Exhibit 99.2

| |

| TABLE OF CONTENTS | |

| | |

| Overview | 13 |

| Disclosure of Outstanding Share Data | 19 |

| Summary of Quarterly Results | 20 |

| Results of Operations | 20 |

| Additional Disclosure for Venture Issuers Without Significant Revenue | 23 |

| Liquidity and Capital Resources | 23 |

| Operating, Investing and Financing Activities | 24 |

| Financial Risk Management | 25 |

| Measurement Uncertainty and Impairment Assessments | 25 |

| Transactions with Related Parties | 25 |

| Proposed Transactions | 27 |

| Critical Accounting Policies and Estimates | 27 |

| Changes in Accounting Standards not yet Effective | 27 |

| Off-Balance Sheet Arrangements | 27 |

| Risks and Uncertainties | 28 |

| Forward-Looking Statements | 30 |

Management’s Discussion and Analysis

The following MD&A is prepared as of June 18, 2020 and is intended to assist the understanding of the results of operations and financial condition of the Company.

This MD&A should be read in conjunction with the unaudited condensed interim consolidated financial statements and accompanying notes of the Company for the three months ended March 31, 2020, which have been prepared in accordance with IAS 34 - Interim Financial Reporting as issued by the International Accounting Standards Board (“IASB”) and the annual consolidated financial statements for the years ended December 31, 2019, 2018, and 2017 which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the IASB. This MD&A contains forward-looking statements that are subject to risk factors set out in a cautionary note contained herein. All figures are in Canadian dollars unless otherwise noted.

Additional information related to the Company is available on its website at www.emeraldhealth.ca. Other information related to the Company, including the Company’s most recent Annual Information Form (“AIF”) and financial statements referred to herein are available on the Canadian Securities Administrator’s website at www.sedar.com.

Overview

Emerald Health Therapeutics Inc. (the “Company”), was incorporated pursuant to the Business Corporations Act (British Columbia) on July 31, 2007. The Company is classified as a Tier 1 Venture Issuer on the TSX Venture Exchange (the “TSXV”), with its common shares listed under the trading symbol “EMH.” The Company is also traded on the OTCQX, with its common shares listed under the trading symbol “EMHTF.”

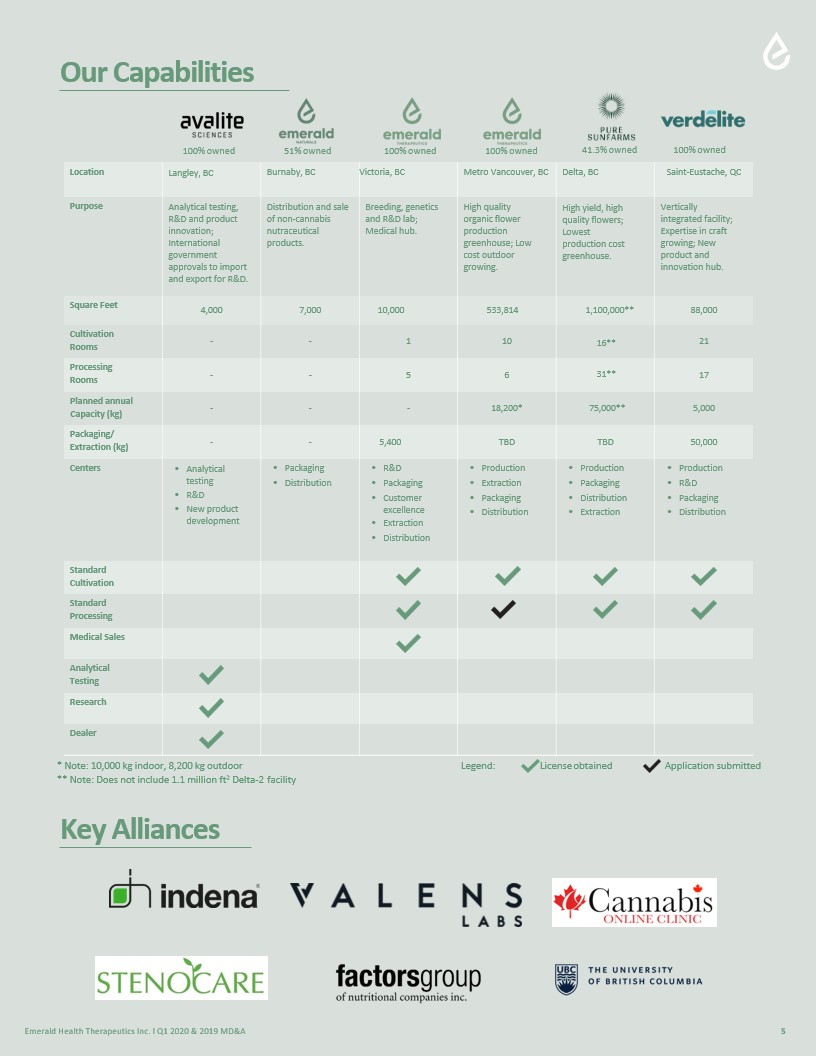

The Company owns:

| | (a) | 100% of the shares of EHTC, a British Columbia-based licence holder under the Cannabis Act (Canada) (the “Cannabis Act”); |

| | | |

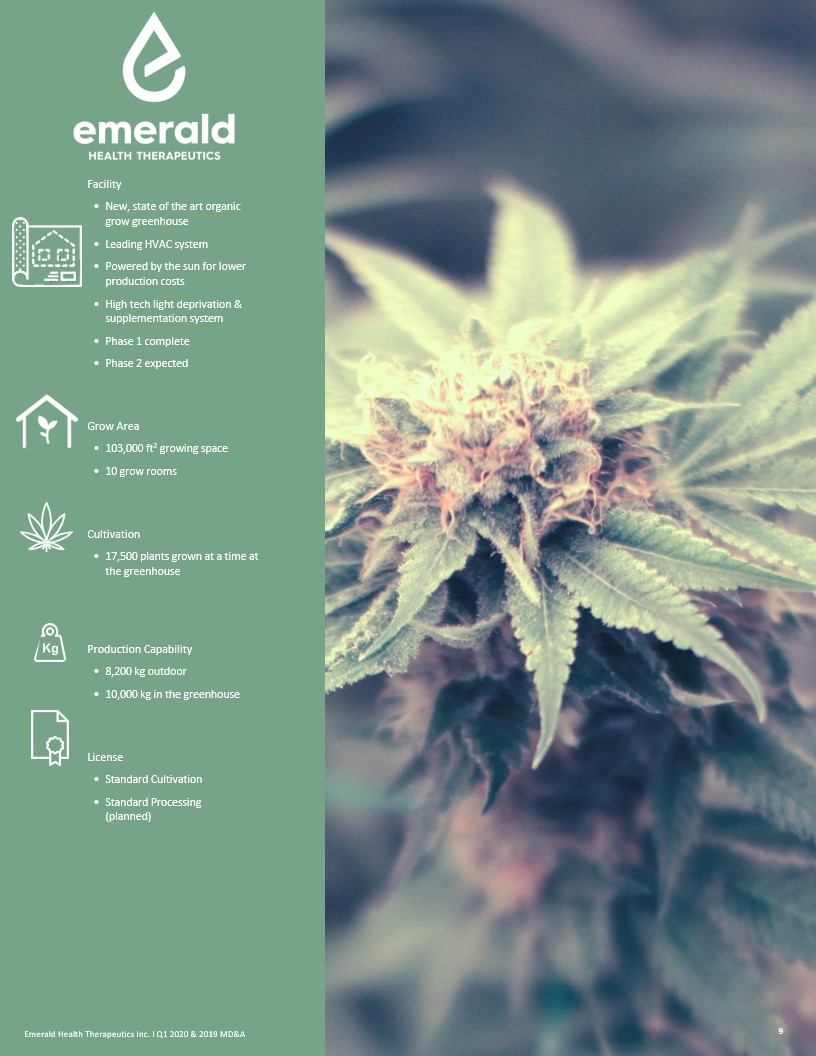

| | (b) | 100% of the shares of Verdélite Sciences, Inc. (formerly, Agro-Biotech Inc.) (“Verdélite”), a Québec-based licence holder under the Cannabis Act; |

| | | |

| | (c) | 100% of the shares of Verdélite Property Holdings,Inc. (formerly, Agro-Biotech Property Holdings Inc.) (“Verdélite Holdings”), a Québec-based holding corporation that owns the Verdélite facility (as defined below); and |

| | | |

| | (d) | 51% of the shares of Emerald Health Naturals Inc. (“EHN”), a joint venture between the Company and Emerald Health Bioceuticals, Inc. (“EHB”). |

The Company, through EHTC, also holds:

| | (e) | 41.3% of the shares of Pure Sunfarms Corp. (the “Joint Venture”), a British Columbia-based licence holder under the Cannabis Act (whereas at December 31, 2019, the Company held 46.5% of shares in the Joint Venture and as March 31, 2020, held 42.6%); and |

- 13 -

| | (f) | 100% of the shares of Avalite Sciences Inc. (formerly Northern Vine Canada Inc.) (“Avalite”), a British Columbia-based licenced dealer under the provisions of the Controlled Drugs and Substances Act (Canada) (the “CDSA”) and a licence holder under the Cannabis Act. |

Coronavirus

In December 2019, the novel Coronavirus (“COVID-19”) emerged in Wuhan, China, and has since spread throughout the world. On March 11, 2020, the World Health Organization declared the outbreak of COVID-19 a global pandemic. In response to this, global reactions have led to significant restrictions on travel, quarantines, temporary business closures and a general reduction in consumer activity. Provincial governments in the provinces of British Columbia and Quebec, where the Company’s facilities and those of the Joint Venture are located, have recognized the production and sale of cannabis as essential services. Consumer cannabis sales are primarily with government bodies, which continue to offer end customers online ordering and home delivery options. Consumer market retail stores are generally permitted to remain open subject to adhering to the required social distancing measures. All of the Company’s facilities in Canada continue to be operational at full capacity and the Company continues to work closely with local, and national government authorities to ensure that it is following the required protocols and guidelines related to COVID-19 within each region. Although there have not been any significant impacts to the Company’s operations to date, the Company cannot provide assurance that there will not be disruptions to its operations in the future. Refer to the “Risk Factors” section below for further discussion on the potential impacts of COVID-19.

The Company is closely monitoring the rapid evolution of COVID-19 with a focus on the jurisdictions in which the Company operates. During this period of uncertainty, it is the Company’s priority to safeguard the health and safety of its personnel, support and enforce government actions to slow the spread of COVID-19, and continually assess and mitigate the risks to its business operations. The Company has taken responsible measures to maximize the safety of staff working at all of its facilities. This includes working remotely, reorganizing physical layouts, adjusting schedules to improve physical distancing, implementing extra health screening measures for employees, and applying rigorous standards for personal protective equipment. The Company continues to maintain regular communications with legal and government representatives, suppliers, customers and business partners to identify and monitor any potential risks to our ongoing operations.

COVID-19 impact on near term operations

The impact of the COVID-19 pandemic on the drivers of growth in the Canadian consumer market is difficult to forecast. While the Company is optimistic about the total accessible market size of Canadian consumer cannabis over time, the variables related to the pandemic make the short-term growth of the market, and the Company’s revenue expectations difficult to project. Due to the uncertainty, magnitude and duration of the pandemic, COVID-19 impacts on the Company’s operations and financial results, continue to be highly uncertain and cannot be predicted with confidence.

- 14 -

Development of Business in the three months ended March 31, 2020

Highlights

Prospectus offerings of $3.00 million in gross proceeds

Shares for debt financings totalling $3.20 million

Settlement of outstanding disputes with Village Farms

Signed a Letter of Intent for the sale of Avalite with Sigma Analytical Services Inc.

Shipped its first harvest of premium cannabis from its Metro Vancouver greenhouse

On January 31, 2020, the Company settled $2.82 million (the “Debt”) of the aggregate debt owed by the Company to Emerald Health Sciences Inc. (“Sciences”), a control person of the Company, in exchange for the issuance of 9,713,666 Common Shares of the Company (each, a “Debt Share”) at a deemed value of $0.29 per Debt Share (the “Debt Settlement”). The Debt consisted of: (i) $0.80 million owed to Sciences pursuant to a previously disclosed loan agreement between the parties; and (ii) $2.02 million owed to Sciences pursuant to a previously disclosed hemp supply agreement in which Emerald received approximately 135,000 kg of product. The Debt Settlement was approved by the independent members of the board of directors of the Company.

In lieu of the remaining portion of a private placement announced on December 16, 2019 (the “December 2019 Private Placement”), on February 6, 2020, the Company closed the initial tranche of a prospectus offering by issuing 7,596,551 units to certain accredited investors at a priceof $0.29 per unit for aggregate gross proceeds of $2.20 million. Each unit consisted of one Common Share and one common share purchase warrant. Each warrant entitles the holder thereof to acquire one Common Share at a price of $0.385 per Common Share until February 6, 2025. In the event that the closing sale price of the Common Shares on the TSXV, or such other principal exchange on which the Common Shares are then trading, is greater than $0.75 per Common Share for a period of ten consecutive trading days at any time, the Company may accelerate the expiry date of the warrants by giving written notice to the holder thereof and in such case the warrants will expire on the 15th day after the date on which such notice is given by the Company.

Also on February 6, 2020 an additional 1,322,627 Common Shares were issued to certain accredited investors at a deemed price of $0.29 per Common Share to settle interest in the amount of $0.38 million accrued to December 31, 2019 on the Company’s outstanding convertible debentures (the “Convertible Debentures”).

On February 14, 2020, the Company closed the final tranche of a prospectus offering by issuing 2,748,276 units to certain accredited investors at a price of $0.29 per unit for aggregate gross proceeds of $0.80 million. Each unit consists of one Common Share and one common share purchase warrant. Each warrant will entitle the holder thereof to acquire one Common Share at a price of $0.385 per Common Share until February 14, 2025 and is subject to the same acceleration provisions as the warrants which were issued on February 6, 2020.

On March 2, 2020, the Company entered into a settlement agreement (the “PSF Settlement Agreement”) with Village Farms International Inc. (“Village Farms”) and the Joint Venture. Pursuant to the PSF Settlement Agreement, the supply agreements entered into between the Company and the Joint Venture

- 15 -

dated December 21, 2018 (for the supply to the Company of cannabis product by the Joint Venture in 2019), and March 29, 2019 (for the supply to the Company of cannabis product by the Joint Venture from 2020 to the end of 2022), respectively, were terminated effective as of December 31, 2019, and the Company and the Joint Venture released each other from all previous, current, and future obligations, liabilities and payments thereunder. Also during the year ended December 31, 2019, the Company forfeited all amounts due from the Joint Venture pursuant to a shareholder’s loan of $13 million that the Company previously advanced to the Joint Venture plus accrued interest thereon of $1.1 million, and issued a promissory note to the Joint Venture in the amount of $0.95 million. The Company also agreed to the cancellation of 5,940,000 of its common shares in the Joint Venture (previously held in escrow). During the three months ended March 31, 2020, the Company transferred 2.5% of its ownership interest in the Joint Venture to Village Farms. Village Farms also purchased additional shares of the Joint Venture from treasury in exchange for an $8 million cash payment to the Joint Venture. Following these transactions, the Company held 42.6% of the Joint Venture. All previously disclosed disputes between the Company, the Joint Venture and Village Farms have now been settled.

On March 9, 2020, the Company announced that it had signed a letter of intent under which Sigma Analytical Services Inc. (“Sigma”), a full-service Good Manufacturing Practices (“GMP”)-compliant testing laboratory for cannabis, hemp, and derived products, may acquire Avalite’s cannabis analytical testing operation. The companies also intend to establish a preferred partner relationship. The execution of definitive agreements is subject to due diligence and board approval of both companies. Completion of the transaction will be subject to a number of conditions including settlement of final documentation and receipt of applicable regulatory and third-party approvals.

On March 23, 2020, the Company announced that its Joint Venture had received approval from Health Canada for the final components of its 65,000 square foot processing center. The additional capabilities relate to an area of 29,475 square feet within the total 65,000 square foot processing centre and include an additional 33 dedicated rooms for drying, extraction, packaging, testing, production, staging and storage. Eight rooms (3,800 sf) in this additional space are built to satisfy European Union GMP certification requirements.

Development of Business after the Reporting Period

Highlights

$1.06 million in gross proceeds from the exercise of warrants

Prospectus offering of $2.10 million in gross proceeds

Announced the launch of its new nanoemulsion-based Fast Action Spray product line

Received initial cultivation and sales licence for the Joint Venture’s Delta 2 Facility

Continued optimization at the Joint Venture resulted in the Joint Venture recognizing gross sales of $21.5 million, largely through the adult recreational sales channel

On April 3, 2020, the Credit Facility established by the Joint Venture was expanded (the “Amended Credit Facility”). The Amended Credit Facility consists of a $7.5 million revolving operating loan (the “Revolver”) and a $12.5 million term loan (the “New Term Loan”), in addition to its existing $19 million term loan (the “Existing Term Loan”). The $7.5 million Revolver and the $12.5 million New Term Loan include an

- 16 -

accordion provision that allows the Joint Venture to request additional lender commitments of up to an additional $7.5 million and $12.5 million, respectively, subject to certain conditions. Each of the components of the Amended Credit Facility, including the Existing Term Loan, mature on February 7, 2022. As part of this transaction, Village Farms completed an additional investment in the Joint Venture of $8 million, which reduced the Company’s equity position in the Joint Venture by 1.3%to 41.3%. The Company has retained three of the six seats on the board of directors of the Joint Venture.

The New Term Loan is specifically designated for the 1.1 million square foot Delta 2 Facility, while the Existing Term Loan is specifically designated for the 1.1 million square foot Delta 3 Facility.

On April 9, 2020, the Company amended the terms of the 12,500,000 common share purchase warrants originally issued on September 9, 2019 (the “September 2019 Warrants”) in connection with the issuance of the Convertible Debentures. The exercise price of the September 2019 Warrants was amended from the original exercise price of $2.00 per Common Share such that:

6,250,000 September 2019 Warrants had an exercise price of $0.17 per Common Share (the “$0.17 Warrants”);and

6,250,000 September 2019 Warrants have an exercise price of $0.21 per Common Share (the “$0.21 Warrants”). If, at any time prior to the expiry date of the $0.21 Warrants, the closing market price of the Common Shares on the TSXV is greater than $0.2625 for 10 consecutive trading days, the Company may deliver a notice to the holder of the $0.21 Warrants accelerating the expiry date of the $0.21 Warrants to the date that is 30 days following the date of such notice.

Holders of the $0.17 Warrants immediately exercised all such warrants after the amendment for gross proceeds to the Company of $1.06 million. The $0.21 Warrants remain outstanding and expire on September 9, 2021.

On April 29, 2020, the Company announced its new nanoemulsion-based Fast Action Spray product line, an important step in the Company’s Cannabis 2.0 strategy and a unique offering in the Canadian cannabis marketplace. This unique formulation is expected to offer advantages over existing formats of cannabis consumption in terms of convenience and predictability of consumption. The product line will consist of CBD and THC cannabinoids mixed with specific terpenes and flavorings. The first product is planned for launch in June.

On May 25, 2020, the Company announced that its Joint Venture had received its Health Canada cannabis cultivation and sales licence based on an initial production area within its Delta 2 Facility, allowing it to expand capacity as needed through successive licence amendments.

On May 27, 2020, the Company announced that it had terminated the previously disclosed sublease agreement (“Sublease Agreement”) and cultivation agreement (“Cultivation Agreement”) pertaining to its cannabis cultivation operation in Metro Vancouver with Sciences, a control person of the Company. Previously existing rights and continuing usage of the land and its cultivation operation in Metro Vancouver are unaffected by these terminations. The Company confirms that no payments were made to Sciences under eitherthe Sublease Agreement or the CultivationAgreement.The Company’s previously existing rights related to the 12-acre land parcel that was subject to the Sublease Agreement and Cultivation Agreement are unaffected by these terminations.

- 17 -

On June 2, 2020, the Company announced that it had closed a prospectus offering pursuant to which the Company issued 11,351,351 units to certain institutional accredited investors at a price of $0.185 per unit for total gross proceeds of $2.1 million. Each unit consisted of one Common Share of the Company and one Common Share purchase warrant. Each warrant entitles the holder thereof to acquire one additional Common Share at a price of $0.27 per Common Share until June 2, 2023. In the event that the closing sale price of the Common Shares on the TSXV, or such other principal exchange on which the Common Shares are then trading, is greater than $0.40 per Common Share for a period of 10 consecutive trading days at any time after the closing of the Offering, the Company may accelerate the expiry date of the warrants by giving written notice to the warrant holders and in such case the warrants will expire on the 15th day after the date on which such notice is given by the Company.

For the remainder of 2020, the Company intends to focus its efforts on:

Production and Processing - The focus is on delivering high-quality consumer products to the recreational and medical markets while leveraging internal expertise to support positive margins in 2020.

New Product Development - The Company intends to continue developing intellectual property as the second phase of recreational cannabis products become permissible in Canada. Specifically, development is focused on products that align with the Company’s core strategy of enhancing health and wellness through modulation of the Endocannabinoid System.

Strategic Partnerships - The Company is continuing to develop and nurture its strategic partnerships with outsourced extraction and processing companies with a goal of enhancing profitability and leveraging expertise in specific fields.

Efficiency and Cost Control - The Company completed an internal reorganization, including the reduction of its workforce and other expenditures in the second half of FY2019 and the first half of 2020. The reorganization is expected to result in material cost savings and help focus on improving cash flow going forward. The Company intends to continue to pursue efficiencies and seek other opportunities to reduce future expenses.

Financing - The Company continues to focus on sourcing cash through equity and debt capital from public and private markets in Canada, to ensure it has adequate cash on hand to continue its operations and meet its financial obligations.

Licences

The Company holds licences from Health Canada under the Cannabis Act to produce and sell cannabis products in accordance with applicable laws in Canada (the “Licences”). The Company currently indirectly holds a number of licences through its wholly owned direct and indirect subsidiaries, EHTC, Verdélite and Avalite, as well as others which are held by the Joint Venture. The licences held by EHTC permit it to cultivate cannabis and produce and sell dried cannabis, cannabis oils, cannabis plants and cannabis seeds; the licences held by Verdélite permit it to cultivate, extract, manufacture, synthesize, test and sell cannabis; the licences held by Avalite permit it to process cannabis, produce cannabis oil and conduct analytical testing; and the licences held by the Joint Venture permit it to cultivate cannabis and produce and sell dried cannabis, cannabis oils,cannabis plants and cannabis seeds, all in accordancewith the terms and conditions specified in the applicable Licences and the Cannabis Act.

- 18 -

Disclosure of Outstanding Share Data

The Company’s authorized share capital consists of an unlimited number of Common Shares of which 182,367,493 were issued and outstanding as of March 31, 2020 and 200,143,844 were issued and outstanding as of June 18, 2020.

During the three months ended March 31, 2020, the Company granted an aggregate of 4,580,000 stock options to directors, employees and consultants. Each option is exercisable into one Common Share for a period of up to five years. The exercise prices at the time of the grants ranged from $0.29 and $0.32 per share. In addition, an aggregate of 375,000 restricted share units were granted during the three months ended March 31, 2020. These restricted share units vest one year from the grant date and convert into Common Shares of the Company at a fair market value of $0.30 per Common Share. Subsequent to the period ended March 31, 2020, the Company granted an additional 1,500,000 stock options to directors with an exercise price of $0.17, that vested immediately and have an expiry date five years from the grant date.

There were 15,445,759 stock options and 1,000,000 restricted share units outstanding as of March 31, 2020. As of June 18, 2020, there were 14,947,662 stock options and 825,000 restricted share units outstanding.

There were 36,815,498 warrants outstanding as of March 31, 2020 and 41,916,849 as of June 18, 2020.

- 19 -

Summary of Quarterly Results

The financial information in the following tables summarizes selected information for the Company for the last eight quarters which was derived from annual financial statements prepared in accordance with IFRS or interim financial statements prepared in accordance with IFRS applicable to the preparation of interim financial statements, IAS 34, Interim Financial Reporting:

| | | | |

| (000’s) | 2020 | 2019 |

March 31

($) | December 31

($) | September 30

($) | June 30

($) |

| Revenue | 3,333 | 4,940 | 9,718 | 5,070 |

| Share-based payments | 986 | 346 | 2,993 | 6,421 |

| Interest income | 13 | (71) | 221 | 165 |

| Share of income (loss) from Joint Venture | 5,205 | 492 | (1,202) | 14,489 |

Gain (loss) on changes in the fair value of

the Company’s biological assets | 644 | 3,159 | (433) | 259 |

| Net Loss | (4,879) | (90,344) | (17,461) | (453) |

| Net Loss per share (basic and diluted) | (0.027) | (0.590) | (0.121) | (0.003) |

| | | | |

| (000’s) | 2019 | 2018 |

March 31

($) | December 31

($) | September 30

($) | June 30

($) |

| Revenue | 2,610 | 1,132 | 321 | 284 |

| Share-based payments | 2,023 | 1,297 | 2,166 | 2,082 |

| Interest income | 638 | 439 | 223 | 274 |

| Share of income from Joint Venture | 5,812 | 1,433 | 3,940 | 682 |

Gain on changes in the fair value of the

Company’s biological assets | 719 | 144 | 1,302 | 979 |

| Net Loss | (3,649) | (13,924) | (6,427) | (5,611) |

| Net Loss per share (basic and diluted) | (0.026) | (0.100) | (0.047) | (0.043) |

Included in the share of income from the Joint Venture for the three months ended March 31, 2020, is an unrealized gain of $0.88 million (March 31, 2019 - unrealized gain of $4.56 million) on the changes in the fair value of the Joint Venture’s biological assets.

Results of Operations

Quarter ended March 31, 2020

The net loss for the quarter ended March 31, 2020, was $4.88 million (loss of $0.03 per share), compared to the net loss of $3.65 million (loss of $0.03 per share) for the same quarter in the prior year. Diluted loss per share is the same as basic loss per share as the outstanding options and warrants have an anti-dilutive effect on the loss per share.

- 20 -

Factors contributing to the net loss for the three-month period ended March 31, 2020 include the following:

Revenue

Revenue for the quarter ended March 31, 2020, was $3.33 million compared to $2.61 million for the same period in the prior year. The revenue for the three months ended March 31, 2020 demonstrated the Company’s continued growth in the market. The Company was shipping to more provinces and territories as compared to the prior year resulting in an increase in revenue compared to the prior year. For the quarter ended March 31, 2020, revenue was comprised of approximately 59% dried product, 38% oils and 3% other, compared to approximately 87% dried product and 13% oils in the quarter ended March 31, 2019.

| | |

| | Three months ended March 31, |

| 2020 | 2019 |

| Average selling price of adult-use dried flower per gram & gram equivalents | $4.32 | $4.98 |

| Kilograms sold of adult-use dried flower & kilogram equivalents | 555 | 376 |

| Average selling price of medical dried flower per gram & gram equivalents | $7.95 | $7.17 |

| Kilograms sold of medical dried flower & kilogram equivalents | 55 | 59 |

| Total kilograms produced of dried flower | 2,507 | 212 |

Kilogram and gram equivalent represent the amount of dried flower used to produce the units of oils sold.

Cost of Sales

Cost of goods sold currently consists of four main categories: (i) cost of goods sold expensed from inventory, (ii) production costs, (iii) change in the fair value of biological assets, and (iv) amortization of the Health Canada licences.

Cost of goods sold represents the deemed cost of inventory that arose from the fair value measurement of biological assets, subsequent post-harvest costs capitalized to inventory, purchased dried cannabis, costs to produce cannabis oils capitalized to inventory (including the deemed cost of dried inventory that arose from the fair value measurement of biological assets that were used to produce cannabis oils), and packaging costs. Cost of goods sold expensed to inventory for the quarters ended March 31, 2020 and March 31, 2019 was $2.14 million and $2.71 million, respectively. The decrease in cost of goods sold in the current period was due to a larger proportion of higher margin product sold as well as lower cost base of input material expensed by the Company compared to the prior period. During the quarter ended March 31, 2020 the cost per gram of dried flower and trim was $1.30. The Company does not have comparative information for the quarter ended March 31, 2019 as the Company was not yet in full production.

Production costs include all direct and indirect production related costs, including security, compliance, quality control and quality assurance costs, as well as related overhead. In addition, all inventory production cost in excess of standard cost are not capitalized and expensed in production cost. Inventory value in excess of net realizable value are written down as impairment. During the quarter ended March 31, 2020, the Company incurred production costs of $1.04 million versus $0.88 million in the quarter ended March 31, 2019. The increase in production costs is substantially attributable to the increase in

- 21 -

operating expenses associated with the acquired subsidiaries and the related increase in the number of plants cultivated and staff required for production activities. During the three months ended March 31, 2020, the Company also recognized $0.44 million (March 31, 2019 - $0.48 million) in excise taxes. The excise tax attributable to medical sales was absorbed by the Company.

The change in biological assets for the quarter ended March 31, 2020 was again of $0.64 million compared to a gain of $0.72 million in the same quarter of the prior year. The decrease is substantially due to a decrease in the net realizable value of recreational dried cannabis used as input in the valuation of biological assets.

The amortization of the Health Canada licence represents the amortization of an acquired licence that is recorded at cost less accumulated amortization. Amortization will be expensed as a cost of sales and the unamortized balance will remain on the Company’s balance sheet as an intangible asset. Amortization of the licence is recognized on a straight-line basis irrespective of either production or sale of cannabis from that facility.

The Company measures biological assets consisting of cannabis plants at fair value less cost to sell up to the point of harvest, which becomes the basis for the cost of finished goods inventories after harvest. Seeds are measured at fair market value, except for a portion which are restricted with respect to distribution due to the conditions under which they were acquired that are measured at cost. The significant assumptions used in determining the fair value of cannabis plants are as follows: plant waste rate for various stages of development; yield per plant; selling price less costs to sell; percentage of total expected costs incurred to date; and costs incurred for each stage of plant growth.

Gains recognized in the fair value of biological assets are recorded in a manner that decreases the cost of sales. Changes in the fair value of biological assets can be significant during periods of large expansion in the cultivation area. In determining the fair value of cannabis plants, assumptions are used regarding the variability in the average age and number of cannabis plants available at each period end.

Inventory write-down - During the quarter ended March 31, 2020, a write-down of $1.05 million was recognized for packaged inventory and extracted cannabis oils (March 31, 2019 - $Nil) related to product deterioration, limited remaining shelf life and fair market value.

Other expenses

General and Administrative - During the quarter ended March 31, 2020, the Company incurred general and administrative expenses of $2.78 million versus $4.14 million for the quarter ended March 31, 2019. The current quarter saw decreased expenses in professional and consulting services, investor relations, and office and insurance. Severance pay of several key personnel as part of the later 2019 cost reduction initiative contributed to comparable expenses in wages and benefits incurred as compared to the first quarter in 2019. In the quarter ended March 31, 2020, general and administrative costs included; salaries and benefits of $1.41 million (three months ended March 31, 2019 - $1.40 million), consulting and professional services fees of $0.65 million (three months ended March 31, 2019 - $1.08 million), investor relations fees of $0.05 million (three months ended March 31, 2019 - $0.59 million), office and insurance of $0.59 million (three months ended March 31, 2019 - $1.03 million) and travel and accommodation of $0.07 million (three months ended March 31, 2019 - $0.05 million).

Sales and marketing - In the quarter ended March 31, 2020, the Company incurred sales and marketing expenses of $0.68 million versus $0.93 million in the comparable 2019 prior period. These costs are

- 22 -

related to general sales and marketing, patient acquisition, and education expenses. The current period decrease reflects the Company’s focus on cost reduction and the use of internal resources.

Research and development - In the quarter ended March 31, 2020, the Company incurred research and development expenses of $0.43 million (three months ended March 31, 2019 - $0.93 million). These costs related to consulting fees and wages associated with the development of new cannabis products. The substantial decrease in research and development expenditures was related to the amendment of the management agreement with Sciences effective October 1, 2019 (see Related Party Transactions).

Share-based compensation - In the quarter ended March 31, 2020, the Company incurred share-based compensation expenses of $0.99 million versus $2.02 million in the comparable 2019 prior period. The amounts are compensation expenses related to employee, director and consultant incentive stock options and restricted share units which are measured at fair value at the date of grant and expensed over the vesting period. During the current quarter, the Company granted 4,580,000 stock options and 375,000 restricted share units to employees and consultants, compared to 468,000 stock options during the same period in 2019.

Share of income from joint venture - In the quarter ended March 31, 2020, the Company recognized $5.21 million as its share of the income versus $5.81 million in the comparable 2019 prior period. The Joint Venture continued to expand its recreational sales distribution as it made its first shipments of product to Alberta during the three months ended March 31, 2020. The Joint Venture also recognized $6.04 million in non-recurring income during the current quarter (March 31, 2019 - $Nil), following the PSF Settlement Agreement. This amount represents the balance of the forfeited shareholders’ loan plus accrued interest previously loaned to the Joint Venture by the Company. The Company recognized a non-recurring loss for the forgiven loan in the three months ended December 31, 2019.

Additional Disclosure for Venture Issuers Without Significant Revenue

As the Company did not have significant revenue from operations in 2018, the following is a breakdown of the material costs incurred:

| | |

| | For the three months ended | For the three months ended |

| | March 31, 2020 | March 31, 2019 |

| (000’s) | ($) | ($) |

| Expensed research and development costs | 433 | 928 |

| General and administrative expenses | 2,781 | 4,141 |

| Purchase of plant and equipment | 132 | 6,012 |

Liquidity and Capital Resources

The Company continually monitors and manages its cash flow to assess the liquidity necessary to fund operations and capital projects. The Company manages its capital resources and adjusts it to take into account changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust itscapital resources, the Company may,where necessary, control the amount of working capital, pursue financing or manage the timing of its capital expenditures. As at March 31, 2020, the Company had working capital deficiency of $9.49 million.

- 23 -

These unaudited condensed interim consolidated financial statements have been prepared by management on a going concern basis which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. As at March 31, 2020, the Company had not yet achieved profitable operations. The Company is actively seeking alternative financing alternatives in order to manage current cash flows until such time as the Company is profitable. The continuing operations of the Company are dependent upon its ability to continue to raise adequate capital, to commence profitable operations in the future, to satisfy its commitments and to repay its liabilities arising from normal business operations as they become due. Management is aware, in making its assessment, of material uncertainties related to events or conditions that may cast substantial doubt upon the Company’s ability to continue as a going concern. The Company has raised gross proceeds of $6.16 million from private placements and the exercise of warrants during the current fiscal year. Management continues to closely monitor its cash flows and, as necessary, will seek additional equity and debt financing to offset the working capital deficit. There can be no certainty that such financing will be available on terms acceptable to the Company or at all.

The Company has committed to certain projects which may require significant cash injections over the next 12 months. The Company’s second greenhouse facility in Metro Vancouver will require approximately $2.60 million of additional spend prior to completion.

The Company has renegotiated the terms of the payout of the remaining amounts owed to the vendors of Verdélite, pursuant to the Company’s 2018 purchase of Verdélite, on May 30, 2019. The amount outstanding as at the date of this MD&A is $8.51 million.

The Company has also committed to contributing $5.00 million to EHN in exchange for its 51% initial ownership in EHN, of which, $1.75 million has been paid as at March 31, 2020.

Operating, Investing and Financing Activities

The chart below highlights the Company’s cash flows:

| | |

| | For the three months | For the three months |

| | ended March 31, 2020 | ended March 31, 2019 |

| (000’s) | ($) | ($) |

| Net cash (used in) provided by: | | |

Operating activities | (3,161) | (8,866) |

Investing activities | (1,413) | (9,483) |

Financing activities | 2,630 | (2,028) |

| Decrease in cash | (1,944) | (20,377) |

Cash used in operating activities for the three-month period ended March 31, 2020 was $3.16 million, compared to cash used of $8.87 million in the comparative period of the prior year. The current quarter amount reflects the decrease in general and administrative, sales and marketing and research and development expenditures, decreases in cash outflows for payments of current liabilities, inventories and decrease in current assets from the comparable 2019 period. The Company incurred losses during the quarter as a result of the ramp up of its operating entities.

- 24 -

Cash used in investing activities for the three-month period ended March 31, 2020 was $1.41 million, compared to cash used of $9.48 million during the same period in 2019. During the three months ended March 31, 2020:

$0.71 million was used to invest in the Joint Venture;

$0.38 million was used to invest in EHN;

$0.20 million was used to purchase equipment for the Company’s various operating facilities;

$0.12 million was used in the research and preparation of 16 patents.

Cash provided by financing activities for the three months ended March 31, 2020 was $2.63 million, compared to cash used of $2.03 million in the three months ended March 31, 2019. Cash generated in the current period included $3.00 million in gross proceeds from private placement offerings. Offsetting this positive source of cash flow was a $0.27 million repayment of lease liabilities and interest and a $0.10 million outflow in share issuance costs.

Financial Risk Management

The Company’s board of directors has overall responsibility for the establishment and oversight of the Company’s risk management policies on an annual basis. Management identifies and evaluates the Company’s financial risks and is charged with the responsibility of establishing controls and procedures to ensure financial risks are mitigated in accordance with the approved policies.

Measurement Uncertainty and Impairment Assessments

As of March 31, 2020, management of the Company has determined that no impairment indicators of its long-term assets were present and no additional impairment write-downs in excess of those that had been previously recorded were required. Management continues to review each of its assets for indications of impairment.

Transactions with Related Parties

The Company has entered into transactions with a control person of the Company, a wholly owned subsidiary of such control person, a company controlled by the Company’s Executive Chairman, a company whose CEO is also a director of the Company, and with the Joint Venture.

With Emerald Health Sciences Inc.

On October 4, 2019, the Company announced that it had entered into an agreement to amend the purchase price payable by the Company pursuant to the hemp supply agreement dated September 26, 2018 with Emerald Health Hemp Inc. (“EHH”). Pursuant to this amendment, the Company was only required to pay EHH the reasonable and documented costs incurred by EHH in exchange for hemp products. During the year ended December 31, 2019, the Company wrote down $2.02 millionof inventory related to hemp harvested that did not meet the quality standards for extraction. On January 31, 2020, the Company settled the trade payables for hemp purchased of $2.02 million with shares for debt at a deemed price of $0.29 per Common Share.

- 25 -

On October 4, 2019, the Company announced that it had entered into a Sublease Agreement and a Cultivation Agreement with Sciences. Pursuant to the Sublease Agreement, the Company agreed to sublease 12 acres of land in Metro Vancouver to Sciences for which Sciences agreed to pay the Company rent equal to the amount that the Company pays to the head-landlord for the subleased land. Pursuant to the Cultivation Agreement, Sciences granted the Company the right to cultivate cannabis for the sole benefit of the Company, on the subleased land. In exchange for this right, the Company agreed to waive the amounts payable by Sciences under the Sublease Agreement. On May 27, 2020, the Company announced that it had terminated both the Sublease Agreement and the Cultivation Agreement. No payments were made to Sciences under either the Sublease Agreement or the Cultivation Agreement.

As at March 31, 2020, Sciences held an aggregate of 39,401,608 Common Shares, representing approximately 22% of the issued and outstanding Common Shares and it held 9,099,706 common share purchase warrants of the Company. As at December 31, 2019 Sciences held an aggregate of 29,687,942 Common Shares, representing approximately 18% of the issued and outstanding Common Shares and it held 9,099,706 common share purchase warrants of the Company.

On May 30, 2019, the Company amended a previous loan agreement with Sciences pursuant to which Sciences agreed to loan up to $6 million to the Company, in amounts and at times agreed to by the parties. Amounts loaned bear interest at 10% per annum and are repayable on demand. On July 5, 2019, the loan agreement with Sciences was amended to increase the available loan amount to $15 million and the rate of interest charged was increased to 12%. On January 31, 2020, the Company settled all outstanding principal and accrued interest for a total of $0.80 million with shares for debt at a deemed price of $0.29 per Common Share.

With Subsidiaries of Emerald Health Sciences Inc.

On October 3, 2018, the Company announced that it entered into a research agreement with EH Spain, an institute focused on cannabis research, which will provide its cannabis-industry-leading contract research organization (“CRO”) services to the Company to elucidate the mechanism of action of proprietary formulations and dosage forms that the Company is developing. EH Spain is a wholly-owned subsidiary of Sciences, who is a control person of the Company. EH Spain is a wholly-owned subsidiary of Sciences and is therefore a related party of the Company. To date, the Company has used the CRO services of EH Spain with total costs incurred of €0.02 million.

With a company controlled by the Company’s Executive Chairman

In 2017, the Company entered into a 30-year lease with a company (the “Landlord”) that is controlled by Avtar Dhillon, MD, the Executive Chairman of the Company with respect to land in Metro Vancouver, British Columbia on which the Company has built its new production facility. The lease amount of $0.08 million per quarter was determined by an independent valuation. The Landlord also charged the Company $Nil during the three months ended March 31, 2020 (March 31, 2019 - $0.16 million) for development fees and services related to construction of the Company’s new facility.

- 26 -

With a company whose CEO is also a director of the Company

As at March 31, 2020, the Company holds 1,666,667 common shares and 1,666,667 common share purchase warrants of Avricore Health Inc. (“Avricore” formerly VANC Pharmaceuticals Inc) for investment purposes. The CEO of Avricore is also a director of the Company.

The 1,666,667 common shares represent 2.9% of the issued and outstanding common shares of Avricore at the date of this MD&A. Upon exercise of the common share purchase warrants of Avricore, the Company would hold 3,333,334 common shares of Avricore, representing 5.8% of the issued and outstanding common shares of Avricore.

With the Company’s joint venture

As at March 31, 2020, the Joint Venture owes the Company $0.17 million (March 31, 2019 - $2.03 million) for expenditures made on behalf of the Joint Venture. As of March 31, 2020, the Company owes to the Joint Venture $0.96 million (March 31, 2019 - $Nil) for bulk resales as well as storage, logistical, and administrative related fees. As of March 31, 2020, the Company owes to the Joint Venture $Nil (March 31, 2019 - $2.89 million) for inventory purchased. Pursuant to the PSF Settlement Agreement, the Company issued a promissory note to the Joint Venture in the amount of $0.95 million. The note bears interest at a rate of 6.2% per annum, and will mature on the earlier of (a) December 31, 2020; (b) the Company ceasing to be a shareholder of Pure Sunfarms; or (c) the acquisition by any party of a majority of the outstanding shares of the Company. The principal amount is the amount owed by the Company to Pure Sunfarms as remittance for bulk sales under the 2018 Supply Agreement. Refer to Development of Business in the three months ended March31,2020for information related to the Settlement Agreement.

Proposed Transactions

There are no material decisions by the Company’s board of directors with respect to any imminent or proposed transactions that have not been disclosed herein.

Critical Accounting Policies and Estimates

The critical accounting policies and estimates are included in each of the notes of the Company’s audited consolidated financial statements for the year ended December 31, 2019, 2018 and 2017. These are the accounting policies and estimates that are critical to the understanding of the business operations and results of operations.

Changes in Accounting Standards not yet Effective

Refer to Note 2 of the Company’s audited consolidated financial statements for the years ended December 31, 2019, 2018 and 2017 for additional information on several new standards, amendments to standards and interpretations, which are not yet effective. There were no new standards adopted in the three months ended March 31, 2020 condensed interim consolidated financial statements.

Off-Balance Sheet Arrangements

The Company has not entered into any material off-balance sheet arrangements such as guarantee contracts, contingent interests in assets transferred to unconsolidated entities, derivative financial obligations, or with respect to any obligations under a variable interest equity arrangement.

- 27 -

Risks and Uncertainties

The Company’s actual results may differ materially from those expected or implied by the forward-looking statements and forward-looking information contained in this interim management discussion and analysis due to the proposed nature of the Company’s business and its present stage of development. A non-exhaustive list of risk factors associated with the Company are discussed in detail under the heading “Risk Factors” in the Company’s AIF dated May 13, 2020.

Risks Related to the Joint Venture

Although the Company has certain rights pursuant to the shareholders' agreement governing the Joint Venture (the “JV SHA”), the Company does not directly control the management of the Joint Venture and the Joint Venture has its own management. Success of the Joint Venture will depend, in part, on the expertise of such management. The business of the Joint Venture is itself subject to the operational and business risks inherent in the large-scale production of cannabis and to that extent, the business of the Joint Venture will be subject to many of the same business risks applicable to the Company and which are described under the heading “Risks Relating to the Joint Venture” in the Company’s AIF dated May 13, 2020. In particular, the production and sale of cannabis at the Joint Venture’s facilities in Delta, British Columbia is subject to obtaining and maintaining all necessary permits and licences. There can be no assurance that the Company and the Joint Venture will be successful in obtaining and maintaining all such permits and licences. In the event that all such licences and permits are not obtained or maintained then the Joint Venture may not be permitted to produce or sell cannabis or the amount which it is permitted to produce or sellmay be reduced, eitherof whichwould have a material adverse effect on theCompany’s business, results of operations and financial performance.

The Joint Venture may require additional capital. To the extent the Joint Venture is unable to internally fund its operating requirements or expansion plans it may make additional capital calls on its shareholders. Failure by the Company to meet such a capital call would not constitute a default under the JV SHA, but in the event that its joint venture partner, Village Farms, elects to make its capital contributions the Company’s interest in the Joint Venture may, in certain circumstances, be diluted. If the Company elects to fund a capital call but Village Farms fails to do so then the Company may need to advance additional capital in order to meet the Joint Venture’s needs. There can be no assurance that the Company or Village Farms will have the necessary capital resources to meet a capital call when and if made by the Joint Venture. In the event that the Joint Venture cannot raise the necessary funds from its shareholders, including the Company, it may need to raise additional funds through debt or equity financings that may be dilutive to the Company’s interest in the Joint Venture. If the Joint Venture cannot obtain adequate capital to the extent required on favorable terms or at all, it may be required to scale back or entirely halt its operating or expansion plans and its business, financial condition and results of operations could be adversely affected. As of the date of this MD&A, the Company owns 41.3% of the outstanding shares of the Joint Venture. In the event that shares of the Joint Venture are issued to raise capital, the Company’s interest inthe Joint Venturemay bediluted. Any dilution of the Company’sinterest in the Joint Venture may have a material adverse impact on the business, financial condition, cash flow and results of operations of the Company.

In late 2019 and early 2020, the Company was party to certain disputes with the Joint Venture and Village Farms with respect to the Joint Venture and certain supply agreements as more particularly described in the Company’s AIF dated May 13, 2020, certain of which were referred to arbitration. All such disputes have now been settled among the parties and arbitration has been halted, however, additional disputes

- 28 -

may arise between the Company and the Joint Venture or between the Company and its joint venture partner, Village Farms, that may adversely affect the success of the Joint Venture and which would have a material adverse effect on the Company’s business, results of operations and financial performance. Failure by the Company to otherwise comply with its obligations under the JV SHA may result in the Company being in default under the shareholders' agreement and could result in the Company losing some or all of its interest in the Joint Venture.

Additionally, the Company has provided a limited guarantee of $10 million in connection with the Joint Venture’s Amended Credit Facility. If the Joint Ventureis unable to fulfill its obligations under such facility, the creditor may enforce such limited guarantee against the Company. The Company may be unable to satisfy such guarantee. Any such enforcement action could adversely affect the business, financial condition and financial performance of the Company.

Public Health Crises

The Company’s business, operations and financial condition could be materially adversely affected by the outbreak of epidemics, pandemics or other health crises, such as COVID-19. As at the date of this MD&A, the global reactions to the spread of COVID-19 which led to, among other things, significant restrictions on travel, quarantines, temporary business closures and a general reduction in consumer activity, have started to ease. Provincial governments in the provinces of British Columbia and Quebec, where the Company’s facilities and those of the Joint Venture are located, initially passed orders with respect to closure of non-essential business, and some of these orders are now being lifted. Each such province has designated the production of cannabis as an essential service and, accordingly, the Company’s facilities and thoseof the Joint Venture remained, and still currently remain open and in production, however there can be no certainty that this will remain the case.

The risks to the Company of such public health crises also include risks to employee health and safety and a slowdown or temporary suspension of operations in geographic locations impacted by an outbreak. The Company has taken what it believes to be appropriate safety precautions at its facilities to safeguard the health of its employees including remote work plans and additionalprotectivemeasuresonsite, and there have been no outbreaks to date at any of the Company’s facilities. However, if an outbreak were to occur, the Company may be required to temporarily close the facility. Any such closure could have a material adverse impact on production and sales. Widespread uncertainty, government restrictions on personal mobility and the other impacts of the COVID-19 crisis on the Company’s employees, together with the potential to contract COVID-19 and/or be subject to quarantine may have an impact on the ability or willingness of the Company’s employees and those of the Joint Venture to attend their workplace. Although certain administrative functions can be conducted remotely, other functions, such as growth, picking and packaging of the Company’s products and maintenance of the Company’s products and facilities cannot be conducted remotely and may be adversely impacted by any resulting decrease in employee availability.

Such public health crises can also result in disruptions and volatility in financial markets and global supply chains as well as declining trade and market sentiment and reduced mobility of people, all of which could impact cannabis product prices, interest rates, credit ratings, credit risk and inflation. In addition, the Company’s businessmay be impacted by supply chain disruptions caused by the COVID-19 crisis, including the delivery of essential imports for the Company’s products or the delivery of the Company’s products to markets. The COVID-19 crisis may also have a negative impact on consumer demand for the Company’s

- 29 -

products due to, among other things, economic contraction and the potential closure of vendors of the Company’s products, which could result in reduced revenue to the Company.

While these effects are expected to be temporary, the duration of the disruptions to business and the related financial impact cannot be estimated with any degree of certainty at this time. Although a number of jurisdictions have commenced steps to reduce restrictions on businesses and to re-open their economies there can be no guarantee that these steps will be successful or that additional future outbreaks will not lead to a re-imposition of restrictions. At this point, the extent to which COVID-19 may impact the Company is uncertain; however, it is possible that COVID-19 could have a material adverse effect on the Company’s business, results of operations and financial condition.

Forward-Looking Statements

Certain statements contained in this Management Discussion and Analysis (“MD&A”) constitute forward-looking information or forward-looking statements under applicable securities laws (collectively, “forward-looking statements”). These statements relate to future events or future performance, business prospects or opportunities of Emerald Health Therapeutics, Inc. and its subsidiaries (together the “Company” or “Emerald”). All statements other than statements of historical fact may be forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “forecast”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions) are not statements of historical fact and may be “forward-looking statements”.

Examples of forward-looking statements in this MD&A include, but are not limited to, statements in respect of: future financings; the retrofit of the Delta2 Facility; the expansion of the Company’s operations in British Columbia and Québec; payment of outstanding amounts in respect of the acquisition of Verdélite and Verdélite Holdings; the conversion of the Convertible Debentures; the acceleration of the outstanding common share purchase warrants; the Company’s intention to use proceeds of financings to fund the completion of capital projects and potential future expansion and acquisitions, including partnership transactions, for research and development and to expand the Company’s existing extraction capabilities, and for working capital and general corporate purposes; potential proceeds from the exercise of the Company’s outstanding common share purchase warrants; actions taken by the Company to maintain or adjust its capital structure; management’s anticipation of long-term future profitability; the Company’s intentions to acquire and/or construct additional cannabis production and manufacturing facilities and to expand the Company’s marketing and sales initiatives; benefits received by the Company from its transactions with Sciences,a control person of the Company, and the opportunities that such transactions provide; the development of the Joint Venture’s business; production at the Company’s facilities; the focus of the Company’s efforts; the business goals and strategy of the Company; development of products and related research; license applications and amendments; and the effect that each risk factor will have on the Company.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The reader of these statements is cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. These forward-looking statements involve risks and uncertainties relating to, among others: market price of cannabis; securing product supply; continued availability of capital financing and general economic, market or business conditions; reliance on cultivation, production and

- 30 -

sales licences to produce and sell cannabis and cannabis oils issued to the Company under the Cannabis Act and its ability to maintain these licences; regulatory risks relating to the Company’s compliance with the applicable law; regulatory approvals for expansion of current production facility, development of new production facilities and greenhouse retrofits by the Company and the Joint Venture; the Joint Venture’s and the Company’s reliance on their respective licences to cultivate and sell cannabis under the Cannabis Act and their respective abilities to maintain such licences; Avalite’s reliance on its analytical testing licence issued under the Cannabis Act to provide testing of cannabis and its ability to maintain this licence; the Company’s ability to execute its multi-phase expansion plan and its plans with the Joint Venture; changes in laws, regulations and guidelines; changes in government; changes in government policy; increased competition in the cannabis market; the limited operating history of the Company; the Company’s reliance on key persons; failure of counterparties to perform contractual obligations; difficulties in securing additional financing; unfavourable publicity or consumer perception of the cannabis industry; the impact of any negative scientific studies on the effects of cannabis; demand for labour; difficulties in construction or in obtaining qualified contractors to complete greenhouse retrofits; actual operating and financial performance of facilities, equipment and processes relative to specifications and expectations; results of litigation; the Company’s ability to develop and commercialize pharmaceutical products; failure to obtain regulatory approval for pharmaceutical products; changes in the Company’s over-all business strategy; restrictions of the TSXV on the Company’s business; and the Company’s assumptions stated herein being correct. See “Risks and Uncertainties” in this MD&A and other factors described in the Company’s AIF under the heading “Risk Factors”.

The Company believes that the expectations reflected in any forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in, or incorporated by reference into, this MD&A should not be unduly relied upon. These statements speak only as of the date of this MD&A. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws. Actual results may differ materially from those expressed or implied by such forward-looking statements.

- 31 -