The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 18, 2019

PRELIMINARY PROSPECTUS

10,000,000 Series A Shares, including Series A Shares

represented by American Depositary Shares

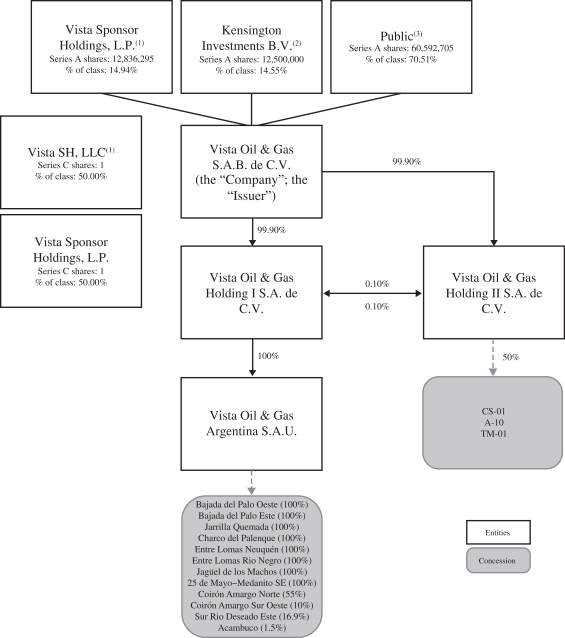

Vista Oil & Gas, S.A.B. de C.V.

This is a public offering of our series A shares of common stock, no par value and one vote per share, or the “series A shares.” We are offering series A shares in a global offering, which consists of (i) an international offering of series A shares represented by American Depositary Shares, or ADSs, in the United States of America, or the United States, and other countries outside of Mexico, which we refer to as the “international offering” and (ii) a concurrent public offering authorized by the Mexican National Banking and Securities Commission (ComisiónNacionalBancariaydeValoresor “CNBV”) of series A shares in Mexico, which we refer to as the “Mexican offering,” and together with the international offering, the “global offering.” The international offering is being underwritten by the international underwriters named in this prospectus. The Mexican offering is being conducted by the lead Mexican underwriters named elsewhere in this prospectus, or the “Mexican underwriters,” pursuant to a prospectus prepared in accordance with the laws of Mexico. The closings of the international and Mexican offerings are conditioned upon each other. Each ADS represents one series A share.

Our series A shares are listed on the Bolsa Mexicana de Valores, S.A.B. de C.V., or the “Mexican Stock Exchange,” under the symbol “VISTA.” Prior to this offering, no public market existed for the ADSs. On July 17, 2019, the closing price of our series A shares on the Mexican Stock Exchange was Ps. 180.00 per series A share (equivalent to approximately US$9.46 per series A share or US$9.46 per ADS, based on the exchange rate of Ps. 19.0233 per US$1.00 reported by theMexican Central Bankon such date). After the pricing of this offering, we expect the ADSs to trade on the New York Stock Exchange, or the “NYSE,” under the symbol “VIST.”

Neither the U.S. Securities and Exchange Commission, or the “Commission” or the “SEC,” the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria de Valores or “CNBV”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Registration of the securities described in this prospectus with the Mexican National Securities Registry (Registro Nacional de Valores or “RNV”) does not imply any certification as to the investment quality of the securities offered pursuant to this prospectus, our solvency, liquidity, credit quality or the accuracy or completeness of the information contained herein, and does not ratify or validate acts or omissions, if any, undertaken in contravention of applicable law. The information set forth in this prospectus or in any other related materials is the sole responsibility of Vista Oil & Gas, S.A.B. de C.V. and has not been reviewed nor authorized by the CNBV. The information set forth in this prospectus will be notified to the CNBV only for informational purposes, which does not imply or represent any certification by such authority with respect to the investment quality of the securities offered pursuant to this prospectus or our solvency liquidity, credit quality or the accuracy or completeness of the information contained herein, and does not ratify or validate acts or omissions, if any, undertaken in contravention of applicable law. This prospectus may not be publicly distributed in Mexico.

We have granted to the international underwriters and the Mexican underwriters options, exercisable for 30 days from the date of this prospectus, to purchase up to an aggregate of 1,500,000 additional series A shares, including series A shares represented by ADSs in the case of the international underwriters, at the public offering prices listed below, less the underwriting discounts and commissions. The international underwriters and Mexican underwriters may exercise these options solely for the purpose of covering over-allotments, if any, made in connection with the global offering, on an independent but coordinated basis.

We are an “emerging growth company” as defined in Section 2(a)(19) of the U.S. Securities Act of 1933, as amended, or the “Securities Act,” and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. In addition, for as long as we remain an emerging growth company, we will qualify for certain limited exceptions from the Sarbanes-Oxley Act of 2002. See “Risk Factors—Risks Related to the ADSs and the Offering—As a foreign private issuer and an “emerging growth company,” we will have different disclosure and other requirements than U.S. domestic registrants and non-emerging growth companies.”

Investing in the ADSs involves risks. See “Risk Factors” beginning on page 32 of this prospectus.

| | | | | | | | | | | | | | | | |

| | | Per

ADS | | | Total

per ADS | | | Per series

A share | | | Total | |

Public offering price | | US$ | | | | US$ | | | | US$ | | | | US$ | | |

Underwriting discounts and commissions(1) | | US$ | | | | US$ | | | | US$ | | | | US$ | | |

Proceeds, before expenses | | US$ | | | | US$ | | | | US$ | | | | US$ | | |

| (1) | See “Underwriting” for a description of the compensation payable to the international underwriters. |

The international underwriters expect to deliver the ADSs to purchasers on or about , 20 through the book-entry facilities of the Depository Trust Company, or “DTC.”

Joint Global Coordinators and Joint Bookrunners

Joint Bookrunners

| | | | | | |

| Itau BBA | | Morgan Stanley | | Santander |

The date of this prospectus is , 2019