Exhibit 99.4

| KEYNOTE 3.25.2022 © 2022 LORDSTOWN MOTORS CORPORATION |

| This presentation includes forward looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “feel,” “expects,” “estimates,” “projects,” “intends,” “should,” “is to be,” or the negative of such terms, or other comparable terminology. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained herein due to many factors, including, but not limited to: the need to raise substantial additional capital well in advance of our target of third quarter of 2022 for the start of commercial production and sale of our vehicles, to continue ongoing operations, and remain a going concern, and our ability to raise such funding on a reasonable timeline and with suitable terms; the cost and other impacts of litigation, regulatory proceedings, investigations, claims and/or adverse publicity, which may have a material adverse effect, whether or not successful or valid, on our business prospects and ability to obtain financing; our limited operating history and our ability to execute our business plan, including through any relationship with Foxconn; our ability to raise sufficient capital in the future in order to invest in the tooling to eventually lower the bill of materials for, and make continued design enhancements to, the Endurance and any future vehicles we may develop; the rollout of our business and the timing of expected business milestones, including our ability to complete the engineering of the Endurance, and conversion and retooling of the Lordstown facility, to establish and maintain appropriate supplier relationships, to successfully complete testing, homologation and certification, and to start production of the Endurance in accordance with our projected timeline; supply chain disruptions, inflation and the potential inability to source essential components and raw materials, including on a timely basis or at acceptable cost, and their consequences on testing, production, sales and other activities; our ability to obtain binding purchase orders and build customer relationships; our ability to deliver on the expectations of customers with respect to the pricing, performance, quality, reliability, safety and efficiency of the Endurance and to provide the levels of service and support that they will require; our ability to conduct business using a direct sales model, rather than through a dealer network used by most other OEMs; the effects of competition on our ability to market and sell vehicles; our inability to retain key personnel and to hire additional personnel; the ability to protect our intellectual property rights; the failure to obtain required regulatory approvals; changes in laws, regulatory requirements, governmental incentives and fuel and energy prices; the impact of health epidemics, including the COVID-19 pandemic, on our business; cybersecurity threats and compliance with privacy and data protection laws; failure to timely implement and maintain adequate financial, information technology and management processes and controls and procedures; and the possibility that we may be adversely affected by other economic, geopolitical, business and/or competitive factors. The transactions contemplated with Foxconn under the asset purchase agreement are subject to closing conditions, including further negotiation and execution of the contract manufacturing agreement and regulatory approvals, and may not be consummated. In addition, no assurances can be given that LMC and Foxconn will enter into a joint product development or similar agreement, with an appropriate funding structure, or as to the terms of any such agreement. Our inability to reach such agreements with an appropriate funding structure would likely have a material adverse effect on our ability to execute our operating plan, our financial condition and our business prospects. Further information on potential factors that could affect the financial results of the Company and its forward-looking statements is included in its most recent Form 10-K and subsequent filings with the Securities and Exchange Commission. All forward-looking statements are qualified in their entirety by this cautionary statement. Any forward-looking statements speak only as of the date on which they are made, and Lordstown Motors undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this presentation. Forward Looking Statements Keynote |

| President Lordstown Motors Corp. Edward T. Hightower 03 00 00 00 00 |

| We are Lordstown Motor Corporation, an electric vehicle company focused on commercial solutions. Everything we do is with workers in mind. Our goal is to accelerate EV adoption through products, production and partnerships. HELLO 00 00 00 00 04 |

| Lordstown Motors has transformed its team and culture to bring the Endurance to market and accelerate the transition to electric vehicles About Us 01 01 00 00 00 05 |

| 1 H 2022 01 00 00 00 06 Since 2021, Lordstown Motors has taken transformative steps to build the team, strategy, culture, and capabilities to succeed in the commercial fleet BEV market CMA: contract manufacturing agreement JPDA: joint product development agreement Source: Lordstown Motors Corp. |

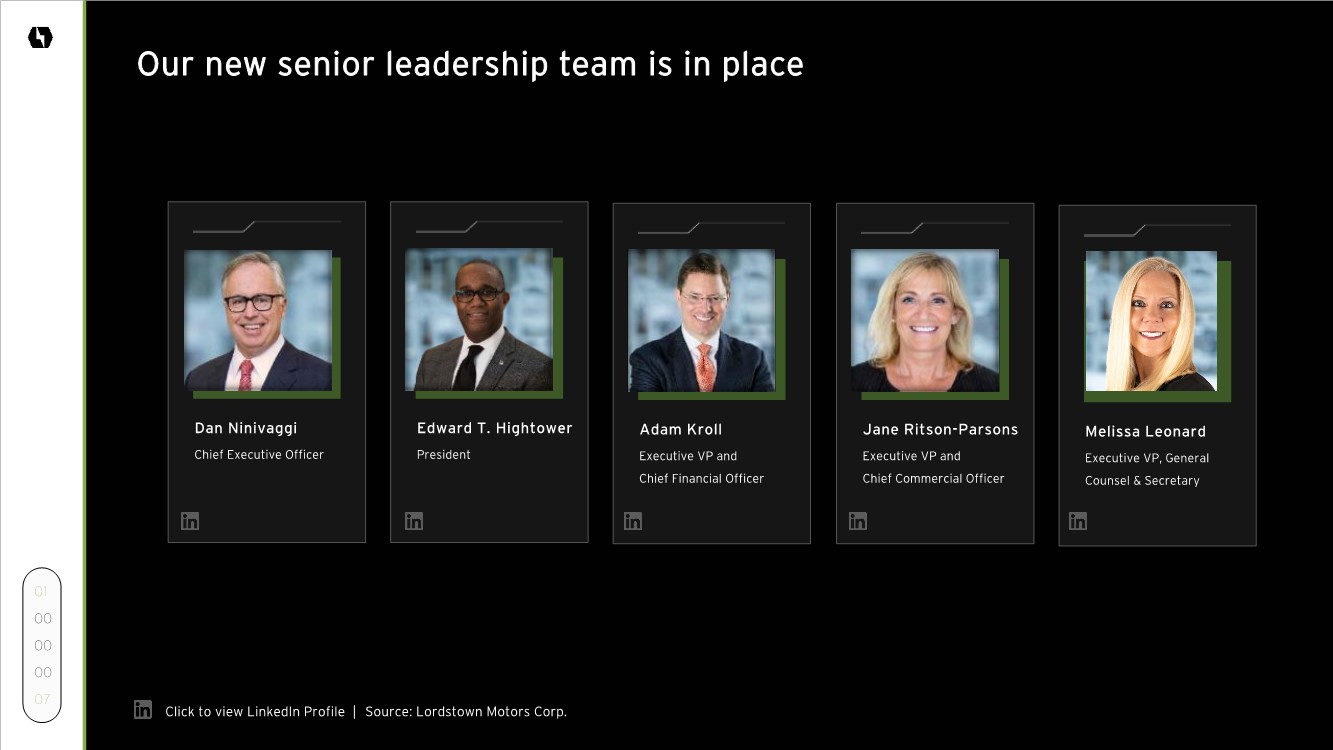

| Chief Executive Officer Dan Ninivaggi President Edward T. Hightower Executive VP and Chief Financial Officer Adam Kroll Executive VP and Chief Commercial Officer Jane Ritson-Parsons 01 00 00 00 07 Executive VP, General Counsel & Secretary Melissa Leonard Source: Lordstown Motors Corp. Our new senior leadership team is in place Click to view LinkedIn Profile | |

| 01 00 00 00 08 Source: Lordstown Motors Corp. Principles Endure We are building a strong company culture to move us forward. INTEGRITY We operate with transparency and do what we say. DISCIPLINE We utilize systems, processes, and metrics to meet our objectives. COLLABORATION We form great partnerships to succeed.. |

| Fleet-first products, capital-light production and flexible partnerships Start production of the Endurance pickup truck in the third quarter of 2022 Our Strategy Immediate Focus 01 00 00 00 We are an engineering technology company focused on the fundamentals of what it takes to build an all-electric truck made for work. We are executing our mission with a clear strategy and focus Accelerate EV Adoption Our Mission 09 |

| Lordstown Motors anticipates market opportunities within commercial fleets, especially where state, local, and federal governments offer tax credits for replacing ICE vehicles with BEVs Market Opportunities 02 00 00 00 10 02 |

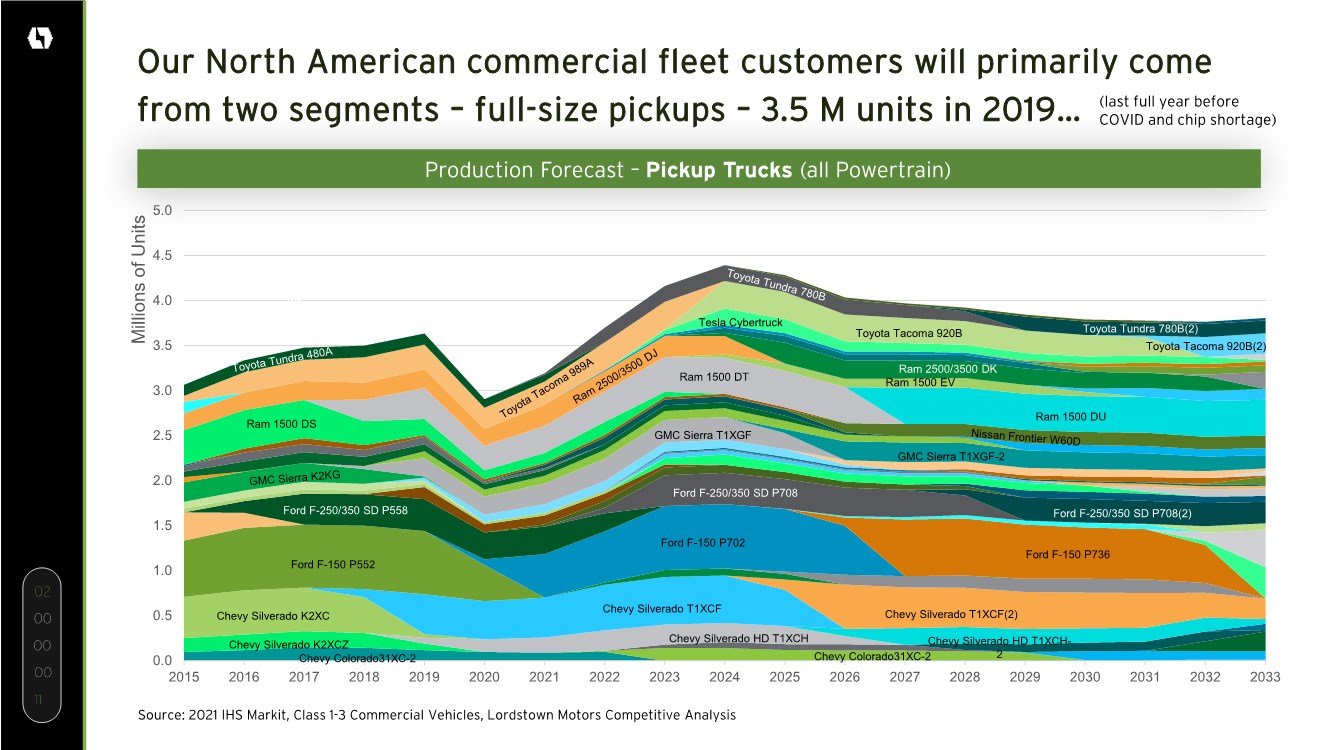

| 11 00 00 00 02 Our North American commercial fleet customers will primarily come from two segments – full-size pickups – 3.5 M units in 2019… 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Millions of Units Ford F-150 P736 Ford F-150 P702 Ford F-250/350 SD P708 Ford F-250/350 SD P708(2) Chevy Silverado T1XCF(2) Chevy Silverado T1XCF Ram 1500 DT Ram 1500 DU Toyota Tacoma 920B Tesla Cybertruck Toyota Tacoma 920B(2) Ram 2500/3500 DK GMC Sierra T1XGF-2 Chevy Silverado HD T1XCH Chevy Silverado HD T1XCH- 2 Chevy Silverado K2XC Chevy Silverado K2XCZ Ford F-150 P552 Ford F-250/350 SD P558 GMC Sierra T1XGF Ram 1500 DS Toyota Tacoma 920B Ram 1500 EV Toyota Tundra 780B(2) Chevy Colorado31XC-2 Chevy Colorado31XC-2 Source: 2021 IHS Markit, Class 1-3 Commercial Vehicles, Lordstown Motors Competitive Analysis (last full year before COVID and chip shortage) Production Forecast – Pickup Trucks (all Powertrain) |

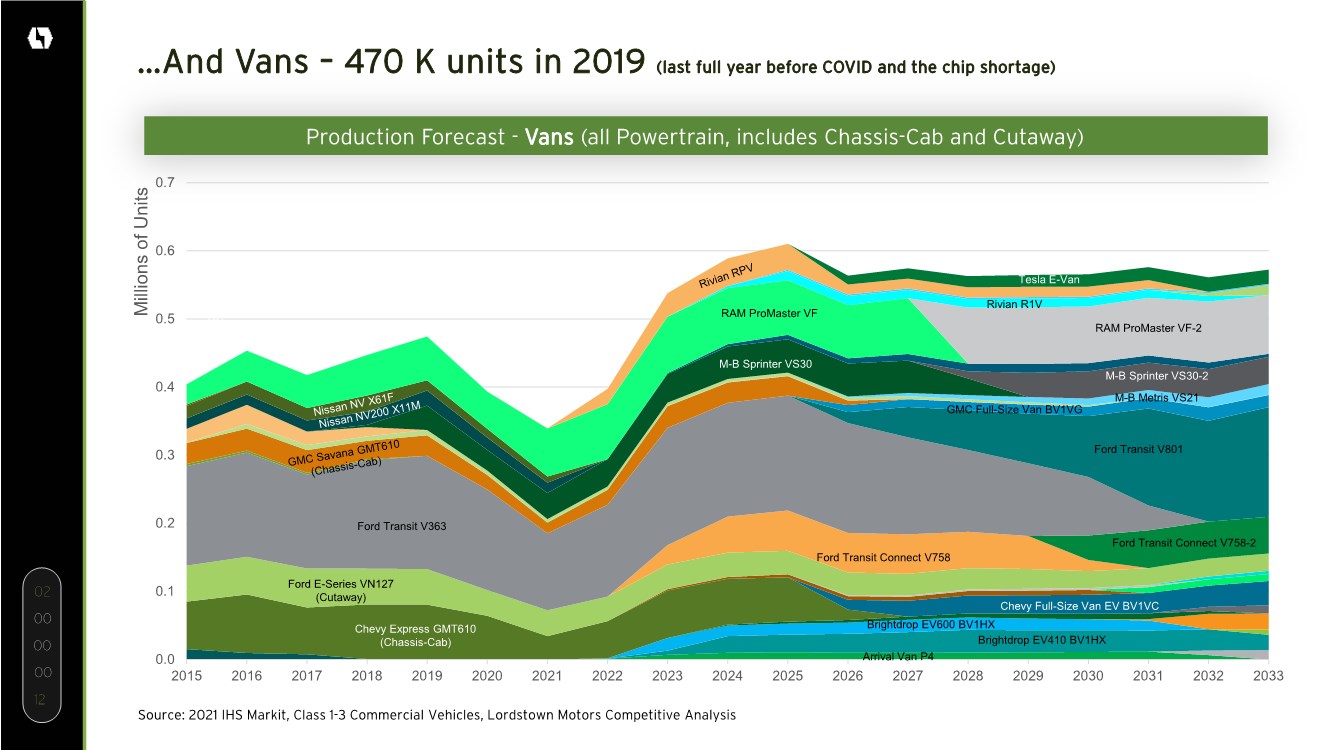

| 12 00 00 00 Source: 2021 IHS Markit, Class 1-3 Commercial Vehicles, Lordstown Motors Competitive Analysis 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Millions of Units Toyota Tacoma 920B Chevy Express GMT610 (Chassis-Cab) Brightdrop EV410 BV1HX Brightdrop EV600 BV1HX Chevy Full-Size Van EV BV1VC Ford E-Series VN127 (Cutaway) Ford Transit V363 Ford Transit V801 RAM ProMaster VF RAM ProMaster VF-2 M-B Sprinter VS30 M-B Sprinter VS30-2 Tesla E-Van Rivian R1V Ford Transit Connect V758 Ford Transit Connect V758-2 GMC Full-Size Van BV1VG M-B Metris VS21 Arrival Van P4 …And Vans – 470 K units in 2019 (last full year before COVID and the chip shortage) Production Forecast - Vans (all Powertrain, includes Chassis-Cab and Cutaway) 02 |

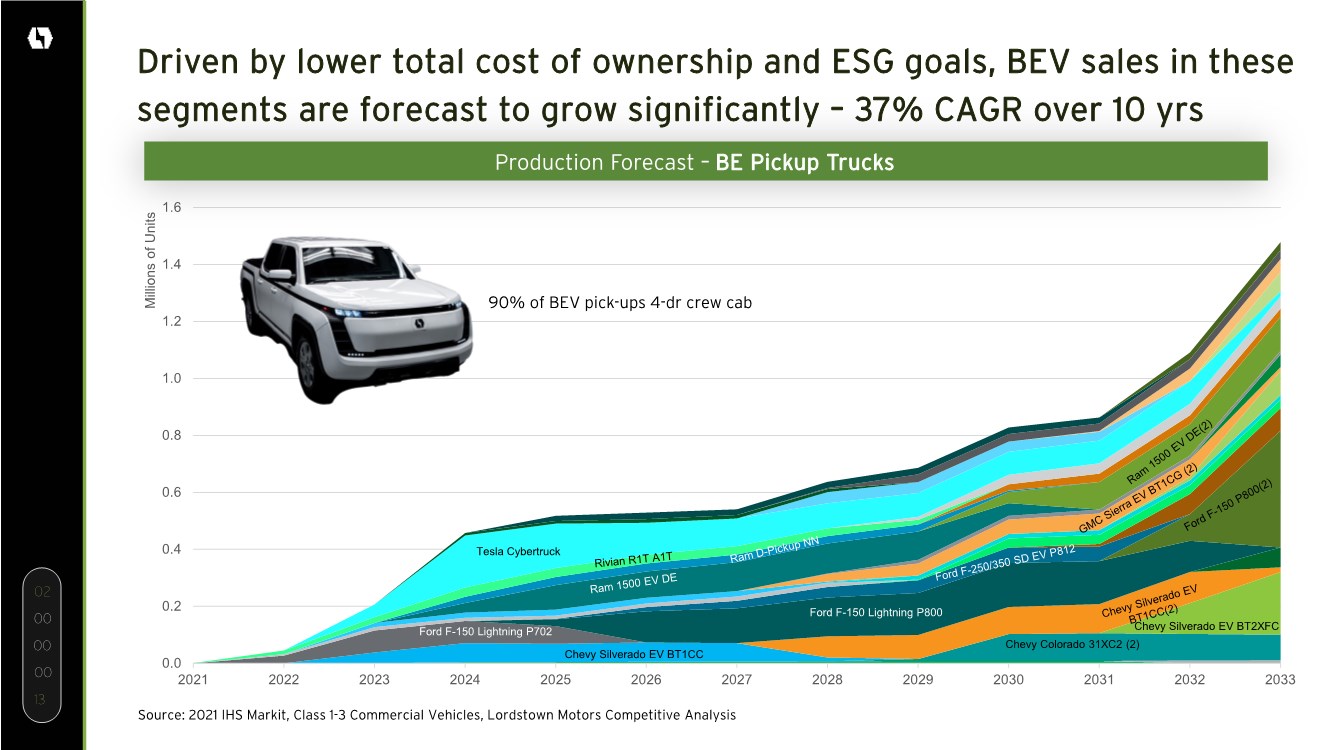

| 13 00 00 00 Driven by lower total cost of ownership and ESG goals, BEV sales in these segments are forecast to grow significantly – 37% CAGR over 10 yrs Source: 2021 IHS Markit, Class 1-3 Commercial Vehicles, Lordstown Motors Competitive Analysis 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Millions of Units Tesla Cybertruck Ford F-150 Lightning P800 Chevy Silverado EV BT1CC Chevy Silverado EV BT2XFC Ford F-150 Lightning P702 Chevy Colorado 31XC2 (2) 90% of BEV pick-ups 4-dr crew cab Production Forecast – BE Pickup Trucks 02 |

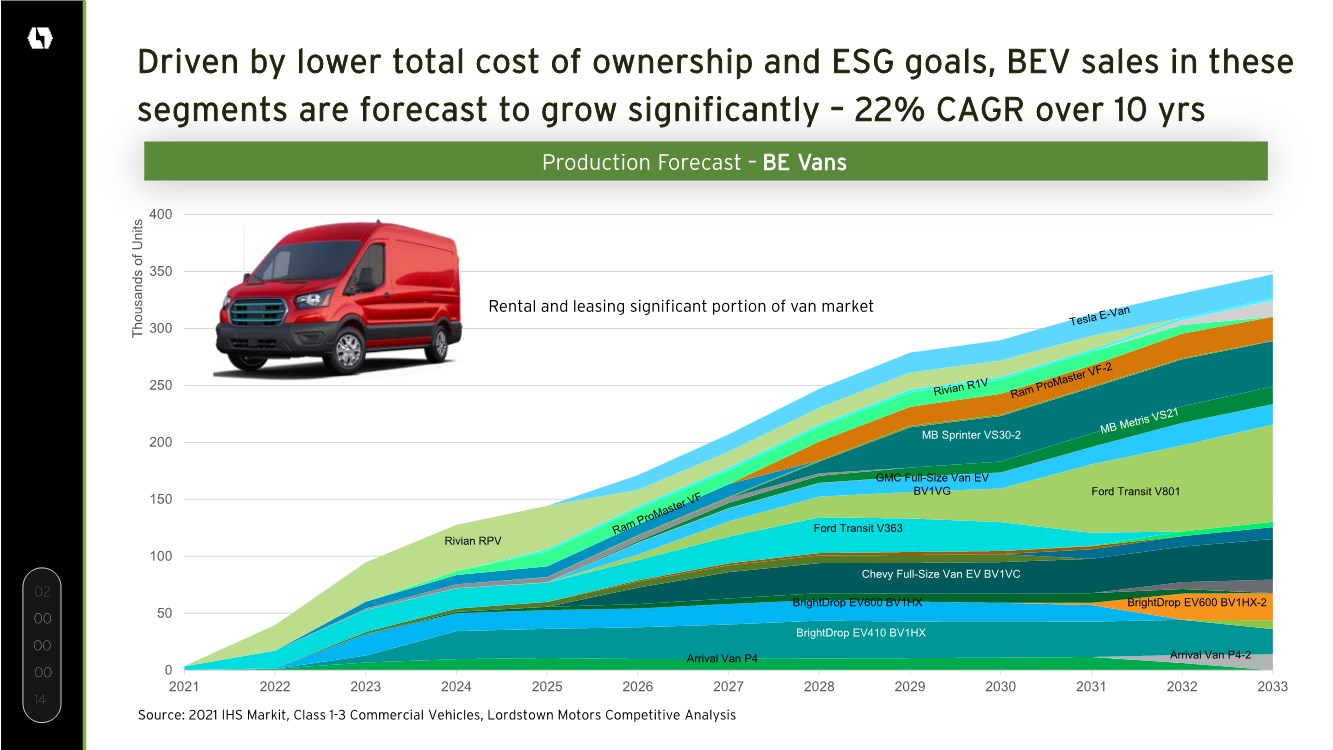

| 14 00 00 00 Source: 2021 IHS Markit, Class 1-3 Commercial Vehicles, Lordstown Motors Competitive Analysis 0 50 100 150 200 250 300 350 400 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Thousands of Units Rivian RPV MB Sprinter VS30-2 GMC Full-Size Van EV BV1VG Ford Transit V801 Ford Transit V363 Chevy Full-Size Van EV BV1VC BrightDrop EV600 BV1HX BrightDrop EV600 BV1HX-2 BrightDrop EV410 BV1HX Arrival Van P4 Arrival Van P4-2 Driven by lower total cost of ownership and ESG goals, BEV sales in these segments are forecast to grow significantly – 22% CAGR over 10 yrs Rental and leasing significant portion of van market Production Forecast – BE Vans 02 |

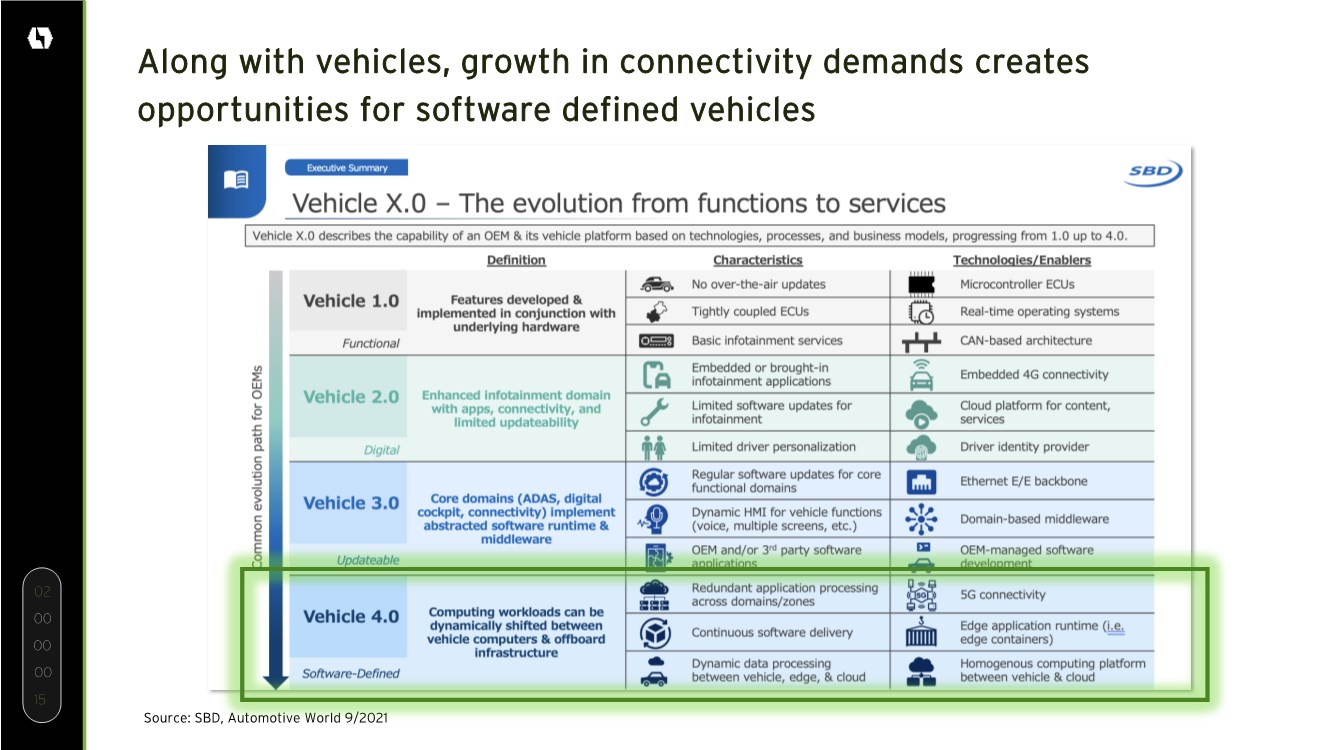

| 15 00 00 00 Along with vehicles, growth in connectivity demands creates opportunities for software defined vehicles Source: SBD, Automotive World 9/2021 02 |

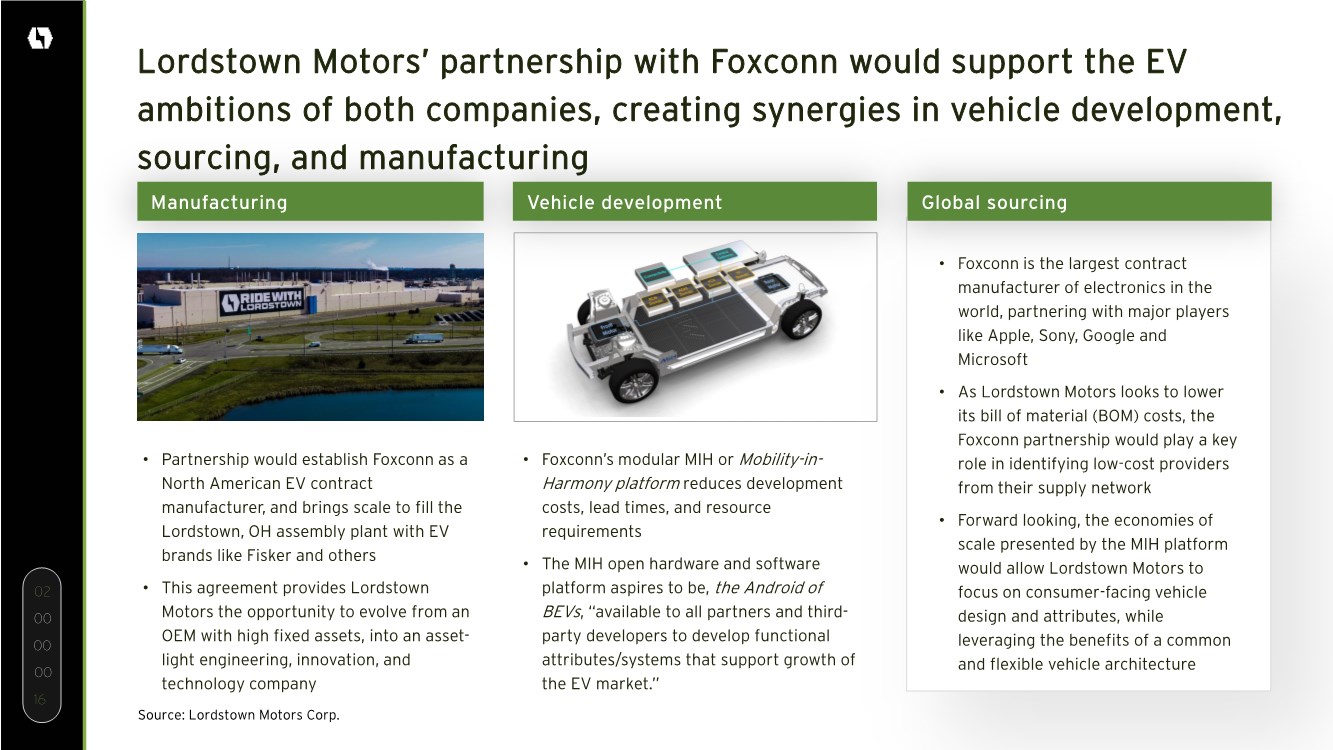

| 16 00 00 00 Lordstown Motors’ partnership with Foxconn would support the EV ambitions of both companies, creating synergies in vehicle development, sourcing, and manufacturing Manufacturing Vehicle development • Foxconn is the largest contract manufacturer of electronics in the world, partnering with major players like Apple, Sony, Google and Microsoft • As Lordstown Motors looks to lower its bill of material (BOM) costs, the Foxconn partnership would play a key role in identifying low-cost providers from their supply network • Forward looking, the economies of scale presented by the MIH platform would allow Lordstown Motors to focus on consumer-facing vehicle design and attributes, while leveraging the benefits of a common and flexible vehicle architecture • Partnership would establish Foxconn as a North American EV contract manufacturer, and brings scale to fill the Lordstown, OH assembly plant with EV brands like Fisker and others • This agreement provides Lordstown Motors the opportunity to evolve from an OEM with high fixed assets, into an asset- light engineering, innovation, and technology company • Foxconn’s modular MIH or Mobility-in- Harmony platform reduces development costs, lead times, and resource requirements • The MIH open hardware and software platform aspires to be, the Android of BEVs, “available to all partners and third- party developers to develop functional attributes/systems that support growth of the EV market.” Global sourcing Source: Lordstown Motors Corp. 02 |

| © 2022 LORDSTOWN MOTORS CORPORATION Thank you! INVESTOR RELATIONS carter.driscoll@lordstownmotors.com MEDIA INQUIRIES crobar@robarpr.com | 313.207.5960 #RIDEWITHLORDSTOWN KEYNOTE 3.25.2022 |