UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22393

Cohen & Steers Preferred Securities and Income SMA Shares, Inc.

(Exact name of registrant as specified in charter)

1166 Avenue of the Americas, 30th Floor, New York, NY 10036

(Address of principal executive offices) (Zip code)

Dana A. DeVivo

Cohen & Steers Capital Management, Inc.

1166 Avenue of the Americas, 30th Floor,

New York, NY 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 832-3232

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Item 1. Reports to Stockholders.

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

To Our Shareholders:

We would like to share with you our report for the year ended October 31, 2023. The total returns for Cohen & Steers Preferred Securities and Income SMA Shares, Inc. (the Fund) and its comparative benchmarks were:

| | | | | | | | |

| | | Six Months Ended

October 31, 2023 | | | Year Ended

October 31, 2023 | |

Cohen & Steers Preferred Securities and Income SMA Shares | | | 1.98 | % | | | 2.47 | % |

Blended Benchmark—75% ICE BofA U.S. IG Institutional Capital Securities Index/ 25% Bloomberg Developed Market USD Contingent Capital Index(a) | | | 0.37 | % | | | 4.30 | % |

S&P 500 Index(a) | | | 1.39 | % | | | 10.14 | % |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment of all dividends and distributions at net asset value (NAV). Shareholders should be aware that the Fund is managed within the context of separately managed account programs and not with the objective of matching or exceeding the Fund’s stated indexes, which are used for Fund reporting purposes. As such, comparisons of the Fund’s performance to that of the indicated indexes are not likely to be meaningful. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized. Performance figures do not reflect the effect of fees and expenses associated with a separately managed account (SMA) program or fees paid to the investment advisor for SMA advisory services. Such fees are paid directly or indirectly by the SMA program sponsor to the investment advisor. The investment advisor does not charge an advisory fee to the Fund. The investment advisor has contractually agreed to reimburse the Fund so that the total annual Fund operating expenses (excluding acquired fund fees and expenses, interest, taxes, extraordinary expenses, and other expenses approved by the Board of Directors) do not exceed 0.00%. This contractual agreement is currently expected to remain in place for the life of the Fund, can only be amended or terminated by agreement of the Fund’s Board of Directors and the investment advisor and will terminate automatically in the event of termination of the investment advisory agreement between the Fund and the investment advisor.

| (a) | The ICE BofA U.S. IG Institutional Capital Securities Index tracks the performance of U.S. dollar denominated investment grade hybrid capital corporate and preferred securities publicly issued in the U.S. domestic market. The Bloomberg Developed Market USD Contingent Capital Index includes hybrid capital securities in developed markets with explicit equity conversion or write down loss absorption mechanisms that are based on an issuer’s regulatory capital ratio or other explicit solvency-based triggers. The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance. |

1

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

Market Review

The 12 months ended October 31, 2023 were mostly favorable for financial markets amid better-than-expected economic resilience, although an associated continued rise in interest rates weighed on rate-sensitive investments such as Treasury bonds. Stocks and credit-sensitive fixed income assets had generally positive returns.

While bond yields initially ticked down as inflation rates moderated from high levels, interest rate pressures began to build again as some positive economic data pushed out expectations for an end to the Federal Reserve’s (and other central banks’) rate hikes. The yield on the 10-year Treasury rose from 4.1% to 4.9% at the end of the period, reaching levels not seen since the financial crisis.

In this environment, preferreds had a modest gain as a group, but with over-the-counter (OTC) preferreds faring considerably better than more rate-sensitive exchange-traded issues. Preferred securities outperformed Treasuries and investment-grade corporate bonds but trailed high-yield debt.

Fund Performance

The portfolio had a positive total return in the period but underperformed its blended benchmark. The portfolio is part of a component SMA and does not necessarily reflect the performance of the overall SMA program.

In the U.S., the sudden collapse of Silicon Valley Bank, Signature Bank and First Republic Bank in early 2023 raised concerns about funding and contagion risk. In Europe, struggling Credit Suisse was acquired by rival UBS in March. Financial regulators took swift action to mitigate contagion risk; the Fed and other central banks assured that funding would remain readily available in the global banking system.

Concerns around these events eased as the period progressed and fundamentals of the broader banking system remained healthy and resilient. Industry data and individual company comments suggested that the well-publicized U.S. regional bank failures were idiosyncratic and not reflective of systemic risk. Credit Suisse, meanwhile, appeared to be an outlier among European banks. Overall, the banking sector in the U.S. and Europe continued to generate solid profitability and strong capitalization.

Security selection in the banking sector detracted from the portfolio’s relative performance, partly due to out-of-benchmark investments in several issues from Silicon Valley Bank. Our overall allocation to securities from Credit Suisse did not have a meaningful impact on relative performance.

The insurance sector performed well during the period. Property & casualty insurance companies experienced significant premium growth due to the recovering economy, while life insurers benefited from the declining impact of the Covid pandemic. An underweight in insurance securities as a group hindered relative performance.

The pipeline sector outperformed as company cash flows improved, supported by recovering demand and high crude oil and refined product prices. The portfolio’s overweight in pipelines contributed to relative performance, although the effect was countered by security selection in that sector. Utilities also outperformed; an overweight and security selection benefited the portfolio’s performance. Telecommunication services performed well, aided by overall operational health in the sector. The portfolio’s overweight in the telecommunication services sector modestly contributed to relative performance.

2

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

Impact of Derivatives on Fund Performance

The Fund used derivatives in the form of forward foreign currency exchange contracts to passively manage currency risk on certain Fund positions denominated in foreign currencies. The currency forward contracts detracted from the Fund’s total return for the 12 months ended October 31, 2023.

Sincerely,

| | |

| |  |

WILLIAM F. SCAPELL Portfolio Manager | | ELAINE ZAHARIS-NIKAS Portfolio Manager |

| | |

|

|

JERRY DOROST Portfolio Manager |

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds specializes in liquid real assets, including real estate securities, listed infrastructure and natural resource equities, as well as preferred securities and other income solutions.

3

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

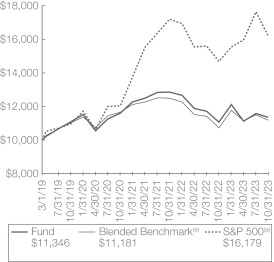

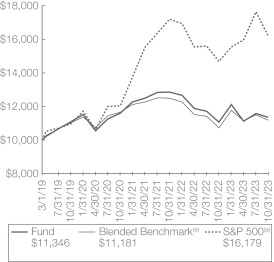

Performance Review (Unaudited)

Average Annual Total Returns—For Periods Ended October 31, 2023

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Since Inception(b) | |

Cohen & Steers Preferred Securities and Income SMA Shares, Inc. | | | 2.47 | % | | | — | | | | — | | | | 2.74 | % |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month end can be obtained by visiting our website at cohenandsteers.com. Total return assumes the reinvestment of all dividends and distributions at NAV. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During the periods presented above, the investment advisor waived fees and/or reimbursed expenses. Without this arrangement, performance would have been lower.

4

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

Performance Review (Unaudited)—(Continued)

The annualized gross and net expense ratios, respectively, as disclosed in the prospectus dated March 1, 2023, supplemented on December 13, 2023, was 0.10% and 0.00%. The investment advisor has contractually agreed to reimburse the Fund so that the total annual Fund operating expenses (excluding acquired fund fees and expenses, interest, taxes, extraordinary expenses, and other expenses approved by the Board of Directors) do not exceed 0.00%. This contractual agreement is currently expected to remain in place for the life of the Fund, can only be amended or terminated by agreement of the Fund’s Board of Directors and the investment advisor and will terminate automatically in the event of termination of the investment advisory agreement between the Fund and the investment advisor.

| (a) | The comparative indexes are not adjusted to reflect expenses or other fees that the U.S. Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. The Fund’s performance assumes the reinvestment of all dividends and distributions at NAV. For more information, including charges and expenses, please read the prospectus carefully before you invest. |

| (b) | Commencement of investment operations was March 1, 2019. |

5

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

Expense Example (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs including investment advisory fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period May 1, 2023—October 31, 2023.

Actual Expenses

The first line of the following table provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2023 | | | Ending

Account Value

October 31, 2023 | | | Expenses Paid

During Period(a)

May 1, 2023—

October 31, 2023 | |

Actual (1.98% return) | | $ | 1,000.00 | | | $ | 1,019.80 | | | $ | 0.00 | |

Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,025.21 | | | $ | 0.00 | |

6

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

Expense Example (Unaudited)—(Continued)

| (a) | Expenses are equal to the Fund’s annualized net expense ratio of 0.00% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The investment advisor does not charge an advisory fee to the Fund. The investment advisor has contractually agreed to reimburse the Fund so that the total annual Fund operating expenses (excluding acquired fund fees and expenses, interest, taxes, extraordinary expenses, and other expenses approved by the Board of Directors) do not exceed 0.00%. This contractual agreement is currently expected to remain in place for the life of the Fund, can only be amended or terminated by agreement of the Fund’s Board of Directors and the investment advisor and will terminate automatically in the event of termination of the investment advisory agreement between the Fund and the investment advisor. |

7

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

October 31, 2023 Top Ten Holdings(a) (Unaudited)

| | | | | | | | |

Security | | Value | | | % of

Net

Assets | |

| | |

Wells Fargo & Co., 3.90%, Series BB | | $ | 7,908,546 | | | | 2.4 | |

BNP Paribas SA, 7.75% (France) | | | 6,693,648 | | | | 2.0 | |

Wells Fargo & Co., 7.625% | | | 5,018,985 | | | | 1.5 | |

Citigroup, Inc., 3.875%, Series X | | | 4,409,760 | | | | 1.3 | |

Toronto-Dominion Bank, 8.125% due 10/31/82 (Canada) | | | 4,327,673 | | | | 1.3 | |

BP Capital Markets PLC, 4.875% (United Kingdom) | | | 4,183,012 | | | | 1.3 | |

QBE Insurance Group Ltd., 5.875% (Australia) | | | 4,120,349 | | | | 1.2 | |

Emera, Inc., 6.75%, Series 16-A (Canada) | | | 3,971,251 | | | | 1.2 | |

Charles Schwab Corp., 4.00%, Series I | | | 3,756,002 | | | | 1.1 | |

Algonquin Power & Utilities Corp., 4.75% (Canada) | | | 3,672,686 | | | | 1.1 | |

| (a) | Top ten holdings (excluding short-term investments and derivative instruments) are determined on the basis of the value of individual securities held. The Fund may also hold positions in other securities issued by the companies listed above. See the Schedule of Investments for additional details on such other positions. |

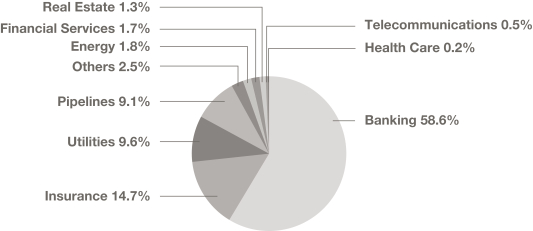

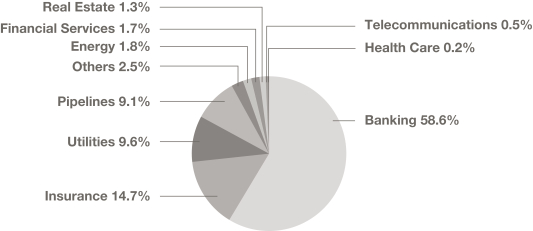

Sector Breakdown(b)

(Based on Net Assets)

(Unaudited)

| (b) | Excludes derivative instruments. |

8

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS

October 31, 2023

| | | | | | | | | | | | |

| | | | Shares | | | Value | |

PREFERRED SECURITIES—EXCHANGE-TRADED | | | 1.8% | | | | | | | | | |

BANKING | | | 0.4% | | | | | | | | | |

Bank of America Corp., 4.375%, Series NN(a) | | | | 9,993 | | | $ | 166,484 | |

Bank of America Corp., 4.75%, Series SS(a) | | | | 5,639 | | | | 100,769 | |

Morgan Stanley, 4.25%, Series O(a) | | | | 7,773 | | | | 127,555 | |

Morgan Stanley, 5.85%, Series K(a)(b) | | | | 18,000 | | | | 393,480 | |

U.S. Bancorp, 4.00%, Series M(a) | | | | 41,534 | | | | 615,949 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,404,237 | |

| | | | | | | | | | | | |

CONSUMER DISCRETIONARY PRODUCTS | | | 0.0% | | | | | | | | | |

Ford Motor Co., 6.50%, due 8/15/62 | | | | 6,658 | | | | 139,285 | |

| | | | | | | | | | | | |

INSURANCE | | | 0.3% | | | | | | | | | |

Athene Holding Ltd., 6.375% to 6/30/25, Series C(a)(c) | | | | 39,366 | | | | 955,413 | |

Athene Holding Ltd., 7.75% to 12/30/27, Series E(a)(c) | | | | 4,227 | | | | 105,252 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,060,665 | |

| | | | | | | | | | | | |

PIPELINES | | | 1.1% | | | | | | | | | |

Enbridge, Inc., 3.94% to 3/1/25, Series 11 (Canada)(a)(c) | | | | 46,275 | | | | 492,199 | |

Energy Transfer LP, 7.60% to 5/15/24, Series E(a)(c) | | | | 72,332 | | | | 1,788,047 | |

TC Energy Corp., 3.903% to 4/30/24, Series 7 (Canada)(a)(c) | | | | 112,182 | | | | 1,233,658 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,513,904 | |

| | | | | | | | | | | | |

TOTAL PREFERRED SECURITIES—EXCHANGE-TRADED

(Identified cost—$6,190,766) | | | | | | | | 6,118,091 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Principal

Amount | | | | |

PREFERRED SECURITIES—OVER-THE-COUNTER | | | 95.7% | | | | | | | | | |

BANKING | | | 58.2% | | | | | | | | | |

Abanca Corp. Bancaria SA, 6.00% to 1/20/26 (Spain)(a)(c)(d)(e) | | | $ | 1,200,000 | | | | 1,141,079 | |

AIB Group PLC, 6.25% to 6/23/25 (Ireland)(a)(c)(d)(e) | | | | 1,518,000 | | | | 1,529,979 | |

Banco Bilbao Vizcaya Argentaria SA, 6.125% to 11/16/27 (Spain)(a)(c)(d) | | | | 400,000 | | | | 318,643 | |

Banco Bilbao Vizcaya Argentaria SA, 6.50% to 3/5/25,

Series 9 (Spain)(a)(c)(d) | | | | 2,400,000 | | | | 2,267,084 | |

Banco Bilbao Vizcaya Argentaria SA, 9.375% (Spain)(a)(c)(d) | | | | 1,200,000 | | | | 1,160,101 | |

Banco de Sabadell SA, 5.75% to 3/15/26 (Spain)(a)(c)(d)(e) | | | | 800,000 | | | | 741,491 | |

Banco de Sabadell SA, 9.375% to 7/18/28 (Spain)(a)(c)(d)(e) | | | | 1,600,000 | | | | 1,665,209 | |

See accompanying notes to financial statements.

9

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | |

| | | Principal

Amount | | | Value | |

Banco Mercantil del Norte SA/Grand Cayman,

6.625% to 1/24/32 (Mexico)(a)(c)(d)(f) | | $ | 800,000 | | | $ | 602,379 | |

Bank of America Corp., 4.375% to 1/27/27, Series RR(a)(c) | | | 1,561,000 | | | | 1,263,787 | |

Bank of America Corp., 5.875% to 3/15/28, Series FF(a)(c) | | | 1,199,000 | | | | 1,033,838 | |

Bank of America Corp., 6.10% to 3/17/25, Series AA(a)(c) | | | 2,943,000 | | | | 2,844,921 | |

Bank of America Corp., 6.125% to 4/27/27, Series TT(a)(c) | | | 835,000 | | | | 787,171 | |

Bank of America Corp., 6.25% to 9/5/24, Series X(a)(c) | | | 1,763,000 | | | | 1,737,140 | |

Bank of Ireland Group PLC, 6.00% to 9/1/25 (Ireland)(a)(c)(d)(e) | | | 600,000 | | | | 601,584 | |

Bank of Ireland Group PLC, 7.50% to 5/19/25 (Ireland)(a)(c)(d)(e) | | | 1,800,000 | | | | 1,881,181 | |

Bank of New York Mellon Corp., 3.75% to 12/20/26, Series I(a)(c) | | | 631,000 | | | | 489,975 | |

Bank of New York Mellon Corp., 4.625% to 9/20/26, Series F(a)(c) | | | 1,687,000 | | | | 1,453,995 | |

Bank of Nova Scotia/The, 4.90% to 6/4/25 (Canada)(a)(c) | | | 1,745,000 | | | | 1,596,722 | |

Bank of Nova Scotia/The, 8.625% to 10/27/27, due 10/27/82 (Canada)(c) | | | 1,200,000 | | | | 1,176,894 | |

Barclays Bank PLC, 6.278% to 12/15/34, Series 1

(United Kingdom)(a)(c) | | | 1,360,000 | | | | 1,270,807 | |

Barclays PLC, 6.125% to 12/15/25 (United Kingdom)(a)(c)(d) | | | 1,800,000 | | | | 1,610,046 | |

Barclays PLC, 7.125% to 6/15/25 (United Kingdom)(a)(c)(d) | | | 1,000,000 | | | | 1,134,974 | |

Barclays PLC, 8.00% to 6/15/24 (United Kingdom)(a)(c)(d) | | | 1,000,000 | | | | 980,544 | |

Barclays PLC, 8.00% to 3/15/29 (United Kingdom)(a)(c)(d) | | | 2,700,000 | | | | 2,394,900 | |

Barclays PLC, 8.875% to 9/15/27 (United Kingdom)(a)(c)(d)(e) | | | 2,400,000 | | | | 2,706,926 | |

BNP Paribas SA, 4.625% to 1/12/27 (France)(a)(c)(d)(f) | | | 2,079,000 | | | | 1,644,602 | |

BNP Paribas SA, 4.625% to 2/25/31 (France)(a)(c)(d)(f) | | | 1,800,000 | | | | 1,252,752 | |

BNP Paribas SA, 7.00% to 8/16/28 (France)(a)(c)(d)(f) | | | 1,200,000 | | | | 1,073,492 | |

BNP Paribas SA, 7.375% to 8/19/25 (France)(a)(c)(d)(f) | | | 600,000 | | | | 586,012 | |

BNP Paribas SA, 7.75% to 8/16/29 (France)(a)(c)(d)(f) | | | 7,200,000 | | | | 6,693,648 | |

BNP Paribas SA, 8.50% to 8/14/28 (France)(a)(c)(d)(f) | | | 2,400,000 | | | | 2,305,653 | |

BNP Paribas SA, 9.25% to 11/17/27 (France)(a)(c)(d)(f) | | | 1,600,000 | | | | 1,630,382 | |

CaixaBank SA, 8.25% to 3/13/29 (Spain)(a)(c)(d)(e) | | | 2,600,000 | | | | 2,685,613 | |

Charles Schwab Corp., 4.00% to 6/1/26, Series I(a)(c) | | | 4,725,000 | | | | 3,756,002 | |

Charles Schwab Corp., 4.00% to 12/1/30, Series H(a)(c) | | | 4,815,000 | | | | 3,291,861 | |

Charles Schwab Corp., 5.375% to 6/1/25, Series G(a)(c) | | | 773,000 | | | | 737,873 | |

Citigroup, Inc., 3.875% to 2/18/26, Series X(a)(c) | | | 5,244,000 | | | | 4,409,760 | |

Citigroup, Inc., 4.00% to 12/10/25, Series W(a)(c) | | | 1,500,000 | | | | 1,291,625 | |

See accompanying notes to financial statements.

10

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | |

| | | Principal

Amount | | | Value | |

Citigroup, Inc., 5.95% to 5/15/25, Series P(a)(c) | | $ | 2,412,000 | | | $ | 2,296,226 | |

Citigroup, Inc., 7.625% to 11/15/28, Series AA(a)(c) | | | 3,300,000 | | | | 3,185,962 | |

CoBank ACB, 6.45% to 10/1/27, Series K(a)(c) | | | 1,350,000 | | | | 1,257,442 | |

Commerzbank AG, 7.00% to 4/9/25 (Germany)(a)(c)(d)(e) | | | 1,000,000 | | | | 905,075 | |

Credit Agricole SA, 4.00% to 12/23/27 (France)(a)(c)(d)(e) | | | 600,000 | | | | 544,675 | |

Credit Agricole SA, 4.75% to 3/23/29 (France)(a)(c)(d)(f) | | | 2,400,000 | | | | 1,782,496 | |

Credit Agricole SA, 6.875% to 9/23/24 (France)(a)(c)(d)(f) | | | 1,800,000 | | | | 1,751,273 | |

Credit Agricole SA, 7.25% to 9/23/28, Series EMTN (France)(a)(c)(d)(e) | | | 1,200,000 | | | | 1,255,963 | |

Credit Agricole SA, 8.125% to 12/23/25 (France)(a)(c)(d)(f) | | | 1,600,000 | | | | 1,585,000 | |

Credit Suisse Group AG, 5.25% to 2/11/27, Claim (Switzerland)(a)(c)(d)(f)(g)(h) | | | 400,000 | | | | 42,000 | |

Credit Suisse Group AG, 6.375% to 8/21/26, Claim (Switzerland)(a)(c)(d)(f)(g)(h) | | | 1,600,000 | | | | 168,000 | |

Credit Suisse Group AG, 7.25% to 9/12/25, Claim (Switzerland)(a)(c)(d)(f)(g)(h) | | | 2,000,000 | | | | 210,000 | |

Credit Suisse Group AG, 7.50%, Claim (Switzerland)(a)(d)(f)(g)(h) | | | 2,400,000 | | | | 252,000 | |

Deutsche Bank AG, 6.00% to 10/30/25 (Germany)(a)(c)(d) | | | 2,200,000 | | | | 1,782,343 | |

Deutsche Bank AG, 7.50% to 4/30/25 (Germany)(a)(c)(d) | | | 1,600,000 | | | | 1,421,694 | |

Deutsche Bank AG, 10.00% to 12/01/27 (Germany)(a)(c)(d)(e) | | | 2,000,000 | | | | 2,118,059 | |

DNB Bank ASA, 4.875% to 11/12/24, Series EMTN (Norway)(a)(c)(d)(e) | | | 400,000 | | | | 382,545 | |

Dresdner Funding Trust I, 8.151%, due 6/30/31 (TruPS)(f) | | | 800,000 | | | | 838,500 | |

Farm Credit Bank of Texas, 5.70% to 9/15/25, Series 4(a)(c)(f) | | | 2,925,000 | | | | 2,764,125 | |

First Horizon Bank, 6.518%

(3 Month USD Term SOFR + 1.112%, Floor 3.75%)(a)(b)(f) | | | 3,500 | † | | | 2,380,000 | |

Goldman Sachs Capital I, 6.345%, due 2/15/34 (TruPS) | | | 1,334,000 | | | | 1,288,633 | |

Goldman Sachs Group, Inc., 3.65% to 8/10/26, Series U(a)(c) | | | 786,000 | | | | 611,077 | |

Goldman Sachs Group, Inc., 3.80% to 5/10/26, Series T(a)(c) | | | 301,000 | | | | 235,606 | |

Goldman Sachs Group, Inc., 7.50% to 2/10/29, Series W(a)(c) | | | 1,860,000 | | | | 1,828,850 | |

HSBC Capital Funding Dollar 1 LP, 10.176% to 6/30/30, Series 2 (United Kingdom)(a)(c)(f) | | | 2,025,000 | | | | 2,454,019 | |

HSBC Holdings PLC, 4.60% to 12/17/30

(United Kingdom)(a)(c)(d) | | | 2,400,000 | | | | 1,741,221 | |

See accompanying notes to financial statements.

11

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | |

| | | Principal

Amount | | | Value | |

HSBC Holdings PLC, 6.375% to 3/30/25

(United Kingdom)(a)(c)(d) | | $ | 2,200,000 | | | $ | 2,076,937 | |

HSBC Holdings PLC, 6.50%, due 9/15/37

(United Kingdom) | | | 800,000 | | | | 756,100 | |

HSBC Holdings PLC, 8.00% to 3/7/28

(United Kingdom)(a)(c)(d) | | | 3,200,000 | | | | 3,148,000 | |

Huntington Bancshares, Inc./OH., 4.45% to 10/15/27, Series G(a)(c) | | | 1,680,000 | | | | 1,257,874 | |

ING Groep NV, 4.25% to 5/16/31, Series NC10 (Netherlands)(a)(c)(d) | | | 1,400,000 | | | | 869,750 | |

ING Groep NV, 4.875% to 5/16/29 (Netherlands)(a)(c)(d)(e) | | | 1,200,000 | | | | 876,000 | |

ING Groep NV, 5.75% to 11/16/26 (Netherlands)(a)(c)(d) | | | 2,800,000 | | | | 2,465,064 | |

ING Groep NV, 6.50% to 4/16/25 (Netherlands)(a)(c)(d) | | | 1,600,000 | | | | 1,498,503 | |

ING Groep NV, 6.75% to 4/16/24 (Netherlands)(a)(c)(d)(e) | | | 800,000 | | | | 784,444 | |

ING Groep NV, 7.50% to 5/16/28 (Netherlands)(a)(c)(d)(e) | | | 2,000,000 | | | | 1,797,332 | |

Intesa Sanpaolo SpA, 7.70% to 9/17/25 (Italy)(a)(c)(d)(f) | | | 2,400,000 | | | | 2,247,286 | |

Intesa Sanpaolo SpA, 9.125% to 9/7/29 (Italy)(a)(c)(d)(e) | | | 2,000,000 | | | | 2,133,024 | |

JPMorgan Chase & Co., 3.65% to 6/1/26, Series KK(a)(c) | | | 1,946,000 | | | | 1,692,969 | |

JPMorgan Chase & Co., 4.60% to 2/1/25, Series HH(a)(c) | | | 832,000 | | | | 777,224 | |

JPMorgan Chase & Co., 6.10% to 10/1/24, Series X(a)(c) | | | 860,000 | | | | 848,820 | |

JPMorgan Chase & Co., 6.75% to 2/1/24, Series S(a)(c) | | | 701,000 | | | | 700,906 | |

JPMorgan Chase & Co., 8.889%

(3 Month USD Term SOFR + 3.512%), Series Q(a)(b) | | | 999,000 | | | | 1,002,342 | |

Julius Baer Group Ltd., 6.875% to 6/9/27 (Switzerland)(a)(c)(d)(e) | | | 1,000,000 | | | | 867,120 | |

KeyCorp Capital III, 7.75%, due 7/15/29 (TruPS) | | | 1,000,000 | | | | 889,487 | |

Lloyds Banking Group PLC, 7.50% to 6/27/24

(United Kingdom)(a)(c)(d) | | | 1,600,000 | | | | 1,560,707 | |

Lloyds Banking Group PLC, 7.50% to 9/27/25

(United Kingdom)(a)(c)(d) | | | 2,000,000 | | | | 1,860,600 | |

Lloyds Banking Group PLC, 8.00% to 9/27/29

(United Kingdom)(a)(c)(d) | | | 2,900,000 | | | | 2,553,761 | |

M&T Bank Corp., 3.50% to 9/1/26, Series I(a)(c) | | | 247,000 | | | | 165,788 | |

M&T Bank Corp., 5.125% to 11/1/26, Series F(a)(c) | | | 1,229,000 | | | | 931,426 | |

Nationwide Building Society, 5.75% to 6/20/27

(United Kingdom)(a)(c)(d)(e) | | | 800,000 | | | | 828,779 | |

NatWest Group PLC, 6.00% to 12/29/25

(United Kingdom)(a)(c)(d) | | | 2,600,000 | | | | 2,388,382 | |

See accompanying notes to financial statements.

12

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | |

| | | Principal

Amount | | | Value | |

NatWest Group PLC, 8.00% to 8/10/25

(United Kingdom)(a)(c)(d) | | $ | 3,000,000 | | | $ | 2,915,640 | |

Nordea Bank Abp, 6.625% to 3/26/26 (Finland)(a)(c)(d)(f) | | | 1,200,000 | | | | 1,127,825 | |

PNC Financial Services Group, Inc., 3.40% to 9/15/26, Series T(a)(c) | | | 2,000,000 | | | | 1,444,083 | |

PNC Financial Services Group, Inc., 6.00% to 5/15/27, Series U(a)(c) | | | 470,000 | | | | 395,157 | |

PNC Financial Services Group, Inc., 6.20% to 9/15/27, Series V(a)(c) | | | 1,841,000 | | | | 1,642,513 | |

PNC Financial Services Group, Inc., 6.25% to 3/15/30, Series W(a)(c) | | | 2,742,000 | | | | 2,263,523 | |

Regions Financial Corp., 5.75% to 6/15/25, Series D(a)(c) | | | 889,000 | | | | 817,699 | |

Skandinaviska Enskilda Banken AB, 6.875% to 6/30/27 (Sweden)(a)(c)(d)(e) | | | 600,000 | | | | 562,951 | |

Societe Generale SA, 5.375% to 11/18/30 (France)(a)(c)(d)(f) | | | 2,200,000 | | | | 1,583,354 | |

Societe Generale SA, 6.75% to 4/6/28 (France)(a)(c)(d)(f) | | | 1,400,000 | | | | 1,129,280 | |

Societe Generale SA, 8.00% to 9/29/25 (France)(a)(c)(d)(f) | | | 1,600,000 | | | | 1,568,169 | |

Societe Generale SA, 9.375% to 11/22/27 (France)(a)(c)(d)(f) | | | 2,600,000 | | | | 2,516,471 | |

Standard Chartered PLC, 4.30% to 8/19/28

(United Kingdom)(a)(c)(d)(f) | | | 800,000 | | | | 561,817 | |

Standard Chartered PLC, 4.75% to 1/14/31

(United Kingdom)(a)(c)(d)(f) | | | 1,600,000 | | | | 1,116,942 | |

Standard Chartered PLC, 7.75% to 8/15/27

(United Kingdom)(a)(c)(d)(f) | | | 1,400,000 | | | | 1,346,719 | |

Swedbank AB, 7.625% to 3/17/28 (Sweden)(a)(c)(d)(e) | | | 600,000 | | | | 558,524 | |

Toronto-Dominion Bank, 8.125% to 10/31/27, due 10/31/82 (Canada)(c) | | | 4,400,000 | | | | 4,327,673 | |

Truist Financial Corp., 4.80% to 9/1/24, Series N(a)(c) | | | 397,000 | | | | 326,339 | |

Truist Financial Corp., 4.95% to 9/1/25, Series P(a)(c) | | | 739,000 | | | | 672,076 | |

Truist Financial Corp., 5.10% to 3/1/30, Series Q(a)(c) | | | 2,068,000 | | | | 1,666,563 | |

U.S. Bancorp, 3.70% to 1/15/27, Series N(a)(c) | | | 914,000 | | | | 643,945 | |

U.S. Bancorp, 5.30% to 4/15/27, Series J(a)(c) | | | 2,010,000 | | | | 1,582,164 | |

UBS Group AG, 4.375% to 2/10/31 (Switzerland)(a)(c)(d)(f) | | | 1,400,000 | | | | 975,455 | |

UBS Group AG, 4.875% to 2/12/27 (Switzerland)(a)(c)(d)(f) | | | 2,400,000 | | | | 1,979,695 | |

UBS Group AG, 5.125% to 7/29/26 (Switzerland)(a)(c)(d)(e) | | | 800,000 | | | | 713,770 | |

UBS Group AG, 6.875% to 8/7/25 (Switzerland)(a)(c)(d)(e) | | | 3,500,000 | | | | 3,308,848 | |

UBS Group AG, 7.00% to 2/19/25 (Switzerland)(a)(c)(d)(e) | | | 1,400,000 | | | | 1,361,500 | |

UniCredit SpA, 8.00% to 6/3/24 (Italy)(a)(c)(d)(e) | | | 1,000,000 | | | | 987,650 | |

See accompanying notes to financial statements.

13

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | | | |

| | | | Principal

Amount | | | Value | |

Wells Fargo & Co., 3.90% to 3/15/26, Series BB(a)(c) | | | $ | 9,124,000 | | | $ | 7,908,546 | |

Wells Fargo & Co., 5.95%, due 12/15/36 | | | | 1,532,000 | | | | 1,404,700 | |

Wells Fargo & Co., 7.625% to 9/15/28(a)(c) | | | | 5,000,000 | | | | 5,018,985 | |

Wells Fargo & Co., 7.95%, due 11/15/29, Series B | | | | 23,000 | | | | 24,271 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 192,264,901 | |

| | | | | | | | | | | | |

ENERGY | | | 1.8% | | | | | | | | | |

BP Capital Markets PLC, 4.375% to 6/22/25

(United Kingdom)(a)(c) | | | | 1,843,000 | | | | 1,754,332 | |

BP Capital Markets PLC, 4.875% to 3/22/30

(United Kingdom)(a)(c) | | | | 4,788,000 | | | | 4,183,012 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,937,344 | |

| | | | | | | | | | | | |

FINANCIAL SERVICES | | | 1.7% | | | | | | | | | |

Aircastle Ltd., 5.25% to 6/15/26, Series A(a)(c)(f) | | | | 940,000 | | | | 741,799 | |

American Express Co., 3.55% to 9/15/26, Series D(a)(c) | | | | 1,902,000 | | | | 1,497,825 | |

Apollo Management Holdings LP, 4.95% to 12/17/24,

due 1/14/50(c)(f) | | | | 450,000 | | | | 400,024 | |

Ares Finance Co. III LLC, 4.125% to 6/30/26,

due 6/30/51(c)(f) | | | | 851,000 | | | | 638,021 | |

Charles Schwab Corp., 5.00% to 6/1/27, Series K(a)(c) | | | | 2,035,000 | | | | 1,612,309 | |

ILFC E-Capital Trust II, 7.459%

(3 Month USD Term SOFR + 2.062%),

due 12/21/65(TruPS)(b)(f) | | | | 940,000 | | | | 703,681 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,593,659 | |

| | | | | | | | | | | | |

HEALTH CARE | | | 0.2% | | | | | | | | | |

Bayer AG, 7.00% (Germany)(c)(e) | | | | | | | 700,000 | | | | 737,367 | |

INSURANCE | | | 14.4% | | | | | | | | | |

Aegon Ltd., 5.50% to 4/11/28, due 4/11/48 (Netherlands)(c) | | | | 600,000 | | | | 543,283 | |

Aegon Ltd., 5.625% to 4/15/29 (Netherlands)(a)(c)(d)(e) | | | | 1,800,000 | | | | 1,663,485 | |

Allianz SE, 3.50% to 11/17/25 (Germany)(a)(c)(d)(f) | | | | 1,400,000 | | | | 1,154,961 | |

Allianz SE, 6.35%, due 9/6/53 (Germany)(c)(f) | | | | 2,400,000 | | | | 2,294,852 | |

American International Group, Inc., 5.75% to 4/1/28,

due 4/1/48, Series A9(c) | | | | 200,000 | | | | 182,490 | |

AXA SA, 8.60%, due 12/15/30 (France) | | | | 1,025,000 | | | | 1,178,107 | |

CNP Assurances SACA, 4.875% to 10/7/30 (France)(a)(c)(d)(e) | | | | 400,000 | | | | 290,164 | |

See accompanying notes to financial statements.

14

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | |

| | | Principal

Amount | | | Value | |

CNP Assurances SACA, 5.25% to 1/18/33, due 7/18/53, Series EMTN (France)(c)(e) | | $ | 400,000 | | | $ | 399,879 | |

Corebridge Financial, Inc., 6.875% to 9/15/27, due 12/15/52(c) | | | 1,550,000 | | | | 1,433,834 | |

Dai-ichi Life Insurance Co. Ltd., 5.10% to 10/28/24 (Japan)(a)(c)(f) | | | 900,000 | | | | 880,703 | |

Enstar Finance LLC, 5.50% to 1/15/27, due 1/15/42(c) | | | 2,700,000 | | | | 2,156,776 | |

Enstar Finance LLC, 5.75% to 9/1/25, due 9/1/40(c) | | | 2,160,000 | | | | 1,909,433 | |

Equitable Holdings, Inc., 4.95% to 9/15/25, Series B(a)(c) | | | 1,485,000 | | | | 1,357,078 | |

Fukoku Mutual Life Insurance Co., 5.00% to 7/28/25 (Japan)(a)(c)(e) | | | 600,000 | | | | 580,225 | |

Global Atlantic Fin Co., 4.70% to 7/15/26, due 10/15/51(c)(f) | | | 2,832,000 | | | | 1,975,483 | |

Hartford Financial Services Group, Inc., 7.751%

(3 Month USD Term SOFR + 2.387%), due 2/12/47, Series ICON(b)(f) | | | 1,236,000 | | | | 1,059,746 | |

La Mondiale SAM, 5.875% to 1/26/27, due 1/26/47 (France)(c)(e) | | | 600,000 | | | | 557,424 | |

Lancashire Holdings Ltd., 5.625% to 3/18/31, due 9/18/41 (United Kingdom)(c)(e) | | | 1,200,000 | | | | 966,667 | |

Liberty Mutual Group, Inc., 4.125% to 9/15/26,

due 12/15/51(c)(f) | | | 1,470,000 | | | | 1,169,606 | |

Liberty Mutual Group, Inc., 7.80%, due 3/15/37(f) | | | 250,000 | | | | 240,821 | |

Lincoln National Corp., 9.25% to 12/01/27, Series C(a)(c) | | | 699,000 | | | | 705,289 | |

MetLife Capital Trust IV, 7.875%, due 12/15/37 (TruPS)(f) | | | 1,700,000 | | | | 1,735,295 | |

MetLife, Inc., 3.85% to 9/15/25, Series G(a)(c) | | | 850,000 | | | | 774,943 | |

MetLife, Inc., 9.25%, due 4/8/38(f) | | | 2,000,000 | | | | 2,169,050 | |

MetLife, Inc., 10.75%, due 8/1/39 | | | 905,000 | | | | 1,143,877 | |

Nippon Life Insurance Co., 5.10% to 10/16/24, due 10/16/44 (Japan)(c)(f) | | | 1,400,000 | | | | 1,374,945 | |

Prudential Financial, Inc., 5.125% to 11/28/31, due 3/1/52(c) | | | 1,600,000 | | | | 1,363,403 | |

Prudential Financial, Inc., 5.20% to 3/15/24, due 3/15/44(c) | | | 875,000 | | | | 863,788 | |

Prudential Financial, Inc., 6.00% to 6/1/32, due 9/1/52(c) | | | 1,920,000 | | | | 1,721,325 | |

Prudential Financial, Inc., 6.75% to 12/1/32, due 3/1/53(c) | | | 2,040,000 | | | | 1,924,926 | |

QBE Insurance Group Ltd., 5.875% to 6/17/26, due 6/17/46, Series EMTN (Australia)(c)(e) | | | 800,000 | | | | 758,968 | |

QBE Insurance Group Ltd., 5.875% to 5/12/25 (Australia)(a)(c)(f) | | | 4,300,000 | | | | 4,120,349 | |

QBE Insurance Group Ltd., 6.75% to 12/2/24, due 12/2/44 (Australia)(c)(e) | | | 800,000 | | | | 788,245 | |

See accompanying notes to financial statements.

15

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | | | |

| | | | Principal

Amount | | | Value | |

Rothesay Life PLC, 4.875% to 4/13/27, Series NC6 (United Kingdom)(a)(c)(d)(e) | | | $ | 2,000,000 | | | $ | 1,450,000 | |

SBL Holdings, Inc., 6.50% to 11/13/26(a)(c)(f) | | | | 2,200,000 | | | | 1,246,405 | |

SBL Holdings, Inc., 7.00% to 5/13/25(a)(c)(f) | | | | 1,940,000 | | | | 1,188,482 | |

Swiss Re Finance Luxembourg SA, 5.00% to 4/2/29 (Switzerland)(c)(f) | | | | 400,000 | | | | 375,500 | |

Zurich Finance Ireland Designated Activity Co.,

3.00% to 1/19/31, due 4/19/51, Series EMTN (Switzerland)(c)(e) | | | | 2,400,000 | | | | 1,794,312 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 47,494,119 | |

| | | | | | | | | | | | |

PIPELINES | | | 8.1% | | | | | | | | | |

Enbridge, Inc., 5.50% to 7/15/27, due 7/15/77,

Series 2017-A (Canada)(c) | | | | 385,000 | | | | 328,230 | |

Enbridge, Inc., 5.75% to 4/15/30, due 7/15/80,

Series 20-A (Canada)(c) | | | | 3,280,000 | | | | 2,738,011 | |

Enbridge, Inc., 6.00% to 1/15/27, due 1/15/77,

Series 16-A (Canada)(c) | | | | 2,362,000 | | | | 2,059,505 | |

Enbridge, Inc., 6.25% to 3/1/28, due 3/1/78 (Canada)(c) | | | | 1,271,000 | | | | 1,115,417 | |

Enbridge, Inc., 7.375% to 10/15/27, due 1/15/83 (Canada)(c) | | | | 1,838,000 | | | | 1,704,936 | |

Enbridge, Inc., 7.625% to 10/15/32, due 1/15/83 (Canada)(c) | | | | 2,232,000 | | | | 2,001,973 | |

Enbridge, Inc., 8.25%, due 1/15/84, Series NC (Canada)(c) | | | | 2,900,000 | | | | 2,780,899 | |

Enbridge, Inc., 8.50%, due 1/15/84 (Canada)(c) | | | | 1,960,000 | | | | 1,878,607 | |

Energy Transfer LP, 6.50% to 11/15/26, Series H(a)(c) | | | | 2,040,000 | | | | 1,852,687 | |

Energy Transfer LP, 7.125% to 5/15/30, Series G(a)(c) | | | | 1,176,000 | | | | 979,523 | |

Enterprise Products Operating LLC, 8.619%

(3 Month USD Term SOFR + 3.248%), due 8/16/77, Series D(b) | | | | 1,628,000 | | | | 1,594,091 | |

Transcanada Trust, 5.50% to 9/15/29, due 9/15/79 (Canada)(c) | | | | 3,449,000 | | | | 2,745,591 | |

Transcanada Trust, 5.60% to 12/7/31, due 3/7/82 (Canada)(c) | | | | 2,398,000 | | | | 1,853,827 | |

Transcanada Trust, 5.875% to 8/15/26, due 8/15/76, Series 16-A (Canada)(c) | | | | 3,407,000 | | | | 3,060,232 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 26,693,529 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

16

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | | | |

| | | | Principal

Amount | | | Value | |

REAL ESTATE | | | 1.2% | | | | | | | | | |

Scentre Group Trust 2, 4.75% to 6/24/26, due 9/24/80 (Australia)(c)(f) | | | $ | 2,500,000 | | | $ | 2,247,439 | |

Scentre Group Trust 2, 5.125% to 6/24/30, due 9/24/80 (Australia)(c)(f) | | | | 2,300,000 | | | | 1,899,222 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,146,661 | |

| | | | | | | | | | | | |

TELECOMMUNICATIONS | | | 0.5% | | | | | | | | | |

Telefonica Europe BV, 6.135% to 2/3/30 (Spain)(a)(c)(e) | | | | 400,000 | | | | 398,716 | |

Vodafone Group PLC, 4.125% to 3/4/31, due 6/4/81

(United Kingdom)(c) | | | | 970,000 | | | | 735,072 | |

Vodafone Group PLC, 6.25% to 7/3/24, due 10/3/78

(United Kingdom)(c)(e) | | | | 400,000 | | | | 395,208 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,528,996 | |

| | | | | | | | | | | | |

UTILITIES | | | 9.6% | | | | | | | | | |

Algonquin Power & Utilities Corp., 4.75% to 1/18/27, due 1/18/82 (Canada)(c) | | | | | | | 4,646,000 | | | | 3,672,686 | |

CMS Energy Corp., 4.75% to 3/1/30, due 6/1/50(c) | | | | | | | 1,388,000 | | | | 1,152,730 | |

Dominion Energy, Inc., 4.35% to 1/15/27, Series C(a)(c) | | | | | | | 2,632,000 | | | | 2,154,688 | |

Dominion Energy, Inc., 4.65% to 12/15/24, Series B(a)(c) | | | | | | | 910,000 | | | | 830,980 | |

Edison International, 5.00% to 12/15/26, Series B(a)(c) | | | | | | | 1,707,000 | | | | 1,523,432 | |

Edison International, 5.375% to 3/15/26, Series A(a)(c) | | | | | | | 2,830,000 | | | | 2,543,241 | |

Electricite de France SA, 7.50% to 9/6/28, Series EMTN (France)(a)(c)(e) | | | | | | | 2,000,000 | | | | 2,144,346 | |

Electricite de France SA, 9.125% to 3/15/33 (France)(a)(c)(f) | | | | | | | 2,200,000 | | | | 2,263,512 | |

Emera, Inc., 6.75% to 6/15/26, due 6/15/76, Series 16-A (Canada)(c) | | | | | | | 4,206,000 | | | | 3,971,251 | |

NextEra Energy Capital Holdings, Inc., 3.80% to 3/15/27, due 3/15/82(c) | | | | | | | 400,000 | | | | 321,996 | |

NextEra Energy Capital Holdings, Inc., 5.65% to 5/1/29, due 5/1/79(c) | | | | | | | 1,298,000 | | | | 1,153,544 | |

Sempra, 4.125% to 1/1/27, due 4/1/52(c) | | | | | | | 3,640,000 | | | | 2,808,207 | |

Sempra, 4.875% to 10/15/25(a)(c) | | | | | | | 3,080,000 | | | | 2,884,008 | |

See accompanying notes to financial statements.

17

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| | | | | | | | | | | | |

| | | | Principal

Amount | | | Value | |

Southern Co., 3.75% to 6/15/26, due 9/15/51, Series 21-A(c) | | | | | | $ | 2,854,000 | | | $ | 2,445,212 | |

Southern Co., 4.00% to 10/15/25, due 1/15/51, Series B(c) | | | | | | | 2,010,000 | | | | 1,837,098 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 31,706,931 | |

| | | | | | | | | | | | |

TOTAL PREFERRED SECURITIES—OVER-THE-COUNTER

(Identified cost—$351,935,153) | | | | | | | | 316,103,507 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Shares | | | | |

SHORT-TERM INVESTMENTS | | | 0.5% | | | | | | | | | |

MONEY MARKET FUNDS | | | | | | | | | | | | |

State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.30%(i) | | | | 1,575,640 | | | | 1,575,640 | |

| | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$1,575,640) | | | | | | | | 1,575,640 | |

| | | | | | | | | | | | |

TOTAL INVESTMENTSIN SECURITIES

(Identified cost—$359,701,559) | | | 98.0% | | | | | | | | 323,797,238 | |

OTHER ASSETSIN EXCESSOF LIABILITIES | | | 2.0 | | | | | | | | 6,455,228 | |

| | | | | | | | | | | | |

NET ASSETS | | | 100.0% | | | | | | | $ | 330,252,466 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

18

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

Forward Foreign Currency Exchange Contracts

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Counterparty | | Contracts to

Deliver | | | In Exchange

For | | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

Brown Brothers Harriman | | CAD | | | 122,768 | | | USD | | | 90,888 | | | | 11/2/23 | | | $ | 2,358 | |

Brown Brothers Harriman | | CAD | | | 2,051,784 | | | USD | | | 1,516,078 | | | | 11/2/23 | | | | 36,496 | |

Brown Brothers Harriman | | EUR | | | 23,175,059 | | | USD | | | 24,558,378 | | | | 11/2/23 | | | | 36,842 | |

Brown Brothers Harriman | | GBP | | | 3,862,436 | | | USD | | | 4,718,727 | | | | 11/2/23 | | | | 24,131 | |

Brown Brothers Harriman | | USD | | | 776,450 | | | EUR | | | 727,560 | | | | 11/2/23 | | | | (6,618 | ) |

Brown Brothers Harriman | | USD | | | 554,394 | | | EUR | | | 522,735 | | | | 11/2/23 | | | | (1,288 | ) |

Brown Brothers Harriman | | USD | | | 488,929 | | | EUR | | | 461,010 | | | | 11/2/23 | | | | (1,134 | ) |

Brown Brothers Harriman | | USD | | | 517,616 | | | EUR | | | 488,614 | | | | 11/2/23 | | | | (613 | ) |

Brown Brothers Harriman | | USD | | | 1,566,240 | | | CAD | | | 2,174,552 | | | | 11/2/23 | | | | 1,872 | |

Brown Brothers Harriman | | USD | | | 4,686,409 | | | GBP | | | 3,862,436 | | | | 11/2/23 | | | | 8,186 | |

Brown Brothers Harriman | | USD | | | 22,173,030 | | | EUR | | | 20,975,140 | | | | 11/2/23 | | | | 20,771 | |

Brown Brothers Harriman | | CAD | | | 2,188,170 | | | USD | | | 1,576,605 | | | | 12/4/23 | | | | (2,058 | ) |

Brown Brothers Harriman | | CAD | | | 198,784 | | | USD | | | 143,781 | | | | 12/4/23 | | | | 368 | |

Brown Brothers Harriman | | EUR | | | 20,858,400 | | | USD | | | 22,076,113 | | | | 12/4/23 | | | | (22,429 | ) |

Brown Brothers Harriman | | GBP | | | 3,888,273 | | | USD | | | 4,718,264 | | | | 12/4/23 | | | | (8,614 | ) |

| | | | | | | | | | | | | | | | | | $ | 88,270 | |

| |

Glossary of Portfolio Abbreviations

| | |

CAD | | Canada Dollar |

EMTN | | Euro Medium Term Note |

EUR | | Euro Currency |

GBP | | British Pound |

ICON | | Indexed Currency Option Note |

SOFR | | Secured Overnight Financing Rate |

TruPS | | Trust Preferred Securities |

USD | | United States Dollar |

Note: Percentages indicated are based on the net assets of the Fund.

| (a) | Perpetual security. Perpetual securities have no stated maturity date, but they may be called/redeemed by the issuer. |

| (b) | Variable rate. Rate shown is in effect at October 31, 2023. |

See accompanying notes to financial statements.

19

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2023

| (c) | Security converts to floating rate after the indicated fixed–rate coupon period. |

| (d) | Contingent Capital security (CoCo). CoCos are debt or preferred securities with loss absorption characteristics built into the terms of the security for the benefit of the issuer. Aggregate holdings amounted to $111,379,527 or 33.7% of the net assets of the Fund. |

| (e) | Securities exempt from registration under Regulation S of the Securities Act of 1933. These securities are subject to resale restrictions. Aggregate holdings amounted to $45,864,327 which represents 13.9% of the net assets of the Fund, of which 0.2% are illiquid. |

| (f) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold to qualified institutional buyers. Aggregate holdings amounted to $76,049,242 which represents 23.0% of the net assets of the Fund, of which 0.9% are illiquid. |

| (g) | Security is in default. |

| (h) | Non-income producing security. |

| (i) | Rate quoted represents the annualized seven-day yield. |

| | | | |

Country Summary | | % of Net

Assets | |

United States | | | 40.6 | |

United Kingdom | | | 13.6 | |

Canada | | | 11.7 | |

France | | | 10.8 | |

Switzerland | | | 3.6 | |

Netherlands | | | 3.2 | |

Germany | | | 3.2 | |

Spain | | | 3.1 | |

Australia | | | 3.0 | |

Italy | | | 1.6 | |

Ireland | | | 1.2 | |

Japan | | | 0.9 | |

Other (includes short-term investments) | | | 3.5 | |

| | | | |

| | | 100.0 | |

| | | | |

See accompanying notes to financial statements.

20

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2023

| | | | |

ASSETS: | | | | |

Investments in securities, at value (Identified cost—$359,701,559) | | $ | 323,797,238 | |

Foreign currency, at value (Identified cost—$15,502) | | | 15,507 | |

Receivable for: | | | | |

Dividends and interest | | | 4,861,689 | |

Investment securities sold | | | 3,615,447 | |

Fund shares sold | | | 652,614 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | 131,024 | |

Due from investment advisor | | | 70,308 | |

Other assets | | | 952 | |

| | | | |

Total Assets | | | 333,144,779 | |

| | | | |

LIABILITIES: | | | | |

Unrealized depreciation on forward foreign currency exchange contracts | | | 42,754 | |

Payable for: | | | | |

Dividends and distributions declared | | | 1,785,957 | |

Fund shares redeemed | | | 697,296 | |

Investment securities purchased | | | 138,429 | |

Directors’ fees | | | 1,359 | |

Other liabilities | | | 226,518 | |

| | | | |

Total Liabilities | | | 2,892,313 | |

| | | | |

NET ASSETS applicable to 37,146,610 shares of $0.001 par value of common stock outstanding | | $ | 330,252,466 | |

| | | | |

NET ASSET VALUE PER SHARE: | | | | |

($330,252,466 ÷ 37,146,610 shares outstanding) | | $ | 8.89 | |

| | | | |

NET ASSETS consist of: | | | | |

Paid-in capital | | $ | 403,452,704 | |

Total distributable earnings/(accumulated loss) | | | (73,200,238 | ) |

| | | | |

| | $ | 330,252,466 | |

| | | | |

See accompanying notes to financial statements.

21

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

STATEMENT OF OPERATIONS

For the Year Ended October 31, 2023

| | | | |

Investment Income: | | | | |

Interest income | | $ | 19,703,594 | |

Dividend income (net of $22,506 of foreign withholding tax) | | | 1,157,041 | |

| | | | |

Total Investment Income | | | 20,860,635 | |

| | | | |

Expenses: | | | | |

Professional fees | | | 118,659 | |

Registration and filing fees | | | 73,593 | |

Administration fees | | | 69,031 | |

Shareholder reporting expenses | | | 46,771 | |

Transfer agent fees and expenses | | | 22,960 | |

Directors’ fees and expenses | | | 15,449 | |

Custodian fees and expenses | | | 10,965 | |

Miscellaneous | | | 45,543 | |

| | | | |

Total Expenses | | | 402,971 | |

Reduction of Expenses (See Note 2) | | | (402,971 | ) |

| | | | |

Net Expenses | | | — | |

| | | | |

Net Investment Income (Loss) | | | 20,860,635 | |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) on: | | | | |

Investments in securities | | | (23,193,270 | ) |

Forward foreign currency exchange contracts | | | (862,019 | ) |

Foreign currency transactions | | | 41,487 | |

| | | | |

Net realized gain (loss) | | | (24,013,802 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments in securities | | | 7,647,032 | |

Forward foreign currency exchange contracts | | | 492,437 | |

Foreign currency translations | | | 4,727 | |

| | | | |

Net change in unrealized appreciation (depreciation) | | | 8,144,196 | |

| | | | |

Net Realized and Unrealized Gain (Loss) | | | (15,869,606 | ) |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 4,991,029 | |

| | | | |

See accompanying notes to financial statements.

22

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the

Year Ended

October 31, 2023 | | | For the

Year Ended

October 31, 2022 | |

Change in Net Assets: | | | | | | | | |

From Operations: | | | | | | | | |

Net investment income (loss) | | $ | 20,860,635 | | | $ | 17,270,557 | |

Net realized gain (loss) | | | (24,013,802 | ) | | | (11,905,750 | ) |

Net change in unrealized appreciation (depreciation) | | | 8,144,196 | | | | (57,996,890 | ) |

| | | | | | | | |

Net increase (decrease) in net assets

resulting from operations | | | 4,991,029 | | | | (52,632,083 | ) |

| | | | | | | | |

Distributions to Shareholders | | | (22,204,636 | ) | | | (19,464,229 | ) |

| | | | | | | | |

Capital Stock Transactions: | | | | | | | | |

Increase (decrease) in net assets from

Fund share transactions | | | 41,419,081 | | | | 13,818,352 | |

| | | | | | | | |

Total increase (decrease) in net assets | | | 24,205,474 | | | | (58,277,960 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | | 306,046,992 | | | | 364,324,952 | |

| | | | | | | | |

End of year | | $ | 330,252,466 | | | $ | 306,046,992 | |

| | | | | | | | |

See accompanying notes to financial statements.

23

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

FINANCIAL HIGHLIGHTS

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended

October 31, | | | For the Period

March 1, 2019(a)

through

October 31, 2019 | |

Per Share Operating Data: | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

Net asset value, beginning of period | | | $9.26 | | | | $11.38 | | | | $10.73 | | | | $10.74 | | | | $10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)(b) | | | 0.57 | | | | 0.51 | | | | 0.51 | | | | 0.49 | | | | 0.35 | |

Net realized and unrealized gain (loss) | | | (0.34 | ) | | | (2.04 | ) | | | 0.65 | | | | (0.01 | ) | | | 0.71 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.23 | | | | (1.53 | ) | | | 1.16 | | | | 0.48 | | | | 1.06 | |

| | | | | | | | | | | | | | | | | | | | |

Less dividends and distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.60 | ) | | | (0.55 | ) | | | (0.51 | ) | | | (0.48 | ) | | | (0.32 | ) |

Net realized gain | | | — | | | | (0.04 | ) | | | — | | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions to shareholders | | | (0.60 | ) | | | (0.59 | ) | | | (0.51 | ) | | | (0.49 | ) | | | (0.32 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in net asset value | | | (0.37 | ) | | | (2.12 | ) | | | 0.65 | | | | (0.01 | ) | | | 0.74 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $8.89 | | | | $ 9.26 | | | | $11.38 | | | | $10.73 | | | | $10.74 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Total return | | | 2.47 | % | | | –13.90 | % | | | 10.93 | % | | | 4.66 | % | | | 10.77 | %(c) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of period (in millions) | | | $330.3 | | | | $306.0 | | | | $364.3 | | | | $271.1 | | | | $66.7 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average daily net assets: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses (before expense reduction) | | | 0.12 | % | | | 0.10 | % | | | 0.11 | % | | | 0.15 | % | | | 1.13 | %(d) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses (net of expense reduction)(e) | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | %(d) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)

(before expense reduction) | | | 6.02 | % | | | 4.88 | % | | | 4.36 | % | | | 4.60 | % | | | 3.93 | %(d) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)

(net of expense reduction) | | | 6.14 | % | | | 4.98 | % | | | 4.47 | % | | | 4.75 | % | | | 5.06 | %(d) |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 58 | % | | | 72 | % | | | 71 | % | | | 99 | % | | | 25 | %(c) |

| | | | | | | | | | | | | | | | | | | | |

| (a) | Commencement of investment operations. |

| (b) | Calculation based on average shares outstanding. |

| (d) | Ratios for periods less than one year are annualized. Certain professional, shareholder reporting and non-recurring expenses incurred by the Fund are not annualized for periods less than one year. |

| (e) | The Fund’s expenses have been contractually capped at 0.00%. See Note 2 in Notes to Financial Statements. |

24

See accompanying notes to financial statements.

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

NOTES TO FINANCIAL STATEMENTS

Note 1. Organization and Significant Accounting Policies

Cohen & Steers Preferred Securities and Income SMA Shares, Inc. (the Fund) was incorporated under the laws of the State of Maryland on November 16, 2018 and is registered under the Investment Company Act of 1940 (the 1940 Act) as a non-diversified, open-end management investment company. On January 30, 2022, the Fund’s diversification status under the 1940 Act changed from a nondiversified fund to a diversified fund. The Fund’s investment objective is total return. Investment operations commenced on March 1, 2019. Shares of the Fund are only offered to participants in separately managed account (SMA) programs and to certain non-program SMA clients that have an agreement with Cohen & Steers Capital Management, Inc. (the investment advisor).

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price. Forward foreign currency exchange contracts are valued daily at the prevailing forward exchange rate.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges (including NASDAQ) are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the over-the-counter (OTC) market, including listed securities whose primary market is believed by the investment advisor to be OTC, are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment advisor, pursuant to delegation by the Board of Directors, to reflect the fair value of such securities.

Fixed-income securities are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment advisor, pursuant to delegation by the Board of Directors, to reflect the fair value of such securities. The pricing services or broker-dealers use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services or broker-dealers may utilize a market-based approach

25

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services or broker-dealers also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features which are then used to calculate the fair values.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at net asset value (NAV).

The Board of Directors has designated the investment manager as the Fund’s “Valuation Designee” under Rule 2a-5 under the 1940 Act. As Valuation Designee, the investment advisor is authorized to make fair valuation determinations, subject to the oversight of the Board of Directors. The investment advisor has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable, or securities for which the investment advisor determines that the bid and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund’s Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

The Fund’s use of fair value pricing may cause the NAV of Fund shares to differ from the NAV that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund’s investments is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.) |

26

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

| | • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing investments may or may not be an indication of the risk associated with those investments. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the inputs used as of October 31, 2023 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | | | | | |

| | | Quoted Prices

in Active

Markets for

Identical

Investments

(Level 1) | | | Other

Significant

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

Preferred Securities—

Exchange-Traded | | $ | 6,118,091 | | | $ | — | | | $ | — | | | $ | 6,118,091 | |

Preferred Securities—Over-the-Counter | | | — | | | | 316,103,507 | | | | — | | | | 316,103,507 | |

Short-Term Investments | | | — | | | | 1,575,640 | | | | — | | | | 1,575,640 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities(a) | | $ | 6,118,091 | | | $ | 317,679,147 | | | $ | — | | | $ | 323,797,238 | |

| | | | | | | | | | | | | | | | |

Forward Foreign Currency Exchange Contracts | | $ | — | | | $ | 131,024 | | | $ | — | | | $ | 131,024 | |

| | | | | | | | | | | | | | | | |

Total Derivative Assets(a) | | $ | — | | | $ | 131,024 | | | $ | — | | | $ | 131,024 | |

| | | | | | | | | | | | | | | | |

Forward Foreign Currency Exchange Contracts | | $ | — | | | $ | (42,754 | ) | | $ | — | | | $ | (42,754 | ) |

| | | | | | | | | | | | | | | | |

Total Derivative Liabilities(a) | | $ | — | | | $ | (42,754 | ) | | $ | — | | | $ | (42,754 | ) |

| | | | | | | | | | | | | | | | |

| (a) | Portfolio holdings are disclosed individually on the Schedule of Investments. |

The following is a reconciliation of investments for which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | | | | | |

| | | Balance

as of

October 31,

2022 | | | Transfer

out of

Level 3(a) | | | Change in

unrealized

appreciation

(depreciation) | | | Balance

as of

October 31,

2023 | |

Preferred Securities—Over-the-Counter—Banking | | $ | 2,801,313 | | | $ | (2,380,000 | ) | | $ | (421,313 | ) | | $ | — | |

| (a) | As of October 31, 2022, the Fund used significant unobservable inputs in determining the value of this investment. As of October 31, 2023, the same investment was transferred from Level 3 to Level 2 as a result of the availability of observable inputs. |

27

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Security Transactions and Investment Income: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income, which includes the amortization of premiums and accretion of discounts, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date, except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments in securities.

Net realized foreign currency transaction gains or losses arise from sales of foreign currencies, (excluding gains and losses on forward foreign currency exchange contracts, which are presented separately, if any), currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency translation gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates. Pursuant to U.S. federal income tax regulations, certain foreign currency gains/losses included in realized and unrealized gains/losses are included in or are a reduction of ordinary income for federal income tax purposes.

Forward Foreign Currency Exchange Contracts: The Fund enters into forward foreign currency exchange contracts to hedge the currency exposure associated with certain of its non-U.S. dollar denominated securities. A forward foreign currency exchange contract is a commitment between two parties to purchase or sell foreign currency at a set price on a future date. The market value of a forward foreign currency exchange contract fluctuates with changes in foreign currency exchange rates. These contracts are marked to market daily and the change in value is recorded by the Fund as unrealized appreciation and/or depreciation on forward foreign currency exchange contracts. Realized gains or losses equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed are included in net realized gain or loss on forward foreign currency exchange contracts. For federal income tax purposes, the Fund has made an election to treat gains and losses from forward foreign currency exchange contracts as capital gains and losses.

Forward foreign currency exchange contracts involve elements of market risk in excess of the amounts reflected on the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rate underlying the contract. Risks may also arise upon entering these contracts from the potential inability of the counterparties to meet the terms of their contracts. In connection with these contracts, securities may be identified as collateral in accordance with the terms of the respective contracts.

28

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are declared and paid monthly. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are paid in cash. Dividends from net investment income are subject to recharacterization for tax purposes.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company (RIC), if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to RICs, and by distributing substantially all of its taxable earnings to its shareholders. Also, in order to avoid the payment of any federal excise taxes, the Fund will distribute substantially all of its net investment income and net realized gains on a calendar year basis. Accordingly, no provision for federal income or excise tax is necessary. Dividend and interest income from holdings in non-U.S. securities are recorded net of non-U.S. taxes paid. Management has analyzed the Fund’s tax positions taken on federal and applicable state income tax returns as well as its tax positions in non-U.S. jurisdictions in which it trades for the current tax year and has concluded that as of October 31, 2023, no additional provisions for income tax are required in the Fund’s financial statements. The Fund’s tax positions for the current tax year for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service, state departments of revenue and by foreign tax authorities.

Note 2. Investment Advisory Fees, Administration Fees and Other Transactions with Affiliates

Investment Advisory Fees: Cohen & Steers Capital Management, Inc. serves as the Fund’s investment advisor pursuant to an investment advisory agreement (the investment advisory agreement). Under the terms of the investment advisory agreement, the investment advisor provides the Fund with day-to-day investment decisions and generally manages the Fund’s investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Directors.

For its services under the investment advisory agreement, the investment advisor receives no investment advisory or other fees from the Fund. This arrangement recognizes that shares of the Fund are only offered to participants in SMA programs (each, a Program Participant) who pay fees to program sponsors (each, a Sponsor) for the costs and expenses of the programs, including fees for investment advice, custody and portfolio execution, and to certain non-program SMA clients of the investment advisor. When a Program Participant, alone or with his or her Sponsor, elects to allocate assets in an SMA to an investment strategy managed or advised by the investment advisor, the investment advisor typically receives a fee from the Sponsor for providing such advisory services to the SMA, including with respect to assets that may be invested in the Fund. In certain cases, a Program Participant will pay a fee for investment advice directly to the investment advisor in its capacity as advisor to the Program Participant’s SMA. Similarly, non-program SMA clients will pay fees directly to the investment advisor.

29

COHEN & STEERS PREFERRED SECURITIES AND INCOME SMA SHARES, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

The investment advisor has contractually agreed to reimburse the Fund so that the total annual Fund operating expenses (excluding acquired fund fees and expenses, interest, taxes, extraordinary expenses, and other expenses approved by the Board of Directors) do not exceed 0.00%. This contractual agreement is currently expected to remain in place for the life of the Fund, can only be terminated by agreement of the Fund’s Board of Directors and the investment advisor, and will terminate automatically in the event of termination of the investment advisory agreement between the Fund and the investment advisor. For the year ended October 31, 2023, fees waived and/or expenses reimbursed totaled $402,971.