Currently, there are no legal proceedings pending before any court or governmental authority against Wells Fargo Delaware that would have a material adverse effect on the ability of Wells Fargo Delaware to perform it obligations as owner trustee under the trust agreement.

On March 23, 2021, Wells Fargo & Company announced that it had entered into a definitive agreement with Computershare Ltd (“Computershare”) to sell substantially all of its Corporate Trust Services (“CTS”) business. The transaction is expected to close in the second half of 2021, subject to customary closing conditions and regulatory approvals. Virtually all CTS employees, along with most existing CTS systems, technology and offices, are expected to transfer to one or more Computershare-affiliated entities as part of the sale.

Wells Fargo Delaware will act as owner trustee under the trust agreement and perform its obligations in such role through its CTS line of business. Subject to any requirements set forth in the trust agreement and in the definitive agreement between Wells Fargo & Company and Computershare, Wells Fargo Delaware intends to transfer to a Computershare-affiliated entity its duties, obligations and rights as owner trustee on or after the closing of the transaction with Computershare.

In the event that the transfer of any of Wells Fargo Delaware’s duties, obligations and rights as owner trustee under the trust agreement to a Computershare-affiliated entity does not occur on the closing of the transaction with Computershare, Wells Fargo Delaware intends to continue to perform such duties, obligations and rights through a Computershare-affiliated entity as its agent.

Other than the above five paragraphs, Wells Fargo Delaware has not participated in the preparation of, and is not responsible for, any other information contained in this document.

The owner trustee’s liability in connection with the issuance and sale of the notes and the certificate is limited solely to the express obligations of the owner trustee set forth in the trust agreement and the sale and servicing agreement. In no event shall the owner trustee have any responsibility to monitor compliance with or enforce compliance with the credit risk retention requirements for asset-backed securities or other rules or regulations relating to risk retention. The owner trustee shall not be charged with knowledge of such rules, nor shall it be liable to any noteholder, certificateholder, the depositor, the servicer or any other person for violation of such rules now or hereafter in effect. The owner trustee shall not be required to monitor, initiate or conduct any proceedings to enforce the obligations of the trust, the depositor, the servicer or any other person with respect to any breach of representation or warranty under any transaction document and the owner trustee shall not have any duty to conduct any investigation as to the occurrence of any condition requiring the repurchase of any receivable by any person pursuant to any transaction document. In the ordinary course of its business, the owner trustee and its affiliates have engaged and may in the future engage in commercial banking, trustee or financial advisory transactions with the depositor, the servicer and their affiliates. The owner trustee is an affiliate of Wells Fargo Bank, N.A., which is one of a number of banks with which Deere and JDCC maintain ordinary banking relationships and from which Deere and JDCC have obtained credit facilities and lines of credit.

The owner trustee is, and any successor owner trustee must be, a financial institution with trust powers, with a combined capital and surplus of at least $50,000,000, and subject to supervision by state or federal authorities. Under the administration agreement, JDCC, as administrator, is obligated to perform on behalf of the owner trustee all of the administrative obligations of the owner trustee under the trust agreement. The owner trustee shall not have any liability for those obligations that the administrator has agreed to perform.

The owner trustee may resign at any time, in which event the administrator will be obligated to appoint a successor owner trustee. The administrator may also remove the owner trustee if the owner trustee ceases to be eligible to continue as owner trustee under the trust agreement or if the owner trustee becomes insolvent. In either of these circumstances, the administrator will be obligated to appoint a successor owner trustee. Any resignation or removal of the owner trustee and appointment of a successor owner trustee will not become effective until acceptance of the appointment by the successor owner trustee. Expenses associated with replacing the owner trustee with a successor owner trustee will be paid by the depositor, unless the removal is a result of the willful misconduct or negligence of the owner trustee, in which case, such expenses will be the responsibility of the replaced owner trustee.

The depositor will pay the fees of the owner trustee. The depositor will reimburse and indemnify the owner trustee for all liabilities, losses, damages and expenses that are incurred by the owner trustee or arise out of its actions in connection with the trust, except where such liabilities, losses, damages or expenses arise from the owner trustee’s willful misconduct or negligence. The owner trustee will not be liable for any error in judgment made in good faith and will not be liable for any action taken at the direction of the administrator or any noteholder. The owner trustee will not be required to expend its own funds or incur any financial liability in respect of any of its actions as owner trustee if the owner trustee determines that repayment of such funds or indemnity reasonably satisfactory to it against such risk or liability is not reasonably assured or provided to it.

THE DEPOSITOR, THE SPONSOR AND SERVICER

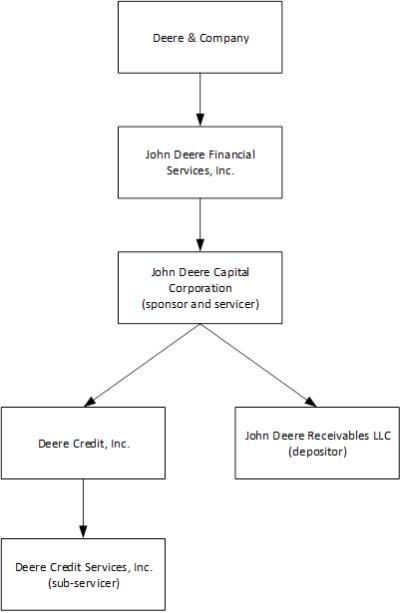

John Deere Receivables LLC

John Deere Receivables LLC (“JDRL” or the “depositor”) is a Nevada limited liability company created in July 2018. JDCC is the sole member of the depositor. JDRL was formed for the limited purpose of purchasing retail receivables, transferring those receivables to third parties and performing any activities incidental to, and necessary or convenient for, the accomplishment of those purposes (including repurchase obligations for breaches of representations and warranties regarding receivables). The principal executive offices of JDRL are located at 10587 Double R Blvd, Suite 100, Reno, Nevada 89521, and its telephone number is (775) 786-5527.

26