| O L S H A N | 1325 AVENUE OF THE AMERICAS ● NEW YORK, NEW YORK 10019

TELEPHONE: 212.451.2300 ● FACSIMILE: 212.451.2222 |

EMAIL: AFREEDMAN@OLSHANLAW.COM

DIRECT DIAL: 212.451.2250

May 22, 2019

VIA EDGAR AND ELECTRONIC MAIL

Daniel F. Duchovny

Special Counsel

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Mergers and Acquisitions

100 F Street, N.E.

Washington, D.C. 20549

Re: MiMedx Group, Inc. (“MiMedx”, “MDXG” or the “Company”)

Soliciting Materials filed pursuant to Rule 14a-12 on May 7, 2019

Filed by Prescience Partners, LP, Prescience Point Special Opportunity LP, Prescience Capital, LLC, Prescience Investment Group, LLC, Eiad Asbahi, Richard J. Barry, M. Kathleen Behrens Wilsey, Ph.D., Melvin L. Keating, and K. Todd Newton (collectively, “Prescience”)

File No. 001-35887

Dear Mr. Duchovny:

We acknowledge receipt of the comment letter of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “SEC”), dated May 9, 2019 (the “Staff Letter”), with regard to the above referenced matter. We have reviewed the Staff Letter with Prescience and provide the following responses on its behalf. For ease of reference, the comments in the Staff Letter are reproduced in italicized form below. Terms that are not otherwise defined have the meaning ascribed to them in the above referenced soliciting materials filed with the SEC in connection with the upcoming annual meeting of shareholders of the Company.

| 1. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Provide support for your statement that your nominees have “[i]mmense credibility and reputational capital,” “[d]emonstrated public company turnaround and restatement experience,” and “[e]xtensive healthcare and biopharma experience and relationships.” |

Prescience acknowledges the Staff’s comment and notes that in Prescience’s preliminary proxy statement filed with the SEC on May 9, 2019 (the “Proxy Statement”) Prescience revised these statements as set forth below to clarify the factual basis for Prescience’s opinions (changes underlined):

“Immense Credibility and Reputational Capital Based on Decades of Executive and Board Experience”

| | |

| | |

| O L S H A N F R O M E W O L O S K Y L L P | WWW.OLSHANLAW.COM |

“Demonstrated Public Company Turnaround and Restatement Experience as Executives and Board Members”

“Extensive Healthcare and BioPharma Experience and Relationships Developed as Leaders of Healthcare and Biopharmaceutical Companies”

Additionally, Prescience believes that the nominees’ experience as executives and/or directors of public and private companies, as disclosed in Prescience’s above referenced soliciting materials, provide a reasonable factual basis for those statements.

| Ø | Richard Barry – Mr. Barry has healthcare and biopharmaceutical experience from his service as a director of Elcelyx Therapeutics, Inc. (“Elcelyx”), a private pharmaceutical company, since February 2013, as a Managing Member of GSM Fund, LLC, a fund investing in Elcelyx, since February 2013, and as a director of Sarepta Therapeutics, Inc. (“Sarepta”), a genetic medicine company, since June 2015. He also has experience overseeing a turnaround strategy from his service as a director of Sarepta. |

| Ø | M. Kathleen Behrens Wilsey, Ph.D. – Ms. Wilsey has credibility and reputational capital from her service as a member of the President’s Council of Advisors on Science and Technology from 2001 to 2009, and she has healthcare and biopharmaceutical experience and experience overseeing a turnaround strategy from her service as a director of Sarepta, which she joined in 2009 and where she currently serves as Chair. |

| Ø | Melvin Keating – Melvin Keating possesses healthcare and biopharmaceutical experience and overall credibility from his service as a director of various publicly traded marketing, semiconductor and hotel companies and his executive roles at both public and private companies, including as Chief Financial Officer of Quovadx, Inc., a healthcare software company. Additionally, his service as a director at Vitamin Shoppe, Inc. and several semiconductor companies gave him experience overseeing a turnaround strategy. |

| Ø | K. Todd Newton – Mr. Newton possesses healthcare and biopharmaceutical experience from his service as Chief Executive Officer and a member of the board of directors of Apollo Endosurgery, Inc., a leader in the field of gastrointestinal therapeutic endoscopy, since 2014, and as Executive Vice President, Chief Financial Officer and Chief Operating Officer at ArthroCare Corporation (“ArthroCare”), a medical device company, from 2009 to June 2014 (Chief Operating Officer starting in 2013). Mr. Newton also has turnaround and restatement experience from his time at ArthroCare, which restated its financial statements during his tenure. |

| 1. | We note the analytical report dated January 7, 2019 you filed as soliciting materials. You state that the company’s shares “are conservatively worth at least $8.09” per share. The inclusion of valuations in soliciting materials is only appropriate and consonant with Rule 14a-9 when made in good faith and on a reasonable basis and where accompanied by disclosure which facilities shareholders’ understanding of the basis for and the limitations on the projected realizable values. See Exchange Act Release No. 16833 (May 23, 1980). Please provide us with your analysis supporting your valuation of the stock and confirm that in future filings in which you provide a valuation you will include a similar analysis. In addition, supplementally explain why your valuation is not so qualified and subject to such material limitations and qualifications as to make inclusion of the $8.09 figure unreasonable. |

Prescience acknowledges the Staff’s comment and believes that its calculation of a potential value of $8.09 per share was made in good faith and on a reasonable basis. Prescience’s calculation was based mainly on a sensitivity analysis of the Company’s implied share price, reflecting assumptions around revenue retention and valuation multiples, as described in detail below. Prescience confirms that it will include supporting analysis similar to what is provided below in any future soliciting materials in which it provides a valuation for the Company.

The sensitivity analysis in the table below, which is included in Prescience’s above referenced soliciting materials, reflects Prescience’s belief that MiMedx’s share price has substantial growth potential. At the midpoint of Prescience’s valuation, Prescience assumed that MiMedx’s revenue will stabilize at $272m once the current controversy regarding the Company, which has weighed heavily on its business, clears. This represents a 30% decline from MiMedx’s annualized Q2 2018 revenue guidance of $388m, which Prescience believes makes it a conservative estimate of future revenues. By applying a 3.5x sales multiple to those estimated future revenues, which multiple is in line with selected peers who trade at an average of 3.6x LTM revenue (see the table below titled “MDXG Peer Group Valuation Metrics”), Prescience calculated a midpoint valuation of $8.09 per share.

The sensitivity analysis reflects Prescience’s views on MiMedx’s share price in the short-to-medium term. Over the long term, Prescience expects MiMedx to return to substantial growth due to its industry-leading products, attractive end markets and promising pipeline of late-stage clinical trials for its Amniofix Injectable product. On this basis, Prescience believes $8.09 per share to be a conservative estimate of potential long-term value.

| MDXG Share Price Sensitivity Analysis (1) |

| Revenue Retained: % / $ (2) (3) |

| Valuation Multiple | | 50% / $194m | 60% / $233m | 65% / $252m | 70% / $272m | 75% / $291m | 80% / $310m | 85% / $330m |

| 2.5x | $4.13 | $4.95 | $5.36 | $5.78 | $6.19 | $6.60 | $7.01 |

| 3.0x | $4.95 | $5.94 | $6.44 | $6.93 | $7.43 | $7.92 | $8.42 |

| 3.5x | $5.78 | $6.93 | $7.51 | $8.09 | $8.66 | $9.24 | $9.82 |

| 4.0x | $6.60 | $7.92 | $8.58 | $9.24 | $9.90 | $10.56 | $11.22 |

| 4.5x | $7.43 | $8.91 | $9.65 | $10.40 | $11.14 | $11.88 | $12.63 |

| (1) | Based on 117.5m fully diluted shares outstanding. |

| (2) | Revenue retained defined as amount of annualized Q2 2018 revenue retained. |

| (3) | Assumes Q2 2018 revenue was in-line with the midpoint of guidance at $97m, amounting to $388m on an annualized basis. |

| MDXG Peer Group Valuation Metrics (1) |

| ($ in millions, Data as of 1/4/2019) | Ticker | Market Cap | Enterprise Value | EV / LTM Revenue |

| Osiris Therapeutics, Inc. | OSIR | $491.3 | $450.9 | 3.3x |

| Integra LifeSciences Holdings Corporation | IART | $3,660.2 | $4,879.7 | 3.3x |

| Anika Therapeutics, Inc. | ANIK | $470.4 | $321.4 | 3.0x |

| CyroLife, Inc. | CRY | $957.5 | $1,140.7 | 4.6x |

| | Average | 3.6x |

| (1) | Peers selected by Prescience from publicly traded healthcare companies that, like MiMedx, provide wound care and other therapeutic products – developed from naturally occurring tissues and chemicals found in the human body – to the healthcare industry. |

| 3. | Please refer to comment 1 above and provide us the support for the following disclosure included in your January report: |

| · | That the “chances of MDXG going bankrupt are remote.” |

Prescience believes that a bankruptcy filing by MiMedx is highly unlikely, primarily for two reasons:

| Ø | MiMedx has a strong balance sheet – The Company has zero debt and, according to publicly available information, had $33m of cash on its balance sheet as of December 31, 2017. With a significant net cash position, the Company does not have any other major obligations to fund besides its ongoing investigations and restatements. |

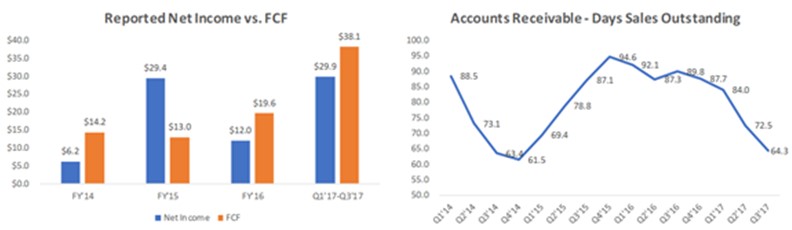

| Ø | MiMedx has a highly flexible cost structure – With Selling, General and Administrative (“SG&A”) expenses accounting for around 80% of its total expenses, MiMedx has a high proportion of variable costs and can easily scale its operating expenses to match its revenue. This gives the Company the ability to generate strong Free Cash Flow (“FCF”) at significantly lower revenue levels, as illustrated by its historical FCF generation: |

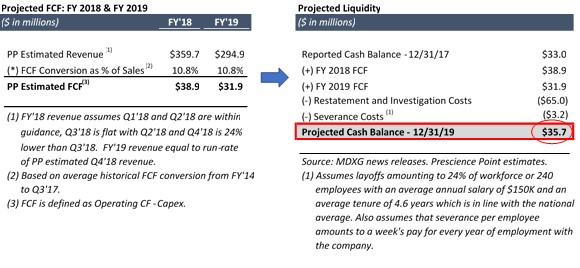

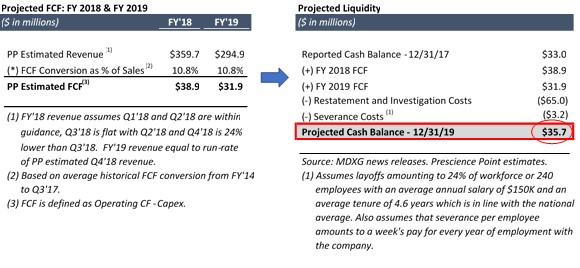

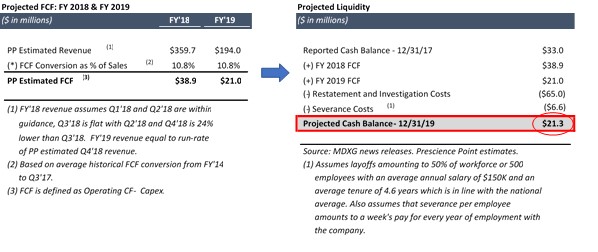

Prescience believes that it is exceedingly rare for a business with such strong financial characteristics to become insolvent. Despite the recent, material contraction in its revenue, the Company’s debt-free balance sheet and flexible cost structure should enable it to generate enough liquidity to fund itself through its current crisis. To illustrate, Prescience has constructed a liquidity analysis with the following assumptions:

| Ø | Restatement period concludes at the end of FY 2019; |

| Ø | Restatement and investigation costs total $65m combined in FY 2018 and FY 2019;1 |

| Ø | Q1 2018 and Q2 2018 revenue are in-line with guidance at $92m and $97m, respectively, Q3 2018 is flat with Q2 2018, and Q4 2018 is 24% lower than Q3 2018 at $73.7m,2 adding up to total FY 2018 revenue estimated at $359.7m; |

| Ø | FY 2019 revenue is equal to run-rate Q4 2018 revenue of $294.9m (estimated Q4 2018 revenue of $73.7m multiplied by 4); and |

| Ø | FCF conversion of 10.8% of sales, which is equal to MDXG’s average FCF conversion from FY 2014 through the first nine months of FY 2017. |

Using the above assumptions, Prescience projected that the Company will have approximately $35.7m of cash remaining on its balance sheet when its restatement process concludes:

1 Prescience believes this is a fair and conservative assumption based in part on director nominee K. Todd Newton’s experience at Arthrocare, which spent ~$50m over approximately 1.5 years (late 2008 to early 2010) for a restatement process which was similar in scope.

2 The estimated decline of 24% from Q3 to Q4 is based on the recently announced 24% headcount reduction, which was in response to a recent softening in the Company’s revenue.

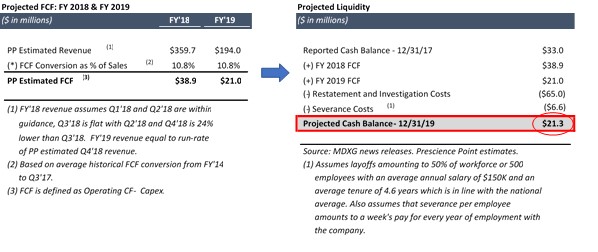

Even in a severe downside scenario where MiMedx’s FY 2019 revenue declines to $194.0m, representing a 50% decline from its annualized Q2 2018 guidance, Prescience projects that the Company will still have $21.3m of cash on its balance sheet when its restatement process concludes:

| · | That the “majority of MDXG’s sales are legitimate and sustainable. Only a small portion of revenue was attributable to end-of-quarter channel stuffing, while widespread bribes/kickbacks did not occur.” |

Prescience spoke with several doctors, other industry participants and former Company employees about MiMedx. These individuals had overwhelmingly positive things to say about MiMedx’s products, including that they (i) are dehydrated and thus store easier than competing products, which are cryogenically frozen, (ii) are offered in a wider variety of sizes than competing products, (iii) have a long, five-year shelf life, (iv) reimburse well from private insurance and Medicare / Medicaid, and (v) perhaps most importantly, are highly effective in healing wounds. Even the Wall Street Journal, which has written a series of scathing articles about the Company, has noted the quality of its products:

“No one has suggested MiMedx’s products are faulty… MiMedx’s amniotic-membrane products are the ones most commonly used by doctors and are generally considered to be safe and of good quality, said Robert Kirsner, director of the University of Miami Hospital Wound Center.” 3

MiMedx’s main competitors in the allograft space, Osiris Therapeutics, Inc. (“Osiris”) and Organogenesis Holdings, Inc. (“Organogensis”), are sizable and thriving. Based on publicly available information, these companies currently generate almost $150m and $200m of annual revenue, respectively, and both are growing their toplines in excess of 20% YoY due to the rapid growth of the allograft market. Based on the foregoing, Prescience believes that MiMedx has been well-positioned to take advantage of a sizable, fast-growing market in which other companies have proven successful.

See Exhibit A attached hereto for a discussion of Prescience’s analysis of the Company’s financial results and belief that allegations of massive fraud do not reconcile with the numbers.

3 Gretchen Morgenson, et al., Highflying Medical Firm, a Help to Wounded Veterans, Falls to Earth. The Wall Street Journal. July 23, 2018.

See Exhibit B attached hereto for a discussion of Prescience’s views with respect to the allegations against the Company.

| · | That the “government is highly unlikely to levy a fine large enough to cause |

MDXG any serious distress.”

Based on Prescience’s research, which included discussions with an attorney specializing in government investigations and security enforcement, Prescience believes that any future government fines to be levied by the SEC, Department of Justice (“DOJ”) and/or Veteran Affairs (“VA”) are unlikely to be sizable enough to put the Company in serious distress. This view is based on, among other things, (i) the remedial measures already taken by MiMedx to clean-up its business (e.g. firing its CEO, CFO and COO for cause, clawing back compensation, hiring a restructuring firm, etc.) and the general willingness of regulators to recognize such actions in determining fines, (ii) expectations of the regulatory environment under the current enforcement administrations and (iii) general recent experience regarding the size of fines relative to a company’s ability to pay. Prescience believes that this view also is supported by the following comments from SEC Commissioner Hester M. Pierce given during a recent speech in May 2018:

“Civil penalties against corporations are another area of concern and a reason that I have voted against some enforcement recommendations…After being the victims of the fraud that has led to an SEC investigation, shareholders are now paying a corporate penalty to resolve the matter…The responsible individuals have twice forced the shareholders to pay for their wrongdoing. The SEC needs to be extremely careful in how and when it imposes corporate penalties to avoid making an already bad situation worse for shareholders.”

| · | The first and third-seventh bullet points under the caption “Research Highlights.” |

The referenced statements are reproduced below with the corresponding support.

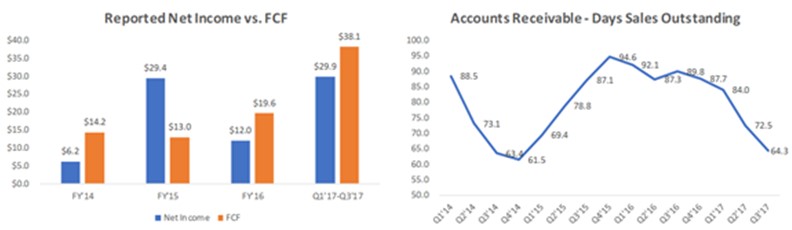

| Ø | MiMedx has a highly flexible cost structure which allows it to generate strong free cash flow at much lower revenue levels. For example, in FY’14, MiMedx generated $14.2m of FCF on just $118.2m of revenue. |

As shown in the below table, MiMedx generated $14.2m of FCF (defined as operating cash flow less capital expenditures) in FY 2014 and generated a total of $84.9m of FCF from FY 2014 through YTD Q3 2017 based on financial statements filed by the Company with the SEC.

| Ø | According to numerous former employees and physicians, MiMedx’s allograft products are considered among the best in the industry. Given this, along with the fact that competitors Osiris and Organogenesis generate hundreds of millions of dollars in revenue with products of similar or lesser quality, the claim that the vast majority of MiMedx sales are fraudulent appears quite far-fetched. |

See the support provided for Prescience’s belief for the statements beginning “majority of MDXG’s sales are legitimate and sustainable…” on page 6 above.

| Ø | Critics have failed to produce any smoking guns – such as internal documents or emails, or any other direct evidence – proving the existence of 1) a widespread physician inducement scheme, or 2) multiple years-worth of product stuffed in the channel. |

See Exhibit B attached hereto for a discussion of Prescience’s views with respect to the allegations against the Company.

| Ø | Allegations by key whistleblowers are largely centered around end-of-quarter channel stuffing, not massive fraud. |

See Exhibit B attached hereto for a discussion of Prescience’s views with respect to the allegations against the Company.

| Ø | Former employees we spoke with also indicated that MDXG engaged in end-of-quarter channel stuffing, not massive fraud. |

See Exhibit B attached hereto for a discussion of Prescience’s views with respect to the allegations against the Company.

| Ø | Claims of massive fraud are not supported by the numbers. From FY’14 through Q3’17, reported FCF exceeded net income, and DSOs during that time period averaged a reasonable 79.6 days. Further, MDXG’s revenue growth, sales per rep and SG&A expenses as a % of sales are all in-line with Osiris and Organogenesis. |

See Exhibit A attached hereto for a discussion of Prescience’s analysis of the Company’s financial results and belief that allegations of massive fraud do not reconcile with the numbers.

| · | Your belief that “MDXG shareholders will enjoy a similarly positive outcome once the current turmoil clears” in reference to past events at Arthrocare and two other companies. |

Prescience believes that past events at Arthocare and certain other companies demonstrate that the negative news flow that typically accompanies the announcement of financial restatements and internal investigations does not mean that a company is doomed. In Prescience’s view, the market often overly discounts uncertainty. Time and again, Prescience has seen the market automatically price-in the worst-case scenario without fully taking into consideration all of the prevailing evidence. Provided below is an explanation for why Prescience believes these examples are relevant to MiMedx’s current situation:

Arthrocare

In late 2007, Arthrocare was accused by short sellers of channel stuffing and insurance fraud. In July 2008, Arthrocare announced that its financial statements going back to 2006 would have to be restated due to revenue recognition issues. That same month, the company also announced that it was the subject of a formal SEC investigation. In December 2008, the company revealed that it had identified additional accounting irregularities, and that the scope of its restatements had expanded to include fiscal years 2000 through 2005. Then, in January 2009, its shares were delisted from the Nasdaq. Prescience believes these developments were remarkably similar to those at MiMedx, and the headlines were similarly concerning for investors. Also, like MiMedx, Arthrocare kept investors largely in the dark during its restatement process and did not issue any updates on the ongoing performance of the business.

On November 18, 2009, Arthrocare announced that it had completed its restatements after nearly 16 months of work. The results of the restatements revealed that Arthrocare’s revenue had been inflated by only a modest amount from end-of-quarter channel stuffing – Total revenue in 2007, 2006, 2005 and 2004 were reduced by 12%, 7%, 4% and 1%, respectively. After hitting a low of $2.95 following its delisting, Arthrocare shares subsequently rallied and a little over a year later were trading above $30. The company was eventually sold a few years later to Smith & Nephew for $48.25 per share.

Other Examples

Prescience notes that the recent resignation of Ernst & Young LLP (“E&Y”) as MiMedx’s auditor appears to have created a significant amount of anxiety for investors. Adding to this anxiety was the Current Report on Form 8-K that MiMedx filed with the SEC on December 7, 2018, which outlined the adverse audit events that occurred prior to E&Y’s resignation. These adverse events included the identification of insufficient internal controls, the need for an expanded audit scope, and E&Y’s determination that it could not rely on representations from management due to the presence of some legacy personnel. While Prescience believes that although the resignation of an auditor during a restatement process is certainly not a positive, other companies experiencing similar events have been able to hire a new auditor, complete their restatements, and eventually get relisted.

One recent example is Advanced Emissions Solutions, Inc. (“ADES”). ADES initially engaged KPMG as its outside auditor in May 2013. In August 2014, the company revealed that its prior financial statements for FY 2011 and FY 2012 could no longer be relied upon and would have to be restated. Then, on January 23, 2015, KPMG abruptly resigned as ADES’s auditor. In a Current Report on Form 8-K providing further detail on KPMG’s resignation, a number of adverse audit events were disclosed. This included the identification of insufficient internal controls along with the identification of numerous potential accounting irregularities. In our view, the most concerning adverse event was KPMG’s determination that it could no longer rely on management representations for the following reasons:

“In addition, KPMG expressed to management and the Audit Committee its concern that there is an inappropriate tone at the top, discontent with the Company’s timeliness and responsiveness to its requests for information and inability to determine whether management has made available all financial records and related data. In giving the Company its resignation notice, KPMG referenced the issues noted above and its inability to rely on management’s representations.”4

4 ADES Form 8-K filed with the SEC on January 23, 2015.

Prescience believes the adverse events that KPMG identified appeared to be just as, if not more, concerning to investors than what E&Y identified in connection with its resignation as MiMedx’s auditor.

In June 2015, ADES managed to replace KPMG by hiring Hein & Associates as its new outside auditor. The company undertook a corporate restructuring and replaced several of its senior executives. After almost two years of work, the company completed its financial restatement in April 2016. Soon after, in July 2016, its shares were relisted on Nasdaq. After cratering to an all-time low of $2.75 during its restatement process, ADES shares as of early January 2019 traded near $11.

While Prescience believes the above referenced examples are most relevant to MiMedx, Prescience also is aware of others. Another recent example is MiMedx’s competitor Osiris, whose stock as of January 2019 had almost quintupled since cratering to an all-time low of $2.68 during its lengthy financial restatement process, which was completed in March 2017. Osiris was accused of overstating its revenue in a number of ways including channel stuffing and recognizing revenue using artificially inflated prices, and in November 2017, the company settled with the SEC and agreed to pay a $1.5 million fine.

| · | Your belief on page 4 that “management was overly aggressive in growing non-core revenue sources…” |

MiMedx generates the majority of its revenue from the use of its Epifix allograft for diabetic foot ulcers and venous leg ulcers (DFUs/VLUs). The Company also generates a smaller portion of its revenue from the use of Epifix for non-DFUs/VLUs, as well as from its Amniofix injectable product. Prescience was informed by the Company’s investor relations department, and confirmed independently through its own research, that the recent softening in MiMedx’s revenue was primarily attributable to reimbursement changes for some of its non-core revenue sources. These changes included Noridian Healthcare Solutions, LLC (“Noridian”), a government claims contractor for Medicare in certain west coast states, recently dropping coverage of allograft products for non-core indications (i.e. non-DFUs/VLUs). Additionally, Blue Cross Blue Shield recently dropped coverage of MiMedx’s Amniofix injectable product, which Prescience believes is most likely because this product is not yet approved by the U.S. Food and Drug Administration (the “FDA”). Both of these changes took effect in the fourth quarter of 2018.

Prescience was also informed by MiMedx’s investor relations team, as well as by industry experts, that reimbursement was cut for these non-core revenue sources because the use of Amniofix for non-DFU/VLU indications is not backed by extensive clinical data and that Amniofix – although currently in clinical trials – is a biologic which is not currently approved by the FDA. Based on this, Prescience believes it has a reasonable basis to conclude that MiMedx management was overly aggressively in pursuing and growing its non-core revenue sources.

* * * * *

The Staff is invited to contact the undersigned with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments. Thank you for your assistance.

| Sincerely, |

| |

| /s/ Andrew Freedman |

| |

| Andrew Freedman |

cc: Eiad Asbahi, Prescience Partners, LP

EXHIBIT A

Prescience believes that allegations of massive fraud at MiMedx do not reconcile with the numbers. If MiMedx was massively stuffing the channel, then Prescience believes this should have resulted in extremely poor FCF generation in relation to net income, as well as significantly elevated DSOs; however, this was not the case. From FY 2014 to Q3 2017, the Company’s reported cumulative FCF (defined as operating CF – capex) was $84.9m, while reported cumulative net income was actually $7.4m lower at $77.5m. Meanwhile, during that same time period, DSOs have trended downwards and have averaged a reasonable 79.6 days.

Some may argue that because MiMedx is restating almost six years of financials, its historical cash flow statements should not be relied upon, however, in its experience, Prescience believes that the amount of a company’s cash flow is a metric that is difficult to fabricate.

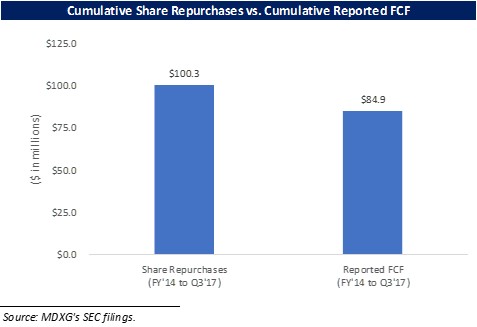

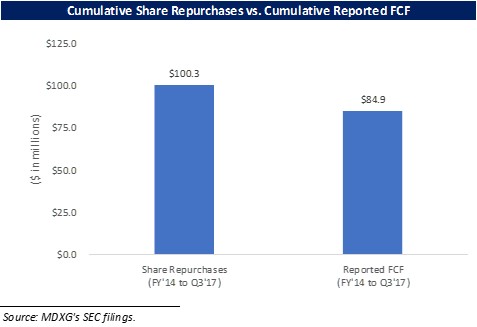

Furthermore, the Company repurchased $100.3m worth of shares from FY 2014 to Q3 2017 without taking on any debt, which leads Prescience to believe that its reported cumulative FCF of $84.9m during that time period is accurate.

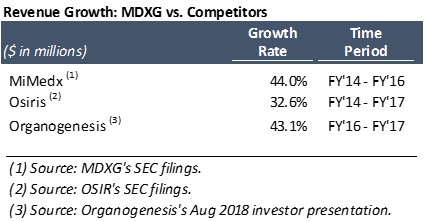

Prescience believes that the claim that MiMedx is a massive fraud is also refuted by the fact that its historical sales growth, sales per rep and SG&A expenses are all in line with those of its competitors:

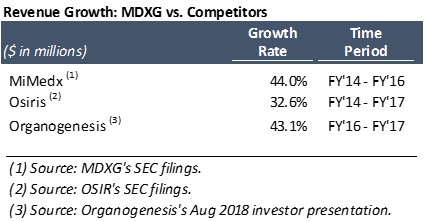

- Sales growth: Critics have argued that MiMedx’s revenue CAGR of 44.0% from FY 2014 to FY 2016 could only have been achieved through illegal sales practices. But due to the rapid growth of the wound care market, many of the Company’s competitors are also growing in excess of 30%. Notably, Osiris grew its revenue at a 32.6% CAGR from FY 2014 to FY 2017, while Organogenesis grew its revenue by 43.1% in FY 2017 (as disclosed in its August 2018 investor presentation).

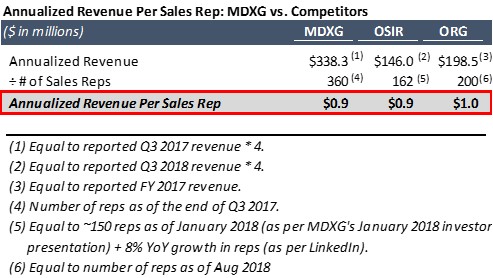

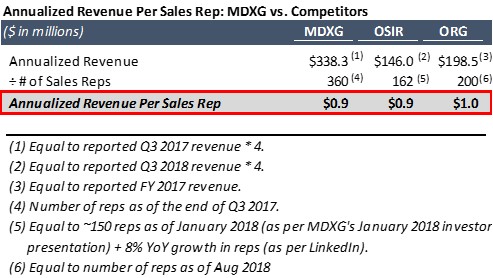

- Sales per rep: If MiMedx was massively stuffing the channel and inducing doctors, then Prescience believes that the Company’s revenue per sales rep would be significantly higher than its competitors. However, as shown in the table below, MiMedx’s annualized revenue per rep in its last reported quarter (Q3 2017) was $0.9m, while Osiris and Organogenesis are currently generating around the same amount per rep at around $1m:

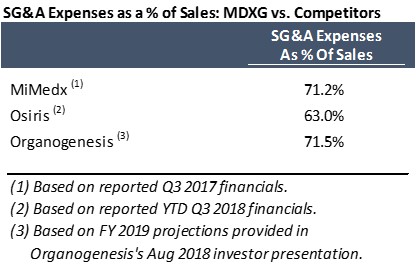

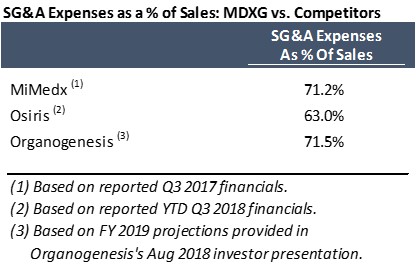

- SG&A expenses: Critics have pointed to the Company’s high SG&A expenses – 72.1% of sales in the first three quarters of FY 2017 – as evidence of fraudulent behavior. They believe that these expenses are elevated due to (1) bribery payments, and/or (2) improper expensing of returned channel stuffed product. Yet, Organogenesis projects that it will spend a similar amount on SG&A expenses in FY 2019 at 71.5% of sales, while Osiris also spent a significant amount on SG&A expenses in YTD Q3 2018 at 63.0% of sales.

Prescience believes that the timing of recent revenue decline supports Prescience’s conclusion that MiMedx is a mainly legitimate business.

Prescience further believes that if MiMedx were committing massive fraud, then the Company’s revenue would have almost immediately started to collapse following the hiring of Mr. Coles as interim CEO, who Prescience believes would have undoubtedly begun to correct much of the fraudulent behavior. Yet, this did not happen.

Prescience was informed by MiMedx’s investor relations department and confirmed independently through its own research, that the recent softening in MiMedx’s revenue was primarily attributable to reimbursement changes for some of its non-core revenue sources. These changes included Noridian, a government claims contractor for Medicare in certain west coast states, recently dropping coverage of allograft products for non-core indications (i.e. non-DFUs/VLUs). Additionally, BCBS recently dropped coverage of MiMedx’s Amniofix injectable product. Both of these changes took effect in the fourth quarter of FY 2018. Prescience believes the fact that the recent decline in MiMedx’s revenue was primarily attributable to reimbursement changes rather than changes to improper sales practices strongly indicates that the Company did not engage in massive fraud.

Prescience believes that the reason insurance companies and Medicare are suddenly dropping coverage for some of MiMedx’s non-core products and indications is because the Company’s Amniofix injectable product, although undergoing clinical trials at the moment, does not have FDA approval. Furthermore, the use of allografts for indications beyond DFUs and VLUs is backed by less clinical data. Prescience believes the current controversy has resulted in the riskier parts of MiMedx’s business being treated with extra scrutiny, and these cuts are the result of that scrutiny. Prescience believes it is doubtful that these cuts will spread to MiMedx’s core business given that the use of allografts in treating DFUs and VLUs is a well-accepted and common practice in wound care. Furthermore, Prescience does not believe that insurance and Medicare singling out MiMedx for reimbursement cuts when its products are some of, if not the best in the industry.

EXHIBIT B

Prescience’s views with respect to certain of the allegations made against the Company are discussed below. Overall, Prescience believes that critics of the Company have not proved the existence of a widespread physician inducement scheme or other massive fraud. These views are based on publicly available information and Prescience’s conversations with several doctors, other industry participants and former Company employees.

Channel Stuffing Allegations

Prescience believes that the whistleblower allegations regarding the Company’s channel stuffing activities (such as Whistleblower cases of Luke Tornquist, Jess Kruchoski, Mike Fox and Hal Purdy) generally discuss activities carried out at quarter end to hit earnings targets and amounting to a few million dollars per quarter. For example, whistleblower allegations estimated that Q1 2016 revenue was inflated by $2.5 million from channel stuffing.5 This represents just 4.6% of the Company’s reported Q1 2016 revenue of $53.4 million. Former employees with whom Prescience spoke also indicated that the Company’s channel stuffing only amounted to only a small portion of total revenue per quarter and was primarily done at the end of quarters to hit earnings targets. As a result, Prescience does not believe that the Company’s channel stuffing activities were on a large enough scale to constitute massive fraud relative to MiMedx as a whole. In addition, Prescience respectfully refers the Staff to Exhibit A attached hereto for further discussion regarding Prescience’s belief that the Company’s channel stuffing activities were not on a large enough scale to constitute massive fraud relative to MiMedx as a whole.

Bribery Allegations

Recent indictments of doctors at VA hospitals in South Carolina and Minneapolis have been cited as key evidence in support of bribery claims. In May 2018, three South Carolina VA workers were indicted for excessively using MiMedx products in exchange for meals, tips and gratuities. Four months later, in September 2018, five Minneapolis VA workers resigned over undisclosed issues related to MiMedx products.

Critics believe that these recent developments at the VA prove that MiMedx is extensively bribing doctors. However, Prescience believes that this conclusion is unfounded. To begin with, Prescience believes it is too attenuated to conclude that evidence of potentially questionable sales tactics at two hospitals means that this is a systemic, Company-wide issue. Additionally, the available evidence indicates that these alleged bribes were not directed by senior management but were instead committed by sales agents who were subsequently terminated for their behavior. Prescience believes this is further supported by the fact that: (i) MiMedx has yet to be indicted for any crimes related to these cases; (ii) MiMedx had previously sent information to the Office of Inspector General (“OIG”) regarding employees it terminated for possibly not following VA rules; and (iii) MiMedx’s investor relations staff informed Prescience that, based on information received to date, the South Carolina VA indictments appear to be linked to a terminated South Carolina sales rep that the Company had referred to the OIG.

Further, the South Carolina VA doctors under indictment (Donna Becker, Dolores Farrer and Carol Guardiola) were granted a continuance by agreeing to a Pretrial Diversion Program (“PTD”), indicating that these doctors will be placed on probation and the charges will likely be dropped. This indicates that the alleged misconduct that occurred between these doctors and the MiMedx sales reps was not severe enough to warrant criminal prosecution. Per the U.S. Department of Justice’s website, PTD is an alternative to prosecution which seeks to divert certain offenders from traditional criminal justice processing into a program of supervision and services administered by the U.S. Probation Service. Participants who successfully complete the program are not charged or, if charged, have the charges against them dismissed; unsuccessful participants are returned for prosecution.

5 Kruchoski et al v. MiMedx Group, Inc. et al, 16 CV 04171; MiMedx Group, Inc. v. Fox, 16 CV 11715

Kickback Allegations

In regards to the allegations that MiMedx had provided kickbacks to doctors primarily via physician-owned distributors (“PODs”), critics have pointed to the Company’s relationships with distributors and sales agents RedMed and CPM Medical (“CPM”) as key evidence that MiMedx is using PODs to provide kickbacks – RedMed was recently charged with providing kickbacks to doctors of the South Texas Health System, while CPM previously sold product to Forest Park Medical Center, a physician-owned hospital whose owners were indicted for paying kickbacks to doctors.

Critics argue that, because RedMed and CPM have ties to kickbacks not involving MiMedx, these distributors must have also provided kickbacks related to MiMedx products. However, Prescience does not believe that such critics have produced direct evidence to support this claim. Additionally, it is important to note that neither RedMed nor CPM are owned by physicians. In other words, they are not PODs. Critics have also pointed to a letter that they received from a former MiMedx employee alleging a kickback scheme involving MiMedx products at Baylor Surgical Hospital (as discussed in a February 2018 Periscope). Prescience has been unable to confirm or deny this claim, but believes it would go too far to conclude that a single allegation of kickbacks at a single hospital means that MiMedx is providing kickbacks to doctors across the country.

Prescience believes that the U.S. government’s and healthcare industry’s efforts to crackdown on PODs due to their inherent conflicts of interest casts further doubt on the allegations of widespread kickbacks, and that, as a result of this increased scrutiny, many large hospital chains have strictly forbid or curtailed business with PODs. The 2013 SFA helped to inform the medical community of the dangers posed by PODs, and many hospitals and health systems have recognized these dangers and implemented policies to better govern their relationships with PODs. Prescience believes that PODs are no longer concentrated in large hospital chains, many of which have adopted policies forbidding or strictly curtailing business with PODs.

Finally, numerous former employees with whom Prescience spoke were dismissive of the allegation that MiMedx was extensively using PODs. Several doctors who are users of MiMedx products and healthcare industry experts with whom Prescience recently spoke also agreed with this assessment.

In regards to additional evidence of the inducement of doctors, critics have pointed to the hiring of several former ABH sales reps by MiMedx. ABH paid bribes and kickbacks to doctors to induce the use of its products over a period of several years, starting in 2008. However, Prescience believes that the fact that MiMedx hired several reps from ABH does not automatically lead to the conclusion that the Company adopted ABH’s fraudulent sales practices across its organization. As an example, Osiris hired ABH’s former CEO Todd Clawson as its National Sales Director and, based on its recently completed internal investigation, was not found to have paid bribes or kickbacks.