Table of Contents

The registrant is submitting this amended draft registration statement confidentially as an "emerging growth company" pursuant to Section 6(e) of the Securities Act of 1933, as amended. As submitted confidentially to the Securities and Exchange Commission on February 14, 2020

Registration Statement No. 333-

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form S-11

FOR REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

Angel Oak Mortgage, Inc.

(Exact Name of Registrant as Specified in Its Governing Instruments)

Angel Oak Mortgage, Inc.

3344 Peachtree Road, Suite 1725

Atlanta, Georgia 30326

(404) 953-4900

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Dory Black

Angel Oak Mortgage, Inc.

3344 Peachtree Road NW, Suite 1725

Atlanta, Georgia 30326

(404) 953-4900

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

| | |

| Copies to: |

J. Gerard Cummins

Sidley Austin LLP

787 Seventh Avenue

New York, New York 10019

Tel (212) 839-5300

Fax (212) 839-5599 |

|

Andrew S. Epstein

Jason D. Myers

Clifford Chance US LLP

31 West 52nd Street

New York, New York 10019

Tel (212) 878-8000

Fax (212) 878-8375 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the registration statement becomes effective.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý | | Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ý

CALCULATION OF REGISTRATION FEE

| | | | |

| | | | |

| |

Title of securities

to be registered

| | Proposed maximum

aggregate offering

price(1)(2)

| | Amount of

registration fee(1)

|

|---|

| |

Common Stock, $0.01 par value per share | | $ | | $ |

|

- (1)

- Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

- (2)

- Includes shares of common stock subject to the underwriters' over-allotment option.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), shall determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2020

Shares

Angel Oak Mortgage, Inc.

Common Stock

This is our initial public offering. We are offering shares of our common stock, $0.01 par value per share (our "common stock"). We expect that the initial public offering price will be between $ and $ per share. Prior to this offering, there has been no public market for shares of our common stock. We intend to apply to have our common stock listed on the New York Stock Exchange (the "NYSE") under the symbol "AOMR."

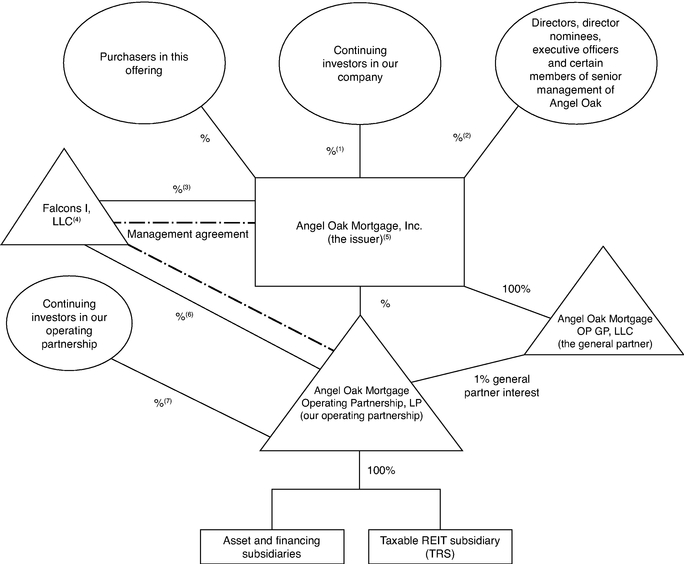

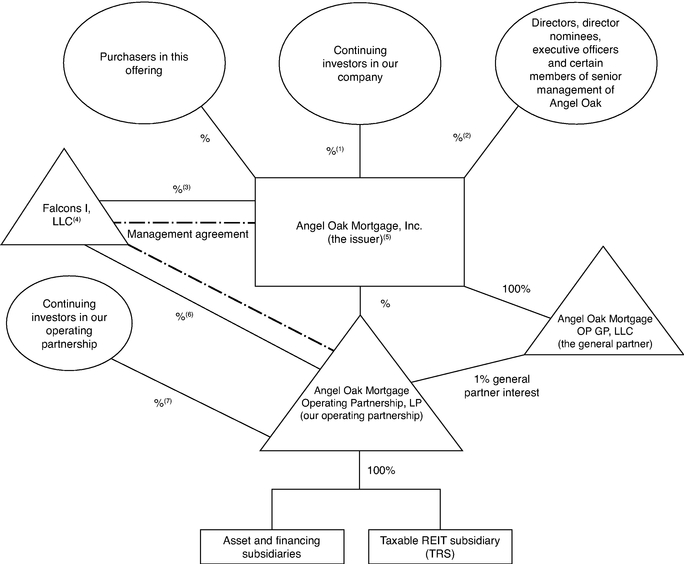

We are a real estate finance company focused on acquiring and investing in newly-originated first lien "non-qualified" mortgage loans ("non-QM loans") and other mortgage-related assets in the U.S. mortgage market. We are externally managed by Falcons I, LLC, an affiliate of Angel Oak Capital Advisors, LLC. Our objective is to generate attractive risk-adjusted returns for our stockholders, through cash distributions and capital appreciation, across interest rate and credit cycles. We commenced operations in September 2018 and are organized as a Maryland corporation. As of December 31, 2019, we had total assets of approximately $ million, including a $ million portfolio of non-QM loans and other target assets.

We intend to elect and qualify to be taxed as a real estate investment trust (a "REIT") for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2019. Subject to certain exceptions, our charter provides that no person may beneficially or constructively own shares of common stock in excess of 9.8% in value or in number of shares, whichever is more restrictive. In addition, our charter contains various other restrictions on the ownership and transfer of shares of our stock. See "Description of Stock — Restrictions on Ownership and Transfer."

We are an "emerging growth company" as defined under the U.S. federal securities laws and, as such, will be subject to reduced public company reporting requirements for this prospectus and future filings. See "Summary — Implications of Being an Emerging Growth Company."

Concurrently with the completion of this offering, Falcons I, LLC, our Manager, as well as certain members of senior management of Angel Oak, will invest an aggregate of $ million in a private placement of shares of our common stock at a price per share equal to the initial public offering price per share of common stock in this offering (without the payment of any underwriting discounts and commissions) (the "private placement").

See "Risk Factors" beginning on page 49 to read about certain factors you should consider before making a decision to invest in our common stock.

| | | | | | | |

| | Per share | | Total | |

|---|

Initial public offering price | | $ | | | $ | | |

Underwriting discounts and commissions(1) | | $ | | | $ | | |

Proceeds, before expenses, to us(2) | | $ | | | $ | | |

- (1)

- Angel Oak Capital Advisors, LLC has agreed to pay the underwriting discounts and commissions in connection with this offering. Please see the section entitled "Underwriting" for a complete description of the compensation payable to the underwriters.

- (2)

- Angel Oak Capital Advisors, LLC has agreed to pay all of our expenses incurred in connection with this offering. Please see the section entitled "Underwriting" for more information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters have the option to purchase up to an additional shares of our common stock from us at the initial public offering price less the underwriting discounts and commissions, exercisable at any time or from time to time within 30 days after the date of this prospectus, solely to cover over-allotments, if any.

The underwriters expect to deliver the shares of our common stock on or about , 2020.

| | | | | | |

Wells Fargo Securities |

|

BofA Securities |

|

Morgan Stanley |

|

UBS Investment Bank |

Prospectus dated , 2020

TABLE OF CONTENTS

| | |

| | Page |

|---|

GLOSSARY | | iii |

SUMMARY | | 1 |

THE OFFERING | | 41 |

RISK FACTORS | | 49 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | | 118 |

USE OF PROCEEDS | | 120 |

DILUTION | | 121 |

DISTRIBUTION POLICY | | 124 |

CAPITALIZATION | | 125 |

SELECTED FINANCIAL INFORMATION | | 126 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 130 |

BUSINESS | | 156 |

OUR STRUCTURE AND FORMATION | | 194 |

MANAGEMENT | | 199 |

OUR MANAGER AND THE MANAGEMENT AGREEMENT | | 211 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 222 |

PRINCIPAL STOCKHOLDERS | | 228 |

DESCRIPTION OF STOCK | | 232 |

SHARES ELIGIBLE FOR FUTURE SALE | | 239 |

OUR OPERATING PARTNERSHIP AND THE PARTNERSHIP AGREEMENT | | 242 |

CERTAIN PROVISIONS OF MARYLAND LAW AND OF OUR CHARTER AND BYLAWS | | 247 |

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS | | 255 |

ERISA CONSIDERATIONS | | 281 |

UNDERWRITING | | 284 |

LEGAL MATTERS | | 289 |

EXPERTS | | 289 |

WHERE YOU CAN FIND MORE INFORMATION | | 289 |

INDEX TO FINANCIAL STATEMENTS | | F-1 |

Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared by us or on our behalf. Neither we nor the underwriters take any responsibility for, or can provide any assurance as to the reliability of, any information other than the information contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared by us or on our behalf. We and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. You should assume that the information appearing in this prospectus or in any free writing prospectus prepared by us is accurate only as of their respective dates or on the date or dates which are specified in such documents. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

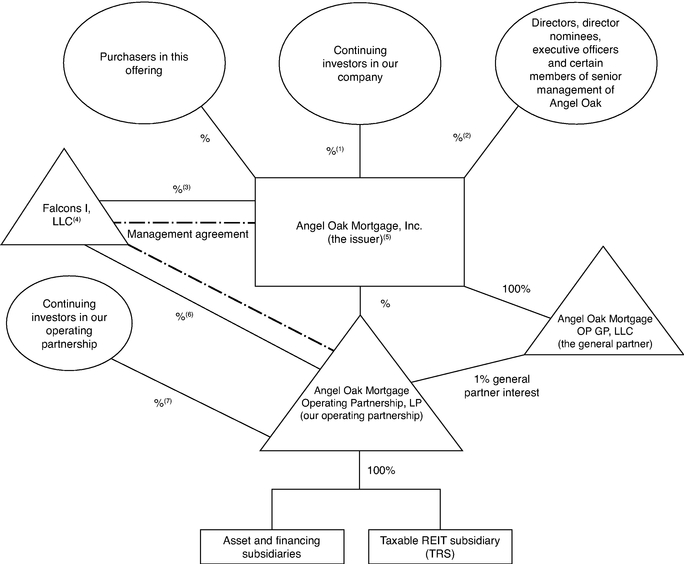

Unless the context otherwise requires or indicates, the terms "we," "us," "our" and "our company" refer to Angel Oak Mortgage, Inc., a Maryland corporation, our operating partnership and their respective subsidiaries (except that, prior to the completion of this offering, the private placement and our formation transactions (as described below), unless the context otherwise requires or indicates, "we,"

i

"us," "our" and "our company" may also refer to Angel Oak Mortgage Fund or AOMF PV); the term "our operating partnership" means Angel Oak Mortgage Operating Partnership, LP, a Delaware limited partnership, through which we hold substantially all of our assets and conduct our operations; the term "Angel Oak Mortgage Fund" refers to Angel Oak Mortgage Fund, LP, a private investment fund formed in February 2018 that, prior to the completion of this offering, the private placement and our formation transactions, owns all of the common stock of Angel Oak Mortgage, Inc.; the term "AOMF PV" refers to AOMF PV, LP, the entity that was formed for the benefit of certain investors to invest alongside Angel Oak Mortgage Fund and that invests directly in our operating partnership instead of through us; the term "Manager" refers to Falcons I, LLC, our external manager; the term "Angel Oak Companies" refers to Angel Oak Companies LLC; the term "Angel Oak Capital" refers to Angel Oak Capital Advisors, LLC; the term "Angel Oak Mortgage Lending" refers collectively to Angel Oak Mortgage Solutions, Angel Oak Home Loans and Angel Oak Commercial Lending; the term "Angel Oak Mortgage Solutions" refers to Angel Oak Mortgage Solutions LLC; the term "Angel Oak Home Loans" refers to Angel Oak Home Loans LLC; the term "Angel Oak Commercial Lending" refers to Angel Oak Commercial Lending, LLC, Angel Oak Prime Bridge, Angel Oak Commercial Bridge and Cherrywood Mortgage; the term "Angel Oak Prime Bridge" refers to Angel Oak Prime Bridge, LLC; the term "Angel Oak Commercial Bridge" refers to Angel Oak Commercial Bridge, LLC; and the term "Cherrywood Mortgage" refers to Cherrywood Mortgage, LLC.

The term "Angel Oak" refers collectively to Angel Oak Capital and its affiliates, including our Manager, Angel Oak Companies and Angel Oak Mortgage Lending; and the term "AOMT" refers to Angel Oak Mortgage Trust I, LLC, Angel Oak's securitization platform, including its subsidiaries and affiliates. In certain instances, references to our Manager and services to be provided to us by our Manager may also include services provided by Angel Oak Capital or its affiliates from time to time.

The term "stock" refers, unless the context requires otherwise, to all classes or series of stock of Angel Oak Mortgage, Inc. The term "OP units" refers to units of limited partnership interest in our operating partnership, which are redeemable for cash, based upon the value of an equivalent number of shares of our common stock at the time of the redemption, or, at our election, shares of our common stock on a one-for-one basis, subject to certain adjustments and the restrictions on ownership and transfer of our stock set forth in our charter and described under the section entitled "Description of Stock — Restrictions on Ownership and Transfer."

Market Data

We use market data and industry forecasts and projections throughout this prospectus, and in particular in the sections entitled "Summary" and "Business." Such market data and industry forecasts and projections have been taken from publicly available industry publications. These sources generally state that the information they provide has been obtained from sources they believe to be reliable, but we have not investigated or verified the accuracy and completeness of such information. Forecasts, projections and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties regarding our forward-looking statements in this prospectus. See "Special Note Regarding Forward-Looking Statements."

ii

Table of Contents

GLOSSARY

This glossary highlights some of the industry and other terms that we use elsewhere in this prospectus and is not a complete list of all the defined terms used herein.

"ABS" means securities collateralized by a pool of assets, such as loans, credit card debt, royalties or receivables, but typically excluding mortgages.

"Agency" means a U.S. Government agency, such as Ginnie Mae, or a federally chartered corporation, such as Fannie Mae or Freddie Mac, which guarantees payments of principal and interest on MBS.

"Agency RMBS" means residential mortgage-backed securities for which an Agency guarantees payments of principal and interest on the securities.

"Alt-A mortgage loans" mean residential mortgage loans made to borrowers whose qualifying mortgage characteristics do not conform to Agency underwriting guidelines, but whose borrower characteristics may. Generally, Alt-A mortgage loans allow homeowners to qualify for a mortgage loan with reduced or alternate forms of documentation. The credit quality of an Alt-A borrower generally exceeds the credit quality of subprime borrowers.

"Angel Oak" means collectively Angel Oak Capital Advisors, LLC and its affiliates, including our Manager, Angel Oak Companies and Angel Oak Mortgage Lending.

"A-Note" means a senior interest in a mortgage loan secured by a first mortgage on a single large commercial property or group of related commercial properties. A-Notes have a senior right to receive interest and principal related to the mortgage loan.

"ATR rules" means the Ability-to-Repay rules under the Truth-in-Lending Act established by the CFPB pursuant to authority granted under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), which rule, among other matters, requires lenders to make a reasonable and good faith determination of a borrower's ability to repay when underwriting a new mortgage, including documenting and verifying income and assets, as well as other factors.

"B-Note" means an interest in a loan secured by a first mortgage on a single large commercial property or group of related commercial properties and that is subordinated in right of payment to an A-Note, which is a senior interest in such loan.

"CFPB" means the Consumer Financial Protection Bureau, an agency of the U.S. Government responsible for consumer protection in the financial sector.

"CMBS" means mortgage-backed securities that are secured by interests in a single commercial real estate loan or a pool of mortgage loans secured by commercial properties.

"Commercial bridge loans" mean, generally, floating rate whole loans secured by first priority mortgage liens on the commercial real estate made to borrowers seeking short-term capital (typically with terms of up to five years) to be used in the acquisition, construction or redevelopment of commercial properties. This type of bridge financing enables the borrower to secure short-term financing while improving the commercial property and avoid burdening it with restrictive long-term debt.

"Commercial real estate loans" mean, with respect to our target assets, senior mortgage loans, commercial bridge loans, mezzanine loans, B-Notes, construction loans and small balance commercial real estate loans.

"Conforming residential mortgage loans" mean residential mortgage loans that conform to the underwriting guidelines of a GSE.

"Construction loans" mean short-term mortgage loans secured by first priority mortgage liens on the real estate used to finance the cost of construction or rehabilitation of commercial properties, and are typically disbursed over time as construction progresses.

iii

Table of Contents

"Consumer loans" mean loans made to individuals for personal, family or household purposes (such as auto loans, credit cards and student loans).

"CRT securities" mean risk-sharing instruments issued by GSEs, or similarly structured transactions arranged by third-party market participants, that transfer a portion of the risk associated with credit losses within pools of conventional residential mortgage loans to investors such as us. Unlike Agency RMBS, full repayment of the original principal balance of CRT securities is not guaranteed by a GSE; rather, "credit risk transfer" is achieved by writing down the outstanding principal balance of the CRT securities if credit losses on the related pool of loans exceed certain thresholds. By reducing the amount that issuers are obligated to repay to holders of CRT securities, the issuers of CRT securities are able to offset credit losses on the related pool of loans.

"DTI" means debt-to-income ratio, which is calculated as a borrower's monthly debt payments, divided by the borrower's monthly gross income.

"EU Risk Retention Rules" mean the credit risk retention rules of the European Union that generally require the originator, the original lender or the sponsor of a securitization to retain, on an ongoing basis, a material net economic interest in the relevant securitization of not less than 5% in respect of certain specified credit risk tranches or asset exposures. For more information, see "Business — Our Financing Strategies and Use of Leverage — Risk Retention."

"Fannie Mae" means the Federal National Mortgage Association, a federally chartered corporation.

"Freddie Mac" means the Federal Home Loan Mortgage Corporation, a federally chartered corporation.

"Ginnie Mae" means the Government National Mortgage Association, a wholly-owned corporate instrumentality of the United States within the U.S. Department of Housing and Urban Development.

"GSE" means a government-sponsored enterprise. When we refer to GSEs, we mean Fannie Mae or Freddie Mac.

"Investment property loans" mean mortgage loans made on portfolios of residential rental properties.

"Jumbo prime mortgage loans" mean residential mortgage loans that do not conform to GSE underwriting guidelines, primarily because the mortgage balance exceeds the maximum amount permitted by such underwriting guidelines.

"LTV" means loan-to-value ratio, which is calculated for purposes of this prospectus as the outstanding principal amount of a loan plus any financing that is pari passu with or senior to such loan at the time of acquisition, divided by the applicable real estate value at acquisition of such loan. The real estate value reflects the results of third-party appraisals obtained by the selling mortgage companies prior to the loan closing.

"MBS" means mortgage-backed securities that are secured by interests in a pool of mortgage loans secured by property.

"Mezzanine loans" mean loans made to commercial property owners that are secured by pledges of the borrowers' ownership interests, in whole or in part, in entities that directly or indirectly own the properties, such loans being subordinate to whole loans secured by first or second mortgage liens on the properties themselves. Mezzanine loans may be structured as preferred equity investments which provide substantively the same rights for the lender but involve the lender holding actual equity interests with preferential rights over the common equity.

"Mortgage loans" mean loans secured by real estate with a right to receive the payment of principal and interest on the loans (including servicing fees).

iv

Table of Contents

"MSRs" mean mortgage servicing rights. MSRs represent the right to service mortgage loans, which involves activities such as collecting mortgage payments, escrowing and paying taxes and insurance premiums and forwarding principal and interest payments to the mortgage lender. In return for providing these services, the holder of an MSR is entitled to receive a servicing fee, typically specified as a percentage (expressed in basis points) of the serviced loan's unpaid principal balance. An MSR is made up of two components: a basic fee and an "excess MSR." The basic fee is the amount of compensation for the performance of servicing duties (including advance obligations), and the excess MSR is the amount that exceeds the basic fee.

"non-Agency RMBS" means RMBS that are not issued or guaranteed by an Agency or a GSE.

"non-QM loans" mean residential mortgage loans that do not satisfy the requirements for QM loans, including "exempt loans," such as "Investor" loans made to real estate investors and originated by Angel Oak Mortgage Lending that do not need to meet the ATR rules. For more information on "Investor" loans, see "Summary — Our Strategy."

"QM loans" mean residential mortgage loans that comply with the ATR rules and related guidelines of the CFPB.

"Residential bridge ('fix and flip') loans" mean short-term residential mortgage loans secured by a first priority security interest in non-owner occupied single family or multi-family residences, which loans are typically used in the acquisition and re-development of the residences with a view to the borrowers selling the residences.

"Residential mortgage loans" mean, with respect to our target assets, non-QM loans, QM loans, conforming residential mortgage loans, second lien mortgage loans, residential bridge ('fix and flip') loans, investment property loans, jumbo prime mortgage loans, Alt-A mortgage loans and subprime residential mortgage loans.

"RMBS" means mortgage-backed securities that are secured by interests in a pool of mortgage loans secured by residential property. RMBS may be senior, subordinate, interest-only, principal-only, investment-grade, non-investment grade or unrated.

"Second lien mortgage loans" mean residential mortgage loans that are subordinate to the primary or first lien mortgage loans on a residential property.

"Senior mortgage loans" mean commercial real estate loans secured by first mortgage liens on commercial properties, which loans may vary in duration, may bear interest at fixed or floating rates and may amortize, and typically require balloon payments of principal at maturity.

"Small balance commercial real estate loans" mean commercial real estate loans that typically range in original principal amounts of between $250,000 and $15 million.

"Subprime residential mortgage loans" mean residential mortgage loans that do not conform to GSE underwriting guidelines. These lower standards permit loans to be made to borrowers having low credit scores and/or imperfect or impaired credit histories (including outstanding judgments or prior bankruptcies), loans with no income disclosure or verification and loans with high LTVs.

"U.S. Risk Retention Rules" mean the credit risk retention rules of the Securities and Exchange Commission (the "SEC") that generally require the sponsor of asset-backed securities to retain not less than 5% of the credit risk of the assets collateralizing the issuer's securities. For more information, see "Business — Our Financing Strategies and Use of Leverage — Risk Retention."

"UPB" means unpaid principal balance of a mortgage loan.

"WAC" means weighted average coupon, which is the weighted average interest rate of the mortgage loans underlying the indicated investment.

"Whole loans" mean direct investments in whole residential mortgage loans, as opposed to investments in other structured products that are backed by such loans.

v

Table of Contents

SUMMARY

This summary highlights information contained elsewhere in this prospectus. It is not complete and may not contain all of the information that you should consider before making a decision to invest in our common stock. You should read carefully the more detailed information set forth under "Risk Factors" and the other information included in this prospectus. For a description of certain industry terms used in this prospectus, see "Glossary" beginning on page (iii).

Unless the context otherwise requires or indicates, the information in this prospectus assumes: (1) our formation transactions (as described below) have been, or will be, completed prior to, or concurrently with, the completion of this offering and the private placement; (2) the shares of our common stock sold in this offering and the private placement are sold at $ per share, which is the mid-point of the price range indicated on the front cover page of this prospectus; and (3) no exercise of the underwriters' over-allotment option.

Our Company

Angel Oak Mortgage, Inc. is a real estate finance company focused on acquiring and investing in first lien non-QM loans and other mortgage-related assets in the U.S. mortgage market. Our strategy is to make credit sensitive investments in newly-originated first lien non-QM loans that are primarily made to higher-quality non-QM loan borrowers and primarily sourced from Angel Oak's proprietary mortgage lending platform, Angel Oak Mortgage Lending. This origination platform operates through wholesale and retail channels and has a national origination footprint. We also may invest in other residential mortgage loans, commercial real estate loans, RMBS and CMBS, and other mortgage-related assets, which, together with non-QM loans, we refer to in this prospectus as our target assets. Our objective is to generate attractive risk-adjusted returns for our stockholders, through cash distributions and capital appreciation, across interest rate and credit cycles.

We commenced operations in September 2018 and have raised $ million in equity commitments since then. On , 2020, we formed our operating partnership through which we conduct our operations. Substantially all of our assets are held by, and substantially all of our operations are conducted through, our operating partnership, either directly or through subsidiaries. As of December 31, 2019, we had total assets of approximately $ million, including a $ million portfolio of non-QM loans and other target assets, which were financed with several term securitizations as well as with in-place loan financing lines and securities repurchase facilities with a combination of global money center and large regional banks. Our portfolio consists primarily of mortgage loans and mortgage-related assets that have been underwritten in-house by Angel Oak Mortgage Lending, and are subject to Angel Oak Mortgage Lending's rigorous underwriting guidelines and procedures. As of the date of origination of each of the loans underlying our portfolio of RMBS, such loans had a weighted average FICO score of , a weighted average LTV of % and a weighted average down payment of $ . During the year ended December 31, 2019, we generated a return on average equity of %, which was comprised of . Our return on average equity during the year ended December 31, 2019 may not be indicative of our return on average equity in the future and our past performance may not be indicative of our future results.

We intend to elect and qualify to be taxed as a REIT commencing with our taxable year ended December 31, 2019. Commencing with our taxable year ended December 31, 2019, we believe that we have been organized and operated and intend to continue to operate in conformity with the requirements for qualification and taxation as a REIT under the Internal Revenue Code (the "Code"). Our qualification as a REIT, and maintenance of such qualification, will depend on our ability to meet, on a continuing basis, various complex requirements under the Code relating to, among other things, the sources of our gross income, the composition and values of our assets, our distribution levels and the concentration of ownership of our stock. We also intend to operate our business in a manner that will

1

Table of Contents

allow us to maintain our exclusion from regulation as an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Act").

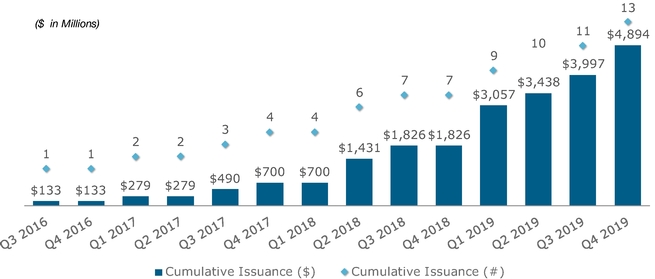

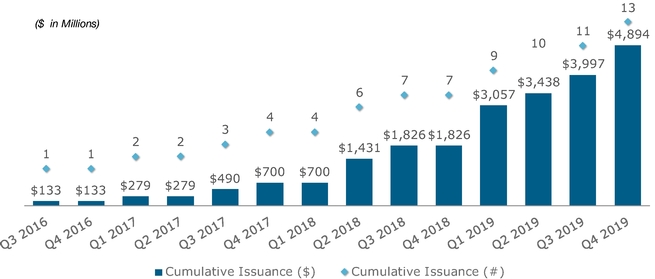

Our Manager and its Operating Platform

Since we commenced operations, we have been externally managed and advised by our Manager, a registered investment adviser under the Investment Advisers Act of 1940, as amended (the "Advisers Act"), and an affiliate of Angel Oak. Angel Oak is a leading alternative credit manager with market leadership in mortgage credit that includes asset management, lending and capital markets. Angel Oak Capital was established in 2009 and had approximately $ billion in assets under management as of December 31, 2019, across private credit, multi-strategy funds, separately managed accounts and mutual funds, including $ billion of mortgage-related assets. Angel Oak Mortgage Lending is a market leader in non-QM loan production and, as of December 31, 2019, had originated over $7.6 billion in total non-QM loan volume since its inception in 2011. AOMT, Angel Oak's securitization platform, is a leading programmatic issuer of non-QM securities and had issued approximately $5.1 billion in such securities through 13 rated offerings as of December 31, 2019 — making AOMT among the largest issuers of such securities since 2015. Angel Oak managed entities have retained subordinated bonds from these transactions and, as of December 31, 2019, these investments have exhibited strong credit performance, with delinquency rates greater than 60 days representing less than % of such portfolios. Angel Oak is headquartered in Atlanta and has over 700 employees across its enterprise.

Through our relationship with our Manager, we benefit from Angel Oak's vertically integrated platform and in-house expertise, providing us with the resources that we believe are necessary to generate attractive risk-adjusted returns for our stockholders. Angel Oak Mortgage Lending provides us with proprietary and ongoing access to non-QM loans, as well as transparency over the underwriting process and the ability to acquire loans with our desired credit and return profile. In addition, we believe we have significant competitive advantages due to Angel Oak's experience in the mortgage industry, analytical investment tools, extensive relationships in the financial community, financing and capital structuring skills, investment surveillance capabilities and operational expertise.

Our Manager is led by a cycle-tested team of professionals, each with over 15 years of experience in the finance and mortgage business sectors, including Robert Williams, our Chief Executive Officer and the Chief Executive Officer of our Manager, Brandon Filson, our dedicated Chief Financial Officer and Treasurer, Sreeniwas Prabhu, Managing Partner and Co-Chief Executive Officer of Angel Oak Capital and the President of our Manager, Michael Fierman, the Chairman of our Board of Directors and a Managing Partner and Co-Chief Executive Officer of Angel Oak Companies, and Namit Sinha, Co-Chief Investment Officer, Private Strategies of Angel Oak. Our Manager's senior management team is supported by approximately 75 employees, across Angel Oak Capital's executive, portfolio management, capital markets, operations, risk, compliance, and sales and marketing teams. Further, our Manager benefits from access to Angel Oak Mortgage Lending's over 550 employees across its platform.

Angel Oak's Proprietary Mortgage Lending Platform

Angel Oak operates a comprehensive mortgage lending platform that is a leading originator of non-QM loans, which provides us access to assets to pursue our strategy. The mortgage lending platform was created in 2011 and serves an integral role in Angel Oak's residential mortgage credit strategy and third-party fund complex by sourcing mortgage assets as well as allowing for transparency and control of the underwriting and origination process. Angel Oak Mortgage Lending's strategy is focused on originating high quality residential mortgage loans that are acquired by various Angel Oak managed entities, including us, creating alignment with Angel Oak and our Manager. Further, the mortgage lending platform is led by Michael Fierman, the Chairman of our Board of Directors and a Managing Partner and Co-Chief Executive Officer of Angel Oak Companies.

2

Table of Contents

Through our Manager's relationship with Angel Oak Mortgage Lending, we are able to utilize an "originator model" of sourcing loans, which we believe provides tangible value and differentiation compared to an "aggregator model" that is dependent on third-party origination and underwriting. The originator model allows for verification of the credit underwriting process instead of outsourcing this critical function, and provides the ability to create a desired credit and return profile at the source. Moreover, this model provides for the ability to quickly adapt and customize the collateral profile depending on market conditions. We believe that the originator model has been well-received by market participants, including rating agencies and senior bond buyers of securitizations sponsored by Angel Oak managed entities, and it demonstrates a strong alignment of interests with regard to credit quality given the retention of junior bonds by Angel Oak managed entities. Furthermore, we believe that our access to Angel Oak Mortgage Lending's robust origination platform also differentiates us among most other U.S. public mortgage REIT peers by providing us with the ability to pursue our primary strategy focused on non-QM loans.

Angel Oak Mortgage Lending originated over $2.2 billion and $ billion in non-QM loans for the years ended December 31, 2018 and 2019, respectively. The mortgage lending platform has a diverse product offering of non-QM loans as well as a national origination footprint through its wholesale and retail channels, as described below.

Angel Oak Mortgage Lending also has a commercial real estate lending channel, Angel Oak Commercial Lending, which has been an active originator of commercial bridge loans across the United States as well as a direct portfolio lender of small balance commercial real estate loans. Our Manager is able to access the commercial real estate lending channel in a similar manner to the residential wholesale and retail channels, providing us with a direct ability to competitively invest in various commercial real estate loans that are complementary to our non-QM strategy.

Angel Oak Mortgage Lending's Platform Would be Difficult to Replicate

- •

- Substantial capital investment and significant resources have been devoted to the mortgage lending platform since 2011, building a leading non-QM lender in the United States.

- •

- We believe that Angel Oak Mortgage Lending's experience and reputation in the industry create strong relationships with its mortgage broker clients, which are the primary source of non-QM loan opportunities. These clients generally originate a small percentage of their total volume in

3

Table of Contents

non-QM loans, and therefore often seek a partner with strong customer service levels that can seamlessly close loans. These client relationships have been built over years and span the clients' senior management teams, loan officers and support staffs.

- •

- Relationships with a network of brokers provide a continual flow of loans on a programmatic basis, which we believe compares favorably to many of our competitors that do not have the operating infrastructure to source loans in the same manner. Instead, many of our competitors purchase loans on a "bulk" or "mini-bulk" basis, which is subject to inconsistent loan flow and credit profiles.

- •

- We believe that Angel Oak Mortgage Lending's "boots on the ground" in its retail channel provides us with deep insight into residential mortgage lending as well as the ability to identify trends in real time.

Our Strategic Affiliation with Angel Oak

Investment from Angel Oak Creates a Strong Alignment of Interests

Concurrently with the completion of this offering, our Manager as well as certain members of senior management of Angel Oak, will invest an aggregate of $ million in the private placement to purchase shares of our common stock (assuming an initial public offering price of $ per share, which is the mid-point of the price range indicated on the front cover page of this prospectus) at a price per share equal to the initial public offering price per share of our common stock sold in this offering (without the payment of any underwriting discounts or commissions). We believe that the significant investment and ownership by our Manager and the members of senior management of Angel Oak participating in the private placement will further align our Manager's interests and the interests of Angel Oak executives with those of our stockholders. These investments, combined with the grants of shares of restricted stock to our directors, director nominees and executive officers that we intend to make in connection with this offering, will result in our Manager, certain members of senior management of Angel Oak and our directors, director nominees and executive officers owning an aggregate of approximately % of the outstanding shares of our common stock upon the completion of this offering, the private placement and our formation transactions (based on the mid-point of the price range indicated on the front cover page of this prospectus and assuming the exchange of OP units for shares of our common stock on a one-for-one basis). Our Manager and the members of senior management of Angel Oak participating in the private placement have agreed for a period of days after the date of this prospectus, and our directors, director nominees and executive officers have agreed for a period of days after the date of this prospectus, not to sell or otherwise transfer, directly or indirectly, any shares of our common stock or securities convertible into or exchangeable for shares of our common stock (including OP units) owned by them at the completion of this offering, the private placement and our formation transactions or thereafter acquired by them, subject to specified exceptions, without the prior written consent of the representatives of the underwriters. In addition, Angel Oak Capital has agreed to pay all of our expenses incurred in connection with this offering, including the underwriting discounts and commissions payable to the underwriters in this offering, eliminating stockholder dilution from such expenses. See "Underwriting."

Leveraging Angel Oak's In-House Capabilities and Proprietary Mortgage Infrastructure

We benefit from our Manager's ability to draw on the knowledge, resources, and relationships of Angel Oak, which has an 11-year history in mortgage credit investments. Angel Oak has deep experience originating loans with desired credit and return profiles and utilizing prudently structured financing. Angel Oak's in-house expertise also extends beyond non-QM loans to include commercial real estate, structured credit with an emphasis on MBS, as well as corporate debt, enabling a holistic view of financial markets. Our Manager has direct access to Angel Oak's platform and mortgage credit resources, providing our Manager with the ability to identify trends and to access Angel Oak's deep

4

Table of Contents

market knowledge and operational expertise. Further, our Manager's relationship with Angel Oak creates the ability for our Manager to source, acquire, finance and securitize, and manage target assets on our behalf.

Through our Manager's relationship with Angel Oak, we have direct access to the following value-added services:

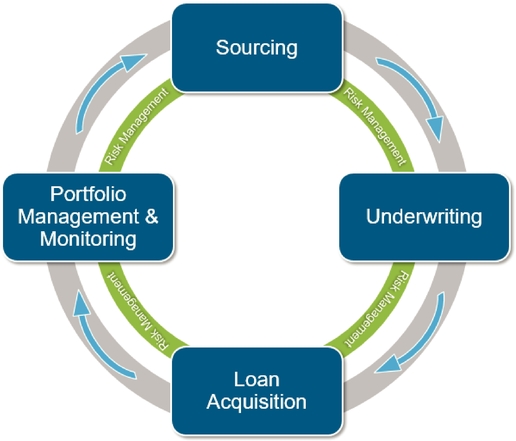

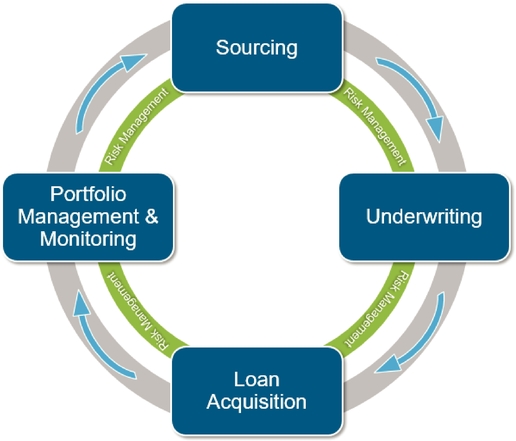

- •

- Mortgage Sourcing — Consists of approximately 280 sales professionals across Angel Oak Mortgage Lending as of December 31, 2019. The wholesale channel has expertise in educating originators regarding Angel Oak's non-QM loan origination "best practices," building loan officer relationships at the local level and spreading awareness of program availability. The retail channel leverages its referral network to access origination volume and utilizes a "grass roots" marketing approach to further grow brand awareness.

- •

- Mortgage Underwriting — Consists of over 40 underwriters in Angel Oak Mortgage Lending as of December 31, 2019. The in-house team serves as a centralized function for the lending platform and ensures that the loans we acquire are subject to high quality underwriting standards and requirements, including the assessment and documentation of the borrower's ability to repay under the ATR rules. Underwriters have access to a comprehensive set of tools and training to assist in their loan evaluation. All loans are subject to incremental review and oversight through in-house pre-closing quality control, a post-closing review by a third-party due diligence firm and investor due diligence in connection with securitization transactions.

- •

- Portfolio Management and Monitoring — Consists of approximately individuals in Angel Oak Capital as of December 31, 2019, with expertise across all segments of mortgage and structured credit. The team has access to proprietary analytical models and investment infrastructure developed by Angel Oak Capital, and utilizes a quantitative assessment of interest rate risk, prepayment risk and, where applicable, credit risk, both on a portfolio-wide basis and an asset-by-asset basis. The asset management process relies on the sophisticated quantitative tools and methodologies that are the foundation of Angel Oak's investment technique and asset surveillance. These tools enable our Manager to make its asset selection and monitoring decisions.

- •

- Capital Markets — Angel Oak Capital is focused on optimizing capital efficiency. The capital markets team has significant experience in non-QM loan securitizations and manages all Angel Oak financing facilities. Further, the capital markets team is able to leverage Angel Oak's relationships with leading financial institutions to increase the overall number of financing counterparties available to us.

- •

- Business Operations — Our Manager is supported by Angel Oak Capital, which provides an efficient method of accessing institutional-quality services for key operational functions, such as finance, accounting, legal, compliance, risk, information technology, cyber security, human resources, marketing and other services.

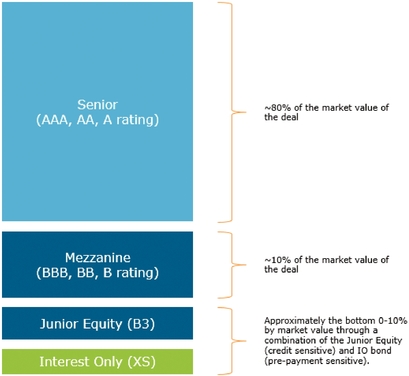

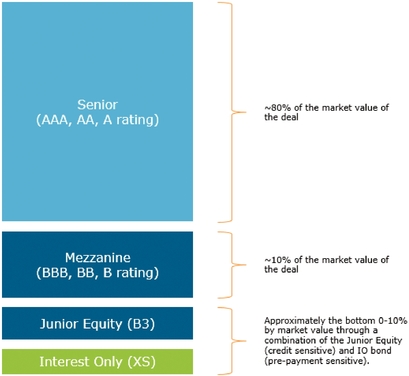

Access to Angel Oak Mortgage Trust Securitizations

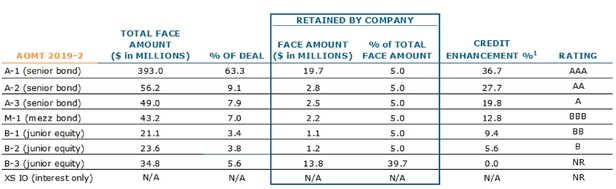

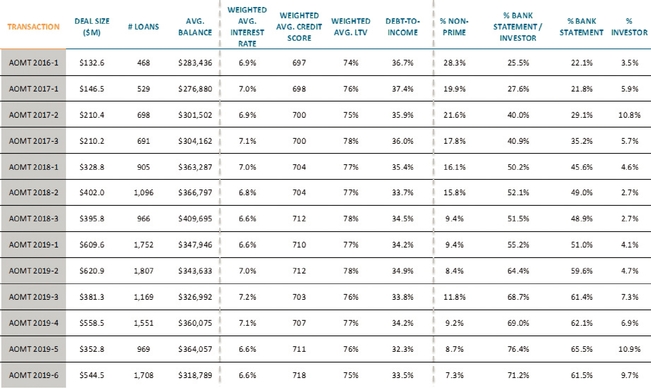

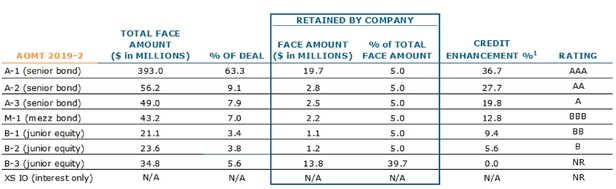

AOMT, Angel Oak's securitization platform, is a leading programmatic issuer of non-QM securities with an established track record and consistent and growing investor base. We, along with other Angel Oak managed entities, have participated together in AOMT non-QM securitizations. In particular, in March 2019, we completed a securitization transaction of a pool of residential mortgage loans, a substantial majority of which were non-QM loans, secured primarily by first or second liens on one-to-four family residential properties. In the transaction, Angel Oak Mortgage Trust I 2019-2 ("AOMT 2019-2") issued approximately $620.9 million in bonds. We served as the "sponsor" (as defined in the U.S. Risk Retention Rules) of the transaction and contributed non-QM loans with a carrying value of approximately $255.7 million that we had accumulated on our balance sheet. The remaining non-QM loans that

5

Table of Contents

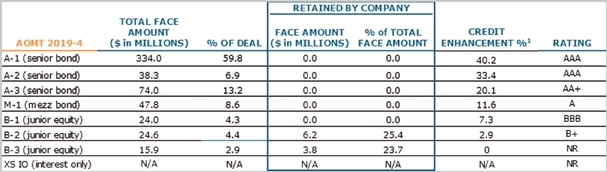

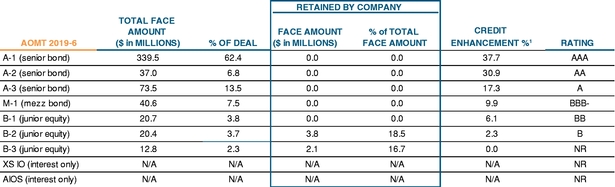

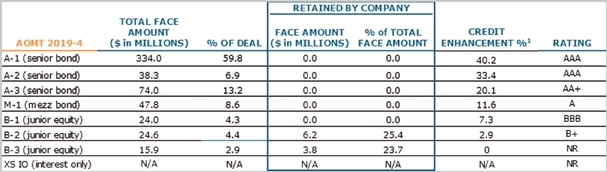

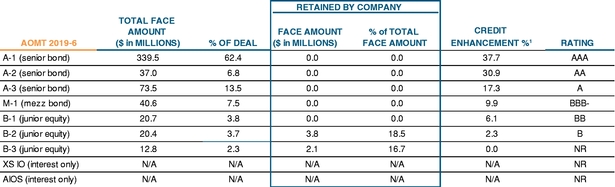

we contributed to AOMT 2019-2 were purchased from affiliated and unaffiliated entities. Additionally, in August 2019, we completed a second securitization transaction of a pool of residential mortgage loans consisting of residential mortgage loans similar to those contributed to AOMT 2019-2. In the transaction, Angel Oak Mortgage Trust 2019-4 ("AOMT 2019-4") issued approximately $558.5 million in bonds and we contributed non-QM loans with a carrying value of approximately $147.4 million that we had accumulated on our balance sheet. Another Angel Oak managed entity served as the sponsor of AOMT 2019-4. Furthermore, in November 2019, we completed a third securitization transaction of a pool of residential mortgage loans consisting of residential mortgage loans similar to those contributed to AOMT 2019-2 and AOMT 2019-4. In the transaction, Angel Oak Mortgage Trust 2019-6 ("AOMT 2019-6") issued approximately $544.5 million in bonds and we contributed non-QM loans with a carrying value of approximately $100.5 million that we had accumulated on our balance sheet. Another Angel Oak managed entity served as the sponsor of AOMT 2019-6. Growth in Angel Oak Mortgage Lending and Angel Oak managed entities has allowed AOMT to issue securities with greater frequency and in larger deal sizes, enabling economies of scale related to transaction costs. We believe this steady, periodic issuances help increase liquidity and provide transparency into collateral performance, which has garnered positive bond holder sentiment.

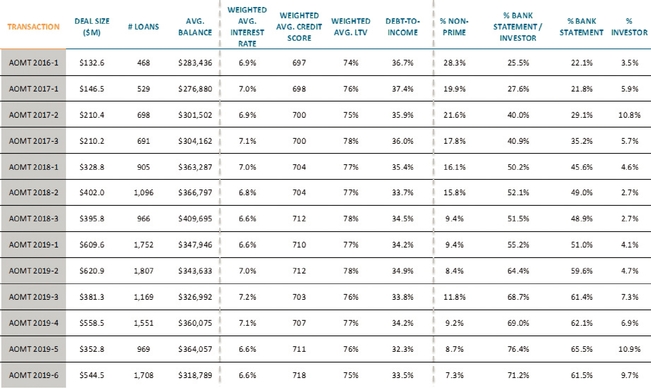

Angel Oak Capital's portfolio management team has worked with Angel Oak Mortgage Lending to provide attractive collateral backing AOMT securitizations. AOMT's securitizations have maintained generally consistent weighted average credit score, DTI and LTV metrics since 2016. In addition, the percentage of (1) loans made to "bank statement borrowers," and (2) "Investor" loans, each of which is described below under "— Our Strategy," has increased since 2016. As of December 31, 2019, approximately 64.4%, 69.0% and 71.2% of the collateral in AOMT 2019-2, AOMT 2019-4 and AOMT 2019-6, respectively, consisted of loans made to "bank statement borrowers" or "Investor" loans. Furthermore, geographic representation has remained diverse and the average deal size has generally increased in conjunction with origination volumes over time.

Performance of AOMT's securitizations has reflected Angel Oak's disciplined underwriting practices and driven continued demand for AOMT new issuance. As of December 31, 2019, delinquency rates greater than 60 days across all of AOMT's securitizations represented less than 1.6% of the current unpaid principal balances of the loans in such securitizations, and such securitizations have experienced losses aggregating 0.01% of the original unpaid principal balances of the loans contributed to such securitizations.

Market Opportunity

We believe that the experience and resources of Angel Oak, including our Manager, position us to capitalize on opportunities resulting from the following market conditions:

Non-QM Loans Have Significant Runway for Continued Growth

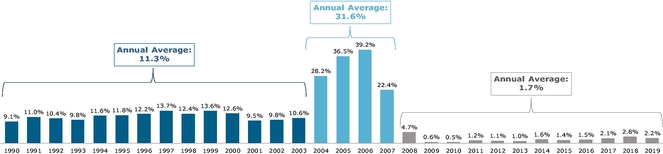

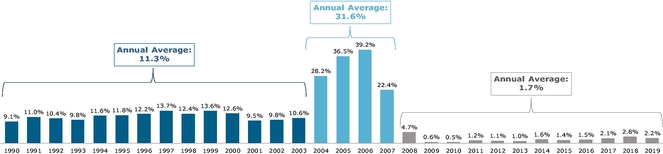

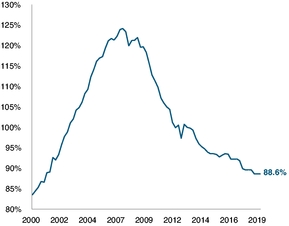

Total residential first lien mortgage volume in the United States broadly falls into three categories, with a majority of the volume from 1990 to 2019 consisting of Agency loans and jumbo prime mortgage loans. The remainder of origination volume during this period has been facilitated by private capital investors ("Private Capital Volume"). As a provider of private capital to the residential mortgage market, primarily through non-QM loans, our opportunity lies in this segment of the market.

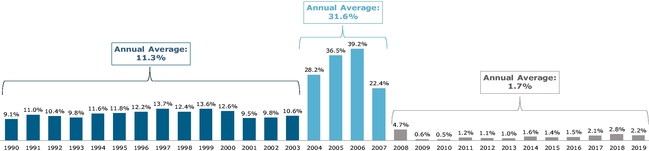

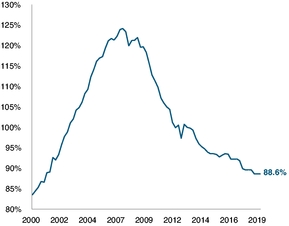

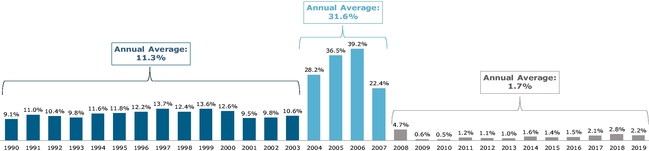

According to Inside Mortgage Finance, Private Capital Volume accounted for approximately 9% to 14% of total residential first lien mortgage volume for the 14 years prior to the "bubble years" of 2004 to 2007. Following the financial crisis in 2008 to 2009, Private Capital Volume declined to approximately 0.6% of total residential first lien mortgage volume in 2009, and has gradually increased to approximately 2.2% of total residential first lien mortgage volume in 2019. Over the same period, the total residential first lien mortgage market volume has ranged from $1.3 trillion to $2.4 trillion. With the increased demand for, and growing acceptance of, private capital loan products, including non-QM loans, we believe Private Capital Volume should continue to increase over time. We believe Angel Oak Mortgage Lending's position as a market leader in non-QM loan production will enable us to capitalize on growing Private Capital Volume.

6

Table of Contents

The following chart depicts Private Capital Volume as a percentage of total residential market volume since 1990:

Private Capital as a Percentage of Total Market Volume

Source: Inside Mortgage Finance Publications, Inc.

We believe underlying demand for non-QM loans has primarily been driven by loan officers and borrowers becoming more educated and familiar with non-QM loan products. Loan officer education has been bolstered in part by loan officers seeking new products to support origination volume during periods of lower refinance volume as well as to capitalize on the growth of the non-QM loan market. We believe that Angel Oak Mortgage Lending is well-positioned to participate as a market leader in the potential growth of the non-QM loan market as it continues to educate loan officers of the benefits and opportunities related to non-QM loans. We also believe that Angel Oak Mortgage Lending's regular interaction with loan officers and other market participants provides it with valuable insight and direct market feedback, enabling Angel Oak to capitalize on opportunities in the non-QM loan market.

Angel Oak Mortgage Lending Provides Borrowers with Access to Non-QM Mortgage Products

Beginning on January 10, 2014, residential mortgage originators became subject to lending standards established by the CFPB pursuant to authority granted under the Dodd-Frank Act. Central to the updated lending standards are the ATR rules, which require mortgage lenders to make a reasonable, good faith determination of each borrower's ability to repay a loan without selling the property. A lender who fails to comply with the ATR rules could be liable for all finance charges and fees paid by the borrower, legal costs, and other applicable damages unless the lender demonstrates that such failure to comply was not material. With respect to mortgage loans originated to the standards of QM loans, such loans that are not "higher-priced" are provided a safe harbor, whereas loans that are higher-priced are given a rebuttable presumption of compliance with the ATR rules, provided that certain requirements are met. Further, lenders that originate mortgage loans to the standards of QM loans are granted a safe harbor from litigation if borrowers default, provided that certain requirements are met. Any loan that fails to meet these strict criteria and falls outside the parameters is deemed "non-QM."

Non-QM loans have become an increasingly important component of the residential mortgage market since first being offered in 2014, which we believe is being driven in large part by higher-quality borrowers continuing to be left behind because they fall outside the stringent QM loan standards. Angel Oak Mortgage Lending's non-QM loan products are designed to provide financing to higher-quality non-QM loan borrowers, including bank statement borrowers, just missed DTI borrowers, high net worth borrowers, real estate investors and prior credit event borrowers. See "— Our Strategy" below for a description of Angel Oak Mortgage Lending's lending programs.

Non-QM Criteria Incorporates Lessons Learned from the Financial Crisis

We believe that non-QM loans should not be compared to non-Agency loans issued prior to the financial crisis. As shown in the table below, the underwriting standards relating to these two types of

7

Table of Contents

loans are vastly different, as the underwriting process has been transformed because of regulatory changes and enhanced lender oversight, resulting in better quality borrowers being subject to heightened underwriting requirements. Today, originators use fraud risk tools that did not exist in the pre-crisis period. These tools flag misrepresentations, undisclosed property and occupancy fraud and undisclosed debt. In the pre-crisis period, loan officers were incentivized to close loans to generate volume and were able to influence the appraisal process. Originators now use independent third-party appraisal management companies to maintain appraiser independence. In addition, all loans now require a form of income documentation (e.g., tax documents or bank statements) to prove the borrower's ability to repay as required by the ATR rules. In comparison, pre-crisis underwriting practices utilized low or no documentation of borrower assets or income. Further, most non-QM loans generally include a significant equity buffer, as most loans have an LTV of less than 80%.

The following chart sets out certain general characteristics of 2006 Alt-A mortgage loans and subprime mortgage loans compared to 2019 non-QM loans:

Illustrative Loan Characteristics

| | | | | | | | |

Loan Origination

Year | | LTV | | Low or No

Documentation

of Borrower

Assets or

Income | | DTI | | Appraisal |

|---|

| 2006 Alt A | | 82%(1) | | 80% | | 37%(2) | | Loan officer in charge of the appraisal process |

| 2006 Subprime | | 86%(1) | | 38% | | 41%(2) | | Loan officer in charge of the appraisal process |

| 2019 Non-QM | | Generally, LTVs less than 80% | | — | | 36%(3) | | Appraisal provided by independent third party, ordered by the lender |

Source for 2006 LTVs, Documentation and DTIs: United States Government Accountability Office Report: 09-848R Nonprime Mortgages

- (1)

- Represents average combined loan-to-value ("CLTV"), which includes both the first mortgage and any subsequent second-lien mortgage loans.

- (2)

- Represents average DTI.

- (3)

- Represents average DTI on expanded credit securitizations in 2019, as reported by Inside Mortgage Finance Publications, Inc.

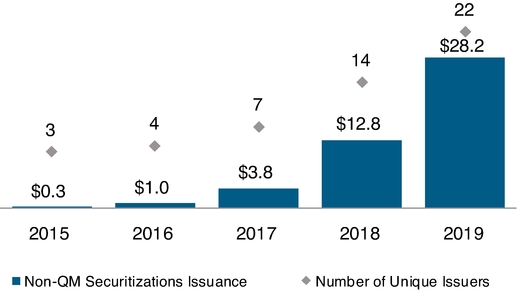

Growing Non-QM Securitization Market Supports Strategy and Financial Performance

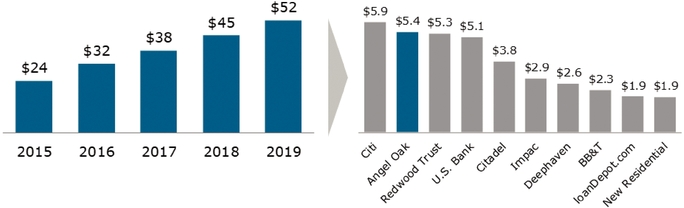

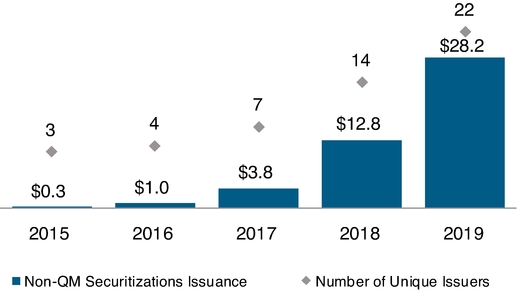

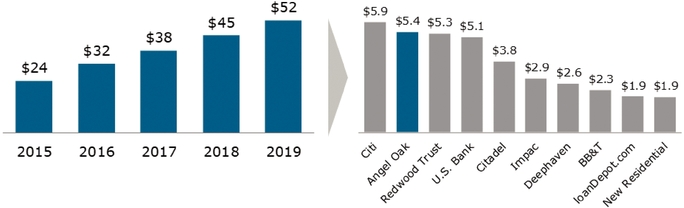

From December 31, 2014 to December 31, 2019, a total of 128 non-QM securitization transactions have been completed, generating cumulative issuance volume of approximately $46.1 billion in the non-QM securitization market. Growth of the non-QM securitization market during this period has provided, and we expect will continue to provide, us and Angel Oak Mortgage Lending with significant benefits. As the non-QM securitization market has grown, rating agencies have entered the space, providing third-party assessments on the quality of collateral and helping investors gain comfort around the asset class, which we believe has led to increased demand for new issuance. AOMT, Angel Oak's securitization platform, is a leading programmatic issuer of non-QM securities and its issuances have benefited from increased demand and a larger, more liquid market. We believe that ongoing access to a growing non-QM securitization market will continue to enable us to execute our strategy, as we expect it to provide us with attractive term financing for our mortgage loans and the opportunity to retain securities that we believe contribute in providing attractive risk-adjusted returns for our stockholders. Furthermore, we expect this access to continue to enable us to grow our asset base, use our capital efficiently and achieve what we believe to be an attractive leverage profile for our stockholders.

8

Table of Contents

Market Supported by Favorable Macroeconomic Trends

The U.S. residential credit market in which we invest is supported by strong macroeconomic trends, favorable sector-level supply and demand dynamics and a healthy borrower base.

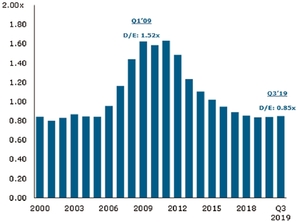

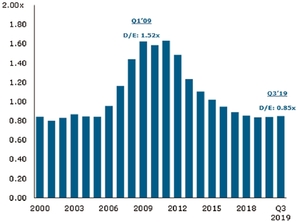

- •

- Consumer is Healthy — The financial health of U.S. households has improved markedly from 2009 to 2019. U.S. households have de-levered substantially from the peak levels leading up to and following the financial crisis. Total mortgage debt to home equity has decreased to levels prior to the financial crisis, reaching less than 0.85x at September 30, 2019, its lowest level since 2005. Further, limited debt growth combined with income growth has resulted in declining household debt to income, and household net worth has increased roughly 89% from the beginning of 2009 through June 30, 2019. The combination of lower leverage and increased net worth creates an attractive backdrop for the residential credit market.

- •

- Housing Supported by Balanced Supply and Demand Environment — The U.S. residential credit market benefits from stable home prices and low interest rates for home buyers. Following a volatile period during the financial crisis, the supply of residential homes for sale has remained constrained, with supply ranging between four months and 7.4 months from 2012 to 2019. Over the same period of time, home prices have appreciated. We believe that modest price appreciation indicates a healthy balance of supply and demand, which is favorable for the residential housing market in the long term. Furthermore, the U.S. Federal Reserve continues to remain accommodative, with interest rates below pre-financial crisis levels, creating an attractive environment for home buyers and facilitating stable lending volume.

Potential Reduction in GSE Footprint Creates Incremental Opportunity

In connection with the implementation of the ATR rules, the GSEs were given a broad-based exemption from certain regulatory and compliance requirements relating to DTI, referred to as the "QM Patch." In 2018, approximately 16% of residential mortgage loans acquired by GSEs would be considered non-QM loans if it were not for the QM Patch. The QM Patch is set to expire in January 2021, creating an opportunity for policy makers to reduce the government's role, and bring more private capital into the residential mortgage market. In July 2019, the CFPB issued an Advance Notice of Proposed Rulemaking in which it announced its intent to let the QM Patch expire in 2021. Furthermore, in September 2019, the U.S. Department of Treasury released its Housing Reform Plan, which outlines potential changes to the U.S. Government's role in the mortgage market, such as recommendations to end the conservatorships of the GSEs and allow the QM Patch to expire. There can be no assurance that the QM Patch will expire as scheduled or that we will benefit from the expected increase in the amount of private capital in the residential mortgage market.

In addition, we believe a minor decrease in the maximum loan limit allowed by the GSEs would result in a meaningful shift of activity into the private sector. Furthermore, we believe a potential increase in ongoing guarantee fees, charged by GSEs to cover the credit risk and other costs incurred by GSEs when acquiring mortgages, could generate increased demand for non-QM loans.

Non-QM Lenders Benefit from More Limited Competition Due to Barriers to Entry

The origination process for non-QM loans is substantially different from that required to originate Agency loans. Non-QM loans typically require more comprehensive upfront underwriting to ensure that a loan will meet specified credit and regulatory standards. This approach is a meaningful contrast to the typical methods of originating Agency loans, which are more commoditized in nature. In addition, non-QM loan volume constitutes a relatively small portion of the total loan volume that most Agency lenders produce. Accordingly, many Agency lenders have chosen to focus production on their core Agency products, which can be originated using existing operational infrastructure, and have formed relationships with experienced non-QM lenders, such as Angel Oak Mortgage Lending, to provide a competitive non-QM loan offering for their loan officers and borrowers.

9

Table of Contents

Banks participate in the non-QM loan market; however, private capital lenders continue to maintain a larger market share. We believe that larger banks originate non-QM loans typically when a strong customer relationship exists. Recently, larger banks have focused their mortgage loan origination activity on their core Agency and jumbo prime mortgage loans. We expect this trend to continue since we believe that perceived risks will limit larger banks from increasing their non-QM loan origination volume in the near term. Further, we believe bank regulatory capital requirements make other mortgage products more attractive on a relative basis compared to non-QM loans. In the future, we believe that banks may enter the market in greater scale as non-QM loans become a larger segment of the overall mortgage market.

Our Competitive Strengths

We believe the following competitive strengths differentiate us and position us to implement our strategy:

Access to Angel Oak's Capabilities to Organically Create Attractive Investments that are Difficult to Replicate

Angel Oak Mortgage Lending originated over $2.2 billion and $ billion in non-QM loans for the years ended December 31, 2018 and 2019, respectively. The lending platform is an integral component of Angel Oak's historical expertise in mortgage credit, and we believe will serve as a source of non-QM loans and other target assets with sufficient scale necessary for us to quickly and efficiently deploy our capital. We believe that our access to Angel Oak Mortgage Lending's robust origination platform also differentiates us among most other U.S. public mortgage REIT peers by providing us with the ability to pursue our primary strategy focused on non-QM loans.

Through our Manager's relationship with Angel Oak Mortgage Lending, we are able to utilize an "originator model" of sourcing loans, which we believe provides tangible value and differentiation compared to an "aggregator model" that is dependent on third-party origination and underwriting. Angel Oak Mortgage Lending has control over the credit underwriting process, the ability to source loans with our desired credit and return profile, as well as access to loans from a diverse geographic footprint and from a broad set of loan programs — enabling us to acquire and invest in loans with attractive relative value. Further, we believe the regulatory and operational burden of launching a mortgage company creates significant barriers to entry.

Angel Oak Provides Customized Solutions for Non-QM Loan Borrowers

We believe there is an opportunity to generate attractive risk-adjusted returns by acquiring and investing in mortgage loans that solve the needs of a large population of higher-quality non-QM loan borrowers currently with limited access to Agency and traditional bank origination channels. We, through Angel Oak Mortgage Lending, provide non-QM loan borrowers with tailored loan products that also meet disciplined underwriting standards. Angel Oak Mortgage Lending originates loans that have low LTVs (generally in the range of 70% to 80%) and that have adequate borrower reserves in case of unexpected job loss or other contingencies across all programs. The combination of different loan programs leads to diversification by borrower profile and helps to mitigate risks in broad pools of loans. Our non-QM loan assets generally fall into the following four loan programs: "Bank Statement" loans, "Just Missed Prime" loans, "Investor" loans, and "Non-Prime" loans. See "— Our Strategy" below for a description of Angel Oak Mortgage Lending's lending programs.

Additionally, we believe that the disciplined underwriting standards of Angel Oak Mortgage Lending and the credit quality of the loans underlying our portfolio of RMBS are reflected in the credit characteristics of the pool of mortgage loans securitized by AOMT 2019-2, AOMT 2019-4 and AOMT 2019-6. We present the characteristics of loans underlying our portfolio of RMBS issued in securitizations because, pursuant to our strategy, our directly held loans are typically contributed to securitizations

10

Table of Contents

after a limited time period. In contrast, the loans underlying our portfolio of RMBS that we receive in respect of such contribution are generally held by such securitizations for a significant time period and such loans reflect the credit and other characteristics of the assets (i.e., RMBS) that we will likely hold for a longer duration.

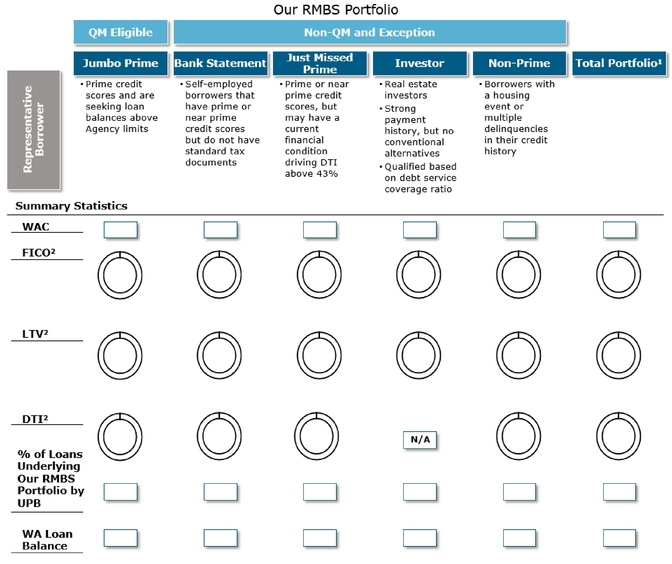

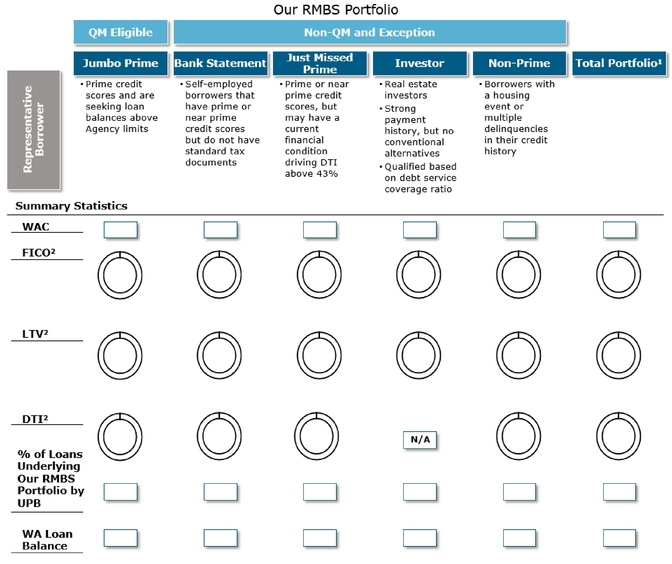

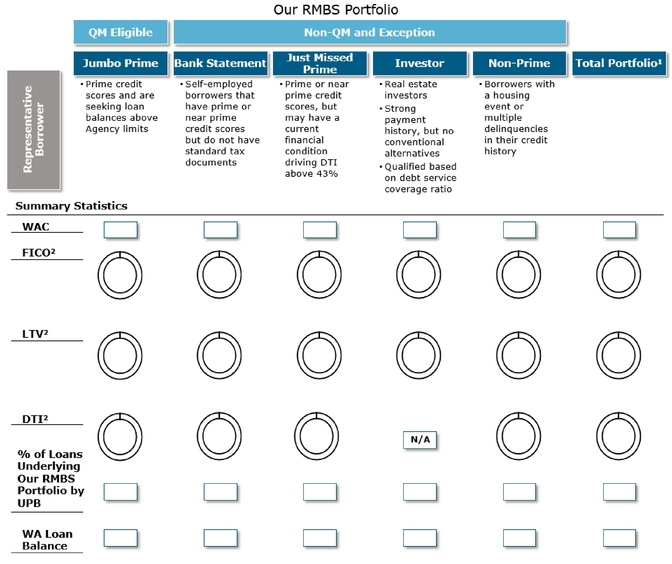

The following charts provide additional information regarding the credit characteristics of the loans underlying our portfolio of RMBS issued by AOMT 2019-2, AOMT 2019-4 and AOMT 2019-6 as of December 31, 2019 based on the type of loan program utilized and do not include our other assets, such as non-QM loans that we owned directly at such date:

Our RMBS Portfolio Characteristics

- (1)

- Total portfolio also includes Agency second lien mortgage loans with an unpaid principal balance of approximately $ as of December 31, 2019.

- (2)

- As of the date of origination of each of the loans underlying our portfolio of RMBS.

In Place Portfolio Demonstrates Execution of our Strategy

Since our commencement of operations in September 2018 through December 31, 2019, we have acquired $ million of residential mortgage loans and commercial real estate loans, a substantial portion of which were sourced by Angel Oak Mortgage Lending. As of December 31, 2019, we have

11

Table of Contents

completed three rated securitization transactions and we had total assets of approximately $ million, including a $ million portfolio of non-QM loans and other target assets. During the year ended December 31, 2019, we generated a return on average equity of %, which was comprised of . Our return on average equity during the year ended December 31, 2019 may not be indicative of our return on average equity in the future and our past performance may not be indicative of our future results. We believe that our portfolio validates our strategy of making credit sensitive investments in newly-originated first lien non-QM loans that are primarily made to higher-quality non-QM loan borrowers and primarily sourced from Angel Oak's proprietary mortgage lending platform, Angel Oak Mortgage Lending.

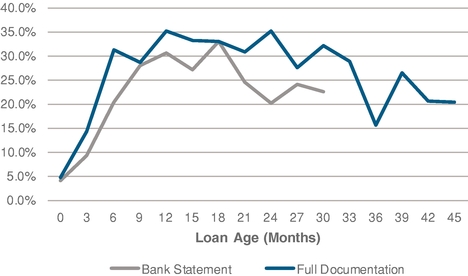

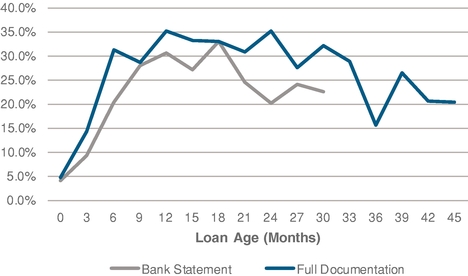

AOMT 2019-2's, AOMT 2019-4's and AOMT 2019-6's portfolios of non-QM loans include "Bank Statement" loans made to "bank statement borrowers" who are underwritten using bank statement documentation. These "bank statement borrowers," who had a weighted average FICO score of 726 as of the date of origination of each loan, are self-employed and need an alternate income calculation. In addition, AOMT 2019-2's, AOMT 2019-4's and AOMT 2019-6's portfolios include "Investor" loans made to professional real estate investors in connection with them purchasing, renting and managing investment properties. See "— Our Strategy" below for a description of Angel Oak Mortgage Lending's lending programs. Both of these types of borrowers have generally exhibited slower prepayment speeds, and collectively represented 64.4%, 69.0% and 71.2% of the portfolios owned by AOMT 2019-2, AOMT 2019-4 and AOMT 2019-6, respectively, as of December 31, 2019, which does not include our other assets, such as non-QM loans that we owned directly at such date.

As of December 31, 2019, our portfolio consisted predominantly of non-QM loans owned directly and underlying our RMBS issued by AOMT 2019-2, AOMT 2019-4 and AOMT 2019-6, as well as $ million of commercial real estate loans, representing approximately % of our portfolio of non-QM loans and other target assets.

The following charts illustrate the quality and diversity of the loans underlying our portfolio of RMBS as of December 31, 2019, based on the product profile, borrower profile and geographic location and do not include our other assets, such as non-QM loans that we owned directly at such date.

Our RMBS Portfolio Characteristics

- (1)

- No state in "Other" represents more than a % concentration of the loans in the portfolios owned by AOMT 2019-2, AOMT 2019-4 and AOMT 2019-6.

Additionally, as of December 31, 2019, our portfolio consisted of approximately $ million of non-QM loans and $ million of commercial real estate loans that we owned directly at such date. For more information regarding the characteristics of the non-QM loans and commercial real estate loans that we owned directly as of December 31, 2019, see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Our Portfolio — Residential Mortgage Loans" and "— Commercial Real Estate Loans."

12

Table of Contents

Target Assets Generate Attractive Risk-Adjusted Returns Across Interest Rate and Credit Cycles

We intend to continue growing our portfolio by acquiring target assets that we believe will provide attractive risk-adjusted returns for our stockholders, through cash distributions and capital appreciation, across interest rate and credit cycles. As of December 31, 2019, the loans underlying our portfolio of RMBS had a WAC of %, which was over basis points above the interest rates for 30-year fixed rate Agency loans as of the same date.

We believe that non-QM loan borrower prepayment behavior is typically driven by factors beyond changes in interest rates alone, such as credit improvement and housing turnover. Accordingly, we believe the non-QM loans underlying our portfolio of RMBS are less sensitive to prepayment risk if interest rates decline. Further, approximately 64.4%, 69.0% and 71.2% of the portfolio of loans owned by AOMT 2019-2, AOMT 2019-4 and AOMT 2019-6, respectively, as of December 31, 2019 were made to "bank statement borrowers" and "Investor" loan borrowers, a group of borrowers that generally demonstrate a slower prepayment speed. See "— Our Strategy" below for a description of Angel Oak Mortgage Lending's lending programs.

At the same time, our portfolio benefits from certain downside protections. As of December 31, 2019, over 98.2%, 99.5% and 95.6% of the portfolio of loans owned by AOMT 2019-2, AOMT 2019-4 and AOMT 2019-6, respectively, were first lien on the underlying asset. Such loans have strong credit characteristics with a weighted average FICO score of 711, 707 and 716, a weighted average LTV of 78%, 77% and 75% and a weighted average DTI of 35%, 34% and 33%, respectively, as of the date of origination of each loan. As of December 31, 2019, delinquency rates greater than 60 days across all of AOMT's securitizations represented less than % of the current unpaid principal balances of the loans in such securitizations, and such securitizations have experienced losses aggregating % of the original unpaid principal balances of the loans contributed to such securitizations.

Leading Management Team with Extensive Experience in the Residential Mortgage Business

We believe that the significant and diverse experience of our officers and members of the senior management team of our Manager and Angel Oak provides us with access to investment opportunities and management expertise across our target assets. Our Manager is led by a cycle-tested team of professionals, each with over 15 years of experience in the finance and mortgage business sectors. This group is led by Robert Williams, our Chief Executive Officer and the Chief Executive Officer of our Manager, Brandon Filson, our dedicated Chief Financial Officer and Treasurer, Sreeniwas Prabhu, Managing Partner and Co-Chief Executive Officer of Angel Oak Capital and the President of our Manager, Michael Fierman, the Chairman of our Board of Directors and a Managing Partner and Co-Chief Executive Officer of Angel Oak Companies, and Namit Sinha, Co-Chief Investment Officer, Private Strategies of Angel Oak. Mr. Williams has more than 30 years of experience in the banking, investment banking and mortgage banking sectors and formerly served as a Senior Vice President with SunTrust Banks, Inc., where he was head of fixed income trading and research and managed a team that handled all treasury capital market functions, such as investment portfolio, funding and capital management. Mr. Filson has more than 15 years of experience in financial and accounting roles in the real estate sector and, prior to Angel Oak, was the Vice President and Real Estate Controller of iStar Inc. (NYSE: STAR) and Safehold Inc. (NYSE: SAFE), formerly Safety, Income and Growth, Inc., both publicly traded REITs. Mr. Prabhu has over 20 years of investment experience across residential and commercial strategies, including serving as the Chief Investment Officer of the investment portfolio at Washington Mutual Bank in Seattle. Mr. Fierman has over 20 years of investment experience and prior to Angel Oak Companies, founded SouthStar Funding, a national wholesale mortgage lender specializing in non-Agency mortgage products. Mr. Sinha has more than 15 years of experience in fixed income products including structured credit and, prior to Angel Oak, Mr. Sinha spent four years as Senior Vice President at Canyon Capital Advisors, where he was a leader in its residential loan trading business in addition to covering its structured products operations. We believe this experience enhances our ability to invest in our target assets across a range of interest rate and credit cycles.

13

Table of Contents

Capital Markets Experience Assists in Cost of Capital Efficiencies

Our Manager has access to Angel Oak Capital's portfolio management team, which has significant experience executing non-QM loan securitization transactions and manages all Angel Oak financing facilities. Our Manager is able to leverage Angel Oak's expertise and relationships with a large network of financial institutions, including by increasing the overall number of financing counterparties available to us. We have in-place loan financing lines with a combination of global money center and large regional banks, under which we had an aggregate of approximately $ million of debt outstanding as of December 31, 2019. Our loan financing lines permit borrowings in an aggregate amount of up to $ million, leaving approximately $ million of capacity as of December 31, 2019. AOMT, Angel Oak's securitization platform, is a leading programmatic issuer of non-QM securities and had issued approximately $5.1 billion in such securities through 13 rated offerings as of December 31, 2019 — making AOMT among the largest issuers of such securities since 2015.

Underwriting Approach Utilizes Multiple Layers of Quality Control

The loans we acquire from Angel Oak Mortgage Lending are subject to disciplined underwriting and evaluation by Angel Oak Mortgage Lending's in-house team of over 40 underwriters, ensuring that our loans meet desired credit and return profiles. Regardless of the type of loan, the underwriting process is the same and consists of income and asset verification through tax documents or bank statements that are corroborated independently with available technology that goes directly to the source, such as the Internal Revenue Service (the "IRS") or a bank. Angel Oak Mortgage Lending uses fraud risk tools, which flag misrepresentation and fraudulent activity, such as IRS Form 4506T, Mortgage Electronic Registration Systems ("MERS") to identify undisclosed property and occupancy fraud and Credit GAP Reports to identify undisclosed debt. Further, the lending platform utilizes independent appraisal management companies to maintain appraiser independence by creating a wall between the appraisers and the loan officers. Moreover, a third-party due diligence firm reviews all of the loans and their supporting documents. Angel Oak Mortgage Lending's underwriting process has several layers of checks and balances, as well as incremental focus on credit quality from rating agencies and senior bond buyers of Angel Oak securitizations.