Exhibit 99.1

ANNUAL INFORMATION FORM

For the year ended December 31, 2019

Date: May 13, 2020

TABLE OF CONTENTS

| |

| PRELIMINARY NOTES | 1 |

Date of Information | 1 |

Financial Information | 1 |

| FORWARD-LOOKING INFORMATION | 1 |

Currency and Exchange Rate Information | 3 |

| MEANING OF CERTAIN REFERENCES | 3 |

| CORPORATE STRUCTURE | 3 |

Name, Address and Incorporation | 3 |

Intercorporate Relationships | 3 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 5 |

Three Year History | 5 |

| DESCRIPTION OF BUSINESS | 14 |

General Description of the Business | 14 |

Risk Factors | 25 |

| DIVIDENDS | 46 |

| CAPITAL STRUCTURE | 46 |

Common Shares | 46 |

Preferred Shares | 46 |

Convertible Debentures | 47 |

Warrants | 47 |

Stock Options | 47 |

Restricted Share Units | 48 |

| MARKET FOR SECURITIES | 48 |

Trading Price and Volume | 48 |

| PRIOR SALES | 48 |

Convertible Debentures | 48 |

Warrants | 49 |

Stock Options | 49 |

Restricted Stock Units | 49 |

| DIRECTORS AND OFFICERS | 49 |

Name, Occupation and Security Holdings | 49 |

Director Biographies | 51 |

Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 53 |

- ii -

| |

Conflicts of Interest | 54 |

| AUDIT COMMITTEE INFORMATION | 54 |

Audit Committee Mandate | 54 |

Composition of the Audit Committee | 54 |

Relevant Education and Experience | 55 |

Reliance on Certain Exemptions | 55 |

Audit Committee Oversight | 55 |

Pre-Approval Policy and Procedures | 55 |

External Auditor Service Fees | 56 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 56 |

Legal Proceedings | 56 |

Regulatory Actions | 56 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 56 |

| TRANSFER AGENT AND REGISTRAR | 57 |

| MATERIAL CONTRACTS | 57 |

| INTERESTS OF EXPERTS | 57 |

| ADDITIONAL INFORMATION | 57 |

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form ("AIF") of Emerald Health Therapeutics, Inc. (the "Company") is as of December 31, 2019.

Financial Information

The Company's financial results are prepared and reported in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and are presented in Canadian dollars.

FORWARD-LOOKING INFORMATION

Certain statements contained in this AIF constitute forward-looking information or forward-looking statements under applicable securities laws (collectively, "forward-looking statements"). These statements relate to future events or future performance, business prospects or opportunities of the Company that are based on forecasts of future results, estimates of amounts not yet determined and assumptions of management made in light of management's experience and perception of historical trends, current conditions and expected future developments. All statements other than statements of historical fact may be forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "forecast", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions) are not statements of historical fact and may be "forward-looking statements".

Examples of forward-looking statements in this AIF include, but are not limited to, statements in respect of: the approval of Licence (as defined below) applications submitted to Health Canada; the Company's intention to significantly increase its production of cannabis and cannabis oils through a multi-phase expansion plan; the building of a Health Canada licensed production facility to expand growing capability; the development of the Joint Venture (as defined below) as a standalone entity; the rapid and cost effective acceleration of cannabis production by the Joint Venture; the exercise by the Joint Venture of options to lease or purchase additional greenhouses from Village Farms (as defined below); the potential aggregate production capacity of the Delta 1 greenhouse, the Delta 2 Facility (as defined below) and the Delta 3 Facility, all of which are located in Delta, British Columbia; the use of the Amended Credit Facility (as defined below) by the Joint Venture; the expansion of the Company's operations in Richmond, British Columbia and the costs associated with such expansion; the Company's expectation of requirements for quantities of CBD (as defined below); payment of additional amounts in respect of the acquisition of the Verdélite Entities (each as defined below); the Company's expectation that the acquisition of Verdélite will strengthen its ability to market products in Quebec and Eastern Canada; the high-yield production of the Verdélite Facility; the potential sale of Avalite; the Company's use of proceeds of financings; the suitability of infrastructure at the facility of FTI (as defined below) and FTI's extraction of hemp biomass into CBD oil on behalf of the Company; the services to be provided by FTI to the Company; the entering into of an exclusive agreement between EHN (as defined below) and FTI; the entering into of definitive agreements with the Company's business partners; the approval of patent applications that have been submitted by the Company; potential proceeds from the exercise of the Company's outstanding common share purchase warrants and options; actions taken by the Company to maintain or adjust its capital

- 2 -

structure; increases to the Company's plant diversity and product offering; improvements to the Company's cultivation, manufacturing and standardization processes; partnerships with professional organizations in connection with educating medical doctors and other healthcare professionals about cannabis products; the development of distribution channels for non-medical cannabis products in Canada; anticipated long-term future profitability of the Company; potential effects of regulations under the Cannabis Act (as defined below) and related legislation introduced by provincial governments; the undertaking of clinical research to study the effects of the Company's products on client health; the Company's longer term strategy of becoming a leading provider of quality products for the broader adult recreational cannabis market; the ability of the Company to take advantage of the legalization of adult-use recreational cannabis products; the Company's intentions to acquire and/or construct additional cannabis production and manufacturing facilities and to expand the Company's marketing initiatives both in Canada and internationally; the Company building valuable intellectual property in Canada which could lead to accelerated sales growth and profit margins; the offering of additional cannabis products; and future sales opportunities in other emerging medical markets and the effect that each risk factor will have on the Company.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The investor is cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. These forward-looking statements involve risks and uncertainties relating to, among others: the market price of cannabis; ability of the Company to secure cannabis supply; continued availability of capital financing and general economic, market or business conditions; reliance on licences to produce and sell cannabis and cannabis oils issued to the Company under the Cannabis Act and its ability to maintain these licences; regulatory risks relating to the Company's compliance with the Cannabis Act; failure to obtain regulatory approvals for expansion of the Company's current production facilities, development of new production facilities and greenhouse retrofits by the Company and the Joint Venture; Avalite's reliance on its dealer licence issued to it under the CDSA (as defined below) to provide analytical testing of cannabis and importation of CBD and its ability to maintain this licence; the Company's ability to execute its multi-phase expansion plan and its plans with the Joint Venture; failure to execute a definitive agreement with FTI; changes in laws, regulations and guidelines; changes in government; changes in government policy; increased competition in the cannabis market in Canada and internationally; the limited operating history of the Company; the Company's reliance on key persons; failure of counterparties to perform contractual obligations; failure to obtain additional financing; unfavourable publicity or consumer perception of the Company and the cannabis industry; the impact of any negative scientific studies on the effects of cannabis; demand for labour; difficulties in construction or in obtaining qualified contractors to complete expansion projects and greenhouse retrofits; impact of any recall of the Company's products; actual operating and financial performance of facilities, equipment and processes relative to specifications and expectations; results of litigation; the Company's ability to develop and commercialize pharmaceutical or nutraceutical products; failure to obtain regulatory approval for pharmaceutical or nutraceutical products; changes in the Company's over-all business strategy; stock exchange rules or policies which may restrict the Company's business; and the Company's assumptions stated herein being correct. Additional factors that could cause actual results to differ materially include, but are not limited to, the risk factors described herein and as discussed in the Company's financial statements and other filings, under the heading "Risk Factors".

The Company believes that the expectations reflected in any forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking

- 3 -

statements included in this AIF should not be unduly relied upon. These statements speak only as of the date of this AIF. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws. Actual results may differ materially from those expressed or implied by such forward-looking statements.

Currency and Exchange Rate Information

All dollar amounts (i.e. "$"), unless otherwise indicated, are expressed in Canadian dollars and United States dollars are referred to as "US$".

MEANING OF CERTAIN REFERENCES

For simplicity, the Company uses terms in this AIF to refer to the investments and operations of the Company and its direct and indirect subsidiaries as a whole. Accordingly, in this AIF, unless the context otherwise requires, the "Company" is referring to Emerald Health Therapeutics, Inc., its direct and indirect subsidiaries and the Company's joint venture with Village Farms International Inc. ("Village Farms"), Pure Sunfarms Corp. (to the extent applicable).

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated pursuant to the Business Corporations Act (British Columbia) on July 31, 2007 as Firebird Capital Partners Inc. and changed its name to Firebird Energy Inc. in December 2012. On September 4, 2014, the Company completed the acquisition of all of the issued and outstanding common shares of Thunderbird Biomedical Inc. ("Thunderbird"), by way of a reverse takeover (the "RTO") under the rules of the TSX Venture Exchange (the "TSXV") and concurrently changed its name to T-Bird Pharma, Inc. At that time, Thunderbird became a wholly-owned subsidiary of the Company. In June 2015, the Company changed its name to Emerald Health Therapeutics, Inc. and Thunderbird changed its name to Emerald Health Botanicals Inc. On February 23, 2018, Emerald Health Botanicals Inc. changed its name to Emerald Health Therapeutics Canada Inc. (the "Operating Subsidiary").

The Company is headquartered in Vancouver, British Columbia, with its head office located at Suite 210 -800 West Pender Street, Vancouver, British Columbia V6C 1J8 and its registered office located at Suite 2500 - 666 Burrard Street, Vancouver, British Columbia, V6C 2X8.

The Company is a reporting issuer in each of the provinces of Canada, and not in any other jurisdiction and its common shares (the "Common Shares") are listed on the TSXV under the trading symbol "EMH". The Company is classified as a Tier 1 Venture Issuer on the TSXV. The Common Shares also quoted for trading on the OTCQX International Marketplace under the trading symbol "EMHTF".

Intercorporate Relationships

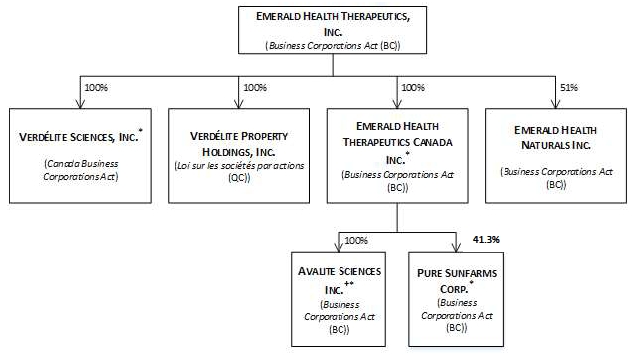

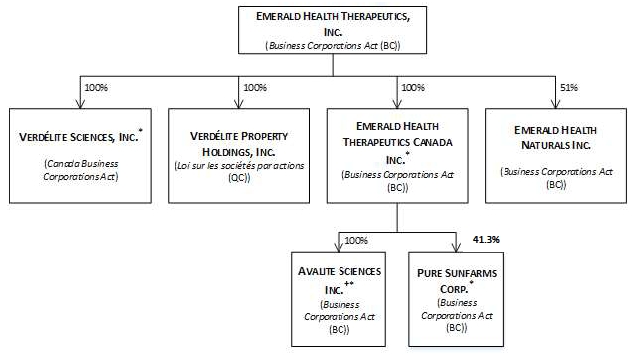

The Company owns:

| | (a) | 100% of the shares of the Operating Subsidiary, a British Columbia-based licence holder under the Cannabis Act (Canada) (the"Cannabis Act"); |

- 4 -

| | (b) | 100%of the shares of Verdélite Sciences, Inc. (formerly, Agro-Biotech Inc.) ("Verdélite"), a Quebec-based licence holder under the Cannabis Act; |

| | | |

| | (c) | 100% of the shares of Verdélite Property Holdings,Inc. (formerly, Agro-Biotech Property Holdings Inc.) ("Verdélite Holdings"), a Quebec-based holding corporation that owns the Verdélite Facility (as defined below); and |

| | | |

| | (d) | 51% of the shares of Emerald Health Naturals Inc. ("EHN"), a joint venture between the Company and Emerald Health Bioceuticals, Inc. ("EHB"). |

The Company, through the Operating Subsidiary, also holds:

| | (a) | approximately 41.3% of the shares of Pure Sunfarms Corp. (the "Joint Venture"), a British Columbia-based licence holder under the Cannabis Act;and |

| | | |

| | (b) | 100% of the shares of Avalite Sciences Inc. (formerly Northern Vine Canada Inc.) ("Avalite"), a British Columbia-based licenced dealer under the provisions of the Controlled Drugs and Substances Act (Canada) (the "CDSA") and a licence holder under the Cannabis Act. |

See "General Development of the Business" and "Description of the Business" for a description of the business of each of the Company's subsidiaries and joint ventures.

The following chart illustrates the Company's corporate structure.

Notes:

| |

| * | Indicates a licence holder under the Cannabis Act. |

| + | Indicates a licenced dealer under the CDSA. |

- 5 -

GENERAL DEVELOPMENT OF THE BUSINESS

The principal business of the Company is the production and sale of cannabis and cannabis products pursuant to the Cannabis Act. The Company currently offers a variety of dried cannabis strains and cannabis oils each with varying levels of Tetrahydrocannabinol ("THC"), cannabidiol ("CBD") and other cannabinoids. The Company does not engage in any U.S. marijuana-related activities as defined in Canadian Securities Administrators Staff Notice 51-352 (Revised) dated February 8, 2018. To the extent that the Company pursues international expansion, it will only conduct business in jurisdictions outside of Canada where such operations are legally permissible in accordance with the laws of the jurisdiction and applicable Canadian regulatory and stock exchange requirements.

Three Year History

Development of Business in 2017

On January 25, 2017, the Company filed a final short form base shelf prospectus (the "2017 Base Shelf Prospectus") in, and was receipted by, each of the provinces of Canada, except Quebec. The 2017 Base Shelf Prospectus qualified the issuance of up to $50,000,000 of Common Shares, preferred shares, debt securities, warrants, units or subscription receipts of the Company or a combination thereof from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the offering and as set out in an accompanying prospectus supplement, during the 25-month period that the 2017 Base Shelf Prospectus remained effective.

In February 2017, the Company completed a bought deal offering of units of the Company with Dundee Capital Partners ("Dundee"), as underwriter, pursuant to a prospectus supplement to the 2017 Base Shelf Prospectus (the "February Prospectus Offering"). Each unit consisted of one Common Share and one-half of one warrant. Each such whole warrant entitled the holder thereof to acquire one Common Share at a price of $2.00 per Common Share for a period of 24 months following the closing of the February Prospectus Offering, subject to acceleration. The Company issued 10,235,000 units, comprised of 10,235,000 Common Shares and 5,117,500 warrants for gross proceeds of $13,817,250. In addition, the Company issued to Dundee 307,050 compensation options exercisable into units at $1.35 per unit for a period of twenty-four months.

On March 1, 2017, the Company commenced a lease for office space located near the Victoria Facility (as defined below). The lease had an initial one-year term to February 28, 2018 and the Company exercised its option to renew for an additional three-year term to February 2021. The Company received a Health Canada license for these premises and relocated its client services team in October 2017. This facility also houses certain administration functions of the Company.

In April 2017, the Company completed a bought deal offering of units of the Company with Eight Capital ("Eight Capital"), as underwriter, pursuant to a prospectus supplement to the 2017 Base Shelf Prospectus (the "April Prospectus Offering"). Each unit consisted of one Common Share and one-half of one warrant. Each such whole warrant entitled the holder thereof to acquire one Common Share at a price of $2.60 per Common Share for a period of 24 months following the closing of the April Prospectus Offering, subject to acceleration. The Company issued an aggregate of 14,635,100 Common Shares and 7,572,750 warrants for gross proceeds of $27,123,423. In addition, the Company issued to Eight Capital 439,053 compensation options exercisable into units at $1.85 per unit for a period of twenty-four months.

- 6 -

In May 2017, the Company entered into a thirty-year agreement to lease the Richmond Facility at a market rate of $320,000 per year (the "Richmond Lease Agreement").

Also in May 2017, the board of directors of the Company (the "Board") approved the adoption of a new Omnibus Incentive Plan (the "Incentive Plan"), which was approved by the shareholders in June 2017. The Incentive Plan replaced the stock option plan that was previously approved by the shareholders (the "Previous Plan"). Options granted under the Previous Plan will remain outstanding and governed by the terms of the Previous Plan. Under the Incentive Plan, the following types of awards can be issued: stock options, share appreciation rights, restricted share units and other performance awards.

On June 6, 2017, the Company announced that it had entered into a definitive agreement with Village Farms to form the Joint Venture for large-scale, high-quality, low-cost cannabis production. Under the terms of the agreement, Village Farms contributed a 1.1 million-square foot (25-acre) greenhouse facility located on a 50-acre parcel of land in Delta, British Columbia (with ancillary buildings) (the "Delta 3 Facility"). The Company agreed to contribute an aggregate of $20 million in cash, which has been advanced in full.

On July 13, 2017, the Company filed an amended and restated short form base shelf prospectus (the "Amended Base Shelf Prospectus") increasing the total amount of securities qualified under the 2017 Base Shelf Prospectus up to $150,000,000.

On October 2, 2017, Bin Huang resigned from her position as the Company's Chief Executive Officer and the Company appointed Chris Wagner as her replacement.

Effective October 5, 2017, the Company amended and restated the amended and restated independent contractor agreement (the "Second Amended and Restated ICA"), dated September 12, 2017 with Emerald Health Sciences ("Sciences"), a control person of the Company, pursuant to which Sciences agreed to provide services, as requested by the Board. This agreement has been subsequently amended and restated effective January 1, 2018 and October 1, 2019.

On November 17, 2017, the Company acquired a 53% interest in Avalite, a licensed dealer under the provisions of the CDSA for a purchase price of $2,500,000 in cash paid on closing.

On November 20, 2017, the Company's Chief Financial Officer, Sandra Pratt resigned and the Company appointed Robert Hill as her replacement.

Development of Business in 2018

Effective January 1, 2018, the Company amended and restated the Second Amended and Restated ICA (the "Third Amended and Restated ICA") with Sciences, a control person of the Company, pursuant to which Sciences agreed provide to the Company certain services relating to, among other things, corporate administration and strategy, facility management and construction, business development, human resources and scientific advisory and technical advice. The Company agreed to pay a fixed monthly fee of $350,000 to Sciences for the services. This agreement has been subsequently amended effective October 1, 2019.

On January 9, 2018, the Company completed a prospectus offering of 3,000,000 units of the Company at a price of $5.00 per unit with a single Canadian institutional accredited investor (the "Investor") (the "January Prospectus Offering") pursuant to a prospectus supplement to the Amended Base Shelf

- 7 -

Prospectus. Each unit was comprised of one Common Share and one Common Share purchase warrant with each warrant exercisable into one Common Share at a price of $6.00 per share for a period of 36 months from the date of issuance. The January Prospectus Offering was completed without the involvement of an underwriter. The Investor also concurrently purchased 2,000,000 Common Shares from Sciences, a control person of the Company, at a price of $5.00 per share.

On January 28,2018, the Company and DMG Blockchain Solutions Inc. signed a non-binding letter of intent to form a joint venture for the purpose of developing a foundational blockchain-based supply chain management system and e-commerce marketplace for the legal cannabis industry. As of August 2018, the Company determined that it would no longer pursue the formation of the joint venture.

On January 30, 2018, the Company and Namaste Technologies Inc. ("Namaste") signed a non-binding letter of intent whereby the Company and Namaste proposed to enter into a definitive agreement to collaborate on strategic business opportunities and develop a fully integrated e-commerce platform. As of October 2018, the Company determined that it would no longer pursue the development of the ecommerce platform in partnership with Namaste Technologies Inc.

On January 31, 2018, the Company filed a second amended and restated base shelf prospectus (the "Second Amended Base Shelf Prospectus") increasing the total amount of securities qualified under the Amended Base Shelf Prospectus to $250,000,000. The Second Amended Base Shelf Prospectus also qualified the sale of securities of the Company pursuant to a secondary offering.

On February 8, 2018, the Company completed a prospectus offering of 3,000,000 units of the Company at a price of $6.00 per unit with the Investor pursuant to a prospectus supplement to the Second Amended Base Shelf Prospectus (the "February 2018 Prospectus Offering"). Each unit was comprised of one Common Share and one Common Share purchase warrant with each warrant exercisable into one Common Share at a price of $7.00 per share for a period of six months from the date of issuance. The February 2019 Prospectus Offering was completed without the involvement of an underwriter. The Investor also concurrently purchased 2,000,000 Common Shares from Sciences, a control person of the Company, at a price of $6.00 per share. The Investor exercised in full the warrants issued in connection with the January Prospectus Offering within three days of the completion of the February Prospectus Offering.

On March 5, 2018, the Joint Venture was issued a cultivation licence by Health Canada under the ACMPR for the Delta 3 Facility.

Between March 2018 and August 2018 the Company filed 17 provisional US patent applications covering, among other things, the Company's unique Defined Dose cannabis dosage forms and formulations. Of the 17 original filings, eight filings were converted from US patent filings to international Patent Cooperation Treaty filings during 2019. Nine provisional US patent applications were re-filed in 2019 and one US patent application was not pursued. The applications have not yet been approved and the Company has no indication as to when or if they will be approved.

On April 17, 2018, the Company entered into a binding agreement with EHB, EHN, GAB Innovations, Inc. and Dr. Gaetano Morello, a director of Sciences, a control person of the Company, with respect to the formation of the business and operations of EHN. EHN holds the exclusive Canadian distribution rights for EHB's endocannabinoid-supporting nutritional products (the "Endocannabinoid Supplement Portfolio"), which consist of nutritional supplements that use non-cannabis, non-psychoactive plant-based bioactive

- 8 -

compounds to support the body's endocannabinoid system. EHB is a partially-owned subsidiary of Sciences and EHB is therefore a related party of the Company.

On April 30, 2018, the Company entered into a supply agreement (the "2019 Supply Agreement") with the Joint Venture whereby the Company agreed to purchase 40% of the Joint Venture's cannabis production in 2018 and 2019. The 2019 Supply Agreement was terminated on March 6, 2020, pursuant to the PSF Settlement Agreement (as defined below).

On May 2, 2018, the Company acquired 100% of the issued and outstanding shares of Verdélite and its affiliate Verdélite Holdings (together, the "Verdélite Entities") for consideration of $90 million, subject to adjustment, payable 50% in cash and 50% in Common Shares. The Company paid $22.5 million in cash upon closing and $45 million of the purchase price was satisfied by the issuance of 9,911,894 Common Shares, of which 4,955,947 Common Shares were to be held in escrow until May 1, 2019, pursuant to an escrow agreement. An additional $22.5 million in cash was payable by the Company to the vendors (the "Verdélite Vendors") on May 1, 2019.The acquisition was not considered significant as defined in National Instrument 51-102.

On April 24, 2018, a statement of claim (the "Claim") was served on Verdélite and its former shareholders by Pivot Pharmaceuticals Inc. ("Pivot"), a party with whom Verdélite and its former shareholders had previously entered into a non-binding letter of intent with respect to a potential sale of Verdélite. The Claim sought to recover $72.4 million in damages for loss of profits allegedly suffered as a result of the bad faith and lack of cooperation of Verdélite and its shareholders in the negotiations surrounding the contemplated acquisition by Pivot of Verdélite. On January 30, 2019, the Company announced that Verdélite had entered into a release, discharge and transaction agreement (the "Verdélite Settlement Agreement") settling the claims made by Pivot against Verdélite and its former shareholders. Pursuant to the Verdélite Settlement Agreement, the Claim against Verdélite has been discharged without Verdélite making any payment or providing any compensation to Pivot.

On May 15, 2018, the Company exercised its right to purchase additional common shares of Avalite for $2.75 million, increasing its ownership stake of Avalite from 53% to 65%.

On July 24, 2018, the Company signed a non-binding memorandum of understanding (the "MOU") with the British Columbia Liquor Distribution Branch ("BCLDB") to supply cannabis products to the BCLDB to serve the non-medical market throughout the province from the date the Cannabis Act came into force. The MOU is in BCLDB's standard form. Pursuant to the MOU, the Company has agreed to make 1,086 kg of cannabis products available for purchase by the BCLDB if the BCLDB elects to purchase cannabis products from the Company.

On August 8, 2018, the Company signed a non-binding term sheet for a strategic alliance with Factors R&D Technology, Inc. ("FTI"), a division of Factors Group of Nutritional Companies Inc. Pursuant to the term sheet, FTI would provide to the Company pharmaceutical-grade, industrial-scale manufacturing capacity as well as expertise in GMP-level extraction, softgel production, and packaging focused on the medicinal cannabis market in Canada and internationally. Further, the term sheet provides that FTI would be issued shares of EHN representing 25% of EHN's issued share capital. To date the parties have not finalized this arrangement and no shares of EHN have been issued to FTI, however the parties continue to evaluate the prospects for such an alliance going forward.

- 9 -

On August 15, 2018, the Company acquired the remaining shares of Avalite for a purchase price of $2,000,000 in cash and 1,093,938 Common Shares. The transaction increased the Company's ownership of Avalite from 65% to 100%.

On September 26, 2018, the Company announced that it had agreed to purchase from Emerald Health Hemp Inc. ("EHH") CBD-containing hemp biomass for extraction into CBD oil pursuant to a supply agreement between the Company and EHH. The supply agreement (the "Hemp Supply Agreement") was for four years (five harvests) with an option to extend for an additional two years. On October 3, 2019, the Company entered into an amendment agreement pursuant to which the Company would only pay EHH the reasonable and documented costs incurred by EHH in exchange for hemp products. EHH is a wholly-owned subsidiary of Sciences, a control person of the Company, and EHH is therefore a related party of the Company. The Hemp Supply Agreement was terminated by the Company on January 21, 2020 and the Company does not owe any amounts to EHH thereunder.

In October 2018, the Company entered into a research agreement (the "Research Agreement") with Emerald Health Biotechnology España S.L.U. (formerly, Viva Cell Biotechnologies Spain S.L.U.) ("EH Spain"), a company focused on cannabis research, pursuant to which EH Spain agreed to provide contract research organization services to the Company to elucidate the mechanism of action of proprietary formulations and dosage forms that the Company is developing. EH Spain is a wholly-owned subsidiary of Sciences, a control person of the Company, and EH Spain is therefore a related party of the Company.

On October 17, 2018, the Cannabis Act came into force, legalizing the recreational use of cannabis by adults. When the Cannabis Act came into force, the Renewed Licence and other licences held by the Company which were issued under the ACMPR were deemed to be their functionally equivalent licences under the Cannabis Act (the "Licences"). See "Description of Business - Licences" for a description of the Licences held by the Company.

On November 28, 2018, the Company announced that Dr. Avtar Dhillon, the Company's Executive Chairman, was appointed President of the Company and the Company's Chief Executive Officer, Chris Wagner, had stepped down.

On December 3, 2018, the Company announced a prospectus offering with the Investor (the "December 2018 Offering") and on December 7, 2018, the Company closed the December 2018 Offering by issuing 4,000,000 Common Shares to the Investor at a price of $2.70 per share for aggregate gross proceeds of $10,800,000.

On December 4, 2018, the Company announced that EHN had received product licences and natural product numbers from Health Canada to sell the Endocannabinoid-Supplement Portfolio in Canada.

Development of Business in 2019

On January 10, 2019 the Company closed its acquisition of 51% of EHN and EHB granted EHN the exclusive Canadian distribution rights to the Endocannabinoid-Supplement Portfolio in exchange for 49% ownership of EHN. Sciences is a control person of the Company. On January 10, 2019, the Company also announced the resignation of Chris Wagner as a director of the Company.

On January 15, 2019, the Company announced a secondary offering of 2,800,000 Common Shares by Sciences, a control person of the Company, which closed on January 16, 2019. After completion of the secondary offering, Sciences held approximately 28.6% of the Common Shares on a fully-diluted basis.

- 10 -

On February 5, 2019, the Company announced that it had entered into a binding licence agreement with Indena S.p.A. ("Indena"), an arm's length party, pursuant to which Indena granted the Company a perpetual exclusive licence for the use in Canada of Indena's CBD-extraction technology, and agreed to contract manufacturing services to the Company for CBD extraction. The Company has agreed to pay Indena a license fee of €450,000 (payable in two tranches of €250,000 and €200,000, respectively). The first payment was paid in 2019. The second payment is not payable until certain technological information has been transferred to the Company. The Company has adjusted its plans to use the technological information as described and is in discussions with Indena regarding the continuation of the licence agreement.

On February 13, 2019, the Company announced that the Joint Venture had entered into a credit agreement with Bank of Montreal, as agent and lead lender, and Farm Credit Canada, as lender, in respect of a $20 million secured non-revolving term loan (the "Credit Facility"). The Credit Facility, which matures on February 7, 2022, is secured by the Delta 3 Facility, and contains customary financial and restrictive covenants. The Company is not a party to the Credit Facility but has provided a limited guarantee in the amount of $10 million in connection with the Credit Facility. See "Development of Business in 2020" for further updates on the Credit Facility.

On March 13, 2019, the Company filed a final short form base shelf prospectus (the "2019 Base Shelf Prospectus") in each of the provinces of Canada. The 2019 Base Shelf Prospectus qualifies the issuance and secondary sale of up to $150,000,000 of Common Shares, preferred shares, debt securities, warrants, units or subscription receipts of the Company or a combination thereof from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the offering and as set out in an accompanying prospectus supplement, during the 25-month period that the 2019 Base Shelf Prospectus remains effective.

On March 27, 2019, the Company filed a prospectus supplement in connection with an at-the-market equity program ("ATM Program") that it established with GMP Securities L.P. (the "Agent"). In connection with the ATM Program, the Company entered into an equity distribution agreement with the Agent. The ATM Program allows the Company to issue Common Shares from treasury having an aggregate gross sales price of up to $39 million to the public from time to time, at the Company's discretion, at the prevailing market price when issued on the TSXV or on any other marketplace for the Common Shares in Canada. The ATM Program is effective until the earlier of April 13, 2021 or completion of the sale of the maximum amount of shares thereunder. Sales of Common Shares will be made through "at-the-market distributions" as defined in National Instrument 44-102 - Shelf Distributions on the TSXV or on any other existing marketplace for the Common Shares in Canada. The Common Shares will be distributed at the prevailing market prices at the time of the sale and, as a result, prices may vary among purchasers and during the period of distribution.

On April 1, 2019, the Company announced that the Joint Venture had exercised its option to acquire from Village Farms a second 1.1 million square foot greenhouse ("Delta 2 Facility") adjacent to the Delta 3 Facility in Delta, British Columbia. In connection therewith, the Company agreed to advance a further $25 million to the Joint Venture in tranches as and when required. The Company also entered into a supply agreement with the Joint Venture to purchase 25% of its aggregate cannabis production from the Delta 2 Facility and the Delta 3 Facility in 2020, 2021 and 2022. This supply agreement was terminated on March 6, 2020 pursuant to the PSF Settlement Agreement, as discussed below.

- 11 -

On April 8, 2019, the Company announced that its Verdélite Facility had received its standard processing licence from Health Canada, allowing Verdélite to extract, manufacture, synthesize, test and sell cannabis products, in addition to its right to cultivate and sell cannabis flowers.

On May 1, 2019, the Company announced that the Verdélite Vendors elected to receive Common Shares in exchange for $7.5 million of the $22.5 million cash they were to receive from the Company as the final payment for their shares of the Verdélite Entities. The Common Shares were issued by the Company to the Verdélite Vendors on May 27, 2019.

On May 22,2019, the Company announced the appointment of Sean Rathbone as Chief Operating Officer.

From June to November 2019, the Company received certain licenses and certifications for its organic growing facility in Metro Vancouver, BC including: an initial cultivation license for a 65,000 square foot greenhouse; a cultivation license for a 12-acre outdoor grow area from Health Canada; and organic certification from an accredited inspection agency.

In June 2019, the Company paid the Verdélite Vendors $5.0 million of the remaining $15.0 million in cash they were owed in connection with the acquisition of the Verdélite Entities. On July 25, 2019, the Company and the Verdélite Vendors agreed to amend the payment terms of the purchase agreement with the Verdélite Vendors whereby the Company agreed to pay to the Verdélite Vendors $1.0 million in cash per month from July through November 2019 and a final payment of $5.0 million in cash in December 2019, plus interest (calculated on the basis of $15.0 million) accruing at a rate of 10% per annum from May 31, 2019. To date, the Company has paid down a total of $3.0 million of the amount owing to the Verdélite Vendors. The Company is currently in negotiations with the Verdélite Vendors to further amend the payment terms with respect to the remaining outstanding amount of $7.0 million (plus interest).

On July 30, 2019, the Company announced the appointments of Riaz Bandali as Chief Executive Officer and Thierry Schmidt as Chief Commercial Officer, respectively.

From August 2019 to October 2019, the Company conducted an internal reorganization, including the reduction of its workforce and other expenditures. As part of the reorganization, the Company reduced its workforce by approximately 65 staff positions. These reductions included the departures of Mr. Rob Hill, Chief Financial Officer and Mr. Sean Rathbone, Chief Operating Officer. Effective October 29, 2019, Ms. Jenn Hepburn, previously Director, Finance, was appointed Chief Financial Officer and Corporate Secretary of the Company and Dr. Avtar Dhillon ceased to be President. Dr. Dhillon continues as Executive Chairman and Mr. Riaz Bandali is now President and Chief Executive Officer of the Company.

On September 9, 2019, the Company issued 2,500 secured convertible debenture units at a price of $10,000 per unit for gross proceeds of $25,000,000. Each unit was comprised of one 5.0% secured convertible debenture (each, a "Convertible Debenture") of the Company in the principal amount of $10,000 and 5,000 common share purchases warrants of the Company. The Convertible Debentures have a maturity date of September 9, 2021 and bear interest (at the option of the Company payable in cash or, pursuant to TSXV rules and subject to certain limitations on a holder's ownership levels, in Common Shares) at 5.0% per annum, accrued and payable semi-annually on June 30th and December 31st of each year. The Convertible Debentures have a conversion price of $2.00 per Common Share (the "Conversion Price"). If, at any time prior to the maturity date, the volume weighted average trading price of the Common Shares on the TSXV is greater than $3.50 for 10 consecutive trading days, the Company may force the conversion of the then outstanding principal amount owing pursuant to the Convertible Debentures at the Conversion Price provided the Company gives 30 days' notice of such conversion to the

- 12 -

holder. Each warrant was exercisable to purchase one Common Share at an exercise price of $2.00 per share until September 9, 2021.

On October 1, 2019, the Company and Sciences, a control person of the Company, amended the Third Amended and Restated ICA pursuant to which Sciences provided certain management services to the Company. Pursuant to the amended agreement (the "ICA Amendment"), Sciences is not entitled to further cash consideration beyond amounts currently accrued and outstanding. Following the amendment, $1.0 million of the $2.1 million accrued was repaid with $1.1 million remaining outstanding.

In October 2019, Verdélite received certain licenses for its facility in St. Eustache, Québec, including: a license amendment for the complete growing and processing area in its 88,000 square foot indoor facility; and a license amendment permitting it to sell and distribute packaged, branded dried cannabis products directly to provincial/territorial wholesalers and authorized private retailers.

On November 7, 2019, the Company entered into an agreement to become a new supplier to STENOCARE A/S ("STENOCARE") of medical cannabis for Denmark and STENOCARE's international markets, subject to having cannabis products approved by the Danish Medical Cannabis Pilot Programme.

On November 15, 2019, the Company announced preliminary unaudited financial results for the third quarter of 2019 for the Joint Venture and announced that the Joint Venture had completed installation of extraction equipment with processing capacity of 35,000 kilograms of biomass annually in the Delta 3 greenhouse facility. On March 23, 2020, the Company announced that the Joint Venture had received approval from Health Canada for the final components of its 65,000 square foot processing centre. The Company anticipates the processing centre to be operational in the near future.

On November 29, 2019, the Company closed a prospectus offering with the Investor (the "November 2019 Offering"), issuing 4,385,965 units at a price of $0.57 per unit for aggregate gross proceeds of $2,500,000. Each unit consists of one Common Share and one common share purchase warrant. Each warrant entitles the Investor to acquire one Common Share at a price of $0.75 per Common Share until November 13, 2024. In the event that the closing sale price of the Common Shares on the TSXV, or such other principal exchange on which the Common Shares are then trading, is greater than $1.50 per Common Share for a period of ten consecutive trading days at any time after the closing, the Company may accelerate the expiry date of the warrants by giving written notice to the Investor and in such case the warrants will expire on the 15th day after the date on which such notice is given by the Company.

On December 16, 2019, the Company announced a private placement of a minimum of 5,172,414 units and a maximum of 15,517,241 units at a price of $0.29 per unit, for gross proceeds of a minimum of $1,500,000 and a maximum of $4,500,000 (the "December 2019 Private Placement"). The initial tranche of the December 2019 Private Placement closed on December 30, 2019 for gross proceeds of $1,500,153. The Company issued 5,172,942 units at an issue price of $0.29 per unit. All units sold pursuant to the initial tranche of the December 2019 Private Placement were purchased by Sciences, a control person of the Company, and certain directors and officers of the Company. Each unit consists of one Common Share and one common share purchase warrant. Each warrant entitles the holder thereof to acquire one Common Share at a price of $0.385 per Common Share until December 16, 2024. In the event that the closing sale price of the Common Shares on the TSXV, or such other principal exchange on which the Common Shares are then trading, is greater than $0.75 per Common Share for a period of ten consecutive trading days at any time, the Company may accelerate the expiry date of the warrants by giving written

- 13 -

notice to the holder thereof and in such case the warrants will expire on the 15th day after the date on which such notice is given by the Company.

On December 16, 2019, the Company also reached an agreement with Sciences (the "Debt Settlement Agreement") to settle certain debt owed by the Company to Sciences pursuant to a previously disclosed loan agreement between the parties, as well as other related party transactions. On January 31, 2020, the Company closed the debt settlement with Sciences. An aggregate of $2,816,963 owed by the Company to Sciences was settled by the issuance of 9,713,666 Common Shares at a deemed value of $0.29 per Common Share.

Development of Business in 2020

In lieu of the remaining portion of the December 2019 Private Placement, on February 6, 2020, the Company closed the initial tranche of a prospectus offering by issuing 7,596,551 units to certain accredited investors at a price of $0.29 per unit for aggregate gross proceeds of $2,203,000. Each unit consists of one Common Share and one common share purchase warrant, expiring February 6, 2025, but otherwise on the same terms as the December 2019 Private Placement. An additional 1,322,627 Common Shares were issued to the Investor at a deemed price of $0.29 per Common Share to settle interest in the amount of $383,562 accrued to December 31, 2019 on its previously issued Convertible Debentures.

On February 14, 2020, the Company closed the final tranche of a prospectus offering by issuing 2,748,276 units to the Investor at a price of $0.29 per Unit for aggregate gross proceeds of $797,000. Each unit consists of one Common Share and one common share purchase warrant. Each warrant will entitle the holder thereof to acquire one Common Share at a price of $0.385 per Common Share until February 14, 2025.

On March 9, 2020, the Company announced it had signed a letter of intent under which Sigma Analytical Services Inc. ("Sigma"), a full-service GMP-compliant testing laboratory for cannabis, hemp and derived products, may acquire the Company's cannabis analytical testing operations (currently conducted by Avalite). Terms of the deal have been agreed to in principle and the parties are engaged in preparation of final documentation. Terms will be announced upon execution of a final purchase agreement.

On April 3, 2020, the Credit Facility established by the Joint Venture was expanded (the "Amended Credit Facility"). The Amended Credit Facility consists of a $7.5 million revolving operating loan (the "Revolver") and a $10 million term loan (the "New Term Loan"), in addition to its existing $19 million term loan (the "Existing Term Loan"). The $7.5 million Revolver and the $10 million New Term Loan include an accordion provision that allows the Joint Venture to request additional lender commitments of up to an additional $7.5 million and $15 million, respectively, subject to certain conditions. Each of the components of the Amended Credit Facility, including the Existing Term Loan, mature on February 7, 2022. As part of this transaction, Village Farms completed an additional investment in the Joint Venture, reducing the Company's equity position in the Joint Venture by 1.3% to 41.3%. The Company continues to hold three of six seats on the Joint Ventures' Board of Directors.

On April 9, 2020, the Company amended the terms of the 12,500,000 common share purchase warrants originally issued on September 9, 2019 (the "September 2019 Warrants") in connection with the issuance of the Convertible Debentures. The exercise price of the September 2019 Warrants was amended from the original exercise price of $2.00 per Common Share such that:

- 14 -

6,250,000 September 2019 Warrants had an exercise price of $0.17 per Common Share (the "$0.17 Warrants"); and

6,250,000 September 2019 Warrants have an exercise price of $0.21 per Common Share (the "$0.21 Warrants"). If, at any time prior to the expiry date of the $0.21 Warrants, the closing market price of the Common Shares on the TSXV is greater than $0.2625 for 10 consecutive trading days, the Company may deliver a notice to the holder of the $0.21 Warrants accelerating the expiry date of the $0.21 Warrants to the date that is 30 days following the date of such notice.

Holders of the $0.17 Warrants immediately exercised all such warrants after the amendment. The $0.21 Warrants remain outstanding and expire on September 9, 2021.

The PSF Settlement

In September through November certain disputes arose between the Company, the Joint Venture and the Company's joint venture partner Village Farms regarding amounts which the Joint Venture claimed were owed by the Company to the Joint Venture pursuant to the 2019 Supply Agreement and the alleged nonpayment of $5.94 million due to the Joint Venture from the Company in connection with the Delta 2 Facility.

On March 2, 2020, the Company entered into a settlement agreement (the "PSF Settlement Agreement") with Village Farms and the Joint Venture. Pursuant to the PSF Settlement Agreement, the supply agreements entered into between the Company and the Joint Venture dated December 21, 2018 (for the supply to the Company of cannabis product by the Joint Venture in 2019), and March 29, 2019 (for the supply to the Company of cannabis product by the Joint Venture from 2020 to the end of 2022), respectively, were terminated effective as of December 31, 2019, and the Company and the Joint Venture released each other from all previous, current, and future obligations, liabilities and payments thereunder. The Company forfeited all amounts due from the Joint Venture pursuant to a shareholder's loan of $13 million that Emerald previously advanced to the Joint Venture plus accrued interest thereon of $1.1 million, and issued a promissory note to the Joint Venture in the amount of $952,237. The Company also agreed to the cancellation of 5,940,000 of its common shares in the Joint Venture (previously held in escrow), fully resolving all issues in the arbitration process. In addition, the Company transferred 2.5% of its ownership interest in the Joint Venture to Village Farms. Village Farms also purchased additional shares of the Joint Venture from treasury in exchange for an $8 million cash payment to the Joint Venture, following these transactions. The Company held a 42.6% equity interest (which has since been reduced to 41.3%) in the Joint Venture. All previously disclosed disputes between the Company, the Joint Venture and Village Farms have now been settled.

DESCRIPTION OF BUSINESS

General Description of the Business

Licences

The Company holds licences from Health Canada under the Cannabis Act to produce and sell cannabis products in accordance with applicable laws in Canada. When the Cannabis Act came into force on October 17, 2018, the Company's licences, which were issued under the ACMPR, were deemed to be their functionally equivalent licences under the Cannabis Act. The Company currently indirectly holds a number of Licences through its wholly-owned direct and indirect subsidiaries, the Operating Subsidiary, Verdélite

- 15 -

and Avalite, as well as others which are held by the Joint Venture. The Licences held by the Operating Subsidiary permit it to cultivate cannabis and produce and sell dried cannabis, cannabis oils, cannabis plants and cannabis seeds; the Licence held by Verdélite permits it to cultivate, extract, manufacture, synthesize, test and sell cannabis; the Licence held by Avalite permits it to process cannabis and produce cannabis oil; and the Licences held by the Joint Venture permit it to cultivate cannabis and produce and sell dried cannabis, cannabis oils, cannabis plants and cannabis seeds, all in accordance with the terms and conditions specified in the applicable Licence and the Cannabis Act. Particulars of the Licences are set out in the table below.

| | | | | | | | |

| | | | Authorized | | | | | |

| | | | Products for | | Original | Date of | Expiration | |

| Licence | | | Sale in Some | Applications | Date of | Amendment | Date of | Application |

| Holder | Location | Licence Held | Capacity | Submitted | Licensing | of Licence | Licence | Status |

| Emerald Health Therapeutics Canada, Inc. | Victoria, BC | Standard Cultivation | Plants/Seeds/Dried/Fresh Cannabis and

Cannabis oil to Provinces/Territories | -- | February 5, 2014 | July 12, 2019 | Oct 6, 2020 | -- |

| Standard Processing | -- |

| Sale for Medical Purposes | -- |

Emerald Health Therapeutics Canada, Inc.

(2ndSite) | Victoria, BC | Sale for Medical Purposes | Plants/Seeds/Dried/Fresh Cannabis and

Cannabis oil to Provinces/Territories | -- | October 6, 2017 | October 24, 2019 | October 24, 2022 | -- |

| Standard Cultivation | -- | October 6, 2017 | October 24, 2019 | October 24, 2022 | -- |

| Standard Processing | -- | -- | October 24, 2019 | October 24, 2022 | -- |

Emerald Health Therapeutics Canada, Inc.

(3rdSite) | Richmond,

BC | Standard Cultivation | -- | -- | July 12, 2019 | -- | June 21, 2022 | -- |

Verdélite Sciences, Inc.

(formerly Agro-Biotech Inc.) | Saint-

Eustache,

QC | Standard Cultivation | Plants/Seeds/Dried and

Fresh Cannabis to Provinces/Territories | -- | January 12, 2018 | October 15, 2019 | January 12, 2021 | -- |

| Standard Processing | -- | April 5, 2019 | October 15, 2019 | January 12, 2021 | -- |

Avalite Sciences Inc.

(formerly Northern Vine Canada Inc.) | Langley, BC | Dealer's Licence1 | -- | -- | January 1, 2020 | -- | September 30, 2021 | -- |

| Analytical Testing | -- | -- | January 17, 2019 | December 23, 2019 | December 23, 2022 | -- |

| Research | -- | -- | December 31, 2019 | -- | December 31, 2024 | -- |

| Pure Sunfarms Corp. | Delta, BC | Standard Cultivation | Plants/Seeds/Dried and

Fresh Cannabis to Provinces/Territories | -- | March 2, 2018 | March 11, 2019 | March 2, 2021 | -- |

| Standard Processing | -- | May 17, 2019 | September 6, 2019 | March 2, 2021 | -- |

| -- | -- | Research | -- | -- | -- | Submitted March 6, 2020;

pending approval |

- 16 -

Notes:

|

| (1) Indicates a licenced dealer under the CDSA. |

Facilities

Verdélite. Verdélite operates an 88,000 square foot facility in Saint-Eustache, Quebec (the "Verdélite Facility"), which is owned by Verdélite Holdings and is in full production. The facility is an indoor grow facility with 20 fully equipped grow rooms totaling 49,060 square feet of cultivation area and automated packaging capabilities.

Delta 3 Facility. The Joint Venture owns and operates the Delta 3 Facility. The Joint Venture's cultivation licence currently permits it to produce cannabis in approximately 1.03 million square feet of the facility. The facility currently has 16 growing rooms and 10 processing rooms active, with approved extraction and processing capabilities in-house.

Delta 2 Facility. The Joint Venture owns and operates the 1.1-million square foot Delta 2 Facility, which is adjacent to the Delta 3 Facility. Planning and procurement for the Delta 2 Facility and the Joint Venture's applications for licensing under the Cannabis Act are under process.

Avalite. Avalite owns and operates a laboratory facility located in Langley, British Columbia at which chemical analyses and testing of cannabis products is conducted.

Victoria. The Company leases 16,000 square feet of mixed-use space in Victoria, British Columbia with approximately 500 square feet of cultivation area (the "Victoria Facility") with the balance dedicated to laboratory and packaging activities and the Company's national call centre for customer service.

Richmond. The Company owns and operates a 156,000 square foot facility in Richmond, British Columbia (the "Richmond Facility"). The Richmond Facility consists of two greenhouses. The first greenhouse with approximately 55,337 square feet of cultivation area was completed in early 2019 and is currently in full production. The second greenhouse is under construction and requires approximately $3 million of additional expenditure for completion.

Regulatory Framework

The Cannabis Act and related federal and provincial legislation (collectively, "Cannabis Legislation") came into force on October 17, 2018, thereby legalizing the sale of cannabis in Canada for adult recreational use, and replacing the ACMPR and the CDSA, as the governing legislation on the production, sale and distribution of cannabis. The ACMPR was repealed on the same day.

The Cannabis Legislation establishes the regulatory framework and licensing scheme for production, importation, exportation, testing, packaging, labelling, sending, delivery, transportation, sale, possession disposal of and access to cannabis for both recreational and medical cannabis. The Cannabis Act also regulates access to cannabis for medical purposes. The various regulations provide the more detailed rules and standards that apply to the production, distribution, sale, importation and exportation of cannabis by federal licence holders.

- 17 -

Products of the Company

The Company currently offers a variety of dried cannabis strains, pre-rolls and cannabis oil products each with varying levels of THC and CBD in both the Canadian adult-use and medical-use markets.

The Company currently sells dried cannabis and cannabis oils through to its medical patients. It currently has eight cannabis oil products in production, including: THC acid (THCA Indica and THC Sativa) oils, THC oil, two different strength THC oils, two different strengths of oils containing both THC and CBD, and two different strengths of oils containing primarily CDB oil. The cannabis oils are whole plant extracts that deliver the benefits of cannabinoids orally. The Company also offers compassion pricing to clients who have annual incomes of $30,000 or less or who are classified by their physician as palliative.

Following the legalization of cannabis in Canada, the Company started selling dried cannabis and pre-rolls to the adult use market. The Company produces approximately 13 strains from its own genetics, which are available at different times, subject to growing cycles. The Company's products are currently available for purchase from licensed vendors in the recreational market in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec and Newfoundland and Labrador, Prince Edward Island, Nova Scotia and in the Yukon Territory.

Sales to the recreational market commenced on October 17, 2018. During the fourth quarter of 2018, the Company had gross revenue from the sales of cannabis products of approximately $1,131,853 of which 67% was derived from the adult recreational market and 33% was derived from the medical market. During 2019, the Company had gross revenue from the sales of cannabis products of approximately $22,337,636 of which 90% was derived from the adult recreational and wholesale market and 10% was derived from the medical market.

Operations

The Company's primary operations consist of:

| | (a) | production of cannabis for the purpose of sale, production of cannabis oils and research and development; |

| | | |

| | (b) | sale of medical products through an online secure customer portal and non-medical products directly to provincial and territorial governments and private retail stores (where permitted); |

| | | |

| | (c) | registration, sales and customer service by way of its online secure customer portal and telephone; |

| | | |

| | (d) | research and development related to the characterization of cannabis strains, new product formulations and delivery systems; |

| | | |

| | (e) | extraction of cannabis oils;and |

| | | |

| | (f) | sourcing, quality control verification and purchase of wholesale dried cannabis and cannabis oils from other licensed producers (a "Licensed Producer"). |

- 18 -

Distribution

The Company distributes its recreational cannabis products in accordance with applicable federal and provincial regulatory frameworks. The Company's recreational products are available from licensed vendors in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec and Newfoundland and Labrador, Prince Edward Island, Nova Scotia and in the Yukon Territory and the Company has entered into supply agreements with the applicable government-owned distributors (where applicable) in each of those provinces/territories.

The Company also continues to distribute its medical cannabis products directly to its customers. The Company currently has more than 4,000 registered medical clients for its medicinal products. Any cannabis or cannabis extracts sold or provided directly to medical clients must be delivered through secure shipping only and include a means of tracking the package during transit. The Company ships all products discretely to Clients through Purolator and Canada Post in accordance with current regulations. Medical clients order from the Company primarily through the Company's secure online customer portal and through telephone ordering with the Company's customer service team.

Storage, Security and Quality Control

Storage is a very important aspect of maintaining the integrity and quality of cannabis. The environment needs to be controlled. The Company is sensitive to the environmental conditions that may negatively impact product quality and stores its finished product in a secure area with environmental controls, including controls for heat, light, temperature and humidity to preserve product quality and minimize the risk of deterioration. The Company's ability to control aspects of the environment within the storage facility allow the Company to maintain the quality of its products.

In addition, the Company's facilities meet the following prescribed security requirements for its sites and storage areas:

| | (a) | each site is designed in a manner that prevents unauthorized access to the site itself and, once inside the site, to any area within the site where cannabis is present (the "Key Areas"); |

| | | |

| | (b) | the perimeter of each site and the Key Areas are each visually monitored at all times by recording devices that will detect any actual or attempted unauthorized access or illicit conduct; |

| | | |

| | (c) | there is an intrusion detection system which detects actual or attempted unauthorized access to the site or, once inside the site, to the Key Areas which intrusion detection system be monitored by such personnel as can take appropriate steps in response to any such unauthorized access and make a record on any such unauthorized access; |

| | | |

| | (d) | records are kept of every person entering and exiting the Key Areas; |

| | | |

| | (e) | there are physical barriers preventing unauthorized access to Key Areas; and |

| | | |

| | (f) | the Key Areas are equipped with an air filtration system that prevents the escape of odours and pollen. |

- 19 -

Health Canada conducts ad hoc, unscheduled site inspections of Licensed Producers. The Company has consistently responded to and complied with all requests from Health Canada resulting from these inspections within the time frames indicated in such requests. The Company is continuously reviewing and enhancing its operational procedures at its facilities. The Company follows all regulatory requirements in response to inspections in a timely manner. As of the date hereof, there are no outstanding inspection issues with Health Canada beyond day-to-day adjustments that may occur in order to ensure ongoing compliance. The Company has not been required to recall any distributed product.

The Cannabis Act also requires that certain individuals associated with a licensee, such as directors, officers, large shareholders and individuals identified by the Minister of Health (the "Minister"), obtain security clearances with Health Canada. The Minister grants security clearances if the Minister determines that the applicant does not pose an unacceptable risk to public health or public safety. The Minister may refuse to grant security clearance to individuals with associations to organized crime or with past criminal convictions. Individuals with a record of non-violent, lower-risk criminal activity may still be granted security clearance at the discretion of the Minister.

A cannabis tracking system was also established by ministerial order, and came into effect on October 17, 2018. The purpose of this system is to track cannabis throughout the supply chain to help prevent diversion of cannabis into, and out of, the legal market. Under the tracking system licence holders are required to submit monthly reports to the Minister relating to inventory of its recreational and medical cannabis products.

The Company understands the importance placed upon adhering to "Good Production Practices" under the Cannabis Legislation. T hese practices relate to the premises for and production of cannabis, as well as the equipment, sanitation program, standard operating procedures, recall, and quality assurance personnel required to operate in these regulations. The Company currently employs quality assurance persons with appropriate training, experience, and technical knowledge to assure the quality of the Company's products. All of the Company's procedures required for Good Production Practices have been outlined for all personnel as standard operating procedures. New employees undergo a training program in which they receive training on the appropriate implementation of these procedures.

For the purposes of product quality and traceability, the Company tracks each "lot or batch" (a specific strain of cannabis that is initiated for production at one time, either by seed or clonal propagation) using a unique lot or batch number, via electronic and paper based systems. Furthermore, the lot or batch number is used in all sales transactions, and as such serves as an identifier to rapidly initiate recall reporting.

Final dried cannabis that meets all quality requirements of the Cannabis Legislation is packaged, labeled and stored within the climate-controlled secure area. Cannabis extract that meets quality requirements is packaged, labeled and also stored in a climate-controlled, secure area. All product is tested according the requirements of the Cannabis Legislation, including but not limited to potency, microbiological and chemical contamination, heavy metals, residues of solvents (for cannabis oil) and pesticide contamination using validated methods. Only products that meet the acceptance criteria in compliance with the Cannabis Regulations are released for sale.

The Company has implemented a rigorous process to maintain a sanitary environment for the cultivation of cannabis, which includes: a sanitation program and procedures for personnel hygiene, behaviour, clean zone gowning and entry/exit into the controlled areas, the use of materials such as stainless steel to allow

- 20 -

for effective cleaning and sanitation and regularly scheduled surface, room and drain sanitization. The COVID-19 pandemic has required the Company to implement further stringent sanitation processes in addition to physical distancing.

Specialized Skill and Knowledge

Knowledge with respect to cultivating and growing cannabis is important to the cannabis industry. The nature of growing cannabis is not substantially different from the nature of growing other agricultural products. Variables such as temperature, humidity, lighting, air flow, watering and feeding cycles are defined and controlled to produce consistent product and to avoid contamination. The product is cut, sorted and dried under defined conditions that are established to protect the activity and purity of the product. Once processing is complete, each processing batch is subjected to testing against quality specifications set for activity and purity.

The Company has recruited a cultivation team with specialized skill sets unique to indoor agricultural cultivation and growing cannabis. The Company's management team has extensive indoor cannabis production experience since the implementation by Health Canada of the Medical Marihuana Access Regulations. The Company's advisors, senior management and management include molecular biologists, geneticists and plant biologists who collectively have extensive expertise in large-scale agriculture with crops other than cannabis.

Reporting Requirements

Licence holders have extensive reporting obligations under the Cannabis Legislation and under the specific terms of the licences they hold.

The following are some of the reporting requirements of licensees under the Cannabis Legislation:

| | (a) | record of key investors- a "key investor" is a person who exercises, or is in a position to exercise, control over the licensee; |

| | | |

| | (b) | notice of new products - before making a product available for sale that is distinct from other products sold by the licence holder, the licensee must provide notice to Health Canada; |

| | | |

| | (c) | reporting of information on promotional activities, including expenditure on promotion, and description of the type of promotion; |

| | | |

| | (d) | inventory reporting into the Cannabis Tracking and Licensing System; |

| | | |

| | (e) | reporting of theft or loss of cannabis; |

| | | |

| | (f) | reporting of voluntary recalls; and |

| | | |

| | (g) | reporting of serious adverse reactions to a cannabis product. |

- 21 -

In addition to general reporting requirements, the Licences require that the Company makes a report of information including, but not limited to, the following to the Office of Controlled Substances of Health Canada on a monthly basis:

| | (a) | the total amount of dried cannabis (in kgs) and cannabis oil produced in the reporting period; |

| | | |

| | (b) | the total amount of dried cannabis (in kgs) and cannabis oil sold or transferred to the following during the reporting period: |

| | | |

| | (i) | clients; |

| | | |

| | (ii) | other License Holders; and |

| | | |

| | (iii) | provinces/territories; |

| | | |

| | (c) | the number of clients who had a valid registration on the last day of the previous month; |

| | | |

| | (d) | the number of clients who, in the previous month, had their medical document transferred to another holder of a licence for sale or returned to them at their request or at the request of a named responsible adult; |

| | | |

| | (e) | in respect of the medical documents that formed the basis for registrations that were valid on the last day of the previous month: |

| | | |

| | (i) | the average daily quantity of dried cannabis, expressed in grams, |

| | | |

| | (ii) | the median daily quantity of dried cannabis, expressed in grams, and |

| | | |

| | (iii) | the highest daily quantity of dried cannabis, expressed in grams; |

| | | |

| | (f) | the number of applicants whom the holder refused to register during the previous month, including the number of them who were refused for each of the following reasons: |

| | | |

| | (i) | the application was incomplete, |

| | | |

| | (ii) | the holder had reasonable grounds to believe that false or misleading information was, or false or falsified documents were, provided in, or in support of, the application, and |

| | | |

| | (iii) | the medical document or registration certificate that formed the basis for the application was not valid; |

| | | |

| | (g) | the number of purchase orders referred to in subsection 289(1) that the holder refused to fill during the previous month, including the number of them that were refused for each of the following reasons: |

| | | |

| | (i) | the purchase order was incomplete, |

| | | |

| | (ii) | the client's registration had expired or been revoked, |

- 22 -

| | (iii) | the purchase order specified cannabis products, other than cannabis plants or cannabis plant seeds, in respect of which the quantities of cannabis exceeded the equivalent of 150 g of dried cannabis, and |

| | | |

| | (iv) | the cannabis product specified in the purchase order was unavailable; |

| | | |

| | (h) | the given name, surname, profession and business address of each health care practitioner who provided a medical document referred to in paragraph (e), together with the province in which the health care practitioner was authorized to practice their profession at the time they signed the document and the number assigned by the province to that authorization; and |

| | | |

| | (i) | the number of medical documents referred to in paragraph (d) that were signed by each health care practitioner referred to in paragraph (h). |

Cannabis Market

Statistics Canada reported that sales of adult-use recreational cannabis between legalization in October 2018 and September 2019 was approximately $907.8 million.1The Company expects that the market for legal cannabis will continue to grow. The legalization of edibles and drinkables in October 2019 is expected to play a major role in the growth of the market.2

Competitive Environment

The legal adult-use recreational cannabis market has grown more slowly3in Canada than originally anticipated. Although the impact on the market of the ongoing COVID-19 crisis remains difficult to predict, the Company anticipates that the recreational market will be in a better position to grow in 2020 due in part to the expansion in product mixes which may lead to opportunities to reach new cannabis consumers.4

The Company's primary competition in the Canadian recreational market is from other licensed producers under the Cannabis Act, including existing licensed producers and new entrants who receive licenses from Health Canada and unlicensed cannabis growers in the black market.

As of May 7, 2020, Health Canada has issued approximately 364 licenses to Licensed Producers, and there are also a number of unlicensed cannabis growers in the black market that continue to compete with the legal market. On October 17, 2019, Health Canada introduced updated cannabis regulations to establish rules for the legal production and sales of the three new classes of cannabis (Edible Cannabis, Cannabis Extracts and Cannabis Topicals).

According to Health Canada, as of September 2019 there were 369,614 patients registered, under the ACMPR to possess and consume dried cannabis for medicinal purposes in Canada.

Of the 364 Licensed Producers, 19 are authorized to only sell to registered patients, while 152 have full medical sales, cultivation and processing licenses. Of those that are authorized to sell to provincially

____________________

1https://www.bnnbloomberg.ca/pot-sales-in-canada-fall-short-of-forecasts-in-first-year-of-legalization-1.1361025

2https://www.newswire.ca/news-releases/edibles-and-drinkables-are-leading-canada-s-legal-cannabis-market-in-2020-894861674.html

3https://www.bnnbloomberg.ca/pot-sales-in-canada-fall-short-of-forecasts-in-first-year-of-legalization-1.1361025

4https://www.mintel.com/press-centre/food-and-drink/edibles-and-drinkables-are-leading-canadas-legal-cannabis-market-in-2020

- 23 -

provincially/territorially authorized distributors/retailers in the adult-use market alone, 40 have both cultivation and processing licenses, while 85 have a cultivation license only; and 34 have only a processing license. In addition, there are 64 Licensed Producers of cannabis extracts: 47 are licensed to cultivate, process and sell cannabis extracts to provincially/territorially authorized distributors/retailers and to registered patients; and 9 are licensed to sell cannabis extracts to registered patients alone.

The Company believes that the stringent application and compliance requirements of the Cannabis Act together with the requirements and process to obtain the requisite licences will restrict the number of new entrants to the medical cannabis market. However, the Company does believe that the number of new competitors, all vying for market share, will continue to increase.

As cannabis is largely perceived as a commodity product, there is initially little to differentiate the Company's products in terms of unique features or benefits. The Company believes that competition in the future will be based on issues such as product quality, variety, price and client services.

Business Strategy

The Company's current strategy is to meet all of its product manufacturing and distribution channel requirements with cannabis grown from the Richmond Facility and Verdélite Facility.

During 2019, the Company commenced cultivation at the first greenhouse at its Richmond Facility and at the Verdélite Facility. The Company currently produces cannabis products for both the adult recreational market and the medical channel. Both the Richmond Facility and the Verdélite Facility use purpose-built grow rooms that create highly controlled cultivation environments. The Company is focused on growing consistent, high-quality, strain-specific cannabis products in 2020. During 2020, the Company will be focused on enhancing its existing distribution channels and product offerings to best serve the Canadian markets it is operating in. The Company also plans to expand its product portfolio to include new cannabis products with expected roll out in late 2020 of novel products that became legally permitted in the fourth quarter of 2019.