366 Madison Avenue, 11th Floor, New York, NY 10017

August 14, 2020

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

Office of Trade & Services

100 F Street, NE

Washington, D.C. 20549

Attention: Suying Li

Re: Acreage Holdings, Inc.

Form 10-K for Fiscal Year Ended December 31, 2019

Filed May 29, 2020

Item 2.02 Form 8-K dated June 26, 2020

File No. 000-56021

Dear Ms. Suying Li:

This letter sets forth responses of Acreage Holdings, Inc. (the “Company” or “Acreage”) to the comments of the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) set forth in the Staff’s letter dated August 7, 2020, with respect to the above referenced Form 10-K for Fiscal Year ended December 31, 2019 and (File No. 000-56021) (the “2019 Form 10-K”) and Item 2.02 Form 8-K dated June 26, 2020 (File No. 000-56021).

The text of the Staff’s comments has been included in this letter for your convenience, and we have numbered the paragraphs below to correspond to the numbers in the Staff’s letter. For your convenience, we have also set forth the Company’s response to each of the numbered comments immediately below each numbered comment.

In addition, the Company has prepared an amendment to its 2019 Form 10-K (the “2019 10-K Amendment”) in response to the Staff’s comments and the Company is concurrently filing the 2019 10-K Amendment with this letter, which reflects these revisions and updates certain other information.

Form 10-K for Fiscal Year Ended December 31, 2019

Item 9A. Controls and Procedures Management’s Annual Report on Internal Control over Financial Reporting, page 130

| 1. | You state that you did not provide a report of management’s assessment regarding internal control over financial reporting due to a transition period established by the rules of the SEC for newly public companies. However, we note that you have been required to file an annual report on Form 40-F for the year ended December 31, 2018 pursuant to section 13(a) or 15(d) of the Exchange Act. Please tell us how you have considered Instruction 1 to Item 308 of Regulation S-K in determining that you were not required to provide management’s report on internal control over financial reporting in your Form 10-K for the year ended December 31, 2019. |

Response: The Company has complied with Item 308(a) of Regulation S-K for the year ended December 31, 2019 and is filing the 2019 10-K Amendment containing the required disclosure. Please note that the Section 302 certifications as originally filed as Exhibits 31.1 and 31.2 with the 2019 Form 10-K did include the required certifications with regard to internal control over financial reporting.

Item 2.02 Form 8-K dated June 26, 2020

Exhibit 99.1 Non-GAAP Measures, Reconciliations and Discussion (Unaudited), page 3

| 2. | Staff’s Comment: You present managed revenue, pro forma revenue, and pro forma adjusted EBITDA as non-GAAP financial measures. Please tell us in detail your purpose for including the “revenue from entities under management or consulting agreements”, “pro forma adjustments”, and “managed/pro forma adjustments” as non-GAAP adjustments in calculating these non-GAAP financial measures and how you determined these non-GAAP adjustments. Please also explain why your management believes that non-GAAP financial measures with these adjustments provide useful information to investors. Please refer to the guidance in Items 10(e)(1)(i)(C) and (D) of Regulation S-K and Question 100.04 of the Non-GAAP Financial Measures Compliance and Disclosure Interpretations. |

Response: The Company respectfully refers the Staff to the descriptions of these and other non-GAAP financial measures presented by the Company on page 4 of the Company’s earnings release furnished as Exhibit 99.1 to its Current Report on Form 8-K filed with the Commission on August 11, 2020.

The Company includes certain adjustments in calculating its non-GAAP financial measures. For example, “Revenue from entities under management or consulting agreements” refers to the revenue of all entities for which we provide operational assistance to through management or consulting services or other agreements. This is calculated by obtaining monthly trial balances from the managed entities and performing an overarching elimination of any intercompany balances. The aggregated resulting balances are incorporated as revenues from entities under management or consulting agreements. Such entities operate independently, and the Company has no control over their operations. The

Company does not consolidate revenue from these entities due to lack of control. The Company believes an adjustment for this revenue in its non-GAAP presentation is important to investors because the Company advises these entities under management and the strength or weakness in the economic performance of these entities is an indication of the Company’s ability to effectively advise these entities on industry and product trends. The Company believes the non-GAAP measure of “Revenue from entities under management or consulting agreements” is important to investors as the management contracts with these managed entities could result in additional revenue to the Company. The management contracts with these entities are based on the sales of certain product or gross revenue generated or pounds of production at these entities. The total amount of management fees in any period presented was immaterial, but this metric provides investors with insights to performance and potential additional management revenue the Company could receive as a result of the managed entity performance.

“Pro forma revenue”, “pro forma EBITDA”, “pro forma adjustments” and “managed/pro forma adjustments” each refer to the Company’s managed revenue/EBITDA, plus the pre-acquisition results for all acquired entities from the beginning of the applicable period resented through the date prior to the acquisition date. The Company believes that non-GAAP measures that adjust for acquisitions are important to investors as they indicate if and when the acquisition is completed what the potential economic performance of the combined entities could be when the transaction is closed. Additionally, the Company provides pro-forma EBIDTA and pro-forma adjustment information on non-cash and one-time items in the reconciliation as management believes that this information assists investors to better understand the nature of revenue and expenses incurred during the period and to provide better comparability period over period as the nature of the non-cash and one-time items fluctuates over period.

The Company’s management uses each of the non-GAAP financial measures internally to understand, manage and evaluate the Company’s business. The Company believes each of the non-GAAP financial measures is useful to investors in allowing for greater transparency with respect to supplemental information used by management in its financial and operational decision making. The Company will provide additional information regarding its use of these measures and its belief in their importance to investors on a going forward basis, and did enhance these disclosures in its earnings release furnished as Exhibit 99.1 to its Form 8-K filed with the Commission on August 11, 2020.

| 3. | Staff’s Comment: You present the reconciliation of adjusted net income (loss) attributable to Acreage Holdings, Inc. and adjusted net earnings (loss) per share attributable to Acreage Holdings, Inc. to the most directly comparable GAAP measure. Please tell us your consideration of the guidance in Question 102.11 of the Non-GAAP Financial Measures Compliance and Disclosure Interpretations that requires the entity to present the income tax impact attributable to the non-GAAP adjustments as a separate adjustment in the reconciliation. |

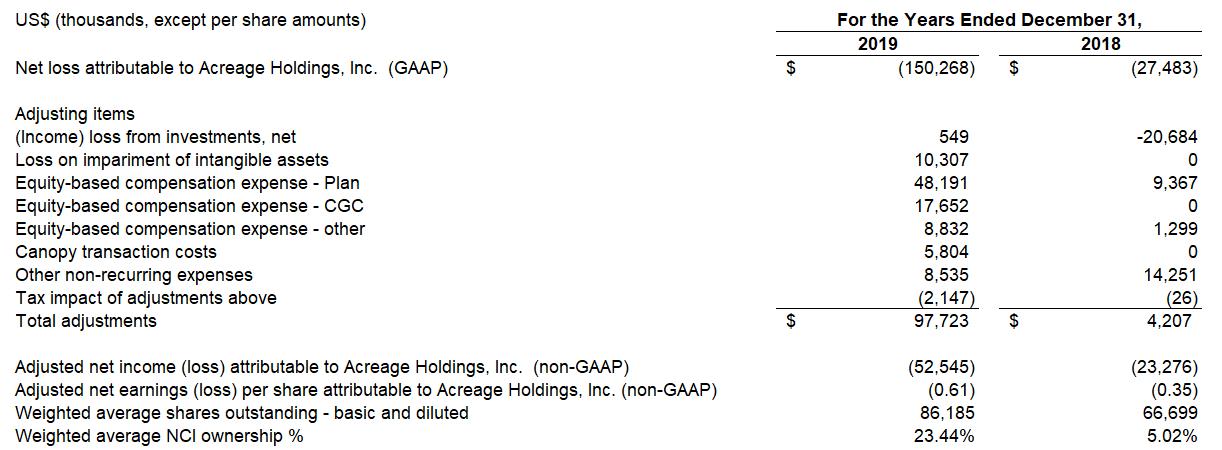

Response: In future filings, the Company will revise the reconciliation table to present the effect of income taxes as a separate adjustment and disclose how the tax effects of non-GAAP adjustments were calculated. The proposed revised presentation using amounts

from our Company’s fourth quarter and full year 2019 earnings release furnished as Exhibit 99.1 on Form 8-K filed with the Commission on February 26, 2020 is shown below:

Further, on August 11, 2020, within the context of our Form 8-K filed with the Commission to include our second quarter 2020 earnings release, the Company disclosed in Exhibit 99.1 to the Form 8-K the effect of income taxes as a separate adjustment relating to adjusted net income (loss) attributable to Acreage Holdings, Inc. and adjusted net earnings (loss) per share attributable to Acreage Holdings, Inc. consistent with the manner shown above. This disclosure is consistent with the manner in which we intend to present these reconciliations in the future.

We hope that the foregoing has been responsive to the Staff’s comments. If you have any questions related to this letter, please contact the undersigned at 347-952-6840 or Jessica S. Lochmann of Foley & Lardner LLP at 414-297-5817.

Sincerely,

/s/ Glen Leibowitz

Glen Leibowitz

Via E-mail:

cc: James A. Doherty, III, Esq.

Acreage Holdings, Inc.

Jessica S. Lochmann, Esq.

Foley and Lardner, LLP

Anson Augustine, MS, MBA, CPA

Matthew Jahrsdoerfer, CPA

Marcum llp