Exhibit 4.1

| ANNUAL INFORMATION FORM |

| For the year ended December 31, 2017 |

| Date: March 29, 2018 |

TABLE OF CONTENTS

| PRELIMINARY NOTES | 1 |

| Date of Information | 1 |

| Financial Information | 1 |

| | |

| FORWARD-LOOKING INFORMATION | 1 |

| Currency and Exchange Rate Information | 3 |

| | |

| MEANING OF CERTAIN REFERENCES | 3 |

| | |

| CORPORATE STRUCTURE | 3 |

| Name, Address and Incorporation | 3 |

| Intercorporate Relationships | 4 |

| | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 5 |

| Three Year History | 5 |

| Recent Developments Relating to Expected Legalization of Cannabis in Canada | 11 |

| | |

| DESCRIPTION OF BUSINESS | 12 |

| General Description of the Business | 12 |

| Risk Factors | 18 |

| | |

| DIVIDENDS | 33 |

| | |

| CAPITAL STRUCTURE | 33 |

| Common Shares | 33 |

| Preferred Shares | 33 |

| Warrants | 33 |

| Stock Options | 34 |

| Restricted share units | 34 |

| | |

| MARKET FOR SECURITIES | 34 |

| Trading Price and Volume | 34 |

| | |

| PRIOR SALES | 35 |

| Warrants | 35 |

| Stock Options | 36 |

| Restricted Stock Units | 36 |

| | |

| DIRECTORS AND OFFICERS | 36 |

| Name, Occupation and Security Holdings | 36 |

| Director Biographies | 38 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 40 |

| Conflicts of Interest | 41 |

| AUDIT COMMITTEE INFORMATION | 41 |

| Audit Committee Mandate | 41 |

| Composition of the Audit Committee | 41 |

| Relevant Education and Experience | 42 |

| Reliance on Certain Exemptions | 42 |

| Audit Committee Oversight | 42 |

| Pre-Approval Policy and Procedures | 42 |

| External Auditor Service Fees | 42 |

| | |

| PROMOTERS | 43 |

| | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 44 |

| Legal Proceedings | 44 |

| Regulatory Actions | 44 |

| | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 44 |

| | |

| TRANSFER AGENT AND REGISTRAR | 44 |

| | |

| MATERIAL CONTRACTS | 44 |

| | |

| INTERESTS OF EXPERTS | 45 |

| | |

| ADDITIONAL INFORMATION | 45 |

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form (“AIF”) of Emerald Health Therapeutics, Inc. (the “Company”) is as of December 31, 2017.

Financial Information

The Company’s financial results are prepared and reported in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) and are presented in Canadian dollars.

FORWARD-LOOKING INFORMATION

Certain statements contained in this AIF and the documents incorporated by reference herein and therein constitute forward-looking information or forward-looking statements under applicable securities laws (collectively, “forward-looking statements”). These statements relate to future events or future performance, business prospects or opportunities of the Company. All statements other than statements of historical fact may be forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “forecast”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions) are not statements of historical fact and may be “forward-looking statements”.

Examples of forward-looking statements in this AIF and the documents incorporated by reference herein and therein include, but are not limited to, statements in respect of: the Company’s intention to significantly increase its production of cannabis and cannabis oils through a multi-phase expansion plan; the building of a modular hybrid greenhouse growing facility with 50,000 square feet of production space; the building of a Health Canada licensed production facility to expand growing capability; the conversion of the Initial Greenhouse (as defined below) to cannabis production; the advancement of the remaining $2 million of the Company’s investment into the Joint Venture (as defined below) as determined by the board of directors of the Joint Venture); the carrying out by Northern Vine of analytics on the Company’s cannabis on a preferred customer basis; the development of a foundational blockchain-based supply chain management system and e-commerce marketplace for the legal cannabis industry; the entering into of a definitive agreement with Namaste (as defined below) to collaborate on strategic business opportunities worldwide and develop a fully integrated e-commerce platform to serve as a retail channel for the Company’s patients; the expectations that no draft regulations relating to the Cannabis Act (as defined below) will be released prior to July 1, 2018 and that the Cannabis Act will return to the Senate for a final debate and vote by June 7, 2018; the commencement of the legal adult use cannabis sales in Canada in August or September 2018; the purchasing of additional strains of dried medical cannabis from other Licensed Producers (as defined below) to supplement inventory levels for both dried medical cannabis sales and cannabis oil production; the potential changes in regulations governing Canada’s medical cannabis program as the federal government of Canada monitors Licensed Producers in action; the Company’s belief that the stringent application and compliance requirements of the ACMPR (as defined below) together with the requirements and process to obtain the requisite licences will restrict the number of new entrants to the medical cannabis market, that the number of new competitors, all vying for market share, will continue to increase and that competition in the future will be based on issues such as product quality, variety, price and client services; the Company’s strategy to accelerate the growth of its client base and sales revenue through cannabis oil products and the introduction of new delivery methods, such as oil capsules; the Company continuing to provide a wide range of strains of dried cannabis, THCA, THC, THC:CBD (each as defined below) and high CBD oils; increases to the Company’s client base continuing as a result of the introduction of cannabis oils and increases to revenues in 2018 as a result; the Company communicating with medical doctors and other healthcare professionals and providing the best education and services to these professionals; the Company’s collection of genetic materials and established team of experts playing a major role as the Company continues to build its propriety strains, products and reputation; strains with exceptionally high CBD levels allowing the Company to produce CBD oils in the future with unique compositions of cannabinoids through blending; the Company undertaking clinical research to study the effects of its products on client health; the Company’s longer term strategy of becoming a leading provider of quality products for the broader adult recreational cannabis market; the Company being able to take advantage of the legalization of adult use recreational cannabis when it occurs; through the Phase 1 Expansion (as defined below), partnerships, and acquisitions, the Company being well positioned to serve the adult use recreational cannabis market across Canada when the Cannabis Act (as defined below) is enacted; the Company meeting the requirements of the ACMPR for further extensions or renewals of the Licence (as defined below); the Company’s intentions to acquire and/or construct additional cannabis production and manufacturing facilities and to expand the Company’s marketing and sales initiatives; the Company achieving production at the Joint Venture facility in the near term; and benefits received by the Company from its transactions with Sciences (as defined below), a control person of the Company, and the opportunities that such transactions will provide; rapid production capacity expansion; the production gap for medical and non-therapeutic adult-use cannabis; commencement of clinical research on the Company’s products; development of pharmaceutical formulations to provide patients with high-quality pharmaceutical-based cannabis products; evolution in the medicinal cannabis market; future availability of pharmaceutical formulations; increases in the number of physicians willing to prescribe cannabis; building valuable intellectual property in Canada which could lead to accelerated sales growth and profit margins; and future sales opportunities in other emerging medical markets and the effect that each risk factor will have on the Company.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The investor is cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. These forward-looking statements involve risks and uncertainties relating to, among others: market price of medical cannabis; continued availability of capital financing and general economic, market or business conditions; the Company’s reliance on the Licence to produce and sell medical cannabis and cannabis oils and its ability to maintain the Licence; the Company’s ability to increase registered patients and sales and to make the Company profitable; regulatory risks relating to the Company’s compliance with the ACMPR; regulatory approvals for expansion of the Company’s current production facility and development of new production facilities and the greenhouse retrofits; the Company’s ability to execute its multi-phase expansion plan and Joint Venture; the estimated costs associated with the Company’s multi-phase expansion plan; changes in laws, regulations and guidelines relating to medical cannabis including the adoption of the Cannabis Act, the implementation of provincial and territorial legislation related to the Cannabis Act and changes to the Excise Tax Act by the federal government of Canada; changes in government; changes in government policy; increased competition in the cannabis market; the limited operating history of the Company; the Company’s reliance on a single production facility; the Company’s reliance on key persons; difficulties in securing additional financing; unfavourable publicity or consumer perception of the cannabis industry; the impact of any negative scientific studies on the effects of cannabis; changes in the Company’s over-all business strategy; restrictions of the Exchange on the Company’s business; difficulties in construction or in obtaining qualified contractors to complete greenhouse retrofits; actual operating and financial performance of facilities, equipment and processes relative to specifications and expectations; the Company’s ability to develop and commercialize pharmaceutical products; the Company’s ability to protect the intellectual property relating to its propriety strains and products; failure to obtain regulatory approval for pharmaceutical products; actual operating and financial performance of facilities, equipment and processes relative to specifications and expectations; and changes in the Company’s over-all business strategy. Additional factors that could cause actual results to differ materially include, but are not limited to, the risk factors described herein and as discussed in the Company’s financial statements and other filings, under the heading “Risk Factors”.

The Company believes that the expectations reflected in any forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in, or incorporated by reference into, this AIF should not be unduly relied upon. These statements speak only as of the date of this AIF. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws. Actual results may differ materially from those expressed or implied by such forward-looking statements.

Currency and Exchange Rate Information

All dollar amounts (i.e. “$”), unless otherwise indicated, are expressed in Canadian dollars and United States dollars are referred to as “US$”.

MEANING OF CERTAIN REFERENCES

For simplicity, the Company uses terms in this AIF to refer to the investments and operations of the Company and its direct and indirect subsidiaries, including Emerald Health Therapeutics Canada Inc. as a whole. Accordingly, in this AIF, unless the context otherwise requires, the “Company” is referring to Emerald Health Therapeutics, Inc. and its direct and indirect subsidiaries.

CORPORATE STRUCTURE

Name, Address and Incorporation

Emerald Health Therapeutics, Inc. was incorporated pursuant to theBusiness Corporations Act(British Columbia) on July 31, 2007 as Firebird Capital Partners Inc. and changed its name to Firebird Energy Inc. in December 2012. On September 4, 2014, the Company completed the acquisition of all of the issued and outstanding common shares of Thunderbird Biomedical Inc. (“Thunderbird”), by way of a reverse takeover (the “RTO”) under the rules of the TSX Venture Exchange (the “TSXV”) and concurrently changed its name to T-Bird Pharma, Inc. At that time, Thunderbird became a wholly-owned subsidiary of the Company. In June 2015, the Company changed its name to Emerald Health Therapeutics, Inc. and Thunderbird changed its name to Emerald Health Botanicals Inc. On February 23, 2018, Emerald Health Botanicals Inc. changed its name to Emerald Health Therapeutics Canada Inc. (the “Operating Subsidiary”).

The Company’s head office address is PO Box 24076 - 4420 West Saanich Road, Victoria, British Columbia, V8Z 7E7 and its registered office is located at #2600 – 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1.

The Company is a reporting issuer in each of the provinces of Canada, except Quebec, and not in any other jurisdiction.

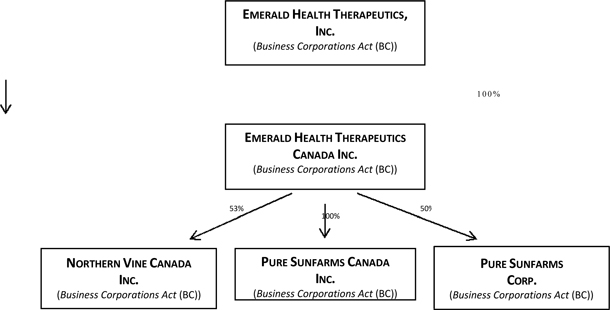

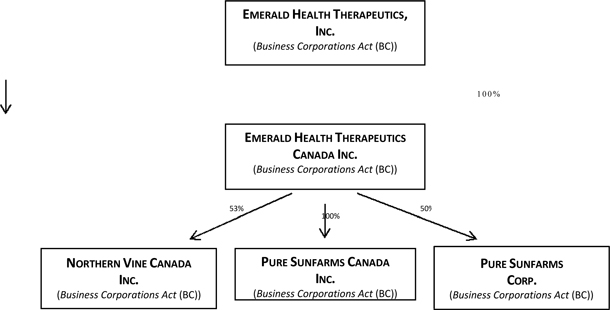

Intercorporate Relationships

Emerald Health Therapeutics, Inc. owns 100% of the shares of the Operating Subsidiary, a private Victoria, British Columbia based company which was incorporated on January 28, 2013. The principal business of the Operating Subsidiary is the production and sale of medical cannabis pursuant to the Access to Cannabis for Medical Purposes Regulations (the “ACMPR”). The Operating Subsidiary holds:

| · | a 50% equity interest in Pure Sunfarms Corp. (the “Joint Venture”), incorporated for the purpose of producing, cultivating and distributing wholesale cannabis and cannabis extracts for therapeutic and non-therapeutic use purposes, as permitted by applicable law. |

| · | 100% of the shares of Emerald Health Farms Inc. (“Farms”), a holding company. In March 2018, Farms changed its name to Pure Sunfarms Canada Inc. |

| · | 53% of the shares of Northern Vine Canada Inc. (“Northern Vine”), a licensed dealer under the provisions of theControlled Drugs and Substances Act(Canada) (the “CDSA”) that is licensed to provide analytical testing services, to import/export cannabis oils and to manufacture CBD oil. |

The following chart (as of the date hereof) illustrates the Company’s corporate structure.

GENERAL DEVELOPMENT OF THE BUSINESS

The Company is headquartered in Victoria, British Columbia, Canada and its common shares (the “Common Shares”) are listed on the TSXV under the trading symbol “EMH”. The Company is classified as a Tier 1 Venture Issuer on the TSXV.

The principal business of the Operating Subsidiary is the production and sale of medical cannabis and cannabis oils pursuant to a licence issued to the Operating Subsidiary under the ACMPR.

Three Year History

The Operating Subsidiary commenced business as a private company in January 2013 with the goal of becoming a “Licensed Producer” under the Marihuana for Medicinal Purposes Regulations (the “MMPR”). The Operating Subsidiary applied to Health Canada under the MMPR for approval to become a licensed producer and obtained the necessary licence (the “Producer Licence”) in February 2014.

Development of Business in 2015

In January 2015, the Chief Executive Officer, Robert Gagnon, stepped down and was replaced by Dr. Bin Huang, who had previously been appointed as the Company’s President and Chief Operating Officer. In February 2015, Chris Taylor, the Chief Financial Officer, stepped down and was replaced by Sandra Pratt.

In April 2015, the Company, together with certain of its shareholders, completed a transaction (the “Escrow Transfer”) with Emerald Health Sciences Inc. (“Sciences”), currently a control person of the Company, whereby Sciences acquired a total of 20,156,790 Common Shares (equal to 44% of the Company’s then issued and outstanding Common Shares) from five of its founding shareholders, including its former Chief Executive Officer and Chief Financial Officer, at a price of $0.21 per Common Share.

Concurrent with the completion of the Escrow Transfer, three new board members were appointed to the Company’s Board of Directors (the “Board”) and three existing Board members resigned. Dr. Avtar Dhillon was appointed as Executive Chairman of the Company and director, Jim Heppell and Punit Dhillon were also appointed as directors and Mr. David Raffa, previous Executive Chairman, continued as a member of the Board.

In May 2015, the Company received from Health Canada a sales licence (the “Sales Licence”) permitting the Company to sell medical cannabis as permitted under the MMPR.

In the third quarter of 2015, the Company’s client service representative team began registering patients and product sales commenced. As it takes time to register patients under the MMPR, the Company did not have significant revenue in 2015.

In August 2015, the Company entered into a loan agreement with Sciences (the “Loan Agreement”), pursuant to which Sciences agreed to loan monies to the Company on a revolving basis, in amounts and at times agreed to by the parties, at an interest rate of 5% repayable on demand. The Company and Sciences increased the interest rate to 12% per annum, effective February 26, 2016.

The Company began construction of lab space within its current Victoria facility and purchased lab equipment in September 2015 in anticipation of receiving the Supplemental Licence.

In November 2015, the Company received a supplemental license (the “Supplemental Licence”) from Health Canada authorizing the production of cannabis oils by the Company. The Company started production of cannabis oils shortly after receiving the Supplemental Licence.

In November 2015, Health Canada approved two additional production rooms at the Company’s facility and renewed its Producer Licence under the MMPR for an additional period of one year. The two additional production rooms increased the Company’s growing capacity by 50%, however the Company’s production capacity in its current facility remained limited due to space constraints. In addition, a new expanded vault was installed and approved by Health Canada in December 2015. As production by the Company was moderate in 2015, the Company was not able to build up large quantities of inventory prior to sales commencing. The Company purchased additional strains of dried medical cannabis from another producer who is a licensed producer (a “Licensed Producer”) under the ACMPR to supplement its inventory levels as per approval received from Health Canada.

The Company also completed expansion of the extract lab in December 2015, which allowed the Company to increase its production capacity of oils. The Company continued to assess growth strategies based on market demand.

Also during 2015, the Company started a research and development project related to the strains of medical cannabis cultivated by the Company. The project was used to characterize strains and utilize the data generated by the study to assist in identifying strains with specific compositions of cannabinoids, developing new strains using the Company’s range of genetic material and ultimately matching these strains with patients’ needs. The project was partially funded through the National Research Council of Canada-IRAP (“NRC-IRAP”). The Company concluded the project in August 2016. As a result of the project, the Company was able to characterize several new strains from its diverse pool of cannabis seeds. The results of the project indicated that the Company’s genetic material holds a significant range of cannabinoids that can be used in a variety of products.

Development of Business in 2016

During the first four months of 2016, the Company primarily focussed on developing the operating procedures required to manufacture cannabis oils in order to apply to Health Canada for a supplemental sales licence (the “Supplemental Sales Licence”) allowing for the sale of cannabis oils. The application for the Supplemental Sales Licence was submitted in April 2016 and was approved in July 2016. Once the Company received the Supplemental Sales Licence, production began on initial products that were available for sale starting in September 2016.

The Company launched a new website and a new logo in June 2016 and re-branded its products by way of new packaging and increased social media presence and community engagement. The Company’s e-commerce ordering system was also updated, improving the efficiency of client ordering and inventory management.

In August 2016, Health Canada announced that the ACMPR would replace the MMPR as the regulations governing Canada’s medical cannabis program. The ACMPR came into force on August 24, 2016 and provides individuals who received a medical document signed by a health care practitioner prescribing the use of medical cannabis with three options to access medical cannabis:

(a) through a Licensed Producer;

(b) produce a limited amount of cannabis for their own medical purposes; or

(c) designate someone to produce it for them.

Under the MMPR, the only option for individuals to access medical cannabis was to purchase it from a Licensed Producer. To date, the adoption of the ACMPR has not significantly impacted the operations of the Company and the Company does not expect any significant impact in the future.

During 2016, the Company produced several dried medical cannabis products that sold out very quickly. However, due to limited growth space, the Company was limited on the volume of product it is able to grow and continued to purchase additional strains of dried medical cannabis from other Licensed Producers to supplement inventory levels for both dried medical cannabis sales and cannabis oil production.

On November 7, 2016, the Company received a new licence (the “Licence”) from Health Canada under the ACMPR. Further details regarding the Licence are set out under the heading “Description of the Business - Current Licence under the ACMPR”.

Transactions with Sciences in 2016

In March 2016, the Company and Sciences agreed to convert outstanding debt in the aggregate amount of $1,392,796 owed by the Company to Sciences as of February 26, 2016 (the date Sciences agreed to the conversion of the debt) into 8,097,651 Common Shares at a deemed price of $0.172 per share (the “May Shares for Debt Transaction”). Such debt consisted of $1,374,808 in loans from Sciences to the Company and $17,988 outstanding for services provided by Sciences to the Company including accrued interest. The May Shares for Debt Transaction closed on May 12, 2016.

In August 2016, the Company and Sciences announced a private placement (the “August Private Placement”) of an aggregate of 4,077,687 units of the Company at a price of $0.205 per unit, for gross proceeds of $835,926. Each unit was comprised of one Common Share and one Common Share purchase warrant with each warrant entitling the holder to acquire an additional Common Share for a period of 24 months at an exercise price of $0.27. The August Private Placement closed on September 21, 2016.

Also in August 2016, the Company and Sciences agreed to convert additional outstanding debt in the aggregate amount of $921,465 owed by the Company to Sciences as of August 5, 2016 (the date Sciences agreed to the conversion of the debt) into 4,494,955 Common Shares at a deemed price of $0.205 per share (the “September Shares for Debt Transaction”). Such debt consisted of $921,465.17 for loans from Sciences including accrued interest. The September Shares for Debt Transaction closed on September 21, 2016.

On August 7, 2016, Mr. David Raffa resigned as a director of the Company and the directors appointed Mr. Bob Rai to fill the vacancy left by Mr. Raffa’s resignation. Sciences concurrently reached an agreement to purchase 4,407,708 Common Shares from Mr. Raffa (the “Share Purchase Agreement”). Pursuant to the Share Purchase Agreement, Sciences acquired ownership of 2,203,854 Common Shares on September 15, 2016 at a price of $0.29 per share and 2,203,854 Common Shares on October 26, 2016 at a price of $0.31 per Common Share.

On November 16, 2016, the Company completed a private placement (the “November Private Placement”) of 4,411,764 units of the Company at a price of $0.68 per unit to Sciences. Each unit was comprised of one Common Share and one Common Share purchase warrant with each warrant entitling the holder to acquire an additional Common Share at a price of $0.85 per Common Share for a period of five years from the closing date.

The Company entered into a non-binding letter of intent on November 28, 2016 with a corporation controlled by Dr. Avtar Dhillon, the Executive Chairman of the Company, to lease at current market rates up to 32 acres of Agricultural Land Reserve lands in Richmond, British Columbia for the purposes of expanding its operations and growing capability (the “Metro Vancouver Site”). The Company intends to significantly increase its production of cannabis and cannabis oils through a multi-phase expansion plan. In phase one, the Company proposes to build a modular hybrid greenhouse growing facility with 50,000 square feet of production space using its team of builders, designers, and growers (“Phase 1 Expansion”).

Development of Business in 2017

On January 25, 2017, the Company filed a final short form base shelf prospectus (the “Base Shelf Prospectus”) in, and was receipted by, each of the provinces of Canada, except Quebec. The Base Shelf Prospectus qualified the issuance of up to $50,000,000 of Common Shares, preferred shares, debt securities, warrants, units or subscription receipts of the Company or a combination thereof from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the offering and as set out in an accompanying prospectus supplement, during the 25-month period that the Base Shelf Prospectus remains effective.

The Licence was amended to permit the sale of cannabis seeds by the Company on February 2, 2017.

In February, 2017, the Company completed a bought deal offering of units of the Company with Dundee Capital Partners (“Dundee”), as underwriter, pursuant to a prospectus supplement to the Base Shelf Prospectus (the “February Prospectus Offering”). Each unit consisted of one Common Share and one-half of one warrant (the “February Warrants”). Each February Warrant entitled the holder thereof to acquire one Common Share at a price of $2.00 per Common Share for a period of 24 months following the closing of the February Prospectus Offering, subject to acceleration.

On February 10, 2017, the Company completed the February Prospectus Offering and issued 10,235,000 Units (including exercise in full of the over-allotment option).

Pursuant to the February Prospectus Offering, the Company issued 10,235,000 Common Shares and 5,117,500 February Warrants. In addition, the Company issued to the Underwriter 307,050 compensation options exercisable into units at $1.35 per unit for a period of twenty-four months.

On March 1, 2017, the Company commenced a lease for office space located near the current production facility. The lease had an initial one year term to February 28, 2018 and the Company exercised its option to renew for an additional two year term to February 2020. The Company received a Health Canada licence for these premises and relocated its client services team in October 2017. This facility also houses the administration functions of the Company.

In April 2017, the Company completed a bought deal offering of units of the Company with Eight Capital (“Eight Capital”), as underwriter, pursuant to a prospectus supplement to the Base Shelf Prospectus (the

“April Prospectus Offering”). Each unit consisted of one Common Share and one-half of one warrant (the “April Warrants”). Each April Warrant entitled the holder thereof to acquire one Common Share at a price of $2.60 per Common Share for a period of 24 months following the closing of the April Prospectus Offering, subject to acceleration.

Pursuant to the April Prospectus Offering, the Company issued an aggregate of 14,635,100 Common Shares and 7,572,750 warrants for gross proceeds of $27,123,423. In addition, the Company issued to the Underwriter 439,053 compensation options exercisable into units at $1.85 per unit for a period of twenty-four months.

In May 2017, the Company entered into a thirty-year agreement to lease the Metro Vancouver Site at a market rate of $320,000 per year. The land was leased for the purpose of building a Health Canada licensed production facility to expand growing capability.

Also in May 2017, the board of directors approved the adoption of a new Omnibus Incentive Plan (the “Incentive Plan”), which was approved by the shareholders in June 2017. The Incentive Plan replaces the stock option plan that was previously approved by the shareholders (the “Previous Plan”). Options granted under the Previous Plan will remain outstanding and governed by the terms of the Previous Plan. Under the Incentive Plan, the following types of awards can be issued: stock options, share appreciation rights, restricted share units and other performance awards.

On June 6, 2017, the Company announced that it had entered into a definitive agreement with Village Farms International Inc. (“Village Farms”) to form the Joint Venture for large-scale, high-quality, low-cost cannabis production. Under the terms of the agreement, Village Farms contributed a 1.1 million-square foot (25-acre) greenhouse facility located on a 50-acre parcel of land in Delta, British Columbia (with ancillary buildings) (the “Initial Greenhouse”). Subject to obtaining necessary licensing, the Initial Greenhouse will be converted to cannabis production. The Company agreed to contribute an aggregate of $20 million in cash (of which $18 million has been advanced prior to the date of this AIF and the remaining $2 million will be advanced at such time as determined by the board of directors of the Joint Venture) to fund conversion of the Initial Greenhouse and each party has a 50% ownership stake in the Joint Venture.

On June 12, 2017, the Common Shares began trading on the OTCQX under the ticker symbol “TBQBF”. The ticker symbol was subsequently changed on July 10, 2017 to “EMHTF”.

On July 13, 2017, the Company filed an amended and restated short form base shelf prospectus (the“Amended Base Shelf Prospectus”) increasing the total amount of securities qualified under the Base Shelf Prospectus up to $150,000,000.

On October 2, 2017, Bin Huang resigned from her position as the Company’s Chief Executive Officer and the Company appointed Chris Wagner as her replacement. Ms. Huang remains as the President of the Operating Subsidiary.

Effective October 5, 2017, the Company amended and restated the amended and restated independent contractor agreement, dated September 12, 2017 with Sciences (the “Second Amended and Restated ICA”). Sciences agreed to provide services, as requested by the Board, for a fixed monthly fee of $200,000. This agreement has been subsequently amended and restated effective January 1, 2018. See discussion under “Material Contracts”.

On November 17, 2017, the Company acquired a 53% interest in Northern Vine, a licensed dealer under the provisions of the CDSA for a purchase price of $2,500,000 in cash. Abattis Bioceuticals Corp. holds the remaining 47% interest in Northern Vine. Northern Vine offers licensed producers under the ACMPR and patients registered under the ACMPR complete microbiology and chemical analyses, with testing of product potency as well as testing for the presence of unwanted pesticides, microbes, and environmental toxins in dried plant products, extracts, derivatives and edibles. Northern Vine will carry out analytics on the Company’s cannabis on a preferred customer basis.

In November 2017, the Licence was renewed and is valid for a two-year period ending November 8, 2019 (the “Licence Period”). The Licence supersedes and replaces the previous licences granted to the Company under the MMPR and the ACMPR. Further details regarding the Licence are set out under the heading “Description of the Business - Current Licence under the ACMPR”.

On November 20, 2017, the Company’s Chief Financial Officer, Sandra Pratt resigned and the Company appointed Robert Hill as her replacement.

On December 20, 2017, the Company accelerated the expiry date of the February Warrants to January 19, 2018.

Development of Business in 2018

On January 5, 2018, the Company accelerated the expiry date of the April Warrants to February 5, 2018.

On January 9, 2018, the Company completed a private offering of 3,000,000 units of the Company at a price of $5.00 per unit with a single Canadian institutional accredited investor (the “Investor”) (the “January Prospectus Offering”) pursuant to a supplement to the Amended Base Shelf Prospectus. Each Unit was comprised of one Common Share and one Common Share purchase warrant (the “January 2018 Warrants”) with each warrant exercisable into one Common Share at a price of $6.00 per share for a period of 36 months from the date of issuance. The January Prospectus Offering was completed without the involvement of an underwriter. The Investor also purchased 2,000,000 Common Shares from Sciences at a price of $5.00 per share (the “Concurrent Sale”).

On January 28, 2018, the Company and DMG Blockchain Solutions Inc. signed a non-binding letter of intent to form a joint venture, to be named CannaChain Technologies Inc., for the purpose of developing a foundational blockchain-based supply chain management system and e-commerce marketplace for the legal cannabis industry.

On January 30, 2018, the Company and Namaste Technologies Inc. (“Namaste”) signed a non-binding letter of intent whereby the Company and Namaste propose to enter into a definitive agreement to collaborate on strategic business opportunities worldwide and develop a fully integrated e-commerce platform to serve as a retail channel for the Company’s patients.

On January 31, 2018, the Company filed a second amended and restated base shelf prospectus (the “Second Amended Base Shelf Prospectus”) increasing the total amount of securities qualified under the Amended Base Shelf Prospectus to $250,000,000 of securities of the Company. The Second Amended Base Shelf Prospectus also qualifies the sale of securities of the Company pursuant to a secondary offering.

On February 8, 2018, the Company completed a private placement offering of 3,000,000 units of the Company at a price of $6.00 per unit (the “February Prospectus Offering”) pursuant to a supplement to the Second Amended Base Shelf Prospectus. Each unit was comprised of one Common Share and one Common Share purchase warrant with each warrant exercisable into one Common Share at a price of $7.00 per share for a period of six months from the date of issuance. The February Prospectus Offering was completed without the involvement of an underwriter. The Investor also purchased 2,000,000 Common Shares from Sciences at a price of $6.00 per share (the “Secondary Sale”). The Investor exercised in full the January 2018 Warrants within three days of the completion of the February Prospectus Offering.

On March 5, 2018, the Joint Venture was issued a cultivation licence by Health Canada under the ACMPR for the Initial Greenhouse.

Recent Developments Relating to Expected Legalization of Cannabis in Canada

On April 13, 2017, the federal government of Canada introduced before parliament Bill C-45An Act respecting cannabis and to amend the Controlled Drugs and Substances Act, the Criminal Code and Other Acts(the “Cannabis Act”), the draft legislation setting out the federal regulatory framework for legalization of cannabis for non-medical purposes. On October 3, 2017, the Parliamentary Standing Committee on Health proposed amendments to the Cannabis Act including, among other things, an amendment that would permit cannabis edibles and concentrates to be sold, to come into force no later than twelve months after the Cannabis Act comes into force. On November 10, 2017, the Government of Canada proposed that federal tax on cannabis for medical and non-medical purposes should not exceed $1 per gram or 10% of the producer’s price, whichever is higher, with retail sales taxes levied on top of that amount.

On November 27, 2017, the House of Commons passed the Cannabis Act on its third reading.

Once the Cannabis Act is passed by the Senate, it will receive royal assent and become law, however the provinces will need an additional eight to twelve weeks from such date to prepare for retail sales. On March 22, 2018, the Cannabis Act passed second reading in the Senate, giving the bill approval in principle. The bill now proceeds to the Standing Senate Committee for closer scrutiny, witness testimony and proposed amendments before returning to the Senate for a final debate and vote expected by June 7, 2018. It is anticipated that legal adult use cannabis sales in Canada will commence in August or September 2018.

Until the Cannabis Act is in force, existing laws remain in place and the provisions discussed below are subject to change. The Cannabis Act also provides for licensing of the import or export of cannabis in respect of medical or scientific purposes only.

While the Cannabis Act provides for the regulation of the commercial production of cannabis for non-medical purposes and related matters by the federal government, the provinces and territories of Canada have authority to regulate other aspects of non-medical cannabis (similar to what is currently the case for liquor and tobacco products), such as sale and distribution, minimum age requirements, places where cannabis can be consumed, and a range of other matters. To date, the governments of most of the provinces of Canada have announced partial regulatory regimes for the distribution and sale of cannabis for non-medical purposes within those provinces.

On November 22, 2017, Health Canada released for public consultation its proposed approach to the regulation of cannabis. The purpose of the consultation paper was to solicit public feedback on an initial set of regulatory proposals that Health Canada is considering, focused on the regulations that would facilitate the coming into force of the proposed Cannabis Act. Health Canada’s consultation addresses licensing, security requirements for producers and their facilities, product standards, labelling and packaging, and the proposed cannabis tracking system. It also addresses cannabis for medical purposes and health products containing cannabis. Health Canada proposes a risk-based approach to regulation, balancing the protection of health and safety of Canadians while enabling a competitive legal industry made up of large and small enterprises in all regions of Canada producing quality-controlled cannabis. The consultations were open until January 20, 2018 and it is expected that no draft regulations will be released prior to July 1, 2018.

There is no guarantee that any of the provincial frameworks which have been announced prior to the date of this AIF supporting the legalization of cannabis for non-medical use in Canada will be implemented on the terms announced or at all. See “Risk Factors”.

The Canadian federal government has not currently proposed any changes to the ACMPR and as such, medical cannabis is expected to continue to be sold online directly to patients.

DESCRIPTION OF BUSINESS

General Description of the Business

The Company is a Licensed Producer of medical cannabis under the ACMPR, and was a Licensed Producer under its predecessor, the MMPR. On November 7, 2016, the Company received the Licence. In November 2017, the Licence was renewed for the Licence Period. The Licence supersedes and replaces the previous licences granted to the Company under the MMPR and the ACMPR.

Current Licence under the ACMPR

The Licence allows the Company to produce for medical purposes dried cannabis, cannabis oils, cannabis resins, cannabis plants and cannabis seeds. The License permits the Company to sell dried cannabis and cannabis oils to clients for medical purposes and to other Licensed Producers. The Company is also permitted to sell cannabis plants and cannabis seeds to other Licensed Producers and to individuals who are registered to grow cannabis plants under Part 2 of the ACMPR. Individuals may become clients of the Company (“Clients”) by registering with the Company through its secure online portal or via telephone after the individual has received a medical document signed by a licensed health care practitioner setting out the daily quantity of dried cannabis, in grams, that the practitioner authorizes for the person (which will be converted by the Company using an equivalency factor in the case of purchases of oils).

Products of the Company

The Company currently offers a variety of dried cannabis strains and cannabis oils each with varying levels of tetrahydrocannabinol (“THC”) and cannabidiol (“CBD”) as more particularly described below. There is no limit imposed by the ACMPR on the amount of THC or CBD a strain of dried cannabis may contain nor does the ACMPR set out specific requirements for pricing of dried cannabis or cannabis oils. Currently, pursuant to the ACMPR, cannabis oils are limited to 30 mg per ml, or 3%, THC for oil and 10 mg per capsule. There is no limit on the amount of CBD in cannabis oil.

The Company currently sells dried cannabis between $8.50 and $12.50 per gram and cannabis oils between $75.00 and $150.00 per 30 ml bottle. However, future products may sell above or below these price ranges. The Operating Subsidiary also offers compassion pricing to clients who have annual incomes of $30,000 or less or who are classified by their physician as palliative. Compassion pricing provides discounts of 30% on dried cannabis and 20% on cannabis oils.

The Company generally provides eight to ten options of dried medical cannabis products for clients and currently produces approximately eight strains from its own genetics, which are available at different times, subject to growing cycles. However, due to limited growth space, the Operating Subsidiary is currently limited on the volume of product it is able to produce internally and may purchase additional strains of dried medical cannabis from other Licensed Producers to supplement inventory levels for both dried medical cannabis sales and cannabis oil production.

The Company currently has four cannabis oil products in production, including: THC acid (“THCA”) oil, THC oil, two different strengths of oils containing both THC and CBD and two different strengths of oils containing primarily CDB oil. The cannabis oils are whole plant extracts that deliver the benefits of cannabinoids orally.

For the year ended December 31, 2017, dried cannabis sales accounted for 62% (2016 - 89%) of total consolidated revenue and cannabis oil sales accounted for 36% (2016 - 10%) of total consolidated revenue.

Operations

The Company’s primary operations consist of:

| (a) | limited production of cannabis for the purpose of sale, production of cannabis oils and research and development; |

| (b) | sale of products through an online secure customer portal; |

| (c) | registration, sales and customer service by way of its online secure customer portal and telephone; |

| (d) | research and development related to the characterization of cannabis strains; |

| (e) | extraction of cannabis oils; and |

| (f) | sourcing, quality control verification and purchase of wholesale dried cannabis and cannabis oils from other Licensed Producers. |

Distribution

Under the Licence, the Company is licensed to sell or provide dried cannabis and cannabis oils to Clients. Clients order from the Company primarily through the Company’s secure online customer portal and through telephone ordering with the Company’s customer service team. The Company ships all products discretely to Clients through Purolator and Canada Post in accordance with current regulations.

Storage and Security

The ACMPR requires commercial production sites to be located indoors, and not in private dwellings. Subdivision C of the ACMPR sets out physical security requirements that are necessary to secure sites where Licensed Producers conduct activities with medical cannabis other than storage. As per Health Canada regulations, the Operating Subsidiary’s facilities contain two safes and one vault that have been designated as security level 6, 6 and 7, respectively.

The vault is equipped with security cameras, motion sensors, finger print scanners, code locked doors and seismic sensors that set alarms off when vibrations are detected. These security measures ensure the Operating Subsidiary is compliant with all of Health Canada’s necessary security requirements.

Health Canada conducts ad hoc, unscheduled site inspections of Licensed Producers. The Company has consistently responded to and complied with all requests from Health Canada resulting from these inspections within the time frames indicated in such requests. As of the date hereof, there are no outstanding inspection issues with Health Canada beyond day-to-day adjustments that may occur in order to ensure ongoing compliance. The Company has not been required to recall any distributed product or otherwise been formally reprimanded.

Specialized Skill and Knowledge

Knowledge with respect to cultivating and growing medical cannabis is important to the medical cannabis industry. The nature of growing cannabis is not substantially different from the nature of growing other agricultural products. Variables such as temperature, humidity, lighting, air flow, watering and feeding cycles are defined and controlled to produce consistent product and to avoid contamination. The product is cut, sorted and dried under defined conditions that are established to protect the activity and purity of the product. Once processing is complete, each processing batch is subjected to testing against quality specifications set for activity and purity.

The Company has recruited a cultivation team with specialized skill sets unique to indoor agricultural cultivation and growing cannabis. The Company’s management team has extensive indoor cannabis production experience since the implementation by Health Canada of the Medical Marihuana Access Regulations, the predecessor to the MMPR and ACMPR. The Company’s senior management and management include molecular biologists, geneticists and plant biologists who collectively have extensive expertise in large-scale agriculture with crops other than cannabis.

Reporting Requirements

In addition to general reporting requirements prescribed by the ACMPR, the Licence requires that the Company makes a report of information including, but not limited to, the following to the Office of Controlled Substances of Health Canada on a monthly basis:

| (a) | the total amount of dried cannabis and cannabis oil (in kgs) produced in the reporting period; |

| (b) | the total amount of dried cannabis and cannabis oil (in kgs) sold or transferred to the following during the reporting period: |

| (ii) | other Licensed Producers; and |

| (c) | the total number of persons that were registered clients of the Operating Subsidiary at the end of the reporting period, including only those persons whose registrations were valid on the last day of the reporting period, and the total number of persons that were registered as new Clients of the Operating Subsidiary during the reporting period; |

| (d) | persons registered under the ACMPR to obtain interim supply; |

| (e) | persons registered under the ACMPR to obtain starting materials; |

| (f) | the number of individuals who tried to register with the Operating Subsidiary, but could not be registered, regardless of the reason, and the number of Clients who placed orders or tried to place orders that could not be filled, regardless of the reason; |

| (g) | the total amount of dried cannabis and cannabis oil (in kgs) held by the Operating Subsidiary as of the final day of the reporting period; |

| (h) | the total amount of dried cannabis and cannabis oil (in kgs) that the Operating Subsidiary imported and exported during the reporting period; |

| (i) | the total amount of dried cannabis and cannabis oil (in grams) lost, stolen and/or destroyed during the reporting period; |

| (j) | the total number of shipments of dried cannabis and cannabis oils sent to the following during the reporting period in each province and territory: |

| (ii) | other Licensed Producers; and |

| (k) | the average and median daily amount of dried cannabis and cannabis oil (in grams) supported by health care practitioners to be used by Clients; |

| (l) | the average and median shipment size (in grams) sent to Clients during the reporting period; |

| (m) | the ten highest and ten lowest amounts of dried cannabis shipped to Clients in the reporting period (the name or other information of the Client must not be identified); |

| (n) | the total number of shipments of dried cannabis and cannabis oils to Clients in various defined ranges (in grams); and |

| (o) | a list of all physicians and all nurse practitioners who provided a medical document for a Client in the reporting period, including the location and the number of medical documents the physician or nurse practitioner signed during the reporting period. |

The Licence also requires that the Company makes a report of the following additional information to the Office of Controlled Substances of Health Canada on a yearly basis:

| (a) | the quantities of starting materials actually used in the production of finished products; |

| (b) | the quantity in inventory of cannabis on the premises as at December 31, including harvested cannabis prior to drying and after drying as well as the bulk and packaged dried cannabis held in stock; |

| (c) | the quantity of cannabis produced on the premises during the calendar year; |

| (d) | annual estimates of the production of cannabis for the following calendar year; and |

| (e) | an annual summary of any adverse reactions reported. |

Medical Cannabis Market

On its website, Health Canada indicates that as of December 31, 2017, there were 269,502 (December 31, 2016 – 129,876) individuals registered under the ACMPR, to possess and consume dried cannabis or cannabis oil for medicinal purposes in Canada. This represents a 108% increase in the number of registered individuals since December 31, 2016. Those individuals purchased 23,979kg of dried cannabis and 28,810kg of cannabis oil during 2017.

According to the Health Canada website, as of December 31, 2017, the average size of dosage per prescription for licences granted to individual users by Health Canada is 2.4 grams of cannabis per day.

The market for medical cannabis in Canada is tightly controlled by and subject to regulation, including the ACMPR, the Narcotic Control Regulations and the CDSA. The commercial medical cannabis industry is a relatively new industry and the Company anticipates that such regulations will be subject to change as the federal government of Canada monitors Licensed Producers in action.

Competitive Environment

As of March 29, 2018, Health Canada had licensed a total of 97 Licensed Producers. Of the 97 Licensed Producers, 38 are fully authorized to cultivate and sell finished product to registered customers, 53 have a licence restricted to the cultivation of medical cannabis and four have a licence just to sell medical cannabis. In addition, there are 35 licensed producers of cannabis extracts: 13 are only licensed to produce cannabis extracts; 21 are licensed to produce and sell cannabis extracts; and three are licensed only to sell cannabis extracts.

The Company believes that the stringent application and compliance requirements of the ACMPR together with the requirements and process to obtain the requisite licences will restrict the number of new entrants to the medical cannabis market. However, the Company does believe that the number of new competitors, all vying for market share, will continue to increase.

As cannabis is largely perceived as a commodity product, there is initially little to differentiate the Company’s products in terms of unique features or benefits. The Company believes that competition in the future will be based on issues such as product quality, variety, price and client services.

Business Strategy

The Company’s current strategy is to remain a reputable and trusted provider of medical cannabis and to accelerate the growth of its client base and sales revenue through cannabis oil products and the introduction of new delivery methods, such as oil capsules. All new products are subject to Health Canada approval. The Company is committed to providing a consistent supply of high quality products and maintaining its excellence in client services. Through a combination of in house production and wholesale purchase from other Licensed Producers, the Company expects to continue to provide a wide range of strains of dried cannabis, THCA, THC, THC:CBD and high CBD oils.

Client acquisition and client service is an ongoing focus for the Company. After the introduction of cannabis oils, the Company’s client base began to increase quickly and the Company expects the trend to continue and revenue to increase in 2018. The Company’s on-line ordering system provides a simple and efficient method for clients to order products.

The Company also recognizes that the medical profession plays an important role in the introduction of medical cannabis to clients and continuing education of medical professionals on the product is required. In partnership with other professional organizations, the Company intends to continue to communicate with medical doctors and other healthcare professionals and to provide the best education and services to these professionals.

The Company’s collection of genetic materials and established team of experts will continue to play a major role as the Company continues to build its propriety strains, products and reputation. Through its research program supported by a contribution from the NRC-IRAP grants, the Company has characterized the cannabinoids and terpenes profiles of its plant materials and has identified several new strains from its diverse pool of cannabis seeds. Strains with exceptionally high CBD levels are expected to allow the Company to produce CBD oils in the future with unique compositions of cannabinoids through blending. In addition to continued research and development of strains and products, the Company also plans to undertake clinical research to study the effects of its products on client health.

The Company’s longer term strategy includes becoming a leading provider of quality products for the broader adult recreational cannabis market. As one of the limited number of Licensed Producers with scalable systems and processes, management believes that the Company will be able to take advantage of the legalization of adult use recreational cannabis when it occurs. Through the Phase 1 Expansion, partnerships, and acquisitions, the Company expects to be well positioned to serve the adult use recreational cannabis market across Canada when the Cannabis Act is enacted.

Protection of Intellectual Property

The Company filed for Canadian trademark protection for the word “Emerald” for use in connection with the Company’s business, which includes medical cannabis and cannabis.

The Company is also determining what additional unregistered intellectual property for which there may be opportunities for protection. The Company reviews its options on an ongoing basis.

Employees

As of December 31, 2017, the Company directly employed three full-time employees, no part-time or temporary employees and one consultant and the Operating Subsidiary employed twenty-one full-time employees, two part-time or temporary employees and three consultants. The Company believes its relationship with its employees is good. None of the Company’s employees are represented by a labour union or subject to a collective bargaining agreement nor are any of the Operating Subsidiary’ employees.

Risk Factors

The Company, and thus the securities of the Company, should be considered a speculative investment due to the high-risk nature of the Company’s business, and investors should carefully consider all of the information disclosed in this AIF prior to making an investment in the Company. In addition to the other information presented in this AIF, the following risk factors should be given special consideration when evaluating an investment in the Company’s securities:

Reliance on Licence

The Company’s ability to grow, store and sell medical cannabis in Canada is dependent on the Licence. Failure to comply with the requirements of the Licence, or any failure to maintain the Licence would have a material adverse impact on the business, financial condition and financial performance of the Company. The Company believes it will meet the requirements of the ACMPR for further extensions or renewals of the Licence. However, should Health Canada not extend or renew the Licence, or should it renew the License on different terms, the business, financial condition and results of the operation of the Company would be materially adversely affected.

Expansion Risks

There is no guarantee that the Company’s intentions to acquire and/or construct additional cannabis production and manufacturing facilities and to expand the Company’s marketing and sales initiatives will be successful. Any such activities will require, among other things, various regulatory approvals, licences and permits (such as additional site licences from Health Canada under the ACMPR, as applicable) and there is no guarantee that all required approvals, licences and permits will be obtained in a timely fashion or at all. There is also no guarantee that the Company will be able to complete any of the foregoing activities as anticipated or at all. The failure of the Company to successfully execute its expansion strategy (including receiving required regulatory approvals and permits) could adversely affect the Company’s business, financial condition and financial performance and may result in the Company failing to meet anticipated or future demand for its cannabis-based pharmaceutical products, when and if it arises. See also “Factors which may Prevent Realization of Growth Targets.”

Change in Laws, Regulations and Guidelines

The Company’s operations are subject to a variety of laws, regulations and guidelines relating to the manufacture, management, transportation, storage and disposal of cannabis but also including laws and regulations relating to health and safety, privacy, the conduct of operations and the protection of the environment. While, to the knowledge of the Company’s management, the Company is currently in material compliance with all such laws, changes to such laws, regulations and guidelines due to matters beyond the control of the Company may cause adverse effects to the Company’s operations and the financial condition of the Company.

The Government of Canada has provided guidance that, subject to Parliamentary approval and Royal Assent, it intends to provide regulated and restricted access to cannabis pursuant to the Cannabis Act in 2018. The Cannabis Act has passed third reading in the House of Commons. However there remains no assurance that the legalization of non-medical cannabis by the Government of Canada will occur as anticipated or at all.

Health Canada’s proposed approach to the regulation of cannabis includes proposals relating to cannabis for medical purposes and health products containing cannabis. See “Recent Developments – Recent Developments Relating to Expected Legalization of Cannabis in Canada” for a description of Health Canada’s proposed approach to the regulation of cannabis. Such proposals, if implemented, could result in changes to the current regulatory regime under the ACMPR, which may impact the operations of Licensed Producers or affect the Canadian medical cannabis industry generally. Any such regulatory changes could adversely affect the Company’s business, financial condition and financial performance.

In addition, if the Cannabis Act comes into effect, there is no guarantee that provincial legislation regulating the distribution and sale of cannabis for non-medical purposes will be enacted according to the terms announced by such provinces, or at all, or that any such legislation, if enacted, will create the opportunities for growth anticipated by the Company or other commentators. For example, the Provinces of Ontario (Canada’s most populous province), Québec and New Brunswick have announced sales and distribution models that would create government-controlled monopolies over the legal retail and distribution of cannabis for non-medical purposes in such provinces, which could limit the Company’s opportunities for the sale of cannabis in those provinces.

The Cannabis Act is currently under consideration by the federal government of Canada and no drafts of the necessary federal regulations or provincial legislation have been circulated publicly. There is no guarantee that changes to the existing regime would be favourable to current Licensed Producers and may include provisions that have a materially adverse impact on the Company including, but not limited to:

| (a) | restrictions on the Company’s ability to run its business as it currently operates or the imposition of new restrictions on Licensed Producers, including restrictions on the products that may be produced or made available by Licensed Producers, restrictions on strains (including restrictions on potency) and types of products (oil, resin, concentrates, edible products containing cannabis extracts), and additional restrictions on advertising of the Company’s products; |

| (b) | changes to the legislation with the effect of reducing barriers to entry for new entrants to the industry, some of whom may have more financial resources and marketing expertise than the Company; |

| (c) | changes to the current distribution channels, including the introduction of retail distribution or other new types of licensed distributors, or the imposition of a government monopoly on distribution which would impact the Company’s ability to sell its products; |

| (d) | changes to limit the types of customers the Company can sell to (for example, age restrictions), changes in the manner in which customers are licensed to purchase the Company’s products, or which limit the amount of product that purchasers may buy, any of which may reduce the number of the Company’s possible customers or the average amount of purchased product; |

| (e) | the implementation of additional taxes on the Company’s products, which may reduce the demand of the Company’s products and reduce the quantity of products sold by the Company; and |

| (f) | changes to the legislation to impose new requirements on Licensed Producers, including changes to the labeling requirements for the Company’s products or the manner in which the products are required to be tested or approved for sale, which could increase the cost of producing the Company’s products and could reduce the Company’s earnings and margins. |

While the impact of any of such changes are uncertain and are highly dependent on which specific laws, regulations or guidelines are changed, it is not expected that any such changes would have an effect on the Company’s operations that are materially different than the effect on similar-sized companies in the same business as the Company.

Supply Risks

The Company is limited in its ability to grow, store and sell cannabis under the terms of the Licence and as a result of its reliance on a single growing facility. As a result, the Company may, from time to time, purchase additional dried cannabis from other Licensed Producers to supplement its own production. If the Company is unable to acquire additional cannabis sufficient to meet demand on terms and conditions favourable to the Company, it could have a material adverse effect on the business, results of operations and financial condition of the Company.

Reliance on a Single Facility

Although the Company is in the process of constructing additional growing facilities, to date, the Company’s production has come solely from its initial facility in British Columbia. The Company does expect to achieve production at the Joint Venture facility in the near term, however, the Joint Venture has not yet finished the process to attain its sales licence under the ACMPR. Adverse changes or developments affecting the Company’s current facility could have a material and adverse effect on the Company’s business, financial condition and prospects.

The Company’s facility requires regular maintenance on both the heating and cooling systems and regular power component maintenance on the generator and delivery systems. Any failure of the heating and cooling systems or electrical delivery systems could have a material and adverse effect on the Company’s business, financial condition and financial prospects. The Company is currently constructing a second production facility in Metro Vancouver, British Columbia which will require licencing by Health Canada and significant investment of capital. Neither the Health Canada licencing nor the investment of capital are assured.

Regulatory Risks

The activities of the Company are subject to regulation by governmental authorities, particularly Health Canada. Achievement of the Company’s business objectives are contingent, in part, upon compliance with regulatory requirements enacted by these governmental authorities and obtaining all regulatory approvals, where necessary, for the sale of its products. The Company will also require Health Canada and other regulatory approval in order to proceed with construction of its proposed new growing facilities as part of its expansion plans and will be required to apply for and obtain an additional licence under the ACMPR before it begins growing medical cannabis at such facilities. The Company cannot predict the time required to secure all appropriate regulatory approvals for its proposed facilities or products, or the extent of testing and documentation that may be required by Health Canada or other governmental authorities. Any delays in obtaining, or failure to obtain regulatory approvals would significantly delay the development of facilities, markets and/or products and could have a material adverse effect on the business, financial performance and financial condition of the Company.

Limited Operating History

The Company was incorporated in 2013 and has yet to generate significant revenue. The Company is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues. There is no assurance that the Company will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of the early stage of the Company’s operations.

Joint Ventures

Although the Company has certain rights pursuant to the shareholders’ agreement governing the Joint Venture, the Company does not directly control the management of the Joint Venture and it is intended that the Joint Venture will have its own management. Success of the Joint Venture will depend, in part, on the expertise of such management. The business of the Joint Venture is itself subject to the operational and business risks inherent in the large scale production of cannabis and to that extent, the business of the Joint Venture will be subject to many of the same business risks applicable to the Company and which are set out elsewhere in this AIF. In particular, the production and sale of cannabis at the Joint Venture’s facilities in Delta, British Columbia is subject to obtaining all necessary permits and licenses, including a sales license under the ACMPR. There can be no assurance that the Company and the Joint Venture will be successful in obtaining all such permits and licenses. In the event that all such licenses and permits are not obtained then the Joint Venture will not be permitted to produce or sell cannabis which would have a material adverse effect on the Company’s business, results of operations and financial performance.

Pursuant to the shareholders’ agreement governing the Joint Venture, the Company has advanced $18 million and has agreed to advance an additional $2 million in respect of the Company’s equity ownership in the Joint Venture. Failure to advance such sums when and as due may constitute a default under the shareholders’ agreement and could result in the Company losing some or all of its interest in the Joint Venture. The Joint Venture may require additional capital subsequent to such $20 million. To the extent the Joint Venture is unable to internally fund its operating requirements or expansion plans it may make additional capital calls on its shareholders. Failure by the Company to meet such a capital call would not constitute a default under the shareholders’ agreement but in the event that its joint venture partner, Village Farms, elects to make its capital contributions the Company’s interest in the Joint Venture may, in certain circumstances, be diluted. If the Company elects to fund a capital call but Village Farms fails to do so, the Company may need to advance additional capital in order to meet the Joint Venture’s needs. There can be no assurance that the Company or Village Farms will have the necessary capital resources to meet a capital call when and if made by the Joint Venture. In the event that the Joint Venture cannot raise the necessary funds from its shareholders it may need to raise additional funds through debt or equity financings that may be dilutive to the Company’s interest in the Joint Venture. If the Joint Venture cannot obtain adequate capital to the extent required on favorable terms or at all, it may be required to scale back or halt entirely its operating or expansion plans and its business, financial condition and results of operations could be adversely affected. Disputes may arise between the Company and its joint venture partner, Village Farms, that may adversely affect the success of the Joint Venture and which would have a material adverse effect on the Company’s business, results of operations and financial performance. Failure by the Company to otherwise comply with its obligations under the shareholders’ agreement may result in the Company being in default under the shareholders’ agreement and could result in the Company losing some or all of its interest in the Joint Venture.

Reliance on Management

The success of the Company is primarily dependent upon the ability, expertise, judgment, discretion and good faith of its senior management. While employment agreements are customarily used as a primary method of retaining the services of key employees, these agreements cannot assure the continued services of such employees indefinitely. Any loss of the services of any such individuals could have a material adverse effect on the Company’s business, financial performance or financial condition. In addition, the Company has entered into a services agreement with Sciences pursuant to which Sciences provides certain management services to the Company and if such agreement were terminated, it may have a material adverse impact on the Company’s business, financial performance or financial condition.

Shelf Life of Inventory

The Company holds finished goods in inventory and its inventory has a shelf life. Finished goods in the Company’s inventory include dried cannabis and cannabis oil products. The Company follows Health Canada’s testing requirements for product release and re-tests its inventory for information purposes. Based on such testing results and management’s experience, the Company believes that there is no significant change in product composition during a twelve-month storage under its current vault conditions. The Company’s typical turnover rate for inventory varies between two weeks and six months from final production, however this turnover rate may change and its inventory may reach its expiration and may not be sold. Even though management of the Company on a regular basis reviews the amount of inventory on hand, reviews the remaining shelf life and estimates the time required to manufacture and sell such inventory, write-down of inventory may still be required. Any such write-down of inventory could have a material adverse effect on the Company’s business, financial condition, and financial performance.

Information Systems Security Threats

The Company has entered into agreements with third parties for hardware, software, telecommunications and other information technology (“IT”) services in connection with its operations. The Company’s operations depend, in part, on how well it and its suppliers protect networks, equipment, IT systems and software against damage from a number of threats, including, but not limited to, cable cuts, damage to physical plants, natural disasters, terrorism, fire, power loss, hacking, computer viruses, vandalism and theft. The Company’s operations also depend on the timely maintenance, upgrade and replacement of networks, equipment, IT systems and software, as well as pre-emptive expenses to mitigate the risks of failures. Any of these and other events could result in information system failures, delays and/or increase in capital expenses. The failure of information systems or a component of information systems could, depending on the nature of any such failure, adversely impact the Company’s reputation and financial performance.

The Company has not experienced any material losses to date relating to cyber-attacks or other information security breaches, but there can be no assurance that the Company will not incur such losses in the future. The Company’s risk and exposure to these matters cannot be fully mitigated because of, among other things, the evolving nature of these threats. As a result, cyber security and the continued development and enhancement of controls, processes and practices designed to protect systems, computers, software, data and networks from attack, damage or unauthorized access is a priority. As cyber threats continue to evolve, the Company may be required to expend additional resources to continue to modify or enhance protective measures or to investigate and remediate any security vulnerabilities.

Damage to the Company’s Reputation

Damage to the Company’s reputation could be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether true or not. The increased usage of social media and other web-based tools used to generate, publish and discuss user-generated content and to connect with other users has made it increasingly easier for individuals and groups to communicate and share opinions and views in regard to the Company and its activities, whether true or not. Although the Company believes that it operates in a manner that is respectful to all stakeholders and that it takes care in protecting its image and reputation, the Company does not ultimately have direct control over how it is perceived by others. Reputational loss may result in decreased investor confidence, increased challenges in developing and maintaining community relations and an impediment to the Company’s overall ability to advance its projects, thereby having a material adverse impact on financial performance, financial condition, cash flows and growth prospects.

Third Party Reputational Risk

The parties with which the Company does business may perceive that they are exposed to reputational risk as a result of the Company’s cannabis business activities. This may impact the Company’s ability to retain current partners, such as its banking relationship, or source future partners as required for growth or future expansion. Failure to establish or maintain such business relationships could have a material adverse effect on the Company.

Factors which may Prevent Realization of Growth Targets

The Company is currently in the early development stage and its growth strategy contemplates expanding its production facility with additional production resources and constructing new growing facilities. There is a risk that such construction and expansion will not be achieved on time, on budget, or at all, as they can be adversely affected by a variety of factors, including some that are discussed elsewhere in these risk factors and the following:

| (a) | delays in obtaining, or conditions imposed by, regulatory approvals and licences including approvals from Health Canada; |

| (c) | environmental pollution; |

| (d) | non-performance by third party contractors; |

| (e) | increases in materials or labour costs; |

| (f) | production falling below expected levels of output or efficiency; |