UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| | [ ] | Preliminary Proxy Statement. |

| | [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| | [X] | Definitive Proxy Statement. |

| | [ ] | Definitive Additional Materials. |

| | [ ] | Soliciting Material Pursuant to § 240.14a-12. |

X-Square Balanced Fund, LLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

X-SQUARE BALANCED FUND, LLC

Popular Center

209 Munoz Rivera, Suite 1111

San Juan, Puerto Rico 00918

(Address of Principal Executive Offices)

March 9, 2022

Dear X-Square Balanced Fund, LLC Shareholder:

You are cordially invited to attend a Special Meeting of Shareholders (the “Meeting”) of X-Square Balanced Fund, LLC (the “Fund”) to be held on April 22, 2022 at 8:00 a.m. Eastern Time at Popular Center, 209 Munoz Rivera, Suite 1111, San Juan, Puerto Rico 00918.

At the Meeting, you will be asked to vote upon the following proposal:

| ● | Election of two new Managers and one existing Manager of the Fund. |

A formal Notice of Special Meeting of Shareholders and Proxy Statement setting forth in detail the matter to come before the Meeting are attached hereto, and a proxy card is enclosed for your use. You should read the Proxy Statement carefully. WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING, YOUR VOTE IS NEEDED. The Board of Managers of the Fund unanimously recommends that you vote “FOR” the proposal described in the Proxy Statement. We value our relationship with you and look forward to your vote in favor of the election of Managers.

| | Sincerely, | |

| | | |

| | /s/Ignacio Canto | |

| | Ignacio Canto | |

| | Chairman | |

Please review the enclosed materials and, if you do not plan to be present at the Meeting, complete, sign, date and return the enclosed proxy card. It is important that you return the proxy card to ensure your shares will be represented at the Meeting.

X-SQUARE BALANCED FUND, LLC

Popular Center

209 Munoz Rivera, Suite 1111

San Juan, Puerto Rico 00918

(Address of Principal Executive Offices)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held on April 22, 2022

To the Shareholders of X-Square Balanced Fund, LLC:

A Special Meeting of Shareholders (the “Meeting”) of X-Square Balanced Fund, LLC (the “Fund”) will be held on April 22, 2022 at 8:00 a.m. Eastern Time at Popular Center, 209 Munoz Rivera, Suite 1111, San Juan, Puerto Rico 00918 for the following purposes:

| (1) | To elect two new Managers to the Fund and one existing Manager of the Fund; |

| (2) | To transact such other business as may properly come before the Meeting and any adjournment thereof. |

The Managers of the Fund unanimously recommend that you vote FOR the proposal.

The matter referred to above is discussed in the Proxy Statement attached to this Notice. Shareholders of record at the close of business on January 31, 2022, the record date for the Meeting, are entitled to receive notice of and to vote at the Meeting or at any adjournments thereof. Each Shareholder is invited to attend the Meeting in person.

If you cannot be present at the Meeting, we urge you to sign, date and return promptly in the enclosed envelope the accompanying proxy card. This is important for the purpose of ensuring a quorum at the Meeting. A proxy may be revoked by any shareholder at any time before it is exercised by executing and submitting a revised proxy, by giving written notice of revocation to the Fund’s Secretary, or by withdrawing the proxy and voting in person at the Meeting.

| | By Order of the Board of Managers of X-Square Balanced Fund, LLC |

| | |

| | Gabriel Medina |

| | Secretary |

March 9, 2022

X-SQUARE BALANCED FUND, LLC

Popular Center

209 Munoz Rivera, Suite 1111

San Juan, Puerto Rico 00918

(Address of Principal Executive Offices)

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Managers (the “Board” or the “Managers”) of X-Square Balanced Fund, LLC (the “Fund”) for use at the Fund’s Special Meeting of Shareholders to be held at Popular Center, 209 Munoz Rivera, Suite 1111, San Juan, Puerto Rico 00918, on April 22, 2022 at 8:00 a.m. Eastern Time. The Special Meeting of Shareholders and any adjournments thereof are referred to in this Proxy Statement as the “Meeting.”

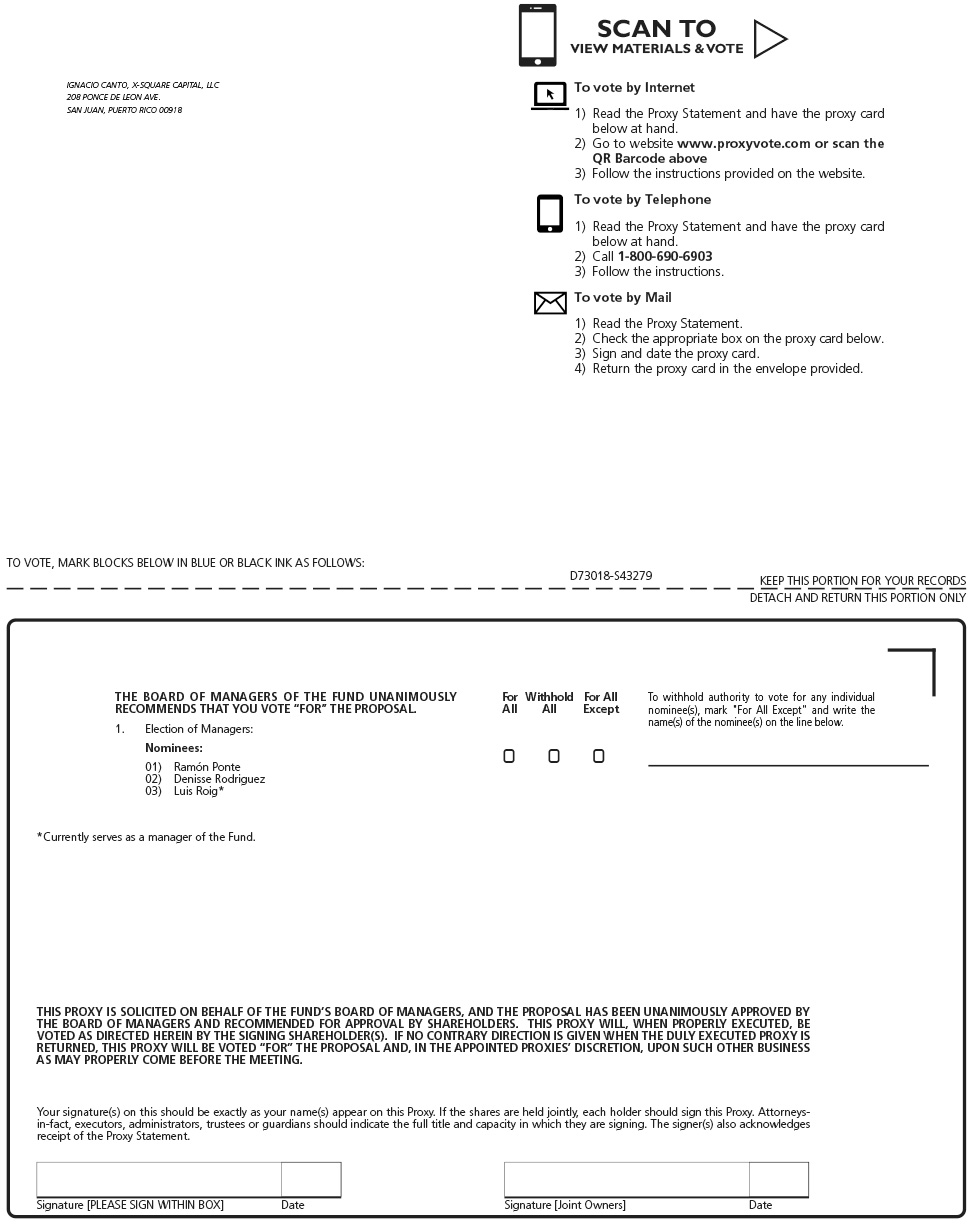

This Proxy Statement, the accompanying Notice of Special Meeting of Shareholders and accompanying proxy card(s) will first be mailed on or about March 28, 2022.

The following table summarizes the proposal to be voted on at the Meeting and indicates those shareholders that are being solicited with respect to the proposal:

| Proposal | Shareholders Solicited |

| (1) | To elect two (2) new Managers and one (1) existing Manager. | All shareholders of the Fund will vote together in the aggregate. |

| (2) | To transact such other business as may properly come before the Meeting and any adjournment thereof. | |

Record holders of shares of beneficial interest of the Fund at the close of business on January 31, 2022, the record date for the Meeting (“Record Date”), will be entitled to notice of and to vote at the Meeting. As of the Record Date, the number of outstanding shares of the Fund was as follows:

| Fund | Number of Shares |

| X-Square Balanced Fund, LLC | 2,667,385 |

Each whole share will be entitled to one vote as to any matter on which it is entitled to vote, and each fractional share will be entitled to a proportionate fractional vote. There will be no cumulative voting in the election of Managers. Shares may be voted in person or by proxy.

It is expected that the solicitation of proxies will be primarily by mail. However, the Fund’s officers and personnel of the Fund’s administrator and transfer agent may also solicit proxies by telephone, facsimile, the Internet or in person. In addition, Broadridge Financial Solutions, Inc. has been engaged to assist in the solicitation of proxies at an estimated cost of $2,711.39.

Signed proxies received by the Fund in time for voting and not revoked will be voted in accordance with the directions specified therein. The Board recommends a vote FOR the election of the Manager nominees described in this Proxy Statement. If no specification is made, the proxy will be voted FOR the election of the Manager nominees, and in the discretion of the persons named as proxies in connection with any other matter that may properly come before the Meeting or any adjournment thereof.

Any person giving a proxy may revoke it any time before it is exercised by submitting to the Secretary of the Fund at the Fund’s principal executive offices a written notice of revocation or subsequently executed proxy or by attending the Meeting and electing to vote in person.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 22, 2022. THIS PROXY STATEMENT IS AVAILABLE ONLINE AT WWW.XSQUARECAPITAL.COM

The Fund will furnish, without charge, copies of its most recent Annual and Semi-Annual Reports to any shareholder upon request. The Annual and Semi-Annual Reports may be obtained by calling toll free at 1-833-X-SQUARE.

PROPOSAL

ELECTION OF MANAGERS

At the Meeting, shareholders will be asked to elect each of the following three nominees to serve as Managers of the Fund (the “Board”): Ramón Ponte, Denisse Rodriguez, and Luis Roig (each a “Nominee” and, collectively, the “Nominees”). The Nominees have not previously been elected by shareholders of the Fund.

Luis Roig has served (and currently serves) as Manager of the Fund since he was originally appointed in 2019. The other two individuals, Ramón Ponte and Denisse Rodriguez, do not currently serve on the Board. However, on January 6, 2022, Mr. Ponte and Ms. Rodriguez were unanimously approved by the Board, including the Managers who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Fund (the “Independent Managers”), to stand for election, upon a recommendation from the Fund’s Nominating and Governance Committee.

If elected by shareholders at the Meeting, the Nominees will hold office for an indefinite term beginning on the date of such approval by shareholders. The Board would be able to fill future vacancies by appointment (subject to the requirements of the limited liability company agreement of the Fund and the 1940 Act that, after such appointment, at least two-thirds of the Managers holding office must have been elected by shareholders) without incurring the additional expense associated with calling shareholder meetings to fill those vacancies.

Information concerning the Nominees and other relevant information is set forth below. The persons named as proxies in the accompanying Proxy have been designated by the Board and intend to vote for the Nominees named below, unless authority to vote for a particular Nominee is withheld. Each Nominee has consented to being named in this Proxy Statement and to serve if elected. Should any Nominee withdraw from the election or otherwise be unable to serve, the named proxies will vote for the election of such substitute Nominee as the Board may recommend unless a decision is made to reduce the number of Managers serving on the Board.

The following table sets forth the Nominees and Managers, their birth year, addresses, positions held with the Fund, term of office and length of time served, principal occupations for the past five years, and other directorships they hold in companies that are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “1934 Act”), or are registered as investment companies under the 1940 Act. Nominees and current Managers who are not deemed to be “interested persons” of the Fund are referred to as “Independent Managers.” Managers who are deemed to be “interested persons” of the Fund are referred to as “Interested Managers.”

The Nominating and Governance Committee of the Board, in consultation with legal counsel for the Independent Managers and counsel for the Fund, conducted a search for qualified candidates for Board membership, seeking nominees who were both qualified and who would bring relevant expertise to the Board.

Independent Manager Nominees

| Name, Birth Year and Address1 | Position(s) Held with Fund | Term of Office and Length of Time Served2 | Principal Occupation(s)

During Past 5 Years | Number of Funds in Fund Complex Overseen by Manager3 | Other Directorships Held by Manager4 |

Ramón Ponte (1958) | N/A | N/A | Independent consultant, 2011 to present; Board Member and Chair of the Audit Committee, Bancredito International Bank and Trust, 2014 to present; Board Member, Puerto Rico CPA Society, from 2013 to 2019; Board President, Puerto Rico CPA Society, from 2017 to 2018; Board Member, Puerto Rico CPA Society Foundation, 2019 to present; Chairman, Puerto Rico CPA Society Foundation, 2020 to present, Board Member, Fundación Intellectus, from 2020 to present; Managing Member, BRAG BP LLC. | N/A | None |

Denisse Rodriguez (1984) | N/A | N/A | Executive Director, PR Science, Technology & Research Trust, 2015 to present; Chief Operating Director, CodeTrotters, from 2015 to 2017. | N/A | None |

Luis Roig (1959) | Manager | Since January 2019 | Managing Director and CFO, Santander Securities LLC from 2013 until 2016; Chief Financial Officer, Americas Leading Finance LLC since 2016. | 1 | None |

Independent Manager

| Name, Birth Year and Address1 | Position(s) Held

with Fund | Term of Office and Length of Time Served2 | Principal Occupation(s)

During Past 5 Years | Number of Funds in Fund Complex Overseen by Manager3 | Other

Directorships Held by Manager4 |

Fernando Nido (1959) | Manager | Since January 2019 | Independent consultant. | 1 | Trans-Oceanic Life Company |

Interested Manager5

| Name, Birth Year and Address | Position(s) Held

with Fund | Term of Office and Length of Time Served2 | Principal Occupation(s)

During Past 5 Years | Number of Funds in Fund Complex Overseen by Manager | Other

Directorships Held by Manager3 |

Ignacio Canto (1983) | Manager | Since January 2019 | President of X-Square Capital, LLC since 2013. | 1 | Director of X2 Alternative Dividend Alpha Fund, Inc. |

| 1 | Each Manager may be contacted by writing to the Manager, c/o Faegre Drinker Biddle & Reath LLP, One Logan Square, Ste. 2000, Philadelphia, PA 19103. |

| 2 | Each Manager holds office until he or she dies, adjudicated incompetent, voluntarily withdraws, is removed, certified as mentally or physically incapable to perform their duties, declared bankrupt, has a receiver appointed to administer the property or affairs of such Manager, reaches a mandatory age for retirement, or ceases to be a Manager under the Puerto Rico General Corporations Law. |

| 3 | The “Fund Complex” consists of the Fund. |

| 4 | Directorships of companies required to report to the SEC under the 1934 Act (i.e., “public companies”) or other investment companies registered under the 1940 Act. |

| 5 | An “interested person,” as defined by the 1940 Act. Mr. Canto is deemed to be an “interested” Manager because he is the owner of all membership interests of X-Square Capital, LLC (the Adviser), and also serves as its President, Treasurer and sole director. |

Nominee and Manager Experience, Qualifications, Attributes and/or Skills

The information above includes each Nominee’s and Manager’s principal occupations during the last five years. Each Nominee and Manager possesses extensive additional experience, skills and attributes relevant to his or her qualifications to serve as a Manager. The cumulative background of each Nominee and Manager led to the conclusion that each Nominee and Manager should serve as a Manager for the Fund.

Independent Manager Nominees

Luis Roig has been a Manager since June 2019. Mr. Roig is the Chief Financial Officer in Americas Leading Finance LLC. From 2001 to 2016, Mr. Roig was the Managing Director and Chief Financial Officer of Santander Securities LLC (“Santander”) responsible for the Puerto Rico, Miami and North East businesses daily financial accounting processes, financial and operating budgets, monthly financial reporting and analysis to management and Board of Directors, regulatory compliance reporting, and compliance with all federal and state tax laws and regulations. Also he acted as President (2010-2011), Chief Compliance Officer (2011-2012) and Chief Risk Officer (2016). From 1996 to 2000 he was a Vice President and Comptroller of Santander.

Prior to working with Santander, Mr. Roig was the Comptroller of The Bank and Trust of Puerto Rico and Oriental Bank and Trust. Before joining Oriental Bank and Trust, he was an Audit Manager at Arthur Andersen & Co. specializing in financial institutions. Mr. Roig is a Certified Public Accountant (CPA) and Chartered Global Management Accountant (CGMA), member of the Puerto Rico Society of Certified Public Accountants and of the American Institute of CPAs. He has a BSBA in Accounting from the Interamerican University of Puerto Rico.

Ramón Ponte has worked as an independent consultant with a variety of companies and the Puerto Rican government, principally on reporting financial matters since 2011. He resides in San Juan, Puerto Rico. Mr. Ponte practiced public accounting for over 30 years. Mr. Ponte joined PricewaterhouseCoopers LLP (“PwC”) upon his graduation from college. His career at PwC allowed him the opportunity to constantly interact with top management and the boards of clients primarily in the financial services sector both in Puerto Rico and Latin America. Mr. Ponte currently serves on the Board of Directors and is the Chair of the Audit committee for Bancredito International Bank and Trust. Mr. Ponte served as a Board Member and acted as President of the Board for Puerto Rico CPA Society from 2013 to 2019 and from 2017 to 2018, respectfully. Mr. Ponte currently serves as a Board Member and acted as Chairman of the Board for Puerto Rico CPA Society Foundation since 2019 and 2020, respectively. Mr. Ponte has also served on a Board Member for Fundaction Intellectus, a non-profit organization supporting health sciences education and research, since 2020. Mr. Ponte is a Managing Member of BRAG LLC, a family investment company that was created in 2020, but is currently inactive. Mr. Ponte has BS in Economics Degree from The Wharton School, University of Pennsylvania, and an MBA from the University of Chicago.

Denisse Rodriguez currently serves as the Executive Director for the PR Science Technology & Research Trust and has held that position since 2015. In that role, Ms. Rodriguez has held roles as an Ecosystem Builder, Strategy Lead and Designer. All of which she performed with great success and outcomes in these various roles. Ms. Rodriguez was also appointed to many representative roles with businesses outside of the company, including acting as a Delegate for the Americas Competitiveness Exchange Entrepreneurship & Innovation in Israel and Germany. Ms. Rodriguez also was selected as the Vice President of the business incubator Kingbird Innovation Center Board of Directors.

Ms. Rodriguez also served as Chief Operating Officer for CodeTrotters from 2015 to 2017. In that role, Ms. Rodriguez designed strategies to build the first coding academy in Puerto Rico, and expanded the program throughout the Caribbean and Latin America. Ms. Rodriguez not only helped build a network of global startups to aid in offering opportunities to new talent in the tech arena, but designed and implemented the administrative and operation processes to further expand the program’s growth.

Independent Manager

Fernando Nido has been a Manager since January 2019. Mr. Nido practiced public accounting for over thirty years and now serves as a consultant for various private businesses. He resides in San Juan, Puerto Rico. Mr. Nido joined Deloitte & Touche LLP upon his graduation from college. His 33 year career at Deloitte, including 23 years as a partner, allowed him the opportunity to constantly interact with top management and the boards of clients in a wide variety of industries and sectors both in Puerto Rico and in the United States. His achievements at Deloitte were recognized with a multitude of appointments, including his designation as the managing partner for Deloitte’s practice in Puerto Rico until the time of his retirement in 2014.

As managing partner, Mr. Nido was responsible for client service delivery, professional practice quality, financial performance, and attracting, developing and retaining talent, among other matters. Prior to his Puerto Rico managing partner designation, Mr. Nido served as the professional practice director and as head of the audit practice in Puerto Rico. Mr. Nido also served as the liaison between Deloitte’s audit practices in the United States and Spain. Mr. Nido is a magna cum laude BBA graduate from the University of Puerto Rico, a former member of Puerto Rico’s Board of Accountancy, a former Vice Chair of Puerto Rico’s CPA Association, and has served on non-profit boards for over twenty years.

Interested Manager

Ignacio Canto has been a Manager since January 2019. Mr. Canto was Executive Vice President and Treasurer of Government Development Bank for Puerto Rico (GDB) from August 2010 until December 31, 2012. In such capacity, he was responsible for GDB’s asset and liability management, and for pricing and structuring over $18 billion of bonds issued by the Commonwealth of Puerto Rico and its instrumentalities. While at GDB, Mr. Canto implemented a global macro trading strategy with success, focusing on fundamental trends and technical studies. Between July 2005 and August 2010, Mr. Canto worked as a portfolio manager and portfolio analyst at Santander Asset Management Corporation, where he traded interest rate derivatives, U.S. Government agency debentures, structured products, municipal bonds, equities and equity derivatives, and in the Investment Banking division of Santander Securities Corporation. Mr. Canto has a Bachelor of Business Administration with a concentration in Finance from Boston University’s School of Management.

Board and Committee Meetings

During the fiscal year ended December 31, 2021, the Board met four times. Each of the Managers attended all of the meetings of the Board.

Standing Board Committees

The Board of Managers has established two committees: The Audit Committee and the Nominating and Governance Committee.

The Board has an Audit Committee, whose function is to recommend independent auditors of the Fund and monitor accounting and financial matters. The Audit Committee is composed of the Independent Managers. Mr. Nido serves as the Chairman of the Audit Committee. The Board has determined that Mr. Nido and Mr. Roig may serve as the Audit Committee Financial Expert. During the fiscal year ended December 31, 2021, the Audit Committee met two times.

The Board has a standing Nominating and Governance Committee that is composed of the Independent Managers. The principal responsibility of the Nominating Committee is to consider, recommend and nominate candidates to fill vacancies on the Fund’s Board, if any. The Nominating Committee will review all shareholder recommendations for nominations to fill vacancies on the Board if such recommendations are submitted in writing and addressed to the Committee at the Fund’s office. During the fiscal year ended December 31, 2021, the Nominating and Governance Committee met two times.

Risk Oversight

The Fund is subject to a number of risks, including investment, compliance, operational and valuation risks, among others. Risk oversight forms part of the Board’s general oversight of the Fund and is addressed as part of various Board and committee activities. Day-to-day risk management functions are subsumed within the responsibilities of the Adviser and other service providers (depending on the nature of the risk), which carry out the Fund’s investment management and business affairs. The Adviser and other service providers employ a variety of processes, procedures and controls to identify various events or circumstances that give rise to risks, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Each of the Adviser and other service providers have their own independent interests in risk management, and their policies and methods of risk management will depend on their functions and business models.

The Board recognizes that it is not possible to identify all of the risks that may affect the Fund or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Board requires senior officers of the Fund and the Adviser to report to the full Board on a variety of matters at regular and special meetings of the Board, including matters relating to risk management. The Board and the Audit Committee also receive regular reports from the Fund’s independent registered public accounting firm on internal control and financial reporting matters. The Board also receives reports from certain of the Fund’s other primary service providers on a periodic or regular basis. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Board Compensation

The Independent Managers receive a quarterly retainer of $2,000 and a fee of $1,000 per quarterly or special Board meeting attended in- person or telephonically. The Managers do not receive pension or retirement benefits as part of their compensation from the Fund. The Chairman of the Audit Committee, Fernando Nido, does not receive an additional quarterly retainer. Ignacio Canto does not receive compensation in the form of manager fees from the Fund.

As of January 31, 2022, the Managers and Officers as a group held 0.15%, 0.87% and 3.19% of the outstanding shares of Class A, Class C and Institutional Class, respectively.

The table below sets forth the compensation that the Independent Managers of the Fund received for the fiscal year ended December 31, 2021.

Name of

Person/Position | | Compensation from the Fund | | Total Compensation from Fund and Fund Complex Paid to Manager* |

Fernando Nido

Manager | | $ | 12,000 | | | $ | 12,000 | |

Luis Roig

Manager | | $ | 12,000 | | | $ | 12,000 | |

| * | The “Fund Complex” consists of the Fund. |

Nominee and Manager Beneficial Ownership of Fund Shares

The table below sets forth the dollar range of equity securities beneficially owned by each Nominee and Manager as of December 31, 2021.

| Name of Manager | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Manager in Fund Complex* |

| Uninterested Managers | | |

| Fernando Nido | None | None |

Ramón Ponte | Over $100,000 | Over $100,000 |

| Denisse Rodriguez | None | None |

| Luis Roig | None | None |

| Interested Managers | | |

| Ignacio Canto | Over $100,000 | Over $100,000 |

| * | The “Fund Complex” consists of the Fund. |

Independent Registered Public Accounting Firms

On May 24, 2021, the Fund by action of the Board upon the recommendation of the Board’s Audit Committee selected Kevane Grant Thorton as the independent registered public accounting firm to audit the Fund’s financial statements for the fiscal year ended December 31, 2021. During the Fund’s fiscal years ended December 31, 2020 and December 31, 2019, neither the Fund nor anyone on their behalf has consulted with Kevane Grant Thorton on items which (i) concerned the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Fund’s financial statements; or (ii) concerned the subject of a disagreement (as defined in paragraph (a)(l)(iv) of Item 304 of Regulation S-K under the 1934 Act (“Regulation S-K”)) or reportable events (as defined in paragraph (a)(l)(v) of said item 304).

BDO Puerto Rico, P.S.C. (“BDO”), was dismissed as the independent registered public accounting firm to the Fund effective May 24, 2021. BDO’s reports on the Fund’s financial statements for the fiscal years ended December 31, 2020 and December 31, 2019 contained no adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the Fund’s fiscal years ended December 31, 2020 and December 31, 2019, (i) there were no disagreements with BDO on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to satisfaction of BDO, would have cause it to make reference to the subject matter of the disagreements in connection with its report on the Fund’s financial statements for such fiscal years, and (ii) there were no “reportable events” of the kind described in Item 204(a)(l)(v) of Regulation S-K.

Representatives of Kevane Grant Thorton are not expected to be present at the Meeting or be available by telephone to respond to questions from shareholders. Representatives of Kevan Grant Thorton will not be given an opportunity to make statements at the Meeting.

Independent Registered Public Accounting Firm’s Fees

The following paragraphs include information about the aggregate fees paid to Kevane Grant Thornton and BDO for the two most recent fiscal years.

Audit Fees

Audit fees are fees related to the audit of and review of the Fund’s financial statements included in annual reports and registration statements and other services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements. The aggregate fees billed for each of the last two fiscal years for professional services rendered by BDO for the audit of the Fund’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $0 and $33,000 for fiscal year ended December 31, 2021 and fiscal year ended December 31, 2020, respectively. The aggregate fees billed for each of the last two fiscal years for professional services rendered by Kevane Grant Thornton for the audit of the Fund’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $39,350 and $0 for fiscal year ended December 31, 2021 and fiscal year ended December 31, 2020, respectively

Audit-Related Fees

Audit-related fees are fees for assurance and related services that are reasonably related to the performance of the audit or review of financial statements, but are not reported as audit fees. The aggregate fees billed in each of the last two fiscal years for assurance and related services by BDO that are reasonably related to the performance of the audit of the Fund’s financial statements were $0and $0 for the fiscal years ended December 31, 2021 and fiscal year ended December 31, 2020, respectively. The aggregate fees billed in each of the last two fiscal years for assurance and related services by Kevane Grant Thornton that are reasonably related to the performance of the audit of the Fund’s financial statements were $0 and $0 for the fiscal years ended December 31, 2021 and fiscal year ended December 31, 2020, respectively.

Tax Fees

Tax fees are fees associated with tax compliance, tax advice and tax planning. The aggregate fees billed in each of the last two fiscal years for professional services rendered by BDO for tax compliance were $0 and $0 for the fiscal years ended December 31, 2021 and fiscal year ended December 31, 2020, respectively. The aggregate fees billed in each of the last two fiscal years for professional services rendered by Kevane Grant Thornton for tax compliance were $3,750 and $0 for the fiscal years ended December 31, 2021 and fiscal year ended December 31, 2020, respectively.

All Other Fees

No fees were billed by BDO or Kevane Grant Thornton for products and services provided to the Fund other than the services reported in “Audit Fees,” “Audit-Related Fees,” and “Tax Fees” above for the fiscal years ended December 31, 2021 and fiscal year ended December 31, 2020, respectively.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee shall pre-approve all auditing services and permissible non-audit services (e.g., tax services) to be provided to the Fund by the Auditor, including the fees associated with those services. Additionally, the Committee shall pre-approve any engagement of the Auditor to provide non-audit services to an investment adviser of the Fund or to any affiliate of such investment adviser that provides ongoing services to the Fund, if the engagement relates directly to the operations and financial reporting of the Fund.

None of the audit-related fees and tax fees reported above were approved by the Fund’s Audit Committee pursuant to the “de minimis” exception of Rule 2-01(c)(7)(i)(C) of Regulation S-X under the 1934 Act. In addition, there were no services provided by the Fund’s independent registered public accounting firm to the Fund’s service affiliates that were approved by the Fund’s Audit Committee pursuant to the “de minimis” exception of Rule 2-01(c)(7)(ii) of Regulation S-X.

The Fund’s Audit Committee has considered whether the provision of non-audit services to the Advisor and service affiliates that did not require pre-approval pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X is compatible with maintaining the auditor’s independence.

The Board of Managers unanimously recommends that

shareholders vote “FOR” the election of each of the Nominees.

ADDITIONAL INFORMATION

Officers of the Fund

The following table lists each officer of the Fund, his or her year of birth, position with the Fund, and principal occupations during the past five years. There is no defined term of office, and each officer of the Fund serves until the earlier of his or her resignation, retirement, removal, death, or the election of a qualified successor

| Name, Birth Year and Address* | Position(s) Held with the Fund | Served in Position Since | Principal Occupation(s) During Past 5 Years |

OFFICERS | | | |

Lucas D. Foss (1977) | Chief Compliance Officer | Since January 2019 | Deputy Chief Compliance Officer, ALPS Holdings, Inc. since December 2017. Mr. Foss joined ALPS in November 2017 as Vice President and Deputy Chief Compliance Officer. Prior to his current role, Mr. Foss served as the Director of Compliance at Transamerica Asset Management (July 2015 - November 2017). Deputy Chief Compliance Officer at ALPS (September 2012 - June 2015). Mr. Foss is also CCO of ALPS Series Trust, Clough Funds Trust, Clough Global Equity, Clough Global Opportunities Fund and Clough Global Dividend and Income Fund, Goehring & Rozencwajg Investment Funds, 1WS Credit Income Fund. |

Ignacio Canto (1983) | President | Since January 2019 | President of X-Square Capital, LLC since 2013. |

| Name, Birth Year and Address* | Position(s) Held with the Fund | Served in Position Since | Principal Occupation(s) During Past 5 Years |

| OFFICERS | | | |

Ruben Tapia (1986) | Treasurer | Since January 2019 | Chief Compliance Officer and Chief Financial Officer of X-Square Capital, LLC since 2018. Vice President of Finance, Premier Warranty Services from 2015 to 2018. Investment adviser for Banco Popular de Puerto Rico from 2013 to 2015. |

Gabriel Medina (1989) | Secretary | Since January 2019 | Portfolio Manager of X-Square Capital, LLC since 2018. Chief Compliance Officer of X-Square Capital, LLC from 2015 to 2018. Analyst at Accenture from 2014 to 2015. |

| * | The mailing address of each officer of the Fund is Popular Center Building, 209 Munoz Rivera, Suite 1111, San Juan, Puerto Rico 00918. |

The officers of the Fund receive no compensation from the Fund for performing the duties of their offices.

INFORMATION ABOUT ADVISOR, ADMINISTRATOR, TRANSFER AGENT AND DISTRIBUTOR

Investment Advisor. X-Square Capital, LLC, a Puerto Rico limited liability company registered as an investment adviser with the SEC, serves as the investment adviser to the Fund. Mr. Ignacio Canto is the owner of all the membership interests of the Adviser and also serves as its President, Treasurer and sole director. As of November 30, 2021, the Adviser managed approximately $300 million for numerous clients.

Administrator and Transfer Agent. ALPS Fund Services, Inc., acts as the administrator (“Administrator”) for the Fund. The Administrator assists in the filing of required disclosure documents with the SEC, preparation of Board materials and assisting with compliance testing. For its services as Administrator, ALPS Fund Services, Inc. receives an annual fee from the Fund.

In addition, the Administrator provides the Fund with fund accounting services, which includes certain monthly reports, record- keeping and other management-related services. The associated fees for these services are reflected in the Administration Agreement.

The Administrator began providing transfer agency, fund administration and fund accounting services to the Fund on March 25, 2019. The Administrator receives an annual base fee from the Fund of $125,000. During the fiscal year ended December 31, 2021 and the fiscal year ended December 31, 2020, the Fund paid the Administrator $198,367 and $195,533, respectively, in Fund accounting, administration and compliance fees.

Distributor. ALPS Distributors, Inc., 1290 Broadway, Suite 1000, Denver, CO 80203 (the “Distributor”) serves as distributor for the continuous offering of the Fund’s shares.

Beneficial Owners of the Fund

The beneficial owners of more than 5% of the outstanding shares of the Fund as of the Record Date are as follows:

| Class | Name and Address of Owner | Number of Shares | Percentage of Class | Percentage of Fund |

| Class A | Charles Schwab & Co., Inc. 211 Main St., San Francisco,

California 94105 | 607,753 | 27.65% | 22.78% |

| Class A | National Financial Services LLC 82 Devonshire St., Popular

Center FL 1, San Juan, Puerto Rico 00918 | 954,107 | 43.40% | 35.77% |

| Class A | Pershing LLC 1 Pershing Plz., Jersey City,

New Jersey 07399 | 601,680 | 27.37% | 22.56% |

| Class C | National Financial Services LLC 208 Munoz Rivera Ave.,

Popular Center FL 12, San Juan, Puerto Rico 00918 | 45,277 | 13.18% | 1.70% |

| Class C | Pershing LLC 1 Pershing Plz., Jersey City,

New Jersey 07399 | 295,244 | 85.93% | 11.07% |

| Institutional Class | National Financial Services LLC 82 Devonshire St., Mail Zone

ZE7F, Boston, Massachusetts 02109 | 8,948 | 7.13% | 0.34% |

| Institutional Class | Pershing LLC 1 Pershing Plz., Jersey City,

New Jersey 07399 | 112,440 | 89.62% | 4.22% |

For purposes of the 1940 Act, any person who owns directly or through one or more controlled companies more than 25% of the voting securities of a company is presumed to “control” such company.

Other Matters

No business other than the matters described above is expected to come before the Meeting, but should any other matter requiring a vote of shareholders arise, including any question as to adjournment of the Meeting, the persons named as proxies will vote thereon according to their best judgment in the interests of the Fund and its shareholders.

Voting Information

The enclosed proxy is revocable by a shareholder at any time before it is exercised by written notice to the Fund (addressed to the Secretary at the Fund’s principal executive offices), by executing another proxy or by attending the Meeting and voting in person. All valid proxies received prior to the Meeting will be voted at the Meeting. Matters on which a choice has been provided will be voted as indicated on the proxy and, if no instruction is given, the persons named as proxies will vote the shares represented thereby in favor of the matters set forth in the Proposal and will use their best judgment in connection with the transaction of such other business as may properly come before the Meeting.

In the event that at the time the Meeting is called to order a quorum is not present in person or by proxy, the persons named as proxies may vote those proxies that have been received to adjourn the Meeting to a later date. In the event that a quorum is present but sufficient votes in favor of the Proposal have not been received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies with respect to such proposal. Any such adjournment will require the affirmative vote of a majority of the shares of the Fund present and voting in person or by proxy at the session of the Meeting to be adjourned. Any adjourned session may be held without further notice. The persons named as proxies will vote those proxies which they are entitled to vote in favor of any such Proposal in favor of such an adjournment, and will vote those proxies required to be voted against any such Proposal against any such adjournment. A shareholder vote may be taken on the Proposal prior to such adjournment if sufficient votes for their approval have been received and it is otherwise appropriate.

One-third of the outstanding shares entitled to vote shall be a quorum for the transaction of business at a shareholders’ meeting, but any lesser number shall be sufficient for adjournments.

With respect to the Proposal, a plurality will elect a Manager.

Procedures For Shareholder Communications With Board

The Fund’s Board will receive and review written correspondence from shareholders. Each Manager may be contacted by writing to the Secretary, c/o Gabriel Medina, Popular Center Building, 209 Munoz Rivera, Suite 1111, San Juan, Puerto Rico 00918.

Cost of Proxy Solicitation

The Fund will bear its allocable portion of proxy solicitation expenses, including the cost of preparing, assembling and mailing materials used in connection with solicitation of proxies. The Fund will reimburse brokers, nominees and similar record holders for their reasonable expenses incurred in connection with forwarding proxy materials to beneficial holders.

Shareholder Proposals

The Nominating and Governance Committee will consider nominee candidates recommended by members (or shareholders) of the Fund. The Nominating and Governance Committee will evaluate such nominees according to the Statement of Policy on Qualifications for Board Membership, attached as Exhibit A, in the same manner as nominee candidates not recommended by shareholders.

Shareholders who wish to recommend individuals for consideration by the Nominating and Governance Committee as nominee candidates may do so by submitting a written recommendation to the Secretary of the Fund at: Popular Center, 209 Munoz Rivera, Suite 1111, San Juan, Puerto Rico 00918. Submissions must include sufficient biographical information concerning the recommended individual, including age, twenty years of employment history with employer names and a description of the employer’s business, and a list of board memberships (if any). The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected. Recommendations must be received in a sufficient time, as determined by the Nominating and Governance Committee in its sole discretion, prior to the date proposed for the consideration of nominees by the Board.

Dated: March 9, 2022

Shareholders who do not expect to be present at the Meeting and who wish to have their shares voted are requested to date and sign the enclosed proxy and return it in the enclosed envelope. No postage is required if mailed in the United States.

EXHIBIT A

X-Square Balanced Fund, LLC

Nominating and Governance Committee Charter

The Nominating and Governance Committee (the “Committee”) shall be a standing committee of the Board of Managers (the “Board”) of the X-Square Balanced Fund, LLC (the “Fund”). The purpose of the Committee is to:

| 1. | Recommend, for the Board’s approval, a statement of fund governance principles; |

| 2. | Make recommendations to the Board regarding (a) its size, structure and composition; (b) qualifications for Board membership, and (c) compensation and indemnification of, and insurance for, Board members; |

| 3. | Identify and recommend qualified individuals for Board membership and for the chairmanship of the Board; |

| 4. | Oversee the self-evaluation of the Board and its committees; and |

| 5. | Identify and recommend to the Board, from time to time, qualified individuals to serve as the Fund’s Chief Compliance Officer (“CCO”), President, and other officers and monitor such officers’ performance. The Committee shall also make recommendations to the Board with respect to such officers’ responsibilities, retention and compensation. |

II. ORGANIZATION

A. Membership

| 1. | The Committee shall consist of at least two Managers, none of whom is an “interested person” of the Fund, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940. |

| 2. | The Board shall elect each member of the Committee and the chairman of the Committee (the “Chairman”). If the Board does not elect a Chairman, the Committee shall designate a Chairman by majority vote of the Committee. The Board may replace any member of the Committee for any reason. |

| 3. | The Chairman shall designate a secretary for each meeting of the Committee to record the minutes thereof. |

B. Meetings

| 1. | The Committee shall meet at least two times a year. The Chairman may call additional meetings as are necessary or appropriate. |

| 2. | The Committee shall have the authority to meet privately and to allow nonmembers to attend by invitation. |

| 3. | A majority of the Committee members shall constitute a quorum for the transaction of business. Approval of actions by a majority of the members present at a meeting at which a quorum is present shall constitute approval by the Committee. The Committee may also act by unanimous written consent to action without a meeting. |

| 4. | The Chairman shall distribute a meeting agenda to the Committee members at a reasonable time prior to each meeting. |

| 5. | The secretary appointed by the Chairman shall prepare written minutes of each meeting. |

C. Reporting

Any action taken by the Committee shall be reported to the Board at the next Board meeting following such action.

III. AUTHORITY

| 1. | The Committee shall have authority to retain and terminate any search firm used to identify candidates for Board membership, including the authority to approve such firm’s fees or retention terms. |

| 2. | The Committee is authorized to obtain advice and assistance from the Fund’s counsel, independent accountant and other service providers in connection with the performance of its responsibilities. If the Committee determines that it is necessary to do so in order for the Committee to discharge its responsibilities, the Committee may retain independent counsel and accounting services at the Fund’s expense. |

| 3. | In discharging its responsibilities, the Committee shall have full access to any relevant and material records of the Fund. |

IV. RESPONSIBILITIES

A. Size, Structure and Composition of the Board and Qualifications for Membership

| 1. | The Committee shall review periodically the size, structure and composition of the Board to determine the appropriate number of Managers comprising the Board, the ratio of interested to non-interested Managers, the number and types of committees, the functions of the Fund’s officers, and the types of expertise and experience needed among the Managers. Accordingly, the Committee shall recommend to the Board: |

(a) a Statement of Policy on Qualifications for Board Membership; and

(b) a Statement of Policy on Qualifications for Chairman of the Board.

| 2. | The Committee shall be responsible for overseeing the orientation and training of new Managers and the continuing education of all Managers. |

| 3. | The Committee shall make recommendations to the Board with respect to the level and types of compensation for Board members and the Chairman of the Board. The Committee shall review such compensation arrangements annually. |

| 4. | The Committee shall make recommendations to the Board with respect to level and extent of insurance for and indemnification of Board members and the Chairman of the Board. The Committee shall review such insurance and indemnification arrangements annually. |

B. Identification and Nomination of Candidates for Membership and Chairmanship

| 1. | The Committee shall develop a list of possible new members for the Board, even when there is no current or anticipated vacancy on the Board, for consideration by the Board when appropriate. |

| 2. | The Committee shall identify and recommend candidates for nomination by the Board in accordance with the Statement of Policy on Qualifications for Board Membership, and candidates for the chairmanship of the Board in accordance with the Statement of Policy on Qualifications for Chairman of the Board. |

C. Committee Structure

| 1. | The Committee shall review periodically the Board’s committee structure and make recommendations to the Board regarding the formation and/or dissolution of committees. |

| 2. | The Committee shall make recommendations to the Board with respect to membership on committees. |

D. Self-evaluation of the Board and its Committees

| 1. | The Committee shall recommend a plan and schedule to the Board for annual self-evaluation by the Board and its committees. |

| 2. | The Committee shall oversee the process of self-evaluation approved by the Board. |

E. Chief Compliance Officer, President and Other Fund Officers

| 1. | The Committee shall identify and recommend to the Board qualified individuals, from time to time, to serve as CCO, President and other Fund officers. The Committee shall also make recommendations to the Board with respect to such officers’ responsibilities, retention and compensation. |

| 2. | The Committee shall monitor (a) the performance of the CCO and (b) the cooperation of the advisers and service providers with the CCO, including the requirement of regular reports by the CCO to both committees and, as appropriate, the Board. |

| 3. | The Committee shall annually review the CCO’s responsibilities and the extent of his or her authority. |

F. Committee Charter

The Board shall adopt and approve this Charter and may amend it on the Board’s own motion. The Committee shall review this Charter at least annually and recommend to the full Board any changes the Committee deems appropriate.

IV. NOMINEE CANDIDATES RECOMMENDED BY MEMBERS

A. Policy

The Committee will consider nominee candidates recommended by members (or shareholders) of the Fund. The Committee will evaluate such nominees according to the Statement of Policy on Qualifications for Board Membership in the same manner as nominee candidates not recommended by shareholders.

B. Process

Shareholders who wish to recommend individuals for consideration by the Committee as nominee candidates may do so by submitting a written recommendation to the Secretary of the Fund at: Popular Center, 209 Munoz Rivera, Suite 1111, San Juan, Puerto Rico 00918. Submissions must include sufficient biographical information concerning the recommended individual, including age, twenty years of employment history with employer names and a description of the employer’s business, and a list of board memberships (if any). The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected. Recommendations must be received in a sufficient time, as determined by the Committee in its sole discretion, prior to the date proposed for the consideration of nominees by the Board.

STATEMENT OF POLICY ON QUALIFICATIONS FOR MEMBERSHIP

ON THE BOARD OF MANAGERS

All members of the Board of Managers (the “Board”) of the X-Square Balanced Fund, LLC (the “Fund”) shall possess:

1. The ability to apply reasonable business judgment and exercise properly their duties of care and loyalty in the best interests of the members (or shareholders) of the Fund.

2. Proven leadership ability, high integrity, collegiality and moral character, substantial business or other relevant experience, and a demonstrated capacity to manage a high level of responsibility;

3. The ability to understand complex principles of business and investment, to solve multi-faceted problems, and to operate positively in the regulatory environment of the Fund; and

4. The ability to read and understand basic financial statements.

In addition, as may be required by the Fund in order to take advantage of certain exemptive rules under the Investment Company Act of 1940 (the “1940 Act”), certain members of the Board of Managers may also need to be “disinterested” managers as such term is defined in Rule 0-1(a)(7) under the 1940 Act.

In selecting among potential candidates for Board membership, the Board shall give effect to a preference for candidates who hold or have held senior-level positions in business, finance, law, education, research or government.

The Board does not believe that a manager should be required to resign in the event a manager retires or changes from the position they held when they were elected to the Board. The Nominating and Governance Committee will consider age, experience and other relevant factors described above when making nominations to the Board.

STATEMENT OF POLICY ON QUALIFICATIONS FOR SELECTION AS

CHAIRMAN OF THE BOARD

I. REQUIRED SKILLS

In addition to the basic qualifications for all members of the Fund, the Chairman shall possess the ability to:

| 1. | Foster a boardroom culture consistent with the Fund’s statement of fund governance principles. |

| 2. | Exercise leadership among the Managers. |

| 3. | Chair Board meetings in an evenhanded and open manner. |

| 4. | Communicate effectively with the Fund’s members (or shareholders), service providers, regulatory agencies, the press and other relevant parties. |

| 5. | Represent the Fund’s interests effectively in all dealings with the Fund’s adviser and other service providers. |

| 6. | Evaluate and prioritize issues for consideration by the Board. |

II. REQUIRED EXPERIENCE

The Chairman shall have senior-level experience in business, finance, law, education, research or government, including experience in managing a high level of responsibility.

III. COMMITMENT

The Chairman must have the commitment, availability and time needed to discharge the responsibilities of the position to the extent necessary to serve the best interests of the shareholders.