UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant¨

Filed by a Party other than the Registrantx

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| x | Soliciting Material Pursuant to §240.14a-12 | |

Versum Materials, Inc.

(Name of the Registrant as Specified In Its Charter)

Merck KGaA

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

This filing contains the following communications:

| 1. | Proposal Letter to Versum Materials, Inc. |

| 2. | News Release |

| 3. | Ad hoc Release |

| 4. | Investor Relations Presentation |

| 5. | Screenshots of Microsite |

| 6. | Q&A |

| 7. | News Release Posted to Internal Site |

| 8. | Stakeholder Letter |

| 9. | Call Script |

| 10. | Employee Letter |

1. The following proposal was sent to the board of directors of Versum Materials, Inc. by Merck KGaA, Darmstadt, Germany on February 27, 2019.

Dr. Stefan Oschmann

Chairman of the Executive Board & CEO

Versum Materials, Inc.

Board of Directors

8555 South River Parkway

Tempe, AZ 85284

February 27, 2019

Ladies and Gentlemen:

As leading technology innovators backed by approximately $3 billion in annual R&D and capex spending, I and my colleagues of Merck KGaA, Darmstadt, Germany have long been impressed with Versum Materials, Inc. (“Versum”) and the potential that Versum’s management and employees has for delivering value to Versum’s customers, communities and stockholders. The transaction that Versum recently disclosed – one in which Versum stockholders would receive stock of Entegris, Inc. (“Entegris”) – significantly undervalues Versum. Accordingly, I am pleased to propose, with the unanimous and enthusiastic support of our executive board, that Merck KGaA, Darmstadt, Germany acquire all of the outstanding shares of Versum common stock for $48 per share in cash (the “Proposal”). The Proposal reflects an enterprise value for Versum of $6 billion and an EV/FY 2018 EBITDA multiple of approximately 13.3x. The Proposal represents a premium of 15.9% to the current value per Versum share and a premium of 51.7% to the undisturbed trading price per Versum share on the trading day prior to announcement of the Entegris transaction.

Instead of the speculative value offered by the Entegris transaction, the all-cash Proposal would deliver immediate and certain cash value to Versum stockholders and employees, shielding them from the significant integration, operational and market risks posed by the all-stock Entegris transaction.

There can be no question that the Proposal is a Superior Proposal for purposes of the Versum-Entegris merger agreement, and we wish to engage with Versum and its advisors immediately in order to capture for Versum’s stockholders, employees, and customers the tremendous superior value inherent in the Proposal.

Merck KGaA Darmstadt, Germany Frankfurter Strasse 250 64293 Darmstadt · Germany Phone +49 6151 72 9880 Fax +49 6151 72 5962 stefan.oschmann@merckgroup.com |

Corporation with General Partners Commercial Register AG Darmstadt HRB 6164 Registered Office: Darmstadt Chairman of the Supervisory Board: Wolfgang Büchele |

Executive Board and General Partners: Stefan Oschmann (Chairman), Udit Batra, Kai Beckmann, Belén Garijo, Marcus Kuhnert |

| 1/6 |

Dr. Stefan Oschmann

Chairman of the Executive Board & CEO

Commitment to Investment Benefitting Employees and Customers

As you know, Merck KGaA, Darmstadt, Germany is a leading science and technology company which operates across healthcare, life sciences and performance materials with a market capitalization of approximately $47 billion and revenues of approximately $17 billion. Our Performance Materials business is an innovation driven market leader in electronic chemicals with exposure to high growth market segments. Given ongoing technological change including AI, internet-of-things, data analytics and the like, long term secular trends will create lasting demand for semiconductors. The leaders in the industry will be those willing to invest and able to innovate and adapt to changing technologies.

Together we will be one of those leaders. The complementary fit of our and Versum’s businesses and the strength of our combined team will justify significant and sustained investment, which will benefit all of Merck KGaA, Darmstadt, Germany’s and Versum’s employees and customers worldwide. An important part of our strategy will be to maintain Versum’s headquarters as the major hub for the combined electronic materials business in the U.S.

Transaction Terms

Merck KGaA, Darmstadt, Germany is prepared to complete the transaction on terms consistent with the terms agreed with Entegris, aside from changes relating to us as the counterparty, the necessary differences between a cash and stock transaction and other changes necessary in light of applicable laws and regulations.

Certainty of Closing

In addition to its tremendous financial superiority relative to the Entegris transaction, please note the following benefits of the Proposal:

| · | No Financing Risk: Merck KGaA, Darmstadt, Germany has a very substantial market capitalization and a strong investment grade credit rating. The definitive agreement would not contain a financing condition, and any requisite financing in excess of cash on hand would be supported by committed financing with no incremental conditionality. |

| · | Strong Track Record of Completing Acquisitions: Merck KGaA, Darmstadt, Germany has a strong record of completing acquisitions and is well-known as a reliable merger partner. Since 2009, we have completed acquisitions with a total transaction value of approximately $27 billion. Our track record includes two acquisitions of large U.S. public companies, including the $7 billion acquisition of Millipore and the $17 billion acquisition of Sigma-Aldrich as well as the $2.5 billion acquisition of UK-based AZ Electronic Materials. |

| 2/6 |

Dr. Stefan Oschmann

Chairman of the Executive Board & CEO

| · | No Anticipated Regulatory Issues: Given our strong M&A track record, we have significant experience in obtaining antitrust approvals both in the U.S. and globally, as well as CFIUS approval in the U.S. Based on our review of available information, the complementary nature of the businesses and our prior experience, there should not be regulatory obstacles to the transaction and we believe the necessary approvals can be secured without undue delay. |

| · | No Shareholder Vote: Unlike the pending transaction with Entegris, we do not require a shareholder vote and already have all necessary internal approvals in place. |

Next Steps and Timing

After entering into a mutually agreeable confidentiality agreement with Merck KGaA, Darmstadt, Germany, we wish to undertake discussions and review the information required for us to complete our due diligence – including information that Versum has furnished to Entegris. Our team is in a position to complete diligence expeditiously and finalize a transaction agreement at the same time. Given that we assume that Versum has significantly progressed its proxy statement, we are confident that Versum stockholder approval of a transaction with Merck KGaA, Darmstadt, Germany can be obtained rapidly.

Advisors

Merck KGaA, Darmstadt, Germany has engaged Guggenheim Securities, LLC as its financial advisor and Sullivan & Cromwell LLP as its legal counsel. Our advisors are ready, willing and able to coordinate with Versum’s advisors concerning next steps.

Public Disclosure

Please be aware that given applicable requirements under German law, Merck KGaA, Darmstadt, Germany is required to disclose this proposal publicly and simultaneously with its delivery to you. A copy of the release we have made is attached hereto.

Non-Binding Effect

This letter does not create or constitute any legally binding obligation or commitment by either of us relating to the proposed transaction or otherwise. A binding agreement will only arise when and if a definitive transaction is agreed and a definitive merger agreement is executed and delivered by each of the parties.

| 3/6 |

Dr. Stefan Oschmann

Chairman of the Executive Board & CEO

We look forward to your prompt response and to moving forward together so that we may complete this transaction expeditiously and unlock the value inherent in this exciting and valuable transaction.

Sincerely,

Stefan Oschmann

Chief Executive Officer

| 4/6 |

Dr. Stefan Oschmann

Chairman of the Executive Board & CEO

About Merck KGaA, Darmstadt, Germany

Merck KGaA, Darmstadt, Germany a leading science and technology company, operates across Healthcare, Life Science and Performance Materials. Around 51,000 employees work to make a positive difference to millions of people’s lives every day by creating more joyful and sustainable ways to live. From advancing gene editing technologies and discovering unique ways to treat the most challenging diseases to enabling the intelligence of devices – Merck KGaA, Darmstadt, Germany is everywhere. In 2017, Merck KGaA, Darmstadt, Germany generated sales of € 15.3 billion in 66 countries.

Scientific exploration and responsible entrepreneurship have been key to Merck KGaA, Darmstadt, Germany’s technological and scientific advances. This is how Merck KGaA, Darmstadt, Germany has thrived since its founding in 1668. The founding family remains the majority owner of the publicly listed company. Merck KGaA, Darmstadt, Germany holds the global rights to the Merck KGaA, Darmstadt, Germany name and brand. The only exceptions are the United States and Canada, where the business sectors of Merck KGaA, Darmstadt, Germany operate as EMD Serono in healthcare, MilliporeSigma in life science, and EMD Performance Materials.

Cautionary Statement Regarding Forward-Looking Information

This communication may contain forward-looking statements based on current assumptions and forecasts made by Merck KGaA, Darmstadt, Germany management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include those discussed in Merck KGaA, Darmstadt, Germany’s public reports which are available on the Merck KGaA, Darmstadt, Germany website at www.emdgroup.com. Merck KGaA, Darmstadt, Germany assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Merck KGaA, Darmstadt, Germany has made for a business combination transaction with Versum. In furtherance of this proposal and subject to future developments, Merck KGaA, Darmstadt, Germany (and, if a negotiated transaction is agreed, Versum) intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document Merck KGaA, Darmstadt, Germany, Versum or Entegris may file with the SEC in connection with the proposed transaction.STOCKHOLDERS OF VERSUM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive Proxy Statement will be delivered to the stockholders of Versum. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Merck KGaA, Darmstadt, Germany through the website maintained by the SEC at http://www.sec.gov.

| 5/6 |

Dr. Stefan Oschmann

Chairman of the Executive Board & CEO

Participants in Solicitation

Merck KGaA, Darmstadt, Germany and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

| 6/6 |

2.Merck KGaA, Darmstadt, Germany issued the following news release on February 27, 2019.

Your Contact

Investor Relations |

February 27, 2019

Merck KGaA, Darmstadt, Germany, Submits All-Cash

Proposal to Acquire Versum

| · | $48 Per Share Proposal Represents a Premium to Current Value of Entegris’ All-stock Proposal |

Darmstadt, Germany, February 27, 2019 – Merck KGaA, Darmstadt, Germany, a leading science and technology company, today delivered a letter to the Board of Directors of Versum Materials, Inc. (“Versum”), outlining the terms of a superior proposal to acquire Versum for $48 per share in cash, representing a premium of 51.7% to the undisturbed trading price per Versum share on the trading day prior to announcement of the Entegris, Inc. (“Entegris”) transaction (January 25, 2019). Merck KGaA, Darmstadt, Germany’s proposal is therefore substantially superior to the Entegris transaction.

“We truly believe in the power of a combined electronic materials portfolio of Merck KGaA, Darmstadt, Germany and Versum. Our attractive cash proposal to Versum’s investors underlines that we are fully committed to completing this transaction successfully”, said Stefan Oschmann, Chairman of the Executive Board and CEO of Merck KGaA, Darmstadt, Germany. “It is our clear intention to further strengthen our operations in the U.S. We are proud of our nearly 130 years of U.S. market history and already more than 10,000 highly qualified employees today working at more than 50 sites coast-to-coast.”

| Frankfurter Strasse 250 64293 Darmstadt · Germany Hotline +49 6151 72-5000 www.emdgroup.com | Head of Media Relations -6328 Spokesperson: -9591 / -7144 / -8908 / -55707 |

Page 1 of 5

The combination of Merck KGaA, Darmstadt, Germany’s and Versum’s businesses would create a deep and complementary portfolio of electronic materials, equipment and services for the semiconductor and display industries. The combined R&D capabilities would enable faster innovation cycles and strengthen the product offering to customers. They would offer increased scale, product and service depth, an enhanced global presence and a strengthened supply chain, which would help drive leading innovation supported by long-term tailwinds in the industry. Moreover, they would provide an additional source for innovation through leading positions in attractive segments.

All-cash consideration offering attractive premium

Merck KGaA, Darmstadt, Germany’s all-cash proposal represents an attractive premium across key benchmarks:

| · | 51.7% premium to Versum’s undisturbed share price, on January 25, 2019, the day prior to the Versum-Entegris merger announcement; |

| · | 15.9% premium to Versum’ current share price as of February 26, 2019. |

Additionally, the all-cash proposal offers Versum’s shareholders certain value, and does not leave them exposed to integration or other post-merger risks. With Merck KGaA, Darmstadt, Germany’s strong credit rating, the transaction will be fully financed and the transaction agreement will not have a financing contingency.

Commitment to strengthen U.S. operations

Merck KGaA, Darmstadt, Germany has a strong reputation for innovation and has demonstrated a robust commitment to R&D spending and capital investment. As the long-term secular trends in science and technology continue to drive lasting demand for electronic materials, the leaders will be those willing to invest, innovate and adapt in this fast-developing environment. Merck KGaA, Darmstadt, Germany believes this philosophy is consistent with Versum’s culture and strength of its employees, and as such intends to maintain Versum’s Tempe, AZ site as the major hub for the combined electronic materials business in the U.S., complementing Merck KGaA, Darmstadt, Germany’s already strong commitment to this important market.

Page 2 of 5

An opportunity for Versum employees

Merck KGaA, Darmstadt, Germany is a long-term oriented, predominantly family-owned science & technology company. “Performance, People & Technology” are its three strategic priorities. In Merck KGaA, Darmstadt, Germany’s more than 350-year history, people have always been and will continue to be at the center of everything it does.

Merck KGaA, Darmstadt, Germany already has a strong footprint in the U.S. and a track record as a top employer. Over the past decade, the company has invested some $24bn in the U.S. through acquisitions alone, including the successful acquisitions of Millipore in 2010 and Sigma-Aldrich in 2015.

Versum employees will become an integral part of a leading electronic materials business and will benefit from new and exciting development opportunities within a truly global science and technology company.

Timing

Merck KGaA, Darmstadt, Germany is confident it can close a transaction with Versum in the second half of 2019, assuming expedient engagement by the Versum Board of Directors. Merck KGaA, Darmstadt, Germany’s long track record of completing acquisitions, its strong balance sheet and investment-grade credit rating position the combined company well for a future of investment and growth. Unlike the Entegris transaction, the only shareholder approval required by Merck KGaA, Darmstadt, Germany’s proposal is that of Versum’s shareholders, and Merck KGaA, Darmstadt, Germany fully expects to receive all customary regulatory clearances in a timely manner.

A full copy of the letter delivered by Merck KGaA, Darmstadt, Germany to the Versum, Board of Directors is attached to this release.

Page 3 of 5

Advisors

Merck KGaA, Darmstadt, Germany has engaged Guggenheim Securities, LLC as its financial advisor and Sullivan & Cromwell LLP as its legal counsel.

Investor Conference Call

Merck KGaA, Darmstadt, Germany will host aconference call with the financial community at 9:30am EST today. For further details please also seewww.thesuperiorproposal.com.

All Merck KGaA, Darmstadt, Germany, press releases are distributed by e-mail at the same time they become available on the EMD Group Website. In case you are a resident of the USA or Canada please go towww.emdgroup.com/subscribe to register for your online subscription of this service as our geo-targeting requires new links in the email. You may later change your selection or discontinue this service.

About Merck KGaA, Darmstadt, Germany

Merck KGaA, Darmstadt, Germany, a leading science and technology company, operates across healthcare, life science and performance materials. Around 51,000 employees work to make a positive difference to millions of people’s lives every day by creating more joyful and sustainable ways to live. From advancing gene editing technologies and discovering unique ways to treat the most challenging diseases to enabling the intelligence of devices – the company is everywhere. In 2017, Merck KGaA, Darmstadt, Germany, generated sales of € 15.3 billion in 66 countries.

The company holds the global rights to the name and trademark “Merck” internationally. The only exceptions are the United States and Canada, where the business sectors of Merck KGaA, Darmstadt, Germany operate as EMD Serono in healthcare, MilliporeSigma in life science, and EMD Performance Materials. Since its founding 1668, scientific exploration and responsible entrepreneurship have been key to the company’s technological and scientific advances. To this day, the founding family remains the majority owner of the publicly listed company.

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements based on current assumptions and forecasts made by Merck KGaA, Darmstadt, Germany’s management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include those discussed in our public reports which are available on our company’s website at www.emdgroup.com. Merck KGaA, Darmstadt, Germany assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.

Additional Important Information and Where to Find It

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Merck KGaA, Darmstadt, Germany has made for a business combination transaction with Versum Materials, Inc. (“Versum”). In furtherance of this proposal and subject to future developments, Merck KGaA, Darmstadt, Germany (and, if a negotiated transaction is agreed, Versum) intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document Merck KGaA, Darmstadt, Germany, Versum or Entegris, Inc. may file with the SEC in connection with the proposed transaction.STOCKHOLDERS OF VERSUM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive Proxy Statement will be delivered to the stockholders of Versum. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Merck KGaA, Darmstadt, Germany through the website maintained by the SEC at http://www.sec.gov.

Page 4 of 5

Participants in Solicitation

Merck KGaA, Darmstadt, Germany and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Page 5 of 5

3.Merck KGaA, Darmstadt, Germany made the following ad-hoc announcement according to Article 17 of the EU Market Abuse Regulation on February 27, 2019.

Merck KGaA, Darmstadt, Germany: Merck KGaA, Darmstadt, Germany Proposes to Acquire Versum for USD 48 per Share and to Create a Leading Electronic Materials Player

Merck KGaA, Darmstadt, Germany / Key word(s): Mergers & Acquisitions

Merck KGaA, Darmstadt, Germany: Merck KGaA, Darmstadt, Germany Proposes to Acquire Versum for USD 48 per Share and to Create a Leading Electronic Materials Player

27-Feb-2019 / 13:59 CET/CEST

Disclosure of an inside information acc. to Article 17 MAR of the Regulation (EU) No 596/2014, transmitted by DGAP - a service of EQS Group AG.

The issuer is solely responsible for the content of this announcement.

Today, Merck KGaA, Darmstadt, Germany has proposed to the board of directors of Versum Materials, Inc. (Versum) (ISIN: US92532W1036) that Merck KGaA, Darmstadt, Germany should acquire all of the issued and outstanding common shares of Versum for USD 48 per share or an enterprise value of USD 5.9 billion in an all-cash transaction. Versum is a Delaware corporation based in Tempe, Arizona, United States of America.

This offer represents a substantial premium to the last undisturbed share price before the Versum/Entegris merger announcement of 51.7% and a 15.9% premium to Versum's closing price on February 26, 2019.

Through the acquisition, Merck KGaA, Darmstadt, Germany would further strengthen its position as a leading supplier for electronic materials.

Merck KGaA, Darmstadt, Germany 's Executive Board unanimously approved the proposal and is fully committed to pursuing the transaction. Merck KGaA, Darmstadt, Germany is prepared to proceed immediately to due diligence and negotiations and to quickly agree to a merger agreement. The completion of the offer will be subject to customary closing conditions, including the receipt of necessary regulatory clearances. Merck KGaA, Darmstadt, Germany’s shareholder vote is not required.

This announcement is made in accordance with Article 17 of the EU Market Abuse Regulation.

Forward-Looking Statements

This communication may contain forward-looking statements based on current assumptions and forecasts made by Merck KGaA, Darmstadt, Germany management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include those discussed in the public reports of Merck KGaA, Darmstadt, Germany which are available on the Merck KGaA, Darmstadt, Germany’s website at www.emdgroup.com. Merck KGaA, Darmstadt, Germany assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.

Additional Information

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Merck KGaA, Darmstadt, Germany has made for a business combination transaction with Versum Materials, Inc. ("Versum"). In furtherance of this proposal and subject to future developments, Merck KGaA, Darmstadt, Germany (and, if a negotiated transaction is agreed, Versum) intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A (the "Proxy Statement"). This communication is not a substitute for the Proxy Statement or any other document Merck KGaA, Darmstadt, Germany, Versum or Entegris, Inc. may file with the SEC in connection with the proposed transaction. STOCKHOLDERS OF Versum ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive Proxy Statement will be delivered to the stockholders of Versum. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Merck KGaA, Darmstadt, Germany through the website maintained by the SEC at http://www.sec.gov.

Participants in Solicitation

Merck KGaA, Darmstadt, Germany and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Contact:

Dr. Thomas Moeller, Head of External Communications

27-Feb-2019 CET/CEST The DGAP Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases.

Archive at www.dgap.de

| Language: | English |

| Company: | Merck KGaA |

| Frankfurter Str. 250 | |

| 64293 Darmstadt | |

| Germany | |

| Phone: | +49 (0)6151 72 - 62445 |

| Fax: | +49 (0)6151 72 - 3183 |

| E-mail: | thomas.moeller@merckgroup.com |

| Internet: | www.merck.de |

| ISIN: | DE0006599905 |

| WKN: | 659990 |

| Indices: | DAX |

| Listed: | Regulated Market in Frankfurt (Prime Standard); Regulated Unofficial Market in Berlin, Dusseldorf, Hamburg, Hanover, Munich, Stuttgart, Tradegate Exchange; London, SIX |

End of Announcement DGAP News Service

4. The following investor presentation was first used on February 27, 2019.

PROPOSAL TO ACQUIRE VERSUM MATERIALS Stefan Oschmann, CEO Marcus Kuhnert, CFO February 27, 2019

Disclaimer Publication of Merck KGaA, Darmstadt, Germany. In the United States and Canada the group of companies affiliated with Merck KGaA, Darmstadt, Germany operates under individual business names (EMD Serono, Millipore Sigma, EMD Performance Materials). To reflect such fact and to avoid any misconceptions of the reader of the publication certain logos, terms and business descriptions of the publication have been substituted or additional descriptions have been added. This version of the publication, therefore, slightly deviates from the otherwise identical version of the publication provided outside the United States and Canada.

DISCLAIMER CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND FINANCIAL INDICATORS This communication may include “forward-looking statements.” Statements that include words such as “anticipate,” “expect,” “should,” “would,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” and other words of similar meaning in connection with future events or future operating or financial performance are often used to identify forward-looking statements. All statements in this communication, other than those relating to historical information or current conditions, are forward-looking statements. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond control of Merck KGaA, Darmstadt, Germany, which could cause actual results to differ materially from such statements. Risks and uncertainties include, but are not limited to: the risks of more restrictive regulatory requirements regarding drug pricing, reimbursement and approval; the risk of stricter regulations for the manufacture, testing and marketing of products; the risk of destabilization of political systems and the establishment of trade barriers; the risk of a changing marketing environment for multiple sclerosis products in the European Union; the risk of greater competitive pressure due to biosimilars; the risks of research and development; the risks of discontinuing development projects and regulatory approval of developed medicines; the risk of a temporary ban on products/production facilities or of non-registration of products due to non-compliance with quality standards; the risk of an import ban on products to the United States due to an FDA warning letter; the risks of dependency on suppliers; risks due to product-related crime and espionage; risks in relation to the use of financial instruments; liquidity risks; counterparty risks; market risks; risks of impairment on balance sheet items; risks from pension obligations; risks from product-related and patent law disputes; risks from antitrust law proceedings; risks from drug pricing by the divested Generics Group; risks in human resources; risks from e-crime and cyber attacks; risks due to failure of business-critical information technology applications or to failure of data center capacity; environmental and safety risks; unanticipated contract or regulatory issues; a potential downgrade in the rating of the indebtedness of Merck KGaA, Darmstadt, Germany; downward pressure on the common stock price of Merck KGaA, Darmstadt, Germany and its impact on goodwill impairment evaluations as well as the impact of future regulatory or legislative actions. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere, including the Report on Risks and Opportunities Section of the most recent annual report and quarterly report of Merck KGaA, Darmstadt, Germany. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. This presentation contains certain financial indicators such as EBITDA pre exceptionals, net financial debt and earnings per share pre exceptionals, which are not defined by International Financial Reporting Standards (IFRS). These financial indicators should not be taken into account in order to assess the performance of Merck KGaA, Darmstadt, Germany in isolation or used as an alternative to the financial indicators presented in the consolidated financial statements and determined in accordance with IFRS. The figures presented in this statement have been rounded. This may lead to individual values not adding up to the totals presented.

DISCLAIMER ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Merck KGaA, Darmstadt, Germany has made for a business combination transaction with Versum Materials, Inc. ("Versum"). In furtherance of this proposal and subject to future developments, Merck KGaA, Darmstadt, Germany (and if a negotiated transaction is agreed, Versum Materials) intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document Merck KGaA, Darmstadt, Germany, Versum Materials or Entegris, Inc. may file with the SEC in connection with the proposed transaction. STOCKHOLDERS OF VERSUM MATERIALS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive Proxy Statement will be delivered to the stockholders of Versum Materials. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Merck KGaA, Darmstadt, Germany through the website maintained by the SEC at http://www.sec.gov. PARTICIPANTS IN SOLICITATION Merck KGaA, Darmstadt, Germany and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum Materials common stock in respect of the proposed transaction. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

AGENDA STRATEGIC RATIONALE TRANSACTION DETAILS AND IMPACTS FOR MERCK KGAA, DARMSTADT, GERMANY EXECUTIVE SUMMARY BACK-UP

STRATEGIC RATIONALE

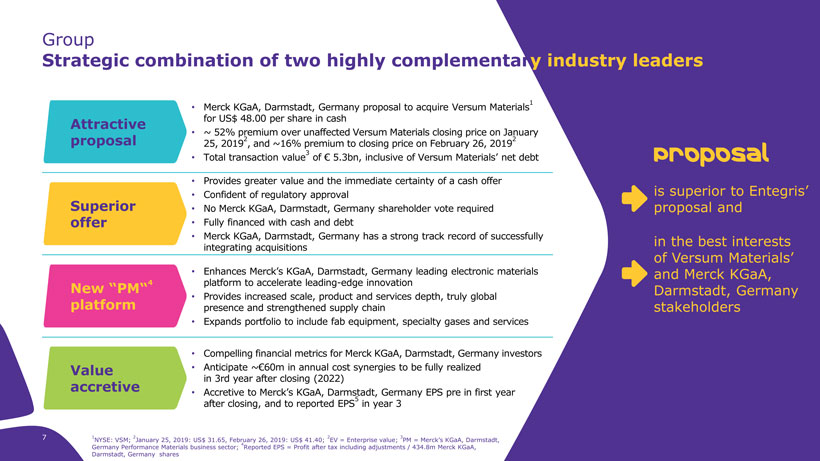

Group STRATEGIC COMBINATION OF TWO HIGHLY COMPLEMENTARY INDUSTRY LEADERS ATTRACTIVE PROPOSAL Merck KGaA, Darmstadt, Germany proposal to acquire Versum Materials1 for US$48.00 per share in cash ~ 52% premium over unaffected Versum Materials closing price on January 25, 20192, and ~16% premium to closing price on February 26, 20192 Total transaction value3 of 5.3bn, inclusive of Versum Materials’ net debt SUPERIOR OFFER Provides greater value and the immediate certainty of a cash offer Confident of regulatory approval No Merck KGaA, Darmstadt, Germany shareholder vote required Fully financed with cash and debt Merck KGaA, Darmstadt, Germany has a strong track record of successfully integrating acquisitions NEW “PM“4 PLATFORM Enhances Merck’s KGaA, Darmstadt, Germany leading electronic materials platform to accelerate leading-edge innovation Provides increased scale, product and services depth, truly global presence and strengthened supply chain Expands portfolio to include fab equipment, specialty gases and services VALUE ACCRETIVE Compelling financial metrics for Merck KGaA, Darmstadt, Germany investors Anticipate ~ 60m in annual cost synergies to be fully realized in 3rd year after closing (2022) Accretive to Merck’s KGaA, Darmstadt, Germany EPS pre in first year after closing, and to reported EPS5 in year 3 Proposal is superior to Entegris’ proposal and in the best interests of Versum Materials’ and Merck KGaA, Darmstadt, Germany stakeholders 1NYSE: VSM; 2January 25, 2019: US$31.65, February 26, 2019: US$41.40; 2EV = Enterprise value; 3PM = Merck’s KGaA, Darmstadt, Germany Performance Materials business sector; 4Reported EPS = Profit after tax including adjustments / 434.8m Merck KGaA, Darmstadt, Germany shares

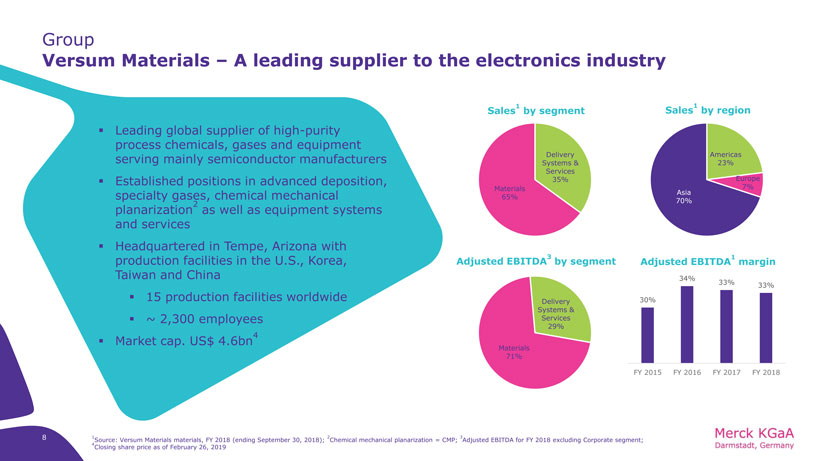

Group VERSUM MATERIALS A LEADING SUPPLIER TO THE ELECTRONICS INDUSTRY Leading global supplier of high-purity process chemicals, gases and equipment serving mainly semiconductor manufacturers Established positions in advanced deposition, specialty gases, chemical mechanical planarization2 as well as equipment systems and services Headquartered in Tempe, Arizona with production facilities in the U.S., Korea, Taiwan and China 15 production facilities worldwide ~ 2,300 employees Market cap. US$4.6bn4 SALES1 BY SEGMENT SALES1 BY REGION ADJUSTED EBITDA3 BY SEGMENT ADJUSTED EBITDA1 MARGIN 1Source: Versum Materials materials, FY 2018 (ending September 30, 2018); 2Chemical mechanical planarization = CMP; 3Adjusted EBITDA for FY 2018 excluding Corporate segment; 4Closing share price as of February 26, 2019

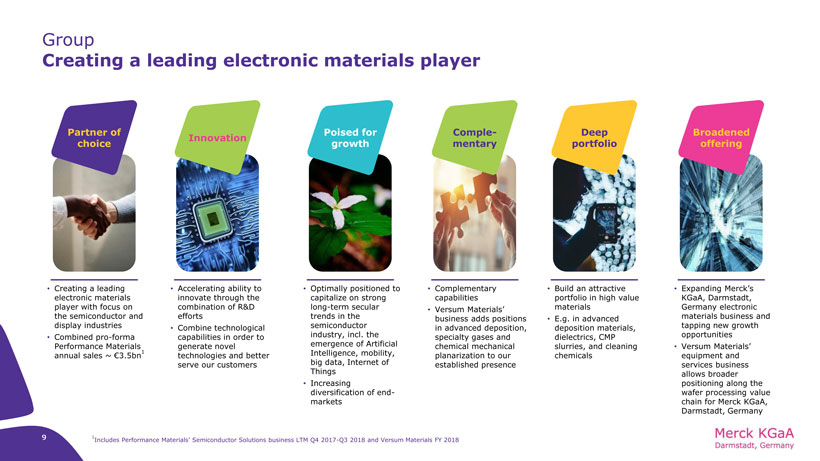

Group CREATING A LEADING ELECTRONIC MATERIALS PLAYER PARTNER OF CHOICE Creating a leading electronic materials player with focus on the semiconductor and display industries Combined pro-forma Performance Materials annual sales ~ 3.5bn1 INNOVATION Accelerating ability to innovate through the combination of R&D efforts Combine technological capabilities in order to generate novel technologies and better serve our customers POISED FOR GROWTH Optimally positioned to capitalize on strong long-term secular trends in the semiconductor industry, incl. the emergence of Artificial Intelligence, mobility, big data, Internet of Things Increasing diversification of end-markets COMPLEMENTARY Complementary capabilities Versum Materials’ business adds positions in advanced deposition, specialty gases and chemical mechanical planarization to our established presence DEEP PORTFOLIO Build an attractive portfolio in high value materials E.g. in advanced deposition materials, dielectrics, CMP slurries, and cleaning chemicals BROADENED OFFERING Expanding Merck’s KGaA, Darmstadt, Germany electronic materials business and tapping new growth opportunities Versum Materials’ equipment and services business allows broader positioning along the wafer processing value chain for Merck KGaA, Darmstadt, Germany 1Includes Performance Materials’ Semiconductor Solutions business LTM Q4 2017-Q3 2018 and Versum Materials FY 2018

Group A COMPELLING PROPOSAL FOR ALL STAKEHOLDERS Combining the certainty of an all-cash transaction with an attractive premium ~ 52% premium to Versum Materials’ unaffected closing price of US$31.65 on January 25, 2019 ~ 16% premium to Versum Materials’ closing price of US$41.40 on February 26, 2019 Becoming an integral part of leading science and technology company Merck KGaA, Darmstadt, Germany Commitment to maintain Tempe, Arizona presence as a major hub for the combined business in the US Providing leading-edge technology backed by the capabilities, scale and quality of Merck KGaA, Darmstadt, Germany Truly global footprint and close proximity to customers worldwide Combines innovation strength to better serve our customers in a rapidly evolving marketplace A strategically and financially compelling transaction for Merck KGaA, Darmstadt, Germany shareholders Delivers on strategy of building leading positions in attractive markets Meeting Merck KGaA, Darmstadt, Germany financial M&A criteria Merck KGaA, Darmstadt, Germany – best strategic owner of Versum Materials to the highest benefit of shareholders, employees and customers

TRANSACTION DETAILS AND IMPACTS FOR MERCK KGAA, DARMSTADT, GERMANY

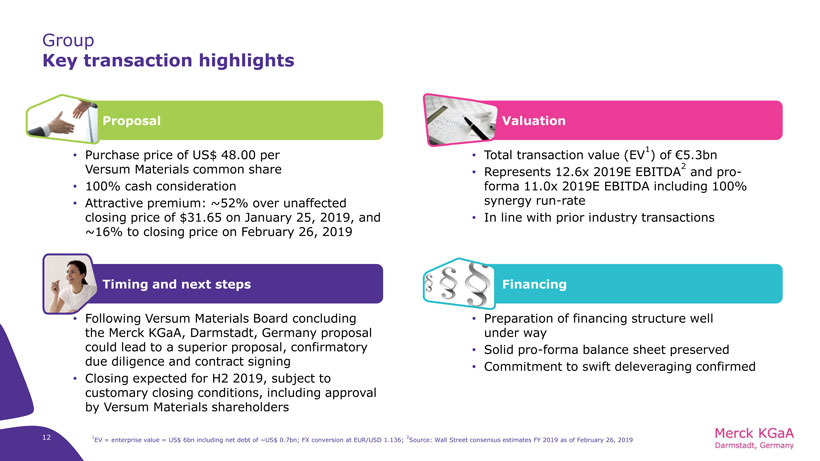

Group KEY TRANSACTION HIGHLIGHTS PROPOSAL Purchase price of US$48.00 per Versum Materials common share 100% cash consideration Attractive premium: ~52% over unaffected closing price of $31.65 on January 25, 2019, and ~16% to closing price on February 26, 2019 VALUATION Total transaction value (EV) of 5.3bn Represents 12.6x 2019E EBITDA2 and pro-forma 11.0x 2019E EBITDA including 100% synergy run-rate In line with prior industry transactions TIMING AND NEXT STEPS Following Versum Materials Board concluding the Merck KGaA, Darmstadt, Germany proposal could lead to a superior proposal, confirmatory due diligence and contract signing Closing expected for H2 2019, subject to customary closing conditions, including approval by Versum Materials shareholders FINANCING Preparation of financing structure well under way Solid pro-forma balance sheet preserved Commitment to swift deleveraging confirmed 1EV = enterprise value = US$6bn including net debt of ~US$0.7bn; FX conversion at EUR/USD 1.136; 2Source: Wall Street consensus estimates FY 2019 as of February 26, 2019

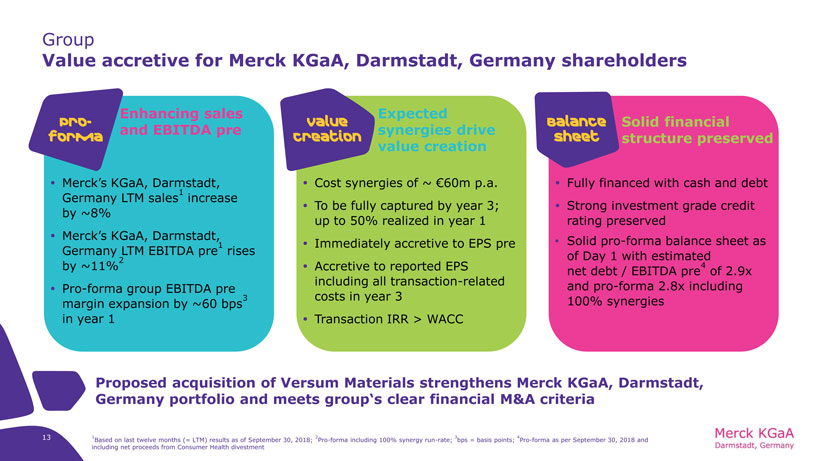

Group VALUE ACCRETIVE FOR MERCK KGAA, DARMSTADT, GERMANY SHAREHOLDERS Pro-forma ENHANCING SALES AND EBITDA PRE Merck’s KGaA, Darmstadt, Germany LTM sales1 increase by ~8%Merck’s KGaA, Darmstadt, Germany LTM EBITDA pre1 rises by ~11%2Pro-forma group EBITDA pre margin expansion by ~60 bps3 in year 1 Value creation EXPECTED SYNERGIES DRIVE VALUE CREATION Cost synergies of ~ 60m p.a. To be fully captured by year 3; up to 50% realized in year 1Immediately accretive to EPS pre Accretive to reported EPS including all transaction-related costs in year 3Transaction IRR > WACC Balance sheet SOLID FINANCIAL STRUCTURE PRESERVED Fully financed with cash and debtStrong investment grade credit rating preserved Solid pro-forma balance sheet as of Day 1 with estimated net debt / EBITDA pre4 of 2.9x and pro-forma 2.8x including 100% synergies PROPOSED ACQUISITION OF VERSUM MATERIALS STRENGTHENS MERCK KGAA, DARMSTADT, GERMANY PORTFOLIO AND MEETS GROUP‘S CLEAR FINANCIAL M&A CRITERIA Based on last twelve months (= LTM) results as of September 30, 2018; 2Pro-forma including 100% synergy run-rate; 3bps = basis points; 4Pro-forma as per September 30, 2018 and including net proceeds from Consumer Health divestment

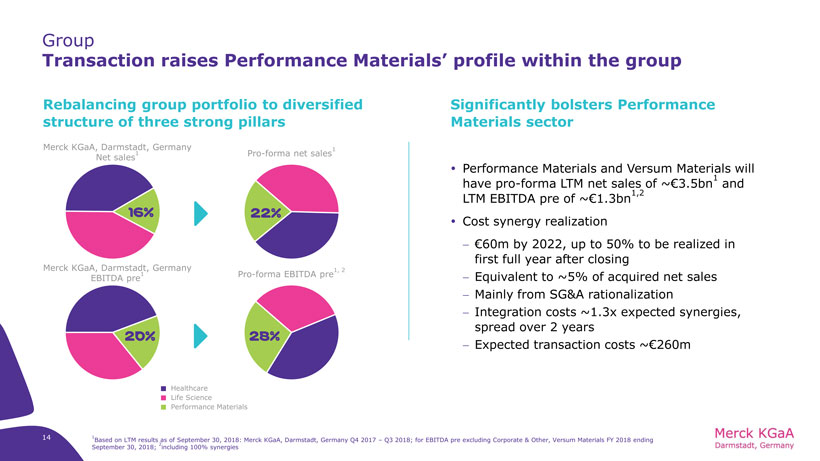

Group TRANSACTION RAISES PERFORMANCE MATERIALS’ PROFILE WITHIN THE GROUP REBALANCING GROUP PORTFOLIO TO DIVERSIFIED STRUCTURE OF THREE STRONG PILLARS Merck KGaA, Darmstadt, Germany Net sales1 Pro-forma net sales1 Merck KGaA, Darmstadt, Germany EBITDA pre1 Pro-forma EBITDA pre1, 2 Healthcare Life Science Performance Materials SIGNIFICANTLY BOLSTERS PERFORMANCE MATERIALS SECTOR Performance Materials and Versum Materials will have pro-forma LTM net sales of ~ 3.5bn1 and LTM EBITDA pre of ~ 1.3bn1,2 Cost synergy realization 60m by 2022, up to 50% to be realized in first full year after closing Equivalent to ~5% of acquired net sales Mainly from SG&A rationalization Integration costs ~1.3x expected synergies, spread over 2 years Expected transaction costs ~ 260m 1Based on LTM results as of September 30, 2018: Merck KGaA, Darmstadt, Germany Q4 2017 Q3 2018; for EBITDA pre excluding Corporate & Other, Versum Materials FY 2018 ending September 30, 2018; 2including 100% synergies

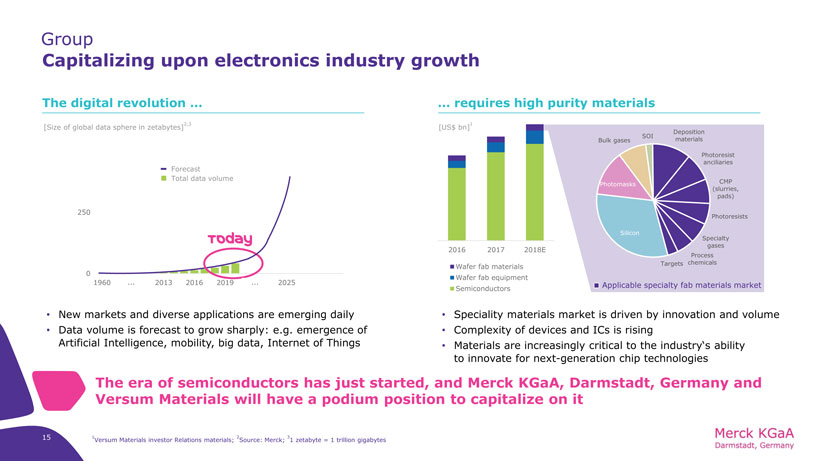

Group CAPITALIZING UPON ELECTRONICS INDUSTRY GROWTH THE DIGITAL REVOLUTION … [Size of global data sphere in zetabytes]2,3 500 Forecast Total data volume 250 Today 0 1960 2010 ... 2013 2016 2019 2022 ... 2025 New markets and diverse applications are emerging daily Data volume is forecast to grow sharply: e.g. emergence of Artificial Intelligence, mobility, big data, Internet of Things … REQUIRES HIGH PURITY MATERIALS [US$bn]1 Deposition SOI Bulk gases materials Photoresist anciliaries Photomasks CMP (slurries, pads) Photoresists Silicon Specialty gases 2016 2017 2018E Process Targets chemicals Wafer fab materials Wafer fab equipment Semiconductors Applicable specialty fab materials market Speciality materials market is driven by innovation and volume Complexity of devices and ICs is rising Materials are increasingly critical to the industry‘s ability to innovate for next-generation chip technologies THE ERA OF SEMICONDUCTORS HAS JUST STARTED, AND MERCK KGAA, DARMSTADT, GERMANY AND VERSUM MATERIALS WILL HAVE A PODIUM POSITION TO CAPITALIZE ON IT 1Versum Materials investor Relations materials; 2Source: Merck; 31 zetabyte = 1 trillion gigabytes

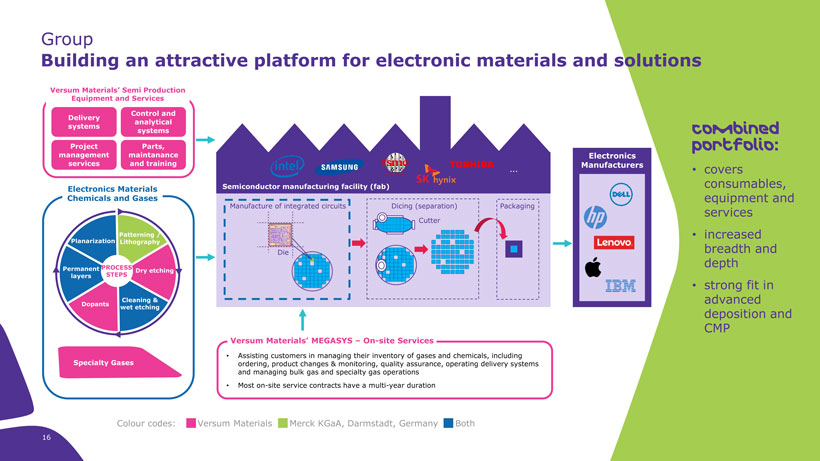

Group BUILDING AN ATTRACTIVE PLATFORM FOR ELECTRONIC MATERIALS AND SOLUTIONS VERSUM MATERIALS’ SEMI PRODUCTION EQUIPMENT AND SERVICES CONTROL AND DELIVERY ANALYTICAL SYSTEMS SYSTEMS PROJECT PARTS, MANAGEMENT MAINTANANCE SERVICES AND TRAINING ELECTRONICS MATERIALS CHEMICALS AND GASES PATTERNING / PLANARIZATION LITHOGRAPHY PERMANENT PROCESS DRY ETCHING LAYERS STEPS CLEANING & DOPANTS WET ETCHING SPECIALTY GASES ELECTRONICS … MANUFACTURERS SEMICONDUCTOR MANUFACTURING FACILITY (FAB) Manufacture of integrated circuits Dicing (separation) Packaging Cutter Die VERSUM MATERIALS’ MEGASYS ON-SITE SERVICES Assisting customers in managing their inventory of gases and chemicals, including ordering, product changes & monitoring, quality assurance, operating delivery systems and managing bulk gas and specialty gas operations Most on-site service contracts have a multi-year duration Colour codes: Versum Materials Merck KGaA, Darmstadt, Germany Both Combined portfolio: covers consumables, equipment and services increased breadth and depth strong fit in advanced deposition and CMP

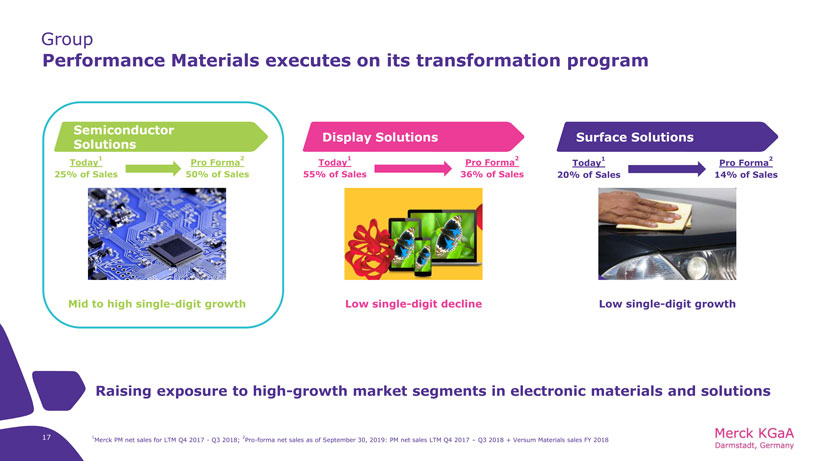

Group PERFORMANCE MATERIALS EXECUTES ON ITS TRANSFORMATION PROGRAM SEMICONDUCTOR SOLUTIONS TODAY1 PRO FORMA2 25% OF SALES 50% OF SALES MID TO HIGH SINGLE-DIGIT GROWTH DISPLAY SOLUTIONS TODAY1 PRO FORMA2 55% OF SALES 36% OF SALES LOW SINGLE-DIGIT DECLINE SURFACE SOLUTIONS TODAY1 PRO FORMA2 20% OF SALES 14% OF SALES LOW SINGLE-DIGIT GROWTH RAISING EXPOSURE TO HIGH-GROWTH MARKET SEGMENTS IN ELECTRONIC MATERIALS AND SOLUTIONS 1Merck PM net sales for LTM Q4 2017 - Q3 2018; 2Pro-forma net sales as of September 30, 2019: PM net sales LTM Q4 2017 Q3 2018 + Versum Materials sales FY 2018

EXECUTIVE SUMMARY

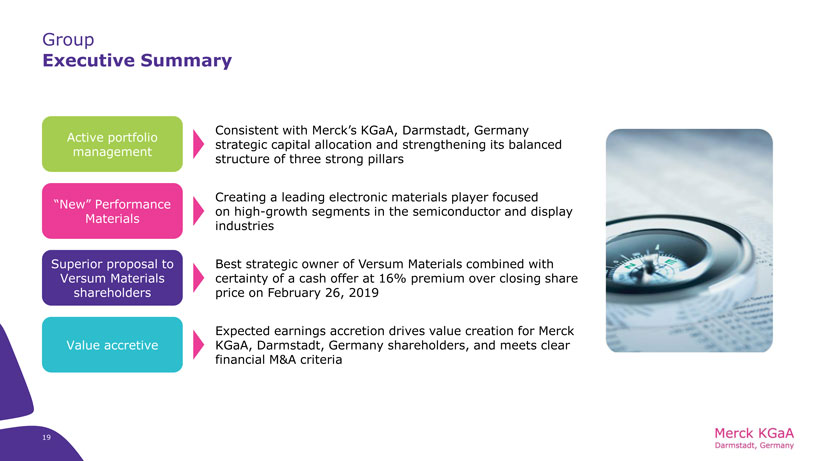

Group EXECUTIVE SUMMARY Active portfolio management Consistent with Merck’s KGaA, Darmstadt, Germany strategic capital allocation and strengthening its balanced structure of three strong pillars “New” Performance Materials Creating a leading electronic materials player focused on high-growth segments in the semiconductor and display industries Superior proposal to Versum Materials shareholders Best strategic owner of Versum Materials combined with certainty of a cash offer at 16% premium over closing share price on February 26, 2019 Value accretive Expected earnings accretion drives value creation for Merck KGaA, Darmstadt, Germany shareholders, and meets clear financial M&A criteria

BACK-UP

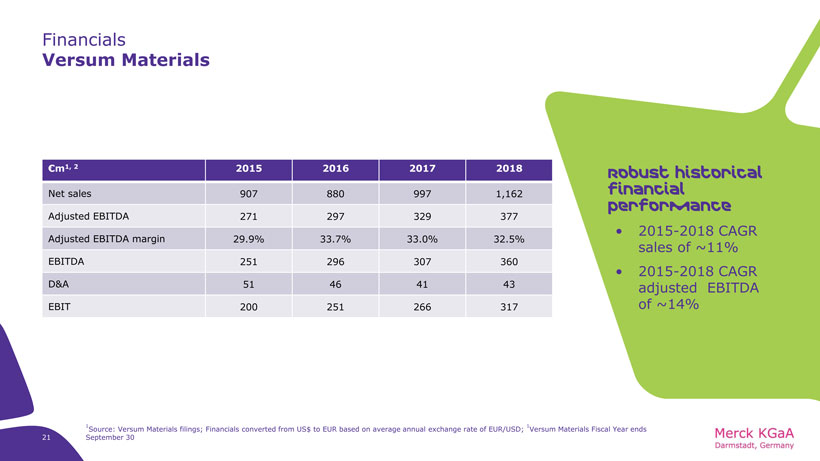

Financials VERSUM MATERIALS M1, 2 2015 2016 2017 2018 Net sales 907 880 997 1,162 Adjusted EBITDA 271 297 329 377 Adjusted EBITDA margin 29.9% 33.7% 33.0% 32.5% EBITDA 251 296 307 360 D&A 51 46 41 43 EBIT 200 251 266 317 Robust historical financial performance 2015-2018 CAGR sales of ~11% 2015-2018 CAGR adjusted EBITDA of ~14% 1Source: Versum Materials filings; Financials converted from US$to EUR based on average annual exchange rate of EUR/USD; 1Versum Materials Fiscal Year ends September 30

CONSTANTIN FEST SVENJA BUNDSCHUH ALESSANDRA HEINZ Head of Investor Relations Assistant Investor Relations Assistant Investor Relations ANNETT WEBER AMELIE SCHRADER EMAIL: investor.relations@emdgroup.com WEB: www.emdgroup.com PHONE: +49 6151 72-3321 Institutional Investors / Institutional Investors / Analysts Analysts EVA STERZEL PATRICK BAYER Retail Investors / AGM / Institutional Investors / CMDs / IR Media Analysts

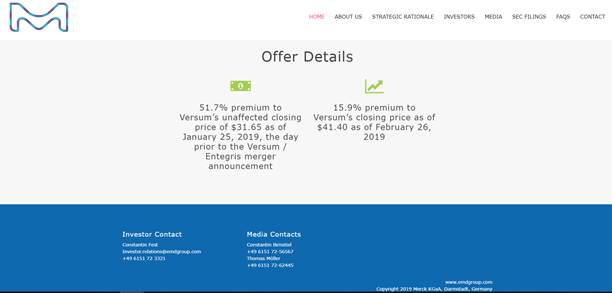

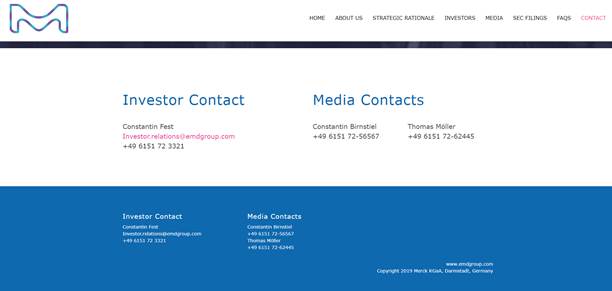

5.Images taken from the microsite at www.thesuperiorproposal.com.

February 27, 2019

11:15 am

Legal Disclaimer

Cookies Disclaimer with Link to Data Protection Policy

February 27, 2019

11:15 am

Home Page

February 27, 2019

11:15 am

About Us Page

February 27, 2019

11:15 am

February 27, 2019

11:15 am

Strategic Rationale Page

February 27, 2019

11:15 am

Investors Page

February 27, 2019

11:15 am

Media Page

February 27, 2019

11:15 am

SEC Filings Page

February 27, 2019

11:15 am

FAQs Page

February 27, 2019

11:15 am

February 27, 2019

11:15 am

February 27, 2019

11:15 am

Contacts Page

6. The following talking points (Q&A) were first used for outreach on February 27, 2019.

Project Sparkling | Q&A

Contents

| I. | Deal financials, technicalities and financing | 1 |

| II. | Strategic rationale | 4 |

| III. | Operational questions (including Tax) | 7 |

| IV. | Regulatory issues | 8 |

| V. | Employees | 9 |

| VI. | Customers | 10 |

| VII. | Suppliers | 11 |

| I. | Deal financials, technicalities and financing |

| 1. | What is the total purchase price based on your proposal of $48 per share? |

| · | Our proposal of $48 per share implies an aggregate purchase price for all outstanding shares of $5.3 billion. |

| 2. | How much conviction do you have behind your proposal? Can we count on you to see it through? |

| · | We believe very strongly in the strategic, financial and operational benefits of this transaction for both companies. |

| · | We fully expect a favorable reaction to our attractive proposal as both financial and non-financial terms clearly speak for themselves. |

| · | We are fully committed to enter into the transaction as soon as reasonably practicable. This is demonstrated by the fact that our proposal reflects a premium of more than 50% to Versum’s undisturbed share price, on 25 January 2019, the day prior to the Versum-Entegris merger announcement. In addition to that, our proposal is all-cash. |

| 3. | Now that you have made the proposal to Versum, what is the next step? |

| · | It is now up to the Versum Board to review our proposal. We trust that they will make the formal determination that Merck KGaA, Darmstadt, Germany’s proposal represents (or could reasonably be expected to represent) a superior proposal to its current pending merger with Entegris. |

| · | Immediately following such determination we are prepared to enter into discussions with Versum to reach a definitive agreement. We expect to be able to complete this process within a very short period of time. |

| 4. | If the Versum Board fails to engage with you, will you consider taking your proposal directly to Versum shareholders through a tender offer? |

| · | We have made a very attractive all-cash proposal to the Versum Board of Directors, which is clearly superior to the proposed transaction with Entegris. We are convinced that the Versum Board of Directors, following a careful review, will arrive at the same conclusion. |

| · | We feel very strongly about this transaction but will not speculate about hypothetical next steps. |

| - 6 - |

| 5. | If necessary, will you consider soliciting proxies against the vote for the existing merger agreement between Versum and Entegris? |

| · | We are convinced that our all-cash proposal is superior to the proposed transaction with Entegris and, as such, is in the best interest of Versum’s shareholders. |

| · | We feel very strongly about this transaction but will not speculate about hypothetical next steps. |

| 6. | Can the Versum management recommend the proposal? Does it have to give a recommendation at all? |

| · | Under U.S. corporate governance, the Versum Board and not management will make determinations about any proposal to acquire Versum. |

| · | The Merger Agreement with Entegris prescribes various protocols for the Versum Board to follow in evaluating the proposal. We fully expect the Versum Board of Directors to abide by the terms of the Merger Agreement with Entegris. |

| · | If the Versum Board concludes that our proposal is a superior proposal, they will have the right to walk away from the Entegris transaction. |

| 7. | Is this a defensive move by Merck KGaA, Darmstadt, Germany? Would the combined Entegris and Versum business challenge your position? |

| · | When we announced the new Performance Materials business strategy last year, we clearly stated that we will focus on the electronic materials market and that the semiconductor business within Performance Materials is our growth area. We see attractive opportunities in this sector for both profitable organic and inorganic growth that we want to leverage. |

| · | This means that our Performance Materials business is and will continue to be strongly positioned irrespective of a potential combination of Entegris and Versum. However, with Versum having made the decision to enter into a merger, we are confident that we are the best home for the business. |

| · | We are confident that a combination of Versum and Merck KGaA, Darmstadt, Germany is a more sustainable and strategically sound alternative, creating a leading player in the electronic materials market. The combined business will deliver leading-edge innovation in electronic materials to our customers around the globe. |

| 8. | What will happen to Merck KGaA, Darmstadt, Germany if the Entegris-Versum merger is successful? |

| · | We will continue executing our strategy with a focus on electronic materials for the semiconductor and display industries as a very attractive, long-term sustainable segment. |

| · | The move does not change the fundamentals of our strategic assumptions. We remain committed to tackling industry challenges and supporting our customers to bring innovative technologies to the market. |

| 9. | Did you first try to talk to the Versum Board of Directors about your proposal? |

| · | The Versum Board of Directors has already decided to merge with Entegris, and therefore precluded themselves from speaking to us before we make a proposal. However, once it made that decision, it opened the door to the possibility of superior offers, which our proposal clearly is. We are making this proposal in the most amicable way possible given the merger agreement and German law requirements. |

| 10. | Do you think your approach will make it more difficult to gain mutual understanding and achieve positive financial results? |

| · | The Versum Board has already made the decision to merge with a partner. We are presenting Versum and its shareholders with a superior proposal. We trust that both stakeholders will come to a mutual agreement. |

| - 7 - |

| 11. | Why don’t you wait until Versum and Entegris have merged and acquire the combined entity? |

| · | We believe strongly in the strategic fit with Versum, which is why we have made a superior proposal. |

| · | The combined business of Merck KGaA, Darmstadt, Germany and Versum would have a stronger R&D capability, which would enable us to accelerate innovation for our customers in a rapidly evolving market place. |

| · | Customers would also benefit from increased scale, product and service depth, enhanced global presence and a strengthened supply chain that would help to drive leading innovation supported by long-term tailwinds in the industry. |

| · | The combined business of Merck KGaA, Darmstadt, Germany and Versum would offer customers a deep and complementary portfolio of electronic materials, equipment and services. |

| 12. | How will this deal be financed? How does your leverage change? |

| · | Merck KGaA, Darmstadt, Germany has a market capitalization of approximately €41 billion and a strong investment grade credit rating. Any requisite financing in excess of cash on hand would be supported by committed financing with no incremental conditionality. |

| 13. | How did you calculate the announced proposal price? How did you value Versum? |

| · | We, along with our advisors, utilized a variety of valuation techniques and methodologies ranging from intrinsic value analysis to market and transaction-based benchmarking in arriving at our announced proposal price for Versum. We firmly believe in Versum’s growth and profitability prospects, as well as the synergistic benefits of a combination and believe that they are deserving of the valuation that we have put forth. |

| 14. | What is the premium and how is it justified, especially to Merck KGaA, Darmstadt, Germany shareholders? |

| · | Our announced transaction price of $48 represents a premium of |

| § | 51.7% to Versum’s unaffected closing price of $31.65 as of January 25, 2019. |

| § | 15.9% to Versum’s closing price as of $41.40 as of February 26, 2019; |

| · | Our proposal implies an enterprise value to 2019 EBITDA multiple of 12.6x, which is reflective of the caliber of business Versum has built. When taking into consideration our expected run rate of combination synergies, the implied enterprise value to 2019 EBITDA multiple is 11.0x. We believe this combination will create substantial value for Merck KGaA, Darmstadt, Germany shareholders as we create a market leading innovator in end markets poised for an inflection. |

| 15. | Your offer represents only a 13.6% premium to the current value of the pending transaction with Entegris. Is that your best offer? |

| · | Our all-cash proposal, representing a premium of 51.7% over unaffected is clearly superior to the offer from Entegris and offers a certain value without subjecting Versum shareholders to the integration risks of the combination and the performance risks of the combined company. |

| · | We believe our proposal is a full and fair price based on publicly available information. |

| 16. | This is the first time in a decade that Merck KGaA, Darmstadt, Germany has made an unsolicited/hostile bid – how certain can we be that this does not become a difficult acquisition for Merck KGaA, Darmstadt, Germany? |

| · | The Versum Board of Directors has already made the decision to merge with a partner. |

| · | We are merely presenting the Versum Board and shareholders with a superior, all-cash proposal. |

| - 8 - |

| · | We are making this proposal in the most amicable way possible under current circumstances. |

| · | We have proposed what we believe is a full and fair price on the basis of the value we identify in the deal. On the topic of value creation we believe the transaction will add value to Merck KGaA, Darmstadt, Germany for two reasons: |

| a. | A compelling strategic fit to complement our Performance Materials platform. |

| b. | We expect the transaction to be EPS pre-accretive already in the 1st full year and accretive to reported EPS – i.e. all in – in the 3rd full year after closing. |

| 17. | What is the source of the announced synergies? |

| · | We expect to realize cost synergies of about €60 million p.a., mainly derived from SG&A rationalization. While we also expect to realize some topline revenue gains, we have not included those in our synergy projections, and as such the final realized synergies from the transaction can be expected to exceed our initial projections. While synergies are of course important, they are not the primary focus for this transaction. Our proposal follows a strong industrial logic and brings two strong complementary partners together to form a leader in the electronic materials market with great growth potential. |

| 18. | Do you expect a rating downgrade? |

| · | We will retain our investment-grade credit-rating and are in close dialogue with the rating agencies. |

| · | On a pro-forma basis, our net debt / EBITDA leverage ratio will be ~2.9x as of day 1 (excluding synergies), and we are highly committed to swiftly deleverage following the closing of the proposed transaction. |

| 19. | Does the potential acquisition of Versum have an impact on your long-term ambition of an around 30% margin level? |

| · | Performance Material’s margin ambition of around ~30% is a long-term view on our business. Given that Versum reports a ~33% margin and we are aiming to realize ~€60 million synergies p.a. this acquisition is expected to be margin accretive to our long term ambition. So you can do your math, and will see that the effect will be visible but should not be overestimated. |

| 20. | What will be our PPA charge from the deal? |

| · | PPA could be in the range of €200-250 million – but a bit early to really assess |

| II. | Strategic rationale |

| 21. | What’s the strategic rationale? |

| · | The combined R&D strength of Merck KGaA, Darmstadt, Germany and Versum would increase innovation speed, capacity and expertise to generate novel technologies. |

| · | Customers would benefit from increased scale, product and service depth, enhanced global presence and a strengthened supply chain which would help to drive leading innovation supported by long-term tailwinds in the industry |

| · | We intend to join forces to strengthen our supplier base, quality and logistics, thereby providing the best total cost of ownership to our customers. |

| · | Versum has a similar innovation-driven business model as Merck KGaA, Darmstadt, Germany. |

| · | Our portfolios are very complementary with our established presence in lithography and Versum’s established position in deposition, thereby bringing novel technologies to our customers. |

| · | Enabling additional source for innovation through leading positions in key segments driven by new chip architectures. |

| - 9 - |

| · | We are the best home for Versum to the highest benefit for shareholders, employees and customers! |

| 22. | Why should Versum shareholders accept your proposal now that the Versum Board of Directors has recommended a merger with Entegris? Why is your proposal superior? How does the deal create value? |

| · | Our proposal is superior for Versum shareholders, combining the certainty of an all-cash transaction with a 51.7% premium over Versum’s last undisturbed trading price on the day prior to the Versum / Entegris merger announcement. |

| · | Unlike the Entegris transaction, the only shareholder approval required by Merck KGaA, Darmstadt, Germany's proposal is that of Versum's shareholders. |

| 23. | Why are you making this proposal now? |

| · | The Versum Board has already decided to merge with a partner. Once it made that decision, it opened the door to the possibility of a superior proposal. |

| 24. | Do you think Merck KGaA, Darmstadt, Germany’s management has the strategic and financial capacity to execute the proposed transaction so shortly after completing Merck KGaA, Darmstadt, Germany’s biggest acquisition ever – Sigma-Aldrich? |

| · | We completed the Sigma-Aldrich integration at the end of 2018 and achieved the targeted synergies of €280 million. |

| · | We also divested our consumer health business at the end of November 2018, which accelerated our deleveraging considerably. |

| · | We also said that the Semiconductor Solutions business is a key area of growth and investment for us, and the fact that Versum’s Board of Directors recently decided to merge with a partner, opened the door to an attractive inorganic growth opportunity. |

| 25. | How do you see the semiconductor industry’s cycle at this stage – when do you expect a pick-up? What is your view on cyclicality? |

| · | We are not buying this for short term cycle gains. We see a positive long-term trend in the market, with semiconductor materials market growth estimate at mid-single digit (equivalent to 1.5-2.0x GDP). In particular, we assume continued outperformance to million square inches from new chip technologies (e.g. 3D Nand ramps) and pick up of the capex cycle for future capacity expansions. |

| · | Within Merck KGaA, Darmstadt, Germany, Versum would become part of a diversified group, which can more easily afford and safeguard investments through the cycle. |

| · | And the end market applications are now much more widely diversified than in the past, especially automotive and industrial. |

| 26. | Can you provide more insight into the semiconductor material’s industry? |

| · | The electronics market is driven by key mega trends and diverse applications. Nearly all market demand innovation in electronics. We see diversification across multiple end applications. For example automotive and industrial applications are key growth drivers. Most mega trends are driven by electronics. Data explosion and AI will have the biggest impact and will be enabled by new chip architectures. |

| · | We see the semiconductor materials industry as a highly attractive segment based on strong demand for semiconductors driven by several key trends: AI, big data, as well as diversity in applications. |

| · | We think these trends will generate sustainable growth and strong margins. |

| - 10 - |

| 27. | Why is Versum’s long-term future better with you than with Entegris? |

| · | We are the best home for Versum to the highest benefit for shareholders, employees and customers! |

| · | The combined R&D strength of Merck KGaA, Darmstadt, Germany and Versum would increase innovation speed, capacity and expertise to generate novel technologies. |

| · | Customers would benefit from increased scale, product and service depth, enhanced global presence and a strengthened supply chain which would help to drive leading innovation supported by long-term tailwinds in the industry |

| · | We intend to join forces to strengthen our supplier base, quality and logistics, thereby providing the best total cost of ownership to our customers. |

| · | Versum has a similar innovation-driven business model as Merck KGaA, Darmstadt, Germany. |

| · | Our portfolios are very complementary with our established presence in lithography and Versum’s established position in deposition, thereby bringing novel technologies to our customers. |

| · | Enabling additional source for innovation through leading positions in key segments driven by new chip architectures. |

| · | Within Merck KGaA, Darmstadt, Germany, Versum would become part of a diversified group and, as such, would be in a much better position to afford and safeguard investments through the cycle – unlike operating as a pure play company. |

| 28. | Why Versum and not Entegris? |

| · | The electronics market is driven by key megatrends and diverse applications; data explosion and AI will have the biggest impact |

| · | These trends will be enabled by innovations in chip technologies (e.g. new memory architectures); these technologies require novel materials e.g. new precision materials to be introduced into the chip (by deposition), CMP polishing of complex layers with multiple materials, greater purity of all materials |

| · | Versum focuses on advanced materials (mainly deposition) w/ complementary equipment & services |

| · | Together, we would be well positioned in future-critical segments, mainly deposition materials, spin-on dielectrics and CMP slurries which is complemented by Merck KGaA, Darmstadt, Germany’s presence in lithography |

| · | With the combined business, we will deliver leading-edge innovation in electronic materials to our customers around the globe |

| · | Our portfolios are very complementary with our established presence in lithography and Versum’s established position in deposition. |

| · | Versum has a similar innovation-driven business model as Merck KGaA, Darmstadt, Germany. The combined R&D strength of Merck KGaA, Darmstadt, Germany and Versum would increase innovation speed, capacity and expertise to generate novel technologies. |

| 29. | Why do you invest in Performance Materials, and then in cyclical Semi, instead of your biggest and most attractive asset Life Science? |

| · | Merck KGaA, Darmstadt, Germany’s guardrails require a balanced structure and three strong businesses – Healthcare, Life Science and Performance Materials. We regularly review our portfolio to ensure sufficient diversification and make disciplined capital allocation decisions accordingly. Given our belief in Healthcare’s pipeline potential as well as Life Science’s recent completion of the Sigma-Aldrich acquisition, investing into the Performance Materials business is a logical next step. |

| - 11 - |

| 30. | We understand why you try to re-position Performance Materials. However, this again stretches your financial room, and in view of the latest developments in the Life Science sector (Danaher acquiring GE Biopharma; 25 February 2019), how do you justify allocating your capital into a sector where you have not been particularly successful recently, as opposed to a cash machine like Life Science? Why Performance Materials instead of Life Science? |

| · | Merck KGaA, Darmstadt, Germany’s guardrails require a balanced structure and three strong businesses – Healthcare, Life Science and Performance Materials. We regularly review our portfolio to ensure sufficient diversification and make disciplined capital allocation decisions accordingly. Given our belief in Healthcare’s pipeline potential as well as Life Science’s recent completion of the Sigma-Aldrich acquisition, investing into the Performance Materials business is a logical next step. |

| · | As for our financial flexibility, over the past months we have continuously stressed the importance of deleveraging as a clear priority for the entire Group. Thanks to this focus, and most recently the successful divestment of the Consumer Health business to P&G in late 2018, we managed to reduce our net debt / EBITDA pre ratio below 2 and have regained the required financial flexibility. |

| · | This proposal executes on the Performance Materials strategy communicated mid-2018 as it repositions the Performance Materials business as a leading electronic materials player by investing into a business that promises mid to high single-digit growth: semi-conductors. The potential acquisition of Versum would allow us to double the contribution of this highly attractive business. |

| · | Having said that, smaller bolt-ons in Life Science are of course not ruled out. |

| 31. | What is your view of the latest initiatives in China to build and strengthen a local semiconductor industry – what makes you so sure that with this development in China, your Semi Solutions business will not go the route of your liquid crystals business? |

| · | We see a strong need for semiconductors for end-users in China. |

| · | We are continuously assessing our strategy in China based on the evolving market place and policy environment. However, the China chip consumption is expected to grow strongly which as a material supplier is beneficial. |

| · | The U.S. share of the semiconductor market is expected to stay constant, while Japan and Korea is decreasing. |

| · | With the combined business, we will deliver leading-edge innovation in electronic materials to our customers around the globe. |

| · | There are two main factors that need to be taken into account that our customers value. The first is technology and performance of our materials, the second is quality of those materials and our strong supply reliability track record. Additionally, we have very strong IP protection, deep process know-how and advanced technology competencies. All in all: It is our global footprint, strong IP and know-how that gives us a competitive advantage. |

| III. | Operational questions (including Tax) |

| 32. | Does the Performance Materials team have enough management capacity to integrate Versum given that it is already engaged in a restructuring process? |

| · | Merck KGaA, Darmstadt, Germany is a large, stable, family-driven organization with a successful track record of completing and integrating acquisitions. |

| · | When we announced the new Performance Materials business strategy last year, we clearly stated that we will focus on the electronic materials market and that the semiconductor business within Performance Materials is a key growth area. |

| · | In order to ensure sustained profitable growth, we must make necessary adjustments, primarily in the display business as well as in R&D and production in order to react to the changed market conditions. |

| - 12 - |

| 33. | Should the combination between the two companies go ahead, do you expect staff reductions? |

| · | We are a long-term oriented, family-owned company. We have a large and sustainable footprint and a proven track record as a conscientious long-term employer, also when executing and integrating acquisitions. |

| · | Our focus is on growing the combined business, not staff reductions. We are excited about the capabilities that Versum’s workforce would bring into the combined business. |

| · | In fact, investing for leadership in semiconductors solutions is at the core of our Performance Materials strategy, and we plan to maintain Versum’s Tempe, Arizona home as the major hub for the combined electronic materials business in the U.S. |

| · | We intend to retain the Versum R&D and manufacturing footprint. |

| 34. | Will Versum be completely integrated? Will the Versum brand continue to exist? |

| · | Our high regard for Versum’s management and its employees will be reflected in all decisions, and we expect the leadership of Versum to be personally involved in this process. Right now, we are focused on closing the transaction and will make integration decisions at the appropriate time. |

| 35. | What will happen to Versum’s management and HQ? |

| · | We are a long-term oriented, family-owned, science & technology company; we have a strong track record of successfully completing large U.S. acquisitions and investing for growth. As a case in point, we will maintain Versum’s home in Tempe as the major hub for the combined electronic materials business in the U.S. |

| · | Our high regard for Versum’s management and its employees will be reflected in all decisions and we expect the leadership of Versum to be personally involved in this process. Right now we are focused on closing the transaction and will make organizational decisions on integration at the appropriate time. |

| 36. | What are the anticipated U.S. (federal and state) tax implications of this acquisition? |

| · | There are no tax implications that would be different than those if a US based multi-national made the purchase. Selling shareholders would have a capital gain that would be subject to tax. |

| 37. | What is your recent history as a U.S. taxpayer? Did your U.S. operations benefit from the recent U.S. tax reform just as U.S. companies did? |

| · | Merck KGaA, Darmstadt, Germany pays all legally required taxes at the Federal, State and local levels. |

| 38. | What is your record of paying taxes in Massachusetts? Have you received tax credits for investing in businesses there? Are you seeking credits for further investment in Billerica? |

| · | Merck KGaA, Darmstadt, Germany pays all legally required taxes to Massachusetts. If there are tax incentives offered by the State or local town governments intended to attract investment, Merck KGaA, Darmstadt, Germany will take advantage of them. |

| 39. | Could this be portrayed as a type of tax inversion? |

| · | No. A cash acquisition is not an inversion. |

| IV. | Regulatory issues |

| 40. | Why are you confident you can obtain the requisite U.S. regulatory clearances to close this deal in a timely manner? |

| · | We expect the transaction can close in 2H19, subject to customary closing conditions. Legal or regulatory obstacles are not expected. |

| - 13 - |

| · | We already have a strong presence in the U.S., where we have proven ourselves to be an outstanding employer of U.S. talent and an outstanding corporate citizen. |

| · | Merck KGaA, Darmstadt, Germany has invested over $25 billion in the U.S. over the past decade and employs more than 10,000 people across 56 sites nationwide. |

| · | We have carefully reviewed the proposed transaction from the regulatory perspective and are confident we will be able to complete the transaction on the timetable we have outlined. |

| · | We are an experienced acquirer and already successfully completed numerous regulatory filings in the U.S. M&A context. |