UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

SCHEDULE 14A INFORMATION

________________________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | |

| Filed by the Registrant | | ☒ |

| Filed by a party other than the Registrant | | ☐ |

Check the appropriate box:

| | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under §240.14a-12 |

Hyliion Holdings Corp.

______________________________________________________________________________

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1202 BMC Drive

Cedar Park, Texas 78613

Dear Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Hyliion Holdings Corp. on Tuesday, May 23, 2023 at 1:30 p.m. Central Time. We are pleased to utilize a virtual format for our Annual Meeting again this year. You will be able to attend the Annual Meeting, submit your questions and vote online during the meeting by visiting https://www.cstproxy.com/hyliion/2023. Our Annual Meeting will only be accessible online as discussed in greater detail in the Proxy Statement. We believe a virtual meeting provides expanded access, improves communication, enables increased stockholder attendance and participation and provides cost savings for our stockholders and the Company.

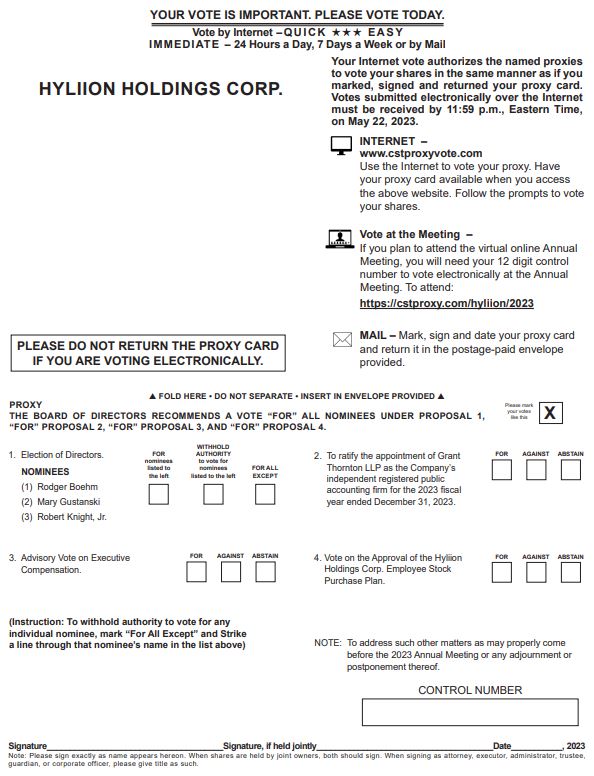

As described in the accompanying Notice and Proxy Statement, at the Annual Meeting you will be asked to (1) elect the three directors named in the Proxy Statement to serve until the 2026 Annual Meeting of Stockholders or until their respective successors are elected and qualified; (2) ratify the appointment of Grant Thornton LLP as our independent auditors for the fiscal year ended December 31, 2023; (3) approve, on a non-binding advisory basis, our named executive officers’ compensation; and (4) approve the Hyliion Holdings Corp. Employee Stock Purchase Plan.

We look forward to you joining us at the virtual Annual Meeting. Thank you for your continued support.

Sincerely,

Jeffrey Craig Thomas Healy

Board Chair Founder & CEO, Director

| | |

| NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT |

1:30 p.m. Central Time

Tuesday, May 23, 2023

Virtual Meeting Site: https://www.cstproxy.com/hyliion/2023

Dear Stockholder:

Notice is hereby given that the 2023 Annual Meeting of Stockholders (“Annual Meeting”) of Hyliion Holdings Corp., a Delaware corporation (the “Company”) will be held on Tuesday, May 23, 2023 at 1:30 p.m. Central Time at https://www.cstproxy.com/hyliion/2023. Our Annual Meeting will only be accessible online as discussed in greater detail in the Proxy Statement.

| | | | | | | | |

| Items of Business | | Our Board of Directors Recommends that You Vote |

| To elect the three directors named in the Proxy Statement to serve until the 2026 Annual Meeting of Stockholders or until their respective successors are elected and qualified | | FOR the election of each director nominee |

| | |

| To ratify the appointment of Grant Thornton LLP (“Grant Thornton”) as our independent auditors for the fiscal year ended December 31, 2023 | | FOR the ratification of the appointment |

| | |

| To approve, on a non-binding advisory basis, compensation for the Company’s named executive officers, as disclosed in the Proxy Statement | | FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers |

| | |

| To approve the Hyliion Holdings Corp. Employee Stock Purchase Plan | | FOR the approval of the Hyliion Holdings Corp. Employee Stock Purchase Plan |

| | |

| To transact such other business as may properly come before the meeting or any adjournment or postponement thereof | | The Board of Directors is not aware of any other business to be brought at the Annual Meeting |

The Board of Directors has fixed April 3, 2023 as the record date for determining stockholders entitled to receive notice of, and to vote at, the Annual Meeting or adjournment or postponement thereof. Only stockholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting. Our proxy materials are first being made available to our stockholders beginning on April 7, 2023.

By Order of the Board of Directors,

Jose Oxholm

Vice President, General Counsel and Chief Compliance Officer

Important Notice Regarding the Availability Of Proxy Materials for the Hyliion 2023 Annual

Meeting to be Held on May 23, 2023.

This Notice, Proxy Statement and our 2022 Annual Report are available at

https://www.cstproxy.com/hyliion/2023

Table of Contents

PROXY STATEMENT

FOR 2023 ANNUAL MEETING OF STOCKHOLDERS OF

HYLIION HOLDINGS CORP.

ANNUAL MEETING INFORMATION

General

The enclosed proxy is solicited by the Board of Directors of Hyliion Holdings Corp. (“Hyliion” or the “Company”) for the Annual Meeting of Stockholders to be held on Tuesday, May 23, 2022 at 1:30 p.m. Central Time, and any adjournment or postponement thereof. We will conduct a virtual online Annual Meeting this year so our stockholders can participate from any geographic location with Internet connectivity. We believe this is an important step to enhancing accessibility to our Annual Meeting for all of our stockholders and reducing the carbon footprint of our activities.

Stockholders may view a live webcast of the Annual Meeting at https://www.cstproxy.com/hyliion/2023 and may submit questions during the Annual Meeting as discussed in greater detail below. Our principal offices are located at 1202 BMC Drive, Suite 100, Cedar Park, Texas 78613. This Proxy Statement is first being made available to our stockholders beginning on April 7, 2023.

Outstanding Securities and Quorum

Only holders of record of our common stock, par value $0.0001 per share, at the close of business on April 3, 2023, the record date, will be entitled to notice of, and to vote at, the Annual Meeting. On that date, we had 180,695,572 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each other item to be voted on at the Annual Meeting. There is no cumulative voting. A majority of the outstanding shares of common stock entitled to vote, present or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. Abstentions and broker nonvotes will be included in determining the presence of a quorum for the Annual Meeting.

Internet Availability of Proxy Materials

We are furnishing proxy materials to some of our stockholders via the Internet by mailing a Notice of Internet Availability of Proxy Materials, instead of mailing or e-mailing copies of those materials. The Notice of Internet Availability of Proxy Materials directs stockholders to a website where they can access our proxy materials, including our proxy statement and our annual report, and view instructions on how to vote via the Internet, mobile device, or by telephone. If you received a Notice of Internet Availability of Proxy Materials and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. We are also providing the option for stockholders to elect to receive our proxy materials via e-mail in the future, and if you make this election, you will receive access to those materials electronically unless you elect otherwise. We encourage you to register to receive all future stockholder communications electronically, instead of in print. This means that access to the annual report, proxy statement, and other correspondence will be delivered to you via e-mail.

Proxy Voting

Shares that are properly voted via the Internet, mobile device, or by telephone or for which proxy cards are properly executed and returned will be voted at the Annual Meeting in accordance with the directions given or, in the absence of directions, will be voted in accordance with the Board’s recommendations as follows: “FOR” the election of each of the nominees to the Board named herein, “FOR” the ratification of the appointment of our independent auditors, “FOR” the approval, on an advisory basis, of the compensation of the Company’s named executive officers, and “FOR” approval of the Hyliion Holdings Corp. Employee Stock Purchase Plan. It is not expected that any additional matters will be brought before the Annual Meeting, but if other matters are properly presented, the persons named as proxies in the proxy card or their substitutes will vote in their discretion on such matters.

Voting via the Internet, mobile device, or by telephone helps save money by reducing postage and proxy tabulation costs. To vote by any of these methods, read this Proxy Statement, have your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form in hand, and follow the instructions below for your preferred method of voting. We believe that each of these voting methods is available 24 hours per day, seven days per week, but you should review your proxy card or voting instruction form for details regarding casting your vote.

We encourage you to cast your vote by one of the following methods:

•You can use the Internet to vote your proxy at www.cstproxyvote.com. Have your proxy card or voting instruction form available when you access the website. Follow the prompts to vote your shares.

•You can vote at the Annual Meeting by using your 12-digit control number to vote electronically.

•You can mark, sign and date your proxy card or voting instruction form and return it in advance of the meeting.

Holders of Record. The manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares are represented by certificates or book entries in your name so that you appear as a stockholder on the records of Continental Stock Transfer & Trust Company, our stock transfer agent, you may vote by proxy, meaning you authorize individuals named in the proxy card to vote your shares. You may provide this authorization by voting via the Internet, mobile device, by telephone, or (if you have received paper copies of our proxy materials) by returning a proxy card. You also may participate in and vote during the Annual Meeting, as described in greater detail below. If you own common stock of record and you do not vote by proxy or at the Annual Meeting, your shares will not be voted.

Shares Held in Street Name. If you own shares in street name, meaning that your shares are held by a bank, brokerage firm, or other nominee, you may instruct that institution on how to vote your shares. You generally may provide these instructions by voting via the Internet, mobile device, by telephone, or (if you have received paper copies of proxy materials through your bank, brokerage firm, or other nominee) by returning a voting instruction form received from that institution. You also generally may participate in and vote during the Annual Meeting, as described in greater detail below. If you own common stock in street name and do not either provide voting instructions or vote during the Annual Meeting, the institution that holds your shares may nevertheless vote your shares on your behalf only with respect to the ratification of the appointment of Grant Thornton as our independent auditors for the fiscal year ended December 31, 2023, and cannot vote your shares on any other matters being considered at the meeting.

Attending and Voting Online

If you plan to attend the Annual Meeting online, please be aware of what you will need to gain admission, as described below. If you do not comply with the procedures described here for attending the Annual Meeting online, you will not be able to participate in the Annual Meeting, but you may view the Annual Meeting webcast. Stockholders may participate in the Annual Meeting by visiting https://www.cstproxy.com/hyliion/2023; interested persons who were not stockholders as of the close of business on April 3, 2023 may view, but not participate, in the Annual Meeting. Regardless of whether you plan to participate in the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Accordingly, we encourage you to log on to https://www.cstproxy.com/hyliion/2023 and vote in advance of the Annual Meeting.

Holders of Record. To attend online and participate in the Annual Meeting, stockholders of record will need to use their control number on their Notice of Internet Availability or proxy card to log in to https://www.cstproxy.com/hyliion/2023.

Shares Held in Street Name. If you are a beneficial stockholder and your voting instruction form or Notice of Internet Availability indicates that you may vote those shares through the https://www.cstproxy.com/hyliion/2023 website, then you may access, participate in, and vote at the Annual Meeting with the 16-digit access code indicated on that voting instruction form or Notice of Internet Availability. Otherwise, beneficial stockholders who do not have a control number or access code should contact their bank, broker or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “control number” in order to be able to attend, participate in or vote at the Annual Meeting.

Participation in the Annual Meeting

This year’s Annual Meeting will be accessible through the Internet. We are conducting a virtual online Annual Meeting so our stockholders can participate from any geographic location with Internet connectivity. We believe this is an important step to enhancing accessibility to our Annual Meeting for all of our stockholders and reducing the carbon footprint of our activities. We discuss how you can participate in the meeting and vote your shares above. You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on April 3, 2023, the record date, or hold a valid proxy for the meeting.

Asking Questions. Stockholders have multiple opportunities to submit questions to the Company for the Annual Meeting. Stockholders who wish to submit a question in advance may do so at https://www.cstproxy.com/hyliion/2023. Stockholders also may submit questions live during the meeting. Based on the time allotted during the

meeting we will answer relevant and appropriate questions as they come in. If the meeting ends, we will answer them on an individual basis. We also will post a replay of the Annual Meeting on our investor relations website, which will be available following the meeting. Additional information regarding the rules and procedures for participating in the Annual Meeting will be set forth in our meeting rules of conduct, which stockholders can view during the meeting at the meeting website or during the seven days prior to the meeting at https://www.cstproxy.com/hyliion/2023.

Technical Support. We encourage you to access the meeting prior to the start time. Please allow ample time for online check-in, which will begin at 1:15 p.m. Central Time. If you have difficulties during the check-in time or during the Annual Meeting, we will have technicians ready to assist you with any difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or course of the Annual Meeting, please call 917-262-2373. We will have technicians available to assist you.

Voting Standard

Nominees for director are elected to the Board by a plurality standard. Practically speaking, this means that the directors who receive the highest number of votes are elected to the available seats. Because there are three seats for which three directors have been nominated, each of the three nominees will be elected. However, if the votes cast for any nominee do not exceed the votes withheld from the nominee, the Board will consider that in assessing the Board’s composition going forward and in considering whether to renominate a particular individual in the future. Abstentions and “broker nonvotes” will have no effect on the outcome of the election. Broker nonvotes occur when a person holding shares in street name, such as through a brokerage firm, does not provide instructions as to how to vote those shares and the broker does not then have the authority to vote those shares on the stockholder’s behalf.

For all other matters proposed for a vote at the Annual Meeting, the affirmative vote of a majority of the outstanding shares of common stock present in person, including by remote communication as applicable, or represented by proxy and entitled to vote on the matter is required to approve the matter. For these matters, cast abstentions are counted as a vote “against” the matter. Broker nonvotes, if any, will have no effect on the outcome of these matters. We do not expect there to be any broker nonvotes for the ratification of the appointment of our independent auditors since brokers have discretion to cast votes on that matter.

Revocation

If you own common stock of record, you may revoke your proxy or change your voting instructions at any time before your shares are voted at the Annual Meeting by delivering to the Corporate Secretary of the Company a written notice of revocation or a duly executed proxy (via the Internet, mobile device, or telephone or by returning a proxy card) bearing a later date or by participating in and voting during the Annual Meeting. A stockholder owning common stock in street name may revoke or change voting instructions by contacting the bank, brokerage firm, or other nominee holding the shares or by participating in and voting during the Annual Meeting.

ITEM 1 — ELECTION OF DIRECTORS

In accordance with our Bylaws, the Board has fixed the number of directors currently constituting the Board at ten. Our Board is currently staggered, which means that only one class of directors is up for election in any given year. At the Annual Meeting, our Class III directors, Rodger Boehm, Mary Gustanski, and Robert Knight, Jr., who currently serve as directors on the Board, are up for election. Our Board, based on the recommendation of the Nominating and Corporate Governance Committee, proposes that Mr. Boehm, Ms. Gustanski and Mr. Knight be elected at the Annual Meeting, with each holding office until the 2026 Annual Meeting of Stockholders or until their respective successors are elected and qualified. Mr. Boehm, Ms. Gustanski and Mr. Knight currently serve on the Board. Biographical information about each of the nominees and a discussion of the qualifications, attributes and skills of each nominee is contained in the following section.

If you are a stockholder of record and you sign your proxy card or vote by telephone or over the Internet but do not give instructions with respect to the voting of directors, your shares will be voted “FOR” the election of Mr. Boehm, Ms. Gustanski and Mr. Knight. Mr. Boehm, Ms. Gustanski and Mr. Knight have accepted such nomination; however, in the event that a nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the Board to fill such vacancy, or the Board may reduce the size of the Board. If you are a beneficial owner holding your shares in street name and you do not give voting instructions to your broker, bank or other intermediary, that organization will leave your shares unvoted on this matter.

The Board of Directors recommends a vote “FOR” the election of Mr. Boehm, Ms. Gustanski and Mr. Knight.

CORPORATE GOVERNANCE: THE BOARD AND MANAGEMENT

Corporate Governance Developments

In 2022, we continued to evolve our corporate governance practices toward best practices that benefit the Company and its strategic interests. Importantly, we expanded our Board to include Jeffrey Craig, who brings key industry expertise and organizational management credentials and we are pleased to have him join us. In addition, the Nominating and Corporate Governance Committee took on the responsibility for environmental, social and governance (“ESG”) efforts and oversight as reflected in its charter. Furthermore, as a result of our acquisition of KARNO generator technology in September 2022, we expect to have more interactions with the United States federal government and the Board approved a revised Code of Business Conduct and Ethics, which includes applicable government contracting requirements. During 2022, Edward Olkkola served as Chair of the Board, and Rob Knight served as our Lead Independent Director. Following Mr. Olkkola’s death in December 2022, the Board elected Mr. Craig as Chair. Because Mr. Craig is an independent director, the Board determined that a Lead Independent Director was no longer required.

Board Leadership

The roles of Board Chair and Chief Executive Officer are currently separated. Although the Board believes that there are advantages to having an independent Board Chair, the Board has no policy regarding the separation of the roles of Chair and Chief Executive Officer, and considers the duties of these roles, and whether they should be combined or separated, during succession planning. In the event the Board elects as its Chair a director who is not independent, the Board shall also designate a lead director who is independent.

Directors

Our directors and their ages as of March 24, 2023 are as follows:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Employee Directors | | | | |

Thomas Healy(4) | | 30 | | Chief Executive Officer and Director |

| Non-Employee Directors | | | | |

Rodger Boehm(1)(4) | | 63 | | Director |

Andrew Card, Jr.(1) | | 75 | | Director |

Jeffrey Craig(3) | | 62 | | Chair of the Board of Directors |

Vincent Cubbage(2*)(3) | | 58 | | Director |

Richard Freeland(2)(4) | | 65 | | Director |

Mary Gustanski(2)(4*) | | 60 | | Director |

Robert Knight, Jr.(1*)(5) | | 65 | | Director |

Stephen Pang(1) | | 41 | | Director |

Melanie Trent(3*) | | 58 | | Director |

____________

(1) Member of the Audit Committee

(2) Member of the Compensation Committee

(3) Member of the Nominating and Corporate Governance Committee

(4) Member of the Technology Committee

(5) Audit Committee Financial Expert

* Committee Chair

Rodger Boehm. Mr. Boehm has served as a director of the Board since March 2023. Mr. Boehm was a senior partner at McKinsey & Company, Inc. where he spent 31 years in a variety of roles in increasing responsibility. He led client service for leading global institutions helping companies to significantly improve their revenue, cost, and service performance. Mr. Boehm currently serves on the board of directors of Ruggable and FreightCar America, and he also served on the board of directors of Meritor Inc. from 2017 to 2023. Mr. Boehm holds a bachelor of science degree from Purdue University and a master of business administration degree from Harvard University.

Andrew Card, Jr. Secretary Card has served as a director of the Board since October 2020. Sec. Card served as Chairman of National Endowment for Democracy, a nonprofit foundation, from January 2018 to January 2021.

From 2015 until 2016, Sec. Card served as President of Franklin Pierce University, and also previously served as the Executive Director of the Office of the Provost and Vice President for Academic Affairs at Texas A&M University. Prior to that, Sec. Card served as Chief of Staff to President George W. Bush, the 11th Secretary of Transportation under President H.W. Bush and Deputy Assistant to the President and Director of Intergovernmental Affairs for President Ronald Reagan. Additionally, Sec. Card previously served as Vice President-Government Relations for General Motors Corporation, and as the President and Chief Executive Officer of the American Automobile Manufacturers Association. Sec. Card has served as a director of Union Pacific Corporation (NYSE: UNP), a transportation company that primarily operates one of the largest railroads in North America, between July 2006 and May 2022, Draganfly Inc. (OTCMKTS: DFLYF), a manufacturer of unmanned aerial vehicles, since November 2019 and Lorillard Inc., a tobacco company, from July 2011 to June 2015. Sec. Card is a graduate of the University of South Carolina with a B.S. in Engineering. He also attended the U.S. Merchant Marine Academy and the John F. Kennedy School of Government at Harvard University. Sec. Card served in the U.S. Navy from 1965 to 1967.

Jeffrey Craig. Mr. Craig has served as a director of the Board since January 2022. Mr. Craig served as Executive Chairman of the Board of Meritor, Inc. (NYSE: MTOR) (“Meritor”) until December 31, 2021 and Chief Executive Officer and President of Meritor from April 2015 to February 28, 2021. He previously served Meritor as President and Chief Operating Officer from June 2014 to March 2015; Senior Vice President and President, Commercial Truck and Industrial from February 2013 to May 2014; Senior Vice President and Chief Financial Officer from February 2009 to January 2013; Acting Controller from May 2008 to January 2009; Senior Vice President and Controller from May 2007 to April 2008; and Vice President and Controller from May 2006 to April 2007. Prior to joining Meritor, Mr. Craig served as President and Chief Executive Officer of General Motors Acceptance Corp. (“GMAC”) Commercial Finance (commercial lending service) from 2001 to April 2006. Prior to that, he served as President and Chief Executive Officer of GMAC’s Business Credit division from 1999 to 2001. He joined GMAC as a general auditor in 1997 from Deloitte & Touche, where he served as an audit Partner. Mr. Craig has been a director of Arcosa, Inc. (NYSE: ACA) (manufacturer of infrastructure-related products) since September 2018, where he serves as a member of the audit committee. Mr. Craig holds a bachelor’s degree in Accounting from Michigan State University and an M.B.A. from Duke University.

Vincent Cubbage. Mr. Cubbage served as Chief Executive Officer and Chairman of Tortoise Acquisition Corp. from March 2019 to the completion of its initial business combination with Hyliion Inc. in October 2020, and has continued to serve on the Board. Mr. Cubbage has served as Chief Executive Officer and Chairman of the board of directors of TortoiseEcofin Acquisition Corp. III since February 2021, and as Managing Director, Private Energy of Tortoise Capital Advisors, L.L.C. since January 2019, and of Ecofin Investments, LLC since September 2020. Mr. Cubbage served as Chief Executive Officer and Chairman of Tortoise Acquisition Corp. II from July 2020 to the completion of its initial business combination with Volta Inc. in August 2021 and continued to serve on its board of directors as a director and as Co-Chairperson from March 2022, and as interim Chief Executive Officer from June 2022 to the completion of its merger with Shell USA, Inc. in March 2023. Mr. Cubbage was the founder and Chief Executive Officer of Lightfoot Capital Partners GP LLC from its formation in 2006 through its wind-up in December 2019. He served as Chief Executive Officer and Chairman of Arc Logistics GP LLC from October 2013 until its sale in December 2017. From 2007 to 2011, Mr. Cubbage served as a director of International Resources Partners LP. Prior to founding Lightfoot Capital, Mr. Cubbage was a Senior Managing Director of Banc of America Securities, where he worked from 1998 to 2006, and as a Vice President of Salomon Smith Barney in the Global Energy and Power Group, where he worked from 1994 to 1998. Mr. Cubbage received an M.B.A. from the American Graduate School of International Management and a B.A. from Eastern Washington University.

Richard Freeland. Mr. Freeland has served as a director of the Board since March 2023. Mr. Freeland served as President and Chief Operating Officer of Cummins Inc., (NYSE: CMI), a global manufacturer of engines, power systems, and related components, from July 2014 to October 2019, prior to which he served in various senior leadership positions, including Vice President of the Engine Business from 2010 to 2014, President of the Components Group from 2008 to 2010, and President of Worldwide Distribution Business from 2005 to 2008. Mr. Freeland serves on the board of directors of Valvoline Inc. (NYSE: VVV) and on the Purdue University, Krannert School of Management Advisory Council. Mr. Freeland holds a bachelor of science degree from Purdue University and a master of business administration degree from Indiana University.

Mary Gustanski. Ms. Gustanski has served as a director of the Board since August 2021. Ms. Gustanski spent over 39 years in the automotive industry. She retired in 2019 as the Senior Vice President and Chief Technology Officer for Delphi Technologies, formerly Delphi Automotive. In this role, Ms. Gustanski was responsible for the company’s innovation and global technologies, including advanced propulsion systems for future vehicle electrification. Prior to this role, she served as Vice President, Engineering & Program Management for Delphi Automotive, which spun off its propulsion business to become Delphi Technologies in 2019. Ms. Gustanski holds a bachelor’s degree in Mechanical Engineering and a master’s degree in Manufacturing Management from Kettering University.

Thomas Healy. Mr. Healy has served as our Chief Executive Officer since October 2020 and prior to this, served as Chief Executive Officer of Hyliion Inc., (“Legacy Hyliion”) since January 26, 2016. While leading the Company, Mr. Healy has been awarded numerous patents in the space of electrifying commercial vehicles. Mr. Healy founded Legacy Hyliion while studying to obtain a Master’s in mechanical engineering and had previously founded multiple start-ups during his undergraduate studies. He took a leave of absence during his Master’s program in 2015 to pursue founding Legacy Hyliion. Mr. Healy holds a B.S. degree in Mechanical Engineering with a double-major in Engineering and Public Policy from Carnegie Mellon University.

Robert Knight, Jr. Mr. Knight has served as a director of the Board since October 2020. Mr. Knight served as Chief Financial Officer of Union Pacific Corporation (NYSE: UNP), a transportation company that primarily operates one of the largest railroads in North America, from 2004 until his retirement in 2019. Mr. Knight has served as a director of Schneider National, Inc. (NYSE: SNDR), a transportation and logistics company, since April 2020, Carrix, Inc., a privately-held marine terminal and rail operator company, from February 2020 to December 2022, and Canadian National Railway Company since May 2022. Mr. Knight holds a bachelor’s degree in business administration from Kansas State University and an M.B.A. from Southern Illinois University.

Stephen Pang. Mr. Pang has served as a director of the Board since October 2020 and prior to this, served as a director of TortoiseCorp since the completion of its initial public offering on March 4, 2019 and as TortoiseCorp’s Chief Financial Officer from January 2020 until the closing of its Business Combination with the Legacy Hyliion on October 1, 2020. Mr. Pang served as a director of Tortoise Acquisition II from the completion of its initial public offering in September 2020 and Chief Financial Officer since July 2020 until the closing of its Business Combination with Volta Industries on August 26, 2021. Mr. Pang currently serves as President and Chief Financial Officer and as a director of TortoiseEcofin Acquisition Corp. III, which completed its initial public offering on the NYSE on July 22, 2021. Since 2019, Mr. Pang has served as a Managing Director and Portfolio Manager at Tortoise and is responsible for Tortoise’s public and private direct investments across its energy strategies. Mr. Pang also served as Vice President of Tortoise Pipeline & Energy Fund, Inc., a closed-end fund, from May 2017 to December 11, 2020. Prior to joining Tortoise Investments, LLC in 2014, Mr. Pang was a Director in Credit Suisse Securities (USA) LLC’s Equity Capital Markets Group. Before joining Credit Suisse Securities (USA) LLC in 2012, he spent eight years in Citigroup Global Markets Inc.’s Investment Banking Division, where he focused on equity underwriting and corporate finance in the energy sector. Mr. Pang also currently serves as a board observer of Mexico Pacific Limited LLC. Mr. Pang holds a B.S. in Business Administration from the University of Richmond and is a CFA charter holder.

Melanie Trent. Ms. Trent has served as a director of the Board since March 2023. Ms. Trent served in various legal, administrative, and compliance roles for Rowan Companies plc (now part of Valaris plc), a global offshore contract drilling company, from 2005 to April 2017, including as Executive Vice President, General Counsel and Chief Administrative Officer from 2014 to April 2017, as Senior Vice President, Chief Administrative Officer and Company Secretary from 2011 to 2014, and as Vice President and Corporate Secretary from 2010 to 2011. Prior to joining Rowan, she served in various legal, administrative and investor relations roles for Reliant Energy Incorporated. Ms. Trent also serves as Lead Director of Diamondback Energy, Inc. (NASDAQ:FANG), an independent oil and natural gas company, since 2018, and as a director of Arcosa, Inc. (NSYE: ACA), a company focused on construction, energy and transportation products and services, since 2018. Ms. Trent preciously served on the boards of Noble Corp (NYSE:NE) from February 2021 until its merger with Maersk Drilling in October 2022, and Frank’s International (from 2019 until its merger with Expro in October 2021. She also serves on the board of directors of several charities. Ms. Trent holds a bachelor's degree in Italian from Middlebury College and a juris doctor degree from Georgetown University Law Center.

Board Composition

Our business and affairs are organized under the direction of the Board which consists of ten members. Jeffrey Craig serves as Chair of the Board. The primary responsibilities of the Board are to provide oversight, strategic guidance, counseling and direction to our management. The Board meets on a regular basis and additionally as required. The Board held five meetings in 2022. Each director attended at least 75% of the meetings of the Board and of each committee on which he or she served in 2022 (held during the period in which the director served). Our independent directors regularly hold executive sessions without our Chief Executive Officer or management present, and in 2022, our independent directors met in executive session in connection with each regular Board meeting. We held an annual meeting of the stockholders on May 10, 2022 (the “2022 Annual Meeting”). All directors who were serving as of the 2022 Annual Meeting attended the 2022 Annual Meeting.

The Board is divided into three classes, Class I, Class II and Class III, with members of each class serving staggered three-year terms, as set forth below:

• Class I, which consists of Vincent Cubbage, Thomas Healy, and Melanie Trent whose terms will expire at our 2024 annual meeting of stockholders;

• Class II, which consists of Andrew Card, Jr., Jeffrey Craig, Richard Freeland, and Stephen Pang, whose terms will expire at our 2025 annual meeting of stockholders; and

• Class III, which consists of Rodger Boehm, Mary Gustanski, and Robert Knight, Jr. whose terms will expire at our 2023 annual meeting of stockholders.

At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election and until their successors are duly elected and qualified.

Director Independence

The Board has determined that each of the following directors qualifies as an independent director as defined under the NYSE listing standards: Sec. Card, Messrs. Boehm, Craig, Cubbage, Freeland, Knight, and Pang and Mses. Gustanski and Trent. Mr. Healy is not independent because of his service as our CEO. The Board consists of a majority of “independent directors,” as defined under the rules of the SEC and NYSE listing standards relating to director independence requirements. In addition, we are subject to the rules of the SEC and the NYSE relating to the membership, qualifications, and operations of the Audit Committee, as discussed below.

Director Skills Matrix

We seek to create a Board of Directors that represents the variety of diverse skills and expertise required to govern a company like Hyliion. We are pleased to have added directors over the past year that further deepen the skills present on our Board, including in the area of technology, organizational management, human resources, regulatory and venture. The matrix below represents the skills that we hold as priority in governing Hyliion and the expertise of each Director that correlates to those skills.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

KNOWLEDGE, SKILLS

AND EXPERIENCE | | RODGER BOEHM | | ANDREW

CARD, JR. | | JEFFREY

CRAIG | | VINCENT

CUBBAGE | | RICHARD FREELAND | | MARY

GUSTANSKI | | THOMAS

HEALY | | ROBERT

KNIGHT. JR. | | STEPHEN

PANG | | MELANIE TRENT |

| Corporate Governance Experience | | X | | X | | X | | X | | X | | | | X | | X | | | | X |

| International Experience | | X | | X | | X | | | | X | | X | | | | X | | | | X |

| Finance Experience | | X | | | | X | | X | | | | | | X | | X | | X | | |

| Corporate Development/Strategic Experience | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X |

Industry/Operations

Experience | | X | | X | | X | | X | | X | | X | | X | | X | | | | |

| Management Experience | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X |

| | | | | | | | | | | | | | | | | | | | | |

| DEMOGRAPHICS | | | | | | | | | | | | | | | | | | | | |

| Age | | 63 | | 75 | | 62 | | 58 | | 65 | | 60 | | 30 | | 65 | | 41 | | 58 |

| Gender Diverse | | | | | | | | | | | | X | | | | | | | | X |

| Racially or Ethnically Diverse | | | | | | | | | | | | | | | | | | X | | |

Role of the Board in Risk Oversight

One of the key functions of the Board is informed oversight of our risk management process. The Board does not have a standing risk management committee, but administers this oversight function directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their respective areas of oversight. In particular, the Board is responsible for monitoring and assessing strategic risk exposure and our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management will take to monitor and control such exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our Audit Committee also monitors compliance with legal and regulatory requirements. Our Compensation Committee assesses and monitors whether our compensation plans, policies and programs comply with applicable legal and regulatory requirements.

Board Committees

The Board has a standing Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Technology Committee, each of which has adopted a charter that complies with the applicable requirements of current NYSE rules. Copies of these charters are available in the “Investors — Governance — Governance Documents” section of our website at www.hyliion.com.

Audit Committee

In 2022 our Audit Committee consisted of Andrew Card, Jr., Jeffrey Craig, Robert Knight, Jr., and Stephen Pang. The Board determined that each of the members of the Audit Committee satisfies the independence requirements of

the NYSE and Rule 10A-3 under the Exchange Act. Each member of the Audit Committee can read and understand fundamental financial statements in accordance with NYSE audit committee requirements. In arriving at this determination, the Board examined each Audit Committee member’s scope of experience and the nature of their prior and/or current employment.

Mr. Knight served as the chair of the Audit Committee. The Board determined that each of the members of our Audit Committee qualifies as an audit committee financial expert within the meaning of SEC regulations and meets the financial sophistication requirements of the NYSE listing rules. In making this determination, the Board considered each such director’s formal education and previous experience in financial roles. Both our independent registered public accounting firm and management periodically will meet privately with our Audit Committee. The Audit Committee held four meetings during the 2022 fiscal year.

The primary functions of this committee include, among other things:

•reviewing the adequacy and effectiveness of our internal control policies and procedures, including the responsibilities, budget, staffing and effectiveness of our internal audit function;

•reviewing our financial reporting processes and disclosure controls;

•evaluating the performance, independence and qualifications of our independent auditors and determining whether to retain our existing independent auditors or engage new independent auditors; and

•reviewing with our independent auditors and management significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy, and effectiveness of our financial controls and critical accounting policies.

Compensation Committee

In 2022 our Compensation Committee consisted of Vincent Cubbage, Mary Gustanski and Howard Jenkins. Mr. Cubbage served as the chair of the Compensation Committee. The Board determined that each of the members of the Compensation Committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act and satisfies the independence requirements of the NYSE. The Compensation Committee held five meetings during the 2022 fiscal year.

The primary functions of the committee include, among other things:

•reviewing and approving the corporate objectives that pertain to the determination of executive compensation;

•reviewing and approving the compensation and other terms of employment of our executive officers; including employment agreements, severance arrangements, change in control protections, indemnification agreements and any other material arrangements for our executive officers;

•reviewing and approving performance goals and objectives relevant to the compensation of our executive officers and assessing their performance against these goals and objectives; and

•administering our equity and cash incentive plans to the extent authorized by the Board including making recommendations to the Board regarding the adoption or amendment of equity and cash incentive plans and approving amendments to such plans to the extent authorized by the Board.

Compensation Committee Interlocks and Insider Participation

None of our executive officers currently serve, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity that has one or more executive officers that has served or currently serves as a member of the Board or the Compensation Committee.

Nominating and Corporate Governance Committee

In 2022 our Nominating and Corporate Governance Committee consisted of Elaine Chao, Jeffrey Craig and Vincent Cubbage. Mr. Craig served as the chair of the Nominating and Corporate Governance Committee. The Board determined that each of the members of our Nominating and Corporate Governance Committee satisfies the independence requirements of the NYSE. The Nominating and Corporate Governance Committee held five meetings during the 2022 fiscal year.

The primary functions of this committee include, among other things:

•identifying, reviewing and making recommendations of candidates to serve on the Board including evaluating nominations by stockholders of candidates for election to the Board;

•evaluating the performance of the Board, committees of the Board and individual directors and determining whether continued service on the Board is appropriate;

•evaluating the current size, composition and organization of the Board and its committees and making recommendations to the Board for approvals; and

•reviewing issues and developments related to corporate governance and identifying and bringing to the attention of the Board current and emerging corporate governance trends.

Technology Committee

In 2022 our Technology Committee consisted of Elaine Chao, Mary Gustanski, and Thomas Healy. Ms. Gustanski served as the chair of the Technology Committee. The Technology Committee held three meetings during the 2022 fiscal year.

The primary functions of this Committee include, among other things:

•assisting the Board of Directors in its oversight of the Company’s product and technology roadmaps;

•providing insight and input to the Corporation’s management in formulating the technology strategy and vision for the Corporation, including assessing technology partnerships or acquisitions;

•assisting in the formation of, and advising the Board regarding the Company’s approaches to acquiring and maintaining a range of diverse technology positions (including but not limited to contracts, grants, collaborative efforts, alliances, and venture capital investments); and

•overseeing and evaluating the Corporation’s efforts and planning as they relate to intellectual property, information technology and cyber security preparedness, including systems, policies and procedures.

Considerations and Process for the Selection of New Directors

In evaluating the nominees for the Board of Directors, the Board and the Nominating and Corporate Governance Committee took into account the qualities they seek for directors, and the directors’ individual qualifications, skills, and background that enable the directors to effectively and productively contribute to the Board’s oversight of the Company. When evaluating re-nomination of existing directors, the Committee also considers the nominees’ past and ongoing effectiveness on the Board and, with the exception of Mr. Healy, who is an employee, their independence.

In fulfilling its responsibility to oversee the selection of directors, the Nominating and Corporate Governance Committee will consider persons identified by our stockholders, management, and others. The Nominating and Corporate Governance Committee considers recommendations for Board candidates submitted by stockholders using substantially the same criteria it applies to recommendations from the Nominating and Corporate Governance Committee, directors and members of management. Stockholders may submit informal recommendations by providing the person’s name and appropriate background and biographical information in writing to the Nominating and Corporate Governance Committee at 1202 BMC Drive, Suite 100, Cedar Park, Texas 78613.

Stockholder Engagement Efforts and Board Communication

In May 2022, the Board submitted for stockholder approval advisory votes on the compensation of the Company's named executive officers (“Say on Pay” and “Say on Frequency”). At the annual meeting in May 2022, approximately 90% and 93% of the votes cast were in favor of the compensation of the Company's named executive officers and of holding a Say on Pay Vote every year, respectively. These were advisory votes only and are not binding on the Board, which remains responsible for its compensation decisions and is not relieved of these responsibilities irrespective of the results of the vote. However, the Board will take the results of these votes into account, as appropriate, when considering future compensation policies, procedures and decisions and in determining whether there is a need to significantly increase their engagement with stockholders on compensation and related matters. The Board continues to believe that stockholders should be able to express their views on executive compensation program on an annual basis.

Our relationship and on-going dialogue with our stockholders are an important part of our Board’s and our executive team’s corporate governance commitment. The Board welcomes communications from our stockholders and other interested parties. We actively seek input from our stockholders because we value the contribution stockholder engagement gives to overall business success. Our executives meet with our investment community regularly and discuss a variety of matters, including common investor interests, ESG matters and emerging issues. We provide our Board with reports on the key themes and results of these discussions.

Stockholders and other interested parties may communicate with our executive team or the Board (including the Board Chair, the chair of any committee, the independent directors as a group and/or any Board member) by email to companysecretary@hyliion.com. Stockholders and any other interested parties should mark the subject line of each communication as “Stockholder Communication with Directors” and clearly identify the intended recipient(s) of the communication.

Code of Business Conduct and Ethics and Corporate Governance Guidelines

We have adopted a Code of Business Conduct and Ethics applicable to the directors, officers and employees of the Company and its subsidiaries. As a result of our acquisition of KARNO generator technology in September 2022, we expect to have more interactions with the United States federal government and the Board approved a revised Code of Business Conduct and Ethics, which includes applicable government contracting requirements. We have also adopted Corporate Governance Guidelines that address, among other things, director qualifications, responsibilities and compensation, director access to officers, employees and advisors, and determinations regarding director independence. Copies of the Code of Business Conduct and Ethics and our Corporate Governance Guidelines are available in the “Investors — Governance — Governance Documents” section of our website at www.investors.hyliion.com. We intend to disclose any amendments to, or waivers from, our Code of Business Conduct and Ethics that apply to senior executives by posting such information, if any, on the Company’s website.

DIRECTOR COMPENSATION

In February 2022, our Board approved the 2022 compensation program for our non-employee directors as follows:

•an annual cash retainer equal to $75,000, paid in four equal quarterly installments;

•additional cash compensation for the chair of the Board, in the amount of $50,000, the chair of the Audit Committee, in the amount of $25,000, the Lead Independent Director, in the amount of $15,000, and for all other committee chairs, in the amount of $15,000; and

•an award of restricted stock units equal to $125,000, which grant fully vests on the first anniversary of the date of grant.

In addition, our Board approved a special grant of restricted stock units covering 2,500 shares of our Common Stock, which grant fully vests on the first anniversary of the date of grant, to Sec. Card and Messrs. Cubbage, Jenkins, Knight, Olkkola and Pang, as compensation for their service on the Board during the fourth quarter of 2020.

| | | | | | | | | | | | | | | | | | | | |

| | Fees Earned

or Paid

in Cash(1) | | Stock

Awards(2) | | Total |

| Andrew Card, Jr. | | $ | 75,000 | | | $ | 135,800 | | | $ | 210,800 | |

| Elaine Chao | | $ | 75,000 | | | $ | 125,000 | | | $ | 200,000 | |

| Jeffrey Craig | | $ | 90,000 | | | $ | 125,000 | | | $ | 215,000 | |

| Vincent Cubbage | | $ | 90,000 | | | $ | 135,800 | | | $ | 225,800 | |

| Mary Gustanski | | $ | 90,000 | | | $ | 125,000 | | | $ | 215,000 | |

| Howard Jenkins | | $ | 75,000 | | | $ | 135,800 | | | $ | 210,800 | |

| Robert Knight, Jr. | | $ | 115,000 | | | $ | 135,800 | | | $ | 250,800 | |

Edward Olkkola(3) | | $ | 125,000 | | | $ | 135,800 | | | $ | 260,800 | |

| Stephen Pang | | $ | 75,000 | | | $ | 135,800 | | | $ | 210,800 | |

____________

(1) Amounts in this column represent the annual cash retainer earned in 2022 for service on the Board and additional fees for service as follows: Mr. Olkkola as chair of the Board, Mr. Knight as chair of the Audit Committee and Lead Independent Director, Mr. Craig as chair of the Nominating and Corporate Governance Committee, Mr. Cubbage as chair of the Compensation Committee, and Ms. Gustanski as chair of the Technology Committee.

(2) Amounts in this column represent the grant date fair market value of RSUs granted during 2022, valued based on the closing price of our common shares on the date of grant of $4.32.

(3) Mr. Olkkola, formerly Chair of the Board, died in December 2022.

In March 2023, our Board approved the 2023 compensation program for our non-employee directors as follows:

•an annual cash retainer equal to $75,000, paid in four equal quarterly installments;

•additional cash compensation for the chair of the Board, in the amount of $50,000, the chair of the Audit Committee, in the amount of $25,000 and for all other committee chairs, in the amount of $15,000; and

•an award of restricted stock units equal to $125,000, which grant fully vests on the first anniversary of the grant date.

The Board expects to continue to review director compensation periodically to ensure that director compensation remains competitive such that we are able to recruit and retain qualified directors. Our goal is to maintain a director compensation program that aligns compensation with our business objectives and the creation of stockholder value, while enabling us to attract, retain, incentivize and reward directors who contribute to our long-term success.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information concerning shares of common stock authorized or available for issuance under the Company’s equity compensation plans as of December 31, 2022.

| | | | | | | | | | | | | | | | | | | | |

| | Number of

securities to

be issued

upon

exercise of

outstanding

options,

warrants

and rights | | Weighted-

average

exercise

price of

outstanding

options,

warrants

and rights | | Number of

securities

remaining

available for

future issuance

under equity

compensation

plans

(excluding

securities

reflected in

column) |

Equity compensation plans approved by security holders (2020 Equity Incentive Plan) | | — | | — | | 7,503,921 | |

Equity compensation plans not approved by security holders(1) | | — | | — | | — |

| Total | | — | | — | | 7,503,921 | |

____________

(1) The Hyliion Inc. 2016 Equity Incentive Plan (the “2016 Plan”) was adopted by Legacy Hyliion prior to the Business Combination, and no additional awards will be granted pursuant to the 2016 Plan. As of December 31, 2022, the number of securities to be issued upon exercise of outstanding options pursuant to the 2016 Plan was 2,541,439, and the weighted-average exercise price of outstanding options pursuant to the 2016 Plan was $0.15.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

A&R Registration Rights Agreement

We entered into the A&R Registration Rights Agreement on October 1, 2020, with Tortoise Sponsor LLC (“Tortoise Sponsor”), Tortoise Borrower and certain stockholders, pursuant to which such stockholders of Registrable Securities (as defined therein), subject to certain conditions, will be entitled to registration rights. Pursuant to the A&R Registration Rights Agreement, we agreed that, within 30 calendar days after the Closing, we would file with the SEC (at our sole cost and expense) a registration statement registering the resale of such registrable securities, and we would use our reasonable best efforts to have such registration statement declared effective by the SEC as soon as reasonably practicable after the filing thereof. Such registration statement was initially filed on October 23, 2020 and declared effective by the SEC on November 27, 2020. Certain of such stockholders have been granted demand underwritten offering registration rights and all of such stockholders will be granted piggyback registration rights. The A&R Registration Rights Agreement does not provide for the payment of any cash penalties by us if we fail to satisfy any of our obligations under the A&R Registration Rights Agreement. The A&R Registration Rights Agreement will terminate upon the earlier of (a) ten years following the Closing or (b) the date as of which such stockholders cease to hold any Registrable Securities (as defined therein).

Lock-Up Agreement

On October 1, 2020, in connection with the Closing, certain of our stockholders agreed, subject to certain exceptions, not to, without the prior written consent of our Board, (a) sell, offer to sell, contract or agree to sell, hypothecate, pledge, grant any option to purchase or otherwise dispose of or agree to dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the Exchange Act and the rules and regulations of the SEC promulgated thereunder, any shares of Common Stock held by them immediately after the Business Combination, or issuable upon the exercise of options to purchase shares of Common Stock held by them immediately after the Business Combination, or securities convertible into or exercisable or exchangeable for Common Stock held by them immediately after the Business Combination, (b) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any of such shares of Common Stock or securities convertible into or exercisable or exchangeable for Common Stock, whether any such transaction is to be settled by delivery of such securities, in cash or otherwise or (c) publicly announce any intention to effect any transaction specified in clause (a) or (b) until March 30, 2021. Thereafter until October 1, 2022, subject to certain exceptions, Thomas Healy also agreed not to Transfer more than 10% of the number of shares of Common Stock held by him immediately after the Effective Time, or issuable upon the exercise of options to purchase shares of Common Stock held by him immediately after the Effective Time.

Related-Person Transactions Policy

The Board has adopted a written Related-Person Transactions Policy that sets forth our policies and procedures regarding the identification, review, consideration and oversight of related-person transactions. For purposes of our policy, a related-person transaction is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which we and any related person are, were or will be participants, in which the amount involved exceeds $120,000. Transactions involving compensation for services provided to us as an employee, consultant or director will not be considered related-person transactions under this policy.

Under the policy, a related person is any executive officer, director, nominee to become a director or a security holder known by us to beneficially own more than 5% of any class of our voting securities (a “significant stockholder”), including any of their immediate family members and affiliates, including entities controlled by such persons or such person has a 5% or greater beneficial ownership interest.

Each director and executive officer is required to identify, and we shall request each significant stockholder to identify, any related-person transaction involving such director, executive officer or significant stockholder or his, her or its immediate family members and inform our Audit Committee pursuant to this policy before such related person may engage in the transaction.

In considering related person transactions, our Audit Committee takes into account the relevant available facts and circumstances, which may include, but are not limited to:

•the risk, cost and benefits to us;

•the impact on a director’s independence in the event the related person is a director, immediate family member of a director or an entity with which a director is affiliated;

•the terms of the transaction; and

•the availability of other sources for comparable services or products.

Our Audit Committee approves only those related-party transactions that, in light of known circumstances, are in, or are not inconsistent with, the best interests of the Company and our stockholders, as our Audit Committee determines in the good faith exercise of its discretion.

BENEFICIAL OWNERSHIP TABLES

The following tables set forth information known to us regarding the beneficial ownership of the Common Stock as of March 24, 2023 by:

•each person who is known by us to be the beneficial owner of more than 5% of the outstanding shares of the Common Stock;

•each current named executive officer and director (including each nominee) of the Company; and

•all current executive officers and directors of the Company, as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options that are currently exercisable or exercisable within 60 days. Unless otherwise noted in the footnotes to the following tables, and subject to applicable community property laws, the persons and entities named in the table have sole voting and investment power with respect to their beneficially owned Common Stock.

Security Ownership of Certain Beneficial Owners

| | | | | | | | | | | | | | |

| | Shares Beneficially Owned |

| Name of Beneficial Owner | | Number | | Percent of Common

Stock |

| The Vanguard Group | | 11,859,854(1) | | 6.6% |

| BlackRock, Inc. | | 10,117,474(2) | | 5.6% |

| Colle Capital Partners I, L. P. | | 9,548,288(3) | | 5.3% |

____________

(1) Information regarding share ownership was obtained from the Schedule 13G/A filed on February 9, 2023 by The Vanguard Group. The Vanguard Group has sole voting power over 0 shares of our common Stock, shared voting power over 81,950 shares of our common stock, sole dispositive power over 11,689,699 shares of our common stock and shared dispositive power over 170,155 shares of our common stock. The business address of Vanguard Group is 100 Vanguard Blvd., Malvern, PA, 19355.

(2) Information regarding share ownership was obtained from the Schedule 13G filed on February 3, 2023 by BlackRock, Inc. BlackRock, Inc. has sole voting power over 9,729,003 shares of our common stock, shared voting power over 0 shares of our common stock, sole dispositive power over 10,117,474 shares of our common stock and shared dispositive power over 0 shares of our common stock. BlackRock, Inc. is the parent company of the following subsidiaries that beneficially own shares of our common stock: BlackRock Advisors, LLC, Aperio Group, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock (Netherlands) B.V., BlackRock Fund Advisors, BlackRock Asset Management Ireland Limited, BlackRock Institutional Trust Company, National Association, BlackRock Financial Management, Inc., BlackRock Fund Managers Ltd, BlackRock Asset Management Schweiz AG and BlackRock Investment Management, LLC. The business address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055.

(3) Information regarding share ownership was obtained from the Schedule 13G/A filed with the SEC on February 1, 2022, which reflects ownership of shares of our common stock by Colle Capital Partners I, L.P., Colle HLN Associates LLC and Colle Logistics Associates LLC, which may be deemed to be beneficially owned by Victoria Grace. Ms. Grace has sole voting power over 9,548,288 shares of our common stock and sole dispositive power over 9,548,288 shares of our common stock. Ms. Grace serves as the sole manager of both Colle HLN Associates LLC and Colle Logistics Associates LLC. Ms. Grace services as the sole manager of Colle Partners GP LLC, which serves as the sole general partner of Colle Capital Partners I LP. Ms. Grace disclaims beneficial interest in the shares of common stock of Hyliion Holdings Corp. held by Colle Capital Partners I, L.P., Colle HLN Associates LLC and Colle Logistics Associates LLC, except to the extent of her pecuniary interest therein. The business address of each of Colle Capital Partners I, L.P., Colle HLN Associates LLC, Colle Logistics Associates LLC and Colle Partners GP LLC is 55 Hudson Yards, Floor 44, New York, NY 10001.

Security Ownership of Directors and Management

| | | | | | | | | | | | | | |

| | Shares Beneficially Owned |

| Name of Beneficial Owner | | Number(1) | | Percent of Common

Stock |

| Thomas Healy | | 33,111,481 | | | 18.3% |

| Jon Panzer | | 25,000 | | | * |

| Dennis Gallagher | | 119,337 | | | * |

| Cheri Lantz | | 38,913 | | | * |

| Jose Oxholm | | 95,903 | | | * |

Rodger Boehm(2) | | — | | | * |

| Andrew Card, Jr. | | 51,435 | | | * |

| Jeffrey Craig | | 28,935 | | | * |

| Vincent Cubbage | | 966,453 | | | * |

Richard Freeland(2) | | — | | | * |

| Mary Gustanski | | 30,701 | | | * |

| Robert Knight, Jr. | | 46,435 | | | * |

| Stephen Pang | | 177,072 | | | * |

Melanie Trent(2) | | — | | | * |

| All Current Directors and Current Executive Officers | | 34,714,498 | | | 19.2% |

____________

* Less than 1%.

(1) Beneficial ownership excludes unvested RSUs and PRSUs that will not vest within 60 days of March 24, 2023.

(2) Director appointed March 17, 2023.

ITEM 2 — RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON

AS OUR INDEPENDENT AUDITORS

Under the rules and regulations of the SEC and the New York Stock Exchange, the Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of our independent auditors. In addition, the Audit Committee considers the independence of our independent auditors and participates in the selection of the independent auditor’s lead engagement partner. The Audit Committee has appointed, and, as a matter of good corporate governance, is requesting ratification by the stockholders of the appointment of, the registered public accounting firm of Grant Thornton LLP (“Grant Thornton”) to serve as independent auditors for the fiscal year ended December 31, 2023. The Audit Committee considered a number of factors in determining whether to re-engage Grant Thornton as the Company’s independent registered public accounting firm, including the firm’s professional qualifications and resources, the firm’s past performance, and the firm’s capabilities in handling the breadth and complexity of our business, as well as the potential impact of changing independent auditors. Grant Thornton representatives are expected to be present at the Annual Meeting to make a statement if he or she desires and to respond to relevant and appropriate questions, if any.

The Board of Directors and the Audit Committee believe that the continued retention of Grant Thornton as the Company’s independent auditor is in the best interests of the Company and its stockholders. If stockholders do not ratify the selection of Grant Thornton, the Audit Committee will evaluate the stockholder vote when considering the selection of a registered public accounting firm for the audit engagement for the 2024 fiscal year. In addition, if stockholders ratify the selection of Grant Thornton as independent auditors, the Audit Committee may nevertheless periodically request proposals from the major registered public accounting firms and as a result of such process may select Grant Thornton or another registered public accounting firm as our independent auditors.

The Board of Directors recommends a vote “FOR” the ratification of the appointment of Grant Thornton as our independent auditors for the fiscal year ended December 31, 2023.

Audit Fees and Services

The following tables present the aggregate fees billed by Grant Thornton LLP to us for the years ended December 31, 2022 and December 31, 2021:

| | | | | | | | |

| | Year Ended

December 31,

2022 |

Audit Fees(1) | | $ | 468,463 |

| Audit Related Fees | | — | |

| Tax Fees | | — | |

| All Other Fees | | — | |

| Total | | $ | 468,463 |

| | | | | | | | |

| | Year Ended

December 31, 2021 |

Audit Fees(1) | | $ | 550,600 |

| Audit Related Fees | | — | |

| Tax Fees | | — | |

| All Other Fees | | — | |

| Total | | $ | 550,600 |

____________

(1) Audit Fees. Audit fees consist of fees billed for professional services rendered for the audit of our year-end consolidated financial statements and the review of our financial statements included in our quarterly filings on Form 10-Q, as well as services that are normally provided by our independent registered public accounting firm in connection with statutory and regulatory filings.

Policy on Board Pre-Approval of Audit and Permissible Non-Audit Services of the Independent Auditors

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent auditors. In recognition of this responsibility, the Audit Committee reviews and, in its sole discretion, pre-approves all audit and permitted non-audit services to be provided by the independent auditors as provided under

the Audit Committee charter. The Audit Committee has established policies and procedures regarding pre-approval of all services provided by the independent registered public accounting firm. The Audit Committee approved or pre-approved all such services for the Company by our independent registered accounting firm in 2022 and 2021.

AUDIT COMMITTEE REPORT

The Audit Committee is composed solely of independent directors meeting the applicable requirements of the NYSE rules. The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for establishing and maintaining adequate internal control over financial reporting, for preparing the financial statements, and for the reporting process. The Audit Committee members do not serve as professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent registered public accounting firm. The Company’s independent auditors are engaged to audit and report on the conformity of the Company’s financial statements to accounting principles generally accepted in the United States and the effectiveness of the Company’s internal control over financial reporting.

In this context, the Audit Committee reviewed and discussed with management and the independent auditors the audited financial statements for the year ended December 31, 2022 (the “Audited Financial Statements”), management’s assessment of the effectiveness of the Company’s internal control over financial reporting, and the independent auditors’ evaluation of the Company’s system of internal control over financial reporting. The Audit Committee has discussed with Grant Thornton, the Company’s independent auditors, the matters required to be discussed by applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission. In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required by applicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committee concerning independence and has discussed with the independent auditors the independent auditors’ independence.

Based upon the reviews and discussions referred to above, the Audit Committee recommended to the Board that the Audited Financial Statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, for filing with the Securities and Exchange Commission.

The Audit Committee

Robert Knight, Jr. (Chair)

Jeffrey Craig

Andrew Card, Jr.

Stephen Pang

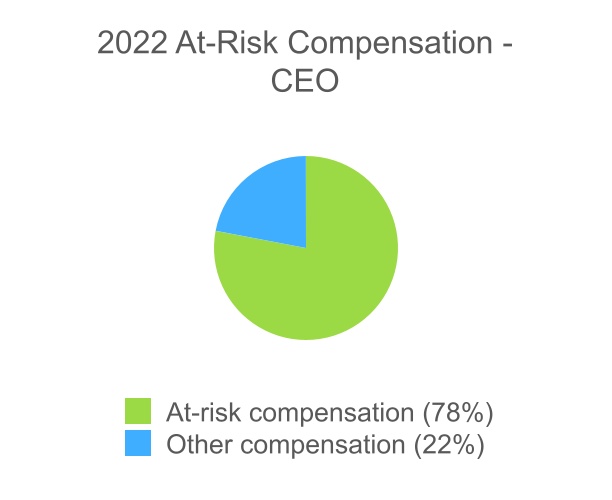

ITEM 3 — ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Company’s compensation program for the named executive officers is designed to attract, motivate and retain talented executives who will provide leadership for the Company’s success. Under this program, the named executive officers are rewarded for individual and collective contributions to the Company consistent with a “pay for performance” orientation. Furthermore, the executive officer compensation program is aligned with the nature and dynamics of the Company’s business, which focuses management on achieving the Company’s annual and long-term business strategies and objectives. The Compensation Committee regularly reviews the executive compensation program to ensure that it achieves the desired goals of emphasizing long-term value creation and aligning the interests of management and stockholders through the use of equity-based awards.

As required by Section 14A of the Exchange Act and pursuant to Rule 14a-21(a) promulgated thereunder, the Company is asking the stockholders to indicate their support for the Company’s named executive officer compensation as described in this Proxy Statement. Accordingly, the Company asks the stockholders to vote “FOR” the following resolution at the 2023 Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2023 Annual Meeting of Stockholders, including the Compensation Discussion & Analysis, the Summary Compensation Table and the other related tables and disclosures.”

As an advisory vote, this proposal is not binding upon the Company. However, the Compensation Committee, which is responsible for designing and administering the Company’s executive compensation program, values the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for named executive officers. At the Company’s 2022 Annual Meeting our stockholders approved, on an advisory basis, an annual frequency of the advisory vote to approve the compensation of our named executive officers. Consistent with the input of our stockholders, the stockholder vote for advisory approval of NEO compensation will occur annually.

The Board recommends a vote “FOR” the proposal to approve, on advisory basis,

the compensation of the Company’s named executive officers.

ITEM 4 — APPROVAL OF THE HYLIION HOLDINGS CORP. EMPLOYEE STOCK PURCHASE PLAN

Overview

On February 28, 2023, the Board, upon recommendation of the Compensation Committee, adopted and approved the Hyliion Holdings Corp. Employee Stock Purchase Plan (the “ESPP”), subject to approval by the stockholders. The ESPP is intended to qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”) and shall be interpreted in a manner that is consistent with the requirements of Section 423 of the Code.

The Board is requesting stockholder approval of the ESPP in accordance with the requirements of Section 423 of the Code and to establish a pool of shares through which shares of the Company’s common stock, $0.0001 par value per share (“Common Stock”), may be issued under the terms and conditions of the ESPP.

The Board believes that adoption of the ESPP will advance and promote the interests of the stockholders of the Company by offering to eligible employees of the Company and its designated subsidiaries (together, the “Participating Companies” and each, a “Participating Company”) an opportunity to conveniently acquire ownership interests in the Company, further aligning their interest with those of our stockholders and providing an incentive for continued employment. The ESPP will allow eligible employees to purchase shares on a discounted basis through payroll deductions.

If this proposal is approved by stockholders, the ESPP will become effective on May 23, 2023, the date of the Annual Meeting. If stockholders do not approve this proposal, the ESPP will not become effective.

The following description of the ESPP is qualified in its entirety by reference to the full text of the ESPP, attached hereto as Annex A.

Material Features of the ESPP

The following summary of the material features of the ESPP is qualified in its entirety by reference to the complete text of the ESPP in Annex A of this Proxy Statement.

Administration

The ESPP will be administered by the Compensation Committee of the Board (the “Committee”), or any other successor committee designated by the Board. The Committee will have full authority to administer, interpret, and