UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------------------------------------------------

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23501

----------------------------------------------------------------

ALTI PRIVATE EQUITY ACCESS AND COMMITMENTS FUND

(Exact name of registrant as specified in charter)

----------------------------------------------------------------

110 East 40th Street, Suite 803

New York, NY 10016

(888) 788-7886

(Address of principal executive offices) (Zip code)

Joseph Bonvouloir

110 East 40th Street, Suite 803

New York, NY 10016

(888) 788-7886

(Name and address of agent for service)

----------------------------------------------------------------

Registrant’s telephone number, including area code: (888) 788-7886

Date of fiscal year end: MARCH 31

Date of reporting period: MARCH 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. (a) REPORTS TO STOCKHOLDERS.

ALTI Private Equity Access and Commitments Fund |

Annual Report

For the Period Ended March 31, 2024

ALTI Private Equity Access and Commitments Fund

For the Period Ended March 31, 2024

Table of Contents

i

ALTI Private Equity Access and Commitments Fund

Letter to Shareholders

(Unaudited)

To our shareholders,

The ALTI Private Equity Access and Commitments Fund (the “Fund”) commenced operations on September 1, 2023. As stated in the prospectus, the Fund’s strategy of investing in private equity co-investments will not commence until the fund has raised approximately $30,000,000 in initial assets. Management is currently focused on securing anchor investors to get the Fund to its first close. During the first six-month period, the Fund invested in a money market fund earning approximately 5.17% annually during the first six months of operations.

Sincerely,

Joseph Bonvouloir

Founder & CEO, ALTI, LLC

1

ALTI Private Equity Access and Commitments Fund

Fund Performance

(Unaudited)

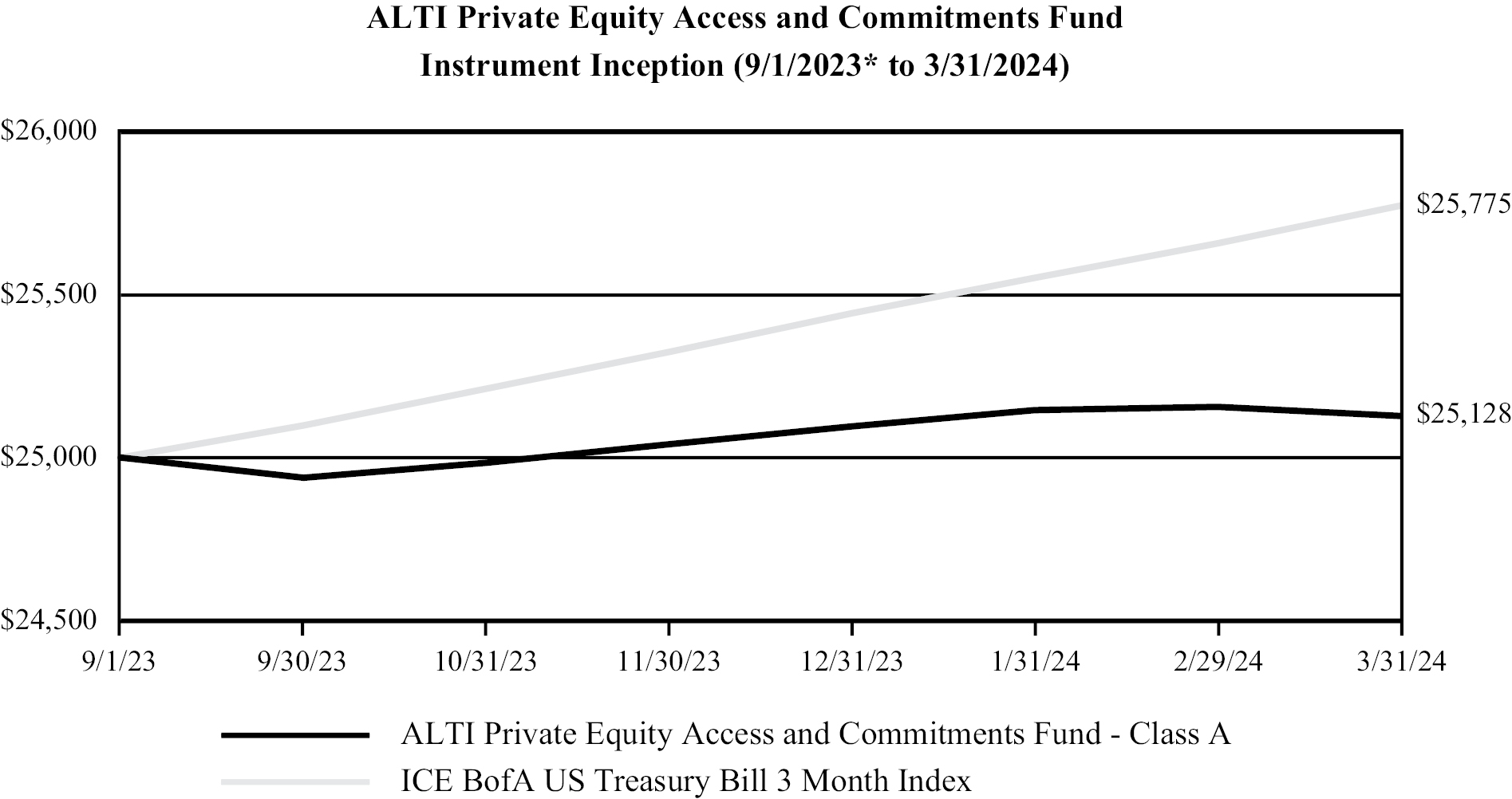

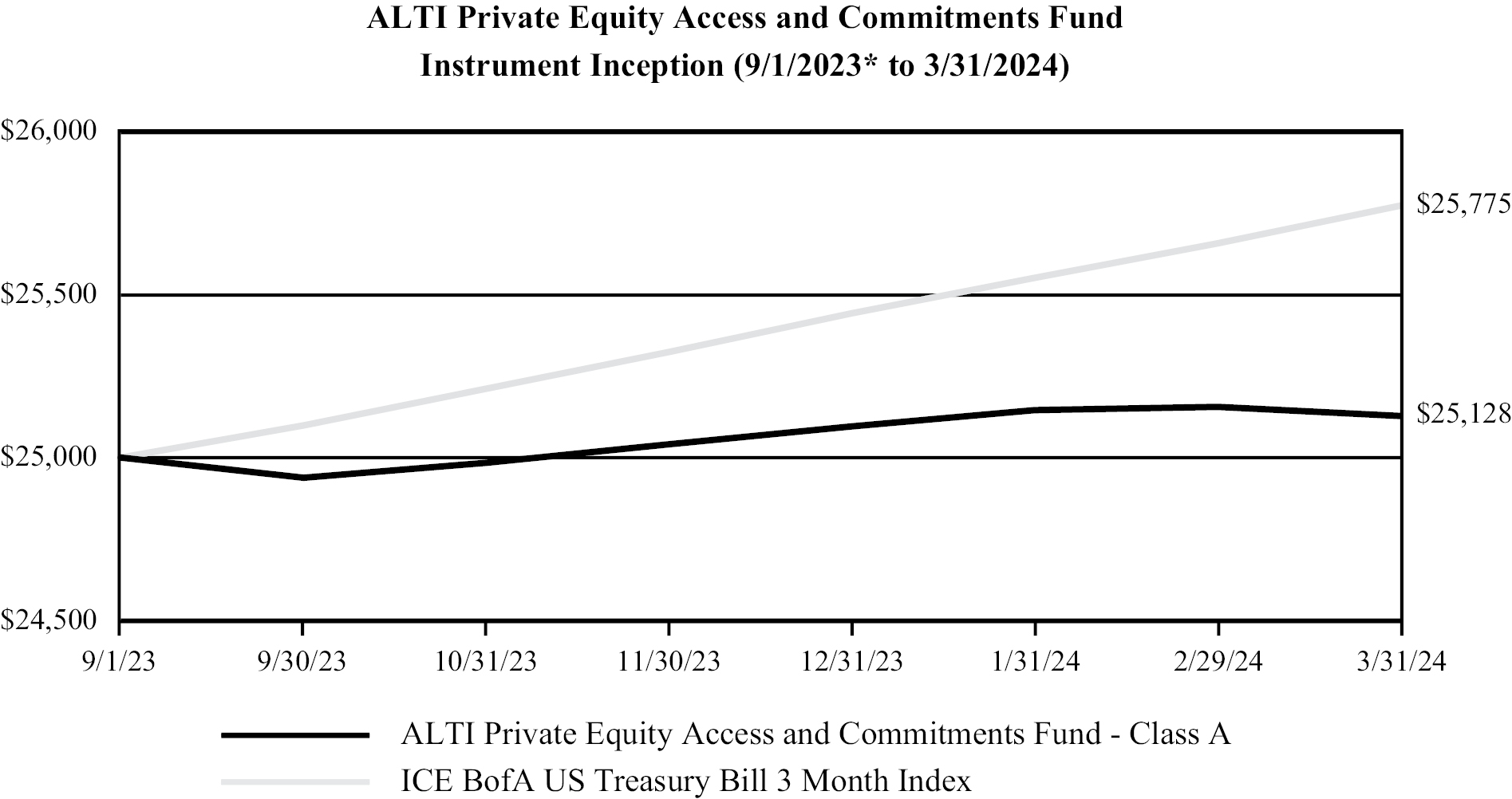

Average Annual Total Returns as of March 31, 2024 | | Since

Inception |

ALTI Private Equity Access and Commitments Fund (Inception Date September 1, 2023) | | 0.51 | % |

ICE BofA US Treasury Bill 3 Month Index | | 3.10 | % |

The graph shown above represents historical performance of a hypothetical investment of $25,000 in the Class A Shares of the Fund since inception. The performance shown represents past performance and does not guarantee future results. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. All returns reflect reinvested distributions, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be higher or lower than the performance data quoted. For performance information current to the most recent month-end, please call 1-(888) 788-7886.

The ICE BofA 3-Month U.S. Treasury Bill Index is comprised of a single U.S. Treasury issue with approximately three months to final maturity, purchased at the beginning of each month and held for one full month. The ICE BofA 3-Month U.S. Treasury Bill Index is unmanaged and it is not available for investment.

2

ALTI Private Equity Access and Commitments Fund

Report of Independent Registered Public Accounting Firm

To the shareholders and the Board of Trustees of ALTI Private Equity Access and Commitments Fund

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of ALTI Private Equity Access and Commitments Fund (the “Fund”), including the schedule of investments, as of March 31, 2024, the related statements of operations, the statements of changes in net assets, and the financial highlights for the period from September 1, 2023 (commencement of operations) through March 31, 2024, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of March 31, 2024, and the results of its operations, the changes in its net assets, and the financial highlights the period from September 1, 2023 (commencement of operations) through March 31, 2024 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of March 31, 2024, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

Emphasis of Matter

As discussed in Note 3 to the financial statements, the Adviser has contractually agreed to waive its fees and to pay or absorb the ordinary operating expenses of the Fund, to the extent that such expenses exceed 3.00% per annum of the Fund’s average daily net assets (the “Expense Limitation”). To the extent the Adviser is unable to pay the expenses covered by the Expense Limitation, the Fund is legally liable to pay such expenses. In the event of non-payment by the Adviser, the Fund’s net assets may be materially different from amounts estimated as of March 31, 2024. Our opinion is not modified with respect to these matters.

Costa Mesa, California

May 30, 2024

We have served as the auditor of one or more ALTI, LLC investment companies since 2023.

3

ALTI Private Equity Access and Commitments Fund

Schedule of Investments

As of March 31, 2024

Number

of Shares | | | | Value |

| | | SHORT-TERM INVESTMENTS — 12.2% | | | |

12,370 | | Fidelity Investments Money Market Treasury Portfolio – Class I, 5.19%(1) | | $ | 12,370 |

| | | Total Short-Term Investments

(Cost $12,370) | | | 12,370 |

| | | TOTAL INVESTMENTS — 12.2%

(Cost $12,370) | | | 12,370 |

| | | Other Assets Less Liabilities — 87.8% | | | 89,141 |

| | | TOTAL NET ASSETS — 100.0% | | $ | 101,511 |

| | |

Short-Term | | 12.2 | % |

Total Investments | | 12.2 | % |

Assets Less Liabilities | | 87.8 | % |

Total Net Assets | | 100.0 | % |

4

ALTI Private Equity Access and Commitments Fund

Statement of Assets and Liabilities

March 31, 2024

Assets: | | | |

Investments, at value (cost $12,370) | | $ | 12,370 |

Due from Adviser (Note 3) | | | 239,008 |

Dividends and interest receivable | | | 140 |

Total assets | | | 251,518 |

| | | | |

Liabilities: | | | |

Due to Adviser (Note 3) | | | 18,288 |

Payable for legal fees | | | 40,383 |

Payable for accounting, administration, and transfer agency fees | | | 50,440 |

Payable for Audit and Tax | | | 35,000 |

Other accrued liabilities | | | 2,351 |

Payable for custody fees | | | 3,000 |

Payable for Adviser management fee | | | 545 |

Total liabilities | | | 150,007 |

Net Assets | | $ | 101,511 |

| | | | |

Components of Net Assets: | | | |

Paid-in capital | | $ | 100,750 |

Total distributable earnings | | | 761 |

Net Assets | | $ | 101,511 |

| | | | |

Net Assets Attributable to: | | | |

Class A Shares | | $ | 100,506 |

Class D Shares | | | 1,005 |

| | | | |

Shares Outstanding: | | | |

Class A Shares | | | 4,000 |

Class D Shares | | | 40 |

| | | | |

Net Asset Value per Share(1): | | | |

Class A Shares | | $ | 25.13 |

Class D Shares | | | 25.13 |

5

ALTI Private Equity Access and Commitments Fund

Statement of Operations

For the Period September 1, 2023* through March 31, 2024

Investment Income: | | | | |

Dividend Income | | $ | 2,268 | |

Total investment income | | | 2,268 | |

| | | | | |

Expenses: | | | | |

Accounting, administration, and transfer agency fees | | | 77,662 | |

Legal fees | | | 60,383 | |

Chief Compliance Officer and Principal Financial Officer fees (Note 4) | | | 53,527 | |

Trustee fees | | | 46,250 | |

Audit and Tax Fees | | | 35,000 | |

Insurance fees | | | 29,730 | |

Other fees | | | 3,625 | |

Custody fees | | | 9,170 | |

Registration fees | | | 2,569 | |

Adviser management fees (Note 3) | | | 762 | |

Total expenses | | | 318,678 | |

Fund expenses waived by the Adviser (Note 3) | | | (316,921 | ) |

Net expenses | | | 1,757 | |

Net Investment Gain | | | 511 | |

| | | | | |

Realized and Unrealized Gain (Loss) on Investments: | | | | |

Net realized gain (loss) on investments | | | — | |

Net change in unrealized appreciation/depreciation on investments | | | — | |

Net Realized and Unrealized Gain (Loss) | | | — | |

Net Increase in Net Assets from Operations | | $ | 511 | |

6

ALTI Private Equity Access and Commitments Fund

Statement of Changes in Net Assets

| | For the Period

September 1, 2023*

through

March 31,

2024 |

Net Increase (Decrease) in Net Assets From: | | | |

Operations: | | | |

Net investment income | | $ | 511 |

Net realized gain (loss) on investments | | | — |

Net change in unrealized appreciation/depreciation on investments | | | — |

Net Increase in Net Assets Resulting from Operations | | | 511 |

| | | | |

Capital Transactions: | | | |

Proceeds from shares sold: | | | |

Class A | | | — |

Class D | | | 1,000 |

Reinvestment of distributions: | | | |

Class A | | | — |

Class D | | | — |

Cost of shares repurchased: | | | |

Class A | | | — |

Class D | | | — |

Net Increase in Net Assets from Capital transactions | | | 1,000 |

Total Increase in Net Assets | | | 1,511 |

| | | | |

Net Assets | | | |

Beginning of period(1) | | | 100,000 |

End of period | | $ | 101,511 |

| | | | |

Capital Share Transactions: | | | |

Shares sold: | | | |

Class A | | | — |

Class D | | | 40 |

Shares reinvested: | | | |

Class A | | | — |

Class D | | | — |

Shares redeemed: | | | |

Class A | | | — |

Class D | | | — |

Net Increase in Capital Share Transactions | | | 40 |

7

ALTI Private Equity Access and Commitments Fund

Financial Highlights

Class A Shares

Per share operating performance for a capital share outstanding throughout each period.

| | For the Period

September 1, 2023*

through

March 31,

2024 |

Net Asset Value, beginning of period | | $ | 25.00 | |

Income from Investment Operations: | | | | |

Net investment income(1) | | | 0.13 | |

Net realized and unrealized gain (loss) on investments | | | — | |

Total from investment operations | | | 0.13 | |

| | | | | |

Less Distributions: | | | | |

From net investment income | | | — | |

Total distributions | | | — | |

| | | | | |

Net Asset Value, end of period | | $ | 25.13 | |

| | | | | |

Total return(2) | | | 0.51 | %(3) |

| | | | | |

Ratios and Supplemental Data(5): | | | | |

Net Assets, end of period (in thousands) | | $ | 100 | |

Net investment income | | | 0.87 | %(4) |

Ratio of expenses to average net assets: | | | | |

Before fees waived and expenses absorbed/recovered | | | 543.19 | %(4) |

After fees waived and expenses absorbed/recovered | | | 3.00 | %(4) |

Portfolio turnover rate | | | 0 | %(3) |

8

ALTI Private Equity Access and Commitments Fund

Financial Highlights

Class D Shares

Per share operating performance for a capital share outstanding throughout each period.

| | For the Period

March 1,

2024*

through

March 31,

2024 |

Net Asset Value, beginning of period | | $ | 25.00 | |

Income from Investment Operations: | | | | |

Net investment income(1) | | | 0.13 | |

Net realized and unrealized gain (loss) on investments | | | — | |

Total from investment operations | | | 0.13 | |

| | | | | |

Less Distributions: | | | | |

From net investment income | | | — | |

Total distributions | | | — | |

| | | | | |

Net Asset Value, end of period | | $ | 25.13 | |

| | | | | |

Total return(2) | | | 0.51 | %(3) |

| | | | | |

Ratios and Supplemental Data(5): | | | | |

Net Assets, end of period (in thousands) | | $ | 1 | |

Net investment income | | | 0.87 | %(4) |

Ratio of expenses to average net assets: | | | | |

Before fees waived and expenses absorbed/recovered | | | 543.19 | %(4) |

After fees waived and expenses absorbed/recovered | | | 3.00 | %(4) |

Portfolio turnover rate | | | 0 | %(3) |

9

ALTI Private Equity Access and Commitments Fund

Notes to Financial Statements

For the Period Ended March 31, 2024

1. Organization

ALTI Private Equity Access and Commitments Fund, a newly organized Delaware statutory trust (the “Fund”), registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified management investment company. The Fund was inactive from the date it was organized except for matters relating to the Fund’s establishment, designation, registration of the Fund’s shares of beneficial interest (“Shares”) until September 1, 2023, commencement of operations. The Fund currently has two classes of shares (Class A Shares and Class D Shares). The Fund has established three classes of shares: Class A, Class D Shares and Class I Shares. Only Class A Shares and Class D Shares have been offered and issued to date. The Fund has registered under the Securities Act of 1933, as amended, 100,000 Shares and is authorized to issue an unlimited number of Shares with no par value.

The Fund’s investment adviser is ALTI, LLC, a registered investment adviser (the “Adviser”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Numeric Investors LLC will serve as the Fund’s investment sub-adviser (the “Sub-Adviser”) pursuant to a sub-advisory agreement between the Sub-Adviser and the Adviser on behalf of the Fund.

The Fund’s investment objective is to is to seek long-term capital appreciation by investing in and/or making capital commitments to direct private equity and through co-investments in operating companies (“Private Equity Investments”). The Fund seeks to generate a return profile that is similar to the U.S. buyout segment of the private equity market while mitigating, whenever possible, many of the traditional issues encountered by private equity fund of funds structures.

2. Summary of Accounting Policies

Basis of Preparation and Use of Estimates — The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statement, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Cash — Cash is held at a major financial institution and is subject to credit risk to the extent those balances exceed Federal Deposit Insurance Corporation (FDIC) limitations.

Calculation of Net Asset Value — The Fund calculates its Net Asset Value (“NAV”) as of the last business day of each calendar month and at such other times as the Fund’s Board of Trustees (the “Board”) upon advice from the Adviser, may determine, including in connection with repurchases of Shares.

Income Recognition and Expenses — Interest income is recognized on an accrual basis as earned. Dividend income is recorded on the ex-dividend date. Distributions received from investments in securities and private funds that represent a return of capital or capital gains are recorded as a reduction of cost of investment or as a realized gain, respectively. Expenses are recognized on an accrual basis as incurred. The Fund bears all expenses incurred in the course of its operations, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Fund’s account; professional fees; costs of insurance; registration expenses; and expenses of meetings of the Board. Expenses are subject to the Fund’s Expense Limitation Agreement (see Note 3).

Investment Transactions — Investment transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the identified cost basis for publicly traded investments and average cost for the Fund’s private investments for both financial statement and federal income tax purposes.

Federal Income Taxes — The Fund intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. The Fund utilizes a tax-year end of September 30 and the Fund’s income and federal excise tax returns and all financial records supporting the prior year returns are

10

ALTI Private Equity Access and Commitments Fund

Notes to Financial Statements

For the Period Ended March 31, 2024

2. Summary of Accounting Policies (cont.)

subject to examination by the federal and Delaware revenue authorities. If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required. Management of the Fund is required to determine whether a tax position taken by the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. Based on its analysis, there were no tax positions identified by management of the Fund which did not meet the “more likely than not” standard as of March 31, 2024. The Fund’s policy is to classify any interest or penalties associated with underpayment of federal and state income taxes as an income tax expense on the Statement of Operations.

Valuation of Investments — The Fund’s Board of Trustees (the “Board”) has designated ALTI LLC (the “Investment Manager” or “Valuation Designee”), the investment manager to the Fund, as the Valuation Designee pursuant to Rule 2a-5 under the 1940 Act to perform the fair value determination relating to any and all Fund investments, subject to the conditions and oversight requirements described in the Fund’s Fair Valuation of Investments Policy. In furtherance of its duties as Valuation Designee, the Investment Manager has formed a valuation committee (the “Valuation Committee”), to perform fair value determinations and oversee the day-to-day functions related to the fair valuation of the Fund’s investments. The Valuation Committee may consult with representatives from the Fund’s outside legal counsel or other third-party consultants in its discussions and deliberations.

While the valuation of the Fund’s publicly traded securities is more readily ascertainable, the Fund’s ownership interest in Private Equity Investments are not publicly traded securities, and the Fund will depend on the portfolio company to provide a valuation of the Fund’s Private Equity Investments. Moreover, the valuation of the Fund’s Private Equity Investments may vary from the fair value of the Private Equity Investments that may be obtained if such Private Equity Investments were sold to a third party. For information about the value of the Fund’s investment in Private Equity Investments, the Adviser will be partially dependent on information provided by the portfolio company, including quarterly unaudited financial statements that if inaccurate, could adversely affect the Adviser’s ability to value the Fund’s Shares accurately.

The Fund generally determines its month-end net asset value based upon the quarterly valuations reported by the sponsors, which may not reflect market or other events occurring subsequent to the quarter-end. The Fund will fair value its holdings in co-investments to reflect such events, consistent with its valuation policies. Additionally, the valuations reported by sponsors may be subject to later adjustment or revision.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

• Level 1 — Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

• Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

• Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for

11

ALTI Private Equity Access and Commitments Fund

Notes to Financial Statements

For the Period Ended March 31, 2024

2. Summary of Accounting Policies (cont.)

instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of March 31, 2024 for the Fund’s assets measured at fair value:

| | Level 1 | | Level 2 | | Level 3 | | Total |

Investments | | | | | | | | | | | | |

Short-Term Investments | | $ | 12,370 | | $ | — | | $ | — | | $ | 12,370 |

Total | | $ | 12,370 | | $ | — | | $ | — | | $ | 12,370 |

3. Investment Advisory Agreement

The Fund has entered into an Investment Management Agreement (the “Investment Management Agreement”) with the Adviser, pursuant to which the Adviser will provide general investment advisory services for the Fund.

Under the Investment Management Agreement, the Fund pays the Adviser a monthly fee of 0.1083333% (1.30% on an annualized basis) of the Fund’s month-end net assets (the “Adviser Management Fee”). However, the Adviser has contractually agreed to waive its fees and to pay or absorb the ordinary operating expenses of the Fund (including all expenses necessary or appropriate for the operation of the Fund and including the Adviser’s investment advisory or management fee detailed in the Investment Advisory Agreement, any Rule 12b-l fees and other expenses described in the Investment Advisory Agreement, but does not include any front-end or contingent deferred loads, interest, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, short selling expenses, expenses incurred in connection with any merger or reorganization, indirect expenses, expense of other investment companies or Underlying Pools in which a Fund may invest, or extraordinary expenses such as litigation), to the extent that such expenses exceed 3.00% per annum of the Fund’s average daily net assets (the “Expense Limitation”). To the extent the Adviser is unable to pay the expenses covered by the Expense Limitation, the Fund is legally liable to pay such expenses. In the event of non-payment by the Adviser, the Fund’s net assets may be materially different from amounts estimated as of March 31, 2024. In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (i) the reimbursement for fees and expenses will be made only if payable not more than three years from the date in which they were incurred; and (ii) the reimbursement may not be made if it would cause the Expense Limitation to be exceeded. The Adviser may not recoup expenses should the recoupment cause the Fund to exceed the lesser of (i) the expense cap in place at the time of waiver or (ii) the time of recoupment. The Expense Limitation Agreement will remain in effect at least until March 31, 2025. The Expense Limitation Agreement may be terminated only by the Board on 60 days’ written notice to the Adviser. For the period ended March 31, 2024, the Adviser waived fees of $316,921. The Investment Adviser has agreed to pay or absorb any and all organizational and offering expenses of the Fund prior to the Fund’s effectiveness and for the period from September 1, 2023 (commencement of operations) through March 31, 2024.

The Adviser has made payments of the Fund’s expenses and the Fund intends to reimburse the Adviser for these expenses. As of March 31, 2024, the reimbursable balance to the Adviser is $18,288 which consists of prepaid insurance fees as reported on the Statement of Assets and Liabilities.

Numeric Investors LLC is serving as the Fund’s investment sub-adviser (the “Sub-Adviser”) pursuant to a sub-advisory agreement between the Sub-Adviser and the Adviser on behalf of the Fund. The Adviser has agreed to pay the Sub-Adviser as compensation under the Sub-Advisory Agreement a monthly fee of 0.054% (0.65% on an annualized basis) of the Fund’s assets allocated to the Sub-Adviser’s liquid private equity alternative strategy month-end invested assets. The Sub-Adviser is compensated by the Adviser out of advisory fees paid by the Fund to the Adviser; the Fund does not compensate the Sub-Adviser.

12

ALTI Private Equity Access and Commitments Fund

Notes to Financial Statements

For the Period Ended March 31, 2024

4. Related Party and Other Agreements

UMB Fund Services, Inc. (the “Administrator”) serves as Administrator, Accounting Agent and Transfer Agent to the Fund. Pursuant to the agreement with the Administrator, for the services rendered to the Fund by the Administrator, the Fund pays the Administrator a minimum fee or fees based on the annual net assets of the Fund (with such minimum fees subject to an annual cost of living adjustment) plus out-of-pocket expenses.

The Fund has entered into a Custody Agreement with UMB Bank, n.a. (the “Custodian”). Under the terms of this agreement, the Custodian will serve as custodian of the Fund’s assets.

The Fund has entered into a distribution agreement with UMB Distribution Services, LLC to act as the distributor for the sale of Shares.

Principal Financial Officer and Chief Compliance Officer Services: PINE Advisors LLC (“PINE”) and Cynthia Aragon, Esq. provide treasury and compliance services to the Fund, respectively, pursuant to services agreements. In consideration for these services, PINE and Cynthia Aragon, Esq. will be paid a monthly and quarterly fee, respectively, out of the assets of the Fund. The Fund may also reimburse PINE and Cynthia Aragon, Esq. for certain out-of-pocket expenses.

5. Investment Transactions

For the period ended March 31, 2024, the Fund did not have any investment transactions other than short-term securities.

6. Capital Share Transactions

Shares are expected to be offered on the first business day of each month or at such other times as determined at the discretion of the Board.

The Fund is obligated to conduct tender offers at least twice per fiscal year, but may voluntarily do so more often, at its discretion. Any such offers to repurchase Shares from Fund shareholders shall be accomplished in accordance with written tenders by shareholders at those times, in those amounts, and on such terms and conditions as the Board may determine in its sole discretion. In determining whether the Fund should offer to repurchase Shares from shareholders, the Board will consider the recommendations of the Adviser as to the timing of such an offer, as well as a variety of operational, business and economic factors. The Adviser anticipates that the Fund will repurchase no more than 5% of its net assets with each tender offer at least twice per year but no more often than quarterly. The results of the repurchase offers conducted by the Fund for the period ended March 31, 2024, are as follows:

Commencement Date | | November 27, 2023 |

Repurchase Request | | March 29, 2024 |

Repurchase Pricing date | | March 29, 2024 |

Net Asset Value as of Repurchase Offer Date | | |

Class A | | $ | 25.13 | |

| | | | | |

Amount Repurchased | | | | |

Class A | | $ | 0 | |

| | | | | |

Percentage of Outstanding Shares Repurchased | | | | |

Class A | | | 0.00 | % |

13

ALTI Private Equity Access and Commitments Fund

Notes to Financial Statements

For the Period Ended March 31, 2024

7. Federal Tax Information

The Fund intends to elect to be treated as a registered investment company (“RIC”) for U.S. federal income tax purposes, and it further intends to elect to be treated, and expects each year to qualify as a RIC for U.S. federal income tax purposes. As such, the Fund generally will not be subject to U.S. federal corporate income tax, provided that it distributes all of its net taxable income and gains each year.

If the Fund distributes less than an amount equal to the sum of 98% of its ordinary income and 98.2% of its capital gain net income, plus any amounts that were not distributed in previous taxable years, then the Fund will be subject to a non-deductible 4% excise tax on the undistributed amounts.

The Fund has selected a tax year end of September 30. As of the Fund’s tax year end, September 30, 2023, the Fund did not hold any investment securities. The federal tax cost of investment securities and unrealized appreciation (depreciation) were as follows:

| | |

Gross unrealized appreciation | | $ | — |

Gross unrealized depreciation | | | (—) |

Net unrealized appreciation | | $ | (—) |

Cost of investments | | $ | — |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

GAAP requires that certain components of net assets to be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the period ended September 30, 2023, permanent differences in book and tax accounting have been reclassified to paid-in capital and total distributable earnings as follows:

| | Increase

(Decrease) |

Paid in Capital | | $ | (250 | ) |

Total Distributable Earnings | | $ | 250 | |

There were no distributions paid during the tax year ended September 30, 2023.

The following information is computed on a tax basis for each item as of March 31, 2024:

| | |

Undistributed ordinary income | | $ | — |

Undistributed long-term capital gains | | | — |

Tax accumulated earnings | | | — |

| | | | |

Accumulated capital and other losses | | | — |

Unrealized appreciation (depreciation) on investments | | | — |

Total accumulated earnings (deficit) | | $ | — |

8. Indemnification

The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

14

ALTI Private Equity Access and Commitments Fund

Notes to Financial Statements

For the Period Ended March 31, 2024

9. Risk Factors

There can be no assurance that the investment objective of the Fund will be achieved or that the Fund’s portfolio design and risk monitoring strategies will be successful. The following list is not intended to be a comprehensive listing of all the potential risks associated with the Fund. The Fund’s prospectus provides further details regarding the Fund’s risks and considerations.

Private Equity Investments Generally. Investing in private equity investments is intended for long-term investment by investors who can accept the risks associated with making highly speculative, primarily illiquid investments in privately negotiated transactions. Attractive investment opportunities in private equity may occur only periodically, if at all. Furthermore, private equity has generally been dependent on the availability of debt or equity financing to fund the acquisitions of their investments. Market conditions, however, can affect the availability of such financing, limiting the ability of private equity to obtain the required financing. Securities issued by private partnerships may be more illiquid than securities issued by other portfolio funds generally because the partnerships’ underlying investments tend to be less liquid than other types of investments. Investing in private equity investments is intended for long-term investment by investors who can accept the risks associated with making highly speculative, primarily illiquid investments in privately negotiated transactions.

Issuer and Non-Diversification Risk. The value of a specific security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. As a non-diversified fund, the Fund may invest more than 5% of its total assets in the securities of one or more issuers. The Fund’s performance may be more sensitive to any single economic, business, political or regulatory occurrence than the value of Shares of a diversified investment company. The value of an issuer’s securities that are held in the Fund’s portfolio may decline for a number of reasons that directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods and services.

Valuation. While the valuation of the Fund’s publicly traded securities are more readily ascertainable, the Fund’s ownership interest in Private Equity Investments are not publicly traded securities, and the Fund will depend on the portfolio company to provide a valuation of the Fund’s Private Equity Investments. Moreover, the valuation of the Fund’s Private Equity Investments may vary from the fair value of the Private Equity Investments that may be obtained if such Private Equity Investments were sold to a third party. For information about the value of the Fund’s investment in Private Equity Investments, the Adviser will be partially dependent on information provided by the portfolio company, including quarterly unaudited financial statements that if inaccurate, could adversely affect the Adviser’s ability to value the Fund’s Shares accurately.

The Fund determines its month-end net asset value based upon the quarterly valuations reported by the sponsors, which may not reflect market or other events occurring subsequent to the quarter-end. The Fund will fair value its holdings in co-investments to reflect such events, consistent with its valuation policies. Additionally, the valuations reported by sponsors may be subject to later adjustment or revision. For example, fiscal year-end net asset value calculations of the co-investments may be revised as a result of audits by their independent auditors. Other adjustments may occur from time to time. Because such adjustments or revisions, whether increasing or decreasing the net asset value of the Fund, at the time they occur, relate to information available only at the time of the adjustment or revision, the adjustment or revision may not affect the amount of the repurchase proceeds of the Fund received by Shareholders who had their Shares repurchased prior to such adjustments and received their repurchase proceeds. As a result, to the extent that such subsequently adjusted valuations from the sponsors or revisions to the net asset value of a direct private equity co-investment adversely affect the Fund’s net asset value, the remaining outstanding Shares may be adversely affected by prior repurchases to the benefit of Shareholders who had their Shares repurchased at a net asset value higher than the adjusted amount. Conversely, any increases in the net asset value resulting from such subsequently adjusted valuations may be entirely for the benefit of the outstanding Shares and to the detriment of Shareholders who previously had their Shares repurchased at a net asset value lower than the adjusted amount. The same principles apply to the purchase of Shares. New Shareholders may be affected in a similar way.

15

ALTI Private Equity Access and Commitments Fund

Notes to Financial Statements

For the Period Ended March 31, 2024

9. Risk Factors (cont.)

Private Equity Investment Risk. Investment in Private Equity Investments involve the same types of risks associated with an investment in an operating company. The eventual success or failure of private equity investing depends on the ability of the Adviser and Private Equity Investors to attract and develop a steady flow of quality investment opportunities to analyze. Generally, little public information exists about privately held companies, and the Adviser and Private Equity Investors will be required to rely on the ability of their management teams to obtain adequate information to evaluate the potential risks and returns involved in investing in these companies. These companies and their financial information will not be subject to the Sarbanes-Oxley Act and other rules that govern public companies. If the Adviser and Private Equity Investors are unable to uncover all material information about these companies, they may not make a fully informed presentation to the Adviser and the Fund may lose money on these investments. Substantially all of the securities of privately held companies will be subject to legal and other restrictions on resale or will otherwise be less liquid than publicly traded securities. Additionally, privately held companies frequently have less diverse product lines and smaller market presence than larger competitors. All of these factors could affect the Fund’s investment returns.

No Operating History. The Fund is a non-diversified, closed-end management investment company with no performance history that investors can use to evaluate the Fund’s investment performance. The operating expenses for funds with no or limited performance histories, including start-up costs, which may be significant, may be higher than the expenses of established funds.

Newly Formed Adviser Risk. The Adviser is newly formed and, as a result, has not previously served as investment adviser to a registered investment company. Since its inception in 2020, the Adviser’s activities have been limited to organizational and fundraising activities. As a start-up company, the Adviser has no operating history and has limited liquidity. The Fund and its investors are subject to the risk that the Adviser will wind-down its business before the Fund reaches the end of its full term.

Liquidity Risk. The Fund is a closed-end investment company structured as a “tender offer fund” and designed for long-term investors. Unlike many closed-end investment companies, the Fund’s Shares are not listed on any securities exchange and are not publicly traded. There currently is no secondary market for the Shares, and the Adviser does not expect that a secondary market will develop. Limited liquidity is provided to shareholders only through the Fund’s repurchase offers. There is no guarantee that shareholders will be able to sell all of the Shares they desire in a repurchase offer. The Fund’s investments are also subject to liquidity risk. Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations. Funds with principal investment strategies that involve securities of companies with smaller market capitalizations, derivatives, or securities with substantial market and/or credit risk tend to have the greatest exposure to liquidity risk.

10. Control Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a portfolio creates a presumption of control of the portfolio under section 2(a)(9) of the 1940 Act. As of March 31, 2024, Joseph Littlefield Federal Marital Trust held 99% of the Fund and may be deemed to control the Fund.

11. Subsequent Events

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and concluded that there were no recognized or unrecognized subsequent events that required disclosure in or adjustment to the Fund’s financial statements.

16

ALTI Private Equity Access and Commitments Fund

Other Information

Information on Proxy Voting

A description of the policies and procedures that the Company uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-888-788-7886. It is also available on the SEC’s website at sec.gov.

Information regarding how the Company voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 1-888-788-7886, and on the SEC’s website at sec.gov.

Availability of Quarterly Report Schedule

The Company files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT Part F. The Company’s Form N-PORT is available on the SEC’s website at sec.gov.

Long-Term Capital Gains Designation

For the period ending March 31, 2024, the Fund did not have any long-term capital gains.

17

ALTI Private Equity Access and Commitments Fund

Fund Management

March 31, 2024 (unaudited)

The identity of the members of the Board and the Fund’s officers and brief biographical information is set forth below. The Fund’s Statement of Additional Information the (“SAI”) includes additional information about the membership of the Board. The SAI is available, without charge, by writing to the Fund at c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212, or by calling the Fund at 1 (888) 788-7886.

INDEPENDENT TRUSTEES

Name, Address(1)

and Year of Birth | | Positions(s)

Held with

the Fund | | Term of Office(2)

and Length of

Time Served

as a Trustee | | Principal

Occupation(s)

During Past

Five Years and

Other Relevant

Qualifications | | Number of

Funds Overseen by

Trustee | | Other Public

Company

Directorships

Held by

Trustee

in the Past

Five Years(3) |

Jeffrey J. Gary [1962] | | Trustee | | Since September 2022 | | Board Member at Insight Acquisition Corp. | | 2 | | 2 |

Michael Singer [1966] | | Trustee | | Since September 2022 | | Management consultant services and directorships through Alternative Insight, LLC; Executive Chairman and CEO at Insight Acquisition Corp | | 1 | | 3 |

Maureen O’Toole [1957] | | Trustee | | Since September 2023 | | Investment Development Group for Actis and former Managing Director at Morgan Stanley; Board Member at AOG Funds and BiGi REIT. | | 1 | | 2 |

INTERESTED TRUSTEES

Name, Address(1)

and Year of Birth | | Positions(s)

Held with

the Fund | | Term of Office(2)

and Length of

Time Served

as a Trustee | | Principal

Occupation(s)

During Past

Five Years and

Other Relevant

Qualifications | | Number of

Funds

Overseen by

Trustee | | Other Public

Company

Directorships

Held by

Trustee

in the Past

Five Years(3) |

Joseph Bonvouloir(4)

[1996] | | Trustee, Chairman and President | | Since 2019 | | Chief Executive Officer of ALTI, LLC. | | 1 | | 0 |

18

ALTI Private Equity Access and Commitments Fund

Fund Management (continued)

March 31, 2024 (unaudited)

OFFICERS

Name, Address(1)

and Year of Birth | | Positions(s)

Held with

the Fund | | Term of Office(2)

and Length of

Time Served

as a Trustee | | Principal

Occupation(s)

During Past

Five Years and

Other Relevant

Qualifications | | Number of

Funds

Overseen by

Trustee | | Other Public

Company

Directorships

Held by

Trustee in

the Past Five Years(3) |

Madeline Arment [1989] | | Principal Financial Officer and Treasurer | | Since 2023 | | Director, PINE Advisor Solutions (since 2022); Principal Financial Officer, Nomura Alternative Income Fund (2023 - present); Treasurer and Principal Financial Officer, XD Treasury Money Market Fund (since 2024); Fund Controller, ALPS Fund Services, Inc., (2018 - 2022) | | N/A | | None |

Cynthia Aragon, Esquire

[1972] | | Chief Compliance Officer | | Since 2021 | | Outsourced Chief Compliance Officer, Cynthia Aragon, Esq (2018 - present) | | N/A | | None |

19

ALTI Private Equity Access and Commitments Fund

Privacy Policy

In the course of doing business with shareholders, ALTI Private Equity Access and Commitments Fund (the “Fund”) collects nonpublic personal information about shareholders. “Nonpublic personal information” is personally identifiable financial information about shareholders. For example, it includes shareholders’ social security number, account balance, bank account information, and purchase and redemption history.

The Fund collects this information from the following sources:

• Information we receive from shareholders on applications or other forms;

• Information about shareholder transactions with us and our service providers, or others;

• Information we receive from consumer reporting agencies (including credit bureaus).

What information does the Fund disclose and to whom does the Fund disclose information?

The Fund only discloses nonpublic personal information collected about shareholders as permitted by law. For example, the Fund may disclose nonpublic personal information about shareholders:

• To government entities, in response to subpoenas or to comply with laws or regulations.

• When shareholders direct us to do so or consent to the disclosure.

• To companies that perform necessary services for the Fund, such as data processing companies that the Fund uses to process shareholders transactions or maintain shareholder accounts.

• To protect against fraud, or to collect unpaid debts.

• Information about former shareholders.

If a shareholder closes its account, we will adhere to the privacy policies and practices described in this notice.

How the Fund safeguards information

Within the Fund, access to nonpublic personal information about shareholders is limited to our employees and in some cases to third parties (for example, the service providers described above) as permitted by law. The Fund and its service providers maintain physical, electronic, and procedural safeguards that comply with federal standards to guard shareholder nonpublic personal information.

20

ALTI Private Equity Access and Commitments Fund

ALTI, LLC

110 East 40th Street, Suite 803

New York, NY 10016

Tel: (347) 644-2066

UMB Distribution Services, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

1-(888) 788-7886

This report is intended for current shareholders. It is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Fund unless accompanied or preceded by the Fund’s current prospectus.

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

(a) The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(c) There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics description.

(d) The registrant has not granted any waivers, during the period covered by this report, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

As of the end of the period covered by the report, the registrant’s board of directors has determined that Michael Singer, Jeffrey Gary, and Maureen O’Toole are each qualified to serve as audit committee financial experts serving on its audit committee and that each is “independent,” as defined by Item 3 of Form N-CSR.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Audit Fees

(a) The aggregate fees billed for the last fiscal period for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the fiscal period is $15,000 for 2024.

Audit-Related Fees

(b) The aggregate fees billed for the last fiscal period for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item is $0 for 2024.

Tax Fees

(c) The aggregate fees billed for the last fiscal period for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning is $20,000for 2024.

All Other Fees

(d) The aggregate fees billed for the last fiscal period for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item is $3,050 for 2024.

(e)(1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

The Registrant’s Audit Committee must pre-approve the audit and non-audit services of the Auditors prior to the Auditor’s engagement.

(e)(2) The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows:

(b) 0%

(c) 0%

(d) 0%

(f) The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal period that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was less than fifty percent.

(g) The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for the last year of the registrant was $0 for 2024.

(h) The registrant’s audit committee of the board of directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this form.

(b) Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

The Proxy Voting Policies are attached herewith.

ALTI, LLC

PROXY VOTING POLICIES AND PROCEDURES

Alti LLC (“ALTI”) has adopted the following guidelines (the “Guidelines”) pursuant to which it, in the absence of special circumstances, generally shall vote proxies for its separately managed account clients and advised/sub-advised mutual funds (collectively, “Clients”). These Guidelines are designed to reasonably ensure that proxies are voted in the best interest of the Clients.

I. Duty to Vote Proxies

ALTI views seriously its responsibility to exercise voting authority over securities that are owned by Clients.

A. It is the policy of ALTI to review each proxy statement on an individual basis and to vote exclusively with the goal to best serve the financial interests of the Client.

B. To document that proxies are being voted, ALTI will keep a record reflecting when and how each proxy is voted. ALTI will keep and maintain such records consistent with the requirements of Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended (“Advisers Act”), and other applicable regulations. ALTI will make its proxy voting history and policies and procedures available to Clients upon request.

C. ALTI may utilize the services of an outside proxy service provider selected by its management at its sole discretion, provided that ALTI determines that the instructions given to such outside proxy service provider are in the best interests of its Clients.

II. Guidelines for Voting Proxies

ALTI will generally vote proxies so as to promote the long-term economic value of the underlying securities, and generally will follow the Guidelines provided below. Each proxy proposal should be considered on its own merits, and an independent determination will be made whether to support or oppose management’s position. ALTI believes that the recommendation of management should be given substantial weight, but ALTI will not support management proposals that may be detrimental to the underlying financial value of a stock.

ALTI’s portfolio management and legal department will be responsible for administrating and overseeing the proxy voting process.

The Guidelines set forth below deal with the two basic categories of proxy proposals. While they are not exhaustive, they do provide a good indication of ALTI’s general approach to a wide range of issues.

ALTI usually will oppose proposals that dilute the economic interest of shareholders, reduce shareholders’ voting rights, or otherwise limit their authority. Proxies will be voted in what is believed to be in Client’s best interest and not necessarily always with management. Each situation is considered individually within the general guidelines. Routine proposals normally are voted based on the recommendation of the issuer’s management. Non-routine proposals that could meaningfully impact the position of existing shareholders are given special consideration and voted in a manner that is believed to support the interests of the Client.

In certain circumstances, ALTI may choose not to exercise its proxy voting authority with respect to separately managed accounts. For example: when ALTI believes that the costs to be incurred in assessing the Client’s best interest are greater than the benefits of exercising voting authority; when ALTI has received or delivered a notice of termination of its investment management agreement with a Client, even if ALTI retains trading authority for a transitional period; when the Client has provided specific voting instructions in writing as to its proxies; or when the Client has specified in writing that it will retain the authority to vote proxies or that it has delegated the right to a third party. ALTI always will exercise its proxy voting authority for mutual funds it advises/sub-advises.

1. Routine Proposals

Routine proposals are those that do not propose to change the structure, bylaws, or operations of the corporation to the detriment of the shareholders. Given the routine nature of these proposals, proxies will nearly always be voted with management. Traditionally, routine proposals include:

• Approval of auditor’s election of directors and officers of the corporation

• Indemnification provisions for directors

• Liability limitations of directors

• Name changes

• Declaring stock splits

• Elimination of preemptive rights

• Incentive compensation plans

• Changing the date and/or the location of the annual meetings

• Minor amendments to the articles of incorporation

• Employment contracts between the company and its executives and remuneration for directors

• Automatic dividend reinvestment plans

• Retirement plans, pensions plans, and profit-sharing plans, creation of and amendments thereto

2. Non-Routine Proposals

These proposals are more likely to affect the structure and operations of the corporation and, therefore, will have a greater impact on the value of the stock. The portfolio voting the proxy will review each issue in this category on a case-by-case basis. ALTI will be especially critical of lavish executive compensation and highly priced merger acquisition proposals, which would tend to lower future corporate earnings potential.

Non-routine proposals typically include:

• Mergers and acquisitions

• Restructuring

• Re-incorporation or formation

• Changes in capitalization

• Increase or decrease in number of directors

• Increase or decrease in preferred stock

• Increase or decrease in common stock

• Stock option plans or other compensation plans

• Social issues

• Poison pills

• Golden parachutes

• Greenmail

• Supermajority voting

• Board classification without cumulative voting

• Confidential voting

ALTI will typically accept management’s recommendations on shareholder proposed social issues, since it does not have the means to either evaluate the economic impact of such proposals or determine a consensus among shareholders’ social and political viewpoints.

3. Proposals Specific to Mutual Funds

ALTI serves as investment adviser to certain investment companies under the Northern Lights Fund Trust. These funds may invest in other investment companies that are not affiliated (“Underlying Funds”) and are required by the Investment Company Act of 1940, as amended (the “1940 Act”) to handle proxies received from Underlying Funds in a certain manner. Notwithstanding the guidelines provided in these procedures, it is the policy of ALTI to vote all proxies received from the Underlying Funds in the same proportion that all shares of the Underlying Funds are voted, or in accordance with instructions received from fund shareholders, pursuant to Section 12(d)(1)(F) of the 1940 Act. After properly voted, the proxy materials are placed in a file maintained by the Chief Compliance Officer for future reference.

III. Conflicts of Interests

ALTI is sensitive to conflicts of interest that may arise in the proxy decision making process between ALTI, its affiliated companies and their clients, or between Clients’ interests and the interests of ALTI, ALTI’s other clients, and ALTI’s affiliated companies. ALTI will seek to resolve all conflicts in its clients’ collective best interest. Voting in accordance with the Guidelines described above will generally prevent any conflicts that may appear to exist from affecting ALTI’s voting. However, if a conflict of interest with respect to a proxy vote is identified, ALTI will not vote the proxy until it has been determined that the conflict of interest is not material or will take appropriate steps to resolve the conflict of interest. In assessing whether a conflict of interest is material and the steps to resolve the conflict, ALTI will consult with senior management, the Chief Compliance Officer, and, as appropriate, an independent consultant or outside counsel in order to act in the collective best interest of ALTI’s clients.

IV. Recordkeeping and Reporting

ALTI is required to maintain records of proxies voted pursuant to Section 204(2) of the Advisers Act and Rule 204-2(c) thereunder. ALTI will maintain and make available to Clients for review a copy of its proxy voting policies and procedures, a record of each vote cast, and each written and verbal Client request for proxy voting records.

Proxy voting books and records are maintained by ALTI for five years. If requested in written form, the proxy voting history and policies and procedures shall be sent to a Client within five business days of such a request. To request a written copy, Clients, or their agents, may contact ALTI by writing to ALTI at 110 East 40th Street, Suite 803, New York, NY 10016.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

(a)(1) Identification of Portfolio Manager(s) or Management Team Members and Description of Role of Portfolio Manager(s) or Management Team Members

The following table provides biographical information about the members of the Portfolio Managers, who are primarily responsible for the day-to-day portfolio management of the Fund as of June 7, 2024:

Name of Portfolio Manager | | Title | | Length of Time of

Service to the Fund | | Business Experience During the Past 5 Years |

Sheryl Schwartz | | Chair of Investment Committee; Portfolio Manager | | Since Inception | | Board Member for GAIA REIT; Board Member for Cartesian Growth II, Professor at Fordham University; Managing Director for Caspian/Flexstone Private Equity (2013 – 2020) |

John Litchfield | | Investment Committee Member | | Since Inception | | Vice President Investment Strategy of CenturyLink Investment Management (2019 – Present) |

Holly Holtz | | Investment Committee Member | | Since Inception | | Founder and Managing Director for Shinrun Advisors (2021 – Present); Secretary, Treasurer and Executive Committee Trustee for Grand Canyon Trust (2016 – Present as Trustee); (2021 – Present as Secretary/Treasurer) |

(2) Other Accounts Managed by Portfolio Manager(s) or Management Team Member and Potential Conflicts of Interest

The following table provides information about portfolios and accounts, other than the ALTI Private Equity Access and Commitments Fund, for which the Fund’s portfolio managers are primarily responsible for the day-to-day portfolio management as of March 31, 2024:

| | Number of Accounts and Total Value of Assets

(in thousands) for Which Advisory Fee is

Performance-Based: | | Number of Other Accounts Managed and Total Value

of Assets (in thousands) by Account Type for Which

There is No Performance-Based Fee: |

| | | Registered

investment

companies | | Other pooled

investment

vehicles | | Other accounts | | Registered

investment

companies

(thousands) | | Other pooled

investment

vehicles | | Other accounts |

Sheryl Schwartz | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 |

John Litchfield | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 |

Holly Holtz | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 |

Potential Conflicts of Interests

As a general matter, certain conflicts of interest may arise in connection with a portfolio manager’s management of the Fund’s investments. Potential conflicts might include conflicts created by specific portfolio manager compensation arrangements, and conflicts relating to the selection of brokers or dealers to execute Fund portfolio trades and/or specific uses of commissions from Fund portfolio trades (for example, research, or “soft dollars,” if any). The Adviser and Sub-Adviser have adopted policies and procedures and have structured their portfolio managers’ compensation in a manner reasonably designed to safeguard the Fund from being negatively affected as a result of any such potential conflicts.

(3) Compensation Structure of Portfolio Manager(s) or Management Team Members

As of March 31, 2024, the compensation of the Portfolio Managers includes a combination of the following: (i) fixed annual salary; and (ii) a discretionary bonus tied to the overall profitability of the Investment Manager and their affiliates, as applicable.

(4) Disclosure of Securities Ownership

The following table sets forth the dollar range of equity securities beneficially owned by each Portfolio Manager in the Fund as of March 31, 2024:

Portfolio Manager | | Dollar Range of Fund Shares Beneficially Owned |

Sheryl Schwartz | | None |

John Litchfield | | None |

Holly Holtz | | None |

(b) Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

(a) Not applicable.

(b) Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There were no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Directors.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)(17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There was no change in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

ITEM 12. DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

(a) Not applicable.

(b) Not applicable.

ITEM 13. EXHIBITS.

(a)(1) The code of ethics of the registrant, or any amendment thereto, that is the subject of disclosure required by Item 2 is attached hereto.

(a)(2) Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto.

(a)(3) Not applicable.

(a)(4) Not applicable.

(b) Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(registrant) | | ALTI PRIVATE EQUITY ACCESS AND COMMITMENTS FUND LLC |

By (Signature and Title)* | | /s/ Joseph Bonvouloir |

| | | Joseph Bonvouloir, President |

| | | (Principal Executive Officer) |

Date | | JUNE 7, 2024 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* | | /s/ Joseph Bonvouloir |

| | | Joseph Bonvouloir, President |

| | | (Principal Executive Officer) |

Date | | JUNE 7, 2024 |

By (Signature and Title)* | | /s/ Madeline Arment |

| | | Madeline Arment, Treasurer |

| | | (Principal Financial Officer) |

Date | | JUNE 7, 2024 |