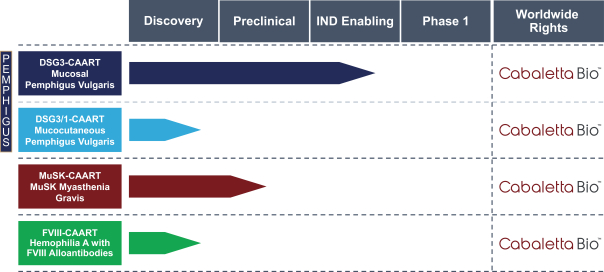

development. The product candidates from our CABA platform address clinical indications where there is a compelling opportunity to improve clinical outcomes in comparison with the current standard of care in an easily identified patient population. Our initial product candidates are focused on rare disease populations where we believe there is potential to commercialize independently. This is due to a concentration of treatment paradigms and limited but easily identified patient populations. Our plan is to focus commercialization and launch efforts initially in the United States, and eventually in the European Union and Asia-Pacific geographies.

Competition

The biotechnology and pharmaceutical industries are characterized by rapidly advancing technologies, intense competition and a strong focus on intellectual property. We face competition from many different players, including large and specialty pharmaceutical and biotechnology companies, academic research organizations and governmental agencies. Any therapeutic candidates we successfully develop and commercialize will compete with the existing standard of care as well as any novel therapies that may gain regulatory approval in the future.

Existing treatment options for PV are limited. Rituximab, marketed by Roche Holding AG, is the first drug to have received approval for PV in the United States in over 60 years. In Europe, the approved therapies for PV are corticosteroids, azathioprine and rituximab. Other standard of care treatments include various immunosuppressants and intravenous immunoglobulin infusions given monthly or on another periodic chronic basis. Additionally, multiple biopharmaceutical companies have therapies in clinical development. We are aware that Affibody AB, Alexion Pharmaceuticals, Inc., argenx SE, Immunovant, Inc., Momenta Pharmaceuticals, Inc., Novartis Pharmaceuticals Corporation, Ono Pharmaceutical Co., Ltd., Principia Biopharma Inc., Rubius Therapeutics, Inc., among others, are developing treatments for PV.

Competition in the MuSK MG autoimmune space is currently dominated by the current standard of care, rituximab. A second approved approach to treating patients is IVIG, which is available through CSL Behring LLC, Grifols, S.A., and Mitsubishi Tanabe Pharma Corporation. Additionally, multiple biopharmaceutical companies have therapies in clinical development. We are aware that argenx SE, BioMarin Pharmaceutical Inc., Catalyst Partners, Inc., CuraVac, Inc., GlaxoSmithKline PLC, Millennium Pharmaceuticals, Inc. (subsidiary of Takeda Pharmaceutical Company Limited), Novartis Pharmaceuticals Corporation, and Ra Pharmaceuticals, Inc., among others, are developing drugs that may have utility for the treatment of MuSK MG.

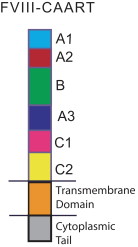

Multiple therapies are approved or in development for the treatment of Hemophilia A patients who develop alloantibodies against FVIII. Standard of care is typically immune tolerance induction, or ITI, therapy with higher doses of FVIII. Available treatments for those who do not respond to ITI include anti-inhibitor coagulation complexes, recombinant factor VIIa, and bispecific factor IXa- and factor X-directed antibodies. Companies who market products or are developing product candidates within these categories of medicine include Catalyst Pharmaceuticals, Inc., Novo Nordisk A/S, OPKO Health, Inc., Roche Holding AG and Takeda Pharmaceutical Company. In addition, we are aware that Alnylam Pharmaceuticals, Inc., Apitope Technology Ltd., Bayer AG, GC Pharma (formerly known as Green Cross Corporation), Idogen AB, Novo Nordisk A/S and Pfizer Inc., Sanofi, Spark Therapeutics, Inc., and uniQure N.V. are developing product candidates with other mechanisms that have the potential to treat Hemophilia A patients with FVIII alloantibodies.

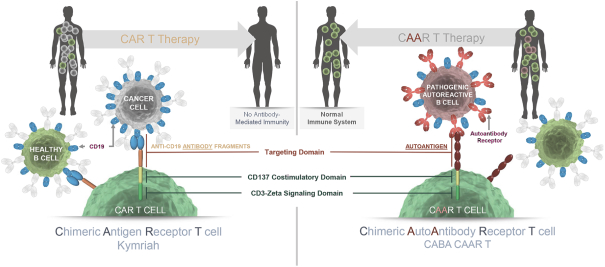

We believe we are the first and only company developing CAAR T drug candidates for the treatment of B cell-mediated autoimmune diseases. However, despite the significant differences in discovery, development and target populations between oncology and autoimmune targets, we recognize that companies with an investment and expertise in CAR T cell development for oncology indications could attempt to leverage their expertise into B cell-mediated autoimmune disease-affected populations. We are aware of biotechnology companies that are exploring other methods of engineering T cells for the treatment of autoimmune conditions. Companies that are developing drug candidates for autoimmune diseases using either traditional CAR T or CAR T regulatory cell approaches include Atara Biotherapeutics, Inc. and Sangamo Therapeutics, Inc. In addition, some biotechnology

133