Exhibit 2

2019 2nd Quarter Results Mexico City, August 7, 2019. BMV: VISTA NYSE: VIST Vista Oil & Gas, S.A.B. de C.V. (“Vista” or the “Company”) (NYSE: VIST and BMV: VISTA), a new generation publicly traded Latin-American oil & gas company.

Vista Oil & Gas Results of the 2nd quarter 2019 August 7th, 2019. México City, México. Vista Oil & Gas, S.A.B. de C.V. (“Vista” or the “Company”) (NYSE: VIST in the New York Stock Exchange and BMV: VISTA in the Mexican Stock Exchange), reported today financial and operational results for the second quarter (“Q2”) of 2019. Q2 2019 highlights: In the second quarter of 2019, our production reached an average daily volume of 29,016 barrels of oil equivalent per day (boed), 19.0% above the 24,381 boed in Q2 2018. Average daily production was comprised by 18,825 barrels of oil per day (bbld), 28.5% above Q2 2018; 1.50 million cubic meters per day (MMm3d) of natural gas, 5.1% above Q2 2018; and 741 boed of natural gas liquids (NGL). Production growth was driven by the shale development in Bajada del Palo Oeste. Shale production from this field reached a total of 4,823 boed in Q2 2019, comprised by 4,425 bbld of oil and 0.06 MMm3d of natural gas. Net revenues in Q2 were 120.4 million US dollars ($MM), 9.1% higher than the 110.3 $MM generated in Q2 2018. This increase was primarily driven by higher crude oil sales volumes as a result of theramp-up in our shale oil production from the Bajada del Palo Oeste block. In Q2 2019, the average realized price was 59.8 US dollars per barrel of oil ($/bbl), which is 12% lower than Q2 2018 due to the introduction of an export parity-based pricing formula and a lower applicable commodity reference price (Brent), which resulted in lower realized domestic sales prices. Natural gas average realized price for Q2 2019 was 3.8 US dollars per million British thermal unit ($/MMBTU), impacted by a lower average realized price in industrial and power generation segments due to excess supply in the domestic market. Average Q2 2019 lifting cost was 12.3 US dollars per barrel of oil equivalent ($/boe), posting a 12.8% decrease compared to the average lifting cost for Q2 2018 of 14.1 $/boe. Consolidated adjusted EBITDA for Q2 2019 reached 51.5 $MM, 5% above Q2 2018 and reflecting an adjusted EBITDA margin of 43%. The first4-well pad drilled in Bajada del Palo Oeste wastied-in in February 2019 and had a total production in Q2 2019 of 4,823 boed, representing 16.6% of our total production for the quarter. The second4-well pad wastied-in during July 2019. In a quarter in which we continued to increase our investments, we closed with a solid financial position: a cash balance of 74.5 $MM and a gross debt of 366.2 $MM, resulting in net debt of 291.8 $MM, a net leverage ratio of 1.6 times and 1.1 timespro-forma for the global primary equity offering. On June 27, 2019, Vista, together with Riverstone and Southern Cross Group, created Aleph Midstream, a company that will seek to become an important midstream player in the Neuquina basin focused in the Vaca Muerta shale oil window. Subject to the satisfaction of certain conditions precedent, including obtaining certain regulatory approvals, the Financial Sponsors expect to contribute up to 160 $MM in the aggregate to Aleph Midstream, in exchange for a controlling interest of up to 78.4% of Aleph Midstream’s total equity, and Vista expects to contribute a majority of its midstream assets located in the Neuquina basin, valued at approximately 45 $MM, to Aleph Midstream, in exchange for an equity interest in Aleph Midstream of at least 21.6%. Page 2

Highlights post Q2 2019: On July 25, 2019, Vista announced the underwritten public offering of the Company’s Series A shares as part of the global primary offering of 10,906,257 Series A shares with NYSE listing (each ADS representing one Series A share). Total gross proceeds of the Company’s global offering reached approximately 101 $MM, before fees and expenses. On July 31, 2019, Vista Argentina issued a24-months bullet bond for 50 $MM at a flat interest rate of 7.88%. On August 7, 2019, Vista Argentina issued a36-months bullet bond for an additional 50 $MM at a flat interest rate of 8.50%. Page 3

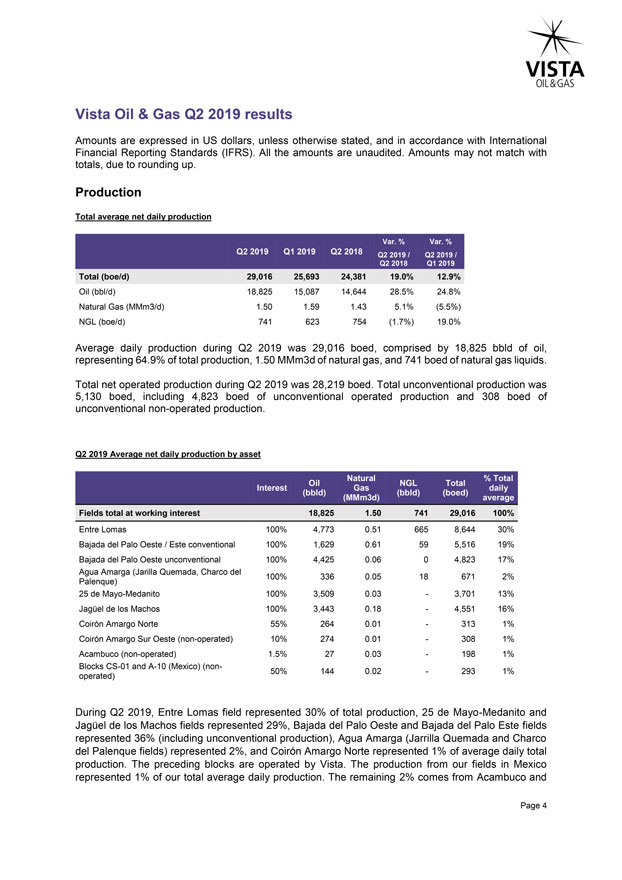

Vista Oil & Gas Q2 2019 results Amounts are expressed in US dollars, unless otherwise stated, and in accordance with International Financial Reporting Standards (IFRS). All the amounts are unaudited. Amounts may not match with totals, due to rounding up. Production Total average net daily production Var. % Var. % Q2 2019 Q1 2019 Q2 2018 Q2 2019 / Q2 2019 / Q2 2018 Q1 2019 Total (boe/d) 29,016 25,693 24,381 19.0% 12.9% Oil (bbl/d) 18,825 15,087 14,644 28.5% 24.8% Natural Gas (MMm3/d) 1.50 1.59 1.43 5.1% (5.5%) NGL (boe/d) 741 623 754 (1.7%) 19.0% Average daily production during Q2 2019 was 29,016 boed, comprised by 18,825 bbld of oil, representing 64.9% of total production, 1.50 MMm3d of natural gas, and 741 boed of natural gas liquids. Total net operated production during Q2 2019 was 28,219 boed. Total unconventional production was 5,130 boed, including 4,823 boed of unconventional operated production and 308 boed of unconventionalnon-operated production. Q2 2019 Average net daily production by asset Oil Natural NGL Total % Total Interest Gas daily (bbld) (bbld) (boed) (MMm3d) average Fields total at working interest 18,825 1.50 741 29,016 100%

Entre Lomas Bajada del Palo Oeste / Este conventional Bajada del Palo Oeste unconventional Agua Amarga (Jarilla Quemada, Charco del Palenque) 25 de Mayo-Medanito Jagüel de los Machos Coirón Amargo Norte Coirón Amargo Sur Oeste(non-operated) Acambuco(non-operated) BlocksCS-01 andA-10 (Mexico)(non-operated) 100% 4,773 0.51 665 8,644 30% 100% 1,629 0.61 59 5,516 19% 100% 4,425 0.06 0 4,823 17% 100% 336 0.05 18 671 2% 100% 3,509 0.03—3,701 13% 100% 3,443 0.18—4,551 16% 55% 264 0.01—313 1% 10% 274 0.01—308 1% 1.5% 27 0.03—198 1% 50% 144 0.02—293 1% During Q2 2019, Entre Lomas field represented 30% of total production, 25 de Mayo-Medanito and Jagüel de los Machos fields represented 29%, Bajada del Palo Oeste and Bajada del Palo Este fields represented 36% (including unconventional production), Agua Amarga (Jarrilla Quemada and Charco del Palenque fields) represented 2%, and Coirón Amargo Norte represented 1% of average daily total production. The preceding blocks are operated by Vista. The production from our fields in Mexico represented 1% of our total average daily production. The remaining 2% comes from Acambuco and Page 4

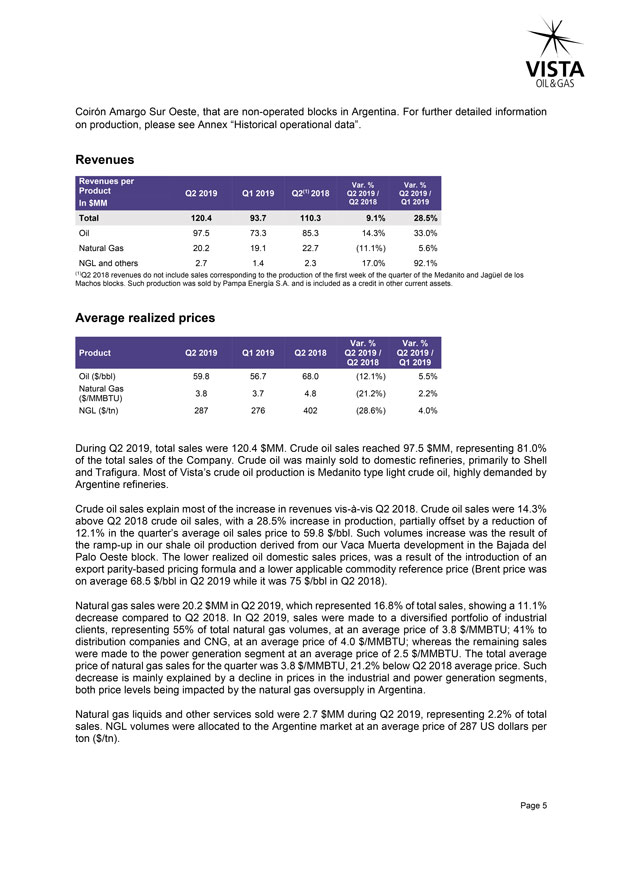

Coirón Amargo Sur Oeste, that arenon-operated blocks in Argentina. For further detailed information on production, please see Annex “Historical operational data”. Revenues Revenues per Var. % Var. % Product (1) Q2 2019 Q1 2019 Q2 2018 Q2 2019 / Q2 2019 / In $MM Q2 2018 Q1 2019 Total 120.4 93.7 110.3 9.1% 28.5% Oil 97.5 73.3 85.3 14.3% 33.0% Natural Gas 20.2 19.1 22.7 (11.1%) 5.6% NGL and others 2.7 1.4 2.3 17.0% 92.1% (1)Q2 2018 revenues do not include sales corresponding to the production of the first week of the quarter of the Medanito and Jagüel de los Machos blocks. Such production was sold by Pampa Energía S.A. and is included as a credit in other current assets. Average realized prices Var. % Var. % Product Q2 2019 Q1 2019 Q2 2018 Q2 2019 / Q2 2019 / Q2 2018 Q1 2019 Oil ($/bbl) 59.8 56.7 68.0 (12.1%) 5.5% Natural Gas 3.8 3.7 4.8 (21.2%) 2.2% ($/MMBTU) NGL ($/tn) 287 276 402 (28.6%) 4.0% During Q2 2019, total sales were 120.4 $MM. Crude oil sales reached 97.5 $MM, representing 81.0% of the total sales of the Company. Crude oil was mainly sold to domestic refineries, primarily to Shell and Trafigura. Most of Vista’s crude oil production is Medanito type light crude oil, highly demanded by Argentine refineries. Crude oil sales explain most of the increase in revenuesvis-à-vis Q2 2018. Crude oil sales were 14.3% above Q2 2018 crude oil sales, with a 28.5% increase in production, partially offset by a reduction of 12.1% in the quarter’s average oil sales price to 59.8 $/bbl. Such volumes increase was the result of theramp-up in our shale oil production derived from our Vaca Muerta development in the Bajada del Palo Oeste block. The lower realized oil domestic sales prices, was a result of the introduction of an export parity-based pricing formula and a lower applicable commodity reference price (Brent price was on average 68.5 $/bbl in Q2 2019 while it was 75 $/bbl in Q2 2018). Natural gas sales were 20.2 $MM in Q2 2019, which represented 16.8% of total sales, showing a 11.1% decrease compared to Q2 2018. In Q2 2019, sales were made to a diversified portfolio of industrial clients, representing 55% of total natural gas volumes, at an average price of 3.8 $/MMBTU; 41% to distribution companies and CNG, at an average price of 4.0 $/MMBTU; whereas the remaining sales were made to the power generation segment at an average price of 2.5 $/MMBTU. The total average price of natural gas sales for the quarter was 3.8 $/MMBTU, 21.2% below Q2 2018 average price. Such decrease is mainly explained by a decline in prices in the industrial and power generation segments, both price levels being impacted by the natural gas oversupply in Argentina. Natural gas liquids and other services sold were 2.7 $MM during Q2 2019, representing 2.2% of total sales. NGL volumes were allocated to the Argentine market at an average price of 287 US dollars per ton ($/tn). Page 5

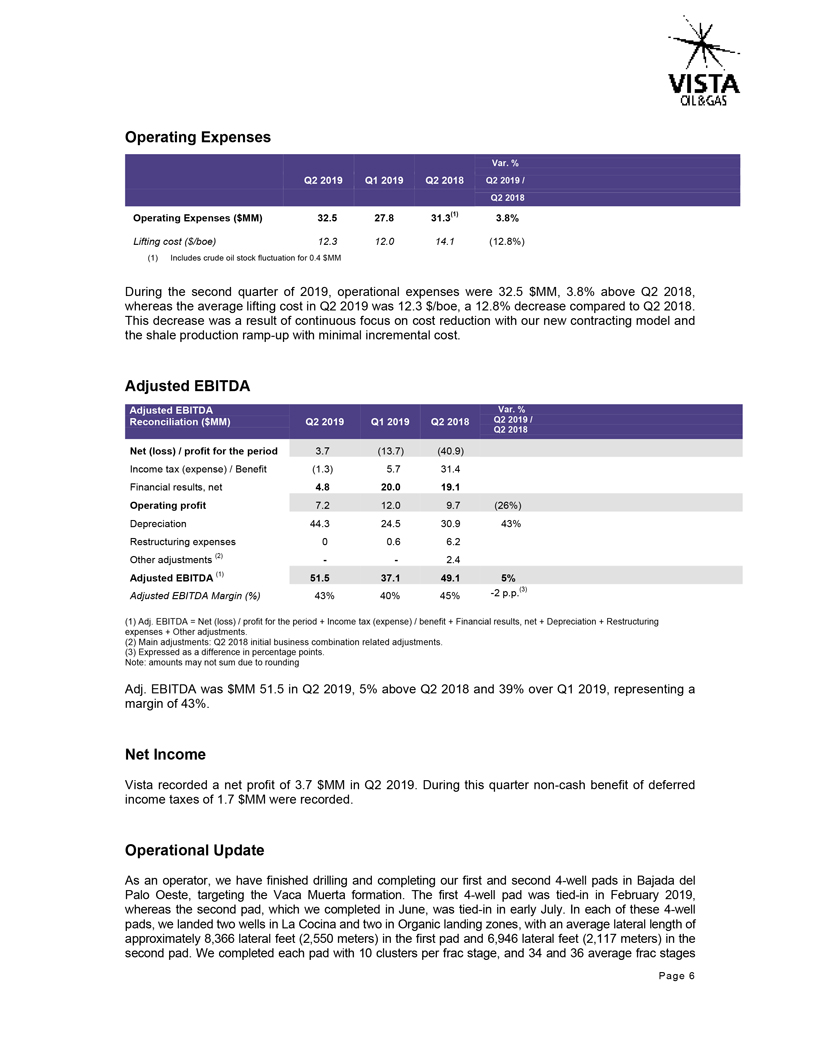

Operating Expenses Q2 2019 Q1 2019 Q2 2018 Var. % Q2 2019 / Q2 2018 Operating Expenses ($MM) 32.5 27.8 31.3(1) 3.8% Lifting cost ($/boe) 12.3 12.0 14.1 (12.8%) Includes crude oil stock fluctuation for 0.4 $MM During the second quarter of 2019, operational expenses were 32.5 $MM, 3.8% above Q2 2018, whereas the average lifting cost in Q2 2019 was 12.3 $/boe, a 12.8% decrease compared to Q2 2018. This decrease was a result of continuous focus on cost reduction with our new contracting model and the shale productionramp-up with minimal incremental cost. Adjusted EBITDA Adjusted EBITDA Q2 2019 Q1 2019 Q2 2018 Var. % Reconciliation ($MM) Q2 2019 / Q2 2018 Net (loss) / profit for the period 3.7, (13.7) (40.9) Income tax (expense) / Benefit (1.3) 5.7 31.4 Financial results, net 4.8 20.0 19.1 Operating profit 7.2 12.0 9.7 (26%) Depreciation 44.3 24.5 30.9 43% Restructuring expenses 0 0.6 6.2 Other adjustments (2) — 2.4 Adjusted EBITDA (1) 51.5 37.1 49.1 5% Adjusted EBITDA Margin (%) 43% 40% 45%-2 p.p. (3) Adj. EBITDA = Net (loss) / profit for the period + Income tax (expense) / benefit + Financial results, net + Depreciation + Restructuring expenses + Other adjustments. Main adjustments: Q2 2018 initial business combination related adjustments. Expressed as a difference in percentage points. Note: amounts may not sum due to rounding Adj. EBITDA was $MM 51.5 in Q2 2019, 5% above Q2 2018 and 39% over Q1 2019, representing a margin of 43%. Net Income Vista recorded a net profit of 3.7 $MM in Q2 2019. During this quarternon-cash benefit of deferred income taxes of 1.7 $MM were recorded. Operational Update As an operator, we have finished drilling and completing our first and second4-well pads in Bajada del Palo Oeste, targeting the Vaca Muerta formation. The first4-well pad wastied-in in February 2019, whereas the second pad, which we completed in June, wastied-in in early July. In each of these4-well pads, we landed two wells in La Cocina and two in Organic landing zones, with an average lateral length of approximately 8,366 lateral feet (2,550 meters) in the first pad and 6,946 lateral feet (2,117 meters) in the second pad. We completed each pad with 10 clusters per frac stage, and 34 and 36 average frac stages per well in the first and second pad, respectively. During the drilling and completion of our second pad, we managed to improve our drilling efficiency by increasing our drilling speed to an average 726 feet per day, from an average of 477 feet per day with respect to our first pad. Furthermore, we also improved our completion efficiency by increasing our average frac stages per day from 5.0 in our first pad to 7.6 in our second pad, representing an increase of 52%. As a result, the average drilling and completion cost per well decreased from 13.8 $MM to 12.6 $MM, resulting in savings of approximately Page 6

8.7%, which were mainly driven by the reduction of cost per frac stage from 0.22 $MM in the first pad to 0.20 $MM in the second pad. Vista’s total capital expenditure (Capex) in Q2 2019 was 63.0 $MM. Vista’s Capex included 11.1 $MM in conventional activity for the drilling and completion of 4 new wells in Jagüel de los Machos. Entre Lomas and Bajada del Palo Oeste fields and 4 workovers in Entre Lomas. All conventional wellstied-in by the Company are currently on production. Capex in unconventional activity was 44.4 $MM for the Vaca Muerta development in Bajada del Palo Oeste where we completed our second4-well pad. Capex in facilities and others was 6.7 $MM in the quarter, mainly corresponding to facilities in Bajada del Palo Oeste and technology communications and infrastructure projects. Financial overview As of June 30, 2019, the Company’s cash and cash equivalents balance was 74.5 $MM and the financial debt was 366.2 $MM, representing a net financial debt of 291.8 $MM. The implied gross leverage ratio was 2.0x, the net leverage ratio was 1.6x andpro-forma for the global primary equity offering was 1.1x. During Q2 2019, cash flow from operations was 4.9 $MM which excluding the annual corporate tax payment and including the working capital reduction from investing activities was 40.2 $MM. On July 25, 2019, we announced the public offering of the Company’s Series A shares as part of the global primary offering of 10,906,257 Series A shares with NYSE listing (each ADS representing one Series A share). Total gross proceeds of the Company’s global offering reached approximately 101 $MM, before fees and expenses. On July 31, 2019, Vista Argentina issued a24-months bullet bond for 50 $MM at a flat interest rate of 7.88%. On August 7, 2019, Vista Argentina issued a36-months bullet bond for an additional 50 $MM at a flat interest rate of 8.50%. Page 7

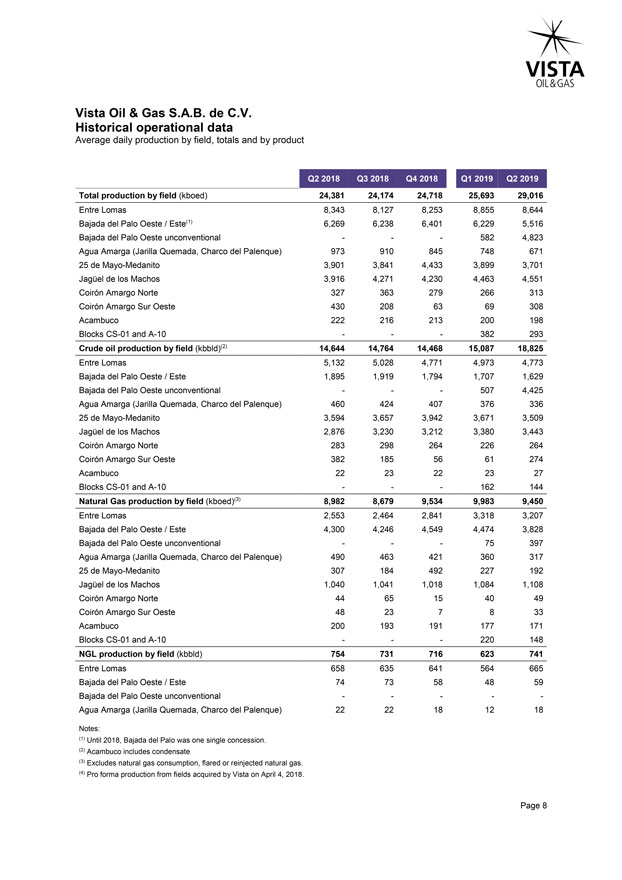

Vista Oil & Gas S.A.B. de C.V. Historical operational data Average daily production by field, totals and by product Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Total production by field (kboed) 24,381 24,174 24,718 25,693 29,016 Entre Lomas 8,343 8,127 8,253 8,855 8,644 Bajada del Palo Oeste / Este(1) 6,269 6,238 6,401 6,229 5,516 Bajada del Palo Oeste unconventional ——582 4,823 Agua Amarga (Jarilla Quemada, Charco del Palenque) 973 910 845 748 671 25 de Mayo-Medanito 3,901 3,841 4,433 3,899 3,701 Jagüel de los Machos 3,916 4,271 4,230 4,463 4,551 Coirón Amargo Norte 327 363 279 266 313 Coirón Amargo Sur Oeste 430 208 63 69 308 Acambuco 222 216 213 200 198 BlocksCS-01 andA-10 ——382 293 Crude oil production by field (kbbld)(2) 14,644 14,764 14,468 15,087 18,825 Entre Lomas 5,132 5,028 4,771 4,973 4,773 Bajada del Palo Oeste / Este 1,895 1,919 1,794 1,707 1,629 Bajada del Palo Oeste unconventional ——507 4,425 Agua Amarga (Jarilla Quemada, Charco del Palenque) 460 424 407 376 336 25 de Mayo-Medanito 3,594 3,657 3,942 3,671 3,509 Jagüel de los Machos 2,876 3,230 3,212 3,380 3,443 Coirón Amargo Norte 283 298 264 226 264 Coirón Amargo Sur Oeste 382 185 56 61 274 Acambuco 22 23 22 23 27 BlocksCS-01 andA-10 ——162 144 Natural Gas production by field (kboed)(3) 8,982 8,679 9,534 9,983 9,450 Entre Lomas 2,553 2,464 2,841 3,318 3,207 Bajada del Palo Oeste / Este 4,300 4,246 4,549 4,474 3,828 Bajada del Palo Oeste unconventional ——75 397 Agua Amarga (Jarilla Quemada, Charco del Palenque) 490 463 421 360 317 25 de Mayo-Medanito 307 184 492 227 192 Jagüel de los Machos 1,040 1,041 1,018 1,084 1,108 Coirón Amargo Norte 44 65 15 40 49 Coirón Amargo Sur Oeste 48 23 7 8 33 Acambuco 200 193 191 177 171 BlocksCS-01 andA-10 ——220 148 NGL production by field (kbbld) 754 731 716 623 741 Entre Lomas 658 635 641 564 665 Bajada del Palo Oeste / Este 74 73 58 48 59 Bajada del Palo Oeste unconventional — ——Agua Amarga (Jarilla Quemada, Charco del Palenque) 22 22 18 12 18 Notes: Until 2018, Bajada del Palo was one single concession. Acambuco includes condensate Excludes natural gas consumption, flared or reinjected natural gas. Pro forma production from fields acquired by Vista on April 4, 2018. Page 8

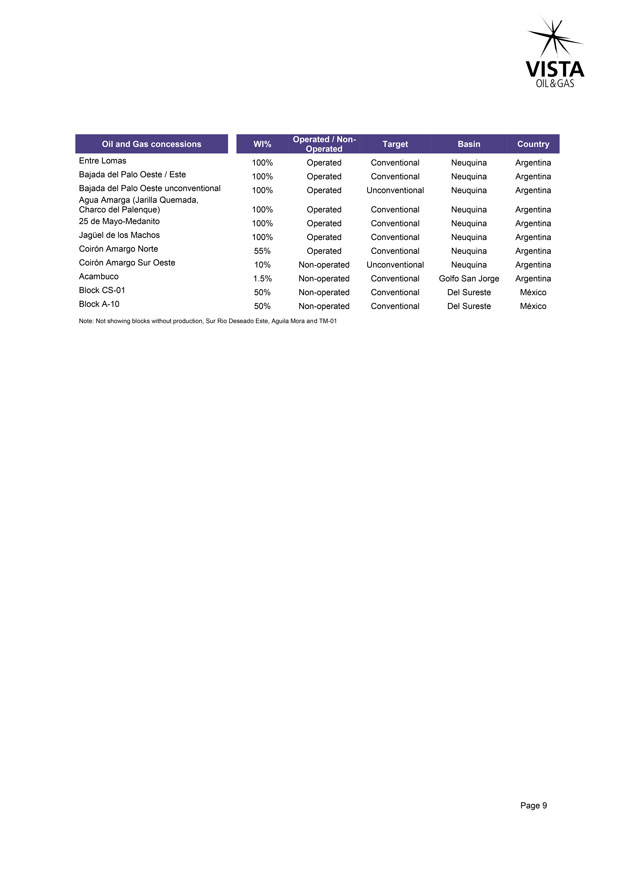

Oil and Gas concessions WI% Operated /Non- Target Basin Country Operated Entre Lomas 100% Operated Conventional Neuquina Argentina Bajada del Palo Oeste / Este 100% Operated Conventional Neuquina Argentina Bajada del Palo Oeste unconventional 100% Operated Unconventional Neuquina Argentina Agua Amarga (Jarilla Quemada, Charco del Palenque) 100% Operated Conventional Neuquina Argentina 25 de Mayo-Medanito 100% Operated Conventional Neuquina Argentina Jagüel de los Machos 100% Operated Conventional Neuquina Argentina Coirón Amargo Norte 55% Operated Conventional Neuquina Argentina Coirón Amargo Sur Oeste 10%Non-operated Unconventional Neuquina Argentina Acambuco 1.5%Non-operated Conventional Golfo San Jorge Argentina BlockCS-01 50%Non-operated Conventional Del Sureste México BlockA-10 50%Non-operated Conventional Del Sureste México Note: Not showing blocks without production, Sur Rio Deseado Este, Aguila Mora andTM-01 Page 9

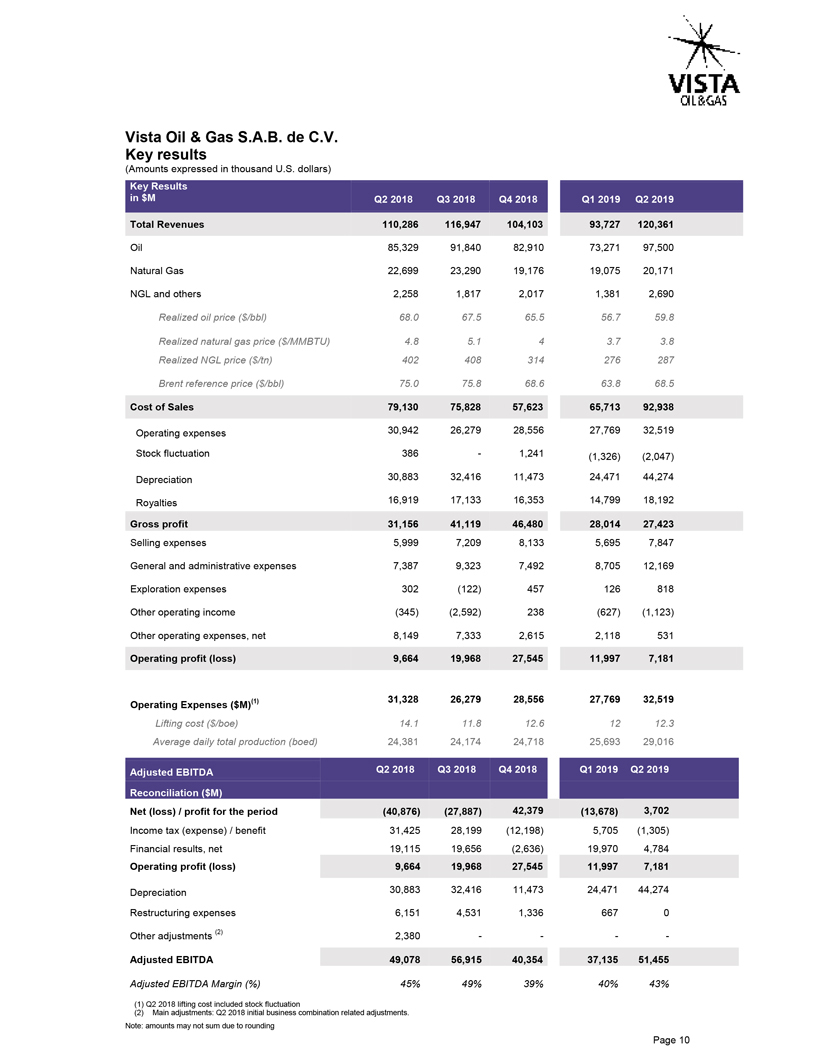

Vista Oil & Gas S.A.B. de C.V. Key results (Amounts expressed in thousand U.S. dollars) Key Results Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 in $M Total Revenues 110,286 116,947 104,103 93,727 120,361 Oil 85,329 91,840 82,910 73,271 97,500 Natural Gas 22,699 23,290 19,176 19,075 20,171 NGL and others 2,258 1,817 2,017 1,381 2,690 Realized oil price ($/bbl) 68.0 67.5 65.5 56.7 59.8 Realized natural gas price ($/MMBTU) 4.8 5.1 4 3.7 3.8 Realized NGL price ($/tn) 402 408 314 276 287 Brent reference price ($/bbl) 75.0 75.8 68.6 63.8 68.5 Cost of Sales 79,130 75,828 57,623 65,713 92,938 Operating expenses 30,942 26,279 28,556 27,769 32,519 Stock fluctuation 386—1,241 (1,326) (2,047) Depreciation 30,883 32,416 11,473 24,471 44,274 Royalties 16,919 17,133 16,353 14,799 18,192 Gross profit 31,156 41,119 46,480 28,014 27,423 Selling expenses 5,999 7,209 8,133 5,695 7,847 General and administrative expenses 7,387 9,323 7,492 8,705 12,169 Exploration expenses 302 (122) 457 126 818 Other operating income (345) (2,592) 238 (627) (1,123) Other operating expenses, net 8,149 7,333 2,615 2,118 531 Operating profit (loss) 9,664 19,968 27,545 11,997 7,181 Operating Expenses ($M)(1) 31,328 26,279 28,556 27,769 32,519 Lifting cost ($/boe) 14.1 11.8 12.6 12.0 12.3 Average daily total production (boed) 24,381 24,174 24,718 25,693 29,016 Adjusted EBITDA Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Reconciliation ($M) Operating profit (loss) 9,664 19,968 27,545 11,997 7,181 Depreciation 30,883 32,416 11,473 24,471 44,274 Restructuring expenses 6,151 4,531 1,336 667 0 Other adjustments (2) 2,380 — — Adjusted EBITDA 49,078 56,915 40,354 37,135 51,455 Adjusted EBITDA Margin (%) 45% 49% 39% 40% 43% Q2 2018 lifting cost included stock fluctuationMain adjustments: Q2 2018 initial business combination related adjustments. Note: amounts may not sum due to rounding Page 10 Net (loss) / profit for the period (40,876) (27,887) 42,379 (13,678) 3,702 Income tax (expense) / benefit 31,425 28,199 (12,198) 5,705 (1,305) Financial results, net 19,115 19,656 (2,636) 19,970 4,784 12

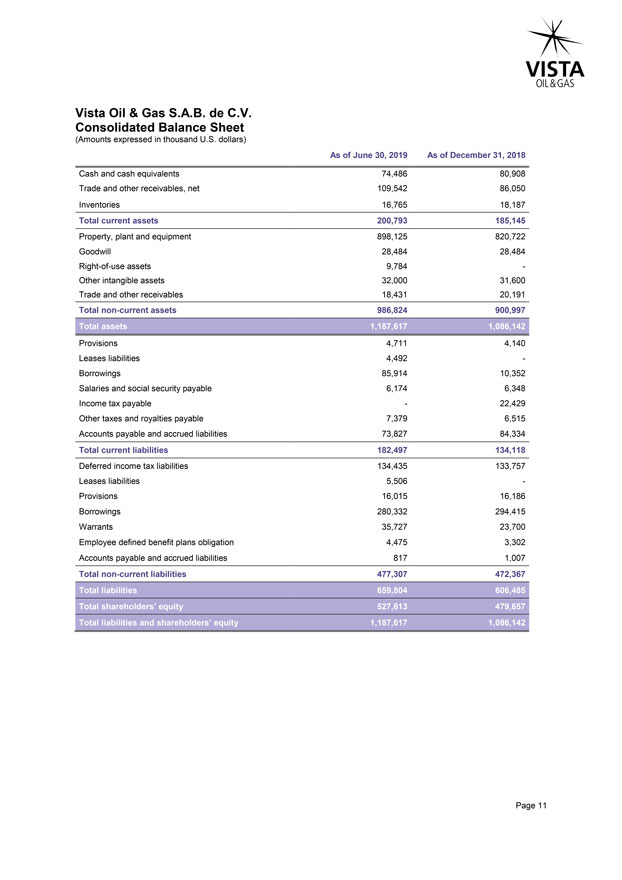

Vista Oil & Gas S.A.B. de C.V. Consolidated Balance Sheet (Amounts expressed in thousand U.S. dollars) As of June 30, 2019 As of December 31, 2018 Cash and cash equivalents 74,486 80,908 Trade and other receivables, net 109,542 86,050 Inventories 16,765 18,187 Total current assets 200,793 185,145 Property, plant and equipment 898,125 820,722 Goodwill 28,484 28,484Right-of-use assets 9,784— Other intangible assets 32,000 31,600 Trade and other receivables 18,431 20,191 Totalnon-current assets 986,824 900,997 Total assets 1,187,617 1,086,142 Provisions 4,711 4,140 Leases liabilities 4,492— Borrowings 85,914 10,352 Salaries and social security payable 6,174 6,348 Income tax payable—22,429 Other taxes and royalties payable 7,379 6,515 Accounts payable and accrued liabilities 73,827 84,334 Total current liabilities 182,497 134,118 Deferred income tax liabilities 134,435 133,757 Leases liabilities 5,506— Provisions 16,015 16,186 Borrowings 280,332 294,415 Warrants 35,727 23,700 Employee defined benefit plans obligation 4,475 3,302 Accounts payable and accrued liabilities 817 1,007 Totalnon-current liabilities 477,307 472,367 Total liabilities 659,804 606,485 Total shareholders’ equity 527,813 479,657 Total liabilities and shareholders’ equity 1,187,617 1,086,142 Page 11

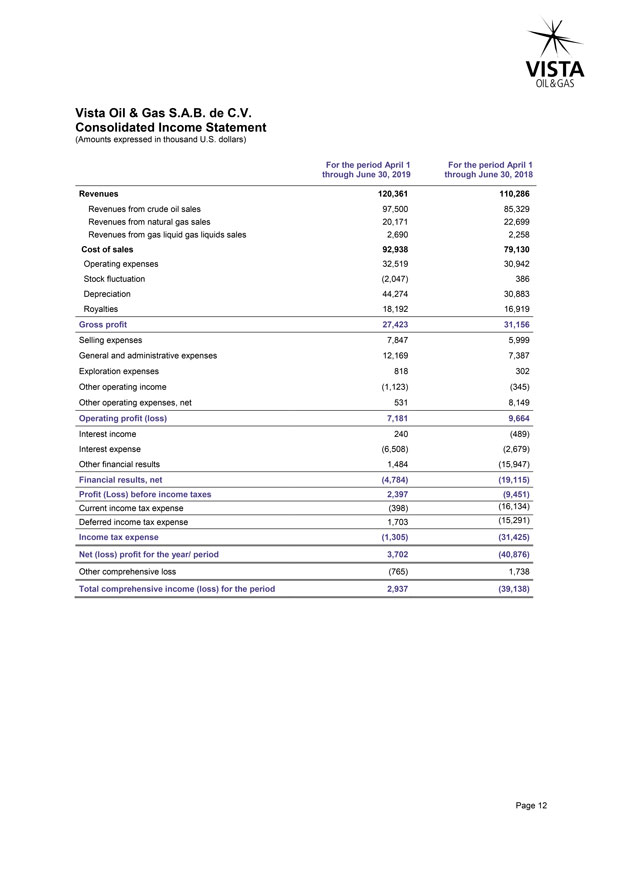

Vista Oil & Gas S.A.B. de C.V. Consolidated Income Statement (Amounts expressed in thousand U.S. dollars) For the period April 1 through June 30, 2019 For the period April 1 through June 30, 2018 Revenues 120,361 110,286 Revenues from crude oil sales 97,500 85,329 Revenues from natural gas sales 20,171 22,699 Revenues from gas liquid gas liquids sales 2,690 2,258 Cost of sales 92,938 79,130 Operating expenses 32,519 30,942 Stock fluctuation (2,047) 386 Depreciation 44,274 30,883 Royalties 18,192 16,919 Gross profit 27,423 31,156 Selling expenses 7,847 5,999 General and administrative expenses 12,169 7,387 Exploration expenses 818 302 Other operating income (1,123) (345) Other operating expenses, net 531 8,149 Operating profit (loss) 7,181 9,664 Interest income 240 (489) Interest expense (6,508) (2,679) Other financial results 1,484 (15,947) Financial results, net (4,784) (19,115) Profit (Loss) before income taxes 2,397 (9,451) Current income tax expense (398) (16,134) Deferred income tax expense 1,703 (15,291) Income tax expense (1,305) (31,425) Net (loss) profit for the year/ period 3,702 (40,876) Other comprehensive loss (765) 1,738 Total comprehensive income (loss) for the period 2,937 (39,138) Page 12

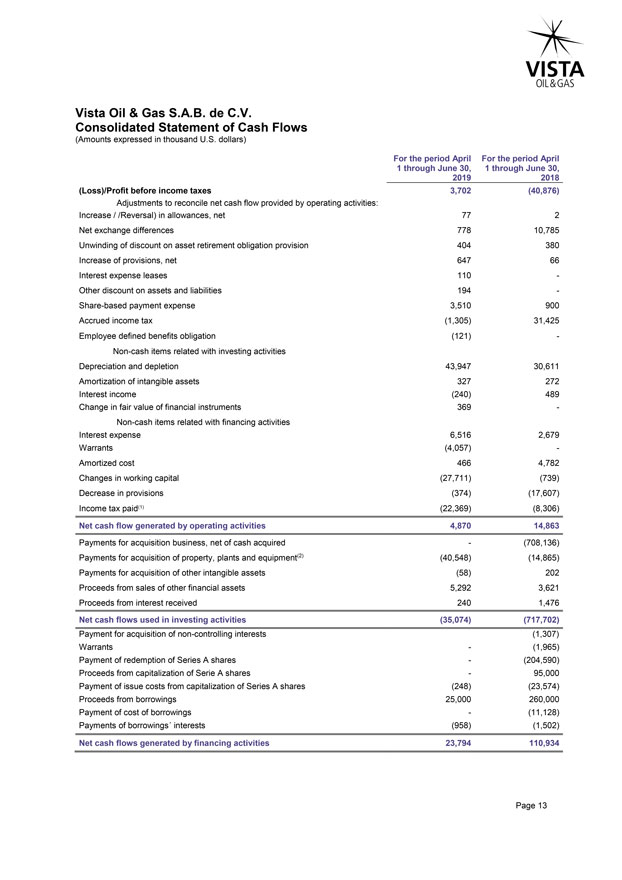

Vista Oil & Gas S.A.B. de C.V. Consolidated Statement of Cash Flows (Amounts expressed in thousand U.S. dollars) For the period April For the period April 1 through June 30, 1 through June 30, 2019 2018 (Loss)/Profit before income taxes 3,702 (40,876) Adjustments to reconcile net cash flow provided by operating activities: Increase / /Reversal) in allowances, net 77 2 Net exchange differences 778 10,785 Unwinding of discount on asset retirement obligation provision 404 380 Increase of provisions, net 647 66 Interest expense leases 110— Other discount on assets and liabilities 194— Share-based payment expense 3,510 900 Accrued income tax (1,305) 31,425 Employee defined benefits obligation (121)—Non-cash items related with investing activities Depreciation and depletion 43,947 30,611 Amortization of intangible assets 327 272 Interest income (240) 489 Change in fair value of financial instruments 369—Non-cash items related with financing activities Interest expense 6,516 2,679 Warrants (4,057)— Amortized cost 466 4,782 Changes in working capital (27,711) (739) Decrease in provisions (374) (17,607) Income tax paid(1) (22,369) (8,306) Net cash flow generated by operating activities 4,870 14,863 Payments for acquisition business, net of cash acquired—(708,136) Payments for acquisition of property, plants and equipment(2) (40,548) (14,865) Payments for acquisition of other intangible assets (58) 202 Proceeds from sales of other financial assets 5,292 3,621 Proceeds from interest received 240 1,476 Net cash flows used in investing activities (35,074) (717,702) Payment for acquisition ofnon-controlling interests (1,307) Warrants—(1,965) Payment of redemption of Series A shares—(204,590) Proceeds from capitalization of Serie A shares—95,000 Payment of issue costs from capitalization of Series A shares (248) (23,574) Proceeds from borrowings 25,000 260,000 Payment of cost of borrowings—(11,128) Payments of borrowings´ interests (958) (1,502) Net cash flows generated by financing activities 23,794 110,934 Page 13

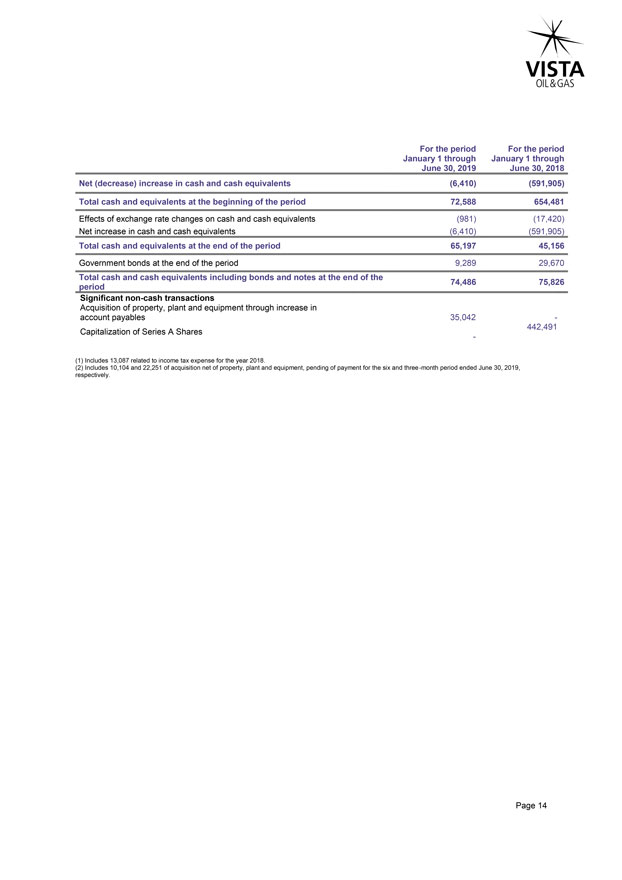

For the period For the period January 1 through January 1 through June 30, 2019 June 30, 2018 Net (decrease) increase in cash and cash equivalents (6,410) (591,905) Total cash and equivalents at the beginning of the period 72,588 654,481 Effects of exchange rate changes on cash and cash equivalents (981) (17,420) Net increase in cash and cash equivalents (6,410) (591,905) Total cash and equivalents at the end of the period 65,197 45,156 Government bonds at the end of the period 9,289 29,670 Total cash and cash equivalents including bonds and notes at the end of the 74,486 75,826 period Significantnon-cash transactions Acquisition of property, plant and equipment through increase in account payables 35,042— 442,491 Capitalization of Series A Shares Includes 13,087 related to income tax expense for the year 2018. Includes 10,104 and 22,251 of acquisition net of property, plant and equipment, pending of payment for the six and three-month period ended June 30, 2019, respectively. Page 14

DISCLAIMER Additional information about Vista Oil & Gas, S.A.B. de C.V., a sociedad anónima bursátil de capital variable organized under the laws of Mexico (the “Company” or “Vista”) can be found in the “Investors” section on the website at www.vistaoilandgas.com. This presentation does not constitute an offer to sell or the solicitation of any offer to buy any securities of the Company, in any jurisdiction. Securities may not be offered or sold in the United States absent registration with the U.S. Securities Exchange Commission (“SEC”), the Mexican National Securities Registry held by the Mexican National Banking and Securities Commission (“CNBV”) or an exemption from such registrations. This presentation does not contain all the Company’s financial information. As a result, investors should read this presentation in conjunction with the Company’s consolidated financial statements and other financial information available on the Company’s website. Rounding amounts and percentages: Certain amounts and percentages included in this presentation have been rounded for ease of presentation. Percentage figures included in this presentation have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, certain percentage amounts in this presentation may vary from those obtained by performing the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this presentation may not sum due to rounding. This presentation contains certain metrics that do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other companies. Such metrics have been included herein to provide readers with additional measures to evaluate the Company’s performance; however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare to the performance in previous periods. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. No representation or warranty, express or implied, is given or will be given by or on behalf of the Company, or any of its affiliates (within the meaning of Rule 405 under the Act, “Affiliates”), members, directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in this presentation or any other material discussed verbally, and any reliance you place on them will be at your sole risk. In addition, no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) is or will be accepted by the Company or any of its Affiliates, members, directors, officers or employees or any other person in relation to such information or opinions or any other matter in connection with this presentation or its contents or otherwise arising in connection therewith. This presentation also includes certainnon-IFRS (International Financial Reporting Standards) financial measures which have not been subject to a financial audit for any period. The information and opinions contained in this presentation are provided as at the date of this presentation and are subject to verification, completion and change without notice. This presentation includes “forward-looking statements” concerning the future. The words such as “believes,” “expects,” “anticipates,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions are included with the intention of identifying statements about the future. We have based these forward-looking statements on numerous assumptions, including our current beliefs, expectations and projections about present and future events and financial trends affecting our business. These expectations and projections are subject to significant known and unknown risks and uncertainties which may cause our actual results, performance or achievements, or industry results, to be materially different from any expected or projected results, performance or achievements expressed or implied by such forward-looking statements. Many important factors could cause our actual results, performance or achievements to differ materially from those expressed or implied in our forward-looking statements, including, among other things: uncertainties relating to future government concessions and exploration permits; adverse outcomes in litigation that may arise in the future; general political, economic, social, demographic and business conditions in Argentina, Mexico and in other countries in which we operate; uncertainties relating to future election results in Argentina and Mexico, particularly presidential elections in Argentina and congressional elections in Mexico; changes in law, rules, regulations and interpretations and enforcements thereto applicable to the Argentine and Mexican energy sectors, including changes to the regulatory environment in which we operate and changes to programs established to promote investments in the energy industry; any unexpected increases in financing costs or an inability to obtain financing and/or additional capital pursuant to attractive terms; any changes in the capital markets in general that may affect the policies or attitude in Argentina and/or Mexico, and/or Argentine and Mexican companies with respect to financings extended to or investments made in Argentina and Mexico or Argentine and Mexican companies; fines or other penalties and claims by the authorities and/or customers; any future restrictions on the ability to exchange Mexican or Argentine Pesos into foreign currencies or to transfer funds abroad; the revocation or amendment of our respective concession agreements by the granting authority; our ability to implement our capital expenditures plans or business strategy, including our ability to obtain financing when necessary and on reasonable terms; government intervention, including measures that result in changes to the Argentine and Mexican, labor markets, exchange markets or tax systems; continued and/or higher rates of inflation and fluctuations in exchange rates, including the devaluation of the Mexican Peso or Argentine Peso; any force majeure events, or fluctuations or reductions in the value of Argentine public debt; changes to the demand for Page 15

energy; environmental, health and safety regulations and industry standards that are becoming more stringent; energy markets, including the timing and extent of changes and volatility in commodity prices, and the impact of any protracted or material reduction in oil prices from historical averages; changes in the regulation of the energy and oil and gas sector in Argentina and Mexico, and throughout Latin America; our relationship with our employees and our ability to retain key members of our senior management and key technical employees; the ability of our directors and officers to identify an adequate number of potential acquisition opportunities; our expectations with respect to the performance of our recently acquired businesses; our expectations for future production, costs and crude oil prices used in our projections; increased market competition in the energy sectors in Argentina and Mexico; and potential changes in regulation and free trade agreements as a result of U.S., Mexican or other Latin American political conditions. Forward-looking statements speak only as of the date on which they were made, and we undertake no obligation to release publicly any updates or revisions to any forward-looking statements contained herein because of new information, future events or other factors. In light of these limitations, undue reliance should not be placed on forward-looking statements contained in this prospectus presentation. Further information concerning risks and uncertainties associated with these forward-looking statements and Vista’s business can be found in Vista’s public disclosures filed on EDGAR (www.sec.gov) or at the web page of the Mexican Stock Exchange (www.bmv.com.mx). This presentation also includes certain financial estimates which have not been subject to a financial audit for any period. The financial estimates set forth in this presentation are based on assumptions made, and information available to us, at the time they were prepared. We do not know whether such assumptions will prove to be correct. If one or more of these assumptions prove inaccurate or if future results differ from expected results, then our actual future results could be less favorable, and could be materially less favorable, than the above-referred projections. Any or all of such estimates may not necessarily be realized. Such estimates can be adversely affected by inaccurate assumptions or by known or unknown risks and uncertainties, many of which are beyond our control. Many factors will be important in determining our future results. As a result of these contingencies, actual future results may vary materially from our estimates. In view of these uncertainties, the inclusion of our financial estimates in this presentation is not and should not be viewed as a representation that the projected results will be achieved. You should not take any statement regarding past trends or activities as a representation that the trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements. This presentation is not intended to constitute, and should not be construed as investment advice. Other Information Vista routinely posts important information for investors in the Investor Relations support section on its website, www.vistaoilandgas.com. From time to time, Vista may use its website as a channel of distribution of material information. Accordingly, investors should monitor Vista’s Investor Relations website, in addition to following Vista’s press releases, SEC filings, public conference calls and webcasts. Additional information about Vista oil and gas can be found in the “Investor Information” section on the website at www.vistaoilandgas.com. INVESTORS CONTACT: Phone in Argentina +54.11.3754.8532 Phone in Mexico +52.55.1167.8250 Page 16