Exhibit (a)(1)(B)

WHITE ASSIGNMENT FORM

FOR POSITION HOLDER TRUST INTERESTS

OF

LIFE PARTNERS POSITION HOLDER TRUST

| Position Holder Trust Beneficiary |

| Name of Holder: | |

| Capacity (Title) of Authorized Representative (if applicable): | |

| Signature: | |

| Date: | |

| Tax Identification Number: | |

| Email Address: | |

| Telephone Number: | |

| Co-Owner (if applicable) |

| Name: | |

| Signature: | |

| Date: | |

| Tax Identification Number: | |

| Number of Position Holder Trust Interests (Interests) |

| Number of Interests Held: | |

| Number of Interests Being Tendered, Sold and Assigned: | |

| Note: | If you execute this Assignment Form, but do not specify the number of Interests to be tendered, sold and assigned, you will be deemed to have elected to tender, sell and assign all of the Interests that you own. |

TO THE HOLDERS OF POSITION HOLDER TRUST INTERESTS:

This Assignment Form is to be used to participate in the Offer (the “Offer”) of CFunds Life Settlement, LLC (referred to as “Offeror”) to acquire up to 71,635,237 position holder trust interests (referred to as “Interests”) of the Life Partners Position Holder Trust (referred to as the “Trust”) for a cash amount of $0.14 per Interest (subject to certain deductions, including any liens, premiums, fees or catchup payments owed, if applicable). By signing this Assignment Form in the place(s) provided above, you are agreeing to tender, sell and assign to Offeror the number of Interests that you specify above (or if you do not specify a number of Interests, all of the Interests that you hold) to Offeror. In order to receive payment for your Interests, your executed Assignment Form (and any other required documents) must be received by the Depositary for the Offer no later than 5:00 p.m., New York City time, on Monday, December 7, 2020. You should also complete a Form W-9, in the form provided, or other appropriate tax form to prevent backup withholding. See paragraph 7 below.

The Offer is only for the Interests received from the bankruptcy court specifically for polices you elected to contribute to the Trust. The Offer is not based on the amount you invested nor is it for policies you continue to pay premiums on.

The offer price of $0.14 per Interest represents a discount of approximately 26.3% from the net asset value of $0.19 per Interest on June 30, 2020, as disclosed in the Trust and Partnership’s last quarterly report on Form 10-Q filed with the Securities and Exchange Commission on August 13, 2020. The offer price takes into account, in our opinion, the many years it will take for the Trust to liquidate its assets and distribute the proceeds to its investors. According to the Trust’s public filings, the Trust was originally anticipated to terminate by December 2026, but the Bankruptcy Court can extend its life no more than four times, with each extension not exceeding five years, or potentially an additional 20 years. While the Partnership does not have an established termination date, the Partnership has disclosed in its public filings that it expects to be wound down by the Trustee as Manager when the liquidation of the Trust is complete.

If you have any questions regarding the Offer, please contact the Offeror’s representatives, as follows: Rhoda Freeman at freeman@contrariancapital.com or John Bright at jbright@contrariancapital.com, or call (800) 266-3810.

You may also contact the representatives of Sanford Scott & Company, as follows: Mike Knowles at mbk@asmcapital.com, or call (516) 422-7101, or Seth Moskowitz at scm@asmcapital.com, or call (516) 422-7111.

The address for delivery of the Assignment Form and the IRS Form W-9 (and any other required documents) is:

| If delivering by mail, hand, overnight or courier to the Depositary: |

Continental Stock Transfer & Trust Company

Attn: Corporate Actions

1 State Street, 30th Floor New York, New York 10004 |

For your convenience, if you were mailed a copy of the Offer, a self-addressed envelope is included for use in returning the Assignment Form and the IRS Form W-9 (and any other required documents) to the Depositary.

You may also deliver your Assignment Form and IRS Form W-9 by fax to the Depositary, as follows:

If delivering by fax to the Depositary: Continental Stock Transfer & Trust Company Reference: Life Partners Tender Offer Fax No.: (212) 616-7610 |

The Assignment Form and IRS Form W-9 (or other appropriate tax form) may also be emailed to the Offeror, as follows: Rhoda Freeman at freeman@contrariancapital.com or John Bright at jbright@contrariancapital.com, or Sanford Scott & Company, as follows: Mike Knowles at mbk@asmcapital.com or Seth Moskowitz at scm@asmcapital.com, who will then forward such documentation to the Depositary.

You may also deliver your Assignment Form and IRS Form W-9 (or other appropriate tax form) to the Depositary via a secure website. Please type the following URL into your internet browser to access the upload area: https://cstt.citrixdata.com/r-re8715e7bcef4efd8. Note, when providing your information, we cannot accept “automated Word font signatures” and if using an electronic utility to gather a signature (such as Docusign) we will need the certificate of completion, as well. Additionally, in order to avoid processing delays, kindly label your documents with your name and date.

Delivery of this Assignment Form, the IRS Form W-9 or any other required documents to an address other than as set forth above does not constitute valid delivery. The method of delivery of all documents is at the election and risk of the tendering Interest holder.

By signing and returning this Assignment Form, you acknowledge, represent, warrant and agree as follows:

| 1. | Offer to Purchase. You understand that the Offer is being made in accordance with the Offer to Purchase, dated October 28, 2020 of Offeror. The Offer is subject to the terms and conditions that are set forth in the Offer to Purchase. You acknowledge that you have received the Offer to Purchase and that you have had an opportunity to read the Offer to Purchase, and to discuss the Offer and the Offer to Purchase with your advisors, if you chose to do so. |

| 2. | Acceptance for Payment. Provided that the conditions to the Offer are satisfied, Offeror will accept the Interests that you tender for payment following expiration of the Offer, as described in the Offer to Purchase. The number of Interests that you are tendering is set forth by you in the space provided above, but if you sign the Assignment Form and do not specify the number of Interests, you will be deemed to have tendered all of the Interests that you hold. If the Offer is oversubscribed with respect to the Interests, the Interests we accept for payment from you and all other tendering holders will be prorated as described in the Offer to Purchase. |

| 3. | Sale of the Interests. You agree and acknowledge that, effective upon acceptance for payment by Offeror of the Interests that you are tendering as provided in the Offer to Purchase, you are selling, assigning and transferring to Offeror all ownership, rights, title and interests in and to tendered Interests as of such date, notwithstanding that the recordation of transfer may not occur until a later date in accordance with the practices and procedures of the Trust. You further agree and acknowledge that if the conditions to the Offer are satisfied and the Offer is consummated, you will be deemed to have assigned all your tendered Interests to the Offeror, and that you authorize the Offeror to direct the Trustee to record, or cause to be recorded, on the books and records of the Trust, the assignment of the tendered Interests to the Offeror as it directs, effective as of December 31, 2020. |

| 4. | Ownership of Interests. You represent and warrant that: |

| · | you own the Interests that you are tendering of record and beneficially and that you have not previously sold or assigned the Interests; |

| · | you have full power and authority to validly tender, sell, assign, and transfer the Interests that you are tendering; |

| · | if there are any liens on your Interests or you owe any premiums, fees or catchup payments to the Trust, or any agent acting on behalf of the Trust, in respect of any of your tendered Interests, by your tender thereof, you are authorizing and directing Offeror to apply the requisite portion of the purchase price for the tendered Interests to the payment and discharge of such liens, premiums, fees or catchup payments on your behalf; |

| · | upon discharge of any such liens, premiums, fees or catchup payments using a portion of the purchase price for the tendered Interests, when the tendered Interests are purchased by Offeror, no person, including the Trustee, will have the right to assert a claim of any kind against Offeror with respect to the Interests, including (but not limited to) any claim by way of a lien, charge, offset or other encumbrance or any claim of beneficial ownership, option or other right that you may have granted with respect to the Interests; except that no holder shall waive or release the Offeror from any law, rule or regulation arising under the Exchange Act of 1934, as amended, and any rule of a self-regulatory organization in connection therewith; |

| · | the Offeror shall not assume any obligations or liabilities, including, without limitation, any premiums, fees, or catchup payments, to the Debtors, Trust, Partnership, or any third party in respect of the Interests (other than to pay amounts deducted from the purchase price as aforesaid); |

| · | if you are submitting this Assignment Form in a representative capacity, for example as an officer of a corporation or a trustee of a trust, you have provided a true and accurate statement of your capacity and you are fully authorized to submit this Assignment Form in that capacity; |

| · | in connection with the sale and assignment of your tendered Interests, you are also selling and assigning all claims, causes of action, or other rights that you may have with respect to your tendered Interests; and |

| · | you will take no action to sell, assign or transfer the Interests that you tender and that have been accepted for payment to any person other than the Offeror, notwithstanding that the recordation of assignment of the Interests to the Offeror may not occur until a later date, and any such sale, assignment or transfer shall be null, void and of no effect. |

| 5. | Bad Actor Disqualification. You represent and warrant that you have not been convicted of, or subject to court or administrative sanctions for, securities fraud or other violations of U.S Federal securities laws. |

| 6. | Payment. You understand that payment for your tendered Interests will be made by check mailed to you at your address set forth on the books and records of the Trust. If you think that address may be in error, you should promptly contact the Trust to ensure that the books and records of the Trust reflect your correct address. Payment will be made as promptly as practicable following expiration of the Offer, in accordance with the requirements of the federal securities laws. |

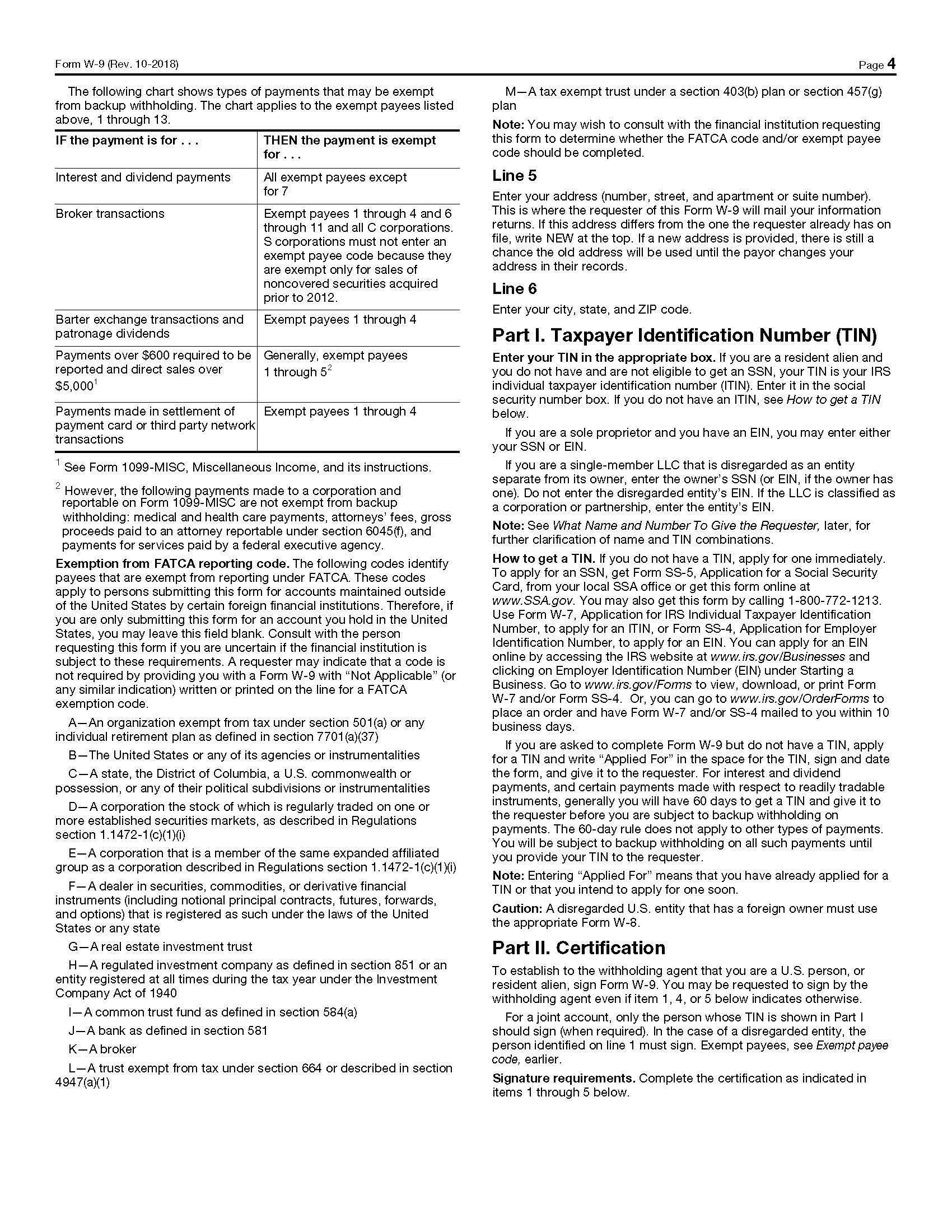

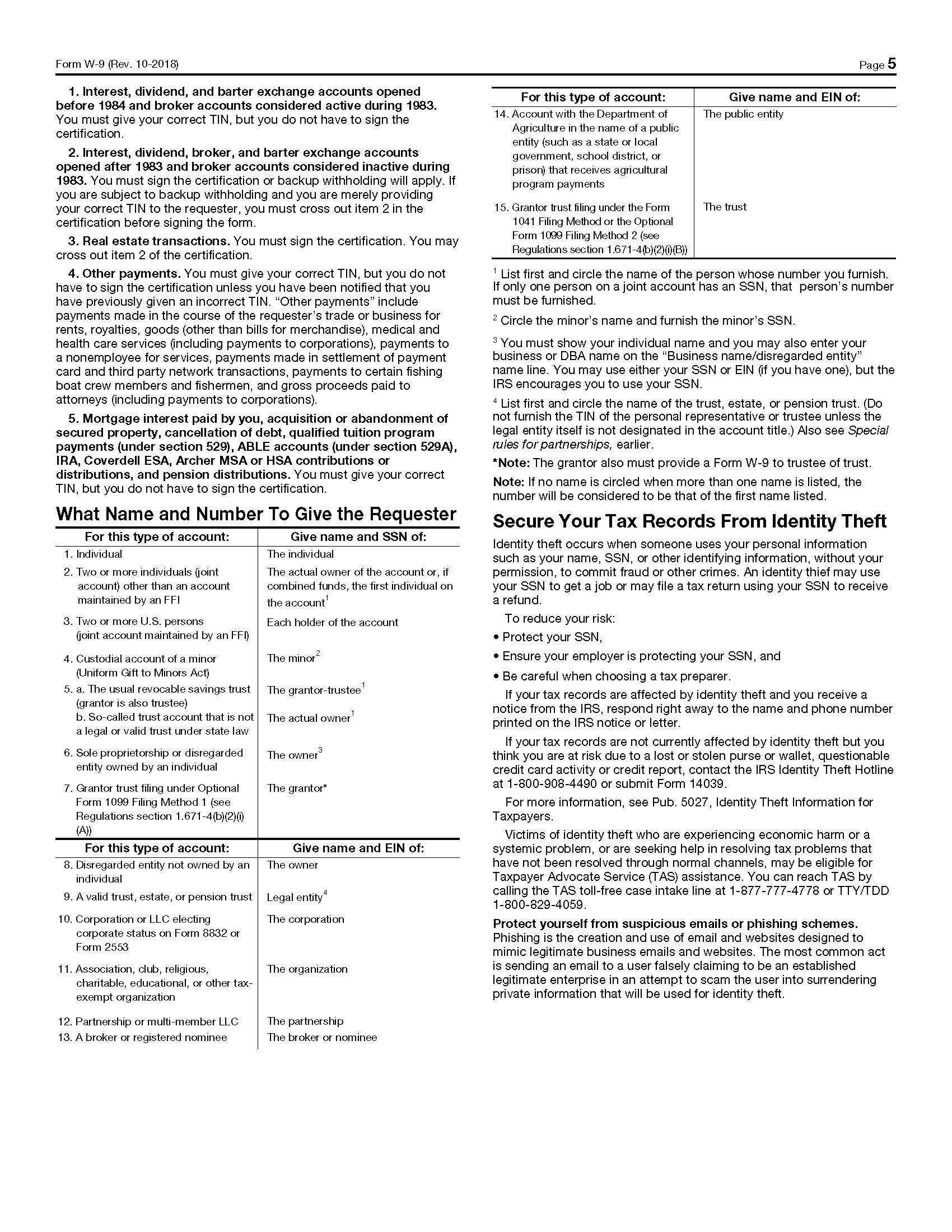

| 7. | Form W-9. If you do not complete the Form W-9 provided below, Offeror may be required to withhold, pursuant to the rules and regulations of the Internal Revenue Service, up to 24% of the payment to which you are entitled. For instructions on completing the Form W-9, see https://www.irs.gov/instructions/iw9. If you are not a United States person, in order to avoid withholding of any portion of the payment to which you are entitled, you will be required to complete the appropriate Form W-8. For information on obtaining and completing the appropriate Form W-8, please see https://www.irs.gov/pub/irs-pdf/iw8.pdf. |

To avoid any tax withholding, a U.S. holder must provide Internal Revenue Service Form W-9, and a non-U.S. holder must provide the applicable Internal Revenue Service Form W-8 or other appropriate tax form.

| 8. | Power of Attorney. Upon acceptance of the Interests for payment, you irrevocably constitute and appoint Offeror or its designees, each with full power of substitution, as your agent and attorney in-fact with respect to your tendered Interests, with full power of substitution, to deliver the Interests to the Trust for transfer, and to transfer ownership of such Interests on the books and records of the Trust, together with all accompanying evidence of transfer and authenticity; to change the address of record for distributions with respect to the tendered Interests to the address of Offeror; and to receive all benefits, and otherwise exercise all rights of beneficial ownership of the tendered Interests, all in accordance with the terms of the Offer. You understand that this power of attorney is an irrevocable power coupled with an interest. |

| 9. | Revocation of Proxies and Consents. You agree and represent that all prior powers of attorney, proxies and consents that you may have given with respect to the tendered Interests will be revoked with respect to Interests accepted by us for payment, and that you will give no subsequent powers of attorney, proxies or consents (and if given will not be deemed effective). |

| 10. | Assignment of Distributions. By executing this Assignment Form, you assign to Offeror all of your rights to receive all dividends, distributions and other remittances from the Trust with respect to the tendered Interests that are paid based on a record date occurring from and after the time of acceptance of the Interests for payment pursuant to the Offer, even if the assignment of the Interests has not been recorded on the register of ownership maintained on behalf of the Trust for this purpose. |

| 11. | Exculpation. You agree to exculpate, and to waive and release any claims or causes of action you may have against, the Trust, the board members of the Trust, the trustee of the Trust, counsel to the Trust, and Magna Servicing LLC, the current servicer for the Trust, and NorthStar Life Services, LLC, which will replace Magna Servicing, LLC as servicer for the Trust commencing November 1, 2020, and their respective affiliates, that relate to your sale, assignment and transfer of the tendered Interests or any other actions contemplated by this Assignment Form. You acknowledge that each of these persons is a beneficiary of this exculpation, waiver and release and may enforce this exculpation, waiver and release independently from Offeror. You are not, however, waiving any non-waivable claims you may have under applicable federal and state securities laws. |

| 12. | Further Documents. Upon request, you agree to execute and deliver any additional documents that Offeror believes are necessary or desirable to complete the assignment, transfer, and purchase of such Interests. In particular, if you are executing this Assignment Form in a representative capacity or as an attorney-in-fact, you may be required upon request of Offeror to furnish documentary evidence of your authority to do so. For example, if you are signing as an officer of a corporation, you may be required to submit an officer’s certificate to evidence your authority. If you are signing as a trustee of a trust, you may be required to submit a certificate of incumbency. |

| 13. | Binding Agreement. You understand that a tender of Interests to Offeror, and this Assignment Form, constitute a binding agreement between you and Offeror upon the terms, and subject to the conditions, that are described in the Offer to Purchase and this Assignment Form. |

| 14. | Survival. All the authority that you are conferring or have agreed to confer in this Assignment Form, and all other agreements, representations, and warranties in this Assignment Form, will survive your death or incapacity, and all such authority, agreements, representations, and warranties will be binding upon your heirs, personal representatives, successors and assigns. |

| 15. | No Waiver. Each of you and Offeror are not waiving, and expressly reserve, any non-waivable rights it may have under federal or state securities laws, rules, and regulations. |

| 16. | Governing Law. The agreements in this Assignment Form will be interpreted, construed, and governed according to federal securities laws and the laws of the State of Texas, as applicable. All matters relating to arbitration will be governed by the Federal Arbitration Act. |

CFUNDS LIFE SETTLEMENT, LLC

The Depositary for the Offer is:

The address for delivery of the Assignment Form and the IRS Form W-9 (and any other required documents) is:

| If delivering by mail, hand, overnight or courier to Depositary: |

Continental Stock Transfer & Trust Company

Attn: Corporate Actions

1 State Street, 30th Floor New York, New York 10004 |

You may also deliver your Assignment Form and IRS Form W-9 by fax to the Depositary, as follows:

If delivering by fax to the Depositary: Continental Stock Transfer & Trust Company Reference: Life Partners Tender Offer Fax No.: (212) 616-7610 |

The Assignment Form and IRS Form W-9 (or other appropriate tax form) may also be emailed to the Offeror, as follows: Rhoda Freeman at freeman@contrariancapital.com or John Bright at jbright@contrariancapital.com or Sanford Scott & Company, as follows: Mike Knowles at mbk@asmcapital.com or Seth Moskowitz at scm@asmcapital.com, who will then forward such documentation to the Depositary.

You may also deliver your Assignment Form and IRS Form W-9 (or other appropriate tax form) to the Depositary via a secure website. Please type the following URL into your internet browser to access the upload area: https://cstt.citrixdata.com/r-re8715e7bcef4efd8. Note, when providing your information, we cannot accept “automated Word font signatures” and if using an electronic utility to gather a signature (such as Docusign) we will need the certificate of completion, as well. Additionally, in order to avoid processing delays, kindly label your documents with your name and date.

DELIVERY WILL BE DEEMED MADE ONLY WHEN DOCUMENTS ARE ACTUALLY RECEIVED BY THE DEPOSITARY. IF DELIVERY IS BY MAIL, IT IS RECOMMENDED THAT ALL SUCH DOCUMENTS BE SENT BY REGISTERED MAIL WITH RETURN RECEIPT REQUESTED, PROPERLY INSURED. IN ALL CASES, SUFFICIENT TIME SHOULD BE ALLOWED TO ENSURE TIMELY DELIVERY.

Any questions or requests for assistance or additional copies of the Offer to Purchase and this Assignment Form may be directed to the Offeror’s representatives, as follows: Rhoda Freeman at freeman@contrariancapital.com or John Bright at jbright@contrariancapital.com, or call (800) 266-3810.

You may also contact the representatives of Sanford Scott & Company, as follows: Mike Knowles at mbk@asmcapital.com, or call (516) 422-7101, or Seth Moskowitz at scm@asmcapital.com, or call (516) 422-7111.