As filed with the Securities and Exchange Commission on December 14, 2021

Registration No. 333-258978

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM S-1

AMENDMENT NO. 3 TO

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________

Microvast Holdings, Inc.

(Exact name of registrant as specified in its charter)

__________________

Delaware | 6770 | 83-2530757 | ||

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

12603 Southwest Freeway, Suite 210

Stafford, Texas 77477

(281) 491-9505

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

__________________

Yanzhuan Zheng

Chief Financial Officer

Microvast Holdings, Inc.

12603 Southwest Freeway, Suite 210

Stafford, Texas 77477

(281) 491-9505

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________

With copies to: | With copies to: |

__________________

Approximate date of commencement of proposed sale to the public: From time to time on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||||

Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling securityholders may sell or distribute the securities described herein until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 14, 2021

PRELIMINARY PROSPECTUS

Microvast Holdings, Inc.

321,460,085 Shares of Common Stock

837,000 Warrants to Purchase Common Stock

__________________

This prospectus relates to: (1) the issuance by us of up to 27,600,000 shares of our common stock, par value $0.0001 per share (“common stock”) that may be issued upon exercise of public warrants (as defined below) to purchase common stock at an exercise price of $11.50 per share of common stock and (2) the offer and sale, from time to time, by the selling holders identified in this prospectus (the “Selling Holders”), or their permitted transferees, of (i) up to 293,860,085 shares of common stock and (ii) up to 837,000 private warrants (each as defined below).

Microvast Holdings, Inc. is a Delaware corporation that is a holding company. As a holding company with no material operations of our own, our operations are conducted through our subsidiaries, including subsidiaries based in China. References to “we,” “us,” “our” and the “Company” refer to Microvast Holdings, Inc. and our subsidiaries, taken as a whole. All securities being offered pursuant to this prospectus are securities of the Delaware holding company, and accordingly no investor will acquire a direct interest in any of the equity securities of our subsidiaries. To date, no subsidiary has made dividends or distributions to the Company.

A substantial portion of our facilities are currently located in the People’s Republic of China, which we refer to as the “PRC” or “China”.

INVESTING IN OUR COMMON STOCK INVOLVES SUBSTANTIAL RISKS, INCLUDING RISKS RELATED TO THE FACT THAT WE ARE A HOLDING COMPANY WITH NO MATERIAL OPERATIONS OF OUR OWN AND THAT WE CONDUCT A SUBSTANTIAL MAJORITY OF OUR OPERATIONS THROUGH OUR OPERATING ENTITIES ESTABLISHED IN THE PRC. RECENT REGULATORY DEVELOPMENTS IN CHINA, IN PARTICULAR WITH RESPECT TO RESTRICTIONS ON CHINA-BASED COMPANIES RAISING CAPITAL OFFSHORE, AND THE GOVERNMENT-LED CYBER SECURITY REVIEWS OF CERTAIN COMPANIES WITH VIE STRUCTURES, MAY LEAD TO ADDITIONAL REGULATORY REVIEW IN CHINA OVER THE CONDUCT OF OUR BUSINESS AND OUR FINANCING AND CAPITAL RAISING ACTIVITIES IN THE UNITED STATES.

THE CENTRAL AND LOCAL PRC GOVERNMENTS CONTINUE TO EXERCISE A SUBSTANTIAL DEGREE OF CONTROL AND INFLUENCE OVER BUSINESSES OPERATING IN CHINA. SUCH INFLUENCE AND CONTROL CAN BE EXERTED IN NUMEROUS WAYS, INCLUDING BY MEANS OF POLICIES IN RESPECT OF THE APPROVALS AND PERMITS REQUIRED TO OPERATE IN CHINA OR OWN A SUBSIDIARY IN CHINA, CONTROL OVER OFFERINGS CONDUCTED OVERSEAS AND/OR FOREIGN INVESTMENT IN CHINA-BASED ISSUERS, CONTROL OVER DATA SECURITY, PREFERENTIAL TREATMENTS SUCH AS TAX INCENTIVES, ELECTRICITY PRICING, AND SAFETY, ENVIRONMENTAL AND QUALITY CONTROL. IF THE PRC GOVERNMENT CHANGES ITS CURRENT POLICIES, OR THE INTERPRETATION OF THOSE POLICIES THAT ARE CURRENTLY BENEFICIAL TO US, WE MAY FACE PRESSURE ON OUR OPERATIONS AND OUR ABILITY TO GENERATE REVENUE OR MAXIMIZE OUR PROFITABILITY, OR WE MAY EVEN BE UNABLE TO CONTINUE TO OPERATE IN CHINA OR OFFER OR CONTINUE TO OFFER SECURITIES, ALL OF WHICH IN TURN COULD CAUSE THE VALUE OF OUR SECURITIES TO SIGNIFICANTLY DECLINE OR BE WORTHLESS.

PLEASE SEE “RISKS RELATED TO DOING BUSINESS IN THE PRC” FOR A LIST OF RISK FACTORS ASSOCIATED WITH OUR SUBSIDIARIES’ OPERATIONS IN CHINA AND THE FACT THAT SUCH RISKS COULD SIGNIFICANTLY AND ADVERSELY AFFECT OUR BUSINESS, OPERATIONS AND PROFITABILITY AND ACCORDINGLY THE VALUE OF OUR COMMON STOCK.

This prospectus provides you with a general description of such securities and the general manner in which we and the Selling Holders may offer or sell the securities. More specific terms of any securities that we and the Selling Holders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

We will not receive any proceeds from the sale of shares of common stock or warrants by the Selling Holders pursuant to this prospectus or of the shares of common stock by us pursuant to this prospectus, except with respect to amounts received by us upon exercise of the warrants to the extent such warrants are exercised for cash. However, we will pay the expenses, other than underwriting discounts and commissions, associated with the sale of securities pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Holders will issue, offer or sell, as applicable, any of the securities. The Selling Holders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information in the section entitled “Plan of Distribution.”

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

Our common stock and warrants are traded on the Nasdaq Capital Market (“NASDAQ”) under the symbols “MVST,” and “MVSTW”, respectively. On [December __], 2021, the closing price of our common stock was $___ per share, and the closing price of our warrants was $____ per warrant.

We are an “emerging growth company,” as that term is defined under the federal securities laws and, as such, are subject to certain reduced public company reporting requirements.

Investing in our securities involves risks. See “Risk Factors” beginning on page [19] and in any applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December , 2021.

TABLE OF CONTENTS

PAGE | ||

ii | ||

iv | ||

v | ||

vi | ||

1 | ||

17 | ||

19 | ||

67 | ||

67 | ||

68 | ||

72 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND | 89 | |

109 | ||

112 | ||

125 | ||

131 | ||

134 | ||

135 | ||

139 | ||

147 | ||

149 | ||

155 | ||

155 | ||

155 | ||

F-1 |

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we and the Selling Holders may, from time-to-time, issue, offer and sell, as applicable, any combination of the securities described in this prospectus in one or more offerings. We may use the shelf registration statement to issue up to an aggregate of 27,600,000 shares of common stock upon exercise of the public warrants. The Selling Holders may use the shelf registration statement to sell up to an aggregate of 293,860,085 shares of common stock and up to 837,000 warrants from time-to-time through any means described in the section entitled “Plan of Distribution.” More specific terms of any securities that the Selling Holders offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the common stock or warrants being offered and the terms of the offering.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

Neither we nor the Selling Holders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Holders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

On July 23, 2021 (the “Closing Date”), the registrant, Microvast Holdings, Inc. (formerly known as Tuscan Holdings Corp.) consummated the previously announced acquisition of Microvast, Inc., a Delaware corporation (“Microvast”), pursuant to the Agreement and Plan of Merger (the “Merger Agreement”) dated February 1, 2021, between the Tuscan Holdings Corp., Microvast and TSCN Merger Sub Inc., a Delaware corporation (“Merger Sub”), pursuant to which Merger Sub merged with and into Microvast, with Microvast surviving the merger (the “Merger”). Unless the context otherwise requires, “Tuscan” refers to the registrant prior to the Closing, and “we,” “us,” “our” and the “Company” refer to the registrant and its subsidiaries, including Microvast, following the Closing.

In connection with the Merger Agreement, Tuscan, MVST SPV Inc., a wholly owned subsidiary of Tuscan (“MVST SPV”), Microvast, Microvast Power System (Huzhou) Co., Ltd., our majority owned subsidiary (“MPS”), certain MPS convertible loan investors (the “CL Investors”) and certain minority equity investors in MPS (the “Minority Investors” and, together with the CL Investors, the “MPS Investors”) and certain other parties entered into a framework agreement (the “Framework Agreement”), pursuant to which, among other things, (1) the CL Investors waived certain rights with respect to the convertible loans (the “Convertible Loans”) held by such CL Investors that were issued under that certain Convertible Loan Agreement, dated November 2, 2018, among Microvast, MPS, such CL Investors and the MPS Investors (the “Convertible Loan Agreement”) and, in connection therewith, certain

ii

affiliates of the CL Investors (“CL Affiliates”) subscribed for 6,719,845 shares of common stock, $0.0001 par value per share (“common stock”), of Tuscan in a private placement in exchange for MPS convertible loans (the “CL Private Placement”).

In connection with the Merger Agreement, Tuscan entered into subscription agreements with (a) the holders of an aggregate of $57,500,000 outstanding promissory notes issued by Microvast (the “Bridge Notes”) pursuant to which Tuscan agreed to issue an aggregate of 6,736,106 shares of common stock upon conversion (the “Bridge Notes Conversion”) of the Bridge Notes, and (b) a number of outside investors who agreed to purchase an aggregate of 48,250,000 shares of common stock at a price of $10.00 per share, for an aggregate purchase price of $482,500,000 (the “PIPE Financing”).

The CL Private Placement, the Bridge Notes Conversion and the PIPE Financing closed contemporaneously with the closing under the Merger Agreement (collectively, the “Closing”). Upon the Closing of the Merger, the CL Private Placement, the Bridge Notes Conversion, the PIPE Financing and related transactions (collectively, the “Business Combination”), Microvast became a wholly-owned subsidiary of the Company, with the stockholders of Microvast becoming stockholders of the Company, and the Company changed its name to “Microvast Holdings, Inc.”

iii

MARKET, RANKING AND OTHER INDUSTRY DATA

Certain market, ranking and industry data included in this prospectus, including the size of certain markets, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate, which, in each case, we believe are reliable.

We are responsible for all of the disclosure in this prospectus and while we believe the data from these sources to be accurate and complete, we have not independently verified data from these sources or obtained third-party verification of market share data and this information may not be reliable. In addition, these sources may use different definitions of the relevant markets. Data regarding our industry is intended to provide general guidance, but is inherently imprecise. Market share data is subject to change and cannot always be verified with certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares.

Assumptions and estimates of our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk factors — Risks Related to Our Business.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Statement Regarding Forward-Looking Statements.”

iv

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus contains some of our trademarks, service marks and trade names. Each one of these trademarks, service marks or trade names is either (1) our registered trademark, (2) a trademark for which we have a pending application, or (3) a trade name or service mark for which we claim common law rights. All other trademarks, trade names or service marks of any other company appearing in this prospectus belong to their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are presented without the TM, SM and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our respective rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

v

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited to, statements regarding our industry and market sizes, future opportunities for us, our estimated future results and the Business Combination, including the implied enterprise value. Such forward-looking statements are based upon the current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements.

In addition to factors identified elsewhere in this prospectus, the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements:

• risks of operations in the PRC;

• a delay or failure to realize the expected benefits from the Business Combination;

• risks related to disruption of management time from ongoing business operations due to the Business Combination;

• the impact of the ongoing COVID-19 pandemic;

• changes in the highly competitive market in which we compete, including with respect to our competitive landscape, technology evolution or regulatory changes;

• changes in the markets that we target;

• risk that we may not be able to execute our growth strategies or achieve profitability;

• the risk that we are unable to secure or protect our intellectual property;

• the risk that our customers or third-party suppliers are unable to meet their obligations fully or in a timely manner;

• the risk that our customers will adjust, cancel or suspend their orders for our products;

• the risk that we will need to raise additional capital to execute our business plan, which may not be available on acceptable terms or at all;

• the risk of product liability or regulatory lawsuits or proceedings relating to our products or services;

• the risk that we may not be able to develop and maintain effective internal controls;

• the outcome of any legal proceedings that may be instituted against us or any of our directors or officers; and

• the failure to realize anticipated pro forma results and underlying assumptions.

Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control.

All information set forth herein speaks only as of the date hereof, and we disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date hereof except as may be required under applicable securities laws. Forecasts and estimates regarding our industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

vi

PROSPECTUS SUMMARY

This summary highlights certain significant aspects of our business and is a summary of information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read this entire prospectus, including the information presented under the sections titled “Risk Factors,” “Cautionary Statement Regarding Forward Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the consolidated financial statements and the related notes thereto included elsewhere in this prospectus before making an investment decision.

Microvast Holdings, Inc.

Microvast Holdings, Inc. is a Delaware corporation that is a holding company. As a holding company with no material operations of our own, our operations are conducted through our subsidiaries, including subsidiaries based in China. Although we are in the process of diversifying the geographic concentration of our operations, including by developing manufacturing facilities in Europe and the United States (“U.S.”), a substantial portion of our facilities are currently located in the PRC. Our auditor is located in China. Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the Public Company Accounting Oversight Board determines that it cannot inspect or fully investigate our auditor, and as a result, an exchange may determine to delist our securities. PLEASE SEE “— RISKS RELATED TO DOING BUSINESS IN THE PRC” FOR A LIST OF RISK FACTORS ASSOCIATED WITH OUR SUBSIDIARIES’ OPERATIONS IN CHINA. All securities being offered pursuant to this prospectus are securities of the Delaware holding company, and accordingly no investor will acquire a direct interest in any of the equity securities of our subsidiaries.

Business Summary

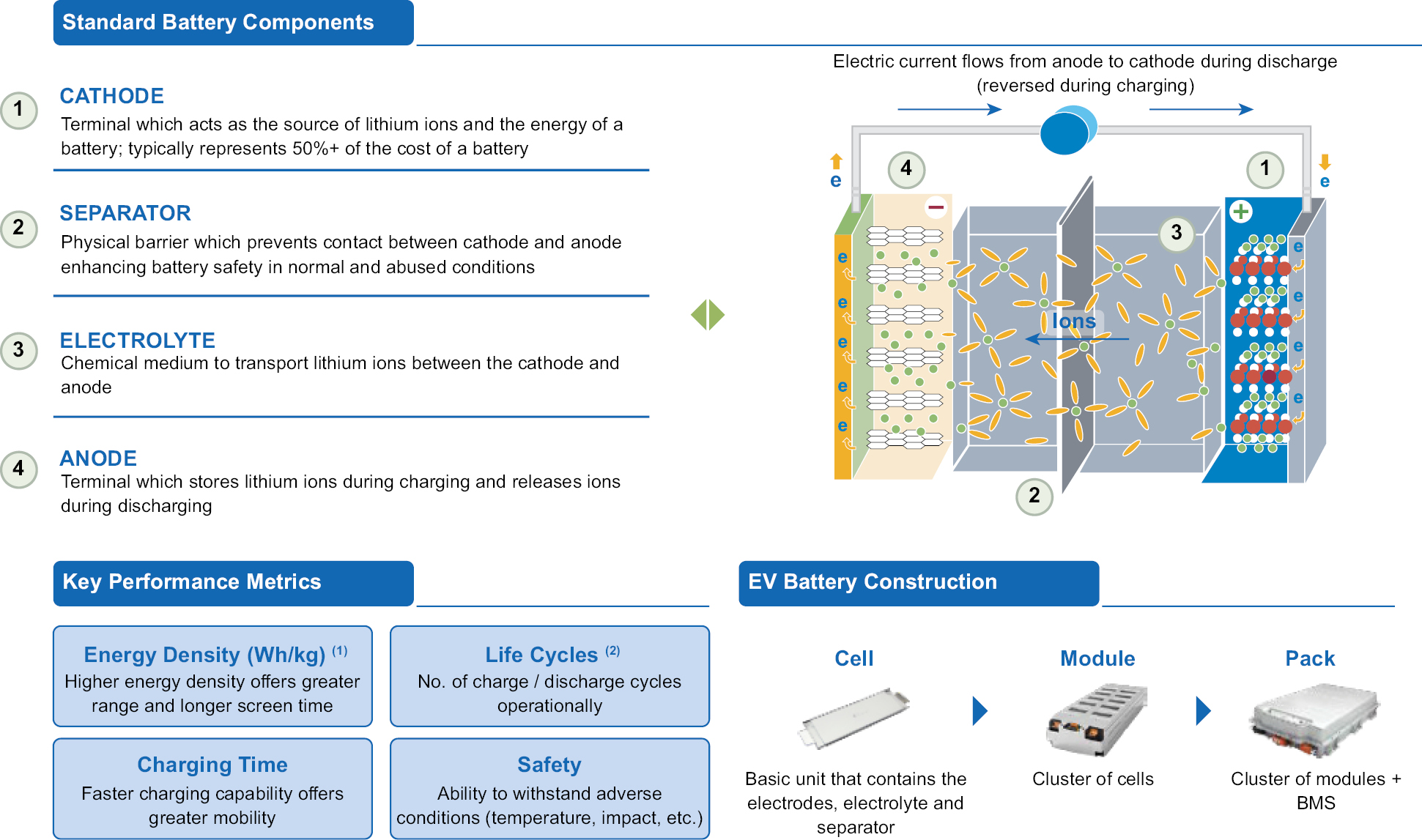

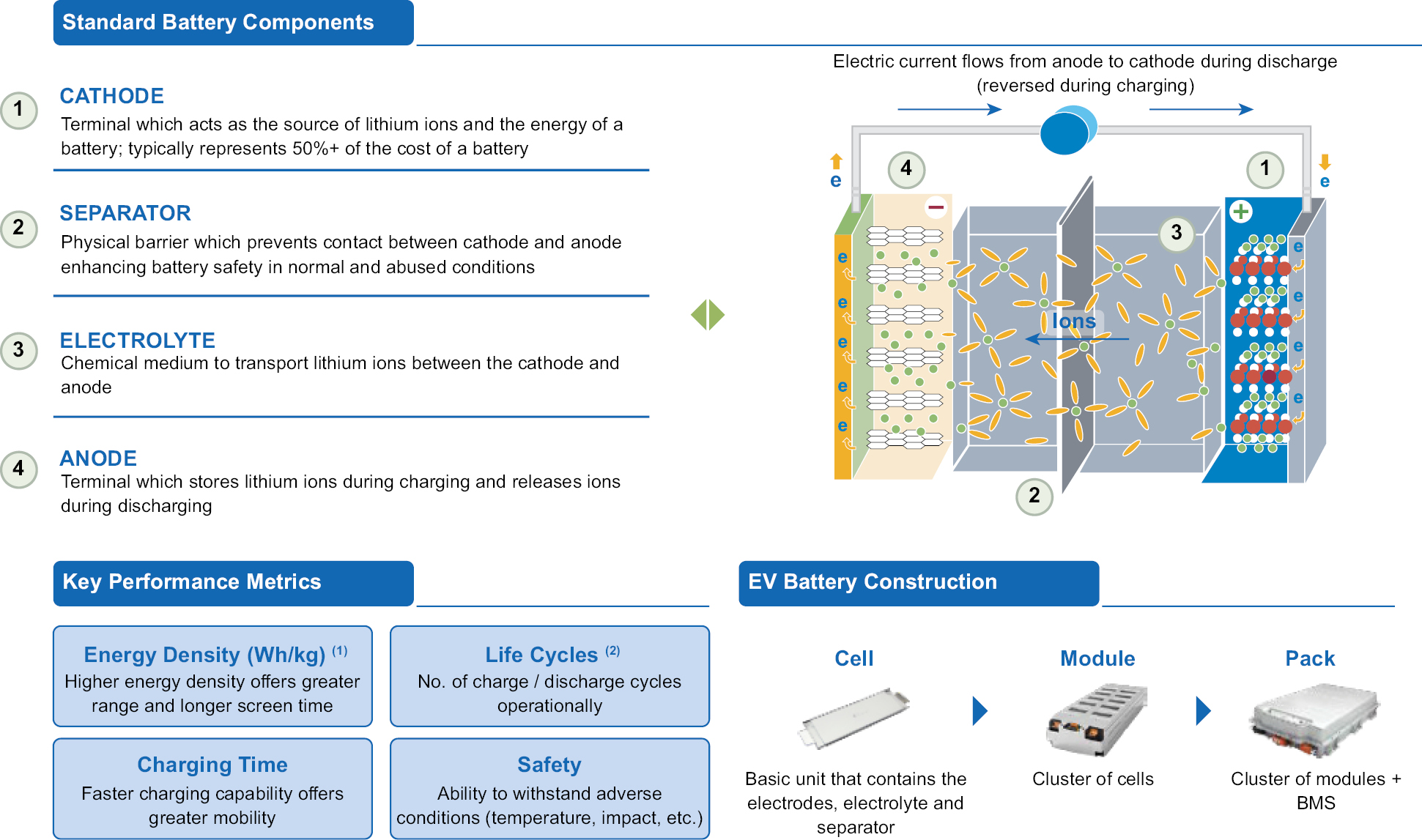

We are a technology innovator for lithium ion (“Li-ion”) batteries. We design, develop and manufacture battery systems for electric vehicles and energy storage systems that feature ultra-fast charging capabilities, long life and superior safety. Our vision is to solve the key constraints in electric vehicle development and in high-performance energy storage applications. We believe the ultra-fast charging capabilities of our battery systems make charging electric vehicles as convenient as fueling conventional vehicles. We believe that the long battery life of our battery systems also reduces the total cost of ownership of electric vehicles and energy storage applications.

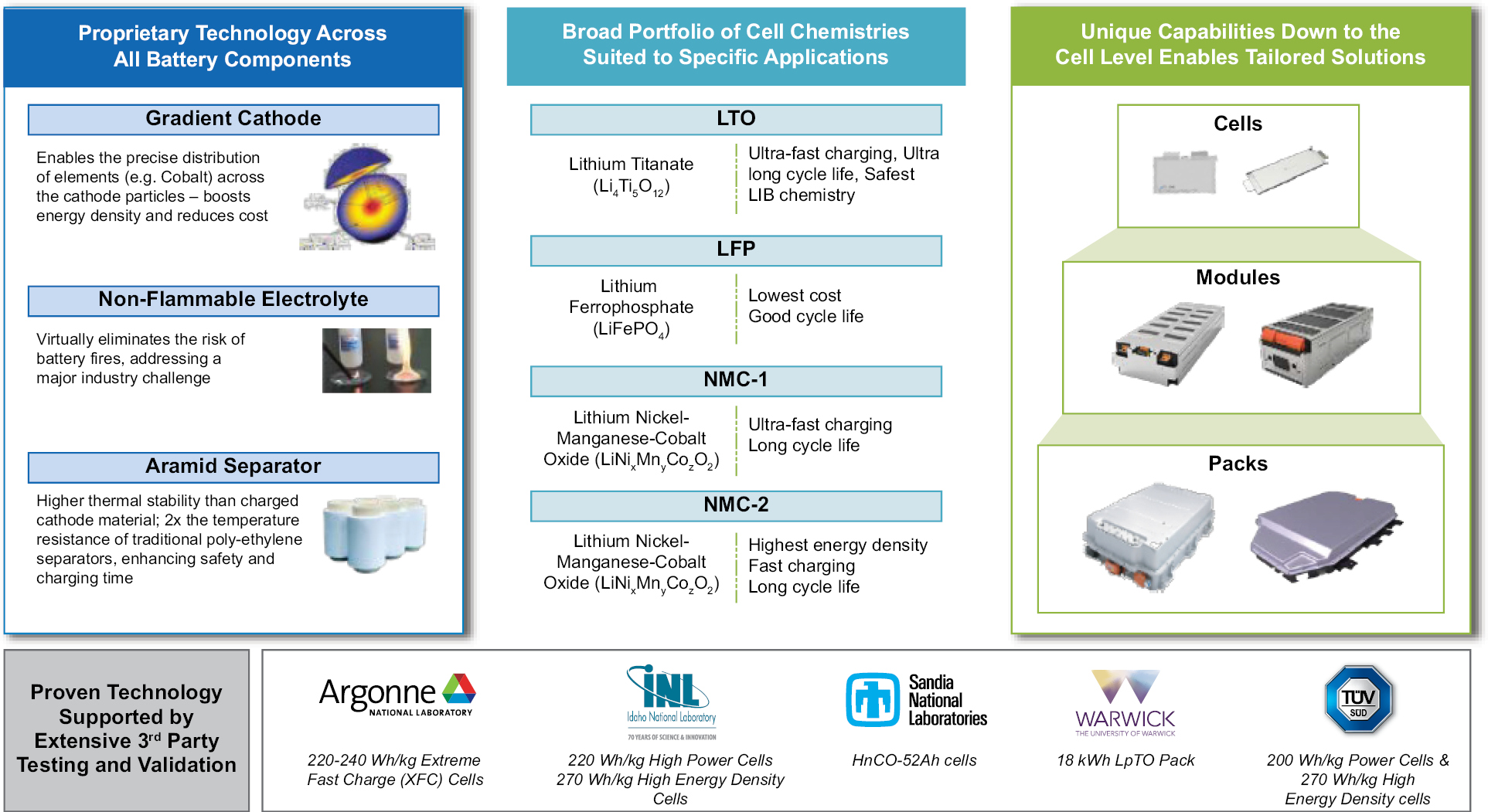

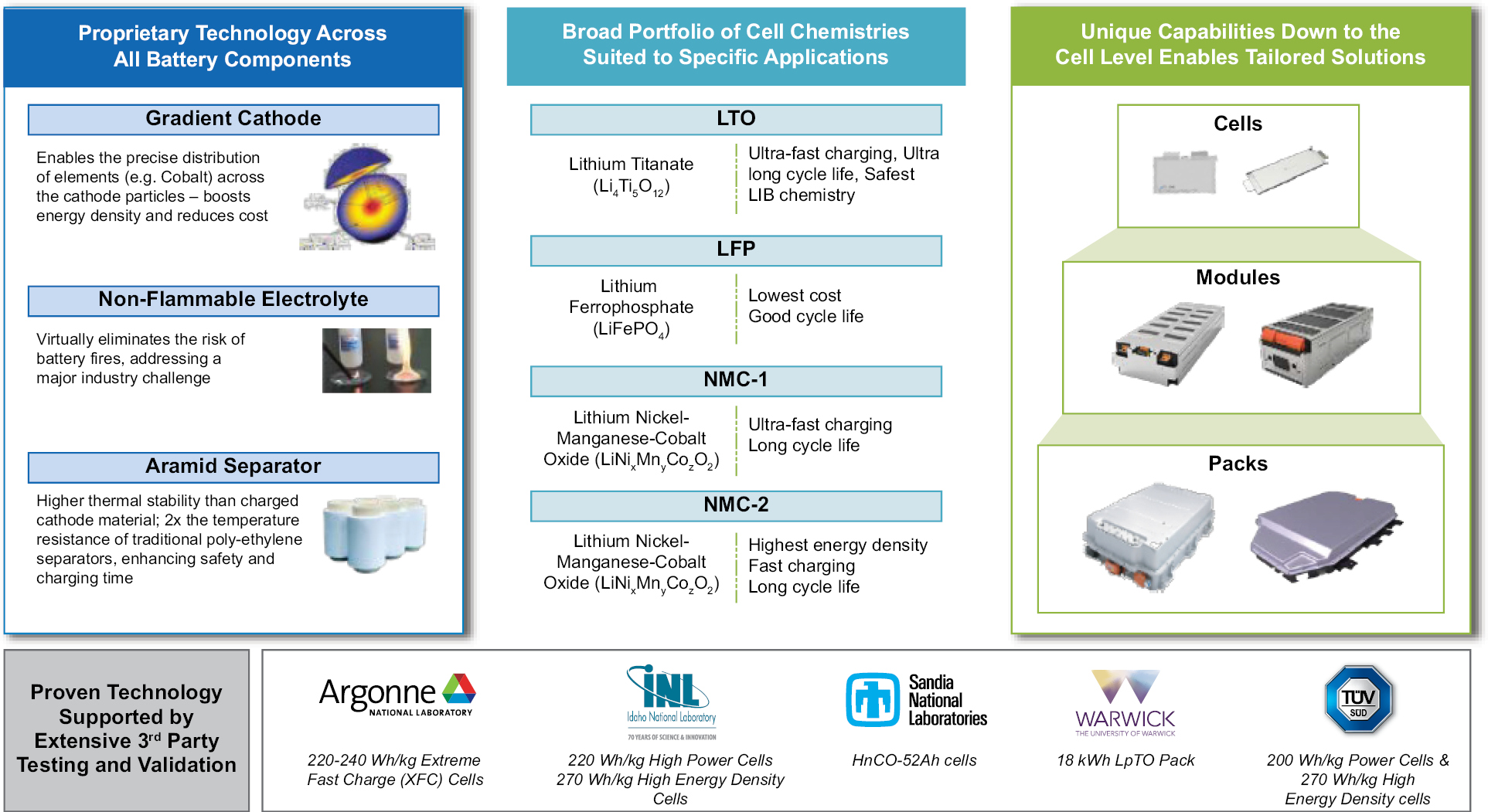

We offer our customers a broad range of cell chemistries: lithium titanate oxide (“LTO”), lithium iron phosphate (“LFP”), nickel manganese cobalt version 1 (“NMC-1”) and nickel manganese cobalt version 2 (“NMC-2”). Based on our customer’s application, we design, develop and integrate the preferred chemistry into our cell, module and pack manufacturing capabilities. Our strategic priority is to offer these battery solutions for commercial vehicles and energy storage systems. We define commercial vehicles as light, medium, heavy-duty trucks, buses, trains, mining trucks, marine and port applications, automated guided and specialty vehicles. For energy storage applications, we focus on high-performance applications such grid management and frequency regulation.

Additionally, as a vertically integrated battery company, we design, develop and manufacture the following battery components: cathode, anode, electrolyte and separator. We also intend to market our full concentration gradient (“FCG”) cathode and polyaramid separator to passenger car original equipment manufacturers (“OEMs”) and consumer electronics manufacturers. Please see the illustration below for an explanation of the functions of different battery parts.

Since we launched our first ultra-fast battery system in 2009, we have sold and delivered approximately 2,422.3 megawatt hours (“MWh”) of battery systems or in terms of vehicles, approximately 28,000 vehicles have been powered by our battery systems. As of September 30, 2021, we had a backlog order of approximately $52.7 million for our battery systems equivalent to approximately 214.6 MWh. Our revenue for the nine months ended September 30, 2021 increased $25.8 million, or 43.4%, compared to the same period in 2020.

After initially focusing on the PRC and the Asia & Pacific regions, we have expanded our presence and product promotion to Europe and the U.S. to capitalize on the rapidly-growing electrification markets.

In Europe, we have delivered over 1,500 units of ultra-fast charging battery systems to bus OEMs and operators as of September 30, 2021. A number of prototype projects are ongoing with regard to sports cars, commercial vehicles (through a partnership with FPT Industrial), trucks, port equipment and marine applications.

1

In addition, we are jointly developing electric power-train solutions with leading commercial vehicle OEMs and a first-tier automotive supplier using LTO, NMC1 and NMC2 technologies. Set forth below is a diagram explaining the basic workings of batteries.

Industry and Market Opportunity

We believe global economic growth, greater awareness of environmental issues, government regulations and incentives and improved electric powertrain technologies are increasing the demand for environmentally friendly energy solutions, including electric vehicles. With the growing focus on, and the broad scientific acceptance of, the link between greenhouse gas emissions and climate change, many countries are adopting increasingly stringent environmental standards, especially as regards the emissions of CO2 from many forms of transport. It will be increasingly difficult for the conventional combustion engine to meet the emission targets being proposed, and it is this which creates the huge opportunity for our battery technologies.

Advances in chemistry and materials, of which we have been a leading innovator, have significantly improved electric powertrains. This, combined with the growing investment in charging station infrastructure and clear air initiatives, is leading to higher penetration rates for electric vehicles globally. Many consumers and businesses are increasingly willing to consider buying electric vehicles with new features and capabilities as their preferred clean-energy solution. We believe the following factors will result in significant growth in the market for electric vehicles:

• Emission regulations: The introduction of public policies related to the reduction of greenhouse gas emissions, enhanced energy efficiency and increasing restrictions on the use of diesel engines, especially in the European Union (“EU”), represent one of the key market drivers for Li-ion e-mobility solutions. In 2014, the EU member states agreed to the 2030 Framework, which includes targets and policy objectives to achieve a more competitive, secure and sustainable energy system within the EU. The 2030 Framework seeks to reduce energy consumption by 27% by the end of 2030 compared to a “business as usual” scenario (base year 2014). The 2030 Framework also seeks to reduce greenhouse gas emissions by 40% when compared to 1990 levels by 2030. In addition, the EU has adopted a European Green Deal with the goal of net zero emissions of greenhouse gases by 2050. We believe that electrifying the many types of commercial vehicles, which is one of our focus areas, is an important step for countries to meet the current CO2 and NOx targets, which make cities and, in particular, city centers cleaner.

2

• Strong pull from transportation authorities and car manufacturers: Transportation authorities across Europe (for example, in London, Copenhagen, Barcelona, Paris and Milan) have communicated their mid-to-long term plans to replace existing internal combustion engine (“ICE”)-based bus fleets with new electrified buses. Moreover, regional and city governments across many countries in Europe have been active in general promotion of e-mobility penetration, through, for example, introduction of bans on diesel cars in city centers and plans for free public transportation in certain towns and cities. More than 200 cities have already introduced emission and access regulation zones and a number of large cities, such as Paris and Madrid, have pledged to ban diesel vehicles from city centers by 2025. On December 15, 2020, the European Automobile Manufacturers’ Association (“ACEA”) announced that Europe’s truck manufacturers have concluded that by 2040 all new trucks sold need to be fossil free in order to reach carbon-neutrality by 2050. ACEA represents 16 major Europe-based car, van, truck and bus makers.

• Push for expanded electric vehicle market from major fleet companies: In January 2020, Amazon.com, AT&T Inc., DHL Express USA Inc. and other select companies with major delivery fleets came together and joined the Corporate Electric Vehicle Alliance (“CEVA”). CEVA will help member companies make and achieve bold commitments to fleet electrification, and is expected to boost the electric vehicle market by signaling the breadth and scale of corporate demand for electric vehicles — expanding the business case for the production of a more diverse array of electric vehicle models:

• Amazon: As part of The Climate Pledge, which includes a commitment to deliver 50% of shipments with net zero carbon by 2030, it is pursuing the highest standards in transportation sustainability.

• DHL: As part of its commitment to achieve net zero emissions from transport activities by 2050 globally, it has set the ambitious interim target of performing 70% of first- and last-mile operations with green vehicles by 2025. Electric vehicles will play an important role in reaching that target.

• IKEA: It has a commitment to use electric vehicles for all of its in-home furniture deliveries by 2025.

Globally, the total addressable market for commercial vehicles is large and rapidly growing. According to Bloomberg New Energy Finance (“BNEF”), electric vehicle penetration in the key markets for commercial vehicle sales (i.e., U.S., Europe, the PRC, Japan and South Korea) is expected to grow from approximately 1.5% of the total units sold in 2020 to approximately 8.5% by 2025. Based on this estimate, the growth in commercial vehicles will increase the demand for battery capacity from 17.5 gigawatt hours (“GWh”) in 2019 to 98.6 GWh in 2025.

We believe that the adoption of electric vehicles has been handicapped by many challenges imposed by conventional battery systems, including:

• Range anxiety and reduced mobility. Electric vehicles powered by conventional battery systems need significantly more time to be fully charged and many models (usually with battery capacity of no more than 40 kilowatts per hour (“kw/h”) only provide up to 100 miles of range. This has compared unfavorably to internal combustion engine vehicles which can travel more than 300 miles between fuel stops and can refuel within 10 minutes.

• High replacement costs. Most conventional battery systems have a shorter life span than the useful life of the vehicles that they are installed in. As a result of this mismatch, the battery typically needs to be replaced during the life of the vehicle, leading to significant replacement costs.

• Safety. Li-ion batteries are known to be a factor in consumer electronic and passenger vehicle fires.

• Design and performance not optimized for commercial vehicles. Conventional battery systems designed for passenger cars offer longer charge times and limited cycle life, thus reducing operational efficiency and battery life.

3

Our Solution

Our approach is offering a tailored battery solution based on the operating requirements of our customers. With a broad range of battery chemistries to select from, we can offer several different battery solutions to our customer. We offer LTO, LFP and two version of nickel, NMC-1, NMC-2. We believe our technologies and battery systems offer the following advantages over commonly used battery systems:

• Ultra-Fast Charging Capability. Depending on the selected battery chemistry, we can offer battery solutions that can be fully charged within 10-30 minutes, significantly faster than commonly used battery systems. The ultra-fast charging capabilities of our battery systems significantly enhance electric vehicle mobility and have the potential to accelerate consumer adoption of electric vehicles. Our latest generation LTO cells can be fully charged within 10 minutes, while providing an energy density up to 180 watt hours per liter (“Wh/l”) and 95 water hours per kilogram (“Wh/kg”). These ultra-fast charging capabilities and long battery life can meet the diverse vehicle design requirements of our OEM customers. Our NMC-2 products can be fully charged within 30 minutes, providing the highest energy density fast charge batteries available on the market today.

• Long Battery Life. Depending on the selected battery chemistry, we can offer battery solutions with a life between 2,500 and 20,000 full charge/discharge cycles. The longer battery life enables our battery systems’ useful life to match the life of the vehicles in which our systems are installed, avoiding the need to replace the battery and thereby lowering our customers’ total cost of ownership. For example, our LTO batteries retain 90% of their initial capacity after approximately 10,300 full charge/discharge cycles, according to a test report produced by WMG, an academic department at the University of Warwick in the United Kingdom.

• Enhanced Margin of Safety. Drawing from an intellectual property library that took over a decade to develop, we work to increase the margin of safety of our products, beginning with the initial design and through the use of carefully selected battery components. Our LTO battery is inherently safer than other battery chemistries, with very good thermal stability, the ability to operate in a broad range of temperatures, and lower risk of internal short circuits and fire-related hazards. For products demanding higher-energy densities, our in-house manufactured battery components, the aramid separator, non-flammable electrolyte, and full-concentration gradient cathode individually or collectively are being implemented in certain current and future products to improve product safety. Our in-depth knowledge of how these battery components interact with each other in the battery cell is utilized in the design and build of our products, helping ensure our products have better safety margins.

Our Competitive Strengths

We believe the following strengths position us well to capitalize on and lead the global vehicle electrification trend:

Breakthrough battery solutions

Our vision is to solve the key constraints in electric vehicle batteries and to design electric vehicle power systems that facilitate the mass adoption of electric vehicles. Our battery solutions have a proven track record enabled by our transformational technologies that make electric vehicles more convenient, affordable and safe.

• We believe our ultra-fast charging battery technology makes charging electric vehicles as convenient as fueling conventional vehicles and has the potential to accelerate consumer adoption of electric vehicles. In addition, our ultra-fast charging battery technology significantly increases the utilization and efficiency of charging stations with its short charging time requirements.

• Our battery solutions significantly reduce the total cost of ownership of an electric vehicle. Our ultra-fast charging battery technology enables our customers to install fewer battery packs per vehicle, while the longer battery life matches with the life of the vehicle, eliminating the need to replace the battery during the life of the vehicle.

4

Since the first electric buses powered with our battery system were put into commercial operation in 2009, we have sold and delivered over 28,000 battery systems for commercial vehicles. As of September 30, 2021, our systems are in use in 200 cities from 20 countries under diverse weather conditions, accumulating an estimated 4.1 billion miles of operational distance.

We believe our battery solutions best position us to be a key player in the vehicle electrification revolution and to pave the way for mass adoption of electric vehicles.

Market leader in providing ultra-fast charging battery solutions

We are a provider of ultra-fast charging battery solutions to electric vehicles globally. We believe our ultra-fast charging battery technology best positions us to continue penetrating the fast-growing global electric vehicle market. Since we first launched our LTO ultra-fast charging battery technology in 2009, we have successfully deployed our product portfolio in large scale commercial operations in the PRC, the Asia & Pacific region and in Europe. With our expanding customer base in Europe, we believe we are well on our way of establishing ourselves as a leading supplier of Li-ion battery solutions for commercial vehicles in Europe.

Vertical integration from initial concept development to final system manufacturing

We have adopted a customer-oriented product development approach to provide highly customized solutions. This is facilitated by our vertical integration which extends from core battery chemistry to application technologies such as battery management systems and other power control electronics. Our vertical integration capability is supported by our unique research and development (“R&D”) and design capabilities across the complete battery system and our established in-house manufacturing capability. This vertical integration capability gives us the flexibility to produce key materials in-house to manage supply and cost of materials. We believe we are one of the very few leading battery solution providers that can provide highly customized battery systems with the ability to address a range of battery materials, manufacturing, application engineering and design issues. The ability to work with partners and customers across the design process enables us to better understand customers’ needs and allows us to customize our products to their specific requirements.

Our vertical integration also enables a quicker and more coordinated development process for new technologies and products. It also ensures better quality and cost control during the manufacturing process. Furthermore, by managing each design step, from battery chemistry to power system, we can better protect our intellectual property and know-how.

Proven track record of innovation

We have adopted a customer focused approach in directing our R&D efforts in order to develop battery technologies that are bespoke to the requirements of commercial vehicle owners. We focus on building our battery systems from the ground up, not relying on any third-party technologies or approaches. The combination of our vertically integrated manufacturing system and cutting-edge lab research has helped us to innovate, develop and quickly commercialize new technologies and products.

We have a strong track record of product innovation, successful commercialization of such innovations, and those products being proven over many years and across many different types of commercial vehicles. For example, we first launched LTO ultra-fast charging battery technology in 2009 and put it into commercial operation in the same year. As of December 31, 2020, our LTO ultra-fast charging battery system has been sold and delivered for use in over 1,200 buses.

In 2013, we launched the second generation LTO battery system which offers higher-energy density while retaining fast-charging and long-cycle life capabilities. In 2017, we launched the NMC-1 battery system, which offers much higher-energy density while maintaining market leading fast charging and long cycle life attributes. Most recently, in 2019, we launched the NMC-2 battery system which can be fully charged in 30 minutes while providing the highest energy density fast charge batteries available on the market today.

We have a R&D team of over 500 scientists and engineers, including leading electric vehicle battery industry veterans as well as experts in the research and science community, who are focused on developing cutting edge technologies. As of September 30, 2021, we have been granted 369 patents and have 130 patent applications pending.

5

Large and growing customer base and applications

We have strategically prioritized the development of battery systems for commercial vehicles and energy storage applications. We believe that our battery systems have a unique combination of features: ultra-fast charging capabilities, long battery life and enhanced safety. These features are highly valued by commercial vehicles and high-performance energy storage customers who are sensitive to the total cost of ownership.

We can count as our customers some of the leading global bus OEMs including Yutong, Higer, Foton, King Long, VDL and Wright Bus. With our batteries being deployed across a broad range of commercial vehicles, including automated guided vehicles, port equipment, mining trucks, fork-lift trucks, we have customer relationships with the likes of Kion, Kalmar, Kone Cranes, Linde, PSA Singapore and Gaussin. All of these names are recognized as leading OEMs in their particular area of focus.

Experienced and visionary senior management team with highly motivated employees

Mr. Yang Wu, our Founder, Chief Executive Officer and Chairman, and Dr. Wenjuan Mattis, our Chief Technology Officer, have led us in successfully innovating and commercializing new technologies. Mr. Wu is a visionary leader and entrepreneur with over 25 years of experience in technology development. While most of our competitors were still focusing on developing lithium iron phosphate-based battery technologies, he focused on developing a new battery technology to create an ultra-fast charging battery to address the key constraints for electric vehicle development. Dr. Mattis has over 16 years of experience in the Li-ion battery industry and has 22 publications and 81 patents.

Our senior management team also includes Mr. Yanzhuan Zheng, our Chief Financial Officer. Mr. Zheng has over 20 years of experience in accounting, finance and capital markets. Our expansion to regions beyond the Asia & Pacific region is led, for the U.S., Canada and South America markets, by Mr. Shane Smith, and for Europe, Middle East and North Africa markets, by Mr. Sascha Kelterborn. Mr. Smith and Mr. Kelterborn are both experienced senior managers with more than 20 years international business experience.

As we grow, we remain focused on hiring employees who share the same ethos. We have built a team focused on developing innovative solutions to the problems faced by electric vehicle batteries, and we believe our employees’ shared passion, experience and vision represent an increasingly important competitive advantage.

Our Strategies

Our strategy is to globally market our competitive product portfolio. Initially, we intend to focus our sales and marketing efforts for our battery solutions in commercial vehicles and energy storage customers, where our vertical integration and high-performance technology can address the challenging and diverse set of requirements desired by these customers. For passenger electric vehicles and consumer electronics applications, we are marketing our FCG cathode and polyaramid separator components to manufacturers that need better materials to meet demands for higher energy densities and greater intrinsic safety.

Global market presence

After primarily being focused on the PRC and the Asia & Pacific regions, we are expanding our presence and product promotion to Europe and the U.S. to capitalize on the rapidly growing electrification markets. In 2021, we are launching a marketing campaign to introduce us to more potential customers in regions outside the Asia & Pacific region and adding more employees to support business development.

The European market presents enormous growth opportunities for electric vehicles, driven by higher emission standards, reduced total cost of ownership compared to gas-based combustion engines and growing environmental awareness. In the U.S., we believe a new political administration is likely to push the electrification revolution through regulation. In pursuing contract opportunities with industry-leading companies in the U.S., we have seen how our potential customers recognize the lower total cost of ownership for commercial vehicles and are seeking alternative forms of energy for energy storage applications.

Our growing operations in Europe and the U.S. are conducted through our subsidiaries in Germany and the U.S.. Revenues generated in these regions are expected to be used to continue to fund operations and growth in those geographies.

6

In addition, as we expand our presence globally, we will continue to invest in our existing partnerships in the PRC and the Asia & Pacific region and continue to grow our business there.

Improve performance and reduce total cost of ownership of our battery systems

The total cost of ownership is an important criterion for commercial electric vehicle and energy storage system customers. In order to maintain our leading position in the market, we will continue investing in R&D for our high performing battery technology and seek new innovations to further lower cost.

For battery system solutions, this means continuing to develop new battery cells and modules and improving the energy densities of our existing batteries. Our R&D team is constantly working to integrate new designs, technologies and materials into our cells to enhance performance and lower the cost. We have used this approach to develop cells with various chemistries (LTO, LFP, NMC-1, NMC-2), and to provide a variety of products (LpTO, LpCO, MpCO, HnCO) with different energy densities, fast charge times and cycle life.

One important strategy we have employed historically, and will continue to focus on going forward, is the research emphasis on advanced materials to enhance our products. For example, our 2019 R&D 100 Award for a battery incorporating our unique FCG and polyaramid components showcases how new materials enable higher energy density and longer cycle life products as well as improving performance and lowering total costs of ownership. Improving performance at the base components has the added advantage of making both our battery solutions and our component products more attractive.

Expand manufacturing capacity to meet growing demand

We plan to prudently expand our manufacturing capacity to capture the large and growing market opportunity for electric vehicles. Our capacity expansion will be phased in based on our ongoing assessment of medium- and long-term demand for our products. We have reached manufacturing capacity of approximately 3 GWh per year as of December 31, 2020. We plan to achieve a total manufacturing capacity of 11 GWh per year by 2025 to support market demand for our existing products. As for battery components, we plan to expand our manufacturing capacity for the polyaramid separator and FCG cathode.

In the fourth quarter of 2021, we completed building a 170,000 square foot facility near Berlin, Germany and installed a fully automated battery module line and started the ramp up phase of the serial production. We are also in the process of installing a semi-automated pack equipment line to support anticipated demand. This facility, once fully equipped, can support up to 6 GWh capacity. In light of anticipated EU regulations designed to require battery cell production to be located in Europe and “green” energy usage for battery production and the introduction of a “battery passport”, we anticipate that in the near future we will need to build additional cell capacity in Europe to meet local demand.

In 2021, we expect to begin converting an existing building we purchased in Clarksville, Tennessee to support 2.0 GWh of cell, module and pack capacity. It is anticipated that this facility will primarily serve our customers in the U.S.

With facilities and resources in the PRC, Europe and the U.S., we have manufacturing capabilities that are close to our customers and poised to meet our customers’ demand. Our strategic footprint also addresses national interest concerns and tariffs and reduce logistic expenses.

Our Solutions, Technologies and Applications

Our Solutions

We are in the business of developing and selling innovative, and industry-leading, energy storage solutions to OEM customers. In addition to designing and manufacturing the physical battery system, we offer services such as engineering and design, maintenance and support services.

The battery system is based on our proprietary LTO, LFP, NMC-1 or NCM-2 cell products. The cells are then made into battery modules, which are then assembled into a battery pack. We handle the manufacturing of the cell, module and pack and work with the OEM to customize the battery system, so it can be integrated into their vehicles. The battery pack maybe air-cooled, or liquid cooled and is designed with a flexible layout to accommodate different cell numbers and multi-layering with frames. In some cases, battery management software and installation may be

7

provided to the customer. The battery management software monitors the battery, improving the safety and thermal control, which enhances the battery system lifetime and cost efficiency. For the packs, we assemble using standard components, making them easier to install and maintain.

As part of the customization process, we conduct feasibility testing using a prototype of a customer’s vehicles to obtain feedback from the customer to customize the battery system for the customer’s specific use. We install the battery systems for our customers after we deliver the battery systems to them. We also provide maintenance services and train our customers’ staff on the use and maintenance of our products.

We currently sell our battery systems primarily to OEMs for use in electric commercial vehicles. Our battery systems have a number of other applications, including (a) as energy storage for renewable energy generators and utility grids, (b) for frequency regulation and (c) as uninterrupted power supply in other high-power electric equipment and devices. In addition, we can sell components of our battery system, such as the FCG cathode or polyaramid separator, to other manufacturers focused on passenger electric vehicles.

Our Technologies

We have been developing technologies for fast charging, long life, high safety batteries since the research objectives were outlined in 2008. Since then, we have developed technologies spanning the battery system production through our vertical integration approach, from basic cell materials like cathode, anode and separator, to cooling systems and software controls for the battery pack. Some of the key highlights from our technology portfolio are:

Battery Cell Materials

• Polyaramid Separator — Our separator, conceived and developed entirely within the Company, is significantly more stable under heat than traditional poly-ethylene separators. Polyaramid is similar to Kevlar, the material that is used in bullet-proof vests, and its excellent thermal properties (stable to nearly 300°C in air) are well known, but only we have developed the techniques necessary to form this material into ~10um thick, meters wide and hundreds of meters long porous separator material that is suited for Li-ion batteries. The material is currently being evaluated through a U.S. Advanced Battery Consortium grant, and the project manager from one of the big three OEMs describes this technology as “the greatest breakthrough in Li-ion battery (“LIB”) separator technology in 20 years.”

8

• Lithium Titanium Oxide (LTO) — Our LTO powder is specifically manufactured to promote high power operation, making it ideal for ultra-fast-charging applications. LTO is the safest Li-ion battery anode material on the market today because it’s one of the only anode materials inherently stable against traditional Li-ion electrolytes.

• Full Concentration Gradient (FCG) Cathode — Our gradient cathode was licensed from Argonne National Labs in 2017. Since then, we have developed significant, flexible manufacturing know-how to produce the material with minimal cost increases compared to normal NMC materials. By controlling the concentration of metals within a particle, the material’s safety can be enhanced. This is because the gradient is a designer cathode, meaning the material design can be tailored for specific end uses and cells/customers can receive a unique material product explicitly for their needs. This customization makes the technology well suited for ultra-fast charge and low-cost advanced Li-ion cells. We believe this technology is especially well suited going forward for the development of materials that greatly reduce or eliminate cobalt from the cathode.

• Non-Flammable Electrolyte — Since Li-ion batteries typically use flammable organic solvents, they have the potential, under certain conditions to catch fire. Our technology, protected through patents and trade secrets, will not catch fire even if a flame is directly brought in contact with a cup of the electrolyte formulation. Using our electrolyte greatly retards, and in some cases can stop entirely, a Li-ion cell from catching fire. Reducing the flammability of Li-ion cells is an important safety feature that we believe will become even more sought after as the market pushes towards ever higher, and hence less stable, energy density cells.

Cell Chemistry

• LTO — This material is used in place of the typical graphite on the anode. LTO greatly enhances the Li-ion cell’s safety and fast charge ability, at the cost of some energy density. Our cells using LTO have exceptional lifetimes. Our cells using LTO have successfully addressed a key problem for the technology, cell gassing. By eliminating the gas generation during cycling, our cells can have exceptionally long performance lifetimes.

• LFP — One of the safest cathode options, LFP is manufactured from low cost materials making it highly affordable. Our LFP cells were developed at the behest of a Chinese OEM, and our technology was selected over one of the biggest battery companies in the world because our performance and price was superior to the competitors.

• NMC — Applications requiring higher energy cell density today must be built using the layered metal oxide crystal structure (which includes NMC, NCA, NMCA and FCG). Our cells based on this chemistry have some of the best cycle performance available today, which we attribute to our better understanding of the various cell materials from our vertical integration structure. By controlling the cathode and separator technologies going forward, our NMC cells will have lower prices and enhanced safety compared to many of our competitors’ products. Cells using NMC technology have been third-party evaluated by TUV and various U.S. National Labs, confirming our claims to performance.

Our Applications

Electric Buses and Other Commercial Vehicles

The ultra-fast charging capabilities of our battery systems means that electric buses equipped with our batteries would only need to charge for 10 to 30 minutes, depending on the battery chemistry. In buses, this allows a single charge for each loop or multiple loops they travel. In contrast, electric buses equipped with certain of our competitors’ technology would need to charge overnight to store sufficient energy to run an entire day. Furthermore, our battery system’s life span matches the useful life of a typical bus, which avoids the need to replace the battery during the useful life of the vehicle.

The high energy density of our battery systems makes our battery systems an ideal choice for delivery vans and trucks. It reduces the charging interval and thus ensures a smooth daily operation of the commercial vehicle by equipping sufficient energy onboard. Ultra-fast charging capability enables the use of automated guided vehicles in harbors and airports applications where 24-hour operations is required.

9

Materials

All Li-ion batteries are comprised of an anode, cathode, electrolyte and separator.

• Anode — Our anode is selected historically from LTO or graphite in our product cells. In the coming years we anticipate that we will develop and market a new product that contains silicon or silicon oxide.

• Cathode — Our LFP is sourced from a commercial supplier. For NMC, our existing products are made using commercially supplied material, and our future cell products will utilize FCG when possible. For NMC based cathodes the sourcing and availability of cobalt is a key issue for many OEM buyers. As such, we are actively engaged in research to greatly reduce or eliminate the use of cobalt from our material stream.

• Electrolyte — Our present Li-ion cells use liquid-based electrolyte formulations. For carbonate-based electrolytes we typically elect to buy the base solvents from commercial suppliers due to lower costs from their economies of scale, and then blend solutions in-house to ensure our proprietary mixtures are not shared outside the company.

• Separator — The separator is another key material in our Li-ion cells. While we have in the past used the industry norm PE/PP materials, we are now working to integrate as many cells as possible with our new polyaramid technology. In addition, we are actively working to build on our polyaramid knowledge to develop a solid electrolyte battery system that incorporates the polyaramid material as a component of the solid electrolytes. If the solid electrolyte approach is successful, not only will it eliminate the use of liquid electrolytes, but it will also potentially enable new anode chemistries such as lithium metal, which is needed to reach cells with over 1000 Wh/L energy densities.

Quality and Safety Control

Our batteries have passed quality and safety control testing under the QC/T 743-2006 standard by the National Coach Quality Supervision and Test Center, a non-government entity accredited to verify certain PRC government quality and safety control standards.

In September and October 2013, we were certified by Shanghai NQA Certification Co., Ltd., a third-party accreditor, to be compliant with ISO 9001:2008 and ISO/TS16949 relating to quality management systems, respectively. ISO/TS16949 is a quality management standard that is required for suppliers to the automobile industry. We have also obtained Conformitè Europëenne, European Quality Standard (“CE”) certification from SGS-CSTC (Shanghai) Co., Ltd. and Underwriter Laboratories, U.S. Quality Certification (“UL”) for product safety. Each certifying institution has its own requirements for maintaining valid certifications. Each of the UL certificates and CE certificates requires our products to be certified before they can be sold in the U.S. and the EU, respectively.

We have obtained the UN38.3 safety certification for Li-ion batteries that allows our batteries to be transported by air.

The Testing Center of MPS is accredited in accordance with ISO/IEC 17025: 2005 General Requirements for the Competence of Testing and Calibration Laboratories (CNAS-CL01 Accreditation Criteria for the Competence of Testing and Calibration Laboratories) for the competence to undertake the services we provide.

Manufacturing Capacity

We measure our manufacturing capacity in MWh, which represents energy capacity of all batteries produced for a single complete discharge, rather than the number of batteries we produce per year.

As of September 30, 2021, we had an annual manufacturing capacity of approximately 3 GWh cell, module and pack capacity, 600 tons per year of cathode capacity, 3,000 tons of electrolyte capacity and 5 million square meters for a separator pilot line in Huzhou, China.

10

We expect to complete the construction of a module and pack manufacturing facility near Berlin, Germany in the fourth quarter of 2021. In the U.S., we plan to add 2 GWh cell, module and pack manufacturing capacity. Additionally, we plan to add 6 GWh battery cell and module capacity and 10 million square meters of separator capacity to our facility in Huzhou, China. We are planning to increase our total battery manufacturing capacity to approximately 11 GWh per year by 2025.

Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

Further, section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible as a result of the potential differences in accounting standards used.

We will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the closing of the IPO, (b) in which we have total annual gross revenue of at least $1.07 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the prior June 30th; and (2) the date on which we have issued more than $1.00 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” will have the meaning associated with it in the JOBS Act.

Corporate Information

We were incorporated on April 25, 2016 as a Delaware corporation under the name “Tuscan Holdings Corp.” and formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. On July 23, 2021, in connection with the consummation of the Business Combination, we changed our name to “Microvast Holdings, Inc.” Our principal executive offices are located at 12603 Southwest Freeway, Suite 210, Stafford, Texas 77477, and our telephone number is (281) 491-9505. Our website is https://microvast.com. The information found on, or that can be accessed from or that is hyperlinked to our website is not part of this prospectus.

11

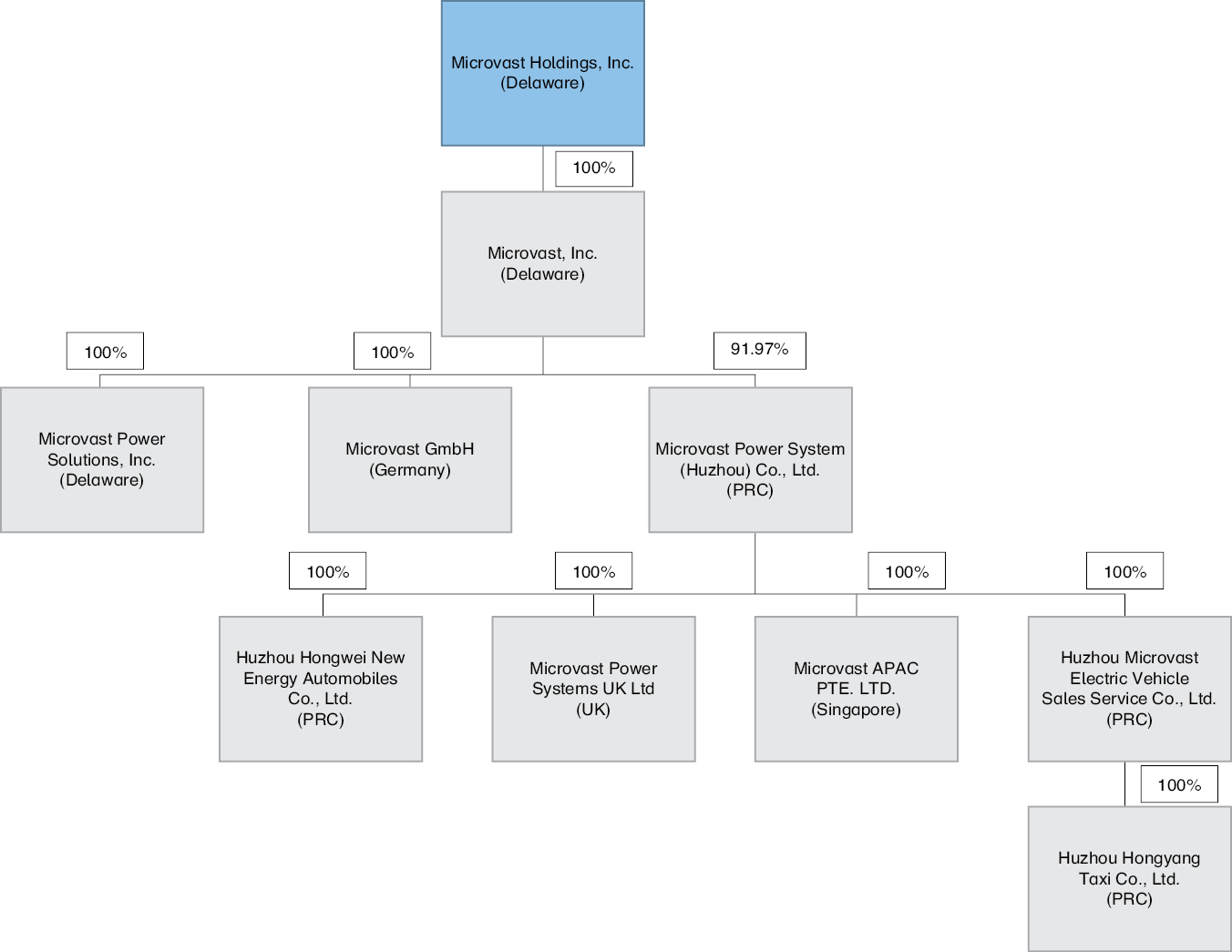

Corporate Structure

Microvast Holdings, Inc. is a Delaware corporation that is a holding company. The following diagram shows the structure of the Company.

As a holding company, all operations of the Company are conducted through our subsidiaries, including our PRC-based subsidiaries. However, all securities being offered pursuant to this prospectus are securities of the Delaware holding company, and accordingly, no investor will acquire a direct interest in any of the equity securities of our subsidiaries. The issuance of these securities to foreign investors is not currently subject to the approval of the China Securities Regulatory Commission (the “CSRC”) or any other governmental agency of the PRC. However, given recent statements by the Chinese government indicating an extent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, this may not continue to be the case in relation to the continued listing of our securities on a securities exchange outside of the PRC, or even when such permission is obtained, it could be subsequently denied or rescinded. If it is determined in the future that approval from the CSRC or other regulatory authorities or other procedures are required for our offshore offerings, it is uncertain whether we can or how long it will take us to obtain such approval or complete such procedures and any such approval could be rescinded. Any failure to obtain or delay in obtaining such approval or completing such procedures for our offshore offerings, or a rescission of any such approval if obtained by us, would subject us to sanctions by the CSRC or other PRC regulatory authorities for failure to seek CSRC approval or other government authorization for our offshore offerings. These regulatory authorities may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operating privileges in China, delay or restrict the repatriation of the proceeds from our offshore offerings into China or take other actions that could materially and adversely affect our business, financial condition, results of operations, and prospects, as well as the trading price of our shares. In addition, if the CSRC or other regulatory authorities later promulgate new rules or explanations requiring that we obtain their approvals or accomplish the required filing or other regulatory procedures for our prior offshore offerings, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties or negative publicity regarding such approval requirement could materially and adversely affect our business, prospects, financial condition, reputation, and the trading price of the shares. Please see “Risk Factors — Risks Related to Doing Business in the PRC — Changes in the policies of the PRC government, including more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, could have a significant impact on the business we may be able to conduct in the PRC, the profitability of our business and the value of our common stock.”

12

To date, no subsidiary has made any payments or transferred any cash or other assets to the Company. Currently, most of the Company’s cash on hand is the result of the Business Combination and is held by the Company in bank accounts in the U.S. The Company intends to use the proceeds from the Business Combination to fund capital expenditures and growth initiatives, primarily through its subsidiaries, in furtherance of the Company’s strategy to diversify geographically. In connection with growing its business and funding operations, for the period between January 1, 2018 and July 22, 2021, the date immediately prior to the consummation of the Business Combination, the Company (including, prior to the Business Combination, its wholly-owned subsidiary Microvast, Inc.) contributed approximately $7.7 million to the Company’s subsidiaries. Since the closing of the Business Combination on July 23, 2021 through September 30, 2021, the Company contributed or settled inter-company payables in favor of its subsidiaries in aggregate of approximately $80 million.

In order to operate in China today, each of our subsidiaries with operations in the PRC is required to obtain a business license from the Administration for Market Regulation of PRC or its competent local counterparts for their operations. Neither the Company nor its subsidiaries (even its subsidiaries in the PRC) are under the purview of the Cyberspace Administration of China (“CAC”) because we do not currently collect any personal information in our operations, and no approvals from any other entity are required to approve our or our subsidiaries’ operations. We currently possess all governmental permits, permissions and approvals required to conduct our operations as currently conducted in the PRC and in the other jurisdictions in which we operate, and to date we have not been denied any such permits, permissions or approvals.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors”, that represent challenges that we face in connection with the successful implementation of our strategy and growth plans forour business. Set forth below is a summary of the risks of investing in the Company. For a more full explanation, see “Risk Factors” beginning on page 19:

• Our future growth depends upon the willingness of commercial vehicle and specialty vehicle operators and consumers to adopt electric vehicles.

• Certain components of our batteries pose safety risks that may cause accidents, which could lead to liability to us, cause delays in manufacturing of our product and/or adversely affect market acceptance.

• We have a limited customer base and depend on a small number of customers for a significant portion of our revenues to date and this dependence is likely to continue.

• The unavailability, reduction or elimination of, or uncertainty regarding, government and economic incentives or subsidies available to end-users and original equipment manufacturers in the PRC and abroad could have a material adverse effect on our business, financial condition, operating results and prospects.

• In connection with the audits of our consolidated financial statements as of and for the years ended December 31, 2018, 2019 and 2020, we and our independent registered public accounting firm identified two material weaknesses in our internal control over financial reporting.

• Our limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of your investment.

• We have incurred losses in the operation of our business and anticipates that we will continue to incur losses in the future. We may never achieve or sustain profitability.

• We may be unable to meet our future capital requirements, which could limit our ability to grow and have a material adverse effect on our financial position and results of operations.

• Extended periods of low oil prices could adversely affect demand for electric and hybrid electric vehicles.

• If we are unable to anticipate customer preferences and successfully develop attractive products, we might not be able to maintain or increase our revenue and profitability.

• Developments in alternative technology may adversely affect the demand for our battery products.

• The battery efficiency of electric vehicles declines over time.

• Our future depends on the needs and success of our customers.

• We may incur significant costs as a result of the warranties we supply with our products and services.

13

• If we cannot continue to develop and commercialize new products in a timely manner, and at favorable margins, we may not be able to compete effectively.

• We may experience significant delays in the design, production and launch of our new products, which could harm our business, prospects, financial condition and operating results.

• We may not be able to substantially increase our manufacturing output in order to fulfill orders from our customers.

• Our failure to cost-effectively manufacture our batteries in quantities which satisfy our customers’ demand and product specifications and their expectations for product quality and reliable delivery could damage our customer relationships and result in significant lost business opportunities for us.

• We may not be able to accurately plan our manufacturing based on our sales contracts, which may result in excess product inventory or product shortages.

• We rely on complex machinery for our operations and production involves a degree of risk and uncertainty in terms of operational performance and costs.

• Our battery packs rely on software and hardware that are highly technical, and if these systems contain errors, bugs or vulnerabilities, or if we are unsuccessful in addressing or mitigating technical limitations in our systems, our business could be adversely affected.

• We rely on third parties to manufacture chargers and charging poles and to build charging stations that are necessary for using our products.

• We currently purchase certain key raw materials and components from third parties, some of which we only source from one supplier or from a limited number of suppliers.

• If we are unable to integrate our products into vehicles manufactured by our OEM customers, our results of operations could be impaired.

• To the extent we enter into strategic relationships, we will be dependent upon our partners.

• Any failure to offer high-quality technical support services may adversely affect our relationships with our customers and harm our financial results.

• Our lengthy and variable sales cycle makes it difficult for us to accurately forecast our revenue and other operating results.

• Our business depends substantially on the continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lost their services.

• Our management has limited experience in operating a public company.

• Our planned expansion into new applications and markets poses additional risks which could adversely affect our business, financial condition and results of operations.

• We may require additional capital to support business growth, and this capital might not be available on acceptable terms, or at all.

• We may be subject to financial and reputational risks due to product recalls and product liability claims, and we could face substantial liabilities which exceed our resources.