Exhibit 10.13

STOCK PURCHASE AGREEMENT

among

G MEDICAL INNOVATIONS USA INC.,

and

SELLERS NAMED HEREIN

Dated as of October 27, 2017

TABLE OF CONTENTS

| | | Page |

| ARTICLE I DEFINITIONS; INTERPRETATION | 1 |

| Section 1.1 | Definitions | 1 |

| Section 1.2 | Additional Defined Terms | 7 |

| Section 1.3 | Interpretation | 8 |

| | | |

| ARTICLE II PURCHASE AND SALE OF SHARES | 8 |

| Section 2.1 | Purchase and Sale | 8 |

| Section 2.2 | Purchase Price | 9 |

| Section 2.3 | Closing | 9 |

| Section 2.4 | Payment of the Purchase Price; Closing Deliverables | 9 |

| Section 2.5 | Escrow | 10 |

| Section 2.6 | Withholding Rights | 11 |

| | | |

| ARTICLE III REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY | 11 |

| Section 3.1 | Organization | 11 |

| Section 3.2 | Noncontravention | 11 |

| Section 3.3 | Law Compliance | 12 |

| Section 3.4 | No Outstanding Rights to Outstanding Shares | 12 |

| Section 3.5 | Financial Statements | 12 |

| Section 3.6 | Liabilities | 13 |

| Section 3.7 | Business Changes | 13 |

| Section 3.8 | Contracts; No Defaults | 14 |

| Section 3.9 | Real Property | 16 |

| Section 3.10 | Title to Company’s Assets | 16 |

| Section 3.11 | Condition and Sufficiency of Assets | 16 |

| Section 3.12 | Intellectual Property | 17 |

| Section 3.13 | Accounts Receivable | 17 |

| Section 3.14 | Major Customers and Suppliers | 17 |

| Section 3.15 | Insurance | 17 |

| Section 3.16 | Legal Proceedings; Actions; Governmental Entity Orders | 18 |

| Section 3.17 | Compliance with Laws; Governmental Authorizations | 18 |

| Section 3.18 | Environmental Matters | 19 |

| Section 3.19 | Labor and Employment Matters | 19 |

| Section 3.20 | Employee Benefit Plans | 20 |

| Section 3.21 | Taxes | 21 |

| Section 3.22 | Books and Records | 22 |

| Section 3.23 | No Material Adverse Effect | 22 |

| Section 3.24 | No Brokers | 22 |

| Section 3.25 | Full Disclosure | 22 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF SELLERS | 22 |

| Section 4.1 | Authorization | 22 |

| Section 4.2 | Noncontravention | 22 |

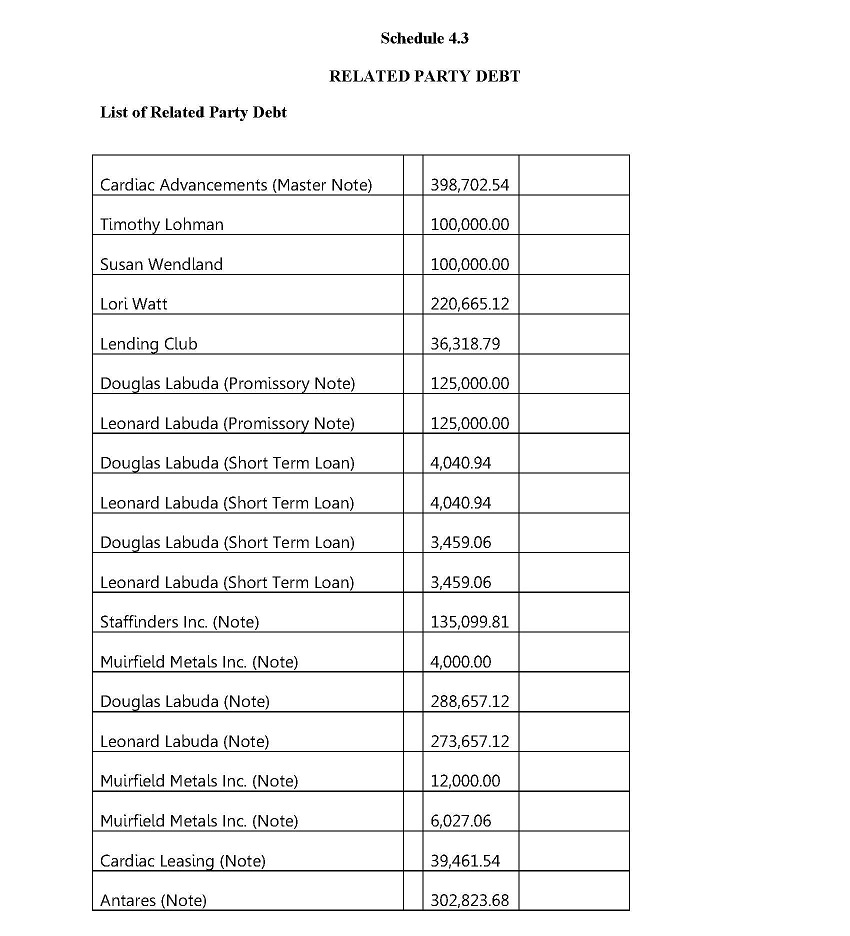

| Section 4.3 | Related Party Debt | 23 |

| Section 4.4 | Title to Outstanding Shares | 23 |

| Section 4.5 | Accredited Investor | 23 |

| Section 4.6 | CDS Representations and Warranties | 23 |

| | | |

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF BUYER | 23 |

| Section 5.1 | Organization | 23 |

| Section 5.2 | Authority; Binding Effect | 23 |

| Section 5.3 | Conflicts; Consents | 24 |

| Section 5.4 | Litigation | 24 |

| Section 5.5 | Brokers | 24 |

| Section 5.6 | Accredited Investor | 24 |

| | | |

| ARTICLE VI COVENANTS | 24 |

| Section 6.1 | Fulfillment of Obligations | 24 |

| Section 6.2 | Notices, Consents and Approvals | 25 |

| Section 6.3 | Conduct of Business | 25 |

| Section 6.4 | Access and Information | 27 |

| Section 6.5 | Confidentiality | 27 |

| Section 6.6 | Public Announcements | 27 |

| Section 6.7 | Expenses | 27 |

| Section 6.8 | Exclusivity | 28 |

| Section 6.9 | Accounts Receivable | 28 |

| Section 6.10 | Covenant Not to Compete | 29 |

| Section 6.11 | Covenant Not to Solicit | 29 |

| Section 6.12 | Release | 29 |

| Section 6.13 | Further Assurances | 30 |

| Section 6.14 | Self-Help | 30 |

| Section 6.15 | Attorney Client Privilege and Documents | 30 |

| Section 6.16 | Schedule Supplement | 31 |

| | | |

| ARTICLE VII CONDITIONS TO THE CLOSING | 31 |

| Section 7.1 | Conditions to Buyer’s Obligations | 31 |

| Section 7.2 | Conditions to Sellers’ Obligations | 32 |

| | | |

| ARTICLE VIII TERMINATION OF AGREEMENT | 33 |

| Section 8.1 | Events of Termination | 33 |

| Section 8.2 | Effect of Termination | 34 |

| | | |

| ARTICLE IX INDEMNITY | 34 |

| Section 9.1 | Sellers’ Indemnification | 34 |

| Section 9.2 | Buyer’s Indemnification | 35 |

| Section 9.3 | Indemnification Procedure | 35 |

| Section 9.4 | Third Party Claims | 36 |

| Section 9.5 | Obligation to Set Off | 37 |

| Section 9.6 | Survival of Representations and Warranties | 37 |

| Section 9.7 | Indemnity Cap | 37 |

| Section 9.8 | Payer Agreements | 37 |

| Section 9.7 | Indemnity Cap | 37 |

| Section 9.8 | Payer Agreements | 37 |

| | | |

| ARTICLE X MISCELLANEOUS | 38 |

| Section 10.1 | Entire Agreement | 38 |

| Section 10.2 | Descriptive Headings; Joint Drafting | 38 |

| Section 10.3 | Notices | 38 |

| Section 10.4 | Counterparts | 39 |

| Section 10.5 | Benefits of Agreement | 40 |

| Section 10.6 | Amendments and Waivers | 40 |

| Section 10.7 | Assignment | 40 |

| Section 10.8 | Enforceability | 40 |

| Section 10.9 | GOVERNMENT LAW; JURISDICTION; WAIVER OF JURY | 41 |

| Section 10.10 | Specific Performance | 41 |

| Section 10.11 | Delays or Omissions | 41 |

| Section 10.12 | Joint and Several Liability | 42 |

| Section 10.13 | Disclosure Schedules | 42 |

| Section 10.14 | Sellers’ Representative | 42 |

| Section 10.15 | Guaranty | 43 |

| | | |

| Schedule 1.1 | VOLUNTARY ESCROW AGREEMENT | |

| Schedule 2.4(d) | LIST OF RELIEF PAYMENTS TO BE MADE AT CLOSING | |

| Schedule 2.5(a) | SELLER PERCENTAGE SHARE | |

| Schedule 3.2(ii) | CONSENTS | |

| Schedule 3.4 | CAPITALIZATION OF THE COMPANY IMMEDIATELY PRIOR TO THE CLOSING | |

| Schedule 3.5 | FINANCIAL DISCLOSURES | |

| Schedule 3.6 | DISCLOSED LIABILITIES | |

| Schedule 3.8 | CONTRACTS | |

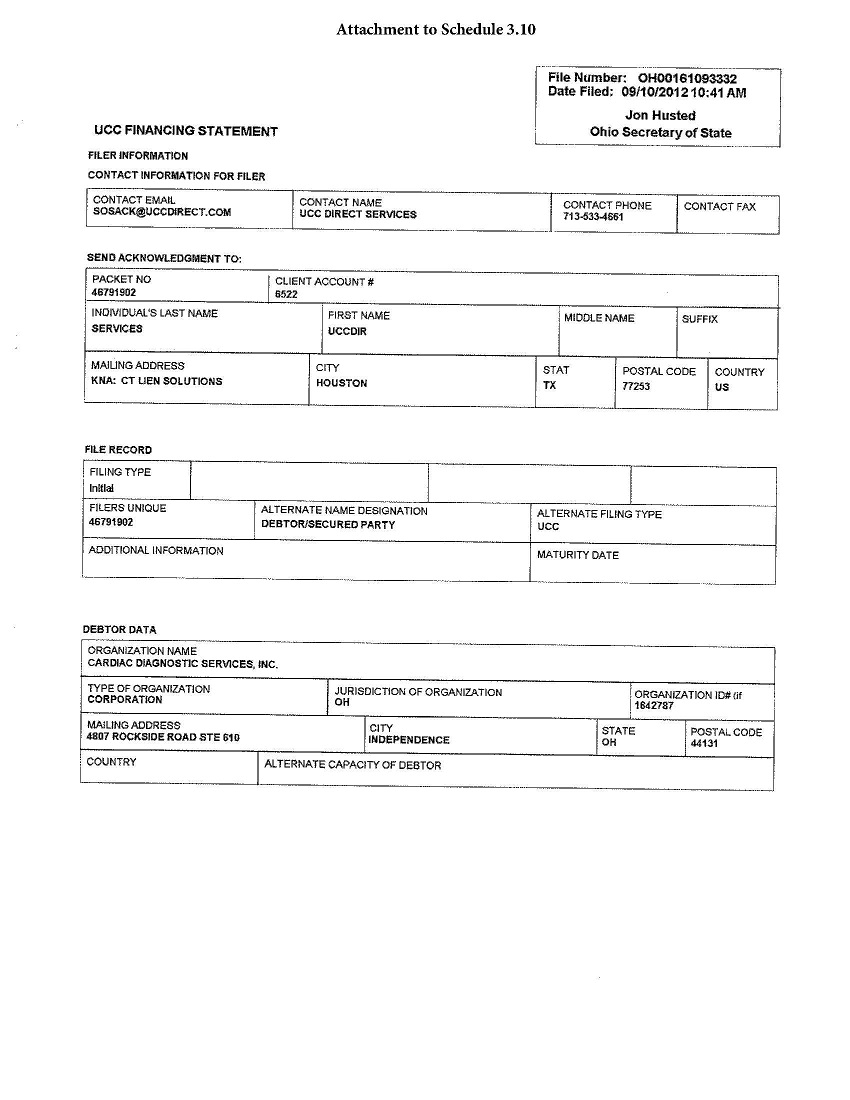

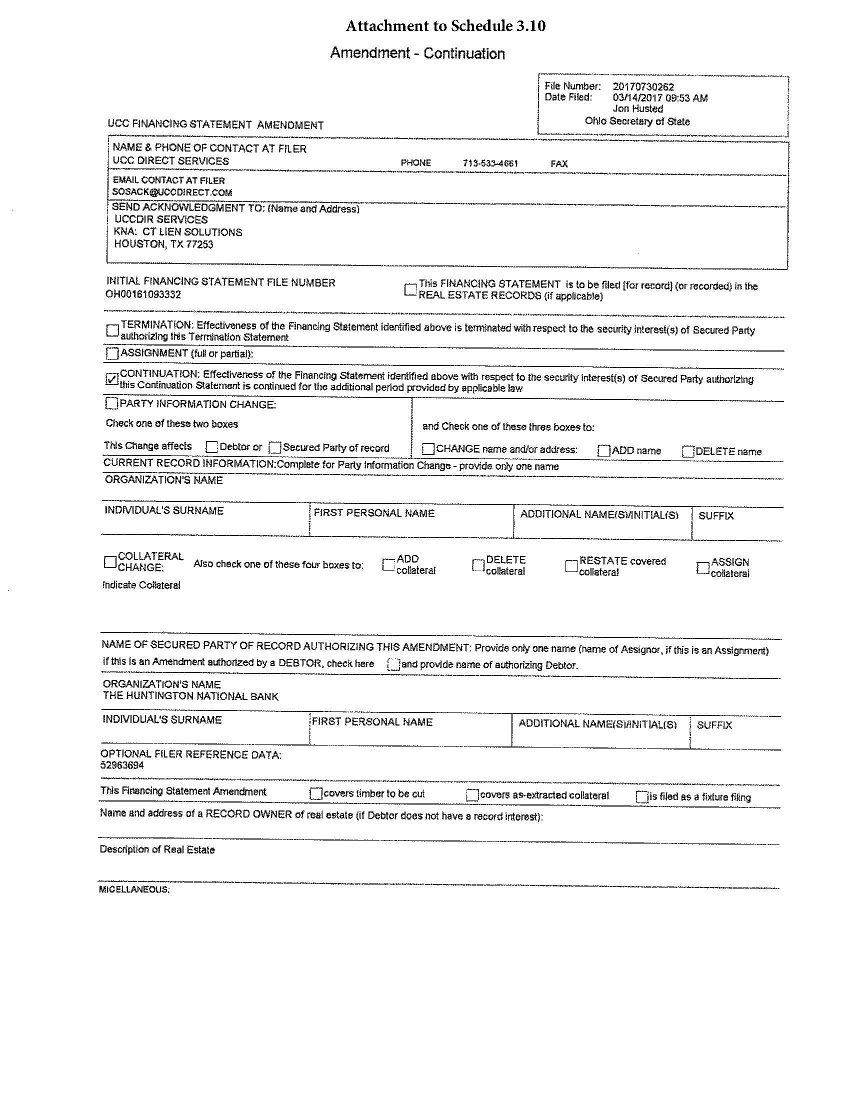

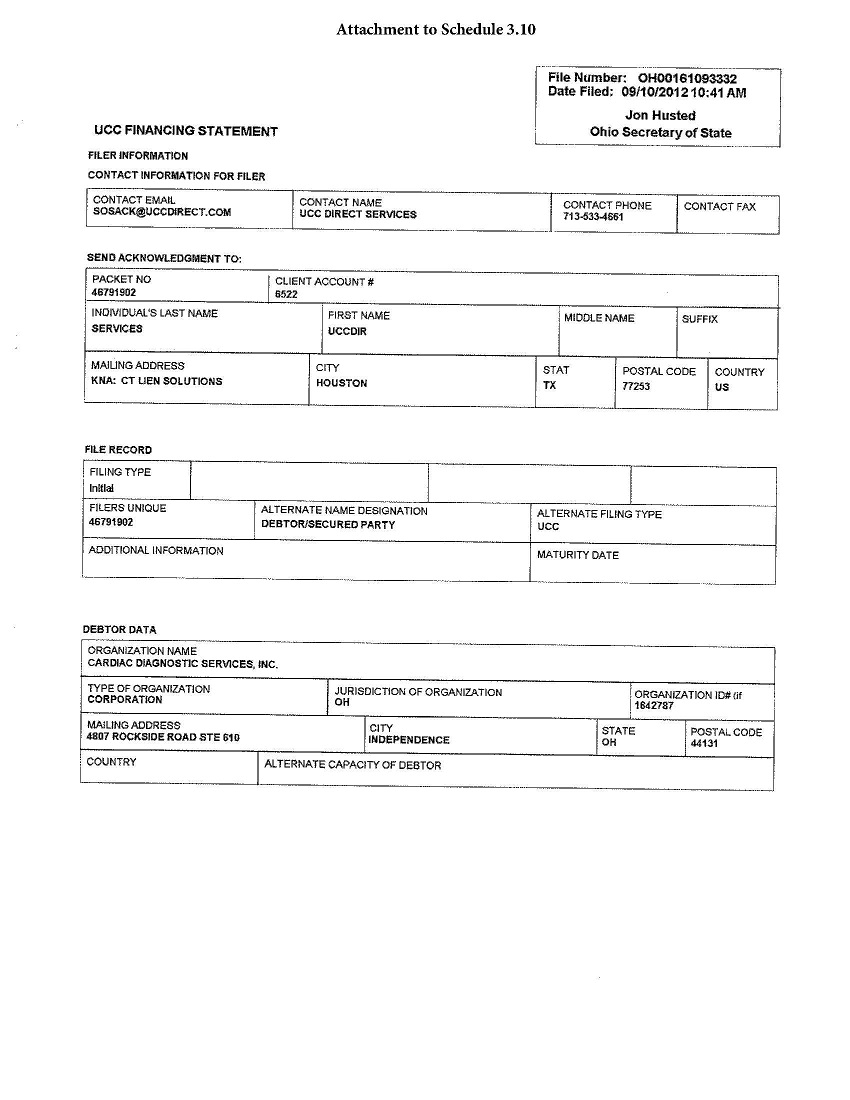

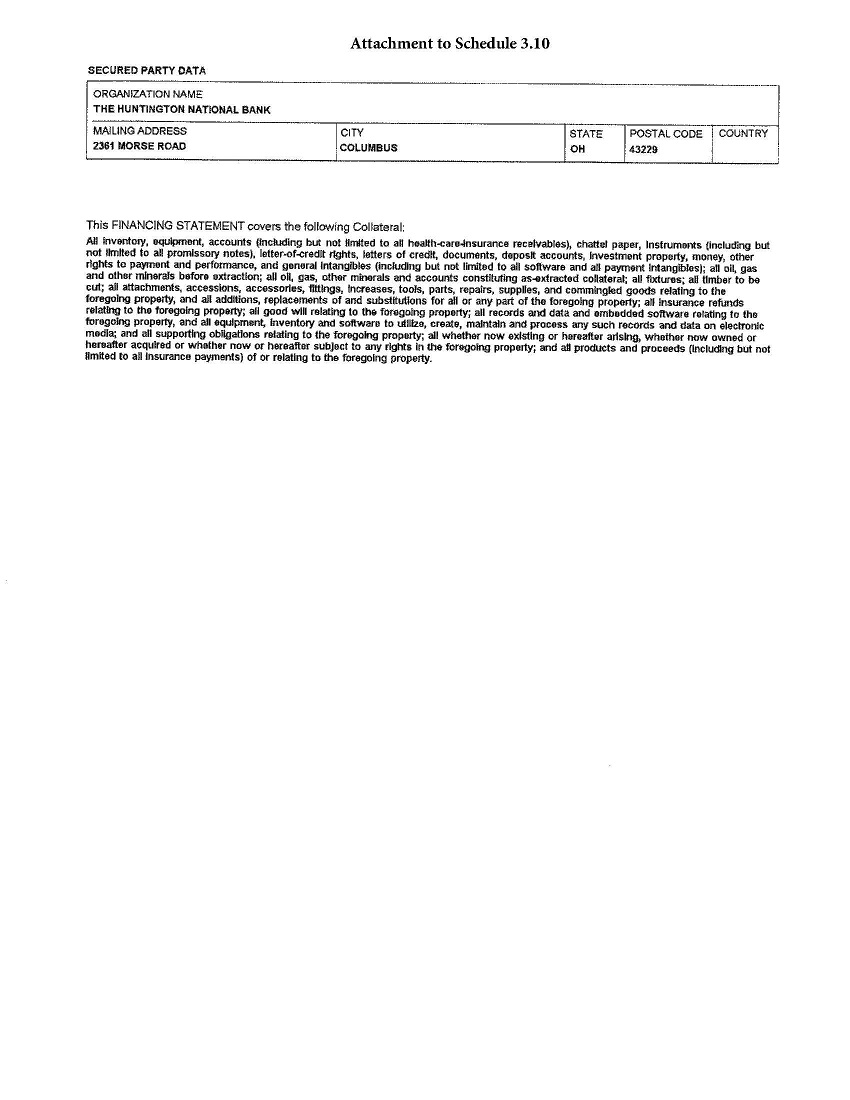

| Schedule 3.10 | PERMITTED ENCUMBRANCES | |

| Schedule 3.12 | COMPANY INTELLECTUAL PROPERTY | |

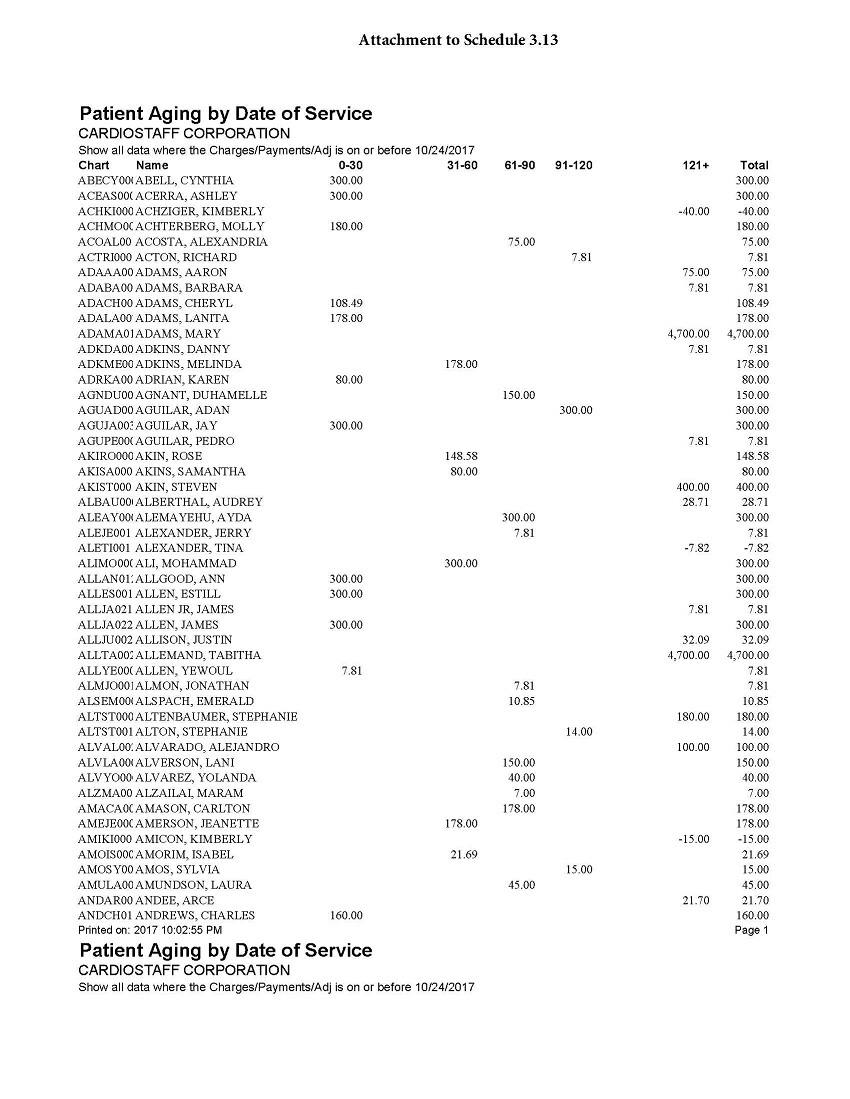

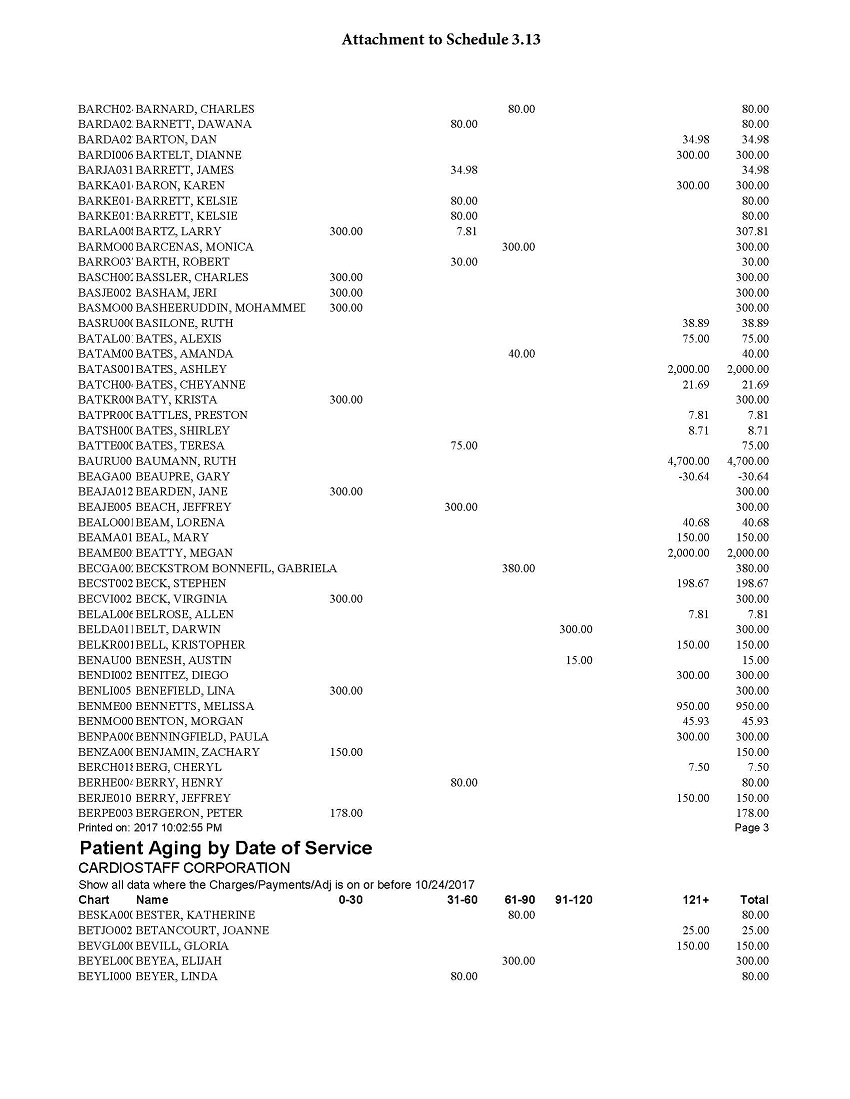

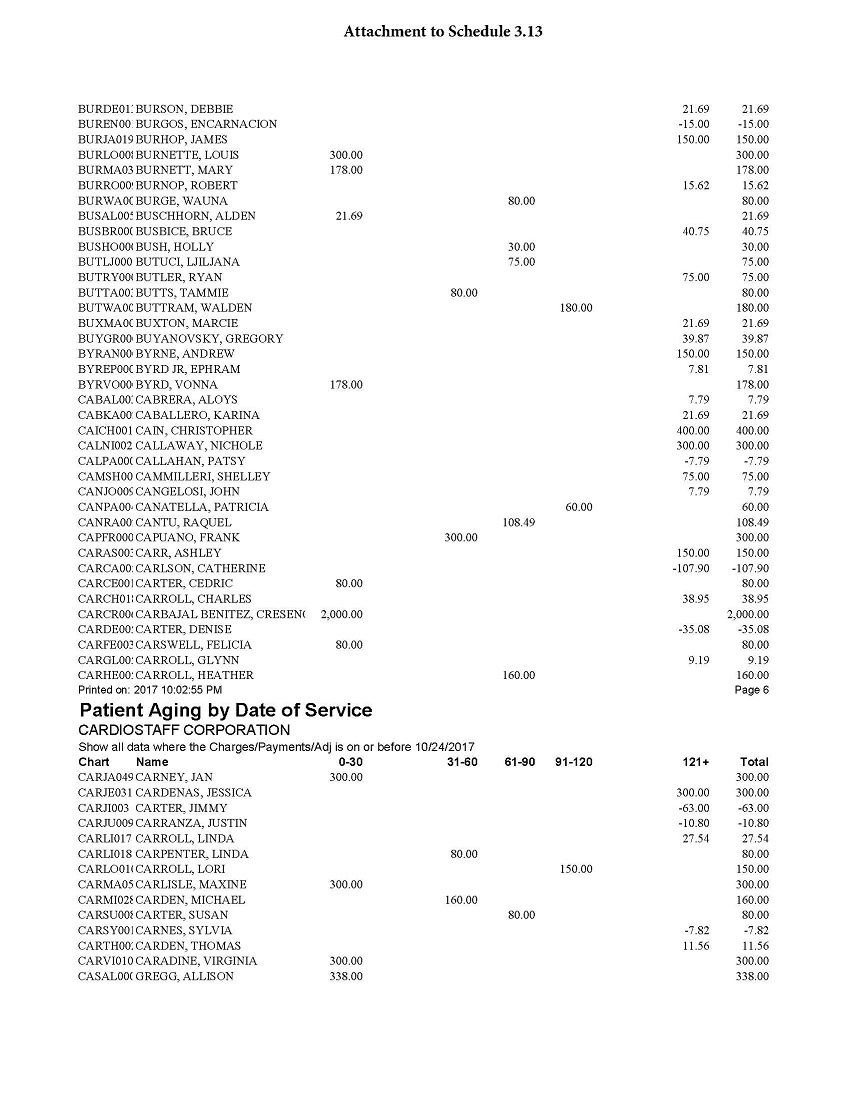

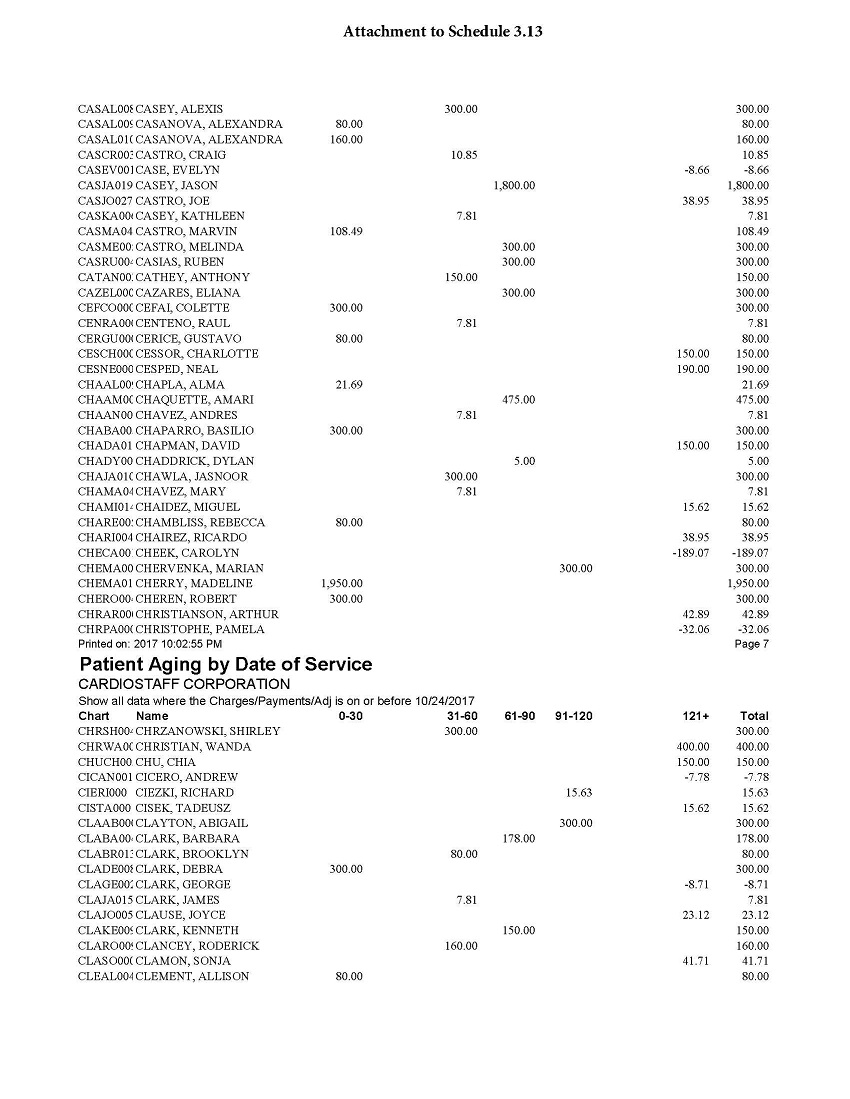

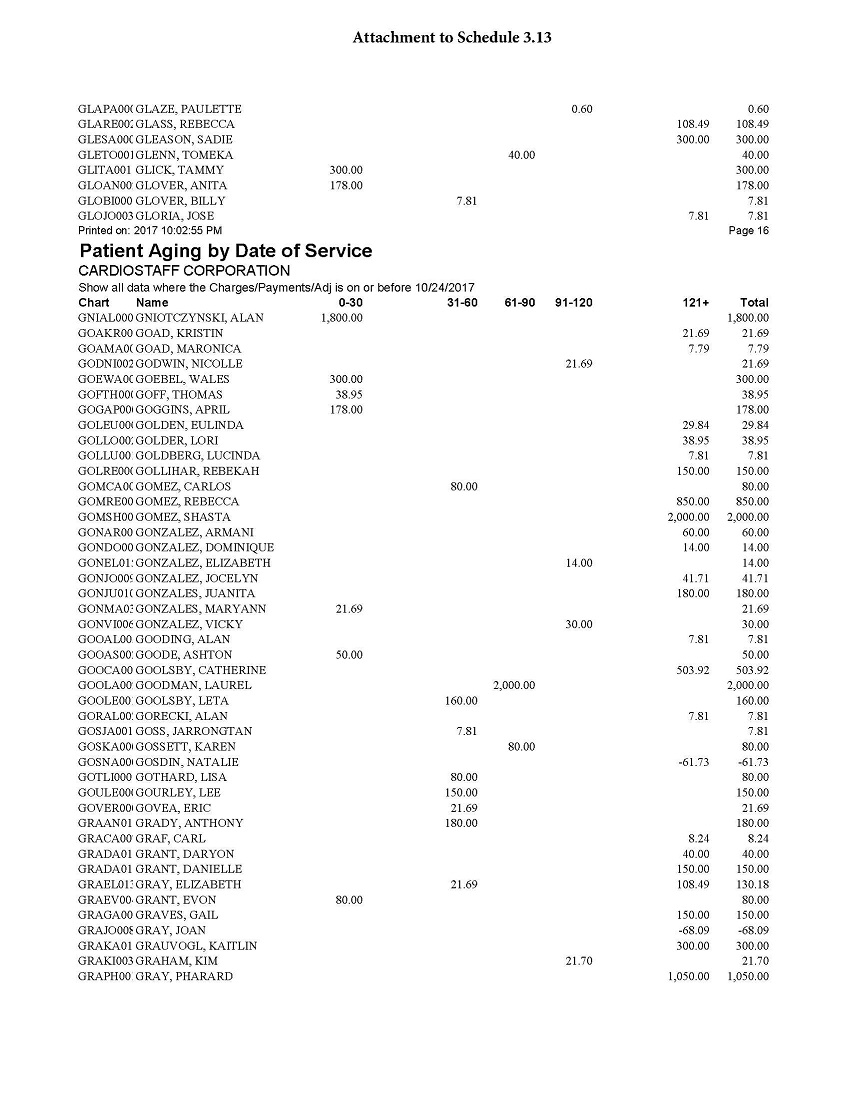

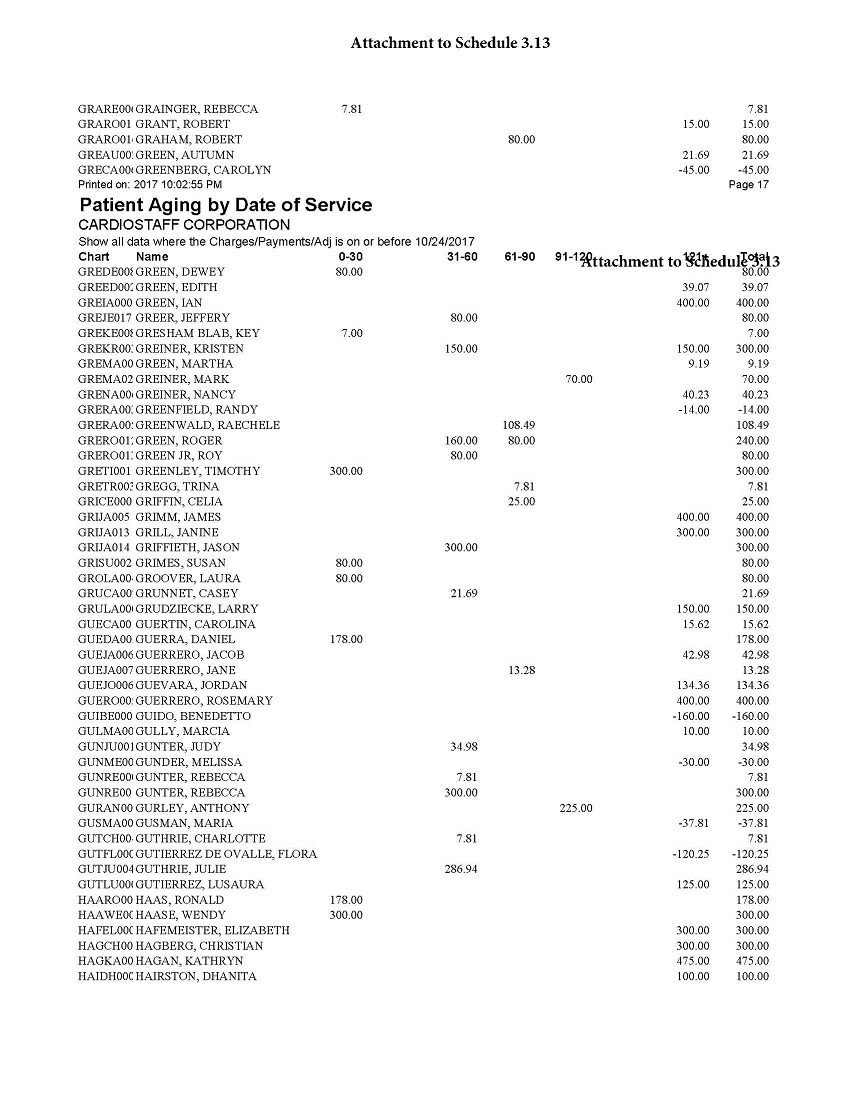

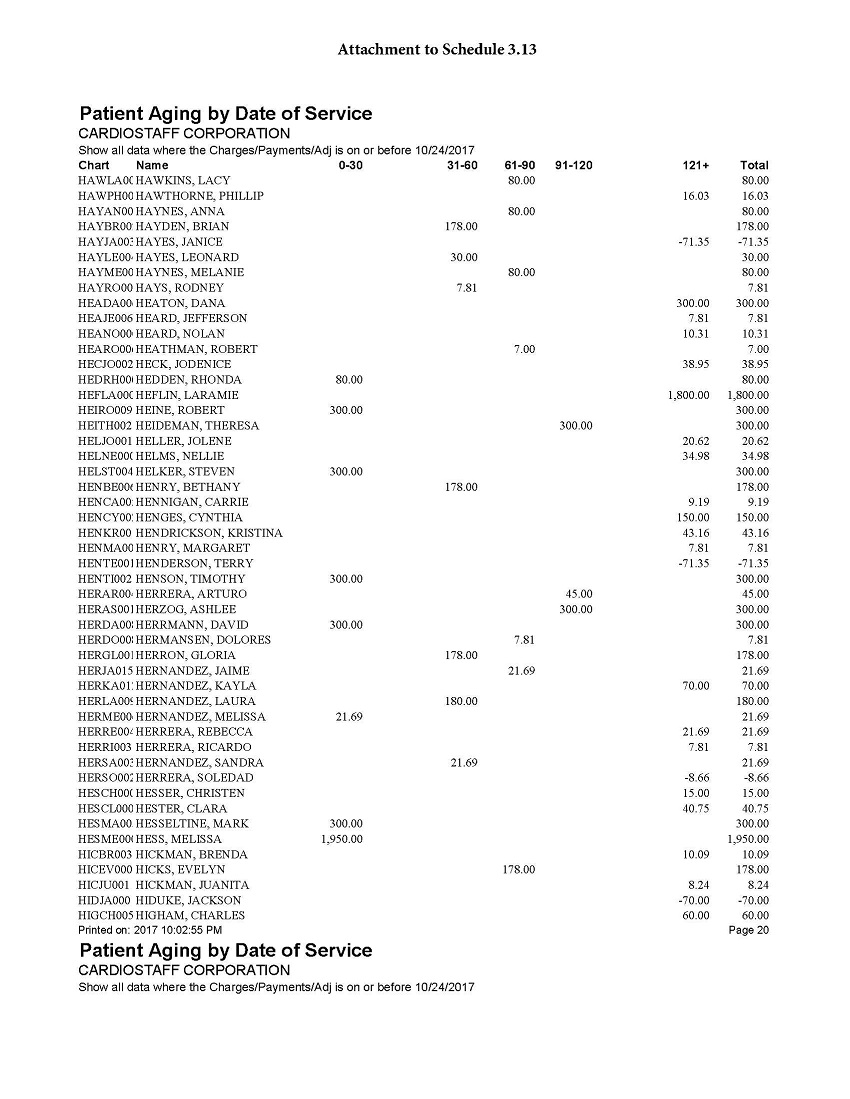

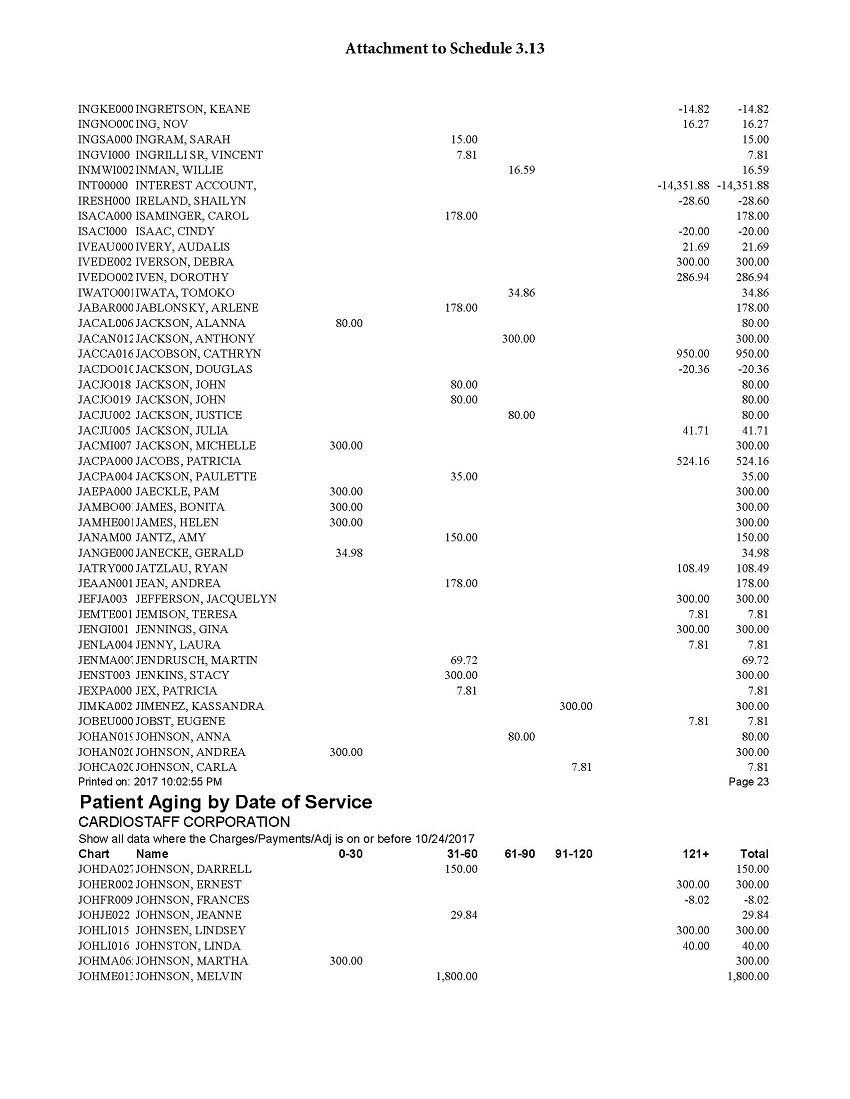

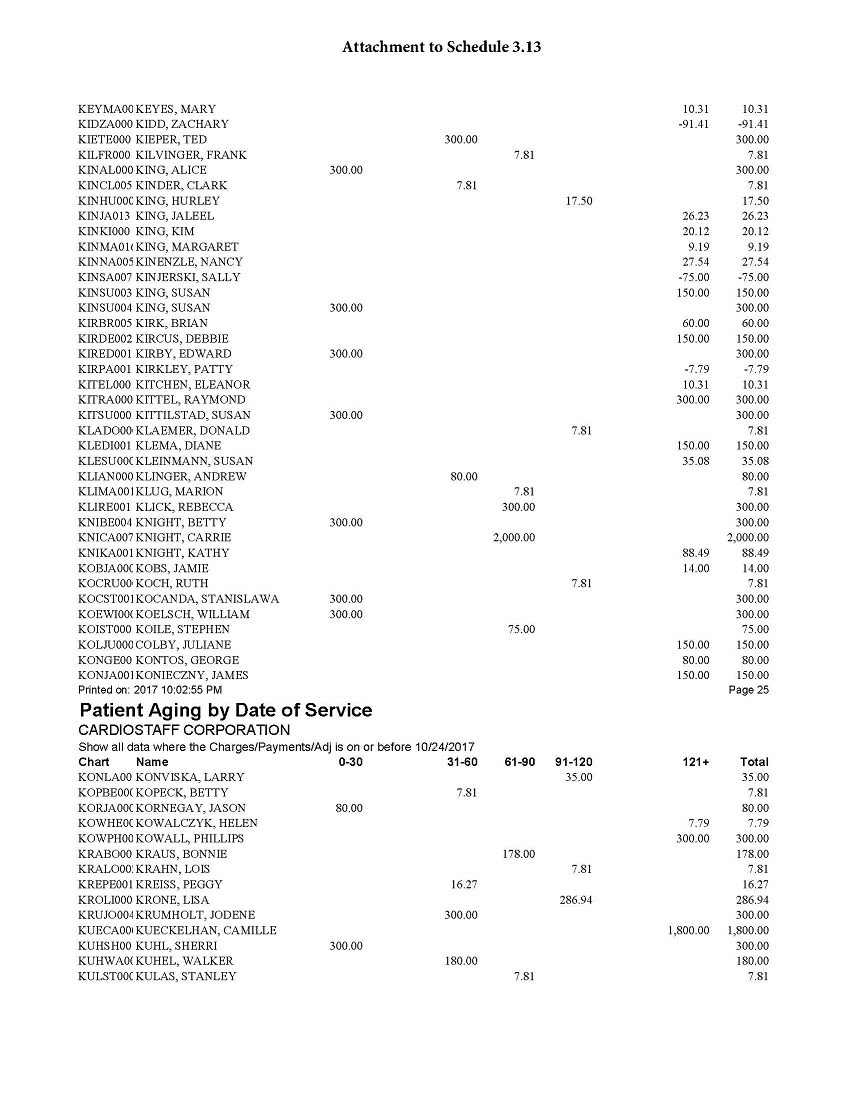

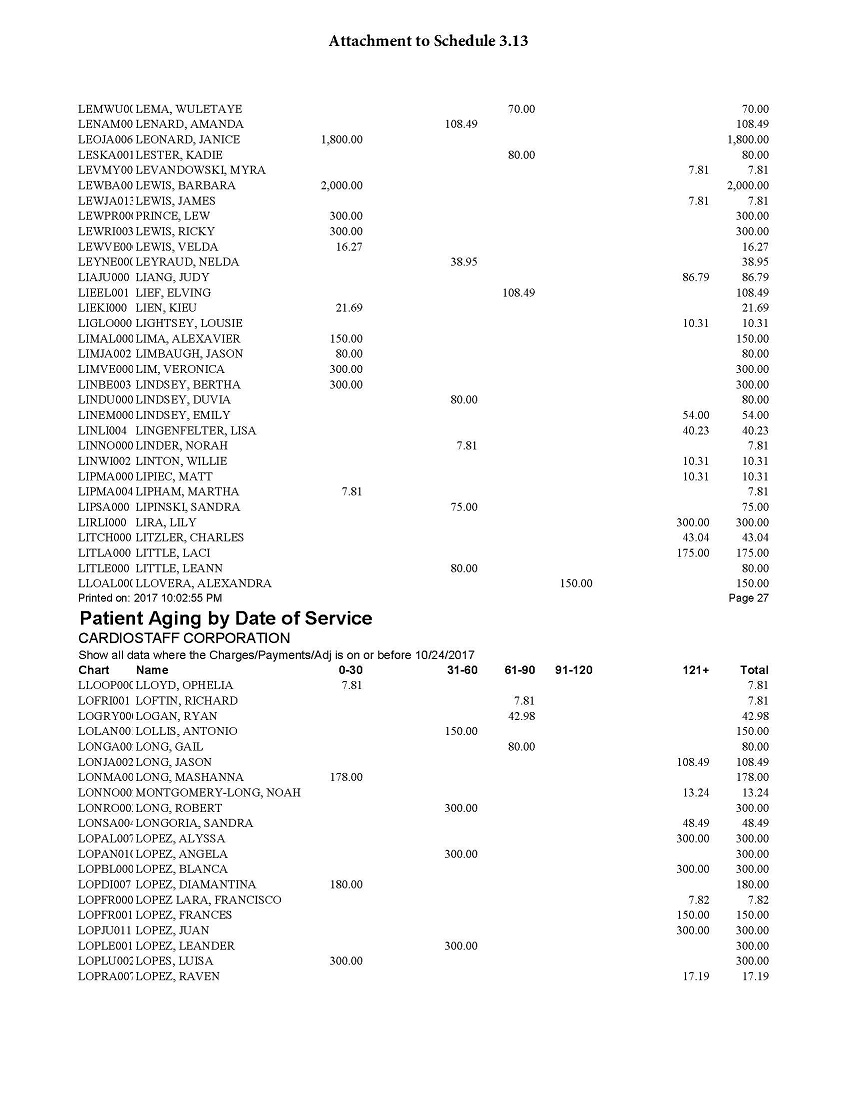

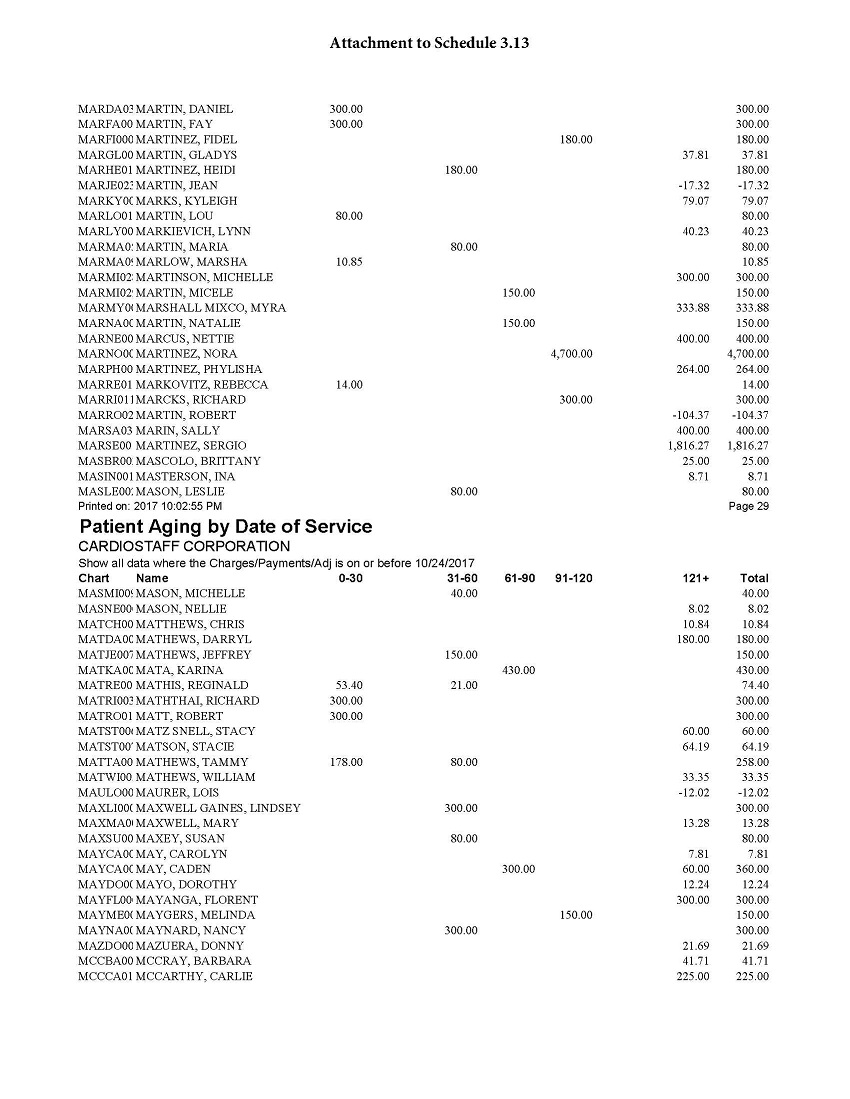

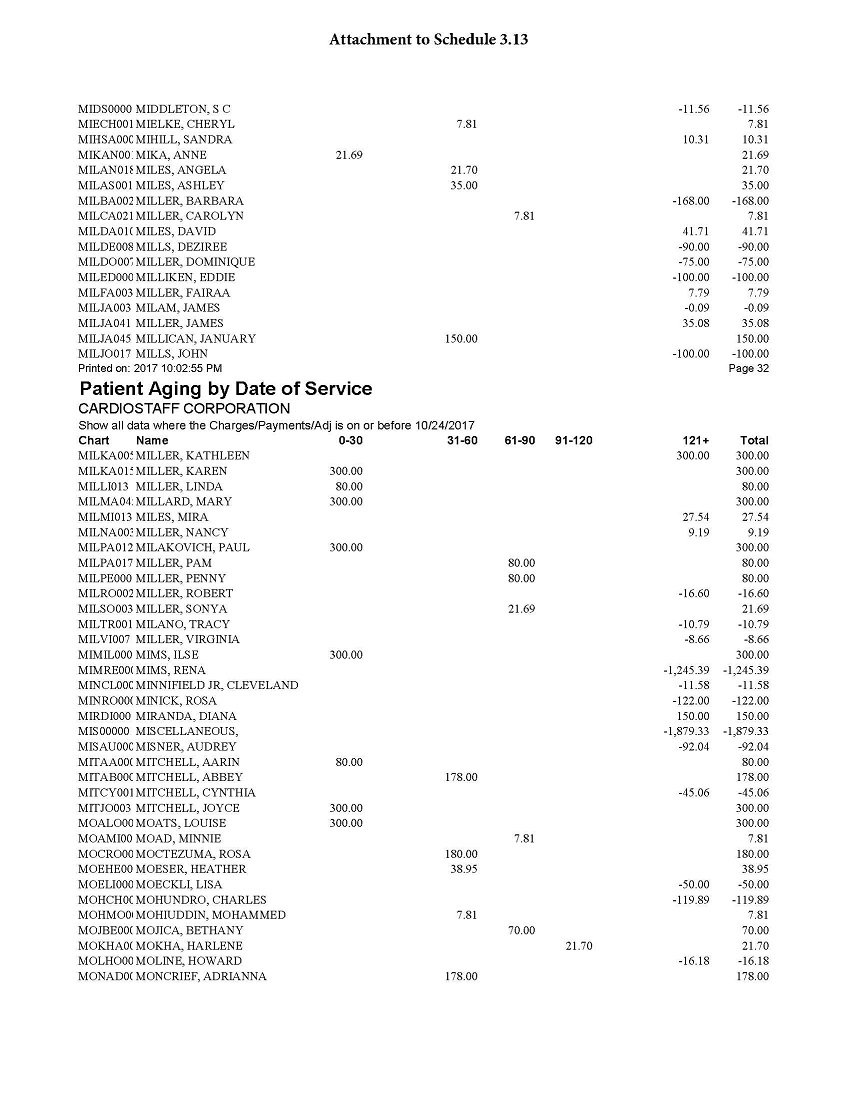

| Schedule 3.13 | ACCOUNTS RECEIVABLE | |

| Schedule 3.14 | MAJOR CUSTOMERS AND SUPPLIERS | |

| Schedule 3.15 | INSURANCE | |

| Schedule 3.19(c) | EMPLOYEES | |

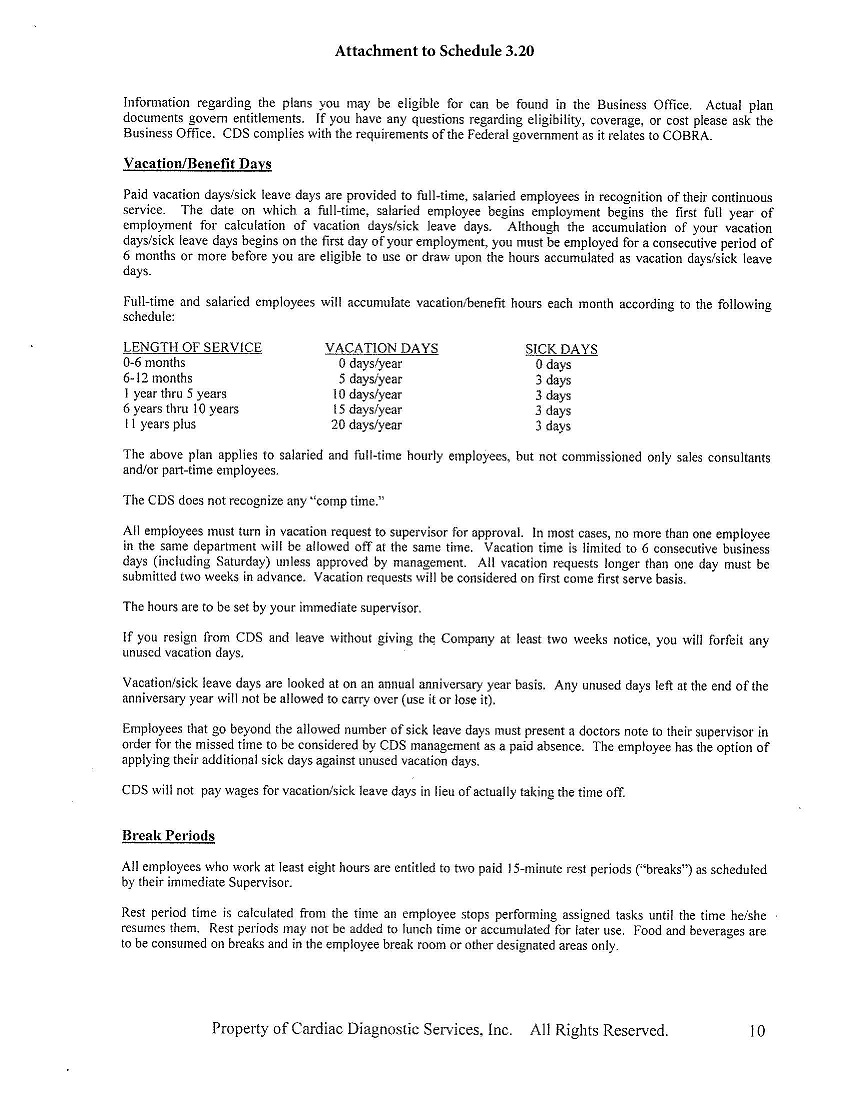

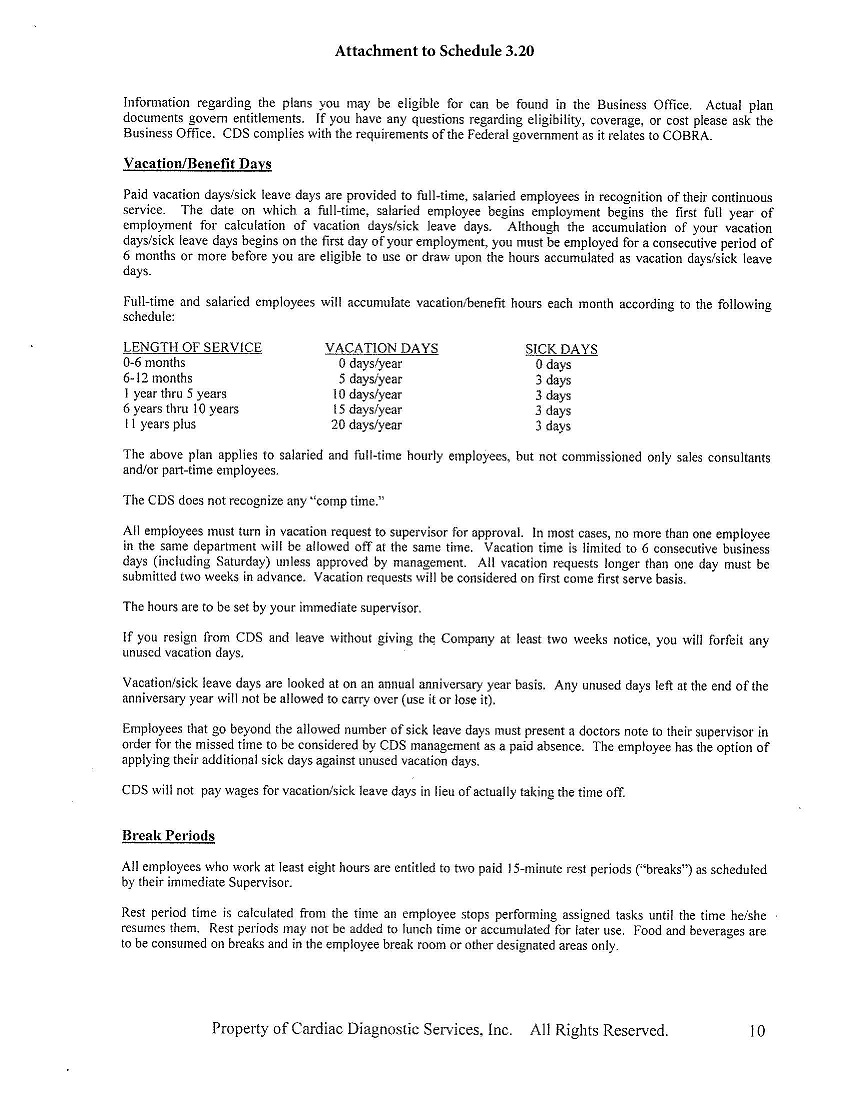

| Schedule 3.20 | EMPLOYEE BENEFIT PLANS | |

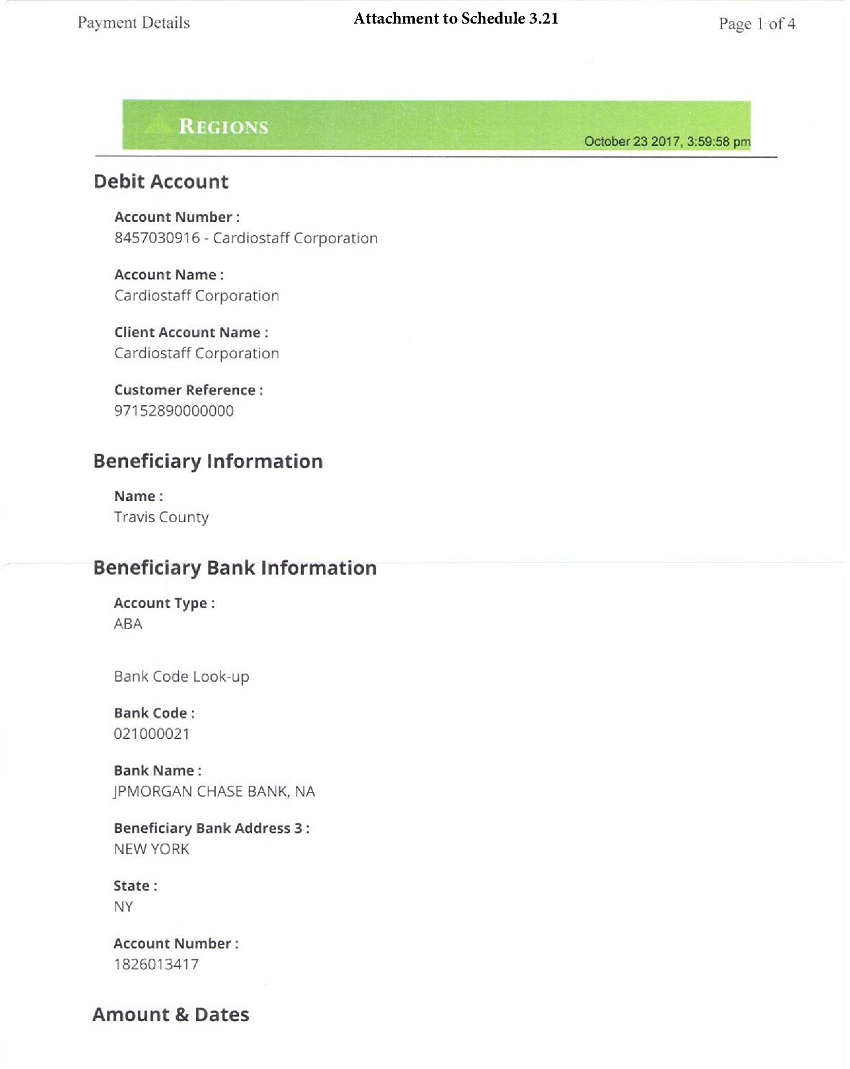

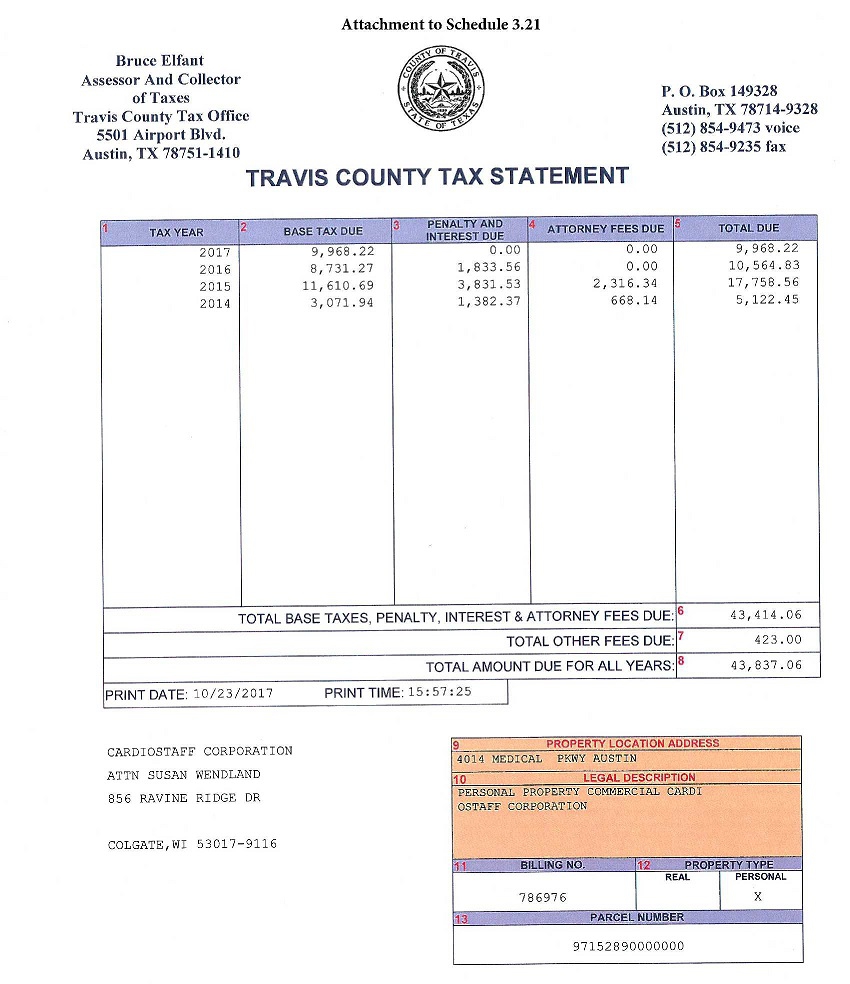

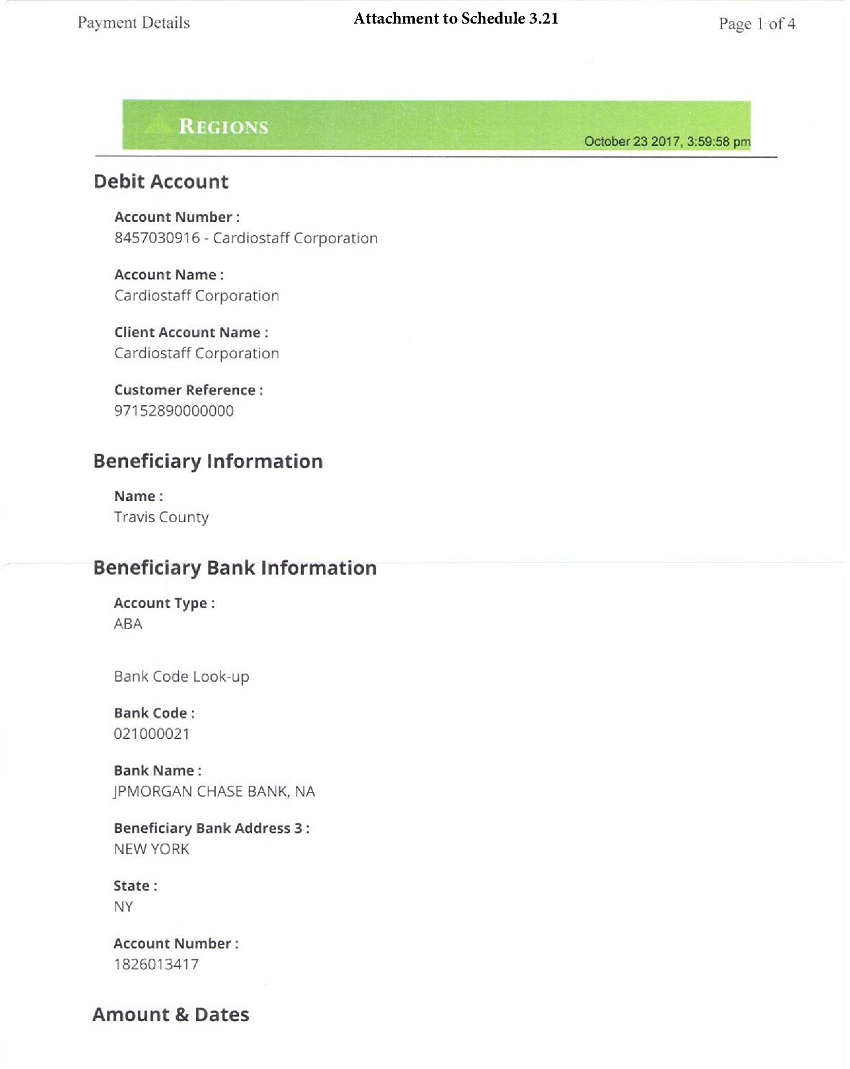

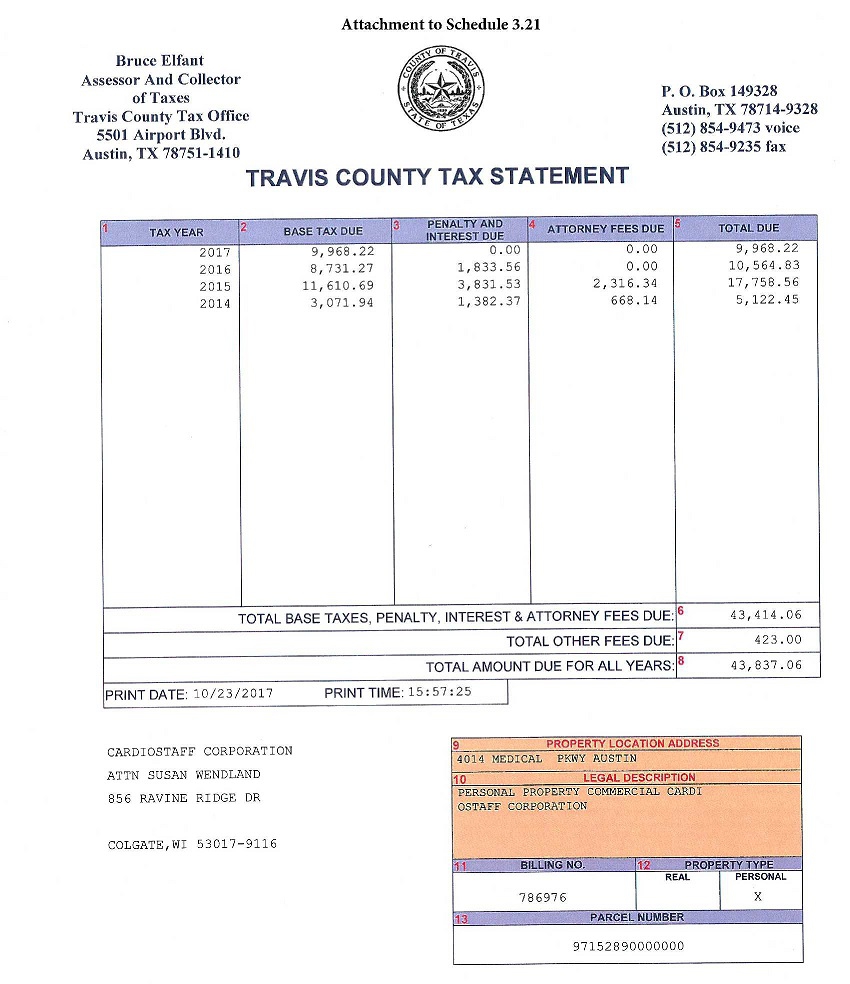

| Schedule 3.21 | TAXES | |

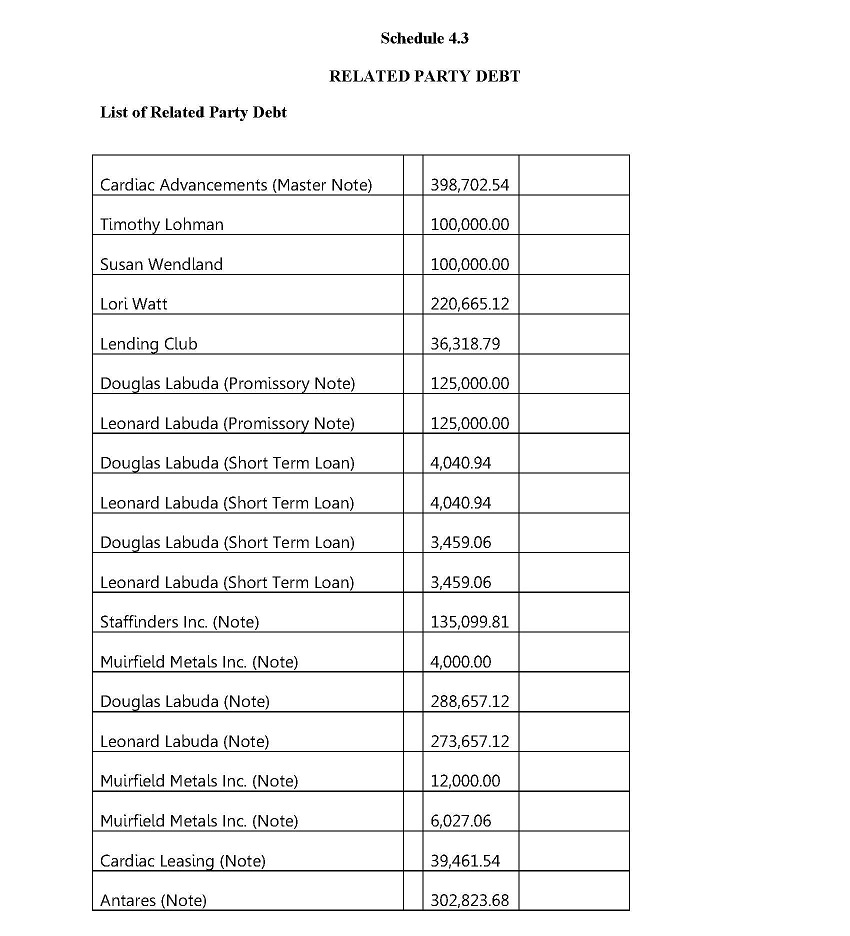

| Schedule 4.3 | RELATED PARTY DEBT | |

| Schedule 7.1(h) | CARDIAC DIAGNOSTICS DEBT SCHEDULE | |

SHARE PURCHASE AGREEMENT

This SHARE PURCHASE AGREEMENT (this “Agreement”) is dated as of October 27, 2017, by and among G MEDICAL INNOVATIONS USA INC., a Delaware corporation (“Buyer”) and the persons named as sellers on the signature pages hereto (each, a “Seller” and collectively, “Sellers”), and Timothy L. Lohman, (the “Sellers’ Representative”). Buyer, the Company, Sellers, and the Sellers’ Representative are each sometimes referred to herein as a “Party” and, collectively, as the “Parties.” Capitalized terms which are used but not otherwise defined herein are defined in Section 1.1 below.

WHEREAS, Sellers own immediately prior to Closing (as defined below) all of the issued and outstanding shares of common stock of the Company;

WHEREAS, the Company and CDS (as defined below) have completed or intend to complete a Merger (as defined below) prior to the Closing (as defined below) and the Company is the surviving entity in such Merger;

WHEREAS, Buyer wishes to acquire all of the outstanding shares of common stock of the Company; and

WHEREAS, the Parties desire to enter into this Agreement pursuant to which each Seller agrees to sell to Buyer, and Buyer agrees to purchase from each Seller, all of the Outstanding Shares owned by such Seller in the Company, on and subject to the terms and conditions contained herein, and that immediately after the Closing, Buyer shall be the sole owner of all shares and equity interests in the Company.

NOW, THEREFORE, in consideration of the representations, warranties, covenants and agreements contained herein, the Parties hereby agree as follows:

ARTICLE I

DEFINITIONS; INTERPRETATION

Section 1.1 Definitions. For the purposes of this Agreement, each of the following terms shall have the following respective meanings:

“Action” means any action, claim, dispute, arbitration, audit, hearing, investigation, litigation, suit or other proceeding (whether civil, criminal, arbitral, administrative, investigative, or informal) commenced, brought, conducted, or heard by or before, or otherwise involving, any Governmental Entity or any referee, trustee, arbitrator or mediator.

“Affiliate” means, with respect to any Person, any other Person who directly or indirectly controls, is controlled by, or is under common control with, such Person. The term “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlled,” “controlling,” “controlled by” and “under common control with” have meanings correlative thereto.

“Applicable Law” means, with respect to any Person, any Law and other provisions having the force or effect of law applicable to such Person or any of its Affiliates or any of their respective Assets, officers, directors or employees (in connection with such officer’s, director’s or employee’s activities on behalf of such Person or any of its Affiliates).

“Assets” means all properties, assets and rights of every kind, nature and description whatsoever whether tangible or intangible, real, personal or mixed, wherever located, (including, without limitation, cash, cash equivalents, accounts receivable, inventory, equipment, improvements, intellectual property, contracts, real estate, claims and defenses).

“Balance Sheet Date” means September 30, 2017.

“Books and Records” means all books and records pertaining to the Company or CDS, of any and every kind, including client and customer lists, Tax Returns and supporting workpapers and schedules (including accountants’ workpapers), referral sources, research and development reports, operating guides and manuals, financing and accounting records, programs, inventory lists, correspondence, emails, word and data storage systems, compact disks, compact disk lists, account ledgers, minute books, stock ledgers, articles of incorporation, bylaws, files, reports, plans, advertising materials, promotional materials, drawings and operating records, held or maintained by the Company, CDS or any Affiliate of the Company.

“Business” means the business and operations presently conducted and as presently contemplated to be conducted by the Company and CDS.

“Business Day” means any day other than a Saturday, Sunday or other day on which banks in New York, New York, Austin, Texas, or Independence, Ohio are required to be closed.

“Buyer Parent” means G Medical Innovations Holdings Ltd.

“CDS” means Cardiac Diagnostic Services, Inc., formerly an Ohio corporation prior to the Merger.

“Code” means the United States Internal Revenue Code of 1986, as amended.

“Company” means Cardiostaff Corporation, a Texas corporation, and pursuant to the Merger (and for all purposes under this Agreement) includes all aspects of CDS, no exceptions or reservations.

“Company Intellectual Property” means all Intellectual Property that is (i) used in or necessary or material to the conduct of the Business, and/or (ii) owned by or licensed to the Company or CDS.

“Consent” means any approval, consent, ratification, waiver, clearance or other authorization of, notice to or registration, qualification, designation, declaration or filing with any Person, including, without limitation, any authorization from a Governmental Entity.

“Employee Benefit Plans” mean any “employee pension benefit plans” (as defined in Section 3(2) of ERISA), “employee welfare benefit plans” (as defined in Section 3(1) of ERISA) and all other bonus, pension, profit sharing, deferred compensation, incentive compensation, stock ownership, stock purchase, stock option, phantom stock, equity-based retirement, vacation, severance, employment agreement, change in control agreement, indemnification agreement, disability, death benefit, hospitalization, medical or other plan, arrangement or understanding (whether or not legally binding) providing benefits to any current or former employee, officer, director or other service provider of the Company or CDS, or with respect to which the Company or CDS has any liability or obligation to contribute.

“Environmental Laws” means any Applicable Law relating to the injury to, or the pollution or protection of human health and safety or the environment.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and any laws, rules, or regulations related thereto.

“Escrow Agreement” means the Voluntary Escrow Agreement, in the form attached hereto as Schedule 1.1 by and among Sellers and Buyer Parent, including any amendment, modification, supplement or replacement thereto.

“Fraud” means the Sellers’ actual and intentional fraud with respect to the making of the representations and warranties pursuant to Section 4, provided, that such actual and intentional fraud of Sellers shall only be deemed to exist if Sellers had actual knowledge (as opposed to imputed or constructive knowledge) that the representations and warranties made by the Sellers pursuant to Section 4 were actually breached when made, with the express intention that the Buyer rely thereon to its detriment.

“Fully-Diluted Basis” means the calculation of shareholding ratio on the basis of the assumption that all the outstanding options, warrants and other stock equity securities convertible into, exercisable or exchangeable for any shares of the Company (whether or not they are at present convertible, exercisable or exchangeable according to the relevant provisions) have been converted, exercised or exchanged accordingly.

“GMV” means G Medical Innovations Holdings Ltd.

“Governmental Entity” means any government or governmental or regulatory body, or any agency, political subdivision, authority or instrumentality thereof, whether foreign, federal, provincial, state, municipal or local or any court or arbitrator (whether public or private).

“Hazardous Material” means any chemical, substance, material, waste, pollutant or contaminant regulated under applicable Environmental Laws, including petroleum, petroleum products, petroleum-derived substances, radioactive materials, medical or infections waste, hazardous wastes, polychlorinated biphenyls, lead based paint, radon, urea formaldehyde, asbestos or any materials containing asbestos, lead-based paint, mold, greenhouse gases, noise and any materials or substances regulated or defined as or included in the definition of “hazardous substances,” “hazardous materials,” “hazardous constituents,” “toxic substances,” “pollutants,” “contaminants” or any similar denomination intended to classify or regulate substances by reason of toxicity, carcinogenicity, ignitability, corrosivity or reactivity under any Environmental Law.

“Income Tax” means any federal, state, local or foreign Tax based on, measured by or with respect to income, net worth or capital, including any interest, penalty or addition thereto.

“Indebtedness” means, with respect to any Person, (a) indebtedness of such Person for borrowed money, (b) indebtedness evidenced by notes, debentures, bonds or other similar instruments, the payment for which such Person is responsible or liable, (c) all obligations of such Person issued or assumed as the deferred purchase price of property, all conditional sale obligations of such Person, all obligations of such Person under any title retention agreement and all obligations of such Person or any other Person secured by any Lien on any property or asset of such Person, (d) all obligations of such Person under capital lease obligations, (e) all obligations of such Person for the reimbursement of any obligor on any letter of credit, surety bond, banker’s acceptance or similar credit transaction, (f) all obligations of such Person under interest rate, currency swap or hedging transactions (valued at the termination value thereof), (g) all unfunded pension and other employee related obligations, (h) the liquidation value, accrued and unpaid dividends and other monetary obligations in respect of any redeemable preferred shares of such Person, (i) all obligations of the type referred to in clauses (a) through (h) of any other Person, the payment for which such Person is responsible or liable, directly or indirectly, as obligor, guarantor, surety or otherwise, including guarantees of such obligations, and (j) all principal, accreted value, accrued and unpaid interest, prepayment and redemption premiums or penalties (if any), unpaid fees or expenses and other monetary obligations in respect of the obligations of the type referred to in clauses (a) through (i).

“Intellectual Property” means, anywhere in the world, all of the following: (a) patents, patent applications, utility models, foreign priority rights and invention registrations, together with continuations, continuations-in-part, extensions, provisionals, divisions, reissues, patent disclosures, inventions (whether or not patentable) and improvements thereto, (b) registered and unregistered trademarks, service marks, logos, trade dress, trade names and other source-identifying designations and devices as well as all applications for registration, (c) copyrights and design rights, whether registered or unregistered, and pending applications to register the same, (d) Internet domain names and registrations thereof, (e) trade secrets, confidential or nonpublic technical or business information, know-how, works-in-progress, concepts, methods, processes, (whether or not at a commercial stage and whether in written, electronic, magnetic, verbal or any other form and whether or not patentable), (f) all actions and rights to sue at law or in equity for past, present or future infringement or other impairment of any of the foregoing, including the right to receive all proceeds and damages therefrom, and (g) any other intellectual property recognized by Applicable Law.

“Law” means any domestic or foreign, federal, provincial, state or local statute, law (including the common law), ordinance, rule, regulation, directive, Order, writ, injunction, judgment, administrative or judicial decision or interpretation, treaty, decree or other requirement of any Governmental Entity.

“Legal Requirement” means any requirement of Applicable Law, including Permits.

“Liability” means any direct or indirect indebtedness, obligation, liability, claim, suit, judgment, demand, loss, damage, deficiency, cost, expense, fee, fine, penalty, responsibility or obligation (whether known or unknown, whether asserted or unasserted, whether absolute or contingent, whether secured or unsecured, whether choate or inchoate, whether fixed or unfixed, whether accrued or unaccrued, whether liquidated or unliquidated, and whether due or to become due and regardless of when asserted), including liability for Taxes.

“Lien” means any claim, lien (statutory or otherwise), encumbrance, pledge, Liability, restriction, charge, instrument, license, preference, priority, security agreement, covenant, right of recovery, option, charge, hypothecation, easement, security interest, interest, right of way, encroachment, mortgage, deed of trust, imperfection of title, prior assignments, Order or other encumbrance or charge of any kind or nature whatsoever or any conditional sale or other title retention agreement or other Contract having substantially the same effect as any of the foregoing.

“Material Adverse Effect” means any fact, event, circumstance or change affecting the Company or the Business which individually or in the aggregate when taken together with one or more other facts, events, circumstances or changes effecting the Company or the Business is materially adverse to (a) the condition (financial or otherwise), business, prospects, revenue, profitability, Assets, Liabilities or results of operations of the Company, any of its Subsidiaries or the Business or (b) the ability of Sellers or the Company to perform their respective obligations hereunder and under the other Transaction Documents.

“Merger” means the merger of CDS into the Company pursuant to the merger agreement between CDS, the Company, and the shareholders of CDS dated July 14, 2017 and amended October 17, 2017.

“Merger Agreement” means that certain Merger Agreement dated July 14, 2017 by and among the Sellers, CDS, and the Company and amended October 17, 2017.

“Order” means any decree, injunction, ruling, judgment, assesment, award, consent or other order of or entered by any Governmental Entity, including any judicial or administrative interpretaions, guidances, directives, policy, statements or opinions.

“Ordinary Course of Business” means the ordinary course of business of the Company and its Subsidiaries consistent with past custom and practice (including with respect to quantity, quality and frequency) during the one year period preceding the date of this Agreement.

“Organizational Documents” means with respect to any particular entity, (a) if a U.S. corporation, the articles or certificate of incorporation, the bylaws, and the Shareholder Agreement dated October 18, 2017 by and among the Company and the Sellers (b) if a US limited liability company, the articles or certificate of organization and operating agreement, (c) if a partnership, the partnership agreement and any certificate of partnership, and (d) if another type of Person, any other charter or similar document adopted or filed in connection with the creation, formation or organization of the person, (e) all equity holders’ agreements, voting agreements, voting trusts, joint venture agreements or other agreements or documents relating to the organization, management or operation of any Person or related to the duties, rights and obligations of the equity holders of any Person, and (f) any amendment or supplement to any of the foregoing.

“Outstanding Shares” means 100% of the issued and outstanding shares of Common Stock of the Company with no par value.

“Payer Agreements” means certain agreements entered into between CDS and various insurance companies pursuant to which CDS was accredited with such insurance companies as a payee under such insurance company’s coverage network.

“Permits” means all filings, franchises, permits, approvals, certificates, licenses, agreements, waivers, quotas, authorizations and similar rights with or issued by a Governmental Entity held or used in connection with the Company or its Subsidiaries, or required under any Applicable Law for the continued operation of the Business.

“Person” means an individual, a partnership, a corporation, a joint venture, an association, a limited liability company, a joint stock company, a trust, a joint venture, an unincorporated organization or a Governmental Entity.

“Representative” means, with respect to any Person, its attorneys, accountants, agents, consultants or other representatives.

“Securities Act” means, the Securities Act of 1933, as amended.

“Sellers’ Knowledge” means the knowledge after reasonable inquiry of Timothy L. Lohman, Susan J. Wendland, and Ron Ciocca.

“Seller Transaction Expenses” has such meaning as set forth in Section 6.7.

“Shareholder Agreement” means the shareholder agreement entered into between the shareholders of the Company dated October 18, 2017.

“Statement Date” means September 30, 2017.

“Stock Split” means the reverse stock split transaction pursuant to that certain Plan of Corporate Reorganization dated as of October 12, 2017, which was completed in connection with the Merger to reduce the number of Outstanding Shares of the Company.

“Subsidiary” means, with respect to any Person, any corporation, limited liability company, partnership, association or other business entity of which (i) if a corporation or a limited liability company (with voting securities), a majority of the total voting power of securities entitled (without regard to the occurrence of any contingency) to vote in the election of directors or managers thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof, or (ii) if a limited liability company (without voting securities), partnership, association or other business entity, a majority of the partnership or other similar ownership interest thereof is at the time owned or controlled, directly or indirectly, by any Person or one or more Subsidiaries of that Person or a combination thereof.

“Tax” and, with correlative meaning, “Taxes” means with respect to any Person (i) all federal, state, local, county, foreign and other taxes, assessments or other government charges, including, without limitation, any income, alternative or add-on minimum tax, estimated gross income, gross receipts, sales, use, ad valorem, value added, transfer, capital, stock, franchise, profits, license, registration, recording, documentary, intangibles, conveyancing, gains, withholding, payroll, employment, social security (or similar), unemployment, disability, excise, severance, stamp, occupation, premium, property (real and personal), environmental or windfall profit tax, custom duty or other tax, governmental fee or other like assessment, charge, or tax of any kind whatsoever, together with any interest, penalty, addition to tax or additional amount imposed by any Governmental Entity responsible for the imposition of any such tax (domestic or foreign) whether such Tax is disputed or not, (ii) liability for the payment of any amounts of the type described in clause (i) above relating to any other Person as a result of being party to any agreement, including an agreement to indemnify such other Person, being a successor or transferee of such other Person, or being a member of the same affiliated, consolidated, combined, unitary or other group with such other Person, or (iii) liability for the payment of any amounts of the type described in clause (i) arising as a result of being (or ceasing to be) a member of any affiliated group as defined in Section 1504 of the Code, or any analogous combined, consolidated or unitary group defined under state, local or foreign income Tax Law (or being included (or required to be included) in any Tax Return relating thereto).

“Tax Law” means any Law relating to Taxes.

“Tax Return” means any report, return, declaration, claim for refund or other information or statement or schedule supplied or required to be supplied by the Company or any of its Subsidiaries, relating to Taxes, including any schedules or attachments thereto and any amendments thereof.

“Transaction Documents” means this Agreement, the Escrow Agreement, and all other agreements, instruments and certificates to which any of Buyer, or any Seller is a party arising out of or in connection with the transactions contemplated by this Agreement to be delivered by any party hereto at or prior to the Closing.

Section 1.2 Additional Defined Terms.

Each of the following terms is defined in the Section set forth opposite such term:

| Agreement | Preamble |

| Acquisition Transaction | Section 6.8 |

| Buyer | Preamble |

| Buyer Indemnified Parties | Section 9.1 |

| Claim Notice | Section 9.3(a) |

| Claims | Section 6.12 |

| Closing | Section 2.3 |

| Closing Date | Section 2.3 |

| Company | Preamble |

| Consideration Shares | Section 2.2(a) |

| Contracts | Section 3.8(a) |

| Employee Benefit Plan | Section 3.20(a) |

| Employees | Section 3.19(c) |

| Encumbrances | Section 3.10 |

| Escrow Release Date | Section 2.5(a) |

| Financial Statements | Section 3.5 |

| Indemnified Party | Section 9.3(a) |

| Indemnifying Party | Section 9.3(a) |

| Leases | Section 3.9 |

| Liabilities Cap | Section 2.2(a) |

| Losses | Section 9.1 |

| Permitted Encumbrances | Section 3.10 |

| Pre-Closing Accounts Receivable | Section 6.9(a) |

| Purchase Price | Section 2.2(a) |

| Releasees | Section 6.12 |

| Releasors | Section 6.12 |

| Relief Payments | Section 2.2(a) |

| Sellers | Preamble |

| Sellers’ Representative | Preamble |

| Termination Date | Section 8.1(d) |

| Third Party Claim | Section 9.4(a) |

Section 1.3 Interpretation. Unless otherwise indicated to the contrary herein by the context or use thereof (i) the words, “herein,” “hereto,” “hereof’ and words of similar import refer to this Agreement as a whole and not to any particular Section or paragraph hereof, (ii) the word “including” means “including, but not limited to”, (iii) words importing the singular will also include the plural, and vice versa, and (iv) any reference to any federal, state, local, or foreign statute or law will be deemed also to refer to all rules and regulations promulgated thereunder. References to $ will be references to United States Dollars, and with respect to any contract, obligation, liability, claim or document that is contemplated by this Agreement but denominated in currency other than United States Dollars, the amounts described in such contract, obligation, liability, claim or document will be deemed to be converted into United States Dollars for purposes of this Agreement as of the applicable date of determination.

ARTICLE II

PURCHASE AND SALE OF SHARES

Section 2.1 Purchase and Sale. At the Closing, upon the terms and subject to the conditions set forth herein, Buyer shall purchase from each Seller, and each Seller shall sell, convey, assign, transfer, and deliver to Buyer, all of the Outstanding Shares owned by such Seller, free and clear of any Encumbrances.

Section 2.2 Purchase Price.

(a) The aggregate purchase price for the Outstanding Shares shall consist of: (i) the assumption, through acquisition of the Outstanding Shares by the Buyer of all Liabilities and Indebtedness of the Company and CDS subject to a maximum amount of $3,220,000.00 (the “Liabilities Cap”), (ii) shares of G Medical Innovations Holdings Ltd. valued at $1,000,000 (the “Consideration Shares”), and (iii) the Pre-Closing Accounts Receivable (the Liabilities Cap, the Consideration Shares, and the Pre-Closing Accounts Receivable collectively, the “Purchase Price”).

Section 2.3 Closing. The closing of the transactions contemplated hereby (collectively, the “Closing”) shall take place through electronic means of communication (except where originals are specifically required below) on the date that is the twelvth (12th) Business Day following the satisfaction or waiver of the conditions specified in ARTICLE VII (other than conditions with respect to actions the respective Parties shall take at the Closing itself), or such other place or date as the Parties may mutually agree to in writing (the “Closing Date”).

Section 2.4 Payment of the Purchase Price; Closing Deliverables. At the Closing, subject to the satisfaction or waiver of each of the conditions specified in Section 7.1 and Section 7.2, as applicable:

(a) Each Seller shall deliver to Buyer certificates representing the Outstanding Shares, duly endorsed in blank.

(b) The Sellers’ Representative shall deliver or cause to be delivered to Buyer:

(i) Stock powers executed by all Sellers (CDS stock powers should evidence the transfer of CDS stock to the Company pursuant to the Merger Agreement) and copies of the updated stock transfer books of the Company (and CDS if in existence) evidencing that there are no outstanding owners of any shares of stock of CDS and that the Buyer is the registered owner of all of the Outstanding Shares, certified by the Sellers’ Representative, as being true and correct copies of the originals which have not been modified or amended and which are in effect at the Closing;

(ii) a certificate, signed by the secretary of the Company dated within 10 days of the Closing, establishing that the Company is in existence and otherwise is in good standing under the laws of the jurisdiction of its incorporation, organization or formation, as applicable;

(iii) a copy of the Certificate of Merger filed in respect of the Company the Texas Secretary of State on October 18, 2017; and a copy of the approval certificate issued by the Ohio Secretary of State in response to the certificate of merger or consolidation filed in respect of CDS;

(iv) a certificate of the secretary of the Company certifying as of the Closing as to the fulfillment of the conditions set forth in Section 7.1(a) through Section 7.1(g); and

(c) Buyer shall issue to Sellers the Consideration Shares, which shall be valued at $1,000,000.00 in the aggregate, calculated using the closing price for shares of GMV on the day before the Closing Date, and which shall be subject to the Escrow Agreement.

(d) Buyer shall make aggregate cash payments in an amount not to exceed $657,080.19 to the Persons listed on Schedule 2.4(d) ((the “Relief Payments”) which shall count against and decrease the Liabilities Cap) to such accounts as indicated to the Buyer by the Sellers’ Representative in a draft (but not final) form not less than 2 Business Days prior to the Closing Date. A final form of the Schedule 2.4(d) shall be provided by Sellers’ Representative on the Closing Date.

(e) Buyer shall have received resignations, effective as of the Closing Date in form and substance satisfactory to Buyer, of all the officers and directors of the Company (and CDS as applicable).

(f) Buyer shall have received all other documents required to transfer operation of the Business from the Sellers and managers of the Company and CDS to the Buyer and Buyer’s Representatives, including but not limited to bank mandates for all bank accounts owned by the Company and CDS and business credit cards.

(g) Each of the Sellers and Buyer Parent shall deliver a duly executed Escrow Agreement.

Section 2.5 Escrow. On the Closing Date, the Consideration Shares shall be placed in escrow pursuant to the Escrow Agreement to serve as security for Sellers’ obligations under this Agreement. The Consideration Shares shall be released from escrow as follows:

(a) on the date which is one-hundred and eighty (180) days following the Closing Date, unless extended by the Buyer in connection with any claims (the “Escrow Release Date”), the Consideration Shares shall be released to Sellers in accordance with the Escrow Agreement and the percentage set forth opposite each such Seller’s name in the “Percentage of Consideration Shares” column of Schedule 2.5(a); provided, however, that if prior to the Escrow Release Date Buyer gives notice of a claim or claims for indemnification pursuant to ARTICLE IX and the amounts claimed by Buyer cannot be satisfied or covered in full as provided in Section 6.9, then: (A) if any such claim is resolved prior to the Escrow Release Date, by judicial determination or otherwise, any sums due Buyer shall be paid to Buyer through the delivery to Buyer Parent for cancellation of such number of Consideration Shares equal to the amount of such claim (based on the market value of the Consideration Shares on the date of cancellation) deducted pro-rata from the Consideration Shares issued to each of the Sellers (unless any judicial determination or other resolution of such disputes determines otherwise), and (B) if any such claim is not resolved prior to the Escrow Release Date, the number of Consideration Shares with a value equal to the amount of such claim (based on the market value of the Consideration Shares on the Escrow Release Date) shall be retained in escrow (in amounts allocated pro-rata between the Sellers) pursuant to the Escrow Agreement until such claim is resolved. Each of the Sellers hereby consents that if any Consideration Shares are delivered to Buyer Parent as provided in this Agreement and the Escrow Agreement, Buyer Parent shall have the right to and is hereby instructed to cancel such Consideration Shares.

(b) Each of the Sellers and Buyer agree that it will act pursuant to this Agreement and the Escrow Agreement with respect to the release of any Consideration Shares to which either of them is entitled pursuant to this Agreement. Any distribution of Consideration Shares to Buyer Parent shall be treated as an adjustment to the Purchase Price for all Tax purposes, unless otherwise required by applicable Tax Law.

Section 2.6 Withholding Rights. The Buyer and the Company shall be entitled to deduct and withhold from any consideration otherwise payable to any Person pursuant to this Agreement such amounts as it is required to deduct and withhold with respect to the making of such payment under any applicable Tax Law, as determined in the Buyer’s reasonable discretion. To the extent such amounts are so withheld or paid over to or deposited with the relevant Governmental Entity by the Buyer or the Company, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the applicable Person in respect to which such deduction and withholding was made.

ARTICLE III

REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY

The Sellers, jointly and severally, represent and warrant to Buyer, as of the date hereof and as of the Closing Date, as follows:

Section 3.1 Organization. The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Texas. CDS was, prior to the Merger, a corporation duly organized, validly existing and in good standing under the laws of the State of Ohio. The Company is qualified to do business as a foreign entity in each jurisdiction wherein the location of its assets or the conduct of the Business requires such qualification, except where the failure to be so qualified could not reasonably be expected to have a Material Adverse Effect.

Section 3.2 Noncontravention. This Agreement and the execution, performance, and consummation of the transactions contemplated under this Agreement do not violate or contradict the Organizational Documents of the Company. All of the rights and obligations of the shareholders of the Company under the Shareholder Agreement have been properly observed and all waivers of preemptive rights have been duly obtained. The Sellers’ compliance with the terms and provisions hereof, do not (i) contravene any Law or Order specifically applicable to the Company, or (ii) except as set forth on Schedule 3.2(ii), require the Company to obtain the approval, consent or authorization of any Person which has not been obtained in writing prior to the date of Closing. No Consents are required to consummate, perform, and give full effect to this Agreement and the transactions contemplated hereby or for the operation of the Business immediately after the Closing in the same manner operated immediately prior to the Closing.

Section 3.3 Law Compliance. The Outstanding Shares were issued in compliance with Applicable Law. The Outstanding Shares were not issued in violation of the Organizational Documents of the Company or any other agreement, arrangement or commitment to which the Sellers or the Company is a party and are not subject to or in violation of any preemptive or similar rights of any Person.

Section 3.4 No Outstanding Rights to Outstanding Shares. Schedule 3.4 is complete, true, and accurate in all respects and sets out on a Fully-Diluted Basis the shares owned by each of the Sellers and all of the issued and outstanding shares of the Company in issue immediately prior to the Closing. Except for the Shareholder Agreement, there are no outstanding or authorized options, warrants, convertible securities or other rights, agreements, arrangements or commitments of any character relating to any stock or equity interests in the Company or CDS or obligating the Company to issue or sell any stock or equity interests, or any other interest, in the Company or CDS. Other than the Organizational Documents, there are no voting trusts, proxies or other agreements or understandings in effect with respect to the voting or transfer of any of the Outstanding Shares. The Outstanding Shares represents 100% of the issued and Outstanding Shares of the Company. There are no other outstanding securities, equity interests, or claims on the share capital of the Company or CDS.

Section 3.5 Financial Statements. The Sellers have delivered to the Buyer:

(a) in respect of CDS, unaudited trial balances for the period commencing January 1, 2015 and ending September 30, 2017 (the “CDS Financial Statements”);

(b) in respect of the Company, (i) compiled profit and loss statement and balance sheets for the period commencing January 1, 2015 and ending December 31, 2016, and (ii) unaudited trial balances for the period from January 1, 2017 to September 30, 2017 (the “CC Financial Statements”); (the CDS Financial Statements and the CC Financial Statements, collectively the “Financial Statements”).

Except as set forth in Schedule 3.5, the Financial Statements are complete and correct in all respects and present fairly the financial condition and position of the Company and CDS for the periods and as of the dates reflected therein. Such Financial Statements do not contain any items of special or nonrecurring income or any other income not earned in the Ordinary Course of Business except as expressly specified therein. The Financial Statements are consistent in all material respects with the books and records of the Company and CDS (which books and records are correct and complete in all material respects).

Section 3.6 Liabilities.

(a) There are no liabilities or obligations, direct or indirect, absolute or contingent, known or unknown, arising out of or relating to the Business or the Company or CDS, except (i) liabilities or obligations reflected or reserved against on Financial Statements; (ii) liabilities incurred in the Ordinary Course of Business after the Statement Date, consistent with the Company’s prior practice, which, in the aggregate, do not result in any Material Adverse Effect in the financial condition of the Business or the Company or CDS from that set forth in the Financial Statements; (iii) liabilities arising under the Contracts (except for any liability or obligation arising out of the breach, nonperformance or defective performance by the Company of any of the Contracts (defined below)) and set forth on Schedule 3.6(a)(iii); and (iv) liabilities or obligations incurred in connection with this Agreement. Except as set forth in the Financial Statements and Schedule 3.6, there are no liabilities, accounts payable, notes payable, or obligations, direct or indirect, absolute or contingent, known or unknown, arising out of or relating to the Company or CDS.

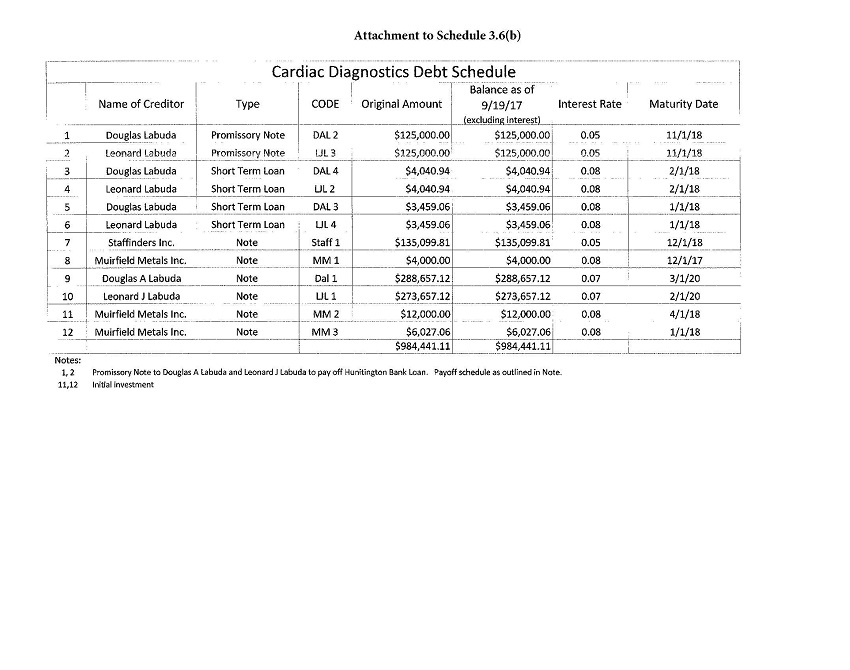

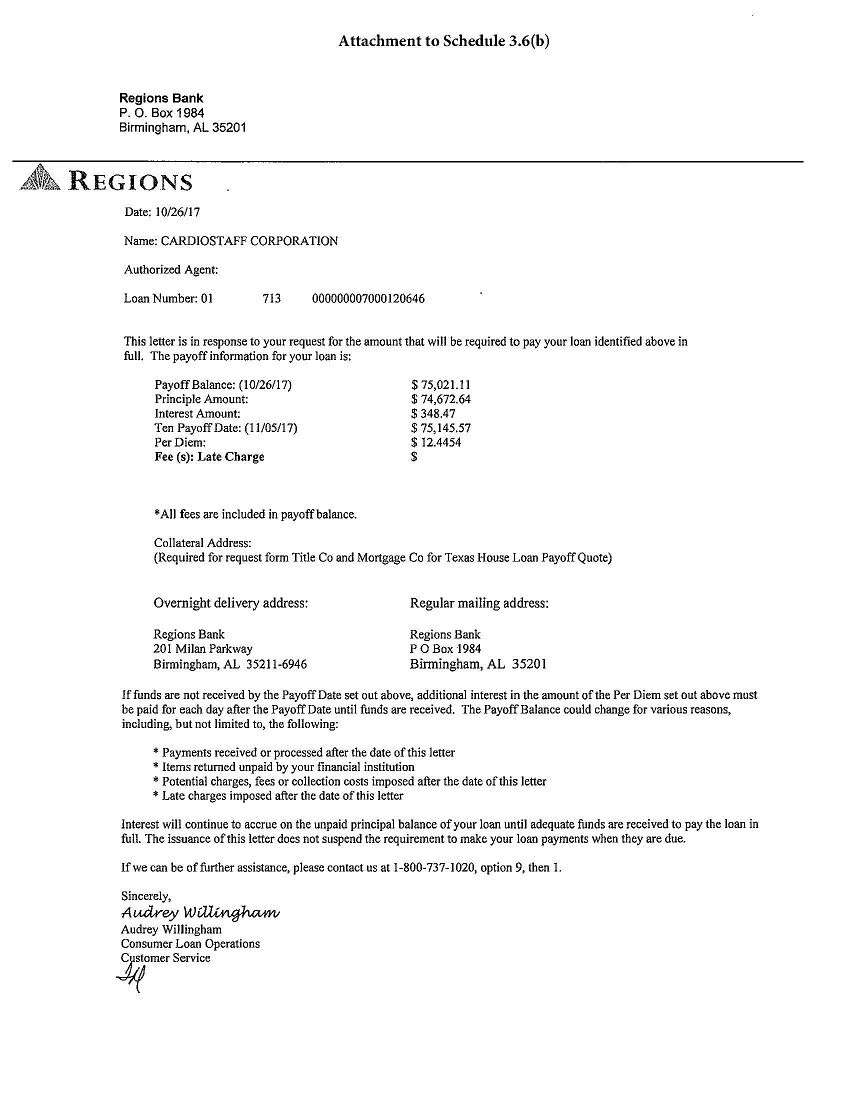

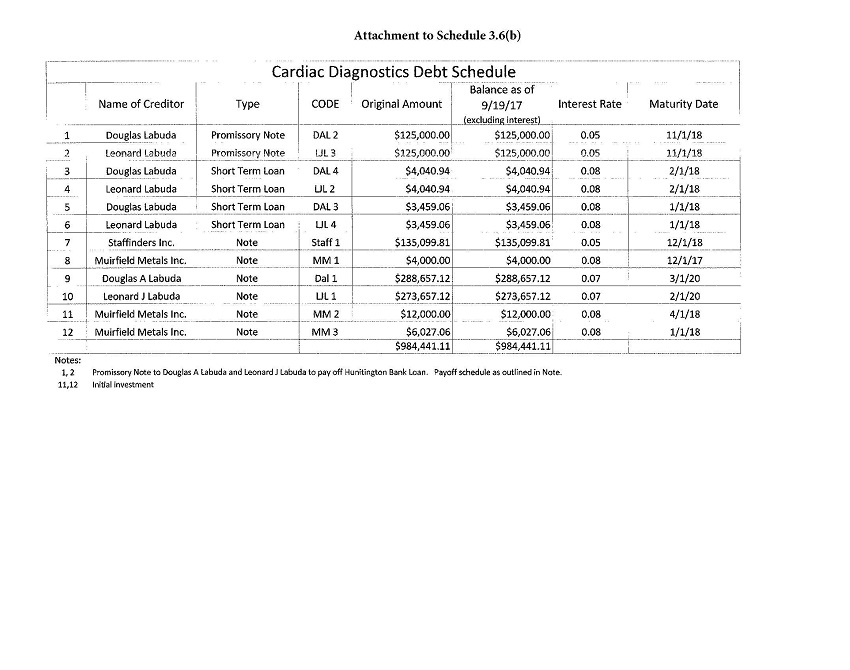

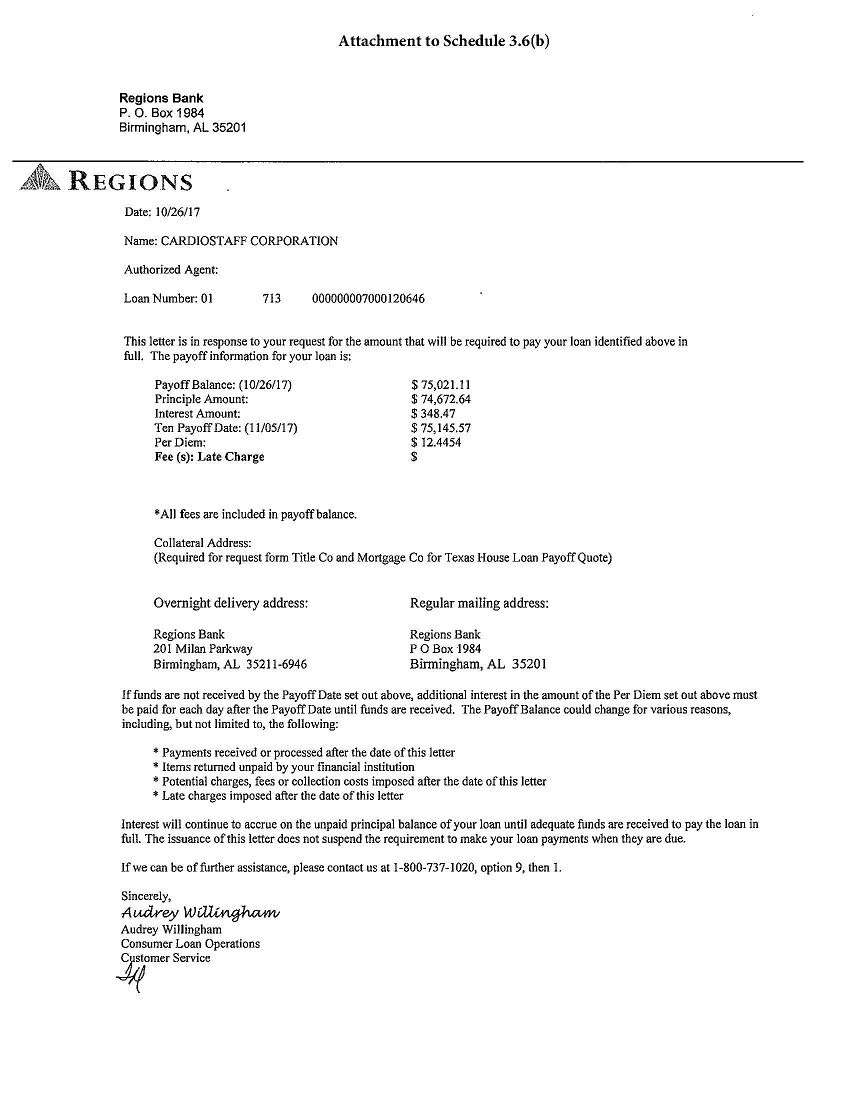

(b) Schedule 3.6(b) sets forth all of the Liabilities and Indebtedeness (the “Assumed Liabilities”) of the Company and CDS as of the Closing Date to be assumed by the Buyer, the total amount of which shall not exceed the Liabilities Cap.

(c) The Payer Agreements require third-party consent to assign. CDS did not obtain such third-party consents prior to the Merger. CDS’ failure to obtain such third-party consents shall in no way be deemed to be a breach of this Section 3.6.

Section 3.7 Business Changes. Since the Balance Sheet Date:

(a) other than the Merger and the Stock Split, there have been no events which have caused (i) Material Adverse Effect in the Business, condition (financial or other), results of operations, prospects or properties; (ii) damage, destruction or loss (whether or not covered by insurance); or (iii) transaction outside the Ordinary Course of Business;

(b) there has not been any sale, lease, transfer, assignment, abandonment or other disposition of any asset of the Company or CDS outside the Ordinary Course of Business;

(c) there has not been any change in the rate of compensation, commission, bonus or other direct or indirect remuneration payable or to be paid, or any agreement or promise to pay, conditionally or otherwise, any bonus, extra compensation, pension or severance or vacation pay, to any employee, member, director, officer, sales distributor or agent of the Company, other than in the Ordinary Course of Business;

(d) there has not been any payment outside of the Ordinary Course of Business of any liability of the Company;

(e) other than the Merger, there has not been any deviation from the ordinary and usual course of conducting the Business in contemplation of the transactions described in this Agreement or otherwise;

(f) there has not been any mortgage, pledge or creation of any lien, charge, security interest or other encumbrance on any of the membership interests and/or the Company’s assets ;

(g) there has not been any change or modification to the Company’s (or CDS’ as applicable) accounting methods or practices;

(h) there has not been any material change in the general composition of the Company’s assets and liabilities, including, without limitation, an acceleration of the collection of any accounts receivable or a delay in the payment of any accounts payable outside of the Ordinary Course of Business;

(i) there has not been any labor union organizing activity, any actual or threatened employee strikes, work stoppages, slow-downs or lockouts or any events which could cause a Material Adverse Effect in its relations with its employees, agents, customers or suppliers;

(j) other than pursuant to the Merger, the Company has not incurred or assumed any Indebtedness, entered into any capitalized leases or incurred any liability or obligation not in the Ordinary Course of Business or made any loan or advance to any Person;

(k) other than the Stock Split, the Company has not declared or made any payment or distribution to its holders of its stock, including stock splits, stock dividends and dividends, or purchased or redeemed any stock, notes or other debt or equity or other similar ownership or participation interests;

(l) other than the Stock Split, the Company has not issued, sold, distributed or disposed of any stock, notes or other equity interests or securities or committed itself to do so;

(m) the Company has not written up or down any of its assets, revalued any of its inventory or made any other change in its management of working capital or cash balances; and/or

(n) the Company and CDS have not entered into any agreement or commitment (whether written or oral) to do any of the foregoing.

Section 3.8 Contracts; No Defaults.

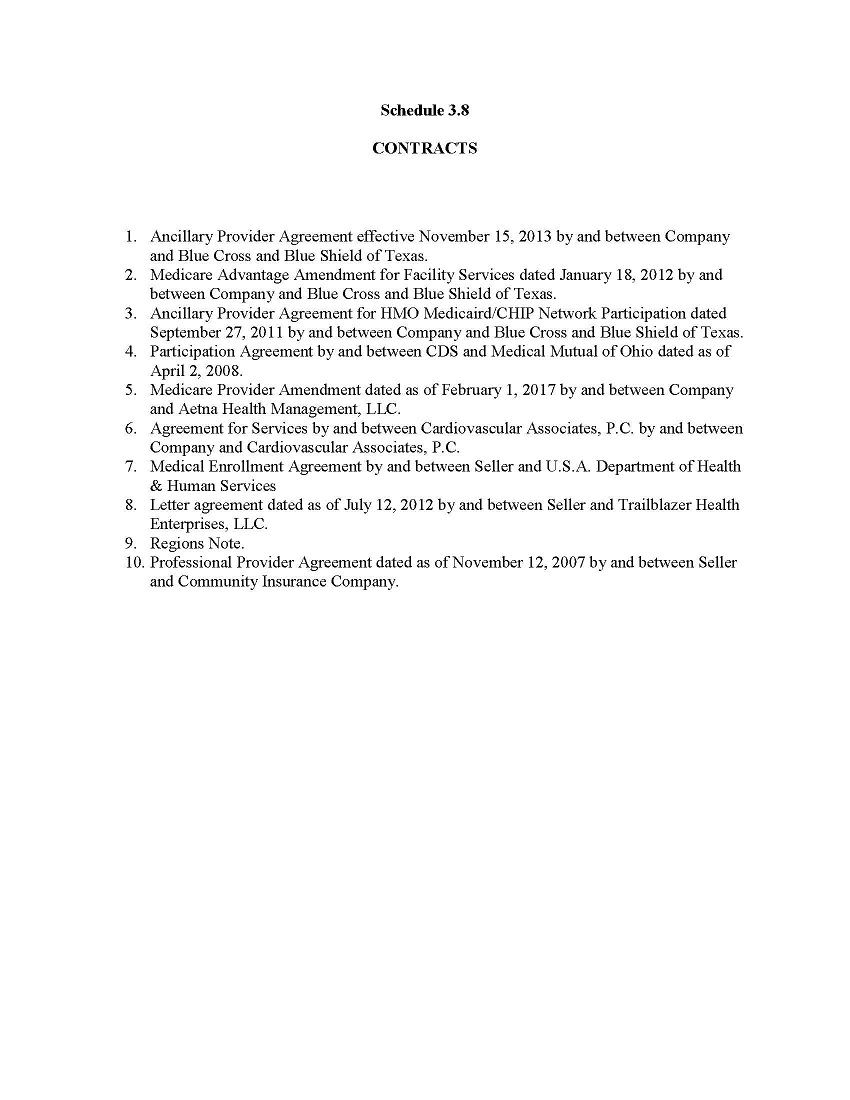

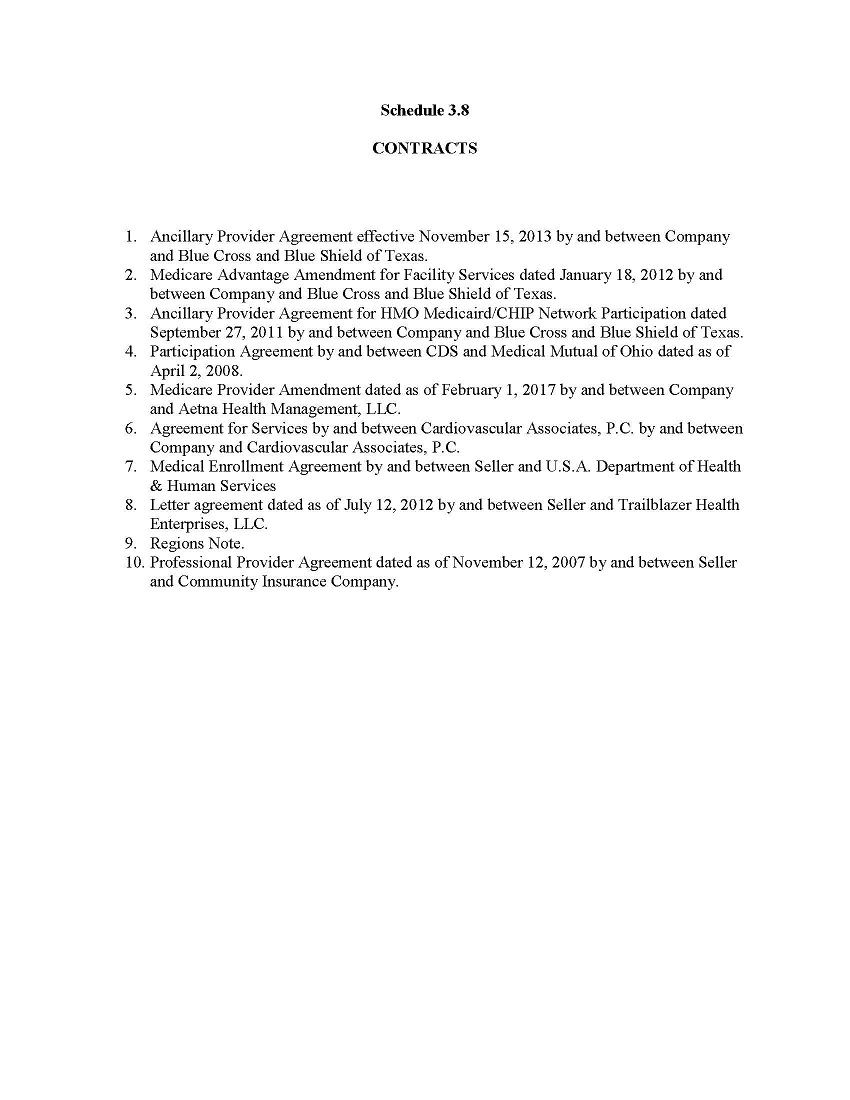

(a) Schedule 3.8 contains a complete and accurate list of all outstanding contracts to which the Company or CDS is a party, or by which it is bound, that involve consideration to or from the Company in an amount equal to or greater than $65,000.00 (“Contracts”), and the Sellers’ Representative has delivered to Buyer true and complete copies (if in writing, otherwise, a written description of the terms), of all such Contracts, grouped into the following categories:

(i) each Contract for sales of goods or services by the Company or CDS;

(ii) each Contract affecting the ownership of, leasing of, title to, or any leasehold or other interest in, any leased real or personal property;

(iii) each in-license or other licensing agreement or Contract with respect to Intellectual Property excluding shrink-wrap, click-wrap, click through or other similar licenses with respect to off-the-shelf or personal computer software, including agreements with current or former employees, consultants, or contractors regarding the appropriation, use or the non-disclosure of Intellectual Property rights;

(iv) each joint venture, partnership, and other Contract (however named) involving a sharing of profits, losses, costs, or liabilities by the Company or CDS, with any other Person;

(v) each Contract containing covenants that in any way purport to restrict the business activity of the Company or CDS or to limit the freedom of any of the Company or CDS to engage in any line of business or to compete with any Person;

(vi) each Contract for capital expenditures;

(vii) each broker, distributor, dealer, sales representative, manufacturer’s representative, franchise, agency, sales promotion, market research, marketing consulting and advertising Contract;

(viii) each Contract with any sourcing partner or other supplier to the Company or CDS;

(ix) each Contract with any Governmental Entity;

(x) each Contract between or among the Company or CDS and any Affiliates of the Company or CDS;

(xi) each Contract (x) providing for employment of any Person, (y) providing for the payment of any salary, bonus or commission based on sales or earnings, or (z) providing for severance or salary continuation benefits;

(xii) each Contract providing for discounts or acceptance of returns not in the Ordinary Course of Business; and

(xiii) each other Contract, whether or not made in the Ordinary Course of Business, which is material to the Company or the conduct of the Business, or the absence of which would constitute a Material Adverse Effect.

(b) Each Contract identified in Schedule 3.8 is in full force and effect and constitutes a legal, valid and binding obligation of the Company and the other parties to the Contract, enforceable in accordance with its terms.

(c) No event has occurred or circumstance exists that (with or without notice or lapse of time) would contravene, conflict with, or result in a violation or breach of, or give the Company or CDS or other Person the right to declare a default or exercise any remedy under, or to accelerate the maturity or performance of, or to cancel, terminate, or modify any Contract identified in Schedule 3.8.

(d) Except as expressly set forth in any Contract, copies of which Sellers’ Representative has provided to Buyer prior hereto, no customer of the Company or CDS is entitled to or customarily receives discounts, allowances, profit margin guarantees, volume rebates or similar reductions in price or trade terms.

(e) The Payer Agreements require third-party consent to assign. CDS did not obtain such third-party consents prior to the Merger. CDS’ failure to obtain such third-party consents shall in no way be deemed to be a breach of this Section 3.8.

Section 3.9 Real Property. The Company and CDS own no real property. The Sellers’ Representative has delivered to Buyer a true and correct copy of its lease of the Company’s and CDS’ current leases (the “Leases”). The Company holds valid leasehold interests in the leased property, the Leases are valid and in full force, and there does not exist any default or event that with notice or lapse of time, or both, would constitute a default by the Company or CDS under the Leases. Subject to the terms and conditions of the Leases, the Company has the right to quiet enjoyment of all the Company’s and CDS’ leased property for the full term of the Leases (and any renewal option related thereto) relating thereto. The Company and CDS have not assigned, subleased or conveyed any interest in the Leases or the premises covered thereby to any third party. All the buildings, fixtures and leasehold improvements used by the Company or CDS in the Business are located on the Company’s or CDS’ leased real property and are, as a whole, in good condition and repair, ordinary wear and tear excepted, and are sufficient to carry out the Business as currently conducted and are structurally sound, and all mechanical and other systems located therein are, as a whole, in good condition and repair, ordinary wear and tear excepted, and are sufficient to carry out the Business as currently conducted. The improvements on the Company’s or CDS’ leased property are not in violation of any applicable Law or similar regulatory requirement or zoning requirement, the violation of which would in any way materially impair the use of any such improvement in the manner presently used by the Company or CDS. The rights and privileges of the Company and CDS under the Leases are sufficient to permit the Company and CDS to conduct the Business as currently conducted. The Company and CDS hves all required legal and valid permits and other licenses required of the Company and CDS for all the Company’s and CDS’ leased property.

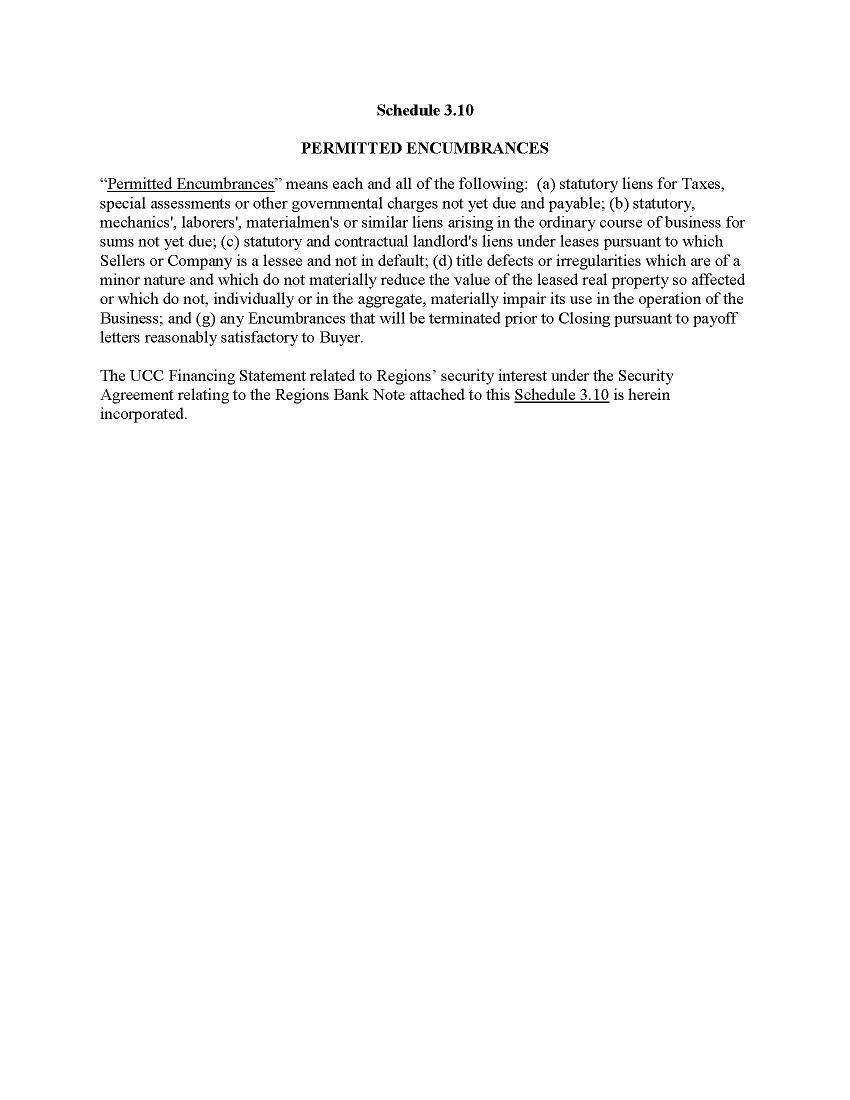

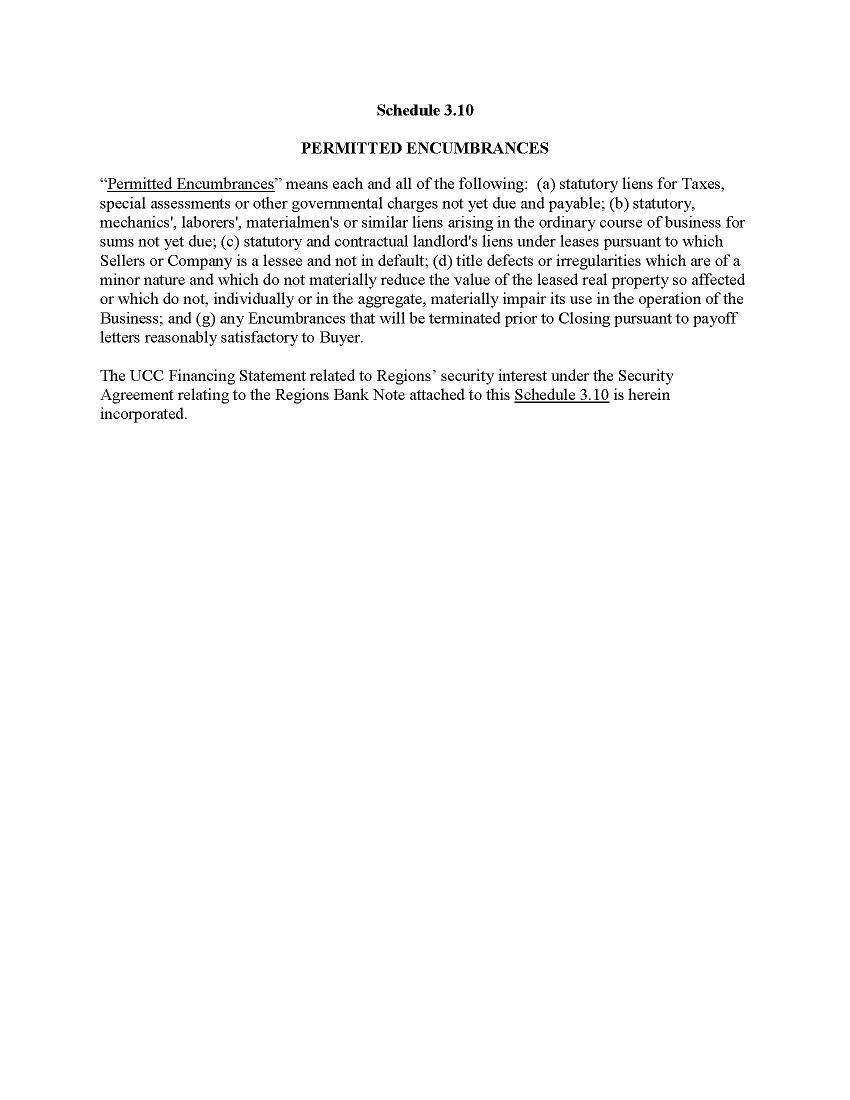

Section 3.10 Title to Company’s Assets. The Company has good and marketable title to, or a valid and binding leasehold interest in, all of its Assets and properties, free and clear of all mortgages, security interests, title retention agreements, voting rights, options to purchase, rights of first refusal, liens, easements, encumbrances and restrictions (“Encumbrances”), except for those Encumbrances described on Schedule 3.10 (collectively, “Permitted Encumbrances”).

Section 3.11 Condition and Sufficiency of Assets. No maintenance outside the Ordinary Course of Business is needed with respect to the Company’s and CDS’ Assets and properties and the Company’s and CDS’ leased property. The tangible assets of the Company and CDS are in all respects in good condition and working order (reasonable wear and tear excepted) and are adequate, in quality and quantity, for the operation of the Business. The Company’s and CDS’ Assets constitute all of the Assets, tangible and intangible, of any nature whatsoever, necessary to conduct the Business in the manner presently conducted.

Section 3.12 Intellectual Property. Schedule 3.12 contains a true and complete list of all of the Company’s patents, tradenames, registered and unregistered trademarks, Internet domain names, and copyrights of the Company. The Company Intellectual Property is all of the Intellectual Property necessary for the operation of the Business as it is currently conducted. The current use by the Company or CDS of the Company Intellectual Property does not infringe any patents, trademarks, trade names, service marks, copyrights, licenses, intangible assets or intellectual property rights of others. There are no Actions challenging or threatening to challenge the Company’s or CDS’ right, title and interest with respect to its ownership, continued use and right to preclude others from using any Company Intellectual Property. No other Person is infringing on the Company Intellectual Property.

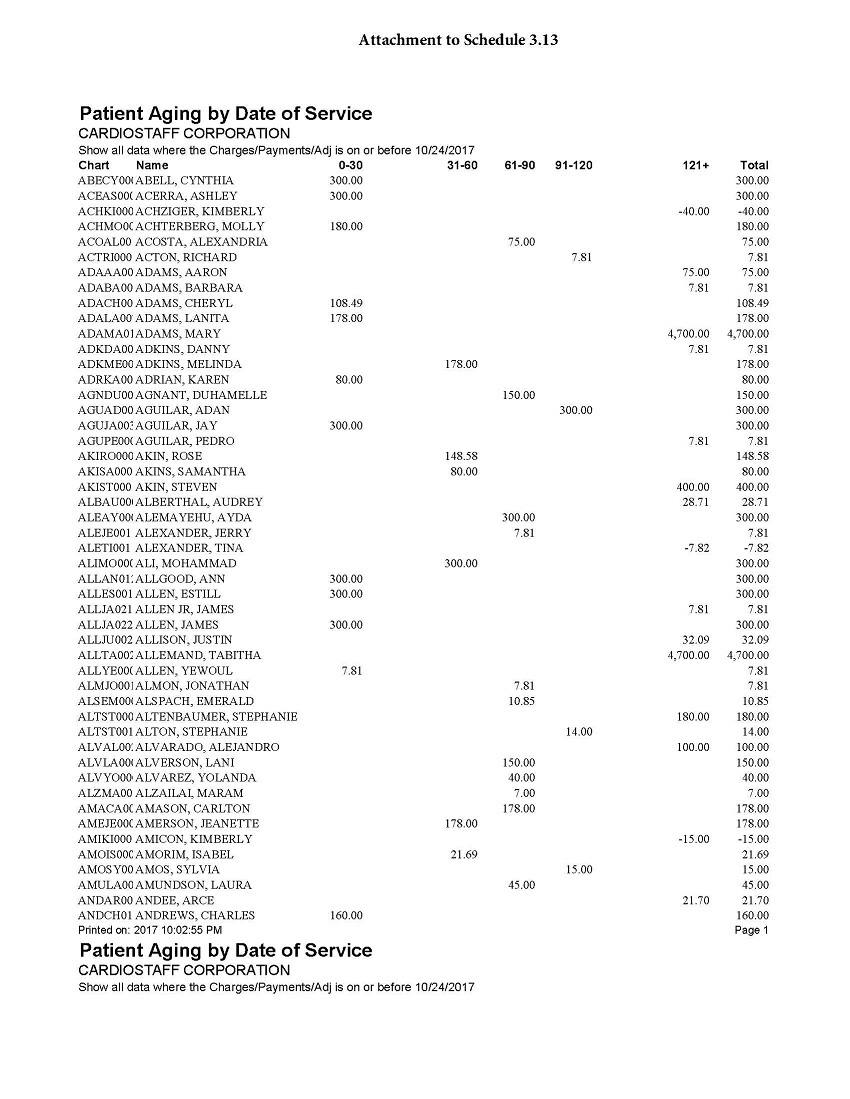

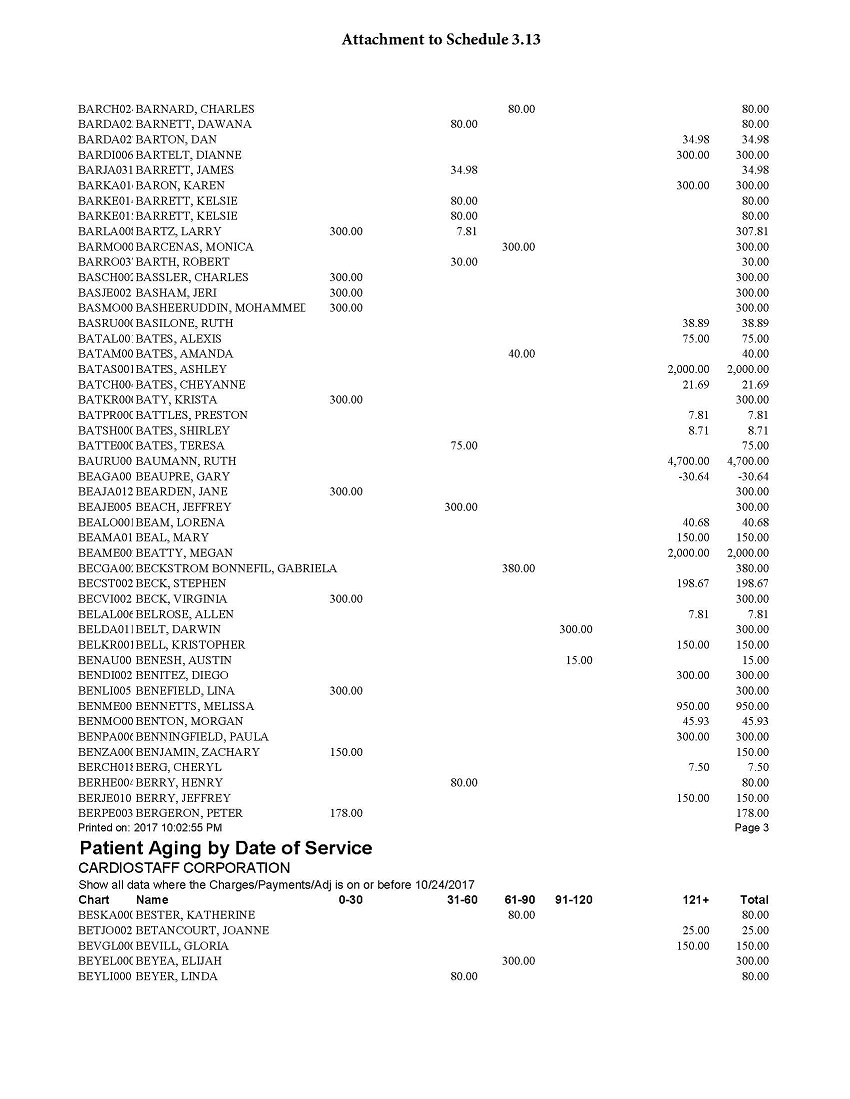

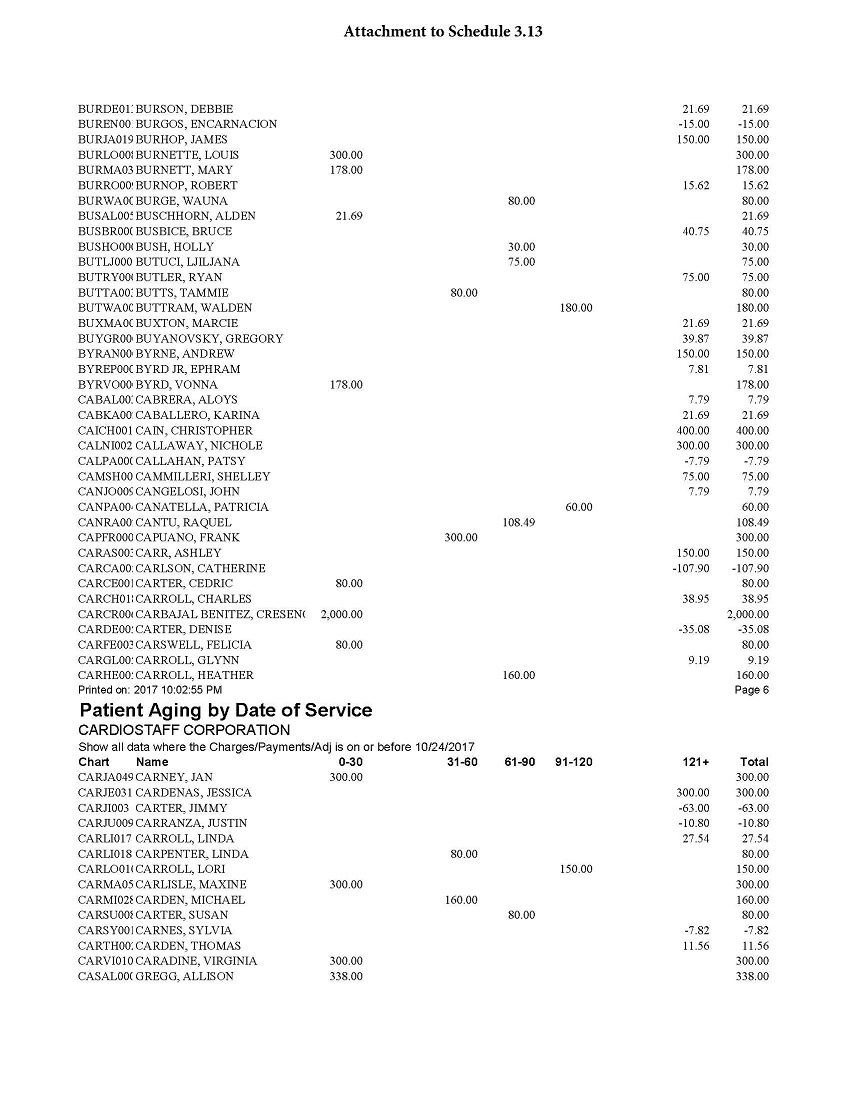

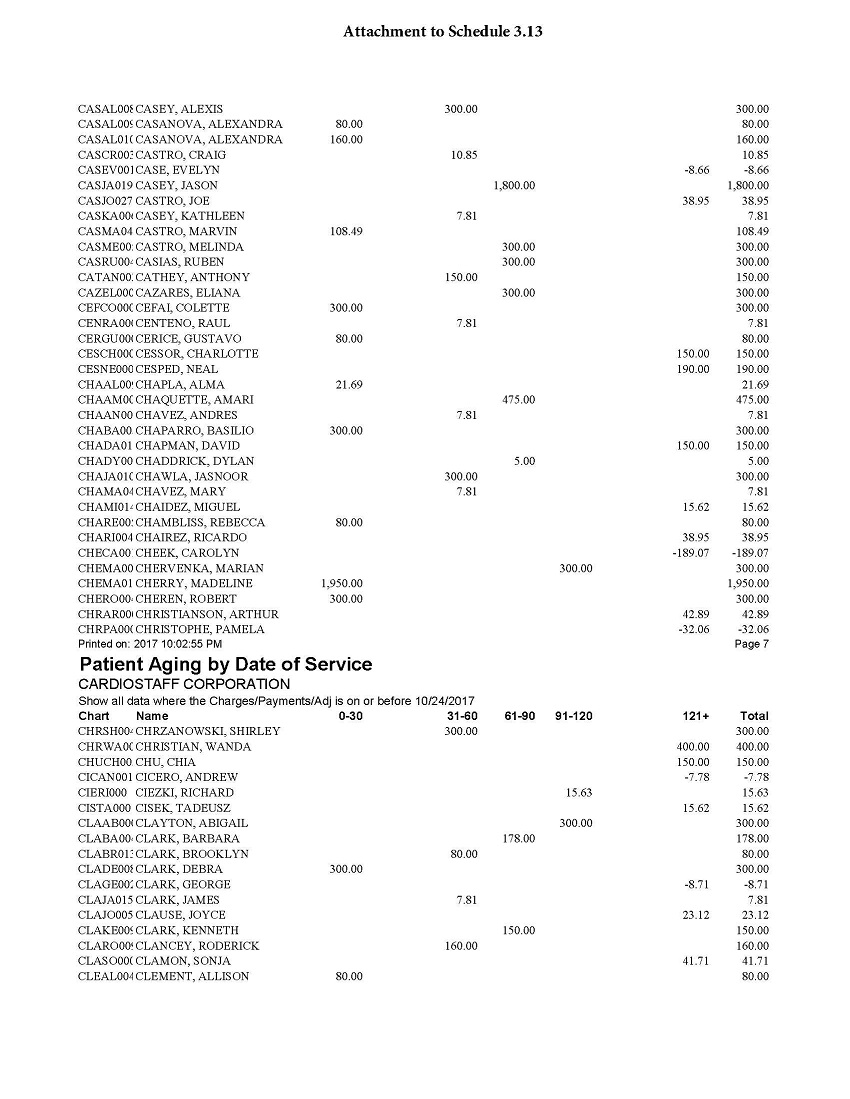

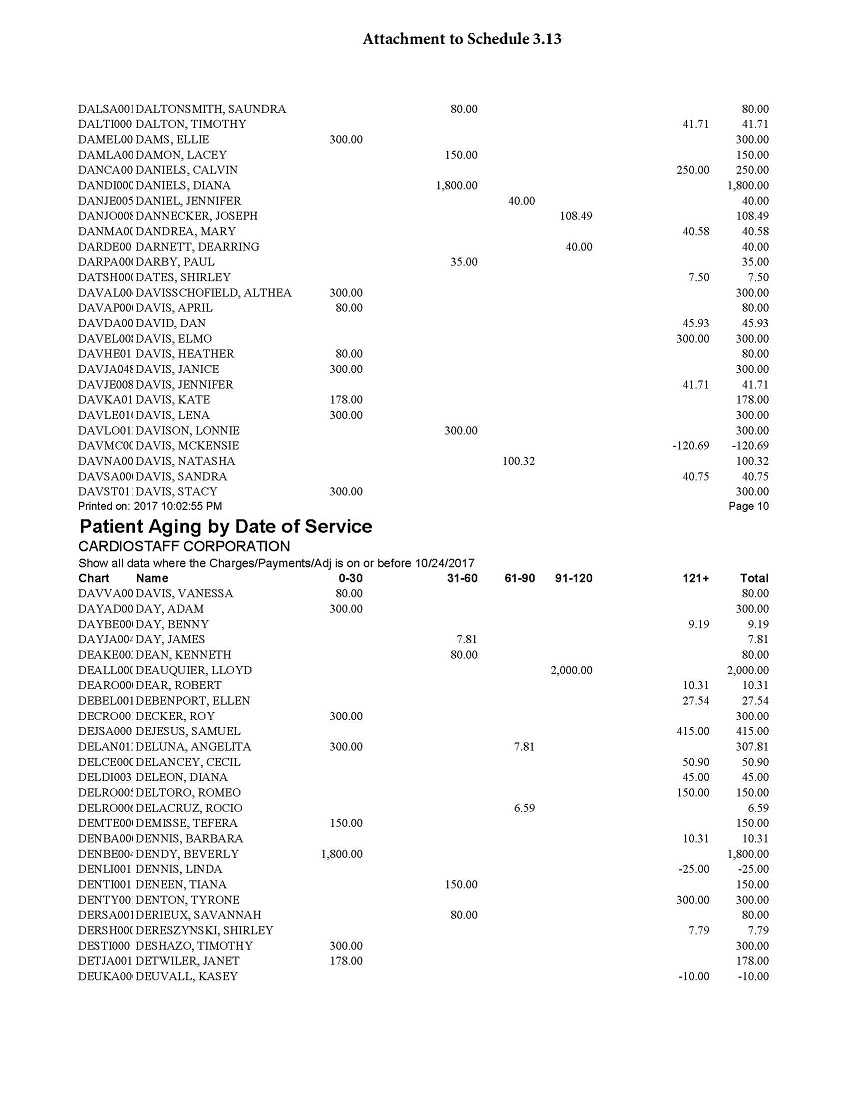

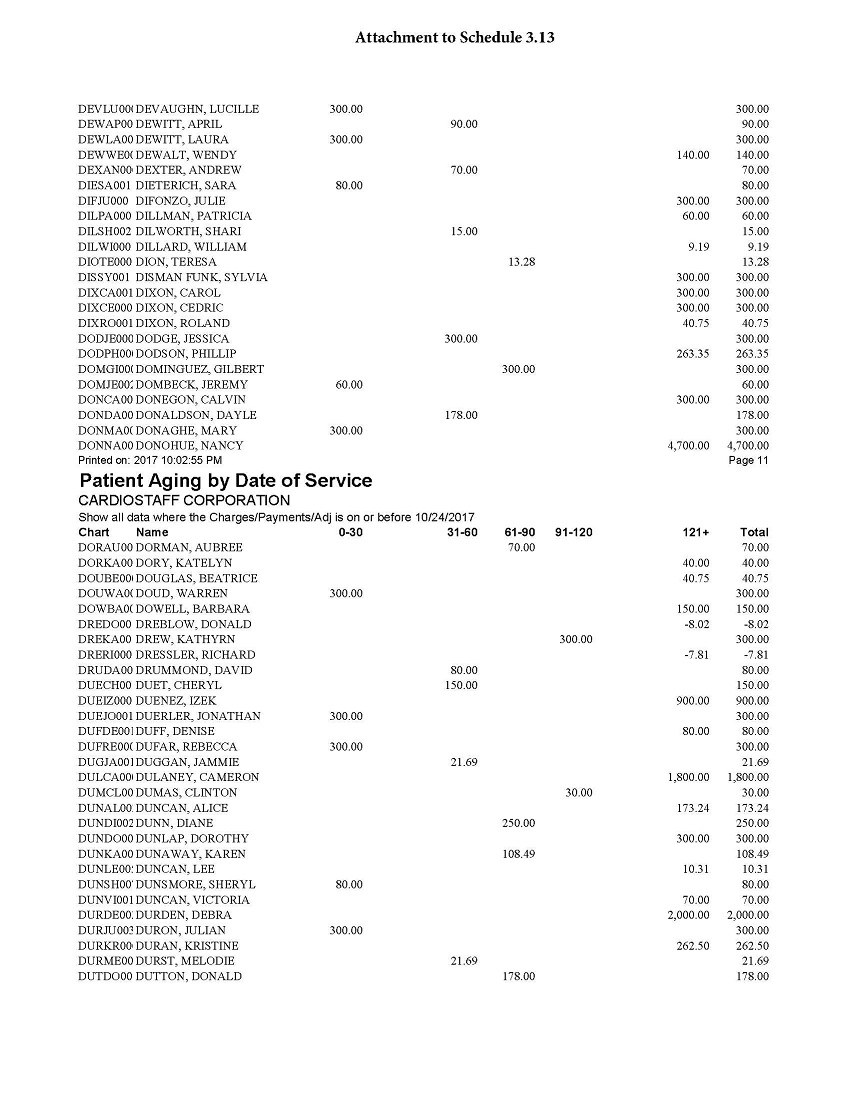

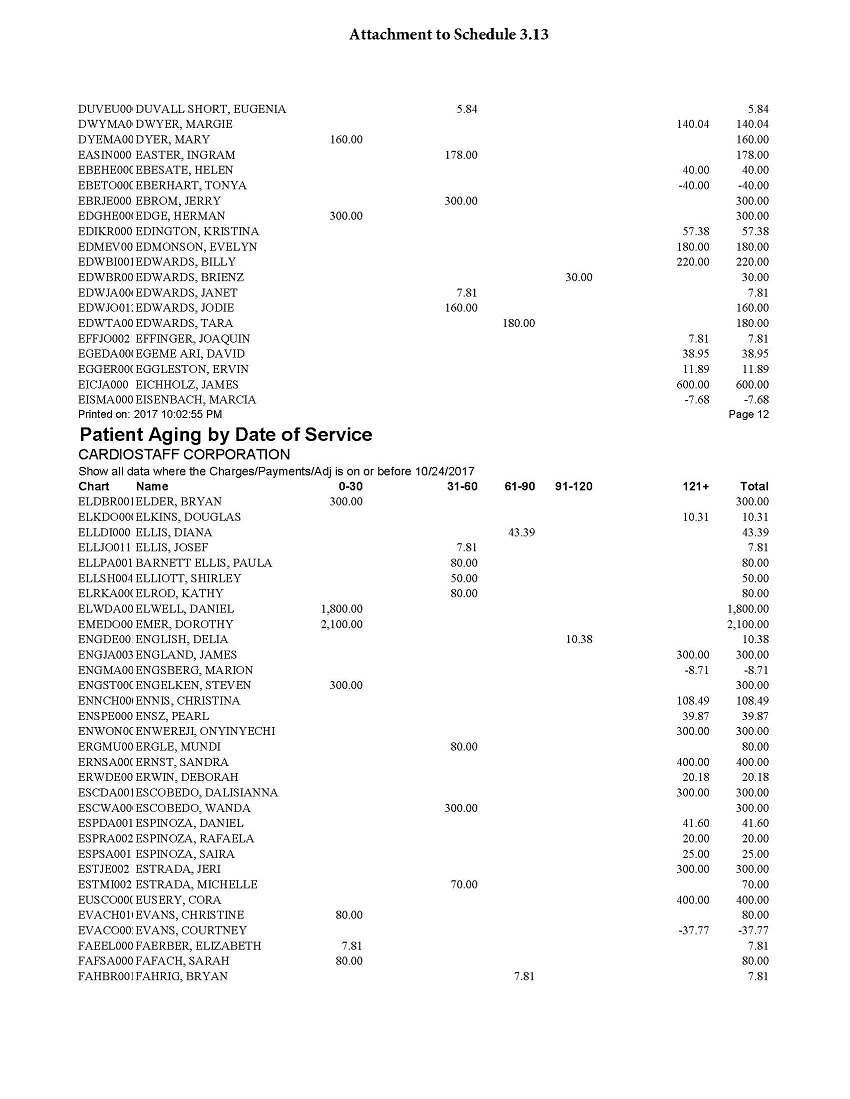

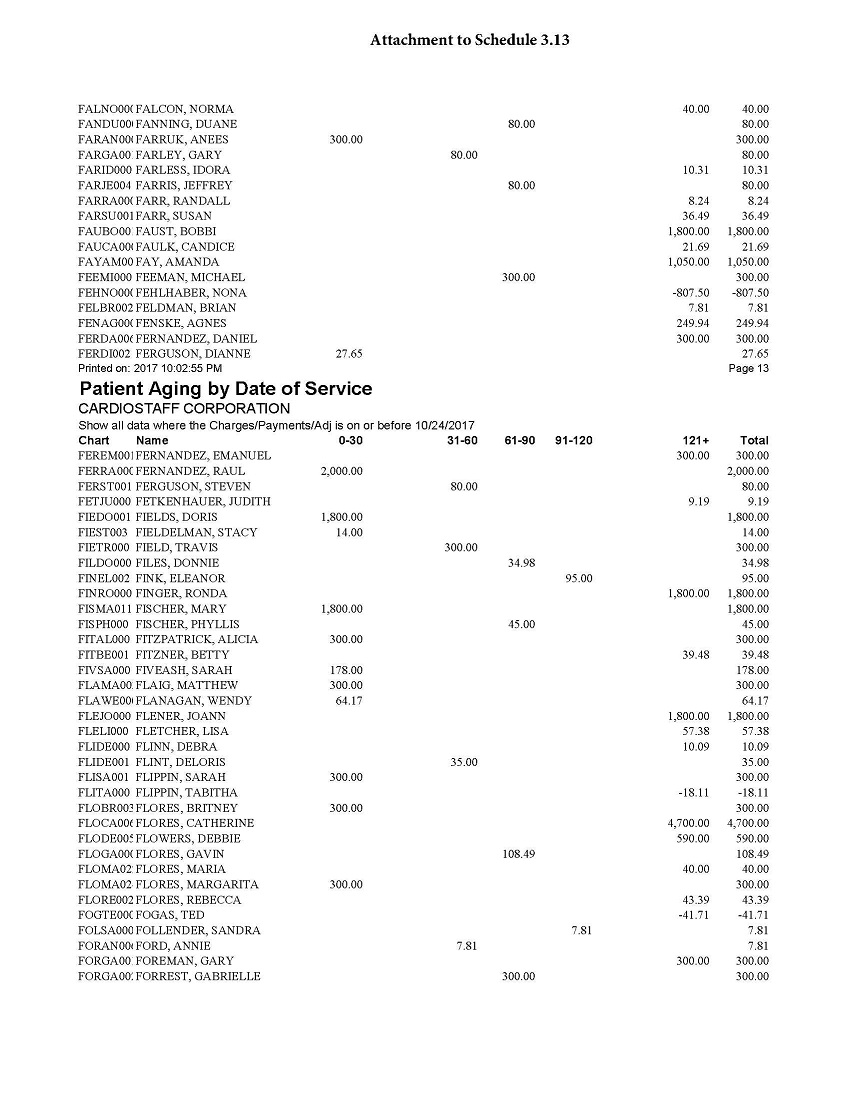

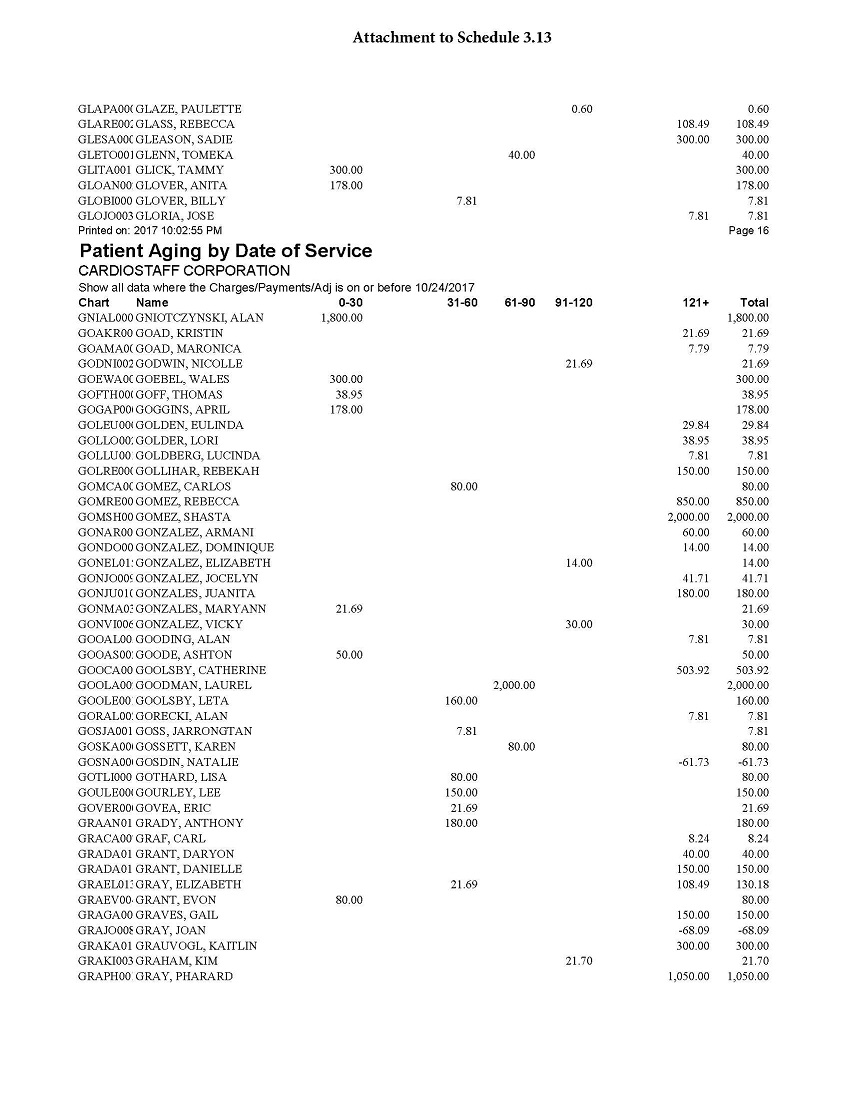

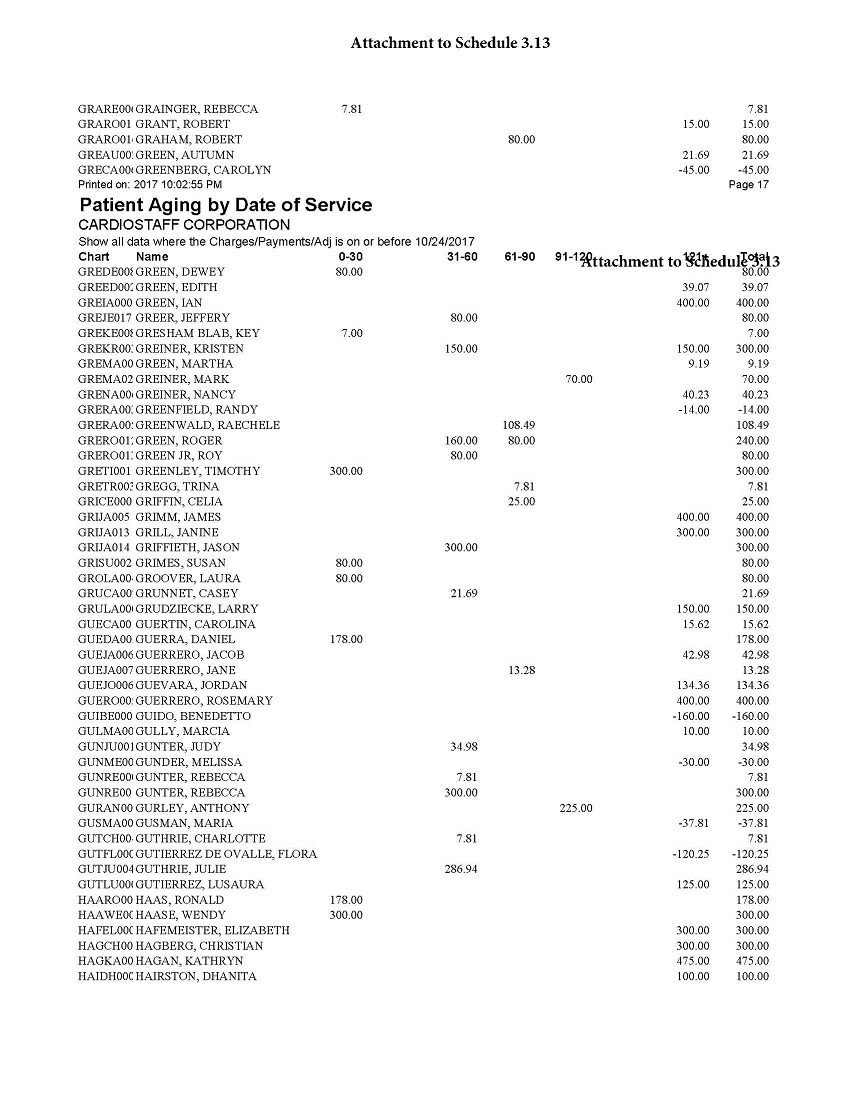

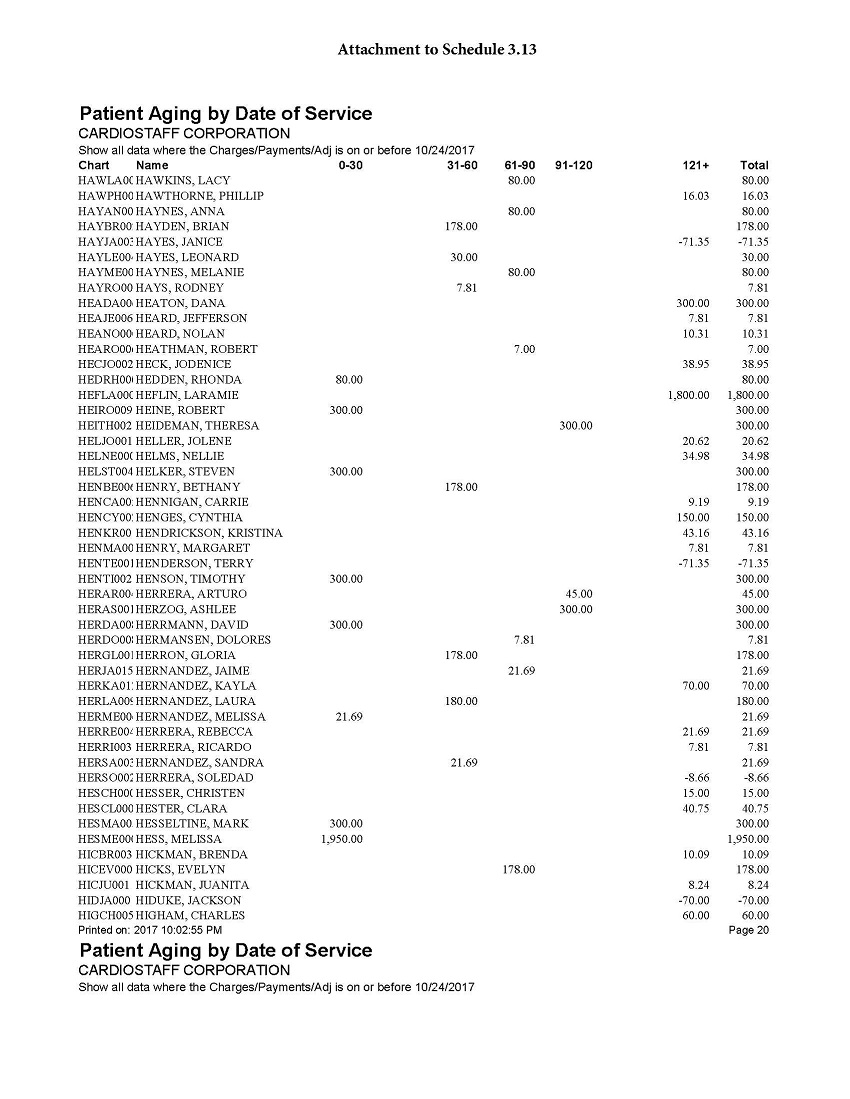

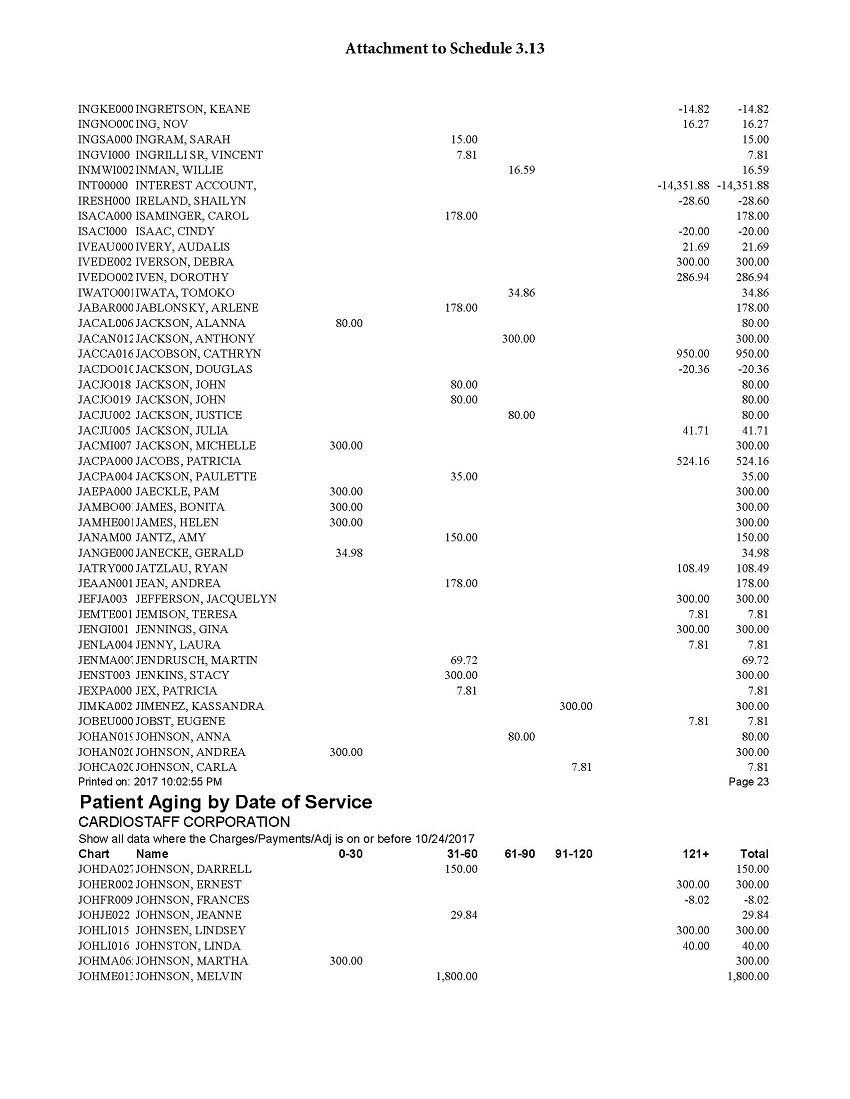

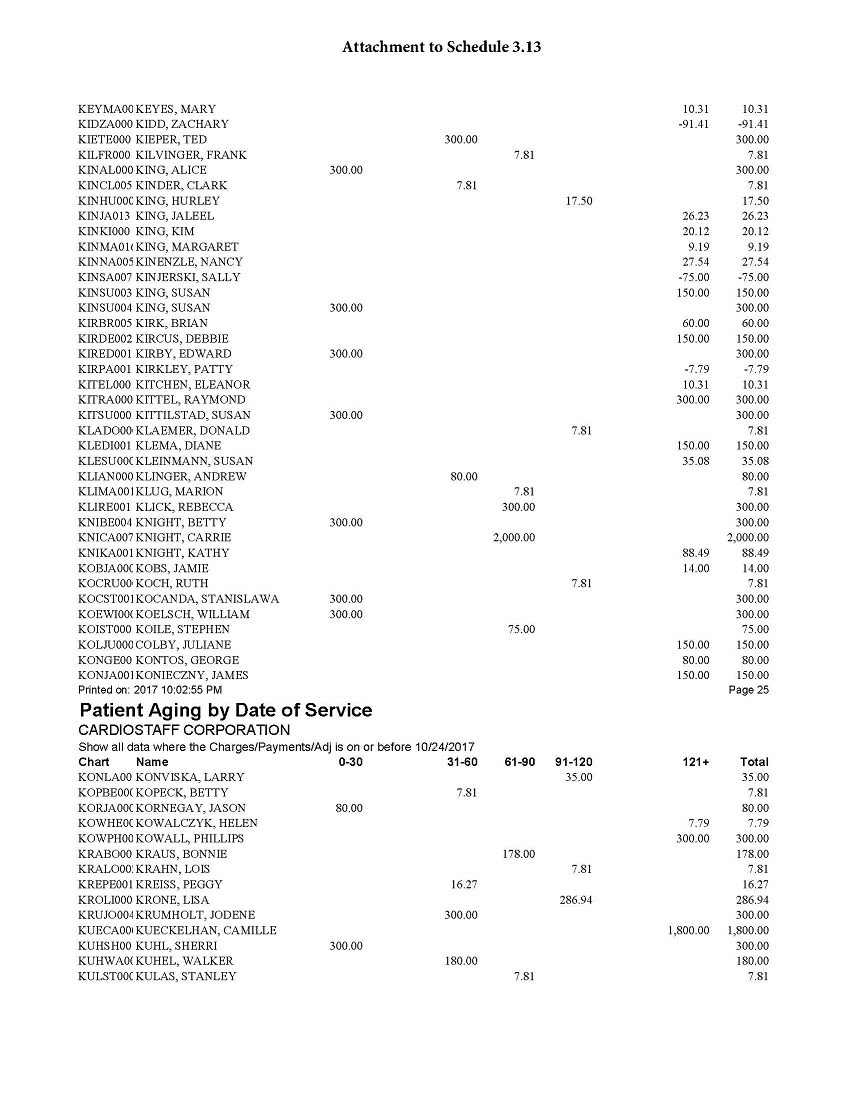

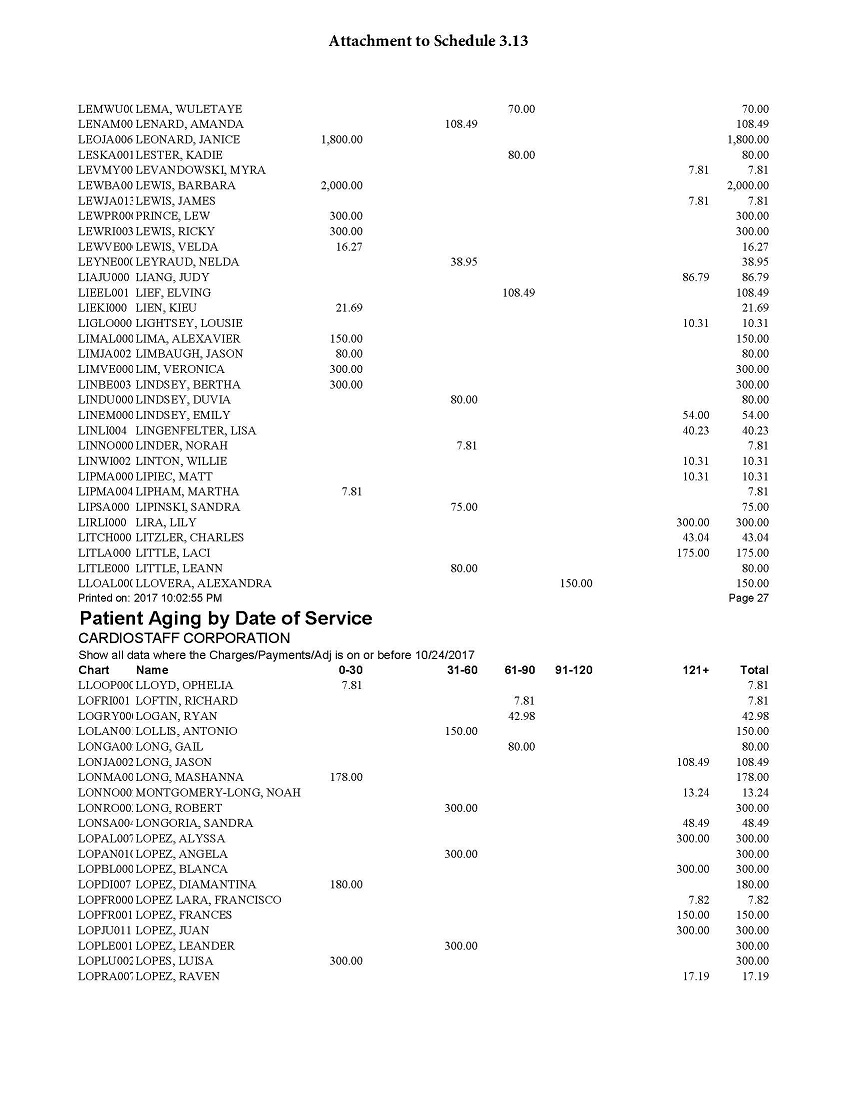

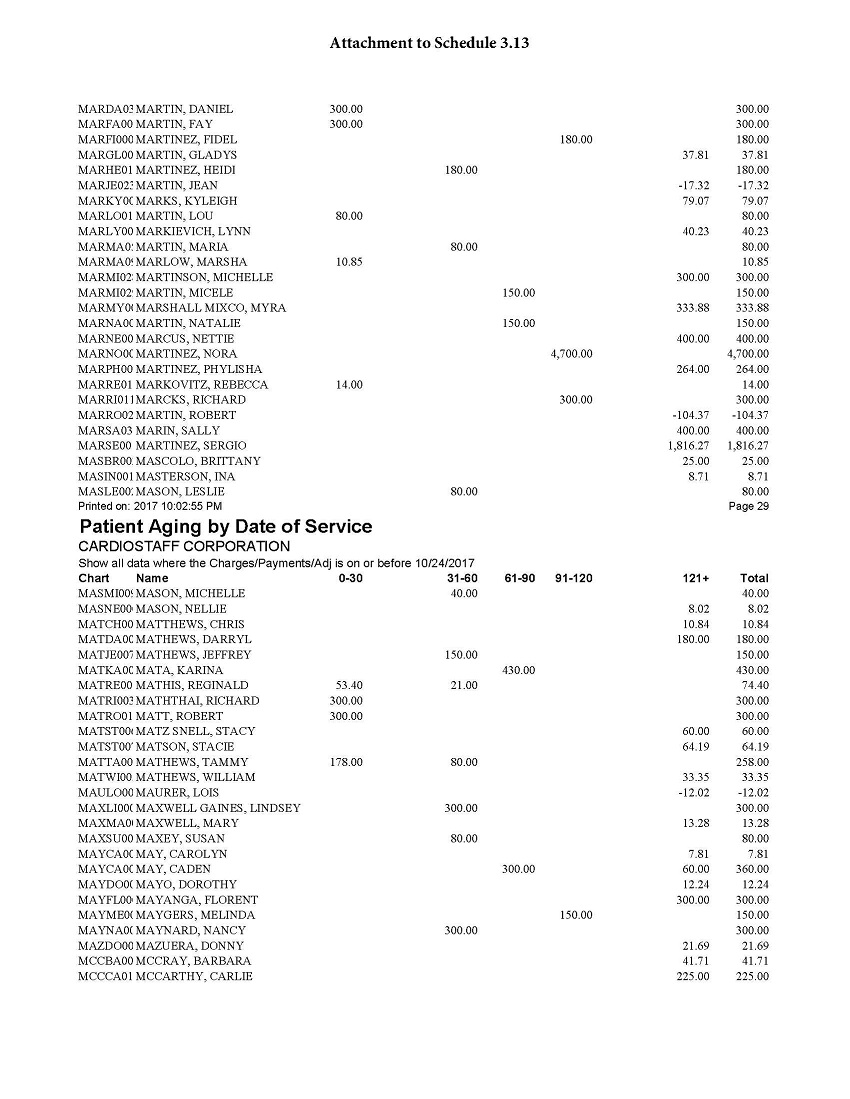

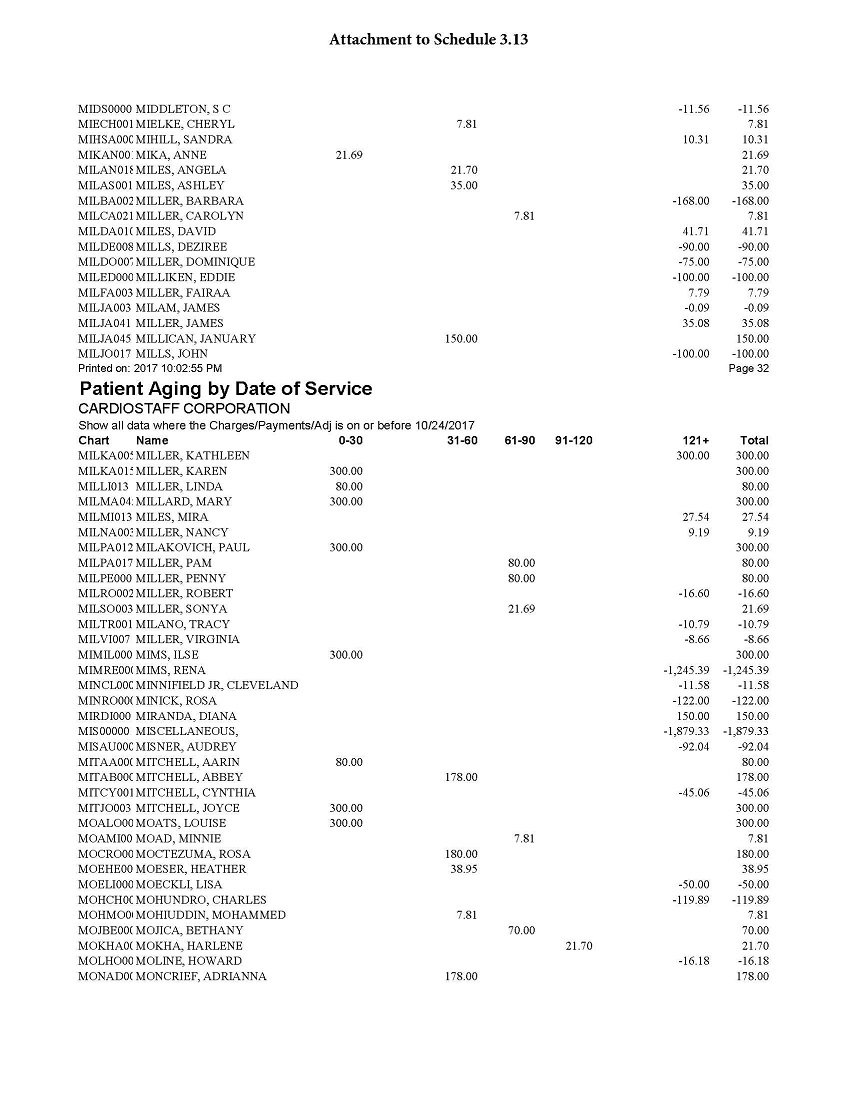

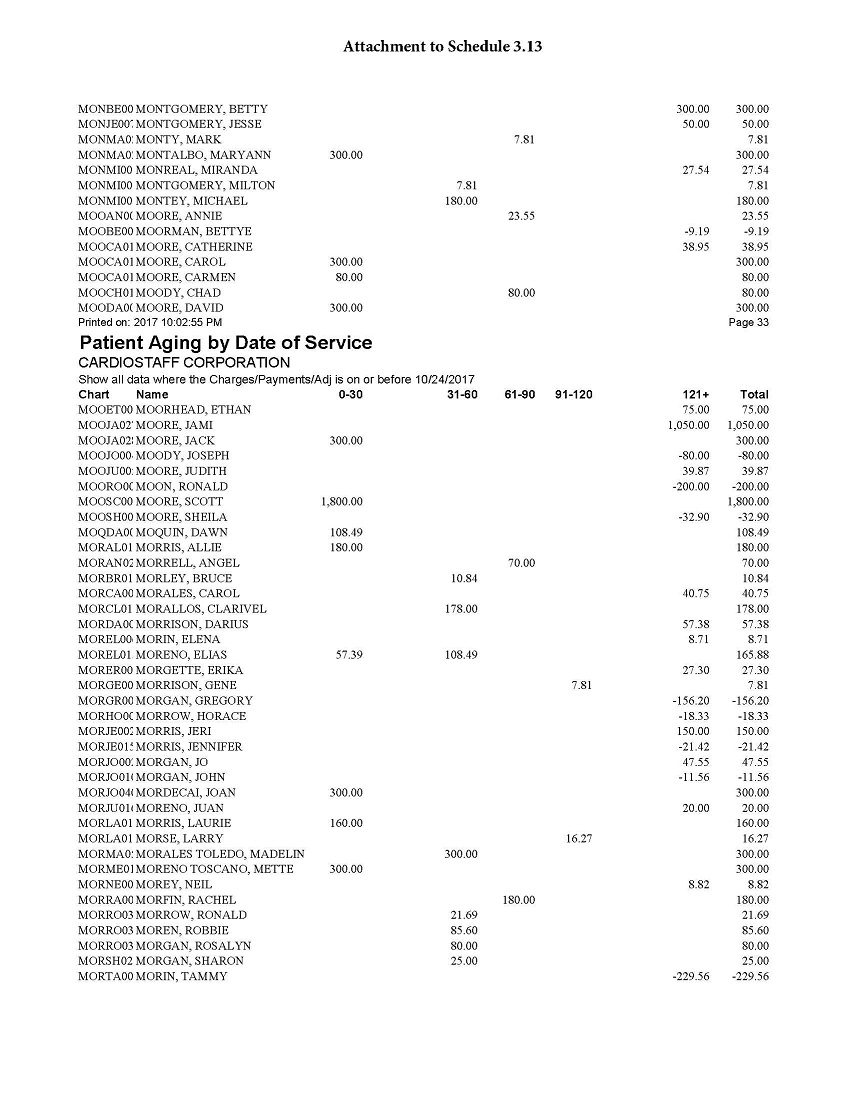

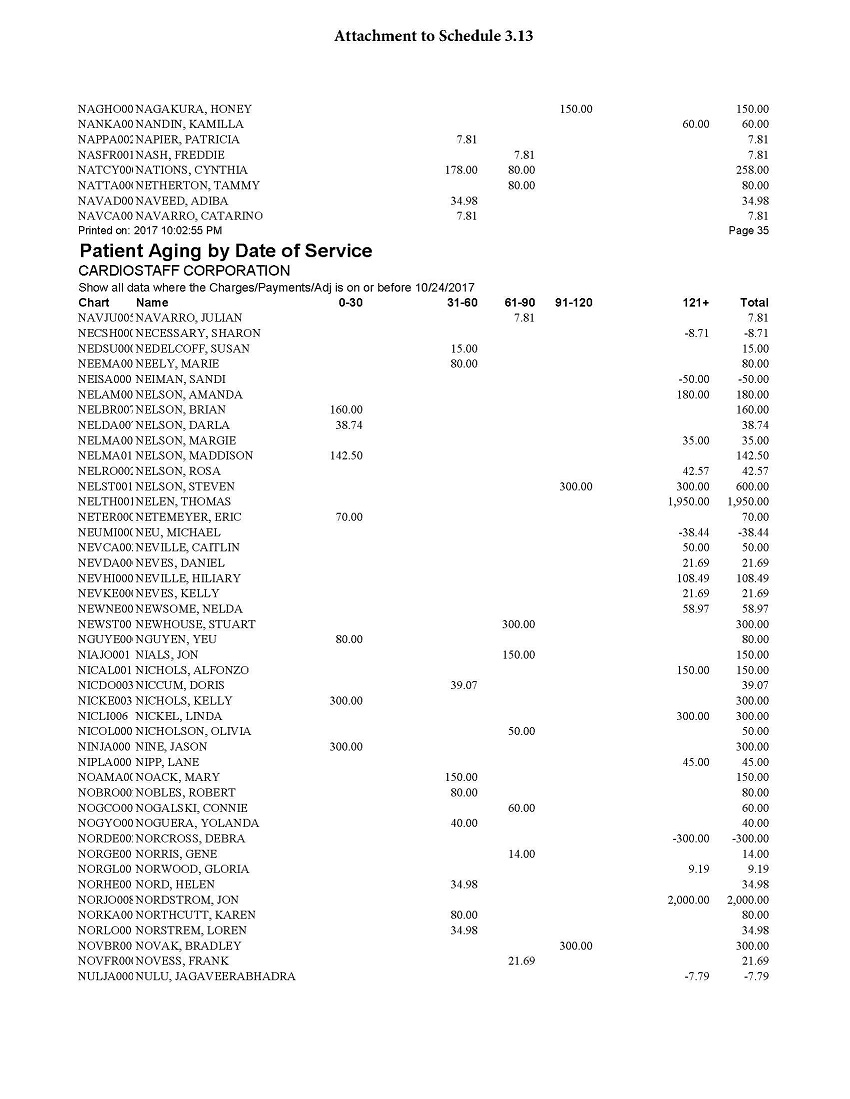

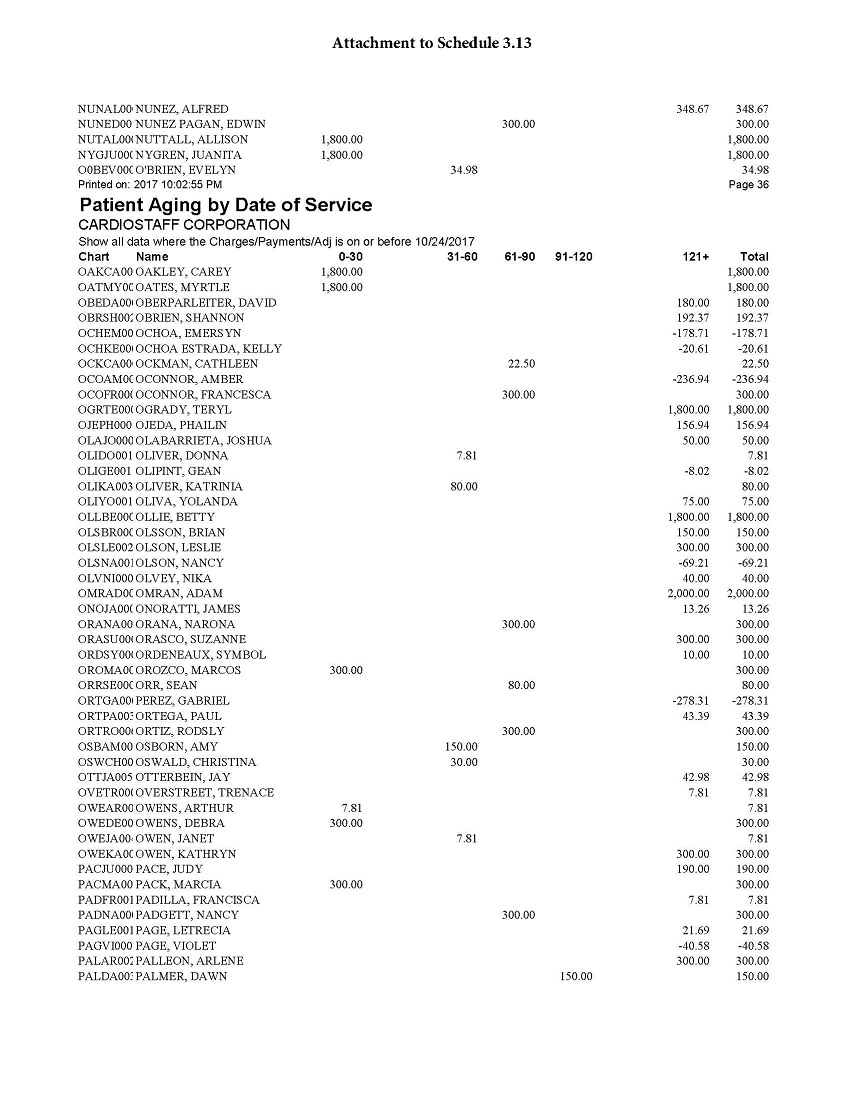

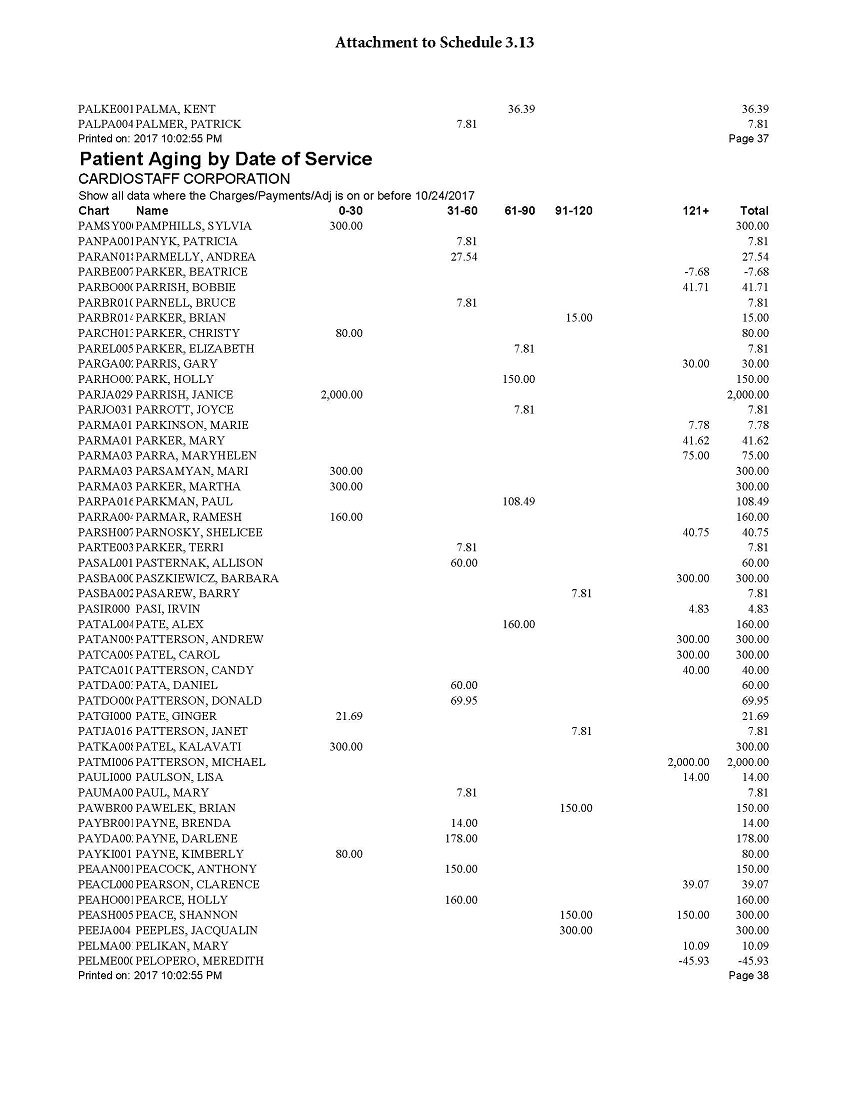

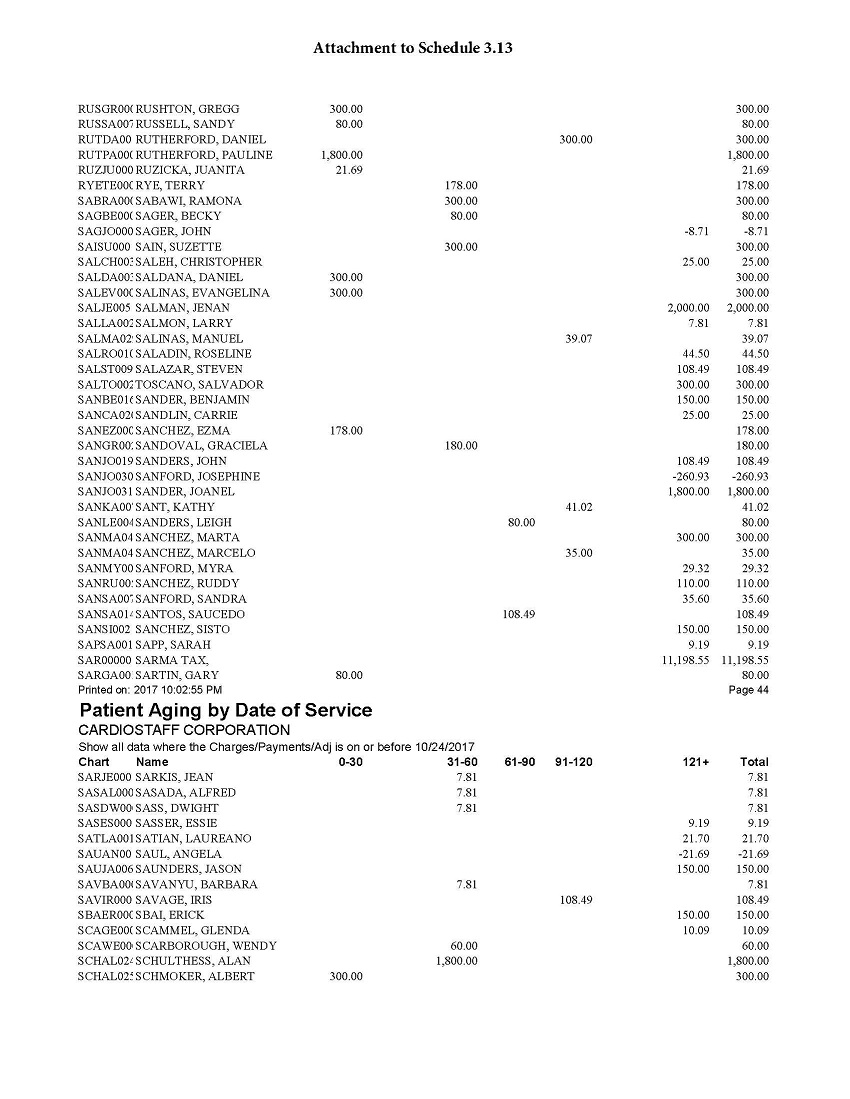

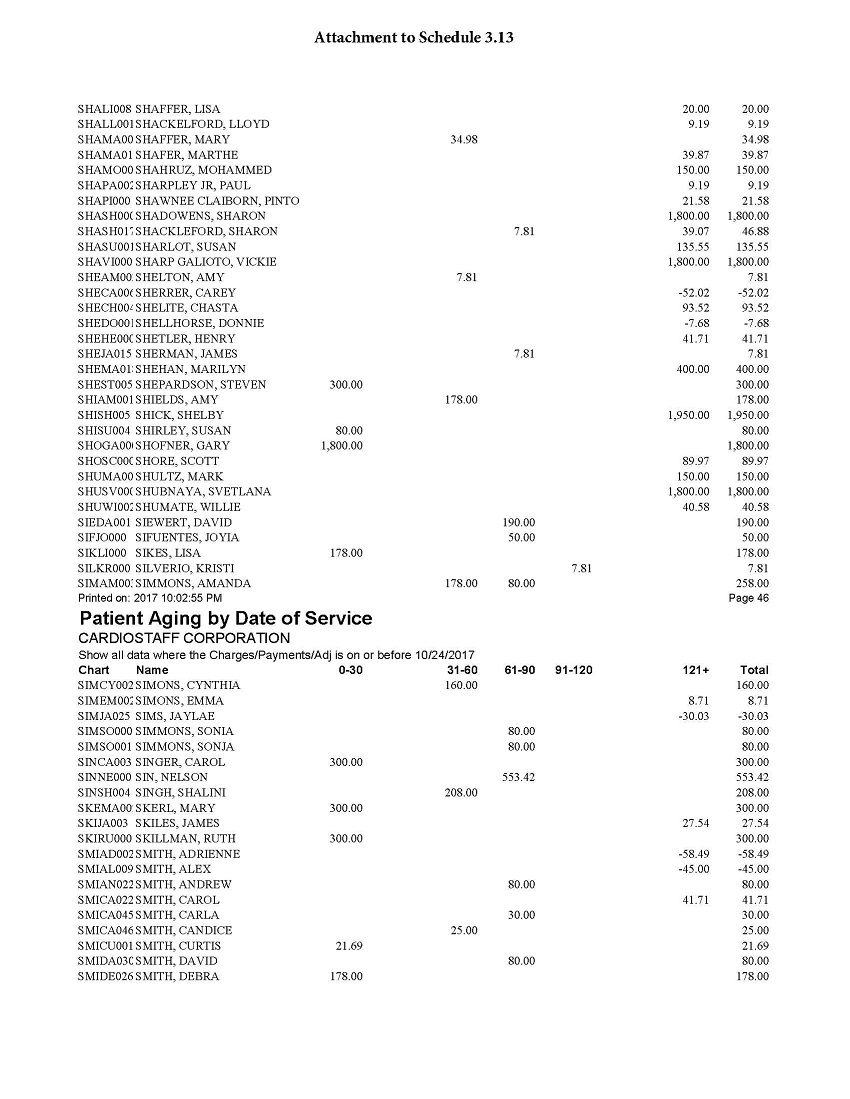

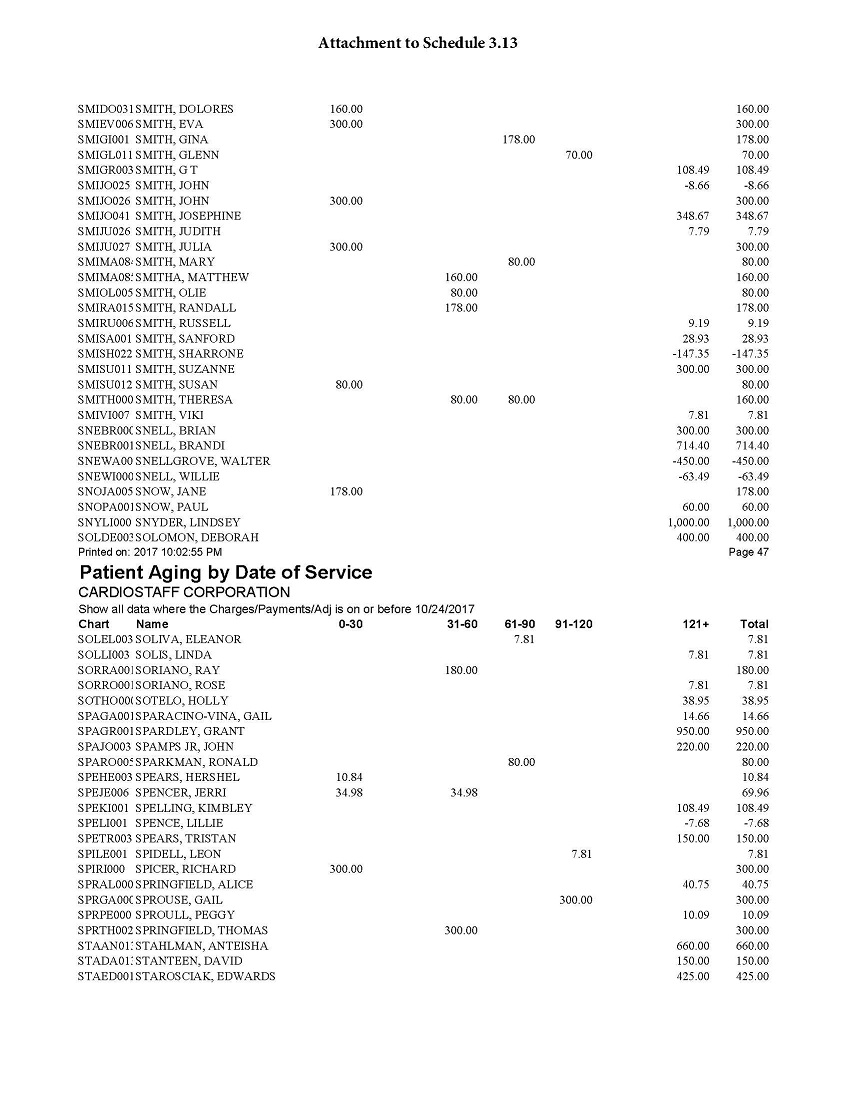

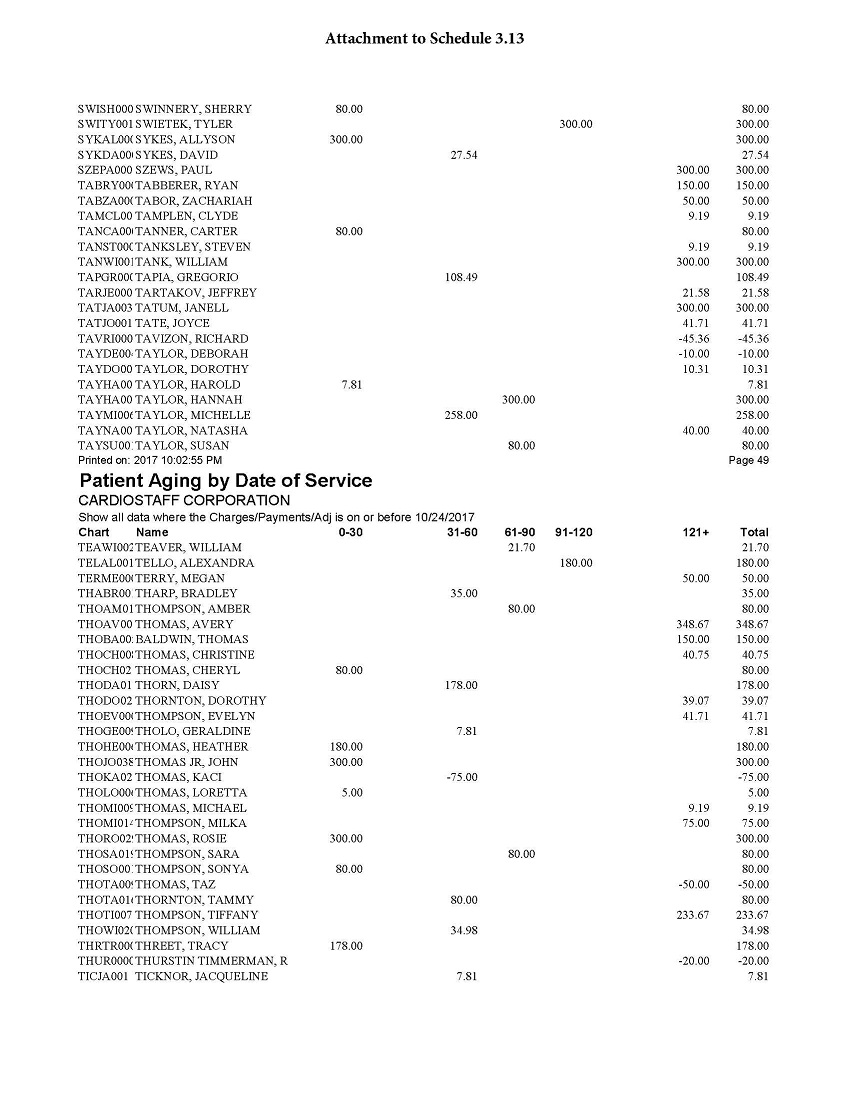

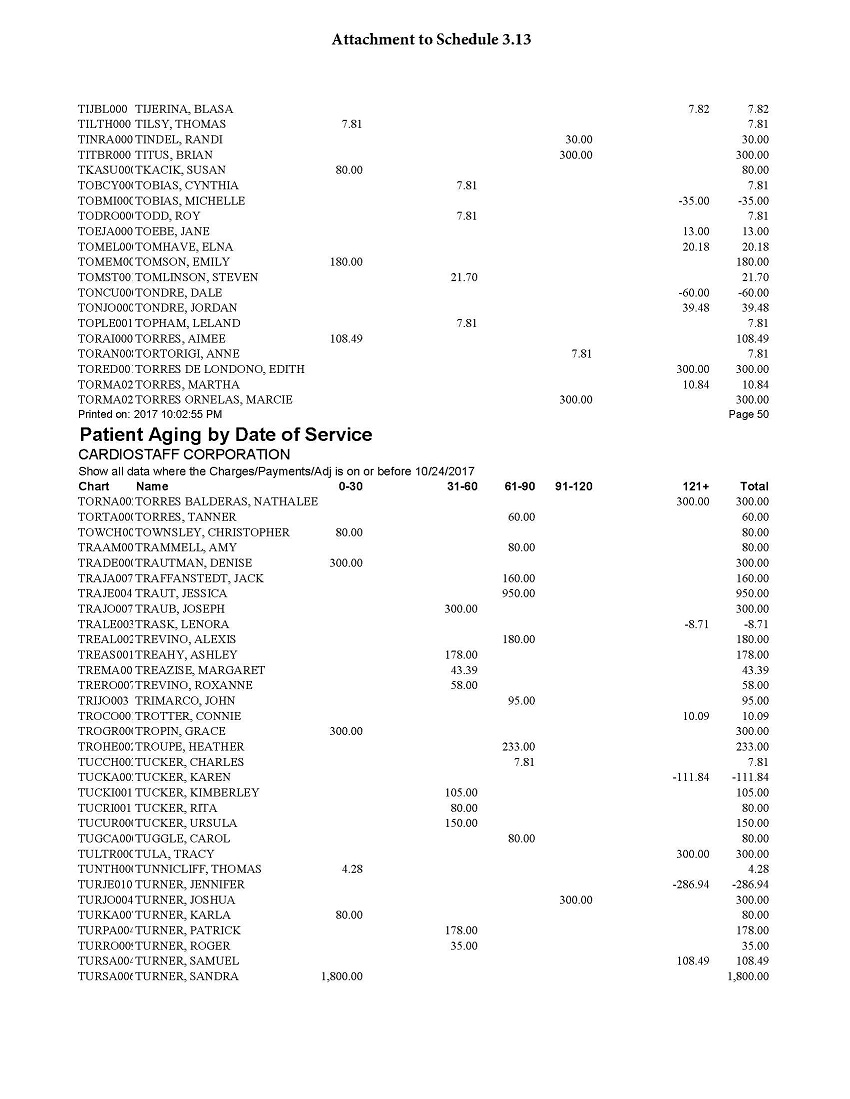

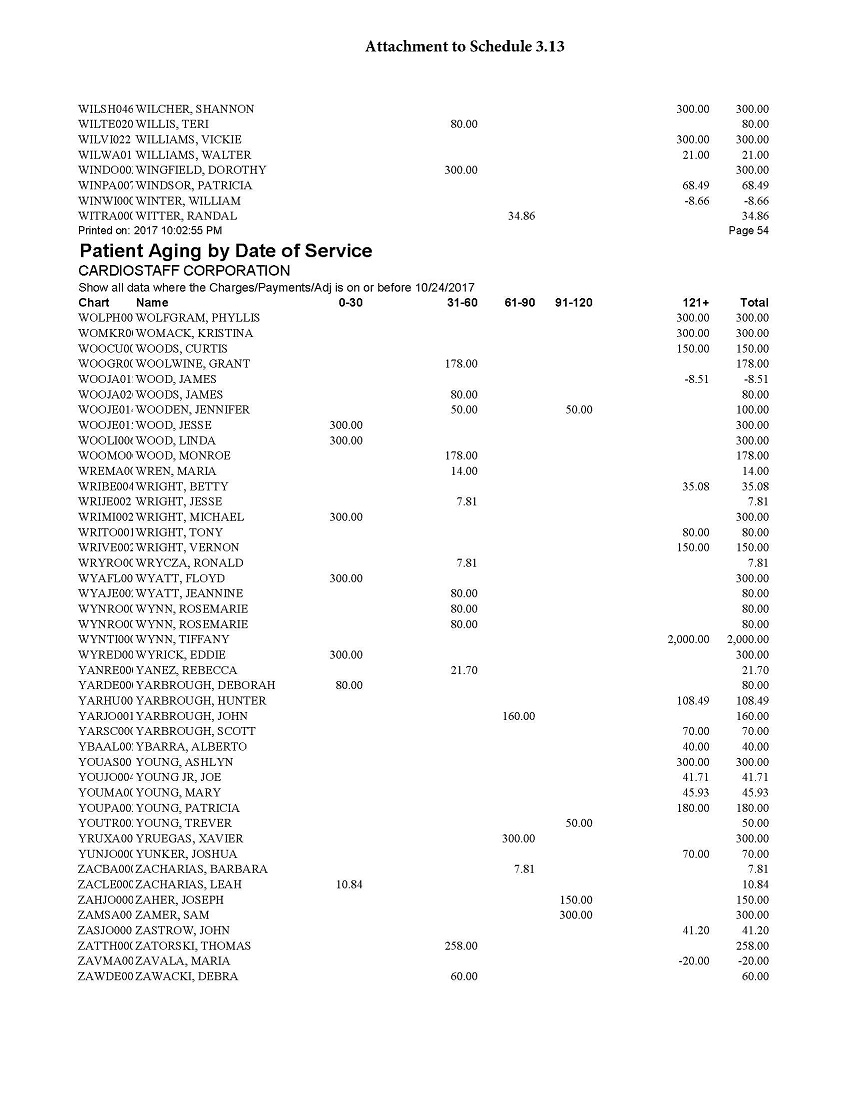

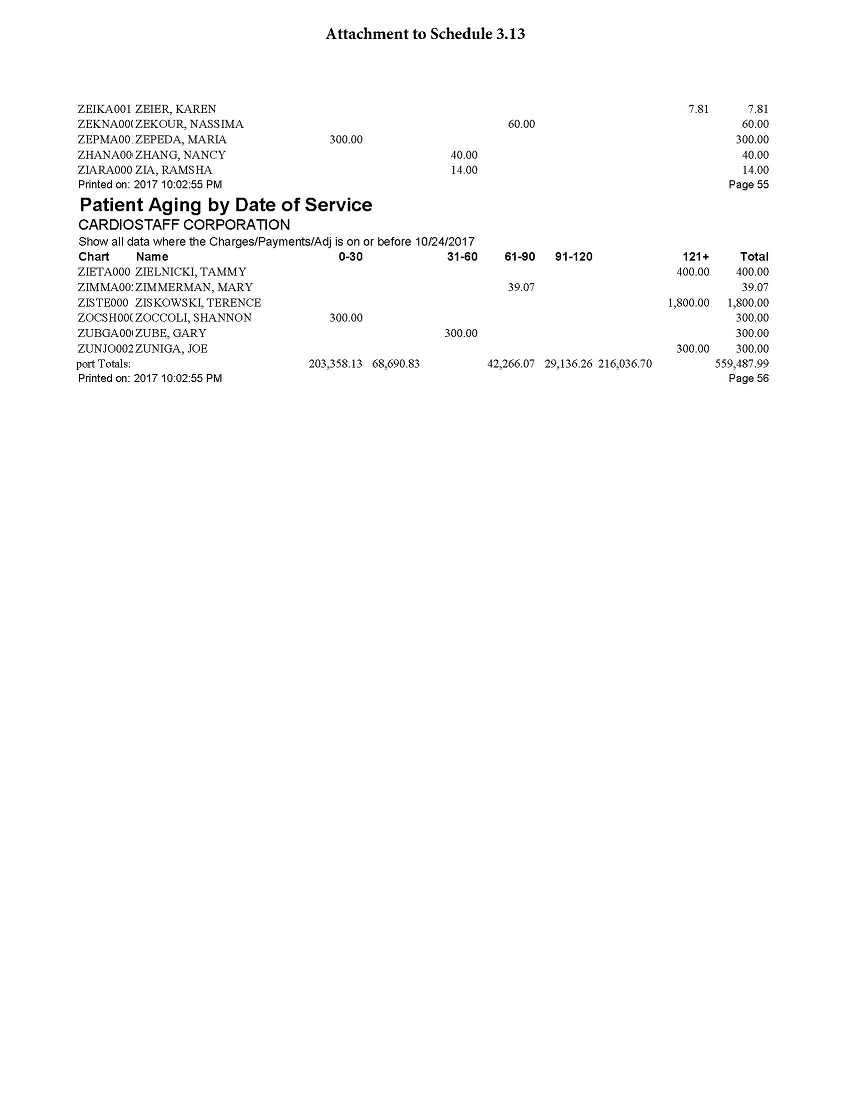

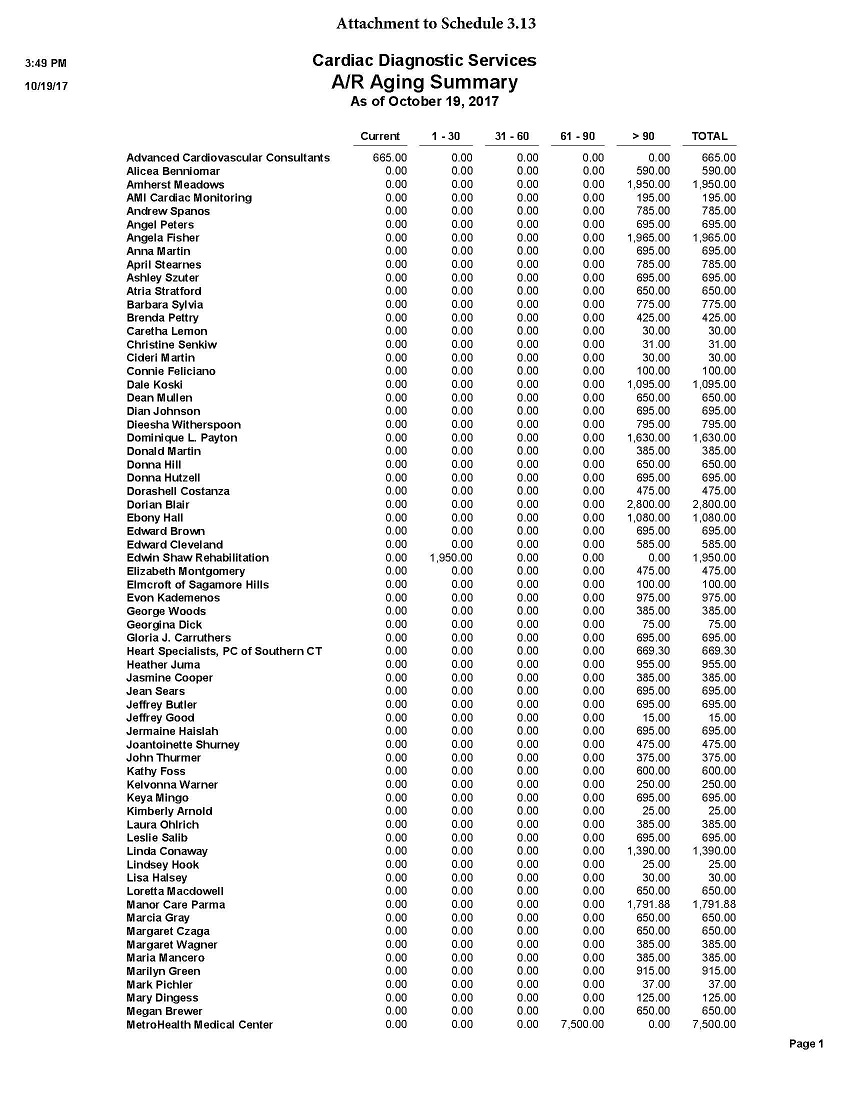

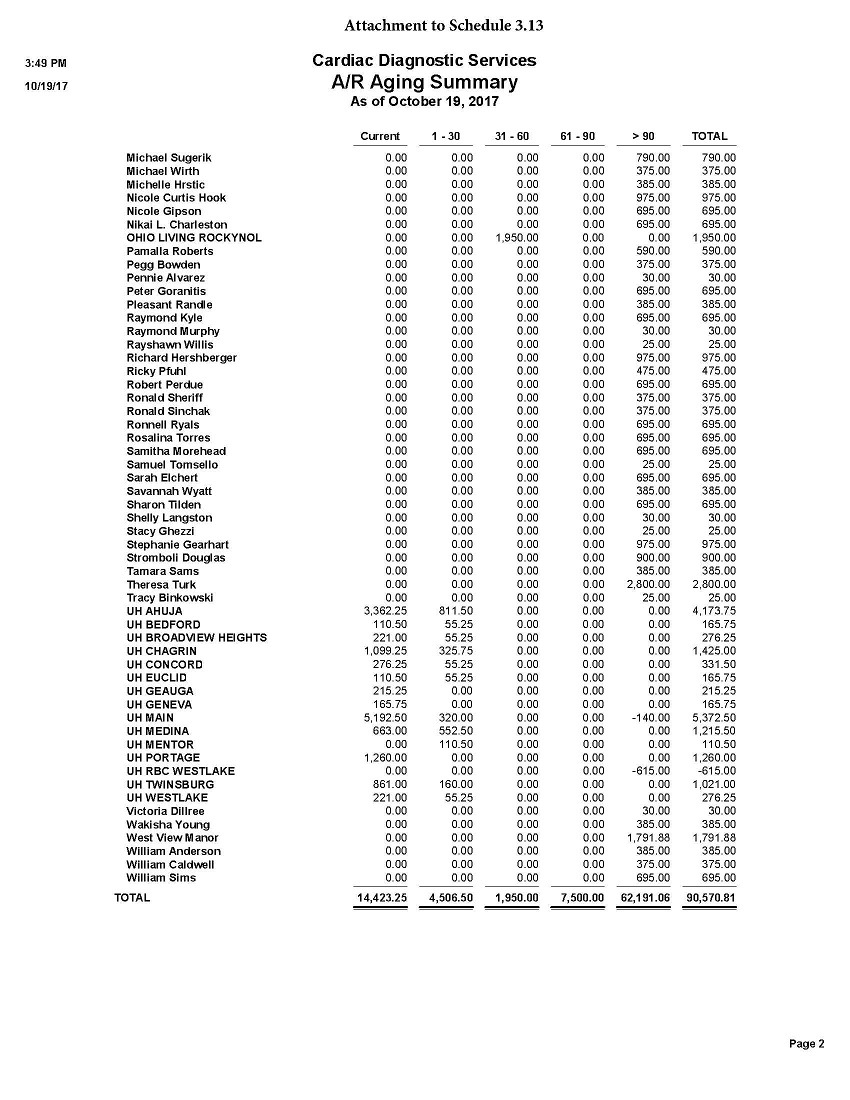

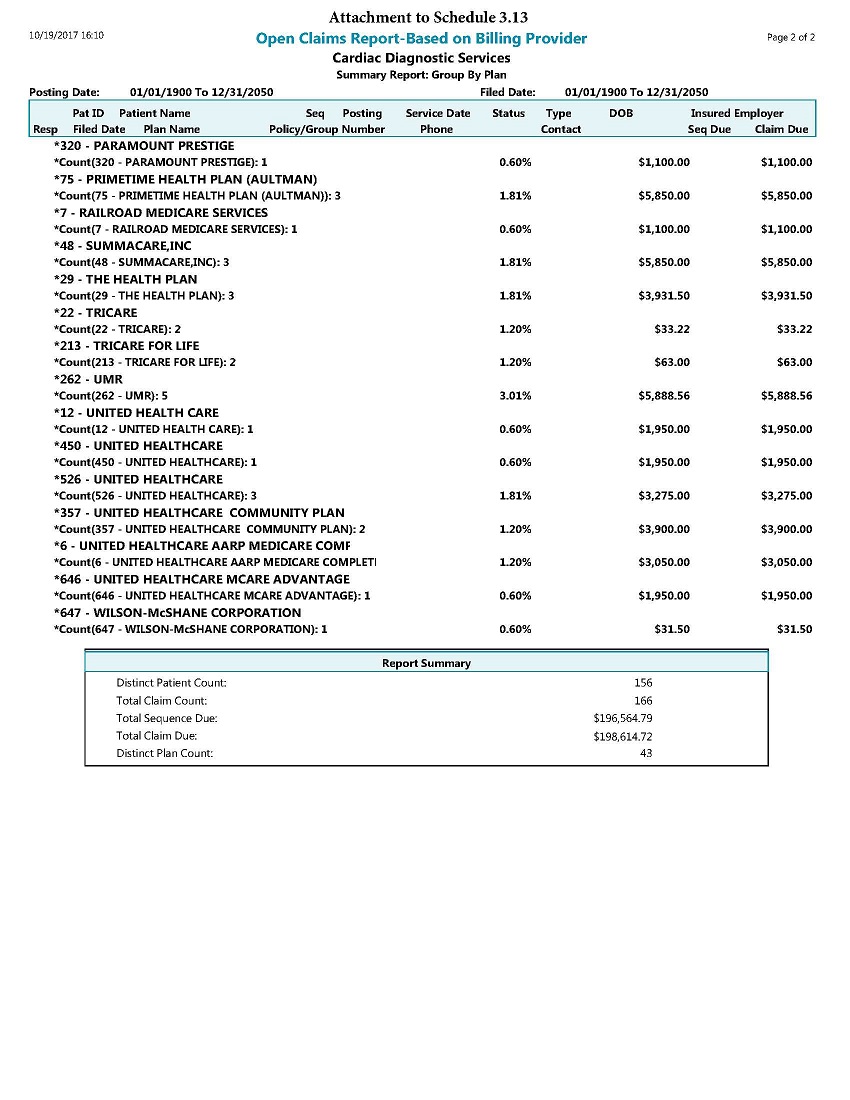

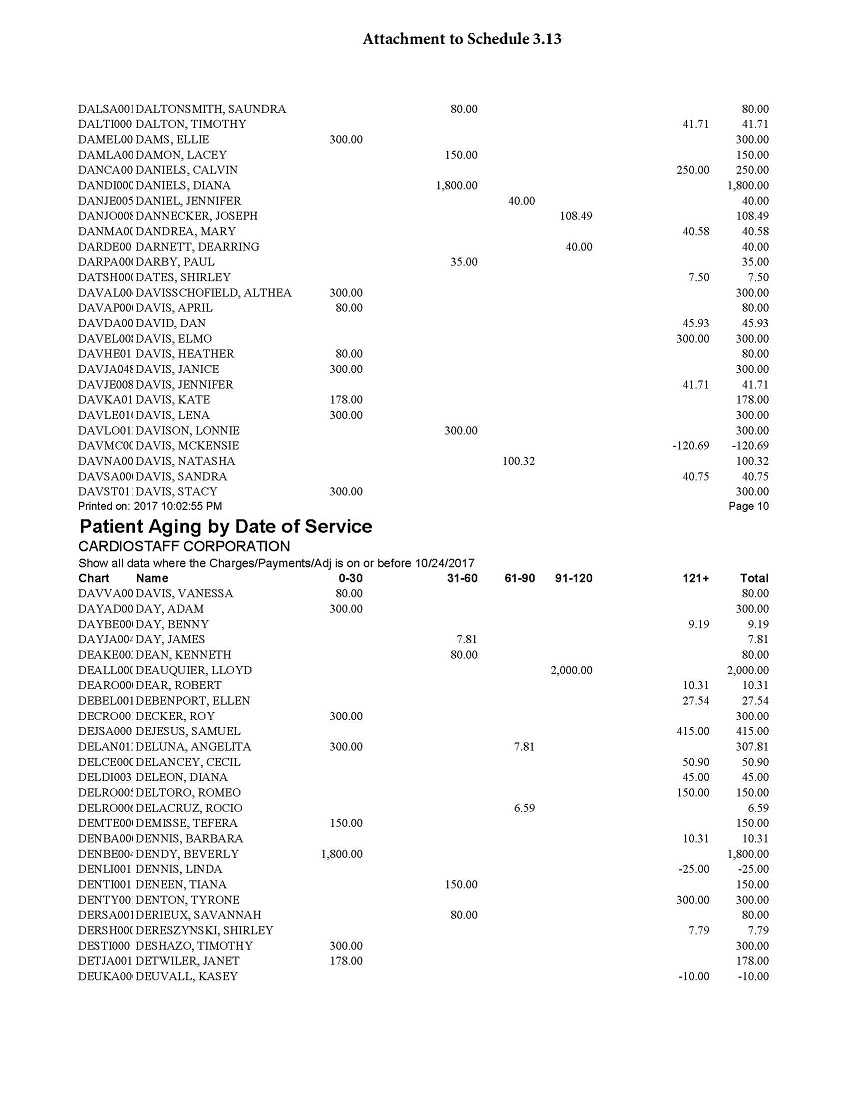

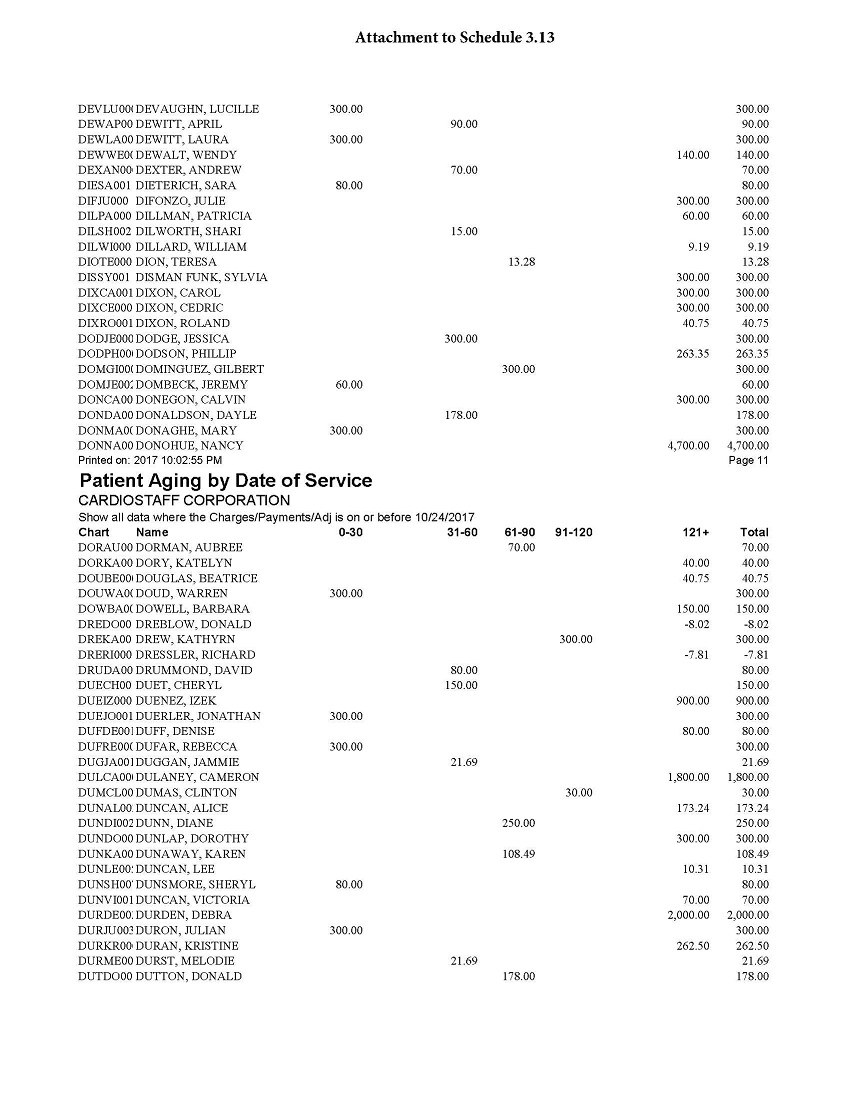

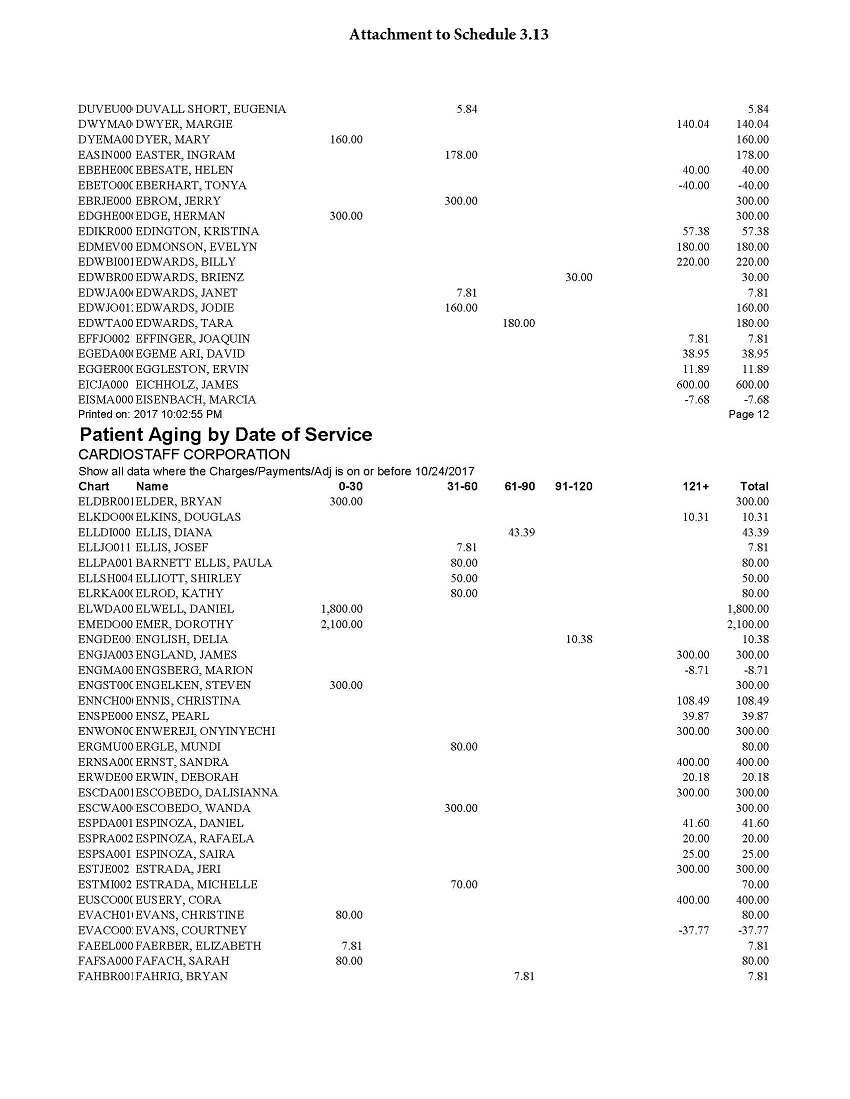

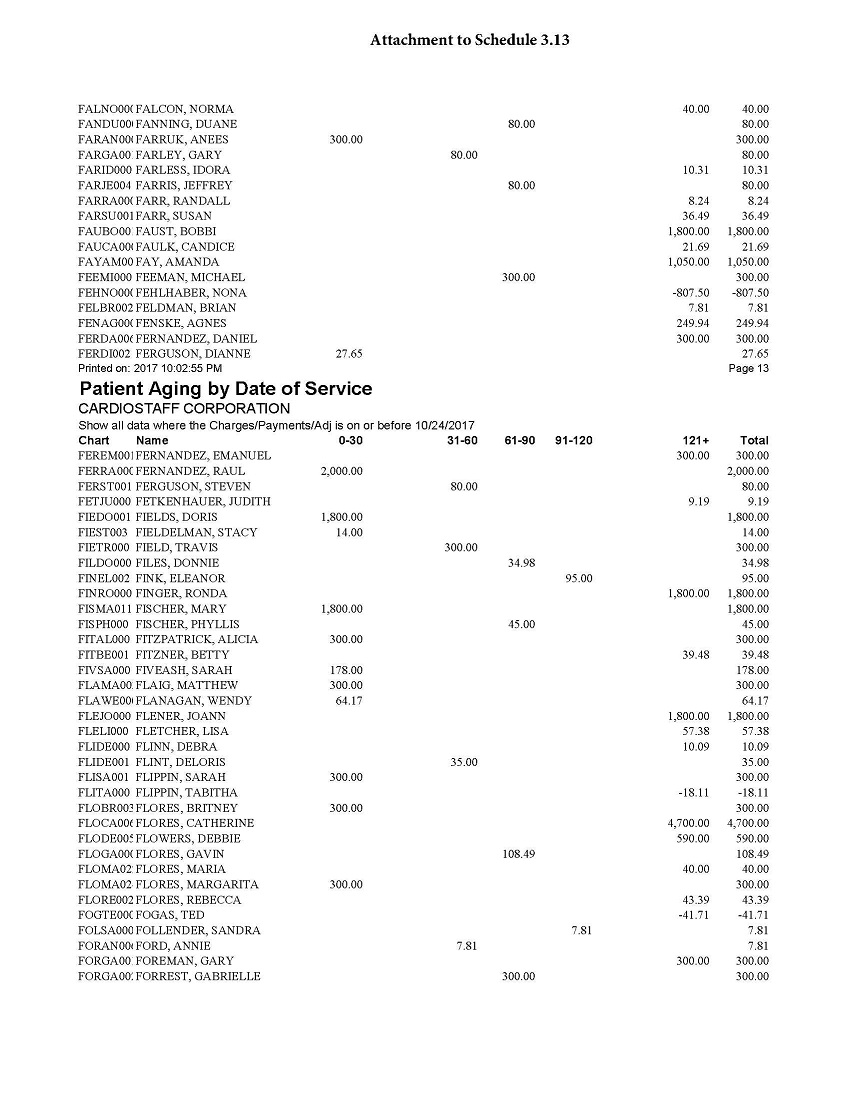

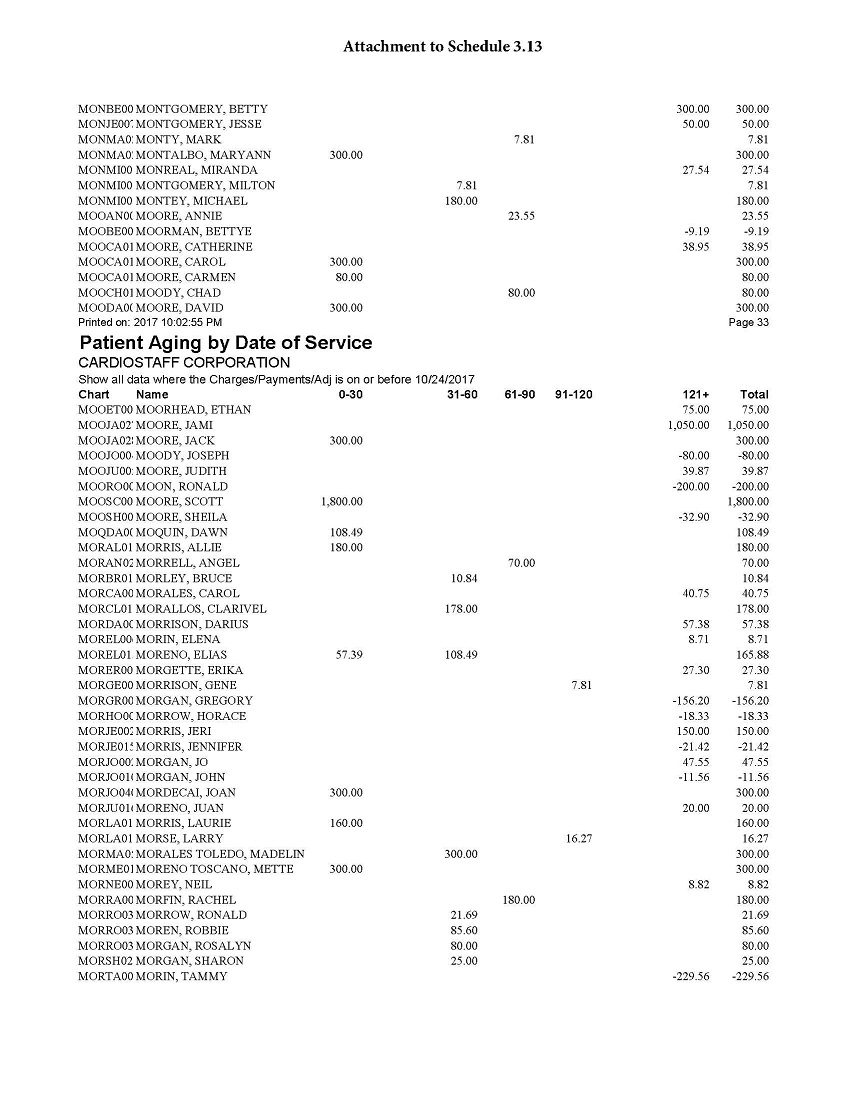

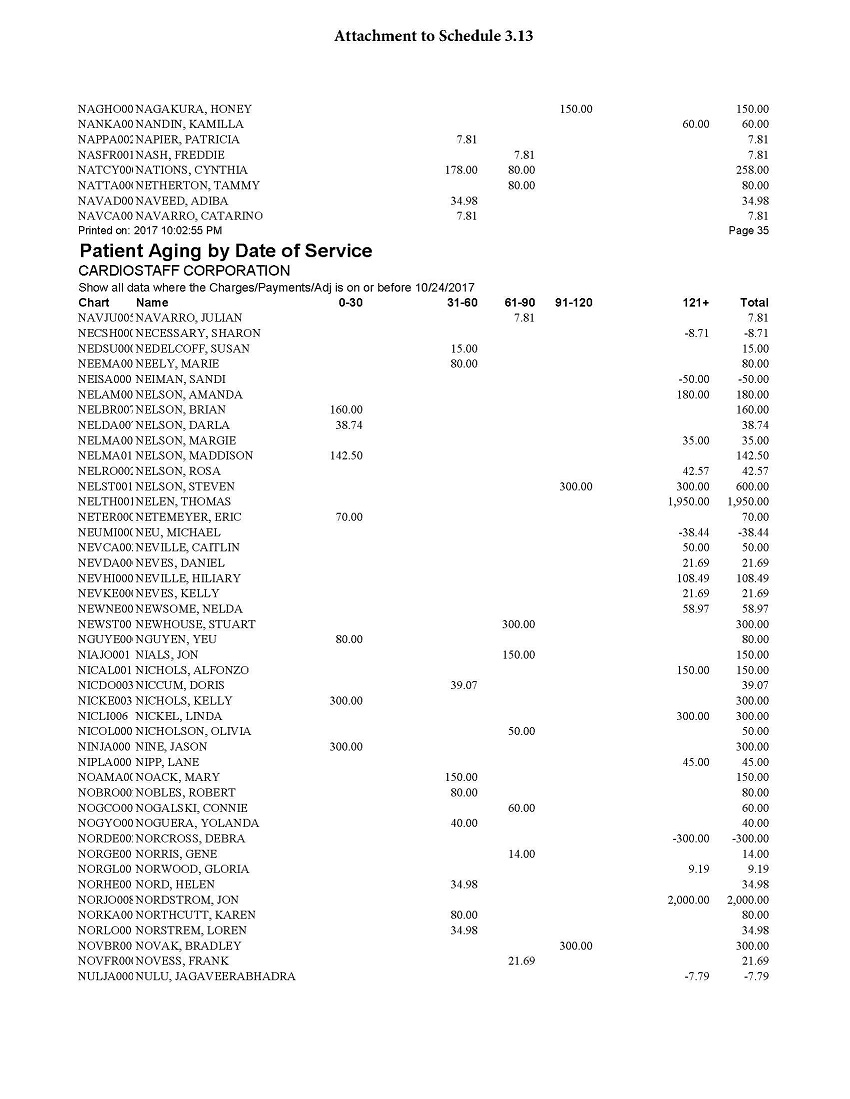

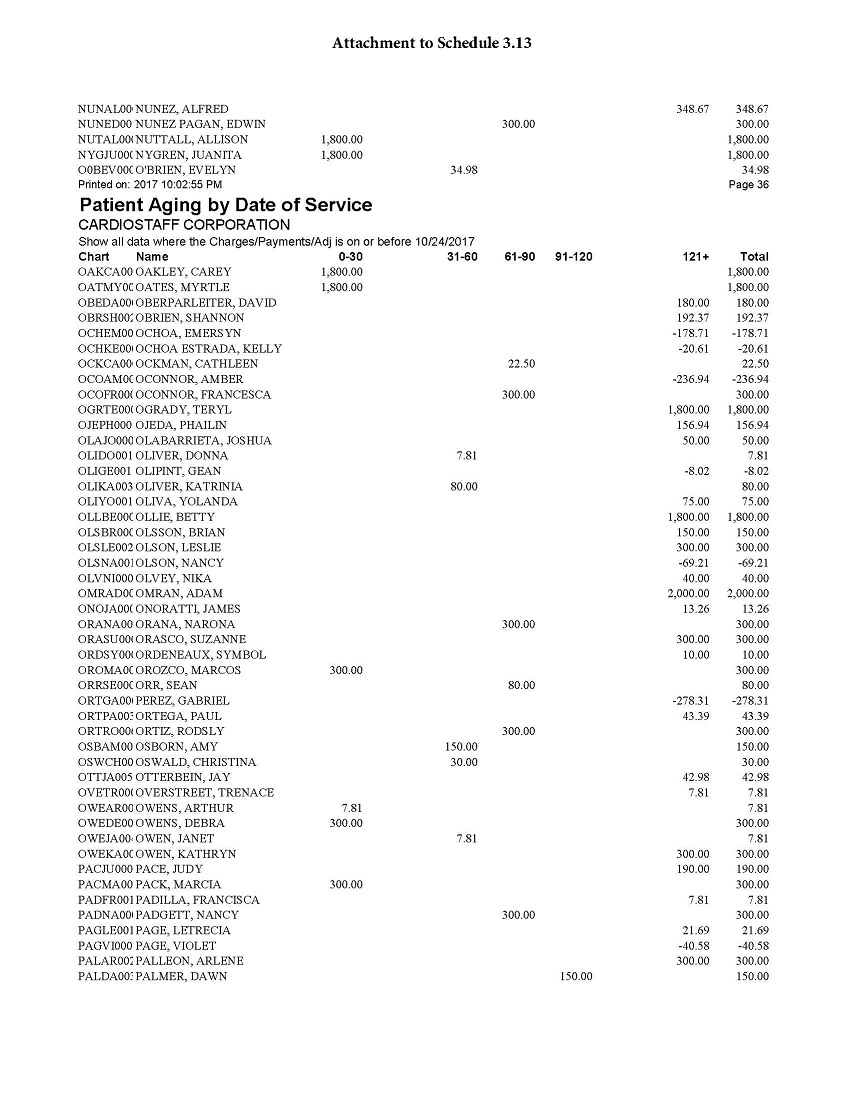

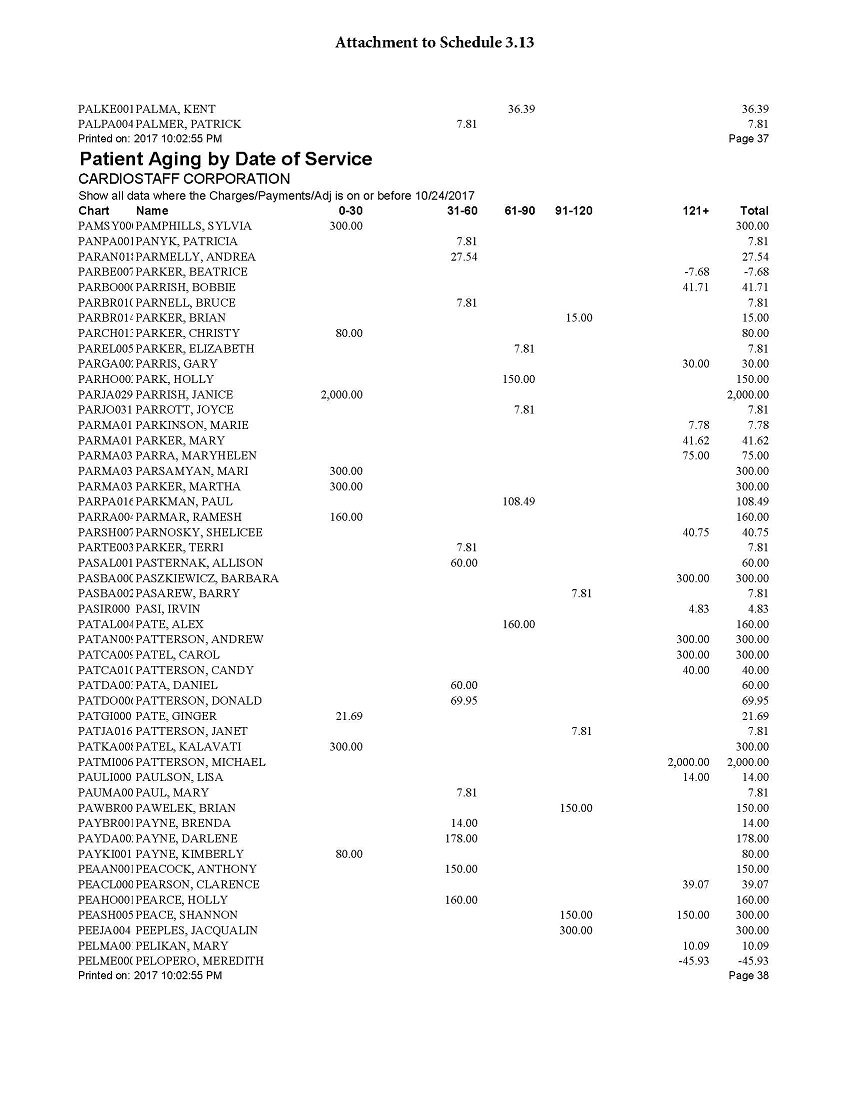

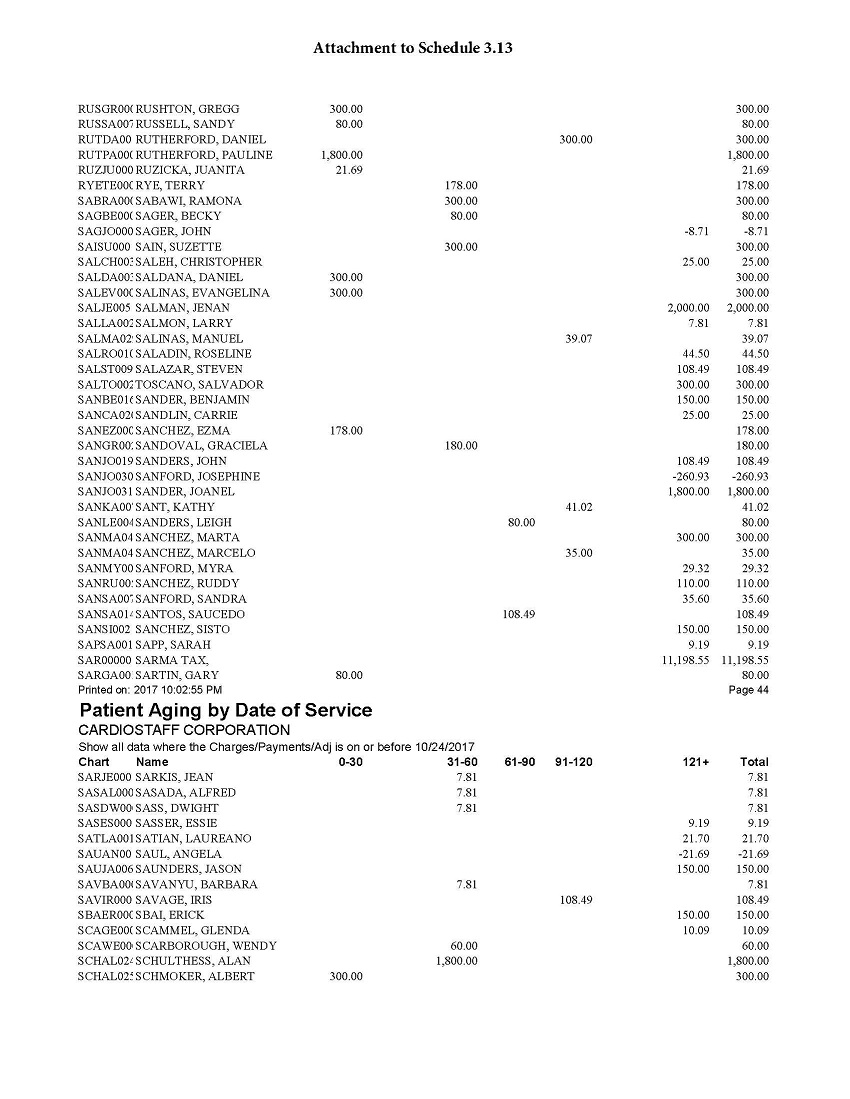

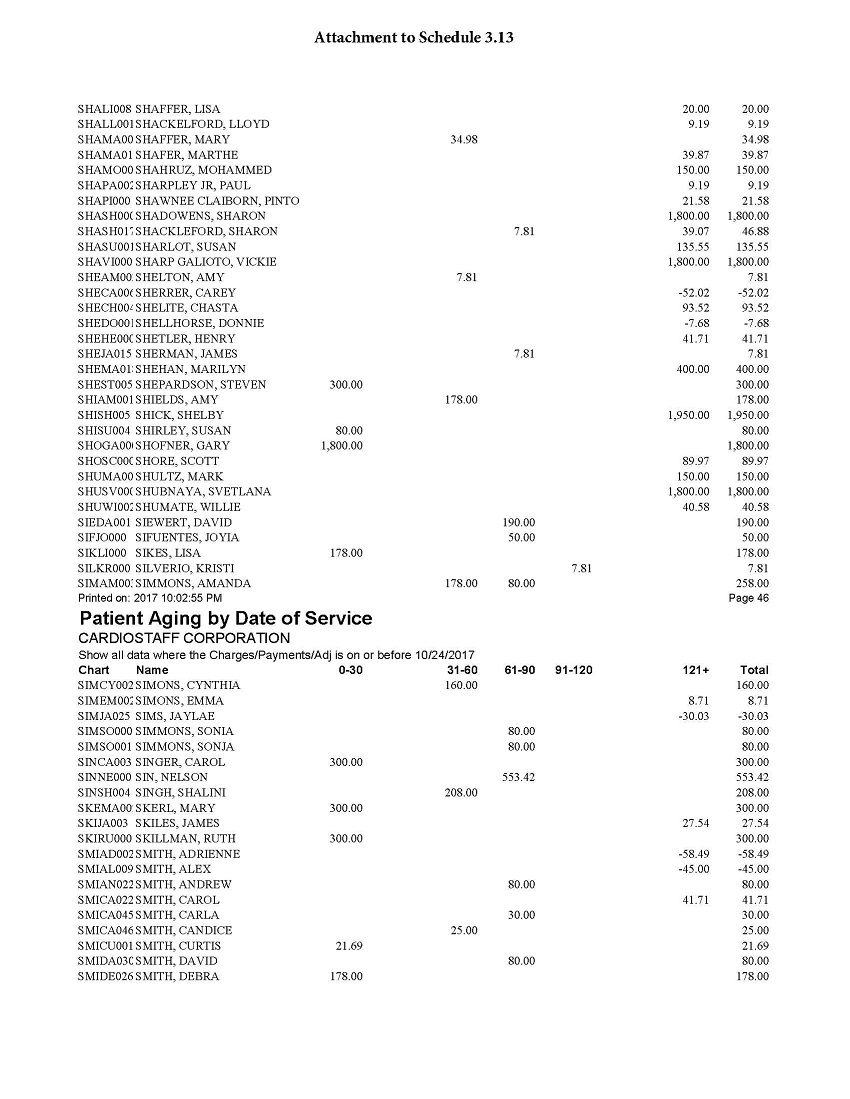

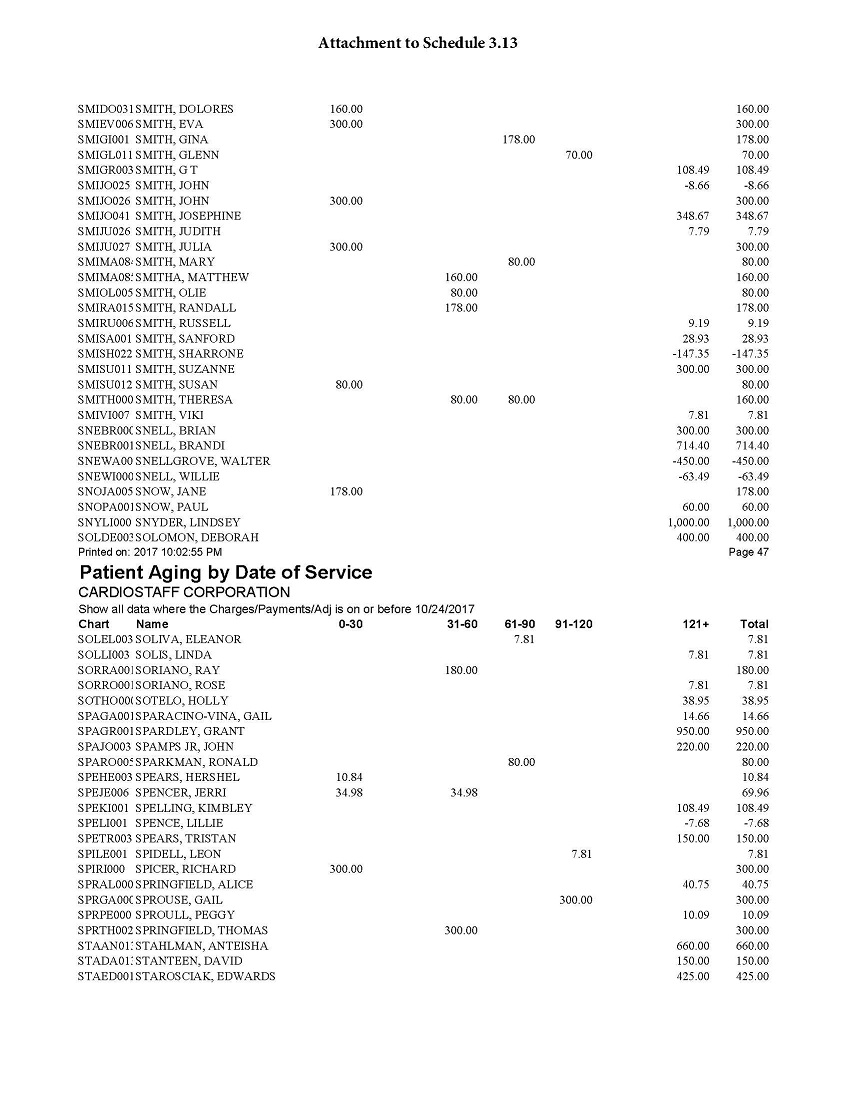

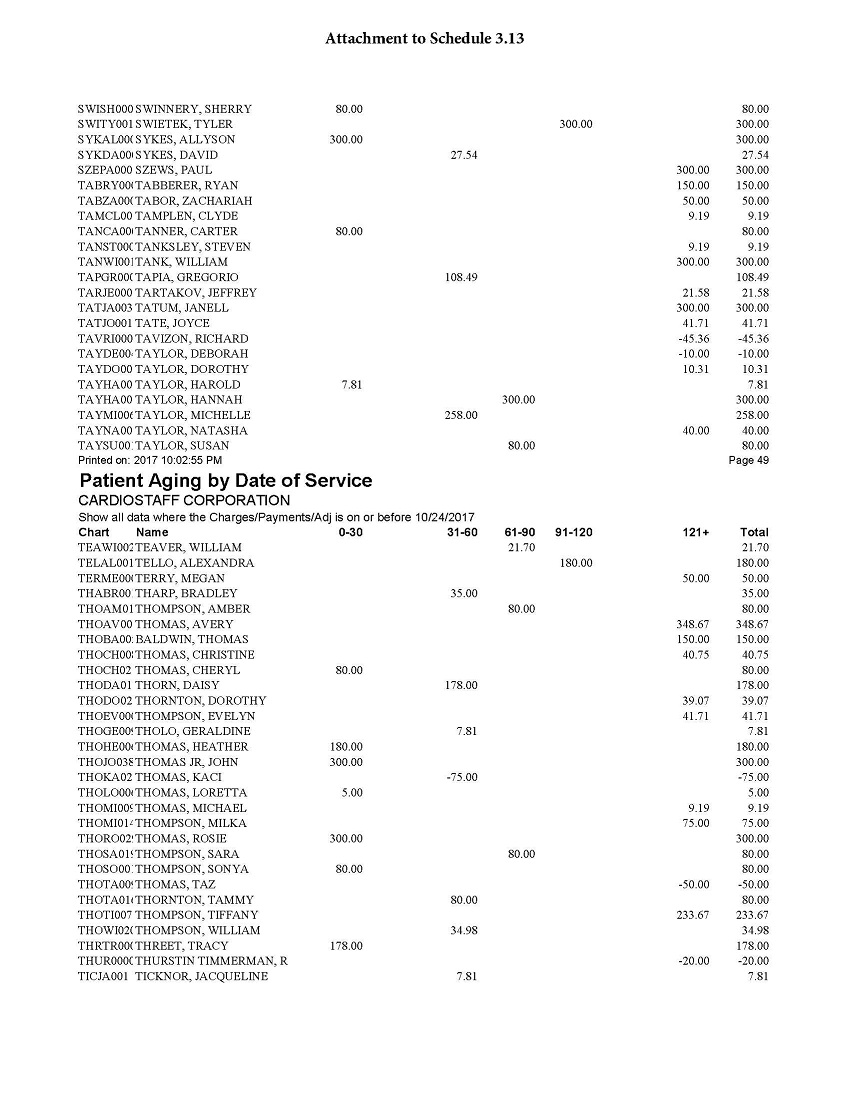

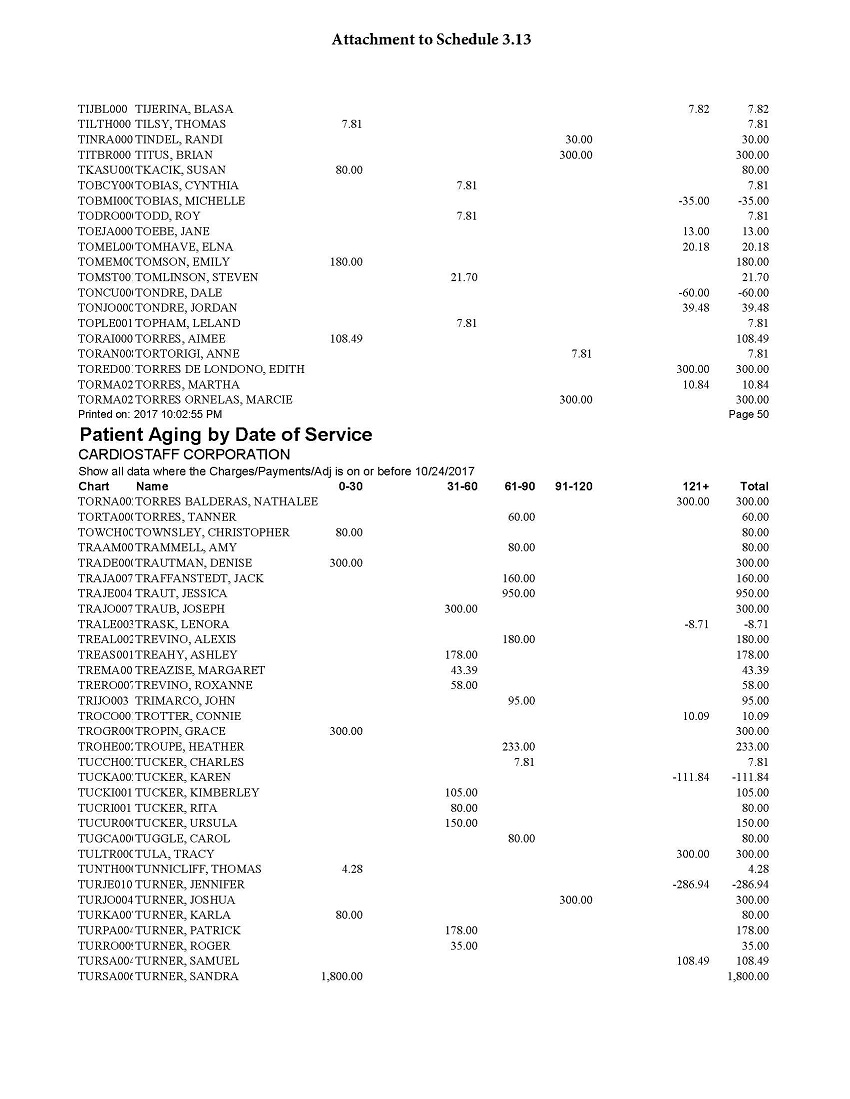

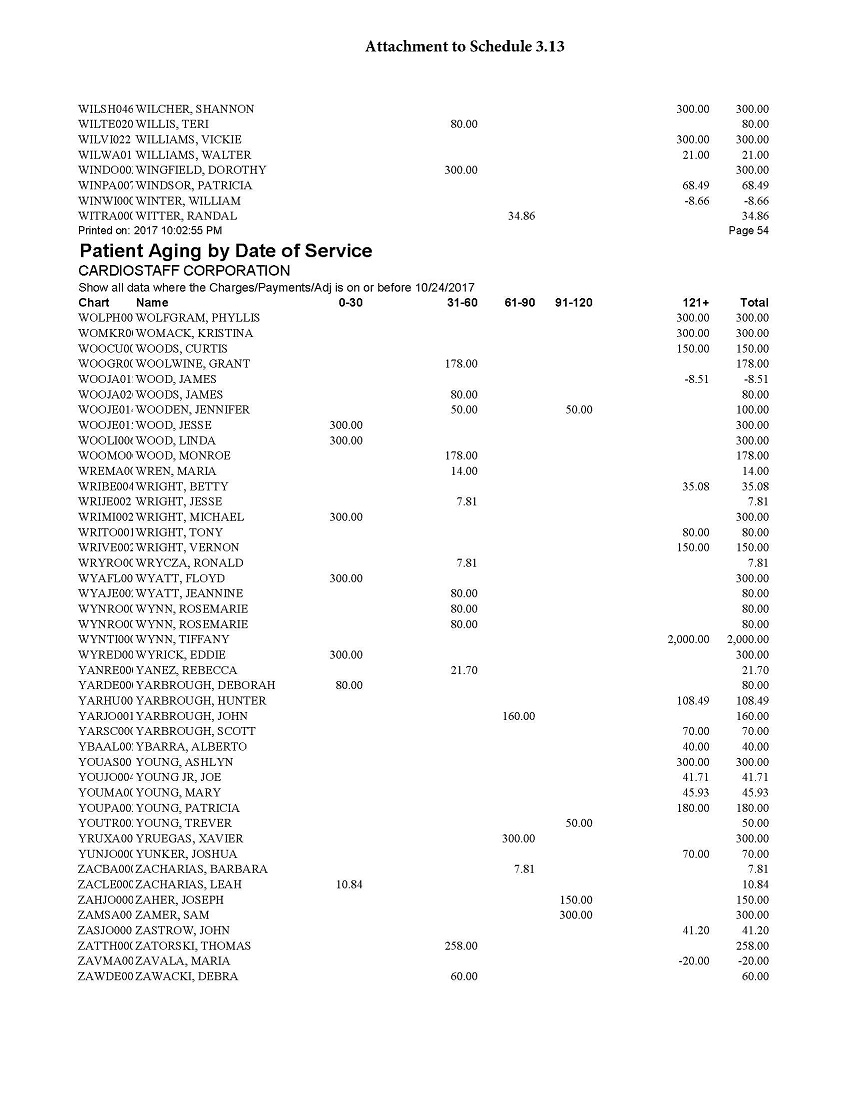

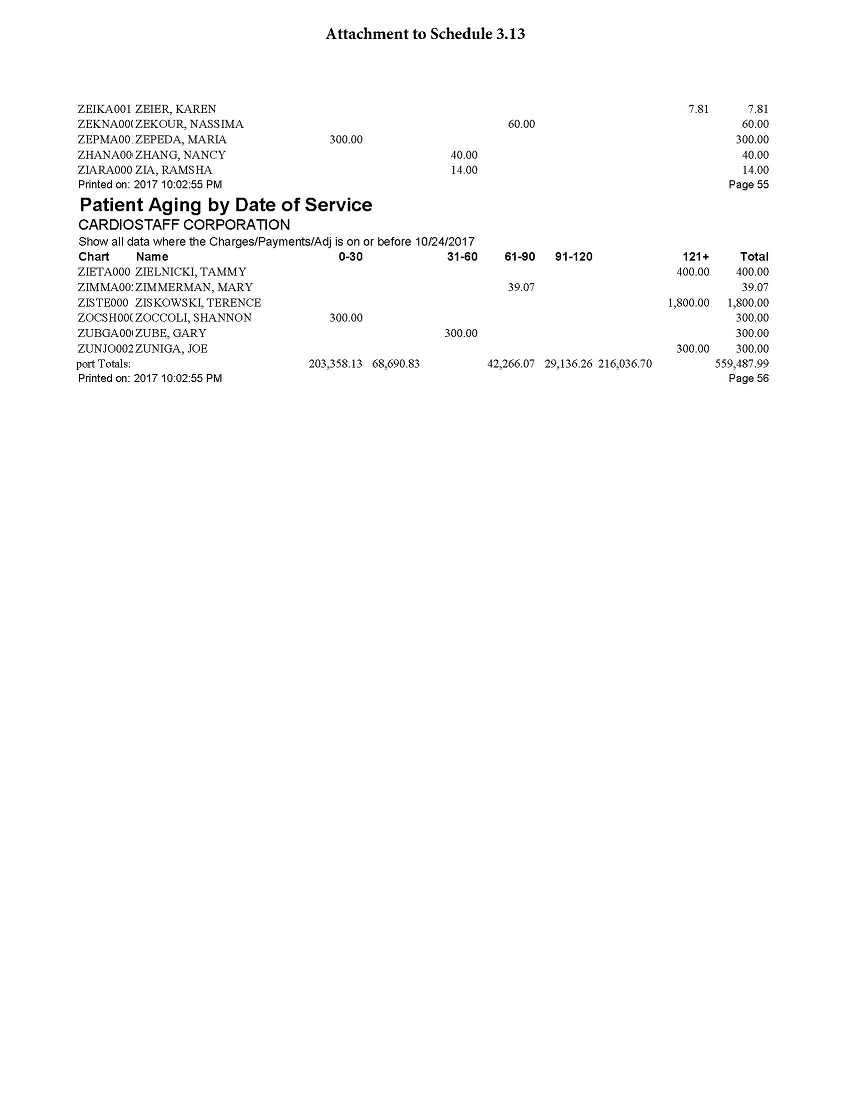

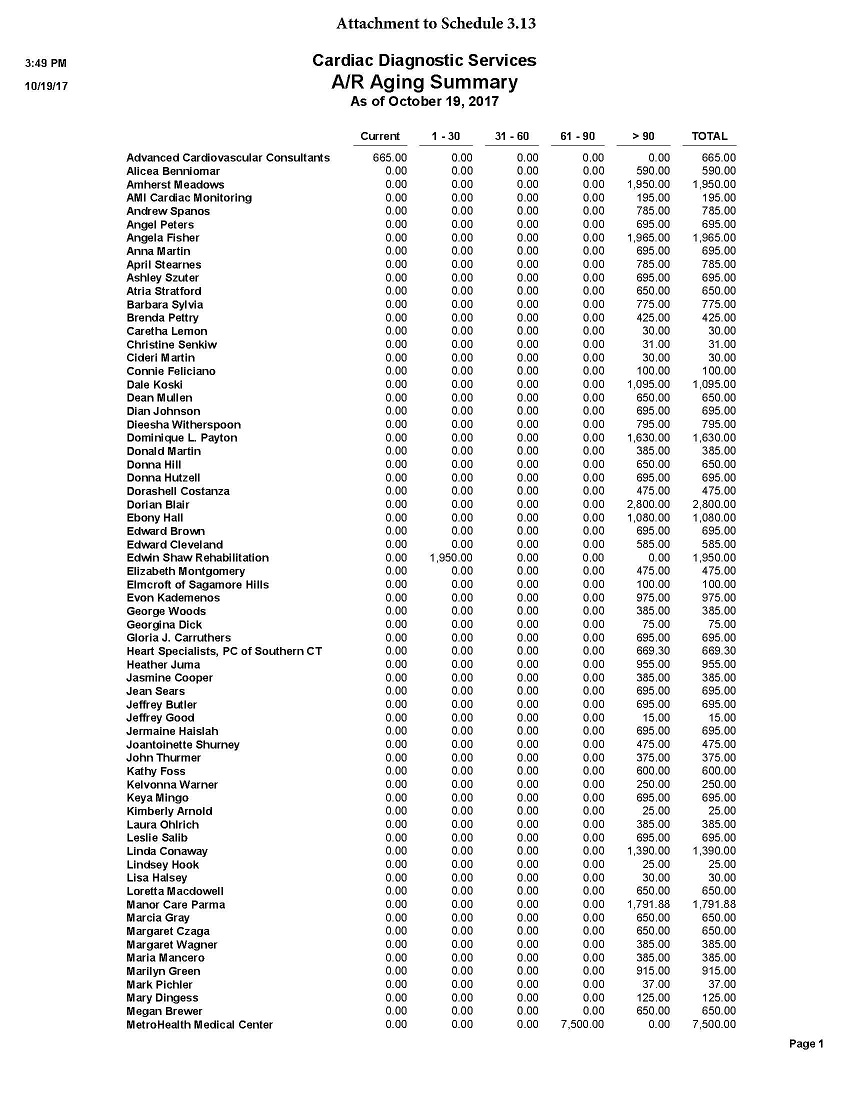

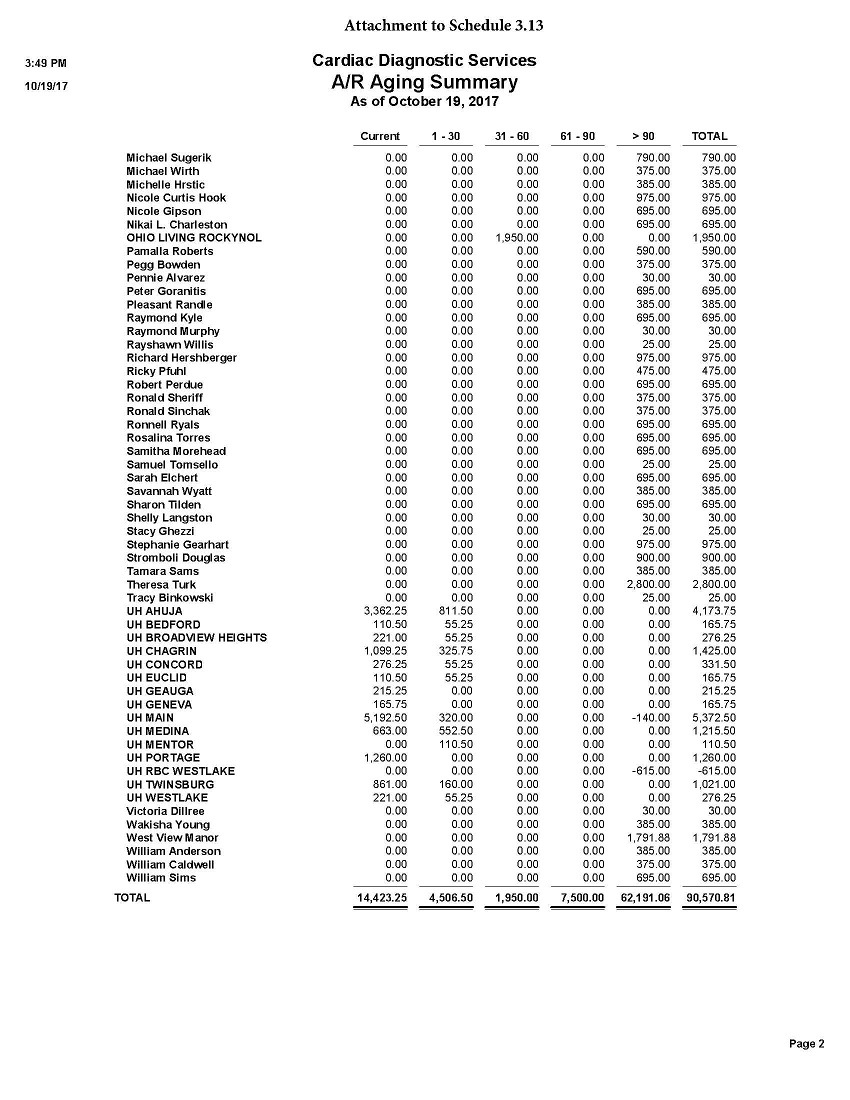

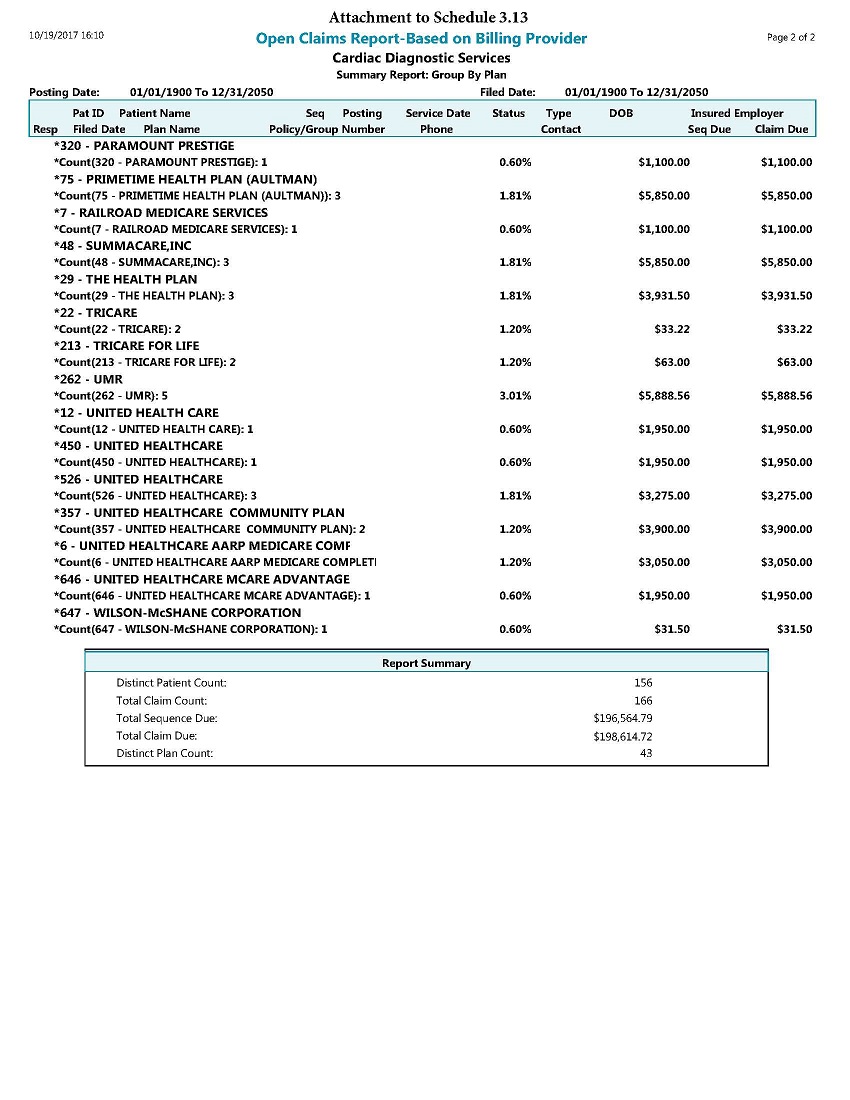

Section 3.13 Accounts Receivable. Schedule 3.13 contains a complete and accurate list of all accounts receivable of the Company as of the Closing Date (the “Pre-Closing Accounts Receivable”) and sets forth all aging of those accounts receivable. Except as set forth on Schedule 3.13, the Pre-Closing Accounts Receivable (i) have arisen from bona fide transactions entered into by the Company or CDS involving the sale of goods or the rendering of services in the Ordinary Course of Business; and (ii) constitute only valid, undisputed claims of the Company or CDS not subject to claims of set-off or other defenses or counterclaims other than normal cash discounts accrued or discounts paid by insurance companies in relation to the original face value of the accounts receivable in the Ordinary Course of Business consistent with past practice. For purposes of clarity, the current value of Accounts Receivable do not become fully collectible due to discounted reimbursement from insurance companies. Such discounted reimbursement occurs within the Ordinary Course of Business and such discounted reimbursement shall in no way be deemed to be a violation of this section.

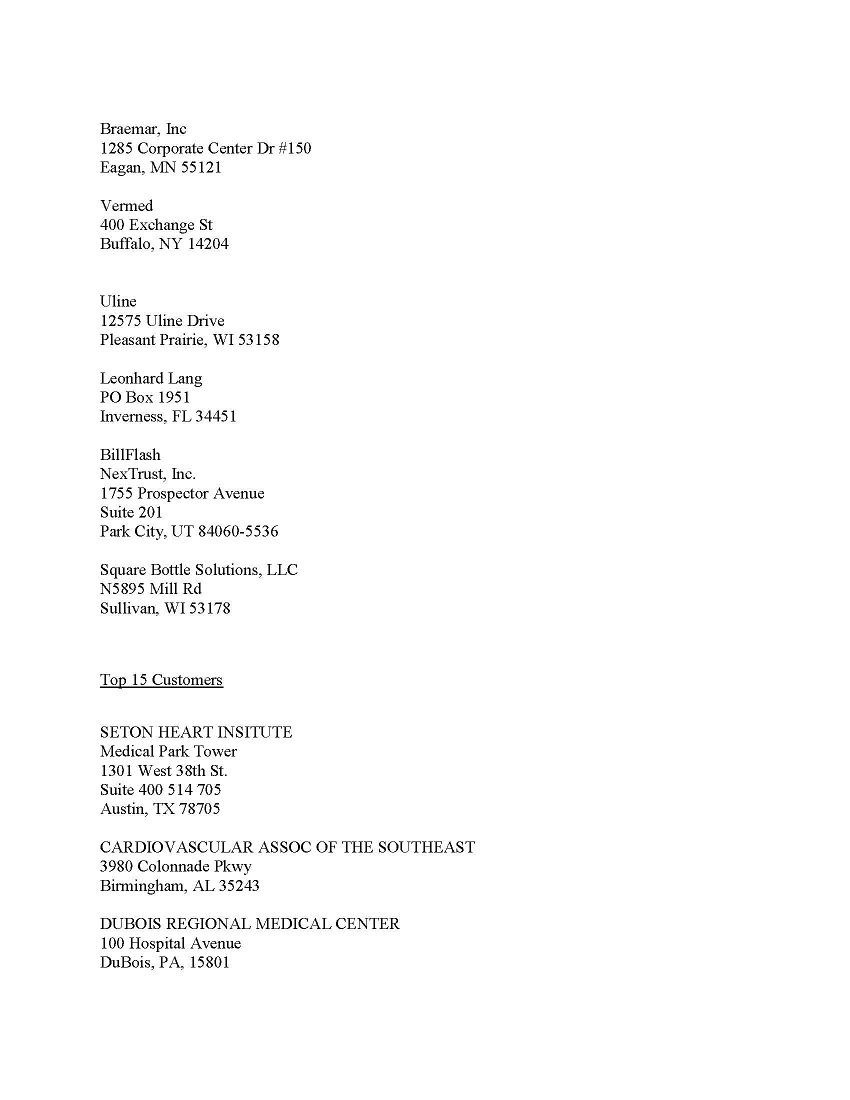

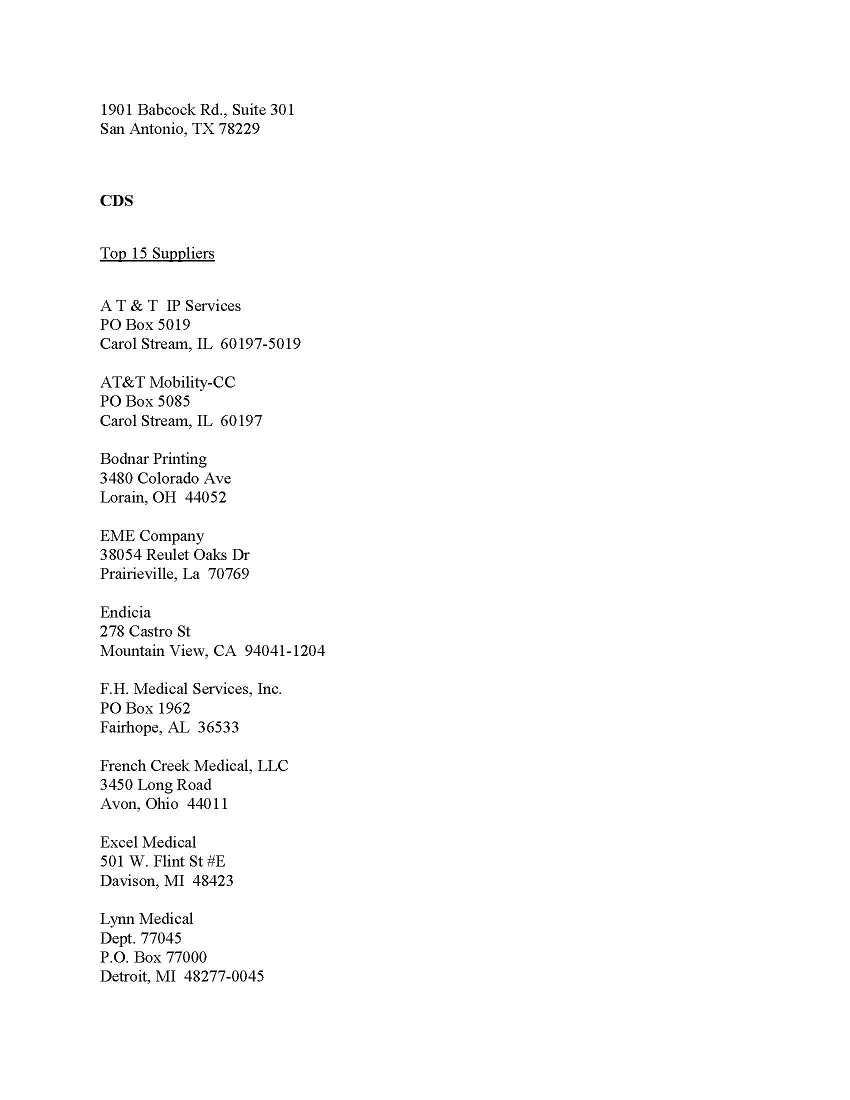

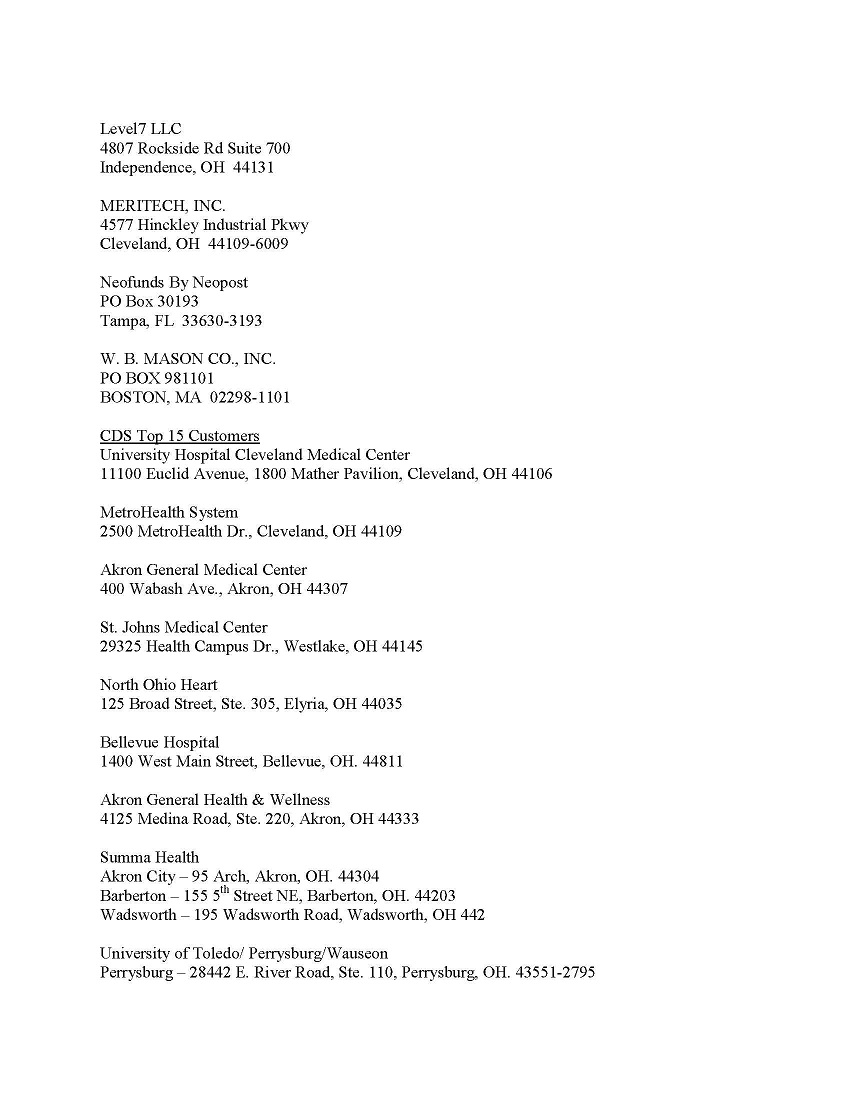

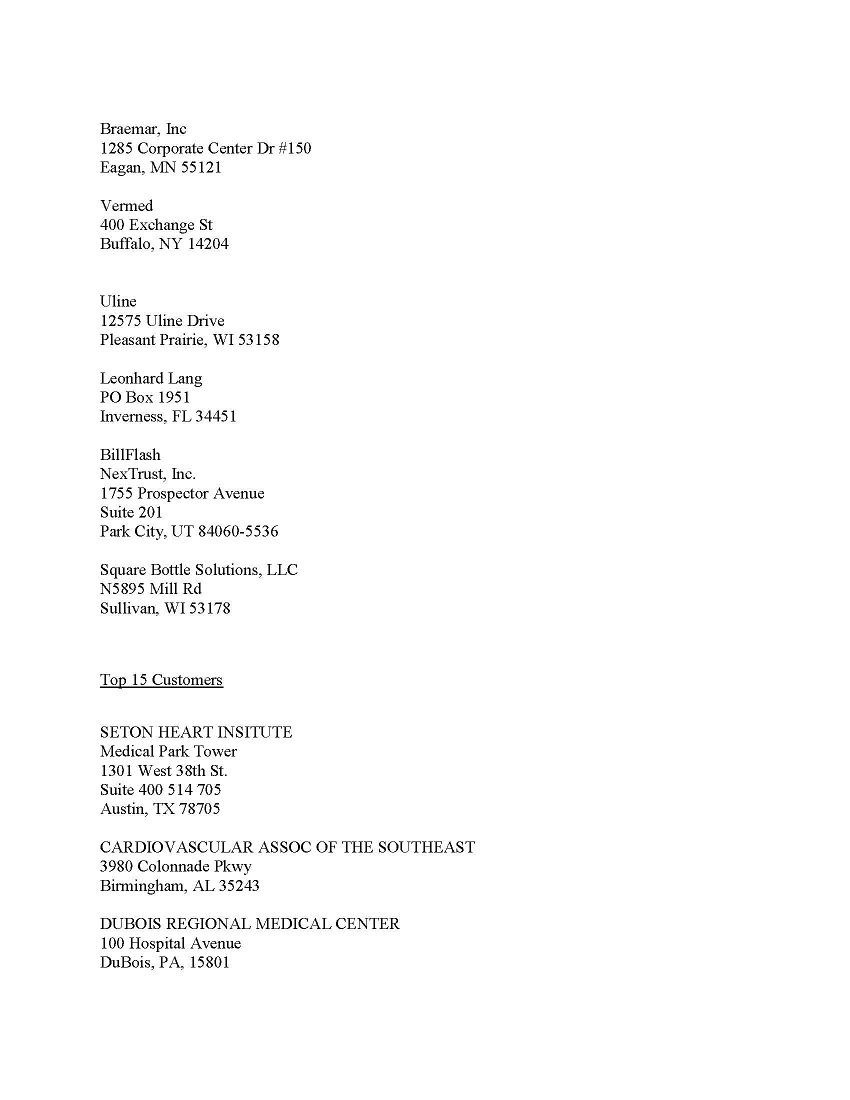

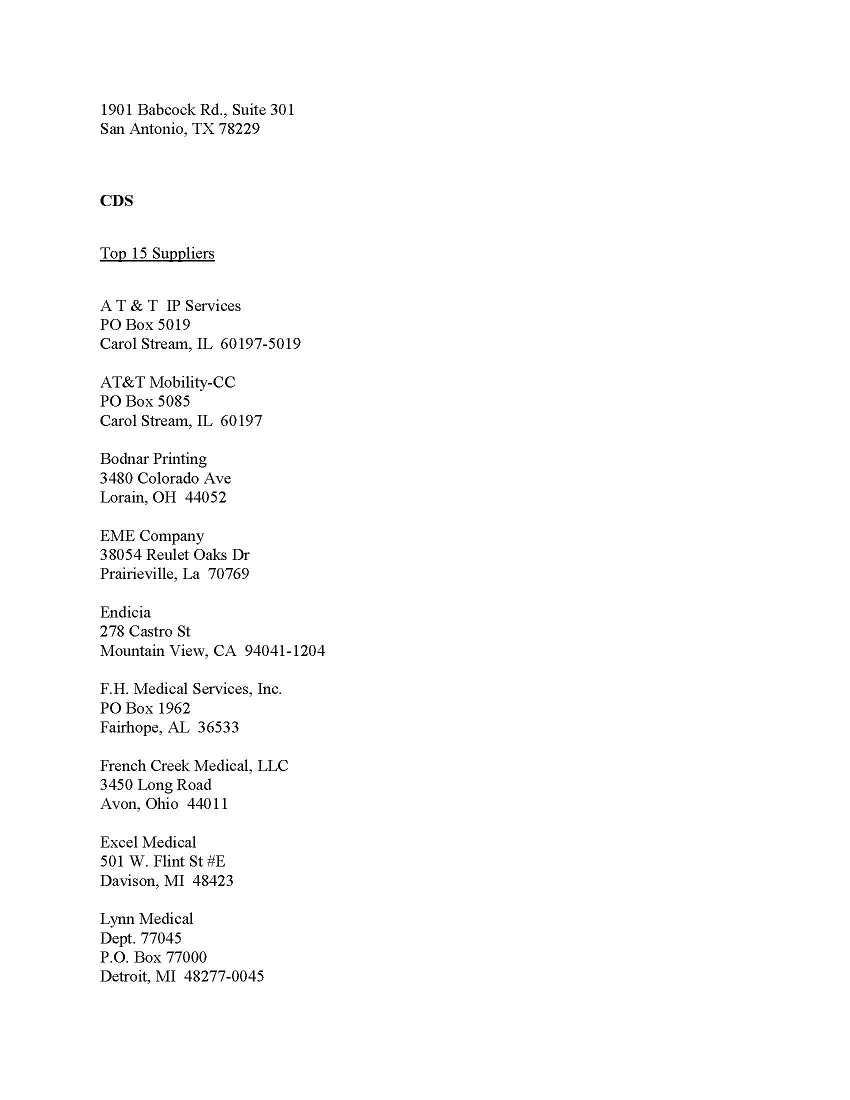

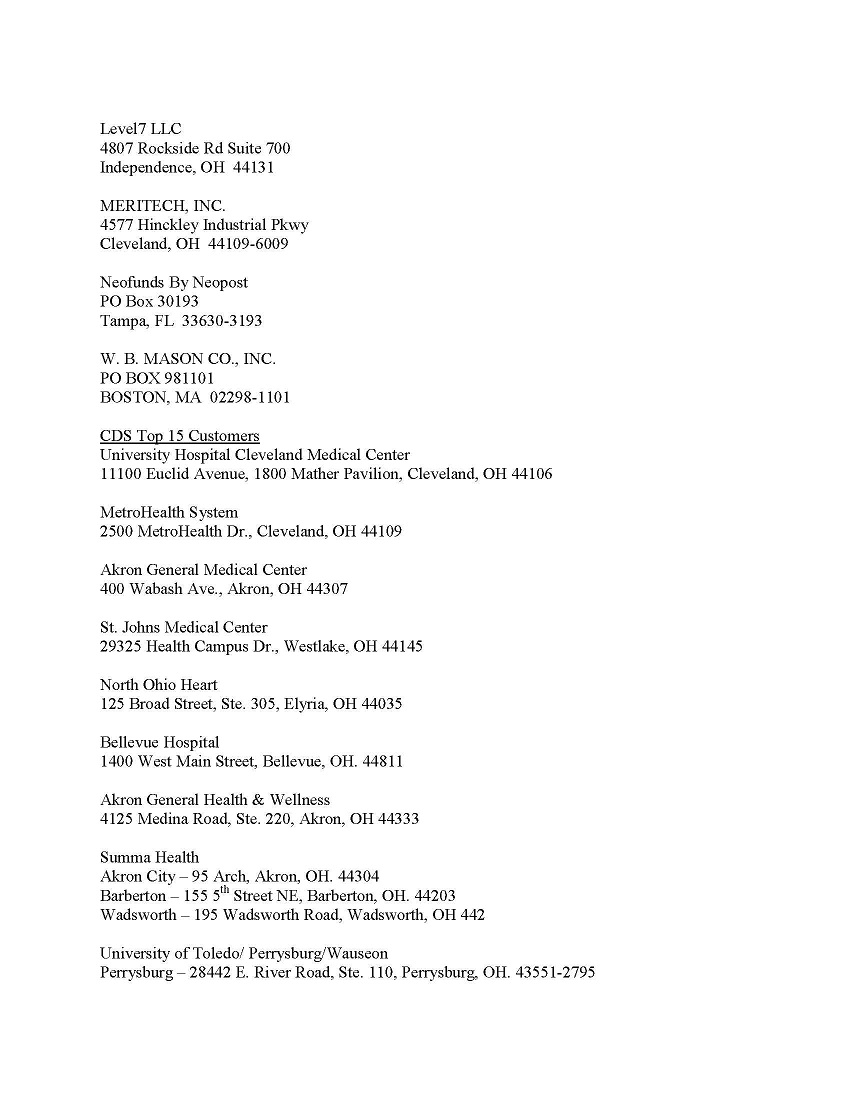

Section 3.14 Major Customers and Suppliers. Schedule 3.14 lists the names and addresses of the top 15 customers and the top 15 suppliers of the Company and CDS as of the Statement Date (based on annual sales and/or purchases for fiscal year 2016 and the first half of fiscal year 2017). No customer or supplier listed on Schedule 3.14 has canceled or modified in any materially adverse manner or put the Company or CDS on notice that it intends to cancel or modify in any materially adverse manner, its relationship with the Company or CDS.

Section 3.15 Insurance. Schedule 3.15 sets forth a complete and accurate list and description of all policies of insurance presently in effect with respect to the Business and/or the Company’s Assets (the “Insurance Policies”). All of those policies are valid, outstanding and enforceable policies. No written notice of cancellation or termination has been received by Company with respect to any such policy. All premiums currently payable or previously due on the Insurance Policies have been paid. Company has not received written notice from any of its insurance carriers that any insurance premiums relating to the Insurance Policies will be increased in the future outside of the Ordinary Course of Business, that any insurance coverage provided by the Insurance Policies will not be available to Company in the future on substantially the same terms as now in effect or that any historical limits have been materially impaired or exhausted. Company has previously made available to Buyer complete copies of each of the Insurance Policies.

Section 3.16 Legal Proceedings; Actions; Governmental Entity Orders.

(a) There are no Actions pending or, to Sellers’ Knowledge, threatened (a) against or by the Company or CDS affecting any of its properties or assets; or (b) against or by the Company, CDS, or Sellers, that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

(b) Except as set forth in Section 3.21 and its accompanying schedules, there are no outstanding Orders of any Governmental Entities and no unsatisfied judgments, penalties or awards against or affecting the Company or CDS or any of their properties or assets. No event has occurred or circumstances exist that may constitute or result in (with or without notice or lapse of time) a violation of any such Order.

Section 3.17 Compliance with Laws; Governmental Authorizations.

(a) The Company and CDS are in compliance with all Applicable Laws;

(b) Except as set forth in Section 3.21 and its accompanying schedules, the Company and CDS have filed all reports, statements, documents, registrations, filings or submissions required to be filed with any Governmental Entity, in connection with the operation of the Business. All such filings complied with Applicable Law when filed and no deficiencies have been asserted by any such Governmental Entity with respect to such filings and submissions;

(c) Except as set forth in Section 3.21 and its accompanying schedules, the Company and CDS have not received, at any time within the last two years, any notice or other communication (whether oral or written) from any Governmental Entity or any other Person regarding (A) any actual, alleged, possible, or potential violation of, or failure to comply with, any Law, or (B) any actual, alleged, possible or potential obligation on the part of the Company or CDS to undertake, or to bear all or any portion of the cost of, any remedial action of any nature;

(d) all applications required to have been filed for the renewal of all Consents required by any Governmental Entities have been duly filed on a timely basis with the appropriate Governmental Entity, and all other filings required to have been made with respect to each Consent have been duly made on a timely basis with the appropriate Governmental Entity; and

(e) the Company and CDS have obtained all necessary Consents and satisfied all Legal Requirements pursuant to all Applicable Laws necessary to permit the Company, and the Buyer to lawfully conduct and operate the Business going forward and to permit the Company, and the Buyer to own and use the Assets of the Company and CDS in the manner in which it currently owns and uses such assets going forward. No other Consents are necessary to conduct the Business.

Section 3.18 Environmental Matters. The Company and CDS have at all times complied, and are in compliance, in all material respects with all Environmental Laws, except as would not cause a Material Adverse Effect. The Company or CDS have not received any notice, report, order, directive, or other information regarding any actual or alleged violation of, or liability (including any investigatory, corrective or remedial obligation) under, Applicable Laws; without limiting this section, none of the following exists at the Company’s or CDS’ leased property: (i) underground storage tanks (ii) asbestos or asbestos containing material; (iii) materials or equipment containing polychlorinated biphenyls; or (iv) landfills, surface impoundments, or disposal areas; the Company and CDS have not treated, stored, disposed of, arranged for or permitted the disposal of, transported, handled, released, or exposed any Person to, any Hazardous Material, or owned or operated any property or facility which is or has been contaminated by any Hazardous Material, so as to give rise to any current or future liabilities, including any investigatory, corrective or remedial obligations, pursuant to CERCLA or any other Environmental Laws; the Company and CDS have not manufactured, sold, marketed, installed or distributed products or items containing asbestos, silica or other Hazardous Materials, and does not have any liability (contingent or otherwise) with respect to the presence or alleged presence of Hazardous Materials in any product or item or at or upon any property or facility; the Sellers’ Representative has furnished to Buyer true and correct copies of all environmental audits, assessments and reports, and all other documents materially bearing on environmental, health or safety liabilities, relating to the past or current operations, properties or facilities of the Business (including anyof Company’s or CDS’ leased real property), in each case which are in Company’s or CDS’ possession or under its reasonable control.

Section 3.19 Labor and Employment Matters.

(a) No employees of the Company or CDS are legally organized or recognized as a labor organization or represented by any labor union or labor organization with respect to their employment with the Company or CDS. As of the date of this Agreement, the Company (or CDS) is not a party to any pending arbitration or grievance proceedings or any other claim relating to any labor contract is any such action threatened. The Company and CDS have not experienced any labor disputes, union organization attempts or any work stoppages due to labor disagreements, and there is currently no labor strike, dispute, request for representation, slow down or stoppage actually pending or threatened against the Company.

(b) The Company is not bound by any court, administrative, agency, tribunal, commission or board decree, judgment, decision, arbitration agreement or settlement relating to collective bargaining agreements, conditions of employment, employment discrimination or attempts to organize a collective bargaining unit which, in any case, would reasonably be expected to materially adversely affect the Company, the Business or its assets. The Company has at all times complied in all material respects with all Laws relating to employment, harassment (of any nature or basis as may be protected by Law), equal employment opportunity, nondiscrimination, reasonable accommodations, immigration, wages, hours, benefits, collective bargaining, the payments of Social Security and similar Taxes, occupational safety and health, plant closings, and reductions in force. The Company is not liable for the payment of any compensation, damages, Taxes, fines, penalties or other amounts, however designated, for failure to comply with any of the foregoing requirements of Law.

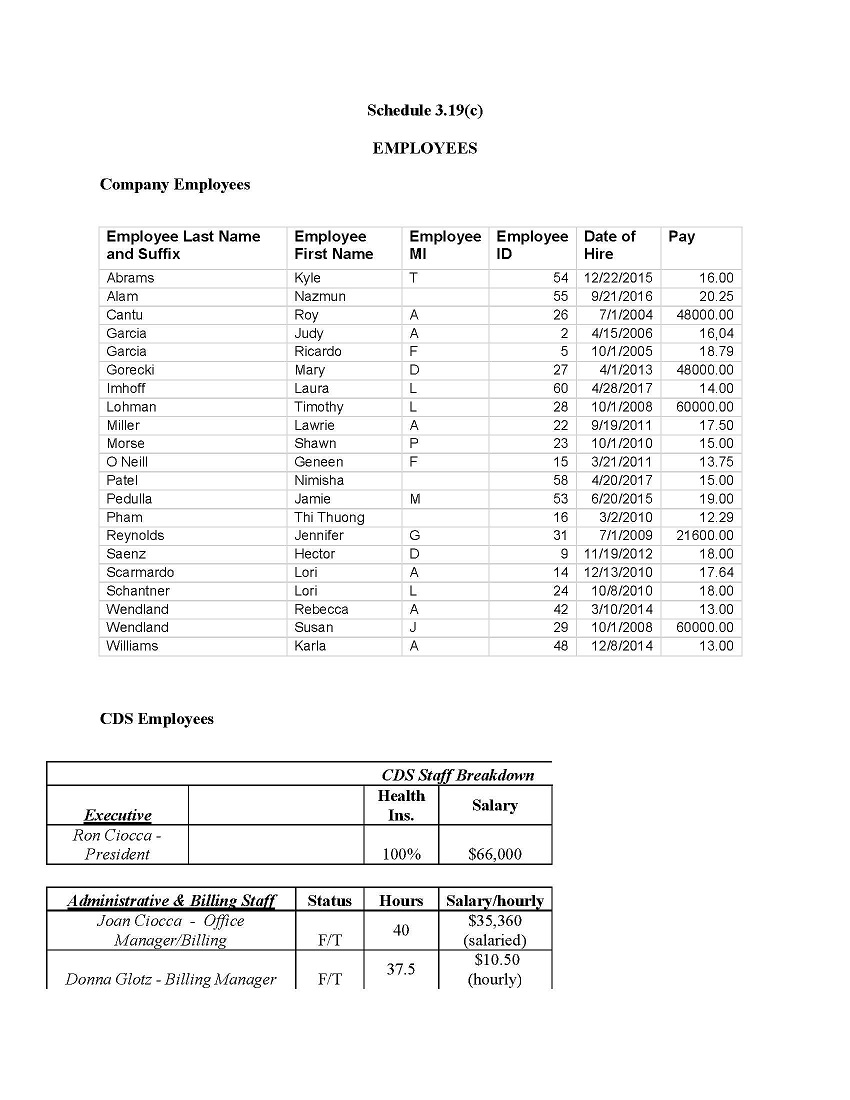

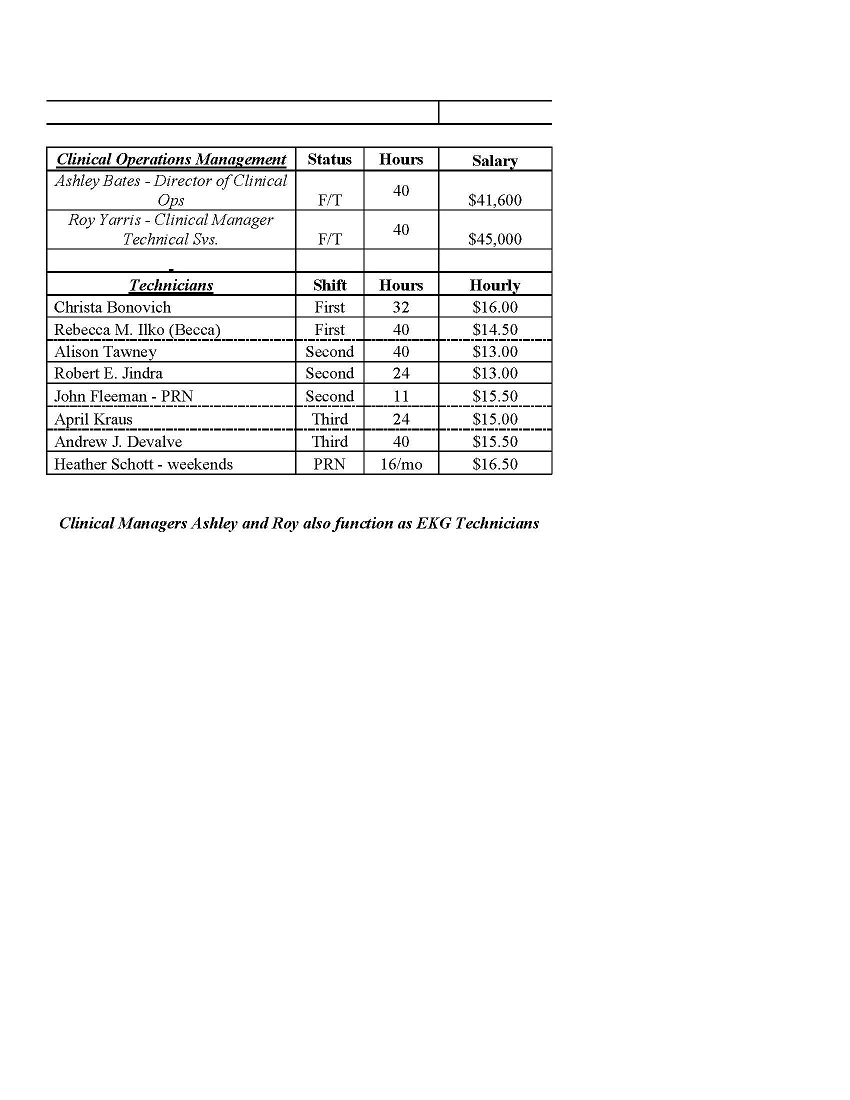

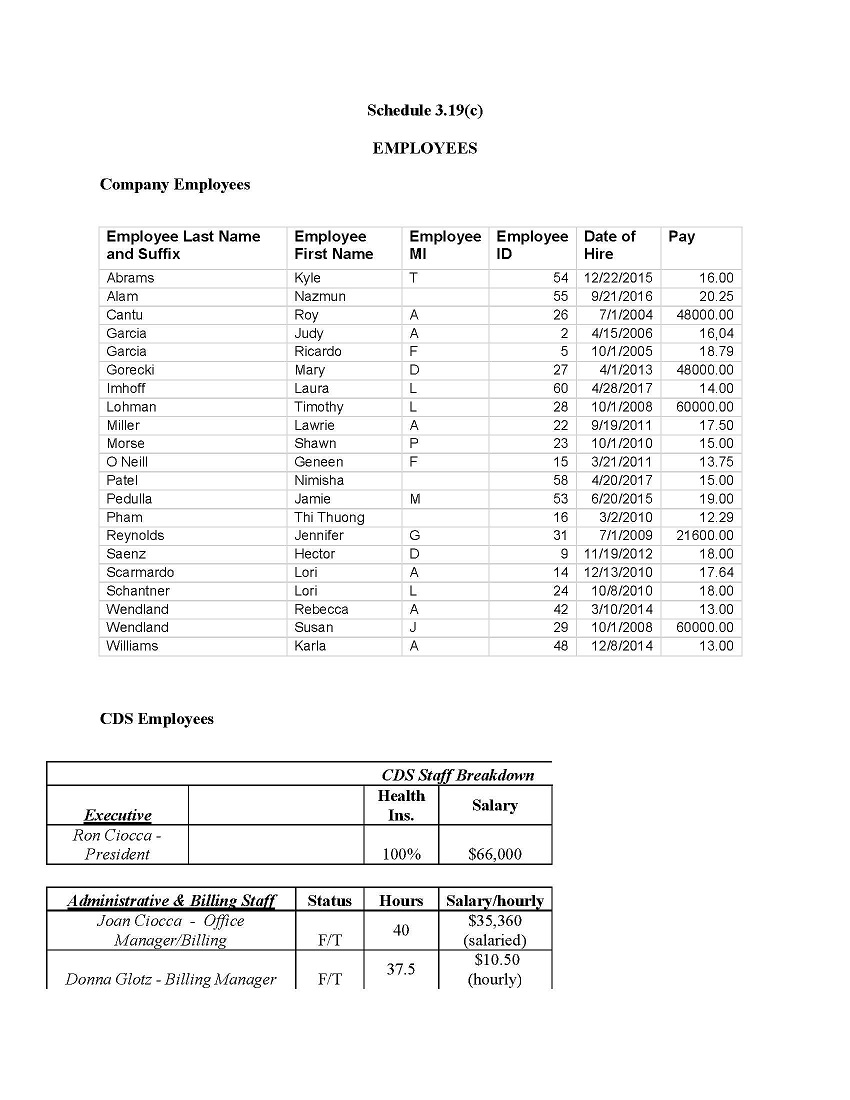

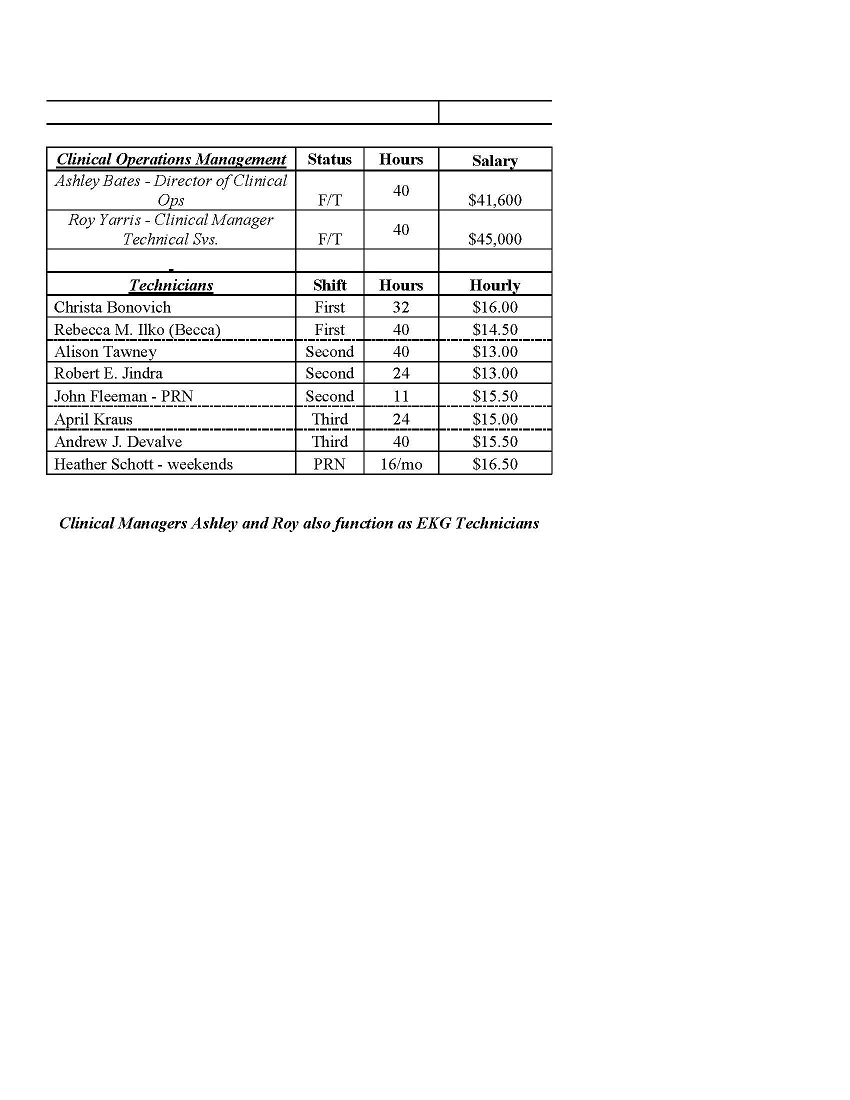

(c) Schedule 3.19(c) lists all of the Company’s current employees (the “Employees”) and their date of hire by the Company and current salary or wage rate. Each of the Employees hired has provided to the Company or CDS proof of their eligibility to work in the United States. Each of the Employees has been properly classified with the Company or CDS with respect to applicable wage and hour Laws. The employment relationship between the Company or CDS and each current employee of the Company or CDS is “employment at will.” There are no current employees of the Company or CDS who are not actively at work on a regular basis due to a short- or long-term disability leave or other leave of absence.

(d) The Company only has Employees in Ohio, Texas, Wisconsin, and Indiana.

(e) Neither the execution and delivery of this Agreement nor consummation of the transactions contemplated hereby will (A) result in any material payment (including, without limitation, severance, bonus, unemployment compensation, golden parachute or otherwise) becoming due any individual employed by the Company or CDS just prior to or on the date of Closing, (B) materially increase the amount of benefits payable under any compensation or Employee Benefit Plan, program or agreement, or (C) result, to any material extent, in the acceleration of the time of payment or vesting of any such benefits.

(f) There are no workers’ compensation claims pending against the Company or CDS, nor does any circumstance exist that is reasonably likely to result in such a claim.

(g) There are no pending or threatened investigations, audits, complaints, or proceedings against the Company or CDS by and Governmental Entity respecting or involving any Employee, applicant for employment, former employee, or any class of the foregoing.

(h) Each Employee has completed and the Company has retained an Immigration and Naturalization Service Form I-9 in accordance with applicable rules and regulations. No current employee of the Company is (a) a non-immigrant employee whose status would terminate or otherwise be affected by the business transaction consummated under this Agreement, or (b) an alien who is authorized to work in the United States in non-immigrant status.

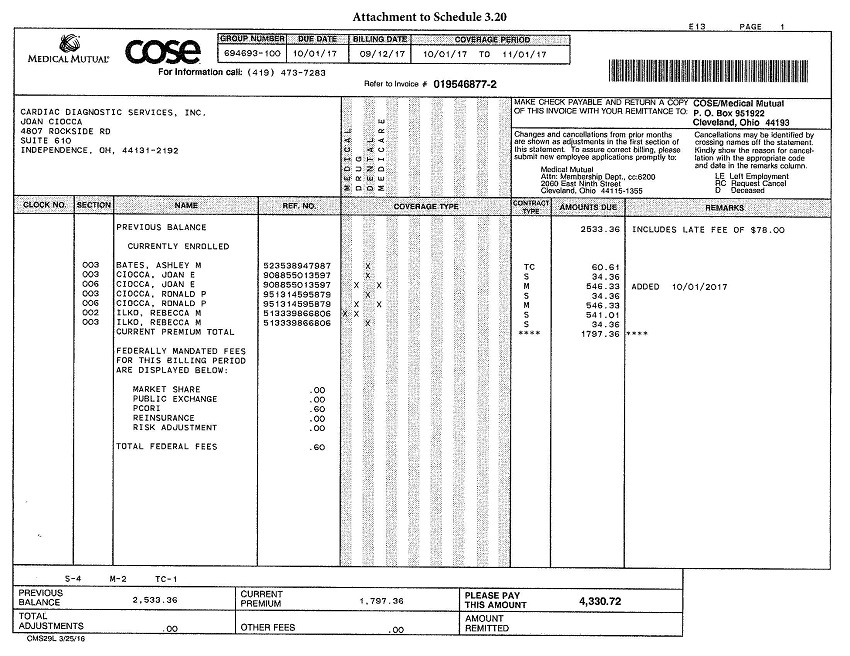

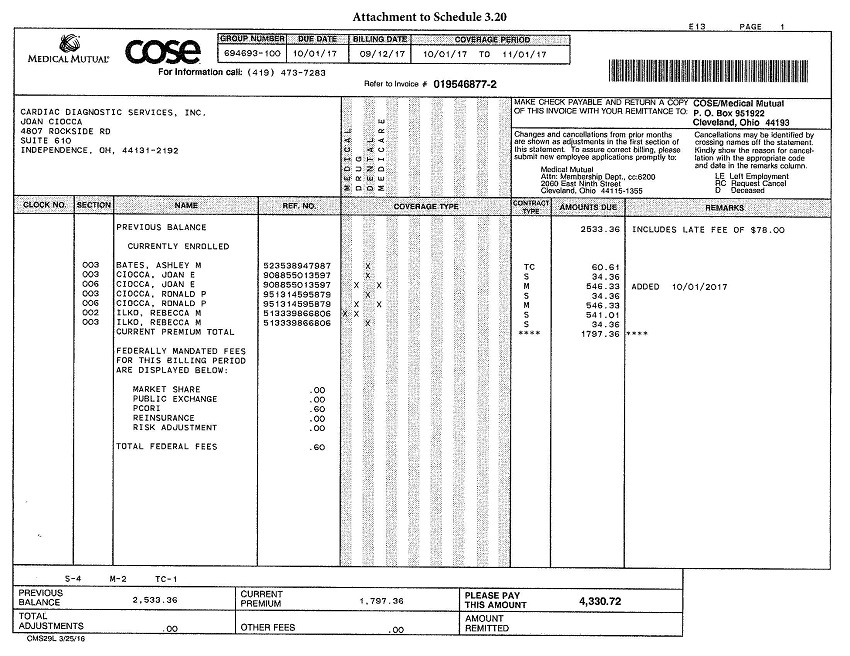

Section 3.20 Employee Benefit Plans.

(a) Schedule 3.20 sets forth a list of each and every “employee benefit plan” (as such term is defined in ERISA Section 3(3)) and any other employee benefit plan, program or arrangement of any kind (each, an “Employee Benefit Plan”) that the Company or CDS maintains, to which the Company or CDS contributes or has any obligation to contribute, or with respect to which the Company has any Liability. The Sellers have delivered true and accurate copies of each Employee Benefit Plan to the Buyer. Each Employee Benefit Plan is in full compliance with all Applicable Laws.

(b) Company Benefit Plans. With respect to each Employee Benefit Plan, to the extent applicable, the Company or CDS has made available to Buyer true, accurate and complete copies of (A) the plan document or other governing contract or a description of any unwritten plan, (B) the most recently distributed summary plan description, (C) each trust or other funding contract, including any and all policies of insurance maintained in connection with the Employee Benefit Plan, (D) all filings by the Company or CDS with Governmental Entities for the previous three years (including schedules and attachments) with respect to the Employee Benefit Plan (including, but not limited to, securities filings), (E) the most recently received IRS determination letter or IRS opinion letter (in the case of a prototype plan), (F) the financial statements, and, if applicable, the most recent actuarial analysis or opinion for each Employee Benefit Plan, for the previous three years, and (G) all contracts with a service provider to an Employee Benefit Plan, including, but not limited to, contracts with third-party administrators, actuaries, investment managers and consultants.

(c) Multiemployer. Multiple Employer and Defined Benefit Plans. None of the Employee Benefit Plans is a “multiemployer plan” as defined in Section 4001(a)(3) of ERISA, or a plan that has two or more contributing sponsors at least two of whom are not under common control within the meaning of Section 4063 of ERISA and to which the Company or CDS or any entity within the same “controlled group” as the Company or CDS within the meaning of Section 4001(a)(14) of ERISA contributes or has an obligation to contribute. Further, none of the Employee Benefit Plans is a “defined benefit plan” as that term is defined in Section 3(35) of ERISA.

(d) Compliance. (A) Each Employee Benefit Plan is in compliance in form and operation with its own terms and in compliance in form and operation with all applicable Laws; (B) all notices, reports and information relating to the Employee Benefit Plans required by applicable Law to be filed with any Governmental Entity or provided to participants or their beneficiaries have been so filed and provided and are true, accurate and complete; (C) as of the date of this Agreement, (1) there is no investigation or inquiry by any Governmental Entity pending or threatened, and there are no facts and circumstances related to one or more Employee Benefit Plans that would lead to such an investigation or inquiry, and (2) there is no litigation, arbitration or similar proceeding pending or threatened with respect to any Employee Benefit Plan or against the assets of any Employee Benefit Plan and there are no facts and circumstances related to any Employee Benefit Plan that would lead to litigation, arbitration or a similar proceedings against an Employee Benefit Plan; (D) each Employee Benefit Plan intended to be qualified under Section 401(a) of the Code is covered by a current favorable IRS determination letter as to the tax-qualified status of the plan and trust as to form or is a prototype covered by a favorable IRS opinion letter and no facts or circumstances exist that would result in a revocation of that exemption; (E) with respect to each Employee Benefit Plan, all required contributions for periods ending on or before the date hereof have been made by the Company or CDS or have been reflected as an accrued liability on the Financial Statements and disclosed specifically to Buyer; (F) no accumulated funding deficiency or liquidated shortfall (as those terms are defined in Section 302 of ERISA and Section 412 of the Code) have been incurred with respect to any Employee Benefit Plan; (G) the value of the assets of each Employee Benefit Plan exceeds the amount of all benefit liabilities; (H) no person has engaged in a “prohibited transaction” as defined in Section 406 of ERISA or Section 4975 of the Code, with respect to any Employee Benefit Plan for which no individual or class exemption exists; (I) the Company or CDS is not party to any agreement to provide, nor does the Company or CDS have an obligation to provide, any individual with any welfare benefit following his or her retirement, death or termination of employment, except to the extent required under COBRA or other comparable Law; (J) no written or oral representations have been made to any of the Company’s or CDS’ employees or former employees promising or guaranteeing any employer payment or funding for the continuation of medical, dental, life or disability coverage for any period of time beyond the end of the current plan year (except to the extent such coverage is required by COBRA); (K) no written or oral representations have been made to any Company or CDS employee or former employee regarding the employee benefits of the Company, CDS, or the Buyer after the Closing Date. Each of the Company’s and CDS’ Employee Benefit Plans have been terminated and cancelled prior to the Closing Date in compliance their terms and in compliance with all Laws.

Section 3.21 Taxes. Except as set forth in Schedule 3.21, the Company and CDS have filed or caused to be filed on a timely basis all Tax Returns and all reports required to be filed with a Governmental Entity with respect to Taxes that each was required to file on or before the date of this Agreement and has paid all Taxes due and owing by each prior to the date of this Agreement. The Sellers’ Representative has delivered or made available to Buyer copies of all Tax Returns filed since 2009. All such Tax Returns or reports are true, accurate and complete. The Company and CDS have withheld, deducted, collected and paid all Taxes required to have been withheld, deducted, collected and paid by the Company and CDS prior to the date of this Agreement under any applicable federal, state or local law, including without limitation, any amounts required to be withheld or collected with respect to employee, state and federal income tax withholding, employment taxes, social security, unemployment compensation, workers compensation or other similar Taxes, and all such amounts have been timely remitted to the proper authorities. No claim has ever been made or is expected to be made by a Governmental Entity in a jurisdiction where Tax Returns by the Company or CDS has not been filed that the Company or CDS is or may be subject to taxation by such jurisdiction. There are no liens or encumbrances on the Company’s or CDS’ assets or properties that arose in connection with any failure (or alleged failure) to pay any Tax. No Tax Return of the Company or CDS has been audited or is currently under audit or examination, nor has any Governmental Entity threatened to audit a Tax Return. The Tax Returns, or any other documents related to Taxes filed with a Governmental Entity, contain no undisclosed deficiencies that would be expected to result in an audit by a Governmental Entity. There is no tax sharing agreement, tax allocation agreement, tax indemnity obligation or similar written or unwritten agreement, arrangement or understanding or practice with respect to Taxes (including any advance pricing agreement, closing agreement or other agreement relating to Taxes) that will or may require payment by the Company or CDS. The Company and CDS have not waived any statute of limitations in respect of any Taxes or agreed to any extension of time with respect to any Tax assessment. The Company or CDS is not the beneficiary of any extension of time within which to file any Tax Return that has not been filed as of the date of this Agreement. The Company or CDS is not a member of an affiliated group within the meaning of Section 1504(a) of the Code. The Company and CDS have no liability for Taxes of any person (other than Seller) under Treas. Reg. Section 1.1502-6 (or any similar provision of state, local or foreign law) as a transferee or successor by contract or otherwise. The Company and CDS have disclosed in its federal income Tax Returns all positions taken therein that could result in a substantial understatement of federal income Tax under Section 6662 of the Code.

Section 3.22 Books and Records. The minute books of the Company and CDS have been made available to Buyer, are complete and correct and have been maintained in accordance with sound business practices. The minute books of the Company and CDS contain accurate and complete records of all meetings, and actions taken by written consent of, the board of directors and its shareholders (of each of the Company and CDS), and no meeting, or action taken by written consent, of any such board of directors or its shareholders has been held for which minutes have not been prepared and are not contained in such minute books. At the Closing, all of those books and records will be in the possession of the Company or CDS.

Section 3.23 No Material Adverse Effect. Since the Balance Sheet Date, nothing has occurred that would cause a reasonable person to conclude that a Material Adverse Effect has, or is likely to, occur.

Section 3.24 No Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of the Company, CDS, or the Sellers.

Section 3.25 Full Disclosure. Sellers jointly and severally, represent and warrant to the Buyer tha no representation or warranty by any of them in this Agreement and no statement contained in the Schedules to this Agreement or any certificate or other document furnished or to be furnished to Buyer pursuant to this Agreement contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements contained therein, in light of the circumstances in which they were made, not misleading.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF SELLERS

The Sellers, jointly and severally, represent and warrant to Buyer, as of the date hereof and as of the Closing Date, as follows:

Section 4.1 Authorization. Each Seller has all requisite power and authority to execute and deliver this Agreement and to perform, carry out and consummate the transaction contemplated by this Agreement and all other Transaction Documents. The execution, delivery and performance of this Agreement have been duly authorized by all necessary action on their part. This Agreement and all Transaction Documents have been duly executed and delivered by all and each Seller and constitutes the legal, valid and binding obligation of the Sellers enforceable against them, in accordance with their respective terms, subject, in each case, to bankruptcy, reorganization, insolvency and other similar laws affecting the enforcement of creditors’ rights in general, and general principles of equity.

Section 4.2 Noncontravention. The execution, delivery and performance by each Seller of this Agreement and all Transaction Documents, the consummation by each of them of the transactions contemplated thereby and hereby, and their compliance with the terms and provisions thereof and hereof, do not (i) contravene any Law or Order specifically applicable to the Sellers, or (ii) require any of the Sellers to obtain the approval, Consent or authorization of any Person which has not been obtained in writing prior to the date of Closing.

Section 4.3 Related Party Debt. All the indebtedness of the Company or CDS to the Sellers is set forth on Schedule 4.3 (the “Related Party Debt”). The Related Party Debt is the only indebtedness of the Company or CDS to the Sellers or any of their Affiliates. There are no other obliations of any kind between any of the Sellers and any of their Affiliates and Company or CDS except as disclosed on Schedule 4.3.