UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23395

Gabelli Innovations Trust

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

John C. Ball

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant's telephone number, including area code:1-800-422-3554

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

Gabelli Media Mogul Fund

Annual Report — September 30, 2022

Christopher J. Marangi

Co-Chief Investment Officer

BA, Williams College

MBA, Columbia

Business School

To Our Shareholders,

For the fiscal year ended September 30, 2022, the net asset value (NAV) total return per Class I Share of the Gabelli Media Mogul Fund was (36.1)% compared with a total return of (15.5)% for the Standard & Poor’s (S&P) 500 Index. Another class of shares is available. See page 3 for additional performance information.

Enclosed are the financial statements, including the schedule of investments, as of September 30, 2022.

Investment Objective and Strategy

The Fund invests in companies that are primarily engaged in the production, sale, and distribution of goods or services used in the media industry. Gabelli Media Mogul specifically focuses on companies spun-off from Liberty Media Corporation (Liberty Media) as constituted in 2001, as well as in companies that resulted from the subsequent mergers of any such spin-offs or stocks that track performance of such spin-offs or companies that resulted from subsequent mergers of any such spin-offs, and in public companies in which Liberty Media and its successor companies invest. The current investable universe includes U.S. and non-U.S. listed companies in the media industry.

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.gabelli.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Fund, you may call 800-422-3554 or send an email request to info@gabelli.com.

Performance Discussion (Unaudited)

The Fund’s focus on live entertainment generally benefitted the Fund in the fourth quarter of 2021, with motorsports league owner Formula One (+26%), concert promoter Live Nation (+31%), and Atlanta Braves baseball club owner Liberty Braves (+6%) all up on the prospect for a return to in-person event attendance. Liberty SiriusXM (+7%), the third member of the Liberty tracking group along with Formula One and Liberty Braves, rose as the company positioned itself to separate the trackers into two or three independent corporations. In contrast to the re-opening enthusiasm above, travel restrictions continued to weigh on TripAdvisor controlling shareholder Liberty TripAdvisor (-30%). Finally, U.S. cable stocks including Comcast Corp. (-10%), Charter Communications (-10%), and 26% Charter-owner Liberty Broadband (-7%) all declined after disclosing broadband subscriber growth would decelerate more than expected.

For the first quarter of 2022, enthusiasm for re-opening predominated as illustrated by strong performance from FormulaOne (+34%), Liberty Braves (+6%), and LiveNation Entertainment (+29%). For the reasons described above, Grupo Televisa (+7%) was the fourth largest contributor to returns. In spite of record free cash flow generation, cable stocks posted some of their worst returns in years. That included Liberty Broadband (C -22%, A -22%), its chief underlying asset Charter Communications (-25%), and Liberty Latin America (-27%).

Due to the cyclical sensitivity of advertising and the secular changes occurring in the way consumers pay for video, media stocks were among the weakest performers in the second quarter of 2022. This was reflected in the negative contributions of Warner Brothers Discovery (WBD) (-46%) and Paramount (-34%) as each firm invests in their direct-to-consumer video services and WBD juggles the integration of the recently acquired WBD/HBO assets. Liberty SiriusXM (-21%), whose primary asset is an 81% stake in subscription radio service SiriusXM (-7%), was impacted by concerns over the availability of new cars. The Fund’s cable holdings, including Charter Communications (-14%) and Liberty Broadband (-15%) declined less than the market during the quarter, but remained under pressure owing to concerns about incremental fiber and fixed wireless competition.

The third quarter of 2022 saw many of the same challenges from earlier in the year. For the first time in their history, U.S. cable companies reported broadband subscriber losses due to a combination of a COVID-related pull-forward of demand, a reduction in household moves, and new competition from fixed-wireless providers. Liberty Global (-25%), and the complex of Charter (-35%) and Liberty Broadband (-36%) remained the biggest detractors in the third quarter. One positive trend has been consumer demand for live entertainment and experiences, which we expect to remain unquenched even as inflation pressures household wallets.

The biggest contributors to performance for the fiscal year were Liberty Media Corp.-Liberty Formula One (6.3% of net assets as of September 30, 2022), Liberty Media Corp.-Liberty Braves (11.9%), and T-Mobile US Inc. (4.0%).

Detractors from performance included Liberty Global plc (7.3%), Liberty Broadband Corp. Cl. C (4.0%), and Qurate Retail Inc. (1.0%).

We appreciate your confidence and trust.

The views expressed reflect the opinions of the Fund’s portfolio manager and Gabelli Funds, LLC, the Adviser, as of the date of this report and are subject to change without notice based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Comparative Results

Average Annual Returns through September 30, 2022 (a)(b) (Unaudited)

Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses.

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception

(12/1/16)(c) | |

| Class I (MOGLX) | | (36.10 | )% | | (9.02 | )% | | (6.20 | )% | | (3.22 | )% | |

| S&P 500 Index (d) | | (15.47 | ) | | 8.16 | | | 9.24 | | | 10.80 | | |

| Class A (MLGLX) | | (36.18 | ) | | (9.06 | ) | | (6.23 | ) | | (3.24 | ) | |

| With sales charge (e) | | (39.85 | ) | | (10.83 | ) | | (7.33 | ) | | (4.22 | ) | |

| (a) | The Fund’s fiscal year ends on September 30. |

| (b) | Returns would have been lower had the Adviser not reimbursed certain expenses of the Fund. The Class I Share NAVs are used to calculate performance for the periods prior to the issuance of Class A Shares on May 17, 2022. The actual performance of the Class A shares would have been lower due to the additional fees and expenses associated with this class of shares. |

| (c) | Performance prior to the commencement of operations on April 1, 2019 is from the Predecessor Fund, Gabelli Media Mogul NextShares. |

| (d) | The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. |

| (e) | Performance results include the effect of the maximum 5.75% sales charge at the beginning of the period. |

In the current prospectus dated May 16, 2022, the expense ratios for Class A and I shares are 4.20% and 3.95%, respectively, and the net expense ratios for these share classes after contractual reimbursements by the Adviser are 1.18% and 0.93%, respectively. The contractual reimbursement is in effect through January 31, 2023.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.gabelli.com.

Returns represent past performance and do not guarantee future results. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.gabelli.com for performance information as of the most recent month end.

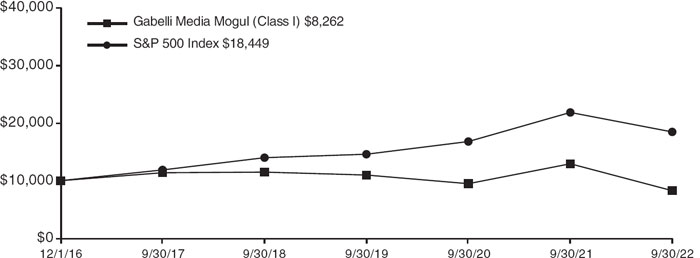

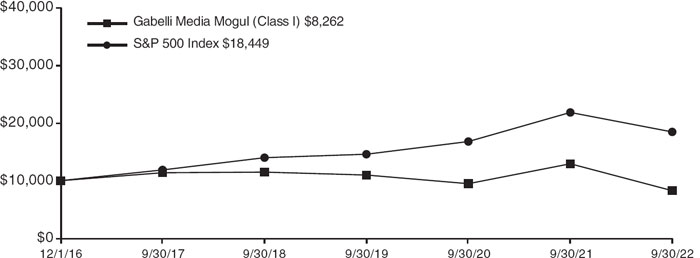

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE GABELLI MEDIA MOGUL

FUND CLASS I AND THE S&P 500 INDEX (Unaudited)

| Average Annual Total Returns* |

| | 1 Year | 5 Year | Since Inception |

| Class I | (36.10)% | (6.20)% | (3.22)% |

* Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Gabelli Media Mogul Fund

Disclosure of Fund Expenses (Unaudited)

| For the Six Month Period from April 1, 2022 through September 30, 2022 | Expense Table |

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return: This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’s actual return during the past six months, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return: This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this case – because the hypothetical return used is not the Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you

paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which are described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the fiscal year ended September 30, 2022.

| | | Beginning

Account Value

04/01/22 | | Ending

Account Value

09/30/22 | | Annualized

Expense

Ratio | | Expenses

Paid During

Period | |

| The Gabelli Media Mogul Fund | | | | | | | | |

| Actual Fund Return | | | | | | | | | | |

| Class A | | $1,000.00 | | $797.20 | | | 1.15 | % | | $3.85 | * | |

| Class I | | $1,000.00 | | $695.84 | | | 0.90 | % | | $3.83 | ** | |

| Hypothetical 5% Return | | | | | | | | | | |

| Class A | | $1,000.00 | | $1,019.30 | | | 1.15 | % | | $5.82 | ** | |

| Class I | | $1,000.00 | | $1,020.56 | | | 0.90 | % | | $4.56 | ** | |

| * | Expenses are equal to the Fund's annualized expense ratio since inception, multiplied by the average account value over the period, multiplied by the number of days in the period since inception May 17, 2022 through September 30, 2022 (137 days), then divided by 365. |

| ** | Expenses are equal to the Fund’s annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183 days), then divided by 365. |

Summary of Portfolio Holdings (Unaudited)

The following table presents portfolio holdings as a percent of net assets as of September 30, 2022:

Gabelli Media Mogul Fund

| Content Creation and Aggregation | 47.5% | | Telecommunications | 3.3 | % |

| Television and Broadband Services | 18.8% | | Entertainment | 2.7 | % |

| Digital Marketing and Retail | 7.3% | | Telecommunication Services | 2.4 | % |

| U.S. Government Obligations | 5.6% | | Other Assets and Liabilities (Net) | 3.1 | % |

| Wireless Telecommunication Services | 5.0% | | | 100.0 | % |

| Diversified Consumer Services | 4.3% | | | | |

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on Form N-PORT. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at 800-GABELLI (800-422-3554). The Fund’s Form N-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

The Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Fund’s proxy voting policies, procedures, and how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

Gabelli Media Mogul Fund

Schedule of Investments — September 30, 2022

| Shares | | | | | Cost | | | Market

Value | |

| | | | COMMON STOCKS — 84.9% | | | | | | |

| | | | | Content Creation and Aggregation — 47.5% |

| | 27,000 | | | comScore Inc.† | | $ | 71,159 | | | $ | 44,550 | |

| | 3,200 | | | DISH Network Corp., Cl. A† | | | 74,868 | | | | 44,256 | |

| | 18,000 | | | Grupo Televisa SAB, ADR | | | 207,243 | | | | 96,840 | |

| | 17,000 | | | Liberty Latin America Ltd., Cl. C† | | | 270,971 | | | | 104,550 | |

| | 15,500 | | | Liberty Media Acquisition Corp., Cl. A† | | | 156,334 | | | | 154,070 | |

| | 16,000 | | | Liberty Media Corp.- Liberty Braves, Cl. C† | | | 339,248 | | | | 440,000 | |

| | 4,450 | | | Liberty Media Corp.- Liberty Formula One, Cl. A† | | | 132,475 | | | | 233,714 | |

| | 5,900 | | | Liberty Media Corp.- Liberty SiriusXM, Cl. C† | | | 226,104 | | | | 222,489 | |

| | 1,000 | | | Live Nation Entertainment Inc.† | | | 27,236 | | | | 76,040 | |

| | 1,350 | | | Madison Square Garden Entertainment Corp.† | | | 94,318 | | | | 59,521 | |

| | 1,000 | | | Madison Square Garden Sports Corp.† | | | 153,071 | | | | 136,660 | |

| | 4,000 | | | Paramount Global, Cl. B | | | 119,708 | | | | 76,160 | |

| | 13,000 | | | Sirius XM Holdings Inc. | | | 68,341 | | | | 74,230 | |

| | | | | | | | 1,941,076 | | | | 1,763,080 | |

| | | | | Digital Marketing and Retail — 2.2% |

| | 40,000 | | | Liberty TripAdvisor Holdings Inc., Cl. A† | | | 136,980 | | | | 43,600 | |

| | 19,000 | | | Qurate Retail Inc., Cl. A | | | 159,068 | | | | 38,190 | |

| | | | | | | | 296,048 | | | | 81,790 | |

| | | | | Diversified Consumer Services — 4.3% |

| | 110 | | | Cie de L'Odet SE | | | 163,353 | | | | 124,192 | |

| | 600 | | | IAC Inc.† | | | 62,925 | | | | 33,228 | |

| | | | | | | | 226,278 | | | | 157,420 | |

| | | | | Entertainment — 2.7% |

| | 8,500 | | | Warner Bros Discovery Inc.† | | | 224,782 | | | | 97,750 | |

| | | | | | | | | | | | | |

| | | | | Telecommunication Services — 2.4% |

| | 3,300 | | | AT&T Inc. | | | 69,664 | | | | 50,622 | |

| | 5,000 | | | Telesat Corp.† | | | 150,129 | | | | 39,050 | |

| | | | | | | | 219,793 | | | | 89,672 | |

| | | | | Telecommunications — 3.3% |

| | 4,200 | | | Comcast Corp., Cl. A | | | 196,244 | | | | 123,186 | |

| | | | | | | | | | | | | |

| | | | | Television and Broadband Services — 17.5% |

| | 250 | | | Charter Communications Inc., Cl. A† | | | 63,214 | | | | 75,838 | |

| | 1,500 | | | Liberty Broadband Corp., Cl. A† | | | 152,814 | | | | 111,900 | |

| | 2,000 | | | Liberty Broadband Corp., Cl. C† | | | 142,651 | | | | 147,600 | |

| Shares | | | | | Cost | | | Market

Value | |

| | 16,500 | | | Liberty Global plc, Cl. C† | | $ | 448,633 | | | $ | 272,250 | |

| | 3,100 | | | Telenet Group Holding NV | | | 116,814 | | | | 42,868 | |

| | | | | | | | 924,126 | | | | 650,456 | |

| | | | | Wireless Telecommunication Services — 5.0% |

| | 4,000 | | | Radius Global Infrastructure Inc., Cl. A† | | | 56,600 | | | | 37,680 | |

| | 1,100 | | | T-Mobile US Inc.† | | | 104,388 | | | | 147,587 | |

| | | | | | | | 160,988 | | | | 185,267 | |

| | | | | TOTAL COMMON STOCKS | | | 4,189,335 | | | | 3,148,621 | |

| | | | | | | | | | | | | |

| | | | | PREFERRED STOCKS — 6.4% |

| | | | | Digital Marketing and Retail — 5.1% |

| | 4,115 | | | Qurate Retail Inc., 8.000%, 03/15/31 | | | 323,818 | | | | 187,397 | |

| | | | | | | | | | | | | |

| | | | | Television and Broadband Services — 1.3% |

| | 2,000 | | | Liberty Broadband Corp., Ser. A, 7.000% | | | 39,409 | | | | 49,840 | |

| | | | | | | | | | | | | |

| | | | | TOTAL PREFERRED STOCKS | | | 363,227 | | | | 237,237 | |

| | | | | | | | | | | | | |

| | | | | WARRANTS — 0.0% | | | | | | | | |

| | | | | Content Creation and Aggregation — 0.0% |

| | 3,100 | | | Liberty Media Acquisition Corp., expire 12/31/27† | | | 662 | | | | 13 | |

Principal

Amount | | | | | | | | | |

| | | | | U.S. GOVERNMENT OBLIGATIONS — 5.6% |

| $ | 210,000 | | | U.S. Treasury Bills, 2.976% to 3.124%††, 12/08/22 to 12/15/22 | | | 208,736 | | | | 208,832 | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 96.9% | | $ | 4,761,960 | | | | 3,594,703 | |

| | | | | Other Assets and Liabilities (Net) — 3.1% | | | | 115,058 | |

| | | | | NET ASSETS — 100.0% | | | | | | $ | 3,709,761 | |

| † | Non-income producing security. |

| †† | Represents annualized yields at dates of purchase. |

| ADR | American Depositary Receipt |

See accompanying notes to financial statements.

Gabelli Media Mogul Fund

Statement of Assets and Liabilities

September 30, 2022

| Assets: | | | |

| Investments, at value (cost $4,761,960) | | $ | 3,594,703 | |

| Cash | | | 57,276 | |

| Receivable for investments sold | | | 61,868 | |

| Receivable from Adviser | | | 56,797 | |

| Dividends receivable | | | 4,505 | |

| Prepaid expenses | | | 9,496 | |

| Total Assets | | | 3,784,645 | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 32,491 | |

| Payable for investment advisory fees | | | 3,361 | |

| Payable for distribution fees | | | 2 | |

| Payable for legal and audit fees | | | 25,967 | |

| Payable for shareholder communications | | | 12,088 | |

| Other accrued expenses | | | 975 | |

| Total Liabilities | | | 74,884 | |

| Net Assets | | | | |

| (applicable to 462,200 shares outstanding) | | $ | 3,709,761 | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 4,862,042 | |

| Total accumulated loss | | | (1,152,281 | ) |

| Net Assets | | $ | 3,709,761 | |

| | | | | |

| Shares of Beneficial Interest, issued and outstanding, no par value; unlimited number of shares authorized: | | | | |

| Class A: | | | | |

| Net Asset Value and redemption price per share ($7,809 ÷ 974 shares outstanding) | | $ | 8.02 | |

| Maximum offering price per share (NAV ÷ 0.9425, based on maximum sales charge of 5.75% of the offering price) | | $ | 8.51 | |

| Class I: | | | | |

| Net Asset Value, offering, and redemption price per share ($3,701,952 ÷ 461,226 shares outstanding) | | $ | 8.03 | |

Statement of Operations

For the Year Ended September 30, 2022

| Investment Income: | | | |

| Dividends (net of foreign withholding taxes of $784) | | $ | 76,232 | |

| Interest | | | 1,331 | |

| Total Investment Income | | | 77,563 | |

| Expenses: | | | | |

| Investment advisory fees | | | 50,398 | |

| Distribution fees - Class A | | | 9 | |

| Legal and audit fees | | | 62,071 | |

| Trustees’ fees | | | 41,619 | |

| Registration expenses | | | 39,792 | |

| Shareholder communications expenses | | | 33,557 | |

| Shareholder services fees | | | 3,871 | |

| Custodian fees | | | 929 | |

| Miscellaneous expenses | | | 9,497 | |

| Total Expenses | | | 241,743 | |

| Less: | | | | |

| Expense reimbursements (See Note 3) | | | (195,119 | ) |

| Expenses paid indirectly by broker (See Note 6) | | | (1,258 | ) |

| Total credits and reimbursements | | | (196,377 | ) |

| Net Expenses | | | 45,366 | |

| Net Investment Income | | | 32,197 | |

| Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency: | | | | |

| Net realized gain on investments | | | 158,251 | |

| Net realized loss on foreign currency transactions | | | (1,146 | ) |

| | | | | |

| Net realized gain on investments and foreign currency transactions | | | 157,105 | |

| Net change in unrealized appreciation/depreciation: | | | | |

| on investments | | | (2,301,991 | ) |

| on foreign currency translations | | | (483 | ) |

| | | | | |

| Net change in unrealized appreciation/depreciation | | | | |

| on investments and foreign currency translations | | | (2,302,474 | ) |

| Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency | | | (2,145,369 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (2,113,172 | ) |

See accompanying notes to financial statements.

Gabelli Media Mogul Fund

Statement of Changes in Net Assets

| | | Year Ended

September 30, 2022 | | | Year Ended

September 30, 2021 | |

| | | | | | | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 32,197 | | | $ | 13,194 | |

| Net realized gain on investments and foreign currency transactions | | | 157,105 | | | | 328,285 | |

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | (2,302,474 | ) | | | 1,096,382 | |

| Net Increase/(Decrease) in Net Assets Resulting from Operations | | | (2,113,172 | ) | | | 1,437,861 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Accumulated earnings | | | | | | | | |

| Class I | | | (115,394 | ) | | | (36,312 | ) |

| Total Distributions to Shareholders | | | (115,394 | ) | | | (36,312 | ) |

| | | | | | | | | |

| Shares of Beneficial Interest Transactions: | | | | | | | | |

| Class A | | | 9,796 | | | | — | |

| Class I | | | 320,767 | | | | 198,639 | |

| Net Increase in Net Assets from Shares of Beneficial Interest Transactions | | | 330,563 | | | | 198,639 | |

| | | | | | | | | |

| Net Increase/(Decrease) in Net Assets | | | (1,898,003 | ) | | | 1,600,188 | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 5,607,764 | | | | 4,007,576 | |

| End of year | | $ | 3,709,761 | | | $ | 5,607,764 | |

See accompanying notes to financial statements.

Gabelli Media Mogul Fund

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout each period:

| | | | | | Income (Loss) from Investment

Operations | | | Distributions | | | | | | | | | Ratios to Average Net Assets/Supplemental Data | |

Year Ended

September 30 (a) | | Net Asset Value,

Beginning of

Period | | | Net Investment

Income (Loss)(b) | | | Net Realized

and Unrealized

Gain (Loss) on

Investments | | | Total from

Investment

Operations | | | Net Investment

Income | | | Net Realized

Gain on

Investments | | | Total

Distributions | | | Net Asset Value,

End of Period | | | Total Return† | | | Net Assets, End

of Period (in

000’s) | | | Net Investment

Income (Loss) | | | Operating

Expenses Before

Reimbursement | | | Operating

Expenses Net of

Reimbursement | | | Portfolio

Turnover

Rate | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022(c) | | $ | 10.06 | | | $ | 0.01 | | | $ | (2.05 | ) | | $ | (2.04 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | 8.02 | | | | (20.28 | )% | | $ | 8 | | | 0.15 | %(d) | | 7.74 | %(d) | | 1.15 | %(d)(e) | | | 26 | % |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022 | | $ | 12.83 | | | $ | 0.07 | | | $ | (4.62 | ) | | $ | (4.55 | ) | | $ | (0.09 | ) | | $ | (0.16 | ) | | $ | (0.25 | ) | | $ | 8.03 | | | | (36.10 | )% | | $ | 3,702 | | | 0.64 | % | | 4.79 | % | | 0.90 | %(e) | | | 26 | % |

| 2021 | | | 9.48 | | | | 0.03 | (f) | | | 3.41 | | | | 3.44 | | | | (0.09 | ) | | | — | | | | (0.09 | ) | | | 12.83 | | | | 36.38 | | | | 5,608 | | | 0.25 | (f) | | 3.95 | | | 0.93 | (e) | | | 26 | |

| 2020 | | | 10.97 | | | | 0.13 | (g) | | | (1.62 | ) | | | (1.49 | ) | | | — | | | | — | | | | — | | | | 9.48 | | | | (13.58 | ) | | | 4,008 | | | 1.28 | (g) | | 4.86 | | | 0.90 | | | | 18 | |

| 2019 | | | 11.48 | | | | (0.04 | ) | | | (0.47 | ) | | | (0.51 | ) | | | — | | | | — | | | | — | | | | 10.97 | | | | (4.44 | ) | | | 4,653 | | | (0.39 | ) | | 4.12 | | | 0.90 | | | | 31 | |

| 2018 | | | 11.38 | | | | (0.06 | ) | | | 0.16 | | | | 0.10 | | | | — | | | | — | | | | — | | | | 11.48 | | | | 0.88 | | | | 5,738 | | | (0.54 | ) | | 3.43 | | | 0.90 | | | | 19 | |

| † | Total return represents aggregate total return of a hypothetical investment at the beginning of the year and sold at the end of the year including reinvestment of distributions and does not reflect the applicable sales charges. Total return for a period of less than one year is not annualized. |

| (a) | Information prior to April 1, 2019 is from Gabelli Media Mogul NextShares. |

| (b) | Per share amounts have been calculated using the average shares outstanding method. |

| (c) | Class A commenced on May 17, 2022. |

| (e) | The Fund received credits from a designated broker who agreed to pay certain Fund expenses. For fiscal years ended September 30, 2022 and 2021, if credits had not been received, the expense ratios would have been 1.22% (Class A) and 0.92% (Class I), and 0.95% (Class I), respectively. For the remaining fiscal years, there was no impact to the expense ratios. |

| (f) | Includes income resulting from special dividends. Without these dividends, the per share income (loss) amount would have been $(0.04) and the net investment income (loss) ratio would have been (0.32)%. |

| (g) | Includes income resulting from special dividends. Without these dividends, the per share income (loss) amount would have been $(0.04) and the net investment income (loss) ratio would have been (0.45)%. |

See accompanying notes to financial statements

Gabelli Media Mogul Fund

Notes to Financial Statements

1. Organization. The Gabelli Media Mogul Fund is a series of the Gabelli Innovations Trust that was organized on December 6, 2018 as a Delaware statutory trust and commenced investment operations on April 1, 2019. The Fund is a series successor to the Gabelli Media Mogul NextShares within the Gabelli NextShares Trust that was organized as a Delaware statutory trust on March 20, 2015 and commenced investment operations on December 1, 2016. The Fund is a non-diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act).

The Fund’s investment objective is capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in the media industry. Media industry companies are companies that are primarily engaged in the production, sale, and distribution of goods or services used in the media industry. Media industry companies are companies that derive at least 50% of their revenue from the production or distribution of information and entertainment content, and may include television and radio stations, motion picture companies, print publishing, and providers of internet content, as well as satellite service providers, cable service providers, and advertising service providers. The Fund will specifically invest in companies that were spun-off from Liberty Media Corporation (Liberty Media) as constituted in 2001, as well as in companies that resulted from subsequent mergers of any such spin-offs or stocks that track performance of such spin-offs or companies that resulted from subsequent mergers of any such spin-offs, and in public companies in which Liberty Media and its successor companies invest.

2. Significant Accounting Policies. As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (GAAP) that may require the use of management estimates and assumptions in the preparation of its financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

The global outbreak of the novel coronavirus disease, known as COVID-19, has caused adverse effects on many companies, sectors, nations, regions, and the markets in general, and may continue for an unpredictable duration. The effects of this pandemic may materially impact the value and performance of the Fund, its ability to buy and sell fund investments at appropriate valuations, and its ability to achieve its investment objectives.

Security Valuation. Portfolio securities listed or traded on a nationally recognized securities exchange or traded in the U.S. over-the-counter market for which market quotations are readily available are valued at the last quoted sale price or a market’s official closing price as of the close of business on the day the securities are being valued. If there were no sales that day, the security is valued at the average of the closing bid and asked prices or, if there were no asked prices quoted on that day, then the security is valued at the closing bid price on that day. If no bid or asked prices are quoted on such day, the security is valued at the most recently available price or, if the Board of Trustees (the Board) so determines, by such other method as the Board shall determine in good faith to reflect its fair market value. Portfolio securities traded on more than one national securities exchange or market are valued according to the broadest and most representative market, as determined by the Adviser.

Portfolio securities primarily traded on a foreign market are generally valued at the preceding closing values of such securities on the relevant market, but may be fair valued pursuant to procedures established by the Board if market conditions change significantly after the close of the foreign market, but prior to the close of business on the day the securities are being valued. Debt obligations for which market quotations are readily available are valued at the average of the latest bid and asked prices. If there were no asked prices quoted on such day,

Gabelli Media Mogul Fund

Notes to Financial Statements (Continued)

the security is valued using the closing bid price, unless the Board determines such amount does not reflect the securities’ fair value, in which case these securities will be fair valued as determined by the Board. Certain securities are valued principally using dealer quotations. Futures contracts are valued at the closing settlement price of the exchange or board of trade on which the applicable contract is traded. OTC futures and options on futures for which market quotations are readily available will be valued by quotations received from a pricing service or, if no quotations are available from a pricing service, by quotations obtained from one of more dealers in the instrument in question by the Adviser.

Securities and assets for which market quotations are not readily available are fair valued as determined by the Board. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial and non-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U.S. dollar value American Depositary Receipt securities at the close of the U.S. exchange; and evaluation of any other information that could be indicative of the value of the security.

The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

| ● | Level 1 — quoted prices in active markets for identical securities; |

| ● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

| ● | Level 3 — significant unobservable inputs (including the Board’s determinations as to the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in the aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Gabelli Media Mogul Fund

Notes to Financial Statements (Continued)

The summary of the Fund’s investments in securities by inputs used to value the Fund’s investments as of September 30, 2022 is as follows:

| | | | Valuation Inputs | | | | | |

| | | | Level 1 Quoted Prices | | | | Level 2 Other Significant Observable Inputs | | | | Total Market Value at 09/30/22 | |

| INVESTMENTS IN SECURITIES: | | | | | | | | | | | | |

| ASSETS (Market Value): | | | | | | | | | | | | |

| Common Stocks (a) | | $ | 3,148,621 | | | | — | | | $ | 3,148,621 | |

| Preferred Stocks (a) | | | 237,237 | | | | — | | | | 237,237 | |

| Warrants (a) | | | 13 | | | | — | | | | 13 | |

| U.S. Government Obligations | | | — | | | $ | 208,832 | | | | 208,832 | |

| TOTAL INVESTMENTS IN SECURITIES – ASSETS | | $ | 3,385,871 | | | $ | 208,832 | | | $ | 3,594,703 | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

The Fund held no Level 3 investments at September 30, 2022 or September 30, 2021.

Additional Information to Evaluate Qualitative Information.

General. The Fund uses recognized industry pricing services – approved by the Board and unaffiliated with the Adviser – to value most of its securities, and uses broker quotes provided by market makers of securities not valued by these and other recognized pricing sources. Several different pricing feeds are received to value domestic equity securities, international equity securities, preferred equity securities, and fixed income securities. The data within these feeds are ultimately sourced from major stock exchanges and trading systems where these securities trade. The prices supplied by external sources are checked by obtaining quotations or actual transaction prices from market participants. If a price obtained from the pricing source is deemed unreliable, prices will be sought from another pricing service or from a broker/dealer that trades that security or similar securities.

Fair Valuation. Fair valued securities may be common or preferred equities, warrants, options, rights, or fixed income obligations. Where appropriate, Level 3 securities are those for which market quotations are not available, such as securities not traded for several days, or for which current bids are not available, or which are restricted as to transfer. When fair valuing a security, factors to consider include recent prices of comparable securities that are publicly traded, reliable prices of securities not publicly traded, the use of valuation models, current analyst reports, valuing the income or cash flow of the issuer, or cost if the preceding factors do not apply. A significant change in the unobservable inputs could result in a lower or higher value in Level 3 securities. The circumstances of Level 3 securities are frequently monitored to determine if fair valuation measures continue to apply.

The Adviser reports quarterly to the Board the results of the application of fair valuation policies and procedures. These may include backtesting the prices realized in subsequent trades of these fair valued securities to fair values previously recognized.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments, and other assets and liabilities are translated into U.S. dollars at current exchange rates. Purchases and sales of investment securities, income, and expenses are translated at the exchange rate

Gabelli Media Mogul Fund

Notes to Financial Statements (Continued)

prevailing on the respective dates of such transactions. Unrealized gains and losses that result from changes in foreign exchange rates and/or changes in market prices of securities have been included in unrealized appreciation/depreciation on investments and foreign currency translations. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions, and the difference between the amounts of interest and dividends recorded on the books of the Fund and the amounts actually received. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase trade date and subsequent sale trade date is included in realized gain/(loss) on investments.

Foreign Securities. The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the inability to repatriate funds, less complete financial information about companies, and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Foreign Taxes. The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Restricted Securities. The Fund may invest up to 15% of its net assets in securities for which the markets are restricted. Restricted securities include securities whose disposition is subject to substantial legal or contractual restrictions. The sale of restricted securities often requires more time and results in higher brokerage charges or dealer discounts and other selling expenses than the sale of securities eligible for trading on national securities exchanges or in the over-the-counter markets. Restricted securities may sell at a price lower than similar securities that are not subject to restrictions on resale. Securities freely saleable among qualified institutional investors under special rules adopted by the SEC may be treated as liquid if they satisfy liquidity standards established by the Board. The continued liquidity of such securities is not as well assured as that of publicly traded securities, and accordingly the Board will monitor their liquidity. At September 30, 2022, the Fund did not hold any restricted securities.

Securities Transactions and Investment Income. Securities transactions are accounted for on the trade date with realized gain/(loss) on investments determined by using the identified cost method. Interest income (including amortization of premium and accretion of discount) is recorded on an accrual basis. Premiums and discounts on debt securities are amortized using the effective yield to maturity method or amortized to earliest call date, if applicable. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities that are recorded as soon after the ex-dividend date as the Fund becomes aware of such dividends.

Determination of Net Asset Value and Calculation of Expenses. Certain administrative expenses are common to, and allocated among, various affiliated funds. Such allocations are made on the basis of each fund’s average net assets or other criteria directly affecting the expenses as determined by the Adviser pursuant to procedures established by the Board.

Distributions to Shareholders. Distributions to shareholders are recorded on the ex-dividend date. Distributions to shareholders are based on income and capital gains as determined in accordance with federal income tax

Gabelli Media Mogul Fund

Notes to Financial Statements (Continued)

regulations, which may differ from income and capital gains as determined under GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities and foreign currency transactions held by the Fund, timing differences, and differing characterizations of distributions made by the Fund. Distributions from net investment income for federal income tax purposes include net realized gains on foreign currency transactions. These book/tax differences are either temporary or permanent in nature. Permanent differences were primarily due to the tax treatment of currency gains and losses. To the extent these differences are permanent, adjustments are made to the appropriate capital accounts in the period when the differences arise. These reclassifications have no impact on the NAV of the Fund.

The tax character of distributions paid during the fiscal years ended September 30, 2022 and 2021 was as follows:

| | | Year Ended

September 30, 2022 | | | Year Ended

September 30, 2021 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 40,847 | | | $ | 36,312 | |

| Net long term capital gains | | | 74,547 | | | | — | |

| Total distributions paid | | $ | 115,394 | | | $ | 36,312 | |

Provision for Income Taxes. The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the Code). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

At September 30, 2022, the components of accumulated earnings/losses on a tax basis were as follows:

| Undistributed ordinary income | | $ | 4,831 | |

| Undistributed long term capital gains | | | 45,078 | |

| Net unrealized depreciation on investments and foreign currency translations | | | (1,202,190 | ) |

| Total | | $ | (1,152,281 | ) |

The Fund utilized $34,848 of capital loss carryovers during the fiscal year ended September 30, 2022.

At September 30, 2022, the temporary differences between book basis and tax basis net unrealized depreciation on investments were primarily due to deferral of losses from wash sales for tax purposes.

The following summarizes the tax cost of investments and the related net unrealized depreciation at September 30, 2022:

| | Cost | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | Net Unrealized

Depreciation |

| Investments | $4,796,449 | $328,427 | $(1,530,173) | $(1,201,746) |

The Fund is required to evaluate tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Income tax and related interest and penalties would be recognized by the Fund as tax expense in the Statement of Operations if the tax positions were deemed not to meet the more-likely-than-not

Gabelli Media Mogul Fund

Notes to Financial Statements (Continued)

threshold. During the fiscal year ended September 30, 2022, the Fund did not incur any income tax, interest, or penalties. As of September 30, 2022, the Adviser has reviewed all open tax years and concluded that there was no impact to the Fund’s net assets or results of operations. The Fund’s federal and state tax returns for the prior three fiscal years remain open, subject to examination. On an ongoing basis, the Adviser will monitor the Fund’s tax positions to determine if adjustments to this conclusion are necessary.

3. Investment Advisory Agreement and Other Transactions. The Fund has entered into an investment advisory agreement (the Advisory Agreement) with the Adviser which provides that the Fund will pay the Adviser a fee, computed daily and paid monthly, at the annual rate of 1.00% of the value of its average daily net assets. In accordance with the Advisory Agreement, the Adviser provides a continuous investment program for the Fund’s portfolio, oversees the administration of all aspects of the Fund’s business and affairs, and pays the compensation of all Officers and Trustees of the Fund who are affiliated persons of the Adviser.

The Adviser has contractually agreed to waive its investment advisory fee and/or reimburse expenses to the extent necessary to maintain the total operating expenses (excluding brokerage costs, acquired fund fees and expenses, interest, taxes, and extraordinary expenses) until at least January 31, 2023 at no more than 1.15% and 0.90%, respectively, of Class A and Class I Shares’ average daily net assets. In addition, the Fund has agreed, during the three year period following any waiver or reimbursement by the Adviser, to repay such amount to the extent, that after giving the effect to the repayment, such adjusted annualized total operating expenses of the Fund would not exceed 1.15% and 0.90%, respectively, of Class A and Class I Shares’ average daily net assets. The agreement is renewable annually. At September 30, 2022, the cumulative amount which the Fund may repay the Adviser is $522,572.

| For the year ended September 30, 2020, expiring September 30, 2023 | | | $ | 168,496 | |

| For the year ended September 30, 2021, expiring September 30, 2024 | | | | 158,957 | |

| For the year ended September 30, 2022, expiring September 30, 2025 | | | | 195,119 | |

| | | | $ | 522,572 | |

4. Distribution Plan. The Fund’s Board has adopted a distribution plan (the Plan) for Class A Shares pursuant to Rule 12b-1 under the 1940 Act. Under the Class A Share Plan, payment is authorized to G.distributors, LLC (the Distributor), an affiliate of the Adviser, at an annual rate of 0.25% of the average daily net assets of Class A Shares, the annual limitation under the Plan. Such payments are accrued daily and paid monthly.

5. Portfolio Securities. Purchases and sales of securities during the fiscal year ended September 30, 2022, other than short term securities and U.S. Government obligations, aggregated $1,282,011 and $1,207,786, respectively.

6. Transactions with Affiliates and Other Arrangements. During the fiscal year ended September 30, 2022, the Fund paid $123 in brokerage commissions on security trades to G.research, LLC, an affiliate of the Adviser.

During the fiscal year ended September 30, 2022, the Fund received credits from a designated broker who agreed to pay certain Fund operating expenses. The amount of such expenses paid through this directed brokerage arrangement during this period was $1,258.

The cost of calculating the Fund’s NAV per share is a Fund expense pursuant to the Advisory Agreement. Under the sub-administration agreement with Bank of New York Mellon, the fees paid include the cost of calculating the Fund’s NAV. The Fund reimburses the Adviser for this service. The Adviser did not seek a reimbursement during the fiscal year ended September 30, 2022.

Gabelli Media Mogul Fund

Notes to Financial Statements (Continued)

The Trust pays retainer and per meeting fees to Trustees not affiliated with the Adviser, plus specified amounts to the Lead Trustee and Audit Committee Chairman. Trustees are also reimbursed for out of pocket expenses incurred in attending meetings. Trustees who are directors or employees of the Adviser or an affiliated company receive no compensation or expense reimbursement from the Fund.

7. Significant Shareholder. As of September 30, 2022, approximately 71.13% of the Fund was beneficially owned by the Adviser and its affiliates, including managed accounts for which the affiliates of the Adviser have voting control but disclaim pecuniary interest.

8. Shares of Beneficial Interest. The Fund offers two classes of shares – Class A Shares and Class I Shares. Class A Shares are subject to a maximum front-end sales charge of 5.75%. Class I Shares are offered without a sales charge.

The Fund imposes a redemption fee of 2.00% on all classes of shares that are redeemed or exchanged on or before the seventh day after the date of a purchase. The redemption fee is deducted from the proceeds otherwise payable to the redeeming shareholders and is retained by the Fund as an increase in paid-in capital. The redemption fees retained by the Fund during the fiscal years ended September 30, 2022 and 2021, if any, can be found in the Statement of Changes in Net Assets under Redemption Fees.

Transactions in shares of beneficial interest were as follows:

| | | Period Ended

September 30, 2022 | | | Year Ended

September 30, 2021 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Class A* | | | | | | | | | | | | | | | | |

| Shares sold | | | 974 | | | $ | 9,796 | | | | — | | | $ | — | |

| Shares issued upon reinvestment of distributions | | | — | | | | — | | | | — | | | | — | |

| Shares redeemed | | | — | | | | — | | | | — | | | | — | |

| Net increase | | | 974 | | | $ | 9,796 | | | | — | | | $ | — | |

| Class I | | | | | | | | | | | | | | | | |

| Shares sold | | | 41,068 | | | $ | 528,965 | | | | 26,725 | | | $ | 350,001 | |

| Shares issued upon reinvestment of distributions | | | 9,470 | | | | 115,347 | | | | 3,250 | | | | 36,271 | |

| Shares redeemed | | | (26,324 | ) | | | (323,545 | ) | | | (15,571 | ) | | | (187,633 | ) |

| Net increase | | | 24,214 | | | $ | 320,767 | | | | 14,404 | | | $ | 198,639 | |

* Class A shares were first offered on May 17, 2022.

9. Indemnifications. The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

10. Subsequent Events. Management has evaluated the impact on the Fund of all subsequent events occurring through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

Gabelli Media Mogul Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Gabelli Innovations Trust and Shareholders of Gabelli Media Mogul Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Gabelli Media Mogul Fund (one of the funds constituting Gabelli Innovations Trust, referred to hereafter as the "Fund") as of September 30, 2022, the related statement of operations for the year ended September 30, 2022, the statement of changes in net assets for each of the two years in the period ended September 30, 2022, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended September 30, 2022 and the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2022 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

New York, New York

November 23, 2022

We have served as the auditor of one or more investment companies in the Gabelli Fund Complex since 1986.

Gabelli Media Mogul Fund

Liquidity Risk Management Program (Unaudited)

In accordance with Rule 22e-4 under the 1940 Act, the Fund has established a liquidity risk management program (the LRM Program) to govern its approach to managing liquidity risk. The LRM Program is administered by the Liquidity Committee (the Committee), which is comprised of members of Gabelli Funds, LLC management. The Board has designated the Committee to administer the LRM Program.

The LRM Program’s principal objectives include supporting the Fund’s compliance with limits on investments in illiquid assets and mitigating the risk that the Fund will be unable to meet its redemption obligations in a timely manner. The LRM Program also includes elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the Fund’s liquidity and the monthly classification and re-classification of certain investments that reflect the Committee’s assessment of their relative liquidity under current market conditions.

At a meeting of the Board held on August 16, 2022, the Board received a written report from the Committee regarding the design and operational effectiveness of the LRM Program. The Committee determined, and reported to the Board, that the LRM Program is reasonably designed to assess and manage the Fund’s liquidity risk and has operated adequately and effectively since its implementation. The Committee reported that there were no liquidity events that impacted the Fund or its ability to timely meet redemptions without dilution to existing shareholders. The Committee noted that the Fund is primarily invested in highly liquid securities and, accordingly, continues to be exempt from the requirement to determine a “highly liquid investment minimum” as defined in the Rule 22e-4. Because of that continued qualification for the exemption, the Fund has not adopted a “highly liquid investment minimum” amount. The Committee further noted that while changes to the LRM Program were made during the Review Period and reported to the Board, no material changes were made to the LRM Program as a result of the Committee’s annual review.

There can be no assurance that the LRM Program will achieve its objectives in the future. Please refer to the Fund’s Prospectus for more information regarding its exposure to liquidity risk and other principal risks to which an investment in the Fund may be subject.

Gabelli Media Mogul Fund

Additional Fund Information (Unaudited)

The business and affairs of the Trust are managed under the direction of the Board of Trustees. Information pertaining to the Trustees and Officers of the Trust is set forth below. The Trust’s Statement of Additional Information includes additional information about the Trustees and is available without charge, upon request, by calling 800-GABELLI (800- 422-3554) or by writing to Gabelli Media Mogul Fund at One Corporate Center, Rye, NY 10580-1422.

Name, Position(s)

Address1

and Age | | Term of Office

and

Length of

Time Served2 | | Number of

Funds

in Fund

Complex

Overseen

by Trustee3 | | Principal Occupation(s)

During Past Five Years | | Other Directorships

Held by Trustee3 |

| INTERESTED TRUSTEE4: | | | | | | | | |

| | | | | | | | | |

Mario J. Gabelli, CFA Chairman Age: 80 | | Since 2019 | | 31 | | Chairman, Chief Executive Officer, and Chief Investment Officer– Value Portfolios of GAMCO Investors, Inc. and Chief Investment Officer – Value Portfolios of Gabelli Funds, LLC and GAMCO Asset Management, Inc.; Director/Trustee or Chief Investment Officer of other registered investment companies within the Gabelli Fund Complex; Chief Executive Officer of GGCP, Inc.; Executive Chairman of Associated Capital Group, Inc. | | Director of Morgan Group Holding, Co. (holding company) (2001-2019); Chairman of the Board and Chief Executive Officer of LICT Corp. (multimedia and communication services company); Director of CIBL, Inc. (broadcasting and wireless communications); Director of ICTC Group Inc. (communications) (2013-2018) |

| INDEPENDENT TRUSTEES5: | | | | | | | | |

| | | | | | | | | |

Anthony S. Colavita6 Trustee Age: 61 | | Since 2019 | | 22 | | Attorney, Anthony S. Colavita, P.C., Supervisor, Town of Eastchester, NY | | — |

| | | | | | | | | |

Frank J. Fahrenkopf, Jr.6 Trustee Age: 83 | | Since 2019 | | 11 | | Co-Chairman of the Commission on Presidential Debates; Former President and Chief Executive Officer of the American Gaming Association (1995-2013); Former Chairman of the Republican National Committee (1983-1989) | | Director of First Republic Bank (banking); Director of Eldorado Resorts, Inc. (casino entertainment company) |

| | | | | | | | | |

Michael J. Melarkey Trustee Age: 72 | | Since 2019 | | 23 | | Of Counsel in the law firm of McDonald Carano Wilson LLP; Partner in the law firm of Avansino, Melarkey, Knobel, Mulligan & McKenzie (1980-2015) | | Chairman of Southwest Gas Corporation (natural gas utility) |

| | | | | | | | | |

Kuni Nakamura Trustee Age: 54 | | Since 2019 | | 36 | | President of Advanced Polymer, Inc. (chemical manufacturing company); President of KEN Enterprises, Inc. (real estate); Trustee on Long Island University Board of Trustees; Trustee on Fordham Preparatory School Board of Trustees | | — |

Gabelli Media Mogul Fund

Additional Fund Information (Unaudited) (Continued)

Name, Position(s)

Address1

and Age | | Term of Office

and

Length of

Time Served2 | | Number of

Funds

in Fund

Complex

Overseen

by Trustee3 | | Principal Occupation(s)

During Past Five Years | | Other Directorships

Held by Trustee3 |

Salvatore M. Salibello Trustee Age: 77 | | Since 2019 | | 6 | | Senior Partner of Bright Side Consulting (consulting); Certified Public Accountant and Managing Partner of the certified public accounting firm of Salibello & Broder LLP (1978-2012); Partner of BDO Seidman, LLP (2012-2013) | | Director of Nine West, Inc. (consumer products) (2002- 2014); Director of LICT Corp. (Telecommunications) |

Gabelli Media Mogul Fund

Additional Fund Information (Unaudited) (Continued)

Name, Position(s) Address1 and Age | | Term of Office and Length of Time Served2 | | Principal Occupation(s)

During Past Five Years |

| OFFICERS: | | | | |

| | | | | |

John C. Ball President and Treasurer Age: 46 | | Since 2019 | | Officer of registered investment companies within the Gabelli Fund Complex since 2017; Vice President and Assistant Treasurer of AMG Funds, 2014-2017; Chief Executive Officer, G.distributors, LLC since December 2020 |

| | | | | |

Peter Goldstein Secretary and Vice President Age: 69 | | Since 2020 | | General Counsel, GAMCO Investors, Inc. and Chief Legal Officer, Associated Capital Group, Inc. since 2021; General Counsel and Chief Compliance Officer, Buckingham Capital Management, Inc. (2012-2020); Chief Legal Officer and Chief Compliance Officer, The Buckingham Research Group, Inc. (2012-2020) |

| | | | | |

Richard J. Walz Chief Compliance Officer Age: 63 | | Since 2019 | | Chief Compliance Officer of registered investment companies within the Gabelli Fund Complex since 2013 |

| | | | | |

Bethany A. Uhlein Assistant Vice President Age: 32 | | Since 2019 | | Vice President and/or Ombudsman of closed-end funds within the Gabelli Fund Complex since 2017; Senior Vice President (since 2021) of GAMCO Investors, Inc. |

| 1 | Address: One Corporate Center, Rye, NY 10580-1422, unless otherwise noted. |

| 2 | Each Trustee will hold office for an indefinite term until the earliest of (i) the next meeting of shareholders, if any, called for the purpose of considering the election or re-election of such Trustee and until the election and qualification of his or her successor, if any, elected at such meeting, or (ii) the date a Trustee resigns or retires, or a Trustee is removed by the Board of Trustees or shareholders, in accordance with the Trust’s By-Laws and Declaration of Trust. Each officer will hold office for an indefinite term until the date he or she resigns or retires or until his or her successor is elected and qualified. |

| 3 | This column includes only directorships of companies required to report to the SEC under the Securities Exchange Act of 1934, as amended, i.e., public companies, or other investment companies registered under the 1940 Act. |

| 4 | “Interested person” of the Fund as defined in the 1940 Act. Mr. Gabelli is considered an “interested person” because of his affiliation with the Trust’s Adviser. |

| 5 | Trustees who are not considered to be “interested persons” of a Fund as defined in the 1940 Act are considered to be Independent Trustees. |

| 6 | Mr. Colavita’s father, Anthony J. Colavita, and Mr. Fahrenkopf’s daughter, Leslie F. Foley, each serve as a director of several funds which are part of the Fund Complex. |

GABELLI MEDIA MOGUL FUND

2022 TAX NOTICE TO SHAREHOLDERS (Unaudited)

During the fiscal year ended September 30, 2022, the Fund paid to shareholders ordinary income distributions totaling $0.0903 per share for Class I and long term capital gains totaling $74,547 or the maximum allowable. For the fiscal year ended September 30, 2022, 100% of the ordinary income distribution qualifies for the dividends received deduction available to corporations. The Fund designates 100% of the ordinary income distribution as qualified dividend income pursuant to the Jobs and Growth Tax Relief Reconciliation Act of 2003. The Fund designates 1.15% of the ordinary income distribution as qualified interest income pursuant to the Tax Relief, Unemployment Reauthorization, and Job Creation Act of 2010.

U.S. Government Income:

The percentage of the ordinary income distribution paid by the Fund during the fiscal year ended September 30, 2022 which was derived from U.S. Treasury securities was 1.16%. Such income is exempt from state and local tax in all states. However, many states, including New York and California, allow a tax exemption for a portion of the income earned only if a mutual fund has invested at least 50% of its assets at the end of each quarter of the Fund’s fiscal year in U.S. Government securities. The Gabelli Media Mogul Fund did not meet this strict requirement in 2022. The percentage of U.S. Government securities held as of September 30, 2022 was 5.6%. Due to the diversity in state and local tax law, it is recommended that you consult your personal tax adviser as to the applicability of the information provided to your specific situation.

All designations are based on financial information available as of the date of this annual report and, accordingly, are subject to change. For each item, it is the intention of the Fund to designate the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

Gabelli Funds and Your Personal Privacy

Who are we?

The Gabelli Funds are investment companies registered with the Securities and Exchange Commission under the Investment Company Act of 1940. We are managed by Gabelli Funds, LLC, which is affiliated with GAMCO Investors, Inc., a publicly held company with subsidiaries and affiliates that provide investment advisory services for a variety of clients.

What kind of non-public information do we collect about you if you become a fund shareholder?

If you apply to open an account directly with us, you will be giving us some non-public information about yourself. The non-public information we collect about you is:

| ● | Information you give us on your application form. This could include your name, address, telephone number, social security number, bank account number, and other information. |

| ● | Information about your transactions with us, any transactions with our affiliates, and transactions with the entities we hire to provide services to you. This would include information about the shares that you buy or redeem. If we hire someone else to provide services — like a transfer agent — we will also have information about the transactions that you conduct through them. |

What information do we disclose and to whom do we disclose it?

We do not disclose any non-public personal information about our customers or former customers to anyone other than our affiliates, our service providers who need to know such information, and as otherwise permitted by law. If you want to find out what the law permits, you can read the privacy rules adopted by the Securities and Exchange Commission. They are in volume 17 of the Code of Federal Regulations, Part 248. The Commission often posts information about its regulations on its website, www. sec.gov.

What do we do to protect your personal information?

We restrict access to non-public personal information about you to the people who need to know that information in order to provide services to you or the fund and to ensure that we are complying with the laws governing the securities business. We maintain physical, electronic, and procedural safeguards to keep your personal information.

This page was intentionally left blank.

This page was intentionally left blank.

GABELLI MEDIA MOGUL FUND

One Corporate Center

Rye, NY 10580-1422

Portfolio Manager’s Biography

Christopher J. Marangi joined Gabelli in 2003 as a research analyst. Currently he is a Managing Director and Co-Chief Investment Officer for GAMCO Investors, Inc.’s Value team. In addition, he serves as a portfolio manager of Gabelli Funds, LLC and manages several funds within the Fund Complex. Mr. Marangi graduated magna cum laude and Phi Beta Kappa with a BA in Political Economy from Williams College and holds an MBA degree with honors from Columbia Business School.

Gabelli Innovations Trust

GABELLI MEDIA MOGUL FUND

One Corporate Center

Rye, New York 10580-1422

| t | 800-GABELLI (800-422-3554) |

GABELLI.COM

Net Asset Values per share available daily

by calling 800-GABELLI after 7:00 P.M.

| BOARD OF TRUSTEES | OFFICERS |

| Mario J. Gabelli, CFA | John C. Ball |

| Chairman and | President and Treasurer |

| Chief Executive Officer, | |

| GAMCO Investors, Inc. | Peter Goldstein |

| Executive Chairman, | Secretary and Vice President |

| Associated Capital Group Inc. | |

| | Richard J. Walz |

| Anthony S. Colavita | Chief Compliance Officer |

| President, | |

| Anthony S. Colavita, P.C. | Bethany A. Uhlein |

| | Assistant Vice President |

| Frank J. Fahrenkopf, Jr. | |

| Former President and | DISTRIBUTOR |

| Chief Executive Officer, | G.distributors, LLC |

| American Gaming Association | |

| | CUSTODIAN |

| Michael J. Melarkey | The Bank of New York |

| Of Counsel, | Mellon |

| McDonald Carano Wilson LLP | |

| | TRANSFER AGENT AND |

| Kuni Nakamura | DIVIDEND DISBURSING |

| President, | AGENT |

| Advanced Polymer, Inc. | DST Asset Manager |

| | Solutions, Inc. |

| Salvatore M. Salibello | |

| Senior Partner, | LEGAL COUNSEL |

| Bright Side Consulting | Paul Hastings LLP |

This report is submitted for the general information of the shareholders of Gabelli Media Mogul Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

GAB2993Q322AR

Gabelli Pet Parents’TM Fund

Annual Report — September 30, 2022

Daniel M. Miller

Portfolio Manager

GAMCO Investors

BS, University of Miami

To Our Shareholders,

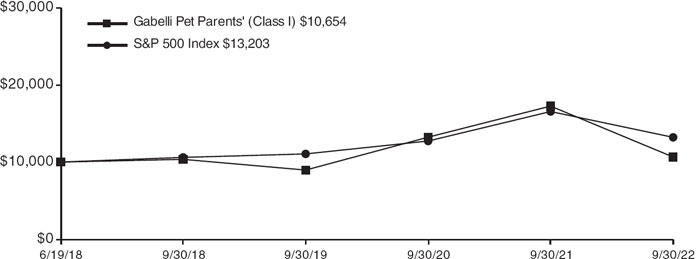

For the fiscal year ended September 30, 2022, the net asset value (NAV) total return per Class I Share of the Gabelli Pet Parents’TM Fund was (38.2)% compared with a total return of (15.5)% for the Standard & Poor’s (S&P) 500 Index. Another class of shares is available. See page 3 for additional performance information.

Enclosed are the financial statements, including the schedule of investments, as of September 30, 2022.

Investment Objective and Strategy

The Fund invests in companies in the pet industry. This includes companies that offer services and products for pets and pet owners (Pet Parents), manufacturers and distributors of pet food, pet supplies, veterinary pharmaceuticals, veterinary wellness, veterinary and other pet services, pet equipment, pet toys, and products and services that support Pet Parents regarding their pet activities. The portfolio manager’s investment philosophy with respect to equity securities is to identify assets that are selling in the public market at a discount to their private market value (PMV). The portfolio manager defines PMV as the value informed purchasers are willing to pay to acquire assets with similar characteristics.

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.gabelli.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Fund, you may call 800-422-3554 or send an email request to info@gabelli.com.

Performance Discussion (Unaudited)

While the global pet economy continues its growth trajectory, the Gabelli Pet Parents Fund (PETZX) decreased 11.2% during the first six months of our fiscal year ending March 31, 2022. While our mandate is to primarily invest in “pure play” pet firms, we were able to moderate our exposure to lofty valuations through exposure to consumer firms with more diversified end markets, including CVS and Nestle, and by holding approximately 13% of the Fund’s AUM in cash. The global pet economy has grown to nearly $250 billion on the heels of pandemic-induced record adoptions and fostering, up double-digits in each of the last two years. Spending is expected to reach $350 billion by 2027, driven by strong industry fundamentals that include an increased pet population, a trend towards healthier diets, innovative medical diagnostics and treatments, and new technologies. Given the important role that pets have come to play in our emotional well-being, particularly in a work-from-home environment that appears increasingly likely to persist, we expect increased investment in diagnostics, mobile technology, and more convenient veterinary solutions.

The Fund decreased 17.3% net of fees and expenses in the quarter ending June 30, 2022, compared to a decrease of 20.8% for the Russell 3000. While growth in the global pet economy accelerated in 2020 and 2021, the industry is now coping with high inflation, rising interest rates and disruptions in the supply chain. Threat of a recession is driving higher pricing discounts, with the corresponding business uncertainly contributing to a significant contraction on the multiples investors were willing to pay in recent months.