Warrants

In the fiscal year ended February 28, 2018, we granted 2,904,000 simple warrants and 8,125,158 performance warrants, collectively exercisable into an aggregate of 11,029,158 common shares, at an average exercise price of $0.82 and $1.39, respectively, as equity incentives to certain of our employees.

In the fiscal year ended December 31, 2018, we granted 3,535,200 simple warrants and 2,188,800 performance warrants, collectively exercisable into an aggregate of 5,724,000 common shares at an average exercise price of $2.61 and $2.48, respectively, as equity incentives to certain of our employees.

In the three months ended March 31, 2019, we granted 1,248,000 simple warrants and 528,000 performance warrants, collectively exercisable into an aggregate of 1,776,000 common shares at an average exercise price of $7.13 and $3.59, respectively, as equity incentives to certain of our employees.

From April 1, 2019 to July 15, 2019, we granted 2,339,200 simple warrants and 166,400 performance warrants, collectively exercisable into an aggregate of 2,505,600 common shares at a weighted average exercise price of $5.92 and $10.74, respectively, as equity incentives to certain of our employees.

See “Executive Compensation—Annual Compensation Components—Long-Term Equity Incentives—Legacy Warrant Grants” in the prospectus which forms part of this registration statement.

In a series of transactions between June 20, 2018 and August 24, 2018, we sold an aggregate of 4,491,154 units, each comprising one common share and one warrant, immediately vested and exercisable into one common share prior to April 30, 2019 at a price of $3.91, for aggregate proceeds of $17.5 million. In August 2018, a total of 558,501 warrants thus issued were exercised at a price of $3.91, for aggregate proceeds of $2.2 million. As an incentive to exercise, the warrant holders received a total of 279,251 warrants, which, upon issuance, became immediately vested and exercisable into an aggregate of 279,251 common shares at a price of $3.91.

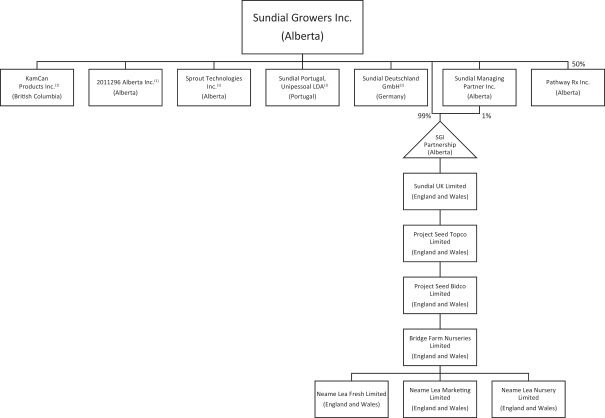

Concurrently with the acquisition of our interest in Pathway Rx Inc., or Pathway Rx, we entered into a license agreement, which granted us an exclusive right to use Pathway Rx’s intellectual property in exchange for consideration which includes the grant of up to 280,000 of warrants to purchase our common shares at an exercise price of $1.81 per share, subject to achievement of certain milestone gross revenues derived from certain activities which use the intellectual property that is the subject matter of the license agreement. See “Business—Acquisition of Interest in Pathway Rx” in the prospectus which forms part of this registration statement.

Consideration for our purchase of world-wide proprietary rights to theTop Leaf,BC Weed Co. and certain other brands from Sun 8 Holdings Inc. on May 1, 2019 included the issuance of 1,800,000 performance warrants, exercisable into an aggregate of 1,800,000 of our common shares at an exercise price of $0.94 per share, and vesting annually over five years, beginning on March 31, 2020. The number of performance warrants eligible to vest each year depends on the achievement of certain thresholds of revenue derived from the brands acquired under the agreement and certain cannabis cultivars. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Contractual Commitments and Obligations—Sun 8 Agreement and Acquired Brands” in the prospectus which forms part of this registration statement.

On June 27, 2019, we entered into a credit agreement, between SGI Partnership, a general partnership controlled by us, and SAF Jackson II LP, or SAF, a limited partnership controlled by SAF Group, as lender and administrative agent, providing for a secured credit facility, or the SAF Jackson Facility, to be advanced in two tranches totalling $159.575 million, less (i) a 6% original issue discount and (ii) upfront fees totalling up to approximately $2.4 million. The first tranche of $115.0 million, less original issue discount and upfront fees, was advanced to the Company to fund the acquisition of Bridge Farm. The second tranche of $44.575 million is available to the Company prior to December 31, 2019 and is subject to a number of conditions precedent, including the Company meeting certain performance and liquidity targets. In connection with each tranche

II-4