Exhibit 15.2

| |

| TABLE OF CONTENTS | |

| | |

| Overview | 16 |

| Recent Developments and Events after the Reporting Period | 20 |

| Disclosure of Outstanding Share Data | 24 |

| Selected Annual Information | 24 |

| Summary of Quarterly Results | 25 |

| Results of Operations | 25 |

| Additional Disclosure for Venture Issuers Without Significant Revenue | 31 |

| Liquidity and Capital Resources | 31 |

| Operating, Investing and Financing Activities | 32 |

| Financial Risk Management | 33 |

| Measurement Uncertainty and Impairment Assessments | 33 |

| Transactions with Related Parties | 34 |

| Proposed Transactions | 35 |

| Critical Accounting Policies and Estimates | 36 |

| Changes in Accounting Standards not yet Effective | 36 |

| Off-Balance Sheet Arrangements | 36 |

| Risks and Uncertainties | 36 |

| Disclosure Controls and Procedures | 53 |

| Forward-Looking Statements | 55 |

Management's Discussion and Analysis

The following MD&A is prepared as of April 30, 2019 and is intended to assist the understanding of the results of operations and financial condition of the Company.

This MD&A should be read in conjunction with the audited consolidated financial statements and accompanying notes of the Company for the years ended December 31, 2018 and 2017 (together with this MD&A, the "Annual Filings") which have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). This MD&A contains forward-looking statements that are subject to risk factors set out in a cautionary note contained herein. All figures are in Canadian dollars unless otherwise noted.

Additional information related to the Company is available on its website atwww.emeraldhealth.ca. Other information related to the Company, including the Company's most recent Annual Information Form ("AIF") and financial statements referred to herein are available on the Canadian Securities Administrator's website atwww.sedar.com.

Overview

The Company was incorporated pursuant to theBusiness Corporations Act(British Columbia) on July 31, 2007 as Firebird Capital Partners Inc. and changed its name to Firebird Energy Inc. in December 2012. On September 4, 2014, the Company completed the acquisition of all the issued and outstanding common shares of Thunderbird Biomedical Inc. (“Thunderbird”), by way of a reverse takeover (the “Transaction”) under the rules of the TSX Venture Exchange (the “TSXV”) and concurrently changed its name to T-Bird Pharma, Inc (“T-Bird”). At that time, Thunderbird became a wholly-owned subsidiary of T-Bird. In June 2015, the Company changed its name to Emerald Health Therapeutics, Inc. and Thunderbird changed its name to Emerald Health Botanicals Inc. (“Botanicals”). In February 2018, Botanicals changed its name to Emerald Health Therapeutics Canada Inc. (“EHTC”).

The Company is a publicly traded company with headquarters in Vancouver, British Columbia, Canada. Common shares of the Company (the “Common Shares”) are listed on the TSXV under the trading symbol “EMH”. The Company is classified as a Tier 1 Venture Issuer on the TSXV. The Company also trades on the OTCQX® Best Market, operated by OTC Markets Group under the ticker symbol “EMHTF”.

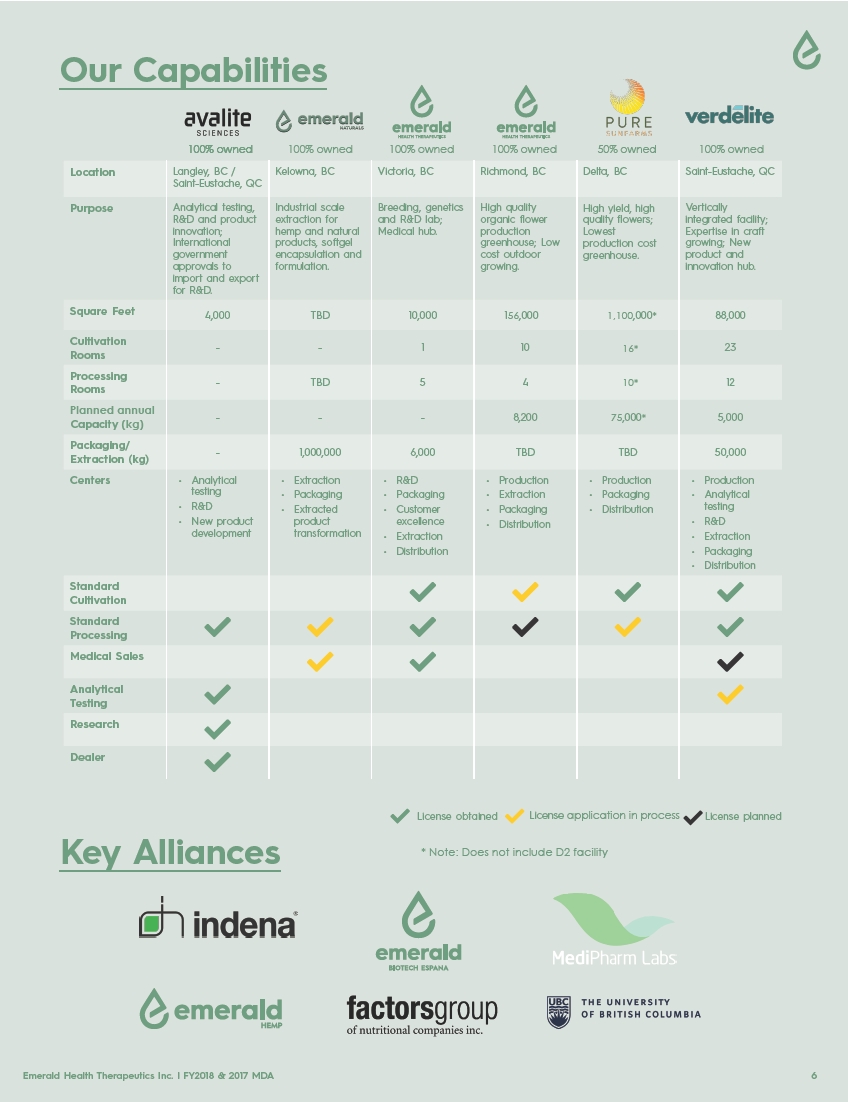

The Company owns:

| | |

| (a) | 100% of the shares of the Operating Subsidiary, a British Columbia-based licence holder under the Cannabis Act (Canada) (the "Cannabis Act"); |

| | |

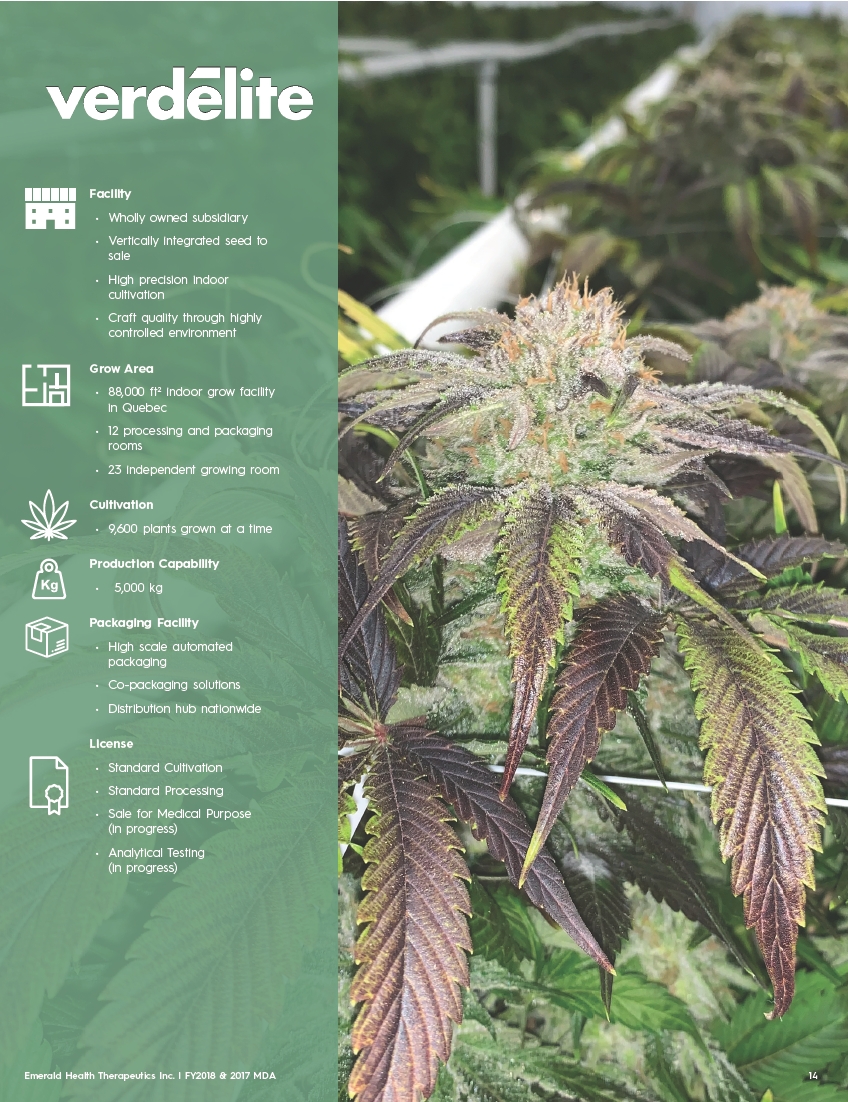

| (b) | 100% of the shares of Verdélite Sciences, Inc. (formerly, Agro-Biotech Inc.) ("Verdélite"), a Quebec-based licence holder under the Cannabis Act; |

| | |

| (c) | 100% of the shares of Verdélite Property Holdings, Inc. (formerly, Agro-Biotech Property Holdings Inc.) ("Verdélite Holdings"), a Quebec-based holding corporation that owns the Verdélite Facility (as defined below); and |

| | |

| (d) | 51% of the shares of Emerald Health Naturals Inc. ("EHN"), a joint venture between the Company and Emerald Health Bioceuticals, Inc. ("EHB"). |

- 16 -

The Company, through the Operating Subsidiary, also holds:

| | |

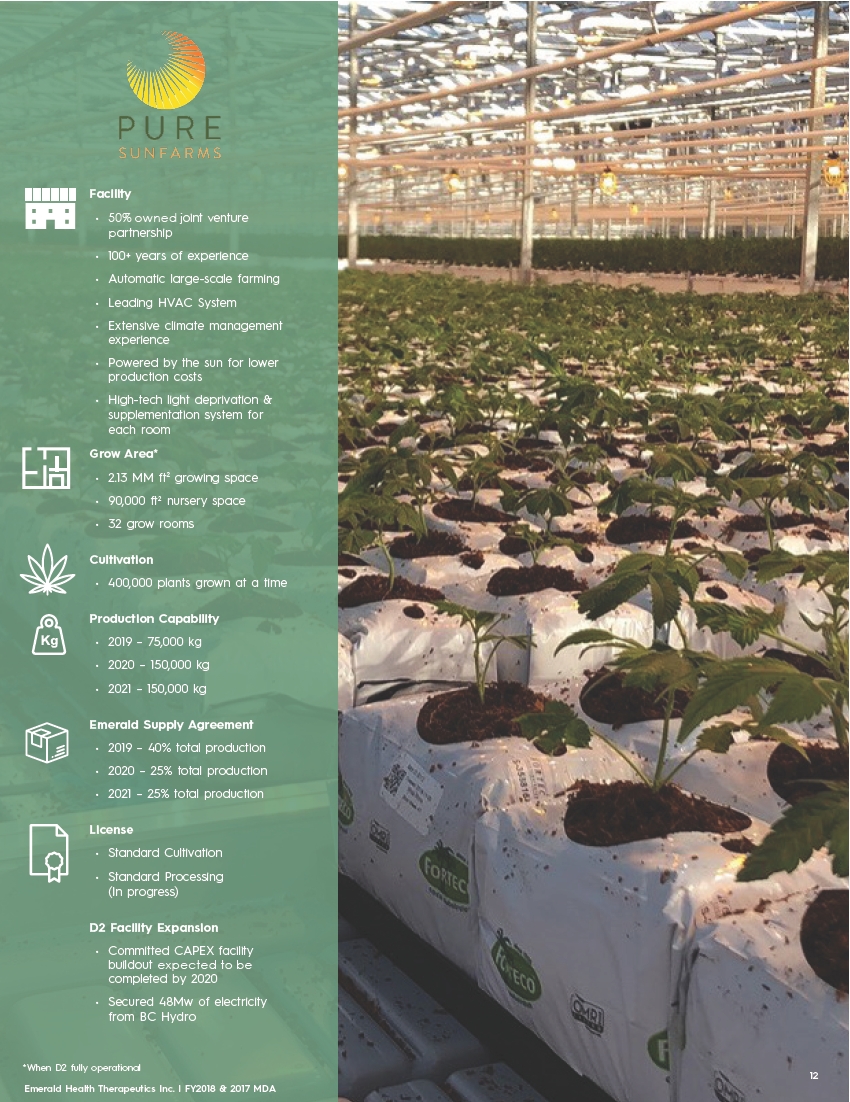

| (e) | 50% of the shares of Pure Sunfarms Corp. (the "Joint Venture"), a British Columbia-based licence holder under the Cannabis Act; and |

| | |

| (f) | 100% of the shares of Avalite Sciences Inc. (formerly Northern Vine Canada Inc.) ("Avalite"), a British Columbia-based licenced dealer under the provisions of the Controlled Drugs and Substances Act (Canada) (the "CDSA") and a licence holder under the Cannabis Act. |

Development of Business in 2018

Effective January 1, 2018, the Company amended and restated the Second Amended and Restated ICA (the "Third Amended and Restated ICA") with Emerald Health Sciences Inc. ("Sciences"), a control person of the Company, pursuant to which Sciences agreed to provide to the Company certain services relating to, among other things, corporate administration and strategy, facility management and construction, business development, human resources and scientific advisory and technical advice. The Company agreed to pay a fixed monthly fee of $350,000 to Sciences for the services.

On January 9, 2018, the Company completed a prospectus offering of 3,000,000 units of the Company at a price of $5.00 per unit with a single Canadian institutional accredited investor (the "Investor") (the "January Prospectus Offering") pursuant to a prospectus supplement to the Company's base shelf prospectus. Each unit was comprised of one Common Share and one Common Share purchase warrant with each warrant exercisable into one Common Share at a price of $6.00 per share for a period of 36 months from the date of issuance. The January Prospectus Offering was completed without the involvement of an underwriter. The Investor also concurrently purchased 2,000,000 Common Shares from Sciences, a control person of the Company, at a price of $5.00 per share.

On February 8, 2018, the Company completed a prospectus offering of 3,000,000 units of the Company at a price of $6.00 per unit with the Investor pursuant to a prospectus supplement to the Company's base shelf prospectus (the "February 2018 Prospectus Offering"). Each unit was comprised of one Common Share and one Common Share purchase warrant with each warrant exercisable into one Common Share at a price of $7.00 per share for a period of six months from the date of issuance. The February 2019 Prospectus Offering was completed without the involvement of an underwriter. The Investor also concurrently purchased 2,000,000 Common Shares from Sciences, a control person of the Company, at a price of $6.00 per share. The Investor exercised in full the warrants issued in connection with the January Prospectus Offering within three days of the completion of the February Prospectus Offering.

Between March 2018 and August 2018, the Company filed 17 provisional US patent applications covering, among other things, the Company's unique Defined DoseTMcannabis dosage forms and formulations. The applications have not yet been approved and the Company has no indication as to when or if they will be approved.

On April 17, 2018, the Company entered into a binding agreement with EHB, EHN, GAB Innovations, Inc. and Dr. Gaetano Morello, a director of Sciences, a control person of the Company, with respect to the formation of the business and operations of EHN. EHN holds the exclusive Canadian distribution rights for EHB's endocannabinoid-supporting nutritional products (the "Endocannabinoid Supplement Portfolio"), which consist of nutritional supplements that use non-cannabis, non-psychoactive plant-based bioactive

- 17 -

compounds to support the body's endocannabinoid system. EHB is a partially-owned subsidiary of Sciences and EHB is therefore a related party of the Company.

On April 30, 2018, the Company entered into a supply agreement with the Joint Venture whereby the Company agreed to purchase 40% of the Joint Venture's cannabis production in 2018 and 2019.

On May 2, 2018, the Company acquired 100% of the issued and outstanding shares of Verdélite and its affiliate Verdélite Holdings for consideration of $90 million, subject to adjustment, payable 50% in cash and 50% in Common Shares. The Company paid $22.5 million in cash upon closing and $45 million of the purchase price was satisfied by the issuance of 9,911,894 Common Shares, of which 4,955,947 Common Shares will be held in escrow until May 1, 2019, pursuant to an escrow agreement. An additional $22.3 million (working capital adjustment) in cash is payable by the Company to the vendors on May 1, 2019.

On May 15, 2018, the Company exercised its right to purchase additional common shares of Avalite for $2.75 million, increasing its ownership stake of Avalite from 53% to 65%.

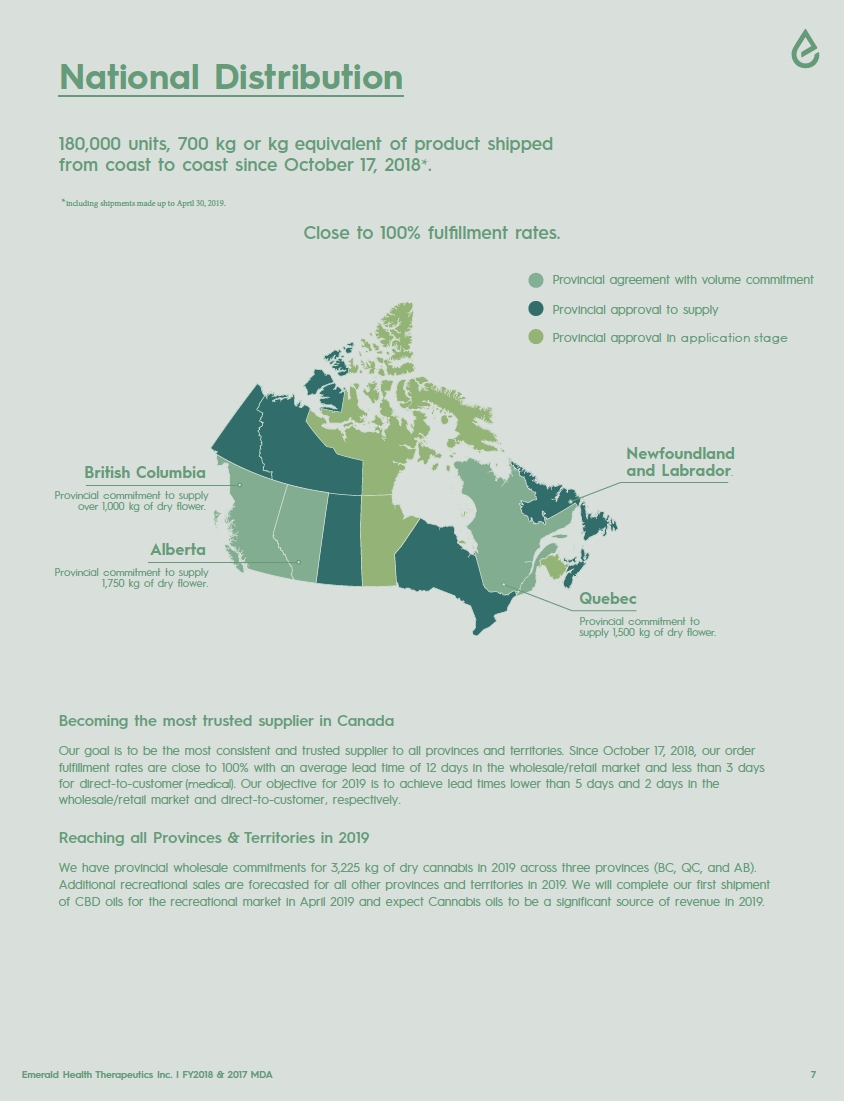

On July 24, 2018, the Company signed a non-binding memorandum of understanding (the "MOU") with the British Columbia Liquor Distribution Branch ("BCLDB") to supply cannabis products to the BCLDB to serve the non-medical market throughout the province from the date the Cannabis Act came into force. The MOU is in BCLDB's standard form. Pursuant to the MOU, the Company has agreed to make 1,086 kg of cannabis products available for purchase by the BCLDB if the BCLDB elects to purchase cannabis products from the Company.

On August 8, 2018, the Company signed a non-binding term sheet to form a strategic alliance with Factors R&D Technology, Inc. ("FTI"), a division of Factors Group of Nutritional Companies Inc. Pursuant to the term sheet, FTI has agreed to provide to the Company pharmaceutical-grade, industrial-scale manufacturing capacity as well as expertise in GMP-level extraction, softgel production, and packaging focused on the emerging market opportunities for medicinal cannabis in Canada and internationally. Further, the term sheet provides that FTI will be issued shares of EHN representing 25% of EHN's issued share capital. The parties agreed to use their best efforts to enter into a definitive agreement within 60 days of the execution of the term sheet. However, the definitive agreement is quite complex, and the parties remain engaged in negotiations regarding the draft and finalization of the definitive agreement.

On August 15, 2018, the Company acquired the remaining shares of Avalite for a purchase price of $2,000,000 in cash and 1,093,938 Common Shares. The transaction increased the Company's ownership of Avalite from 65% to 100%.

On September 7, 2018, it was announced that the Company had been selected as an approved supplier by the Ontario Cannabis Retail Corporation ("OCRC") to supply the Ontario Cannabis Store ("OCS") with its cannabis products.

On September 10, 2018, the Company was selected as an authorized cannabis supplier by the Newfoundland Labrador Liquor Corporation ("NLC") to supply cannabis products to the NLC to serve the adult use market in the province of Newfoundland and Labrador.

On September 26, 2018, the Company announced that it has agreed to purchase from Emerald Health Hemp Inc. ("EHH") cannabidiol ("CBD") oil-containing hemp biomass for extraction into CBD oil pursuant to a supply agreement between the Company and EHH. The supply agreement (the "Hemp Supply Agreement") is for four years (five harvests) with an option to extend for an additional two years. Five

- 18 -

hundred acres of hemp was harvested in October 2018 by EHH from farms located in Manitoba and Prince Edward Island and one thousand acres is expected to be harvested by EHH in each subsequent year of the agreement. CBD yield from the 2018 harvest has yet to be determined, pending analysis and extraction. EHH is a wholly-owned subsidiary of Sciences, a control person of the Company, and EHH is therefore a related party of the Company.

In October 2018, the Company entered into a research agreement (the "Research Agreement") with Emerald Health Biotechnology España S.L.U. (formerly, VivaCell Biotechnologies Spain S.L.U.) ("EH Spain"), a company focused on cannabis research, pursuant to which EH Spain agreed to provide contract research organization services to the Company to elucidate the mechanism of action of proprietary formulations and dosage forms that the Company is developing. EH Spain is a wholly-owned subsidiary of Sciences, a control person of the Company, and EH Spain is therefore a related party of the Company.

On October 17, 2018, the Cannabis Act came into force, legalizing the recreational use of cannabis by adults. When the Cannabis Act came into force, the Renewed Licence and other licences held by the Company which were issued under the ACMPR were deemed to be their functionally equivalent licences under the Cannabis Act (the "Licences"). See "Licences" for a description of the Licences held by the Company.

On November 28, 2018, the Company announced that Avtar Dhillon, MD, the Company's Executive Chairman, was appointed President of the Company and the Company's Chief Executive Officer, Chris Wagner, had stepped down.

On December 4, 2018, the Company announced that EHN had received certain product licences and natural product numbers from Health Canada to sell in Canada.

On December 7, 2018, the Company completed a prospectus offering of 4,000,000 Common Shares at a price of $2.70 per Common Share with the Investor pursuant to a prospectus supplement to the Company's base shelf prospectus (the "December 2018 Prospectus Offering"). The December 2018 Prospectus Offering was completed without the involvement of an underwriter.

The subsidiaries and joint ventures of the Company at December 31, 2018 are:

| | |

| Name of Entity | Ownership Interest |

| | December 31, | December 31, |

| | 2018 | 2017 |

| Emerald Health Therapeutics Canada Inc. | 100% | 100% |

| Avalite Sciences Inc. | 100% | 53% |

| Pure Sunfarms Corp. | 50% | 50% |

| Verdélite Sciences Inc. | 100% | 0% |

| Verdélite Property Holdings Inc. | 100% | 0% |

- 19 -

Recent Developments and Events after the Reporting Period

On January 10, 2019, the Company closed its acquisition of 51% of EHN and EHB granted EHN the exclusive Canadian distribution rights to the Endocannabinoid Supplement Portfolio in exchange for 49% ownership of EHN. Sciences is a control person of the Company. On January 10, 2019, the Company also announced the resignation of Chris Wagner as a director of the Company.

On January 15, 2019, the Company announced a secondary offering of 2,800,000 Common Shares by Sciences, a control person of the Company, which closed on January 16, 2019. After completion of the secondary offering, Sciences held approximately 28.6% of the Common Shares on a fully-diluted basis.

On January 30, 2019, the Company announced that it had entered into a release, discharge and transaction agreement settling all claims made by Pivot against Verdélite and its former shareholders. The claims relate to a non-binding letter of intent which Verdélite and its former shareholders had previously entered into with Pivot with respect to a potential sale of Verdélite. Pursuant to the settlement, all claims against Verdélite have been discharged without Verdélite making any payment or providing any compensation to Pivot.

On February 5, 2019, the Company announced that it had entered into a binding licence agreement with Indena S.p.A. ("Indena"), an arm's length party, pursuant to which Indena granted the Company a perpetual exclusive licence for the use in Canada of Indena's CBD-extraction technology, and agreed to contract manufacturing services to the Company for CBD extraction. The Company has agreed to pay Indena a license fee of €450,000 (payable in two tranches of €250,000 and €200,000, respectively). The first payment is not payable until a definitive agreement has been entered into and the second payment is not payable until certain technological information has been transferred to the Company. The parties expect to enter into a definitive agreement upon completion of ongoing negotiations.

On February 8, 2019, the Company announced that the Joint Venture had been informed by the OCRC operating as the OCS, that it had been selected to supply the OCS with Pure Sunfarms-branded cannabis products for the non-medical market in the province of Ontario.

On February 13, 2019, the Company announced that the Joint Venture had entered into a credit agreement with Bank of Montreal, as agent and lead lender, and Farm Credit Canada, as lender, in respect of a $20 million secured non-revolving term loan (the "Credit Facility"). The Joint Venture intends to use the funds available under the Credit Facility to finance the final costs of converting the Delta 3 Facility for cannabis production, the vast majority of which was completed in January 2019. The funds available under the Credit Facility may also be used by the Joint Venture for general corporate purposes. The Credit Facility, which matures on February 7, 2022, is secured by the Delta 3 Facility, and contains customary financial and restrictive covenants. The Company is not a party to the Credit Facility, but has provided a limited guarantee in the amount of $10 million in connection with the Credit Facility. The Joint Venture has drawn the Credit Facility in full.

On March 13, 2019, the Company filed a final short form base shelf prospectus (the "2019 Base Shelf Prospectus") in each of the provinces of Canada. The 2019 Base Shelf Prospectus qualifies the issuance and secondary sale of up to $150,000,000 of Common Shares, preferred shares, debt securities, warrants, units or subscription receipts of the Company or a combination thereof from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of

- 20 -

the offering and as set out in an accompanying prospectus supplement, during the 25-month period that the 2019 Base Shelf Prospectus remains effective.

On March 27, 2019, the Company filed a prospectus supplement in connection with an at-the-market equity program ("ATM Program") that it established with GMP Securities L.P. (the "Agent"). In connection with the ATM Program, the Company entered into an equity distribution agreement with the Agent. The ATM Program allows the Company to issue Common Shares from treasury having an aggregate gross sales price of up to $39 million to the public from time to time, at the Company's discretion, at the prevailing market price when issued on the TSXV or on any other marketplace for the Common Shares in Canada. The ATM Program is effective until the earlier of April 13, 2021 or completion of the sale of the maximum amount of shares thereunder. Sales of Common Shares will be made through "at-the-market distributions" as defined in National Instrument 44-102 –Shelf Distributionson the TSXV or on any other existing marketplace for the Common Shares in Canada. The Common Shares will be distributed at the prevailing market prices at the time of the sale and, as a result, prices may vary among purchasers and during the period of distribution.

On March 29, 2019, the Company announced that it had fulfilled its first purchase order of cannabis from Yukon Liquor Corporation, signed a sales agreement with Alberta Gaming, Liquor and Cannabis and became registered by the Saskatchewan Liquor and Gaming Authority to supply cannabis to the Saskatchewan market.

On April 1, 2019, the Company announced that the Joint Venture had exercised its option to acquire from Village Farms a second 1.1 million square foot greenhouse (“Delta 2 Facility”) adjacent to the Delta 3 Facility. In connection therewith, the Company has agreed to advance a further $25 million to the Joint Venture in tranches as and when required, of which $2.5 million was advanced on April 1, 2019. The Company also entered into an agreement (the "JV Supply Agreement") with the Joint Venture to purchase 25% of its aggregate cannabis production from the Delta 2 Facility and the Delta 3 Facility in 2020, 2021 and 2022.

On April 3, 2019, the Company announced it had signed a letter of intent to supply cannabis to the Société Québécoise du Cannabis. The Company anticipates fulfilling its first supply order in the second quarter of 2019.

On April 8, 2019, the Company announced that its Verdélite facility had received its standard processing licence from Health Canada, allowing Verdélite to extract, manufacture, synthesize, test and sell cannabis products, in addition to its right to cultivate and sell cannabis flowers.

On April 23, 2019, the Company announced that Pure Sunfarms has completed planting of the final quadrants of the Delta 3 Facility. As a result, the entire 1.03 million square feet of growing area at the Delta 3 Facility, comprising 16 individual grow rooms, is on track to reach its annualized full production run-rate of 75,000 kilograms by mid-2019.

- 21 -

Financings

The table below summarizes the recent offerings conducted by the Company and use of proceeds there from.

| | | |

| Offering / | Use of Proceeds–as disclosed prospectus | | |

| Proceeds Raised | supplement | | Subsequent Use of Proceeds |

January 9, 2018

Treasury Offering

($15,000,000) | Completion of capital projects and potential future expansion and acquisitions; for research and development; expanding the Company’s existing extraction capabilities; and working capital over the next 12 months. | | $2.3 million for development of Richmond facility; $4 million equity investments in Pure Sunfarms; $2.75 million to increase ownership of Avalite from 53% to 65%; $5 million for loans subsequently made to Pure Sunfarms to fund development of its production facility; balance for working capital. |

| | | | |

February 14, 2018

Treasury Offering

($18,000,000) | Completion of capital projects and potential future expansion and acquisitions; for research and development; expanding the Company’s existing extraction capabilities; and working capital over the next 12 months. | | $8 million in loans to Pure Sunfarms to fund development of its production facility; $2 million to increase ownership of Avalite from 65% to 100%; $2 million for development of the Richmond facility; and $6 million for the acquisition cost of Verdélite. |

| | | |

May 23, 2018

Treasury Offering

($16,800,000) | Completion of recently acquired Agro-Biotech facility in Quebec, working capital and general corporate purposes. | | Funding of the acquisition cost of Verdélite. |

| | | | |

December 7, 2018

Treasury Offering

($10,800,000) | Completion of capital projects, research and development, working capital and general corporate purposes. | | $10.8 million to substantially complete Richmond and Verdélite facilities. |

| | | | |

Between March 29, 2019 and April 30, 2019

Treasury Offering through ATM Program

($4,516,371) | The Company currently intends to use the net proceeds from the ATM Program, if any, to fund a portion of the costs for the completion of its capital projects, for research and development, working capital and general corporate purposes. | | The funds are being used to fund completion of the Richmond and Verdélite facilities. |

|

Licences

The Company holds licences from Health Canada under the Cannabis Act to produce and sell cannabis products in accordance with applicable laws in Canada. When the Cannabis Act came into force on October 17, 2018, the Company's licences, which were issued under the ACMPR, were deemed to be their functionally equivalent licences under the Cannabis Act. The Company currently indirectly holds a number of Licences through its wholly-owned direct and indirect subsidiaries, the Operating Subsidiary, Verdélite and Avalite, as well as others which are held by the Joint Venture. The Licences held by the Operating Subsidiary permit it to cultivate cannabis and produce and sell dried cannabis, cannabis oils, cannabis plants and cannabis seeds; the Licence held by Verdélite permits it to cultivate, extract, manufacture, synthesize, test and sell cannabis; the Licence held by Avalite permits it to process cannabis and produce cannabis oil; and the Licences held by the Joint Venture permit it to cultivate cannabis and produce and sell dried cannabis, cannabis oils, cannabis plants and cannabis seeds, all in accordance with the terms and conditions specified in the applicable Licence and the Cannabis Act.

- 22 -

| | | | | | | | |

| Particulars of the Licences are set out in the table below. |

| Licence | Location | Licence | Authorized | Applications | Original | Date of | Expiration | Application |

| Holder | | Held | Products for | Submitted | Date of | Amendment | Date of | Status |

| | | | Sale in Some | | Licensing | of Licence | Licence | |

| | | | Capacity | | | | | |

| Emerald Health Therapeutics Canada, Inc. | Victoria, BC | Standard Cultivation | Plants/Seeds/Dried/Fresh Cannabis and Cannabis oil | -- | February 5, 2014 | November 9, 2018 | November 8, 2019 | -- |

|

| Standard Processing | -- |

| Sale for Medical Purposes | -- |

| -- | -- | To amend licence (to expand licensed facility) | -- | -- | -- | Submitted January 18, 2019; pending approval |

Emerald Health Therapeutics Canada, Inc.

(2ndSite) | Victoria, BC | Sale for Medical Purposes | Cannabis products | -- | October 6, 2017 | November 10, 2018 | October 6, 2020 | -- |

| -- | -- | Standard Cultivation | -- | -- | -- | Submitted March 1, 2019; pending approval |

| -- | -- | Standard Processing | -- | -- | -- | Submitted March 1, 2019; pending approval |

Emerald Health Therapeutics Canada, Inc.

(3rdSite) | Richmond,

BC | -- | -- | Standard Cultivation | -- | -- | -- | Submitted January 16, 2019; pending approval |

Verdélite Sciences, Inc.

(formerly Agro-Biotech Inc.) | Saint-

Eustache,

QC | Standard Cultivation | Plants/Seeds to provinces/territories | -- | January 12,

2018 | November 8,

2018 | January 12,

2021 | -- |

| Standard Processing | -- | -- | April 5, 2019 | -- | January 12, 2021 | -- |

| -- | -- | To amend licence (to expand licensed facility) | -- | -- | -- | Submitted April 11, 2019; pending approval |

Avalite Sciences Inc.

(formerly Northern Vine Canada Inc.) | Langley, BC | Standard Processing | -- | -- | January 17, 2019 | January 17, 2019 | January 17, 2020 | -- |

| Dealer's Licence1 | -- | -- | September 22, 2016 | N/A | December 31, 2019 | -- |

| Analytical Testing | -- | -- | January 17, 2019 | -- | January 17, 2020 | -- |

| Research | -- | -- | February 8, 2019 | -- | December 31, 2019 | -- |

| Saint-Eustache, QC | -- | -- | Analytical Testing | -- | -- | -- | Submitted March 25, 2019; pending approval |

| Pure Sunfarms Corp. | Delta, BC | Standard Cultivation | Plants/

Seeds to

provinces/

territories | -- | March 2, 2018 | March 11, 2019 | March 2, 2021 | -- |

| -- | -- | Standard Processing | -- | -- | -- | Submitted December 18, 2018; pending approval |

- 23 -

| | | | | | | | |

| Licence | Location | Licence | Authorized | Applications | Original | Date of | Expiration | Application |

| Holder | | Held | Products for | Submitted | Date of | Amendment | Date of | Status |

| | | | Sale in Some | | Licensing | of Licence | Licence | |

| | | | Capacity | | | | | |

Emerald

Health

Naturals Inc. | Kelowna,

BC2 | -- | -- | Standard Processing | -- | -- | -- | Submitted October 16, 2018; pending approval |

| -- | -- | Sale for Medical Purposes | -- | -- | -- | Submitted October 16, 2018; pending approval |

| |

| Notes: |

| 1 | Indicates a licenced dealer under the CDSA. |

| 2 | The Company is working with FTI to obtain this licence. |

Disclosure of Outstanding Share Data

The Company’s authorized share capital consists of an unlimited number of Common Shares of which 141,443,116 were issued and outstanding as of December 31, 2018 and 143,932,730 were issued and outstanding as of April 30, 2019, of which 4,955,947 will be held in escrow until May 1, 2019.

During the year ended December 31, 2018, the Company granted an aggregate of 2,811,000 stock options to directors, employees and consultants. Each option is exercisable into one Common Share for a period of up to five years. The exercise prices at the time of the grants ranged from $2.49 and $6.68 per share. Subsequent to the period ended December 31, 2018, the Company granted an additional 5,383,000 stock options, with exercise prices between $2.83 and $4.15. These options vest over three years with an expiry date five years from the grant date.

There were 9,894,211 stock options and 830,000 restricted share units outstanding as of December 31, 2018. As of April 30, 2019, there were 13,621,519 stock options and 950,000 restricted share units outstanding.

There were 8,411,764 warrants outstanding as of December 31, 2018 and as of April 30, 2019.

Selected Annual Information

The financial information presented for the years below was derived from financial statements prepared in accordance with IFRS and is expressed in Canadian dollars.

| | | |

| | For the years ended December 31, |

| | 2018 | 2017 | 2016 |

| | ($) | ($) | ($) |

| Total revenue | 2,110,403 | 937,654 | 253,321 |

| Net loss attributable to the Company | (30,983,408) | (8,731,832) | (2,940,501) |

| Net loss per share (basic and diluted) | (0.22) | (0.10) | (0.05) |

| Total assets | 206,859,494 | 73,730,839 | 4,176,329 |

| Total non-current financial liabilities | 293,886 | 317,497 | - |

- 24 -

Summary of Quarterly Results

The financial information in the following tables summarizes selected financial information for the Company for the last eight quarters which was derived from annual financial statements prepared in accordance with IFRS or interim financial statements prepared in accordance with IFRS applicable to the preparation of interim financial statements,IAS 34, Interim Financial Reporting:

| | | | |

| | 2018 |

| | December 31 | September 30 | June 30 | March 31 |

| | ($) | ($) | ($) | ($) |

| Revenue | 1,131,853 | 321,070 | 284,262 | 373,218 |

| Share-based payments | 1,296,891 | 2,165,851 | 2,081,661 | 1,954,047 |

| Interest revenue | 438,974 | 222,740 | 274,436 | 250,064 |

| Share of income (loss) from JV | 1,432,771 | 3,940,373 | 682,431 | (301,793) |

| Net loss | (13,900,360) | (6,426,658) | (5,610,970) | (5,045,420) |

| Net loss per share (basic and diluted) | (0.10) | (0.05) | (0.04) | (0.04) |

| | | | | |

| | 2017 |

| | December 31 | September 30 | June 30 | March 31 |

| | ($) | ($) | ($) | ($) |

| Revenue | 279,362 | 211,316 | 245,708 | 201,268 |

| Share-based payments | 1,979,553 | 271,968 | 369,788 | 201,186 |

| Interest revenue | 43,024 | 60,997 | 57,497 | - |

| Share of loss from JV | (44,562) | (278,016) | - | - |

| Net loss | (4,027,569) | (1,939,371) | (1,669,026) | (1,205,858) |

| Net loss per share (basic and diluted) | (0.04) | (0.02) | (0.02) | (0.02) |

Included in the gross margin for the three months ended December 31, 2018, is an unrealized gain of $144,181 (December 31, 2017: loss of $44,883) on the changes in the fair value of the Company’s biological assets. Also included in the gross margin for the three months ended December 31, 2018, is a realized fair value gain of $21,749 (December 31, 2017: $123,810) on the change in biological assets included in the cost of inventory sold.

Results of Operations

Quarter ended December 31, 2018

The net loss for the quarter ended December 31, 2018, was $13.9 million (loss of $0.10 per share), compared to the net loss of $4.0 million (loss of $0.04 per share) for the same quarter in the prior year. Diluted loss per share is the same as basic loss per share as the outstanding options and warrants have an anti-dilutive effect on the loss per share.

- 25 -

Factors contributing to the net loss for the three-month period ended December 31, 2018 include the following:

Revenue

Revenue for the quarter ended December 31, 2018, was $1,131,853 compared to $279,362 for the same period in the prior year. The revenue for the three months ended December 31, 2018 demonstrated the

Company’s continued growth in the market. As compared with the previous three months ended December 31, 2017, the Company’s revenue increased 305% as a result of sales of recreational cannabis following the Cannabis Act taking effect. During the three months ended December 31, 2018, the Company began its first recreational shipments to wholesalers. The Company also had a larger medical client base and a greater percentage of sales from oils in the current period resulting in an increase in revenue compared to the prior year. For the quarter ended December 31, 2018, revenue was comprised of approximately 43% dried product, 55% oils and 2% other, compared to approximately 50% dried product and 50% oils in the quarter ended December 31, 2017.

| | |

| | Three months ended December 31, |

| | 2018 | 2017 |

| Average selling price of adult-use dried flower per gram | $5.19 | $ - |

| Kilograms sold of adult-use dried flower | 122 | - |

| Average selling price of medical dried flower per gram & gram equivalents | $8.10 | $10.30 |

| Kilograms sold of medical dried flower & kilogram equivalents | 54.6 | 35.1 |

| Total kilograms produced of dried flower | 175 | 5 |

Cost of Sales

Cost of goods sold currently consists of four main categories: (i) cost of goods sold expensed from inventory, (ii) production costs, (iii) change in the fair value of biological assets, and (iv) amortization of the Health Canada licenses.

Cost of goods sold represents the deemed cost of inventory that arose from the fair value measurement of biological assets, subsequent post-harvest costs capitalized to inventory, purchased dried cannabis, costs to produce cannabis oils capitalized to inventory (including the deemed cost of dried inventory that arose from the fair value measurement of biological assets that were used to produce cannabis oils), and packaging costs. Cost of goods sold expensed to inventory for the quarters ended December 31, 2018 and December 31, 2017 was $2,719,059 and $120,057 respectively. The significant increase in cost of goods sold in the current period was substantially in line with the increase in the amount of product sold by the Company compared to the prior period.

Production costs include all direct and indirect production related costs, including security, compliance, quality control and quality assurance costs, as well as related overhead until the point of harvest. In addition, all inventory costs in excess of net realizable value are expensed to production costs. During the quarter ended December 31, 2018, the Company incurred production costs of $671,467 versus $310,794 in the quarter ended December 31, 2017. The significant increase in production costs is substantially attributable to the increase in operating expenses associated with the acquired subsidiaries and the related increase in the number of plants cultivated and staff required for production activities. During the

- 26 -

three months ended December 31, 2018, the Company also recognized $161,982 in excise taxes. The excise tax attributable to medical sales was absorbed by the Company.

The change in biological assets for the quarter ended December 31, 2018 was a gain of $144,181 compared to a loss of $44,883 in the same quarter in the prior year. The increase is substantially due to the number of plants that were growing in the Verdélite facility during the three months ended December 31, 2018.

The amortization of the Health Canada license represents the amortization of an acquired license that is recorded at cost less accumulated amortization. Amortization will be expensed as a cost of sales and the unamortized balance will remain on the Company’s balance sheet as an intangible asset. Verdélite did not record sales during the three months ended December 31, 2018, however, amortization of the license is recognized on a straight-line basis irrespective of either production or sale of cannabis from that facility.

The Company measures biological assets consisting of cannabis on plants at fair value less cost to sell up to the point of harvest, which becomes the basis for the cost of finished goods inventories after harvest. Seeds are measured at fair market value, except for a portion which are restricted with respect to distribution due to the conditions under which they were acquired that are measured at cost. The significant assumptions used in determining the fair value of cannabis plants are as follows: plant waste rate for various stages of development; yield per plant; selling price less costs to sell; percentage of total expected costs incurred to date; and costs incurred for each stage of plant growth.

Because gains recognized in the fair value of biological assets are recorded in a manner that decreases the cost of goods sold, gross margin is impacted significantly during periods of significant expansion in the cultivation area, as was the case during the three months ended December 31, 2018, when costs of goods sold was $3,322,354 as compared to the three months ended December 31, 2017 of $563,180.

Other expenses

General and Administrative–During the quarter ended December 31, 2018, the Company incurred general and administrative expenses of $3.3 million versus $1.9 million for the quarter ended December 31, 2017. The current quarter included expenses related to an increase in investor relations activities including business development, media, and project management in support of the legalization of the adult-use cannabis market. The significant increase in expenses in this period as compared to the same period in 2017 was largely due to the increase in salaries, wages and benefits associated with an increased headcount from acquisitions and change to the business to prepare for the legalization of cannabis for the adult-use market. In the quarter ended December 31, 2018, general and administrative costs included; salaries and benefits of $410,520 (three months ended December 31, 2017 - $297,748), consulting and professional services fees of $1,581,873 (three months ended December 31, 2017 - $851,469), investor relations fees of $722,339 (three months ended December 31, 2017 - $481,161), office and insurance of $419,446 (three months ended December 31, 2017 - $163,565) and travel and accommodation of $167,661 (three months ended December 31, 2017 - $135,297). Included in consulting and professional service fees, for the quarter ended December 31, 2018, is $1,050,000 in management fees to Sciences as per the amended agreement effective January 2018.

Sales and marketing– In the quarter ended December 31, 2018, the Company incurred sales and marketing expenses of $7,492,906 versus $146,383 in the comparable 2017 prior period. The current period increase reflects the increase in sales and marketing staff and activities as the Company works towards branding itself and launching products into the legal adult use market. Of the $7.5 million

- 27 -

included in sales and marketing expenses for the quarter, approximately $6.9 million related to expenditures billed by the Company’s former advertising agent of record, DDB Canada, for among other things, brand development, design, market research and advertising in anticipation of and commencement in, the legalization of the recreational use of cannabis by adults. The balance is comprised of staff-related costs such as salary, benefits, travel expenses and conference costs.

Research and development– In the quarter ended December 31, 2018, the Company incurred research and development expenses of $527,830 (three months ended December 31, 2017 - $40,226). Research and development projects in the current quarter include development and testing of processes to manufacture new products and designing clinical trials. The prior comparable period included research on cannabis oils and early stage planning for clinical trials.

Share-based compensation– In the quarter ended December 31, 2018, the Company incurred share-based compensation expenses of $1,296,892 versus $1,979,553 in the comparable 2017 prior period. The amounts are compensation expenses related to employee, director and consultant incentive stock options and restricted share units which are measured at fair value at the date of grant and expensed over the vesting period. During the current quarter, the Company granted 793,500 stock options to employees and consultants. Despite the option grants occurring during the period, the share-based compensation expense decreased as a result of the forfeiture of a significantly large number of granted options on termination during the period as compared to the same period in 2017.

Share of income from joint venture– In the quarter ended December 31, 2018, the Company recognized $1,432,771 as its 50% share of the income from the Pure Sunfarms joint venture, compared to $44,562 as its 50% share of the loss in the quarter ended December 31, 2017. Pure Sunfarms commenced operations during the three months ended December 31, 2017 and has since begun producing cannabis for sale, having received its cannabis sales license from Health Canada on July 27, 2018.

Year ended December 31, 2018

The net loss for the year ended December 31, 2018 was $30.9 million (loss of $0.22 per share) compared to a net loss of $8.8 million (loss of $0.10 per share) for the same period in the prior year. Diluted loss per share is the same as basic loss per share as the outstanding options and warrants have an anti-dilutive effect on the loss per share. Factors contributing to the net loss for the year include the following:

| | |

| | For the year ended December 31, |

| | 2018 | 2017 |

| Average selling price of adult-use dried flower per gram | $5.19 | $ - |

| Kilograms sold of adult-use dried flower | 122 | $ - |

| Average selling price of medical dried flower per gram & gram equivalents | $9.10 | $10.40 |

| Kilograms sold of medical dried flower & kilogram equivalents | 189 | 114 |

| Total kilograms produced of dried flower | 323 | 52 |

Included in the gross margin for the year ended December 31, 2018, is an unrealized gain of $2,818,442 (December 31, 2017: $163,754) on the changes in the fair value of the Company’s biological assets. Also included in the gross margin for the year ended December 31, 2018, is a realized fair value gain of

- 28 -

$158,676 (December 31, 2017: $10,328) on the change in biological assets included in the cost of inventory sold.

Revenue

Revenue for the year ended December 31, 2018 increased by 125%, with $2,110,403 recognized during the 2018 fiscal year as compared to $937,654 in the prior fiscal year. The increase in revenue was primarily attributable to the Company’s revenues in the adult-use market during the last three months of the year. Revenues from medical cannabis also increased during the year as the Company expanded its client base. For the year ended December 31, 2018, revenue was comprised of approximately 61% dried product, 37% oils and 2% other, compared to approximately 50% dried product and 50% oils in the prior year to date ended December 31, 2017.

Cost of Sales

Cost of sales increased significantly in the current year compared to the prior year primarily due to: higher packaging costs as a result of regulatory requirements under the Cannabis Act; higher production costs due to increased distribution costs and recognition of the amortization associated with the Health Canada license. Additionally, the acquisition of Verdélite and the associated ramp up of its facilities were included as indirect and direct production costs without corresponding revenue.

Total gross margin is impacted significantly by changes in the fair value of biological assets included in the gross margin. For the year ended December 31, 2018, an unrealized gain of $2,818,442 (December 31, 2017: $163,754) in the fair value of the Company’s biological assets is included in the cost of sales. Also included in the gross margin for the year ended December 31, 2018, is a realized fair value gain of $158,676 (December 31, 2017: $10,328) attributable to the change in biological assets included in the cost of inventory sold.

Despite the gain recognized in the change in biological assets, the Company recorded a negative gross margin of $3,099,225 for the year ended December 31, 2018 and a negative gross margin of $372,963 for the year ended December 31, 2017. The gross margin was also decreased as a result of lower average net selling prices per gram in the adult-use market as compared to the higher net selling prices per gram in the medical cannabis market.

Other expenses

General and Administrative–During the year ended December 31, 2018, the Company incurred general and administration expenses of $14.0 million versus $5.1 million for the same period ended December 31, 2017. The year-to-date expenses included expenses related to a significant increase in activities including corporate branding, business development, media, and project management to prepare for the legal adult-use market. Additional staff have been hired and office space has been expanded. For the year period ended December 31, 2018, general and administrative costs included: salaries and benefits of $2,297,988 (2017 - $854,430), consulting and professional services fees of $7,287,629 (2017 - $2,301,067), investor relations and media $2,377,219 (2017 - $1,026,299), office and insurance of $1,477,764 (2017 -$522,485) and travel and accommodation of $552,897 (2017 - $366,166).

The $7.3 million in consulting and professional services substantially consists of management fees paid to the Company's major shareholder, Emerald Health Sciences Inc. ("Sciences") pursuant to the independent contractor agreement described below ($4.2 million), employee recruitment fees ($0.64 million), general

- 29 -

legal fees ($0.43 million), consultant fees ($1.45 million), auditor fees ($0.36 million), and stipends paid to the Company’s board of directors ($0.12 million).

The $2.4 million in investor relations and media fees substantially consists of conferences and tradeshows ($1.2 million), native advertising and market intelligence services ($0.83 million), shareholder communication fees ($0.14 million), and investor relations consultant fees ($0.20 million).

Sales and marketing– For the year ended December 31, 2018, the Company incurred sales and marketing expenses of $11,333,294 versus $428,541 in the prior year. The current period increase reflects the increase in sales and marketing activity as the Company works towards branding the Company and launching products into the legal adult use market. Of the $11.3 million included in sales and marketing expenses for the year, approximately $9.6 million related to expenditures billed by the Company’s former advertising agent of record, DDB Canada, for among other things, brand development, design, market research and advertising in anticipation of and commencement in, the legalization of the recreational use of cannabis by adults. The balance is comprised of staff-related costs such as salary, benefits, travel expenses and conference costs.

Research and development– For the year ended December 31, 2018, the Company incurred research and development expenses of $801,351 versus $207,500 in the prior year. Research and development projects in the current year include development and testing of processes to manufacture capsules, exploration of other new products and planning for upcoming clinical trials. The Company capitalized development costs associated with the application of 17 patents during the year ended 2018.

Share-based compensation– Share-based compensation expense for the year period ended December 31, 2018 was of $7,498,450 compared to $2,822,495 in the 2017 fiscal year. The amounts are compensation expenses related to employee, director and consultant incentive stock options and restricted share units which are measured at fair value at the date of grant and expensed over the vesting period. During the current year, the Company granted 2,811,000 stock options and 5,000 restricted share units to employees and consultants. The increase in the share-based compensation expense is due to a significantly larger number of granted and outstanding options as at December 31, 2018 as compared to December 31, 2017.

Share of income from joint venture– For the year ended December 31, 2018, the Company recognized $5,753,782 as its 50% share of the income from the Pure Sunfarms joint venture, which commenced operations during the three months ended December 31, 2017. Pure Sunfarms has begun producing cannabis for sale and received its cannabis sales license from Health Canada on July 27, 2018.

- 30 -

Additional Disclosure for Venture Issuers Without Significant Revenue

As the Company did not have significant revenue from operations in either of its last two financial years, the following is a breakdown of the material costs incurred:

| | | | |

| | For the three | For the three | For the year | For the year |

| | months ended | months ended | ended | ended |

| | December 31, | December 31, | December 31, | December 31, |

| | 2018 | 2017 | 2018 | 2017 |

| | ($) | ($) | ($) | ($) |

| Expensed research and development costs | $527,830 | $40,226 | $801,351 | $207,500 |

| General and administrative expenses | $3,301,839 | $1,929,240 | $13,993,498 | $5,070,447 |

| Purchase of plant and equipment | $8,681,850 | $1,096,154 | $17,235,075 | $2,257,022 |

Liquidity and Capital Resources

The Company continually monitors and manages its cash flow to assess the liquidity necessary to fund operations and capital projects. The Company manages its capital resources and adjusts it to take into account changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust its capital resources, the Company may, where necessary, control the amount of working capital, pursue financing or manage the timing of its capital expenditures. As at December 31, 2018, the Company had positive working capital of $27.6 million.

While the Company has incurred losses to date, management anticipates long-term future profitability of the business, though there can be no assurance that the Company will gain adequate market acceptance for its products or be able to generate sufficient gross margins to reach profitability.

The Company has committed to various projects which may require significant cash injections over the next 24 months, including the expansion of service and production facilities of Avalite, the Pure Sunfarms retro-fit of Delta 2 and potentially Delta 1; the Company’s new production facility in Richmond, British Columbia; and Verdélite’s indoor grow facility. As at December 31, 2018, the Company committed to payments of $5.0 million during the remainder of 2019 for the supply of material and labour to build greenhouses at the Richmond site. The Company also committed $25 million to Pure Sunfarms in support of the Delta 2 retro-fit.

On July 27, 2018 Avalite purchased the land and building it had previously leased for $956,000 plus applicable taxes.

On August 15, 2018, the Company expended $2.0 million under the agreement to purchase all of the remaining shares of Avalite held by Abattis.

During the year ended December 31, 2018, the Company made a demand loan in the amount of $13 million to Pure Sunfarms. See discussion of the demand loan to Pure Sunfarms under “Transactions with Related Parties.”

The Company is obligated to pay an additional $22.3 million cash on May 1, 2019, under the Verdélite purchase agreement.

- 31 -

The Company is committed to contributing $5.0 million cash to EHN in exchange for a 51% initial ownership in EHN upon closing of the transactions provided for in the Formation Agreement.

Verdélite held a mortgage with the National Bank of Canada, secured by the property held by Verdélite Property Holdings Inc. with a maturity date of February 2019. The mortgage was paid in March of 2019.

In addition, the Company has entered into operating lease commitments for land and office space through 2047. The future minimum lease payments for the next five years and thereafter are as follows:

| | | | | | |

| | Due by year ending |

| | 2019 | 2020 | 2021 | 2022 | 2023 | Thereafter |

| Production facilities | $210,740 | $49,748 | - | - | - | - |

| Equipment | $21,600 | $19,800 | - | - | - | - |

| Office space | $170,578 | $170,578 | $170,578 | $170,578 | $170,578 | - |

| Temporary housing | $48,600 | - | - | - | - | - |

| Land | $320,000 | $320,000 | $320,000 | $320,000 | $320,000 | $7,440,000 |

| Total | $771,518 | $560,126 | $490,578 | $490,578 | $490,578 | $7,440,000 |

Operating, Investing and Financing Activities

The chart below highlights the Company’s cash flows:

| | |

| | For the year ended | For the year ended |

| | December 31, 2018 | December 31, 2017 |

| | ($) | ($) |

| Net cash provided by (used in): | | |

| Operating activities | ($29,089,202) | ($7,815,986) |

| Investing activities | ($62,478,881) | ($18,932,984) |

| Financing activities | $83,087,028 | $68,054,910 |

| Increase (decrease) in cash | ($8,481,055) | $41,305,940 |

Cash used in operating activities for the year ended December 31, 2018 was $29.1 million, compared to cash used of $7.8 million in the prior year. The current year amount reflects the increase in general and administrative expenditures, additional staff costs, the increase in sales and marketing expenditures, and cash outflows from payments of current liabilities and increase in current assets from the prior year ended December 31,2017 and acquired balances during the year ended December 31, 2018. The Company incurred greater losses during the year as a result of the preparation for the legalization of cannabis in the adult market as well as the ramp up of its acquisitions into operating entities.

- 32 -

Cash used in investing activities for the year ended December 31, 2018 was $62.5 million, compared to cash used of $18.9 million in the prior year. In the current year:

$22.6 million was used to purchase Verdélite;

$4.0 million was used to invest in the Pure Sunfarms joint venture transaction;

$13.0 million was advanced as a demand loan to Pure Sunfarms;

$2.0 million was used in the acquisition of Avalite;

$2.0 million was paid as a deposit for the greenhouse being built at the Richmond site;

$0.50 million was used in the research and preparation of 17 patents;

$1.7 million in equipment purchased for the Richmond site and Victoria site, and renovations at the Victoria site;

$7.2 million was used in construction of the new production facility at the Richmond site; and

$6.6 million was used to complete the renovations on the Verdélite site, and to purchase lab extraction and other equipment.

The prior year cash usage was substantially attributable to the investment in Pure Sunfarms and construction at the Richmond site.

Cash provided by financing activities for Cash provided by financing activities for the year ended December 31, 2018 was $83.1 million, compared to cash provided of $68.1 million in the prior period. Cash generated in the current year included $60.6 million from net proceeds of the prospectus offerings completed in January, February, May and December 2018, $21.9 million received from warrant exercises, and $1.2 million from stock option exercises.

Financial Risk Management

The Company’s board of directors has overall responsibility for the establishment and oversight of the Company’s risk management policies on an annual basis. Management identifies and evaluates the Company’s financial risks and is charged with the responsibility of establishing controls and procedures to ensure financial risks are mitigated in accordance with the approved policies.

Measurement Uncertainty and Impairment Assessments

As of December 31, 2018, management of the Company has determined that no impairment indicators of its assets were present and no additional impairment write-downs in excess of those that had been previously recorded were required. Management continues to review each of its assets for indications of impairment.

- 33 -

Transactions with Related Parties

The Company has entered into transactions with a control person of the Company, a wholly owned subsidiary of such control person, a company controlled by the Company’s Executive Chairman, a company whose CEO is also a director of the Company, and with Pure Sunfarms.

With Emerald Health Sciences Inc.

The Company entered into a management agreement with Sciences, a control person of the Company, in May 2015, which has subsequently been amended, most recently in January 2018, under which the Company pays Sciences $350,000 per month. The Company’s relationship with Sciences allows it to advance the development of its business faster and with fewer resources than would otherwise be possible, and with the benefit of strategic guidance and expertise in the cannabis industry. Sciences is focused on the medicinal potential of cannabis and cannabinoids with investment goals designed to leverage the scientific rigor, federal regulatory compliance, and life-science expertise of its entire Emerald leadership group. Sciences draws upon a large network of professionals with life sciences related expertise, including corporate pharmaceutical and biotechnology management, business development, product development and marketing experience, research scientists, medical doctors, naturopathic doctors, and lawyers - many with deep subject matter expertise in cannabis and the endocannabinoid system - to leverage the Company’s ability to conduct research and development, develop intellectual property, attract talent, manage operations, conduct mergers and acquisitions, and raise capital.

With access to these services, the Company has been able to identify and select new business opportunities, successfully negotiate and develop key strategic partnerships, and efficiently secure capital for the Company.

Management periodically evaluates the terms of the management agreement for reasonableness and adjusts the fee based on that evaluation.

During the year ended December 31, 2018, Sciences exercised 4,077,687 warrants at a price of $0.27 per warrant for total gross proceeds to the Company of $1,100,975.

As at December 31, 2018, Sciences held an aggregate of 43,234,242 Common Shares, representing approximately 31% of the issued and outstanding Common Shares and it held 4,411,764 common share purchase warrants of the Company. As at December 31, 2017, Sciences held an aggregate of 45,156,555 Common Shares, representing approximately 42% of the issued and outstanding Common Shares and it held 8,489,451 common share purchase warrants of the Company.

With Subsidiaries of Emerald Health Sciences Inc.

On September 26, 2018 the Company entered into a long-term supply agreement to obtain harvested hemp chaff, plant material consisting of mainly flower and leaf. The supply agreement was signed with EHH to purchase CBD containing hemp biomass for extraction into CBD oil. The supply agreement is for three years with an option to extend for an additional 2 years. Five hundred acres of hemp was harvested in October 2018 from farms located in Manitoba and Prince Edward Island and one thousand acres is expected to be harvested in each subsequent year of the agreement. CBD yield from the 2018 harvest has yet to be determined, pending analysis and extraction. EHH is a wholly-owned subsidiary of Sciences and is therefore a related party of the Company.

- 34 -

On October 3, 2018 the Company announced that it entered into a research agreement with EH Spain is an institute focused on cannabis research, which will provide its cannabis-industry-leading contract research organization (CRO) services to the Company to elucidate the mechanism of action of proprietary formulations and dosage forms that the Company is developing. EH Spain is a wholly-owned subsidiary of Sciences, who is a control person of the Company. EH Spain is a wholly-owned subsidiary of Sciences and is therefore a related party of the Company.

With a company controlled by the Company’s Executive Chairman

In 2017, the Company entered into a 30-year lease with a company (the “Landlord”) that is controlled by

Avtar Dhillon, MD, the Executive Chairman of the Company with respect to land in Metro Vancouver, British Columbia on which the Company is constructing its new production facility. The lease amount of $80,000 per quarter was determined by an independent valuation. The Landlord also charged the Company $108,855 during the year ended December 31, 2018 (2017 - $144,979) for services related to construction of the Company’s new facility.

With a company whose CEO is also a director of the Company

As at December 31, 2018, the Company holds 1,666,667 common shares and 1,666,667 common share purchase warrants of Avricore Health Inc. (“Avricore” formerly VANC Pharmaceuticals Inc) for investment purposes. The CEO of Avricore is also a director of the Company.

The 1,666,667 common shares represent 4.3% of the issued and outstanding common shares of Avricore at the date of this MD&A. Upon exercise of the common share purchase warrants of Avricore, the Company would hold 3,333,334 common shares of Avricore, representing 8.5% of the issued and outstanding common shares of Avricore, assuming no other share issuances.

With the Company’s joint venture

The Company also has entered into related party transactions with Pure Sunfarms. As at December 31, 2018, Pure Sunfarms owes the Company $1.9 million (December 31, 2017 - $0.3 million) for expenditures made on behalf of Pure Sunfarms. These expenditures were made to facilitate the administration of the retro-fit of the Delta 3 property and Health Canada license application. As of December 31, 2018, the Company owes to Pure Sunfarms $1.3 million (December 31, 2017 - $nil) for inventory, that was paid subsequent to December 31, 2018.

On July 5, 2018, the Company and Village Farms International, Inc. (together, the “Shareholders”) entered into a Shareholder Loan Agreement, subsequently amended August 24, 2018 with Pure Sunfarms, whereby, as at December 31, 2018, the Shareholders had each contributed $13,000,000 in the form of a demand loan to Pure Sunfarms. The loan amounts will initially bear simple interest at the rate of 6.2% per annum, calculated annually. Interest will accrue and be payable upon demand being made by both Shareholders.

Proposed Transactions

There are no material decisions by the Company’s board of directors with respect to any imminent or proposed transactions that have not been disclosed herein.

- 35 -

Critical Accounting Policies and Estimates

Included in Note 3 of the Company’s audited consolidated financial statements for the years ended December 31, 2018 and 2017 are the accounting policies and estimates that are critical to the understanding of the business operations and results of operations. Included in Note 4 of the Company’s audited consolidated financial statements for the year ended December 31, 2018 and 2017 are new accounting policies and changes to existing accounting policies adopted during the current year.

Changes in Accounting Standards not yet Effective

Refer to Note 5 of the Company’s audited consolidated financial statements for the years ended December 31, 2018 and 2017 for additional information on several new standards, amendments to standards and interpretations, which are not effective yet, and have not been applied in preparing these consolidated financial statements but may affect the Company when applied in the future.

Off-Balance Sheet Arrangements

The Company has not entered into any material off-balance sheet arrangements such as guarantee contracts, contingent interests in assets transferred to unconsolidated entities, derivative financial obligations, or with respect to any obligations under a variable interest equity arrangement.

Risks and Uncertainties

The Company’s actual results may differ materially from those expected or implied by the forward-looking statements and forward-looking information contained in this interim management discussion and analysis due to the proposed nature of the Company’s business and its present stage of development. A non-exhaustive list of risk factors associated with the Company are discussed in detail under the heading “Risk Factors” in the Company’s AIF dated April 30, 2019.

The following is a non-exhaustive list of certain additional risk factors associated with the Company that have resulted from new business subsequent to April 30, 2019:

The Company's ability to grow, store and sell cannabis in Canada is dependent on the Company's Licences. Failure to comply with the requirements of the Licences, or any failure to maintain the Licences would have a material adverse impact on the business, financial condition and financial performance of the Company. The Company believes it will meet the requirements of the Cannabis Act for further extensions or renewals of the Licences. However, should Health Canada not extend or renew one or more of the Licences, or should it renew a Licence on different terms, the business, financial condition and results of the operation of the Company would be materially adversely affected.

Joint Ventures

Although the Company has certain rights pursuant to the shareholders' agreement governing the Joint Venture, the Company does not directly control the management of the Joint Venture and the Joint Venture has its own management. Success of the Joint Venture will depend, in part, on the expertise of such management. The business of the Joint Venture is itself subject to the operational and business risks inherent in the large-scale production of cannabis and to that extent, the business of the Joint Venture will be subject to many of the same business risks applicable to the Company and which are set out elsewhere in this AIF. In particular, the production and sale of cannabis at the Joint Venture's facilities in

- 36 -

Delta, British Columbia is subject to obtaining and maintaining all necessary permits and licences. There can be no assurance that the Company and the Joint Venture will be successful in obtaining and maintaining all such permits and licences. In the event that all such licences and permits are not obtained or maintained then production or sale of cannabis by the Joint Venture may be reduced or halted entirely which would have a material adverse effect on the Company's business, results of operations and financial performance.

Pursuant to the shareholders' agreement governing the Joint Venture (the "JV SHA"), the Company has advanced $22.5 million in partial satisfaction its obligations to fund the Joint Venture and is required to advance a further $22.5 million as and when required. The Company has advanced an additional $13.0 million as a loan to the Joint Venture. The Joint Venture may require additional capital. To the extent the Joint Venture is unable to internally fund its operating requirements or expansion plans it may make additional capital calls on its shareholders. Failure by the Company to meet such a capital call could result in the Company's interest in the Joint Venture being diluted. If the Company elects to fund a capital call but Village Farms fails to do so then the Company may need to advance additional capital in order to meet the Joint Venture's needs. There can be no assurance that the Company or Village Farms will have the necessary capital resources to meet a capital call when and if made by the Joint Venture. In the event that the Joint Venture cannot raise the necessary funds from its shareholders, including the Company, it may need to raise additional funds through debt or equity financings that may be dilutive to the Company's interest in the Joint Venture. If the Joint Venture cannot obtain adequate capital to the extent required on favorable terms or at all, it may be required to scale back or halt entirely its operating or expansion plans and its business, financial condition and results of operations could be adversely affected. Disputes may arise between the Company and its joint venture partner, Village Farms, that may adversely affect the success of the Joint Venture and which would have a material adverse effect on the Company's business, results of operations and financial performance. Failure by the Company to otherwise comply with its obligations under the JV SHA may result in the Company being in default under the shareholders' agreement and could result in the Company losing some or all of its interest in the Joint Venture.

Competition

The Company faces intense competition from other companies, some of which have longer operating histories and greater financial resources, production capacity and manufacturing and marketing experience than the Company. Increased competition by larger and better financed competitors could materially and adversely affect the business, financial condition and financial performance of the Company.

Because of the early stage of the industry in which the Company operates, the Company expects to face additional competition from new entrants. If the number of users of legal cannabis in Canada increases, the demand for products is expected to increase and the Company expects that competition will become more intense, as current and future competitors begin to offer an increasing number of diversified products. To remain competitive, the Company will require a continued high level of investment in research and development, marketing, sales and customer support. The Company may not have sufficient resources to maintain research and development, marketing, sales and customer support efforts on a competitive basis which could materially and adversely affect the business, financial condition and financial performance of the Company.

The Company's success depends in part on its ability to attract and retain customers. There are many factors which could impact the Company's ability to attract and retain customers, including but not limited

- 37 -

to competition from other companies in the industry, the Company's ability to continually produce desirable and effective product, the successful implementation of the Company's customer-acquisition plan and the continued growth in the aggregate number of customers selecting cannabis. The Company's continued success depends in part on its ability to anticipate and respond to these changes. The success of the Company's product offering depends on a number of factors, including the Company's ability to:

| | |

| (a) | accurately anticipate customer needs; |

| | |

| (a) | innovate and develop new products or product enhancements that meet these needs; |

| | |

| (b) | successfully commercialize new products or product enhancements in a timely manner; |

| | |

| (c) | price products competitively; |

| | |

| (d) | manufacture and deliver products in sufficient volumes and in a timely manner; and |

| | |

| (e) | differentiate products from those of competitors. |

The Company also faces competition from unlicensed and unregulated market participants, including individuals or groups that produce cannabis without a license similar to that under which the Company currently produces and illegal dispensaries and black market participants selling cannabis and cannabis-based products in Canada. These competitors may be able to offer products at lower prices than the Company's products and with higher concentrations of active ingredients than the Company is authorized to produce and sell and using delivery methods, including edibles, concentrates and extract vaporizers, that the Company is currently prohibited from offering in Canada. The competition presented by these participants, and any unwillingness by consumers currently utilizing these unlicensed distribution channels to begin purchasing from licensed producers for any reason, or any inability of law enforcement authorities to enforce existing laws prohibiting the unlicensed cultivation and sale of cannabis and cannabis-based products, could adversely affect the Company's revenue, market share, result in increased competition through the black market for cannabis or have an adverse impact on the public perception of cannabis use and licensed cannabis producers and dealers.

Expansion Risks

There is no guarantee that the Company's plans to acquire and/or construct additional cannabis production and manufacturing facilities and to expand the Company's marketing and sales initiatives will be successful. Any such activities will require, among other things, various regulatory approvals, licences and permits (such as additional site licences from Health Canada under the Cannabis Act, as applicable) and there is no guarantee that all required approvals, licences and permits will be obtained in a timely fashion or at all. The Company is currently constructing a second production facility in Richmond, British Columbia which will require local government approval, licencing by Health Canada and significant investment of capital. Neither local government approval, Health Canada licencing nor the availability of capital are assured.

The Company's expansion plans will also require significant amounts of capital, including the following expenditures forecast to be made in the current fiscal year:

| | |

| (a) | the Company is required to make a payment on May 1, 2019 of $22.3 million in cash to the vendors in connection with the acquisition of Verdélite and Verdélite Holdings; |

- 38 -

| | |

| (b) | the Company has budgeted approximately $3.7 million to be spent on fully completing the build-out of the Verdélite Facility; |

| | |

| (c) | the Company expects to incur additional costs of approximately $5 million in connection with the completion of construction at its Richmond Facility; |

| | |

| (d) | the Company has budgeted approximately $1.5 million to be spent on completing the Avalite analytical facility; and |

| | |

| (e) | the Company has budgeted approximately $25 million to be spent on completing the building of the Delta 2 Facility. |

There is no guarantee that the Company will be able to obtain the necessary capital, which could result in significant delays or could prevent the Company from completing any of the foregoing activities as anticipated or at all. The failure of the Company to successfully execute its expansion strategy (including receiving required regulatory approvals and permits) could adversely affect the Company's business, financial condition and financial performance and may result in the Company failing to meet anticipated or future demand for its products, when and if it arises. See also "Additional Financing" and "Factors which may Prevent Realization of Growth Targets".

Additional Financing

The building and operation of the Company's facilities and business are capital intensive. In order to execute its anticipated growth strategy, the Company will require additional equity and/or debt financing to support on-going operations, to satisfy capital expenditures or to undertake acquisitions or other business combination transactions. There can be no assurance that additional financing will be available to the Company when needed or on terms which are acceptable. The Company's inability to raise financing to support on-going operations or to fund capital expenditures or acquisitions could limit the Company's growth and may have a material adverse effect upon future profitability. The Company may require additional financing to fund its operations to the point where it is generating positive cash flows.

If additional funds are raised through further issuances of equity or convertible debt securities, existing shareholders could suffer significant dilution. The specific terms of such future offerings, if any, would be established, subject to the approval of the board of directors of the Company, at the time of such offering and will be described in detail in at the time of any such offering. Any new equity securities issued by the Company could have rights, preferences and privileges superior to those of holders of Common Shares.

The perceived risk of dilution may negatively impact the price of the Common Shares and may cause shareholders to sell their Common Shares, which would contribute to a decline in the price of the Common Shares. Moreover, the perceived risk of dilution and the resulting downward pressure on the Company's share price could encourage investors to engage in short sales of the Common Shares, which could further contribute to progressive price declines in the Common Shares.

Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult for the Company to obtain additional capital and to pursue business opportunities, including potential acquisitions.

In addition, the Company has in the past received a substantial amount of its debt financing from Sciences, a control person of the Company, pursuant to the terms of a loan agreement between the Company and

- 39 -

Sciences. There is no guarantee that Sciences will continue to provide funds when needed by the Company or that the terms of such loan agreement will remain the same or acceptable to the Company.

Change in Laws, Regulations and Guidelines