Director Compensation

The Board, on the recommendation of the Compensation Committee, is responsible for reviewing and approving any changes to the directors’ compensation arrangements. Such compensation arrangements are based on multiple factors, including the relatively high number of Board meetings held, high level of activity in which the Corporation engages in and the improved balance sheet of the Corporation, relative to previous years.

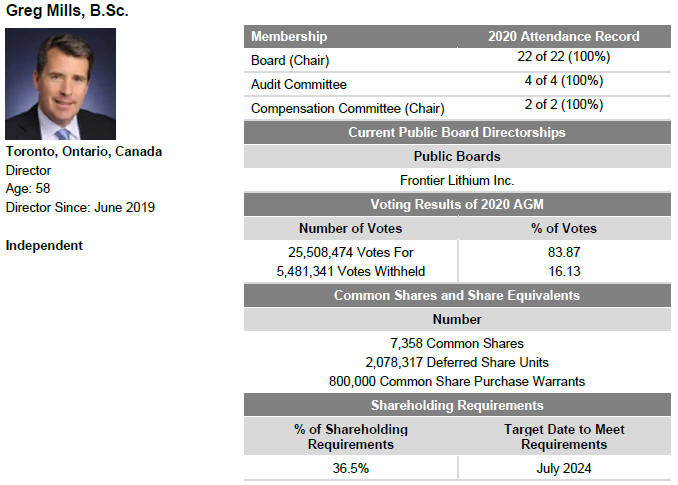

Effective as of May 28, 2020 and in consideration for serving on the Board, each director (other than Excluded Directors and the chairman of the Board) is paid an annual cash retainer of $75,000 and $225,000 in compensation to be paid in DSUs. The chairman of the Board will receive annual cash compensation of $125,000 and $575,000 in compensation to be paid in DSUs, subject to the chairman of the Board continuing to serve on the Board at the time of vesting.

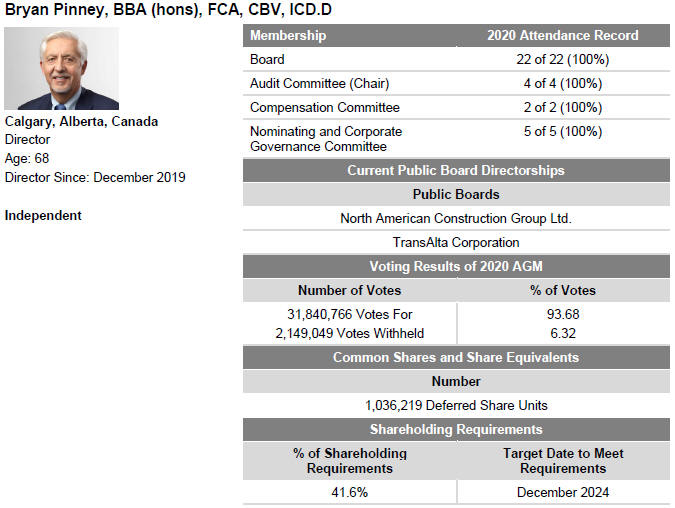

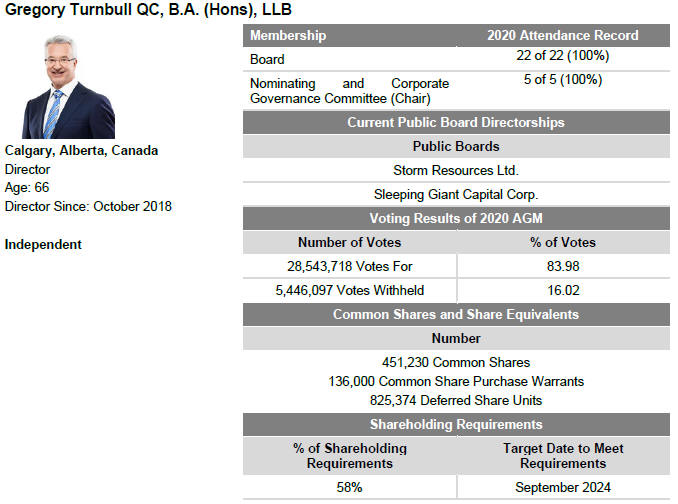

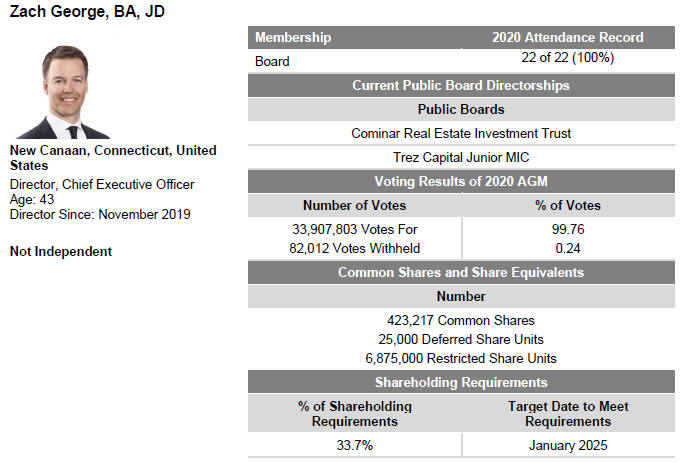

In addition, for serving during the Corporation’s first year as a publicly traded company, Mr. Turnbull, Mr. Mills and Dr. Cannon each received $175,000 payable in DSUs at the IPO price in equal installments on September 30, 2019, December 31, 2019, March 31, 2020 and June 30, 2020. Upon joining the Board on November 27, 2019, Mr. George became entitled to receive 250,000 DSUs in equal installments on December 1, 2019, March 31, 2020, June 30, 2020, September 30, 2020, December 31, 2020, March 31, 2021, June 30, 2021, September 30, 2021, December 31, 2021 and March 31, 2022. Upon joining the Board on December 16, 2019, Mr. Pinney was entitled to $175,000 in DSUs payable in equal installments on March 31, 2020, June 30, 2020, September 30, 2020 and December 31, 2020.

On May 28, 2020, Mr. Mills was granted 600,000 DSUs, Mr. Turnbull was granted 200,000 DSUs, Dr. Cannon was granted 200,000 DSUs and Mr. Pinney was granted 85,000 DSUs. Such DSUs vested in two equal tranches, half on May 28, 2020 and half on December 31, 2020. In addition, Mr. George was granted 750,000 RSUs to vest in equal tranches on December 31, 2020 and December 31, 2021 in consideration for his contributions to certain special projects.

The number of DSUs issuable are determined by the installment payment divided by the fair market value of Common Shares at each installment date.

If a change of control occurs, all DSU grants referred to in the immediately preceding paragraphs will immediately vest.

In addition, to reflect the additional workload required in respect of special projects performed, Mr. George was entitled to receive 500,000 warrants (subsequently amended to an entitlement to 500,000 stock options in accordance with the Stock Option Plan), in equal installments on March 31, 2020, June 30, 2020, September 30, 2020, December 31, 2020, March 31, 2021, June 30, 2021, September 30, 2021, December 31, 2021, March 31, 2022 and June 30, 2022. Mr. George’s compensation as a director (if unvested) was terminated when he became Chief Executive Officer on January 29, 2020.

B-20