- SFTGQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Shift (SFTGQ) 8-KOther Events

Filed: 29 Aug 24, 7:00am

Exhibit 99.1

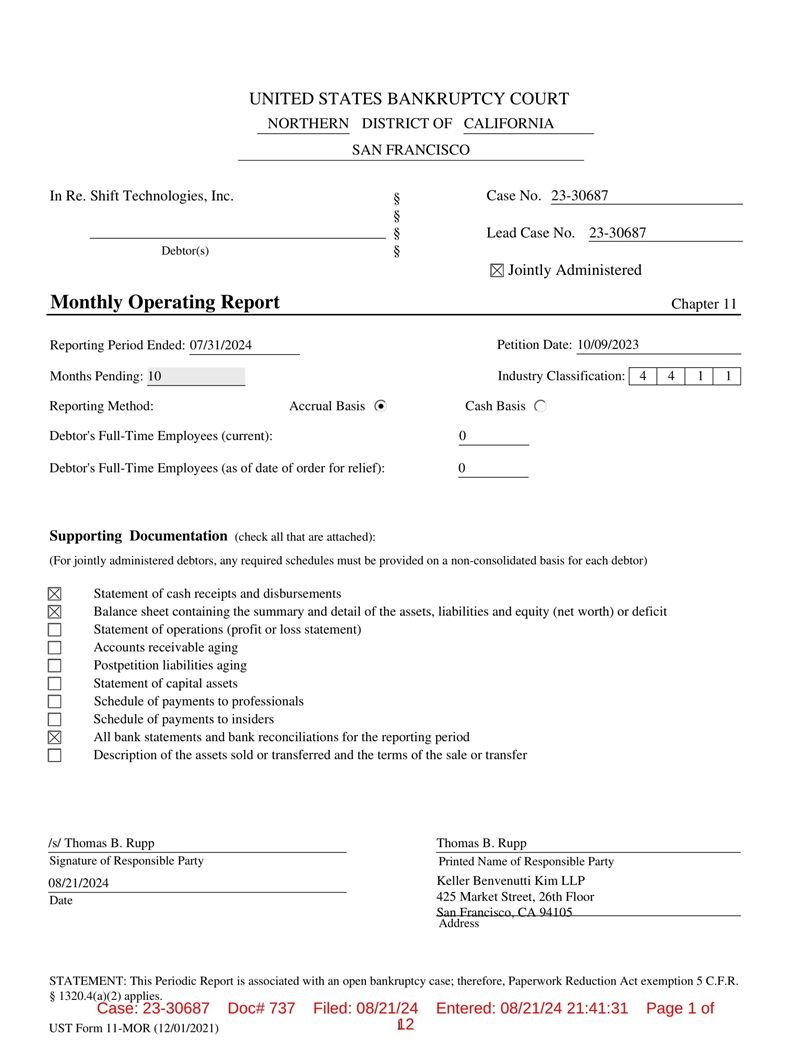

UNITED STATES BANKRUPTCY COURT NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO In Re. Shift Technologies, Inc. Debtor(s) † † † † Case No. 23 - 30687 Lead Case No. 23 - 30687 Jointly Administered Monthly Operating Report Chapter 11 Petition Date: 10/09/2023 Reporting Period Ended: 07/31/2024 Months Pending: 10 Reporting Method: 1 1 4 4 Industry Classification: Accrual Basis Cash Basis Debtor's Full - Time Employees (current): 0 Debtor's Full - Time Employees (as of date of order for relief): 0 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non - consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Date /s/ Thomas B. Rupp Signature of Responsible Party 08/21/2024 Thomas B. Rupp 1 12 UST Form 11 - MOR (12/01/2021) Printed Name of Responsible Party Keller Benvenutti Kim LLP 425 Market Street, 26th Floor San Francisco, CA 94105 Address STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. † 1320.4(a)(2) applies. Case: 23 - 30687 Doc# 737 Filed: 08/21/24 Entered: 08/21/24 21:41:31 Page 1 of

Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month b. Total receipts (net of transfers between accounts) c. Total disbursements (net of transfers between accounts) d. Cash balance end of month (a+b - c) e. Disbursements made by third party for the benefit of the estate f. Total disbursements for quarterly fee calculation (c+e) $844,311 $920 $8,001,938 $338,666 $7,510,171 $506,565 $0 $0 $338,666 $7,510,171 Current Month Part 2: Asset and Liability Status (Not generally applicable to Individual Debtors. See Instructions.) $0 $0 (attach explanation)) a. Accounts receivable (total net of allowance) b. Accounts receivable over 90 days outstanding (net of allowance) c. d e. f. g. h. i. j. k. l. m. n. o. Inventory ( Book Market Other Total current assets Total assets Postpetition payables (excluding taxes) Postpetition payables past due (excluding taxes) Postpetition taxes payable Postpetition taxes past due Total postpetition debt (f+h) Prepetition secured debt Prepetition priority debt Prepetition unsecured debt Total liabilities (debt) (j+k+l+m) Ending equity/net worth (e - n) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Part 3: Assets Sold or Transferred Current Month Cumulative $0 $0 $0 $0 c. a. Total cash sales price for assets sold/transferred outside the ordinary course of business b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business Net cash proceeds from assets sold/transferred outside the ordinary course of business (a - b) $0 $0 Cumulative Current Month Part 4: Income Statement (Statement of Operations) (Not generally applicable to Individual Debtors. See Instructions.) $0 a. Gross income/sales (net of returns and allowances) $0 b. Cost of goods sold (inclusive of depreciation, if applicable) $0 c. Gross profit (a - b) $0 d. Selling expenses $0 e. General and administrative expenses $0 f. Other expenses $0 g. Depreciation and/or amortization (not included in 4b) $0 h. Interest $0 i. Taxes (local, state, and federal) $0 j. Reorganization items $ 0 $0 k. Profit (loss) Case: 23 - 30687 Doc# 737 UST Form 11 - MOR (12/01/2021) Filed: 08/21/24 4 12 Entered: 08/21/24 21:41:31 Page 2 of

Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 Part 5: Professional Fees and Expenses Case: 23 - 30687 Doc# 737 UST Form 11 - MOR (12/01/2021) Filed: 08/21/24 4 12 Entered: 08/21/24 21:41:31 Page 3 of Paid Cumulative Paid Current Month Approved Cumulative Approved Current Month a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total Itemized Breakdown by Firm Role Firm Name i ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi

Case: 23 - 30687 Doc# 737 UST Form 11 - MOR (12/01/2021) Filed: 08/21/24 4 12 Entered: 08/21/24 21:41:31 Page 4 of Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 xxxvi i xxxvi i xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii

Case: 23 - 30687 Doc# 737 UST Form 11 - MOR (12/01/2021) Filed: 08/21/24 4 12 Entered: 08/21/24 21:41:31 Page 5 of Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 lxxix lxxx lxxxi lxxxii lxxxii lxxxi v lxxxv lxxxv i lxxxv i lxxxv i lxxxi x xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Paid Cumulativ e Paid Current Month Approved Cumulative Approved Current Month b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total Itemized Breakdown by Firm Role Firm Name i ii iii iv v vi vii viii ix x xi xii xiii xiv

Case: 23 - 30687 Doc# 737 UST Form 11 - MOR (12/01/2021) Filed: 08/21/24 4 12 Entered: 08/21/24 21:41:31 Page 6 of Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvi i xxxvi i xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi

Case: 23 - 30687 Doc# 737 UST Form 11 - MOR (12/01/2021) Filed: 08/21/24 4 12 Entered: 08/21/24 21:41:31 Page 7 of Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxi v lxxxv lxxxv i lxxxv i lxxxv i lxxxi x xc xci xcii xciii xciv xcv xcvi xcvii xcviii

Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 xcix c $0 $0 $0 $0 c. All professional fees and expenses (debtor & committees) Part 6: Postpetition Taxes Current Month Cumulative $0 $0 a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $0 $0 d. Postpetition employer payroll taxes paid $0 $0 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) Part 7: Questionnaire - During this reporting period: Yes Yes No No Yes Yes Yes Yes Yes No No No No No h. a. Were any payments made on prepetition debt? (if yes, see Instructions) b. Were any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Were any payments made to or on behalf of insiders? d. Are you current on postpetition tax return filings? e. Are you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? g. Was there any postpetition borrowing, other than trade credit? (if yes, see Instructions) Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? If yes, are your premiums current? Casualty/property insurance? If yes, are your premiums current? General liability insurance? If yes, are your premiums current? Yes Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No No N/A (if no, see Instructions) N/A (if no, see Instructions) N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? k. Has a disclosure statement been filed with the court? l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. † 1930 ? Case: 23 - 30687 Doc# 737 UST Form 11 - MOR (12/01/2021) Filed: 08/21/24 4 12 Entered: 08/21/24 21:41:31 Page 8 of

Shift Technologies, Inc. Debtor's Name Case No. 23 - 30687 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages b. Gross income (receipts) from self - employment c. Gross income from all other sources d. Total income in the reporting period (a+b+c) e. Payroll deductions f. Self - employment related expenses g. Living expenses h. All other expenses i. Total expenses in the reporting period (e+f+g+h) j. Difference between total income and total expenses (d - i) k. List the total amount of all postpetition debts that are past due l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C † 101(14A)? m. If yes, have you made all Domestic Support Obligation payments? $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Yes No Yes No N/A Privacy Act Statement 28 U.S.C. † 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. †† 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. † 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST - 001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. † 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ Ayman Moussa Signature of Responsible Party Chief Executive Officer Printed Name of Responsible Party 08/21/2024 Date Title Ayman Moussa Case: 23 - 30687 Doc# 737 UST Form 11 - MOR (12/01/2021) Filed: 08/21/24 4 12 Entered: 08/21/24 21:41:31 Page 9 of

Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 PageOnePartOne PageOnePartTwo PageTwoPartOne P ag e T woP a r tT w o Case: 23 - 30687 UST Form 11 - MOR (12/01/2021) Doc# 737 Filed : 08/21/24 1 1 0 2 Entered: 08/21/24 21:41:31 Page 10 of

Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case: 23 - 30687 UST Form 11 - MOR (12/01/2021) Doc# 737 Filed : 08/21/24 1 1 0 2 Entered: 08/21/24 21:41:31 Page 11 of

Debtor's Name Shift Technologies, Inc. Case No. 23 - 30687 PageFour PageThree Case: 23 - 30687 UST Form 11 - MOR (12/01/2021) Doc# 737 Filed : 08/21/24 1 1 0 2 Entered: 08/21/24 21:41:31 Page 12 of

Case: 23 - 30687 Doc# 737 - 1 Filed: 08/21/24 of 2 Entered: 08/21/24 21:41:31 Page 1 In re Shift Technologies, Inc., et al. Lead Case No. 23 - 30687 (HLB) Global Notes to Monthly Operating Reports General Notes : October 9, 2023 (the “ Petition Date ”), Shift Technologies, Inc.; Shift Platform, Inc.; Shift Finance LLC; Shift Operations LLC; Shift Transportation LLC; Shift Insurance Services LLC; Shift Marketplace Holdings, LLC; Shift Marketplace, LLC; Fair Dealer Services, LLC; CarLotz, Inc., a Delaware Corporation; CarLotz Group, Inc.; CarLotz Nevada, LLC; CarLotz California, LLC; CarLotz, Inc., an Illinois Corporation; CarLotz Logistics, LLC; Orange Peel, LLC; and Orange Grove Fleet Solutions, LLC, as debtors and debtors in possession (collectively, the “ Debtors ”) in the above - captioned chapter 11 cases (the “ Chapter 11 Cases ”), each filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the “ Bankruptcy Code ”) with the United States Bankruptcy Court for the Northern District of California (San Francisco Division) (the “ Bankruptcy Court ”). The Debtors are authorized to operate their businesses and manage their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. The Debtors are providing the information and documents provided herewith (collectively, and for all Debtors, the “ Monthly Operating Reports ”) in response to the Uniform Periodic Reports in Cases Filed Under Chapter 11 of Title 11 , promulgated by the United States Trustee Program, and the United States Trustee Chapter 11 Operating and Reporting Guidelines for Debtors in Possession (Revised March 31, 2023). All information in these Monthly Operating Reports relates solely to the Debtors, and not to any non - Debtor affiliate. The following notes and statements and limitations should be referred to, and referenced in connection with, any review of the Monthly Operating Reports. Basis of Presentation : The Debtors are submitting their Monthly Operating Reports solely for the purposes of complying with requirements applicable in these Chapter 11 Cases. The financial information included in the Monthly Operating Reports is unaudited and has not been prepared in accordance with accounting principles generally accepted in the United States of America (“ U.S. GAAP ”) and does not include all of the information and footnotes required by U.S. GAAP. The Monthly Operating Reports are not intended to reconcile to any financial statements otherwise prepared or distributed by the Debtors. The financial information contained herein is presented per the Debtors’ books and records without, among other things, all adjustments or reclassification that may be necessary or typical in accordance with U.S. GAAP. It is possible that not all assets, liabilities, income, or expenses have been recorded at the time of production. The financial information included in the Monthly Operating Reports has not been subjected to procedures that would typically be applied to financial information presented in accordance with U.S. GAAP or any other recognized financial reporting framework, and, upon application of such procedures, the Debtors believe that the financial information could be subject to changes, and these changes could be material. The results of operations contained in the financial statements provided with these Monthly Operating Reports are not necessarily

Case: 23 - 30687 Doc# 737 - 1 Filed: 08/21/24 of 2 Entered: 08/21/24 21:41:31 Page 2 indicative of results that may be expected from any other period or for the full year and may not necessarily reflect the results of operations and financial position of the Debtors in the future. Reservation of Rights : The Debtors reserve all rights to amend or supplement their Monthly Operating Reports in all respects, as may be necessary or appropriate. Nothing contained in these Monthly Operating Reports shall constitute a waiver of any of the Debtors’ rights under any applicable law or an admission with respect to any issue in the Chapter 11 Case. Bank Accounts : Prior to the Petition Date, the Debtors historically maintained bank accounts associated with specific legal entities, but utilized these accounts for general corporate purposes, without regard to legal entity. After the Petition Date, debtor - in - possession accounts in the name of Shift Technologies, Inc., were established with the Debtors’ new banking partner, Axos Bank. These new accounts are being utilized for all of the Debtors. Additionally, the Debtors are in the process of closing pre - petition bank accounts, but this process is not complete as of the filing of these Monthly Operating Reports. As a result, receipts and disbursements have continued to occur with various Debtors based upon bank accounts held by those Debtors. For the purposes of book and record keeping, all of these activities are associated with the winddown of the Debtors’ business through Shift Operations LLC or Orange Grove Fleet Solutions, LLC. Internal Transfers : Internal transfers between the Debtors are not included as receipts in the financial statements for each Debtor. Because the Monthly Operating Reports have not been prepared on a consolidated basis, this has resulted in negative cash balances for some Debtors. Attachments and Exhibits: Bank statements and other supporting documents and exhibits for all Debtors are attached only to the Monthly Operating Report of Shift Technologies, Inc. Any documents, exhibits, or statements attached to the Monthly Operating Report of Shift Technologies, Inc. are incorporated by reference into the Monthly Operating Reports for all Debtors. Payments Made on Prepetition Debt : On or about October 11 and 12, 2023, the Bankruptcy Court entered interim orders (the “ Interim Orders ”) authorizing, but not directing, the Debtors to, among other things, pay certain prepetition claims relating to (a) employee wages, salaries, and other compensation and benefits; (b) insurance premiums; (c) taxes; and (d) the continued use of the Debtors’ Cash Management System. Final orders granting such relief were entered on or about November 9, 2023 (the “ Final Orders ,” and, collectively with the Interim Orders, the “ First Day Orders ”). Payments made on prepetition debt pursuant to the First Day Orders are not recorded in attachment MOR - 5. Payments to Insiders : All payments made by the Debtors to “Insiders,” as such term is defined in 11 U.S.C. † 101(31), constituted the regular compensation owed to those individuals or reimbursements in the ordinary course of business as recorded in attachment MOR - 5.

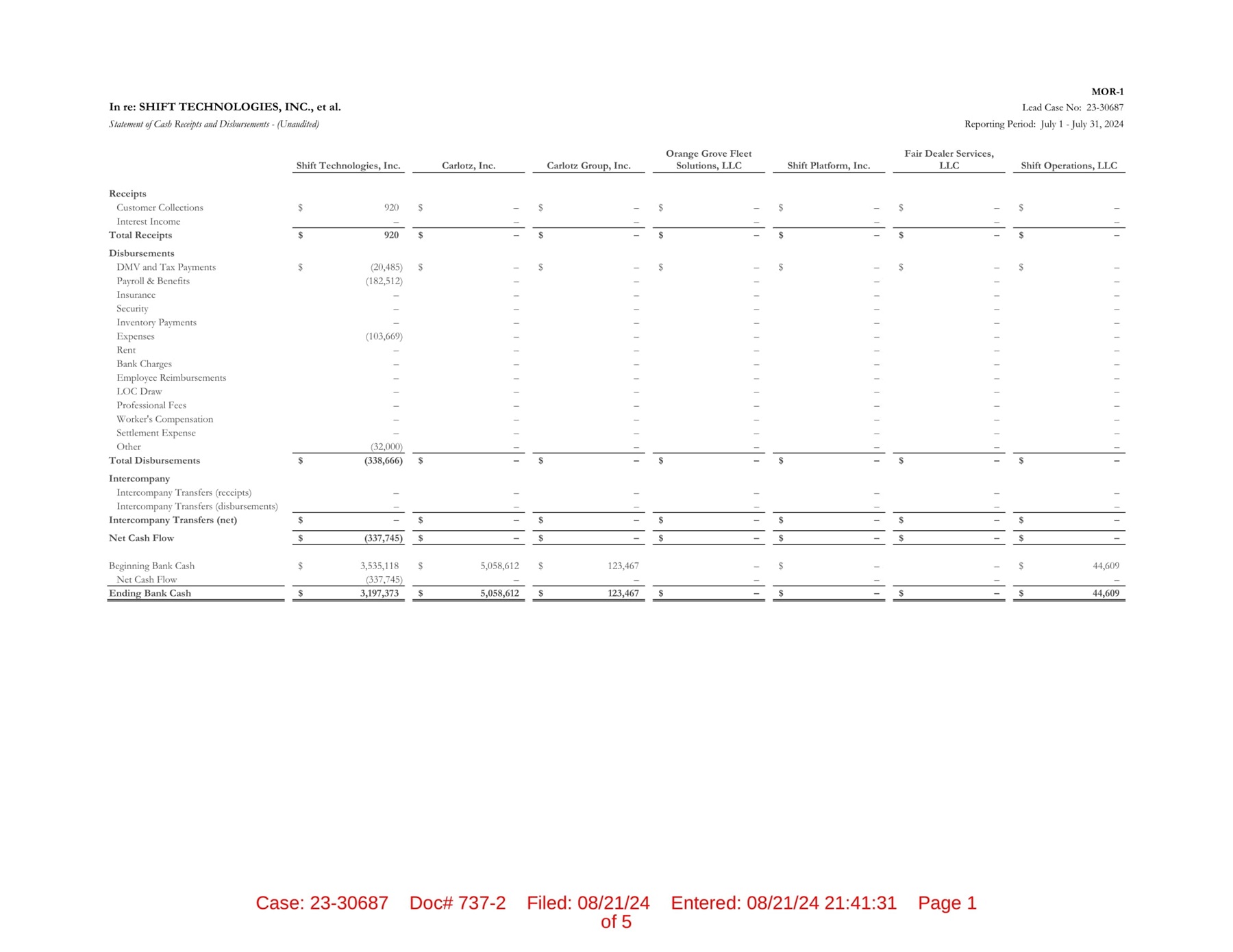

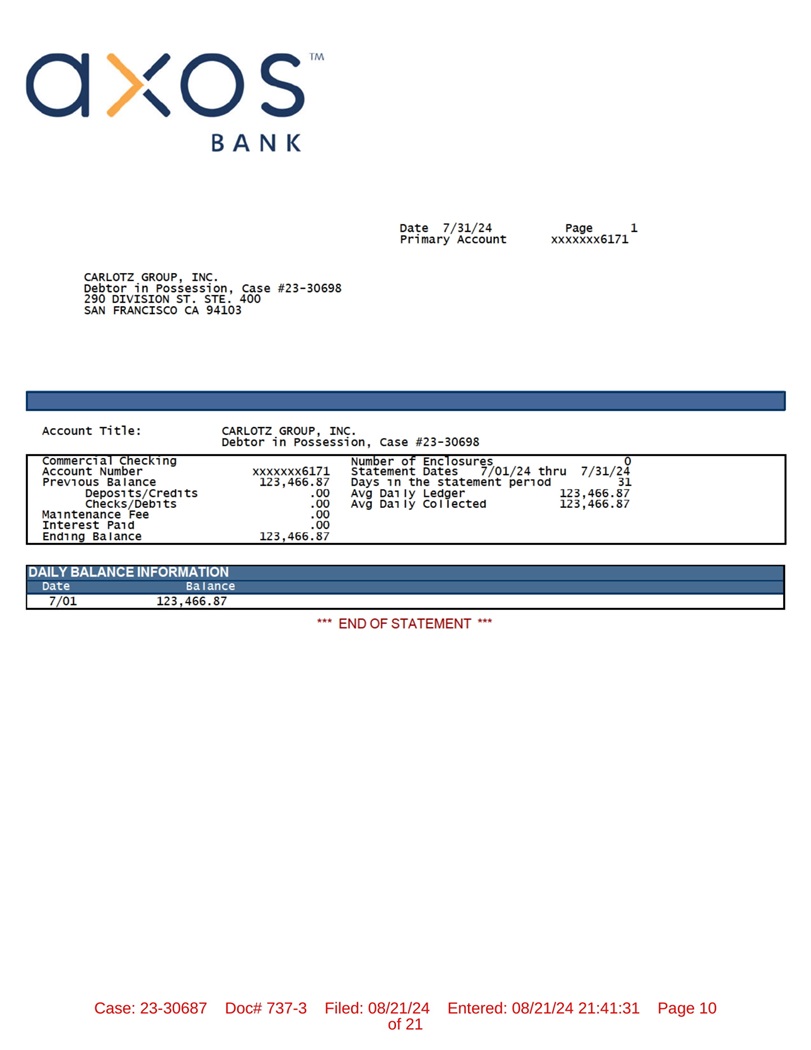

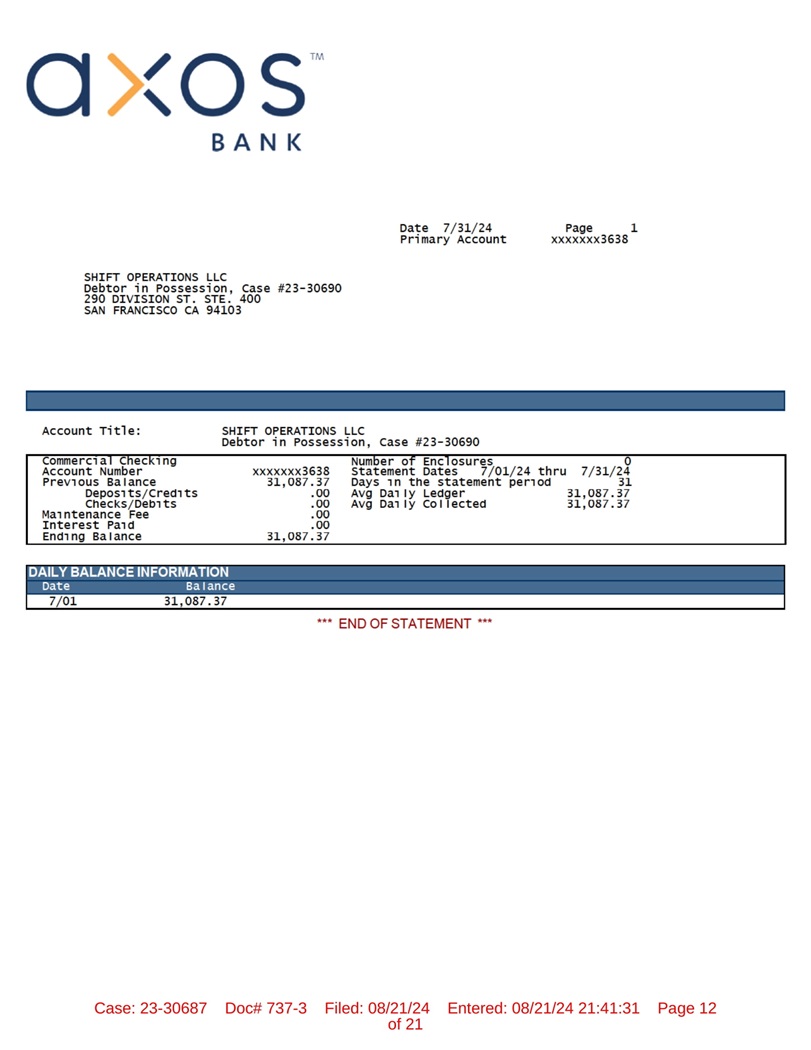

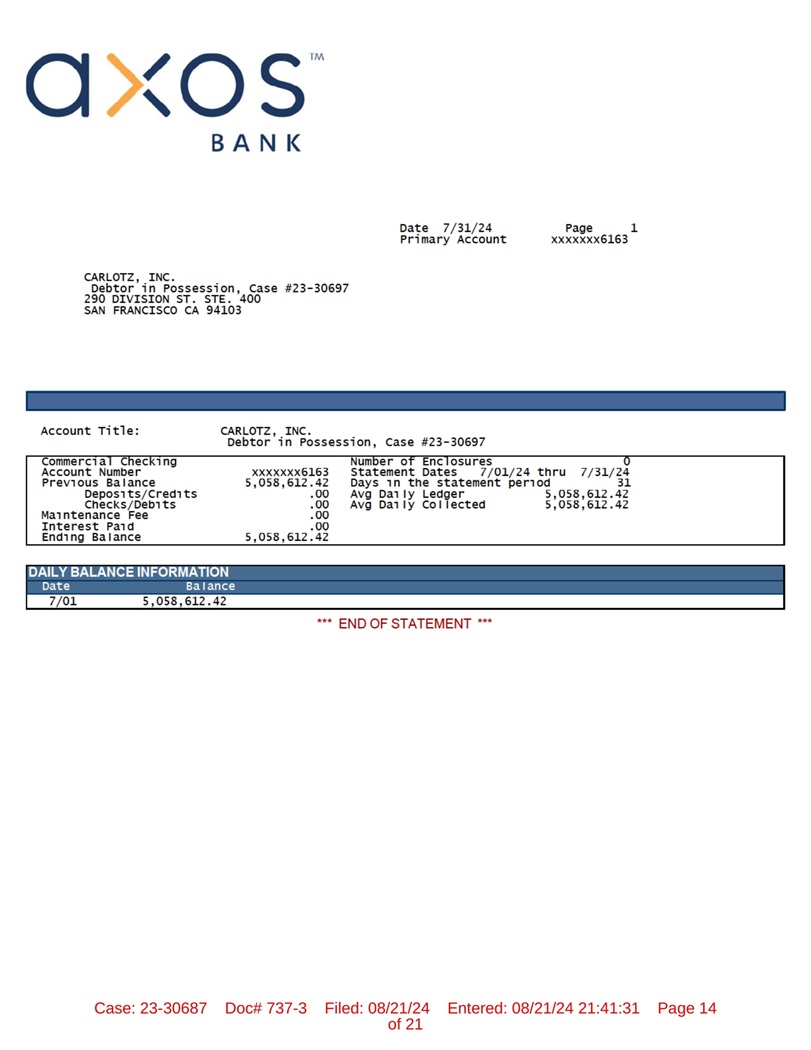

MOR - 1 Lead Case No: 23 - 30687 Reporting Period: July 1 - July 31, 2024 In re: SHIFT TECHNOLOGIES, INC., et al. Statement of Cash Receipts and Disbursements - (Unaudited) Shift Technologies, Inc. Carlotz, Inc. Carlotz Group, Inc. Orange Grove Fleet Solutions, LLC Shift Platform, Inc. F ai r De a l er S e r v i ces, LLC Shift Operations, LLC Receipts Custo m er Col l ect i ons Interest Income $ 920 $ – $ – $ – $ – $ – $ – – – – – – – – – – $ – $ – $ – $ – $ $ 920 $ To ta l R ece ip t s Disbursements – – $ – $ – $ – $ – $ $ (20,485) $ DMV and Tax Payments – – – – – – (182,512) P a y ro ll & Be n efits – – – – – – – Insurance – – – – – – – Security – – – – – – – Inventory Payments – – – – – – (103,669) Expenses – – – – – – – Rent – – – – – – – B an k C har ges – – – – – – – Employee Reimbursements – – – – – – – LOC Draw – – – – – – – Professional Fees – – – – – – – W or ke r 's C o m p e nsat i o n – – – – – – – S e tt le m e n t Exp e ns e (32,000) – – – – – – $ (338,666) $ – $ – $ – $ – $ – $ – – – – – – – – – – – – – – – $ – $ – $ – $ – $ – $ – $ – Other To t a l D i sb u r se m e n t s Intercompany Intercompany Transfers (receipts) Intercompany Transfers (disbursements) Intercompany Transfers (net) Net Cash Flow $ (337,745) $ – $ – $ – $ – $ – $ – Beginning Bank Cash $ 3,535,118 $ 5,058,612 $ 123,467 – $ – – $ 44,609 Net Cash Flow (337,745) – – – – – – Ending Bank Cash $ 3,197,373 $ 5,058,612 $ 123,467 $ – $ – $ – $ 44,609 Case: 23 - 30687 Doc# 737 - 2 Filed: 08/21/24 of 5 Entered: 08/21/24 21:41:31 Page 1

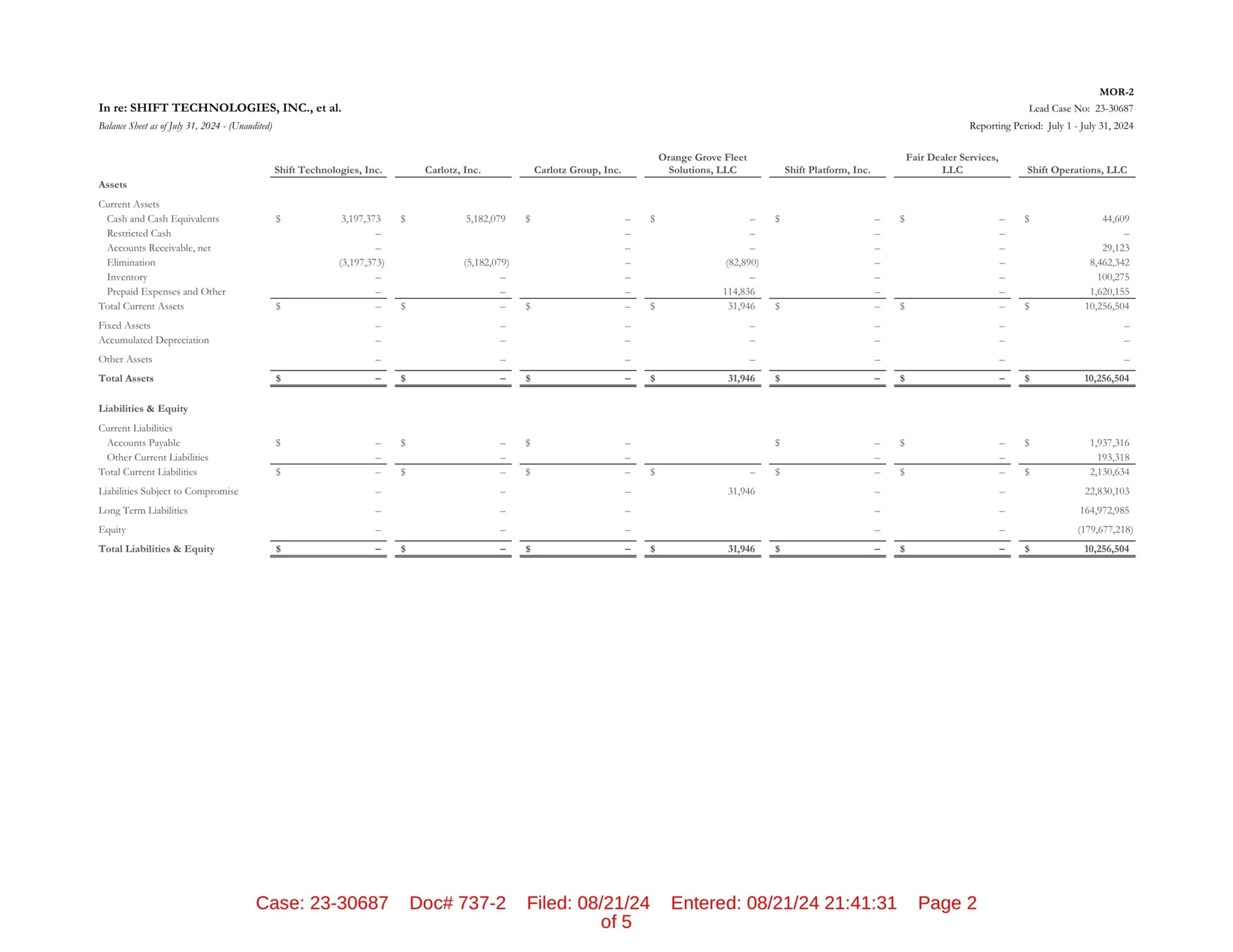

MOR - 2 Lead Case No: 23 - 30687 Reporting Period: July 1 - July 31, 2024 In re: SHIFT TECHNOLOGIES, INC., et al. Balance Sheet a s of July 31, 2024 - (Unaudited) Shift Technologies, Inc. Carlotz , Inc. Carlotz Group, Inc. Orange Grove Fleet Solutions, LLC Shift Platform, Inc. Fair Dealer Services, LLC Shift Operations, LLC Assets Current Assets $ 44,609 $ – $ – $ – $ – $ 5,182,079 $ 3,197,373 Cash and Cash Equivalents – – – – – – Restricted Cash 29,123 – – – – – Accounts Receivable, net 8,462,342 – – (82,890) – (5,182,079) (3,197,373) Elimination 100,275 – – – – – – Inventory 1,620,155 – – 114,836 – – – Prepaid Expenses and Other – $ 10,256,504 – – – $ – $ 31,946 – – $ – – $ – – $ – $ Total Current Assets Fixed Assets – – – – – – – Accumulated Depreciation – – – – – – – Other Assets $ 10,256,504 $ – $ – $ 31,946 $ – $ – $ – Total Assets Liabilities & Equity $ 1,937,316 $ – $ – $ – $ – $ – Current Liabilities Accounts Payable 193,318 – – – – – Other Current Liabilities – $ 2,130,634 – $ $ – – $ – $ – $ $ Total Current Liabilities – 22,830,103 – 31,946 – – – Liabilities Subject to Compromise – 164,972,985 – – – – Long Term Liabilities – (179,677,218) – – – – Equity Total Liabilities & Equity $ – $ – $ – $ 31,946 $ – $ – $ 10,256,504 Case: 23 - 30687 Doc# 737 - 2 Filed: 08/21/24 of 5 Entered: 08/21/24 21:41:31 Page 2

Case: 23 - 30687 Doc# 737 - 2 Filed: 08/21/24 of 5 Entered: 08/21/24 21:41:31 Page 3 MOR - 3 Lead Case No: 23 - 30687 Reporting Period: July 1 - July 31, 2024 In re: SHIFT TECHNOLOGIES, INC., et al. Statement of Operation s for the month of July 2024 - (Unaudited) Shift Technologies, Inc. Carlotz , Inc. Carlotz Group, Inc. Orange Grove Fleet Solutions, LLC Shift Platform, Inc. Fair Dealer Services, LLC Shift Operations, LLC – $ – $ – $ – $ – $ – $ – $ Revenue Vehicle sales – – – – – – – F&I/Other – – – – – – – Total Revenue 21,558 – – – – – – Cost of Sales $ (21,558) $ – $ – $ – $ – $ – $ – Adjusted Gross Profit 187,265 – – – – – – SG&A Payroll and benefits – – – – – – – Insurance – – – – – – – Real Estate (ex HQ) 277,414 – – – – – – Technology 14,166 – – – – – – Professional Services 19,269 – – – – – – Contractors 62,800 – – – – – – Finance 364,291 – – – – – – EBITDA Adjustments (920) – – – – – – Other Selling Expense – – – – – – – Facilities – – – – – – – Marketing Expense – – – – – – – Supplies – – – – – – – Doc Ops – – – – – – – People Ops – – – – – – – Travel – – – – – – – Legal – – – – – – – Bonus $ (945,843) $ – $ – $ – $ – $ – $ – Net Ordinary Income – – – – – – – Interest Expense – – – – – – – Interest Income $ (945,843) $ – $ – $ – $ – $ – $ – Net Income (Loss)

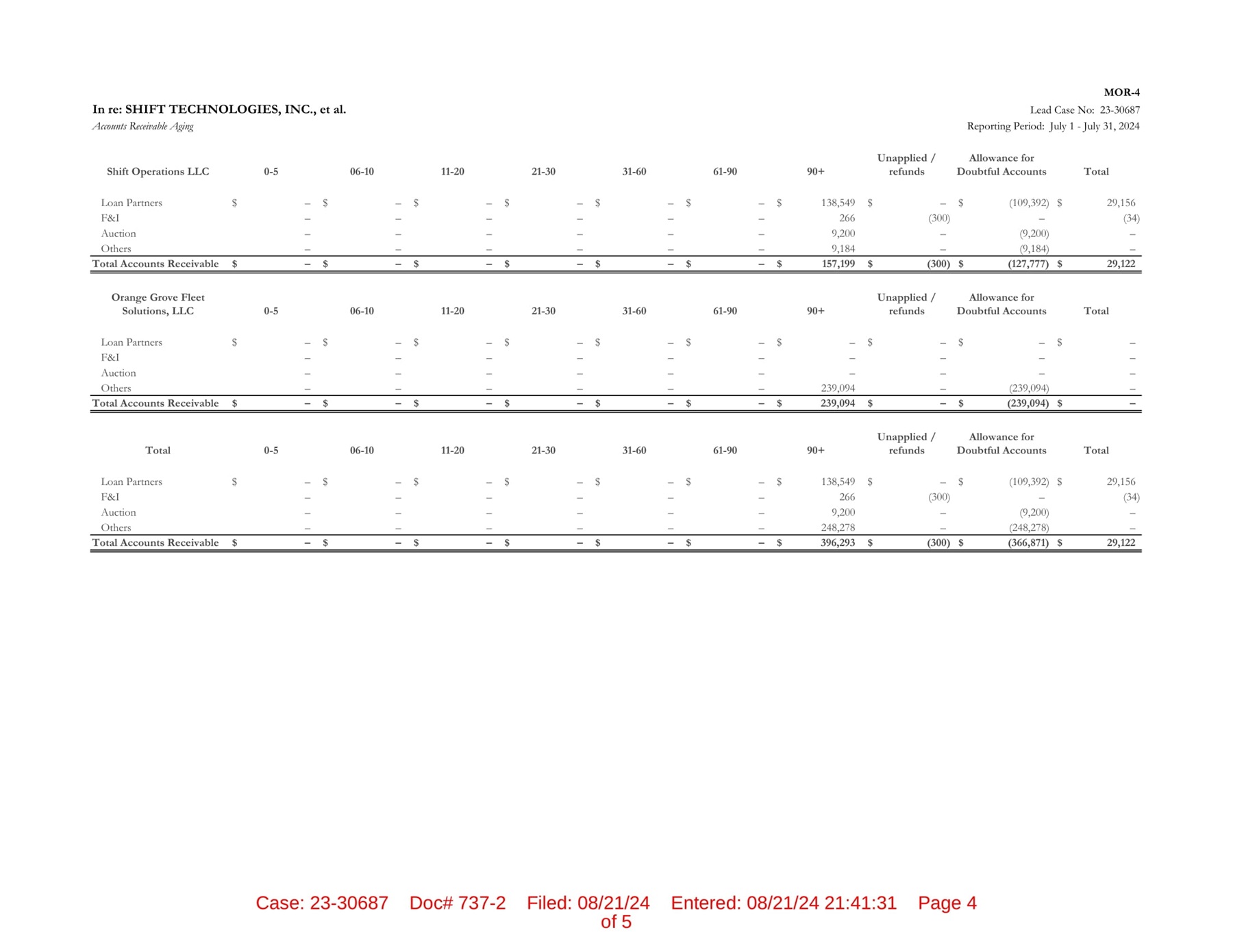

Case: 23 - 30687 Doc# 737 - 2 Filed: 08/21/24 of 5 Entered: 08/21/24 21:41:31 Page 4 MOR - 4 Lead Case No: 23 - 30687 Reporting Period: July 1 - July 31, 2024 In re: SHIFT TECHNOLOGIES, INC., et al. Account s Receivable Aging Allowance for Unapplied / Total Doubtful Accounts refunds 90+ 61 - 90 31 - 60 21 - 30 11 - 20 06 - 10 0 - 5 Shift Operations LLC $ (109,392) $ 29,156 $ – – $ 138,549 – $ – $ – $ – $ – $ $ Loan Partners – (34) (300) – 266 – – – – – F&I (9,200) – – – 9,200 – – – – – Auction (9,184) – – – 9,184 – – – – – Others 29,122 $ (127,777) $ (300) $ 157,199 $ – $ – $ – $ – $ – $ – $ Total Accounts Receivable Allowance for Unapplied / Orange Grove Fleet Total Doubtful Accounts refunds 90+ 61 - 90 31 - 60 21 - 30 11 - 20 06 - 10 0 - 5 Solutions, LLC – $ – $ – $ – $ – – $ – $ – $ – $ – $ $ Loan Partners – – – – – – – – – – F&I – – – – – – – – – – Auction – – (239,094) – 239,094 – – – – – Others – $ – $ (239,094) $ – $ 239,094 – $ – $ – $ – $ – $ $ Total Accounts Receivable Allowance for Unapplied / Total Doubtful Accounts refunds 90+ 61 - 90 31 - 60 21 - 30 11 - 20 06 - 10 0 - 5 Total $ (109,392) $ 29,156 $ – – $ 138,549 – $ – $ – $ – $ – $ $ Loan Partners – (34) (300) – 266 – – – – – F&I (9,200) – – – 9,200 – – – – – Auction (248,278) – – – 248,278 – – – – – Others Total Accounts Receivable $ – $ – $ – $ – $ – $ – $ 396,293 $ (300) $ (366,871) $ 29,122

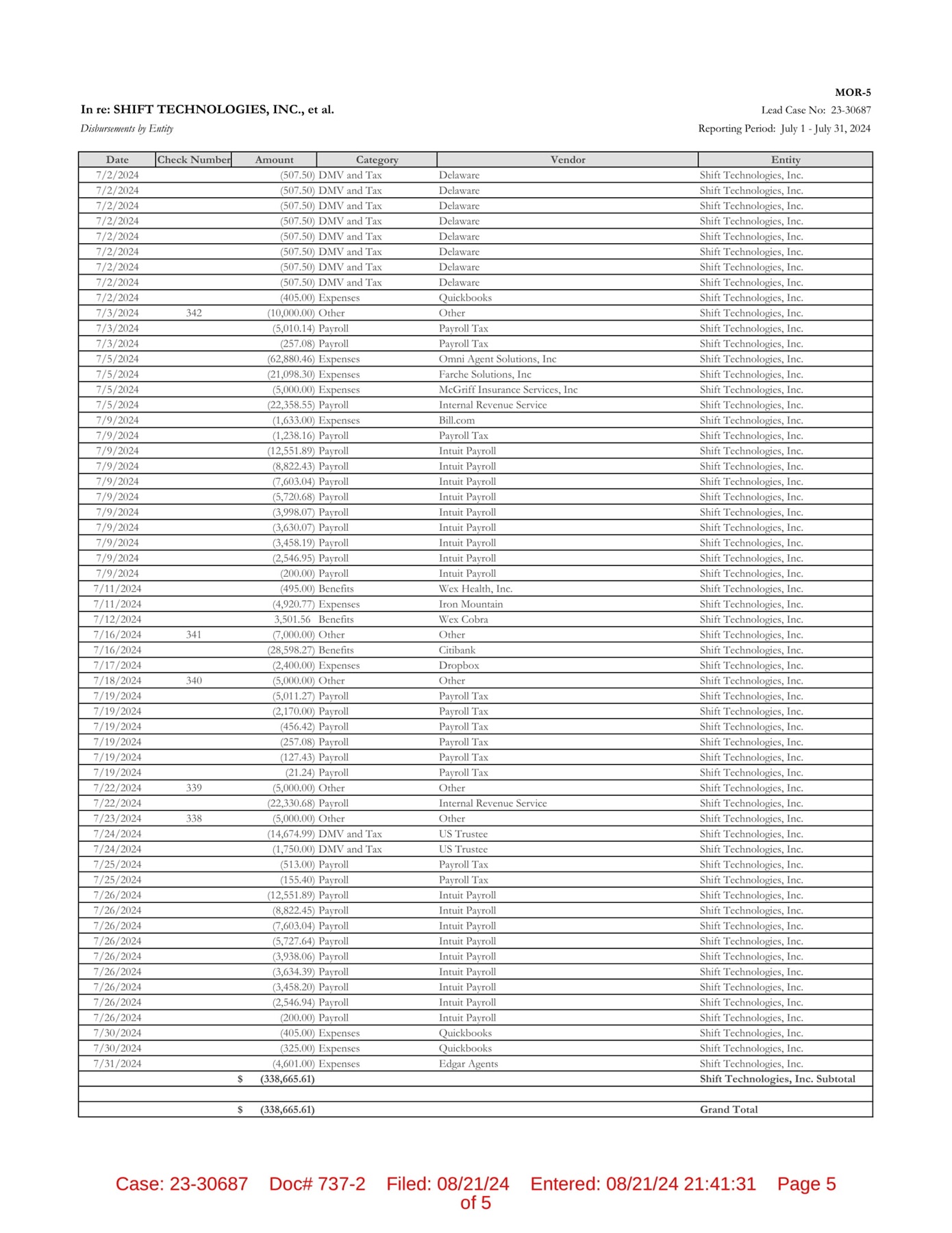

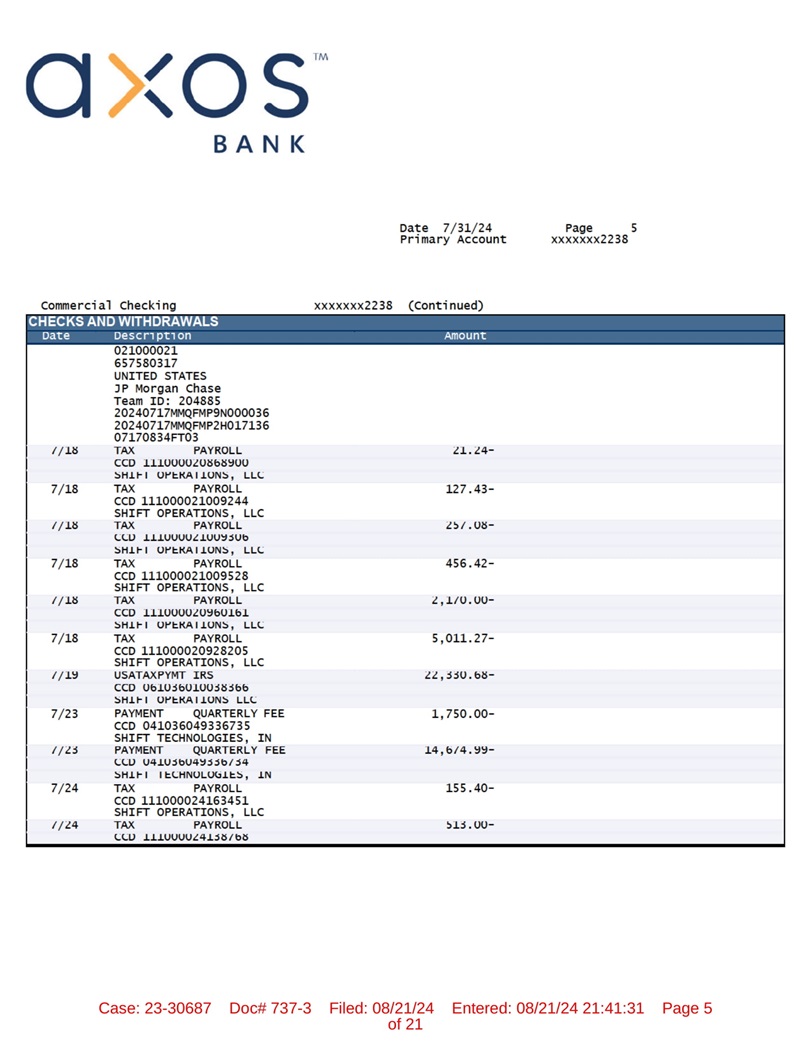

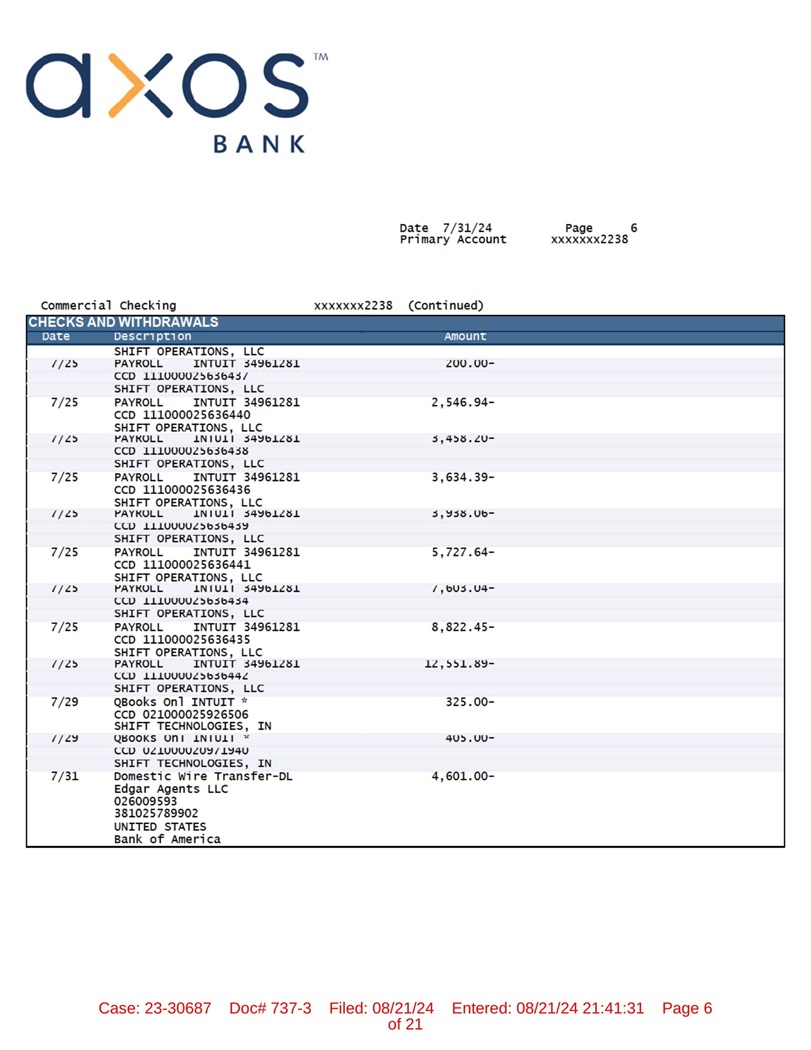

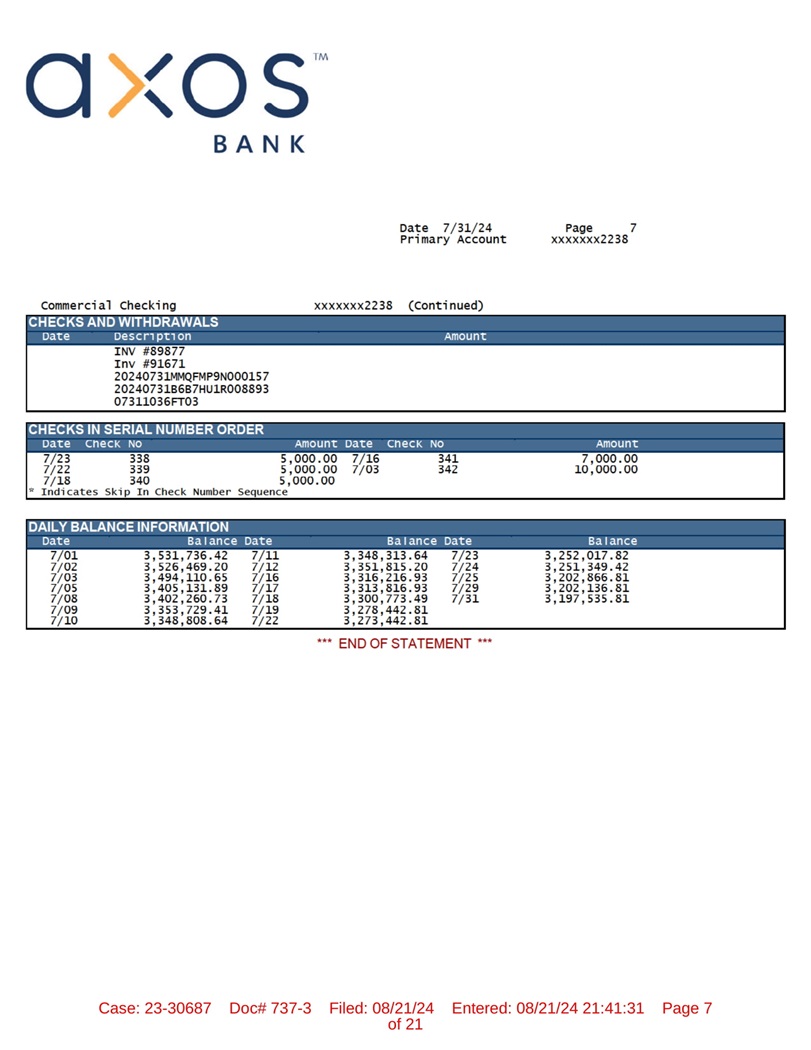

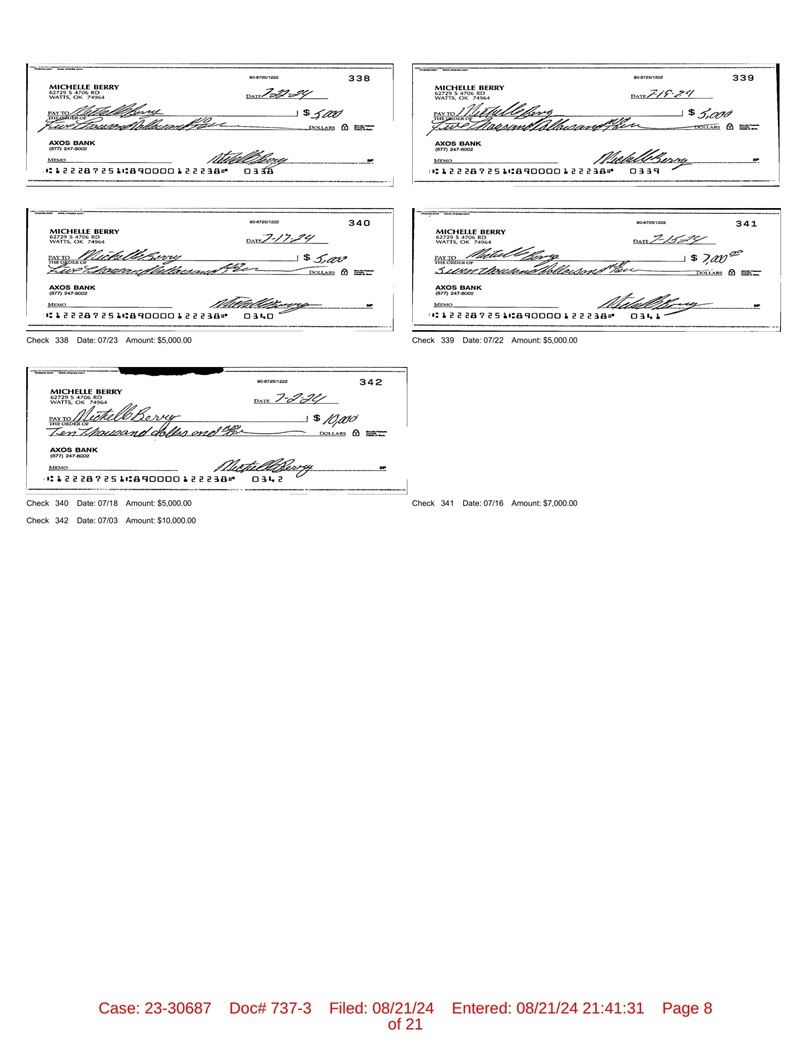

Case: 23 - 30687 Doc# 737 - 2 Filed: 08/21/24 of 5 Entered: 08/21/24 21:41:31 Page 5 Entity Vendor Category Amount Check Number Date Shift Technologies, Inc. Delaware (507.50) DMV and Tax 7/2/2024 Shift Technologies, Inc. Delaware (507.50) DMV and Tax 7/2/2024 Shift Technologies, Inc. Delaware (507.50) DMV and Tax 7/2/2024 Shift Technologies, Inc. Delaware (507.50) DMV and Tax 7/2/2024 Shift Technologies, Inc. Delaware (507.50) DMV and Tax 7/2/2024 Shift Technologies, Inc. Delaware (507.50) DMV and Tax 7/2/2024 Shift Technologies, Inc. Delaware (507.50) DMV and Tax 7/2/2024 Shift Technologies, Inc. Delaware (507.50) DMV and Tax 7/2/2024 Shift Technologies, Inc. Quickbooks (405.00) Expenses 7/2/2024 Shift Technologies, Inc. Other (10,000.00) Other 342 7/3/2024 Shift Technologies, Inc. Payroll Tax (5,010.14) Payroll 7/3/2024 Shift Technologies, Inc. Payroll Tax (257.08) Payroll 7/3/2024 Shift Technologies, Inc. Omni Agent Solutions, Inc (62,880.46) Expenses 7/5/2024 Shift Technologies, Inc. Farche Solutions, Inc (21,098.30) Expenses 7/5/2024 Shift Technologies, Inc. McGriff Insurance Services, Inc (5,000.00) Expenses 7/5/2024 Shift Technologies, Inc. Internal Revenue Service (22,358.55) Payroll 7/5/2024 Shift Technologies, Inc. Bill.com (1,633.00) Expenses 7/9/2024 Shift Technologies, Inc. Payroll Tax (1,238.16) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (12,551.89) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (8,822.43) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (7,603.04) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (5,720.68) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (3,998.07) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (3,630.07) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (3,458.19) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (2,546.95) Payroll 7/9/2024 Shift Technologies, Inc. Intuit Payroll (200.00) Payroll 7/9/2024 Shift Technologies, Inc. We x Health , Inc. (495.00) Benefits 7/11/2024 Shift Technologies, Inc. Iron Mountain (4,920.77) Expenses 7/11/2024 Shift Technologies, Inc. We x Cobra 3,501.56 Benefits 7/12/2024 Shift Technologies, Inc. Other (7,000.00) Other 341 7/16/2024 Shift Technologies, Inc. Citibank (28,598.27) Benefits 7/16/2024 Shift Technologies, Inc. Dropbox (2,400.00) Expenses 7/17/2024 Shift Technologies, Inc. Other (5,000.00) Other 340 7/18/2024 Shift Technologies, Inc. Payroll Tax (5,011.27) Payroll 7/19/2024 Shift Technologies, Inc. Payroll Tax (2,170.00) Payroll 7/19/2024 Shift Technologies, Inc. Payroll Tax (456.42) Payroll 7/19/2024 Shift Technologies, Inc. Payroll Tax (257.08) Payroll 7/19/2024 Shift Technologies, Inc. Payroll Tax (127.43) Payroll 7/19/2024 Shift Technologies, Inc. Payroll Tax (21.24) Payroll 7/19/2024 Shift Technologies, Inc. Other (5,000.00) Other 339 7/22/2024 Shift Technologies, Inc. Internal Revenue Service (22,330.68) Payroll 7/22/2024 Shift Technologies, Inc. Other (5,000.00) Other 338 7/23/2024 Shift Technologies, Inc. U S Trustee (14,674.99) DMV and Tax 7/24/2024 Shift Technologies, Inc. U S Trustee (1,750.00) DMV and Tax 7/24/2024 Shift Technologies, Inc. Payroll Tax (513.00) Payroll 7/25/2024 Shift Technologies, Inc. Payroll Tax (155.40) Payroll 7/25/2024 Shift Technologies, Inc. Intuit Payroll (12,551.89) Payroll 7/26/2024 Shift Technologies, Inc. Intuit Payroll (8,822.45) Payroll 7/26/2024 Shift Technologies, Inc. Intuit Payroll (7,603.04) Payroll 7/26/2024 Shift Technologies, Inc. Intuit Payroll (5,727.64) Payroll 7/26/2024 Shift Technologies, Inc. Intuit Payroll (3,938.06) Payroll 7/26/2024 Shift Technologies, Inc. Intuit Payroll (3,634.39) Payroll 7/26/2024 Shift Technologies, Inc. Intuit Payroll (3,458.20) Payroll 7/26/2024 Shift Technologies, Inc. Intuit Payroll (2,546.94) Payroll 7/26/2024 Shift Technologies, Inc. Intuit Payroll (200.00) Payroll 7/26/2024 Shift Technologies, Inc. Quickbooks (405.00) Expenses 7/30/2024 Shift Technologies, Inc. Quickbooks (325.00) Expenses 7/30/2024 Shift Technologies, Inc. Edgar Agents (4,601.00) Expenses 7/31/2024 Shift Technologies, Inc. Subtotal $ (338,665.61) Grand Total $ (338,665.61) MOR - 5 Lead Case No: 23 - 30687 Reporting Period: July 1 - July 31, 2024 In re: SHIF T TECHNOLOGIES, INC., et al. Disbursements b y Entity

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 5 Entered: 08/21/24 21:41:31 Page 5

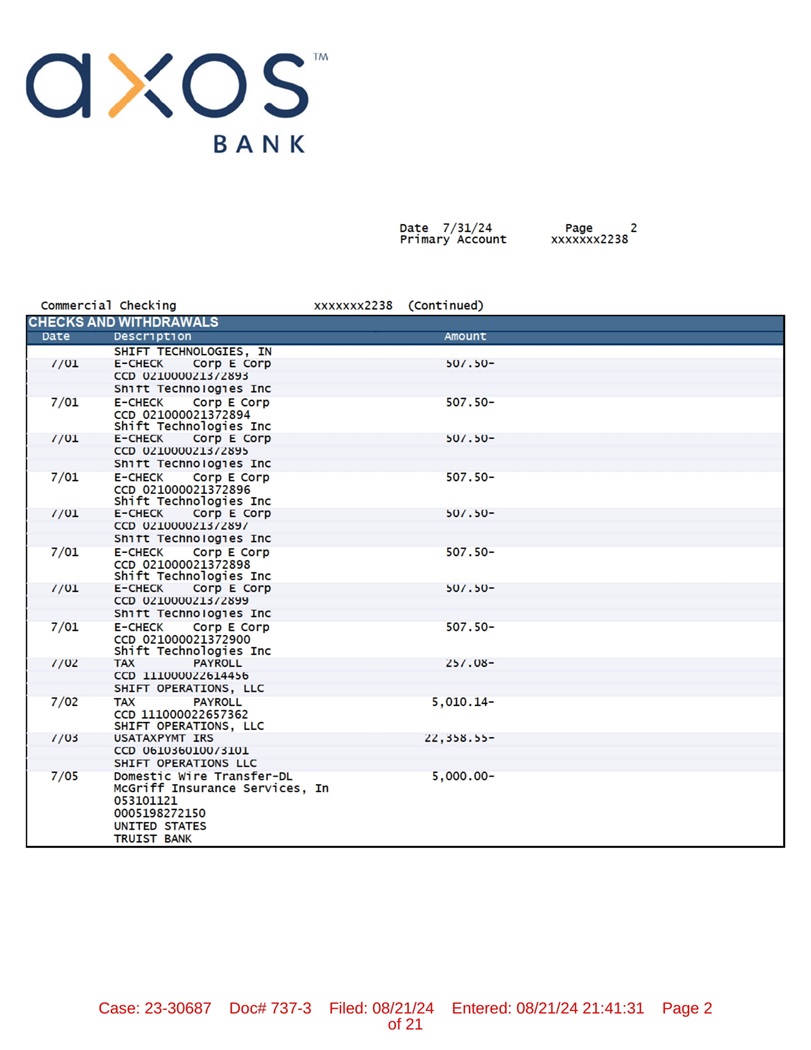

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 2

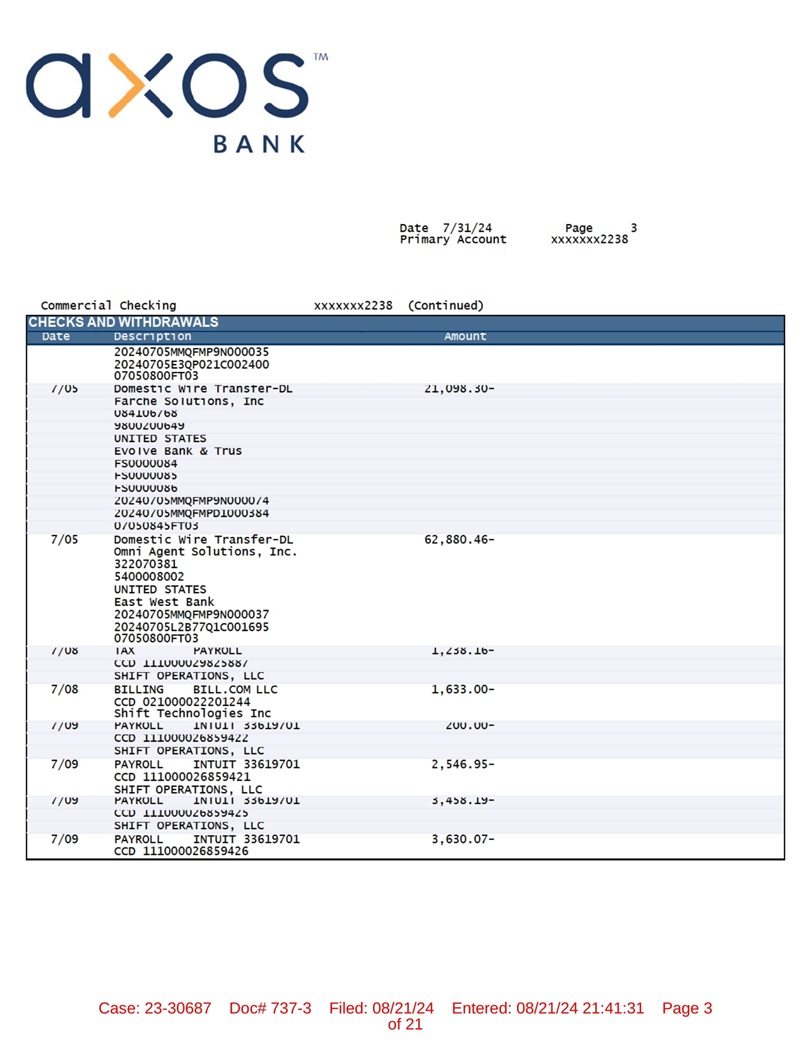

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 3

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 4

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 5

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 6

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 7

Check 338 Date: 07/23 Amount: $5,000.00 Check 339 Date: 07/22 Amount: $5,000.00 Check 340 Date: 07/18 Amount: $5,000.00 Check 341 Date: 07/16 Amount: $7,000.00 Check 342 Date: 07/03 Amount: $10,000.00 Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 8

IMPORTANT DISCLOSURE TO OUR CONSUMER CUSTOMERS In Case of Errors or Questions About Your Electronic Transfers In Case of Errors or Questions About Your Electronic Transfers, Telephone us at 1 - 888 - 502 - 2967 or Write us at the address on the front of this statement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt . We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem appeared . • T el l u s y ou r n a m e an d acc o u nt numbe r (i f any) . • Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information. • T el l u s th e d o ll ar amoun t o f t h e suspect ed e rr or . We will tell you all the results of our investigation within 10 business days and will correct any error promptly. If we need more time, we may take up to 45 days to investigate your complaint. In that case, we will provisionally credit your account for the amount you think is in error, so that you may have use of the money during the time it takes us to complete our investigation. For transfers initiated outside the United States or transfers resulting from a point of sale (POS) debit card transactions, the time period for provisional credit is 10 business days and the time to resolve the investigation is 90 days. IMPORTANT DISCLOSURES TO OUR BUSINESS CUSTOMERS Errors related to any transaction on a business account will be governed by any agreement between us and/or all applicable rules and regulations governing such transactions, including the rules of the Automated Clearing House Association (NACHA Rules) as may be amended from time to time . If you think this statement is wrong, please telephone us at the number listed on the front of this statement immediately . For our 24 - hour Automated Banking System, please call the number located on the front of the Statement. CONSUMER BILLING RIGHTS SUMMARY REGARDING YOUR RESERVE LINE What to do if you think you find a mistake on your statement: Contact us at the address shown on the front of this statement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt . We must hear from you within 60 days after the error appeared on your statement. • T el l u s you r n a m e an d ac c o unt nu m b e r . • Tell us the dollar amount of the suspected error. • Describe the error you are unsure about, and explain as clearly as you can why you believe there is an error or why you need more information. You must notify us of any potential errors in writing or electronically. You may call us, but if you do, we are not required to investigate any potential errors and you may have to pay the amount in question. While we investigate whether or not there has been an error, the following are true: • We cannot try to collect the amount in question, or report you as delinquent on that amount. • The amount in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a mistake,you will not have to pay the amount in question or other fees related to that amount. • While you do not have to pay the amount in question, you are responsible for the remainder of your balance. • We ca n a p pl y a n y un p a id amoun t a g ains t y o u r credi t l i mi t . REPORTS TO AND FROM CREDIT BUREAUS FOR RESERVE LINES We may report information about your account to credit bureaus. Late payments, missed payments or other defaults on your account may be reflected in your credit report. CONSUMER REPORT DISPUTES We may report information about negative account activity on consumer and small business deposit accounts and consumer reserv e l ines to Consumer Reporting Agencies (CRA). As a result, this may prevent you from obtaining services at other financial institutions. If you believe we have inaccurately reported information to a CRA, you may submit a dispute by calling 1 - 800 - 428 - 9623 or by writing to Chex Systems, Attention Consumer Relations, 7805 Hudson Road, Suite 100, Woodbury, MN 55125. In order to assist you with your dispute, you must provide your name, address and phone number; the account number; the specific information you are disputing; the exp lan ation of why it is incorrect; and any supporting documentation (i.e. affidavit of identity theft). If applicable. ©2018 Axos B C an a k s . A e ll : R 2 ig 3 ht - s 3 R 0 e 6 se 8 rv 7 ed. Doc# 737 - 3 DEP 950 (10/18) Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 9

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 10

IMPORTANT DISCLOSURE TO OUR CONSUMER CUSTOMERS In Case of Errors or Questions About Your Electronic Transfers In Case of Errors or Questions About Your Electronic Transfers, Telephone us at 1 - 888 - 502 - 2967 or Write us at the address on the front of this statement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt . We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem appeared . • T el l u s y ou r n a m e an d acc o u nt numbe r (i f any) . • Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information. • T el l u s th e d o ll ar amoun t o f t h e suspect ed e rr or . We will tell you all the results of our investigation within 10 business days and will correct any error promptly. If we need more time, we may take up to 45 days to investigate your complaint. In that case, we will provisionally credit your account for the amount you think is in error, so that you may have use of the money during the time it takes us to complete our investigation. For transfers initiated outside the United States or transfers resulting from a point of sale (POS) debit card transactions, the time period for provisional credit is 10 business days and the time to resolve the investigation is 90 days. IMPORTANT DISCLOSURES TO OUR BUSINESS CUSTOMERS Errors related to any transaction on a business account will be governed by any agreement between us and/or all applicable rules and regulations governing such transactions, including the rules of the Automated Clearing House Association (NACHA Rules) as may be amended from time to time . If you think this statement is wrong, please telephone us at the number listed on the front of this statement immediately . For our 24 - hour Automated Banking System, please call the number located on the front of the Statement. CONSUMER BILLING RIGHTS SUMMARY REGARDING YOUR RESERVE LINE What to do if you think you find a mistake on your statement: Contact us at the address shown on the front of this statement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt . We must hear from you within 60 days after the error appeared on your statement. • T el l u s you r n a m e an d ac c o unt nu m b e r . • Tell us the dollar amount of the suspected error. • Describe the error you are unsure about, and explain as clearly as you can why you believe there is an error or why you need more information. You must notify us of any potential errors in writing or electronically. You may call us, but if you do, we are not required to investigate any potential errors and you may have to pay the amount in question. While we investigate whether or not there has been an error, the following are true: • We cannot try to collect the amount in question, or report you as delinquent on that amount. • The amount in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a mistake,you will not have to pay the amount in question or other fees related to that amount. • While you do not have to pay the amount in question, you are responsible for the remainder of your balance. • We ca n a p pl y a n y un p a id amoun t a g ains t y o u r credi t l i mi t . REPORTS TO AND FROM CREDIT BUREAUS FOR RESERVE LINES We may report information about your account to credit bureaus. Late payments, missed payments or other defaults on your account may be reflected in your credit report. CONSUMER REPORT DISPUTES We may report information about negative account activity on consumer and small business deposit accounts and consumer reserv e l ines to Consumer Reporting Agencies (CRA). As a result, this may prevent you from obtaining services at other financial institutions. If you believe we have inaccurately reported information to a CRA, you may submit a dispute by calling 1 - 800 - 428 - 9623 or by writing to Chex Systems, Attention Consumer Relations, 7805 Hudson Road, Suite 100, Woodbury, MN 55125. In order to assist you with your dispute, you must provide your name, address and phone number; the account number; the specific information you are disputing; the exp lan ation of why it is incorrect; and any supporting documentation (i.e. affidavit of identity theft). If applicable. ©2018 Axos Bank. All Rights Reserved. DEP 950 (10/18) Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 11

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 12

IMPORTANT DISCLOSURE TO OUR CONSUMER CUSTOMERS In Case of Errors or Questions About Your Electronic Transfers In Case of Errors or Questions About Your Electronic Transfers, Telephone us at 1 - 888 - 502 - 2967 or Write us at the address on the front of this statement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt . We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem appeared . • Tell us your name and account number (if any). • Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information. • Tell us the dollar amount of the suspected error. We will tell you all the results of our investigation within 10 business days and will correct any error promptly. If we need more time, we may take up to 45 days to investigate your complaint. In that case, we will provisionally credit your account for the amount you think is in error, so that you may have use of the money during the time it takes us to complete our investigation. For transfers initiated outside the United States or transfers resulting from a point of sale (POS) debit card transactions, the time period for provisional credit is 10 business days and the time to resolve the investigation is 90 days. IMPORTANT DISCLOSURES TO OUR BUSINESS CUSTOMERS Errors related to any transaction on a business account will be governed by any agreement between us and/or all applicable rules and regulations governing such transactions, including the rules of the Automated Clearing House Association (NACHA Rules) as may be amended from time to time . If you think this statement is wrong, please telephone us at the number listed on the front of this statement immediately . For our 24 - hour Automated Banking System, please call the number located on the front of the Statement. CONSUMER BILLING RIGHTS SUMMARY REGARDING YOUR RESERVE LINE What to do if you think you find a mistake on your statement: Contact us at the address shown on the front of this statement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt . We must hear from you within 60 days after the error appeared on your statement . • Tell u s yo u r name an d acc oun t nu m b e r . • Tell us the dollar amount of the suspected error . • Describe the error you are unsure about, and explain as clearly as you can why you believe there is an error or why you need more information . You must notify us of any potential errors in writing or electronically. You may call us, but if you do, we are not required to investigate any potential errors and you may have to pay the amount in question. While we investigate whether or not there has been an error, the following are true: • We cannot try to collect the amount in question, or report you as delinquent on that amount. • The amount in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a mistake,you will not have to pay the amount in question or other fees related to that amount. • While you do not have to pay the amount in question, you are responsible for the remainder of your balance. • We can apply any unpaid amount against your credit limit. REPORTS TO AND FROM CREDIT BUREAUS FOR RESERVE LINES We may report information about your account to credit bureaus. Late payments, missed payments or other defaults on your account may be reflected in your credit report. CONSUMER REPORT DISPUTES We may report information about negative account activity on consumer and small business deposit accounts and consumer reserve lines to Consumer Reporting Agencies (CRA). As a result, this may prevent you from obtaining services at other financial institutions. If you believe we have inaccurately reported information to a CRA, you may submit a dispute by calling 1 - 800 - 428 - 9623 or by writing to Chex Systems, Attention Consumer Relations, 7805 Hudson Road, Suite 100, Woodbury, MN 55125. In order to assist you with your dispute, you must provide your name, address and phone number; the account number; the specific information you are disputing; the explanation of why it is incorrect; and any supporting documentation (i.e. affidavit of identity theft). If applicable. ©2018 Axos Bank. All Rights Reserved. DEP 950 (10/18) Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 13

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 14

IMPORTANT DISCLOSURE TO OUR CONSUMER CUSTOMERS In Case of Errors or Questions About Your Electronic Transfers In Case of Errors or Questions About Your Electronic Transfers, Telephone us at 1 - 888 - 502 - 2967 or Write us at the address on the front of this statement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt . We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem appeared . • T el l u s y ou r n a m e an d acc o u nt numbe r (i f any) . • Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information. • T el l u s th e d o ll ar amoun t o f t h e suspect ed e rr or . We will tell you all the results of our investigation within 10 business days and will correct any error promptly. If we need more time, we may take up to 45 days to investigate your complaint. In that case, we will provisionally credit your account for the amount you think is in error, so that you may have use of the money during the time it takes us to complete our investigation. For transfers initiated outside the United States or transfers resulting from a point of sale (POS) debit card transactions, the time period for provisional credit is 10 business days and the time to resolve the investigation is 90 days. IMPORTANT DISCLOSURES TO OUR BUSINESS CUSTOMERS Errors related to any transaction on a business account will be governed by any agreement between us and/or all applicable rules and regulations governing such transactions, including the rules of the Automated Clearing House Association (NACHA Rules) as may be amended from time to time . If you think this statement is wrong, please telephone us at the number listed on the front of this statement immediately . For our 24 - hour Automated Banking System, please call the number located on the front of the Statement. CONSUMER BILLING RIGHTS SUMMARY REGARDING YOUR RESERVE LINE What to do if you think you find a mistake on your statement: Contact us at the address shown on the front of this statement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt . We must hear from you within 60 days after the error appeared on your statement. • T el l u s you r n a m e an d ac c o unt nu m b e r . • Tell us the dollar amount of the suspected error. • Describe the error you are unsure about, and explain as clearly as you can why you believe there is an error or why you need more information. You must notify us of any potential errors in writing or electronically. You may call us, but if you do, we are not required to investigate any potential errors and you may have to pay the amount in question. While we investigate whether or not there has been an error, the following are true: • We cannot try to collect the amount in question, or report you as delinquent on that amount. • The amount in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a mistake,you will not have to pay the amount in question or other fees related to that amount. • While you do not have to pay the amount in question, you are responsible for the remainder of your balance. • We ca n a p pl y a n y un p a id amoun t a g ains t y o u r credi t l i mi t . REPORTS TO AND FROM CREDIT BUREAUS FOR RESERVE LINES We may report information about your account to credit bureaus. Late payments, missed payments or other defaults on your account may be reflected in your credit report. CONSUMER REPORT DISPUTES We may report information about negative account activity on consumer and small business deposit accounts and consumer reserv e l ines to Consumer Reporting Agencies (CRA). As a result, this may prevent you from obtaining services at other financial institutions. If you believe we have inaccurately reported information to a CRA, you may submit a dispute by calling 1 - 800 - 428 - 9623 or by writing to Chex Systems, Attention Consumer Relations, 7805 Hudson Road, Suite 100, Woodbury, MN 55125. In order to assist you with your dispute, you must provide your name, address and phone number; the account number; the specific information you are disputing; the exp lan ation of why it is incorrect; and any supporting documentation (i.e. affidavit of identity theft). If applicable. ©2018 Axos Bank. All Rights Reserved. DEP 950 (10/18) Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 15

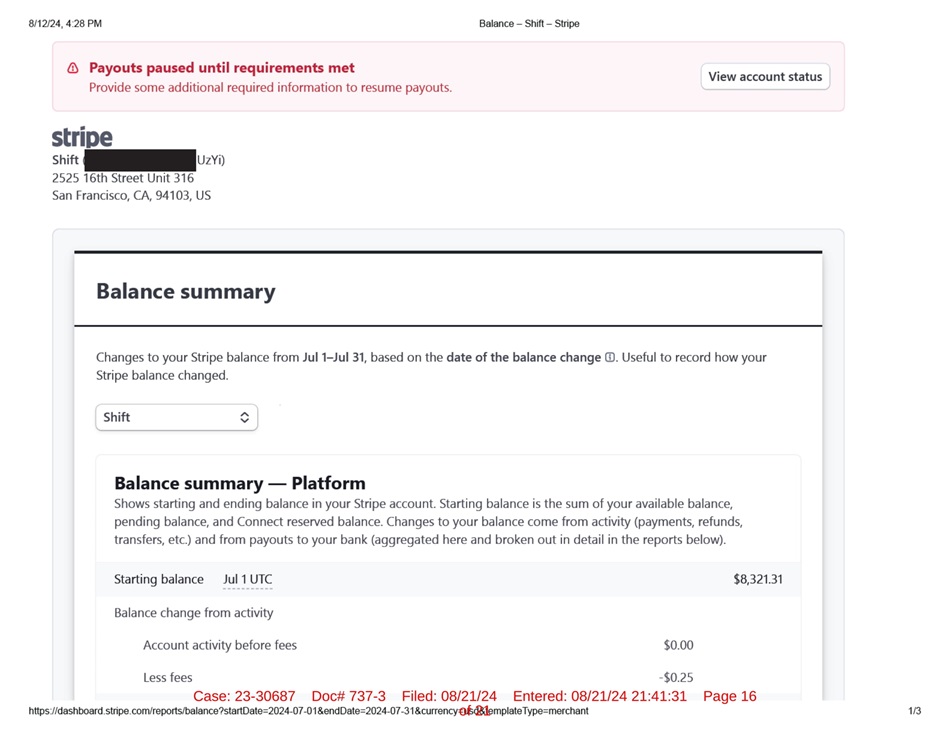

Case: 23 - 30687 of 21 Doc# 737 - 3 Filed: 08/21/24 Entered: 08/21/24 21:41:31 Page 16

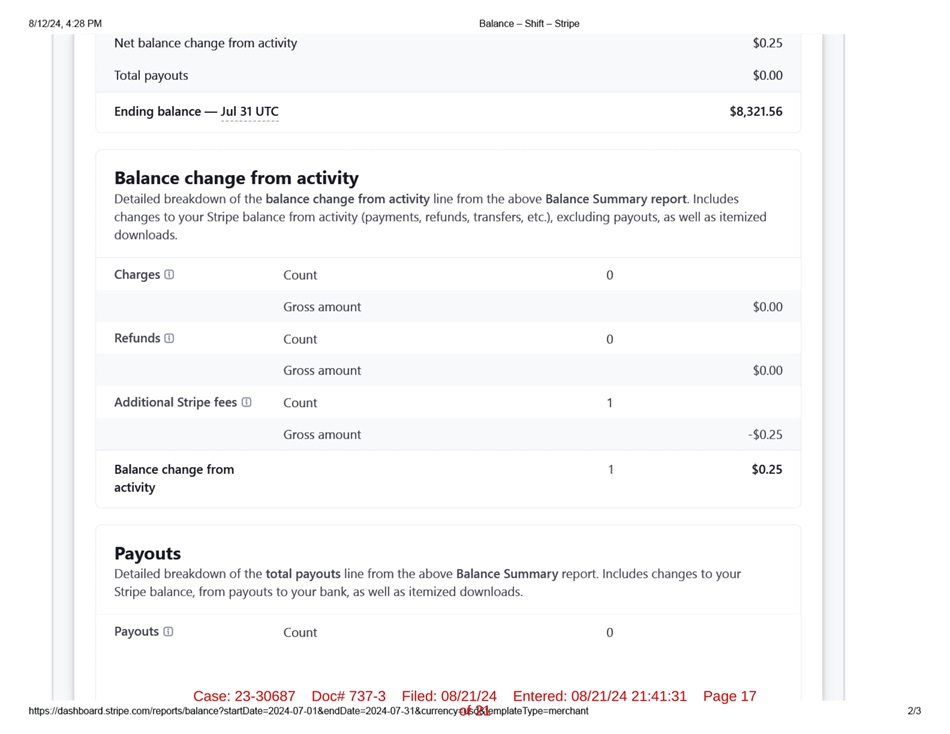

Case: 23 - 30687 of 21 Doc# 737 - 3 Filed: 08/21/24 Entered: 08/21/24 21:41:31 Page 17

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 18

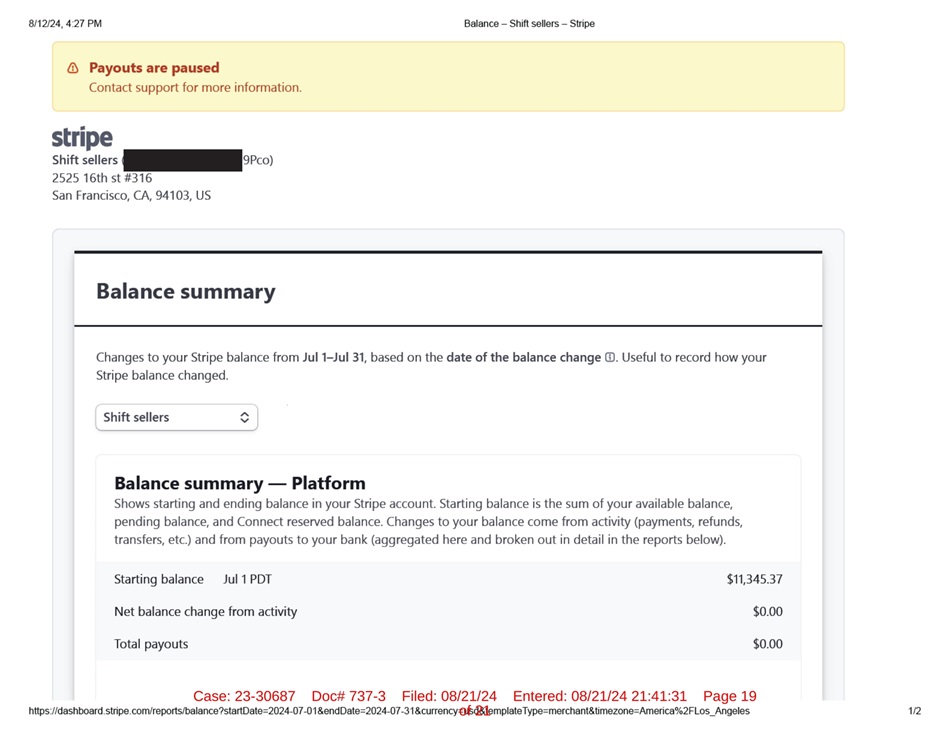

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 19

Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 20

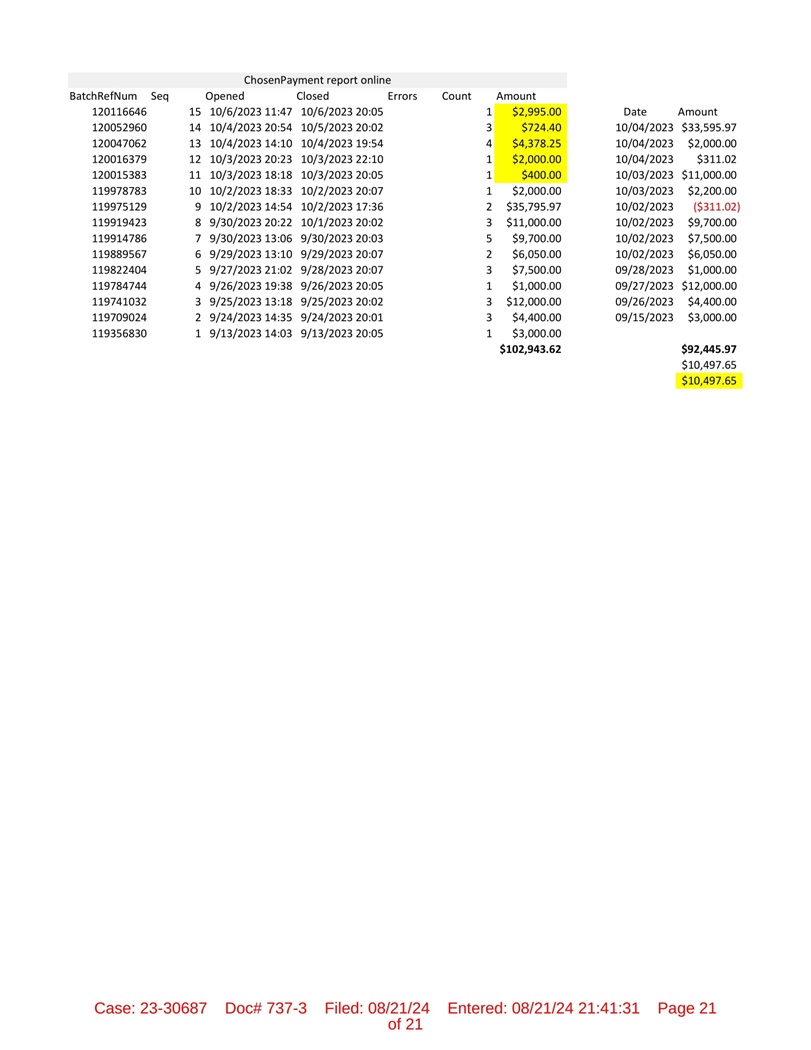

ChosenPayment report online Amount Count Errors Closed Opened BatchRefNum Seq Amount Date $2,995.00 1 10/6/2023 20:05 10/6/2023 11:47 15 120116646 $33,595.97 10/04/2023 $724.40 3 10/5/2023 20:02 10/4/2023 20:54 14 120052960 $2,000.00 10/04/2023 $4,378.25 4 10/4/2023 19:54 10/4/2023 14:10 13 120047062 $311.02 10/04/2023 $2,000.00 1 10/3/2023 22:10 10/3/2023 20:23 12 120016379 $11,000.00 10/03/2023 $400.00 1 10/3/2023 20:05 10/3/2023 18:18 11 120015383 $2,200.00 10/03/2023 $2,000.00 1 10/2/2023 20:07 10/2/2023 18:33 10 119978783 ($311.02) 10/02/2023 $35,795.97 2 10/2/2023 17:36 10/2/2023 14:54 9 119975129 $9,700.00 10/02/2023 $11,000.00 3 10/1/2023 20:02 9/30/2023 20:22 8 119919423 $7,500.00 10/02/2023 $9,700.00 5 9/30/2023 20:03 9/30/2023 13:06 7 119914786 $6,050.00 10/02/2023 $6,050.00 2 9/29/2023 20:07 9/29/2023 13:10 6 119889567 $1,000.00 09/28/2023 $7,500.00 3 9/28/2023 20:07 9/27/2023 21:02 5 119822404 $12,000.00 09/27/2023 $1,000.00 1 9/26/2023 20:05 9/26/2023 19:38 4 119784744 $4,400.00 09/26/2023 $12,000.00 3 9/25/2023 20:02 9/25/2023 13:18 3 119741032 $3,000.00 09/15/2023 $4,400.00 3 9/24/2023 20:01 9/24/2023 14:35 2 119709024 $3,000.00 1 9/13/2023 20:05 9/13/2023 14:03 1 119356830 $92,445.97 $102,943.62 $10,497.65 $10,497.65 Case: 23 - 30687 Doc# 737 - 3 Filed: 08/21/24 of 21 Entered: 08/21/24 21:41:31 Page 21