The products and services produced by the production and precision agriculture, small agriculture and turf and construction and forestry segments above are marketed primarily through independent retail dealer networks and major retail outlets, and, as it relates to roadbuilding products in certain markets outside the United States and Canada, primarily through John Deere-owned sales and service subsidiaries.

Deere is subject to the informational requirements of the Exchange Act, and in accordance therewith files reports and other information with the SEC. For further information regarding Deere, reference is made to those reports and other information which are available as described under “Where You Can Find More Information” in this prospectus.

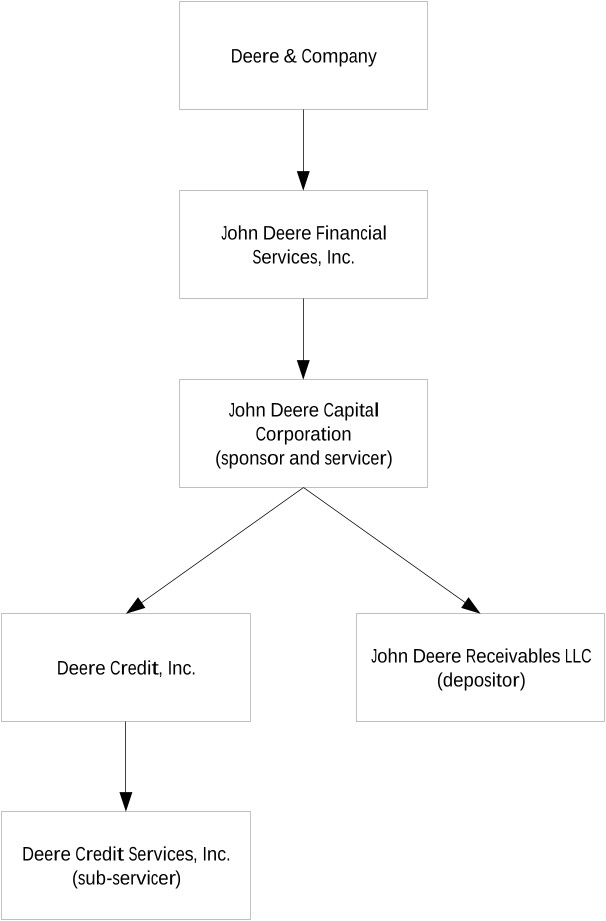

John Deere Capital Corporation

JDCC is the sponsor and servicer. JDCC is a corporation organized under the laws of Delaware, and commenced operations in 1958. John Deere Financial Services, Inc., a wholly owned finance holding subsidiary of Deere, is the parent of JDCC. JDCC’s mailing address is P.O. Box 5328, Madison, Wisconsin 53705-0328. Its telephone number is (800) 438-7394. JDCC and its subsidiaries provide and administer financing for retail purchases of new equipment manufactured by John Deere’s production and precision agricultural operations, small agriculture and turf operations and construction and forestry operations and used equipment taken in trade for this equipment. JDCC and its subsidiaries generally purchase retail installment sales and loan contracts (“retail notes”) from John Deere and its wholly owned subsidiaries. John Deere generally acquires these retail notes through John Deere retail dealers. JDCC and its subsidiaries also purchase and finance a limited amount of non-John Deere retail notes.

JDCC and its subsidiaries also finance and service revolving charge accounts, in most cases acquired from and offered through merchants in the agriculture and turf and construction and forestry markets. JDCC and its subsidiaries also provide wholesale financing to dealers of John Deere agriculture and turf equipment (which include both production and precision agriculture and small agriculture and turf) and construction and forestry equipment, primarily to finance inventories of equipment for those dealers. JDCC and its subsidiaries also lease John Deere equipment and a limited amount of non-John Deere equipment to retail customers.

JDCC subsidiaries also offer credit enhanced international export financing to select customers and dealers, which primarily involves John Deere products.

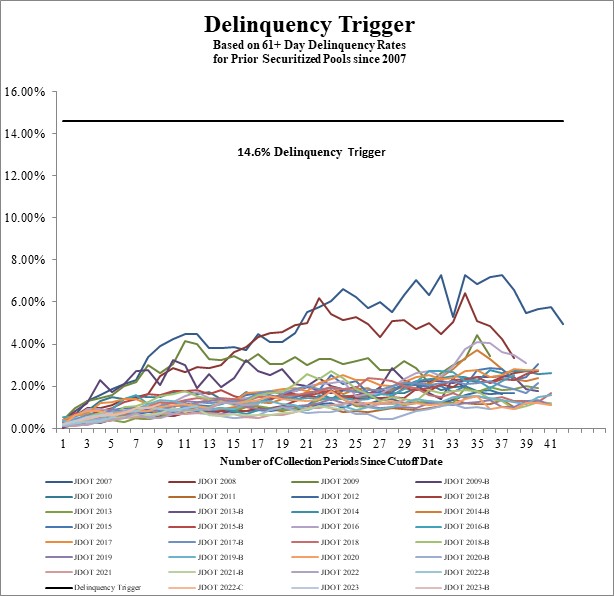

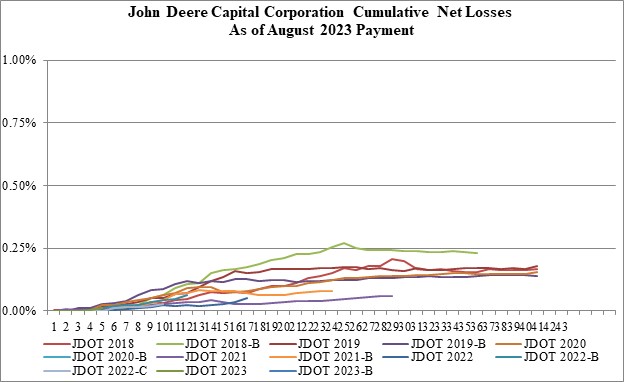

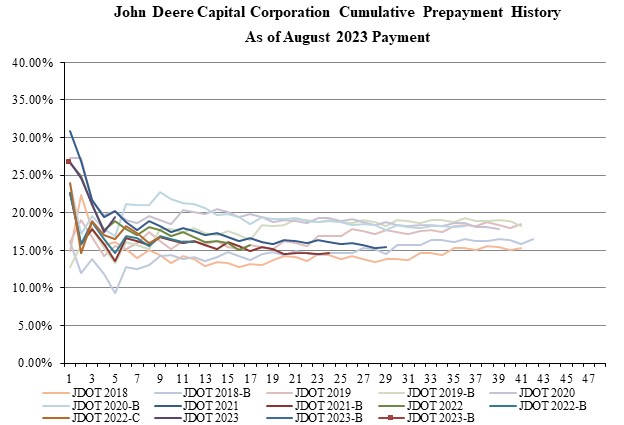

JDCC is the sponsor that initiates and organizes the issuance by the trust and is the servicer of the receivables. JDCC’s role as sponsor includes directing the issuance of the notes by the trust, establishing the terms of the notes, and working with the hired NRSROs, the indenture trustee, the owner trustee, legal counsel, accountants and the underwriters in connection with offering of the notes. JDCC and its predecessors, directly or through one of its affiliated companies, including Deere Credit Services, have been sponsoring and servicing retail installment contracts receivables since 1958. As of July 30, 2023, JDCC was servicing a total portfolio of approximately $30.4 billion in retail notes. JDCC services all of the retail notes that have been securitized by JDCC, which as of July 30, 2023 totaled approximately $7.0 billion in retail notes. There have been no defaults or performance trigger events in any of its public retail agricultural, turf, construction and forestry equipment receivables securitizations. JDCC has not taken any actions outside of its ordinary performance to prevent such events. There have been no material changes in JDCC’s policies or procedures for its servicing of retail agricultural, turf, construction and forestry equipment receivables during the three years preceding the date of this prospectus and JDCC has not had material disclosures nor been terminated as a servicer due to its servicing activities.

JDCC and its subsidiaries use a 52-week or 53-week fiscal year, in each case, ending on the last Sunday in the reporting period. The fiscal year-end dates for 2018, 2019, 2020, 2021 and 2022 were October 28, 2018, November 3, 2019, November 1, 2020, October 31, 2021 and October 30, 2022, respectively (each, a “Specified Fiscal Year End Date”). All such fiscal years contained 52 weeks, with the exception of fiscal year 2019, which contained 53 weeks.

At July 30, 2023, JDCC and its subsidiaries had 1,512 full-time and part-time employees. At that date, net receivables and leases administered by JDCC, which include receivables administered but not owned, were $54.9 billion. The sponsor has significant securitization experience and has sponsored various securitizations of assets