UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

KONTOOR BRANDS, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Dear Shareholders

On behalf of the Board of Directors and the leadership team, I am pleased to invite you to attend the Kontoor Brands, Inc. 2025 Annual Meeting of Shareholders (the “Annual Meeting”) on Thursday, April 24, 2025, at 11:00 a.m., Eastern Time, to be held live via the Internet at www.virtualshareholdermeeting.com/KTB2025. The format of the Annual Meeting will be a virtual-only meeting.

Attached to this letter are a Notice of Annual Meeting of Shareholders and a Proxy Statement, which describe the business to be conducted at the Annual Meeting.

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their shareholders over the Internet, we have sent shareholders of record at the close of business on February 13, 2025 a Notice of Internet Availability of Proxy Materials (“Notice”) beginning on or about March 6, 2025. The Notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of these proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the Notice, as well as in the attached Proxy Statement.

We have designed the format of the Annual Meeting to ensure that shareholders are afforded similar rights and opportunities to participate as they would at an in-person meeting, using online tools to ensure shareholder access and participation. To attend the Annual Meeting, shareholders are encouraged to register in advance, using their control number and other information, at www.proxyvote.com prior to Wednesday, April 23, 2025, at 5:00 p.m., Eastern Time. Upon completing registration, shareholders will receive further instructions by e-mail, including links that will allow them to access the Annual Meeting, submit questions, and vote online during the Annual Meeting.

Beginning fifteen minutes prior to, and during, the Annual Meeting, support will be available to assist shareholders with any technical difficulties they may have accessing, hearing or participating in the virtual meeting. If participants encounter any difficulty accessing, or during, the virtual meeting, they should call the support team at the numbers listed on the virtual meeting registration page.

Your vote is important to us. To ensure that you will be represented, we ask you to vote your shares on the Internet, by telephone or by mail as soon as possible, or you may vote during the live webcast of the Annual Meeting. Voting on the Internet, by telephone or by mail does not deprive you of your right to attend the Annual Meeting. If you do attend the Annual Meeting and wish to vote your shares at the meeting, you may revoke your proxy at or prior to the Annual Meeting.

I thank you for your continued support of our company.

Sincerely,

Scott H. Baxter

President, Chief Executive Officer and Chairman of the Board of Directors

| | | | | | | | | | | | | | |

| | To Our Shareholders

of Kontoor Brands, Inc. |

Notice of Annual

Meeting of

Shareholders | | The 2025 Annual Meeting of Shareholders of Kontoor Brands, Inc. will be held live virtually via the Internet at www.virtualshareholdermeeting.com/KTB2025, on Thursday, April 24, 2025, at 11:00 a.m., Eastern Time, for the following purposes: |

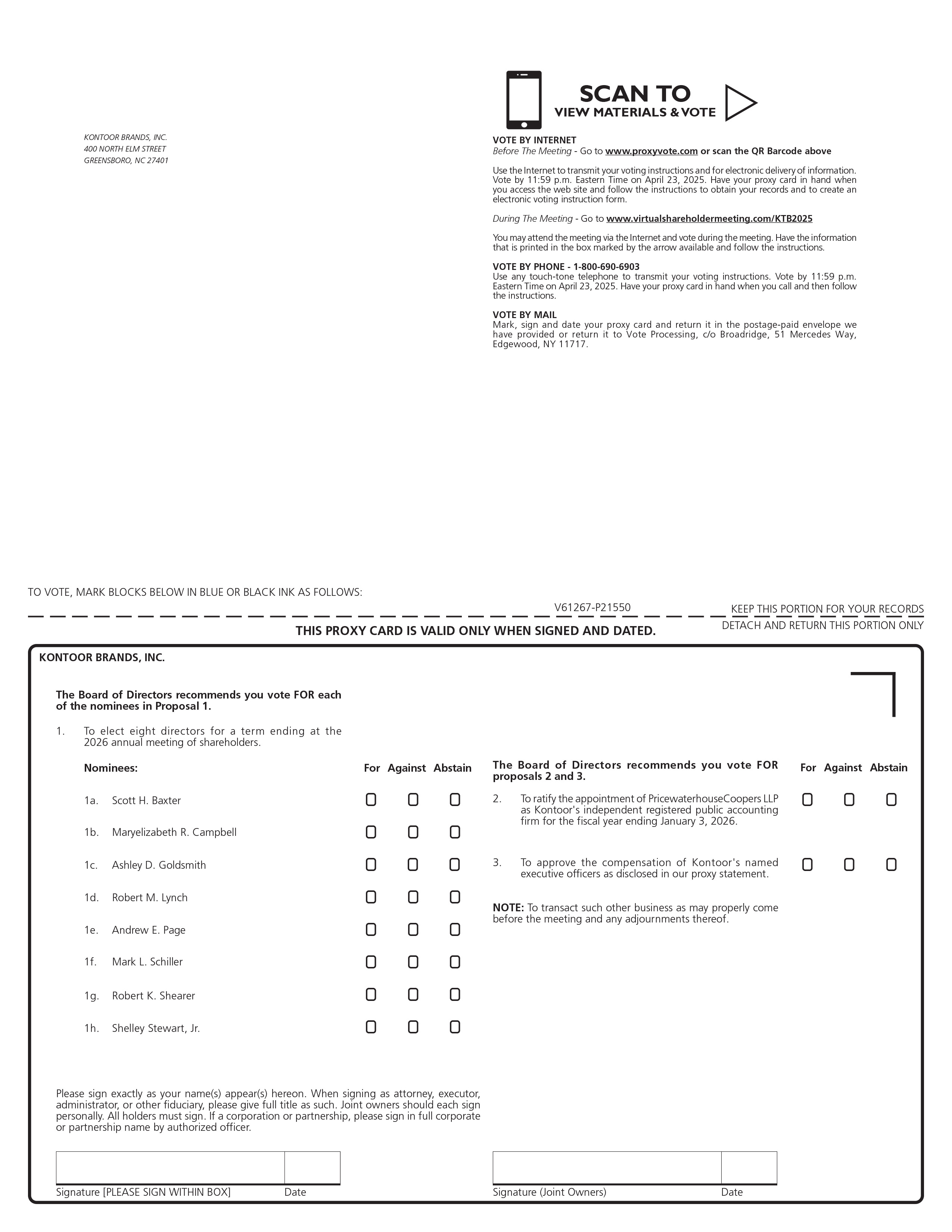

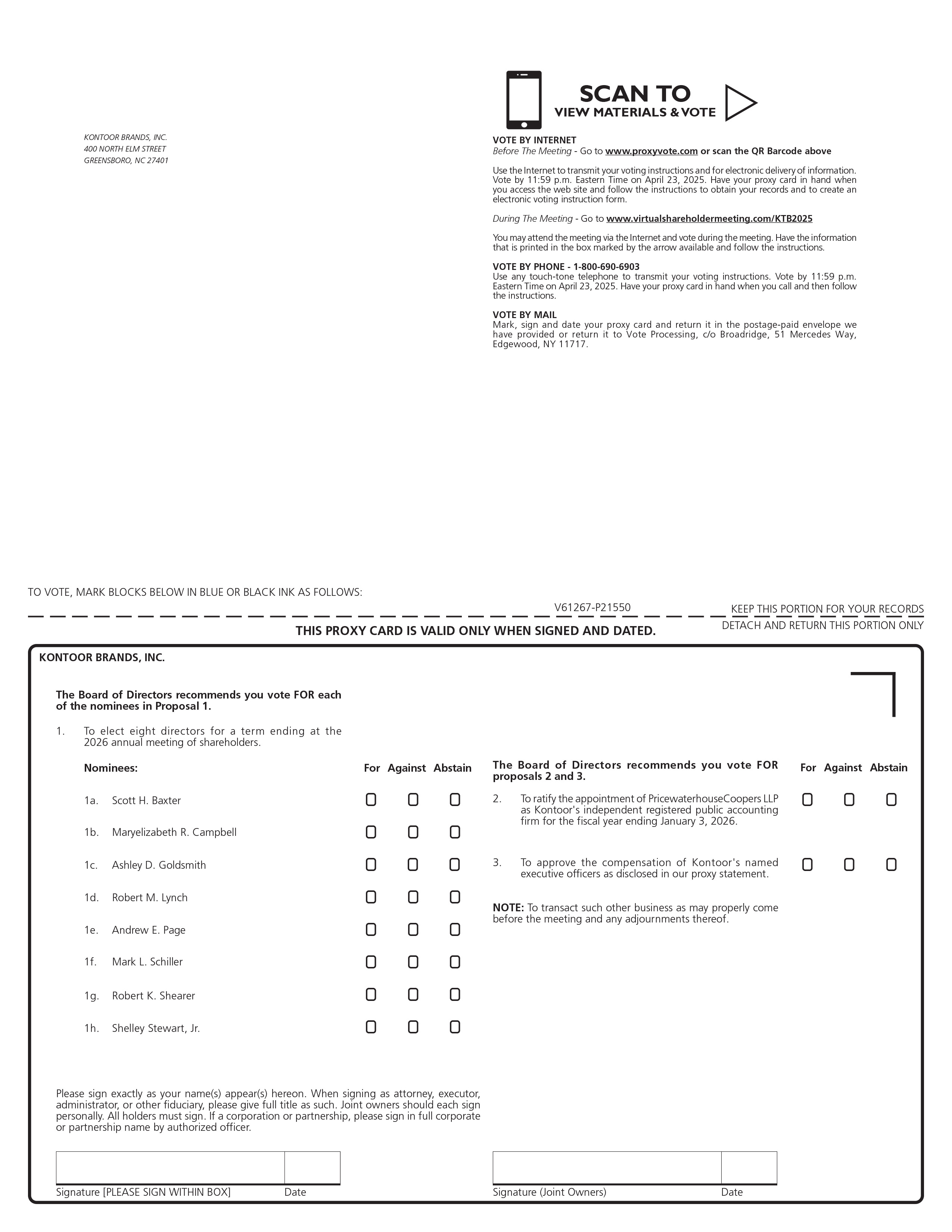

Date: Thursday, April 24, 2025 Time: 11:00 a.m., ET Place: Virtually via the Internet at www.virtualshareholder meeting.com/KTB2025 | | | to elect eight directors to serve until the annual meeting of shareholders to be held in 2026; |

| | to ratify the appointment of PricewaterhouseCoopers LLP as Kontoor’s independent registered public accounting firm for the fiscal year ending January 3, 2026; |

| | to approve the compensation of Kontoor’s named executive officers as disclosed in this Proxy Statement; and |

| | to transact such other business as may properly come before the meeting and any adjournments or postponements thereof. |

| | | | |

| | | A copy of Kontoor’s Annual Report for the fiscal year ended December 28, 2024 is included for your information. Only shareholders of record as of the close of business on February 13, 2025 are entitled to notice of, and to vote at, the Annual Meeting. To attend the Annual Meeting, shareholders must register in advance, using their control number and other information, at www.proxyvote.com prior to the deadline of Wednesday, April 23, 2025, at 5:00 p.m., Eastern Time. Upon completing registration, shareholders will receive further instructions by e-mail, including links that will allow them to access the Annual Meeting, submit questions, and vote online during the Annual Meeting. Shareholders will not be able to attend the Annual Meeting in person. A list of shareholders entitled to vote at the Annual Meeting will be available for inspection during the Annual Meeting at www.virtualshareholdermeeting.com/KTB2025, upon registration and log-in. Sincerely, Thomas L. Doerr, Jr. Executive Vice President, General Counsel and Secretary |

| | |

YOUR VOTE IS IMPORTANT You are urged to vote your shares in advance via the Internet, through our toll-free telephone number, or by signing, dating and promptly returning your completed proxy card. | |

| | | | | | | | |

| | Proxy Statement Summary This summary highlights certain information about Kontoor Brands, Inc. (the “Company,” “Kontoor,” “we,” “us” or “our”) contained in this proxy statement (“Proxy Statement”) but does not contain all the information that you should consider when casting your vote. Please review this entire Proxy Statement as well as our Annual Report for the fiscal year ended December 28, 2024 (“Annual Report”) carefully before voting. |

| | |

| | | | | | | | |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on April 24, 2025. This Proxy Statement and our Annual Report are available at www.proxyvote.com. | | General Information The Board of Directors of the Company (the “Board”) is furnishing you this Proxy Statement to solicit proxies, on its behalf, to be voted at the Company’s 2025 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Thursday, April 24, 2025, at 11:00 a.m., Eastern Time, via the Internet at www.virtualshareholdermeeting.com/KTB2025, and at any adjournments or postponements thereof. The format of the Annual Meeting will be a virtual-only meeting. Shareholders will not be able to attend the Annual Meeting in person. We have designed the format of the Annual Meeting to ensure that shareholders are afforded similar rights and opportunities to participate as they would at an in-person meeting, using online tools to ensure shareholder access and participation. The Board has made this Proxy Statement and our Annual Report available to you over the Internet at www.proxyvote.com or, upon your request, has mailed you a printed version of these proxy materials in connection with the Annual Meeting. We mailed the Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders, and this Proxy Statement and our Annual Report were posted to the above-referenced website, beginning on or about March 6, 2025. |

| | |

| | | | | | | | |

| | Spin-Off On May 22, 2019, V.F. Corporation (“VF”) completed the spin-off of its Jeanswear business, which included the Wrangler®, Lee® and Rock & Republic® brands, as well as the VF Outlet business. The spin-off transaction (the “Spin-Off”) was effected through a pro-rata distribution to VF shareholders of one share of Kontoor common stock for every seven shares of VF common stock held on the record date of May 10, 2019. Kontoor began to trade as a standalone public company on the New York Stock Exchange (the “NYSE”) under the ticker symbol “KTB” on May 23, 2019. |

| | |

Voting Roadmap

| | | | | | | | | | | |

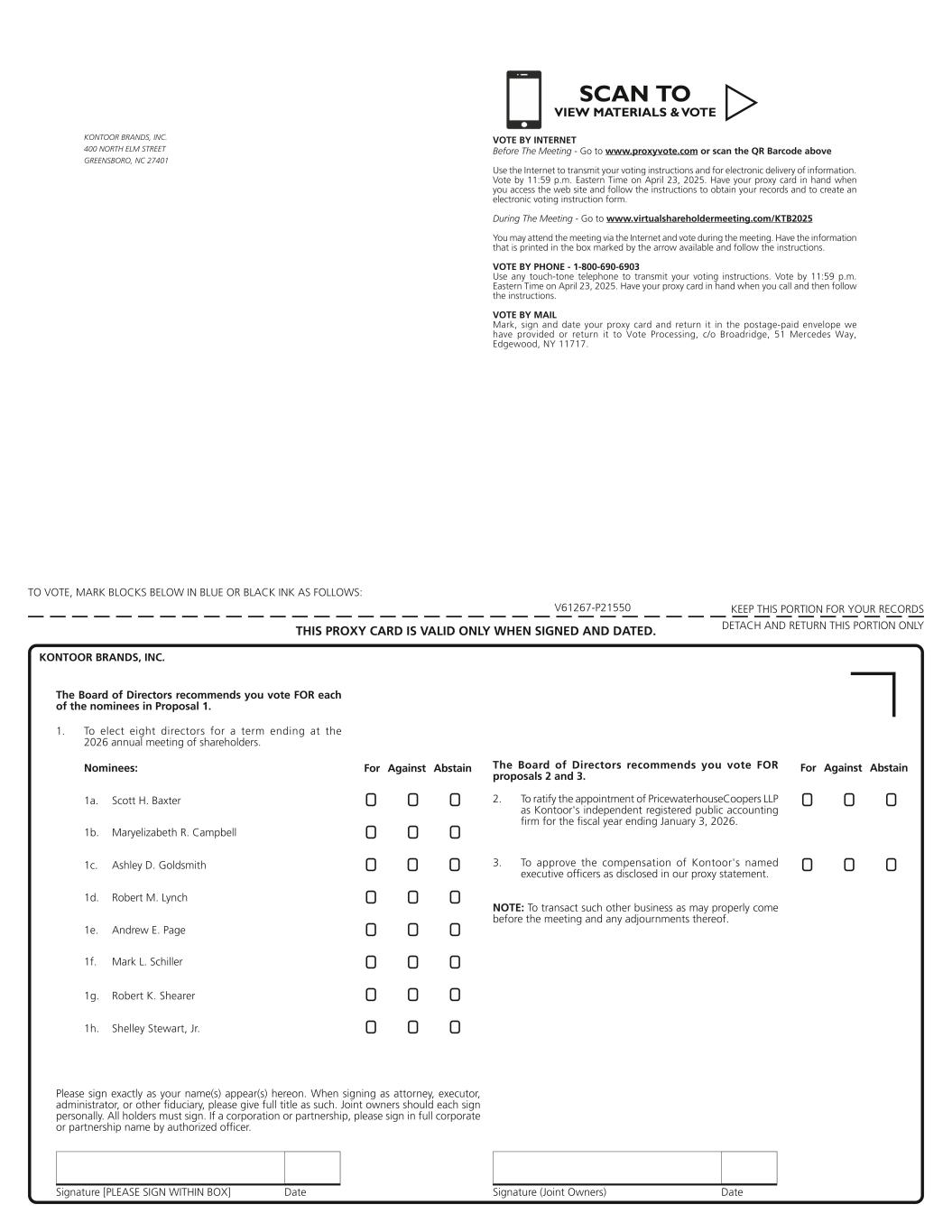

| Proposal | | Board Recommendation | Page Reference |

| | | |

| Proposal No. 1: Election of eight directors for a term ending at the 2026 annual meeting of shareholders. | | The Board recommends a vote “FOR” each of the director nominees. | |

| | | |

| | | |

| Proposal No. 2: Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 3, 2026. | | The Board recommends a vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 3, 2026. | |

| | | |

| Proposal No. 3: Approval of the compensation of our named executive officers on a non-binding advisory basis (“Say-on-Pay vote”). | | The Board recommends a vote “FOR” the approval of the compensation of our named executive officers on a non-binding advisory basis. | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 1 | 2025 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| Voting and Meeting Matters |

| |

| Who May Vote | If, at the close of business on February 13, 2025 (the “Record Date”), you held shares of Kontoor common stock (a) directly in your name as a shareholder of record or (b) through a broker, bank or other nominee (shares held in “street name”), you have one vote for each such share of Kontoor common stock and may vote your shares by proxy via the Internet, by telephone or by mail, or you may vote your shares during the live webcast of the Annual Meeting. For shares held in street name, you generally cannot vote your shares directly and instead may vote by submitting voting instructions to your broker, bank or other nominee. Please refer to information from your broker, bank or other nominee on how to submit voting instructions. As of the close of business on the Record Date, 55,322,973 shares were outstanding and entitled to vote. |

| | | | | |

| How to Obtain Meeting Materials | All Proxy Materials for the Annual Meeting, including this Proxy Statement and our Annual Report, are available to you over the Internet at www.proxyvote.com. All shareholders have been separately provided with the Notice and, as indicated in the Notice, if you want to receive a paper or email copy of these documents, you must request one. There is no charge to you for requesting a copy. Shareholders will not receive printed copies of the proxy materials unless they request them. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions in the Notice for requesting such materials. Please make your request as instructed in that Notice prior to April 10, 2025 to facilitate timely delivery. |

| | | | | |

| What Constitutes a Quorum | The presence, on the live webcast of the Annual Meeting or by proxy, of the holders of a majority of the outstanding shares entitled to cast a vote on a particular matter to be acted upon at the Annual Meeting constitutes a quorum for the purposes of consideration and action on the matter. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, as described below under “How Votes are Counted,” if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). |

| | | | | |

Proposals to be

Voted on | We are asking you to vote on the following: •Proposal No. 1: Election of eight directors for a term ending at the 2026 annual meeting of shareholders; •Proposal No. 2: Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 3, 2026; and •Proposal No. 3: Approval of the compensation of our named executive officers on a non-binding advisory basis (“Say-on-Pay vote”). |

| | | | | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 2 | 2025 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| Votes Required | For Proposal No. 1, you may vote “FOR” or “AGAINST” each of the eight director nominees or abstain from voting. Proposal No. 1 requires that each director is elected by the vote of the majority of the votes cast with respect to the director at a meeting at which a quorum is present assuming the election is uncontested (a plurality voting standard applies in contested elections). For this purpose, a majority of votes cast means that the number of shares voted “FOR” a director nominee must exceed the number of shares voted “AGAINST” such director nominee. Abstentions and broker non-votes will have no effect on the election of directors. Please refer to Proposal No. 1 for information regarding our policy on majority voting in uncontested elections of directors and our policy on incumbent director resignation in an uncontested election. For Proposal No. 2, you may vote “FOR” or “AGAINST” or abstain from voting. Proposal No. 2 requires the affirmative vote of the holders of a majority of the shares cast at a meeting at which a quorum is present. Abstentions will not be considered as votes cast and, as a result, will not have any effect on the proposal. Because the ratification of the appointment of the independent registered public accounting firm is considered a routine matter, there will be no broker non-votes with respect to Proposal No. 2, and a broker will be permitted to exercise its discretion to vote uninstructed shares on Proposal No. 2 in accordance with the applicable NYSE rules. For Proposal No. 3, you may vote “FOR” or “AGAINST” or abstain from voting. Proposal No. 3 requires the affirmative vote of the holders of a majority of the shares cast at a meeting at which a quorum is present. Proposal No. 3 is advisory in nature and non-binding, and the Board will review the voting results and expects to take them into consideration when making future decisions regarding executive compensation. Abstentions and broker non-votes will not be considered as votes cast and, as a result, will not have any effect on Proposal No. 3. |

| | | | | |

How Votes are

Counted | For shareholders of record, all shares represented by the proxies will be voted at the Annual Meeting in accordance with instructions given by the shareholders. Where a shareholder returns its signed proxy and no instructions are given with respect to a given matter, the shares will be voted: (1) “FOR” the election of each of the Board’s director nominees; (2) “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 3, 2026; (3) “FOR” the approval of the compensation of our named executive officers; and (4) as recommended by the Board or, if no recommendation is given, in the discretion of the proxy holders upon such other business as may properly come before the Annual Meeting. If you are a shareholder of record and you do not return your proxy, no votes will be cast on your behalf on any of the items of business at the Annual Meeting. For beneficial owners of shares held in street name, the brokers, banks or other nominees holding shares for beneficial owners will vote those shares as you instruct. Absent instructions from you, brokers, banks and other nominees may vote your shares only as they decide as to matters for which they have discretionary authority under the applicable NYSE rules. A broker, bank or other nominee does not have discretion to vote on the election of directors or approval of the compensation of our named executive officers. If you do not instruct your broker, bank or other nominee how to vote on those matters, no votes will be cast on your behalf on Proposal No. 1, or Proposal No. 3. Your broker will be entitled to vote your shares in its discretion, absent instructions from you, on Proposal No. 2. |

| | | | | |

| Board Recommendations Our Board recommends that you vote your shares: •“FOR” each of the director nominees set forth in this Proxy Statement; •“FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 3, 2026; and •“FOR” the approval of the compensation of our named executive officers. |

| | | | | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 3 | 2025 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| How to Vote | If you are a shareholder of record, please refer to your proxy card to see when your vote must be received by. If you hold shares in street name, please refer to the information forwarded by your bank, broker or other nominee to see when your voting instructions must be received by. |

| | | | | |

| If you are a Shareholder of Record you may Vote by Granting a Proxy. To Vote by Proxy: |

| By Internet Go to the website www.proxyvote.com and follow the instructions on how to complete an electronic proxy card, 24 hours a day, seven days a week. You will need the 16-digit number included on your Notice or proxy card to vote by Internet. | | By Telephone From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week. You will need the 16-digit number included on your Notice or proxy card in order to vote by telephone. | | By Mail Request a proxy card from us by following the instructions on your Notice. When you receive the proxy card, mark your selections on the proxy card. Date and sign your name exactly as it appears on your proxy card. Mail the proxy card in the enclosed postage- paid envelope provided to you, or return it to: VOTE PROCESSING, c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 |

| | | | | |

| If you hold your shares in street name, you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your bank, broker or other nominee on how to submit voting instructions. If you receive more than one Notice, it generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please sign and return each proxy card or, if you vote by Internet or telephone, vote once for each Notice you receive. |

| During the Annual Meeting To submit questions in advance of the meeting, and vote and ask questions during the live webcast of the Annual Meeting, you are encouraged to register at www.proxyvote.com, using your control number and other information, prior to Wednesday, April 23, 2025, at 5:00 p.m. Eastern Time. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you to access the Annual Meeting and vote online during the meeting. Please be sure to follow instructions found on your proxy card or other information forwarded by your bank, broker or other nominee and subsequent instructions that will be delivered to you via email. Beginning fifteen minutes prior to, and during, the Annual Meeting, support will be available to assist shareholders with any technical difficulties they may have accessing, hearing or participating in the virtual meeting. If participants encounter any difficulty accessing, or during, the virtual meeting, they should call the support team at the numbers listed on the virtual meeting registration page. Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by Internet, telephone or mail so that your vote will be counted even if you later decide not to attend the Annual Meeting. |

| | | | | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 4 | 2025 Proxy Statement |

| | | | | | | | | | | | | | | | | |

How to Change

Your Vote or

Revoke Your Proxy | If you are a shareholder of record, you may change your vote or revoke your proxy by: •sending a written statement to that effect to our Corporate Secretary, provided such statement is received no later than April 23, 2025; •voting again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m., Eastern Time, on April 23, 2025; •submitting a properly signed proxy card to: VOTE PROCESSING, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, with a later date that is received no later than April 23, 2025; or •registering prior to the deadline of Wednesday, April 23, 2025, at 5:00 p.m. Eastern Time, attending the Annual Meeting, revoking your proxy and voting during the live webcast of the Annual Meeting. If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy during the live webcast of the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares. |

| | | | | |

How Can I Attend

and Participate in

the Annual Meeting | The Annual Meeting will be accessible only through the Internet. You are entitled to attend and participate in the Annual Meeting if you were a shareholder as of the close of business on the February 13, 2025 Record Date. To attend and participate in the Annual Meeting, shareholders must register in advance, using their control number and other information, at www.proxyvote.com prior to the deadline of Wednesday, April 23, 2025, at 5:00 p.m., Eastern Time. Upon completing registration, shareholders will receive further instructions by e-mail, including links that will allow them to access the Annual Meeting, submit questions, and vote online during the Annual Meeting. The 2025 Annual Meeting will begin promptly at 11:00 a.m. Eastern Time. Beginning fifteen minutes prior to, and during, the Annual Meeting, support will be available to assist shareholders with any technical difficulties they may have accessing, hearing or participating in the virtual meeting. If participants encounter any difficulty accessing, or during, the virtual meeting, they should call the support team at the numbers listed on the virtual meeting registration page. Whether or not you participate in the Annual Meeting, it is important that your shares be part of the voting process. The methods by which you may vote are described above. |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 5 | 2025 Proxy Statement |

Proposal No. 1

Election of Directors

The eight individuals named below currently serve on our Board. Each of our directors will be elected for a one-year term expiring at the next annual meeting of shareholders.

The Board believes that it is currently comprised of global leaders from various fields and industries, with broad and diverse skills, professional experience, perspectives, age, race, ethnicity, gender and cultural backgrounds that reflect our consumer and investor base, and that provide independent governance and oversee the successful execution of the Company’s strategic initiatives. The Board will, however, continue to annually assess the need to add additional directors with the relevant qualifications and skills.

| | | | | | | | | | | | | | | | | |

| Name | Principal Occupation | Audit Committee | Talent and Compensation Committee | Nominating and Governance Committee | Strategy and Finance Committee |

| | | | | |

Scott H. Baxter Chairman of the Board | President and Chief Executive Officer, Kontoor Brands, Inc. | | | | Member |

| Maryelizabeth R. Campbell | Retired; Former President, vCommerce Ventures, Qurate Retail, Inc. | Member | | | |

| Ashley D. Goldsmith | Chief People Officer, Workday, Inc. | | Chair | Member | |

| Robert M. Lynch | Chief Executive Officer, Shake Shack, Inc. | | Member | | |

| Andrew E. Page | Chief Financial Officer, Amer Sports, Inc. | Member | Member | | |

| Mark L. Schiller | Retired; President and Chief Executive Officer, The Hain Celestial Group, Inc. | Member | | Member | |

Robert K. Shearer Lead Independent Director | Retired; Former Senior Vice President and Chief Financial Officer, V.F. Corporation | Chair | | | Chair |

| Shelley Stewart, Jr. | Retired; Former Chief Procurement Officer, E.I. du Pont de Nemours & Co. |

| | Chair | Member |

Composition of the Board

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gender Diversity: 2 of 8 are female | | | Director Independence: 7 of 8 are independent | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Ethnic Diversity: 2 of 8 are ethnically diverse | | | CEO Experience: 3 of 8 have CEO experience | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 6 | 2025 Proxy Statement |

Director Skills and Qualifications Matrix

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Baxter | Campbell | Goldsmith | Lynch | Page | Schiller | Shearer | Stewart, Jr. | Total |

| | | | | | | | | |

Executive Management Experience – Senior leadership experience in operations, strategic planning, risk management and oversight, finance/accounting, and supply chain management | l | l | l | l | l | l | l | l | 8 |

Financial Expertise – Deep understanding of financial and accounting concepts, including experience with financial reporting processes, and financial controls | l | | | l | l | l | l | l | 6 |

International Experience – Exposure to and experience in global markets, diverse business environments, and/or cultural perspectives | l | l | l | l | l | l | l | l | 8 |

Industry – Extensive knowledge and experience in the retail apparel industry, and/or consumer products | l | l | | l | l | l | l | | 6 |

Marketing and Branding – Experience with consumer marketing, branding, media, and reputational management | l | l | | l |

| l | | | 4 |

Supply Chain - Extensive knowledge and experience in global supply chain operations including inventory management, distribution, logistics, product development, and sourcing. | l | l | | l | | l | l | l | 6 |

Digital and eCommerce – Experience with digital business strategies and eCommerce operations, including experience with technology resources, and infrastructure |

| l | l | l | l | l |

|

| 5 |

Corporate Governance – Understanding of public company governance best practices, shareholder relations and institutional investor considerations, including related to executive compensation and risk management along with public company board experience | l | l | l | l | l | l | l | l | 8 |

Sustainability – Understanding of legal and regulatory implications related to environmental, social and governance (“ESG”) matters, experience with sustainable sourcing and operations, and/or experience with social impact matters | l | l | l | l | l | l | l | l | 8 |

Cybersecurity Experience – Understanding of legal and regulatory implications related to cybersecurity matters, experience with cybersecurity strategy and policies, and understanding of risk-based threat management strategies |

| l | l | l | l | l | l |

| 6 |

As reflected in the chart above, we believe our directors offer a diverse range of key skills and experience to provide effective oversight of Kontoor and create long-term sustainable growth through successful execution of the Company’s strategic initiatives.

Our Articles of Incorporation require that, in an uncontested election, each director will be elected by the vote of the majority of the votes cast with respect to the director at a meeting at which a quorum is present, such that the number of shares voted “for” a director nominee must exceed the number of shares voted “against” that director nominee. A plurality voting standard is applicable to any contested election of directors. A “contested election of directors” is one in which the number of nominees for director exceeds the number of directors to be elected.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 7 | 2025 Proxy Statement |

Our Bylaws and Corporate Governance Principles require each director to tender, promptly following the meeting at which he or she is elected as a director, an irrevocable resignation that will be effective upon (a) the failure of such director to receive the number of votes required for re-election, and (b) the acceptance of such director’s resignation by the Nominating and Governance Committee and the Board.

The Nominating and Governance Committee will consider such tendered resignation and, within 30 days following the date of the shareholders’ meeting at which the election occurred at which a director failed to receive the number of votes required for re-election, will make a recommendation to the Board concerning the acceptance or rejection of such resignation. The Board will act on the tendered resignation, taking into account such recommendation, and publicly disclose its decision regarding the tendered resignation within 60 days from the date of the certification of the election results.

The following section provides information with respect to each director nominee. It includes the specific experience, qualifications and skills considered by the Nominating and Governance Committee and/or the Board in assessing the appropriateness of the person to serve as a director. Ages are presented as of March 6, 2025.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 8 | 2025 Proxy Statement |

Director Nominees

| | | | | | | | |

Scott Baxter President, Chief Executive Officer and Chairman of the Board Age: 60 Committees: Strategy and Finance Committee | | Scott Baxter has served on the Board since the Spin-Off and as Chairman of the Board since August 2021. He is President and Chief Executive Officer of Kontoor. Mr. Baxter was named CEO in August 2018 when VF announced its intention to separate its Jeanswear organization into an independent, publicly traded company. Prior to being named CEO of Kontoor, Mr. Baxter was Group President, Americas West, for VF. In this role, he was responsible for overseeing brands such as The North Face® and Vans®. Mr. Baxter’s previous leadership roles at VF also included Group President, Outdoor & Action Sports, Americas and Vice President, V.F. Corporation & Group President, Jeanswear, Imagewear and South America. Mr. Baxter joined VF in 2007 as the President of the Licensed Sports Group. In 2008, he was named Coalition President for the Imagewear coalition, which comprised the Image and Licensed Sports Group divisions. Prior to joining VF, Mr. Baxter served as Senior Vice President of The Home Depot, Inc., leading the Services Division. He also previously served as Executive Vice President of Edward Don & Company and held a series of leadership roles with Nestle and PepsiCo. Mr. Baxter serves on the board of directors of Lowe’s Companies, Inc., a retail company specializing in home improvement. He previously served on the board of directors of Topgolf Callaway Brands Corp., a premium golf equipment and active lifestyle company. An active member of the community, Mr. Baxter is on the board of directors for the Piedmont Triad Partnership. Mr. Baxter also served on the board of directors of the Greensboro Chamber of Commerce, and as the honorary chairman of the PGA TOUR’s 2020 and 2021 Wyndham Championship. Mr. Baxter holds a bachelor’s degree from the University of Toledo and a Master of Business Administration degree from Northwestern University’s Kellogg Graduate School of Management. Specific Experience, Qualifications, Attributes and Skills Relevant to Kontoor: Mr. Baxter has more than 30 years of experience in retail, operations, marketing, merchandising, sales and manufacturing, including extensive executive leadership experience. Mr. Baxter’s service as President and Chief Executive Officer of Kontoor, his previous leadership roles at VF and other public companies, and his service on the board of directors of another public company provide him with valuable insights into our company and industry. |

| | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 9 | 2025 Proxy Statement |

| | | | | | | | |

Maryelizabeth Campbell Retired, President, vCommerce Ventures, Qurate Retail, Inc. Age: 57 Committees: Audit Committee | | Maryelizabeth Campbell has served on the board since February 2024. Ms. Campbell was previously the President, vCommerce Ventures of Qurate Retail, Inc. until her retirement in 2023. Qurate Retail is comprised of a select group of retail brands including QVC, HSN, Ballard Designs, Frontgate, Garnet Hill, and Grandin Road and is a leader in video commerce, a top-10 e-commerce retailer, and a leader in mobile and social commerce. During her more than 20 years with the company, Ms. Campbell held various leadership positions across the Merchandising, Planning and Commerce Platforms functions. Most recently, and prior to serving as President, vCommerce Ventures, she served as Chief Content, Digital, and Platforms Officer of QxH, a segment of Qurate, since 2021, as Chief Merchandising Officer of Qurate Retail Group and Chief Commerce Officer of QVC US from 2018 to 2021, as Chief Merchandising and Interactive Officer in 2018, as Chief Interactive Experience Officer from 2017 to 2018, and as Executive Vice President, Commerce Platforms for QVC from 2014 to 2017. Ms. Campbell has served on the board of directors of Leggett & Platt, Inc. since 2019, where she has served on the Audit Committee since 2019, and on the Nominating, Governance, and Sustainability Committee since 2024. Ms. Campbell holds a bachelor’s degree in psychology from Central Connecticut State University. Specific Experience, Qualifications, Attributes and Skills Relevant to Kontoor: Through her positions at QxH, Qurate Retail Group and QVC, Ms. Campbell has extensive knowledge in consumer driven product innovation, marketing and brand building, and traditional and new media platforms, as well as leading teams long term growth and evolution. |

| | |

| | |

| | | | | | | | |

Ashley Goldsmith Chief People Officer, Workday, Inc. Age: 52 Committees: Talent and Compensation Committee (Chair), Nominating and Governance Committee | | Ashley Goldsmith has served on the Board since February 2022. She has served as Chief People Officer of Workday, Inc. since 2013. Prior to joining Workday, she spent three years with Polycom, Inc., serving as Executive Vice President and Chief Human Resources Officer, leading the company through a high growth phase. Previously, she spent three years at Ventana Medical Systems, a division of the Roche Group, as Senior Vice President, Human Resources, Corporate Communications, Environmental Health & Safety. From 1995 to 2007, she served in a number of leadership positions with increasing responsibility with The Home Depot, Inc., most recently serving as Vice President, Human Resources, Northern Division. Ms. Goldsmith began her career at Great-West Life & Annuity. Ms. Goldsmith holds a bachelor’s degree in psychology from Vanderbilt University, a Master of Human Resources Development degree from Georgia State University and a Master of Business Administration degree from Northwestern University’s Kellogg Graduate School of Management. Specific Experience, Qualifications, Attributes and Skills Relevant to Kontoor: Ms. Goldsmith’s qualifications include her extensive experience across industries in human resource management at large publicly traded companies and scaling companies while developing employment brands recognized for being great workplaces. Ms. Goldsmith brings extensive experience with the social component of ESG matters, providing invaluable insight to the Board. |

| | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 10 | 2025 Proxy Statement |

| | | | | | | | |

Robert Lynch Chief Executive Officer, Shake Shack, Inc. Age: 48 Committees: Talent and Compensation Committee | | Robert Lynch has served on the Board since March 2021. Mr. Lynch has served as Chief Executive Officer and on the board of Directors of Shake Shack, Inc. since May 2024. Mr. Lynch served as President and Chief Executive Officer of Papa John’s International, Inc. from August 2019 until May 2024 and before that he was with Arby’s Restaurant Group, where he served as President since August 2017, and served as Brand President and Chief Marketing Officer from August 2013 to August 2017. Prior to Arby’s Restaurant Group, he served as Vice President of Marketing at Taco Bell. Mr. Lynch has more than 20 years combined experience in the QSR and consumer packaged goods industries, and also held senior roles at H.J. Heinz Company, and Procter & Gamble. Mr. Lynch holds a bachelor’s degree in economics and political science, and a Master of Business Administration degree from the University of Rochester. Specific Experience, Qualifications, Attributes and Skills Relevant to Kontoor: As Chief Executive Officer and Director of Shake Shack, Inc., a large global publicly traded company, Mr. Lynch brings executive leadership, financial expertise and strategic management skills. Mr. Lynch’s qualifications also include extensive marketing experience, leading purpose-driven organizations and high performing teams and growing successful consumer brands. |

| | |

| | |

| | | | | | | | |

Andrew Page Chief Financial Officer, Amer Sports Age: 55 Committees: Audit Committee, Talent and Compensation Committee | | Andrew Page has served on the Board since June 2022. Mr. Page has served as Chief Financial Officer of Amer Sports since April 2023, and as a member of its Executive Committee since April 2023. Prior to joining Amer Sports, Mr. Page served two years as Executive Vice President and Chief Financial Officer of Foot Locker, Inc., where he focused on enterprise optimization to enhance stakeholder and shareholder value. Prior to joining Foot Locker, Mr. Page served as Senior Vice President, Chief Accounting Officer and Controller at Advance Auto Parts, Inc. where he oversaw all accounting, tax, internal controls, and external financial reporting. Previously, he spent eight years at Under Armour, Inc., most recently serving as Senior Vice President and Chief Accounting Officer, and prior to Under Armour, Inc., he held several other senior finance roles at FTI Consulting, Inc., The AES Corporation, General Electric's Consumer and Industrial division, and Discovery Communications, Inc. Mr. Page holds a Master of Business Administration from Georgetown University and a Bachelor of Business Administration in Accounting from Eastern Kentucky University and is a Certified Public Accountant. Specific Experience, Qualifications, Attributes and Skills Relevant to Kontoor: Mr. Page’s qualifications include his experience in senior-level financial positions within the apparel and footwear industry. Mr. Page’s prior chief financial officer and chief accounting officer positions, enables him to provide important insights on a range of financial and corporate matters. |

| | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 11 | 2025 Proxy Statement |

| | | | | | | | |

Mark Schiller Retired; President and Chief Executive Officer, The Hain Celestial Group, Inc. Age: 63 Committees: Audit Committee, Nominating and Governance Committee | | Mark Schiller has served on the Board since May 2021. Mr. Schiller served as Interim Chief Executive Officer of Mid America Pet Food from February 2024 until July 2024. He previously served as President and Chief Executive Officer of The Hain Celestial Group, Inc., a leading organic and natural products company, from November 2018 until his retirement in December 2022. Prior to joining Hain Celestial, he spent eight years with Pinnacle Foods, Inc., most recently serving as Executive Vice President and Chief Commercial Officer, leading the grocery and frozen segments and key commercial functions. During his tenure with Pinnacle Foods, Mr. Schiller progressed through roles of increasing scope and responsibility across the company’s Retail, Birds Eye Frozen and Duncan Hines Grocery divisions. Previously, he spent eight years at PepsiCo, Inc., in a number of leadership positions, including Senior Vice President of Frito Lay New Ventures, President of Quaker Foods and Snacks North America, and Senior Vice President and General Manager of Frito Lay Convenience Foods Division. Earlier in his career, Mr. Schiller held senior roles with Tutor Time Learning Systems, Inc. and Valley Recreation Products, Inc. He began his career at the Quaker Oats Company. Mr. Schiller continues to serve on the board of Mid America Pet Food. He also serve as Executive Chairman and Board Member of Stonewall Kitchen, a leading specialty food, home goods and personal care producer. Mr. Schiller previously served on the board of directors of Hain Celestial. Mr. Schiller holds a bachelor’s degree in sociology from Tulane University and a Master of Business Administration degree from Columbia University. Specific Experience, Qualifications, Attributes and Skills Relevant to Kontoor: Mr. Schiller brings significant experience in the consumer packaged goods industry, including as President, Chief Executive Officer and Director of The Hain Celestial Group, Inc. Through his various roles throughout his career, he has developed extensive management leadership experience as well as strong competencies in sales, marketing strategy, supply chain, innovation, product development, package design, commercialization, productivity, consumer insights and shopper marketing. |

| | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 12 | 2025 Proxy Statement |

| | | | | | | | |

Robert Shearer Lead Independent Director Age: 73 Committees: Audit Committee (Chair), Strategy and Finance Committee (Chair) | | Robert Shearer has served on the Board since the Spin-Off and he is Kontoor’s Lead Independent Director. He previously served as Chair of the Board from the Spin-Off until August 2021. Mr. Shearer brings extensive management expertise to the Board, including a range of leadership experience at V.F. Corporation. From 2005 to 2015, Mr. Shearer served as Senior Vice President and Chief Financial Officer of VF, and from 1986 to 2005, served in various other roles of increasing responsibility at VF, including Vice President-Finance and Chief Financial Officer and Vice President-Controller. For two years, he was President of VF’s Outdoor Coalition, which was formed with the acquisition of The North Face® brand. Prior to joining VF, Mr. Shearer was a Senior Audit Manager for Ernst and Young. Mr. Shearer has served on the board of directors of Yeti Holdings, Inc., a designer, marketer, retailer, and distributor of a variety of innovative, branded, premium products, since 2018 and was named Chair of the board of directors in 2021. Since 2008, Mr. Shearer has served on the board of directors of Church & Dwight Co, Inc., a household products manufacturer, where he currently serves on the audit committee and was Chair of the audit committee from 2009 to February 2023. He previously served on the board of directors of The Fresh Market, Inc., a specialty grocery chain. Mr. Shearer holds a bachelor’s degree in accounting from Catawba College. Specific Experience, Qualifications, Attributes and Skills Relevant to Kontoor: Mr. Shearer’s prior role as Chief Financial Officer of VF, coupled with his 12 years of experience in public accounting, enables him to provide the Board and the Audit Committee with important insights on a range of financial and internal control matters, as well as on matters relating to capital structure, information systems, risk management, public reporting and investor relations. In addition, during his tenure at VF, his participation in expansion initiatives, including a number of acquisitions and growth in international markets, enables him to provide important insights on international operations, business combination opportunities, and strategic planning. Mr. Shearer provides the Board with corporate governance expertise developed through his experience serving on public company boards of directors, including in board leadership roles as the Chair of the board of directors of Yeti Holdings, Inc. and through his service as Chair of the Board from the Spin-Off until August 2021. |

| | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 13 | 2025 Proxy Statement |

| | | | | | | | |

Shelley Stewart, Jr. Retired Chief Procurement Officer, E.I. du Pont de Nemours & Co. Age: 71 Committees: Nominating and Governance Committee (Chair), Strategy and Finance Committee | | Shelley Stewart, Jr. has served on the Board since the Spin-Off. He was previously the Chief Procurement Officer and held responsibility for real estate and facility services at E.I. du Pont de Nemours & Co. from 2012 until his retirement in 2018. Prior to joining DuPont, Mr. Stewart held leadership positions in supply chain and procurement at Tyco International, Invensys PLC, Raytheon Company and United Technologies Corporation. Mr. Stewart currently serves on the board of Otis Worldwide where he is on the compensation committee and nominating and governance committee. He also serves on the board of Clean Harbors where he is on the Environmental, Health and Safety Committee and the Audit Committee. He is chairman of the Billion Dollar Roundtable Inc., a top-level advocacy organization that promotes corporate supplier development. He is also on the Board of Trustees for Howard University as well as chair of the board of visitors for the school of business. Mr. Stewart also serves on the board of trustees for Northeastern University. He previously served on the board of directors for Cleco Corporation. Mr. Stewart holds a bachelor’s degree and a Master of Criminal Justice degree from Northeastern University and received a Master of Business Administration degree from the University of New Haven. Specific Experience, Qualifications, Attributes and Skills Relevant to Kontoor: Mr. Stewart brings extensive experience in senior-level supply chain and operational positions with leading industrial companies. Mr. Stewart’s service on other public company boards of directors provides him with valuable insights on corporate governance and ESG matters. |

| | |

VOTE

The Board unanimously recommends a vote “FOR” each of the director nominees.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 14 | 2025 Proxy Statement |

Executive Officers

Kontoor’s executive officers are as follows:

| | | | | | | | |

| Name | Age | Title |

| | |

| Scott H. Baxter | 60 | President, Chief Executive Officer and Chairman of the Board |

| Joseph A. Alkire | 45 | Executive Vice President and Chief Financial Officer |

| Thomas E. Waldron | 57 | Executive Vice President and Chief Operating Officer |

| Jennifer H. Broyles | 46 | Executive Vice President, Global Brands President, Wrangler & Lee |

| Thomas L. Doerr, Jr. | 50 | Executive Vice President, General Counsel and Secretary |

Certain information with respect to our executive officers is provided below. Officers are appointed to serve at the discretion of the Board. Information regarding Mr. Baxter is included in the director profiles set forth above. Ages are represented as of March 6, 2025.

Joseph A. Alkire is Executive Vice President and Chief Financial Officer (and has served in that role since August 2023). Prior to his role at Kontoor, Mr. Alkire served as Chief Operating Officer and Chief Financial Officer for BrüMate, Inc. He previously served as Vice President, Corporate Development, Treasury, and Investor Relations for V.F. Corporation and as an investment banking and equity research analyst for William Blair & Company. He earned as Master of Business Administration degree from The University of Chicago’s Booth School of Business and a bachelor’s degree in Business from Indiana University’s Kelley School of Business.

Thomas E. Waldron is Executive Vice President and Chief Operating Officer (and has served in that role since March 2024). Prior to his current role, Mr. Waldron was served as Executive Vice President and Co-Chief Operating Officer from March 2022 until March 2024, and Executive Vice President (or Vice President) and Global Brand President–Wrangler from the Spin-Off until March 2022. He previously served as VF’s Global Brand President–Wrangler from October 2018 to the Spin-Off, President—Wrangler from March 2016 until October 2018, Vice President–Mass Brands from July 2010 until March 2016, Vice President General Manager—Wrangler Male Bottoms from July 2005 until July 2010, Merchandise Manager–Wrangler Men’s from January 2003 until July 2005, National Account Executive—Walmart (Boys) from January 2000 until January 2003, National Account Executive—Walmart (Men’s) from November 1996 until January 2000 and Replenishment Manager from September 1995 until November 1996. He earned a B.S. in Economics from the University of North Carolina at Greensboro.

Jennifer H. Broyles is Executive Vice President, Global Brands President, Wrangler & Lee (and has served in that role since March 2024). Prior to her current role, Ms. Broyles was Kontoor’s Senior Vice President, Wrangler since April 2022. She previously held various roles of increasing responsibility in brands management, marketing and merchandising for both Wrangler and Lee. Ms. Broyles holds a bachelor’s degree in advertising from the University of Tennessee, Knoxville, as well as a Master of Business Administration in Marketing and Value Chain Management.

Thomas L. Doerr, Jr. is Executive Vice President, General Counsel and Secretary (and has served in that role since May 2022). Prior to his role at Kontoor, Mr. Doerr served as Executive Vice President (or Senior Vice President), General Counsel & Secretary from November 2017 to May 2022 at The Manitowoc Company, Inc. He previously served as Vice President, General Counsel & Secretary at Jason Industries, Inc., Associate General Counsel at The Manitowoc Company, Inc. and as an associate at the law firm von Briesen & Roper, s.c. He earned his bachelor’s degree in Business Administration from the University of St. Thomas and his law degree from the Marquette University Law School.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 15 | 2025 Proxy Statement |

Corporate Governance

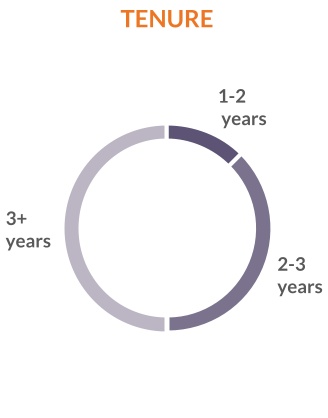

Kontoor’s business is managed under the direction of the Board. The Board regularly assesses its criteria for Board membership to identify the qualifications and skills that directors and candidates should possess. Members of the Board are kept informed of Kontoor’s business through discussions with the Chief Executive Officer and other officers, by reviewing Kontoor’s annual business plan and other materials provided to them and by participating in meetings of the Board and its committees. The Board seeks to maintain a balance of directors who have longer terms of service and directors who have joined more recently.

Corporate Governance Highlights

The Company believes that strong corporate governance is a critical element to achieving long-term shareholder value. We are committed to governance practices and policies that serve the interests of the Company and its shareholders. The following table summarizes certain highlights of corporate practices and policies:

| | | | | | | | | | | | | | |

| | | | |

INDEPENDENCE •All of our directors, except our Chief Executive Officer, are independent •Audit, Nominating & Governance, and Talent & Compensation Committees are composed entirely of independent directors | | | ACCOUNTABILITY •Declassified Board with the annual election of all members of the Board of Directors •Majority voting for members of the Board of Directors in an uncontested election •Directors must tender their resignation if they fail to receive a majority of the votes cast in an uncontested election •No shareholder rights plan (or “poison pill”) •No supermajority voting requirements in our Articles of Incorporation or Bylaws | |

| | | | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 16 | 2025 Proxy Statement |

| | | | | | | | | | | | | | |

| | | | |

BEST PRACTICES •None of our directors are “overboarded” •Share ownership guidelines for our Board of Directors and executives •Published Corporate Governance Guidelines •Published Code of Business Conduct applicable to our Board of Directors •Each Committee of our Board of Directors has a published charter that is reviewed and evaluated at least annually •Independent members of the Board of Directors meet regularly and frequently (at least four times per year) without management present •The Nominating & Governance Committee conducts an annual review of the Board leadership structure to ensure effective Board leadership •The independent Directors evaluate the performance of the Chairman and Chief Executive Officer each year in executive sessions and determine compensation •Directors are allotted time to meet in executive session without management present at each Board and Committee meeting •The Board evaluates its performance on an annual basis. Each committee evaluates its performance on an annual basis based on guidance from the Nominating & Governance Committee •We have comprehensive compensation recoupment policies designed to ensure that management is held accountable in the event of specified misconduct or financial restatements as further described in the respective policy •Insider trading policy governing the purchase, sale and other acquisitions or dispositions of our common stock by all of our directors, officers and employees •No director, executive officer or employee can enter into any derivative or hedging transaction on our stock •No director, executive officer or other designated key employee can pledge our stock or hold it in a margin account | | | RISK OVERSIGHT •The Board of Directors oversees the Company’s overall risk-management structure •Individual Board of Directors committees oversee certain risks related to their specific areas of responsibility •The Board of Directors oversees robust risk management processes throughout the Company | |

| | | | |

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 17 | 2025 Proxy Statement |

The Board continuously evaluates and, as appropriate, updates our corporate governance practices based on recommendations from the Nominating and Governance Committee. In recent years we have made significant governance changes designed to improve and enhance our corporate governance practice, policies, structures and functioning, taking into account ongoing corporate governance trends, peer practices and views and perspectives of our stakeholders, including the following:

•In 2021, the Company’s Board of Directors created the Lead Independent Director role.

•In 2023, the Company’s Board of Directors became unclassified with each director elected annually.

•In 2024, the Company amended its Articles of Incorporation to replace all supermajority voting standards with a majority of the votes entitled to be cast standard.

Corporate Governance Principles

The Board is committed to sound and effective corporate governance practices. A foundation of Kontoor’s corporate governance is the Board’s policy that a substantial majority of the members of the Board must meet the independence requirements of the NYSE. In addition, members of the Board who are also executive officers of a public company can serve on the board of directors of no more than two public companies total, and members of the Board who are not executive officers of a public company can serve on the board of directors of no more than four public companies total. These policies are included in the Board’s written corporate governance principles (the “Corporate Governance Principles”), which address a number of other important governance issues such as:

•composition and selection of the Board;

•a requirement that directors offer to submit their resignation to the Nominating & Governance Committee for consideration upon a substantial change in job responsibilities;

•committee structure and responsibilities;

•Board consideration of shareholder proposals receiving a majority of shareholder votes;

•authority of the Board to engage outside independent advisors as it deems necessary or appropriate;

•majority voting for directors in uncontested elections;

•succession planning for the chief executive officer and other executive officer positions; and

•annual self-evaluation by the Board and each committee.

In addition, the Board has in place formal charters stating the powers and responsibilities of each of its committees.

Director Orientation and Continuing Education

The Board views orientation and continuing education as vital tools for building an effective Board. We provide all new directors, upon joining the Board, with appropriate orientation programs, sessions or materials regarding the Board and the Company’s operations. The orientation consists of presentations by members of senior management on the Company’s financial profile, strategic plans, management organization, compliance programs and corporate policies. Directors are required to continue educating themselves with respect to topics related to the Company’s business. The Board encourages, but does not require, directors to periodically pursue or obtain appropriate programs, sessions or materials as to the responsibilities of directors of publicly-traded companies, and the Company reimburses directors for their reasonable expenses in pursuing such opportunities.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 18 | 2025 Proxy Statement |

Related Person Transactions Policy

Our Related Person Transactions Policy sets forth the policies and procedures governing the review and approval or ratification by the Nominating and Governance Committee of transactions between Kontoor, on the one hand, and (i) an executive officer; (ii) a director or nominee to become director; (iii) any security holder who is known by Kontoor to own of record or beneficially more than five-percent of any class of Kontoor’s voting securities (as defined in the policy) at the time of the transaction; or (iv) an immediate family member of such executive officer, director or nominee to become director, or five-percent holder, on the other hand. Persons in the categories described above are collectively referred to as “related persons.” The policy applies to all related person transactions, and under the policy a “related person transaction” is any transaction in which:

•Kontoor was or is to be a participant;

•the aggregate amount involved exceeds $120,000; and

•any related person had, or will have, a direct or indirect material interest.

No related person transaction shall be approved or ratified if such transaction is contrary to the best interests of the Company and its stakeholders. Unless different terms are specifically approved or ratified by the Nominating and Governance Committee, any approved or ratified transaction must be on terms that are no less favorable to Kontoor than would be obtained in a similar transaction with an unaffiliated third party under the same or similar circumstances. All related person transactions or series of similar transactions must be presented to the Nominating and Governance Committee for review and pre-approval or ratification.

Since the beginning of Kontoor’s last fiscal year, one financial transaction, arrangement or relationship, was disclosed or proposed through Kontoor’s processes for review, approval or ratification of transactions with related persons in which (i) Kontoor was or is to be a participant, (ii) the aggregate amount involved exceeded $120,000, and (iii) any related person had or will have a direct or indirect material interest.

Ms. Jennifer H. Broyles is Executive Vice President, Global Brands President - Wrangler & Lee of the Company. Ms. Broyles’ husband is employed in the Licensing & Business Ventures department of the Company and has no direct reporting relationship to Ms. Broyles. His total compensation for 2024 was approximately $511,373.

Corporate Governance Documents

The Board’s Corporate Governance Principles and the Audit Committee, the Nominating and Governance Committee and the Talent and Compensation Committee charters are available on Kontoor’s website (www.kontoorbrands.com) and will be provided free of charge to any person upon written request directed to the Corporate Secretary. Other than the text of the Corporate Governance Principles, the charters of the Audit Committee, the Nominating and Governance Committee and the Talent and Compensation Committee, and the Code of Conduct, we are not including the information contained on or available through our corporate website as part of, or incorporating such information by reference into, this Proxy Statement.

Code of Conduct

The Board has adopted a written code of business conduct and ethics (the “Code of Conduct”), which applies to all of our employees, officers and directors. Our Code of Conduct is available on Kontoor’s website (www.kontoorbrands.com) and will be provided free of charge to any person upon written request directed to the Corporate Secretary. In addition, we intend to post on our website all disclosures that are required by law or the NYSE listing rules concerning any amendments to, or waivers from, any provision of our Code of Conduct.

Insider Trading Policy

The Board has adopted an Insider Trading Policy that governs the purchase, sale and other acquisitions or dispositions of our common stock by our directors, officers and employees. This policy is designed to promote compliance with insider trading laws, related Securities and Exchange Commission (“SEC”) rules and regulations and the listing standards of the NYSE. In addition, it is our policy that the Company will not trade in its common stock when it is aware of material nonpublic information.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 19 | 2025 Proxy Statement |

Board Leadership Structure

The Board has concluded that Kontoor and its shareholders are best served by not having a formal policy on whether the same individual should serve as both Chief Executive Officer and Chairman of the Board. The Board retains the flexibility to determine the appropriate leadership structure based on the circumstances at the time of the determination. From the Spin-off through August 25, 2021, Mr. Shearer served as Chairman of the Board and Mr. Baxter served as Chief Executive Officer of Kontoor. Effective August 26, 2021, upon the recommendation of the Nominating and Governance Committee, the Board elected Mr. Baxter to the additional position of Chairman of the Board, and elected Mr. Shearer as the Lead Independent Director (“Lead Director”). The Board believes combining the positions of Chairman and Chief Executive Officer enhances overall Board effectiveness and interaction with management, and provides the Company with strong, clear leadership and strategic vision. Mr. Baxter has over 30 years of experience in retail, operations, marketing, merchandising, sales and manufacturing and has served with the Company or VF for over 15 years. In addition, Mr. Baxter has extensive knowledge of, and experience with, all other aspects of the Company’s business, including with its employees, customers, vendors, and shareholders. Having Mr. Baxter serve as both Chairman and Chief Executive Officer helps promote unified leadership and direction for both the Board and management.

The position of Lead Director was created to, among other things, ensure that the non-management directors maintain proper oversight of management and Board process. The responsibilities of Mr. Shearer, as Lead Director, include:

•presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors;

•calling additional meetings of the independent directors;

•facilitating discussion and open dialogue among the independent directors during Board meetings, executive sessions and outside of Board meetings;

•serving as principal liaison between the independent directors and the Chairman, without inhibiting direct communication between them;

•communicating to the Chairman and management, as appropriate, any decisions reached, and suggestions, views or concerns expressed, by independent directors in executive sessions or outside of Board meetings;

•providing the Chairman with feedback and counsel concerning the Chairman’s interactions with the Board;

•working with the Chairman to develop and approve Board meeting agendas and meeting schedules;

•working with the Chairman on the appropriateness (including quality and quantity) and timeliness of information provided to the Board;

•authorizing the retention of advisors and consultants who report directly to the Board when appropriate;

•in consultation with the Nominating and Governance Committee, reviewing and reporting on the results of the Board performance self-evaluations;

•at least annually, meeting individually with independent directors to discuss Board and committee performance, effectiveness and composition; and

•if appropriate, and in coordination with management, being available for consultation and direct communication with major shareholders.

For 2024, the Board decided to continue with a leadership structure composed of a combined Chairman and CEO partnered with a strong Lead Director. Having one leader with deep industry experience and Company knowledge in a combined Chairman and CEO role provides clear accountability and decisive and effective leadership. Working alongside a strong Lead Director, this structure also allows the independent Directors to appropriately challenge management and demonstrate the independence and free thinking necessary for effective oversight. The Board believes there is no single leadership structure that is optimal in all circumstances. Instead, the Board considers the most appropriate leadership structure to provide responsible oversight and create long-term value for our shareholders in the context of the specific circumstances and challenges facing the Company. The Board will continue to monitor Board leadership. considering what it observes in the marketplace, the evolution of viewpoints in the corporate governance community and, most importantly, what the Board believes is in the best interests of our Company and its shareholders.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 20 | 2025 Proxy Statement |

Director Independence

Seven of Kontoor’s current directors are non-employee directors. Under the NYSE listing standards, no director qualifies as “independent” unless the Board affirmatively determines that the director has no material relationship with the company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company). The Board has adopted categorical standards for director independence, which are part of the Corporate Governance Principles, to assist it in making determinations of independence. In evaluating the independence of directors, the Board considered transactions and relationships between each director and members of his or her immediate family members with the Company. When considering commercial transactions that are made from time to time in the ordinary course of business between Kontoor and certain entities affiliated with non-management directors, transactions are not considered to be a material transaction that would impair the independence of the relevant non-management director if the director is an executive officer or employee of another company that does business with

Kontoor in an amount which, in any single fiscal year for the past three fiscal years, is less than the greater of $1 million or 2% of such other company’s consolidated gross revenues.

The Board has determined that all of our non-employee directors are free of any material relationship with Kontoor, other than their service as directors, and are “independent” directors both under the NYSE listing standards and the categorical standards adopted by the Board. The Board determined that Ms. Campbell, Ms. Goldsmith, Mr. Lynch, Mr. Page, Mr. Schiller, Mr. Shearer and Mr. Stewart are independent directors, and that Mr. Baxter is not an independent director. In determining that Ms. Goldsmith was independent, the Board considered her role at Workday, Inc., which is a supplier to Kontoor. Ms. Goldsmith has served as Chief People Officer of Workday since 2013. During fiscal 2024, Kontoor continued its commercial relationship with Workday, paying Workday approximately $1.82 million for goods and services (which represented about 0.02% of Workday’s gross revenues). The transactions with Workday were conducted in arms’ length transactions in the normal and ordinary course of Kontoor’s business.

Annual Board and Committee Evaluation Process

The Board, Audit Committee, Nominating and Governance Committee, and Talent and Compensation Committee conduct an annual evaluation to determine whether the Board is functioning effectively both at the Board and at the committee levels. The Board recognizes that a robust evaluation process is essential to Board effectiveness, which is in turn critical for ensuring that the Company has a comprehensive long-term business strategy, prudent risk management and sound governance. The Nominating and Governance Committee oversees an annual evaluation process in coordination with the Lead Director.

Each director completes a detailed written annual evaluation of the Board and the committees on which he or she serves and the Lead Director conducts one-on-one interviews with each of the directors. These Board evaluations are designed to elicit feedback on the composition, dynamics, operations and structure of the Board and its committees, and to determine whether the Board and its committees are functioning effectively. The process also evaluates the relationship between management and the Board, including the level of access to management, responsiveness of management, and the effectiveness of the Board’s evaluation of management performance. The results of this Board evaluation are discussed by the full Board and changes to the Board’s and its committees’ practices are implemented as appropriate.

The Board is committed to self-improvement and in 2024, at the recommendation of the Nominating and Governance Committee, the Board adopted a self-assessment process that was facilitated by an independent consultant which included an assessment questionnaire and interview with each director. Each director also completed a detailed written annual evaluation of the committee(s) on which he or she serves. The process also evaluated the relationship between management and the Board, including the level of access to management, responsiveness of management, and the effectiveness of the Board’s evaluation of management performance. The results of the independent evaluation were compiled by the independent consultant, and a written report was given to the Chair of the Nominating and Governance Committee and the Lead Director. Changes to the Board’s and its committees’ practices are being implemented as appropriate.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 21 | 2025 Proxy Statement |

Board Meetings and Attendance

During 2024, the Board held five meetings. Under Kontoor’s Corporate Governance Principles, directors are expected to attend all meetings of the Board, all meetings of committees of which they are members and the annual meeting of shareholders. All eight members of the Board then in office attended the 2024 annual meeting of shareholders. Each current member of the Board then in office attended more than 85% of the total number of meetings of the Board and all committees on which he or she served during 2024.

Executive Sessions

To promote open discussion among the non-management directors, those directors meet in executive session without management present on a regular basis. At least once per year, such an executive session is held to review the report of the outside auditors, the criteria upon which the performance of the Chief Executive Officer and other senior managers is based, the performance of the Chief Executive Officer against such criteria, and the compensation of the Chief Executive Officer and other senior managers. Additional executive sessions or meetings of non-management directors may be held from time to time as needed. Executive sessions or meetings are held at each Board meeting with the Lead Director for a general discussion of relevant subjects. At least one meeting or executive session of non-management directors per year shall include only independent directors. During 2024, the non-management directors met in executive session without management present four times. Mr. Shearer, the Lead Director, currently presides over executive sessions.

Board Committees

Each of the Audit Committee, the Nominating and Governance Committee and the Talent and Compensation Committee of the Board is governed by a written charter approved by the Board. Each of these committees is required to perform an annual self-evaluation, and each committee may engage outside independent advisors as the committee deems appropriate. The Board has determined that each of the members of the Audit Committee, the Nominating and Governance Committee and the Talent and Compensation Committee is independent. The Board has also created a Strategy and Finance Committee governed by a Board approved written charter. A brief description of the responsibilities of the Audit Committee, the Nominating and Governance Committee, the Talent and Compensation Committee and the Strategy and Finance Committee follows.

Audit Committee

The Audit Committee is a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. The Audit Committee monitors and makes recommendations to the Board concerning the financial policies and procedures to be observed in the conduct of Kontoor’s affairs. Its duties include:

•selecting the independent registered public accounting firm for Kontoor;

•reviewing the scope of the audit to be conducted by the independent registered public accounting firm;

•meeting with the independent registered public accounting firm concerning the results of its audit and Kontoor’s selection and disclosure of critical accounting policies;

•reviewing with management and the independent registered public accounting firm Kontoor’s annual and quarterly reports prior to filing with the SEC);

•overseeing the scope and adequacy of Kontoor’s system of internal control over financial reporting;

•reviewing the status of compliance with laws, regulations and internal procedures, contingent liabilities and risks that may be material to Kontoor;

•reviewing and assessing, and discussing with management, Kontoor’s cybersecurity, information security and technology risks, and Kontoor’s policies and procedures to monitor, manage and mitigate those risks;

•preparing a report to shareholders annually for inclusion in the Proxy Statement; and

•serving as the principal liaison between the Board and Kontoor’s independent registered public accounting firm.

| | | | | | | | |

| | |

| Kontoor Brands, Inc. | 22 | 2025 Proxy Statement |

As of the date of this Proxy Statement, the members of the Audit Committee are Messrs. Shearer (Chair), Page, and Schiller and Ms. Campbell. The Audit Committee held six meetings during 2024. The Board has determined that all of the members of the Audit Committee are independent as independence for audit committee members is defined in the NYSE listing standards and the SEC regulations and that all are financially literate. The Board has further determined that Messrs. Shearer, Page and Schiller each qualify as an “audit committee financial expert” in accordance with the definition of such term in the SEC regulations and have accounting and related financial management expertise within the meaning of the NYSE listing standards. Messrs. Shearer, Page and Schiller acquired those attributes through acting as or actively overseeing a principal financial officer or principal accounting officer of a public company. Messrs. Shearer, Page and Schiller also have experience overseeing or assessing the performance of companies with respect to the evaluation of financial statements. No Audit Committee member currently serves on the audit committees of more than three public companies.

Nominating and Governance Committee

The responsibilities of the Nominating and Governance Committee include:

•recommending to the Board criteria for Board membership, identifying potential candidates for director and recommending candidates to the Board;

•overseeing Kontoor’s significant strategies and programs, policies and practices relating to ESG issues;

•making recommendations to the Board on matters of Chief Executive Officer succession in the event of an emergency or retirement;