Exhibit 99.2

TABLE OF CONTENTS

| Overview | 14 |

| | |

| Recent Developments and Events after the Reporting Period | 17 |

| | |

| Disclosure ofOutstanding Share Data | 19 |

| | |

| Summary of Quarterly Results | 19 |

| | |

| Results of Operations | 20 |

| | |

| Additional Disclosure for Venture Issuers Without Significant Revenue | 23 |

| | |

| Liquidity and Capital Resources | 23 |

| | |

| Operating, Investing and Financing Activities | 24 |

| | |

| Financial Risk Management | 25 |

| | |

| Measurement Uncertainty and Impairment Assessments | 25 |

| | |

| Transactions with Related Parties | 25 |

| | |

| Proposed Transactions | 26 |

| | |

| Critical Accounting Policies and Estimates | 26 |

| | |

| Changes in Accounting Standards not yet Effective | 27 |

| | |

| Off-Balance Sheet Arrangements | 27 |

| | |

| Risks and Uncertainties | 27 |

| | |

| Forward-Looking Statements | 27 |

Management's Discussion and Analysis

The following MD&A is prepared as of May 30, 2019 and is intended to assist the understanding of the results of operations and financial condition of the Company.

This MD&A should be read in conjunction with the unauditedcondensed interim consolidatedfinancial statements and accompanying notes of the Company forthe three months ended March 31, 2019which have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). This MD&A contains forward-looking statements that are subject to risk factors set out in a cautionary note contained herein. All figures are in Canadian dollars unless otherwise noted.

Additional information related to the Company is available on its website atwww.emeraldhealth.ca. Other information related to the Company, including the Company's most recent Annual Information Form ("AIF") and financial statements referred to herein are available on the Canadian Securities Administrator's website atwww.sedar.com.

Overview

The Company was incorporated pursuant to theBusiness Corporations Act (British Columbia) on July 31, 2007 as Firebird Capital Partners Inc. and changed its name to Firebird Energy Inc. in December 2012. On September 4, 2014, the Company completed the acquisition of all the issued and outstanding common shares of Thunderbird Biomedical Inc. (“Thunderbird”), by way of a reverse takeover (the “Transaction”) under the rules of the TSX Venture Exchange (the “TSXV”) and concurrently changed its name to T-Bird Pharma, Inc (“T-Bird”). At that time, Thunderbird became a wholly owned subsidiary of T-Bird. In June 2015, the Company changed its name to Emerald Health Therapeutics, Inc. and Thunderbird changed its name to Emerald Health Botanicals Inc. (“Botanicals”). In February 2018, Botanicals changed its name to Emerald Health Therapeutics Canada Inc. (“EHTC”).

The Company is a publicly traded company with headquarters in Vancouver, British Columbia, Canada. Common shares of the Company (the “Common Shares”) are listed on the TSXV under the trading symbol “EMH”. The Company is classified as a Tier 1 Venture Issuer on the TSXV. The Company also trades on the OTCQX® Best Market, operated by OTC Markets Group under the ticker symbol “EMHTF”.

The Company owns:

| (a) | 100% of the shares of EHTC, a British Columbia-based licence holder under the Cannabis Act (Canada) (the "Cannabis Act"); |

| (b) | 100% of the shares of Verdélite Sciences, Inc. (formerly, Agro-Biotech Inc.) ("Verdélite"), a Quebec-based licence holder under the Cannabis Act; |

| (c) | 100% of the shares of Verdélite Property Holdings, Inc. (formerly, Agro-Biotech Property Holdings Inc.) ("Verdélite Holdings"), a Quebec-based holding corporation that owns the Verdélite Facility (as defined below); and |

| (d) | 51% of the shares ofEmerald Health Naturals Inc. ("EHN"), a joint venture between the Company and Emerald Health Bioceuticals, Inc. ("EHB"). |

The Company, through EHTC, also holds:

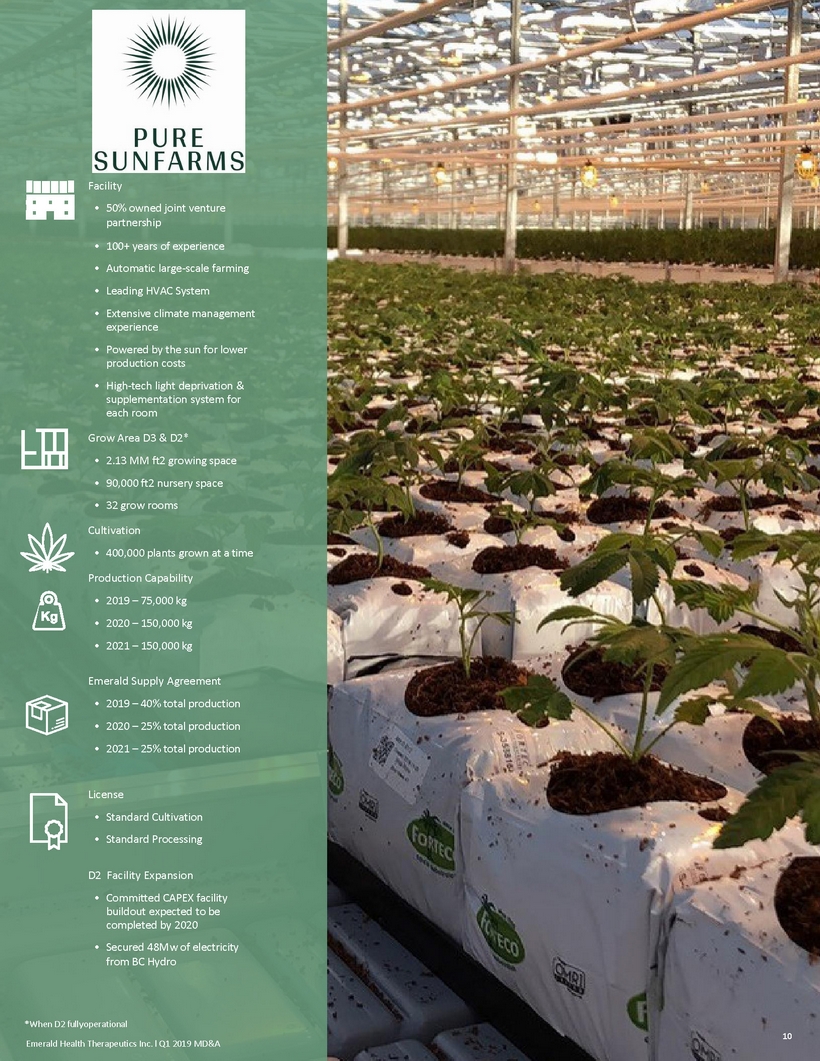

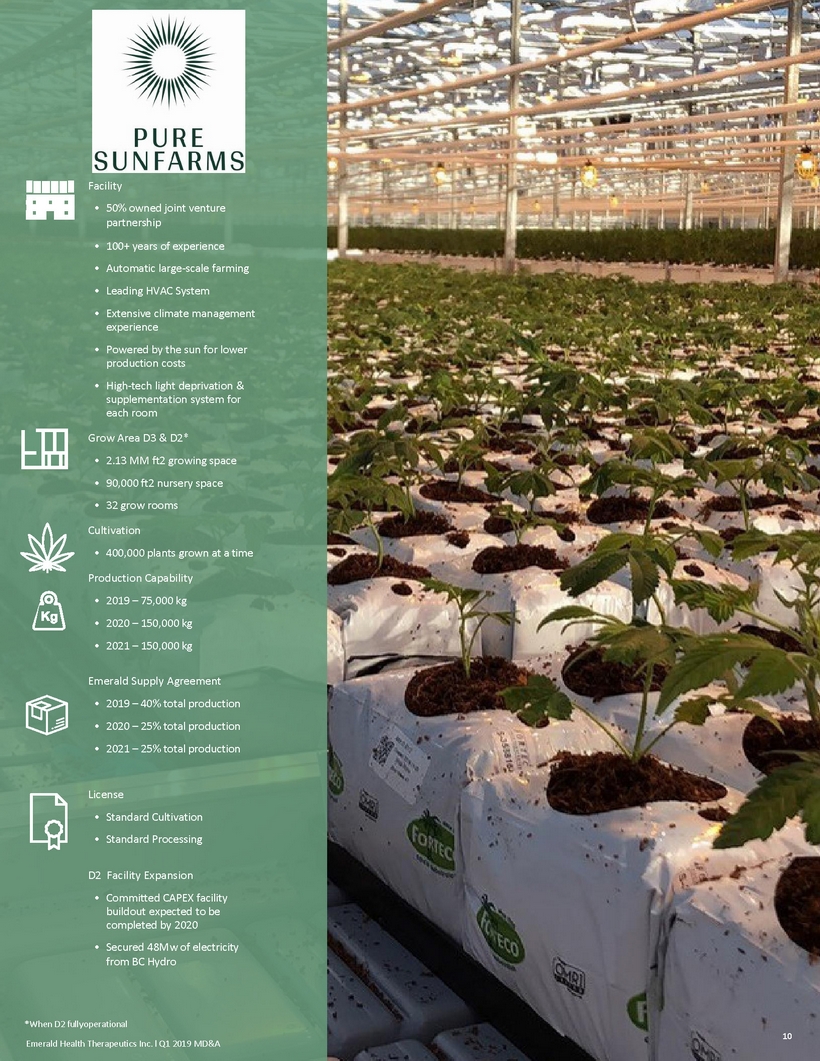

| (a) | 50% of the shares of Pure Sunfarms Corp. (the "Joint Venture"), a British Columbia-based licence holder under the Cannabis Act; and |

| (b) | 100% of the shares ofAvalite Sciences Inc. (formerly Northern Vine Canada Inc.) ("Avalite"), a British Columbia-based licenced dealer under the provisions of the Controlled Drugs and Substances Act (Canada) (the "CDSA") and a licence holder under the Cannabis Act. |

Development of Business in the first quarter of 2019

On January 10, 2019, the Company closed its acquisition of 51% of EHN and EHB granted EHN the exclusive Canadian distribution rights to EHB's endocannabinoid-supporting nutritional products which consist of nutritional supplements that use non-cannabis, non-psychoactive plant-based bioactive compounds to support the body's endocannabinoid system in exchange for 49% ownership of EHN. EHB is a partially-owned subsidiary of Emerald Health Sciences Inc. ("Sciences"), a control person of the Company, and is therefore a related party of the Company.

On January 10, 2019, the Company also announced the resignation of Chris Wagner as a director of the Company.

On January 15, 2019, the Company announced a secondary offering of 2,800,000 Common Shares by Sciences, a control person of the Company, which closed on January 16, 2019. After completion of the secondary offering, Sciences held approximately 28.6% of the Common Shares on a fully diluted basis.

On January 30, 2019, the Company announced that it had entered into a release, discharge and transaction agreement settling all claims made by Pivot Pharmaceuticals Inc. ("Pivot") against Verdélite and its former shareholders. The claims relate to a non-binding letter of intent which Verdélite and its former shareholders had previously entered into with Pivot with respect to a potential sale of Verdélite. Pursuant to the settlement, all claims against Verdélite have been discharged without Verdélite making any payment or providing any compensation to Pivot.

On February 5, 2019, the Company announced that it had entered into a binding licence agreement with Indena S.p.A. ("Indena"), an arm's length party, pursuant to which Indena granted the Company a perpetual exclusive licence for the use in Canada of Indena's CBD-extraction technology, and agreed to contract manufacturing services to the Company for CBD extraction. The Company has agreed to pay Indena a license fee of €450,000 (payable in two tranches of €250,000 and €200,000, respectively). The first payment is not payable until a definitive agreement has been entered into and the second payment is not payable until certain technological information has been transferred to the Company. The parties expect to enter into a definitive agreement upon completion of ongoing negotiations.

On February 8, 2019, the Company announced that the Joint Venture had been informed by the Ontario Cannabis Retail Corporation, operating as the Ontario Cannabis Store ("OCS"), that it had been selected to supply the OCS with Pure Sunfarms-branded cannabis products for the non-medical market in the province of Ontario.

On February 13, 2019, the Company announced thatthe Joint Venture had entered into a credit agreement with Bank of Montreal, as agent and lead lender, and Farm Credit Canada, as lender, in respect of a $20 million secured non-revolving term loan (the "Credit Facility"). The Joint Venture intends to use the funds available under the Credit Facility to finance the final costs of converting the Delta 3 Facility for cannabis production, the vast majority of which was completed in January 2019. The funds available under the Credit Facility may also be used by the Joint Venture for general corporate purposes. The Credit Facility, which matures on February 7, 2022, is secured by the Joint Venture's 1.1 million square foot space at the Delta 3 facility (the "Delta 3 Facility"), and contains customary financial and restrictive covenants. The Company is not a party to the Credit Facility, but has provided a limited guarantee in the amount of $10 million in connection with the Credit Facility. The Joint Venture has drawn the Credit Facility in full.

On March 13, 2019, the Company filed a final short form base shelf prospectus (the"2019 Base Shelf Prospectus") in each of the provinces of Canada. The 2019 Base Shelf Prospectus qualifies the issuance and secondary sale of up to $150,000,000 of Common Shares, preferred shares, debt securities, warrants, units or subscription receipts of the Company or a combination thereof from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the offering and as set out in an accompanying prospectus supplement, during the 25-month period that the 2019 Base Shelf Prospectus remains effective.

On March 27, 2019, the Company filed a prospectus supplement in connection with an at-the-market equity program("ATM Program") that it established with GMP Securities L.P. (the "Agent"). In connection with the ATM Program, the Company entered into an equity distribution agreement with the Agent. The ATM Program allows the Company to issue Common Shares from treasury having an aggregate gross sales price of up to $39 million to the public from time to time, at the Company's discretion, at the prevailing market price when issued on the TSXV or on any other marketplace for the Common Shares in Canada. The ATM Program is effective until the earlier of April 13, 2021 or completion of the sale of the maximum amount of shares thereunder. Sales of Common Shares will be made through "at-the-market distributions" as defined in National Instrument 44-102 –Shelf Distributions on the TSXV or on any other existing marketplace for the Common Shares in Canada. The Common Shares will be distributed at the prevailing market prices at the time of the sale and, as a result, prices may vary among purchasers and during the period of distribution. As at the date of this MD&A, the Company has issued an aggregate of 2,565,100 Common Shares under the ATM Program for gross proceeds of $10,043,680, with an average price of $3.92.

On March 29, 2019, the Company announced that it had fulfilled its first purchase order of cannabis from Yukon Liquor Corporation, signed a sales agreement with Alberta Gaming, Liquor and Cannabis and became registered by the Saskatchewan Liquor and Gaming Authority to supply cannabis to the Saskatchewan market.

Recent Developments and Events after the Reporting Period

On April 1, 2019, the Company announced that the Joint Venture had exercised its option to acquire from Village Farms International Inc. (“Village Farms”) a second 1.1 million square foot greenhouse (“Delta 2 Facility”) adjacent to the Delta 3 Facility. In connection therewith, the Company has agreed to advance a further $25 million to the Joint Venture in tranches as and when required, of which $2.5 million was advanced on April 1, 2019. The Company also entered into an agreement (the "JV Supply Agreement") with the Joint Venture to purchase 25% of its aggregate cannabis production from the Delta 2 Facility and the Delta 3 Facility in 2020, 2021 and 2022.

On April 3, 2019, the Company announced it had signed a letter of intent to supply cannabis to the Société Québécoise du Cannabis.The Company anticipates fulfilling its first supply order in the second quarter of 2019.

On April 8, 2019, the Company announced that its Verdélite facility had received its standard processing licence from Health Canada, allowing Verdélite to extract, manufacture, synthesize, test and sell cannabis products, in addition to its right to cultivate and sell cannabis flowers.

On April 23, 2019, the Company announced that the Joint Venture had completed planting of the final quadrants of the Delta 3 Facility.

On May 1, 2019, the Company announced that the vendors of Verdélite elected to receive $7.5 million of the $22.3 million they were to receive as the final payment for their shares of Verdélite in Common Shares valued on the five-day volume-weighted average price of the Common Shares TSXV, discounted 10%, calculated as of April 30, 2019. The Company agreed to pay the remaining $15 million of the purchase price to the vendors on or before May 30, 2019.

On May 14, 2019, the Company announced it had been authorized by PEI Cannabis and Manitoba Liquor and Lotteries Corporation to supply Emerald-branded cannabis products into those provinces.

On May 17, 2019, the Company announced that it shipped 6,000 40 ml bottles of its SYNC 25 CBD oil to the British Columbia Liquor Distribution Branch.

On May 21, 2019, the Company announced that the Joint Venture had received a standard processing license from Health Canada which permits it to extract and process cannabis at the Delta 3 Facility.

On May 22, 2019, the Company announced the appointment of Sean Rathbone as Chief Operating Officer.

On May 24, 2019, the Company announced that it had been appointed by the American Trade Association for Cannabis and Hemp to lead its International Affairs Council on CBD and Hemp in its engagement with the US Food & Drug Administration regarding policy pertaining to CBD-containing products and associated cross-border trade.

On May 27, 2019, the Company announced the completion of the issuance of 2,129,707 Common Shares to the vendors of Verdélite.

On May 27, 2019, the Company also announced that Punit Dhillon, a director of the Company, has temporarily stepped down as director of the Company to potentially expedite the Company's license application to Health Canada while Health Canada processes Mr. Dhillon's previously submitted normal course application for security clearance to meet the requirements for company directors under the Cannabis Act.

Financings

The table below summarizes the offerings conducted by the Company in the first quarter of 2019 and use of proceeds there from.

Offering /

Proceeds Raised | | Use of Proceeds – as disclosed prospectus

supplement | | Subsequent Use of Proceeds |

Between March 29, 2019 and May 29, 2019 Treasury Offering through ATM Program ($10,043,680) | | The Company currently intends to use the net proceeds from the ATM Program, if any, to fund a portion of the costs for the completion of its capital projects, for research and development, working capital and general corporate purposes. | | The funds are being used to fund completion of the Richmond and Verdélite facilities, as well as the Delta 2 expansion. |

Licences

The Company holds licences from Health Canada under the Cannabis Act to produce and sell cannabis products in accordance with applicable laws in Canada. When the Cannabis Act came into force on October 17, 2018, the Company's licences, which were issued under theAccess to Cannabis for Medical Purposes Regulations, the predecessor legislation to the Cannabis Act, were deemed to be their functionally equivalent licences under the Cannabis Act (the "Licenses"). The Company currently indirectly holds a number of Licences through its wholly owned direct and indirect subsidiaries, EHTC, Verdélite and Avalite, as well as others which are held by the Joint Venture. The Licences held by EHTC permit it to cultivate cannabis and produce and sell dried cannabis, cannabis oils, cannabis plants and cannabis seeds; the Licence held by Verdélite permits it to cultivate, extract, manufacture, synthesize, test and sell cannabis; the Licence held by Avalite permits it to process cannabis and produce cannabis oil; and the Licences held by the Joint Venture permit it to cultivate cannabis and produce and sell dried cannabis, cannabis oils, cannabis plants and cannabis seeds, all in accordance with the terms and conditions specified in the applicable Licence and the Cannabis Act.

Disclosure of Outstanding Share Data

The Company’s authorized share capital consists of an unlimited number of Common Shares of which 142,861,436 were issued and outstanding as of March 31, 2019 and 147,408,197 were issued and outstanding as of May30, 2019.

During the three months ended March 31, 2019, the Company granted an aggregate of 468,000 stock options to directors, employees and consultants. Each option is exercisable into one Common Share for a period of up to five years. The exercise prices at the time of the grants ranged from $2.83 and $3.93 per share. Subsequent to the period ended March 31, 2019, the Company granted an additional 4,915,000 stock options, with exercise prices between $4.04 and $4.15. These options vest over three years with an expiry date five years from the grant date.

There were 8,839,713 stock options and 475,000 restricted share units outstanding as of March 31, 2019. As of May30, 2019, there were 13,463,931 stock options and 950,000 restricted share units outstanding.

There were 8,411,764 warrants outstanding as of March 31, 2019 and as of May30, 2019.

Summary of Quarterly Results

The financial information in the following tables summarizes selected financial information for the Company for the last eight quarters which was derived from annual financial statements prepared in accordance with IFRS or interim financial statements prepared in accordance with IFRS applicable to the preparation of interim financial statements,IAS 34, Interim Financial Reporting:

| 2019 | 2018 |

| | March 31

($)* | December 31

($) | September 30

($) | June 30

($) |

| Revenue | 2,609,559 | 1,131,853 | 321,070 | 284,262 |

| Share-based payments | 2,022,614 | 1,296,891 | 2,165,851 | 2,081,661 |

| Interest income | 638,310 | 438,974 | 222,740 | 274,436 |

| Share of gain from Joint Venture | 5,812,219 | 1,432,771 | 3,940,373 | 682,431 |

| Gain on changes in the fair value of the Company’s biological assets | 718,431 | 144,181 | 1,302,377 | 978,893 |

| Net Loss | (3,648,683) | (13,900,360) | (6,426,658) | (5,610,970) |

| Net Loss per share (basic and diluted) | (0.03) | (0.10) | (0.05) | (0.04) |

| | 2018 | 2017 |

| | March 31

($) | December 31

($) | September 30

($) | June 30

($) |

| Revenue | 373,218 | 279,362 | 211,316 | 245,708 |

| Share-based payments | 1,954,047 | 1,979,553 | 271,968 | 369,788 |

| Interest income | 250,064 | 43,024 | 60,997 | 57,497 |

| Share of gain (loss) from Joint Venture | 301,793 | (44,562) | (278,016) | - |

| Gain on changes in the fair value of the Company’s biological assets | 392,991 | 44,883 | 64,307 | 53,985 |

| Net Loss | (5,045,420) | (4,027,569) | (1,939,371) | (1,669,026) |

| Net Loss per share (basic and diluted) | (0.04) | (0.04) | (0.02) | (0.02) |

*Quarter was prepared using IFRS 16

Included in the share of gain from the Joint Venture for the three months ended March 31, 2019, is an unrealized gain of $4,560,234 (March 31, 2018 - $Nil) on the changes in the fair value of the Joint Venture’s biological assets.

Results of Operations

Quarter ended March 31, 2019

The net loss for the quarter ended March 31, 2019, was $3.6 million (loss of $0.03 per share), compared to the net loss of $5.0 million (loss of $0.04 per share) for the same quarter in the prior year. Diluted loss per share is the same as basic loss per share as the outstanding options and warrants have an anti-dilutive effect on the loss per share.

Factors contributing to the net loss for the three-month period ended March 31, 2019 include the following:

Revenue

Revenue for the quarter ended March 31, 2019, was $2,609,559 compared to $373,218 for the same period in the prior year. The revenue for the three months ended March 31, 2019 demonstrated the Company’s continued growth in the market. As compared with the previous three months ended December 31, 2018, the Company’s revenue increased 131%, substantially as a result of having a full three months’ sales of recreational cannabis following the Cannabis Act taking effect mid-way through the prior quarter. During the three months ended March 31, 2019, the Company began its first recreational shipments to wholesalers in Ontario and Yukon. The Company also had a larger medical client base and a greater percentage of medical sales from oils in the current period resulting in an increase in revenue compared to the prior year. For the quarter ended March 31, 2019, revenue was comprised of approximately 87% dried product and 13% oils, compared to approximately 77% dried product, 20% oils and 3% other in the quarter ended December 31, 2018.

| | Three months ended |

| March 31, 2019 | December 31, 2018 |

| Average selling price of adult-use dried flower per gram | $4.98 | $5.19 |

| Kilograms sold of adult-use dried flower | 376 | 122 |

| Average selling price of medical dried flower per gram & gram equivalents | $7.17 | $8.10 |

| Kilograms sold of medical dried flower & kilogram equivalents | 59 | 55 |

| Total kilograms produced of dried flower | 212 | 175 |

Cost of Sales

Cost of goods sold consists of three main categories: (i) production costs, which includes cost of goods sold expensed from inventory, (ii) change in the fair value of biological assets, and (iii) amortization of the Health Canada licenses.

Cost of goods sold represents the deemed cost of inventory that arose from the fair value measurement of biological assets, subsequent post-harvest costs capitalized to inventory, purchased dried cannabis, costs to produce cannabis oils capitalized to inventory (including the deemed cost of dried inventory that arose from the fair value measurement of biological assets that were used to produce cannabis oils), and packaging costs.In addition, all inventory costs in excess of net realizable value are expensed to cost of sales. Cost of goods sold expensed to inventory for the quarters ended March 31, 2019 and March 31, 2018 was $2,704,521 and $305,527, respectively. The significant increase in cost of sales in the current period was substantially in line with the increase in the amount of product sold by the Company compared to the prior period.

Production costs include all direct and indirect production related costs, including security, compliance, quality control and quality assurance costs, as well as related overhead until the point of harvest. During the quarter ended March 31, 2019, the Company incurred production costs of $877,233 versus $175,646 in the quarter ended March 31, 2018. The significant increase in production costs is substantially attributable to the increase in operating expenses associated with the acquired subsidiaries and the related increase in the number of plants cultivated and staff required for production activities. During the three months ended March 31, 2019, the Company also recognized $479,679 in excise taxes. The excise tax attributable to medical sales was absorbed by the Company.

The change in biological assets for the quarter ended March 31, 2019 was a gain of $718,431compared to a gain of $392,991in the same quarter in the prior year. The increase is substantially due to the number of plants that were growing in the Verdélite facility during the three months ended March 31, 2019.

The amortization of the Health Canada license represents the amortization of an acquired license pertaining to the Verdélite facility that is recorded at cost less accumulated amortization. Amortization will be expensed as a cost of sales and the unamortized balance will remain on the Company’s balance sheet as an intangible asset.The amortization of the license is recognized on a straight-line basis irrespective of either production or sale of cannabis from that facility.

The Company measures biological assets consisting of cannabis on plants at fair value less cost to sell up to the point of harvest, which becomes the basis for the cost of finished goods inventories after harvest. Seeds are measured at fair market value, except for a portion which are restricted with respect to distribution due to the conditions under which they were acquired that are measured at cost. The significant assumptions used in determining the fair value of cannabis plants are as follows: plant waste rate for various stages of development; yield per plant; selling price less costs to sell; percentage of total expected costs incurred to date; and costs incurred for each stage of plant growth.

Because gains recognized in the fair value of biological assets are recorded in a manner that decreases the cost of goods sold, gross margin is impacted significantly during periods of significant expansion in the cultivation area, as was the case during the three months ended March 31, 2019, when costs of sales was $3,783,270 as compared to the three months ended March 31, 2018 of $88,182.

Other expenses

General and Administrative –During the quarter ended March 31, 2019, the Company incurred general and administrative expenses of $4.1 million versus $2.6 million for the quarter ended March 31, 2018. The significant increase in expenses in this period as compared to the same period in 2018 was largely due to the increase in salaries, wages and benefits associated with an increased headcount from acquisitions and continued expansion of the Company’s capacity to meet the increasing demand for the Company’s products. In the quarter ended March 31, 2019, general and administrative costs included; salaries and benefits of $1,397,502 (March 31, 2018 - $381,612), consulting and professional services fees of $1,074,927 (March 31, 2018 - $1,550,409 ), investor relations fees of $584,828 (March 31, 2018 - $347,769), office and general of $1,028,916 (March 31, 2018 - $256,827) and travel and accommodation of $55,309 (March 31, 2018 - $75,389). Included in consulting and professional service fees, for the quarter ended March 31, 2019, is $487,500 in management fees to Sciences, a control person of the Company, as per the amended independent contractor agreement between the Company and Sciences effective January 2018.

Sales and marketing– In the quarter ended March 31, 2019, the Company incurred sales and marketing expenses of $924,706 versus $285,897 in the comparable 2018 prior period. The current period increase reflects the increase in sales and marketing staff and activities as the Company works towards branding itself and launching products into the legal adult use market.

Research and development– In the quarter ended March 31, 2019, the Company incurred research and development expenses of $927,802 (three months ended March 31, 2018 - $97,544). Research and development projects in the current quarter include development and testing of processes to manufacture new products and designing clinical trials. The prior comparable period included research on cannabis oils and early stage planning for clinical trials.

Share-based compensation – In the quarter ended March 31, 2019, the Company incurred share-based compensation expenses of $2,022,614 versus $1,954,047 in the comparable 2018 prior period. The amounts are compensation expenses related to employee, director and consultant incentive stock options and restricted share units which are measured at fair value at the date of grant and expensed over the vesting period. During the current quarter, the Company granted 468,000 stock options to directors, employees and consultants.

Share of income from joint venture – In the quarter ended March 31, 2019, the Company recognized $5,812,219 as its 50% share of the income from the Joint Venture, compared to $301,793 as its 50% share of the loss in the quarter ended March 31, 2018. The Joint Venture commenced operations during the three months ended December 31, 2017 and has since begun producing cannabis for sale, having received its cannabis sales license from Health Canada on July 27, 2018. Net income from the Joint Venture was $11,427,642, which included a net fair value gain of $8,114,017 for the quarter ended March 31, 2019 versus $Nil in the comparable 2018 prior period.

Additional Disclosure for Venture Issuers Without Significant Revenue

As the Company did not have significant revenue from operations in either of its last two financial years, the following is a breakdown of the material costs incurred:

| | For the three months ended

March 31, 2019

($) | For the three months

ended March 31, 2018

($) |

| Expensed research and development costs | 927,802 | 97,544 |

| General and administrative expenses | 4,141,480 | 2,612,006 |

| Purchase of plant and equipment | 6,012,661 | 2,613,401 |

Liquidity and Capital Resources

The Company continually monitors and manages its cash flow to assess the liquidity necessary to fund operations and capital projects. The Company manages its capital resources and adjusts it to take into account changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust its capital resources, the Company may, where necessary, control the amount of working capital, pursue financing or manage thetiming of its capital expenditures. As at March 31, 2019, the Company had negative working capital of $12.9 million, substantially attributable to the decision taken during the quarter to support the Joint Venture’s exercising of its option to Delta 2 Facility, which required a $25 million dollar commitment from the Company with $2.5 million being paid on closing of the exercise of the option and the remainder to be advanced in tranches as needed to cover initial construction costs which are estimated to be approximately $60 million. Subsequent to March 31, 2019, the Company has raised gross proceeds of $10,043,680 of equity financing through the ATM Program. Management continues to closely monitor its cash flows and, as necessary, will seek additional equity and debt financing to offset the working capital deficit.

While the Company has incurred losses to date, management anticipates long-term future profitability of the business, though there can be no assurance that the Company will gain adequate market acceptance for its products or be able to generate sufficient gross margins to reach profitability.

The Company has committed to various projects which may require significant cash injections over the next 24 months, including the expansion of service and production facilities of Avalite, the Delta 2 Facility retrofit and potentially the exercise of the option for the Delta 1 Facility; the Company’s new production facility in Richmond, British Columbia; and Verdélite’s indoor grow facility. As atMarch 31, 2019, the Company committed to payments of $5.0 million during the remainder of 2019 for the supply of material and labour to build greenhouses at the Richmond site. The Company also committed $25 million to the Joint Venture in support of the Delta 2 Facility retrofit, of which $6.4 million has been advanced as at May 30, 2019.

The Company is obligated to pay an additional $15.0 million cash on May 30, 2019, under the Verdélite purchase agreement as modified and announced by the Company on May 1, 2019.

The Company is committed to contributing $5.0 million cash to EHN in exchange for its 51% initial ownership in EHN.

Operating, Investing and Financing Activities

The chart below highlights the Company’s cash flows:

| For the three months

ended March 31, 2019

($) | For the three months

ended March 31, 2018

($) |

| Net cash provided by (used in): | | |

| Operating activities | $(8,866,142) | ($3,358,422) |

| Investing activities | $(9,483,180) | ($6,742,824) |

| Financing activities | $(2,028,050) | $55,081,616 |

| Increase (decrease) in cash | $(20,377,372) | $44,980,370 |

Cash used in operating activities for the three-month period ended March 31, 2019 was $8.9 million, compared to cash used of $3.4 million in the comparative period the prior year. During the three months ended March 31, 2019, the Company recognized an increase in general and administrative expenditures as a result of additional staff costs, an increase in sales and marketing expenditures due to expanded market penetration and staff, and cash outflows from the payments of current liabilities as compared to the three months ended March 31, 2018. The Company incurred greater losses during the period as a result of the continued staffing increases and infrastructure required to support the substantial increase in cannabis sales expected from the legalization of the adult-use cannabis market as well as the ramp up of its acquisitions into operating entities.

Cash used in investing activities for the three-month period ended March 31, 2019was $9.5 million, compared to cash used of $6.7 million in the comparative period in the prior year. During the three months ended March 31, 2019:

| · | $2.8 million was used to invest in the Joint Venture; |

| · | $3.1 million was used in construction of the new production facility at the Richmond site; |

| · | $3.0 million was used to complete the renovations on the Verdélite site, and to purchase lab extraction and other equipment; |

| · | $0.4 million was used to invest in EHN; and |

| · | $0.2 million was used in the research and preparation of 17 patents. |

Cash used in financing activities for the three months ended March 31, 2019 was $2.0 million, compared to cash provided of $55.1 million in the three months ended March 31, 2018. Cash generated during the three months ended March 31, 2019 included $0.8 million from stock option exercises. Offsetting these positive sources of cash flow was a $2.5 million expenditure to retire the mortgage acquired as a part of the Verdélite acquisition and $0.2 million share issuance costs in connection with the ATM Program.

Financial Risk Management

The Company’s board of directors has overall responsibility for the establishment and oversight of the Company’s risk management policies on an annual basis. Management identifies and evaluates the Company’s financial risks and is charged with the responsibility of establishing controls and procedures to ensure financial risks are mitigated in accordance with the approved policies.

Measurement Uncertainty and Impairment Assessments

As of March 31, 2019, management of the Company has determined that no impairment indicators of its assets were present and no additional impairment write-downs in excess of those that had been previously recorded were required. Management continues to review each of its assets for indications of impairment.

Transactions with Related Parties

The Company has entered into transactions with a control person of the Company, a wholly owned subsidiary of such control person, a company controlled by the Company’s Executive Chairman, a company whose CEO is also a director of the Company, and the Joint Venture as more particularly described in the Company’s annual information form dated April 30, 2019.

During the three months ended March 31, 2019, the Company entered into or maintained the following transactions with related parties.

With Emerald Health Sciences Inc.

The Company entered into a management agreement with Sciences, a control person of the Company, in May 2015, which has subsequently been amended, most recently in January 2018, under which the Company pays Sciences $350,000 per month. During the three months ended March 31, 2019, the Company recorded $562,500 in research and development costs and $487,500 in general and administrative fees.

The Company’s relationship with Sciences allows it to advance the development of its business faster and with fewer resources than would otherwise be possible, and with the benefit of strategic guidance and expertise in the cannabis industry. Sciences is focused on the medicinal potential of cannabis and cannabinoids with investment goals designed to leverage the scientific rigor, federal regulatory compliance, and life-science expertise of its entire Emerald leadership group. Sciences draws upon a large network of professionals with life sciences related expertise, including corporate pharmaceutical and biotechnology management, business development, product development and marketing experience, research scientists, medical doctors, naturopathic doctors, and lawyers - many with deep subject matter expertise in cannabis and the endocannabinoid system - to leverage the Company’s ability to conduct research and development, develop intellectual property, attract talent, manage operations, conduct mergers and acquisitions, and raise capital.

With access to these services, the Company has been able to identify and select new business opportunities, successfully negotiate and develop key strategic partnerships, and efficiently secure capital for the Company.

Management periodically evaluates the terms of the management agreement for reasonableness and adjusts the fee based on that evaluation.

As at March 31, 2019, Sciences held an aggregate of 40,434,242 Common Shares, representing approximately 28% of the issued and outstanding Common Shares and it held 4,411,764 common share purchase warrants of the Company.

On May 30, 2019, the Company entered into a loan agreement with Sciences, whereby Sciences agreed to loan funds to the Company, in amounts and times agreed to by the parties. Amounts loaned bear interest at 10% per annum and are repayable on demand.

With a company controlled by the Company’s Executive Chairman

In 2017, the Company entered into a 30-year lease with a company (the “Landlord”) that is controlled by Avtar Dhillon, MD, the Executive Chairman of the Company with respect to land in Metro Vancouver, British Columbia on which the Company is constructing its new production facility. The lease amount of $80,000 per quarter was determined by an independent valuation. The Landlord was reimbursed by the Company for $158,541 for development fees and services related to the construction of the Company’s new facility during the three months ended March 31, 2019 (2018 - $25,720).

With a company whose CEO is also a director of the Company

As at March 31, 2019, the Company holds 1,666,667 common shares and 1,666,667 common share purchase warrants of Avricore Health Inc. (“Avricore”) (formerly VANC Pharmaceuticals Inc.) for investment purposes. The Chief Executive Officer of Avricore is also a director of the Company.

The 1,666,667 common shares of Avricore held by the Company represent 3.7% of the issued and outstanding common shares of Avricore as at the date of this MD&A. Upon exercise of the common share purchase warrants of Avricore, the Company would hold 3,333,334 common shares of Avricore, representing 7.3% of the issued and outstanding common shares of Avricore, assuming no other share issuances. Naturals holds 3,030,303 common share purchase warrants of Avricore.

With the Company’s joint venture

The Company also has entered into related party transactions with the Joint Venture including the entering into of the JV Supply Agreement on April 1, 2019. As at March 31, 2019, the Joint Venture owes the Company $2.0 million for expenditures made on behalf of the Joint Venture. These expenditures were made to facilitate the administration of the retrofit of the Delta 3 Facility and Health Canada license application. As of March 31, 2019, the Company owes to the Joint Venture $2.9 million (March 31, 2018 - $nil) for inventory that was paid for subsequent to March 31, 2019.

Proposed Transactions

There are no material decisions by the Company’s board of directors with respect to any imminent or proposed transactions that have not been disclosed herein.

Critical Accounting Policies and Estimates

Included in Note 3 of the Company’s audited consolidated financial statements for the years ended December 31, 2018 and 2017 are the accounting policies and estimates that are critical to the understanding of the business operations and results of operations. Included in Note 3 of the Company’s audited consolidated financial statements for the years ended December 31, 2018 and 2017 are the accounting policies and estimates that are critical to the understanding of the business operations and results of operations. Included in Note 4 of the Company’s audited consolidated financial statements for the year ended December 31, 2018 and 2017 are new accounting policies and changes to existing accounting policies adopted during the current year.

Changes in Accounting Standards not yet Effective

Refer to Note 5 of the Company’s audited consolidated financial statements for the years ended December 31, 2018 and 2017 for additional information on several new standards, amendments to standards and interpretations, which are not effective yet, and have not been applied in preparing these consolidated financial statements but may affect the Company when applied in the future.

Off-Balance Sheet Arrangements

The Company has not entered into any material off-balance sheet arrangements such as guarantee contracts, contingent interests in assets transferred to unconsolidated entities, derivative financial obligations, or with respect to any obligations under a variable interest equity arrangement.

Risks and Uncertainties

The Company’s actual results may differ materially from those expected or implied by the forward-looking statements and forward-looking information contained in this interim management discussion and analysis due to the proposed nature of the Company’s business and its present stage of development. A non-exhaustive list of risk factors associated with the Company are discussed in detail under the heading “Risk Factors” in the Company’s annual information form dated April 30, 2019.

Forward-Looking Statements

Certain statements contained in this MD&A constitute forward-looking statements. These statements relate to future events or future performance, business prospects or opportunities of the Company. All statements other than statements of historical fact may be forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "forecast", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions) are not statements of historical fact and may be "forward-looking statements".

Examples of forward-looking statements in this MD&A include, but are not limited to, statements in respect of: the entering into of a definitive agreement with Indena and payments thereunder; distributions of Common Shares under the ATM Program; expected date of supply of cannabis toSociété Québécoise du Cannabis; PEI Cannabis and Manitoba Liquor and Lotteries Corporation the exercise by the Joint Venture of the option to lease or purchase the Delta 1 Facility from Village Farms; the retrofit of the Delta 2 Facility; the expansion of the Company's operations in Metro Vancouver, British Columbia; payment of an additional $15.0 million in cash in respect of the acquisition of Verdélite; the Company's intention to use proceeds of financings including the ATM Program to fundthe completion of capital projects and potential future expansion and acquisitions, including partnership transactions, for research and development and to expand the Company's existing extraction capabilities, and for working capital and general corporate purposes;potential proceeds from the exercise of the Company's outstanding common share purchase warrants;actions taken by the Company to maintain or adjust its capital structure;management's anticipation of long-term future profitability;the Company's intentions to acquire and/or construct additional cannabis production and manufacturing facilities and to expand the Company's marketing and sales initiatives; benefits received by the Company from its transactions with Sciences, a control person of the Company, and the opportunities that such transactions provide; and the effect that each risk factor will have on the Company.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The reader of these statements is cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. These forward-looking statements involve risks and uncertainties relating to, among others: market price of cannabis; securing product supply; continued availability of capital financing and general economic, market or business conditions; reliance on Licenses issued to the Company and its subsidiaries and its ability to maintain these licenses; regulatory risks relating to the Company's compliance with the Cannabis Act; regulatory approvals for expansion of current production facility, development of new production facilities and greenhouse retrofits by the Company and the Joint Venture; the Company's ability to execute a definitive agreement with Indena; changes in laws, regulations and guidelines; changes in government; changes in government policy; increased competition in the cannabis market; the limited operating history of the Company; the Company's reliance on key persons; failure of counterparties to perform contractual obligations; difficulties in securing additional financing; unfavourable publicity or consumer perception of the cannabis industry; the impact of any negative scientific studies on the effects of cannabis; demand for labour; difficulties in construction or in obtaining qualified contractors to complete greenhouse retrofits; actual operating and financial performance of facilities, equipment and processes relative to specifications and expectations; results of litigation; the Company's ability to develop and commercialize pharmaceutical products; failure to obtain regulatory approval for pharmaceutical products; changes in the Company's over-all business strategy; restrictions of the TSXV on the Company's business; and the Company's assumptions stated herein being correct. See "Risks and Uncertainties" in this MD&A and other factors described in the Company's Annual Information Form under the heading "Risk Factors".

The Company believes that the expectations reflected in any forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in, or incorporated by reference into, this MD&A should not be unduly relied upon. These statements speak only as of the date of this MD&A. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws. Actual results may differ materially from those expressed or implied by such forward-looking statements.