Role of the Owner Trustee and Indenture Trustee

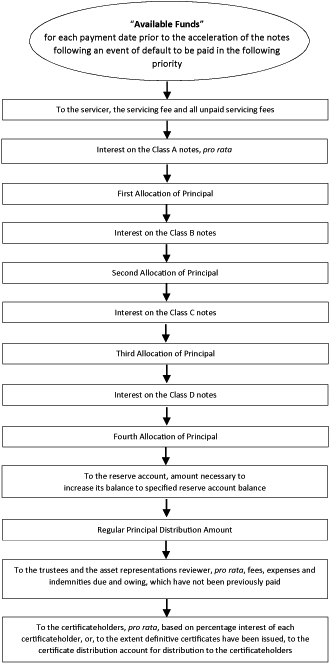

Neither the owner trustee nor the indenture trustee will make any representations as to the validity or sufficiency of the sale agreement, the servicing agreement, the trust agreement, the administration agreement, the indenture, the asset representations review agreement, the notes, the certificates or any related receivables or related documents. As of the closing date, neither the owner trustee nor the indenture trustee will have examined the receivables. If no event of default has occurred under the indenture, the owner trustee and indenture trustee will be required to perform only those duties specifically required of them under the servicing agreement, the trust agreement, the administration agreement or the indenture, as applicable. Generally, those duties are limited to the receipt of the various certificates, reports or other instruments required to be furnished to the owner trustee or indenture trustee under the servicing agreement, the administration agreement, or the indenture, as applicable, the making of payments or distributions to noteholders and certificateholders in the amounts specified in certificates provided by the servicer.

The owner trustee and the indenture trustee will be under no obligation to exercise any of the issuing entity’s powers or powers vested in it by the sale agreement, the servicing agreement, trust agreement or indenture, as applicable, or to make any investigation of matters arising thereunder or to institute, conduct or defend any litigation thereunder or in relation thereto at the request, order or direction of any of the noteholders (other than requests, demands or directions relating to an asset representations review as described under “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Asset Representations Review” or to the investors’ rights to communicate with other investors described under “The Indenture—Noteholder Communication; Lists of Noteholders”), unless those noteholders have offered to the owner trustee or the indenture trustee security or indemnity reasonably satisfactory to it against the reasonable costs, expenses and liabilities which may be incurred therein or thereby.

The owner trustee and the indenture trustee, and any of their affiliates, may hold securities in their own names. In addition, for the purpose of meeting the legal requirements of local jurisdictions or for the enforcement or conflict of interest matters, the owner trustee and indenture trustee, in some circumstances, acting jointly with the depositor or the servicer, respectively, will have the power to appointco-trustees or separate trustees of all or any part of the issuing entity property. In the event of the appointment ofco-trustees or separate trustees, all rights, powers, duties and obligations conferred or imposed upon the owner trustee or indenture trustee by the sale agreement, the servicing agreement, the trust agreement, the administration agreement or the indenture, as applicable, will be conferred or imposed upon the owner trustee or indenture trustee and the separate trustee orco-trustee jointly, or, in any jurisdiction in which the owner trustee or indenture trustee is incompetent or unqualified to perform specified acts, singly upon the separate trustee orco-trustee who will exercise and perform any rights, powers, duties and obligations solely at the direction of the owner trustee or indenture trustee.

CONA, the servicer and the depositor may maintain other banking relationships with the owner trustee and indenture trustee in the ordinary course of business.

The owner trustee and indenture trustee will be entitled to certain fees and indemnities described under “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Fees and Expenses” in this prospectus.

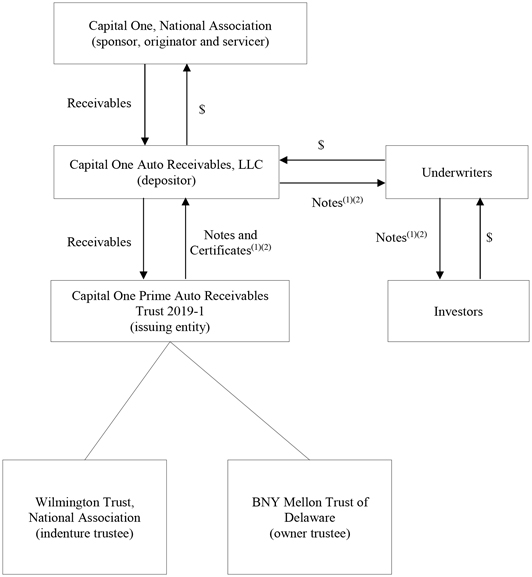

THE DEPOSITOR

The depositor, Capital One Auto Receivables, LLC, a wholly-owned special purpose subsidiary of CONA, was formed on January 26, 2001 as a Delaware limited liability company. The principal place of business of the depositor is at 1600 Capital One Drive, Room 27907B, McLean, Virginia 22102. The depositor was formed to purchase, accept capital contributions of or otherwise acquire motor vehicle retail installment sale contracts and motor vehicle loans; to own, sell, and assign the receivables; and to issue and sell one or more securities. Since its inception, the depositor has been engaged in these activities solely as (i) the purchaser of receivables from CONA pursuant to purchase agreements, (ii) the seller of receivables to securitization trusts pursuant to sale agreements, (iii) the depositor that formed various securitization trusts pursuant to trust agreements and (iv) the entity that executes underwriting agreements and purchase agreements in connection with issuances of asset-backed securities.

39