated market and risk factor disclosure in response to the impact of COVID-19 on real estate markets, the economy and the Company; |

| · | Disclose the letter sent to investors on or about May 7, 2020; and |

| · | Disclose as an appendix the information contained in the Company’s Annual Report on Form 1-K for the fiscal year ended December 31, 2019. |

Revisions to Offering Circular in Response to COVID-19

The revised disclosure set forth under the section of the Offering Circular entitled “Market Opportunities” is as follows:

Market Opportunities

The direct and indirect impact of COVID-19 on the real estate markets are unprecedented. Given the prospect of negative growth for the economy in the near term and anemic growth for the mid-to-long term, we favor a strategy weighted toward targeting senior and mezzanine debt with significant subordinate capital and downside structural protections. In contrast, returns typically associated with pure equity strategies are mostly dependent on asset appreciation, capitalization rate compression, cash flow growth, aggressive refinancing and/or sale of the underlying property. We believe that our investment strategy combined with the experience and expertise of our Manager’s management team provide opportunities to originate investments with attractive current and accrued returns and strong structural features directly with local, joint venture real estate companies, thereby taking advantage of disrupted market conditions in order to seek the best risk-return dynamic for our shareholders.

The revised disclosure set forth under the section of the Offering Circular entitled “Market Overview and Opportunity” is as follows:

Market Overview and Opportunity

As the shocks from the shutdowns and the ongoing health crisis reverberate through the economy, we believe there will be acute demand for senior loans and structured bridge financing throughout real estate markets. We believe that the near and intermediate-term market for investment in commercial real estate loans, commercial real estate and other real estate-related assets is compelling from a risk-return perspective. Given the prospect of negative growth for the economy in the near term and anemic growth for the mid-to-long term, we favor a strategy weighted toward targeting senior and mezzanine debt, which maximize current income, with significant subordinate capital and downside structural protections. In contrast, returns typically associated with pure equity strategies are dependent on asset appreciation, capitalization rate compression, cash flow growth, aggressive refinancing and/or sale of the underlying property. We believe that our investment strategy combined with the experience and expertise of our Manager’s management team will provide opportunities to originate investments with attractive current and accrued returns and strong structural features directly with real estate companies, thereby taking advantage of changing market conditions in order to seek the best risk-return dynamic for our shareholders.

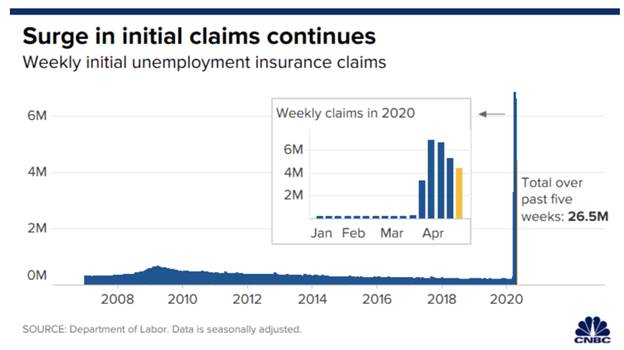

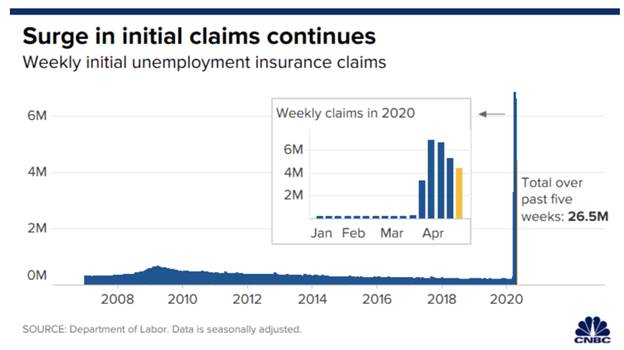

According to the U.S. Department of Labor, there have been 36.8 million initial jobless claims in the nine weeks prior to May 21, 2020, increasing the real unemployment rate to around 25% — the highest level since 1934.

The magnitude of the economic downturn is uncertain but appears to be as severe as the Great Recession, if not more so, as illustrated by a number of recent economic indicators:

| · | During the week of March 31 to April 6, 2020, compared to the same period the year before, hotel occupancy was down nearly 70%, with only 21.6% rooms filled, per a new report from STR, one of the leading hospitality data sources. |

| · | On April 20, 2020, Fitch Ratings published that $100 billion of CMBS borrowers have requested relief in the prior 30-days. |

| · | On April 21, 2020, UBS analysts predicted the coronavirus pandemic could cause 100,000 retail closures by 2025, as compared to 65,000 during the Great Recession. |

| · | On April 24, 2020, Congressional Budget Office forecast 2020's second fiscal quarter GDP to contract 39.6% year over year. |

We believe that the current extraordinary economic conditions will cause an extended credit market dislocation and should create an investment environment in extreme need of new capital sources and additional lending.

The global impact of the outbreak of COVID-19 has been rapidly evolving, continues to have an adverse impact on economic and market conditions and presents material uncertainty and risk with respect to the Company’s future performance and future financial results. The Company is unable to quantify the impact COVID-19 may have on the market opportunity and its future financial results at this time.

The revised disclosure set forth under the section of the Offering Circular entitled “Market Outlook – Real Estate Finance Markets” is as follows:

Market Outlook — Real Estate Finance Markets

The direct and indirect impact of COVID-19 on the real estate markets are unprecedented. Given the prospect of negative growth for the economy in the near term and anemic growth for the mid-to-long term, we favor a strategy weighted toward targeting senior and mezzanine debt, which maximize current income, with significant subordinate capital and downside structural protections. In contrast, returns typically associated with pure equity strategies are mostly dependent on asset appreciation, capitalization rate compression, cash flow growth, aggressive refinancing and/or sale of the underlying property. We believe that our investment strategy combined with the experience and expertise of our Manager’s management team provide opportunities to originate investments with attractive current and accrued returns and strong structural features directly with local, joint venture real estate companies, thereby taking advantage of disrupted market conditions in order to seek the best risk-return dynamic for our shareholders.

Since the beginning of March 2020, the Federal Reserve launched an unprecedented barrage of monetary stimulus, including lowering Federal Reserve benchmark rates to a range of zero to 0.25% and expanding its balance sheet to $6.6 trillion. According to MarketWatch, the Federal Reserve’s balance sheet is likely to expand to $9 trillion by mid-June 2020. On March 9th, 30-year Treasury Rates reached 0.99%, the lowest on record.

The global impact of the outbreak of COVID-19 has been rapidly evolving, continues to have an adverse impact on economic and market conditions and presents material uncertainty and risk with respect to the Company’s future performance and future financial results. At this time, the Company is unable to quantify the impact COVID-19 may have on its future financial results as well as on the broader real estate financial markets.

Risks related to a prolonged economic downturn could adversely affect growth and the values of our investments. In the event market fundamentals continue to deteriorate, our real estate portfolio or the collateral security in any loan investment we make may be impaired as a result of lower occupancy, lower rental rates, and/or declining values. However, the circumstances that materially impact the cost and availability of credit to borrowers should create increased demand for financing and capital infusions that the Company may be able to provide at attractive risk-adjusted returns.

The additional risk factors included under the section of the Offering Circular entitled “Risk Factors – Risks Relating to Economic Conditions” are as follows:

Global economic, political and market conditions and economic uncertainty caused by the recent outbreak of coronavirus (COVID-19) may adversely affect our business, results of operations and financial condition.

The current worldwide financial market situation, various social and political tensions in the United States and around the world, and the recent public health crisis caused by the novel coronavirus (COVID-19), may continue to contribute to increased market volatility, may have long-term effects on the United States and worldwide financial markets, and may cause further economic uncertainties or deterioration in the United States and worldwide. Economic uncertainty can have a negative impact on our business through changing spreads, structures and purchase multiples, as well as the overall supply of investment capital. Since 2010, several European Union, or EU, countries, including Greece, Ireland, Italy, Spain, and Portugal, have faced budget issues, some of which may have negative long-term effects for the economies of those countries and other EU countries. Additionally, the precise details and the resulting impact of the United Kingdom’s vote to leave the EU, commonly referred to as “Brexit”, are impossible to ascertain at this point. The effect on the United Kingdom’s economy will likely depend on the nature of trade relations with the EU following its exit, a matter to be negotiated. The decision may cause increased volatility and have a significant adverse impact on world financial markets, other international trade agreements, and the United Kingdom and European economies, as well as the broader global economy for some time. Further, there is continued concern about national-level support for the Euro and the accompanying coordination of fiscal and wage policy among European Economic and Monetary Union member countries. In addition, the fiscal policy of foreign nations, such as China, may have a severe impact on the worldwide and United States financial markets. Finally, public health crises, pandemics and epidemics, such as those caused by new strains of viruses such as H5N1 (avian flu), severe acute respiratory syndrome (SARS) and, most recently, the novel coronavirus (COVID-19), are expected to increase as international travel continues to rise and could adversely impact our business by interrupting business, supply chains and transactional activities, disrupting travel, and negatively impacting local, national or global economies. We do not know how long the financial markets will continue to be affected by these events and cannot predict the effects of these or similar events in the future on the United States economy and securities markets or on our investments. As a result of these factors, there can be no assurance that we will be able to successfully monitor developments and manage our investments in a manner consistent with achieving our investment objectives.

The ongoing COVID-19 pandemic and measures intended to prevent its spread could have a material adverse effect on our business, results of operations, cash flows and financial condition.

The COVID-19 pandemic has caused, and is likely to continue to cause, severe economic, market and other disruptions worldwide. We cannot assure you that conditions in the bank lending, capital and other financial markets will not continue to deteriorate as a result of the pandemic, or that our access to capital and other sources of funding will not become constrained, which could adversely affect the availability and terms of future borrowings, renewals or refinancings. In addition, the deterioration of global economic conditions as a result of the pandemic may ultimately decrease occupancy levels and pricing across our portfolio and may cause one or more of our tenants to be unable to meet their rent obligations to us in full, or at all, or to otherwise seek modifications of such obligations. In addition, governmental authorities may enact laws that will prevent us from taking action against tenants who do not pay rent.

The extent of the COVID-19 pandemic’s effect on our operational and financial performance will depend on future developments, including the duration, spread and intensity of the outbreak, all of which are uncertain and difficult to predict. Due to the speed with which the situation is developing, we are not able at this time to estimate the effect of these factors on our business, but the adverse impact on our business, results of operations, financial condition and cash flows could be material.

Investor Letter sent on or about May 7, 2020

The following letter was sent by our Manager to our shareholders on or about May 7, 2020. All references to “we,” “our,” and “us” in the following letter refer to our Sponsor, Rise Companies Corp.

An in-depth look at how we plan to invest through the crisis

In our latest letter, we walk through our strategy to fully take into consideration the impacts of the current downturn as we make new investments.

Key takeaways:

| · | As has generally occurred in past recessions, we expect that attractive opportunistic investments will begin to present themselves, but this is likely to take time and patience will be key. |

| · | In the immediate term, the investment plans will primarily be allocated to newly launched funds so that we are able to proactively pursue investment strategies that fully take into consideration the impacts of the current downturn. |

| · | Generally, we expect there to be three broad phases of our investment strategy over the next 12 to 18 months: |

| Objective | Target investments | |

| Phase I | Maximize near term flexibility | Public markets and structured debt |

| Phase II | Maintain stability and increase yield | Distressed debt and private market rescue/bridge loans |

| Phase III | Capitalize on opportunities for higher potential return | Undervalued properties that we intend to hold long-term |

Although the long-term impact of the COVID-19 pandemic on the broader economy remains highly uncertain, we continue to believe that the potential for a deeper and more prolonged recession is much greater than the stock market and its many commentators appear to be anticipating at this time.

While the primary “peak” of new cases in the country may be behind us (and therefore the nationwide shutdown may slowly begin to ease in certain areas), the risk of an ongoing series of localized outbreaks that result in a second wave or even a steady build up of new cases seems highly probable. These outbreaks will likely require further shutdowns which in turn (even if they are limited) will put broadly sustained downward pressure on the economy.

Governments can allow business to reopen, but they cannot force fearful consumers to leave their homes and start spending again. High unemployment, beleaguered business, and real health dangers may dampen any pent-up demand that exists, making it difficult for the recovery to take hold.

Additionally, bills have continued to pile up, in spite of the fact that much of the country has been in suspended animation for the last six weeks. Notwithstanding various government stimulus programs, most businesses that have been forced to temporarily close still have had to carry some payroll and healthcare costs. They may have delayed paying their mortgage, rent, insurance, utilities, and local taxes but those expenses have not been forgiven and more than likely they also have outstanding payments to their vendors. When the economic clock starts up again, all those accumulated bills will come due and many businesses will not be able to pay them.

The market is a complex chain of relationships. One company’s expense is another company’s revenue. So, if customers are afraid to go out and spend, restaurants and retailers won’t earn enough to pay their suppliers and landlords. And if suppliers are left with unpaid orders, they won’t be able to make payroll. And if tenants can’t afford to pay their rent, landlords won’t be able to make their debt service payments to the bank. And if banks are afraid that their borrowers won’t make their loan payments, they will begin to stop extending credit — the very thing every other business needs to get back up and running.

The negative impacts of such a downward spiral are numerous and while the current disruption in the market will inevitably lead to new investment opportunities, we feel that we are still early in this process and now is a time for caution.

Real estate markets move slowly (typically lagging the public stock market), so we believe that it will take several months for the downstream effects of the pandemic and subsequent response to fully work their way into our corner of the economy.The Great Recession, for example, lasted 18 months and many of the best buying opportunities in the real estate market didn’t open up until 12 to 24 months after it began. Meanwhile, it’s barely been 60 days since the current downturn started.

Sources: Federal Reserve Economic Data, Yahoo Finance

At this point, we feel the smartest thing we can do for our investors is to begin putting ourselves in the position to act on these opportunities once they do start to arise. This means both continuing to build up a larger cash reserve across the portfolio (which today totalsnearly $200 million in cash across all active funds) and establishing ourselves as a ready and willing buyer within the channels of brokers and agents that act as a conduit to future deal flow.

Ultimately, the benefit of having been more conservative up to this point in the cycle combined with our willingness to be patient should afford us better opportunities to acquire those assets that we believe will generate outsized returns over the long-term as a result of the more permanent structural changes to behavior that emerge from the pandemic.

Below we walk through our specific investment strategy in more detail, which we’ve broken into three relative phases.

(Keep in mind that the following represents what we believe to be appropriate given what we know today. It’s also important to note that rather than occur in strict succession, there is likely to be some overlap and that, depending on future circumstances, we may deviate from this strategy significantly.)

| · | Phase I: Maximize near term flexibility |

| · | Phase II: Maintain stability and increase yield |

| · | Phase III: Capitalize on opportunities for higher potential return |

Phase I: Maximize near term flexibility

Target investments: liquid and structured debt markets

In most financial crises, the first major asset class to experience disruption is credit markets. This is due to the fact that credit is by far the largest asset class and is simultaneously exposed to both long-term economic riskand overnight margin requirements. A long bull market, like the record-setting one that ended in February, encourages a false sense of security. As we indicated in our2019 year-end letter to investors, the Fed, in its “lower for longer” accommodative monetary policy, effectively signaled to many market participants a green light to take on more risk. Gradually, but ever increasingly, investors borrowed short to lend long. And when the paradigm suddenly and unexpectedly shifted from optimism to fear, institutions called in their lines and demanded paydowns, triggering the start of a vicious doom loop of forced selling and sharp price declines.

For those who don’t make a living trading in them (i.e., nearly everyone), credit markets can often seem completely out of sync with the real world because they trade on the expectations of what the often distant future will bring. They therefore tend to collapse before any real materially adverse changes take place in the economy, and then seemingly rebound even amid mounting job losses, reduced earnings, or even bankruptcies.

For this reason, they can be both a bellwether for the future as well as one of the first places where opportunities to find value emerge.

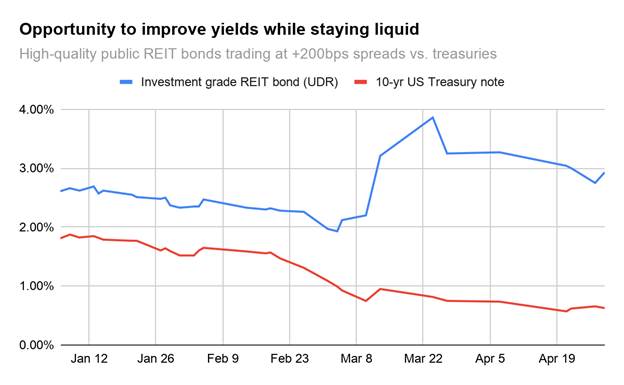

While we’velong believedthat the general stock market was overvalued anddue for a correction, we believe that for certain assets, such as high-quality credit, the recent collapse in pricing was driven more by a lack of liquidity than by weakness in the underlying fundamentals. In some instances, spreads for high grade borrowers have blown out by hundreds of basis points while the underlying assets remain more or less stable. Although spreads have begun to normalize as liquidity returns, we believe there is an interim opportunity to deploy a portion of our existing cash reserves from now near-zero yielding money markets into specific, more liquid securities such as REIT bonds (i.e., loans to public real estate companies), where we have a deep understanding of the underlying assets securing the debt due to managing and operating very similar properties ourselves.

Sources: FINRA Market Data, Yahoo Finance

Today, some of these REIT bonds, with effective LTVs of approximately 40 ‒ 60%, are pricing at +200 basis point spreads above US Treasuries (a basis point equals 1/100th of a percent, so the aforementioned bonds are trading at a price that yields a 2% premium to a US Treasury note). By comparison, the same bond was trading at a +50 basis point spread only a few months earlier. We believe these bonds, with their increased spreads, represent a prudent interim investment today that will generate yields superior to money market funds (which now only pay about 25 basis points) while still providing near term flexibility for when we determine it is appropriate to shift into more illiquid, opportunistic acquisitions.

Phase II: Maintain midterm stability while seeking increased yield

Target investments: distressed debt and private market bridge / rescue loans

As the shock of the abrupt shutdown continues to reverberate through the economy, we expect that some of the first real estate assets to be impacted will be projects that are midway through development. This could include properties that are still in the process of completing their entitlements, or even buildings that are under construction. Either way, the combined impact of the shutdown of non-essential businesses with the rapid change in the commercial lending environment is likely to produce a cohort of projects that are behind schedule and in need of additional funds to reach completion.

In certain cases, these projects may not have inherent flaws or weaknesses, but are simply the victims of poor timing and circumstances changing beneath them. Even experienced developers will often only capitalize a new development with a 10% contingency for timing delays and cost overruns, leaving little room for the unexpected. Many of these projects will need short-term additional funding in order to ensure they are able to deliver. Due to the existential nature of not completing a development — a half-finished building isn’t worth much — the value of these additional funds tends to be extremely high. While the most likely source of additional funding should be capital calls from existing equity investors, some of those equity investors may be unwilling or unable to step up to the plate. In which case, the sponsor would then need to look to external sources to rescue the project and “bridge” it to completion.

In these instances, the combination of substantial cash reserves, along with our experience as an operator and investor in similar projects, should put us in a compelling position to recapitalize select projects that we believe have the strongest fundamentals. Since the liquidity provided by our cash reserves tends to be scarce during times like this, we’d expect to be able to invest at a lower basis and a higher return than we would have been able to only a few months earlier.

Phase III: Capitalize on opportunities for higher potential return

Target investments: Direct ownership of undervalued properties that fit long-term macroeconomic trends

Capitalizing on opportunities for the direct acquisition of assets whose prices have come down substantially below where they were trading previously will have the longest lead time. This is primarily due to the fact that in most instances, unless an existing owner is in a truly distressed situation, they are unlikely to sell an asset for substantially less than what they had expected to receive before the downturn. In other words, external events must force a sale.

In this case, distress would likely come from owners who overleveraged the asset itself or have overextended themselves as the sponsorship-ownership group.

To understand the natural lag in starting to see these opportunities, take for example the hypothetical owner of a retail shopping center in today’s environment.

| 1. | Due to the shutdown, most if not all of the tenants in the center are closed, or at minimum providing delivery-only services. Few are generating enough revenue to afford to pay their rent and the owner is probably willing — if not required in certain states — to extend several months of rent relief to the tenants. |

| 2. | It may be 3+ months before all the tenants are able to fully reopen for business. And once they do, it’s unclear if many will actually be able to survive after having drained much of their cash reserves, and with customers potentially choosing to continue to do a majority of their shopping online. |

| 3. | During what may be a painful 6 to 12 month period, as stores close and income from the property deteriorates, the owner will struggle to cover their debt service payments to their lender. |

| 4. | After a series of short-term extensions and potentially even last-ditch capital infusions from the owner in an attempt to stabilize the property, they may finally determine that |

their best option is either to sell the asset at a substantial discount to their basis, or simply give the asset back to the lender in foreclosure.

In summary, even for assets such as failing retail shopping centers that are likely to experience the most immediate and substantial negative impact, it would take 12 months or more before an asset actually changes hands at a distressed price.

Much like Warren Buffet,we believe it is better to buy great real estate at a good price than bad real estate at a great price.So, we will focus our efforts on those assets that we believe have the strongest fundamentals and long-term growth drivers.

What does this mean for your portfolio?

In the immediate term, the investment plans will primarily be allocated to newly launched funds so that we are able to proactively pursue the aforementioned investment strategies that fully take into consideration the impacts of the COVID-19 downturn, as well as the natural timing of private real estate markets. While having a blank slate from which to invest provides the flexibility necessary to execute on these strategies, it also means that these new dollars invested through the plans will be going into funds with only a limited number of assets for some period of time.

In addition, the relative variation between our income and growth focused plans is likely to be less pronounced while, during Phase I & II, we seek to deploy into those assets that provide investors with the greatest stability and flexibility. As we eventually move into Phase III, we’d expect the plans to begin to diverge more as the income funds would likely continue to hold some of the longer-term income focused assets while the growth funds would likely allocate out of short term, liquid assets to acquire potentially undervalued or distressed assets that may have very little yield during the period required to fix or rebuild the asset but that have much higher potential returns should that work prove accretive.

While investing with Fundrise has and will always be a long-term proposition (something we’ve written about many times),we expect the current environment to require an even greater level of patience from us if we are to fully capture the opportunity created by the moment.

Fortunately, because of the strength and size of our overall portfolio, as well as our ability to deploy into certain types of institutional grade public and private market assets, we believe we will be able to deliver for our investors a strategy that otherwise would not be available to them as individuals.

As always, our unique advantage comes from our 130K strong investor community and the ability for that collective force to come together to direct action for the benefit of the whole.

Annual Report on Form 1-K

The following information is contained in the Company’s Annual Report on Form 1-K for the fiscal year ended December 31, 2019 and is included as an appendix to the Offering Circular:

Appendix

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

We make statements in this Annual Report on Form 1-K (“Annual Report”) that are forward-looking statements within the meaning of the federal securities laws. The words “outlook,” “believe,” “estimate,” “potential,” “projected,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” “could” and similar expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Annual Report or in the information incorporated by reference into this Annual Report.

The forward-looking statements included in this Annual Report are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

| · | our ability to effectively deploy the proceeds raised in our initial and subsequent offerings (the “Offering(s)”); |

| · | our ability to attract and retain shareholders to the online investment platform located atwww.fundrise.com (the “Fundrise Platform”) of Rise Companies Corp. (our “Sponsor”); |

| · | risks associated with breaches of our data security; |

| · | public health crises, pandemics and epidemics, such as those caused by new strains of viruses such as H5N1 (avian flu), severe acute respiratory syndrome (SARS) and, most recently, the novel coronavirus (COVID-19); |

| · | changes in economic conditions generally and the real estate and securities markets specifically; |

| · | limited ability to dispose of assets because of the relative illiquidity of real estate investments; |

| · | increased interest rates and operating costs; |

| · | our failure to obtain necessary outside financing; |

| · | risks associated with derivatives or hedging activity; |

| · | our level of debt and the terms and limitations imposed on us by our debt agreements; |

| · | our ability to retain our executive officers and other key personnel of our advisor, our property manager and their affiliates; |

| · | expected rates of return provided to investors; |

| · | the ability of our Sponsor and its affiliates to source, originate and service our loans and other assets, and the quality and performance of these assets; |

| · | our ability to retain and hire competent employees and appropriately staff our operations; |

| · | legislative or regulatory changes impacting our business or our assets (including changes to the laws governing the taxation of REITs and Securities and Exchange Commission (“SEC”) guidance related to Regulation A (“Regulation A”) of the Securities Act of 1933, as amended (the “Securities Act”), or the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”)); |

| · | changes in business conditions and the market value of our assets, including changes in interest rates, prepayment risk, operator or borrower defaults or bankruptcy, and generally the increased risk of loss if our investments fail to perform as expected; |

| · | our ability to implement effective conflicts of interest policies and procedures among the various real estate investment opportunities sponsored by our Sponsor; |

1

| · | our ability to access sources of liquidity when we have the need to fund redemptions of common shares in excess of the proceeds from the sales of our common shares in our continuous offering and the consequential risk that we may not have the resources to satisfy redemption requests; |

| · | our failure to maintain our status as a real estate investment trust (“REIT”); |

| · | our compliance with applicable local, state and federal laws, including the Investment Advisers Act of 1940, as amended, the Investment Company Act of 1940, as amended, and other laws; and |

| · | changes to U.S. generally accepted accounting principles (“U.S. GAAP”). |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report. All forward-looking statements are made as of the date of this Annual Report and the risk that actual results will differ materially from the expectations expressed in this Annual Report will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Annual Report, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Annual Report will be achieved.

2

| Item 1. | Business |

Fundrise Income eREIT III, LLC is a Delaware limited liability company formed on October 5, 2018 to originate, invest in, and manage a diversified portfolio of commercial real estate investments and other real estate-related assets. We may also invest in real estate-related debt securities (including commercial mortgage-backed securities (“CMBS”), collateralized debt obligations (“CDOs”), and REIT senior unsecured debt) and other real estate-related assets. We may make our investments through majority-owned subsidiaries, some of which may have rights to receive preferred economic returns. The use of the terms “Fundrise Income eREIT III”, the “Company”, “we”, “us” or “our” in this Annual Report refer to Fundrise Income eREIT III, LLC unless the context indicates otherwise.

As a limited liability company, we have elected to be taxed as a C corporation. Commencing with the taxable year ending December 31, 2019, the Company operates in a manner intended to qualify for treatment as a REIT under the Internal Revenue Code of 1986.

As of December 31, 2019 and 2018, our portfolio was comprised of approximately $43.9 million and $0 million, respectively, of gross capital deployed in real estate investments, that in the opinion of Fundrise Advisors, LLC (our “Manager”) meets our investment objectives. SeeItem 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations - Recent Developments for information concerning our investments since December 31, 2019. We intend to diversify our portfolio by investment type, investment size and investment risk with the goal of attaining a portfolio of real estate assets that provide attractive and stable returns to our investors. We make our investments through direct loan origination, the acquisition of individual loan or securities assets or by acquiring portfolios of assets, other mortgage REITs or companies with investment objectives similar to ours.

We are externally managed by our Manager, which is an investment adviser registered with the SEC, and a wholly-owned subsidiary of our Sponsor, the parent company of Fundrise, LLC, our affiliate. Fundrise, LLC owns and operates the Fundrise Platform, which allows investors to hold interests in real estate opportunities that may have been historically difficult to access for some investors. Our Manager has the authority to make all of the decisions regarding our investments, subject to the limitations in our operating agreement and the direction and oversight of our Manager’s investment committee. Our Sponsor also provides asset management, marketing, investor relations and other administrative services on our behalf. Accordingly, we do not currently have any employees nor do we currently intend to hire any employees who will be compensated directly by us.

Investment Strategy

We intend to originate, acquire, asset manage, selectively leverage, syndicate and opportunistically sell investments in a variety of commercial real estate loans (including senior mortgage loans, subordinated mortgage loans (“B-Notes”), mezzanine loans, and participations in such loans) and investments in commercial real estate (through majority-owned subsidiaries with rights to receive preferred economic returns). We may also invest in commercial real estate-related debt securities (including CMBS, CDOs and REIT senior unsecured debt), and other real estate-related assets.

We will seek to create and maintain a portfolio of investments that generate a low volatility income stream that provide attractive and consistent cash distributions. Our focus on investing in debt and debt-like instruments will emphasize the payment of current returns to investors and the preservation of invested capital, with a lesser emphasis on seeking capital appreciation. We expect that our portfolio of investments will be secured primarily by U.S. based collateral and diversified by security type, property type and geographic location.

Our Manager directly structures, underwrites and originates many of the debt products in which we invest, as this provides for the best opportunity to manage our borrower and partner relationships and optimize the terms of our investments. Our proven underwriting process, which our management team has successfully developed over their extensive real estate careers in a variety of market conditions and implemented at our Sponsor, will involve comprehensive financial, structural, operational and legal due diligence of our borrowers and partners in order to optimize pricing and structuring and mitigate risk. We feel the current and future market environment (including any existing or future government-sponsored programs) provides a wide range of opportunities to generate compelling investments with strong risk-return profiles for our shareholders.

In executing on our business strategy, we believe that we benefit from our Manager’s affiliation with our Sponsor given our Sponsor’s strong track record and extensive experience and capabilities as an online real estate origination and funding platform. These competitive advantages include:

| · | our Sponsor’s experience and reputation as a leading real estate investment manager, which historically has given it access to a large investment pipeline similar to our targeted assets and the key market data we use to underwrite and portfolio manage assets; |

3

| · | our Sponsor’s direct and online origination capabilities, which are amplified by a proprietary technology platform, business process automation, and a large user base, of which a significant portion are seeking capital for real estate projects; |

| · | our Sponsor’s relationships with financial institutions and other lenders that originate and distribute commercial real estate debt and other real estate-related products and that finance the types of assets we intend to acquire and originate; |

| · | our Sponsor’s experienced portfolio management team which actively monitors each investment through an established regime of analysis, credit review and protocol; and |

| · | our Sponsor’s management team, which has a successful track record of making commercial real estate investments in a variety of market conditions. |

Investment Objectives

Our primary investment objectives are:

| · | to pay attractive and consistent cash distributions; and |

| · | to preserve, protect and return shareholders’ capital contributions. |

We will also seek to realize growth in the value of our investments by timing their sale to maximize value. However, there is no assurance that our investment objectives will be met. We cannot assure you that we will attain these objectives or that the value of our assets will not decrease. Furthermore, within our investment objectives and policies, our Manager has substantial discretion with respect to the selection of specific investments and the purchase and sale of our assets. Our Manager’s investment committee will review our investment guidelines at least annually to determine whether our investment guidelines continue to be in the best interests of our shareholders.

Competition

Our net income depends, in large part, on our ability to source, acquire and manage investments with attractive risk-adjusted yields. In originating these investments, we compete with other mortgage REITs, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, private funds, other lenders, governmental bodies and other entities, as well as online lending platforms that compete with the Fundrise Platform, many of which have greater financial resources and lower costs of capital available to them than we have. In addition, there are numerous mortgage REITs with asset acquisition objectives similar to ours, and others may be organized in the future, which may increase competition for the investments suitable for us. Competitive variables include market presence and visibility, size of loans offered and underwriting standards. To the extent that a competitor is willing to risk larger amounts of capital in a particular transaction or to employ more liberal underwriting standards when evaluating potential investments than we are, our investment volume and profit margins for our investment portfolio could be impacted. Our competitors may also be willing to accept lower returns on their investments and may succeed in buying the assets that we have targeted for acquisition. Although we believe that we are well positioned to compete effectively in each facet of our business, there is enormous competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter increased competition in the future that could limit our ability to conduct our business effectively.

Risk Factors

We face risks and uncertainties that could affect us and our business as well as the real estate industry generally. These risks are outlined under the heading “Risk Factors” contained in our latest offering circular filed with the SEC (the “Offering Circular”), which may be accessed here, as the same may be updated from time to time by our future filings under Regulation A. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. These risks could result in a decrease in the value of our common shares.

4

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes thereto contained in this Annual Report. The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the “Statements Regarding Forward-Looking Information.” Unless otherwise indicated, latest results discussed below are as of December 31, 2019.

Offering Results

We have offered, are offering, and will continue to offer up to $50.0 million in our common shares in our Offering. As of December 31, 2019 and 2018, we had raised total gross offering proceeds of approximately $49.1 million and $5,000, respectively, from settled subscriptions (including $100,000 received in the private placements to our Sponsor, and Fundrise, L.P., an affiliate of our Sponsor, and $5,000 received in the private placement to our Sponsor, as of December 31, 2019 and 2018, respectively), and had settled subscriptions in our Offering and private placements for an aggregate of approximately 4,914,000 and 500, respectively, of our common shares. Assuming the settlement for all subscriptions received as of December 31, 2019, approximately 95,000 of our previously qualified common shares remained available for sale to the public under our Offering.

We expect to offer common shares in our Offering until we raise the maximum amount permitted based on the maximum number of common shares we are able to qualify under Regulation A at any given time, unless terminated by our Manager at an earlier time. Until December 31, 2019, the per share purchase price for our common shares was $10.00, an amount that was arbitrarily determined by our Manager. Thereafter, the per share purchase price for our common shares will be adjusted at the end of each semi-annual period (or such other period as determined by our Manager in its sole discretion, but no less frequently than annually). Our Manager has initially determined to adjust the per share purchase price semi-annually as of January 1st and July 1st of each year (or as soon as commercially reasonable and announced by us thereafter), to the greater of (i) $10.00 per share or (ii) our net asset value (“NAV”), divided by the number of our common shares outstanding as of the end of the prior semi-annual period (“NAV per share”). Accordingly, beginning on January 1, 2020, the per share purchase price of our common shares was updated to $10.06 per share through June 30, 2020.

Distributions

To maintain our qualification as a REIT, we will be required to make aggregate annual distributions to our shareholders of at least 90% of our REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain), and to avoid federal income and excise taxes on retained taxable income and gains we must distribute 100% of such income and gains annually. Our Manager may authorize distributions in excess of those required for us to maintain REIT status and/or avoid such taxes on retained taxable income and gains depending on our financial condition and such other factors as our Manager deems relevant. Provided we have sufficient available cash flow, we intend to authorize and declare distributions based on daily record dates and pay distributions on a quarterly or other periodic basis. We have not established a minimum distribution level.

While we are under no obligation to do so, we have in the past and expect in the future to declare and pay distributions monthly or quarterly in arrears; however, our Manager may declare other periodic distributions as circumstances dictate. In order that investors may generally begin receiving distributions immediately upon our acceptance of their subscription, we expect to authorize and declare distributions based on daily record dates.

When calculated on a tax basis, distributions were made 100% from return of capital for the year ended December 31, 2019.

On July 11, 2019, we paid our first distribution to shareholders for the distribution period of June 1, 2019 through June 30, 2019. In addition, our Manager has declared daily distributions for shareholders of record as of the close of business on each day from July 1, 2019 through April 30, 2020, as shown in the table below. Linked in the table is the relevant Form 1-U detailing each distribution.

5

| Distribution Period | Daily Distribution Amount/Common Share | Date of Declaration | Payment Date (1) | Annualized Yield (2) | Link | ||||||

| 06/01/2019 – 06/30/2019 | 0.0013698630 | 05/30/2019 | 07/11/2019 | 5.00% | Form 1-U | ||||||

| 07/01/2019 – 07/31/2019 | 0.0024657534 | 06/28/2019 | 10/09/2019 | 9.00% | Form 1-U | ||||||

| 08/01/2019 – 08/31/2019 | 0.0023287671 | 07/30/2019 | 10/09/2019 | 8.50% | Form 1-U | ||||||

| 09/01/2019 – 10/01/2019 | 0.0023287671 | 08/29/2019 | 10/09/2019 | 8.50% | Form 1-U | ||||||

| 10/02/2019 – 10/31/2019 | 0.0020547945 | 10/01/2019 | 01/13/2020 | 7.50% | Form 1-U | ||||||

| 11/01/2019 – 11/30/2019 | 0.0024657534 | 10/31/2019 | 01/13/2020 | 9.00% | Form 1-U | ||||||

| 12/01/2019 – 12/31/2019 | 0.0028767123 | 11/26/2019 | 01/13/2020 | 10.50% | Form 1-U | ||||||

| 01/01/2020 – 01/31/2020 | 0.0026027397 | 12/23/2019 | 04/09/2020 | 9.50% | Form 1-U | ||||||

| 02/01/2020 – 02/29/2020 | 0.0026027397 | 01/29/2020 | 04/09/2020 | 9.50% | Form 1-U | ||||||

| 03/01/2020 – 03/31/2020 | 0.0035616438 | 02/26/2020 | 04/09/2020 | 13.00% | Form 1-U | ||||||

| 04/01/2020 – 04/30/2020 | 0.0023287671 | 03/30/2020 | 07/21/2020 | 8.50% | Form 1-U | ||||||

| Weighted Average | 0.0024571662 | (3) | - | - | 8.97%(4) |

| (1) | Dates presented are the dates on which the distributions were, or are, scheduled to be distributed; actual distribution dates may vary. | |

| (2) | Annualized yield numbers represent the annualized yield amount of each distribution calculated on an annualized basis at the then current rate, assuming a $10.00 per share purchase price. While the Manager is under no obligation to do so, each annualized basis return assumes that the Manager would declare distributions in the future similar to the distributions for each period presented, and there can be no assurance that the Manager will declare such distributions in the future or, if declared, that such distributions would be of a similar amount. | |

| (3) | Weighted average daily distribution amount per common share is calculated as the average of the daily declared distribution amounts from June 1, 2019 through April 30, 2020. | |

| (4) | Weighted average annualized yield is calculated as the annualized yield of the average daily distribution amount for the periods presented, using a $10.00 per share purchase price. |

Any distributions that we make directly impacts our NAV by reducing the amount of our assets. Our goal is to provide a reasonably predictable and stable level of current income, through quarterly or other periodic distributions, while at the same time maintaining a fair level of consistency in our NAV. Over the course of your investment, your distributions plus the change in NAV per share (either positive or negative) will produce your total return.

Our distributions will generally constitute a return of capital to the extent that they exceed our current and accumulated earnings and profits as determined for U.S. federal income tax purposes. To the extent that a distribution is treated as a return of capital for U.S. federal income tax purposes, it will reduce a holder’s adjusted tax basis in the holder’s shares, and to the extent that it exceeds the holder’s adjusted tax basis will be treated as gain resulting from a sale or exchange of such shares.

Redemption Plan

Although we do not intend to list our common shares for trading on a stock exchange or other trading market, we have adopted a redemption plan designed to provide our shareholders with limited liquidity for their investment in our shares. Through December 31, 2019, our redemption plan provided that, on a monthly basis, after observing a mandatory 60-day waiting period, a shareholder could obtain liquidity as described in detail in our Offering Circular. Our Manager may, in its sole discretion, amend, suspend, or terminate the redemption plan at any time, including to protect our operations and our non-redeemed shareholders, to prevent an undue burden on our liquidity, to preserve our status as a REIT, following any material decrease in our NAV, or for any other reason.

As of December 31, 2019, approximately 158,000 common shares had been submitted for redemption and 100% of such redemption requests have been honored.

Effective as of January 1, 2020, we have adopted revisions to our Redemption Plan to implement quarterly instead of monthly redemption requests, and the elimination of the 60-day waiting period. Further, our new policy includes the provision for separate redemption rights in the case of death or “qualifying disability” that eliminates any penalty for redemption in such circumstances and permits the redemption of shares at 100% of the per share price for our common shares in effect at the time of the redemption request.

Effective as of March 31, 2020, our Manager has determined to (i) suspend the processing and payment of redemptions under our redemption plan until further notice, and (ii) delay the consideration and processing of all outstanding redemption requests until further notice. At this time, investors may continue to submit redemption requests, but should know that such redemption requests may not be processed and, ultimately, may be rejected.

Accordingly, all redemption requests, including outstanding redemption requests as of March 31, 2020, may be, at a later date, either (i) considered and processed or (ii) rejected. We intend to reinstate the processing and payment of redemptions under our redemption plan as soon as business prudence allows, but can make no assurances as to when such redemptions will resume.

6

Critical Accounting Policies

Our accounting policies have been established to conform with U.S. GAAP. The preparation of financial statements in conformity with U.S. GAAP requires us to use judgment in the application of accounting policies, including making estimates and assumptions. These judgments may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Management believes that we have made these estimates and assumptions in an appropriate manner and in a way that accurately reflects our financial condition. We continually test and evaluate these estimates and assumptions using our historical knowledge of the business, as well as other factors, to ensure that they are reasonable for reporting purposes. However, actual results may differ from these estimates and assumptions. If our judgment or interpretation of the facts and circumstances relating to various transactions had been different, it is possible that different accounting policies would have been applied, thus resulting in a different presentation of the financial statements.

We believe our critical accounting policies govern the significant judgments and estimates used in the preparation of our financial statements. Please refer toNote 2, Summary of Significant Accounting Policies, in our financial statements, for a more thorough discussion of our accounting policies and procedures.

Recent Accounting Pronouncements

The Financial Accounting Standards Board has released several Accounting Standards Updates (“ASU”) that may have an impact on our financial statements. SeeRecent Accounting Pronouncements inNote 2, Summary of Significant Accounting Policiesin our financial statements for discussion of the relevant ASUs. We are currently evaluating the impact of the various ASUs on our financial statements and determining our plan for adoption.

Extended Transition Period

Under Section 107 of the JOBS Act, we are permitted to use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This permits us to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date that we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B). By electing to extend the transition period for complying with new or revised accounting standards, these financial statements may not be comparable to companies that adopt accounting standard updates upon the public business entity effective dates.

Sources of Operating Revenues and Cash Flows

We expect to primarily generate revenues from net interest income on our real estate debt investments and for income to primarily be derived through the difference between revenue and the cost at which we are able to finance our investments. We may also seek to acquire investments which generate attractive returns without any leverage. See Note 2, Summary of Significant Accounting Policies – Revenue Recognition, in our financial statements for further detail.

Results of Operations

On February 22, 2019, we substantially commenced operations. For the year ended December 31, 2019, we had total net loss of approximately $6.4 million, primarily attributable to equity losses from our equity method investments. We did not have any net income or loss for the period October 5, 2018 (inception) through December 31, 2018, as operations had not yet commenced.

Revenue

Interest Income

For the year ended December 31, 2019 and for the period October 5, 2018 (inception) through December 31, 2018, we earned interest income of approximately $355,000 and $0 respectively, from our real estate debt investments. The increase in interest income is due to the commencement of operations in February 2019.

Equity in Earnings (Losses)

For the year ended December 31, 2019 and for the period October 5, 2018 (inception) through December 31, 2018, we incurred equity in earnings (losses) of approximately $(6.7) million and $0 from our equity method investees, respectively. The decrease in equity in earnings is primarily attributable to a net loss generated by our first equity method investment, acquired in May 2019.

7

Other Income

For the year ended December 31, 2019 and for the period October 5, 2018 (inception) through December 31, 2018, we recognized other income of approximately $181,000 and $0, respectively. The increase in other income is due to the commencement of operations in February 2019.

Expenses

Asset Management and Other Fees – Related Party

For the year ended December 31, 2019 and for the period October 5, 2018 (inception) through December 31, 2018, we incurred asset management fees of approximately $102,000 and $0 from our investments, respectively. The increase in the amount of asset management fees is primarily attributable to the Manager’s decision to waive its asset management fees through September 30, 2019.

General and Administrative

For the year ended December 31, 2019 and for the period October 5, 2018 (inception) through December 31, 2018, we incurred general and administrative expenses of approximately $189,000 and $0, respectively, which included auditing and professional fees, software subscription costs and other costs associated with operating our business. The increase in general and administrative expense is due to operations commencing in February 2019.

Our Investments

As of December 31, 2019, we had entered into the following investments. See “Recent Developments” for a description of investments we have made since December 31, 2019.Note: the use of the term “controlled subsidiary” is not intended to conform with U.S. GAAP definition and does not correlate to a subsidiary that would require consolidation under U.S. GAAP.

| Senior Secured Loans | Location | Type of Property | Date of Acquisition | Interest Rate(1) | Maturity Date(2) | Total Commitment(3) | LTV (4) | LTC (5) | Overview (Form 1-U) | ||||||||||||||

| Hampton Senior Loan(6) | Greenville, SC | Land | 03/13/2019 | 5.5 | % | 03/13/2020 | $ | 2,745,000 | - | 95.0 | % | Initial | Update | ||||||||||

| Hauser SGS Senior Loan | Los Angeles, CA | Land | 10/08/2019 | 9.0 | % | 12/02/2020 | $ | 4,500,000 | 83.0 | % | - | Initial | N/A | ||||||||||

| SF Senior Loan | Los Angeles, CA | Land | 10/15/2019 | 9.0 | % | 04/15/2021 | $ | 3,350,000 | 83.8 | % | - | Initial | N/A | ||||||||||

| 1500 FTL Senior Loan | Los Angeles, CA | Land | 10/16/2019 | 9.0 | % | 04/15/2021 | $ | 6,650,000 | 90.5 | % | - | Initial | N/A | ||||||||||

| (1) | Interest Rate refers to the projected the annual interest rate on each senior loan. The interest rate presented does not distinguish between interest that is paid current and interest that accrues to the maturity date, nor does it include any increases in interest rate that may occur in the future. | |

| (2) | Maturity Date refers to the initial maturity date of each senior loan, and does not take into account any extensions that may be available. | |

| (3) | Total Commitment refers to the total commitment made by the Company to fund the senior loan, not all of which may have been funded on the acquisition date. | |

| (4) | LTV, or loan-to-value ratio, is the approximate amount of the total commitment amount plus any other debt on the asset, divided by the anticipated future value of the underlying asset at stabilization as determined by our Manager. LTVs presented are as of the date of acquisition by the Company, and have not been subsequently updated. There can be no assurance that such value will be achieved. We generally use LTV for properties that are generating cash flow. | |

| (5) | LTC, or loan-to-cost ratio, is the approximate amount of the total commitment plus any other debt on the asset, divided by the anticipated cost to complete the project. We generally use LTC for properties that are subject to construction. LTCs presented are as of the date of acquisition by the Company, and have not been subsequently updated. There can be no assurance that the anticipated completion cost will be achieved. | |

| (6) | On August 16, 2019, the Hampton Senior Loan investment was paid off and is no longer outstanding. |

8

| Real Property Controlled Subsidiaries (JV Equity Investments) | Location | Property Type | Date of Acquisition | Purchase Price(1) | Overview (Form 1-U) | ||||||||

| RSE Carter Portfolio Controlled Subsidiary(2) | GA | Multifamily | 05/31/2019 | $ | 39,076,177 | Initial | Update | ||||||

| (1) | Purchase Price refers to the total price paid by us for our pro rata share of the equity in the controlled subsidiary. | |

| (2) | Approximately $10 million of the total committed capital was funded to the RSE Carter Portfolio Controlled Subsidiary on the date of closing for the acquisition of 6 stabilized garden-style residential properties. On July 18, 2019, the RSE Carter Portfolio Controlled Subsidiary executed an amendment to its operating agreement and we concurrently contributed an additional approximately $19 million, as the RSE Carter Portfolio Controlled Subsidiary closed on the acquisition of 5 additional stabilized garden-style residential properties. |

As of December 31, 2019, the Company's investments in companies that are accounted for under the equity method of accounting included the initial contribution to National Lending, LLC (“National Lending”) in exchange for ownership interests. SeeNote 7, Related Party Arrangements for further information regarding National Lending, LLC.

Liquidity and Capital Resources

We require capital to fund our investment activities and operating expenses. Our capital sources may include net proceeds from our Offering, cash flow from operations, net proceeds from asset repayments and sales, borrowings under credit facilities, other term borrowings and securitization financing transactions.

We are dependent upon the net proceeds from our Offering to conduct our operations. We obtain the capital required to primarily originate, invest in and manage a diversified portfolio of real estate investments and conduct our operations from the proceeds of our Offering and from secured or unsecured financings from banks and other lenders and from any undistributed funds from our operations. As of December 31, 2019, we had deployed approximately $43.9 million for five investments, and had approximately $5.2 million in cash and cash equivalents. In addition to our investments of approximately $43.9 million as of December 31, 2019, we had future funding commitments up to an additional $10.5 million related to our investments. As of December 31, 2019, we anticipate that proceeds from our Offering will provide sufficient liquidity to meet future funding commitments and costs of operations.

We receive distributions from our equity method investees that represent cash flow from operations from the investment. During the year ended December 31, 2019 and the period October 5, 2018 (inception) through December 31, 2018, we received cash distributions of approximately $687,000 and $0, respectively.

We currently have no outstanding fund level debt as of April 23, 2020 and December 31, 2019. Our targeted portfolio-wide leverage after we have acquired an initial substantial portfolio of diversified investments is between 40-60% of the greater of the cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. During the period when we are growing our portfolio, we may employ greater leverage on individual assets (that will also result in greater leverage of the initial portfolio) in order to quickly build a diversified portfolio of assets. Our Manager may from time to time modify our leverage policy in its discretion in light of then-current economic conditions, relative costs of debt and equity capital, market values of our assets, general conditions in the market for debt and equity securities, growth and acquisition opportunities or other factors. However, other than during our initial period of operations, it is our policy to not borrow more than 75% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. We cannot exceed the leverage limit of our leverage policy unless any excess in borrowing over such level is approved by our Manager’s investment committee.

Having completed our initial Offering, we face additional challenges in order to ensure liquidity and capital resources on a long-term basis. If we are unable to raise additional funds from the issuance of common shares, we will make fewer investments resulting in less diversification in terms of the type, number and size of investments we make. We may be subject to more fluctuations based on the performance of the specific assets we acquire. Further, we have certain direct and indirect operating expenses. Our inability to raise substantial funds would increase our fixed operating expenses as a percentage of gross income and would limit our ability to make distributions.

Outlook and Recent Trends

As a result of the global outbreak of a new strain of coronavirus, COVID-19, economic uncertainties have arisen that continue to have an adverse impact on economic and market conditions. The global impact of the outbreak has been rapidly evolving, and the outbreak presents material uncertainty and risk with respect to the Company’s future performance and future financial results. The Company is unable to quantify the impact COVID-19 may have on its future financial results at this time.

9

While we are encouraged by the stability of residential real estate markets, the country has entered a period of a high degree of uncertainty and volatility as a result of the impact of COVID-19. Although that is likely to mean a period of economic stress, broadly speaking, we believe the Fundrise Income eREIT III is well positioned to withstand potential economic shocks or slowdown in the economy.

First, approximately 100% of Fundrise Income eREIT III is invested in stabilized rental property and apartment development. Housing, like food, is a basic good rather than a discretionary expense so we believe that it should perform more resiliently in a downturn. Second,ourreal estate portfolio is only invested in senior loans and joint ventures structured with preferred equity economics (i.e., priority to the common equity), typically with more than 15% equity junior to our investment. Our belief is a portfolio of residential loans and preferred equity investments is likely to be more stable than most other assets.

Lastly, the current interest rate environment has dramatically eased as a result of the Federal Reserve materially lowering rates. Capital markets expect the Federal Reserve to continue to inject more liquidity into the market (similar to previous quantitative easing). Historically when the market recovers, hard assets, such as real estate, see an increase in value as a result of the expanded monetary base.

Off-Balance Sheet Arrangements

As of December 31, 2019 and 2018, we had no off-balance sheet arrangements.

For further information regarding “Related Party Arrangements,” please see Note 7, Related Party Arrangements in our financial statements.

Investments

There have been no real estate investments acquired by or repaid to the Company since December 31, 2019 through April 23, 2020.

Other

| Event | Date | Description | ||

| Declaration of February 2020 Distributions | 01/29/2020 | On January 29, 2020, our Manager declared a daily distribution of $0.0026027397 per share for shareholders of record as of the close of business on each day of the period commencing on February 1, 2020 and ending on February 29, 2020. More information can be foundhere. | ||

| Declaration of March 2020 Distributions | 02/26/2020 | On February 26, 2020, our Manager declared a daily distribution of $0.0035616438 per share for shareholders of record as of the close of business on each day of the period commencing on March 1, 2020 and ending on March 31, 2020. More information can be foundhere. | ||

| Declaration of April 2020 Distributions | 03/30/2020 | On March 30, 2020, our Manager declared a daily distribution of $0.0023287671 per share for shareholders of record as of the close of business on each day of the period commencing on April 1, 2020 and ending on April 30, 2020. More information can be foundhere. | ||

| Share Purchase Price Update | 01/01/2020 | Beginning on January 1, 2020 the per share purchase price of our common shares was updated to $10.06 due to a quarterly change in NAV. More information can be found here. | ||

| Status of our Offering | 04/23/2020 | As of April 23, 2020, we had raised total gross offering proceeds of approximately $49.4 million from settled subscriptions (including the $100,000 received in the private placements to our Sponsor and Fundrise, L.P., an affiliate of our Sponsor), and had settled subscriptions in our Offering and private placements for an aggregate of approximately 4,936,000 of our common shares. |

10

| Revisions to the Redemption Plan | 01/01/2020 | On December 31, 2019, we filed an offering circular supplement pursuant to Rule 253(g)(2), revising our Redemption Plan to reflect the following changes effective January 1, 2020: (1) quarterly instead of monthly redemption requests and elimination of the 60-day waiting period; and (2) separate redemption rights in the case of death or “qualifying disability” that eliminate any penalty for redemption in such circumstances and permit the redemption of shares at 100% of the per share price for our common shares in effect at the time of the redemption request. | ||

| 03/31/2020 | Effective as of March 31, 2020, our Manager has determined to (i) suspend the processing and payment of redemptions under our redemption plan until further notice, and (ii) delay the consideration and processing of all outstanding redemption requests until further notice. At this time, investors may continue to submit redemption requests, but should know that such redemption requests may not be processed and, ultimately, may be rejected. Accordingly, all redemption requests, including outstanding redemption requests as of March 31, 2020, may be, at a later date, either (i) considered and processed or (ii) rejected. We intend to reinstate the processing and payment of redemptions under our redemption plan as soon as business prudence allows, but can make no assurances as to when such redemptions will resume. | |||

| January 2020 Contribution to National Lending | 01/15/2020 | On January 15, 2020, the Company made an additional contribution of $649,000 to National Lending, bringing its total contributions to approximately $1.4 million. | ||

| March 2020 Contribution to National Lending | 03/23/2020 | On March 23, 2020 the Company entered into an Amended and Restated Operating Agreement with National Lending, which increased the contribution for partnership interest from 3% to 5% of a partner’s assets under management. Accordingly, the Company made an additional contribution of $944,000 to National Lending, bringing its total contributions to approximately $2.4 million for a 5.07% ownership in National Lending as of March 23, 2020. |

11

| Item 3. | Directors and Officers |

Our Manager

We operate under the direction of our Manager, which is responsible for directing the management of our business and affairs, managing our day-to-day affairs, and implementing our investment strategy. Our Manager has established an investment committee that makes decisions with respect to all acquisitions and dispositions. The Manager and its officers and directors are not required to devote all of their time to our business and are only required to devote such time to our affairs as their duties require.

We follow investment guidelines adopted by our Manager and the investment and borrowing policies set forth in our Offering Circular unless they are modified by our Manager. Our Manager may establish further written policies on investments and borrowings and will monitor our administrative procedures, investment operations and performance to ensure that the policies are fulfilled. Our Manager may change our investment objectives at any time without approval of our shareholders.

Our Manager performs its duties and responsibilities pursuant to our operating agreement. Our Manager maintains a contractual, as opposed to a fiduciary, relationship with us and our shareholders. Furthermore, we have agreed to limit the liability of our Manager and to indemnify our Manager against certain liabilities.

Executive Officers of Our Manager

As of the date of this Annual Report, the executive officers of our Manager and their positions and offices are as follows:

| Name | Age | Position | ||

| Benjamin S. Miller | 43 | Chief Executive Officer and Interim Chief Financial Officer and Treasurer | ||

| Brandon T. Jenkins | 34 | Chief Operating Officer | ||

| Bjorn J. Hall | 39 | General Counsel, Chief Compliance Officer and Secretary |

Benjamin S. Miller currently serves as Chief Executive Officer of our Manager and has served as Chief Executive Officer and a Director of our Sponsor since its inception on March 14, 2012. As of the date of this Annual Report, Mr. Miller is also serving as Interim Chief Financial Officer and Treasurer of our Manager. Prior to Rise Companies Corp., Mr. Miller had been a Managing Partner of the real estate company WestMill Capital Partners from October 2010 to June 2012, and before that, was President of Western Development Corporation one of the largest mixed-use real estate companies in the Washington, DC metro area, from April 2006 to October 2010, after joining the company in early 2005 as its Chief Operating Officer. From 2003 until 2005, Mr. Miller was an Associate and part of the founding team of Democracy Alliance, a progressive investment collaborative. In 2001, Mr. Miller co-founded and was a Managing Partner of US Nordic Ventures, a private equity and operating company that works with Scandinavian green building firms to penetrate the U.S. market. Mr. Miller has a Bachelor of Arts from the University of Pennsylvania.

|

Brandon T. Jenkins currently serves as Chief Operating Officer of our Manager and has served in such capacities with the Sponsor since February of 2014, prior to which time he served as Head of Product Development and Director of Real Estate which he continues to do currently. Additionally, Mr. Jenkins has served as Director of Real Estate for WestMill Capital Partners since March of 2011. Previously, Mr. Jenkins spent two and a half years as an investment advisor and sales broker at Marcus & Millichap, the largest real estate investment sales brokerage in the country. Prior to his time in brokerage, Mr. Jenkins also worked for Westfield Corporation, a leading shopping center owner. Mr. Jenkins earned his Bachelor of Arts in Public Policy and Economics from Duke University.

|