TABLE OF CONTENT

As filed with the Securities and Exchange Commission on February 14, 2020

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 1-A

REGISTRATION STATEMENT

TIER I OFFERING

REGULATION A OFFERING STATEMENT

UNDER THE SECURITIES ACT OF 1933

E*HEDGE FINANCIAL HOLDING CORP.

(Exact name of registrant as specified in its charter)

Delaware | | 6719 | | 83-4190099 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Classification Code) | | (I.R.S. Employer Identification No.) |

200 S. Biscayne Blvd Ste. 2790

Miami, FL 33131

Telephone: (800) 407-3577

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Devon Parks

President and Chief Executive Officer

1001 4th Ave Ste. 3200

Seattle, WA 98104

Telephone: (800) 407-3577

The address for our corporate agent of service:

8 The Green, STE A Dover, Delaware 19901

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE TERMS OF REGULATION A.

TABLE OF CONTENT

PART I - NOTIFICATION

Part I should be read in conjunction with the attached Document for Items 1-6

PART I - END

.

TABLE OF CONTENT

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

Preliminary Offering Circular, Subject to Completion

Dated February 14, 2020

E*Hedge Financial Holding Corp.

Up to 10,000,000 Shares

Of Common Stock

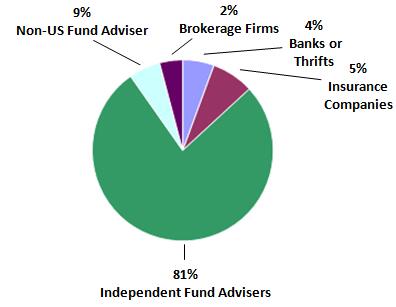

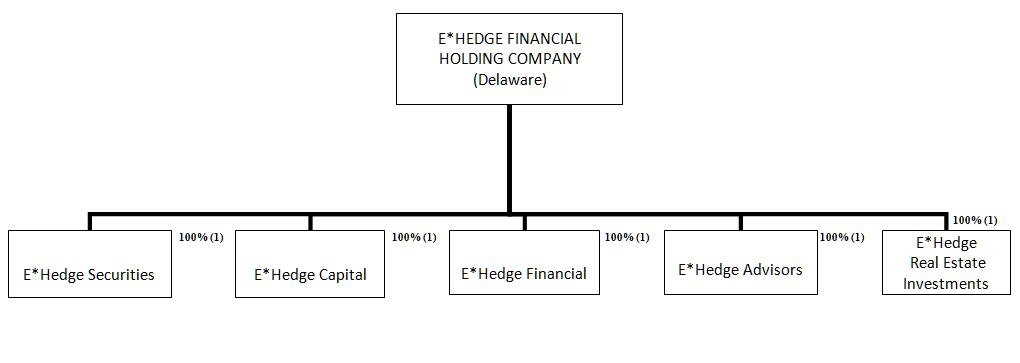

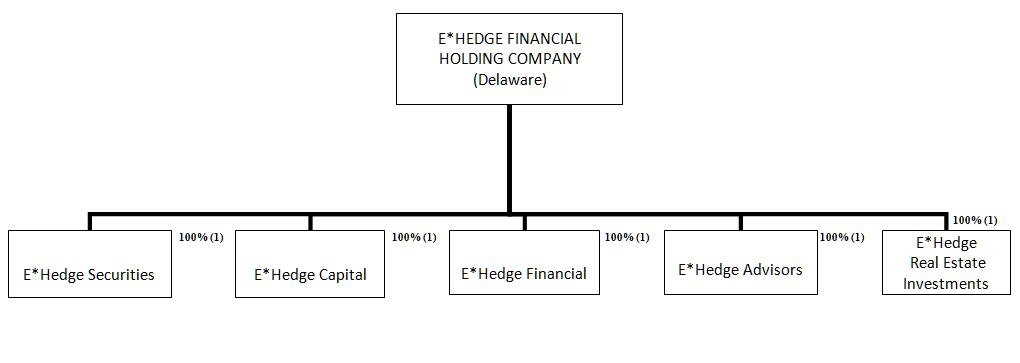

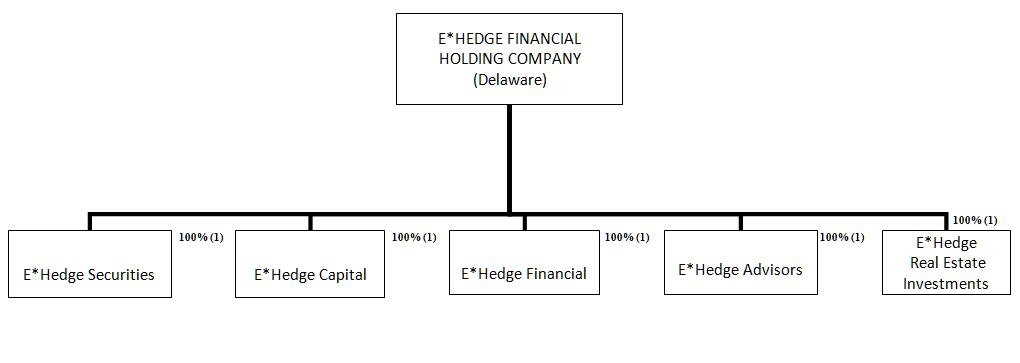

This is the initial public offering of common stock by E*Hedge Financial Holding Corp., doing business as E*Hedge, Inc. the financial holding company for numerous subsidiaries including E*Hedge Financial, E*Hedge Capital, E*Hedge Securities, E*Hedge Advisors, and E*Hedge Real Estate Investments, in one or more classes or series as described in this offering circular and accompanying offering circular.

We currently estimate that the public offering price of our common stock will be $1.00 per share, $0.001 par value. There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this offering circular, we intend to have a intermidiary sponsor file an application with the International Stock Exchange or Euronext for our common stock to be eligible for trading on the International Stock Exchange operated by The International Stock Exchange Group Limited or Euronext Access operated by the Euronext Access Paris respectively. We do not yet have a sponsor who has agreed to participate as an intermediary listing sponsor. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop. We have made no arrangements to place subscription funds in an escrow, trust or similar account. Shares issued under this offering will be issued on a continuous basis under Rule 251(d)(3) under the Securities Act, and the company will have access to such funds from the first dollar invested, even if those proceeds do not cover the costs of this offering. We will impose a zero minimum purchase of the Common Stock.

TABLE OF CONTENT

We will hold an initial closing on any number of shares of common stock at any time during the offering period after we have received notification of approval, or "Notification of Authorization,". The company may list our common stock on the International Exchange or Euronext Access operated by the Euronext Access Paris, subject to meeting all of the requirements of the listing standards and official notice of issuance. Thereafter, we may hold one or more additional closings until we determine to cease having any additional closings during the offering period.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, and are subject to reduced public company disclosure standards.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 10 of this offering circular.

| Price To Public | Commissions | Proceeds to Company |

Per Share | $ 1.00 | $ 0.00 | $ 1.00 |

Maximum Offering | $ 10,000,000 | $ 0.00 | $ 10,000,000 |

(1) Neither the U. S. Securities and Exchange Commission nor any state securities commission has approved or

disapproved of these securities or passed upon the adequacy or accuracy of this offering circular. Any

representation to the contrary is a criminal offense.

(2)This is a "best efforts" offering. We will not impose a zero minimum to sell common shares in the Offering, we will not cancel the offering nor return any investments of the Offering except as applicable by law.

If all the shares are not sold in the company's offering, there is the possibility that the amount raised may be minimal and might not even cover the costs of the offering, which the Company estimates at $68,000. The proceeds from the sale of the securities will be placed directly into the Companies account; any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the offering circular. All proceeds from the sale of the securities are nonrefundable, except as may be required by applicable laws. All expenses incurred in this offering are being paid for by the company. There has been no public trading market for the common stock of E*Hedge Financial Holding Corp.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF A SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

TABLE OF CONTENT

THESE SECURITIES INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO 'RISK FACTORS' BEGINNING ON PAGE 19.

You should rely only on the information contained in this offering circular and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this offering circular. If anyone provides you with different information, you should not rely on it. For more information concerning the procedures of the Offering, please refer to "Plan of Distribution" beginning on page 82, including the sections "Investment Limitations" and "Procedures for Subscribing". This Offering Circular is following the offering circular format described in Part II (a)(1)(ii) of Form 1-A. The following table of contents has been designed to help you find important information contained in this offering circular. We encourage you to read the entire offering circular. The date of this offering circular is February 14, 2020 . |

TABLE OF CONTENTS

Offering Circular

TABLE OF CONTENT

About This Offering Circular

You should rely only on the information contained in this offering circular we may authorize to be delivered to you. We have not authorized any dealer, salesperson agent or other person to give any information or represent anything not contained in this offering circular. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This offering circular is an offer to sell only the shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer of these securities in any state, country or other jurisdiction where the offer is not permitted. You should assume that the information appearing in this offering circular, the accompanying offering circular and the documents incorporated by reference is accurate only as of their respective dates.

Market and Industry Data

Within this offering circular, we reference certain market, industry and demographic data and other statistical information. We have obtained this data and information from various independent, third party industry sources and publications. Nothing in the data or information used or derived from third party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of internal observations and independent sources. We believe that these external sources and estimates are reliable, but have not independently verified them. Statements as to our market position are based on market data currently available to us. Although we are not aware of any misstatements regarding the economic, employment, industry and other market data presented herein, these estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

-we may present as few as two years of audited financial statements and two years of related management discussion and analysis of financial condition and results of operations;

- we are exempt from the requirement to obtain an attestation and report from our auditors on management's assessment of our internal control over financial reporting under the Sarbanes-Oxley Act of 2002;

-we are permitted to provide reduced disclosure regarding our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means we do not have to include a compensation discussion and analysis and certain other disclosures regarding our executive compensation; and

- we are not required to hold non-binding advisory votes on executive compensation or golden parachute arrangements.

In addition to the relief described above, the JOBS Act permits us an extended transition period for complying with new or revised accounting standards affecting public companies. We have elected to use this extended transition period, which means that our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards on a non-delayed basis.

In this offering circular we have elected to take advantage of the reduced disclosure requirements in relation to executive compensation, and applicable exemptions as may follow. Furthermore in the future we may take advantage of any or all of these exemptions for so long as we remain an emerging growth company. We will remain an emerging growth company until the earliest of (i) the end of the fiscal year during which we have total annual gross revenues of $1.07 billion or more, (ii) the end of the fiscal year following the fifth anniversary of the completion of this offering, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt and (iv) the date on which we are deemed to be a "large accelerated filer" under the Securities Exchange Act of 1934, as amended.

i

TABLE OF CONTENT

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This offering circular contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as "may," "might," "should," "could," "predict," "potential," "believe," "expect," "attribute," "continue," "will," "anticipate," "seek," "estimate," "intend," "plan," "projection," "goal," "target," "outlook," "aim," "would," "annualized" and "outlook," or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

The following factors, among others, including those listed under the heading "Risk Factors," could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements:

-adverse changes in the financial industry, securities, credit and national local real estate markets (including real estate values);

- our ability to enter new markets successfully and capitalize on growth opportunities;

- interest rate fluctuations, which could have an adverse effect on our profitability;

- external economic and/or market factors, such as changes in monetary and fiscal policies and laws, including the interest rate policies of the FRB, inflation or deflation, changes in the demand for loans, and fluctuations in consumer spending, borrowing and savings habits, which may have an adverse impact on our financial condition;

- continued or increasing competition from other financial institutions, and non-financial services companies;

- our ability to effectively manage risks related to cash management;

- our ability to leverage the professional and personal relationships of our board members and advisory board members;

- fluctuations in the demand for related financial services;

- risks related to any future acquisitions, including exposure to potential asset and credit quality risks and unknown or contingent liabilities, the time and costs of integrating systems, procedures and personnel, the need for capital to finance such transactions, our ability to obtain required regulatory approvals and possible failures in realizing the anticipated benefits from acquisitions;

- technological changes that may be more difficult or expensive than expected;

- the impact of any potential strategic transactions;

- changes in consumer spending, borrowing and savings habits;

- changes in accounting policies and practices, as may be adopted by the Financial regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission or the Public Company Accounting Oversight Board;

- the impairment of our investment securities;

- our ability to control costs and expenses, particularly those associated with operating as a publicly traded company;

ii

TABLE OF CONTENT

- political instability;

- acts of war or terrorism;

- competition and innovation with respect to financial products and services by Financials, financial institutions and non-traditional providers, including retail businesses and technology companies;

- changes in our organization and management and our ability to retain or expand our management team and our board of directors, as necessary;

- the costs and effects of legal, compliance and regulatory actions, changes and developments, including the initiation and resolution of legal proceedings, regulatory or other governmental inquiries or investigations, and/or the results of regulatory examinations and reviews;

- the ability of key third-party service providers to perform their obligations to us; and

- other economic, competitive, governmental, regulatory and operational factors affecting our operations, pricing, products and services described elsewhere in this offering circular.

- our ability to protect our intellectual property and to develop, maintain and enhance strong brands.

The foregoing factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements that are included in this offering circular. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for us to predict those events or how they may affect us. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

iii

TABLE OF CONTENT

OFFERING CIRCULAR SUMMARY

This summary highlights aspects of our business and this offering, but it does not contain all of the information that you should consider in making your investment decision. You should read this entire offering circular carefully, including the "Risk Factors" section and "Management Discussion and Analysis of Financial Condition and Results of Operations" our consolidated financial statements and unaudited condensed consolidated interim financial statements and related notes, before making an investment decision. Some of the statements in this offering circular constitute forward-looking statements. See "Cautionary Note Regarding Forward-Looking Statements".

Our Company

E*Hedge Financial Holding Corp. doing business as E*Hedge, Inc., is a non-banking financial service company headquartered in Seattle WA. Our goal is to create a bold, and responsible financial organization focused on leading brands working closely with Devon Parks, the Chairman, CEO of E*Hedge Financial Holding Corp or "E*Hedge Financial Group" we seek to operate efficient financial service firms, as well as to grow the portfolio of subsidiaries through strategic acquisitions.

Currently, we have 5 business units:

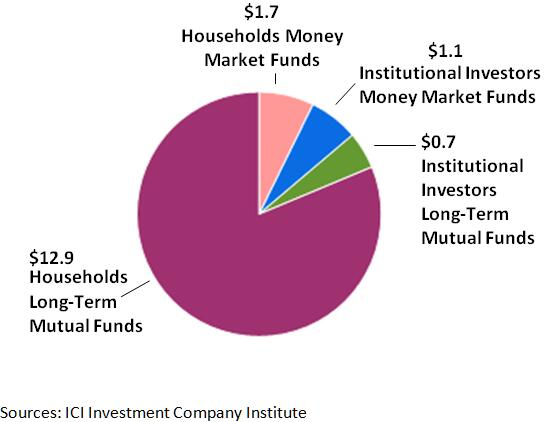

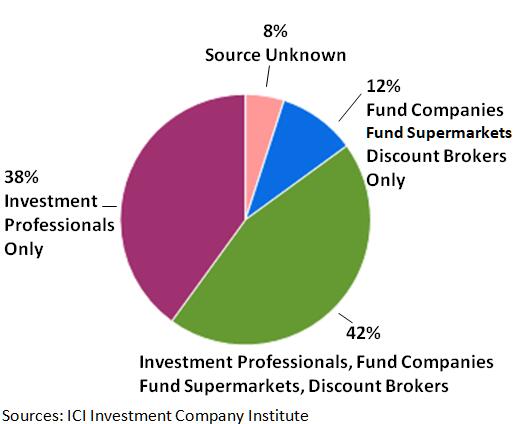

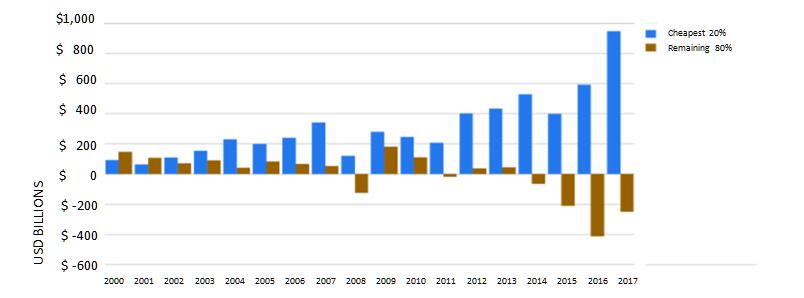

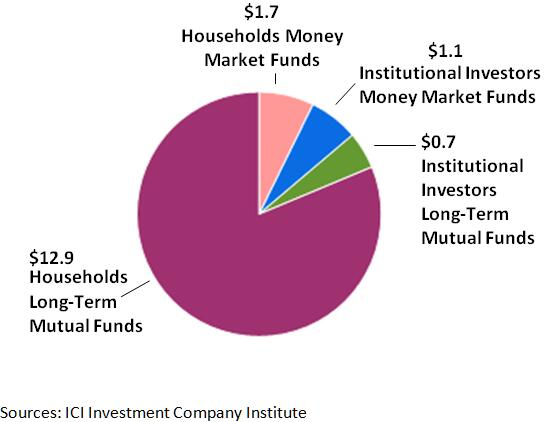

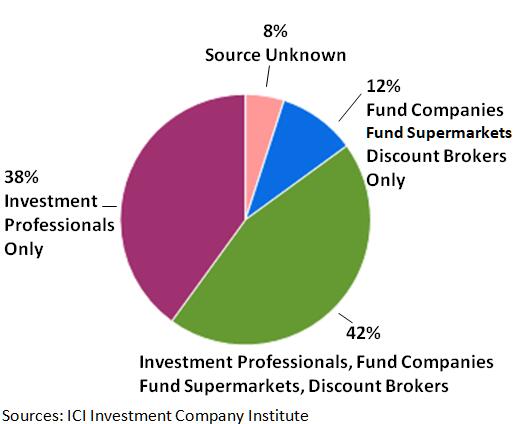

E*Hedge Capital, a Mutual Fund Management subsidiary, actively manages the following regulatory pending funds; Zero Fee Small Company Index Fund, Zero Fee Mid Company Index Fund, Dividend Income Fund and Global Life Science Fund, Zero Fee S&P 500 Index Fund and S&P 500 Inverse Fund. In addition to fund management the organization also advises in separate accounts and matters pertaining to client services. Moreover, the organization leverages investment experience to grow investor assets in order to help financial professionals successfully place investment funds.

Current Business Activities: Limited Operations pending SEC authorizations.

Operational Timeline: Expanding Operations 6- 9 months

E*Hedge Advisors, primary objective is to help clients connect innovative investment ideas in capital markets and bring them to life through a rigorous Research & Development advisory services. The company is Data-driven, Quantitatively-minded and Application-focused. The company strives to connect innovative ideas in finance through exact Research & Development and bring validated trading ideas to life.

Current Business Activities: Limited Operations

Operational Timeline: Exapanding Operations 6- 9 months

E*Hedge Real Estate Investments, is a self-advised real estate investment trust (REIT) pending SEC approvals engaged in the business of investing, on a leveraged basis, in asset-backed securities (ABS) and real estate properties. Our principal business objective is to generate income for distribution to our stockholders resulting from the difference between interest and other income earned on investments and the interest expense we pay on leverage we use to finance investments and operating costs.

Current Business Activities: Developmental stage

Operational Timeline: 6- 9 months

1

TABLE OF CONTENT

E*Hedge Financial is a financial service firm focused on the issuance of white label debit card products as it relates to banking agency agreements in relation to future operations. The company is to be organized under the laws of the State of Delaware. E*Hedge Financial is not seeking membership of the Federal Reserve System and its future deposits will be contingent upon its ability to partner with established banking organizations who are insured by the FDIC up to any applicable legal limit.

Current Business Activities: Developmental stage

Operational Timeline: 6- 9 months

E*Hedge Securities is a registered investment advisory established to provide securities firms and individual investors with more efficient access to small cap initial public offerings. The company provides a singular focused "EHS Platform". Wherein E*Hedge"s proprietary service and technology platform ("EHS Platform") may provide corporate clients with advice, technology, administrative services and assistance with and introductions to resources needed to conduct a Regulation A offering under the Securities Act of 1933, in addition to access to strategic partnerships, and vibrant investor communities.

Current Business Activities: Ongoing operations

Operational Timeline: Current Operations

We currently manage financial service operations based on U.S. geographic markets which allow each division to retain flexibility with regard to enjoying the economies of scale and cost savings realized as a result of consolidated support functions. We believe that this approach differentiates us from other large competitors due to our status as a financial holding company; we operate with greater flexibility to better serve markets and increase responsiveness to the needs of customers. We also provide our business divisions guidance in the areas of improving operational efficiencies.

Our Products and Services

The company will provide a comprehensive set of investments, financial services and advisory platforms customized to meet the needs of our clients.

Real Estate Fund

E*Hedge Real Estate Investments is an emerging developmental stage real estate holding corporation with a commercial focus on revenue generating residential apartment properties through emerging real estate investment funds.

Investment and Financial Advisory Services

E*Hedge Advisors, primary objective is to provide ongoing advisory services relating to the implementation of innovative client supplied investment ideas in capital markets and bring them to life through a rigorous Research & Development advisory process. The company is Data-driven, quantitatively-minded and application-focused on implementing mathematical tools to help our clients build algorithm, quantitative models for capital markets, asset management and data analytics and ultimately trading execution.

E*Hedge Capital, a Mutual Fund Management focuses on the investment advisory services for the following regulatory pending funds; Zero Fee Small Company Index Fund, Zero Fee Mid Company Index Fund, Dividend Income Dividend Fund and Global Life Science Fund, Zero Fee S&P 500 Index Fund and S&P 500 Inverse Fund.

E*Hedge Securities is a registered financial advisory firm positioned to offer its "EHS Platform". Wherein corporate clients are provided with advice, technology, administrative services and assistance with and introductions to resources needed to conduct a Regulation A offer under the Securities Act of 1933.

Consumer Debit Cards

E*Hedge Financial is a financial service firm focused on the issuance of white label debit card products as it relates to banking agency agreements in relation to future operations.

2

TABLE OF CONTENT

Our Market Area

Our primary market consists of the greater United States. Approximately 80% of projected client acquisitions are located within the broader continental U.S centering around the Metropolitan Statistical Areas (MSA) and the outlying regions which may be underserved for the purpose of investments and financial services. The company will primarily focus on areas located within the Northwest (Seattle), Southwest (Los Angeles, San Francisco), Northeast (New York, Boston), Midwest (Chicago) and Southeast (Miami). These markets are well defined with entrenched sector leaders offering the larger market well-diversified financial offerings, while the market for middle market services continue to expand. Within the last decade, middle tier opportunities across the outlined Metropolitan Statistical Areas have expanded due to economic growth and progress post the most recent financial depression. The company and its business units will serve MSAs in which advantageous opportunities abound due to better than average growth relative to other metropolitan regions in the United States.

E*Hedge will continue to expand its business divisions while strategically locating operational centers within close proximity to our prospective clients. We have regional offices located in Seattle Washington. Our quantitative advisory firm E*Hedge Advisors, will operate within the city of Seattle while focusing on major financial centers throughout the continental United States. New York and Chicago will serve as operational centers for mutual fund management company E*Hedge Capital, in addition to operational centers for administrative and accounting staff whom will maintain investment management operations within conjoining offices under a sub-tenant lease arrangement.

Our Growth Strategy

We believe we have managed our growth successfully since inception, and plan to continue our strategy of organic and acquisitive growth, as outlined below:

Organic Growth. Our organic growth strategy involves building upon the relationships of strategic partners, vendors and growing our staff through qualified hires. We have designed our growth plan to emphasize strong foundational growth through risk adverse strategies which focus on each business units core specialty and strength. Since our foundation on February 28, 2019 we have built our foundation around exceptional product offerings which exceed our clients expectations while generating solid profits. With the exception of any future acquisitions of one or more financial organizations, we project net revenues to increase organically.

Core to this growth is region specific growth initiatives; wherein we incentivize channel partners on all levels including our in house associates. E*Hedge will continue to focus on single frame leadership along each business units objectives as opposed to individual result driven compensation which will continue to spur growth.

Combining synergetic strengths across multiple-profit centers remains our core focus and hiring key personnel to drive organic growth, we also look for opportunities to open de novo profit centers focused on emerging trends in existing and new markets. Before introducing a new product offering or entering a new market, we have will identify leveraged opportunities for accelerated growth while ensuring each strategy is properly hedged for minimized risk exposure to potential competition

3

TABLE OF CONTENT

Growth Through Acquisitions. The company may supplement our organic growth through both strategic and planned acquisitions, and we intend to initiate our strategy of opportunistically acquiring our first financial service firm outside of our current footprint. We believe having a publicly traded stock and enhanced access to the capital markets will improve our ability to compete for quality acquisitions. We will seek acquisitions that provide meaningful financial and strategic benefits, long-term organic growth opportunities and expense reductions, without compromising our risk profile. While evaluating acquisition targets, we will focus our efforts on financial organizations with successful operating histories, stable core management, sound asset quality, and emerging growth potential. The company seeks to expand to financial markets with attractive demographics, favorable competitive dynamics and potential consolidation opportunities. We are currently focused on identifying and positioning the company for acquisitions in and surrounding the five major MSA's within the United States New York, Los Angeles, Chicago, Miami and Houston. With hundreds of organizations actively or privately seeking acquirers on an annual basis we believe we will have opportunities for acquisitions both within and outside our current demographic area. Our Competitive Strengths We believe the following strengths differentiate us from our competitors and provide us with the necessary foundation to successfully execute on our business strategy. E*Hedge Financial Holding Corp. and its business units are uniquely positioned in attractive and evolving financial sectors. Our differentiated business model is focused on client relationships. While we pride ourselves on our excellent service, investment products, and management structure when combined allow us to extend a wide range of products and provide differentiated execution models designed to exceed client expectations. Our service focus is to know our clients when possible, acknowledge their importance, and take responsibility for personally answering their inquiries. The majority of our investment and financial service clientele will invariably be acquired through referrals, which contributes to responsive client services which allows the company to nimbly converge profit centers into client centric service offering. All staff members, from executive management to front line representatives, will continue to be versed in our product and service offerings and are trained to be able to make recommendations or referrals in the interests of our clients.

|

|

4

TABLE OF CONTENT

Our Leadership Team

We are led by senior executive officer Devon Parks who has more than 15 years of combined experience in both corporate leadership and financial service industries. Mr. Parks, our Chief Executive Officer, founded our company in February 2019. Mr. Parks has a history of managing privately funded operations in the financial service industry and other growth-oriented industries. Before founding our company, Mr. Parks was the chief executive officer at several multi-national companies servicing global clientele in varied markets including financial services, pharmaceutical research, and SMB advertising sales. Mr. Parks earned a B.A. degree from Bowling Green State University and is actively completing graduate level executive courses.

Our Corporate Information and Incorporation

Our principal executive offices are located at 1001 4th Ave Ste. 3200 Seattle, WA 98104. Through the Financial Holding Company, we maintain an internet website at www.ehedgegroup.com The information contained on or accessible from our website does not constitute a part of this offering circular and is not incorporated by reference herein.

______________________

______________________

(1) Our 100%-owned subsidiary. Percentages above refer to our ownership as of February 28, 2019.

Channels for Disclosure of Information

Investors and other stakeholders should note that we use social media to communicate with the public about our company, our services, new product developments and other matters. Any information that we consider to be material to an evaluation of our company will be included in filings on the SEC website, http://www.sec.gov, and may also be disseminated using our investor relations website, which can be found at www.ehedgegroup.com, and press releases. However, we encourage investors, the media and others interested in our company to also review our social media channels.

We do not incorporate the information on or accessible through, our website into this offering circular, and you should not consider any information on, or that can be accessed through, our website a part of this offering circular.

5

TABLE OF CONTENT

Risk Factors

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this offering circular before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our Common Stock, when and if we trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

-As a business operating in the financial services industry, our business and operations may be adversely affected in numerous and complex ways by weak economic conditions;

-A substantial majority of our business and operations are in the United States, and therefore our business is particularly vulnerable to a downturn in the U.S. economy;

-Our business could suffer if there is a decline in respect to the financial services industry in general;

-We operate in a highly competitive industry and face significant competition from other financial institutions and financial services providers, which may decrease our growth or profits;

-We rely heavily on our executive management team and other key employees, and we could be adversely affected by the unexpected loss of their services;

-A lack of liquidity could adversely affect our financial condition and results of operations;

-We have limited experience operating a multi-national public company and different risks relating to international operations may adversely affect our operations greater than certain of our larger, more diversified competitors;

-We face risks related to our operational, technological and organizational infrastructure;

-A failure in our operational systems or infrastructure, or those of third parties, could impair our liquidity, disrupt our businesses, result in the unauthorized disclosure of confidential information, damage our reputation and cause financial losses;

-Our business, financial condition, results of operations and future prospects could be adversely affected by the highly regulated environment and the laws and regulations that govern our operations, corporate governance, executive compensation and accounting principles, or changes in any of them; and

-An active, liquid trading market for our Common Stock may not develop, and you may not be able to sell your shares at or above the public offering price, or at all.

6

TABLE OF CONTENT

The Offering |

Common stock offered in this Offering | The number of shares to be offered and the price range have not been determined. |

Common stock to be outstanding immediately after this offering | 10,000,000 |

Maximum offering amount | 10,000,000 shares of our common stock will be sold at $1.00 per share. |

Minimum number of shares to be sold in this offering | There is no minimum number of shares that must be sold by in the Offering. |

| |

Voting rights | Holders of our common stock are entitled to one vote for each share of common stock held. |

No Symbol for Common Stock | There is no trading market for our Common Stock. We intend to apply for quotation on the International Stock Exchange operated by The International Stock Exchange Group Limited or Euronext Exchange operated by the Euronext Access respectively. There is no guarantee that a sponsor will agree to facilitate the listing of common shares. |

Proposed Exchange Listing | The company has initiated steps to list our common stock on the International Stock Exchange and Euronext Access. Our common stock will not commence trading on the the International Stock Exchange nor Euronext Access until all of the following conditions are met: (i) the offering is completed; and (ii) we have filed a post-qualification amendment to the Offering Statement and a registration statement on applicable forms under the Exchange Act unless exempt. Such post-qualification amendment if filed is to be qualified by the SEC and the Form 8-A will become effective in kind. Pursuant to applicable rules under Regulation A, the Form 8-A will not become effective until the SEC qualifies the post-qualification amendment if applicable. The company may elect to file a post qualification amendment and request its qualification immediately prior to the termination of the offering in order that the Form 8-A may become effective as soon as practicable if applicable. Even if we meet the minimum requirements for listing on the International Stock Exchange or Euronext Access, we may wait to commence trading of our common stock on the exchange in order to raise additional proceeds. As a result, you may experience a delay |

7

TABLE OF CONTENT

Use of proceeds | between the closing of your purchase of shares of our common stock and the commencement of exchange trading of our common stock on any exchange. The company will receive proceeds from the sale of our common stock in this offering. We estimate that the net proceeds from the offering, if we are successful at selling the shares we are offering, after deducting estimated offering expenses, will be approximately $10,000,000. We intend to use the anticipated net proceeds from the offering of our Common Stock for general corporate purposes. |

Market for the common stock | Our common stock is not quoted on a market or securities exchange. We cannot provide any assurance that an active market in our common stock will develop. We intend to quote our common shares on a market or securities exchange. |

Dividend policy | We have no current plans to pay dividends on our common stock. Our payment of dividends on our common stock in the future will be determined by our Board of Directors in its sole discretion and will depend on business conditions, our financial condition, earnings, liquidity and capital requirements. |

Risk factors | See "Risk Factors" beginning on page 10 of this offering circular for a discussion of risks you should carefully consider before deciding whether to invest in our common stock. |

(1)The number of common shares outstanding immediately after the closing of this offering is based on 10,000,000 based on the number of common shares outstanding as of December 31, 2019, including unvested restricted stock granted under our stock compensation plans. |

8

TABLE OF CONTENT

Risk Factors

Investing in our securities involves risk. You should carefully consider each of the following risks and all of the other information contained in this offering circular before deciding to invest in our securities. Any of the following risks could materially adversely affect our business, financial condition, or results of operations. In such case, the trading price of our securities could decline, and you may lose all or part of your original investment. Our actual results could differ materially from those anticipated in the forward-looking statements, estimates and projections as a result of specific factors, including the risk factors described below. While we describe each risk separately, some of the risks are interrelated and certain risks could trigger the applicability of other risks described below.

Since our officer and directors own greater than 15% of the voting power of our outstanding capital stock. After the offering, assuming all the shares being offered on behalf of the company are sold, our officers and directors will hold or have the ability to control the voting power of our outstanding capital stock since our officers and directors currently own significant voting power, investors may find that their decisions are contrary to their interests. You should not purchase shares unless you are willing to entrust all aspects of management to our officer and directors, or their successors.

As a result, our officer and directors will have control of the Company even if the full offering is subscribed for and be able to choose all of our directors. Their interests may differ from the ones of other stockholders. Factors that could cause their interests to differ from the other stockholders include the impact of corporate transactions on the timing of business operations and their ability to continue to manage the business given the amount of time they are able to devote to us.

Purchasers of the offered shares may not participate in our management and, therefore, are dependent upon their management abilities. The only assurance that our shareholders, including purchasers of the offered shares, have that our officers and directors will not abuse there discretion in executing our business affairs, as their fiduciary obligation and business integrity. Such discretionary powers include, but are not limited to, decisions regarding all aspects of business operations, corporate transactions and financing.

Status as Not a Shell Company

The Company it is not a "shell company" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, The Company is a "start-up" company which the Commission explicitly differentiates in Footnote 172 to SEC Release No. 33-8869 from "shell" companies covered under Rule 144 (i)(1)(i) (the "Rule"). In adopting the definition of a shell company in SEC Release No. 33-8587 (the "Release"), the Commission stated that it intentionally did not define the term "nominal" and it did not set a quantitative threshold of what constitutes a shell company. Indeed, under the Rule, the threshold for what is considered "nominal" is, to a large degree, subjective and based upon facts and circumstances of each individual case.

The Company is actively engaged in the implementation and deployment of its business plan. These activities include:

-Active financial advisory and fund management activities through our subsidiaries.

-Operations are underway to grow commercial operations.

-Plans are being formed to ensure operational details are executed as efficient as possible.

9

TABLE OF CONTENT

The Company's operations are more than just "nominal." As the Commission points out in its Release, there are no established quantitative thresholds to determine whether a company's operations are in-fact "nominal". Instead, the determination is to be made on a case-by-case basis, with significant regards to a subjective analysis aimed at preventing serious problems from allowing scheming promoters and affiliates to evade the definition of a "shell" company (as well as the intent of the Rule). As described in Footnote 32 to the Release, the Commission expounds its rationale for declining to quantitatively define the term "nominal" regarding a shell company.

It is reasonably commonplace that development stage or "start-up" companies have limited assets and resources, as well as having a going concern explanatory paragraph in the report of its independent registered public accounting firm. The Company is considering all possible avenues to develop its business model. The Company believes that by being a public company this should increase its image and credibility in the marketplace and provide possible sources of funding for its business.

The companies management has been working to implement the companies core business strategy, including, but not limited to, meeting with distribution and installation partners, and business development in anticipation of its progressing operations and the development of its business model. The Company's operations are more than "nominal" and that it does not fall within the class of companies for which the Commission was aiming to prevent as referenced in previous notifications.

Risks Related to Our Business

As a holding company with several subsidiaries operating in the financial services industry, our business and operations may be adversely affected in numerous and complex ways by weak economic conditions.

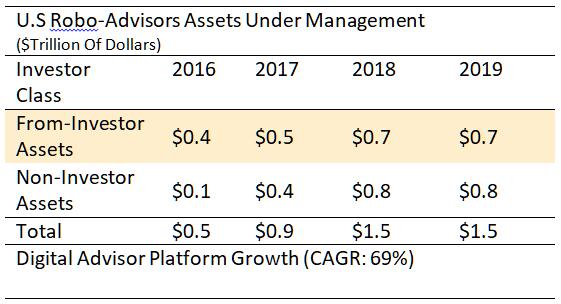

Our business and operations, which primarily consist of financial advisory, investment management and credit and debit card services, financial consulting services, open end fund management, robo-advisory services, are sensitive to general business and economic conditions in the United States and global markets overall. If the U.S. economy weakens, our growth and profitability from our varied investment, consulting and credit and debit card operations could be constrained. Uncertainty about the federal fiscal policymaking process, the medium and long term fiscal outlook of the federal government, and future tax rates is a concern for businesses, consumers and investors in the United States. In addition, economic conditions in foreign countries, including uncertainty over the stability of the euro currency, could affect the stability of global financial markets, which could hinder U.S. economic growth. Weak economic conditions are characterized by deflation, fluctuations in debt and equity capital markets, a lack of liquidity and/or depressed prices in the secondary market for mortgage loans, increased delinquencies on mortgage, consumer and commercial loans, residential and commercial real estate price declines and lower home sales and commercial activity. The current economic environment is also characterized by slowly rising interest rates arising from near historically low levels, which impacts our ability to attract clients and to generate attractive earnings through our investment portfolio. All of these factors are detrimental to our business, and the interplay between these factors can be complex and unpredictable. Our business is also significantly affected by monetary and related policies of the U.S. Federal Government and its agencies. Changes in any of these policies are influenced by macroeconomic conditions and other factors that are beyond our control. Adverse economic conditions and government policy responses to such conditions could have a material adverse effect on our business, financial condition, results of operations and prospects.

10

TABLE OF CONTENT

Interest rate shifts may reduce net interest income and otherwise negatively impact our financial condition and results of operations.

Similar to other financial institutions, our future earnings and cash flows depend to a degree upon the level of our net interest income, or the difference between the interest income we may earn from interest bearing products, investment products and other interest earning assets, and the interest we pay on interest bearing liabilities, such as borrowings. Changes in interest rates can increase or decrease our net interest income, because different types of assets and liabilities may react differently, and at different times, to market interest rate changes. When interest bearing liabilities mature or re-price more quickly, or to a greater degree than interest earning assets in a period, an increase in interest rates could reduce net interest income. Similarity, when interest earning assets mature or re-price more quickly, or to a greater degree than interest bearing liabilities, falling interest rates could reduce net interest income. Additionally, an increase in interest rates may, among other things, reduce the demand for credit linked products and our ability to generate revenue from card products due to a potential decrease in repayment rates. A decrease in the general level of interest rates may affect us through, among other things, increased prepayments on financial card portfolios and increased competition for holders. Accordingly, changes in the level of market interest rates affect our net yield on interest earning assets, and our overall results. Although our asset-liability management strategy is designed to control and mitigate exposure to the risks related to changes in market interest rates, those rates are affected by many factors outside of our control, including governmental monetary policies, inflation, deflation, recession, changes in unemployment, the money supply, international disorder and instability in domestic and foreign financial markets.

Our smaller size makes it more difficult for us to compete.

Our smaller size makes it more difficult to compete with other financial institutions which are generally larger and can more easily afford to invest in the marketing and technologies needed to attract and retain customers. Because our principal source of income consists of financial advisory, investment management and credit and debit card services to customers the net interest income we earn on our fees and investments after deducting expenses and other sources of funds, our ability to generate the revenues needed to cover our expenses and finance such investments is limited by the number of our new client acquisitions and investment portfolios. In addition, we compete with many larger financial institutions and other financial companies who operate in the financial advisory, investment and consumer and business financial services. Accordingly, we are not always able to offer new products and services as quickly as our competitors. Our lower earnings also make it more difficult to offer competitive salaries and benefits. As a smaller institution, we are also disproportionately affected by the continually increasing costs of compliance with federal and state regulations.

We may not be able to grow, and if we do we may have difficulty managing that growth.

Our business strategy is to continue to grow our assets and expand our operations, including potential strategic acquisitions. While we continue to explore acquisition opportunities as they arise, there are no plans or arrangements to make any acquisitions in the near future. One of our current growth initiatives is our plan to expand operations globally in 2020 and we expect to consider new strategic avenues upon successful integration of co-branded consumer financial services, in areas where new client relationships can be established and strengthened. Our ability to grow depends, in part, upon our ability to expand our market share, successfully attract new clients, and to identify niche market segments and investment opportunities as well as opportunities to generate fee-based income from financial advisory services. We can provide no assurance that we will be successful in increasing the volume of consumer and business clientele in terms of receivables at acceptable levels and upon terms acceptable to us. We also can provide no assurance that we will be successful in

11

TABLE OF CONTENT

expanding our operations organically or through strategic acquisition while managing the costs and implementation risks associated with this growth strategy.

We expect to continue to experience growth in the number of our employees and customers and the scope of our operations, but we may not be able to sustain an accelerated rate of growth or continue to grow our business at all. Our success will depend upon the ability of our officers and key employees to implement and improve our operations and core business systems, to manage multiple, concurrent customer relationships, and to hire, train and manage our employees. In the event that we are unable to perform all these tasks and meet these challenges effectively, including continuing to attract new clientele, our operations, and consequently our earnings, could be adversely impacted.

Any future acquisitions will subject us to a variety of risks, including execution risks, failure to realize anticipated transaction benefits, and failure to overcome integration risks, which could adversely affect our growth and profitability.

We plan to grow our businesses organically. Although we do not currently have any plans, arrangements or understandings to make any acquisitions in the near-term, from time to time in the future we may consider acquisition opportunities that we believe support our businesses and enhance our profitability. In the event that we do pursue acquisitions, we may have difficulty executing on acquisitions and may not realize the anticipated benefits of any transaction we complete. Any of the foregoing matters could materially and adversely affect us.

Generally, any acquisition of a target financial institution, branches or other financial assets by us will require approval by, and cooperation from, a number of governmental regulatory agencies, possibly including the Federal Reserve Board, State regulatory agencies, and the OCC or FDIC respectively. Such regulators could deny our application, which would restrict our growth, or the regulatory approvals may not be granted on terms that are acceptable to us. For example, we could be required to sell off subsidiaries as a condition to receiving regulatory approvals, and such a condition may not be acceptable to us or may reduce the benefit of an acquisition.

As to any acquisition that we complete, we may fail to realize some or all of the anticipated transaction benefits if the integration process takes longer or is more costly than expected or otherwise fails to meet our expectations.

In addition, acquisition activities could be material to our business and involve a number of risks, including the following:

-incurring time and expense associated with identifying and evaluating potential acquisitions and negotiating potential transactions, resulting in our attention being diverted from the operation of our existing business;

-using inaccurate estimates and judgments to evaluate credit, operations, management and market risks with respect to the target institution or assets;

-projected results may vary significantly from actual results;

-intense competition from other financial organizations and other inquirers for acquisitions;

-unexpected asset quality problems;

-the time and expense required to integrate the operations and personnel of the combined businesses;

-experiencing higher operating expenses relative to operating income from the new operations;

-creating an adverse short-term effect on our results of operations;

-losing key employees and customers as a result of an acquisition that is poorly received;

12

TABLE OF CONTENT

-significant problems relating to the conversion of the financial and customer data of the entity;

-integration of acquired customers into our financial and customer product systems;

-risk of assuming businesses with internal control deficiencies; or

-risks of impairment to goodwill or other than temporary impairment of investment securities.

Depending on the condition of any institution or assets or liabilities that we may acquire, that acquisition may, at least in the near term, adversely affect our capital and earnings and, if not successfully integrated with our organization, may continue to have such effects over a longer period. We may not be successful in overcoming these risks or any other problems encountered in connection with potential acquisitions, and any acquisition we may consider will be subject to prior regulatory approval. Also, acquisitions may involve the payment of a premium over book and market values and, therefore, some dilution of our book value and net income per common share may occur in connection with any future transaction. Our inability to overcome these risks could have a material adverse effect on our profitability, return on equity and return on assets, our ability to implement our business strategy and enhance stockholder value, which, in turn, could have a material adverse effect on our business, financial condition and results of operations.

We are subject to certain operational risks, including, but not limited to, customer or employee fraud and data processing system failures and errors.

Employee errors and employee and customer misconduct could subject us to financial losses or regulatory sanctions and seriously harm our reputation. Misconduct by our employees could include hiding unauthorized activities from us, improper or unauthorized activities on behalf of our customers or improper use of confidential information. It is not always possible to prevent employee errors and misconduct, and the precautions we take to prevent and detect this activity may not be effective in all cases. Employee errors could also subject us to financial claims for negligence.

We may maintain a system of internal controls and insurance coverage to mitigate against operational risks, including data processing system failures and errors and customer or employee fraud. If our internal controls fail to prevent or detect an occurrence, or if any resulting loss is not insured or exceeds applicable insurance limits, it could have a material adverse effect on our business, financial condition and results of operations.

13

TABLE OF CONTENT

Changes in the valuation of our securities portfolio could hurt our profits and reduce our stockholders equity.

Our securities portfolio may be impacted by fluctuations in market value, potentially reducing accumulated other comprehensive income and/or earnings. Fluctuations in market value may be caused by changes in market interest rates, lower market prices for securities and limited investor demand. Investment management evaluates securities for other-than-temporary impairment on a quarterly basis, with more frequent evaluation for selected issues. In analyzing a prospective portfolio candidate we review financial conditions, management considers whether the securities are issued by the federal government or its agencies, whether downgrades by rating agencies have occurred, industry analysts reports and, to a lesser extent given the relatively insignificant levels of depreciation in our portfolio, spread differentials between the effective prices on instruments in the portfolio compared. In addition to analyzing an equity issuer's financial condition, management considers industry analysts reports, financial performance and projected target prices of investment analysts within a one-year time frame. If this evaluation shows impairment to the actual or projected returns associated with one or more securities, a potential loss to earnings may occur. Changes in interest rates can also have an adverse effect on our financial condition, as our securities are reported at their estimated fair value, and therefore are impacted by fluctuations in interest rates. We increase or decrease our stockholders equity by the amount of change in the estimated fair value of the securities, net of taxes. Declines in market value could result in other-than-temporary impairments of these assets, which would lead to accounting charges that could have a material adverse effect on our net income and capital levels.

We operate in a highly competitive industry and face significant competition from other financial institutions and financial services providers, which may decrease our growth or profits.

Consumer financial services as well as investment solutions are highly competitive industries. Our market contains not only a large number of financial institutions, but also a significant presence of the country's largest investment institutions. We compete with other national consumer financial institutions, such as savings and loan associations, banks, and credit unions. In addition, we compete with financial intermediaries, such as investment companies, specialty finance companies, commercial finance companies, securities firms, mutual funds, all actively engaged in providing various types of either credit services or other financial services, including investment solutions. We also face significant competition from many larger institutions. Some of these competitors may have a long history of successful operations nationally as well as in our four geographic areas of operation and more expansive operations and investing relationships, as well as more established operations, fewer regulatory constraints, and lower cost structures than we do. Competitors with greater resources may

14

TABLE OF CONTENT

possess an advantage through their ability to maintain numerous locations in more convenient sites, to conduct more extensive promotional and advertising campaigns, or to operate a more developed technology platform. Due to their size, many competitors may offer a broader range of products and services, as well as better pricing for certain products and services than we can offer.

For example, in the current interest rate environment, competitors with lower costs of capital may solicit our customers with a lower interest rate product. Further, increased competition among financial services companies due to the ongoing and future consolidation of certain financial institutions may adversely affect our ability to market our products and services.

Technology has lowered barriers to entry and made it possible for financial institutions and specifically finance companies to compete in national markets and to offer products and services traditionally provided by large and mid-size financial institutions.

The financial services industry could become even more competitive as a result of legislative, regulatory, and technological changes and continued consolidation. Financial institutions, securities firms, and insurance companies can merge under the umbrella of a holding company, which can offer virtually any type of financial service, including consumer financial services, investment services, securities underwriting, and merchant services.

Our ability to compete successfully depends on a number of factors, including:

-our ability to develop, maintain, and build upon long-term customer relationships based on quality service and market knowledge;

-our ability to attract and retain qualified employees to operate our business effectively;

-our ability to expand our market position;

-the scope, relevance, and pricing of products and services that we offer to meet customer needs and demands;

-customer satisfaction with our level of service; and

-industry and general economic trends.

Failure to perform in any of these areas could significantly weaken our competitive position, which could adversely affect our growth and profitability, which, in turn, could harm our business, financial condition, and results of operations.

We rely heavily on our executive management team and key employees, and we could be adversely affected by the unexpected loss of their services.

Our success depends in large part on the performance of our key personnel, as well as on our ability to attract, motivate and retain highly qualified senior and middle management and other skilled employees. Competition for employees is intense, and the process of locating key personnel with the combination of skills and attributes required to execute our business plan may be lengthy. We may not be successful in retaining our key employees, and the unexpected loss of services of one or more of our key personnel could have a material adverse effect on our business because of their skills, knowledge of our primary markets, years of industry experience and the difficulty of promptly finding qualified replacement personnel. If the services of any of our key personnel should become unavailable for any reason, we may not be able to identify and hire qualified persons on terms acceptable to us, or at all, which could have a material adverse effect on our business, financial condition, results of operations and future prospects.

15

TABLE OF CONTENT

A lack of liquidity could adversely affect our financial condition and results of operations.

Liquidity is essential to our business. We rely on our ability to generate fee revenue and effectively manage the repayment and maturity schedules of our outstanding account payable and to ensure that we have adequate liquidity to fund our operations. An inability to raise funds through fee schedules could have a substantial negative effect on our liquidity. Our most important source of funds is fees for investment management and consulting services coupled with consumer financial service fees. Revenues can decrease when customers perceive alternative investments as providing a better risk/return tradeoff, which are strongly influenced by such external factors as the direction of interest rates, whether actual or perceived; local and national economic market conditions and competition for credit and debit card holders in the markets we serve. Any changes we make to the rates offered on our consumer financial products or investment products to remain competitive with other financial institutions may also adversely affect our profitability and liquidity. Further, the demand for our consumer financial products may be reduced due to a variety of factors such as demographic patterns, changes in customer preferences, reductions in consumers disposable income, the monetary policy of federal regulators, regulatory actions that decrease customer access to particular products or the availability of competing products.

Other primary sources of funds consist of cash flows from operations, maturities and sales of investment securities, and proceeds from the issuance and sale of our equity securities to investors. We may borrow funds from third-party lenders, such as other financial institutions. Our access to funding sources in amounts adequate to finance or capitalize our activities, or on terms that are acceptable to us, could be impaired by factors that affect us directly or the financial services industry or economy in general, such as disruptions in the financial markets or negative views and expectations about the prospects for the financial services industry. Our access to funding sources could also be affected by a decrease in the level of our business activity as a result of a downturn in our markets or by one or more adverse regulatory actions against us.

Any decline in available liquidity could adversely impact our ability to provide consumer financial products, manage investments in certain securities, meet our expenses, or to fulfill obligations such as paying vendors, any of which could have a material adverse impact on our business, financial condition and results of operations.

Our ability to maintain our reputation is critical to the success of our business, and the failure to do so may materially adversely affect our performance.

We are a financial holding company. As such, we strive to conduct our business in a manner that enhances our reputation. This is done, in part, by recruiting, hiring, and retaining employees who share our core values of being an integral part of the communities we serve, delivering superior service to our customers, and caring about our customers. If our reputation is negatively affected, by the actions of our employees or otherwise, our business and, therefore, our operating results may be materially adversely affected. Further, negative public opinion can expose us to litigation and regulatory action as we seek to implement our growth strategy, which would adversely affect our business, financial condition and results of operations.

16

TABLE OF CONTENT

We face risks related to our operational, technological and organizational infrastructure.

Our ability to grow and compete is dependent on our ability to build or acquire the necessary operational and technological infrastructure and to manage the cost of that infrastructure as we expand. Similar to other corporations, operational risk can manifest itself in many ways, such as errors related to failed or inadequate processes, faulty or disabled computer systems, fraud by employees or outside persons and exposure to external events. As discussed below, we are dependent on our operational infrastructure to help manage these risks. In addition, we are heavily dependent on the strength and capability of our technology systems which we use both to interface with our customers and to manage our internal financial and other systems. Our ability to develop and deliver new products that meet the needs of our existing customers and attract new ones depends on the functionality of our technology systems. Additionally, our ability to run our business in compliance with applicable laws and regulations is dependent on these infrastructures.

The financial services industry is undergoing technological changes with frequent introductions of new technology-driven products and services. Our future success will depend in part upon our ability to address the needs of our clients by using technology to provide products and services that will satisfy client demands for convenience as well as to provide secure electronic environments and create additional efficiencies in our operations as we continue to grow and expand our market area. We continuously monitor our operational and technological capabilities and make modifications and improvements when we believe it will be cost effective to do so. In some instances, we may build and maintain these capabilities ourselves. In connection with implementing new operational and technology enhancements or products in the future, we may experience certain operational challenges (e.g. human error, system error, incompatibility, etc.) which could result in us not fully realizing the anticipated benefits from such new technology or require us to incur significant costs to remedy any such challenges in a timely manner. Many of our larger competitors have substantially greater resources to invest in operational and technological infrastructure and have invested significantly more than us in operational and technological infrastructure. As a result, they may be able to offer additional or more convenient products compared to those that we will be able to provide, which would put us at a competitive disadvantage. Accordingly, we may not be able to effectively implement new technology-driven products and services or be successful in marketing such products and services to our clients, which could impair our growth and profitability.

We also outsource some of our operational and technological infrastructure, including modifications and improvements to these systems, to third parties. Specifically, we depend on third parties to provide our core systems processing, essential web hosting and other internet systems, account processing and other processing services. In connection with our future debit card and cash management solutions, we may rely on various third parties to provide processing and clearing and settlement services to us in connection with card transactions. If these third-party service providers experience difficulties, fail to comply with state and federal regulations or terminate their services and we are unable to replace them with other service providers, our operations could be interrupted. If an interruption were to continue for a significant period of time, our business, financial condition and results of operations could be adversely affected, perhaps materially. Even if we are able to replace them, it may be at a higher cost to us, which could adversely affect our business, financial condition and results of operations. We also face risk from the integration of new platforms and/or new third party providers of such platforms into its existing businesses.

17

TABLE OF CONTENT

A failure in our operational systems or infrastructure, or those of third parties, could impair our operations, disrupt our businesses, result in the unauthorized disclosure of confidential information, damage our reputation and cause financial losses.

Our business, and in particular, our consumer financial, financial advisory and investment business is partially dependent on our ability to process and monitor, on a daily basis, a large number of financial transactions, many of which are highly complex, across numerous and diverse markets. These transactions, as well as the information technology services we provide to clients, often must adhere to client-specific guidelines, as well as legal and regulatory standards. Due to the breadth of our client base and our geographical reach, developing and maintaining our operational systems and infrastructure is challenging, particularly as a result of rapidly evolving legal and regulatory requirements and technological shifts. Our financial, accounting, data processing or other operating systems and facilities, and, as discussed above, those of the third-party service providers upon which we depend, may fail to operate properly or become disabled as a result of events that are wholly or partially beyond our control, such as a spike in transaction volume, cyber-attack or other unforeseen catastrophic events, which may adversely affect our ability to process these financial transactions or provide services.

The company has a limited operating history and has experienced net losses.

The Company has an operating history of fewer than two years and has experienced net losses in each of its first three years of operations. Since inception, the Company's growth has largely been attributable to new investments and such growth may not be sustainable. There can be no assurance that as the Company continues its growth strategy it will not experience net losses in the future, which could have an adverse effect on the Company's results of operations, financial condition and prospects.

The occurrence of fraudulent activity, breaches or failures of our information security controls or cyber security related incidents could have a material adverse effect on our business, financial condition and results of operations.

Our operations rely on the secure processing, storage and transmission of confidential and other sensitive business and consumer information on our computer systems and networks and third party providers. Under various federal and state laws, we are responsible for safeguarding such information. For example, our businesses may be subject to the Gramm-Leach-Bliley Act which, among other things: (i) imposes certain limitations on our ability to share nonpublic personal information about our customers with nonaffiliated third parties; (ii) requires that we provide certain disclosures to customers about our information collection, sharing and security practices and afford customers the right to "opt out" of any information sharing by us with nonaffiliated third parties (with certain exceptions); and (iii) requires that we develop, implement and maintain a written comprehensive information security program containing appropriate safeguards based on our size and complexity, the nature and scope of our activities, and the sensitivity of customer information we process, as well as plans for responding to data security breaches. Ensuring that our collection, use, transfer and storage of personal information comply with all applicable laws and regulations can increase our costs.