Net cash generated from operating activities in 2019 was RMB1,285.1 million, primarily attributable to a net income of RMB226.6 million, adjusted for

non-cash

items that primarily consist of RMB60.2 million in share-based compensation, and a RMB1,065.6 million increase in deferred revenue resulting from our rapid business expansion.

Net cash generated from operating activities in 2018 was RMB241.9 million, primarily attributable to a net income of RMB19.7 million, adjusted for

non-cash

items that primarily consist of RMB4.0 million in depreciation of property, equipment and software, and a RMB222.9 million increase in deferred revenue resulting from our rapid business expansion.

Net cash used in investing activities in 2020 was RMB5,596.3 million (US$857.7 million), primarily due to the purchase of short-term investments of RMB17,394.6 million (US$2,665.8 million), partially offset by proceeds from the maturity of short-term investments of RMB11,689.2 million (US$1,791.4 million).

Net cash used in investing activities in 2019 was RMB2,504.6 million, primarily due to the purchase of short-term investments of RMB8,727.8 million and long-term investments of RMB1,109.2 million, partially offset by proceeds from maturity of short-term investments of RMB7,393.4 million.

Net cash used in investing activities in 2018 was RMB198.7 million, primarily due to purchase of short-term investments of RMB422.8 million, partially offset by proceeds from maturity of short-term investments of RMB233.0 million.

Net cash generated from financing activities in 2020 was RMB5,272.1 million (US$808.0 million), primarily due to net proceeds raised from the private placement of our Class A ordinary shares in December 2020 of RMB5,687.3 million, partially offset by the repurchase of ordinary shares for an amount of RMB282.5 million and an installment payment of RMB132.2 million for the properties purchases in Zhengzhou.

Net cash generated from financing activities in 2019 was RMB1,246.1 million, primarily attributable to net proceeds from our initial public offering and the exercise of over-allotment option by the underwriters of RMB1,366.9 million, partially offset by the repurchase of ordinary shares amounting RMB86.7 million.

Net cash used in financing activities in 2018 was RMB29.2 million, primarily attributable to repayment of the loan extended by Mr. Larry Xiangdong Chen in 2017.

Our capital expenditures primarily relate to purchase of commercial real estate, leasehold improvements and investments in computers, network equipment and software. Our capital expenditures were RMB12.1 million, RMB61.3 million and RMB490.6 million (US$75.2 million) in 2018, 2019 and 2020, respectively. We intend to fund our future capital expenditures with our existing cash balance, short-term investments and proceeds from our initial public offering and our private placement of Class A ordinary shares in December 2020. We will continue to make capital expenditures to meet the expected growth of our business.

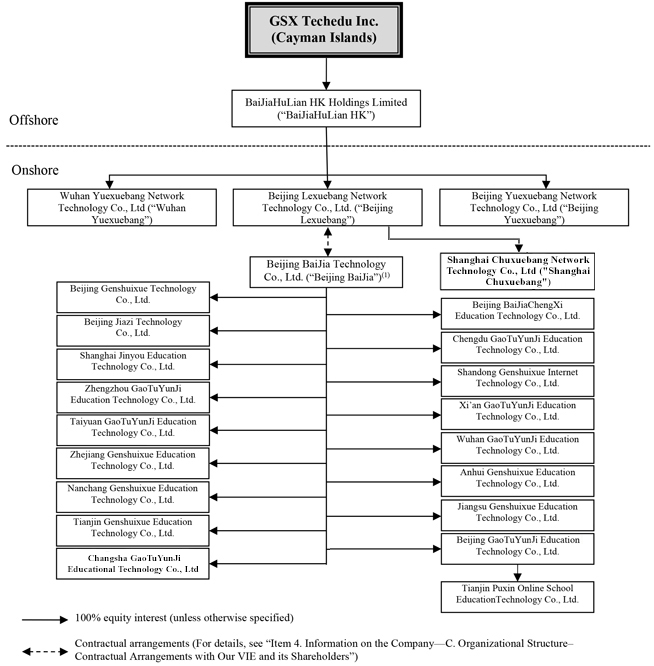

Holding Company Structure

GSX Techedu Inc. is a holding company with no material operations of its own. We conduct our operations primarily through our PRC subsidiaries, our VIE and its subsidiaries in China. As a result, our ability to pay dividends depends upon dividends paid by our PRC subsidiaries. If our existing PRC subsidiaries or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us. In addition, our wholly foreign-owned subsidiaries in China are permitted to pay dividends to us only out of its retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Under PRC law, each of our subsidiaries and our VIE in China is required to set aside at least 10% of its

after-tax

profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of their registered capital. In addition, our wholly foreign-owned subsidiaries in China may allocate a portion of their

after-tax

profits based on PRC accounting standards to enterprise expansion funds and staff bonus and welfare funds at their discretion, and our VIE may allocate a portion of its

after-tax

profits based on PRC accounting standards to a surplus fund at their discretion. The statutory reserve funds and the discretionary funds are not distributable as cash dividends. Remittance of dividends by a wholly foreign-owned company out of China is subject to examination by the banks designated by SAFE. Our PRC subsidiaries have not paid dividends and will not be able to pay dividends until they generate accumulated profits and meet the requirements for statutory reserve funds.