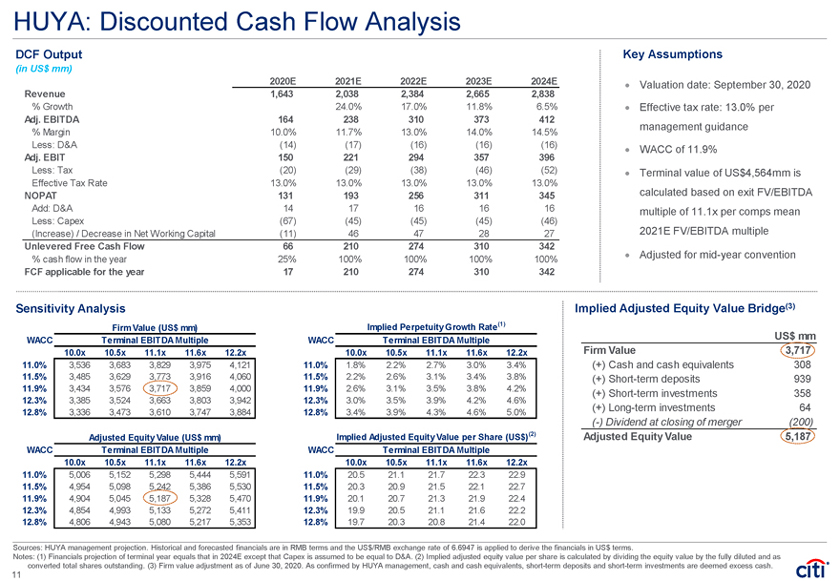

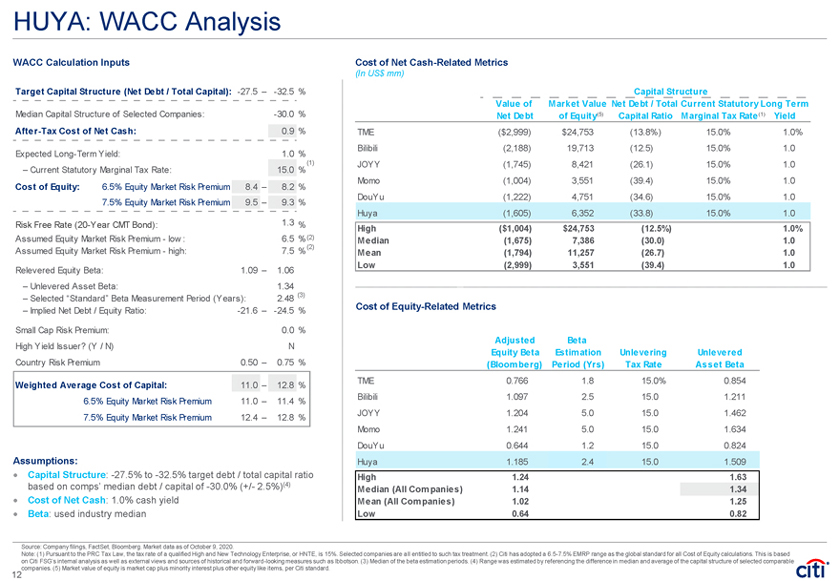

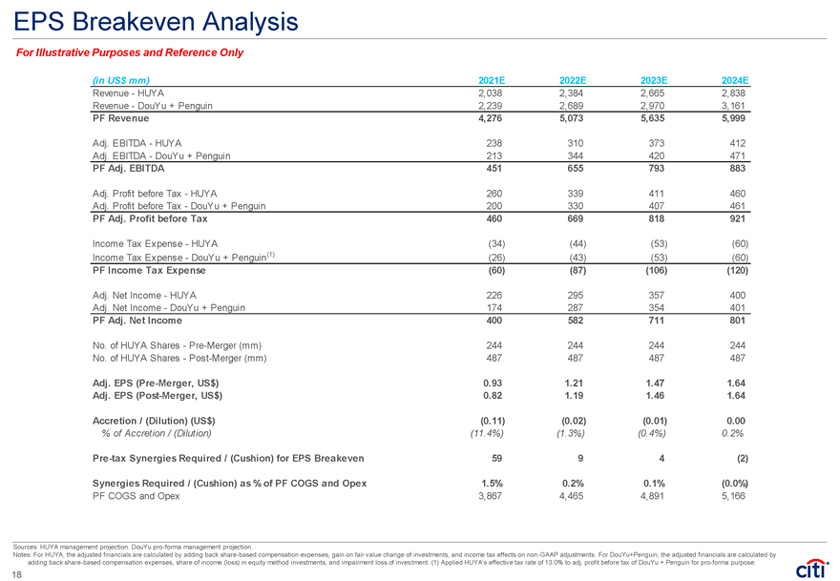

HUYA: Discounted Cash Flow Analysis

DCF Output

(in US$ mm)

2020E 2021E 2022E 2023E 2024E

Revenue 1,643 2,038 2,384 2,665 2,838

% Growth 24.0% 17.0% 11.8% 6.5%

Adj. EBITDA 164 238 310 373 412

% Margin 10.0% 11.7% 13.0% 14.0% 14.5%

Less: D&A (14) (17) (16) (16) (16)

Adj. EBIT 150 221 294 357 396

Less: Tax (20) (29) (38) (46) (52)

Effective Tax Rate 13.0% 13.0% 13.0% 13.0% 13.0%

NOPAT 131 193 256 311 345

Add: D&A 14 17 16 16 16

Less: Capex (67) (45) (45) (45) (46)

(Increase) / Decrease in Net Working Capital (11) 46 47 28 27

Unlevered Free Cash Flow 66 210 274 310 342

% cash flow in the year 25% 100% 100% 100% 100%

FCF applicable for the year 17 210 274 310 342

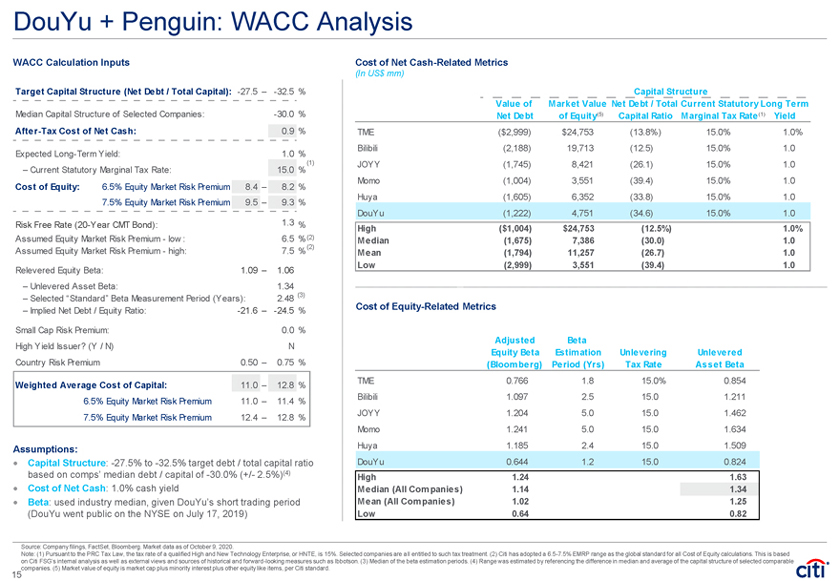

Sensitivity Analysis

Firm Value (US$ mm)

WACC Terminal EBITDA Multiple

####### 10.0x 10.5x 11.1x 11.6x 12.2x

11.0% 3,536 3,683 3,829 3,975 4,121

11.5% 3,485 3,629 3,773 3,916 4,060

11.9% 3,434 3,576 3,717 3,859 4,000

12.3% 3,385 3,524 3,663 3,803 3,942

12.8% 3,336 3,473 3,610 3,747 3,884

Adjusted Equity Value (US$ mm)

WACC Terminal EBITDA Multiple

####### 10.0x 10.5x 11.1x 11.6x 12.2x

11.0% 5,006 5,152 5,298 5,444 5,591

11.5% 4,954 5,098 5,242 5,386 5,530

11.9% 4,904 5,045 5,187 5,328 5,470

12.3% 4,854 4,993 5,133 5,272 5,411

12.8% 4,806 4,943 5,080 5,217 5,353

Implied Perpetuity Growth Rate(1)

WACC Terminal EBITDA Multiple

3.5% 10.0x 10.5x 11.1x 11.6x 12.2x

11.0% 1.8% 2.2% 2.7% 3.0% 3.4%

11.5% 2.2% 2.6% 3.1% 3.4% 3.8%

11.9% 2.6% 3.1% 3.5% 3.8% 4.2%

12.3% 3.0% 3.5% 3.9% 4.2% 4.6%

12.8% 3.4% 3.9% 4.3% 4.6% 5.0%

Implied Adjusted Equity Value per Share (US$)(2)

WACC Terminal EBITDA Multiple

10.0x 10.5x 11.1x 11.6x 12.2x

11.0% 20.5 21.1 21.7 22.3 22.9

11.5% 20.3 20.9 21.5 22.1 22.7

11.9% 20.1 20.7 21.3 21.9 22.4

12.3% 19.9 20.5 21.1 21.6 22.2

12.8% 19.7 20.3 20.8 21.4 22.0

Key Assumptions

Valuation date: September 30, 2020ï,· Effective tax rate: 13.0% per management guidance

ï,· WACC of 11.9%

ï,· Terminal value of US$4,564mm is calculated based on exit FV/EBITDA multiple of 11.1x per comps mean 2021E FV/EBITDA multiple

ï,· Adjusted for mid-year convention

Implied Adjusted Equity Value Bridge(3)

US$ mm Firm Value 3,717

(+) Cash and cash equivalents 308

(+) Short-term deposits 939

(+) Short-term investments 358

(+) Long-term investments 64

(-) Dividend at closing of merger (200)

Adjusted Equity Value 5,187

Sources: HUYA management projection. Historical and forecasted financials are in RMB terms and the US$/RMB exchange rate of 6.6947 is applied to derive the financials in US$ terms.

Notes: (1) Financials projection of terminal year equals that in 2024E except that Capex is assumed to be equal to D&A. (2) Implied adjusted equity value per share is calculated by dividing the equity value by the fully diluted and as converted total shares outstanding. (3) Firm value adjustment as of June 30, 2020. As confirmed by HUYA management, cash and cash equivalents, short-term deposits and short-term investments are deemed excess cash.