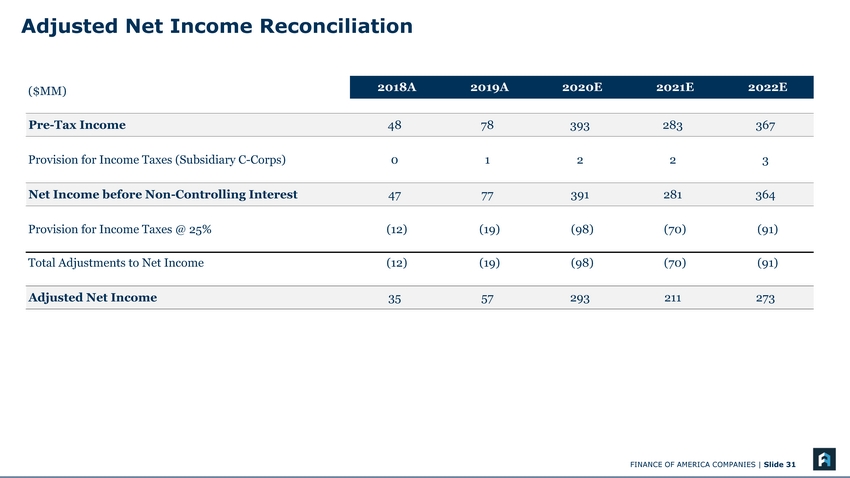

| Disclaimer This presentation contemplates the proposed business combination involving Replay Acquisition Corp. (“Replay”) and Finance of America Equity Capital LLC (together with its subsidiaries and affiliates, “Finance of America”). Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Replay’s and Finance of America’s actual results may differ from their expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should, ” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, Replay’s and Finance of America’s expectations with respect to future performance and anticipated financial impacts of the proposed business combination, the satisfaction or waiver of the closing conditions to the proposed business combination, and the timing of the completion of the proposed business combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially, and potentially adversely, from those expressed or implied in the forward-looking statements. Most of these factors are outside Replay’s and Finance of America’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change, or other circumstances that could give rise to the termination of the definitive merger agreement (the “Agreement”); (2) the outcome of any legal proceedings that may be instituted against Replay, New Pubco (as defined below) and/or Finance of America following the announcement of the Agreement and the transactions contemplated therein; (3) the inability to complete the proposed business combination, including due to failure to obtain approval of the shareholders of Replay, certain regulatory approvals, or satisfy other conditions to closing in the Agreement; (4) the occurrence of any event, change, or other circumstance that could give rise to the termination of the Agreement or could otherwise cause the transaction to fail to close; (5) the impact of COVID-19 on Finance of America’s business and/or the ability of the parties to complete the proposed business combination; (6) the inability to obtain or maintain the listing of New Pubco’s shares of common stock on the NYSE following the proposed business combination; (7) the risk that the proposed business combination disrupts current plans and operations as a result of the announcement and consummation of the proposed business combination; (8) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of Finance of America to grow and manage growth profitably, and retain its key employees; (9) costs related to the proposed business combination; (10) changes in applicable laws or regulations; and (11) the possibility that Finance of America or Replay may be adversely affected by other economic, business, and/or competitive factors. The foregoing list of factors is not exclusive. Additional information concerning certain of these and other risk factors is contained in Replay’s most recent filings with the SEC and will be contained in the Form S-4, including the proxy statement/prospectus expected to be filed in connection with the proposed business combination. All subsequent written and oral forward-looking statements concerning Replay, Finance of America or New Pubco, the transactions described herein or other matters and attributable to Replay, Finance of America, New Pubco or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Each of Replay, Finance of America and New Pubco expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in their expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based, except as required by law. Statement Regarding Non-GAAP Financial Measures This presentation also contains non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be useful to investors in assessing Finance of America’s operating performance. Such non-GAAP financial information, including Finance of America’s definitions and methods of calculation, are not necessarily comparable to similarly titled measures of other companies. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP measures are set forth on in the Appendix. For example, this presentation includes Adjusted EBITDA, which excludes items that are significant in understanding and assessing Finance of America’s financial results or position. Therefore, this measure should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. No Offer or Solicitation This presentation is not a proxy statement or solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed business combination. This presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. Important Information About the Proposed Business Combination and Where to Find It In connection with the proposed business combination, a registration statement on Form S-4 (the “Form S-4”) is expected to be filed by a newly-formed holding company (“New Pubco”) with the SEC that will include a proxy statement of Replay that will also constitute a prospectus of New Pubco. Replay’s shareholders and other interested persons are advised to read, when available, the Form S-4, including the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and documents incorporated by reference therein, as well as other documents filed with the SEC in connection with the proposed business combination, as these materials will contain important information about Finance of America, Replay, and the proposed business combination. Such persons can also read Replay’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, for a description of the security holdings of Replay’s officers and directors and their respective interests as security holders in the consummation of the proposed business combination. When available, the definitive proxy statement/prospectus will be mailed to shareholders of Replay as of a record date to be established for voting on the proposed business combination. Shareholders will also be able to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Replay Acquisition Corp., 767 Fifth Avenue, 46th Floor, New York, New York 10153, or info@replayacquisition.com. Participants in the Solicitation Replay, Finance of America, New Pubco and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Replay’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of Replay’s directors and executive officers in Replay’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on March 25, 2020. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Replay’s shareholders in connection with the proposed business combination will be set forth in the proxy statement/prospectus for the proposed business combination when available. Information concerning the interests of Replay’s and Finance of America’s participants in the solicitation, which may, in some cases, be different than those of Replay’s and Finance of America’s equity holders generally, will be set forth in the proxy statement/prospectus relating to the proposed business combination when it becomes available. FINANCE OF AMERICA COMPANIES | Slide 2 |