Liquidity and Capital Resources

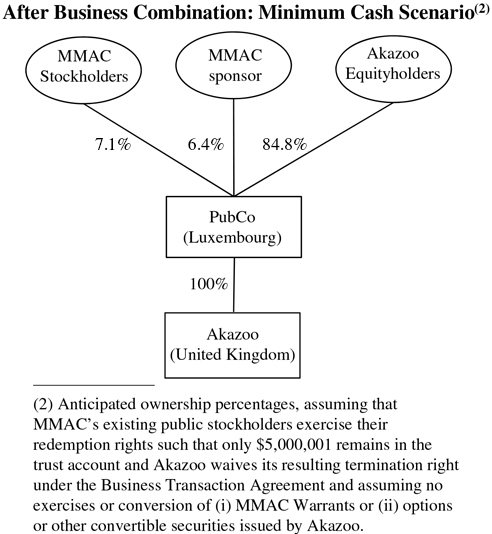

As of June 30, 2019, MMAC had investments held in the trust account of $14,525,384 (including approximately $131,000 of interest income) consisting of money market funds. Interest income on the balance in the Trust Account may be used by MAMC to pay taxes, and to pay up to $50,000 of any dissolution expenses. Through June 30, 2019, MMAC had withdrawn approximately $1,560,000 of interest earned on the trust account balance for taxes, of which approximately $81,000 was withdrawn during the three months ended June 30, 2019. In connection with the approval of the First Extension in February 2019, and pursuant to the terms of MMAC’s Certificate of Incorporation, stockholders elected to redeem an aggregate of 5,942,681 shares of MMAC Common Stock. On June 14, 2019, the Second Charter Amendment was approved and stockholders elected to redeem an aggregate of 13,350,654 shares of the MMAC Common Stock. Following the completion of such redemptions, as of June 30, 2019, MMAC had approximately $14.5 million in cash remaining in the trust account and 6,581,665 shares of common stock issued and outstanding.

In connection with the pending business combination with Akazoo, the underwriters have waived their right to receive $3,000,000 of their deferred fee which had been held in the trust account. Accordingly, as of June 30, 2019, the underwriters are now entitled to receive up to an aggregate amount of $4,785,000 of deferred fees.

For the three months ended June 30, 2019, cash used in operating activities was $217,488. Net income of $173,176 was offset by interest earned on marketable securities held in the trust account of $870,220, which is excluded from operations. Changes in operating assets and liabilities provided $479,556 of cash from operating activities.

For the three months ended June 30, 2018, cash used in operating activities was $167,788. Net income of $479,497 was impacted by interest earned on cash and marketable securities held in the trust account of $802,262, which is excluded from operations. Changes in operating assets and liabilities provided $154,977 of cash from operating activities.

MMAC intends to use substantially all of the funds held in the trust account, including any amounts representing interest earned on the trust account (which interest shall be net of taxes payable), excluding the deferred underwriting commissions, to complete the Business Combination. Prior thereto, MMAC may withdraw interest from the trust account only to pay taxes. Through June 30, 2019, MMAC had withdrawn approximately $1,560,000 of interest earned on the trust account balance for taxes, of which $81,200 was withdrawn during the three months ended June 30, 2019. MMAC’s annual income tax obligations will depend on the amount of interest and other income earned on the amounts held in the trust account. MMAC expects the interest earned on the amounts in the trust account will be sufficient to pay its taxes. To the extent that MMAC’s capital stock or debt is used, in whole or in part, as consideration to complete the initial business combination, the remaining proceeds held in the trust account will be used as working capital to finance the operations of the target business or businesses, make other acquisitions and pursue the company’s growth strategies. MMAC intends to obtain additional capital to supplement the amounts that will be available in the trust account from one or more financing arrangements that would be entered into concurrently with the completion of the Akazoo Business Combination.

MMAC can use a portion of the funds not placed in the trust account to pay commitment fees for financing, fees to consultants to assist it with its search for a target business or as a down payment or to fund a “no-shop” provision (a provision designed to keep target businesses from “shopping” around for transactions with other companies or investors on terms more favorable to such target businesses) with respect to a particular proposed business combination, although MMAC does not have any current intention to do so. If MMAC enters into an agreement where MMAC pays for the right to receive exclusivity from a target business, the amount that would be used as a down payment or to fund a “no-shop” provision would be determined based on the terms of the specific business combination and the amount of MMAC’s available funds at the time. MMAC’s forfeiture of such funds (whether as a result of our breach or otherwise) could result in MMAC not having sufficient funds to continue searching for, or conducting due diligence with respect to, prospective target businesses.

MMAC has until September 17, 2019 to complete an initial business combination. If MMAC is unable to complete an initial business combination by September 17, 2019, MMAC will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, and subject to having lawfully available funds therefor, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest earned on the trust account deposits (which interest shall be net of taxes payable and less up to $50,000 to pay dissolution expenses), divided by the number of then-outstanding public shares, which redemption will completely extinguish the public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law; and (iii) as promptly as reasonably possible following such redemption, subject to the approval of MMAC’s remaining stockholders and MMAC’s board of directors, dissolve and liquidate, subject in each case to MMAC’s obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law.

The underwriters have agreed to waive their rights to their deferred underwriting commissions held in the trust account in the event MMAC does not complete an initial business combination by September 17, 2019 and, in such event, such amounts will be included with the funds held in the trust account that will be available to fund the redemption of the public shares. In the event of such distribution, it is possible that the per share value of the assets remaining available for distribution (including the trust account assets) will be only $10.23 at June 30, 2019.

Going Concern

As of June 30, 2019, MMAC had approximately $9,000 in its operating bank account, approximately $131,000 of interest available to pay its franchise and income taxes (less up to $50,000 of interest to pay dissolution expenses) and working capital deficit of approximately $4,395,000.

In order to finance transaction costs in connection with an intended initial business combination, (i) the sponsor has committed to loan us up to an aggregate of $500,000, to be provided to MMAC in the event that funds held outside of the trust account are insufficient to fund its expenses relating to investigating and selecting a target business and other working capital requirements prior to MMAC’s initial business combination and (ii) the sponsor, one or more affiliates of the sponsor or certain of MMAC’s officers or directors may, but are not obligated to, loan MMAC any additional funds as may be required. If MMAC completes the initial business combination, MMAC would repay such loaned amounts. In the event that the initial business combination does not close, MMAC may use a portion of the working capital held outside the trust account to repay any such loaned amounts but no proceeds from the trust account would be used for such repayment. Up to $1,000,000 of such loans may be convertible into working capital loan warrants of the post business combination entity at a price of $1.00 per warrant at the option of the lender. The working capital loan warrants will be identical to the private placement warrants issued to the sponsor, including as to exercise price, exercisability and exercise period except that, (i) such warrants would not be exercisable more than five years from the closing date of the Initial Public Offering and (ii) pursuant to FINRA Rule 5110(g)(1), such warrants, and the shares of common stock issuable upon exercise of such warrants, shall be subject to certain additional restrictions on transfer. Other than as set forth above, the terms of such loans by the sponsor, an affiliate of the sponsor or certain of MMAC’s officers or directors, if any, have not been determined and no written agreements exist with respect to such loans. MMAC does not expect to seek loans from parties other than the sponsor, an affiliate of the sponsor or certain of MMAC’ officers or directors, if any, as MMAC does not believe third parties will be willing to loan such funds and provide a waiver against any and all rights to seek access to funds in the trust account. As of June 30, 2019, there was $30,000 outstanding of borrowings under the working capital loans.

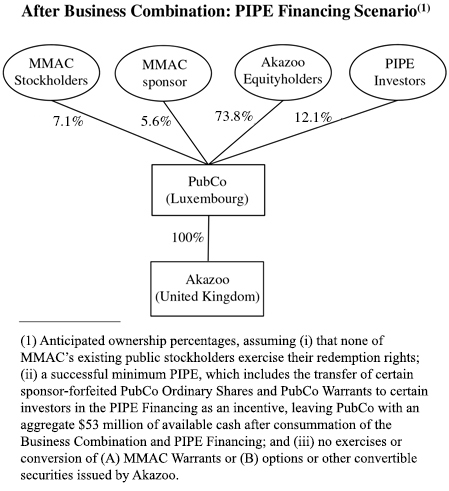

However, MMAC intends to obtain additional capital from the PIPE Financing to supplement the amounts that will be available in the trust account in order to satisfy the closing condition in the Business Transaction Agreement that MMAC have at least $53 million of available cash at the time of the Akazoo Business Combination.

If MMAC is unable to raise additional capital, it may be required to take additional measures to conserve liquidity, which could include, but not necessarily be limited to, suspending the pursuit of a potential transaction. MMAC cannot provide any assurance that new financing will be available to it on commercially acceptable terms, if at all. These conditions raise substantial doubt about MMAC’s ability to continue as a going concern through the Combination Deadline, which is currently scheduled for September 17, 2019.

Off-Balance Sheet Arrangements; Commitments and Contractual Obligations

As of June 30, 2019, MMAC did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K and did not have any commitments or contractual obligations.

The underwriters were paid a cash underwriting discount of $0.20 per MMAC Unit, or $3,600,000 in the aggregate, upon the closing of the IPO. In addition, the underwriters may be entitled to a deferred fee of $0.38 per MMAC Unit, or $7,785,000 in the aggregate. The deferred fee will become payable to the underwriters from the amounts held in the trust account solely in the event that MMAC completes an initial business combination, subject to the terms of the underwriting agreement entered in connection with the IPO.

In connection with the pending Akazoo Business Combination, the underwriters have waived their right to receive $3,000,000 of their deferred fee which had been held in the trust account. Accordingly, as of June 30, 2019, the underwriters are now entitled to receive up to an aggregate amount of $4,785,000 of deferred fees.

MMAC is obligated to pay deferred legal fees of $300,000 upon the consummation of an initial business combination for services performed in connection with the IPO. If no business combination is consummated, MMAC will not be obligated to pay such fee.

Critical Accounting Policies

The preparation of financial statements and related disclosures in conformity with U.S. GAAP requires MMAC’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and income and expenses during the periods reported. Actual results could materially differ from those estimates. For a discussion of MMAC’s critical accounting policies, see Note 2 “Summary of Significant Accounting Policies” to MMAC’s audited financial statements contained elsewhere in this proxy statement/prospectus.

Recently Issued Accounting Standards

MMAC’s management does not believe that any recently issued, but not yet effective, accounting standards, if currently adopted, would have a material effect on MMAC’s condensed financial statements.

158