UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23408

Clarion Partners Real Estate Income Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 777-0102

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

| | |

| Semi-Annual Report | | June 30, 2020 |

CLARION PARTNERS

REAL ESTATE INCOME

FUND INC.

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund’s investment objective is to provide current income and long-term capital appreciation.

The Fund invests primarily in a portfolio of private commercial real estate and publicly traded real estate securities.

Letter from the chairman

Dear Shareholder,

We are pleased to provide the semi-annual report of Clarion Partners Real Estate Income Fund Inc. for the six-month reporting period ended June 30, 2020. Please read on for Fund performance information during the Fund’s reporting period.

Special shareholder notice

On July 31, 2020, Franklin Resources, Inc. (“Franklin Resources”) acquired Legg Mason, Inc. in an all-cash transaction. As a result of the transaction, the Fund’s investment manager, Legg Mason Partners Fund Advisor, LLC (“LMPFA”) became an indirect, wholly owned subsidiary of Franklin Resources and the Fund’s investment subadviser, Clarion Partners, LLC (“Clarion Partners”) became an indirect, majority-owned subsidiary of Franklin Resources. In addition, the Fund’s securities subadviser, Western Asset Management Company, LLC (“Western Asset”), became an indirect wholly-owned subsidiary of Franklin Resources, Under the Investment Company Act of 1940, as amended, consummation of the transaction automatically terminated the management and subadvisory agreements that were in place for the Fund prior to the transaction. LMPFA, Clarion Partners and Western Asset continue to provide uninterrupted services with respect to the Fund pursuant to new management and subadvisory agreements that were approved by the Fund’s stockholders.

As a result of the transaction, Legg Mason Investor Services, LLC, the principal underwriter and distributor of the Common Stock, became an indirect, wholly-owned broker/dealer subsidiary of Franklin Resources.

Franklin Resources, whose principal executive offices are at One Franklin Parkway, San Mateo, California 94403, is a global investment management organization operating, together with its subsidiaries, as Franklin Templeton. As of June 30, 2020, after giving effect to the transaction described above, Franklin Templeton’s asset management operations had aggregate assets under management of approximately $1.4 trillion.

| | |

| II | | Clarion Partners Real Estate Income Fund Inc. |

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

July 31, 2020

| | |

| Clarion Partners Real Estate Income Fund Inc. | | III |

Performance review

For the six months ended June 30, 2020, Class I shares of Clarion Partners Real Estate Income Fund Inc. returned 0.19%.

| | | | |

| Performance Snapshot as of June 30, 2020 (unaudited) | |

| (excluding sales charges) | | 6 months | |

| Clarion Partners Real Estate Income Fund Inc.: | | | | |

Class S | | | -0.23 | % |

Class T | | | -0.17 | % |

Class D | | | 0.03 | % |

Class I | | | 0.19 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com.

All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. Class S and Class T shares are subject to a maximum front-end sales charge of 3.5% and 3.0% of the offering price, respectively. Class T shares are also subject to a dealer manager fee of 0.5% of the offering price. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated May 14, 2020, as supplemented, the gross total annual fund operating expense ratios for Class S, Class T, Class D and Class I shares were 6.14%, 6.14%, 5.54% and 5.29%, respectively. Included in the operating expense ratio of each class are property level expenses and interest payments on properties of 2.12% and 1.25%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of total annual fund operating expenses, including organizational and offering expenses but excluding property management, acquisition, disposition expenses, any other expenses related to investments in real property, debt and real-estate related securities, expenses related to borrowings or the issuance of preferred stock, interest, brokerage, tax and extraordinary expenses and acquired fund fees will not exceed 2.60% for Class S shares, 2.60% for Class T shares, 2.00% for Class D shares and 1.75% of Class I shares, of NAV, subject to recapture as described below. These expense limitation arrangements cannot be terminated prior to

| | |

| IV | | Clarion Partners Real Estate Income Fund Inc. |

December 31, 2021 without the Board of Directors’ consent. In addition, the manager has agreed to waive the Fund’s management fee effective December 4, 2019 through December 31, 2020.

The manager is permitted to recapture amounts waived and/or reimbursed to a class within three years after the fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Thank you for your investment in Clarion Partners Real Estate Income Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

July 31, 2020

RISKS: The Fund is a non-diversified, closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle. The Fund is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Fund will achieve its investment objective. The Fund is newly organized, with a limited history of operations. An investment in the Fund involves a considerable amount of risk. The Fund should be viewed as a long-term investment, as it is inherently illiquid and suitable only for investors who can bear the risks associated with the limited liquidity of the Fund. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no more than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee these repurchases will occur as scheduled, or at all. Shares will not be listed on a public exchange, and no secondary market is expected to develop. Shareholders may not be able to sell their shares in the Fund at all or at a favorable price. Because the Fund is non-diversified, it may be more susceptible to economic, political or regulatory events than a diversified fund.

Fixed income securities involve interest rate, credit, inflation, and reinvestment risks. As interest rates rise, the value of fixed income securities fall. High yield bonds possess greater price volatility, illiquidity, and possibility of default. The Fund’s investments are highly concentrated in real estate investments, and therefore will be subject to the risks typically associated with real estate, including but not limited to local, state, national or international economic conditions;

| | |

| Clarion Partners Real Estate Income Fund Inc. | | V |

Performance review (cont’d)

including market disruptions caused by regional concerns, political upheaval, sovereign debt crises and other factors. Asset-backed, mortgage-backed or mortgage-related securities are subject to prepayment and extension risks. The Fund may employ leverage, which increases the volatility of investment returns and subjects the Fund to magnified losses if an underlying fund’s investments decline in value. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

| | |

| VI | | Clarion Partners Real Estate Income Fund Inc. |

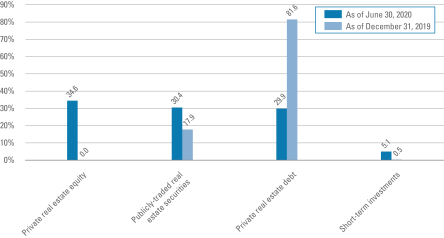

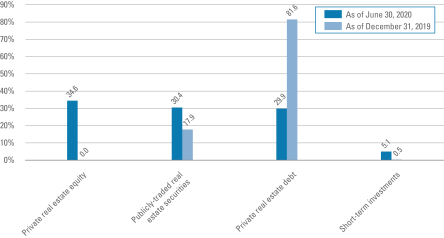

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of June 30, 2020 and December 31, 2019 and does not include derivatives, such as futures contracts. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 1 |

Consolidated schedule of investments (unaudited)

June 30, 2020

Clarion Partners Real Estate Income Fund Inc.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Value | |

| Private Real Estate — 79.8% | | | | | | | | | | | | | | | | |

| | | | |

| Equity — 42.8% | | | | | | | | | | | | | | | | |

| Real Estate Investments — 42.8% | | | | | | | | | | | | | | | | |

Industrials — 42.8% | | | | | | | | | | | | | | | | |

100 Friars Boulevard, West Deptford, NJ

(Cost — $20,358,780) | | | | | | | | | | | | | | $ | 20,300,000 | (a)(b) |

| | | | |

| | | Rate | | | Maturity

Date | | | Face

Amount | | | | |

| Debt — 37.0% | | | | | | | | | | | | | | | | |

| Investments in Real Estate Loans — 37.0% | | | | | | | | | | | | | | | | |

Aertson Midtown Mezzanine B Loan (Cost — $18,000,000) | | | 9.140 | % | | | 10/1/25 | | | $ | 18,000,000 | | | | 17,552,502 | (a) |

| | |

Total Private Real Estate (Cost — $38,358,780) | | | | | | | | 37,852,502 | |

| | | | |

| Publicly-Traded Real Estate Securities — 37.6% | | | | | | | | | | | | | | | | |

| Collateralized Mortgage Obligations (c) — 29.9% | | | | | | | | | | | | | | | | |

Banc of America Commercial Mortgage Trust, 2017-BNK3 E | | | 4.686 | % | | | 2/15/50 | | | | 1,000,000 | | | | 502,157 | (d)(e) |

BHMS Mortgage Trust, 2018-ATLS C (1 mo. USD LIBOR + 1.900%) | | | 2.085 | % | | | 7/15/35 | | | | 300,000 | | | | 273,370 | (d)(e) |

Citigroup Mortgage Loan Trust, 2018-C A1 | | | 4.125 | % | | | 3/25/59 | | | | 190,226 | | | | 192,635 | (d) |

Credit Suisse Mortgage Capital Trust, 2019-ICE4 D (1 mo. USD LIBOR + 1.600%) | | | 1.785 | % | | | 5/15/36 | | | | 240,000 | | | | 233,317 | (d)(e) |

CSMC Trust, 2014-USA F | | | 4.373 | % | | | 9/15/37 | | | | 420,000 | | | | 315,433 | (d) |

CSMC Trust, 2019-RIO B | | | 6.889 | % | | | 12/15/21 | | | | 1,000,000 | | | | 911,341 | (d) |

CSMC Trust, 2020-LOTS A (1 mo. USD LIBOR + 0.750%) | | | 4.725 | % | | | 7/15/22 | | | | 1,000,000 | | | | 1,001,891 | (d)(e) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2018-DNA3 B1 (1 mo. USD LIBOR + 3.900%) | | | 4.085 | % | | | 9/25/48 | | | | 370,000 | | | | 369,697 | (d)(e) |

Federal National Mortgage Association (FNMA) — CAS, 2015-C03 1M2 (1 mo. USD LIBOR + 5.000%) | | | 5.185 | % | | | 7/25/25 | | | | 956,062 | | | | 983,922 | (d)(e) |

Federal National Mortgage Association (FNMA) — CAS, 2017-C05 1M2 (1 mo. USD LIBOR + 2.200%) | | | 2.385 | % | | | 1/25/30 | | | | 129,336 | | | | 127,775 | (d)(e) |

Federal National Mortgage Association (FNMA) — CAS, 2018-C06 1B1 (1 mo. USD LIBOR + 3.750%) | | | 3.935 | % | | | 3/25/31 | | | | 350,000 | | | | 338,644 | (d)(e) |

Federal National Mortgage Association (FNMA) — CAS, 2020-R01 1B1 (1 mo. USD LIBOR + 3.250%) | | | 3.435 | % | | | 1/25/40 | | | | 140,000 | | | | 100,550 | (d)(e) |

GS Mortgage Securities Corp. II, 2018-SRP5 C (1 mo. USD LIBOR + 3.750%) | | | 3.935 | % | | | 9/15/31 | | | | 575,000 | | | | 549,862 | (d)(e) |

GS Mortgage Securities Corp. Trust, 2018-3PCK B (1 mo. USD LIBOR + 2.250%) | | | 2.435 | % | | | 9/15/31 | | | | 575,000 | | | | 518,742 | (d)(e) |

Hawaii Hotel Trust, 2019-MAUI F (1 mo. USD LIBOR + 2.750%) | | | 2.935 | % | | | 5/15/38 | | | | 400,000 | | | | 333,169 | (d)(e) |

JPMorgan Chase Commercial Mortgage Securities Corp., 2020-NNNZ M | | | 8.542 | % | | | 1/16/37 | | | | 910,280 | | | | 646,393 | (d) |

See Notes to Consolidated Financial Statements.

| | |

| 2 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

Clarion Partners Real Estate Income Fund Inc.

| | | | | | | | | | | | | | | | |

| | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Collateralized Mortgage Obligations (c) — continued | | | | | | | | | |

JPMorgan Chase Commercial Mortgage Securities Trust, 2017-FL11 E (1 mo. USD LIBOR + 4.020%) | | | 4.205 | % | | | 10/15/32 | | | $ | 350,000 | | | $ | 292,133 | (d)(e) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2020-MKST G (1 mo. USD LIBOR + 4.250%) | | | 4.435 | % | | | 12/15/36 | | | | 175,000 | | | | 142,920 | (d)(e) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2020-MKST H (1 mo. USD LIBOR + 6.750%) | | | 6.935 | % | | | 12/15/36 | | | | 175,000 | | | | 134,750 | (d)(e) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2020-NNN GFL (1 mo. USD LIBOR + 3.000%) | | | 3.195 | % | | | 1/16/37 | | | | 1,064,000 | | | | 892,178 | (d)(e) |

Mortgage Repurchase Agreement Financing Trust, 2020-2 A2 (1 mo. USD LIBOR + 1.750%) | | | 1.927 | % | | | 5/29/22 | | | | 2,000,000 | | | | 2,005,270 | (d)(e) |

PMT Credit Risk Transfer Trust, 2019-3R A (1 mo. USD LIBOR + 2.700%) | | | 2.884 | % | | | 10/27/22 | | | | 284,446 | | | | 270,859 | (d)(e) |

Radnor RE Ltd., 2020-1 M2B (1 mo. USD LIBOR + 2.250%) | | | 2.435 | % | | | 2/25/30 | | | | 425,000 | | | | 304,069 | (d)(e) |

Residential Mortgage Loan Trust, 2019-2 A1 | | | 2.913 | % | | | 5/25/59 | | | | 956,377 | | | | 974,468 | (d)(e) |

Residential Mortgage Loan Trust, 2019-3 A3 | | | 3.044 | % | | | 9/25/59 | | | | 491,858 | | | | 486,680 | (d)(e) |

Seasoned Credit Risk Transfer Trust, 2019-1 M | | | 4.750 | % | | | 7/25/58 | | | | 600,000 | | | | 581,578 | (d)(e) |

Tharaldson Hotel Portfolio Trust, 2018-THL E (1 mo. USD LIBOR + 3.180%) | | | 3.355 | % | | | 11/11/34 | | | | 445,544 | | | | 374,273 | (d)(e) |

Tharaldson Hotel Portfolio Trust, 2018-THL F (1 mo. USD LIBOR + 3.952%) | | | 4.128 | % | | | 11/11/34 | | | | 445,544 | | | | 328,335 | (d)(e) |

Total Collateralized Mortgage Obligations (Cost — $15,023,202) | | | | | | | | 14,186,411 | |

| Asset-Backed Securities — 7.4% | | | | | | | | | | | | | | | | |

Argent Securities Inc., Asset-Backed Pass-Through Certificates, 2003-W3 M1 (1 mo. USD LIBOR + 1.125%) | | | 1.310 | % | | | 9/25/33 | | | | 220,596 | | | | 203,581 | (e) |

Cascade MH Asset Trust, 2019-MH1 M | | | 5.985 | % | | | 11/25/44 | | | | 300,000 | | | | 294,414 | (d)(e) |

First Franklin Mortgage Loan Trust, 2006-FF15 A5 (1 mo. USD LIBOR + 0.160%) | | | 0.345 | % | | | 11/25/36 | | | | 335,934 | | | | 323,593 | (e) |

JPMorgan Mortgage Acquisition Trust, 2007-CH3 A5 (1 mo. USD LIBOR + 0.260%) | | | 0.445 | % | | | 3/25/37 | | | | 1,060,000 | | | | 1,030,671 | (e) |

Legacy Mortgage Asset Trust, 2019-GS3 A1 | | | 3.750 | % | | | 4/25/59 | | | | 875,396 | | | | 897,453 | (d) |

RAAC Trust, 2007-SP2 A3 (1 mo. USD LIBOR + 0.650%) | | | 0.835 | % | | | 6/25/47 | | | | 775,000 | | | | 756,187 | (e) |

Total Asset-Backed Securities (Cost — $3,429,515) | | | | | | | | 3,505,899 | |

| Mortgage-Backed Securities — 0.3% | | | | | | | | | | | | | | | | |

GNMA — 0.3% | | | | | | | | | | | | | | | | |

Government National Mortgage Association (GNMA) II

(Cost — $153,751) | | | 4.500 | % | | | 8/20/48 | | | | 141,775 | | | | 151,837 | |

Total Investments before Short-Term Investments (Cost — $56,965,248) | | | | | | | | 55,696,649 | |

See Notes to Consolidated Financial Statements.

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 3 |

Consolidated schedule of investments (unaudited) (cont’d)

June 30, 2020

Clarion Partners Real Estate Income Fund Inc.

| | | | | | | | | | | | | | | | |

| | | Rate | | | | | | Shares | | | Value | |

| Short-Term Investments — 6.3% | | | | | | | | | | | | | | | | |

Dreyfus Government Cash Management, Institutional Shares

(Cost — $2,983,366) | | | 0.085 | % | | | | | | $ | 2,983,366 | | | $ | 2,983,366 | |

Total Investments — 123.7% (Cost — $59,948,614) | | | | | | | | | | | | 58,680,015 | |

Series A Cumulative Preferred Stock, at Liquidation Value — (0.3)% | | | | (125,000 | ) |

Liabilities in Excess of Other Assets — (23.4)% | | | | | | | | | | | | | | | (11,099,853 | ) |

Total Net Assets Applicable to Common Shareholders — 100.0% | | | | | | | $ | 47,455,162 | |

| (a) | Security is valued using significant unobservable inputs (Note 1). |

| (b) | All or a portion of this security is pledged as collateral related to the mortgage note payable (Note 5). |

| (c) | Collateralized mortgage obligations are secured by an underlying pool of mortgages or mortgage pass-through certificates that are structured to direct payments on underlying collateral to different series or classes of the obligations. The interest rate may change positively or inversely in relation to one or more interest rates, financial indices or other financial indicators and may be subject to an upper and/or lower limit. |

| (d) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors. |

| (e) | Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| | |

Abbreviation(s) used in this schedule: |

| |

| CAS | | — Connecticut Avenue Securities |

| |

| LIBOR | | — London Interbank Offered Rate |

| |

| USD | | — United States Dollar |

At June 30, 2020, the Fund had the following open futures contracts:

| | | | | | | | | | | | | | | | | | | | |

| | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Market

Value | | | Unrealized

Depreciation | |

| Contracts to Sell: | | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury 5-Year Notes | | | 8 | | | | 9/20 | | | $ | 1,002,986 | | | $ | 1,005,937 | | | $ | (2,951) | |

See Notes to Consolidated Financial Statements.

| | |

| 4 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

Consolidated statement of assets and liabilities (unaudited)

June 30, 2020

| | | | |

| |

| Assets: | | | | |

Investments, at value (Cost — $59,948,614) | | $ | 58,680,015 | |

Cash | | | 139,887 | |

Deferred offering costs | | | 349,710 | |

Interest receivable | | | 185,174 | |

Receivable from investment manager | | | 158,760 | |

Receivable for Fund shares sold | | | 67,721 | |

Deposits with brokers for open futures contracts | | | 18,009 | |

Receivable from broker — net variation margin on open futures contracts | | | 250 | |

Other assets | | | 11,014 | |

Prepaid expenses | | | 45,426 | |

Total Assets | | | 59,655,966 | |

| |

| Liabilities: | | | | |

Mortgage note payable (net of financing cost of $308,698) (Note 5) | | | 9,791,302 | |

Payable to investment manager (Note 2) | | | 1,480,049 | |

Tenant security deposits | | | 289,923 | |

Deferred origination fees | | | 126,826 | |

Distributions payable | | | 8,096 | |

Service and/or distribution fees payable | | | 2,613 | |

Directors’ fees payable | | | 81 | |

Accrued expenses | | | 376,914 | |

Total Liabilities | | | 12,075,804 | |

Series A Cumulative Preferred Stock (125 shares authorized and issued at $1,000 per share) (Note 6) | | | 125,000 | |

| Total Net Assets Applicable to Common Shareholders | | $ | 47,455,162 | |

| |

| Net Assets Applicable to Common Shareholders: | | | | |

Common stock par value (Note 10) | | $ | 4,864 | |

Paid-in capital in excess of par value | | | 48,675,302 | |

Total distributable earnings (loss) | | | (1,225,004) | |

| Total Net Assets Applicable to Common Shareholders | | $ | 47,455,162 | |

See Notes to Consolidated Financial Statements.

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 5 |

Consolidated statement of assets and liabilities (unaudited) (cont’d)

June 30, 2020

| | | | |

| |

| Net Assets: | | | | |

Class S | | | $50,605 | |

Class T | | | $4,579,154 | |

Class D | | | $50,828 | |

Class I | | | $42,774,575 | |

| |

| Common Shares Outstanding: | | | | |

Class S | | | 5,186 | |

Class T | | | 469,692 | |

Class D | | | 5,208 | |

Class I | | | 4,383,985 | |

| |

| Net Asset Value Per Common Share: | | | | |

Class S | | | $9.76 | |

Class T | | | $9.75 | |

Class D | | | $9.76 | |

Class I | | | $9.76 | |

See Notes to Consolidated Financial Statements.

| | |

| 6 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

Consolidated statement of operations (unaudited)

For the Six Months Ended June 30, 2020

| | | | |

| |

| Investment Income: | | | | |

Interest | | $ | 1,050,935 | |

Rental income | | | 431,228 | |

Other income | | | 9,090 | |

Total Investment Income | | | 1,491,253 | |

| |

| Expenses: | | | | |

Offering costs (Note 1) | | | 659,835 | |

Investment management fee (Note 2) | | | 221,786 | |

Transfer agent fees (Note 8) | | | 112,939 | |

Real estate taxes and insurance | | | 82,534 | |

Audit and tax fees | | | 80,555 | |

Legal fees | | | 74,795 | |

Fund accounting fees | | | 48,521 | |

Interest expense (Note 5) | | | 37,319 | |

Real estate investment administration fees | | | 36,938 | |

Real estate operating expenses | | | 25,532 | |

Shareholder reports | | | 22,684 | |

Amortization of mortgage financing costs | | | 8,528 | |

Service and/or distribution fees (Notes 2 and 8) | | | 7,405 | |

Organization costs (Note 1) | | | 6,009 | |

Directors’ fees | | | 4,994 | |

Registration fees | | | 4,527 | |

Custody fees | | | 1,099 | |

Franchise taxes | | | 65 | |

Miscellaneous expenses | | | 14,140 | |

Total Expenses | | | 1,450,205 | |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 8) | | | (1,153,919) | |

Net Expenses | | | 296,286 | |

| Net Investment Income | | | 1,194,967 | |

| |

| Realized and Unrealized Gain (Loss) on Investments and Futures Contracts (Notes 1, 3 and 4): | | | | |

Net Realized Gain (Loss) From: | | | | |

Investment transactions | | | 32 | |

Futures contracts | | | (42,759) | |

Net Realized Loss | | | (42,727) | |

Change in Net Unrealized Appreciation (Depreciation) From: | | | | |

Investments | | | (774,818) | |

Investments in real estate loans | | | (447,498) | |

Real estate investments | | | (58,780) | |

Futures contracts | | | (2,951) | |

Change in Net Unrealized Appreciation (Depreciation) | | | (1,284,047) | |

| Net Loss on Investments and Futures Contracts | | | (1,326,774) | |

Distributions Paid to Series A Cumulative Preferred Stockholders From Net Investment Income (Notes 1, 2 and 6) | | | (1,926) | |

| Decrease in Net Assets Applicable to Common Shareholders From Operations | | $ | (133,733) | |

See Notes to Consolidated Financial Statements.

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 7 |

Consolidated statements of changes in net assets

| | | | | | | | |

For the Six Months Ended June 30, 2020 (unaudited)

and the Period Ended December 31, 2019 | | 2020 | | | 2019† | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 1,194,967 | | | $ | 325,626 | |

Net realized gain (loss) | | | (42,727) | | | | 375 | |

Change in net unrealized appreciation (depreciation) | | | (1,284,047) | | | | 12,497 | |

Distributions Paid to Series A Cumulative Preferred Stockholders From Net Investment Income | | | (1,926) | | | | — | |

Increase (Decrease) in Net Assets Applicable to Common Shareholders From Operations | | | (133,733) | | | | 338,498 | |

| | |

| Distributions to Common Shareholders From (Notes 1 and 9): | | | | | | | | |

Total distributable earnings | | | (1,095,451) | | | | (378,001) | |

Decrease in Net Assets From Distributions to Common Shareholders | | | (1,095,451) | | | | (378,001) | |

| | |

| Fund Share Transactions (Note 10): | | | | | | | | |

Net proceeds from sale of shares | | | 26,632,472 | | | | 21,200,000 | |

Reinvestment of distributions | | | 1,063,577 | | | | 378,001 | |

Cost of shares repurchased through tender offer (Note 11) | | | (561,388) | | | | — | |

Redemption fees (Note 1(j)) | | | 11,187 | | | | — | |

Increase in Net Assets From Fund Share Transactions | | | 27,145,848 | | | | 21,578,001 | |

Increase in Net Assets Applicable to Common Shareholders | | | 25,916,664 | | | | 21,538,498 | |

| | |

| Net Assets Applicable to Common Shareholders: | | | | | | | | |

Beginning of period | | | 21,538,498 | | | | — | |

End of period | | $ | 47,455,162 | | | $ | 21,538,498 | |

| † | For the period September 27, 2019 (inception date) to December 31, 2019. |

See Notes to Consolidated Financial Statements.

| | |

| 8 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

Consolidated statement of cash flows (unaudited)

For the Six Months Ended June 30, 2020

| | | | |

| |

| Increase (Decrease) in Cash: | | | | |

| Cash Flows from Operating Activities: | | | | |

Net decrease in net assets applicable to common shareholders resulting from operations | | $ | (131,807) | |

Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided (used) by operating activities: | | | | |

Purchases of real estate and portfolio securities | | | (35,395,333) | |

Sales of real estate and portfolio securities | | | 381,299 | |

Net purchases, sales and maturities of short-term investments | | | (2,878,791) | |

Net amortization of premium (accretion of discount) | | | (27,266) | |

Increase in interest receivable | | | (34,593) | |

Increase in prepaid expenses | | | (43,736) | |

Increase in other assets | | | (11,014) | |

Decrease in receivable from investment manager | | | 36,191 | |

Decrease in deferred offering costs | | | 659,835 | |

Decrease in payable to investment manager | | | (43,991) | |

Increase in receivable from broker — net variation margin on open futures contracts | | | (250) | |

Decrease in deferred origination fees | | | (9,090) | |

Decrease in Directors’ fees payable | | | (965) | |

Increase in tenant security deposits | | | 289,923 | |

Increase in accrued expenses | | | 152,747 | |

Increase in service and/or distribution fees payable | | | 2,529 | |

Net realized gain on investments | | | (32) | |

Change in net unrealized appreciation (depreciation) of investments | | | 1,281,096 | |

Net Cash Used in Operating Activities* | | | (35,773,248) | |

| |

| Cash Flows from Financing Activities: | | | | |

Distributions paid on common stock (net of distributions payable) | | | (23,778) | |

Distributions paid on Series A Cumulative Preferred Stock | | | (1,926) | |

Proceeds from offering of Series A Cumulative Preferred Stock | | | 125,000 | |

Proceeds from mortgage note payable | | | 9,791,302 | |

Proceeds from sale of shares (net of receivable for Fund shares sold) | | | 26,564,751 | |

Payment for shares repurchased through tender offer (net of redemption fees) | | | (550,201) | |

Net Cash Provided by Financing Activities | | | 35,905,148 | |

| Net Increase in Cash and Restricted Cash | | | 131,900 | |

Cash and restricted cash at beginning of period | | | 25,996 | |

Cash and restricted cash at end of period | | $ | 157,896 | |

| * | Included in operating expenses is cash of $37,319 paid for interest expense on borrowings. |

See Notes to Consolidated Financial Statements.

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 9 |

Consolidated statement of cash flows (unaudited) (cont’d)

For the Six Months Ended June 30, 2020

| | The following table provides a reconciliation of cash and restricted cash reported within the Consolidated Statement of Assets and Liabilities that sums to the total of such amounts shown on the Consolidated Statement of Cash Flows. |

| | | | |

| | | June 30, 2020 | |

| Cash | | $ | 139,887 | |

| Restricted cash | | | 18,009 | |

| Total cash and restricted cash shown in the Consolidated Statement of Cash Flows | | $ | 157,896 | |

| | | | |

| |

| Non-Cash Financing Activities: | | | | |

Proceeds from reinvestment of distributions | | | $1,063,577 | |

See Notes to Consolidated Financial Statements.

| | |

| 10 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

Consolidated financial highlights

| | | | | | | | |

For a share of each class of capital stock outstanding throughout each year ended December 31, unless

otherwise noted: | |

| Class S Shares1 | | 20202 | | | 20193 | |

| | |

| Net asset value, beginning of period | | | $9.99 | | | | $10.00 | |

| | |

| Income (loss) from operations: | | | | | | | | |

Net investment income | | | 0.30 | | | | 0.14 | |

Net realized and unrealized gain (loss) | | | (0.33) | | | | 0.01 | |

Distributions paid to Series A Cumulative Preferred Stockholders from net investment income | | | (0.00) | 4 | | | — | |

Total income (loss) from operations | | | (0.03) | | | | 0.15 | |

| | |

| Less distributions to common shareholders from: | | | | | | | | |

Net investment income | | | (0.20) | | | | (0.16) | |

Total distributions to common shareholders | | | (0.20) | | | | (0.16) | |

| | |

| Net asset value, end of period | | | $9.76 | | | | $9.99 | |

Total return5 | | | (0.23) | % | | | 1.47 | % |

| | |

| Net assets applicable to common shareholders, end of period (000s) | | | $51 | | | | $51 | |

| | |

| Ratios to average net assets: | | | | | | | | |

Gross expenses6 | | | 86.90 | %7 | | | 260.63 | % |

Net expenses6,8,9 | | | 2.37 | 7 | | | 3.39 | |

Net investment income6 | | | 6.04 | 7 | | | 5.34 | |

| | |

| Portfolio turnover rate | | | 1 | % | | | 2 | % |

| | |

| Supplemental data: | | | | | | | | |

Mortgage Note Payable, End of Period (000s) | | | $10,100 | | | | — | |

Asset Coverage Ratio for Mortgage Note Payable | | | 571 | %10 | | | — | |

Asset Coverage, per $1,000 Principal Amount of Mortgage Note Payable | | | $5,711 | 10 | | | — | |

Weighted Average Mortgage Note Payable (000s) | | | $10,100 | | | | — | |

Weighted Average Interest Rate on Mortgage Note Payable | | | 2.40 | % | | | — | |

Series A Cumulative Preferred Stock at Liquidation Value, End of Period (000s) | | | $125 | | | | — | |

Asset Coverage Ratio for Series A Cumulative Preferred Stock | | | 564 | %11 | | | — | |

Asset Coverage, per $1,000 Liquidation Value per Share of Series A Cumulative Preferred Stock | | | $5,641 | 11 | | | — | |

See Notes to Consolidated Financial Statements.

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 11 |

Consolidated financial highlights (cont’d)

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended June 30, 2020 (unaudited). |

| 3 | For the period September 27, 2019 (inception date) to December 31, 2019. |

| 4 | Amount represents less than $0.005 per share. |

| 5 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 7 | Calculated on the basis of average net assets of common stock shareholders. Ratios do not reflect the effect of dividend payments to Series A Cumulative Preferred Stockholders. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | As a result of an expense limitation arrangement, effective May 14, 2020, the ratio of total annual fund operating expenses, other than property management, acquisition, disposition expenses, any other expenses related to investments in real property, debt and real estate related securities, expenses related to borrowings or the issuance of preferred stock, interest, brokerage, tax and extraordinary expenses, to average net assets of Class S shares did not exceed 2.60%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Directors’ consent. Prior to May 14, 2020, expenses related to borrowings or the issuance of preferred stock were included in the expense limitation arrangement. |

| 10 | Represents value of Fund net assets plus the mortgage note payable and Series A Cumulative Preferred Stock, if any, at the end of the period divided by the mortgage note payable at the end of the period. |

| 11 | Represents value of Fund net assets plus the mortgage note payable and Series A Cumulative Preferred Stock at the end of the period divided by the mortgage note payable and Series A Cumulative Preferred Stock outstanding at the end of the period. |

See Notes to Consolidated Financial Statements.

| | |

| 12 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

| | | | | | | | |

For a share of each class of capital stock outstanding throughout each year ended December 31, unless

otherwise noted: | |

| Class T Shares1 | | 20202 | | | 20193 | |

| | |

| Net asset value, beginning of period | | | $9.99 | | | | $10.00 | |

| | |

| Income (loss) from operations: | | | | | | | | |

Net investment income | | | 0.28 | | | | 0.14 | |

Net realized and unrealized gain (loss) | | | (0.30) | | | | 0.01 | |

Distributions paid to Series A Cumulative Preferred Stockholders from net investment income | | | (0.00) | 4 | | | — | |

Total income (loss) from operations | | | (0.02) | | | | 0.15 | |

| | |

| Less distributions to common shareholders from: | | | | | | | | |

Net investment income | | | (0.22) | | | | (0.16) | |

Total distributions to common shareholders | | | (0.22) | | | | (0.16) | |

| | |

| Net asset value, end of period | | | $9.75 | | | | $9.99 | |

Total return5 | | | (0.17) | % | | | 1.47 | % |

| | |

| Net assets applicable to common shareholders, end of period (000s) | | | $4,579 | | | | $51 | |

| | |

| Ratios to average net assets: | | | | | | | | |

Gross expenses6 | | | 11.18 | %7 | | | 260.63 | % |

Net expenses6,8,9 | | | 2.33 | 7 | | | 3.39 | |

Net investment income6 | | | 5.82 | 7 | | | 5.34 | |

| | |

| Portfolio turnover rate | | | 1 | % | | | 2 | % |

| | |

| Supplemental data: | | | | | | | | |

Mortgage Note Payable, End of Period (000s) | | | $10,100 | | | | — | |

Asset Coverage Ratio for Mortgage Note Payable | | | 571 | %10 | | | — | |

Asset Coverage, per $1,000 Principal Amount of Mortgage Note Payable | | | $5,711 | 10 | | | — | |

Weighted Average Mortgage Note Payable (000s) | | | $10,100 | | | | — | |

Weighted Average Interest Rate on Mortgage Note Payable | | | 2.40 | % | | | — | |

Series A Cumulative Preferred Stock at Liquidation Value, End of Period (000s) | | | $125 | | | | — | |

Asset Coverage Ratio for Series A Cumulative Preferred Stock | | | 564 | %11 | | | — | |

Asset Coverage, per $1,000 Liquidation Value per Share of Series A Cumulative Preferred Stock | | | $5,641 | 11 | | | — | |

See Notes to Consolidated Financial Statements.

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 13 |

Consolidated financial highlights (cont’d)

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended June 30, 2020 (unaudited). |

| 3 | For the period September 27, 2019 (inception date) to December 31, 2019. |

| 4 | Amount represents less than $0.005 per share. |

| 5 | Performance figures, exclusive of sales charges and dealer manager fees, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 7 | Calculated on the basis of average net assets of common stock shareholders. Ratios do not reflect the effect of dividend payments to Series A Cumulative Preferred Stockholders. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | As a result of an expense limitation arrangement, effective May 14, 2020, the ratio of total annual fund operating expenses, other than property management, acquisition, disposition expenses, any other expenses related to investments in real property, debt and real estate related securities, expenses related to borrowings or the issuance of preferred stock, interest, brokerage, tax and extraordinary expenses, to average net assets of Class T shares did not exceed 2.60%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Directors’ consent. Prior to May 14, 2020, expenses related to borrowings or the issuance of preferred stock were included in the expense limitation arrangement. |

| 10 | Represents value of Fund net assets plus the mortgage note payable and Series A Cumulative Preferred Stock, if any, at the end of the period divided by the mortgage note payable at the end of the period. |

| 11 | Represents value of Fund net assets plus the mortgage note payable and Series A Cumulative Preferred Stock at the end of the period divided by the mortgage note payable and Series A Cumulative Preferred Stock outstanding at the end of the period. |

See Notes to Consolidated Financial Statements.

| | |

| 14 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

| | | | | | | | |

For a share of each class of capital stock outstanding throughout each year ended December 31, unless

otherwise noted: | |

| Class D Shares1 | | 20202 | | | 20193 | |

| | |

| Net asset value, beginning of period | | | $9.99 | | | | $10.00 | |

| | |

| Income (loss) from operations: | | | | | | | | |

Net investment income | | | 0.33 | | | | 0.15 | |

Net realized and unrealized gain (loss) | | | (0.33) | | | | 0.01 | |

Distributions paid to Series A Cumulative Preferred Stockholders from net investment income | | | (0.00) | 4 | | | — | |

Total income from operations | | | 0.00 | 4 | | | 0.16 | |

| | |

| Less distributions to common shareholders from: | | | | | | | | |

Net investment income | | | (0.23) | | | | (0.17) | |

Total distributions to common shareholders | | | (0.23) | | | | (0.17) | |

| | |

| Net asset value, end of period | | | $9.76 | | | | $9.99 | |

Total return5 | | | 0.03 | % | | | 1.62 | % |

| | |

| Net assets applicable to common shareholders, end of period (000s) | | | $51 | | | | $51 | |

| | |

| Ratios to average net assets: | | | | | | | | |

Gross expenses6 | | | 39.09 | %7 | | | 228.69 | % |

Net expenses6,8,9 | | | 1.87 | 7 | | | 2.80 | |

Net investment income6 | | | 6.69 | 7 | | | 5.94 | |

| | |

| Portfolio turnover rate | | | 1 | % | | | 2 | % |

| | |

| Supplemental data: | | | | | | | | |

Mortgage Note Payable, End of Period (000s) | | | $10,100 | | | | — | |

Asset Coverage Ratio for Mortgage Note Payable | | | 571 | %10 | | | — | |

Asset Coverage, per $1,000 Principal Amount of Mortgage Note Payable | | | $5,711 | 10 | | | — | |

Weighted Average Mortgage Note Payable (000s) | | | $10,100 | | | | — | |

Weighted Average Interest Rate on Mortgage Note Payable | | | 2.40 | % | | | — | |

Series A Cumulative Preferred Stock at Liquidation Value, End of Period (000s) | | | $125 | | | | — | |

Asset Coverage Ratio for Series A Cumulative Preferred Stock | | | 564 | %11 | | | — | |

Asset Coverage, per $1,000 Liquidation Value per Share of Series A Cumulative Preferred Stock | | | $5,641 | 11 | | | — | |

See Notes to Consolidated Financial Statements.

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 15 |

Consolidated financial highlights (cont’d)

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended June 30, 2020 (unaudited). |

| 3 | For the period September 27, 2019 (inception date) to December 31, 2019. |

| 4 | Amount represents less than $0.005 per share. |

| 5 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 7 | Calculated on the basis of average net assets of common stock shareholders. Ratios do not reflect the effect of dividend payments to Series A Cumulative Preferred Stockholders. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | As a result of an expense limitation arrangement, effective May 14, 2020, the ratio of total annual fund operating expenses, other than property management, acquisition, disposition expenses, any other expenses related to investments in real property, debt and real estate related securities, expenses related to borrowings or the issuance of preferred stock, interest, brokerage, tax and extraordinary expenses, to average net assets of Class D shares did not exceed 2.00%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Directors’ consent. Prior to May 14, 2020, expenses related to borrowings or the issuance of preferred stock were included in the expense limitation arrangement. |

| 10 | Represents value of Fund net assets plus the mortgage note payable and Series A Cumulative Preferred Stock, if any, at the end of the period divided by the mortgage note payable at the end of the period. |

| 11 | Represents value of Fund net assets plus the mortgage note payable and Series A Cumulative Preferred Stock at the end of the period divided by the mortgage note payable and Series A Cumulative Preferred Stock outstanding at the end of the period. |

See Notes to Consolidated Financial Statements.

| | |

| 16 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

| | | | | | | | |

For a share of each class of capital stock outstanding throughout each year ended December 31, unless

otherwise noted: | |

| Class I Shares1 | | 20202 | | | 20193 | |

| | |

| Net asset value, beginning of period | | | $9.99 | | | | $10.00 | |

| | |

| Income (loss) from operations: | | | | | | | | |

Net investment income | | | 0.33 | | | | 0.16 | |

Net realized and unrealized gain (loss) | | | (0.31) | | | | 0.01 | |

Distributions paid to Series A Cumulative Preferred Stockholders from net investment income | | | (0.00) | 4 | | | — | |

Total income from operations | | | 0.02 | | | | 0.17 | |

| | |

| Less distributions to common shareholders from: | | | | | | | | |

Net investment income | | | (0.25) | | | | (0.18) | |

Total distributions to common shareholders | | | (0.25) | | | | (0.18) | |

| | |

| Net asset value, end of period | | | $9.76 | | | | $9.99 | |

Total return5 | | | 0.19 | % | | | 1.69 | % |

| | |

| Net assets applicable to common shareholders, end of period (000s) | | | $42,775 | | | | $21,386 | |

| |

| Ratios to average net assets: | | | | | |

Gross expenses6 | | | 7.79 | %7 | | | 15.08 | % |

Net expenses6,8,9 | | | 1.64 | 7 | | | 2.57 | |

Net investment income6 | | | 6.78 | 7 | | | 6.17 | |

| | |

| Portfolio turnover rate | | | 1 | % | | | 2 | % |

| |

| Supplemental data: | | | | | |

Mortgage Note Payable, End of Period (000s) | | | $10,100 | | | | — | |

Asset Coverage Ratio for Mortgage Note Payable | | | 571 | %10 | | | — | |

Asset Coverage, per $1,000 Principal Amount of Mortgage Note Payable | | | $5,711 | 10 | | | — | |

Weighted Average Mortgage Note Payable (000s) | | | $10,100 | | | | — | |

Weighted Average Interest Rate on Mortgage Note Payable | | | 2.40 | % | | | — | |

Series A Cumulative Preferred Stock at Liquidation Value, End of Period (000s) | | | $125 | | | | — | |

Asset Coverage Ratio for Series A Cumulative Preferred Stock | | | 564 | %11 | | | — | |

Asset Coverage, per $1,000 Liquidation Value per Share of Series A Cumulative Preferred Stock | | | $5,641 | 11 | | | — | |

See Notes to Consolidated Financial Statements.

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 17 |

Consolidated financial highlights (cont’d)

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended June 30, 2020 (unaudited). |

| 3 | For the period September 27, 2019 (inception date) to December 31, 2019. |

| 4 | Amount represents less than $0.005 per share. |

| 5 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 7 | Calculated on the basis of average net assets of common stock shareholders. Ratios do not reflect the effect of dividend payments to Series A Cumulative Preferred Stockholders. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | As a result of an expense limitation arrangement, effective May 14, 2020, the ratio of total annual fund operating expenses, other than property management, acquisition, disposition expenses, any other expenses related to investments in real property, debt and real estate related securities, expenses related to borrowings or the issuance of preferred stock, interest, brokerage, tax and extraordinary expenses, to average net assets of Class I shares did not exceed 1.75%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Directors’ consent. Prior to May 14, 2020, expenses related to borrowings or the issuance of preferred stock were included in the expense limitation arrangement. |

| 10 | Represents value of Fund net assets plus the mortgage note payable and Series A Cumulative Preferred Stock, if any, at the end of the period divided by the mortgage note payable at the end of the period. |

| 11 | Represents value of Fund net assets plus the mortgage note payable and Series A Cumulative Preferred Stock at the end of the period divided by the mortgage note payable and Series A Cumulative Preferred Stock outstanding at the end of the period. |

See Notes to Consolidated Financial Statements.

| | |

| 18 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

Notes to consolidated financial statements (unaudited)

1. Organization and significant accounting policies

Clarion Partners Real Estate Income Fund Inc. (the “Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), that continuously offers its shares. The Fund is a Maryland corporation and has elected to be taxed as a real estate investment trust (a “REIT”) for U.S. federal income tax purposes under the Internal Revenue Code of 1986, as amended (the “Code”). The Board of Directors authorized 400 million shares of $0.001 par value common stock. The Fund’s investment objective is to provide current income and long-term capital appreciation.

The Fund seeks to achieve its objective by investing primarily in a portfolio of private commercial real estate and publicly traded real estate securities.

Generally, all investments made by the Fund in private commercial real estate, including real property and investments in real estate loans, will be made through individual special purpose vehicles (“SPV”). Unless otherwise noted, each SPV is wholly-owned by the Fund and these financial statements are consolidated financial statements of the Fund and each SPV. All interfund transactions have been eliminated in consolidation.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The Fund calculates its net asset value by subtracting liabilities (including accrued expenses or distributions) from the total assets of the Fund (the value of investments, plus cash or other assets, including interest and distributions accrued but not yet received). The Fund’s assets and liabilities are valued in accordance with GAAP using the principles set forth below.

Private commercial real estate

The fair values of investments in real estate loans are generally determined by discounting the future contractual cash flows to the present value using a current market interest rate. The market rate is determined by considering one or more of the following criteria as appropriate: (i) interest rates for loans of comparable quality and maturity, (ii) the value of the underlying collateral and (iii) the prevailing state of the debt markets. The valuations of investments in real estate loans are prepared by independent external appraisers. The significant unobservable inputs used in the fair value measurement of the Fund’s investment in real estate loans are the selection of certain credit spreads and the loan to value ratios.

The fair values of real estate investments are generally determined by considering the income, cost and sales comparison approaches of estimating property value. The income

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 19 |

Notes to consolidated financial statements (unaudited) (cont’d)

approach estimates an income stream for a property (typically 10 years) and discounts this income plus a reversion (presumed sale) into a present value at a risk adjusted rate. Yield rates and growth assumptions utilized in this approach are derived from market transactions as well as other financial and industry data. The cost approach estimates the replacement cost of the building less physical depreciation plus the land value. Generally, this approach provides a check on the value derived using the income approach. The sales comparison approach compares recent transactions to the appraised property. Adjustments are made for dissimilarities that typically provide a range of value. The discount rate and the exit capitalization rate are significant inputs to these valuations. These rates are based on the location, type and nature of each property, and current and anticipated market conditions.

Many factors are also considered in the determination of fair value including, but not limited to, the operating cash flows and financial performance of the properties, property types and geographic locations, the physical condition of the asset, prevailing market capitalization rates, prevailing market discount rates, general economic conditions, economic conditions specific to the market in which the assets are located, and any specific rights or terms associated with the investment. Because of the inherent uncertainties of valuation, the values reflected in the consolidated financial statements may materially differ from the values that would be determined by negotiations held between parties in a sale transaction.

The valuations of real estate investments are prepared by independent external appraisers. Since appraisals consider the estimated effect of physical depreciation, historical cost depreciation and amortization on real estate related assets have been excluded from net investment income.

Investments in non-consolidated joint ventures are stated at fair value. The Fund’s ownership interests are valued based on the fair value of the underlying real estate and any related mortgage loans payable using the same techniques as described within this Note. Any other factors, such as ownership percentage, ownership rights, buy/sell agreements, distribution provisions, and capital call obligations are also considered. Upon the disposition of all investments in joint ventures by an investee entity, the Fund will continue to state its equity in the remaining net assets of the investee entity during the wind down period, if any, that occurs prior to the dissolution of the investee entity.

The fair values of mortgage and senior notes payable are generally determined by discounting the difference between the contractual interest rates and estimated market interest rates considering changes in credit spreads, as applicable. The debt valuations for the Fund are prepared by an independent third-party service provider. The significant unobservable inputs used in the fair value measurement of the Fund’s mortgage notes payable are the selection of certain credit spreads and the loan to value ratios. The significant unobservable inputs used in the fair value measurement of the Fund’s senior notes payable are the selection of certain credit spreads.

| | |

| 20 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

Real estate securities and other investments

The valuations for fixed income securities (which may include, but are not limited to, corporate bonds, mortgage-backed and asset-back securities, and collateralized mortgage obligations) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. Futures contracts are valued daily at the settlement price established by the board of trade or exchange on which they are traded. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/ dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.

Valuation oversight

The Board of Directors is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North Atlantic Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Directors, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Directors. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 21 |

Notes to consolidated financial statements (unaudited) (cont’d)

discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Directors, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Directors quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • | | Level 1 — quoted prices in active markets for identical investments |

| • | | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities carried at fair value:

| | | | | | | | | | | | | | | | |

| ASSETS | |

| Description | | Quoted Prices

(Level 1) | | | Other Significant

Observable Inputs (Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| Long-Term Investments†: | | | | | | | | | | | | | | | | |

Real Estate Investments | | | — | | | | — | | | $ | 20,300,000 | | | $ | 20,300,000 | |

Investments in Real Estate Loans | | | — | | | | — | | | | 17,552,502 | | | | 17,552,502 | |

Collateralized Mortgage Obligations | | | — | | | $ | 14,186,411 | | | | — | | | | 14,186,411 | |

Asset-Backed Securities | | | — | | | | 3,505,899 | | | | — | | | | 3,505,899 | |

Mortgage-Backed Securities | | | — | | | | 151,837 | | | | — | | | | 151,837 | |

| Total Long-Term Investments | | | — | | | | 17,844,147 | | | | 37,852,502 | | | | 55,696,649 | |

| Short-Term Investments† | | $ | 2,983,366 | | | | — | | | | — | | | | 2,983,366 | |

| Total Investments | | $ | 2,983,366 | | | $ | 17,844,147 | | | $ | 37,852,502 | | | $ | 58,680,015 | |

| | |

| 22 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

| | | | | | | | | | | | | | | | |

| LIABILITIES | |

| Description | | Quoted Prices

(Level 1) | | | Other Significant

Observable Inputs (Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Other Financial Instruments: | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | 2,951 | | | | — | | | | — | | | $ | 2,951 | |

| † | See Consolidated Schedule of Investments for additional detailed categorizations. |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | | | | | | | | | |

| Investments in Securities | | Balance as of

December 31,

2019 | | | Accrued

premiums/

discounts | | | Realized

gain (loss) | | | Change in

unrealized

appreciation

(depreciation)1 | | | Purchases | |

| Real Estate Investments | | | — | | | | — | | | | — | | | $ | (58,780) | | | $ | 20,358,780 | |

| Investments in Real Estate Loans | | $ | 18,000,000 | | | | — | | | | — | | | | (447,498) | | | | — | |

| Total | | $ | 18,000,000 | | | | — | | | | — | | | $ | (506,278) | | | $ | 20,358,780 | |

| | | | | | | | | | | | | | | | | | | | |

Investments in Securities

(cont’d) | | Sales | | | Transfers

into

Level 3 | | | Transfers

out of

Level 3 | | | Balance as of

June 30, 2020 | | | Net change in

unrealized

appreciation

(depreciation)

for investments

in securities

still held at

June 30, 20201 | |

| Real Estate Investments | | | — | | | | — | | | | — | | | $ | 20,300,000 | | | $ | (58,780) | |

| Investments in Real Estate Loans | | | — | | | | — | | | | — | | | | 17,552,502 | | | | (447,498) | |

| Total | | | — | | | | — | | | | — | | | $ | 37,852,502 | | | $ | (506,278) | |

| 1 | This amount is included in the change in net unrealized appreciation (depreciation) in the accompanying Consolidated Statement of Operations. Change in unrealized appreciation (depreciation) includes net unrealized appreciation (depreciation) resulting from changes in investment values during the reporting period and the reversal of previously recorded unrealized appreciation (depreciation) when gains or losses are realized. |

The following table summarizes the valuation techniques used and unobservable inputs approved by the Valuation Committee to determine the fair value of certain, material Level 3 investments. The table does not include Level 3 investments with values derived utilizing prices from prior transactions or third party pricing information without adjustment (e.g., broker quotes, pricing services, net asset values).

| | | | | | | | | | | | | | | | | | | | |

| | | Fair Value

at 6/30/20

(000’s) | | | Valuation

Technique(s) | | | Unobservable Input(s) | | | Value | | | Impact to Valuation

from an Increase in

Input* | |

| Real Estate Investments: | | | | | | | | | | | | | | | | | |

| Industrial | | $ | 20,300 | | | | Discounted cash flow | | | | Discount rate | | | | 6.5 | % | | | Decrease | |

| | | | | | | | | | | | Exit capitalization rate | | | | 6.0 | % | | | Decrease | |

| Investments in Real Estate Loans: | | | | | | | | | | | | | |

| Mixed use | | $ | 17,553 | | | | Yield method | | | | Credit spread | | | | 9.26 | % | | | Decrease | |

| | | | | | | | | | | | Loan to value ratio | | | | 82.9 | % | | | Decrease | |

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 23 |

Notes to consolidated financial statements (unaudited) (cont’d)

| * | This column represents the directional change in the fair value of the Level 3 investments that would result in an increase from the corresponding unobservable input. A decrease to the unobservable input would have the opposite effect. Significant increases and decreases in these unobservable inputs in isolation could result in significantly higher or lower fair value measurements. |

(b) Private commercial real estate. The Fund’s investments in private commercial real estate (“CRE”) may include whole or partial interests in real properties, mortgage debt and mezzanine debt. The investments typically depend on the generation of cash flows, such as mortgage interest and rental and lease payments. Changes in broad market and economic conditions such as prevailing interest rates, as well as property specific delinquencies, fluctuations in underlying property values, and lease defaults may all impact the valuation of these investments.

(c) Futures contracts. The Fund uses futures contracts generally to gain exposure to, or hedge against, changes in interest rates or gain exposure to, or hedge against, changes in certain asset classes. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date.

Upon entering into a futures contract, the Fund is required to deposit cash or securities with a broker in an amount equal to a certain percentage of the contract amount. This is known as the ‘‘initial margin’’ and subsequent payments (‘‘variation margin’’) are made or received by the Fund each day, depending on the daily fluctuation in the value of the contract. For certain futures, including foreign denominated futures, variation margin is not settled daily, but is recorded as a net variation margin payable or receivable. The daily changes in contract value are recorded as unrealized gains or losses in the Consolidated Statement of Operations and the Fund recognizes a realized gain or loss when the contract is closed.

Futures contracts involve, to varying degrees, risk of loss in excess of the amounts reflected in the financial statements. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid secondary market.

(d) Cash flow information. The Fund invests in securities and distributes dividends from net investment income and net realized gains, which are paid in cash and may be reinvested at the discretion of shareholders. These activities are reported in the Consolidated Statement of Changes in Net Assets and additional information on cash receipts and cash payments are presented in the Consolidated Statement of Cash Flows.

(e) Credit and market risk. Investments in securities that are collateralized by real estate mortgages are subject to certain credit and liquidity risks. When market conditions result in an increase in default rates of the underlying mortgages and the foreclosure values of underlying real estate properties are materially below the outstanding amount of these underlying mortgages, collection of the full amount of accrued interest and principal on these investments may be doubtful. Such market conditions may significantly impair the value and liquidity of these investments and may result in a lack of correlation between their credit ratings and values.

| | |

| 24 | | Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report |

(f) Foreign investment risks. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(g) Counterparty risk and credit-risk-related contingent features of derivative instruments. The Fund may invest in certain securities or engage in other transactions, where the Fund is exposed to counterparty credit risk in addition to broader market risks. The Fund may invest in securities of issuers, which may also be considered counterparties as trading partners in other transactions. This may increase the risk of loss in the event of default or bankruptcy by the counterparty or if the counterparty otherwise fails to meet its contractual obligations. The Fund’s subadviser attempts to mitigate counterparty risk by (i) periodically assessing the creditworthiness of its trading partners, (ii) monitoring and/or limiting the amount of its net exposure to each individual counterparty based on its assessment and (iii) requiring collateral from the counterparty for certain transactions. Market events and changes in overall economic conditions may impact the assessment of such counterparty risk by the subadviser. In addition, declines in the values of underlying collateral received may expose the Fund to increased risk of loss.

With exchange traded and centrally cleared derivatives, there is less counterparty risk to the Fund since the exchange or clearinghouse, as counterparty to such instruments, guarantees against a possible default. The clearinghouse stands between the buyer and the seller of the contract; therefore, the credit risk is limited to failure of the clearinghouse. While offset rights may exist under applicable law, the Fund does not have a contractual right of offset against a clearing broker or clearinghouse in the event of a default of the clearing broker or clearinghouse.

The Fund has entered into master agreements, such as an International Swaps and Derivatives Association, Inc. Master Agreement (“ISDA Master Agreement”) or similar agreement, with certain of its derivative counterparties that govern over-the-counter derivatives and provide for general obligations, representations, agreements, collateral posting terms, netting provisions in the event of default or termination and credit related contingent features. The credit related contingent features include, but are not limited to, a percentage decrease in the Fund’s net assets or NAV over a specified period of time. If these credit related contingent features were triggered, the derivatives counterparty could terminate the positions and demand payment or require additional collateral.

Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment. However, absent an event of default by the counterparty or a termination of the agreement, the terms of the ISDA

| | |

| Clarion Partners Real Estate Income Fund Inc. 2020 Semi-Annual Report | | 25 |

Notes to consolidated financial statements (unaudited) (cont’d)

Master Agreements do not result in an offset of reported amounts of financial assets and financial liabilities in the Consolidated Statement of Assets and Liabilities across transactions between the Fund and the applicable counterparty. The enforceability of the right to offset may vary by jurisdiction.

Collateral requirements differ by type of derivative. Collateral or margin requirements are set by the broker or exchange clearinghouse for exchange traded derivatives while collateral terms are contract specific for over-the-counter traded derivatives. Cash collateral that has been pledged to cover obligations of the Fund under derivative contracts, if any, will be reported separately in the Consolidated Statement of Assets and Liabilities. Securities pledged as collateral, if any, for the same purpose are noted in the Consolidated Schedule of Investments.

As of June 30, 2020, the Fund did not have any open OTC derivative transactions.

(h) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income (including interest income from payment-in-kind securities), adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Rental income, including tenant reimbursements and recovery charges, earned from real estate investments is recognized on an accrual basis in accordance with the terms of the underlying lease agreement. Origination fees received in connection with CRE investments are deferred and recognized as income over the life of each respective investment. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.