UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2022

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to ______________

Commission File Number: 001-40602

ERASCA, INC.

(Exact Name of Registrant as Specified in its Charter)

| |

Delaware | 83-1217027 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

3115 Merryfield Row, Suite 300 San Diego, CA | 92121 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (858) 465-6511

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.0001 par value per share | | ERAS | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | |

Non-accelerated filer | | ☑ | | Smaller reporting company | | ☑ |

| | | | | | |

Emerging growth company | | ☑ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of August 4, 2022, the registrant had 122,147,003 shares of common stock outstanding.

Table of Contents

i

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Erasca, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share and par value amounts)

(Unaudited)

| | | | | | | | |

| | June 30, | | | December 31, | |

| | 2022 | | | 2021 | |

Assets | | | | | | |

Current assets: | | | |

Cash and cash equivalents | | $ | 298,007 | | | $ | 360,487 | |

Short-term marketable securities | | | 73,469 | | | | 53,988 | |

Prepaid expenses and other current assets | | | 9,945 | | | | 5,542 | |

Total current assets | | | 381,421 | | | | 420,017 | |

Long-term marketable securities | | | 19,313 | | | | 44,770 | |

Property and equipment, net | | | 24,191 | | | | 15,954 | |

Operating lease assets | | | 14,778 | | | | 17,356 | |

Restricted cash | | | 408 | | | | 408 | |

Other assets | | | 4,712 | | | | 2,910 | |

Total assets | | $ | 444,823 | | | $ | 501,415 | |

Liabilities and Stockholders' Equity | | | | | | |

Current liabilities: | | | | | | |

Accounts payable | | $ | 2,291 | | | $ | 4,677 | |

Accrued expenses and other current liabilities | | | 19,827 | | | | 21,419 | |

Operating lease liabilities | | | 201 | | | | 285 | |

Total current liabilities | | | 22,319 | | | | 26,381 | |

Operating lease liabilities, net of current portion | | | 27,437 | | | | 18,506 | |

Total liabilities | | | 49,756 | | | | 44,887 | |

Commitments and contingencies (Note 12) | | | | | | |

Stockholders' equity: | | | | | | |

Preferred stock, $0.0001 par value; 80,000,000 shares authorized as of June 30, 2022 and December 31, 2021; 0 shares issued and outstanding as of June 30, 2022 and December 31, 2021 | | | — | | | | — | |

Common stock, $0.0001 par value; 800,000,000 shares authorized as of June 30, 2022 and December 31, 2021; 122,063,473 and 121,382,547 shares issued at June 30, 2022 and December 31, 2021, respectively; 120,545,318 and 119,102,505 shares outstanding at June 30, 2022 and December 31, 2021, respectively | | | 12 | | | | 12 | |

Additional paid-in capital | | | 706,510 | | | | 694,844 | |

Accumulated other comprehensive loss | | | (1,223 | ) | | | (162 | ) |

Accumulated deficit | | | (310,232 | ) | | | (238,166 | ) |

Total stockholders' equity | | | 395,067 | | | | 456,528 | |

Total liabilities and stockholders' equity | | $ | 444,823 | | | $ | 501,415 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

Erasca, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Operating expenses: | | | | | | | |

Research and development | | $ | 27,488 | | | $ | 17,598 | | | $ | 54,917 | | | $ | 29,843 | |

In-process research and development | | | — | | | | 5,488 | | | | 2,000 | | | | 9,168 | |

General and administrative | | | 8,417 | | | | 5,098 | | | | 15,493 | | | | 8,780 | |

Total operating expenses | | | 35,905 | | | | 28,184 | | | | 72,410 | | | | 47,791 | |

Loss from operations | | | (35,905 | ) | | | (28,184 | ) | | | (72,410 | ) | | | (47,791 | ) |

Other income (expense) | | | | | | | | | | | | |

Interest income | | | 388 | | | | 31 | | | | 502 | | | | 61 | |

Other expense | | | (91 | ) | | | (61 | ) | | | (158 | ) | | | (116 | ) |

Change in fair value of preferred stock purchase right liability | | | — | | | | — | | | | — | | | | 1,615 | |

Total other income (expense), net | | | 297 | | | | (30 | ) | | | 344 | | | | 1,560 | |

Net loss | | $ | (35,608 | ) | | $ | (28,214 | ) | | $ | (72,066 | ) | | $ | (46,231 | ) |

Net loss per share, basic and diluted | | $ | (0.30 | ) | | $ | (1.20 | ) | | $ | (0.60 | ) | | $ | (2.02 | ) |

Weighted-average shares of common stock used in computing net loss per share, basic and diluted | | | 120,193,973 | | | | 23,546,390 | | | | 119,844,633 | | | | 22,893,533 | |

Other comprehensive income (loss): | | | | | | | | | | | | |

Unrealized loss on marketable securities, net | | | (272 | ) | | | (2 | ) | | | (1,061 | ) | | | (3 | ) |

Comprehensive loss | | $ | (35,880 | ) | | $ | (28,216 | ) | | $ | (73,127 | ) | | $ | (46,234 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Erasca, Inc.

Condensed Consolidated Statements of Convertible Preferred Stock and Stockholders’ Equity

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | Accumulated | | | | | | | |

| | Convertible | | | | | | | | | Additional | | | Other | | | | | | Total | |

| | Preferred Stock | | | Common Stock | | | Paid-in | | | Comprehensive | | | Accumulated | | | Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Income (Loss) | | | Deficit | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2021 | | | — | | | $ | — | | | | 121,382,547 | | | $ | 12 | | | $ | 694,844 | | | $ | (162 | ) | | $ | (238,166 | ) | | $ | 456,528 | |

Exercise of stock options | | | — | | | | — | | | | 357,244 | | | | — | | | | 460 | | | | — | | | | — | | | | 460 | |

Vesting of early exercised stock options | | | — | | | | — | | | | — | | | | — | | | | 479 | | | | — | | | | — | | | | 479 | |

Repurchases of early exercised stock options and restricted stock | | | — | | | | — | | | | (6,945 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Stock-based compensation expense | | | — | | | | — | | | | — | | | | — | | | | 4,442 | | | | — | | | | — | | | | 4,442 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (36,458 | ) | | | (36,458 | ) |

Unrealized loss on marketable securities, net | | | — | | | | — | | | | — | | | | — | | | | — | | | | (789 | ) | | | — | | | | (789 | ) |

Balance at March 31, 2022 | | | — | | | $ | — | | | | 121,732,846 | | | $ | 12 | | | $ | 700,225 | | | $ | (951 | ) | | $ | (274,624 | ) | | $ | 424,662 | |

Exercise of stock options | | | — | | | | — | | | | 179,985 | | | | — | | | | 375 | | | | — | | | | — | | | | 375 | |

Issuance of common stock under the Employee Stock Purchase Plan | | | — | | | | — | | | | 150,642 | | | | — | | | | 617 | | | | — | | | | — | | | | 617 | |

Vesting of early exercised stock options | | | — | | | | — | | | | — | | | | — | | | | 238 | | | | — | | | | — | | | | 238 | |

Stock-based compensation expense | | | — | | | | — | | | | — | | | | — | | | | 5,055 | | | | — | | | | — | | | | 5,055 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (35,608 | ) | | | (35,608 | ) |

Unrealized loss on marketable securities, net | | | — | | | | — | | | | — | | | | — | | | | — | | | | (272 | ) | | | — | | | | (272 | ) |

Balance at June 30, 2022 | | | — | | | $ | — | | | | 122,063,473 | | | $ | 12 | | | $ | 706,510 | | | $ | (1,223 | ) | | $ | (310,232 | ) | | $ | 395,067 | |

3

Erasca, Inc.

Condensed Consolidated Statements of Convertible Preferred Stock and Stockholders’ Deficit

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | Accumulated | | | | | | | |

| | Convertible | | | | | | | | | Additional | | | Other | | | | | | Total | |

| | Preferred Stock | | | Common Stock | | | Paid-in | | | Comprehensive | | | Accumulated | | | Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Income (Loss) | | | Deficit | | | Deficit | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2020 | | | 69,584,682 | | | $ | 221,405 | | | | 25,189,673 | | | $ | 3 | | | $ | 1,413 | | | $ | 2 | | | $ | (115,402 | ) | | $ | (113,984 | ) |

Issuance of Series B-2 convertible preferred stock for cash, net of $95 in issuance costs | | | 15,931,772 | | | | 119,393 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of common stock in connection with asset acquisition | | | — | | | | — | | | | 500,000 | | | | — | | | | 1,680 | | | | — | | | | — | | | | 1,680 | |

Exercise of stock options | | | — | | | | — | | | | 439,610 | | | | — | | | | 94 | | | | — | | | | — | | | | 94 | |

Vesting of early exercised stock options | | | — | | | | — | | | | — | | | | — | | | | 174 | | | | — | | | | — | | | | 174 | |

Stock-based compensation expense | | | — | | | | — | | | | — | | | | — | | | | 795 | | | | — | | | | — | | | | 795 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (18,017 | ) | | | (18,017 | ) |

Unrealized loss on marketable securities, net | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1 | ) | | | — | | | | (1 | ) |

Balance at March 31, 2021 | | | 85,516,454 | | | $ | 340,798 | | | | 26,129,283 | | | $ | 3 | | | $ | 4,156 | | | $ | 1 | | | $ | (133,419 | ) | | $ | (129,259 | ) |

Issuance of common stock in connection with license agreement | | | — | | | | — | | | | 944,945 | | | | — | | | | 5,488 | | | | — | | | | — | | | | 5,488 | |

Exercise of stock options | | | — | | | | — | | | | 225,895 | | | | — | | | | 180 | | | | — | | | | — | | | | 180 | |

Vesting of early exercised stock options | | | — | | | | — | | | | — | | | | — | | | | 174 | | | | — | | | | — | | | | 174 | |

Stock-based compensation expense | | | — | | | | — | | | | — | | | | — | | | | 1,636 | | | | — | | | | — | | | | 1,636 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (28,214 | ) | | | (28,214 | ) |

Unrealized loss on marketable securities, net | | | — | | | | — | | | | — | | | | — | | | | — | | | | (2 | ) | | | — | | | | (2 | ) |

Balance at June 30, 2021 | | | 85,516,454 | | | $ | 340,798 | | | | 27,300,123 | | | $ | 3 | | | $ | 11,634 | | | $ | (1 | ) | | $ | (161,633 | ) | | $ | (149,997 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Erasca, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | |

| | Six Months Ended June 30, | |

| | 2022 | | | 2021 | |

Cash flows from operating activities: | | | | | | |

Net loss | | $ | (72,066 | ) | | $ | (46,231 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | |

Depreciation and amortization | | | 937 | | | | 318 | |

Stock-based compensation expense | | | 9,497 | | | | 2,431 | |

In-process research and development expenses | | | 2,000 | | | | 9,168 | |

Amortization on marketable securities, net | | | 5 | | | | 46 | |

Change in fair value of preferred stock purchase right liability | | | — | | | | (1,615 | ) |

Changes in operating assets and liabilities: | | | | | | |

Prepaid expenses and other current and long-term assets | | | (4,571 | ) | | | (3,498 | ) |

Accounts payable | | | 14 | | | | 580 | |

Accrued expenses and other current liabilities | | | (646 | ) | | | 4,984 | |

Operating lease assets and liabilities, net | | | 11,883 | | | | (82 | ) |

Net cash used in operating activities | | | (52,947 | ) | | | (33,899 | ) |

| | | | | | |

Cash flows from investing activities: | | | | | | |

Purchases of marketable securities | | | (22,290 | ) | | | (31,911 | ) |

Maturities of marketable securities | | | 27,200 | | | | 42,910 | |

In-process research and development | | | (2,000 | ) | | | (6,000 | ) |

Payment made for investment in equity securities | | | (2,000 | ) | | | — | |

Purchases of property and equipment | | | (11,895 | ) | | | (701 | ) |

Net cash (used in) provided by investing activities | | | (10,985 | ) | | | 4,298 | |

| | | | | | |

Cash flows from financing activities: | | | | | | |

Proceeds from the issuance of convertible preferred stock, net of issuance costs | | | — | | | | 119,393 | |

Proceeds from the exercise of stock options, net of repurchases | | | 835 | | | | 1,324 | |

Proceeds from issuance of common stock under the Employee Stock Purchase Plan | | | 617 | | | | — | |

Net cash provided by financing activities | | | 1,452 | | | | 120,717 | |

| | | | | | |

Net (decrease) increase in cash, cash equivalents and restricted cash | | | (62,480 | ) | | | 91,116 | |

Cash, cash equivalents and restricted cash at beginning of the period | | | 360,895 | | | | 65,688 | |

Cash, cash equivalents and restricted cash at end of the period | | $ | 298,415 | | | $ | 156,804 | |

| | | | | | |

Supplemental disclosure of noncash investing and financing activities: | | | | | | |

Issuance of common stock in connection with asset acquisition | | $ | — | | | $ | 1,680 | |

Issuance of common stock in connection with license agreement | | $ | — | | | $ | 5,488 | |

Amounts accrued for purchases of property and equipment | | $ | 1,178 | | | $ | 101 | |

Vesting of early exercised options | | $ | 717 | | | $ | 348 | |

Amounts accrued for deferred offering costs | | $ | — | | | $ | 1,930 | |

| | | | | | |

Supplemental disclosure of noncash operating activities: | | | | | | |

Operating lease assets obtained in exchange for lease obligation | | $ | 916 | | | $ | — | |

Tenant improvement allowance included in operating lease liabilities | | $ | 6,483 | | | $ | — | |

Reduction in operating lease assets due to lease amendment | | $ | 3,361 | | | $ | — | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Erasca, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1. Organization and basis of presentation

Organization and nature of operations

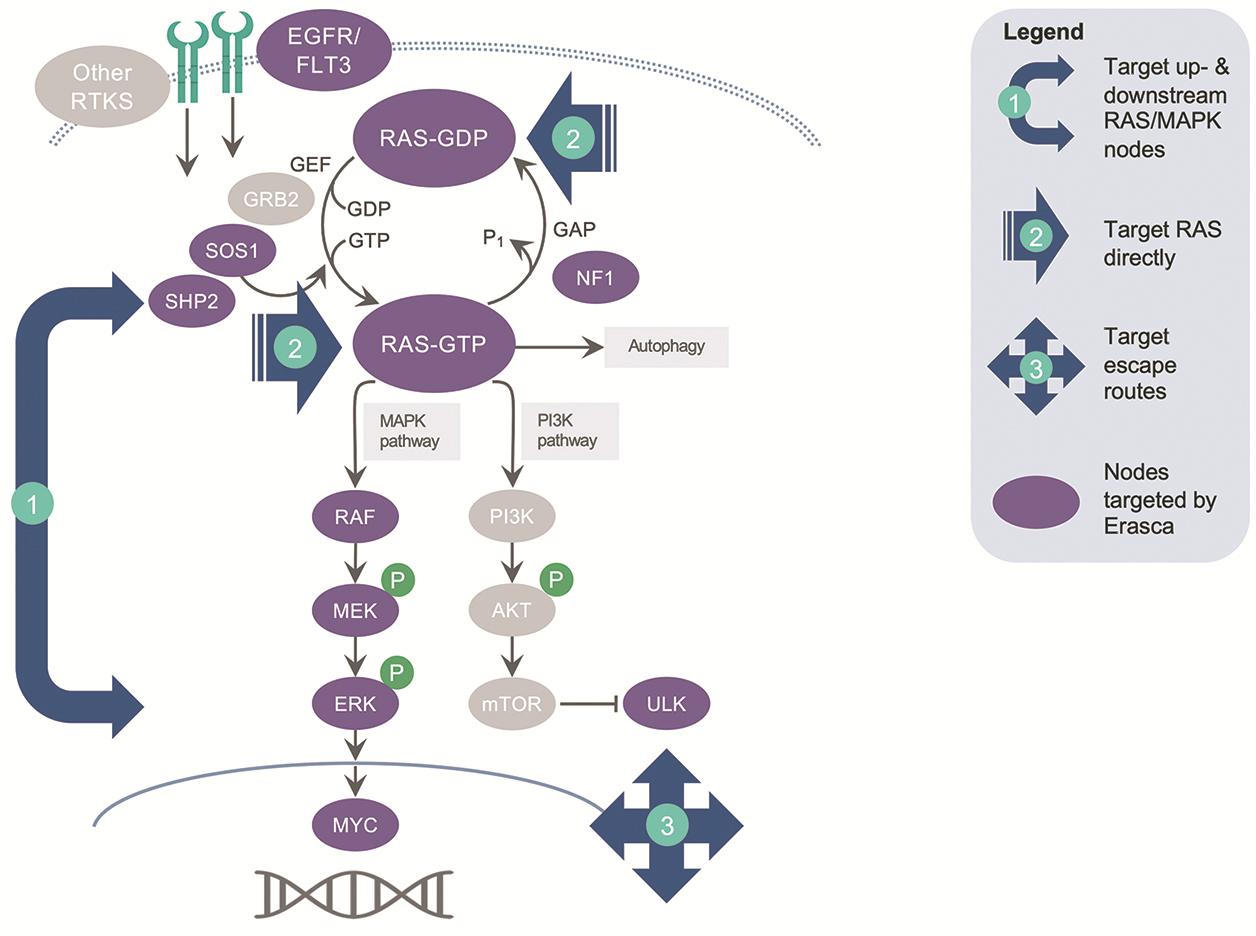

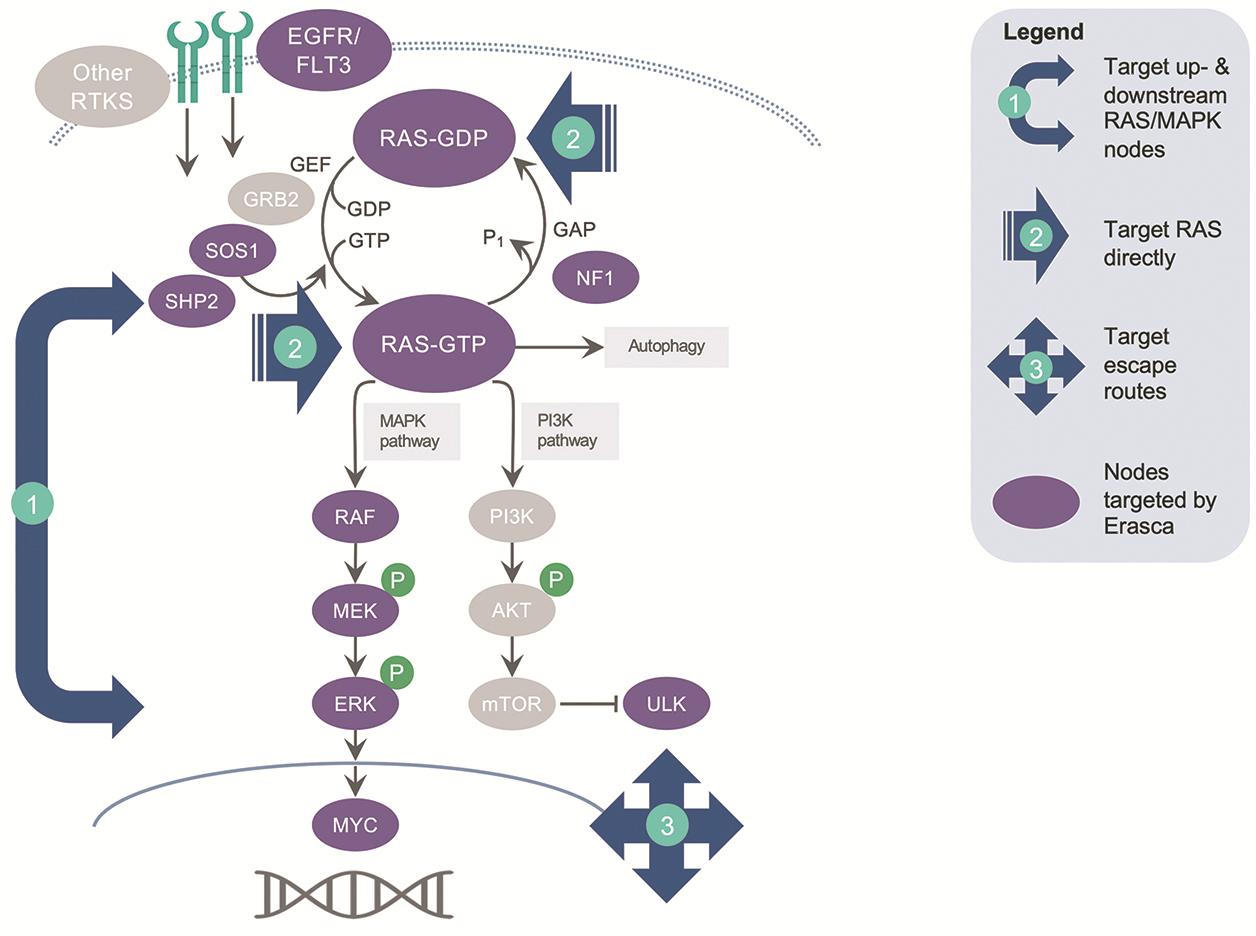

Erasca, Inc. (Erasca or the Company) is a clinical-stage precision oncology company singularly focused on discovering, developing, and commercializing therapies for RAS/MAPK pathway-driven cancers. The Company has assembled a wholly-owned or controlled RAS/MAPK pathway-focused pipeline including 11 disclosed modality-agnostic programs aligned with its three therapeutic strategies of: (i) targeting key upstream and downstream signaling nodes in the RAS/MAPK pathway; (ii) targeting RAS directly; and (iii) targeting escape routes that emerge in response to treatment. The Company was incorporated under the laws of the State of Delaware on July 2, 2018, as Erasca, Inc., and is headquartered in San Diego, California. In September 2020, the Company established a wholly-owned Australian subsidiary, Erasca Australia Pty Ltd (Erasca Australia), in order to conduct clinical activities in Australia for its development candidates. In November 2020, the Company entered into an agreement and plan of merger with Asana BioSciences, LLC (Asana) and ASN Product Development, Inc. (ASN) (the Asana Merger Agreement), pursuant to which ASN became the Company's wholly-owned subsidiary. In March 2021, the Company established a wholly-owned subsidiary, Erasca Ventures, LLC (Erasca Ventures), to make equity investments in early-stage biotechnology companies that are aligned with the Company’s mission and strategy.

Since inception, the Company has devoted substantially all of its efforts and resources to organizing and staffing the Company, business planning, raising capital, identifying, acquiring and in-licensing the Company’s product candidates, establishing its intellectual property portfolio, conducting research, preclinical studies, and clinical trials, establishing arrangements with third parties for the manufacture of its product candidates and related raw materials, and providing general and administrative support for these operations. As of June 30, 2022, the Company had $371.5 million in cash, cash equivalents, and short-term marketable securities, and $19.3 million in long-term marketable securities. As of June 30, 2022, the Company had an accumulated deficit of $310.2 million. The Company has incurred significant operating losses and negative cash flows from operations. From its inception through June 30, 2022, the Company’s financial support has primarily been provided from the sale of its convertible preferred stock and the sale of its common stock in its initial public offering (IPO).

As the Company continues its expansion, it expects to use its cash, cash equivalents, and short-term marketable securities to fund research and development, working capital, and other general corporate purposes. The Company does not expect to generate any revenues from product sales unless and until the Company successfully completes development and obtains regulatory approval for any of its product candidates, which will not be for at least the next several years, if ever. Accordingly, until such time as the Company can generate significant revenue from sales of its product candidates, if ever, the Company expects to finance its cash needs through equity offerings, debt financings, or other capital sources, including potential collaborations, licenses or other similar arrangements. However, the Company may not be able to secure additional financing or enter into such other arrangements in a timely manner or on favorable terms, if at all. The Company’s failure to raise capital or enter into such other arrangements when needed would have a negative impact on the Company’s financial condition and could force the Company to delay, limit, reduce or terminate its research and development programs or other operations, or grant rights to develop and market product candidates that the Company would otherwise prefer to develop and market itself. The Company believes its cash, cash equivalents, and short-term marketable securities as of June 30, 2022 will be sufficient for the Company to fund operations for at least one year from the issuance date of these condensed consolidated financial statements.

Initial public offering

On July 20, 2021, the Company completed its IPO in which the Company issued and sold 21,562,500 shares of its common stock, including the exercise in full by the underwriters of their option to purchase 2,812,500 shares of common stock, at a price to the public of $16.00 per share. Proceeds from the IPO, net of underwriting discounts and commissions of $24.2 million and offering costs of $3.8 million, were $317.0 million. In connection with the completion of the IPO, all outstanding shares of convertible preferred stock were converted into 71,263,685 shares of common stock.

6

Reverse stock split

On July 9, 2021, the Company effected a one-for-1.2 reverse stock split of its issued and outstanding shares of common stock (the Reverse Stock Split). The par value and the number of authorized shares of the convertible preferred stock and common stock were not adjusted as a result of the Reverse Stock Split. All issued and outstanding common stock and the conversion prices and ratio of the convertible preferred stock have been retroactively adjusted to reflect this Reverse Stock Split for all periods presented.

Basis of presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with US generally accepted accounting principles (US GAAP) for interim financial information and pursuant to Form 10-Q and Article 10 of Regulation S-X of the Securities and Exchange Commission (SEC). Accordingly, they do not include all of the information and notes required by US GAAP for complete financial statements. Any reference in these notes to applicable guidance is meant to refer to US GAAP as found in the Accounting Standards Codification (ASC) and Accounting Standards Updates (ASU) promulgated by the Financial Accounting Standards Board (FASB). The Company’s condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Erasca Australia, ASN, and Erasca Ventures. All intercompany balances and transactions have been eliminated.

Note 2. Summary of significant accounting policies

Use of estimates

The preparation of the Company’s condensed consolidated financial statements in conformity with US GAAP requires the Company to make estimates and assumptions that impact the reported amounts of assets, liabilities, expenses, and the disclosure of contingent assets and liabilities in the condensed consolidated financial statements and accompanying notes. Accounting estimates and management judgments reflected in the condensed consolidated financial statements include, but are not limited to, the accrual of research and development expenses, fair value of common stock, preferred stock and freestanding instruments, stock-based compensation expense, and the incremental borrowing rate for determining the operating lease asset and liability. Management evaluates its estimates on an ongoing basis. Although estimates are based on the Company’s historical experience, knowledge of current events, and actions it may undertake in the future, actual results may ultimately materially differ from these estimates and assumptions.

Unaudited interim financial information

The accompanying condensed consolidated balance sheet as of June 30, 2022, the condensed consolidated statements of operations and comprehensive loss for the three and six months ended June 30, 2022 and 2021, the condensed consolidated statements of convertible preferred stock and stockholders’ equity (deficit) for the three and six months ended June 30, 2022 and 2021 and the condensed consolidated statements of cash flows for the six months ended June 30, 2022 and 2021 are unaudited. The unaudited condensed consolidated interim financial statements have been prepared on the same basis as the audited annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for the fair statement of the Company’s condensed consolidated financial position as of June 30, 2022 and the condensed consolidated results of its operations and cash flows for the three and six months ended June 30, 2022 and 2021. The condensed consolidated financial data and other information disclosed in these notes related to the three and six months ended June 30, 2022 and 2021 are unaudited. The condensed consolidated results for the three and six months ended June 30, 2022 are not necessarily indicative of results to be expected for the year ending December 31, 2022, any other interim periods, or any future year or period. These unaudited condensed consolidated financial statements should be read in conjunction with the Company's audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 24, 2022.

7

Concentration of credit risk and off-balance sheet risk

Financial instruments which potentially subject the Company to significant concentration of credit risk consist of cash and cash equivalents and marketable securities. The Company maintains deposits in federally insured financial institutions in excess of federally insured limits. The Company has not experienced any losses in such accounts, and management believes that the Company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held. The Company’s investment policy includes guidelines for the quality of the related institutions and financial instruments and defines allowable investments that the Company may invest in, which the Company believes minimizes the exposure to concentration of credit risk.

Cash, cash equivalents and restricted cash

Cash and cash equivalents include cash in readily available checking and savings accounts, money market funds, and corporate debt securities. The Company considers all highly liquid investments with an original maturity of three months or less from the date of purchase to be cash equivalents.

The Company had deposited cash of $408,000 as of June 30, 2022 and December 31, 2021 to secure a letter of credit in connection with the lease of the Company’s facilities (see Note 11). The Company has classified the restricted cash as a noncurrent asset on its condensed consolidated balance sheets.

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same amounts shown in the condensed consolidated statements of cash flows (in thousands):

| | | | | | | |

| June 30, | |

| 2022 | | | 2021 | |

Cash and cash equivalents | $ | 298,007 | | | $ | 156,396 | |

Restricted cash | | 408 | | | | 408 | |

Total cash, cash equivalents and restricted cash | $ | 298,415 | | | $ | 156,804 | |

Marketable securities and investments

The Company classifies all marketable securities as available-for-sale, as the sale of such securities may be required prior to maturity. Management determines the appropriate classification of its marketable securities at the time of purchase. Marketable securities with original maturities beyond three months at the date of purchase and which mature at, or less than 12 months from, the balance sheet date are classified as short-term marketable securities. Available-for-sale securities are carried at fair value, with the unrealized gains and losses reported as accumulated other comprehensive income (loss) until realized. The amortized cost of available-for-sale debt securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such amortization and accretion are included in interest income. The Company regularly reviews all of its marketable securities for declines in fair value. The review includes the consideration of the cause of the impairment, including the creditworthiness of the security issuers, the number of securities in an unrealized loss position, the severity of the unrealized loss(es), whether the Company has the intent to sell the securities and whether it is more likely than not that the Company will be required to sell the securities before the recovery of their amortized cost basis. If the decline in fair value is due to credit-related factors, a loss is recognized in net income; whereas, if the decline in fair value is not due to credit-related factors, the loss is recorded in other comprehensive income (loss). Realized gains and losses on available-for-sale securities are included in other income or expense. The cost of securities sold is based on the specific identification method. Interest and dividends on securities classified as available-for-sale are included in interest income.

Through its wholly-owned subsidiary, Erasca Ventures, the Company has also invested in equity securities of a company whose securities are not publicly traded and whose fair value is not readily available. This investment is recorded using cost minus impairment, plus or minus changes in its estimated fair value resulting from observable price changes in orderly transactions for the identical or a similar investment of the same issuer. Investments in equity securities without readily determinable fair values are assessed for potential impairment on a quarterly basis based on qualitative factors. This investment is included in other assets in the Company's condensed consolidated balance sheets.

8

Fair value measurements

Certain assets and liabilities are carried at fair value under US GAAP. Fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. Financial assets and liabilities carried at fair value are classified and disclosed in one of the following three levels of the fair value hierarchy, of which the first two are considered observable and the last is considered unobservable:

Level 1—Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

Level 2—Quoted prices for similar assets and liabilities in active markets, quoted prices in markets that are not active, or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability.

Level 3—Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity).

Recently adopted accounting pronouncements

In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (ASU 2016-13) and also issued subsequent amendments to the initial guidance: ASU 2018-19, ASU 2019-04, ASU 2019-05, and ASU 2019-11. The standard requires that credit losses be reported using an expected losses model rather than the incurred losses model that is currently used, and it establishes additional disclosure requirements related to credit risks. For available-for-sale debt securities with expected credit losses, this standard now requires allowances to be recorded instead of reducing the amortized cost of the investment. This guidance was originally effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years, and early adoption was permitted. In November 2019, the FASB subsequently issued ASU 2019-10, Financial Instruments—Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842): Effective Dates, whereby the effective date of this standard for smaller reporting companies was deferred to fiscal years beginning after December 15, 2022, including interim periods within those fiscal years, and early adoption is still permitted. The Company adopted ASU 2016-13, and related updates, on a modified retrospective basis on January 1, 2022, and the adoption had an immaterial impact on its condensed consolidated financial statements and related disclosures.

In August 2020, the FASB issued ASU 2020-06, Debt: Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40) (ASU 2020-06), which simplifies the accounting for convertible instruments and contracts in an entity’s own equity. This guidance is effective for the Company in its annual reporting period beginning after December 15, 2023, including interim periods within that reporting period, with early adoption permitted only as of annual reporting periods beginning after December 15, 2020. The Company adopted ASU 2020-06 on a modified retrospective basis on January 1, 2022, and the adoption had no impact on its condensed consolidated financial statements and related disclosures.

In January 2020, the FASB issued ASU 2020-01, Clarifying the Interactions Between Topic 321, Topic 323, and Topic 815 (ASU 2020-01), which clarifies that an entity should consider observable transactions that require it to either apply or discontinue the equity method of accounting for the purposes of applying the measurement alternative in accordance with Topic 321 immediately before applying or upon discontinuing the equity method. In addition, ASU 2020-01 states that for the purpose of applying paragraph 815-10-15-141(a), an entity should not consider whether, upon the settlement of the forward contract or exercise of the purchased option, individually or with existing investments, the underlying securities would be accounted for under the equity method in Topic 323 or the fair value option in accordance with the financial instruments guidance in Topic 825. The Company adopted the provisions of ASU 2020-01 prospectively as of January 1, 2022, and the adoption had no impact on its condensed consolidated financial statements and related disclosures.

9

Recently issued accounting pronouncements not yet adopted

From time to time, new accounting pronouncements are issued by the FASB or other standard setting bodies that the Company adopts as of the specified effective date. The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (JOBS Act) and has elected not to “opt out” of the extended transition related to complying with new or revised accounting standards, which means that when a standard is issued or revised and it has different application dates for public and nonpublic companies, the Company can adopt the new or revised standard at the time nonpublic companies adopt the new or revised standard and can do so until such time that the Company either (i) irrevocably elects to “opt out” of such extended transition period or (ii) no longer qualifies as an emerging growth company.

Note 3. Fair value measurements

The following tables summarize the Company’s financial assets measured at fair value on a recurring basis and their respective input levels based on the fair value hierarchy (in thousands):

| | | | | | | | | | | | | | | | |

| | | | | Fair value measurements as of June 30, 2022 using | |

| | | | | Quoted prices in | | | Significant | | | Significant | |

| | | | | active markets | | | other | | | unobservable | |

| | June 30, | | | for identical | | | observable | | | inputs | |

| | 2022 | | | assets (level 1) | | | inputs (level 2) | | | (level 3) | |

Assets: | | | | | | | | | | | | |

Money market funds(1) | | $ | 292,924 | | | $ | 292,924 | | | $ | — | | | $ | — | |

US treasury securities(2) | | | 45,972 | | | | 45,972 | | | | — | | | | — | |

Commercial paper(2) | | | 23,422 | | | | — | | | | 23,422 | | | | — | |

Corporate debt securities(2) | | | 2,639 | | | | — | | | | 2,639 | | | | — | |

Yankee debt security(2) | | | 799 | | | | — | | | | 799 | | | | — | |

Supranational debt security(2) | | | 637 | | | | — | | | | 637 | | | | — | |

US treasury securities(3) | | | 19,313 | | | | 19,313 | | | | — | | | | — | |

Total fair value of assets | | $ | 385,706 | | | $ | 358,209 | | | $ | 27,497 | | | $ | — | |

(1)Included as cash and cash equivalents on the condensed consolidated balance sheets.

(2)Included as short-term marketable securities on the condensed consolidated balance sheets.

(3)Included as long-term marketable securities on the condensed consolidated balance sheets.

| | | | | | | | | | | | | | | | |

| | | | | Fair value measurements as of December 31, 2021 using | |

| | | | | Quoted prices in | | | Significant | | | Significant | |

| | | | | active markets | | | other | | | unobservable | |

| | December 31, | | | for identical | | | observable | | | inputs | |

| | 2021 | | | assets (level 1) | | | inputs (level 2) | | | (level 3) | |

Assets: | | | | | | | | | | | | |

Money market funds(1) | | $ | 351,625 | | | $ | 351,625 | | | $ | — | | | $ | — | |

US treasury securities(2) | | | 18,097 | | | | 18,097 | | | | — | | | | — | |

Corporate debt securities(2) | | | 2,822 | | | | — | | | | 2,822 | | | | — | |

Commercial paper(2) | | | 31,566 | | | | — | | | | 31,566 | | | | — | |

Supranational debt securities(2) | | | 1,503 | | | | — | | | | 1,503 | | | | — | |

US treasury securities(3) | | | 44,770 | | | | 44,770 | | | | — | | | | — | |

Total fair value of assets | | $ | 450,383 | | | $ | 414,492 | | | $ | 35,891 | | | $ | — | |

(1)Included as cash and cash equivalents on the condensed consolidated balance sheets.

(2)Included as short-term marketable securities on the condensed consolidated balance sheets.

(3)Included as long-term marketable securities on the condensed consolidated balance sheets.

10

The carrying amounts of the Company’s financial instruments, including cash, prepaid and other current assets, accounts payable, and accrued expenses and other current liabilities, approximate fair value due to their short maturities. As of June 30, 2022, the Company has recorded a $2.0 million equity investment in Affini-T Therapeutics, Inc. (Affini-T) at cost, subject to impairment in accordance with ASC 321, Investments—Equity Securities. None of the Company’s non-financial assets or liabilities are recorded at fair value on a non-recurring basis. NaN transfers between levels have occurred during the periods presented.

Cash equivalents consist of money market funds, short-term marketable securities consist of US treasury securities, corporate debt securities, commercial paper, Yankee debt securities and supranational debt securities, and long-term marketable securities consist of US treasury securities. The Company obtains pricing information from its investment manager and generally determines the fair value of marketable securities using standard observable inputs, including reported trades, broker/dealer quotes, and bid and/or offers.

Note 4. Marketable securities

The following tables summarize the Company’s marketable securities accounted for as available-for-sale securities (in thousands, except years):

| | | | | | | | | | | | | | | | | | |

| | June 30, 2022 | |

| | Maturity | | Amortized | | | Unrealized | | | Unrealized | | | Estimated | |

| | (in years) | | cost | | | gains | | | losses | | | fair value | |

US treasury securities | | 1 or less | | $ | 46,566 | | | $ | — | | | $ | (594 | ) | | | 45,972 | |

Commercial paper | | 1 or less | | | 23,422 | | | | — | | | | — | | | | 23,422 | |

Corporate debt securities | | 1 or less | | | 2,654 | | | | — | | | | (15 | ) | | | 2,639 | |

Yankee debt security | | 1 or less | | | 801 | | | | — | | | | (2 | ) | | | 799 | |

Supranational debt security | | 1 or less | | | 639 | | | | — | | | | (2 | ) | | | 637 | |

US treasury securities | | 1-2 | | | 19,923 | | | | — | | | | (610 | ) | | | 19,313 | |

Total | | | | $ | 94,005 | | | $ | — | | | $ | (1,223 | ) | | $ | 92,782 | |

| | | | | | | | | | | | | | | | | | |

| | December 31, 2021 | |

| | Maturity | | Amortized | | | Unrealized | | | Unrealized | | | Estimated | |

| | (in years) | | cost | | | gains | | | losses | | | fair value | |

US treasury securities | | 1 or less | | $ | 18,116 | | | $ | — | | | $ | (19 | ) | | $ | 18,097 | |

Corporate debt securities | | 1 or less | | | 2,824 | | | | — | | | | (2 | ) | | | 2,822 | |

Commercial paper | | 1 or less | | | 31,566 | | | | — | | | | — | | | | 31,566 | |

Supranational debt securities | | 1 or less | | | 1,503 | | | | — | | | | — | | | | 1,503 | |

US treasury securities | | 1-2 | | | 44,911 | | | | — | | | | (141 | ) | | | 44,770 | |

Total | | | | $ | 98,920 | | | $ | — | | | $ | (162 | ) | | $ | 98,758 | |

As of June 30, 2022, there were 25 available-for-sale securities with an estimated fair value of $70.2 million that were in gross unrealized loss positions. NaN had been in such position for greater than 12 months. As of December 31, 2021, there were 19 available-for-sale securities with an estimated fair value of $68.0 million in gross unrealized loss positions.

As of June 30, 2022 and December 31, 2021, unrealized losses on available-for-sale securities are not attributed to credit risk. The Company believes that an allowance for credit losses is unnecessary because the unrealized losses on certain of the Company’s available-for-sale securities are due to market factors and interest rate increases. Additionally, the Company does not intend to sell the securities nor is it more likely than not that the Company will be required to sell the securities before recovery of their amortized cost basis.

11

Note 5. Property and equipment, net

Property and equipment, net consisted of the following (in thousands):

| | | | | | | | |

| | June 30, | | | December 31, | |

| | 2022 | | | 2021 | |

Construction in process | | $ | 440 | | | $ | 11,228 | |

Laboratory equipment | | | 3,090 | | | | 2,488 | |

Furniture and fixtures | | | 3,868 | | | | 2,455 | |

Leasehold improvements | | | 17,710 | | | | 795 | |

Computer equipment and software | | | 879 | | | | 715 | |

Property and equipment | | | 25,987 | | | | 17,681 | |

Less accumulated depreciation and amortization | | | (1,796 | ) | | | (1,727 | ) |

Property and equipment, net | | $ | 24,191 | | | $ | 15,954 | |

Depreciation and amortization expense related to property and equipment was $534,000 and $937,000 for the three and six months ended June 30, 2022, respectively, and $169,000 and $318,000 for the three and six months ended June 30, 2021, respectively.

Note 6. Accrued expenses and other current liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

| | | | | | | | |

| | June 30, | | | December 31, | |

| | 2022 | | | 2021 | |

Accrued research and development expenses | | $ | 10,760 | | | $ | 9,122 | |

Accrued compensation | | | 5,161 | | | | 7,275 | |

Unvested early exercised stock option liability | | | 2,167 | | | | 2,884 | |

Accrued property and equipment | | | 1,113 | | | | 1,272 | |

Accrued professional services | | | 463 | | | | 383 | |

Other accruals | | | 163 | | | | 483 | |

Total | | $ | 19,827 | | | $ | 21,419 | |

Note 7. Asset acquisitions

The following purchased assets were accounted for as asset acquisitions as substantially all of the fair value of the assets acquired were concentrated in a group of similar assets, and the acquired assets did not have outputs or employees. Because the assets had not yet received regulatory approval, the fair value attributable to these assets was recorded as in-process research and development expenses in the Company’s condensed consolidated statements of operations and comprehensive loss.

Asana BioSciences, LLC

In November 2020, the Company entered into the Asana Merger Agreement, pursuant to which ASN became its wholly-owned subsidiary. Asana and ASN had previously entered into a license agreement, which was amended and restated prior to the closing of the merger transaction (the Asana License Agreement, and collectively with the Asana Merger Agreement, the Asana Agreements), pursuant to which ASN acquired an exclusive, worldwide license to certain intellectual property rights relating to inhibitors of ERK1 and ERK2 owned or controlled by Asana to develop and commercialize ERAS-007 and certain other related compounds for all applications.

12

Under the Asana Merger Agreement, the Company made an upfront payment of $20.0 million and issued 4,000,000 shares of its Series B-2 convertible preferred stock to Asana at a value of $7.50 per share or a total fair value of $30.0 million. In connection with the Company’s IPO, these shares of Series B-2 convertible preferred stock were converted into 3,333,333 shares of the Company’s common stock. The Company is obligated to make future development and regulatory milestone cash payments for a licensed product in an amount of up to $90.0 million. Additionally, upon achieving a development milestone related to demonstration of successful proof-of-concept in a specified clinical trial, the Company will also be required to issue 3,888,889 shares of its common stock to Asana. The Company is not obligated to pay royalties on the net sales of licensed products. The Company recorded IPR&D expense of $50.0 million during the year ended December 31, 2020 in connection with the asset acquisition. NaN IPR&D expense was recorded during the three and six months ended June 30, 2022 and 2021. As of June 30, 2022 and December 31, 2021, 0 milestones had been accrued as the underlying contingencies were not probable or estimable.

Emerge Life Sciences, Pte. Ltd.

In March 2021, the Company entered into an asset purchase agreement (ELS Purchase Agreement) with Emerge Life Sciences, Pte. Ltd. (ELS) wherein it purchased all rights, title, and interest (including all patent and other intellectual property rights) to EGFR antibodies directed against the EGFR domain II (EGFR-D2) and domain III (EGFR-D3) as well as a bispecific antibody where one arm is directed against EGFR-D2 and the other is directed against EGFR-D3 (the Antibodies). Under the terms of the ELS Purchase Agreement, the Company made an upfront payment of $2.0 million and issued to ELS 500,000 shares of the Company’s common stock at a value of $3.36 per share or a total fair value of $1.7 million. Under the ELS Purchase Agreement, ELS was committed to performing certain studies on the applicable antibodies to assist in development activities, the costs of which were mutually agreed upon and for which the Company was responsible. NaN IPR&D expense was recorded during the three and six months ended June 30, 2022. The Company recorded IPR&D expense of $0 and $3.7 million during the three and six months ended June 30, 2021, respectively, in connection with the asset acquisition.

Pursuant to the ELS Purchase Agreement, at any time between 12 months and 36 months after the effective date of the ELS Purchase Agreement, if the Company reasonably determines that none of the Antibodies should be taken into human clinical trials due to safety, efficacy or chemistry, manufacturing and controls (CMC) issues, then the Company has the option to select another antibody developed and solely owned by ELS that is not the subject of a license, collaboration, or option to a third party (the Option). If the Company elects to exercise the Option, then ELS will provide to the Company a list of all available antibodies that meet the aforementioned requirements, and the Company has the right to select one antibody from the list. Upon the Company’s selection of an antibody, ELS will assign to the Company all rights, title and interest to such antibody (including patent and other intellectual property rights) subject to any pre-existing obligations or restrictions. In the event that the Company wishes to have ELS conduct any studies on such optioned antibody, then after mutual agreement as to the scope of the studies, the Company will be responsible for the cost for such studies.

Note 8. License agreements

NiKang Therapeutics, Inc.

In February 2020, the Company entered into a license agreement (the NiKang Agreement) with NiKang Therapeutics, Inc. (NiKang) under which the Company was granted an exclusive, worldwide license to certain intellectual property rights owned or controlled by NiKang related to certain SHP2 inhibitors to develop and commercialize ERAS-601 and certain other related compounds for all applications.

Under the NiKang Agreement, the Company made an upfront payment of $5.0 million to NiKang and reimbursed NiKang $0.4 million for certain initial manufacturing costs. In addition, the Company paid $7.0 million in April 2020 related to the publication of a US patent application that covered the composition of matter of ERAS-601. The Company is also obligated to pay (i) development and regulatory milestone payments in an aggregate amount of up to $16.0 million for the first licensed product, of which $4.0 million was paid in January 2021, and $12.0 million for a second licensed product, and (ii) commercial milestone payments in an aggregate amount of up to $157.0 million for the first licensed product and $151.0 million for a second licensed product. The Company is also obligated to: (i) pay tiered royalties on net sales of all licensed products in the mid-single digit percentages, subject to certain reductions; and (ii) equally split all net sublicensing revenues earned under sublicense agreements that the Company enters into with any third party before commencement of the first Phase I clinical trial for a licensed product. NaN IPR&D expense was recorded during the three and six months ended June 30, 2022 and 2021.

13

Katmai Pharmaceuticals, Inc.

In March 2020, the Company entered into a license agreement (the Katmai Agreement) with Katmai Pharmaceuticals, Inc. (Katmai) under which the Company was granted an exclusive, worldwide, royalty-bearing license to certain patent rights and know-how controlled by Katmai related to the development of small molecule therapeutic and diagnostic products that modulate EGFR and enable the identification, diagnosis, selection, treatment, and/or monitoring of patients for neuro-oncological applications to develop, manufacture, use, and commercialize ERAS-801 and certain other related compounds in all fields of use.

Under the Katmai Agreement, the Company made an upfront payment of $5.7 million and Katmai agreed to purchase shares of the Company’s Series B-1 convertible preferred stock and Series B-2 convertible preferred stock having an aggregate value of $2.7 million. In April 2020, Katmai purchased 356,000 shares of the Company’s Series B-1 convertible preferred stock for $1.8 million, and in January 2021, Katmai purchased 118,666 shares of the Company’s Series B-2 convertible preferred stock for $0.9 million. In connection with the Company's IPO, these shares of Series B-1 convertible preferred stock and Series B-2 convertible preferred stock were converted into 395,555 shares of the Company's common stock, in the aggregate. The Company is obligated to make future development and regulatory milestone payments of up to $24.0 million and commercial milestone payments of up to $101.0 million. The Company is also obligated to pay tiered royalties on net sales of each licensed product, at rates ranging from the mid- to high-single digit percentages, subject to a minimum annual royalty payment in the low six figures and certain permitted deductions. The Company recorded IPR&D expense of $0 and $2.0 million in connection with a development milestone payment made during the three and six months ended June 30, 2022, respectively. NaN IPR&D expense was recorded during the three and six months ended June 30, 2021.

LifeArc

In April 2020, the Company entered into a license agreement with LifeArc (the LifeArc Agreement) under which the Company was granted an exclusive, worldwide license to certain materials, know-how, and intellectual property rights owned or controlled by LifeArc to develop, manufacture, use, and commercialize certain ULK inhibitors for all applications.

Under the LifeArc Agreement, the Company was granted the license at 0 upfront cost and a period of three months after the effective date to conduct experiments on LifeArc’s compounds. Upon completion of this initial testing period, the Company had the option to continue the license and make a one-time license payment of $75,000 to LifeArc, which payment was subsequently made. The Company is obligated to make future development milestone payments for a licensed product of up to $11.0 million and sales milestone payments of up to $50.0 million. The Company is also obligated to pay royalties on net sales of all licensed products, in the low-single digit percentages, subject to certain reductions. NaN IPR&D expense was recorded during the three and six months ended June 30, 2022 and 2021.

University of California, San Francisco

In December 2018, the Company entered into a license agreement, as amended (the UCSF Agreement), with The Regents of the University of California, San Francisco (the Regents), under which the Company was granted an exclusive, worldwide, royalty-bearing license under certain patent rights claiming novel covalent inhibitors of GTP- and GDP-bound RAS for the development and commercialization of products covered by such patent rights for the prevention, treatment and amelioration of human cancers and other diseases and conditions. The UCSF Agreement was amended in May 2021.

Under the UCSF Agreement, the Company made upfront payments of $50,000 to the Regents and pays the Regents an annual license maintenance fee during the term of the license, but such fee will not be due on any anniversary if, on that date, the Company is making royalty payments to the Regents. The Company is obligated to make future development and regulatory milestone payments of up to $6.4 million and a sales milestone payment of $2.0 million for either of the first two licensed products. The Company is also obligated to pay royalties on net sales of all licensed products in the low-single digit percentages, subject to a minimum annual royalty payment in the low six figures, commencing on the year of the first sale of a licensed product and continuing, on a licensed product-by-licensed product and country-by-country basis, until there are no valid claims of the licensed patent rights covering the licensed product in such country.

14

Additionally, the Company is obligated to pay tiered sublicensing fees, with the first two tiers in the low-to-mid teen percentages and the third tier at 30%, on certain fees the Company receives from any sublicense that the Company grants, depending on the stage of development of a licensed product when such sublicense is granted. Prior to the execution of the amendment, the Company was obligated to make a cash payment to the Regents in the event of the Company’s initial public offering, a change of control transaction or a reverse merger (the Corporate Milestone). In the amendment, the amount of the cash payment payable upon the Company’s achievement of a Corporate Milestone was reduced and the Company agreed to issue the Regents 944,945 shares of the Company’s common stock, which issuance was not contingent upon the achievement of a Corporate Milestone and occurred in May 2021. In August 2021, following the achievement of the Corporate Milestone, the Company made a cash payment to the Regents in the amount of $1.7 million. NaN IPR&D expense was recorded during the three and six months ended June 30, 2022. The Company recorded IPR&D expense of $5.5 million during the three and six months ended June 30, 2021 related to the issuance of 944,945 shares of the Company's common stock to the Regents.

Note 9. Stockholders’ equity

In connection with the IPO, on July 20, 2021, the Company amended and restated its certificate of incorporation to, among other things, (i) increase the number of authorized shares of common stock from 156,000,000 to 800,000,000 and (ii) authorize 80,000,000 shares of undesignated preferred stock with a par value of $0.0001 per share.

Convertible preferred stock

Upon the closing of the IPO in July 2021, all shares of convertible preferred stock then outstanding converted into 71,263,685 shares of common stock. Prior to conversion, the Company’s convertible preferred stock was classified outside of stockholders’ equity (deficit) on the consolidated balance sheets because the holders of such shares had liquidation rights in the event of a deemed liquidation that, in certain situations, were not solely within the control of the Company and would require the redemption of the then-outstanding convertible preferred stock. There were 0 shares of convertible preferred stock outstanding as of June 30, 2022 and December 31, 2021.

Common stock

The Company had 800,000,000 shares of its common stock authorized as of June 30, 2022 and December 31, 2021. The Company had 122,063,473 and 121,382,547 shares of its common stock issued and 120,545,318 and 119,102,505 shares of common stock outstanding as of June 30, 2022 and December 31, 2021, respectively.

Shares of common stock subject to repurchase

During 2018, the Company issued 1,458,332 shares of restricted stock for cash at a price of $0.0001 per share. The restricted stock vests 25% one year from the vesting commencement date and monthly thereafter over a three-year period and is subject to repurchase by the Company in the event of any voluntary or involuntary termination of services to the Company prior to vesting. Any shares subject to repurchase by the Company are not deemed, for accounting purposes, to be outstanding until those shares vest. As of June 30, 2022 and December 31, 2021, 30,384 shares and 212,674 shares of common stock, respectively, were subject to repurchase by the Company. The unvested stock liability related to these awards is immaterial for all periods presented. For the three and six months ended June 30, 2022, 91,146 and 182,290 shares vested, respectively. For the three and six months ended June 30, 2021, 91,146 and 182,293 shares vested, respectively.

15

Note 10. Stock-based compensation

In July 2021, the Company’s board of directors adopted and the Company’s stockholders approved the Company’s 2021 Incentive Award Plan (the 2021 Plan), which became effective in connection with the IPO. Upon the adoption of the 2021 Plan, the Company ceased making equity grants under its 2018 Equity Incentive Plan (the 2018 Plan). Under the 2021 Plan, the Company may grant stock options, restricted stock, restricted stock units, stock appreciation rights, and other stock or cash-based awards to individuals who are then employees, officers, directors or non-entity consultants of the Company. A total of 15,150,000 shares of common stock were initially reserved for issuance under the 2021 Plan. In addition, the number of shares of common stock available for issuance under the 2021 Plan may be increased annually on the first day of each calendar year during the term of the 2021 Plan, beginning in 2022, by an amount equal to the lesser of (i) 5% of the shares of common stock outstanding on the final day of the immediately preceding calendar year or (ii) such smaller number of shares as determined by the Company’s board of directors or an authorized committee of the board of directors. As of June 30, 2022, there were 16,404,213 stock-based awards available for future grant under the 2021 Plan.

Subsequent to July 2021, 0 further awards will be granted under the 2018 Plan and all future stock-based awards will be granted under the 2021 Plan. To the extent outstanding options or restricted stock granted under the 2018 Plan are cancelled, forfeited, repurchased, or otherwise terminated without being exercised or becoming vested, and would otherwise have been returned to the share reserve under the 2018 Plan, the number of shares underlying such awards will be available for future grant under the 2021 Plan.

Options granted are exercisable at various dates as determined upon grant and will expire no more than ten years from their date of grant. Stock options generally vest over a four-year term. The exercise price of each option shall be determined by the Company’s Board of Directors based on the estimated fair value of the Company’s stock on the date of the option grant. The exercise price shall not be less than 100% of the fair market value of the Company’s common stock at the time the option is granted. For holders of more than 10% of the Company’s total combined voting power of all classes of stock, incentive stock options may not be granted at less than 110% of the fair market value of the Company’s common stock on the date of grant and for a term that exceeds five years. Early exercise is permitted for certain grants under the 2018 Plan.

Stock options

A summary of the Company’s stock option activity under the 2021 Plan and 2018 Plan is as follows (in thousands, except share and per share data and years):

| | | | | | | | | | | | | | | | |

| | | | | | | | Weighted- | | | | |

| | | | | Weighted- | | | average remaining | | | Aggregate | |

| | | | | average | | | contractual | | | intrinsic | |

| | Shares | | | exercise price | | | term (years) | | | value | |

Outstanding at December 31, 2021 | | | 13,818,212 | | | $ | 3.87 | | | | 8.82 | | | $ | 163,264 | |

Granted | | | 5,291,546 | | | | 10.67 | | | | | | | |

Exercised | | | (537,229 | ) | | | 1.55 | | | | | | | |

Canceled | | | (920,257 | ) | | | 4.98 | | | | | | | |

Outstanding at June 30, 2022 | | | 17,652,272 | | | $ | 5.69 | | | | 8.53 | | | $ | 30,695 | |

Options exercisable at June 30, 2022 | | | 5,704,373 | | | $ | 3.29 | | | | 7.79 | | | $ | 16,089 | |

The weighted-average grant date fair value of options granted for the three and six months ended June 30, 2022 was $5.00 and $7.71, respectively, and for the three and six months ended June 30, 2021 was $4.59 and $3.45, respectively. As of June 30, 2022, the unrecognized compensation cost related to unvested stock option grants was $61.1 million and is expected to be recognized as expense over approximately 2.76 years. The intrinsic value of the options exercised for the three and six months ended June 30, 2022 was $1.0 million and $4.3 million, respectively. The intrinsic value of the options exercised for the three and six months ended June 30, 2021 was $1.5 million and $1.9 million, respectively.

16

Prior to the Company's IPO, certain individuals were granted the ability to early exercise their stock options. The shares of common stock issued from the early exercise of unvested stock options are restricted and continue to vest in accordance with the original vesting schedule. The Company has the option to repurchase any unvested shares at the original purchase price upon any voluntary or involuntary termination. The shares purchased by the employees and non-employees pursuant to the early exercise of stock options are not deemed, for accounting purposes, to be outstanding until those shares vest. The cash received in exchange for exercised and unvested shares related to stock options granted is recorded as a liability for the early exercise of stock options on the accompanying condensed consolidated balance sheets and will be transferred into common stock and additional paid-in capital as the shares vest. As of June 30, 2022 and December 31, 2021, there were 1,448,961 shares and 1,854,427 shares subject to repurchase by the Company, respectively. As of June 30, 2022 and December 31, 2021, the Company recorded $2.2 million and $2.9 million of liabilities associated with shares issued with repurchase rights, respectively, which is recorded in accrued expenses and other current liabilities.

The assumptions used in the Black-Scholes option pricing model to determine the fair value of the employee and nonemployee stock option grants were as follows:

| | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

Risk-free interest rate | | 2.53%-3.23% | | 1.02%-1.09% | | 1.46%-3.23% | | 0.59%-1.09% |

Expected volatility | | 85.51%-87.11% | | 82.08%-82.54% | | 85.51%-87.11% | | 82.08%-83.88% |

Expected term (in years) | | 5.50-6.08 | | 6.08 | | 5.50-6.08 | | 6.08 |

Expected dividend yield | | 0-% | | 0-% | | 0-% | | 0-% |

Employee stock purchase plan

In July 2021, the Company’s board of directors adopted and the Company’s stockholders approved the ESPP, which became effective in connection with the IPO. The ESPP permits participants to contribute up to a specified percentage of their eligible compensation during a series of offering periods of 24 months, each comprised of four six-month purchase periods, to purchase the Company’s common stock. The purchase price of the shares will be 85% of the fair market value of the Company’s common stock on the first day of trading of the applicable offering period or on the applicable purchase date, whichever is lower. A total of 1,260,000 shares of common stock was initially reserved for issuance under the ESPP. In addition, the number of shares of common stock available for issuance under the ESPP may be increased annually on the first day of each calendar year during the term of the ESPP, beginning in 2022, by an amount equal to the lesser of (i) 1% of the shares of common stock outstanding on the final day of the immediately preceding calendar year or (ii) such smaller number of shares as determined by the Company’s board of directors or an authorized committee of the board of directors. The Company recognized $167,000 and $668,000 of stock-based compensation expense related to the ESPP during the three and six months ended June 30, 2022. As of June 30, 2022, the unrecognized compensation cost related to the ESPP was $4.6 million and is expected to be recognized as expense over approximately 1.96 years. As of June 30, 2022, $44,000 has been withheld on behalf of employees for future purchase under the ESPP and is included in accrued expenses and other current liabilities on the condensed consolidated balance sheet. The Company issued and sold 150,642 shares under the ESPP during the three and six months ended June 30, 2022.

17

The assumptions used in the Black-Scholes option pricing model to determine the fair value of the stock to be purchased under the ESPP were as follows:

| | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2022 | | 2021(1) | | 2022 | | 2021(1) |

Risk-free interest rate | | 2.24%-3.14% | | --% | | 2.24%-3.14% | | --% |

Expected volatility | | 84.74%-87.89% | | --% | | 84.74%-87.89% | | --% |

Expected term (in years) | | 0.50-1.99 | | -- | | 0.50-1.99 | | -- |

Expected dividend yield | | 0-% | | --% | | 0-% | | --% |

(1) The ESPP was not in effect until July 2021.

Restricted stock

The Company granted 1,795,827 shares of its restricted stock in 2018, which vest 25% one year from the vesting commencement date and monthly thereafter over a three-year period. The weighted-average grant date fair value of restricted stock granted in 2018 was $0. NaN shares of restricted stock were granted during the three and six months ended June 30, 2022 and 2021. The restricted stock shares are subject to forfeiture upon the stockholders’ termination of employment or service to the Company. Any shares subject to forfeiture are not deemed, for accounting purposes, to be outstanding until those shares vest. As such, the Company recognizes the measurement date fair value of the restricted stock over the vesting period as compensation expense. As of June 30, 2022 and December 31, 2021, 38,810 shares and 212,941 shares of common stock, respectively, were subject to forfeiture.

The summary of the Company’s restricted stock activity during the six months ended June 30, 2022 is as follows:

| | | | | | | | |

| | Number of | | | Weighted- | |

| | restricted | | | average | |

| | stock shares | | | grant date | |

| | outstanding | | | fair value | |

Nonvested at December 31, 2021 | | | 212,941 | | | $ | 0.001 | |

Vested | | | (167,186 | ) | | | 0.001 | |

Forfeited | | | (6,945 | ) | | | 0.001 | |

Nonvested at June 30, 2022 | | | 38,810 | | | $ | 0.001 | |

At June 30, 2022, the total unrecognized compensation related to unvested restricted stock awards granted was $0.

Stock-based compensation expense

The allocation of stock-based compensation for all stock awards was as follows (in thousands):

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Research and development | | $ | 3,003 | | | $ | 925 | | | $ | 5,735 | | | $ | 1,416 | |

General and administrative | | | 2,052 | | | | 711 | | | | 3,762 | | | | 1,015 | |

Total | | $ | 5,055 | | | $ | 1,636 | | | $ | 9,497 | | | $ | 2,431 | |

18

Common stock reserved for future issuance

Common stock reserved for future issuance consisted of the following as of June 30, 2022 and December 31, 2021:

| | | | | | | | |

| | June 30, | | | December 31, | |

| | 2022 | | | 2021 | |

Stock options issued and outstanding | | | 17,652,272 | | | | 13,818,212 | |

Awards available for future grant | | | 16,404,213 | | | | 14,699,430 | |

Shares available for purchase under the ESPP | | | 1,017,371 | | | | 1,168,013 | |

Total | | | 35,073,856 | | | | 29,685,655 | |

Note 11. Leases

Operating leases

The Company has facility leases for office space under non-cancellable and cancelable operating leases with various expiration dates through 2032 and equipment under a non-cancellable operating lease with a term expiring in 2026. Operating lease cost was approximately $1.0 million and $2.0 million, including variable lease costs of $278,000 and $396,000, and short-term lease costs of $31,000 and $62,000, during the three and six months ended June 30, 2022, respectively. Operating lease cost was approximately $380,000 and $742,000, including variable lease costs of $123,000 and $228,000, and short-term lease costs of $30,000 and $59,000, during the three and six months ended June 30, 2021, respectively. The Company paid $417,000 and $535,000 in cash for operating leases that were included in the operating activities section of the condensed consolidated statements of cash flows for the six months ended June 30, 2022 and 2021, respectively.

The weighted-average remaining lease term and the weighted-average discount rate of the Company’s operating leases were 9.60 years and 8.35% at June 30, 2022, respectively. The weighted-average remaining lease term and the weighted-average discount rate of the Company’s operating leases was 9.86 years and 6.9% at December 31, 2021, respectively. The weighted-average remaining lease term does not include any renewal options at the election of the Company.

The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants.

Facility leases

In 2018, the Company entered into a lease agreement for approximately 11,000 square feet of office space in San Diego, California which was subsequently amended resulting in a total of 16,153 square feet of office space leased (the 2018 Lease). The amended space was accounted for as a separate lease. The 2018 Lease was again modified in November 2021 to amend the termination date from May 2024 to April 2022. The Company remeasured the associated lease liability using the incremental borrowing rate at the date of the second amendment selected on the basis of the remaining lease term and remaining lease payments and adjusted the operating lease asset accordingly, resulting in a $539,000 gain on remeasurement, which was recorded as other income (expense), net in the consolidated statements of operations and comprehensive loss. The 2018 Lease was again modified in April 2022 to amend the termination date from April 2022 to May 2022. The Company’s lease payments consisted primarily of fixed rental payments for the right to use the underlying leased assets over the lease term. The Company was responsible for operating expenses over base operating expenses as defined in the original lease agreement.

19

In September 2020, the Company entered into a lease agreement for 59,407 square feet of laboratory and office space in San Diego, California, which represented a portion of a new facility that was under construction and which was subsequently amended in March 2021 to expand the rented premises by 18,421 square feet (the 2020 Lease). The construction and design of the asset was the primary responsibility of the lessor. The Company was involved in certain aspects of construction and design for certain interior features and leasehold improvements that is beneficial to the Company to better suit its business needs and intended purpose of the space. The lease is accounted for as an operating lease and commenced in August 2021. In April 2022, the 2020 Lease was modified to amend the rent commencement date from February 2022 to May 2022. The 2020 Lease, as amended, has an initial term of 10.75 years and includes aggregate monthly payments to the lessor of approximately $51.6 million beginning in May 2023 with a rent escalation clause, and a tenant improvement allowance of approximately $16.8 million. The 2020 Lease is cancellable at the Company’s request after the 84th month with 12 months written notice and a lump-sum cancellation payment of $2.5 million. As discussed in Note 2, the Company provided a letter of credit to the lessor for $408,000, which expires October 31, 2031.

In December 2021, the Company entered into a lease agreement for 29,542 square feet of office and laboratory space in South San Francisco, California (the 2021 Lease). The lease will be accounted for as an operating lease with the associated operating lease assets and liabilities recorded upon commencement, which occurred in July 2022. The non-cancellable operating lease has an initial term of 124 months with an option to extend the lease term by 5 years at the then current market rates and includes aggregate monthly payments to the lessor of approximately $34.4 million beginning in November 2022 with a rent escalation clause and a tenant improvement allowance of approximately $8.2 million. The construction and design of the tenant improvements is the primary responsibility of the lessor. While the Company is involved in certain aspects of construction and design for certain interior features and leasehold improvements that will be beneficial to the Company to better suit its business needs and intended purpose of the space, all construction is handled directly by the landlord. The Company was not deemed to be the accounting owner of the tenant improvements prior to or after the construction period. All payments made by the Company for landlord-owned tenant improvements are recorded as prepaid rent on the condensed consolidated balance sheets prior to lease commencement. In February 2022, the actual project costs exceeded the tenant improvement allowances by $5.1 million, which was paid directly to the landlord by the Company and was recorded as prepaid rent in the condensed consolidated balance sheet and as a cash outflow from operating activities in the condensed consolidated statement of cash flows. The Company paid a security deposit of $874,000 in December 2021 that was recorded as other assets in the condensed consolidated balance sheets.

Future minimum lease payments under the operating leases with initial lease terms in excess of one year (excluding the 2021 Lease) as of June 30, 2022 are as follows (in thousands):

| | | |

Year ending December 31, | | |

2022 (remaining six months) | $ | 135 | |

2023 | | 3,629 | |

2024 | | 5,409 | |

2025 | | 5,564 | |

2026 | | 5,588 | |

Thereafter | | 31,945 | |

Total lease payments | $ | 52,270 | |

Less: Amount representing interest | | (18,149 | ) |

Less: Tenant improvement allowance receivable | | (6,483 | ) |

Operating lease liabilities | $ | 27,638 | |

Note 12. Commitments and contingencies

Liabilities for loss contingencies arising from claims, assessments, litigation, fines, penalties and other sources are recorded when it is probable that a liability has been incurred and the amount can be reasonably estimated. There are no matters currently outstanding for which any such liabilities have been accrued.

20

Note 13. Income taxes