Fourth Quarter 2021 Earnings Supplement Angel Oak Mortgage, Inc.

Table of Contents 2 Angel Oak Overview, Model, and Investment/Funding Strategy 5 Q4 and FY 2021 Financial Results & Metrics 10 Key Portfolio Statistics 18 Appendix 22 Angel Oak Mortgage, Inc.

Important Notices 3 References in this presentation to “we,” “us,” “our,” “AOMR” and the “Company” refer to Angel Oak Mortgage, Inc., a Maryland corporation, its operating partnership and their respective subsidiaries; the term “Manager” refers to Falcons I, LLC, our external manager; the term “Angel Oak Capital” refers to Angel Oak Capital Advisors, LLC; the term “Angel Oak Mortgage Lending” refers collectively to Angel Oak Mortgage Solutions, Angel Oak Home Loans and Angel Oak Commercial Lending; the term “Angel Oak Mortgage Solutions” refers to Angel Oak Mortgage Solutions LLC; the term “Angel Oak Home Loans” refers to Angel Oak Home Loans LLC; the term “Angel Oak Commercial Lending” refers to Angel Oak Commercial Lending, LLC, Angel Oak Prime Bridge, Angel Oak Commercial Bridge and Cherrywood Mortgage; the term “Angel Oak Prime Bridge” refers to Angel Oak Prime Bridge, LLC; the term “Angel Oak Commercial Bridge” refers to Angel Oak Commercial Bridge, LLC; and the term “Cherrywood Mortgage” refers to Cherrywood Mortgage, LLC; the term “Angel Oak” refers collectively to Angel Oak Capital and its affiliates, including our Manager; and the term “AOMT” refers to Angel Oak Mortgage Trust I, LLC, Angel Oak’s securitization platform, including its subsidiaries and affiliates. This presentation has been prepared by the Company solely for your information and may not be reproduced or redistributed, in whole or in part, to any other person. The information contained in this presentation is provided to you as a summary as of the date of this presentation and is subject to change without notice. The Company does not undertake any obligation to update this presentation to reflect actual events, circumstances or changes in expectations. This presentation was prepared based upon information believed to be reliable. However, the Company does not make any representation or warranty with regard to the accuracy or completeness of the information herein and some of such information was obtained from published sources or other third parties without independent verification. This presentation contains certain forward-looking statements that are subject to various risks and uncertainties, including, without limitation, statements relating to the performance of our investments. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue” or by the negative of these words and phrases or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe existing or future plans and strategies, contain projections of results of operations, liquidity and/or financial condition or state other forward-looking information. Our ability to predict future events or conditions or their impact or the actual effect of existing or future plans or strategies is inherently uncertain, in particular due to the uncertainties created by the COVID-19 pandemic, including the projected impact of the COVID-19 pandemic on our business, financial results and performance. Although we believe that such forward-looking statements are based on reasonable assumptions, actual results and performance in the future could differ materially from those set forth in or implied by such forward-looking statements. Factors that could have a material adverse effect on future results and performance relative to those set forth in or implied by the related forward-looking statements, as well as on our business, financial condition, liquidity, results of operations and prospects, include, but are not limited to (see next page): Angel Oak Mortgage, Inc.

Important Notices 4 • the ongoing impact of the COVID-19 pandemic; • the effects of adverse conditions or developments in the financial markets and the economy upon our ability to acquire non-QM loans sourced from Angel Oak’s proprietary mortgage lending platform, Angel Oak Mortgage Lending, and other target assets; • the level and volatility of prevailing interest rates and credit spreads; • changes in our industry, inflation, interest rates, the debt or equity markets, the general economy (or in specific regions) or the residential real estate finance and the real estate markets specifically; • changes in our business strategies or target assets; • general volatility of the markets in which we invest; • changes in the availability of attractive loan and other investment opportunities, including non-QM loans sourced from Angel Oak Mortgage Lending platforms; • the ability of our Manager to locate suitable investments for us, manage our portfolio, and implement our strategy; • our ability to obtain and maintain financing arrangements on favorable terms, or at all; • the adequacy of collateral securing our investments and a decline in the fair value of our investments; • the timing of cash flows, if any, from our investments; • our ability to profitably execute securitization transactions; • the operating performance, liquidity, and financial condition of borrowers; • increased rates of default and/or decreased recovery rates on our investments; • changes in prepayment rates on our investments; • the departure of any of the members of senior management of the Company, our Manager, or Angel Oak; • the availability of qualified personnel; • conflicts with Angel Oak, including our Manager, and its personnel, including our officers, and entities managed by Angel Oak; • events, contemplated or otherwise, such as acts of God, including hurricanes, earthquakes, and other natural disasters, including those resulting from global climate change, pandemics, acts of war and/or terrorism, escalation of military conflicts, and others that may cause unanticipated and uninsured performance declines and/or losses to us or the owners and operators of the real estate securing our investments; • impact of and changes in governmental regulations, disruptions in markets, tax laws and rates, accounting principles and policies and similar matters; • the level of governmental involvement in the U.S. mortgage market; • future changes with respect to government-sponsored enterprises (i.e., Fannie Mae or Freddie Mac) and related events, including the lack of certainty as to the future roles of these entities and the U.S. Government in the mortgage market and changes to legislation and regulations affecting these entities; • effects of hedging instruments on our target assets and our returns, and the degree to which our hedging strategies may or may not protect us from interest rate volatility; • our ability to make distributions to our stockholders in the future at the level contemplated by our stockholders or the market generally, or at all; • our ability to qualify and continue to qualify as a real estate investment trust for U.S. federal income tax purposes; and • our ability to maintain our exclusion from regulation as an investment company under the Investment Company Act of 1940, as amended. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our management’s views only as of the date of this presentation. Actual results and performance may differ materially from those set forth in or implied by our forward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by applicable law, we assume no obligation, and do not intend to, update or otherwise revise any of our forward-looking statements, whether as a result of new information, future events or otherwise. Angel Oak Mortgage, Inc.

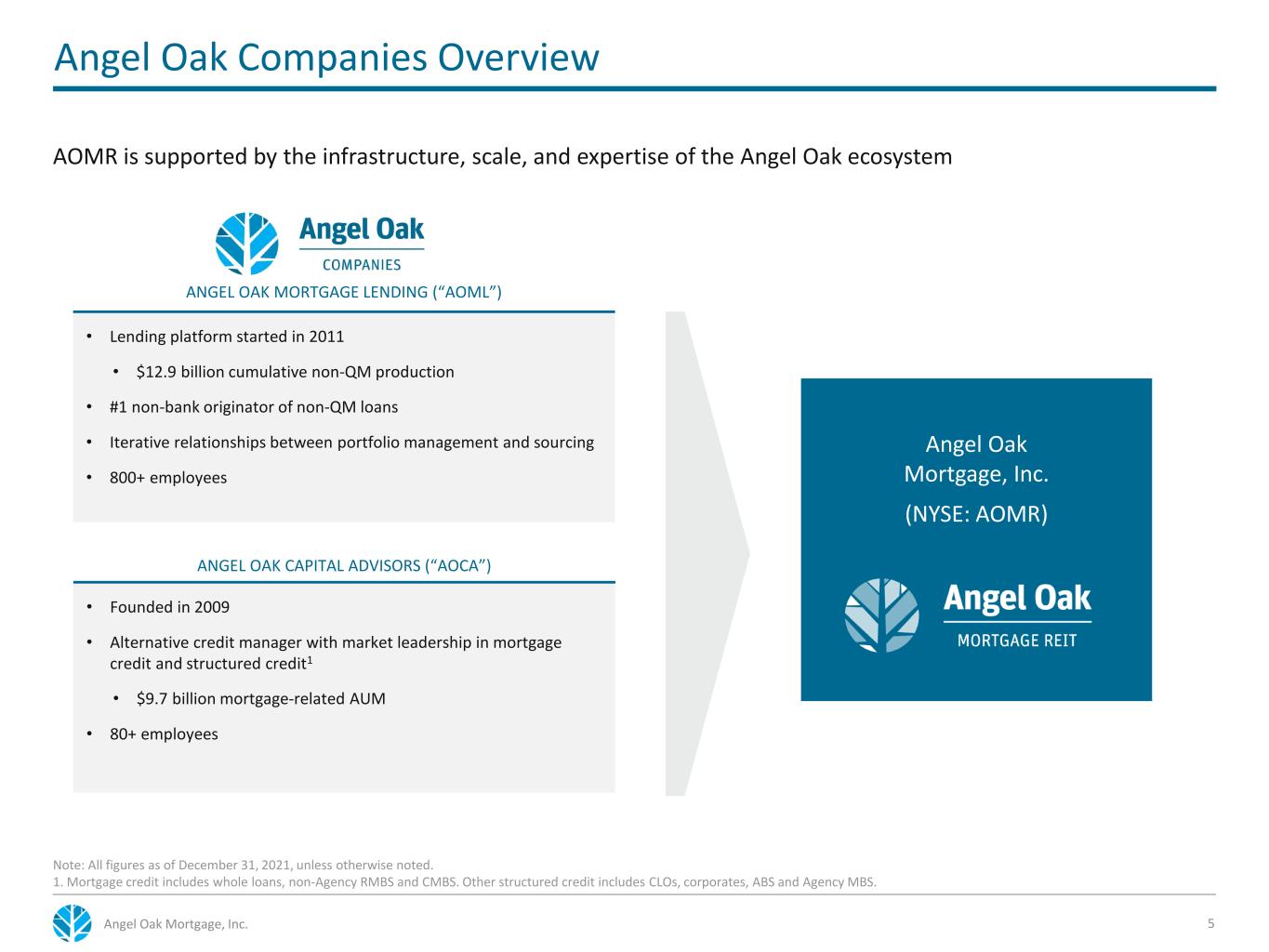

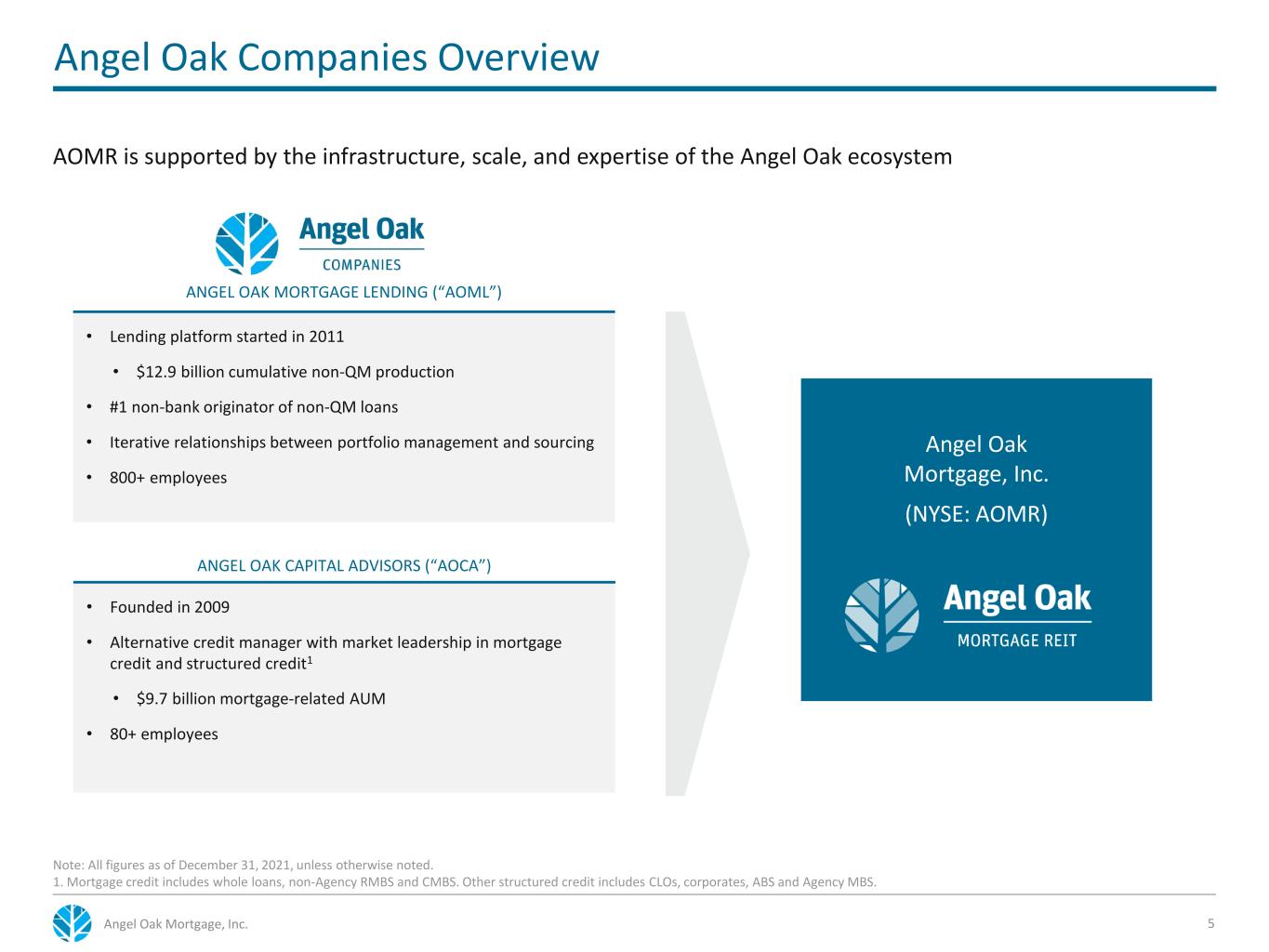

Note: All figures as of December 31, 2021, unless otherwise noted. 1. Mortgage credit includes whole loans, non-Agency RMBS and CMBS. Other structured credit includes CLOs, corporates, ABS and Agency MBS. Angel Oak Companies Overview 5 Angel Oak Mortgage, Inc. (NYSE: AOMR) Angel Oak Mortgage, Inc. ANGEL OAK MORTGAGE LENDING (“AOML”) • Lending platform started in 2011 • $12.9 billion cumulative non-QM production • #1 non-bank originator of non-QM loans • Iterative relationships between portfolio management and sourcing • 800+ employees ANGEL OAK CAPITAL ADVISORS (“AOCA”) • Founded in 2009 • Alternative credit manager with market leadership in mortgage credit and structured credit1 • $9.7 billion mortgage-related AUM • 80+ employees AOMR is supported by the infrastructure, scale, and expertise of the Angel Oak ecosystem

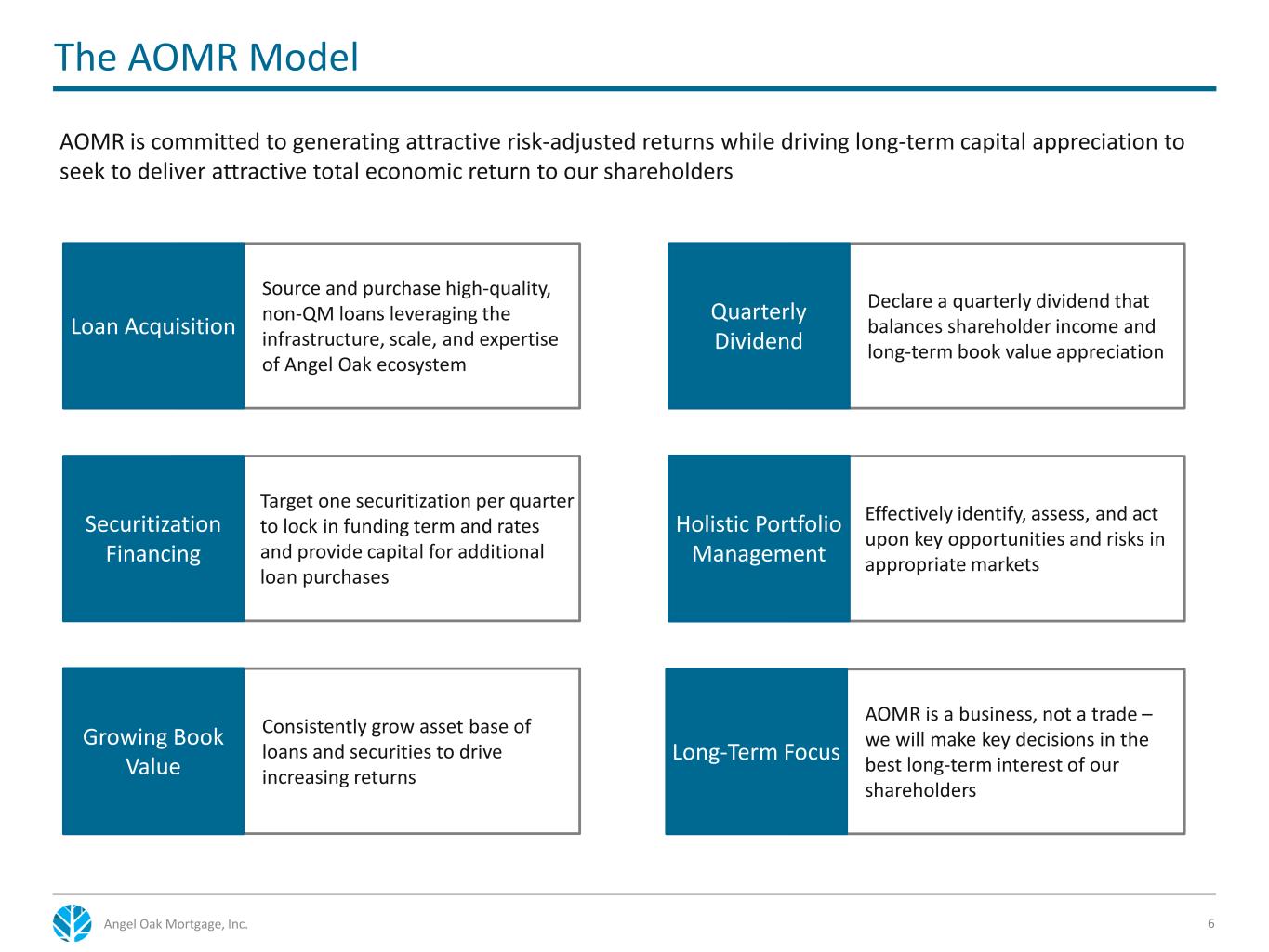

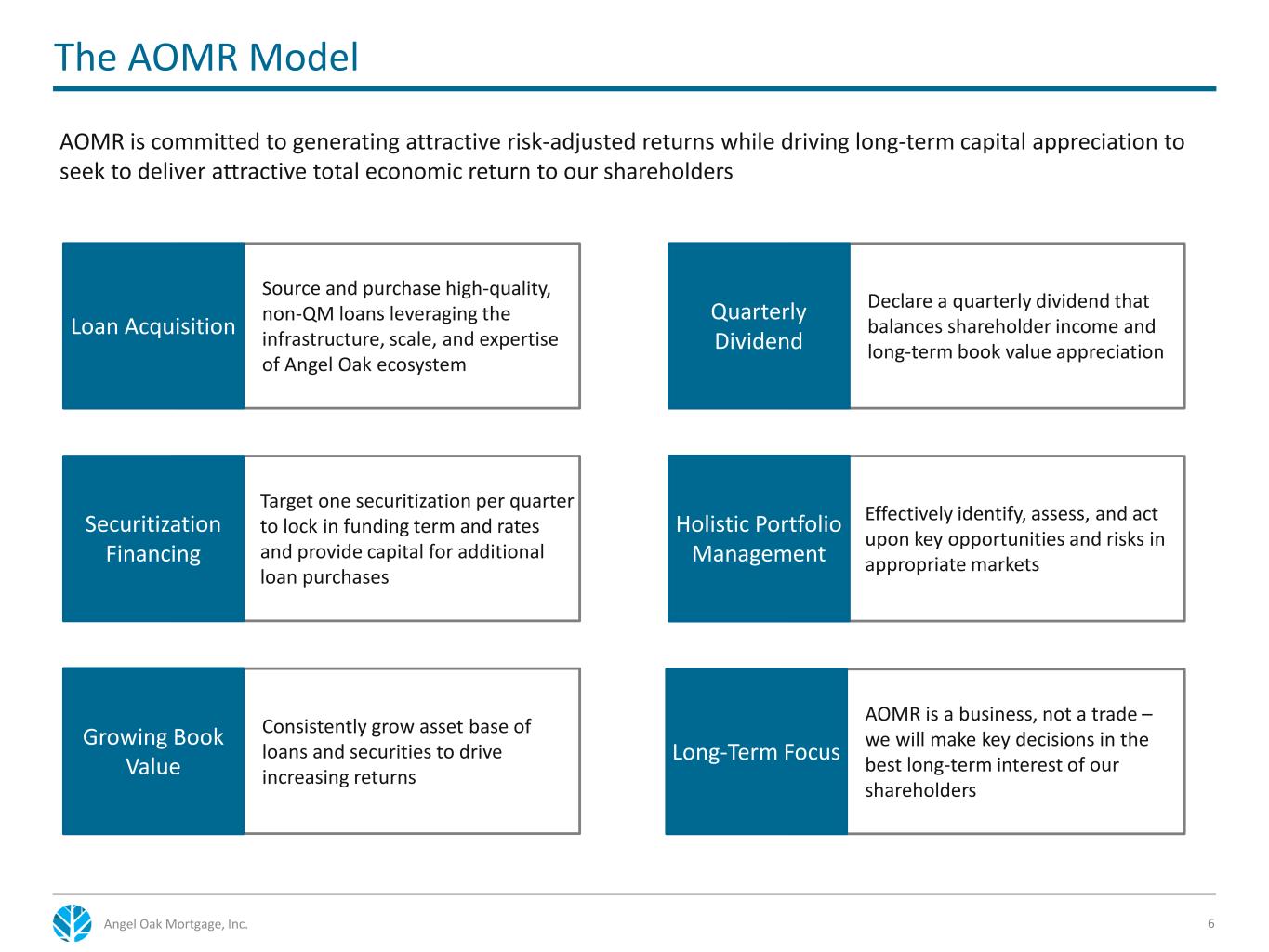

Target one securitization per quarter to lock in funding term and rates and provide capital for additional loan purchases Consistently grow asset base of loans and securities to drive increasing returns Declare a quarterly dividend that balances shareholder income and long-term book value appreciation Effectively identify, assess, and act upon key opportunities and risks in appropriate markets AOMR is a business, not a trade – we will make key decisions in the best long-term interest of our shareholders The AOMR Model 6 Source and purchase high-quality, non-QM loans leveraging the infrastructure, scale, and expertise of Angel Oak ecosystem Loan Acquisition Securitization Financing Growing Book Value Quarterly Dividend Holistic Portfolio Management Long-Term Focus Angel Oak Mortgage, Inc. AOMR is committed to generating attractive risk-adjusted returns while driving long-term capital appreciation to seek to deliver attractive total economic return to our shareholders

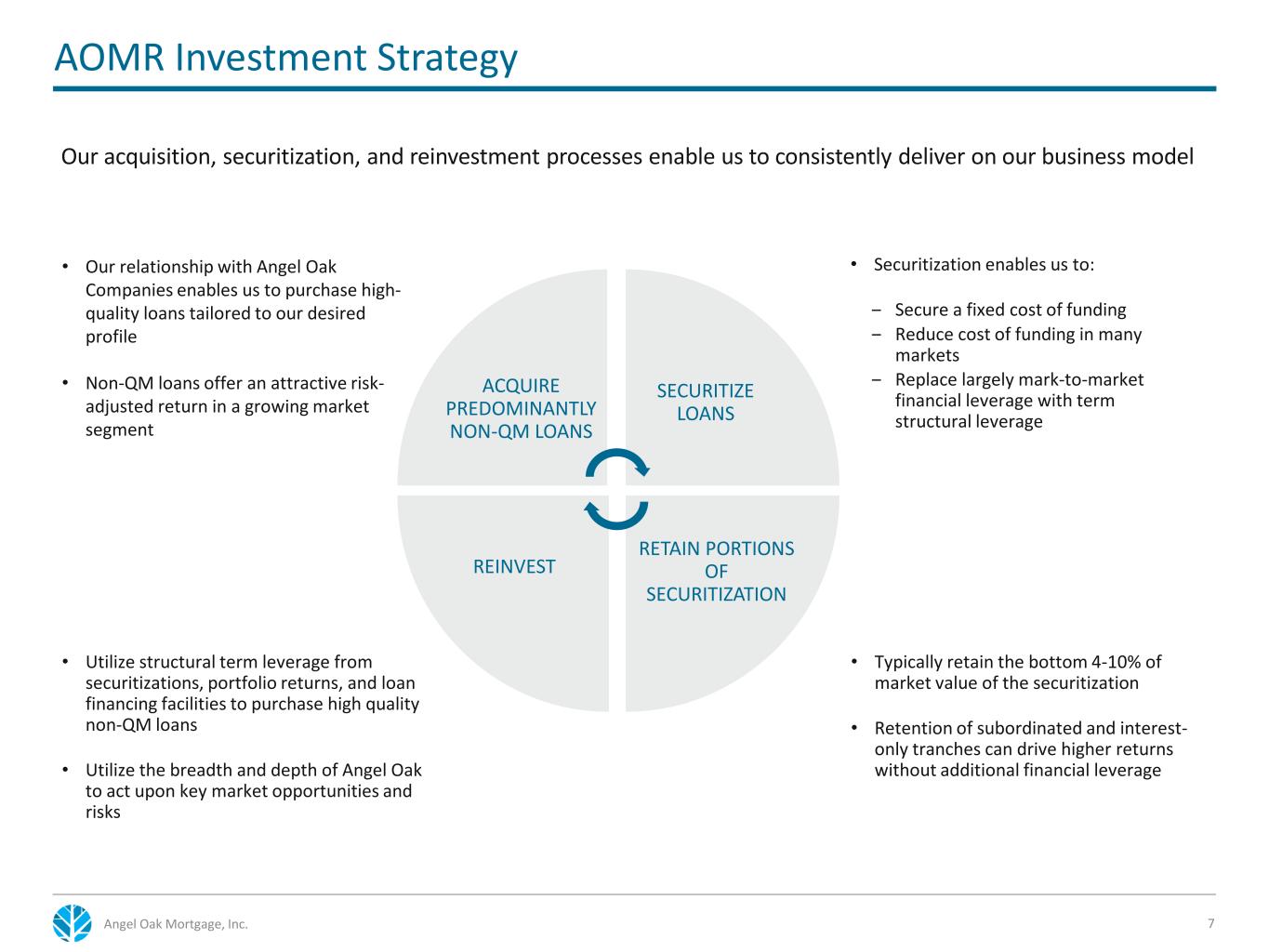

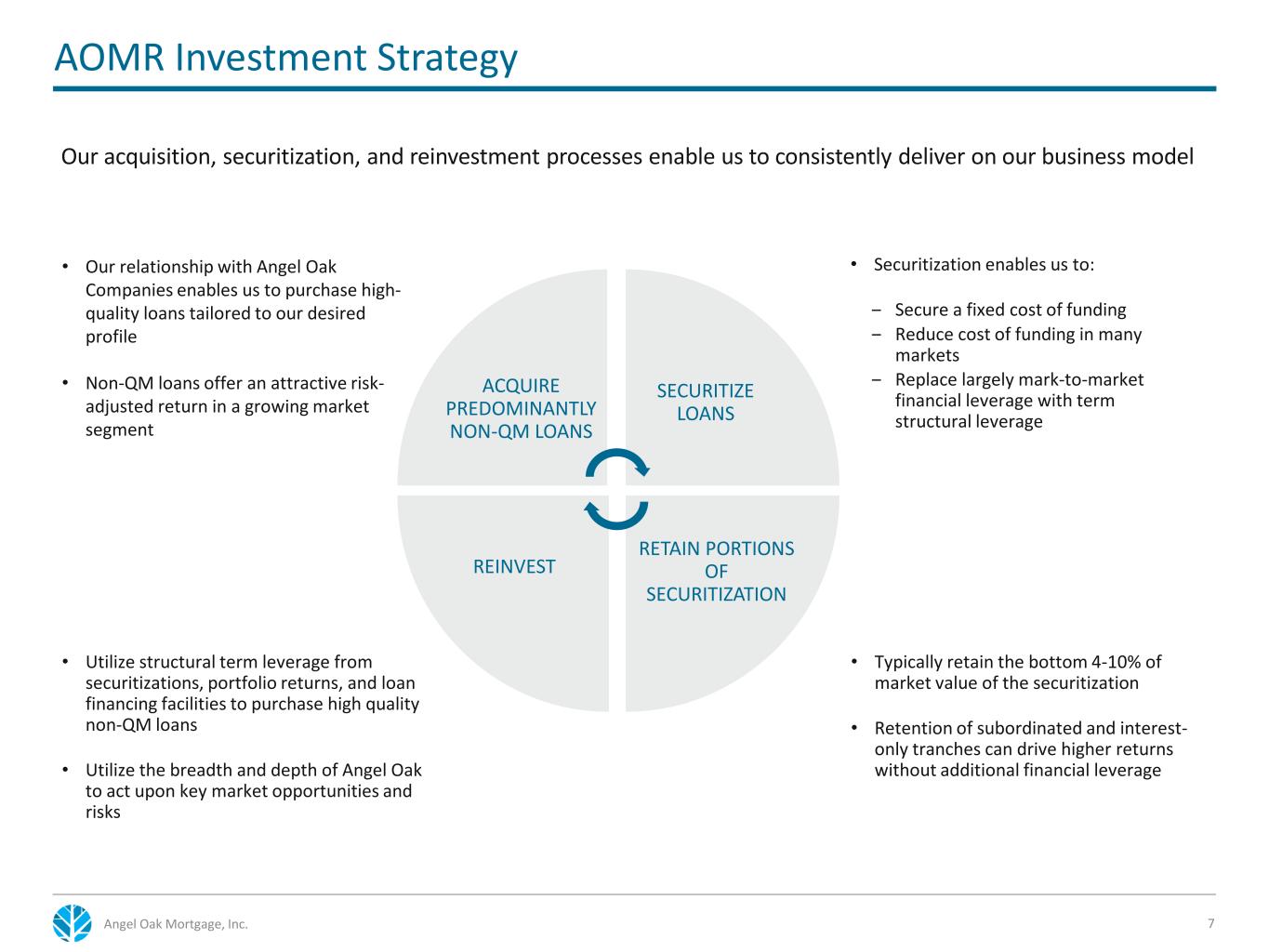

AOMR Investment Strategy 7Angel Oak Mortgage, Inc. ACQUIRE PREDOMINANTLY NON-QM LOANS SECURITIZE LOANS RETAIN PORTIONS OF SECURITIZATION REINVEST • Typically retain the bottom 4-10% of market value of the securitization • Retention of subordinated and interest- only tranches can drive higher returns without additional financial leverage • Securitization enables us to: ‒ Secure a fixed cost of funding ‒ Reduce cost of funding in many markets ‒ Replace largely mark-to-market financial leverage with term structural leverage • Our relationship with Angel Oak Companies enables us to purchase high- quality loans tailored to our desired profile • Non-QM loans offer an attractive risk- adjusted return in a growing market segment • Utilize structural term leverage from securitizations, portfolio returns, and loan financing facilities to purchase high quality non-QM loans • Utilize the breadth and depth of Angel Oak to act upon key market opportunities and risks Our acquisition, securitization, and reinvestment processes enable us to consistently deliver on our business model

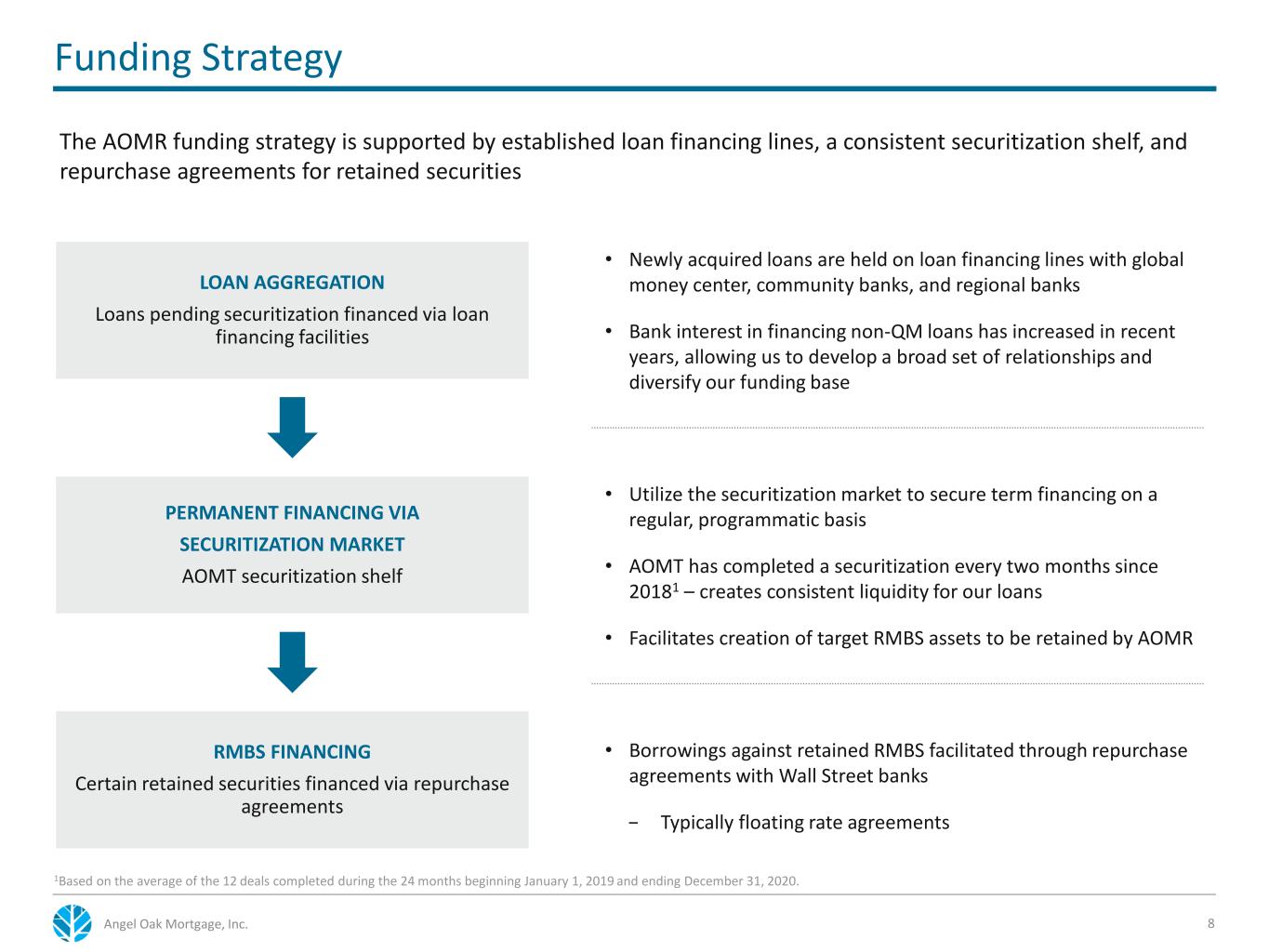

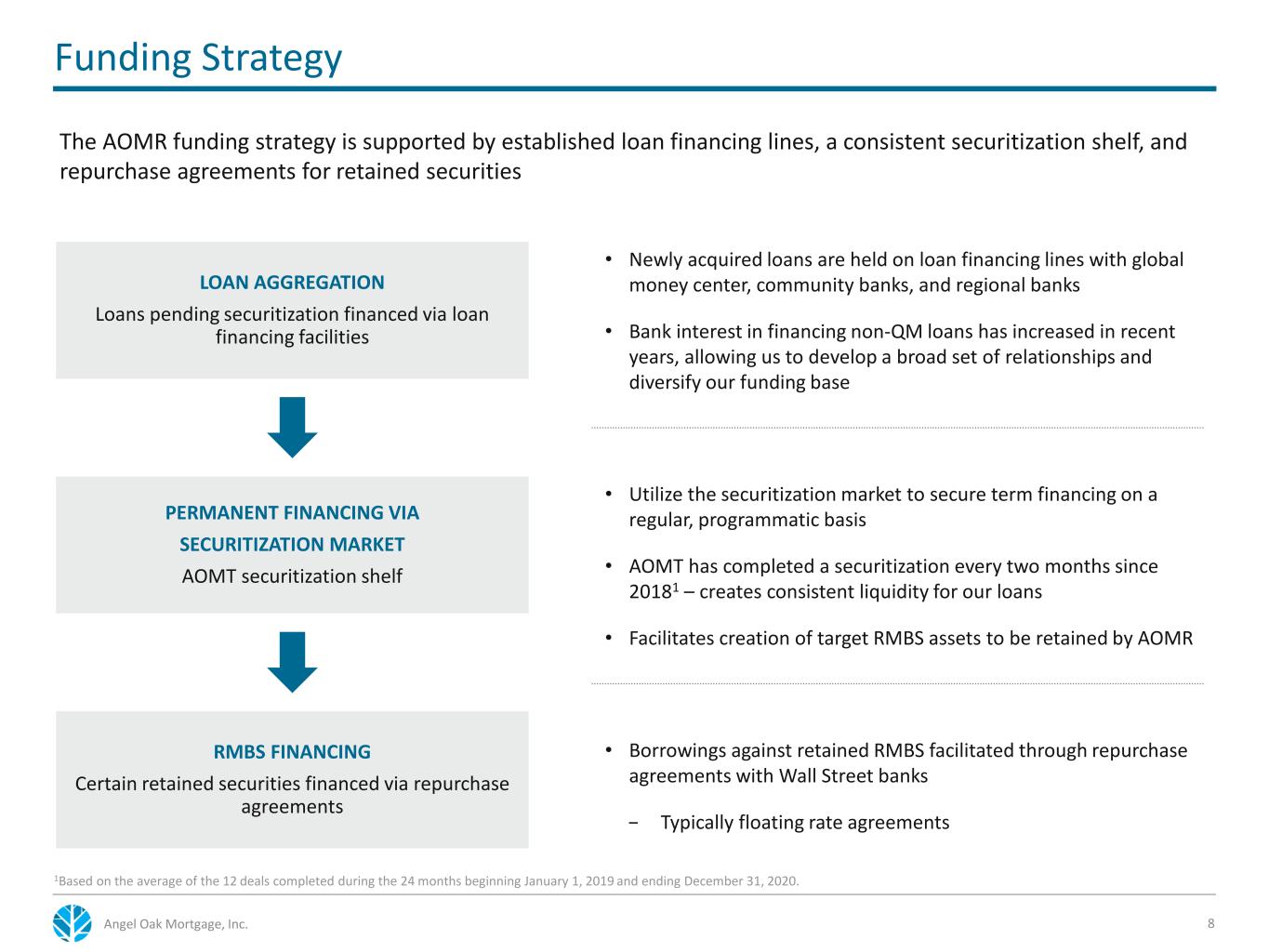

Angel Oak Mortgage, Inc. PERMANENT FINANCING VIA SECURITIZATION MARKET AOMT securitization shelf RMBS FINANCING Certain retained securities financed via repurchase agreements Funding Strategy LOAN AGGREGATION Loans pending securitization financed via loan financing facilities 8 1Based on the average of the 12 deals completed during the 24 months beginning January 1, 2019 and ending December 31, 2020. • Newly acquired loans are held on loan financing lines with global money center, community banks, and regional banks • Bank interest in financing non-QM loans has increased in recent years, allowing us to develop a broad set of relationships and diversify our funding base • Utilize the securitization market to secure term financing on a regular, programmatic basis • AOMT has completed a securitization every two months since 20181 – creates consistent liquidity for our loans • Facilitates creation of target RMBS assets to be retained by AOMR • Borrowings against retained RMBS facilitated through repurchase agreements with Wall Street banks − Typically floating rate agreements The AOMR funding strategy is supported by established loan financing lines, a consistent securitization shelf, and repurchase agreements for retained securities

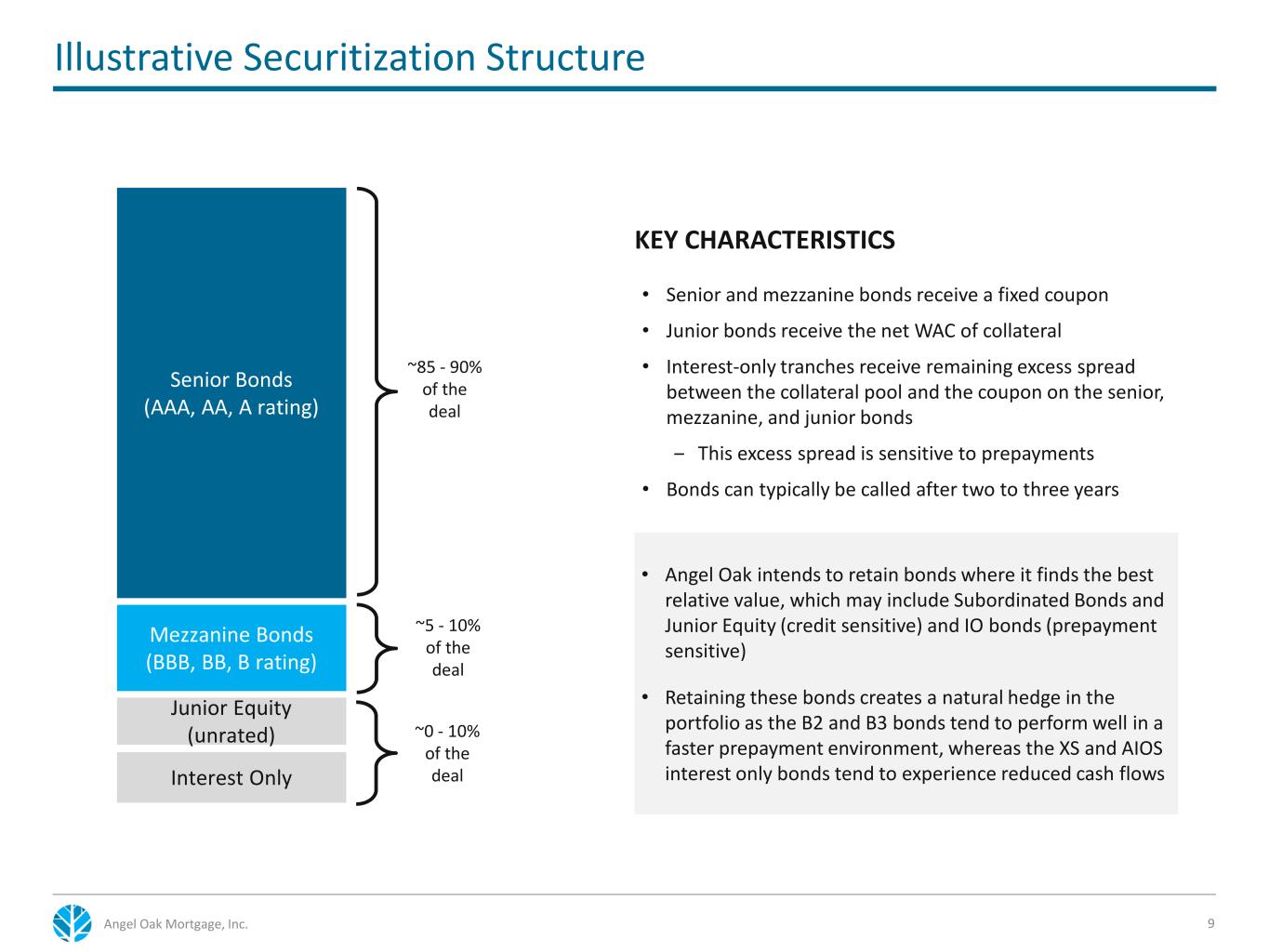

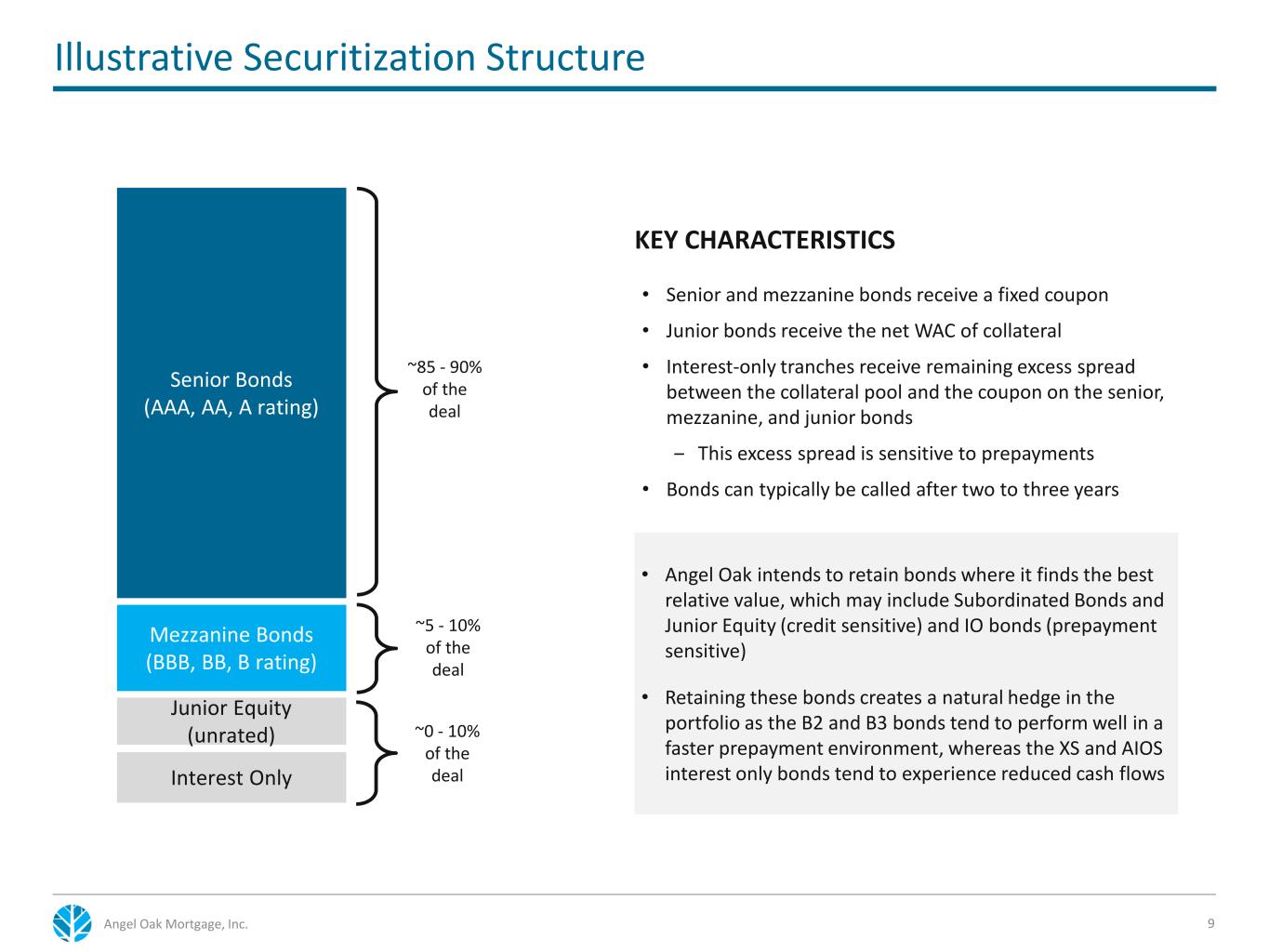

Angel Oak Mortgage, Inc. Illustrative Securitization Structure 9 Senior Bonds (AAA, AA, A rating) Interest Only Mezzanine Bonds (BBB, BB, B rating) ~85 - 90% of the deal Junior Equity (unrated) ~0 - 10% of the deal ~5 - 10% of the deal KEY CHARACTERISTICS • Senior and mezzanine bonds receive a fixed coupon • Junior bonds receive the net WAC of collateral • Interest-only tranches receive remaining excess spread between the collateral pool and the coupon on the senior, mezzanine, and junior bonds ‒ This excess spread is sensitive to prepayments • Bonds can typically be called after two to three years • Angel Oak intends to retain bonds where it finds the best relative value, which may include Subordinated Bonds and Junior Equity (credit sensitive) and IO bonds (prepayment sensitive) • Retaining these bonds creates a natural hedge in the portfolio as the B2 and B3 bonds tend to perform well in a faster prepayment environment, whereas the XS and AIOS interest only bonds tend to experience reduced cash flows

Q4 and FY 2021 Highlights & Financial Results 10

Completed IPO and concurrent private placement in June 2021, raising $176.8MM Q4 GAAP Net Income $0.12/share with Distributable Earnings of $0.89/share; FY21 GAAP Net Income of $1.01/share with FY21 Distributable Earnings of $1.64/share Completed first two securitizations as a public company in Q3 and Q4, totaling over $700MM ‒ Closed third securitization of $536.9MM in February 2022 Declared a 25% increase in quarterly dividend to $0.45/share in March 2022 Book Value/Share of $19.47 Q4 and FY21 Highlights Purchased $1.4B of loans post-IPO in FY21, including $773MM in Q4 ‒ $540MM purchased in Q1 2022 through March 10, 2022 11Angel Oak Mortgage, Inc.

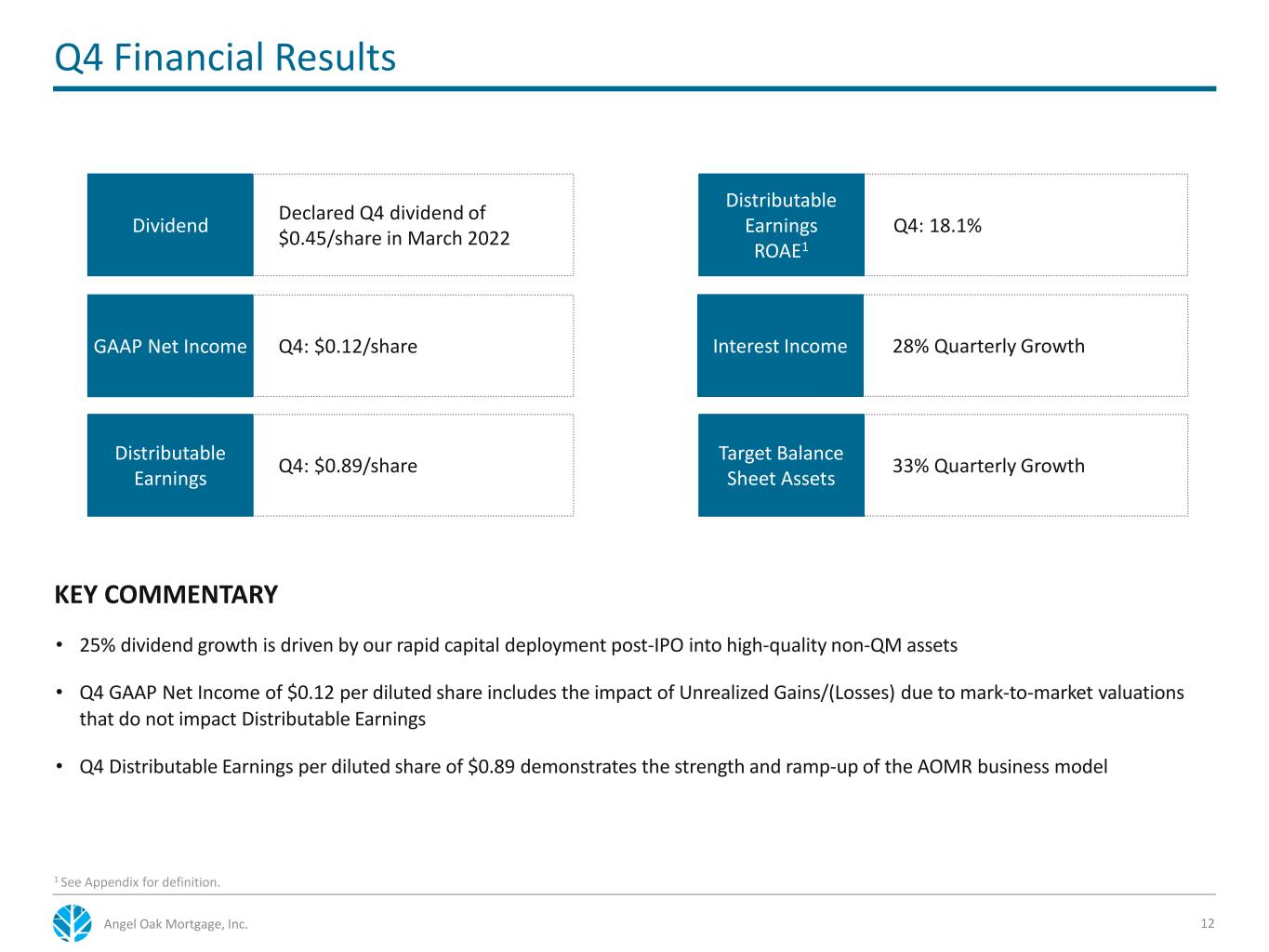

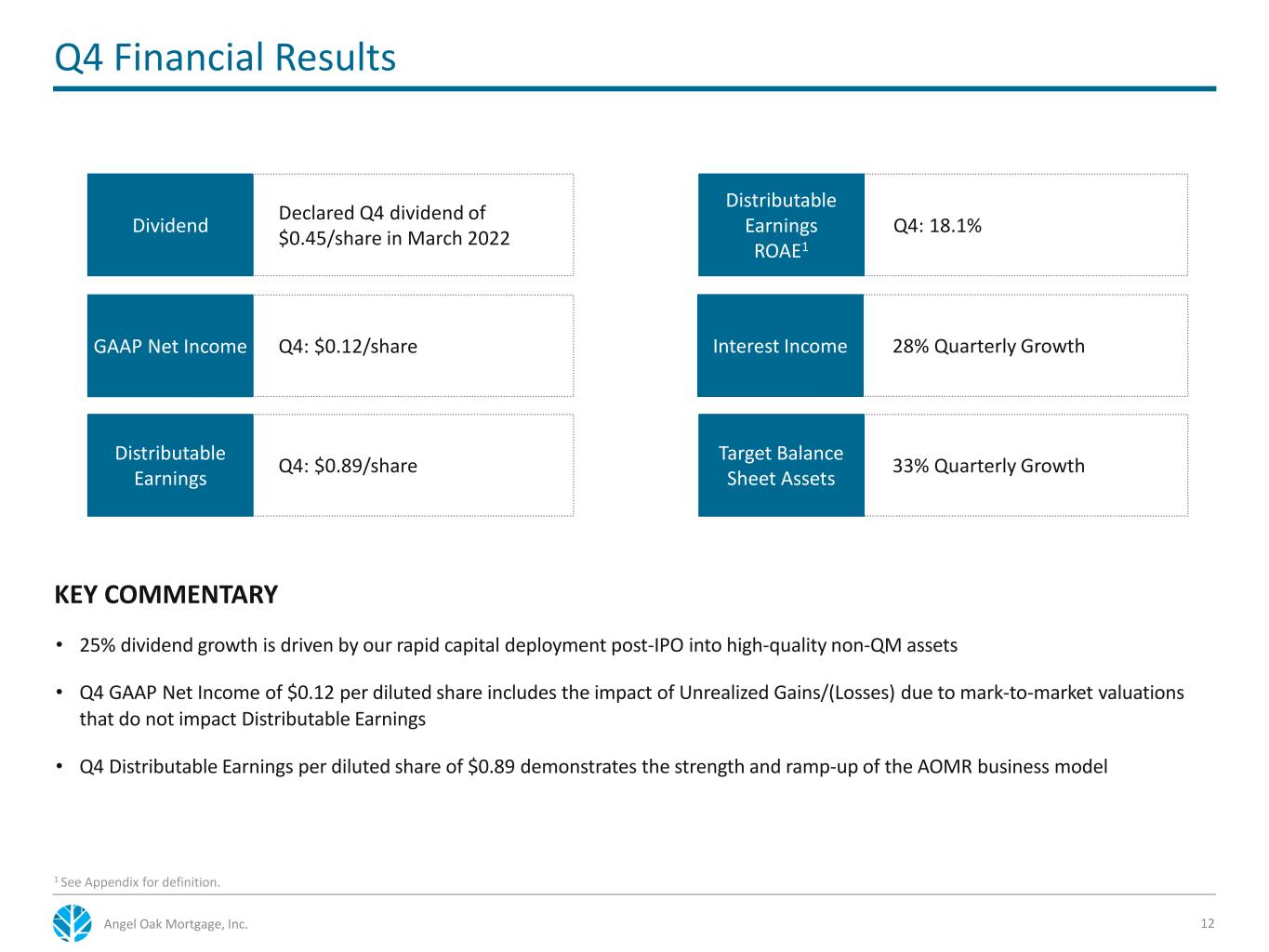

Q4 Financial Results 12 Q4: $0.89/shareDistributable Earnings Declared Q4 dividend of $0.45/share in March 2022Dividend Q4: $0.12/shareGAAP Net Income 33% Quarterly GrowthTarget Balance Sheet Assets Q4: 18.1% Distributable Earnings ROAE1 28% Quarterly GrowthInterest Income 1 See Appendix for definition. Angel Oak Mortgage, Inc. KEY COMMENTARY • 25% dividend growth is driven by our rapid capital deployment post-IPO into high-quality non-QM assets • Q4 GAAP Net Income of $0.12 per diluted share includes the impact of Unrealized Gains/(Losses) due to mark-to-market valuations that do not impact Distributable Earnings • Q4 Distributable Earnings per diluted share of $0.89 demonstrates the strength and ramp-up of the AOMR business model

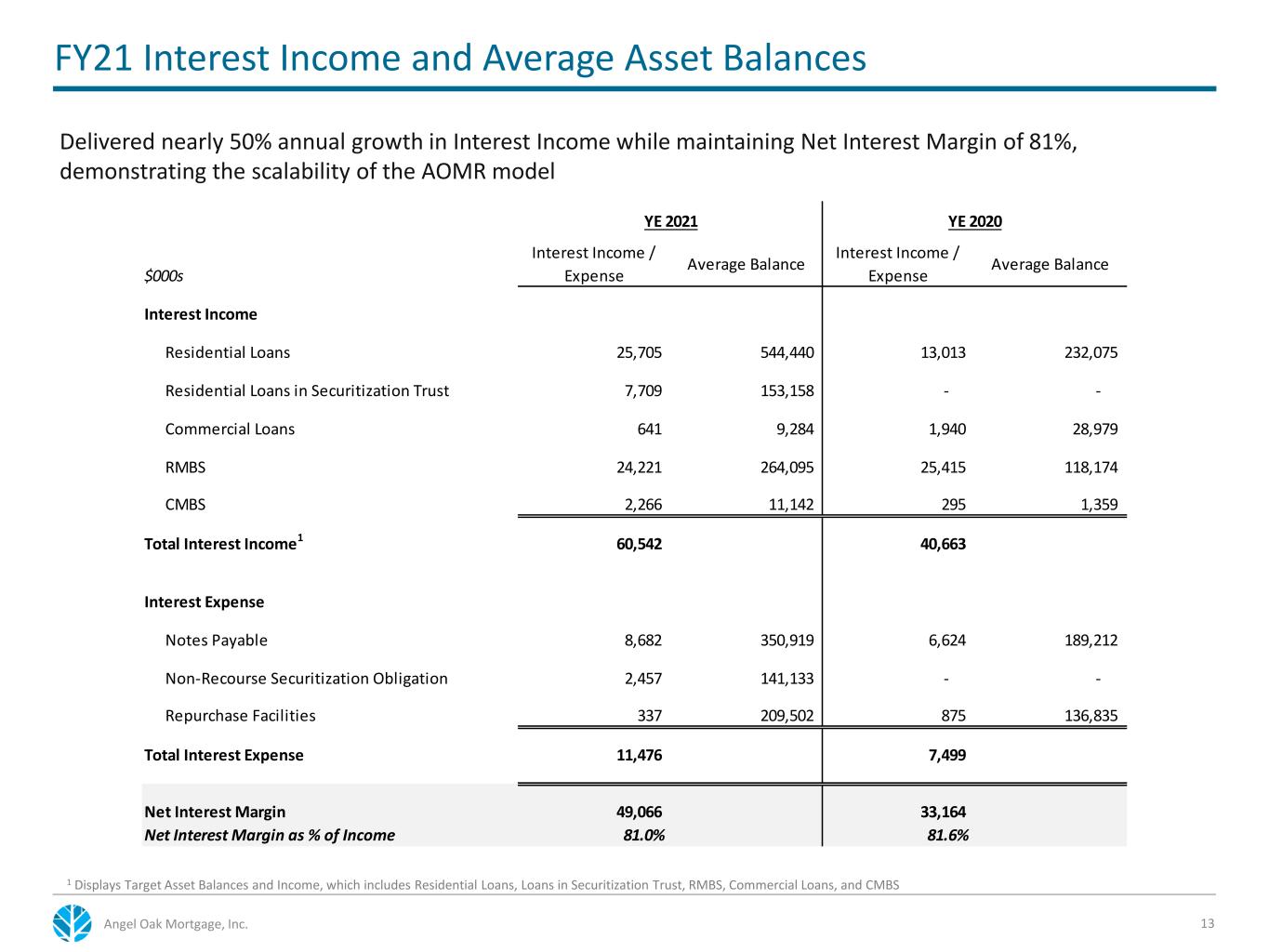

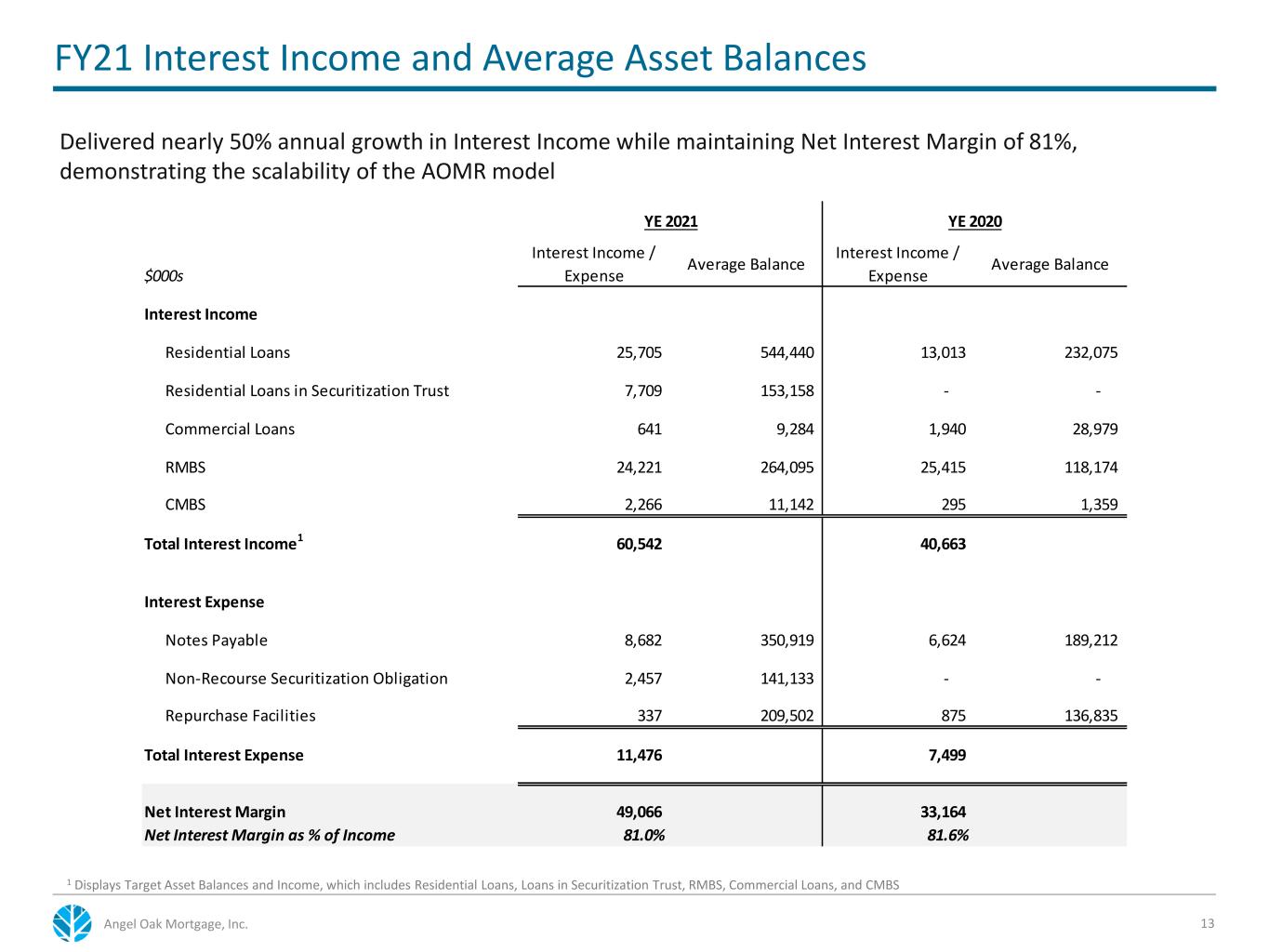

FY21 Interest Income and Average Asset Balances 13 Delivered nearly 50% annual growth in Interest Income while maintaining Net Interest Margin of 81%, demonstrating the scalability of the AOMR model $000s Interest Income / Expense Average Balance Interest Income / Expense Average Balance Interest Income Residential Loans 25,705 544,440 13,013 232,075 Residential Loans in Securitization Trust 7,709 153,158 - - Commercial Loans 641 9,284 1,940 28,979 RMBS 24,221 264,095 25,415 118,174 CMBS 2,266 11,142 295 1,359 Total Interest Income1 60,542 40,663 Interest Expense Notes Payable 8,682 350,919 6,624 189,212 Non-Recourse Securitization Obligation 2,457 141,133 - - Repurchase Facilities 337 209,502 875 136,835 Total Interest Expense 11,476 7,499 Net Interest Margin 49,066 33,164 Net Interest Margin as % of Income 81.0% 81.6% YE 2020YE 2021 1 Displays Target Asset Balances and Income, which includes Residential Loans, Loans in Securitization Trust, RMBS, Commercial Loans, and CMBS Angel Oak Mortgage, Inc.

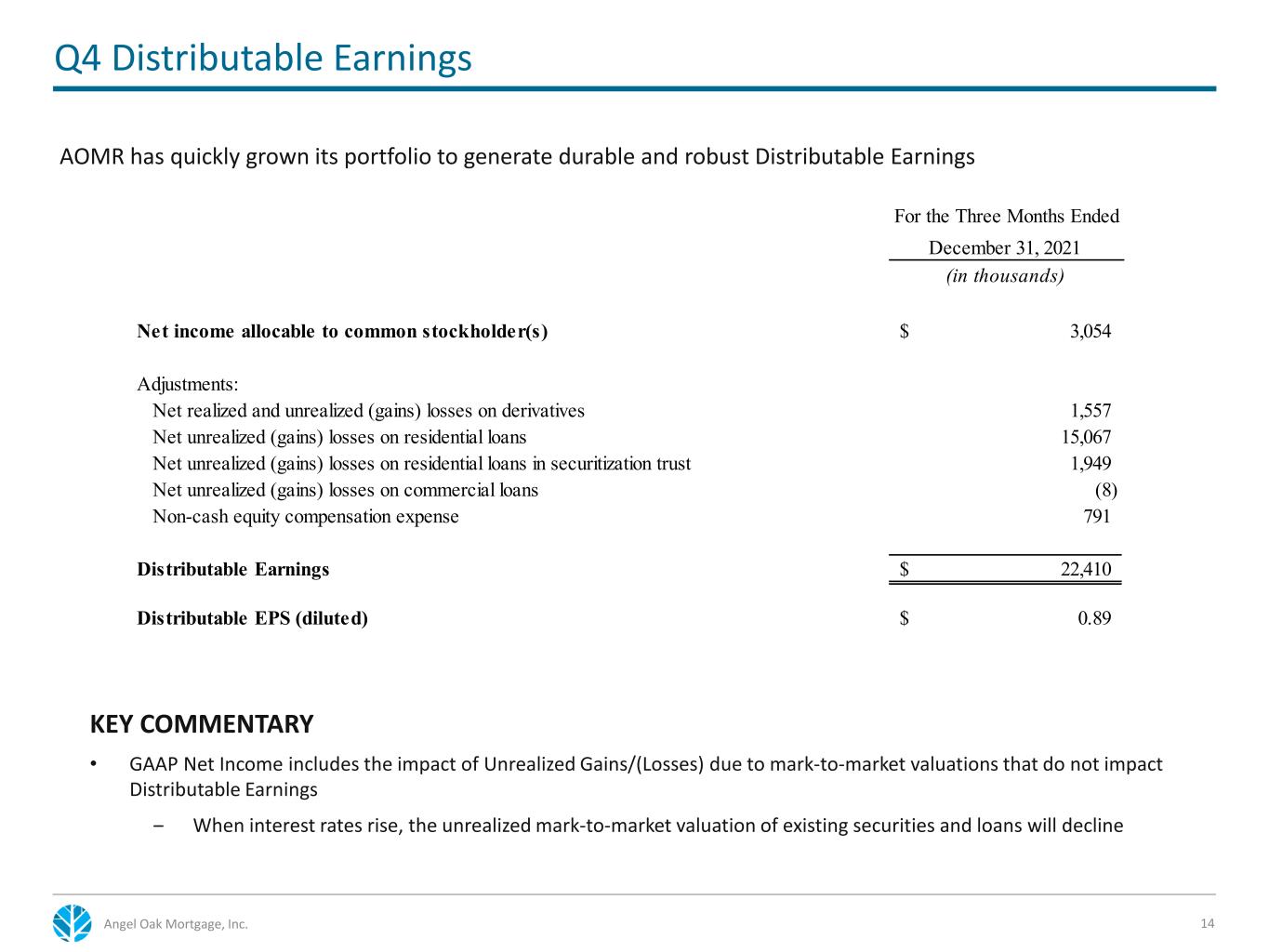

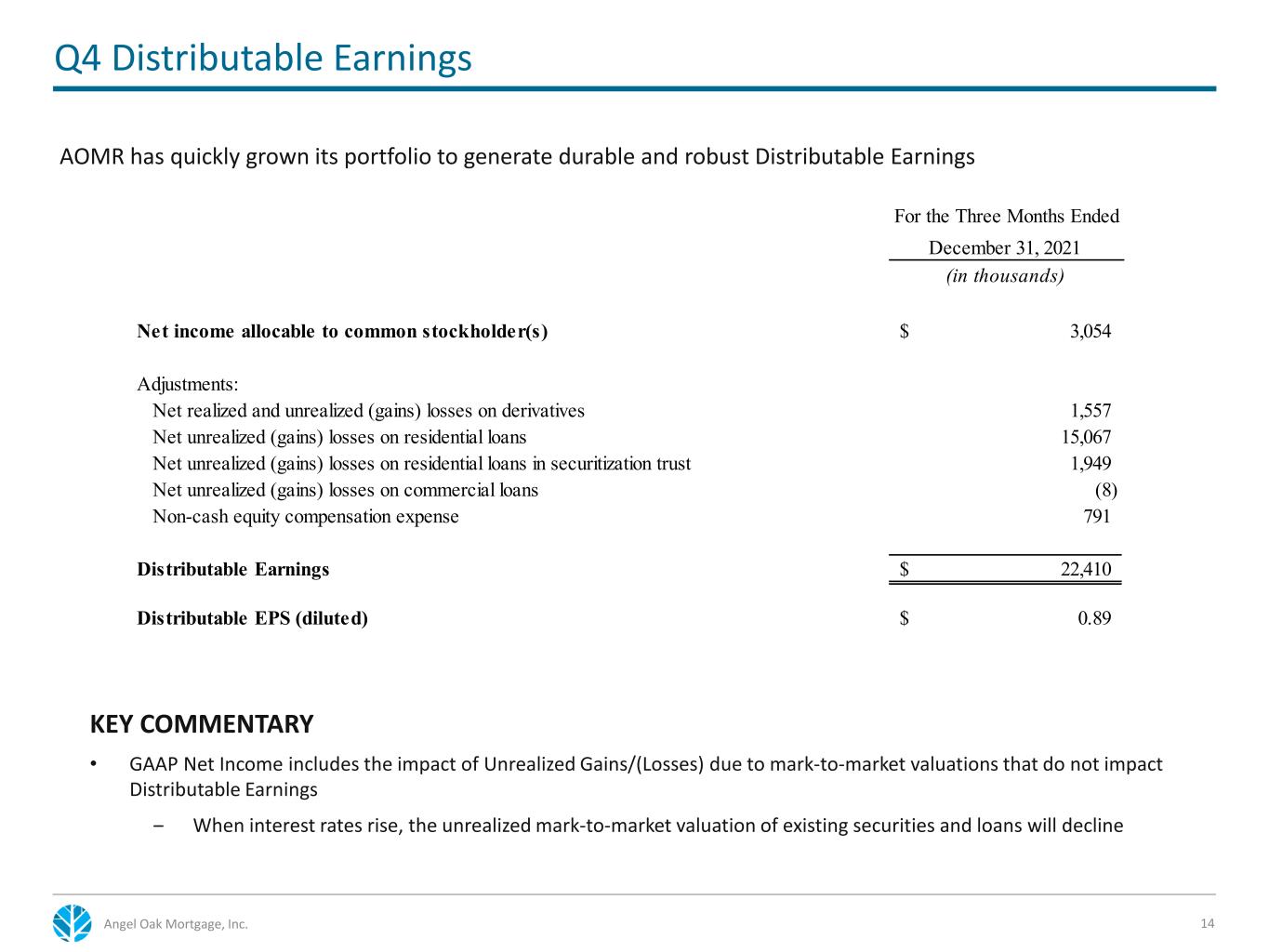

Q4 Distributable Earnings 14 KEY COMMENTARY • GAAP Net Income includes the impact of Unrealized Gains/(Losses) due to mark-to-market valuations that do not impact Distributable Earnings ‒ When interest rates rise, the unrealized mark-to-market valuation of existing securities and loans will decline Angel Oak Mortgage, Inc. AOMR has quickly grown its portfolio to generate durable and robust Distributable Earnings December 31, 2021 Net income allocable to common stockholder(s) 3,054$ Adjustments: Net realized and unrealized (gains) losses on derivatives 1,557 Net unrealized (gains) losses on residential loans 15,067 Net unrealized (gains) losses on residential loans in securitization trust 1,949 Net unrealized (gains) losses on commercial loans (8) Non-cash equity compensation expense 791 Distributable Earnings 22,410$ Distributable EPS (diluted) 0.89$ For the Three Months Ended (in thousands)

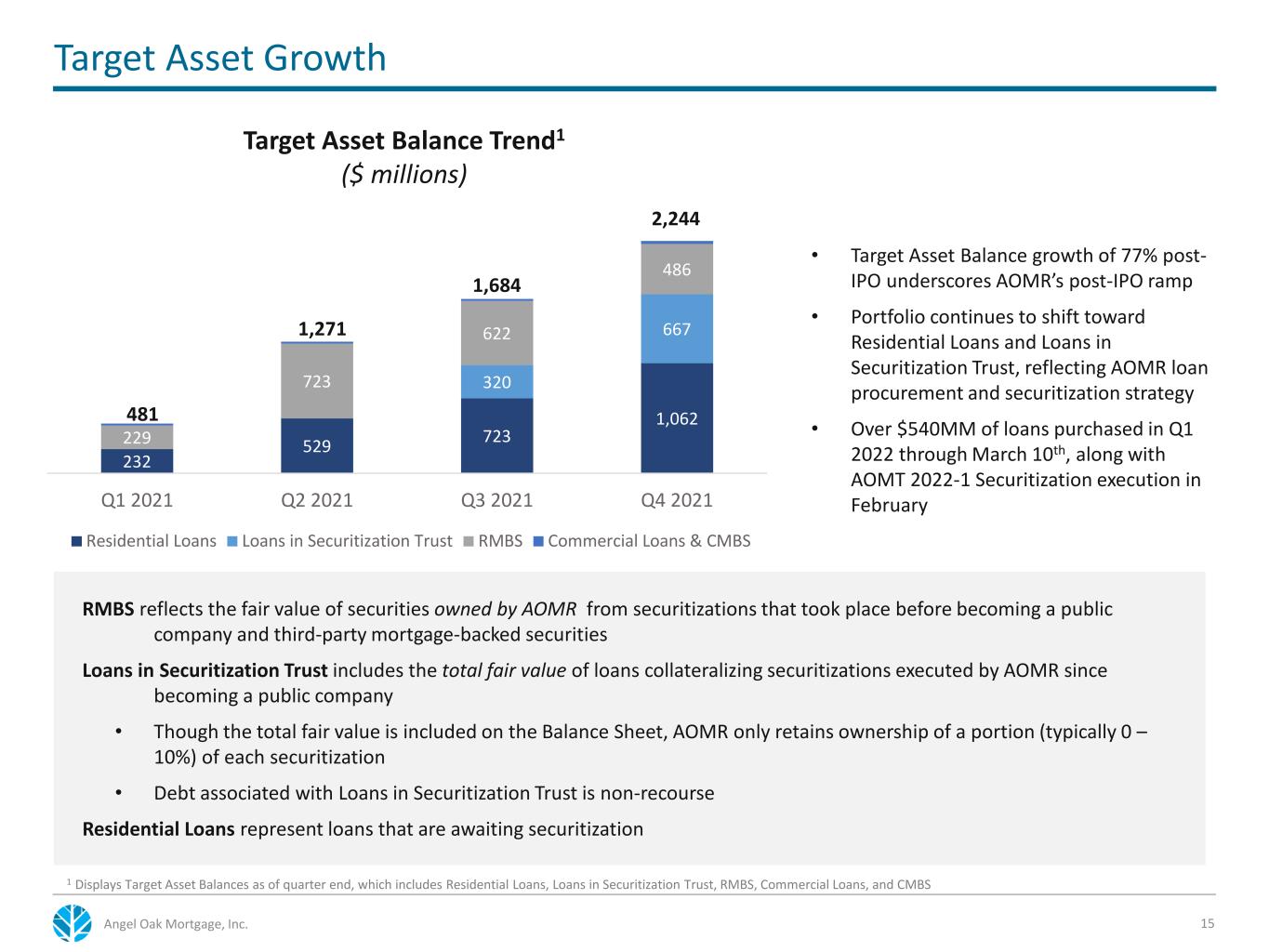

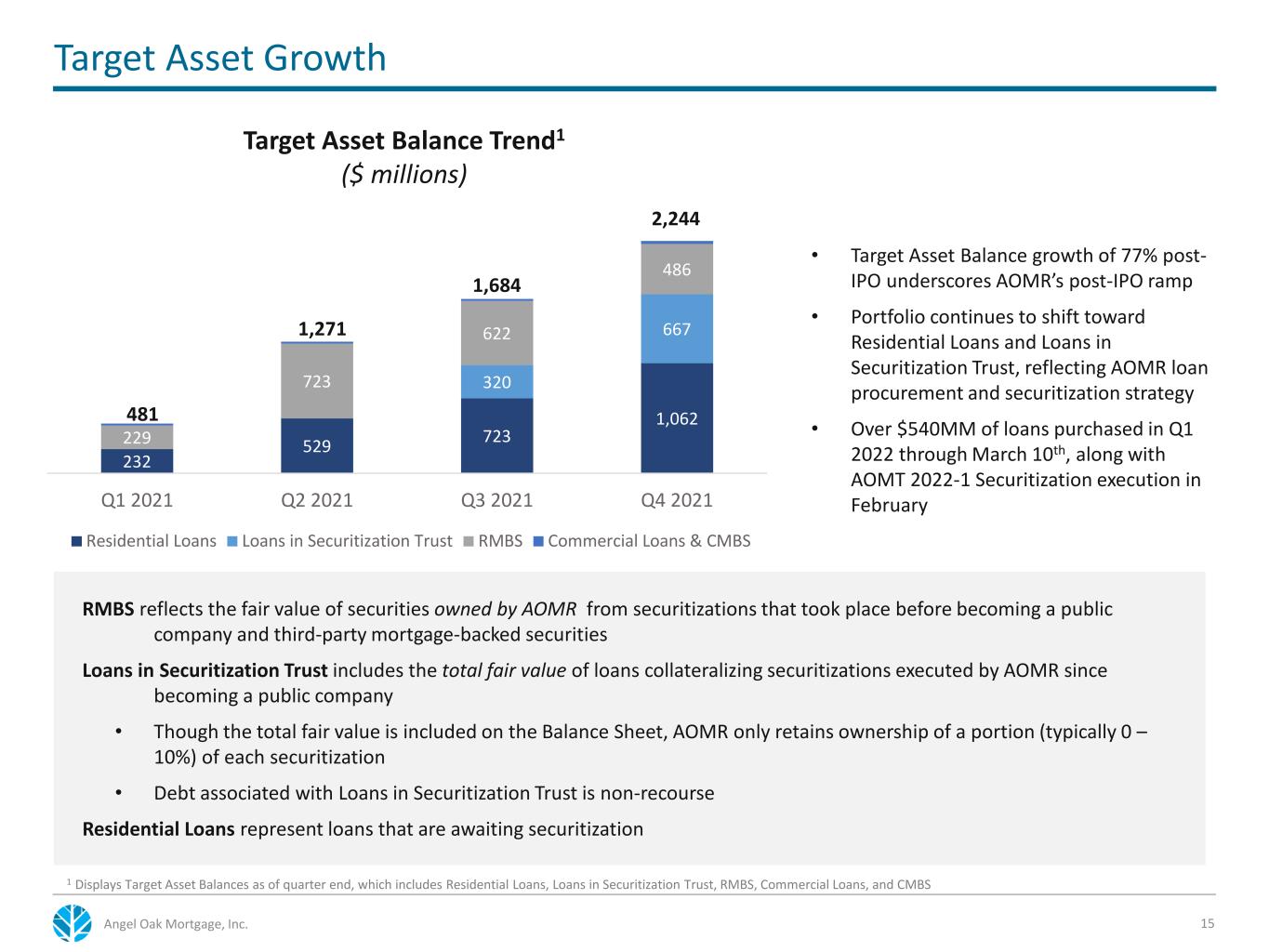

Target Asset Growth 15 232 529 723 1,062 320 667 229 723 622 486 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Residential Loans Loans in Securitization Trust RMBS Commercial Loans & CMBS 1,271 2,244 1,684 481 • Target Asset Balance growth of 77% post- IPO underscores AOMR’s post-IPO ramp • Portfolio continues to shift toward Residential Loans and Loans in Securitization Trust, reflecting AOMR loan procurement and securitization strategy • Over $540MM of loans purchased in Q1 2022 through March 10th, along with AOMT 2022-1 Securitization execution in February Target Asset Balance Trend1 ($ millions) 1 Displays Target Asset Balances as of quarter end, which includes Residential Loans, Loans in Securitization Trust, RMBS, Commercial Loans, and CMBS RMBS reflects the fair value of securities owned by AOMR from securitizations that took place before becoming a public company and third-party mortgage-backed securities Loans in Securitization Trust includes the total fair value of loans collateralizing securitizations executed by AOMR since becoming a public company • Though the total fair value is included on the Balance Sheet, AOMR only retains ownership of a portion (typically 0 – 10%) of each securitization • Debt associated with Loans in Securitization Trust is non-recourse Residential Loans represent loans that are awaiting securitization Angel Oak Mortgage, Inc.

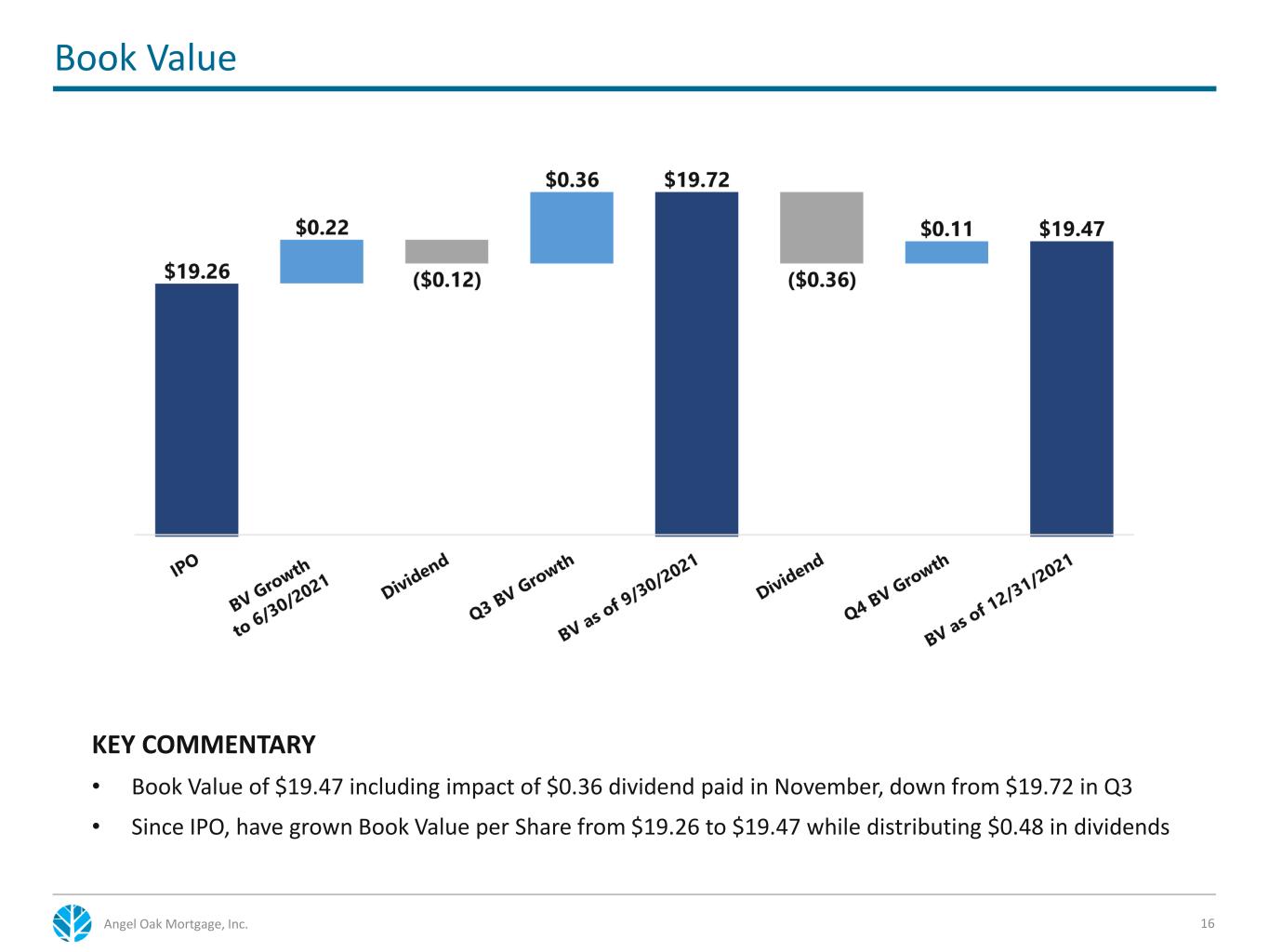

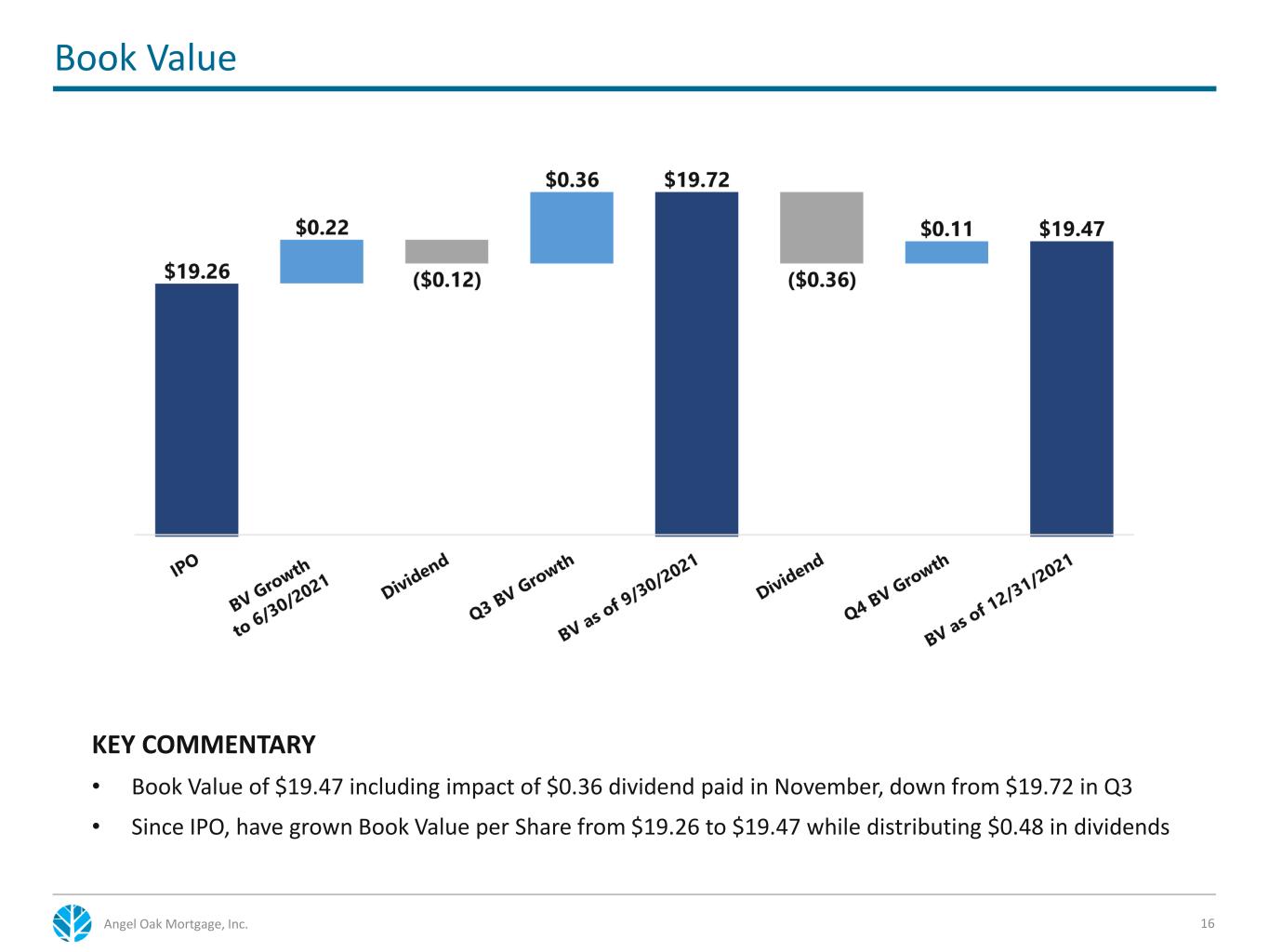

Book Value 16 KEY COMMENTARY • Book Value of $19.47 including impact of $0.36 dividend paid in November, down from $19.72 in Q3 • Since IPO, have grown Book Value per Share from $19.26 to $19.47 while distributing $0.48 in dividends Angel Oak Mortgage, Inc.

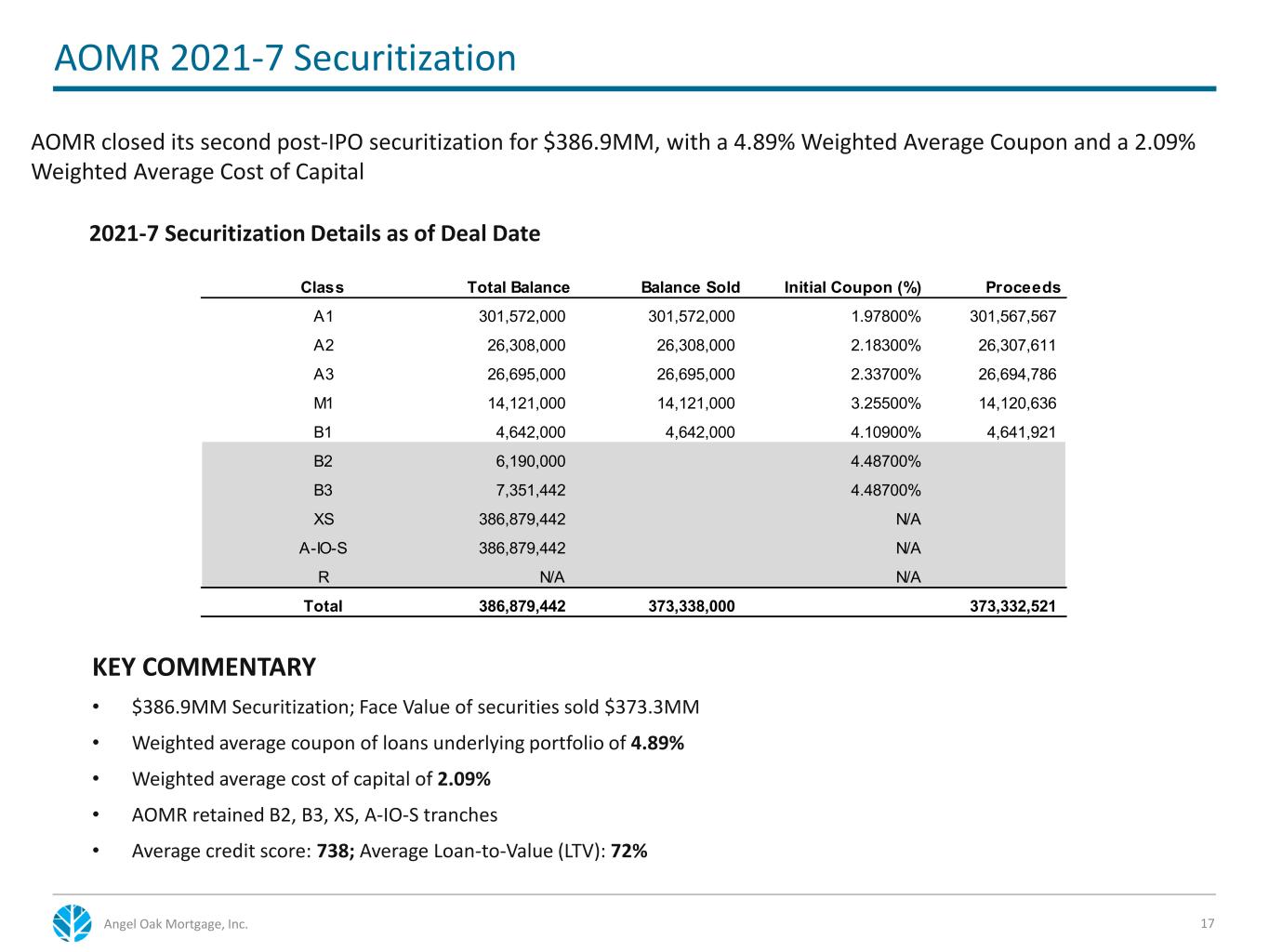

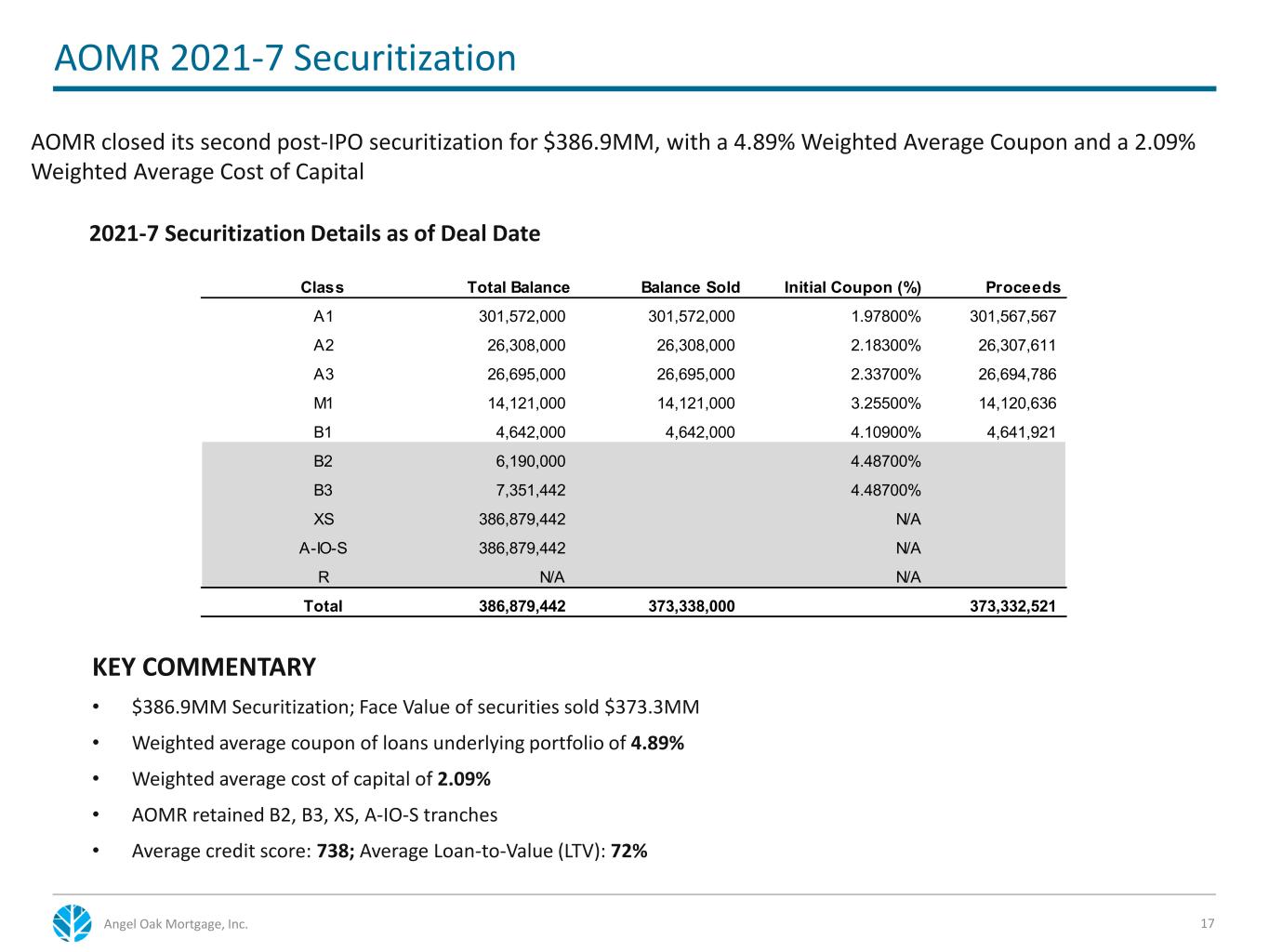

AOMR 2021-7 Securitization 17 KEY COMMENTARY • $386.9MM Securitization; Face Value of securities sold $373.3MM • Weighted average coupon of loans underlying portfolio of 4.89% • Weighted average cost of capital of 2.09% • AOMR retained B2, B3, XS, A-IO-S tranches • Average credit score: 738; Average Loan-to-Value (LTV): 72% 2021-7 Securitization Details as of Deal Date Class Total Balance Balance Sold Initial Coupon (%) Proceeds A1 301,572,000 301,572,000 1.97800% 301,567,567 A2 26,308,000 26,308,000 2.18300% 26,307,611 A3 26,695,000 26,695,000 2.33700% 26,694,786 M1 14,121,000 14,121,000 3.25500% 14,120,636 B1 4,642,000 4,642,000 4.10900% 4,641,921 B2 6,190,000 4.48700% B3 7,351,442 4.48700% XS 386,879,442 N/A A-IO-S 386,879,442 N/A R N/A N/A Total 386,879,442 373,338,000 373,332,521 AOMR closed its second post-IPO securitization for $386.9MM, with a 4.89% Weighted Average Coupon and a 2.09% Weighted Average Cost of Capital Angel Oak Mortgage, Inc.

Key Portfolio Statistics 18

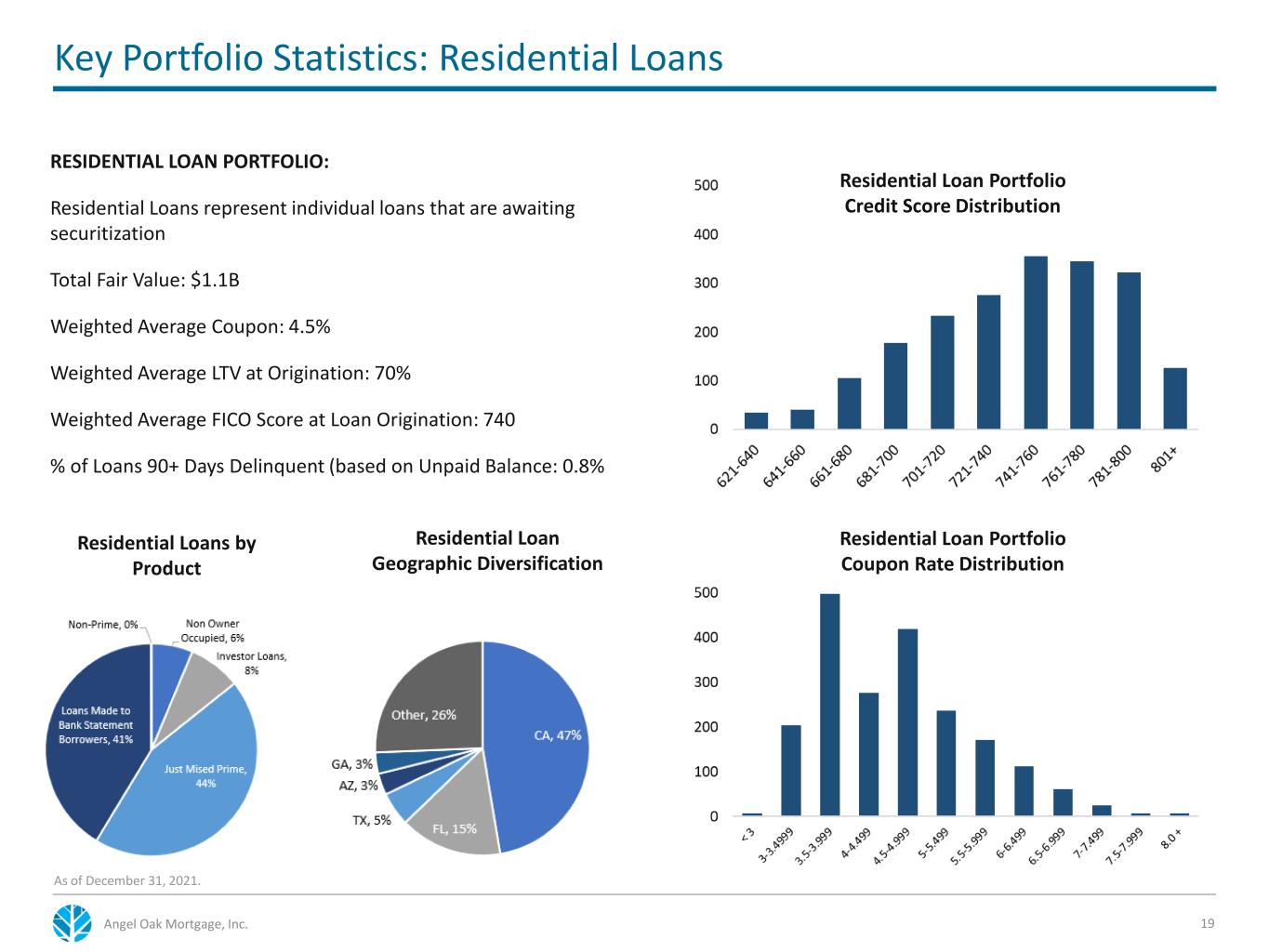

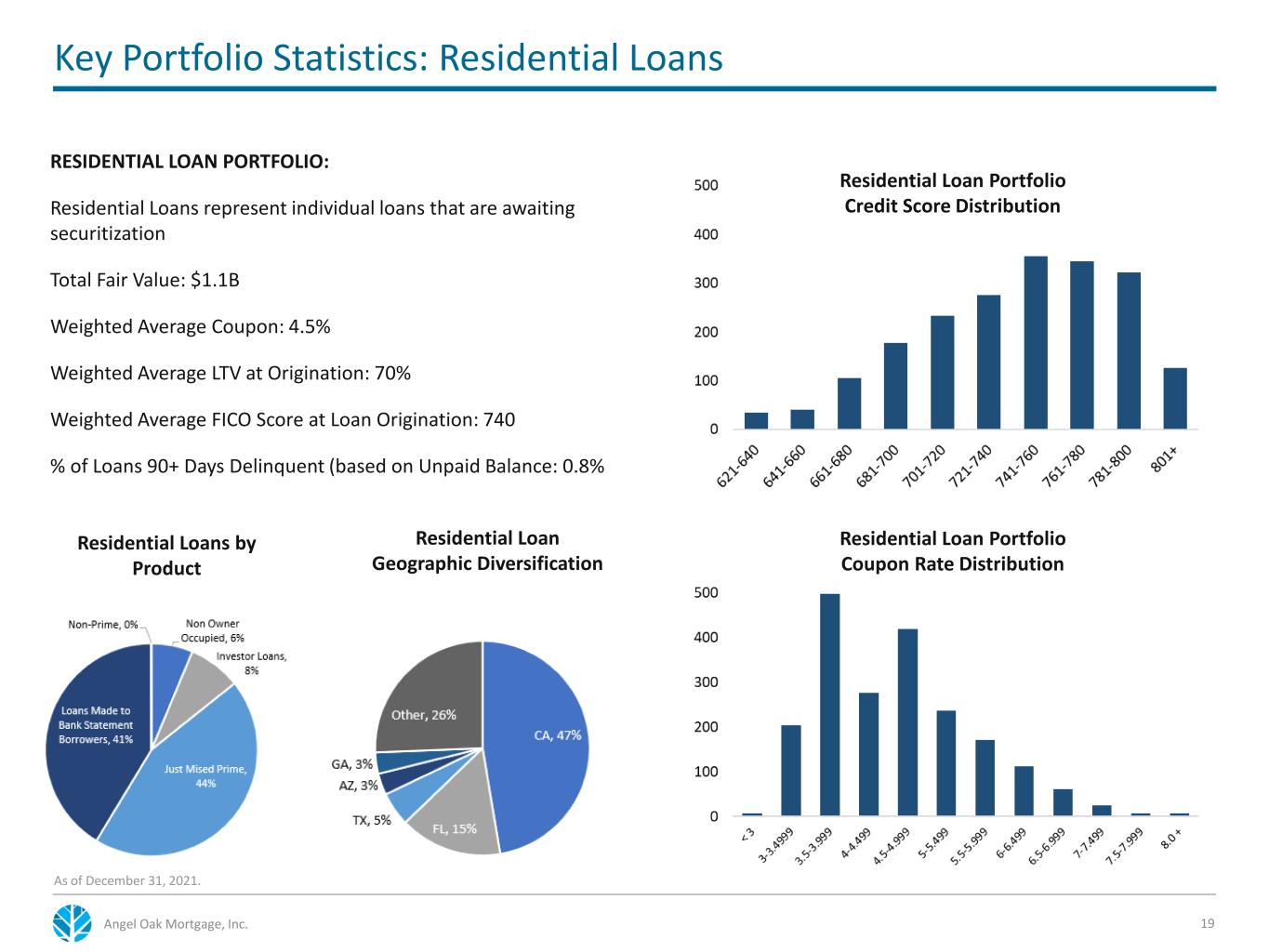

Key Portfolio Statistics: Residential Loans 19 Residential Loans by Product RESIDENTIAL LOAN PORTFOLIO: Residential Loans represent individual loans that are awaiting securitization Total Fair Value: $1.1B Weighted Average Coupon: 4.5% Weighted Average LTV at Origination: 70% Weighted Average FICO Score at Loan Origination: 740 % of Loans 90+ Days Delinquent (based on Unpaid Balance: 0.8% Residential Loan Geographic Diversification As of December 31, 2021. Angel Oak Mortgage, Inc. Residential Loan Portfolio Credit Score Distribution Residential Loan Portfolio Coupon Rate Distribution

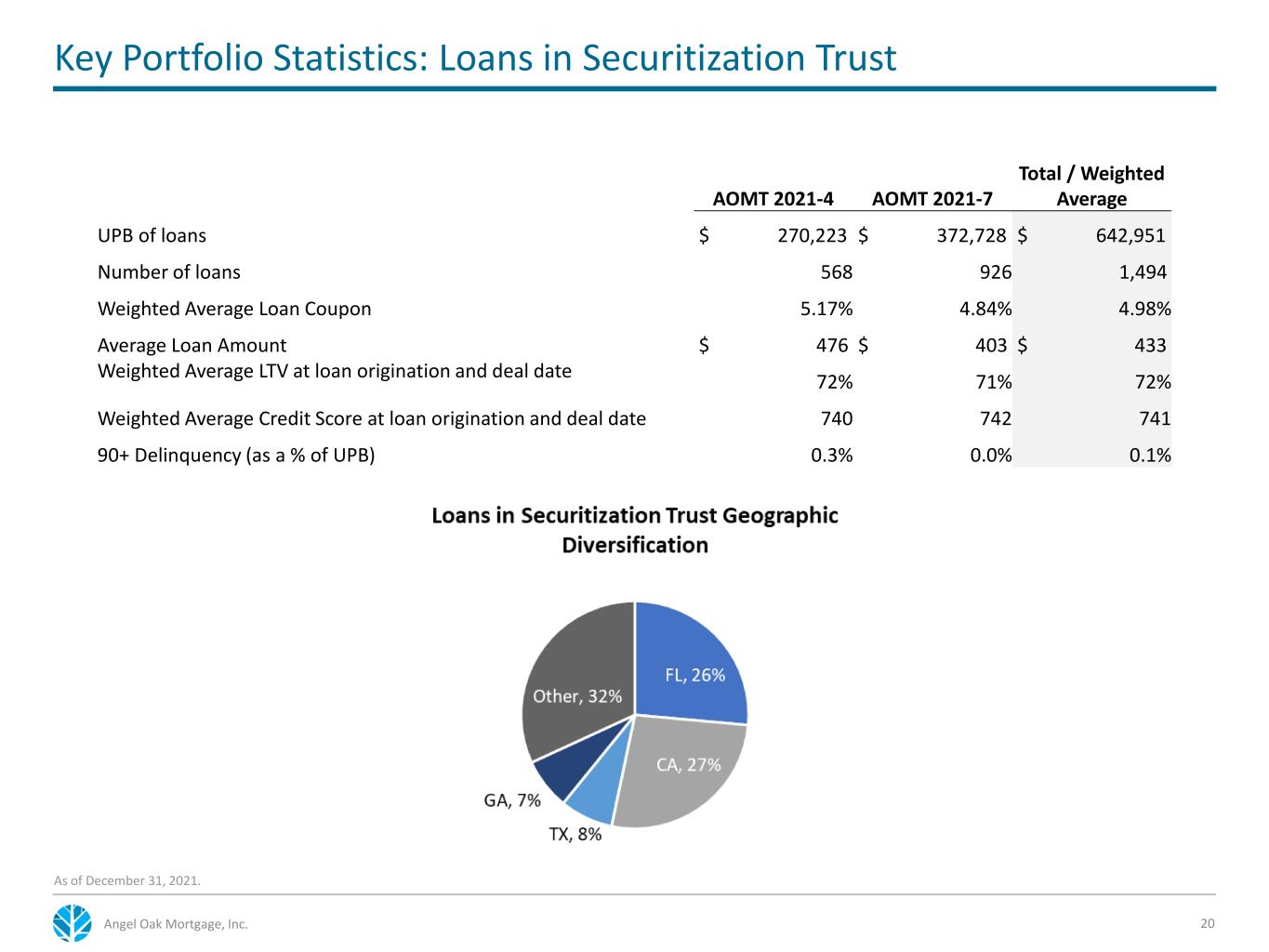

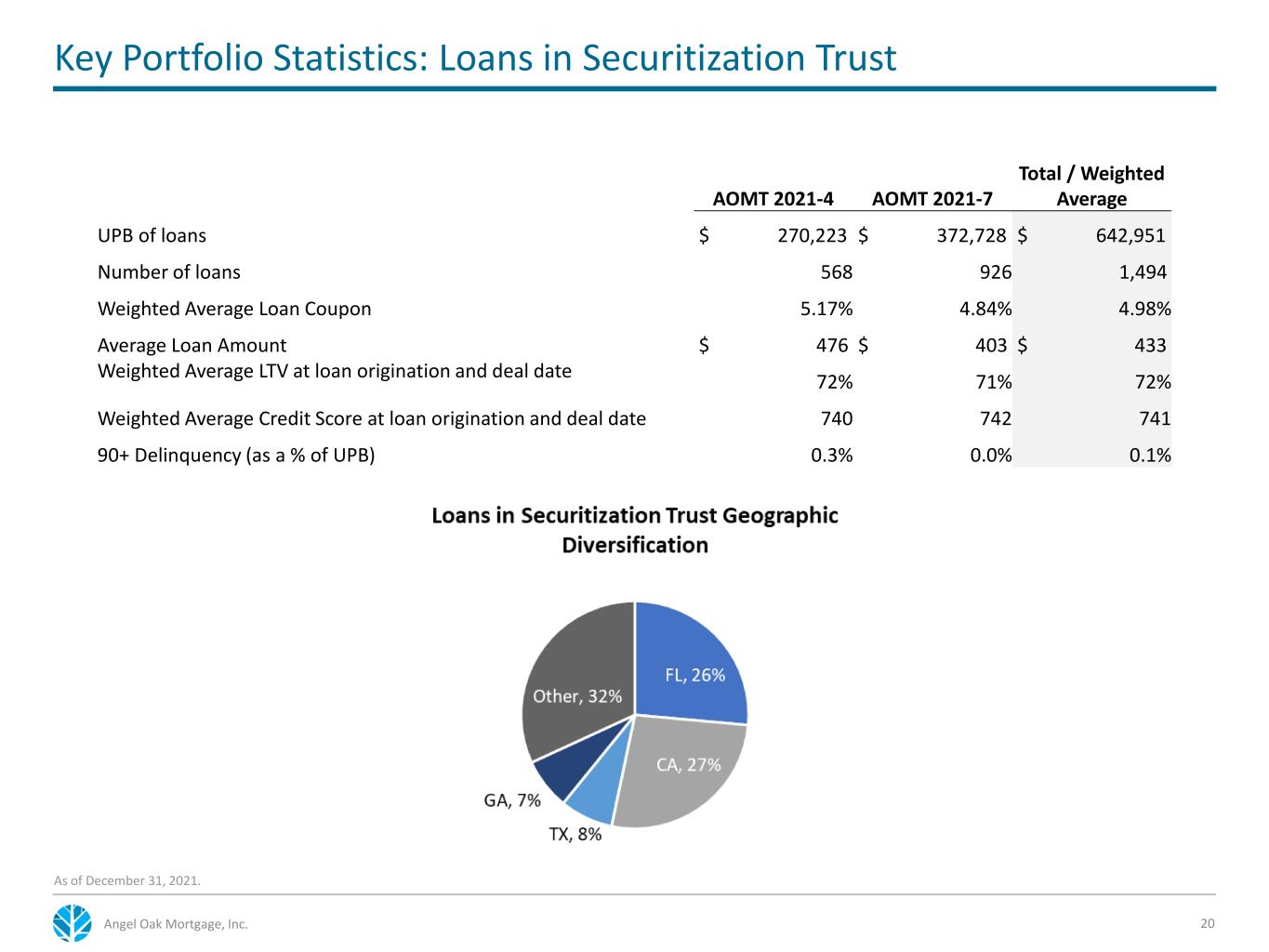

Key Portfolio Statistics: Loans in Securitization Trust 20 AOMT 2021-4 AOMT 2021-7 Total / Weighted Average UPB of loans $ 270,223 $ 372,728 $ 642,951 Number of loans 568 926 1,494 Weighted Average Loan Coupon 5.17% 4.84% 4.98% Average Loan Amount $ 476 $ 403 $ 433 Weighted Average LTV at loan origination and deal date 72% 71% 72% Weighted Average Credit Score at loan origination and deal date 740 742 741 90+ Delinquency (as a % of UPB) 0.3% 0.0% 0.1% As of December 31, 2021. Angel Oak Mortgage, Inc.

Key Portfolio Statistics: RMBS 21 RMBS PORTFOLIO: Our RMBS Portfolio represents the legacy securitizations that AOMR took part in before becoming a public company in June 2021. Only retained tranches of these securitizations are included on our Balance Sheet Total Fair Value: $435.6MM Weighted Average Coupon: 6.6% Weighted Average LTV: 73.4% 90 Day DLQ: 7.16% As of December 31, 2021. 1 As % of Original UPB Angel Oak Mortgage, Inc.

Appendix 22

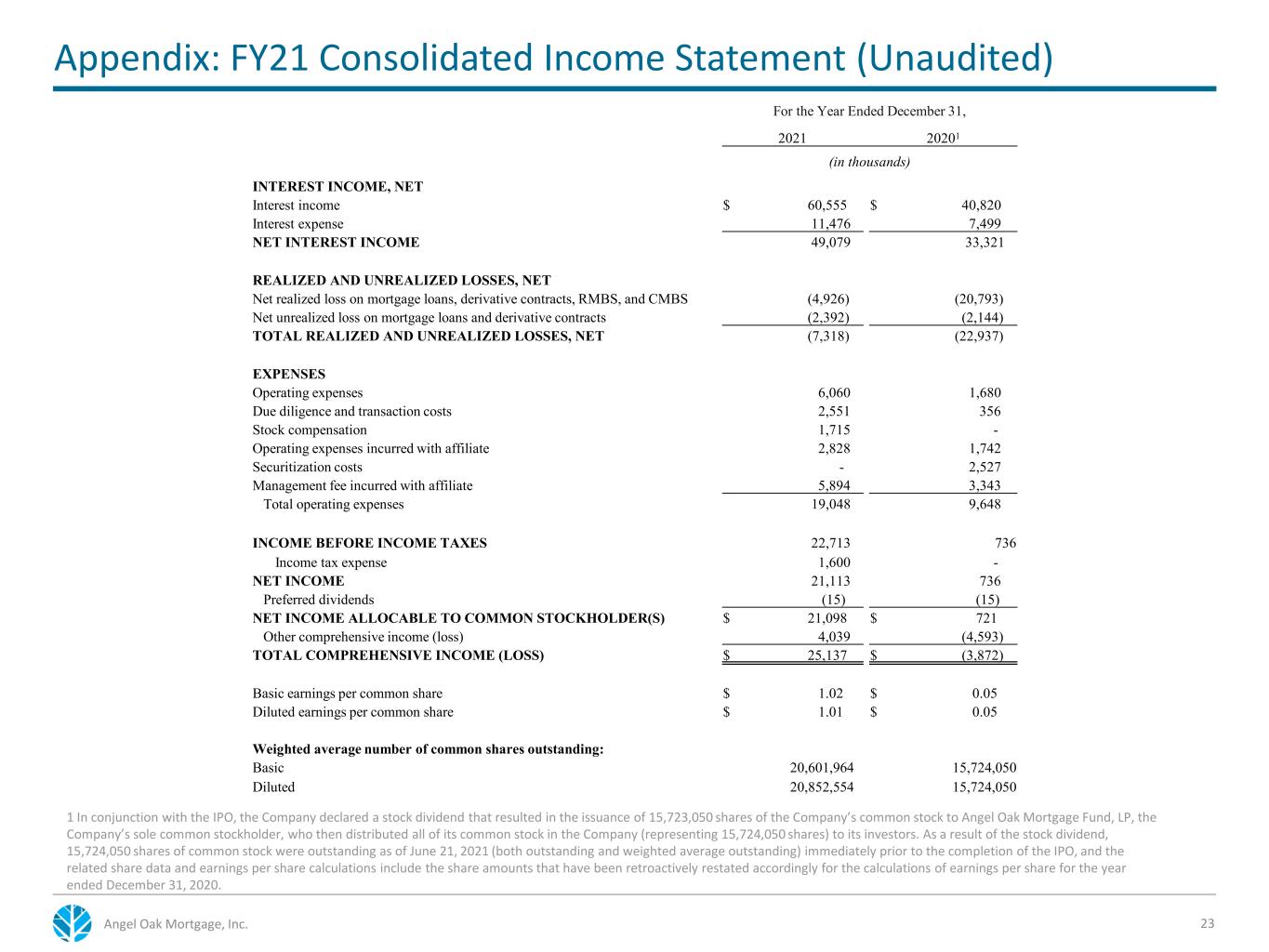

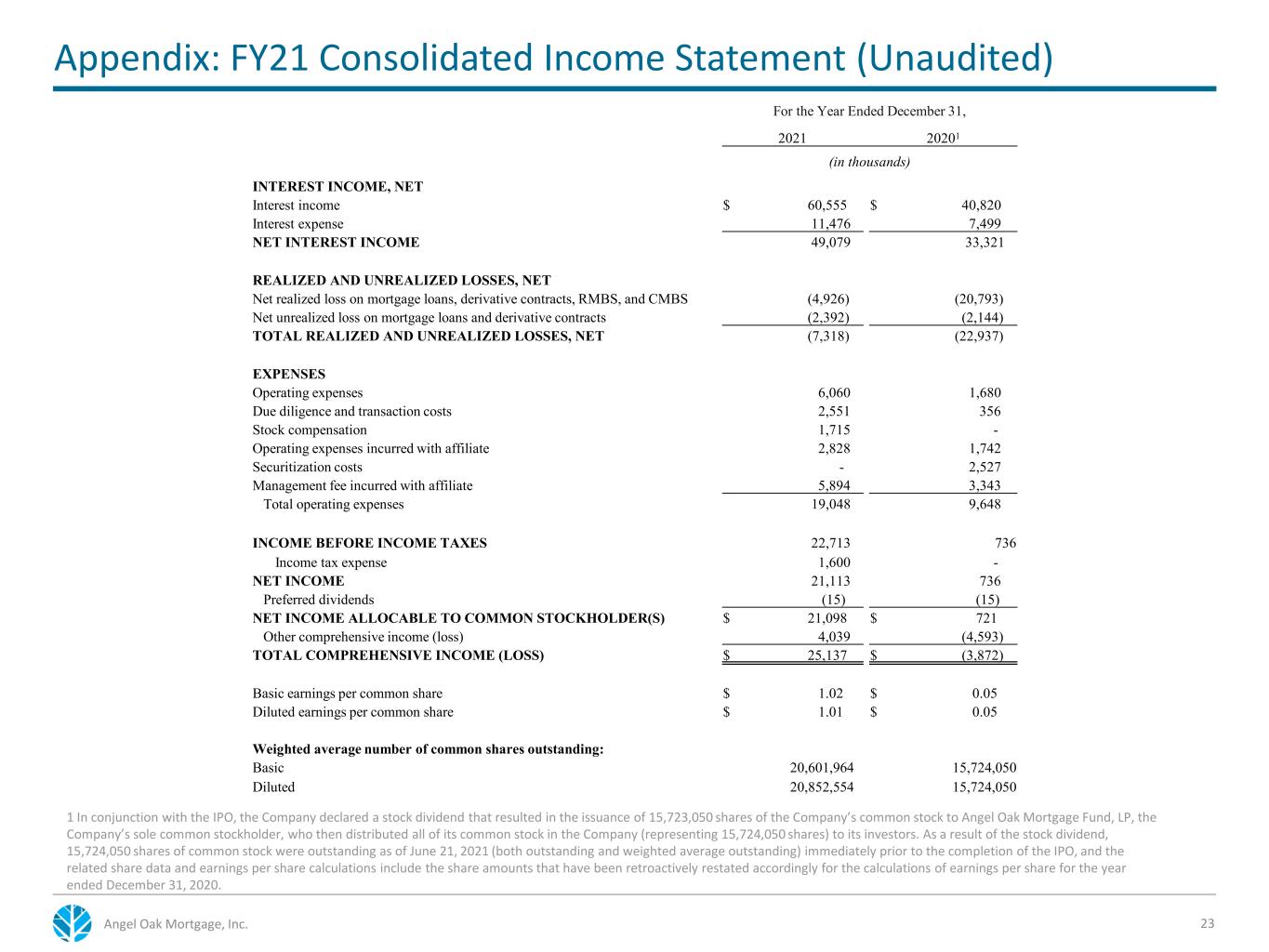

Appendix: FY21 Consolidated Income Statement (Unaudited) 23Angel Oak Mortgage, Inc. For the Year Ended December 31, 2021 20201 (in thousands) INTEREST INCOME, NET Interest income $ 60,555 $ 40,820 Interest expense 11,476 7,499 NET INTEREST INCOME 49,079 33,321 REALIZED AND UNREALIZED LOSSES, NET Net realized loss on mortgage loans, derivative contracts, RMBS, and CMBS (4,926) (20,793) Net unrealized loss on mortgage loans and derivative contracts (2,392) (2,144) TOTAL REALIZED AND UNREALIZED LOSSES, NET (7,318) (22,937) EXPENSES Operating expenses 6,060 1,680 Due diligence and transaction costs 2,551 356 Stock compensation 1,715 - Operating expenses incurred with affiliate 2,828 1,742 Securitization costs - 2,527 Management fee incurred with affiliate 5,894 3,343 Total operating expenses 19,048 9,648 INCOME BEFORE INCOME TAXES 22,713 736 Income tax expense 1,600 - NET INCOME 21,113 736 Preferred dividends (15) (15) NET INCOME ALLOCABLE TO COMMON STOCKHOLDER(S) $ 21,098 $ 721 Other comprehensive income (loss) 4,039 (4,593) TOTAL COMPREHENSIVE INCOME (LOSS) $ 25,137 $ (3,872) Basic earnings per common share $ 1.02 $ 0.05 Diluted earnings per common share $ 1.01 $ 0.05 Weighted average number of common shares outstanding: Basic 20,601,964 15,724,050 Diluted 20,852,554 15,724,050 1 In conjunction with the IPO, the Company declared a stock dividend that resulted in the issuance of 15,723,050 shares of the Company’s common stock to Angel Oak Mortgage Fund, LP, the Company’s sole common stockholder, who then distributed all of its common stock in the Company (representing 15,724,050 shares) to its investors. As a result of the stock dividend, 15,724,050 shares of common stock were outstanding as of June 21, 2021 (both outstanding and weighted average outstanding) immediately prior to the completion of the IPO, and the related share data and earnings per share calculations include the share amounts that have been retroactively restated accordingly for the calculations of earnings per share for the year ended December 31, 2020.

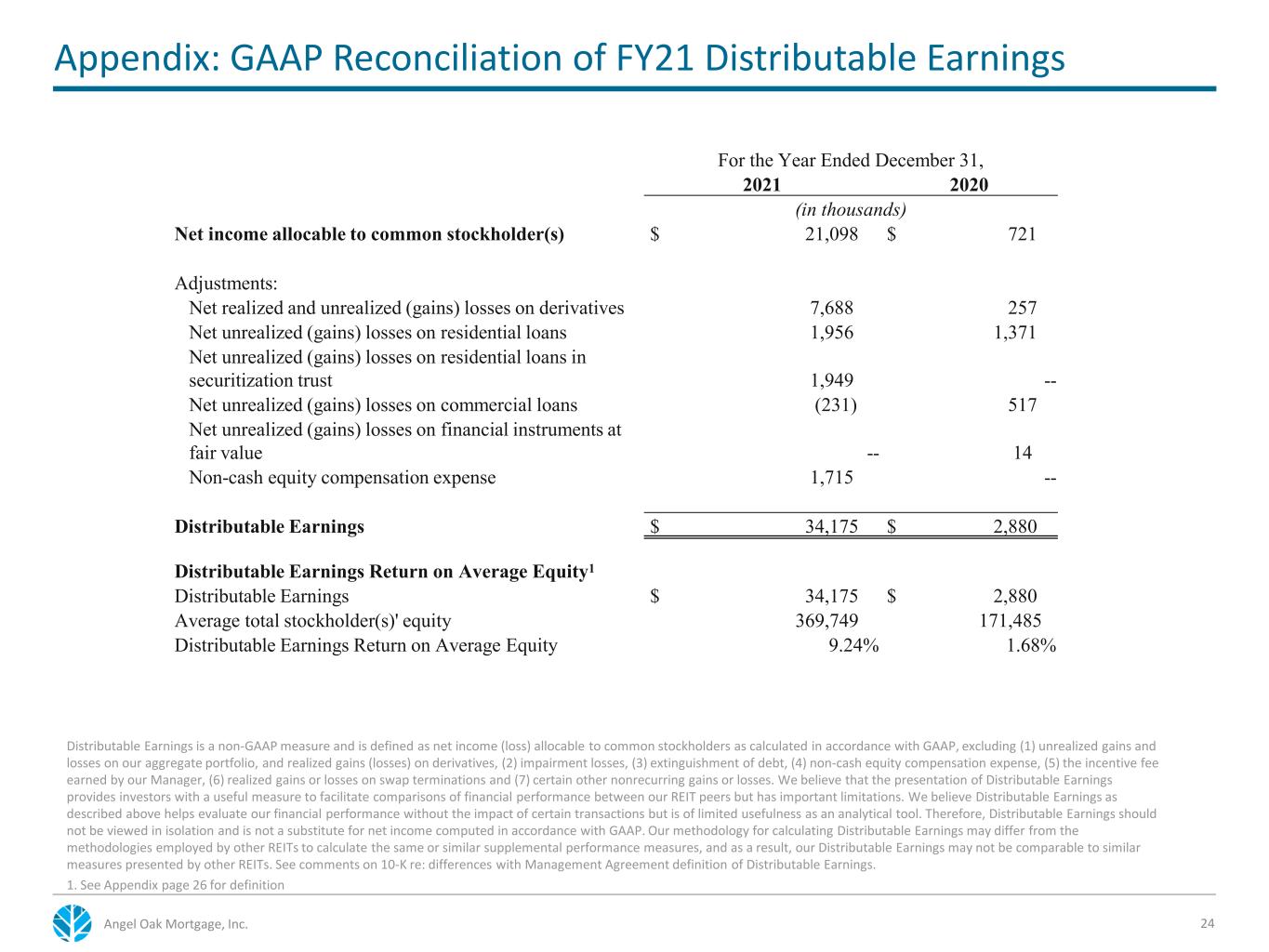

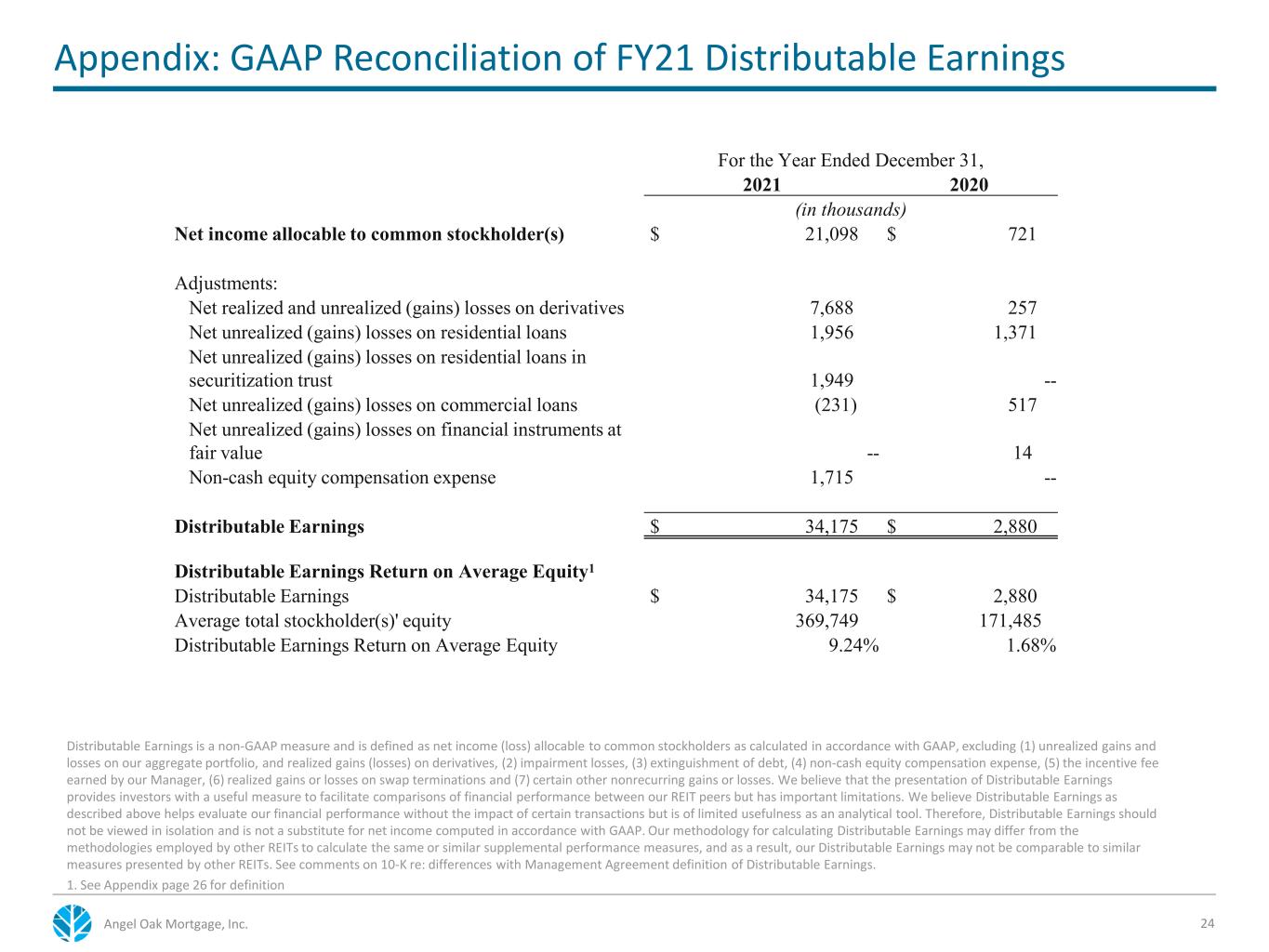

Appendix: GAAP Reconciliation of FY21 Distributable Earnings 24 Distributable Earnings is a non-GAAP measure and is defined as net income (loss) allocable to common stockholders as calculated in accordance with GAAP, excluding (1) unrealized gains and losses on our aggregate portfolio, and realized gains (losses) on derivatives, (2) impairment losses, (3) extinguishment of debt, (4) non-cash equity compensation expense, (5) the incentive fee earned by our Manager, (6) realized gains or losses on swap terminations and (7) certain other nonrecurring gains or losses. We believe that the presentation of Distributable Earnings provides investors with a useful measure to facilitate comparisons of financial performance between our REIT peers but has important limitations. We believe Distributable Earnings as described above helps evaluate our financial performance without the impact of certain transactions but is of limited usefulness as an analytical tool. Therefore, Distributable Earnings should not be viewed in isolation and is not a substitute for net income computed in accordance with GAAP. Our methodology for calculating Distributable Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our Distributable Earnings may not be comparable to similar measures presented by other REITs. See comments on 10-K re: differences with Management Agreement definition of Distributable Earnings. 1. See Appendix page 26 for definition Angel Oak Mortgage, Inc. For the Year Ended December 31, 2021 2020 (in thousands) Net income allocable to common stockholder(s) $ 21,098 $ 721 Adjustments: Net realized and unrealized (gains) losses on derivatives 7,688 257 Net unrealized (gains) losses on residential loans 1,956 1,371 Net unrealized (gains) losses on residential loans in securitization trust 1,949 -- Net unrealized (gains) losses on commercial loans (231) 517 Net unrealized (gains) losses on financial instruments at fair value -- 14 Non-cash equity compensation expense 1,715 -- Distributable Earnings $ 34,175 $ 2,880 Distributable Earnings Return on Average Equity1 Distributable Earnings $ 34,175 $ 2,880 Average total stockholder(s)' equity 369,749 171,485 Distributable Earnings Return on Average Equity 9.24% 1.68%

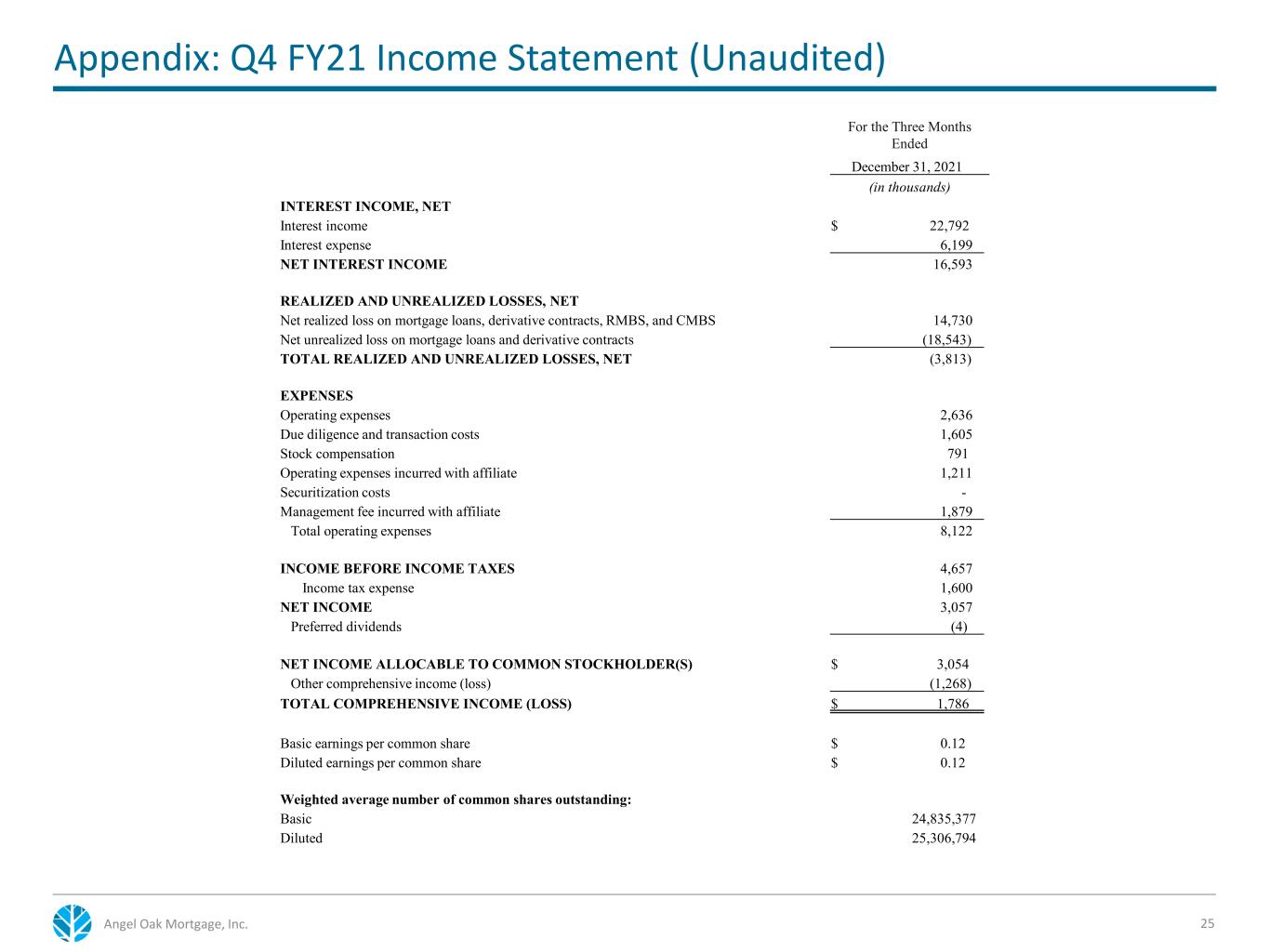

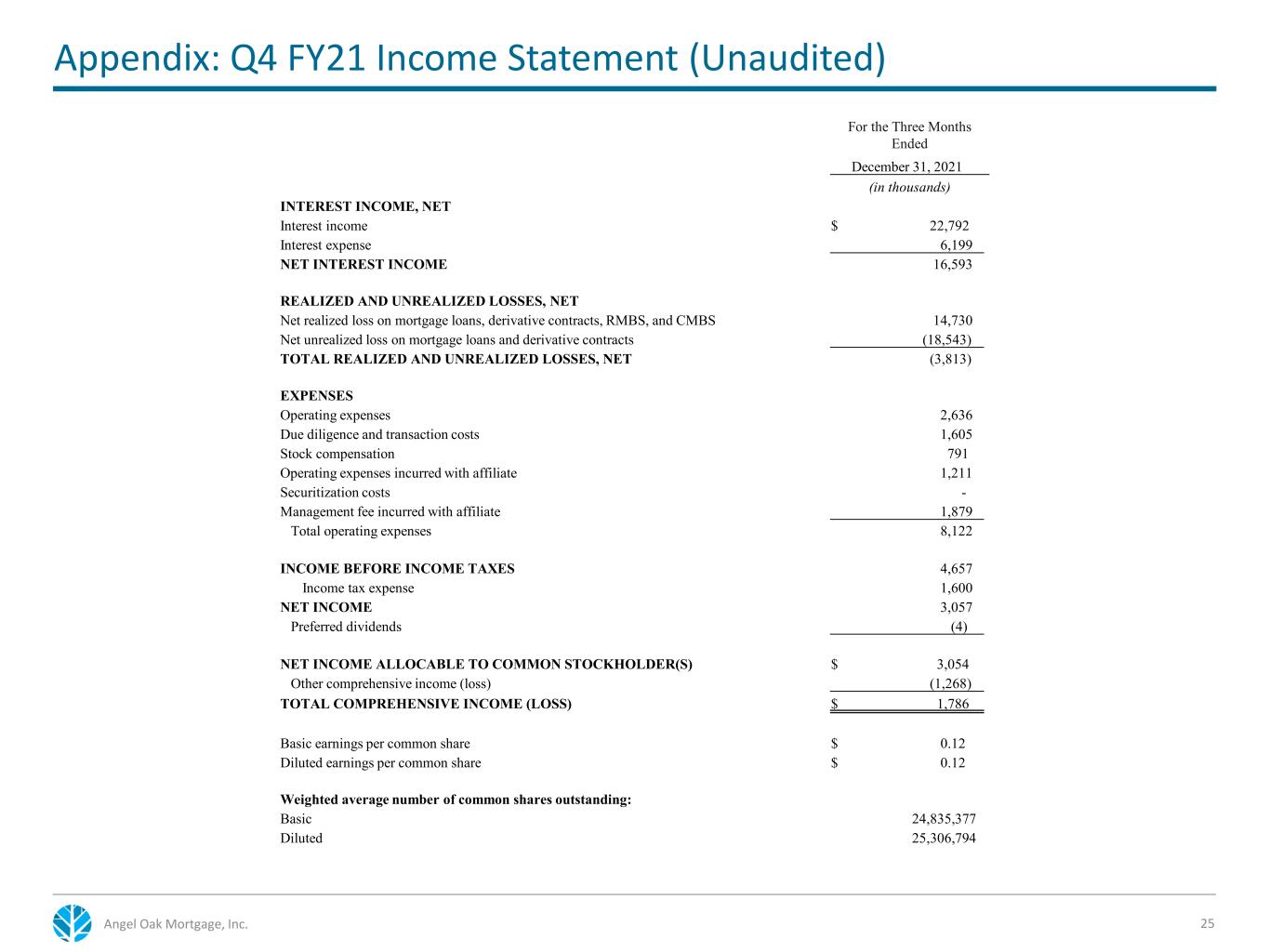

Appendix: Q4 FY21 Income Statement (Unaudited) 25Angel Oak Mortgage, Inc. For the Three Months Ended December 31, 2021 (in thousands) INTEREST INCOME, NET Interest income $ 22,792 Interest expense 6,199 NET INTEREST INCOME 16,593 REALIZED AND UNREALIZED LOSSES, NET Net realized loss on mortgage loans, derivative contracts, RMBS, and CMBS 14,730 Net unrealized loss on mortgage loans and derivative contracts (18,543) TOTAL REALIZED AND UNREALIZED LOSSES, NET (3,813) EXPENSES Operating expenses 2,636 Due diligence and transaction costs 1,605 Stock compensation 791 Operating expenses incurred with affiliate 1,211 Securitization costs - Management fee incurred with affiliate 1,879 Total operating expenses 8,122 INCOME BEFORE INCOME TAXES 4,657 Income tax expense 1,600 NET INCOME 3,057 Preferred dividends (4) NET INCOME ALLOCABLE TO COMMON STOCKHOLDER(S) $ 3,054 Other comprehensive income (loss) (1,268) TOTAL COMPREHENSIVE INCOME (LOSS) $ 1,786 Basic earnings per common share $ 0.12 Diluted earnings per common share $ 0.12 Weighted average number of common shares outstanding: Basic 24,835,377 Diluted 25,306,794

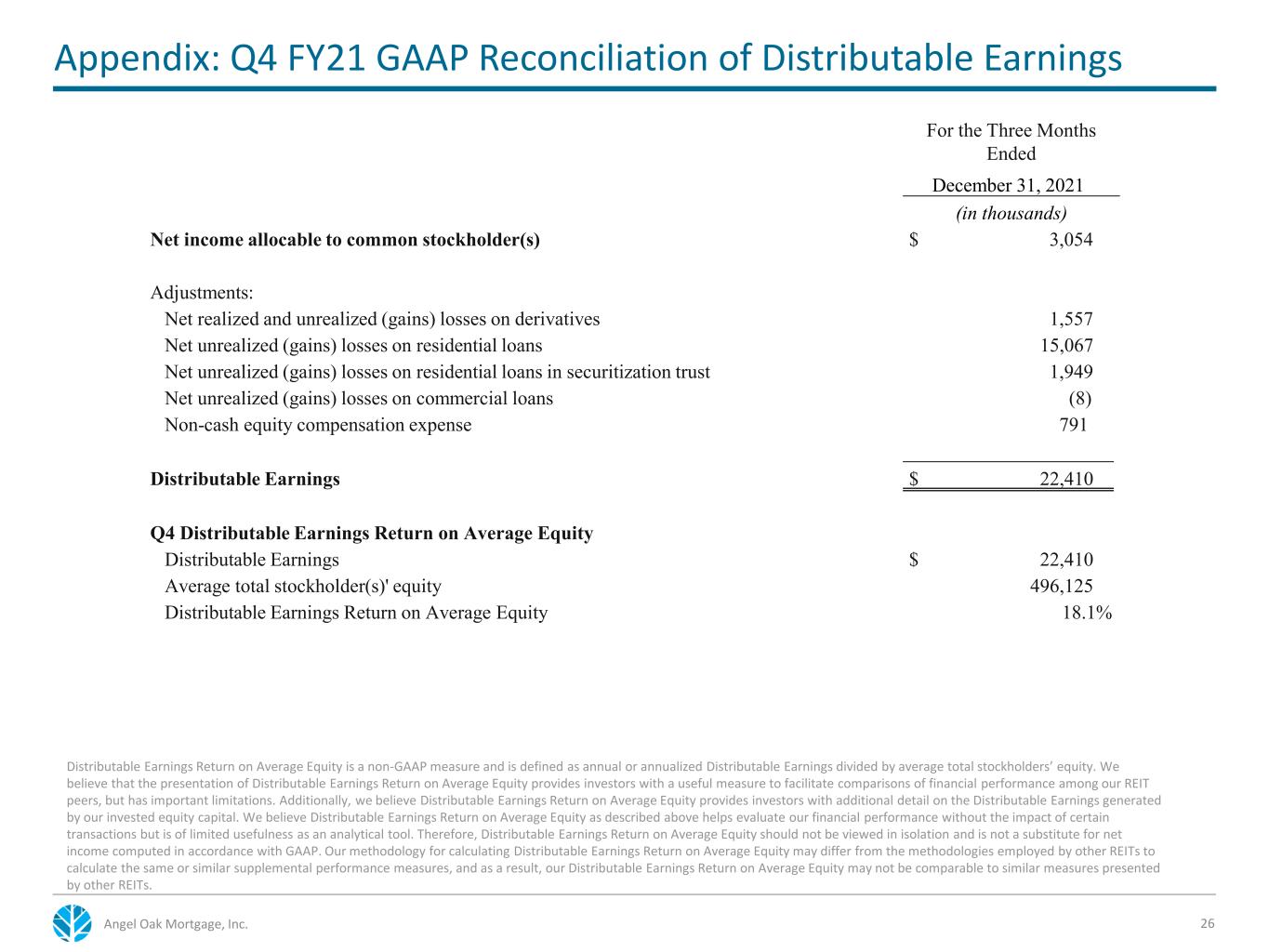

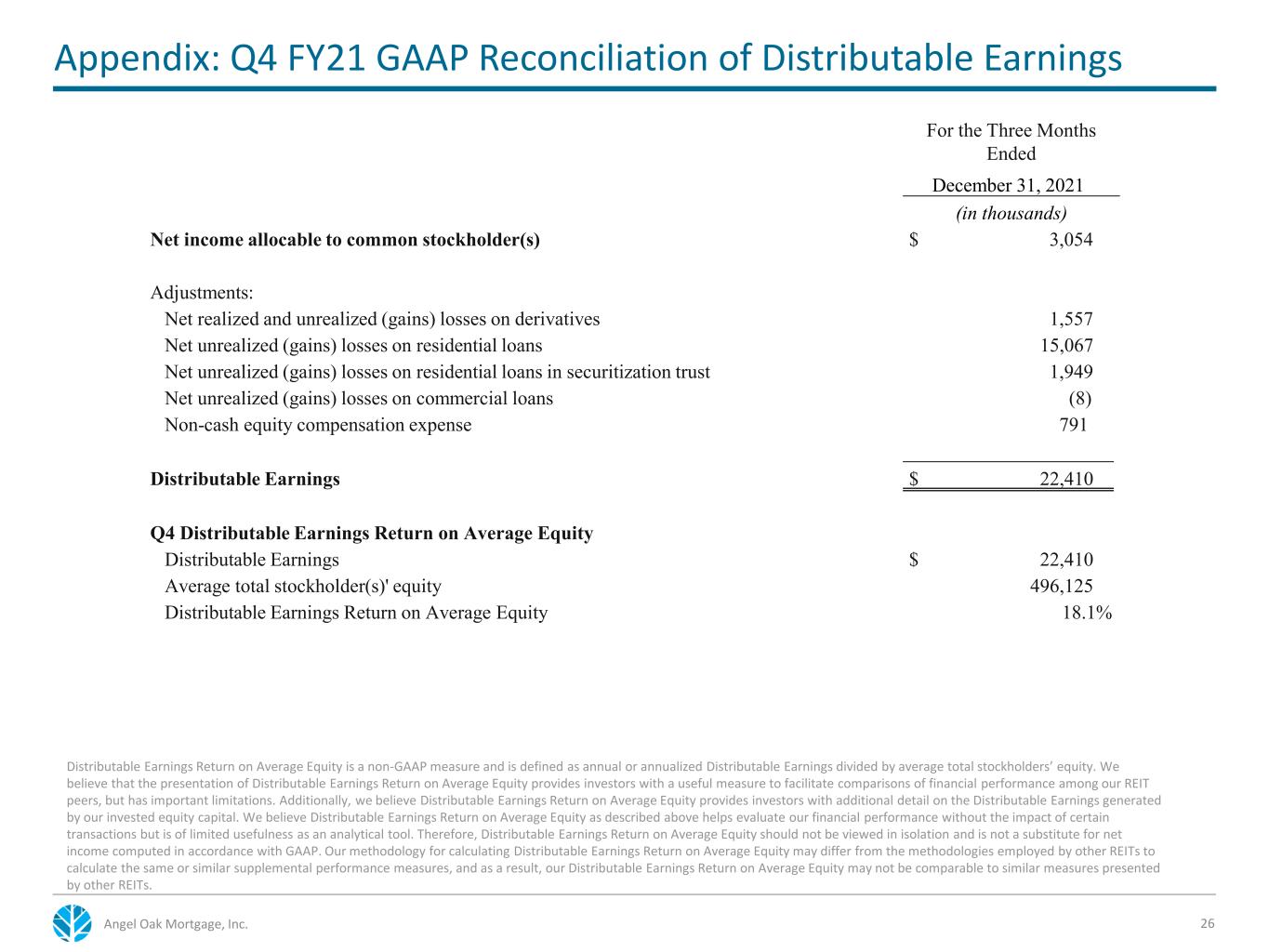

Appendix: Q4 FY21 GAAP Reconciliation of Distributable Earnings 26 Distributable Earnings Return on Average Equity is a non-GAAP measure and is defined as annual or annualized Distributable Earnings divided by average total stockholders’ equity. We believe that the presentation of Distributable Earnings Return on Average Equity provides investors with a useful measure to facilitate comparisons of financial performance among our REIT peers, but has important limitations. Additionally, we believe Distributable Earnings Return on Average Equity provides investors with additional detail on the Distributable Earnings generated by our invested equity capital. We believe Distributable Earnings Return on Average Equity as described above helps evaluate our financial performance without the impact of certain transactions but is of limited usefulness as an analytical tool. Therefore, Distributable Earnings Return on Average Equity should not be viewed in isolation and is not a substitute for net income computed in accordance with GAAP. Our methodology for calculating Distributable Earnings Return on Average Equity may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our Distributable Earnings Return on Average Equity may not be comparable to similar measures presented by other REITs. Angel Oak Mortgage, Inc. For the Three Months Ended December 31, 2021 (in thousands) Net income allocable to common stockholder(s) $ 3,054 Adjustments: Net realized and unrealized (gains) losses on derivatives 1,557 Net unrealized (gains) losses on residential loans 15,067 Net unrealized (gains) losses on residential loans in securitization trust 1,949 Net unrealized (gains) losses on commercial loans (8) Non-cash equity compensation expense 791 Distributable Earnings $ 22,410 Q4 Distributable Earnings Return on Average Equity Distributable Earnings $ 22,410 Average total stockholder(s)' equity 496,125 Distributable Earnings Return on Average Equity 18.1%

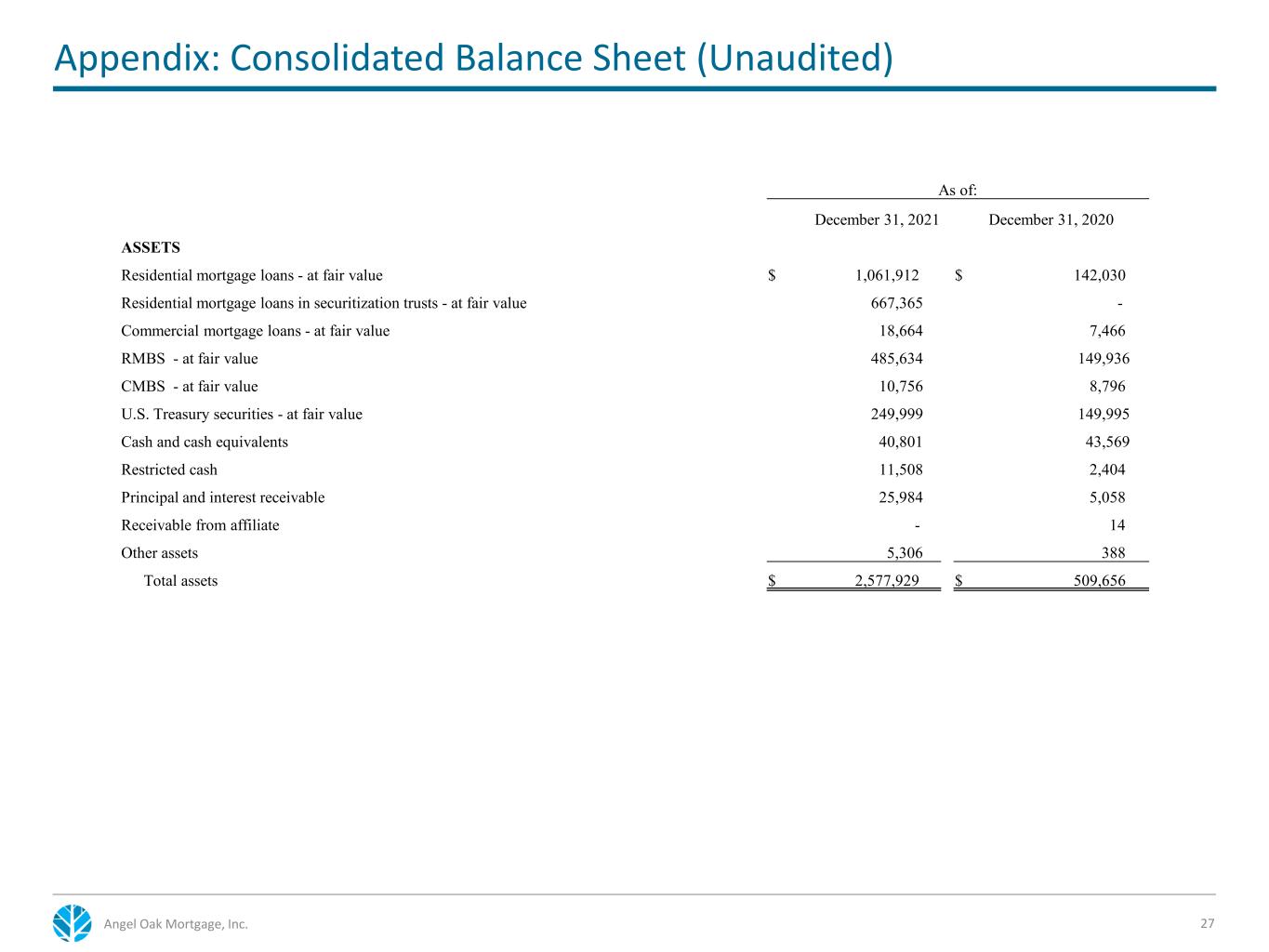

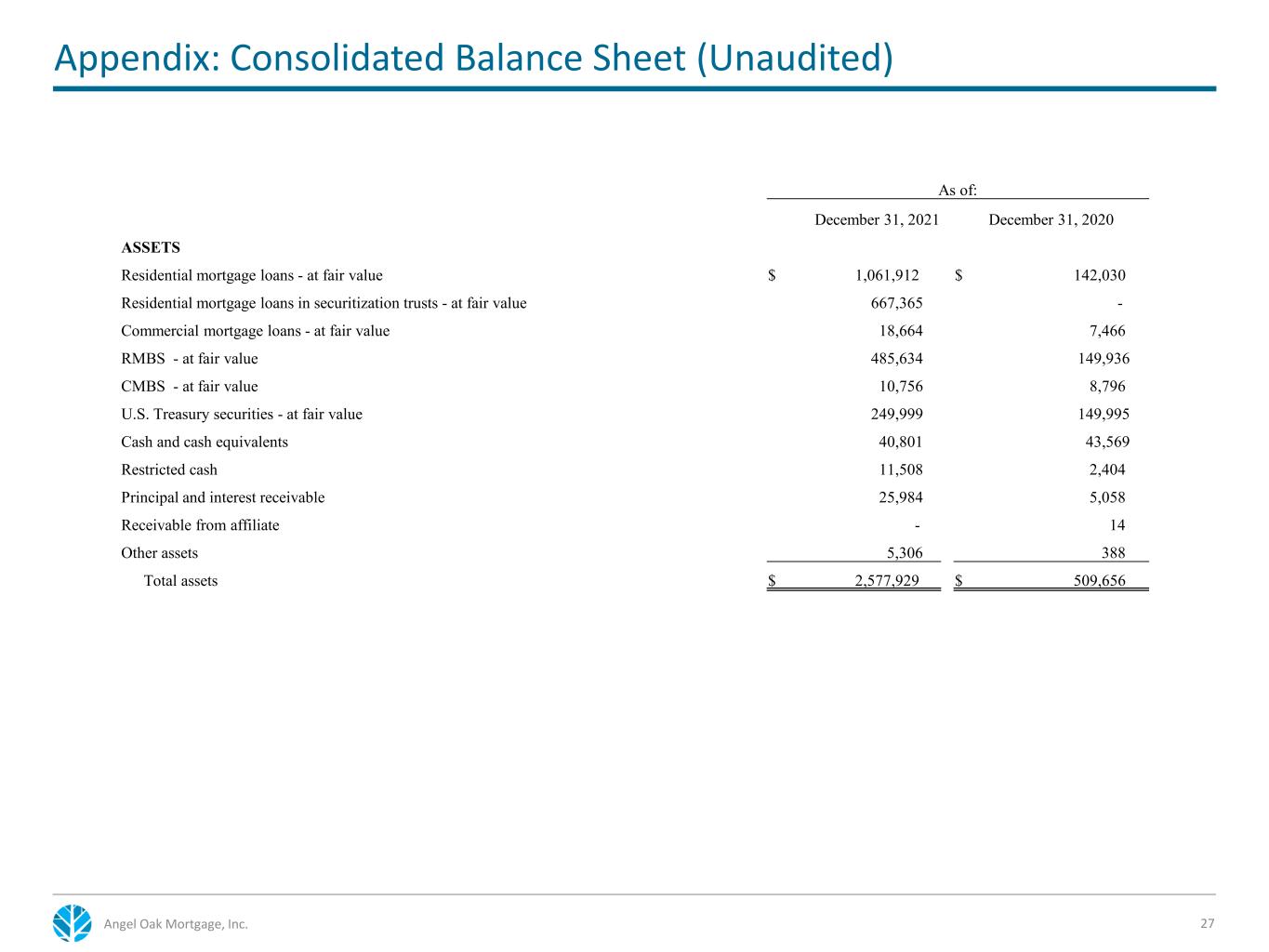

Appendix: Consolidated Balance Sheet (Unaudited) 27Angel Oak Mortgage, Inc. As of: December 31, 2021 December 31, 2020 ASSETS Residential mortgage loans - at fair value $ 1,061,912 $ 142,030 Residential mortgage loans in securitization trusts - at fair value 667,365 - Commercial mortgage loans - at fair value 18,664 7,466 RMBS - at fair value 485,634 149,936 CMBS - at fair value 10,756 8,796 U.S. Treasury securities - at fair value 249,999 149,995 Cash and cash equivalents 40,801 43,569 Restricted cash 11,508 2,404 Principal and interest receivable 25,984 5,058 Receivable from affiliate - 14 Other assets 5,306 388 Total assets $ 2,577,929 $ 509,656

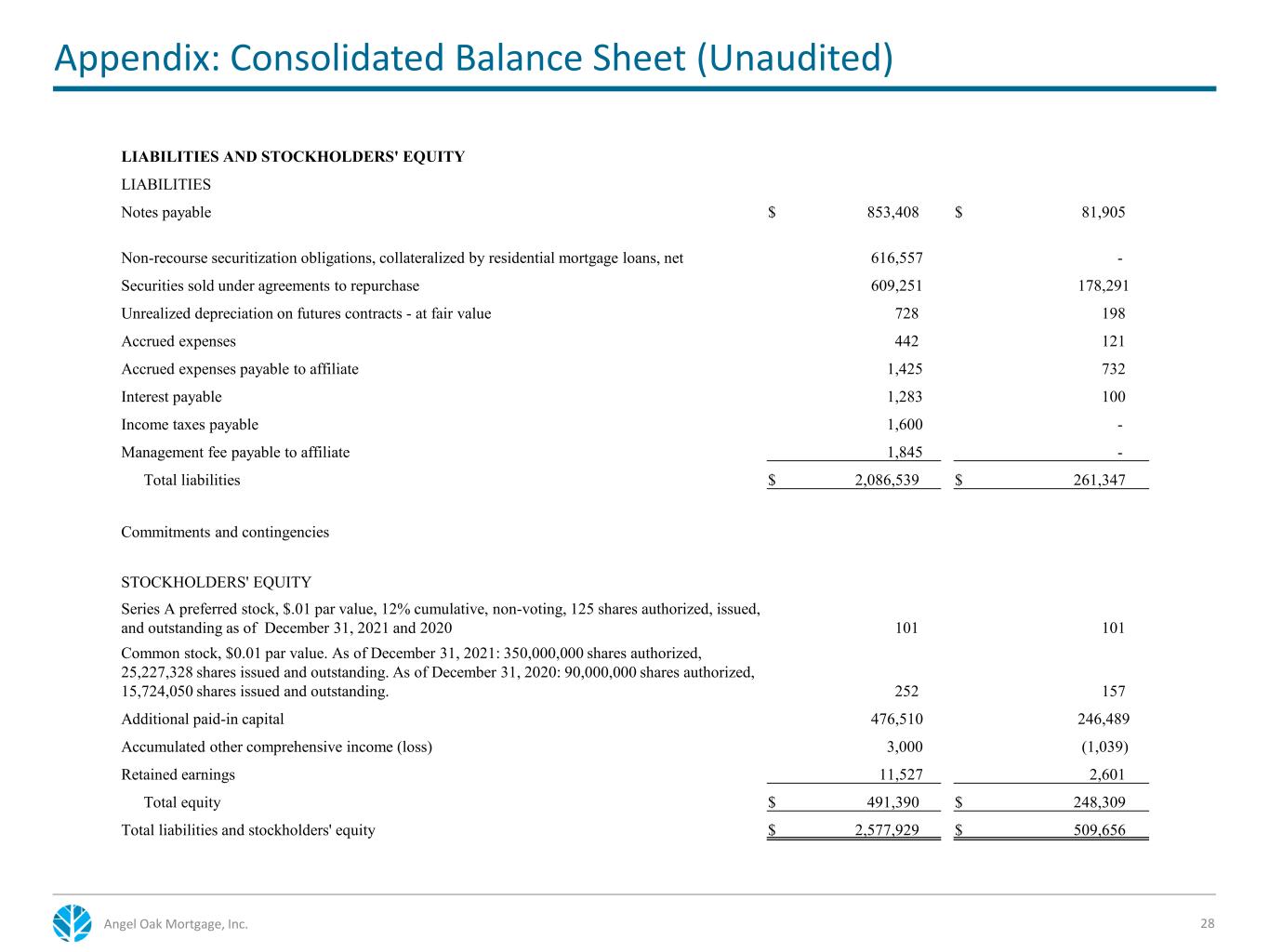

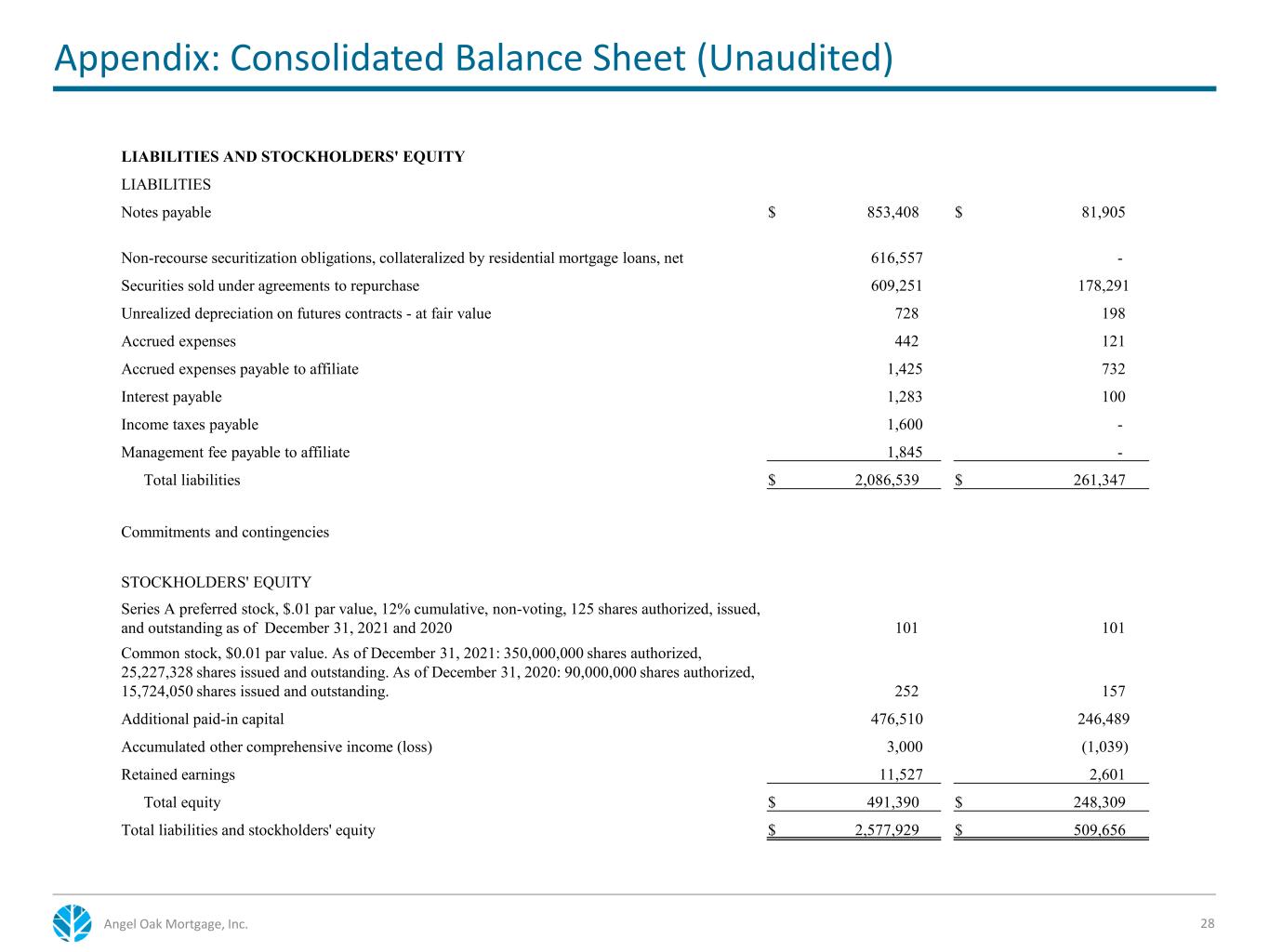

Appendix: Consolidated Balance Sheet (Unaudited) 28Angel Oak Mortgage, Inc. LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES Notes payable $ 853,408 $ 81,905 Non-recourse securitization obligations, collateralized by residential mortgage loans, net 616,557 - Securities sold under agreements to repurchase 609,251 178,291 Unrealized depreciation on futures contracts - at fair value 728 198 Accrued expenses 442 121 Accrued expenses payable to affiliate 1,425 732 Interest payable 1,283 100 Income taxes payable 1,600 - Management fee payable to affiliate 1,845 - Total liabilities $ 2,086,539 $ 261,347 Commitments and contingencies STOCKHOLDERS' EQUITY Series A preferred stock, $.01 par value, 12% cumulative, non-voting, 125 shares authorized, issued, and outstanding as of December 31, 2021 and 2020 101 101 Common stock, $0.01 par value. As of December 31, 2021: 350,000,000 shares authorized, 25,227,328 shares issued and outstanding. As of December 31, 2020: 90,000,000 shares authorized, 15,724,050 shares issued and outstanding. 252 157 Additional paid-in capital 476,510 246,489 Accumulated other comprehensive income (loss) 3,000 (1,039) Retained earnings 11,527 2,601 Total equity $ 491,390 $ 248,309 Total liabilities and stockholders' equity $ 2,577,929 $ 509,656