Cerence Q3 FY23 Earnings Presentation Stefan Ortmanns, Chief Executive Officer Tom Beaudoin, Chief Financial Officer Iqbal Arshad, Chief Technology Officer Rich Yerganian, SVP of Investor Relations August 8, 2023 Exhibit 99.2

Forward-Looking Statements Statements in this presentation regarding: Cerence’s future performance, results and financial condition; expected growth; opportunities; business, industry and market trends; strategy regarding fixed contracts and its impact on financial results; backlog; demand for Cerence products; innovation and new product offerings; and management’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “intends” or “estimates” or similar expressions) should also be considered to be forward-looking statements. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risk, uncertainties and other factors, which may cause actual results or performance of the company to be materially different from any future results or performance expressed or implied by such forward-looking statements, including, but not limited to: the highly competitive and rapidly changing market in which we operate; adverse conditions in the automotive industry, the related supply chain and semiconductor shortage, or the global economy more generally; the impacts of the COVID-19 pandemic on our and our customers’ businesses; the impact of the war in Ukraine on our and our customers’ businesses; our ability to control and successfully manage our expenses and cash position; escalating pricing pressures from our customers; the impact on our business of the transition to a lower level of fixed contracts, including the failure to achieve such a transition; our failure to win, renew or implement service contracts; the cancellation or postponement of existing contracts; the loss of business from any of our largest customers; effects of customer defaults; our inability to successfully introduce new products, applications and services; our strategy to increase cloud offerings; the inability to recruit and retain qualified personnel; disruptions arising from transitions in management personnel; cybersecurity and data privacy incidents; failure to protect our intellectual property; defects or interruptions in service with respect to our products; fluctuating currency rates and interest rates; inflation; financial and credit market volatility; and the other factors discussed in our most recent Annual Report on Form 10-K for the fiscal year ended September 30, 2022, quarterly reports on Form 10-Q, and other filings with the Securities and Exchange Commission. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date made. We undertake no obligation to update any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by law.

Strong executive and company-wide focus drives operational performance Global production vehicle penetration (TTM) rises to 54% Full fiscal year guidance remains on track Successful Convertible Debt Offering reducing interest expense by approximately $8M per year Double-digit revenue growth and strong EBITDA margins remain the company objective for FY24 and beyond Q3 FY23 �Business Highlights 3

Competitive Design Wins Top Japanese OEM for Cerence Cloud Korean OEM for Emergency Vehicle Detection Large Japanese two-wheeler manufacturer for Cerence Ride Major Platform Releases 3 global programs SOPed with luxury OEMs 4 two-wheeler SOPs in NA, China, India Continued focus on several strategic win opportunities in Q4 including potential win-backs Q3 FY23 �Sales Highlights 4 Strategic Wins Drive Future Revenue

© 2023 Cerence Inc. Continued focus on operational excellence Meet or exceed product performance and delivery commitments Maintain strong competitive position Capitalize on strong sales pipeline Deliver on FY23 guidance Execute on innovation roadmap Company Priorities Fueling Growth by Creating an Immersive Cabin Experience 5

Cerence AI Shaping the Future of Automotive User Experiences: The Immersive Companion 6 Leveraging two+ decades of unique experience to create generative-AI powered solutions tailored for transportation Next-gen Cerence Assistant: intuitive & multi-modal user experiences Generative AI-based applications: Cerence Car Knowledge – real-time, contextual information Generative AI and large language model-powered roadmap for the future

Video

Cerence AI Shaping the Future of Automotive User Experiences: The Immersive Companion 8 Leveraging two+ decades of unique experience to create generative-AI powered solutions tailored for transportation Next-gen Cerence Assistant: intuitive & multi-modal user experiences Generative AI-based applications: Cerence Car Knowledge – real-time, contextual information Generative AI and large language model-powered roadmap for the future

Q3 FY23 Financial Details Tom Beaudoin, CFO

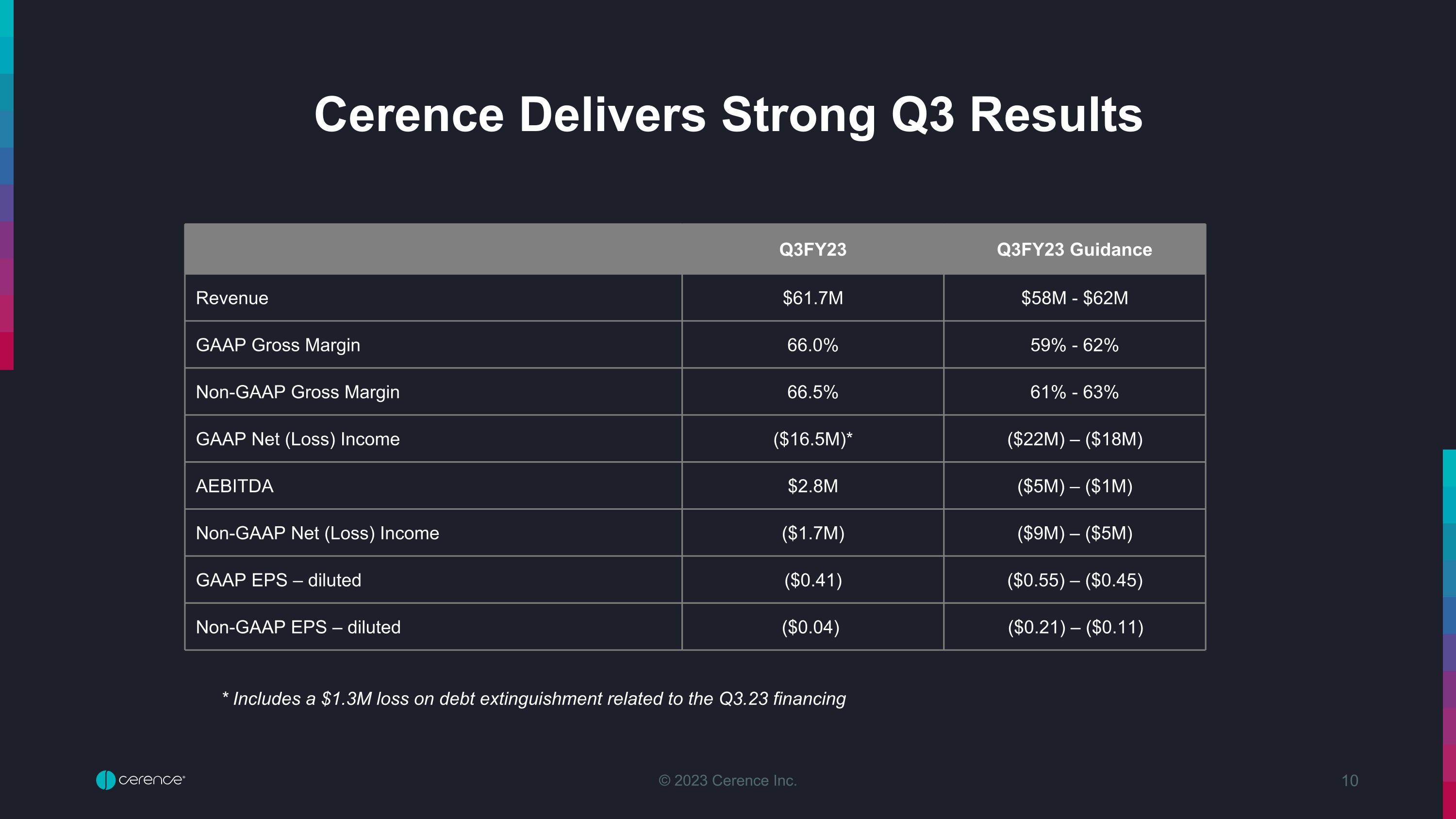

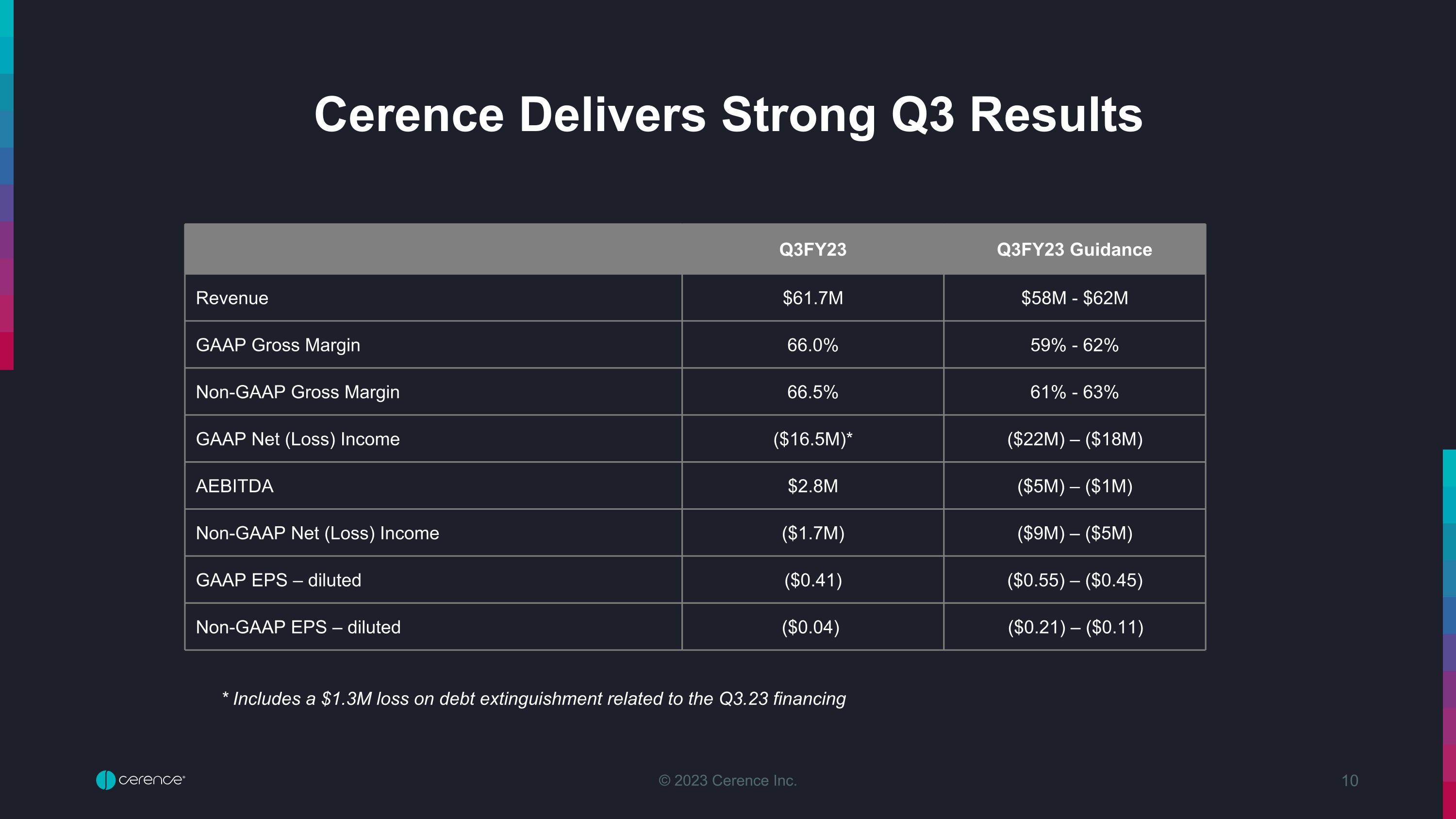

Cerence Delivers Strong Q3 Results Q3FY23 Q3FY23 Guidance Revenue $61.7M $58M - $62M GAAP Gross Margin 66.0% 59% - 62% Non-GAAP Gross Margin 66.5% 61% - 63% GAAP Net (Loss) Income ($16.5M)* ($22M) – ($18M) AEBITDA $2.8M ($5M) – ($1M) Non-GAAP Net (Loss) Income ($1.7M) ($9M) – ($5M) GAAP EPS – diluted ($0.41) ($0.55) – ($0.45) Non-GAAP EPS – diluted ($0.04) ($0.21) – ($0.11) * Includes a $1.3M loss on debt extinguishment related to the Q3.23 financing

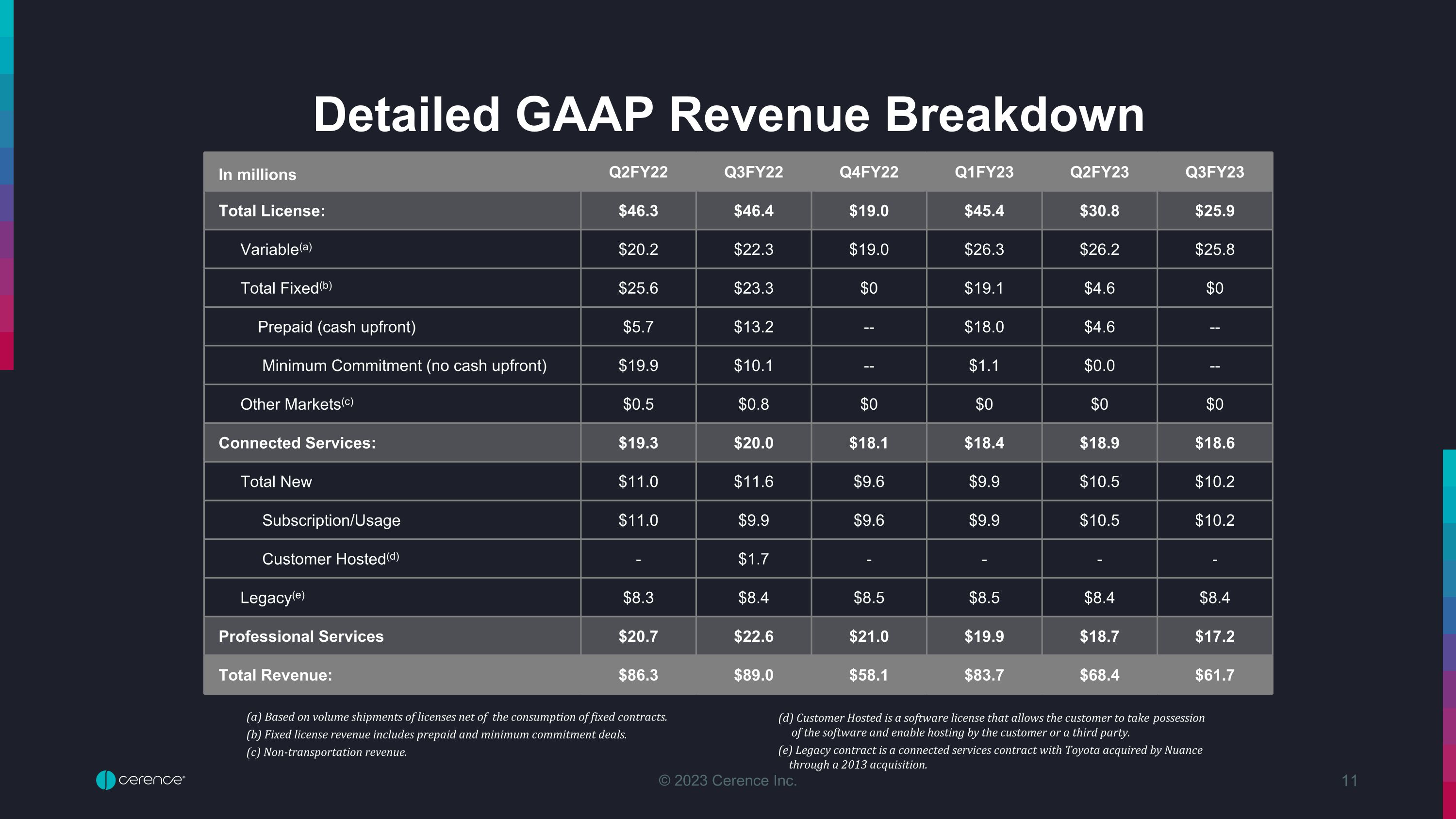

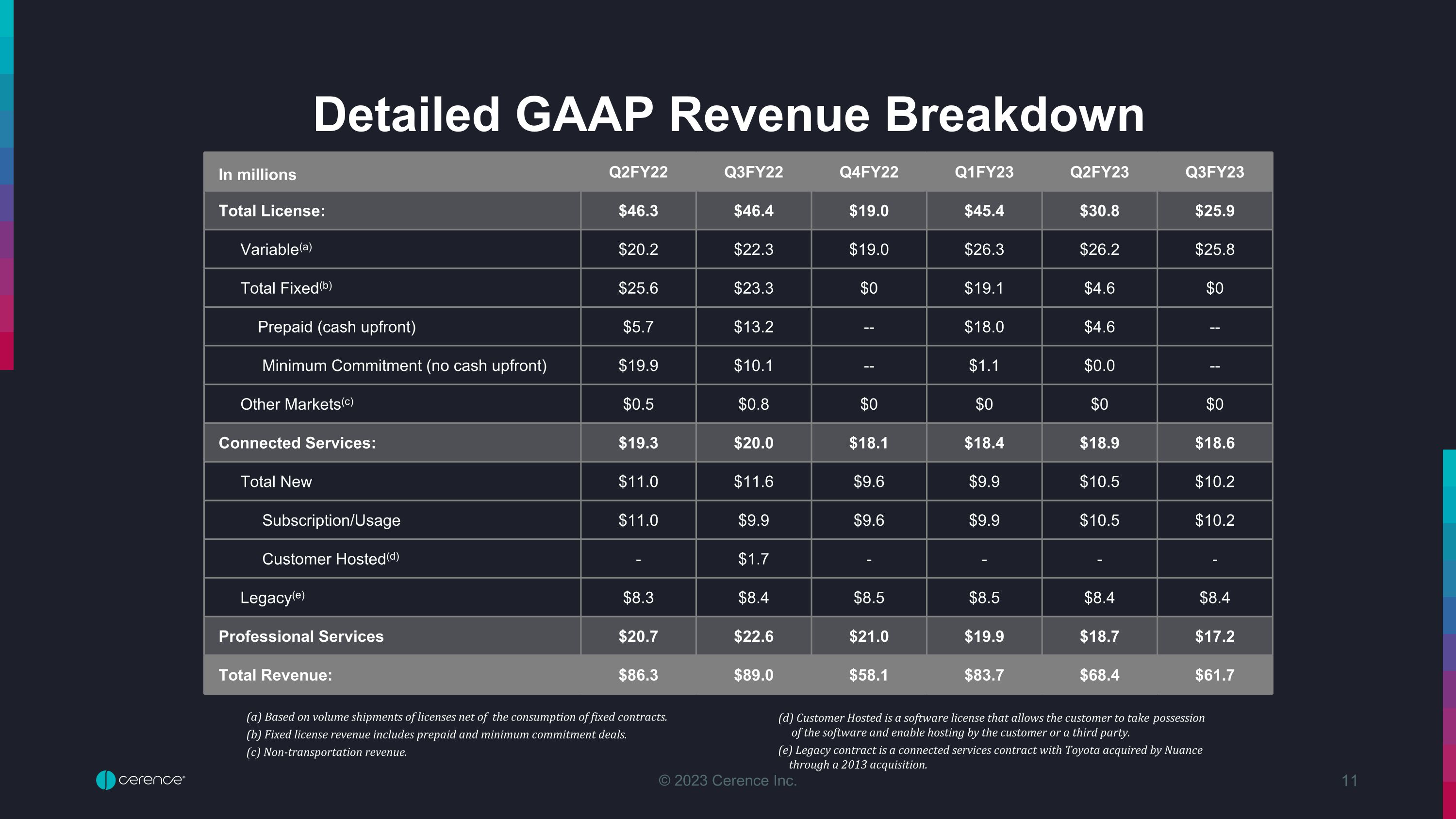

In millions Q2FY22 Q3FY22 Q4FY22 Q1FY23 Q2FY23 Q3FY23 Total License: $46.3 $46.4 $19.0 $45.4 $30.8 $25.9 Variable(a) $20.2 $22.3 $19.0 $26.3 $26.2 $25.8 Total Fixed(b) $25.6 $23.3 $0 $19.1 $4.6 $0 Prepaid (cash upfront) $5.7 $13.2 -- $18.0 $4.6 -- Minimum Commitment (no cash upfront) $19.9 $10.1 -- $1.1 $0.0 -- Other Markets(c) $0.5 $0.8 $0 $0 $0 $0 Connected Services: $19.3 $20.0 $18.1 $18.4 $18.9 $18.6 Total New $11.0 $11.6 $9.6 $9.9 $10.5 $10.2 Subscription/Usage $11.0 $9.9 $9.6 $9.9 $10.5 $10.2 Customer Hosted(d) - $1.7 - - - - Legacy(e) $8.3 $8.4 $8.5 $8.5 $8.4 $8.4 Professional Services $20.7 $22.6 $21.0 $19.9 $18.7 $17.2 Total Revenue: $86.3 $89.0 $58.1 $83.7 $68.4 $61.7 (a) Based on volume shipments of licenses net of the consumption of fixed contracts. (b) Fixed license revenue includes prepaid and minimum commitment deals. (c) Non-transportation revenue. (d) Customer Hosted is a software license that allows the customer to take possession � of the software and enable hosting by the customer or a third party. (e) Legacy contract is a connected services contract with Toyota acquired by Nuance � through a 2013 acquisition. Detailed GAAP Revenue Breakdown

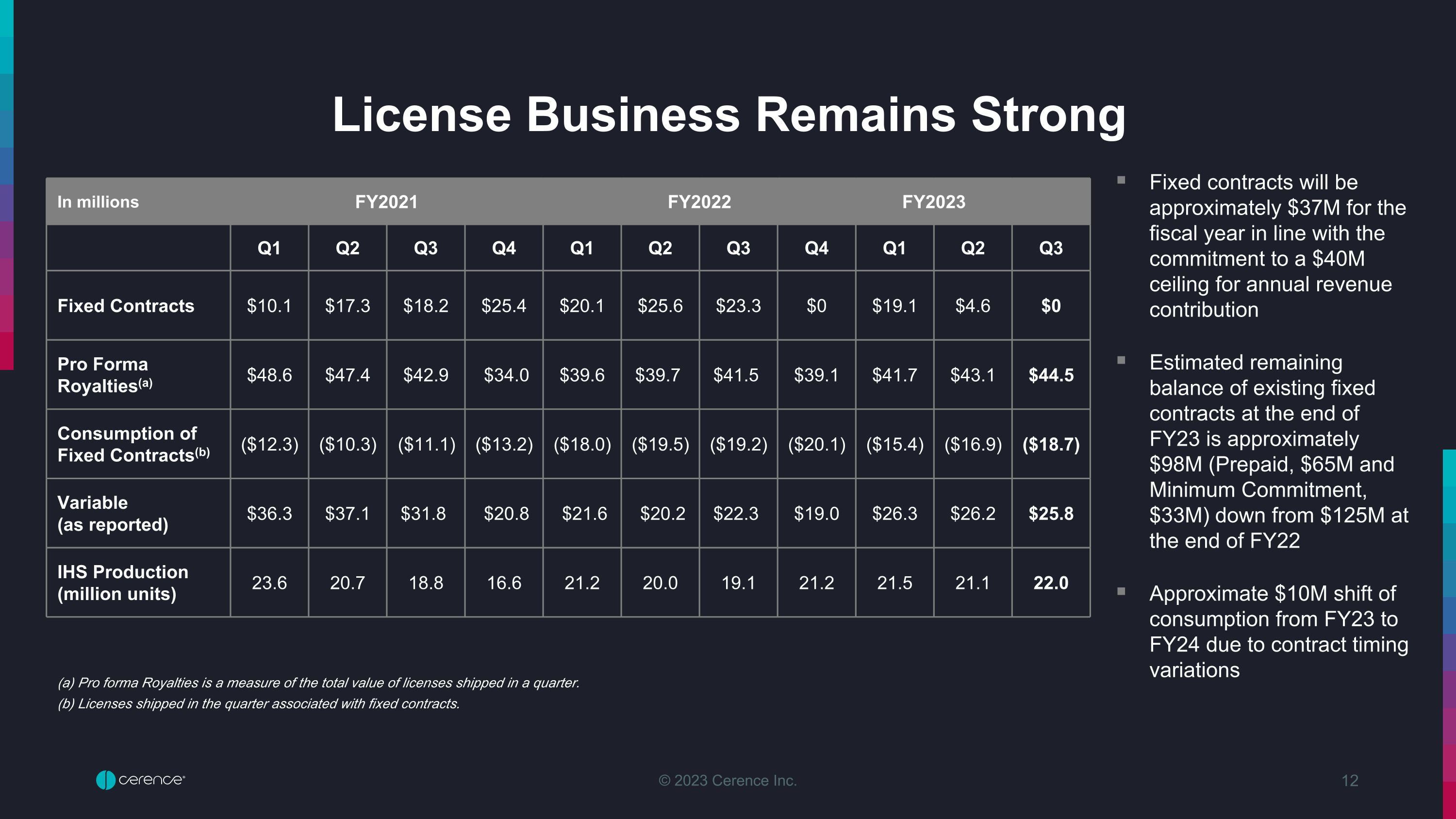

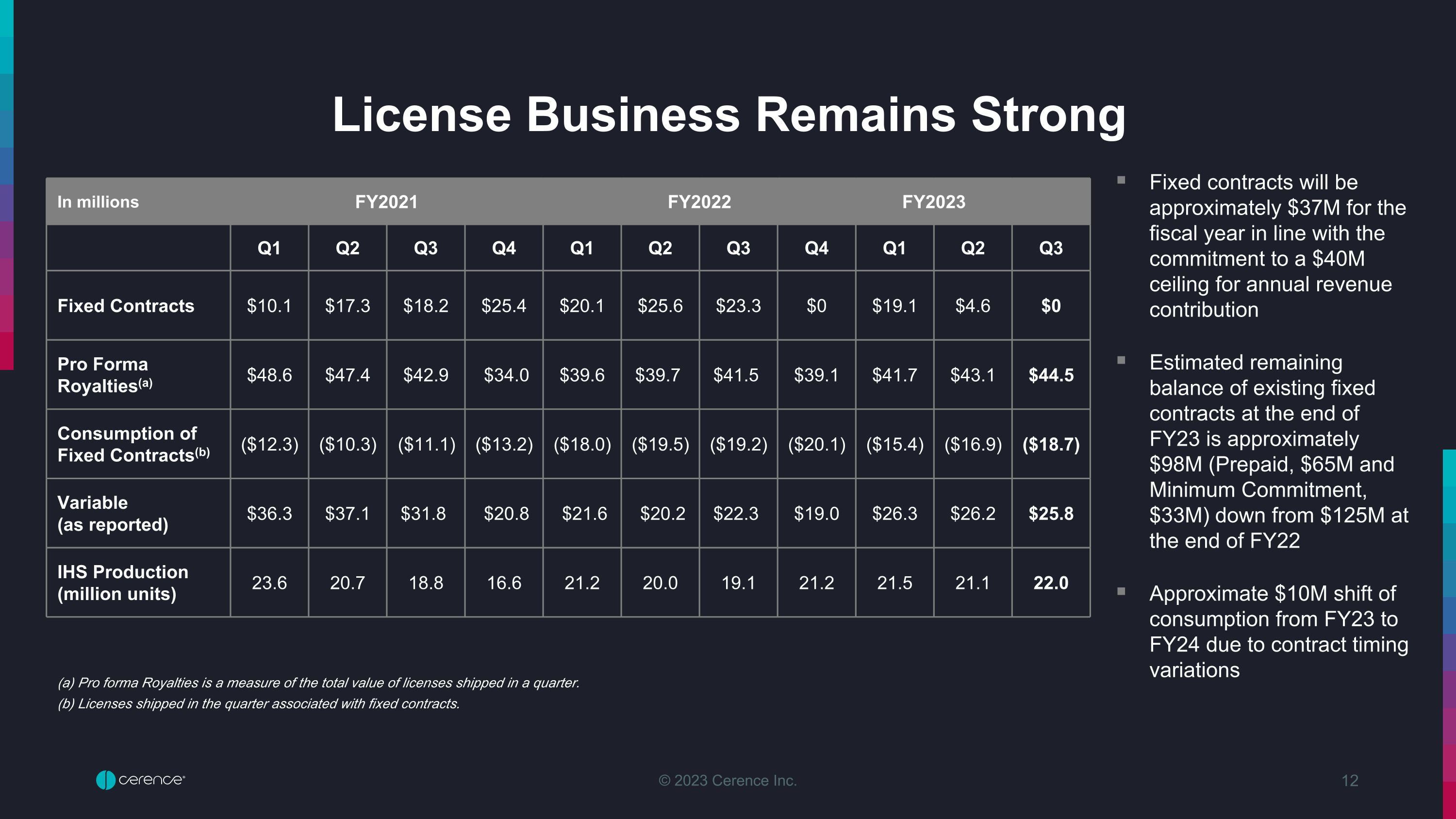

In millions FY2021 Fiscal Year 2021 FY2022 FY2023 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Fixed Contracts $10.1 $17.3 $18.2 $25.4 $20.1 $25.6 $23.3 $0 $19.1 $4.6 $0 Pro Forma Royalties(a) $48.6 $47.4 $42.9 $34.0 $39.6 $39.7 $41.5 $39.1 $41.7 $43.1 $44.5 Consumption of Fixed Contracts(b) ($12.3) ($10.3) ($11.1) ($13.2) ($18.0) ($19.5) ($19.2) ($20.1) ($15.4) ($16.9) ($18.7) Variable �(as reported) $36.3 $37.1 $31.8 $20.8 $21.6 $20.2 $22.3 $19.0 $26.3 $26.2 $25.8 IHS Production (million units) 23.6 20.7 18.8 16.6 21.2 20.0 19.1 21.2 21.5 21.1 22.0 (a) Pro forma Royalties is a measure of the total value of licenses shipped in a quarter. (b) Licenses shipped in the quarter associated with fixed contracts. License Business Remains Strong Fixed contracts will be approximately $37M for the fiscal year in line with the commitment to a $40M ceiling for annual revenue contribution Estimated remaining balance of existing fixed contracts at the end of FY23 is approximately $98M (Prepaid, $65M and Minimum Commitment, $33M) down from $125M at the end of FY22 Approximate $10M shift of consumption from FY23 to FY24 due to contract timing variations

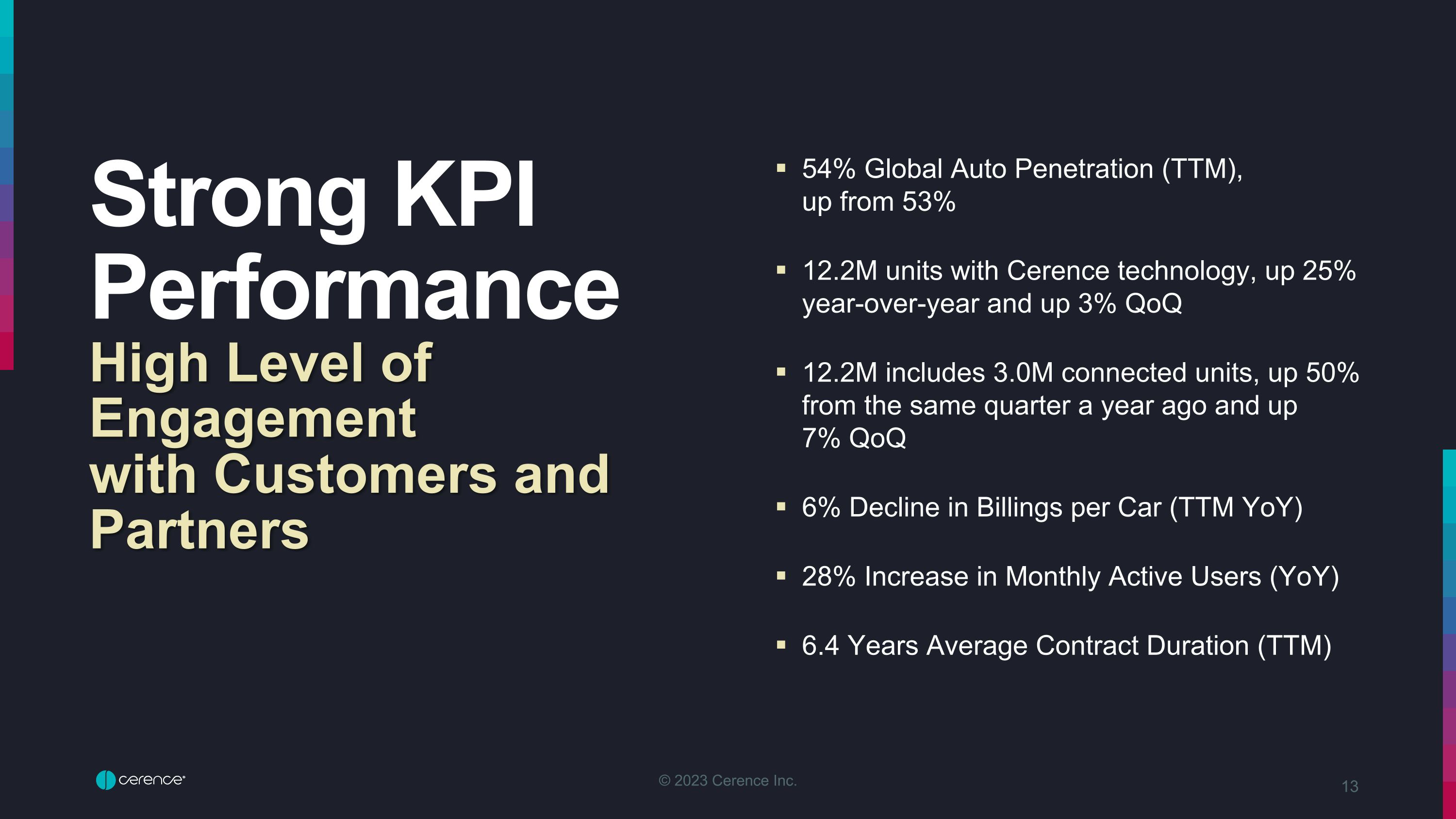

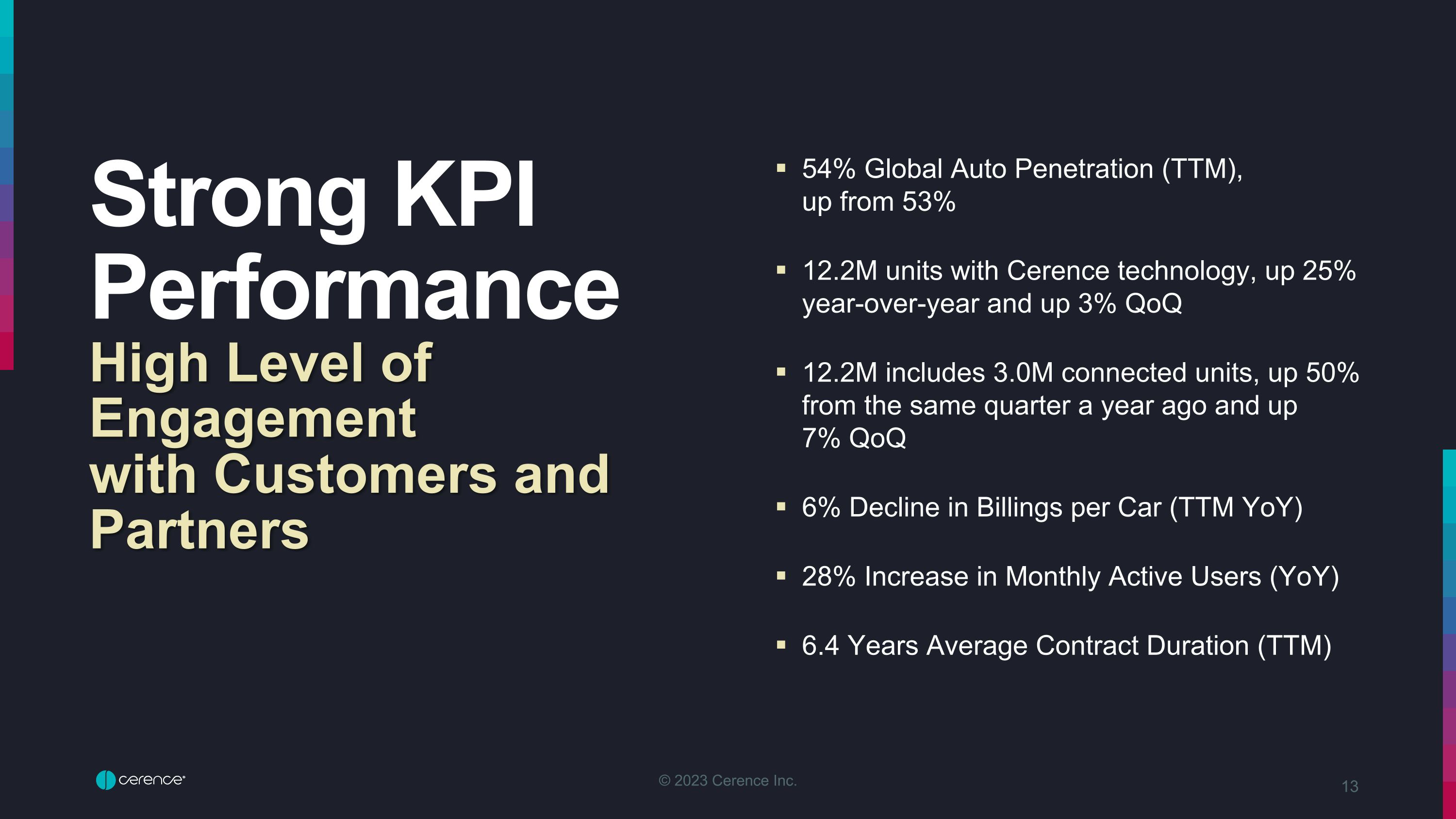

54% Global Auto Penetration (TTM), �up from 53% 12.2M units with Cerence technology, up 25% year-over-year and up 3% QoQ 12.2M includes 3.0M connected units, up 50% from the same quarter a year ago and up 7% QoQ 6% Decline in Billings per Car (TTM YoY) 28% Increase in Monthly Active Users (YoY) 6.4 Years Average Contract Duration (TTM) Strong KPI Performance�High Level of Engagement �with Customers and Partners 13

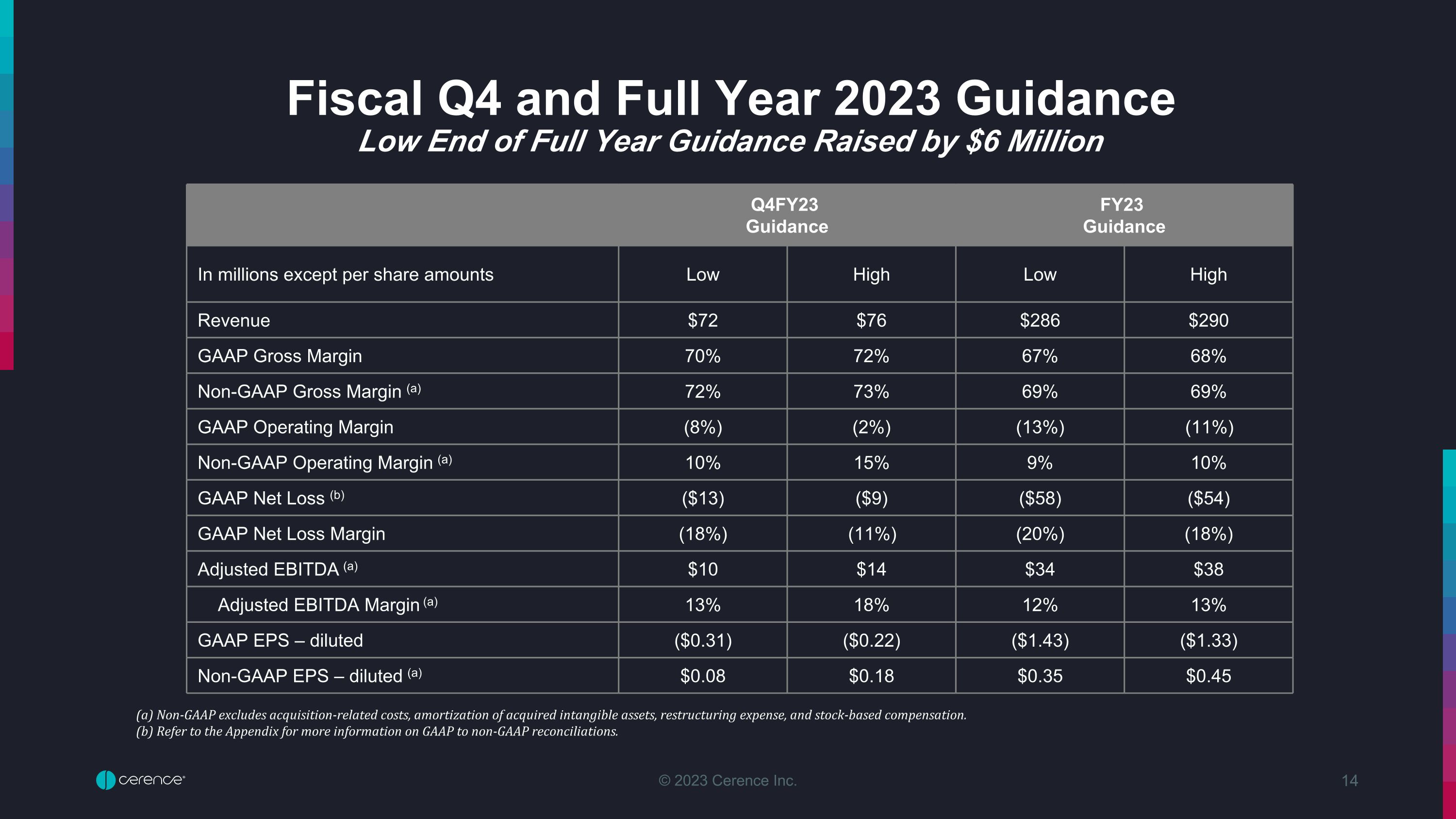

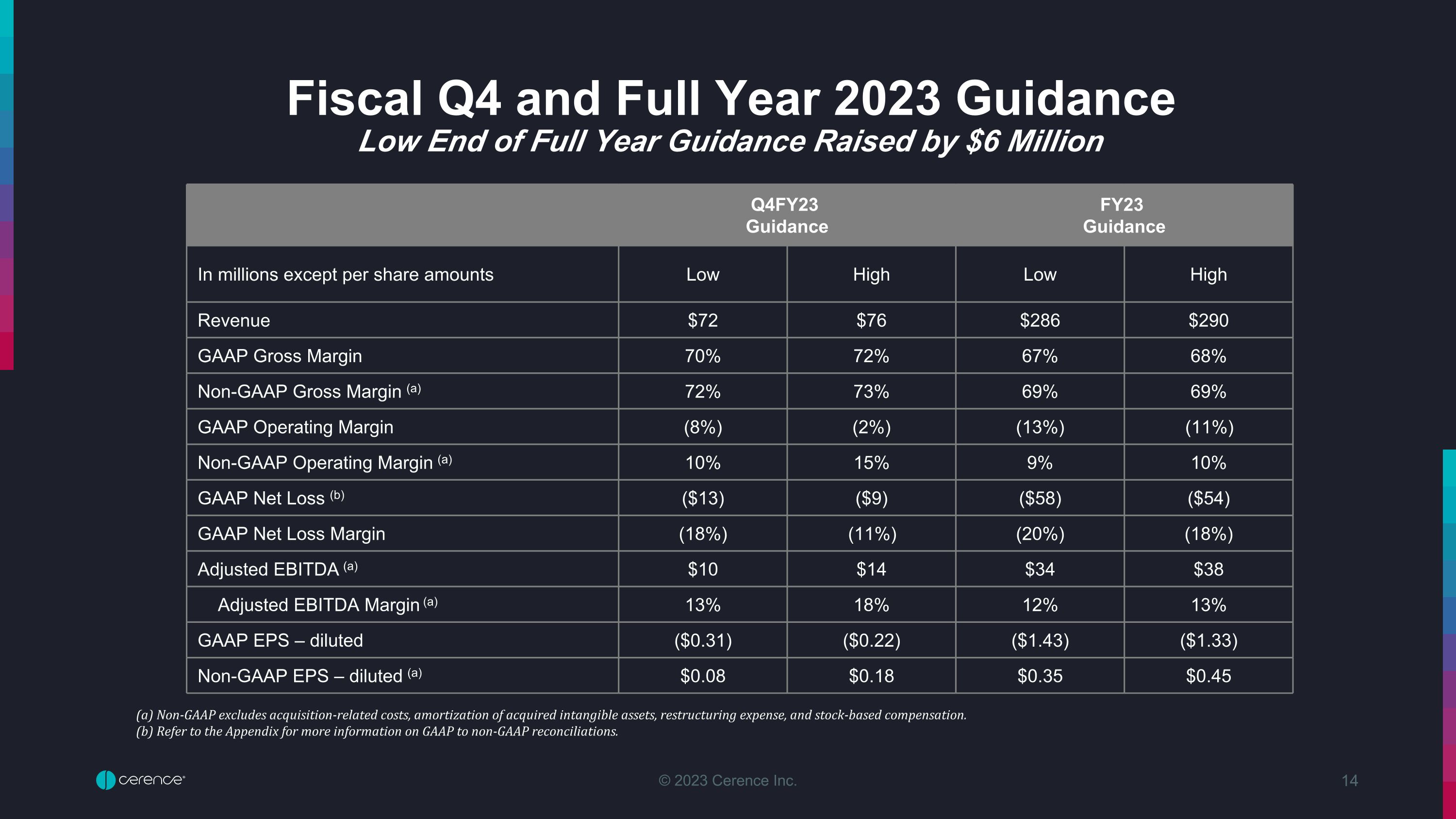

Fiscal Q4 and Full Year 2023 Guidance�Low End of Full Year Guidance Raised by $6 Million Q4FY23 Guidance FY23 Guidance In millions except per share amounts Low High Low High Revenue $72 $76 $286 $290 GAAP Gross Margin 70% 72% 67% 68% Non-GAAP Gross Margin (a) 72% 73% 69% 69% GAAP Operating Margin (8%) (2%) (13%) (11%) Non-GAAP Operating Margin (a) 10% 15% 9% 10% GAAP Net Loss (b) ($13) ($9) ($58) ($54) GAAP Net Loss Margin (18%) (11%) (20%) (18%) Adjusted EBITDA (a) $10 $14 $34 $38 Adjusted EBITDA Margin (a) 13% 18% 12% 13% GAAP EPS – diluted ($0.31) ($0.22) ($1.43) ($1.33) Non-GAAP EPS – diluted (a) $0.08 $0.18 $0.35 $0.45 (a) Non-GAAP excludes acquisition-related costs, amortization of acquired intangible assets, restructuring expense, and stock-based compensation. �(b) Refer to the Appendix for more information on GAAP to non-GAAP reconciliations.

Deliver FY23 Guidance Generate full year positive CFFO Report 2H bookings and 5-year backlog Provide FY24 Guidance Long-term objective remains double-digit revenue growth and strong EBITDA margins Q4 FY23 Focus�Continue to Drive Operational Excellence 15

Q&A Destination Next

Appendix

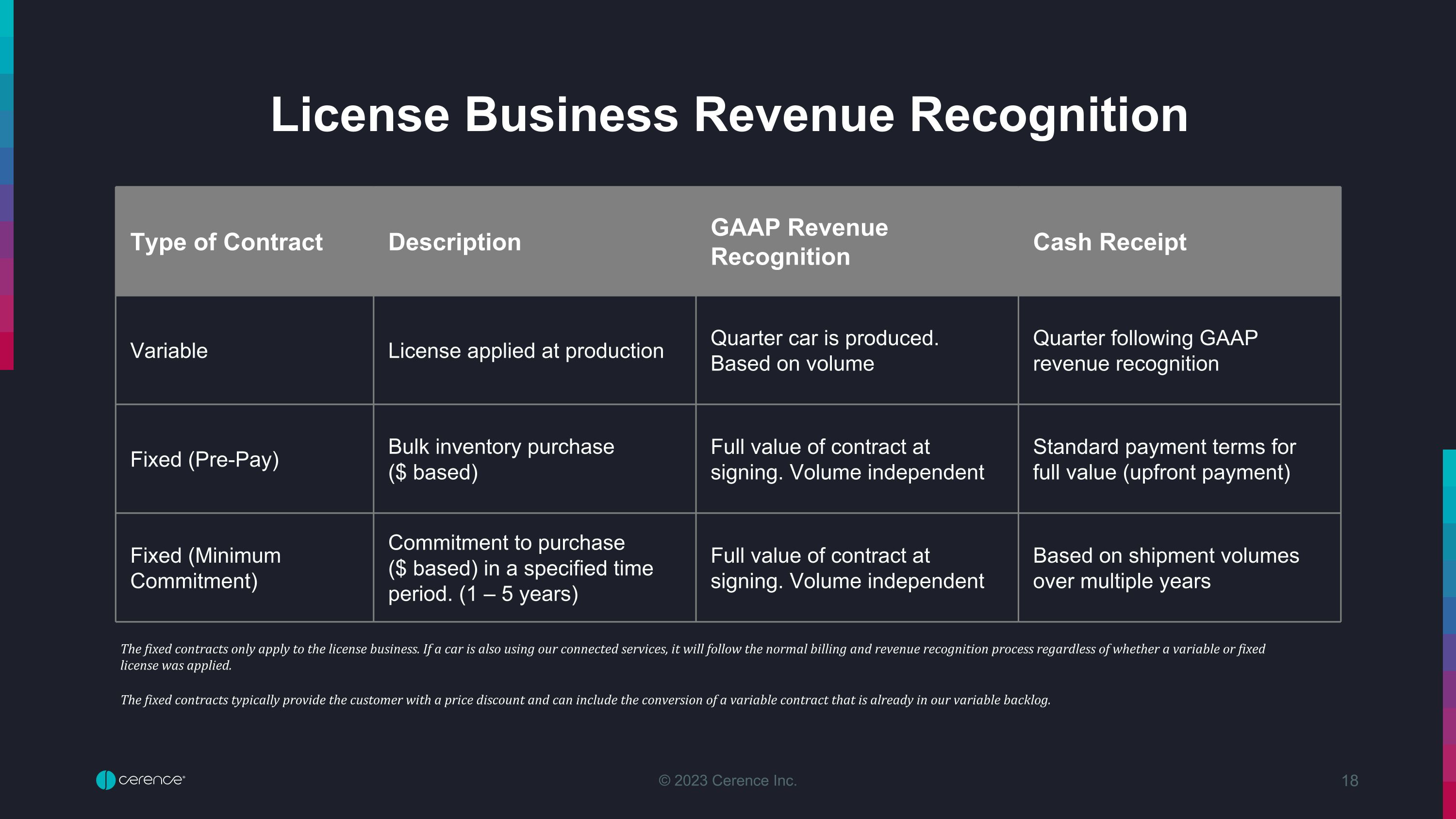

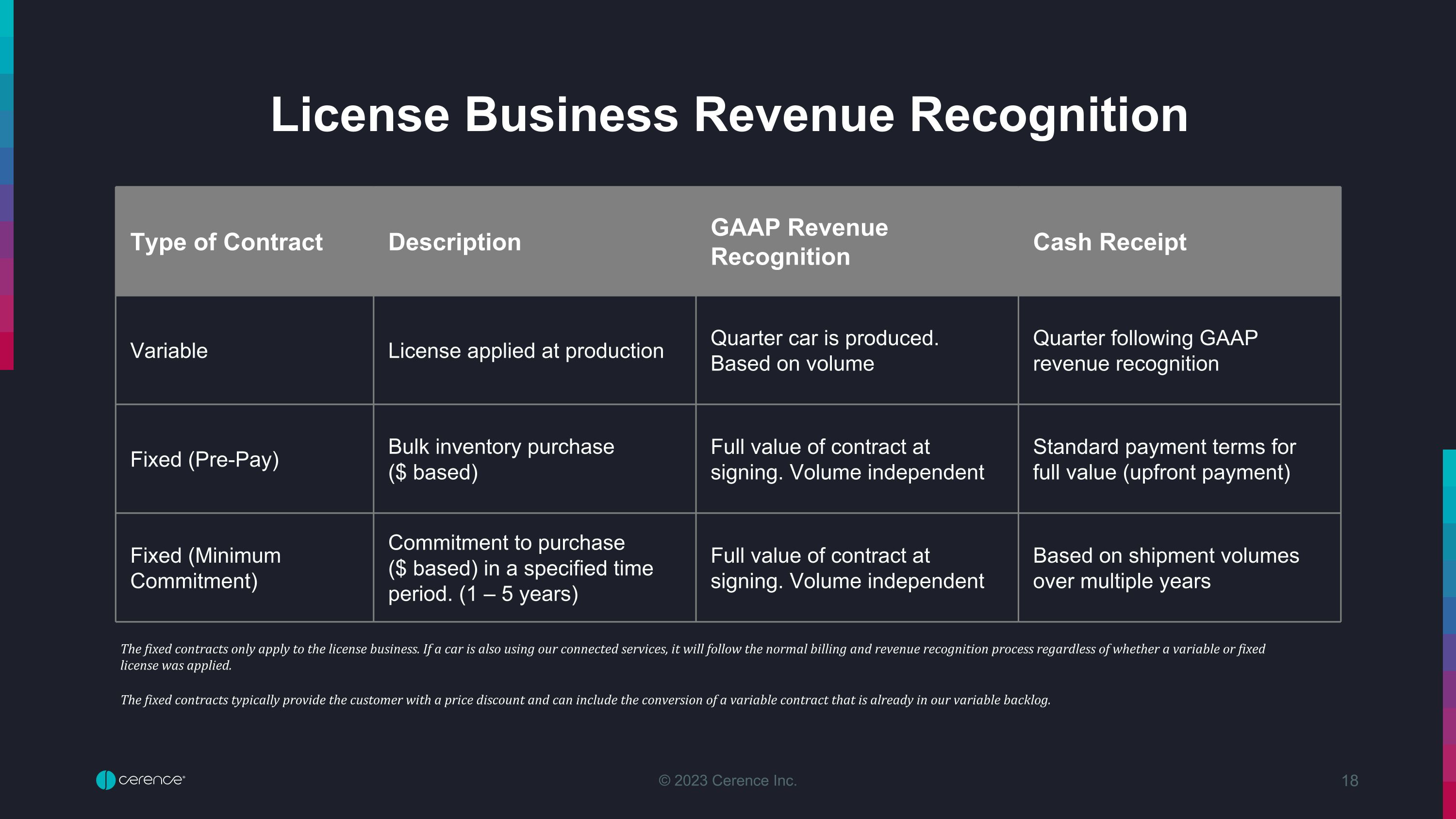

License Business Revenue Recognition Type of Contract Description GAAP Revenue Recognition Cash Receipt Variable License applied at production Quarter car is produced. Based on volume Quarter following GAAP revenue recognition Fixed (Pre-Pay) Bulk inventory purchase �($ based) Full value of contract at signing. Volume independent Standard payment terms for full value (upfront payment) Fixed (Minimum Commitment) Commitment to purchase �($ based) in a specified time period. (1 – 5 years) Full value of contract at signing. Volume independent Based on shipment volumes over multiple years The fixed contracts only apply to the license business. If a car is also using our connected services, it will follow the normal billing and revenue recognition process regardless of whether a variable or fixed license was applied. The fixed contracts typically provide the customer with a price discount and can include the conversion of a variable contract that is already in our variable backlog.

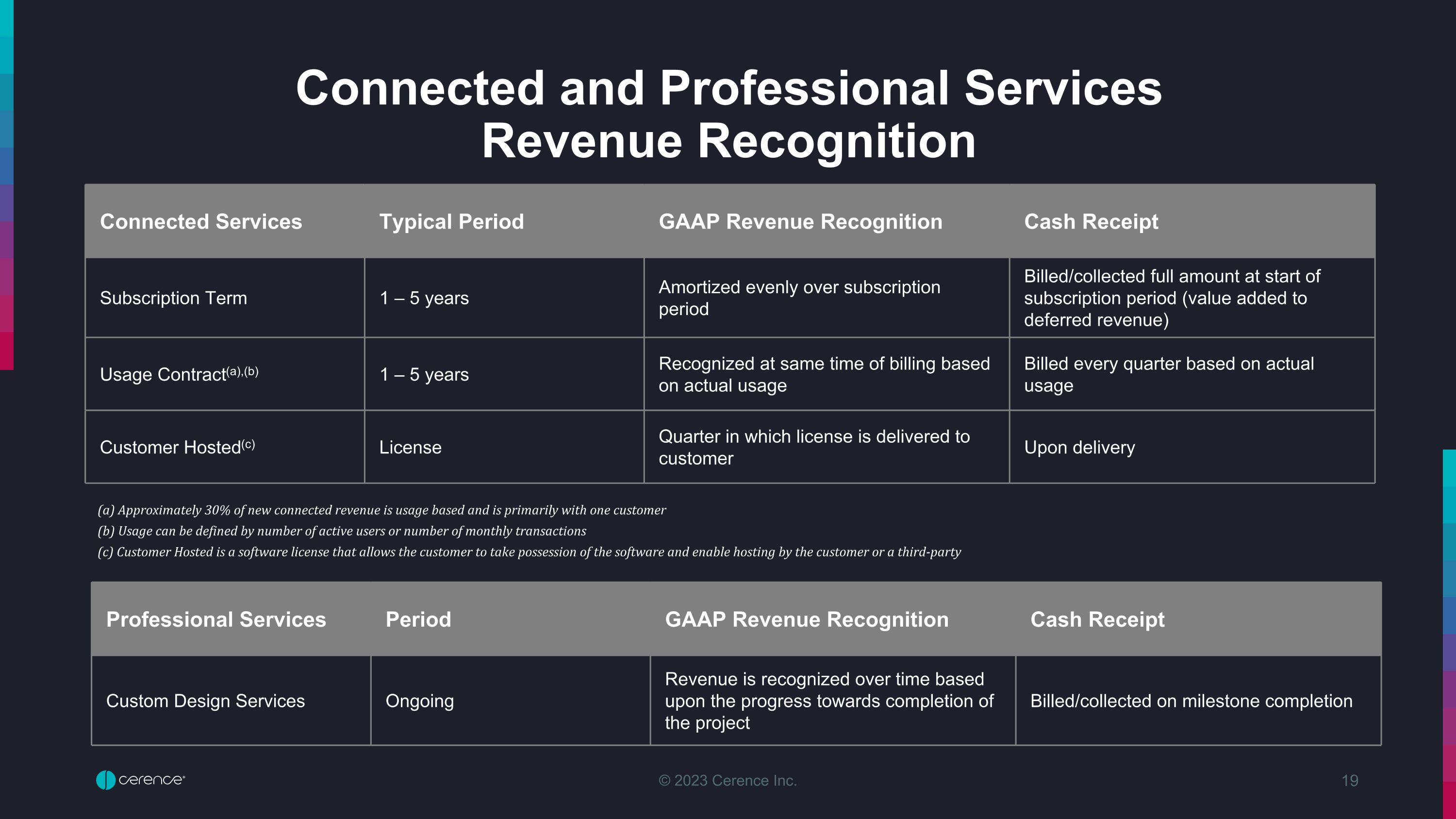

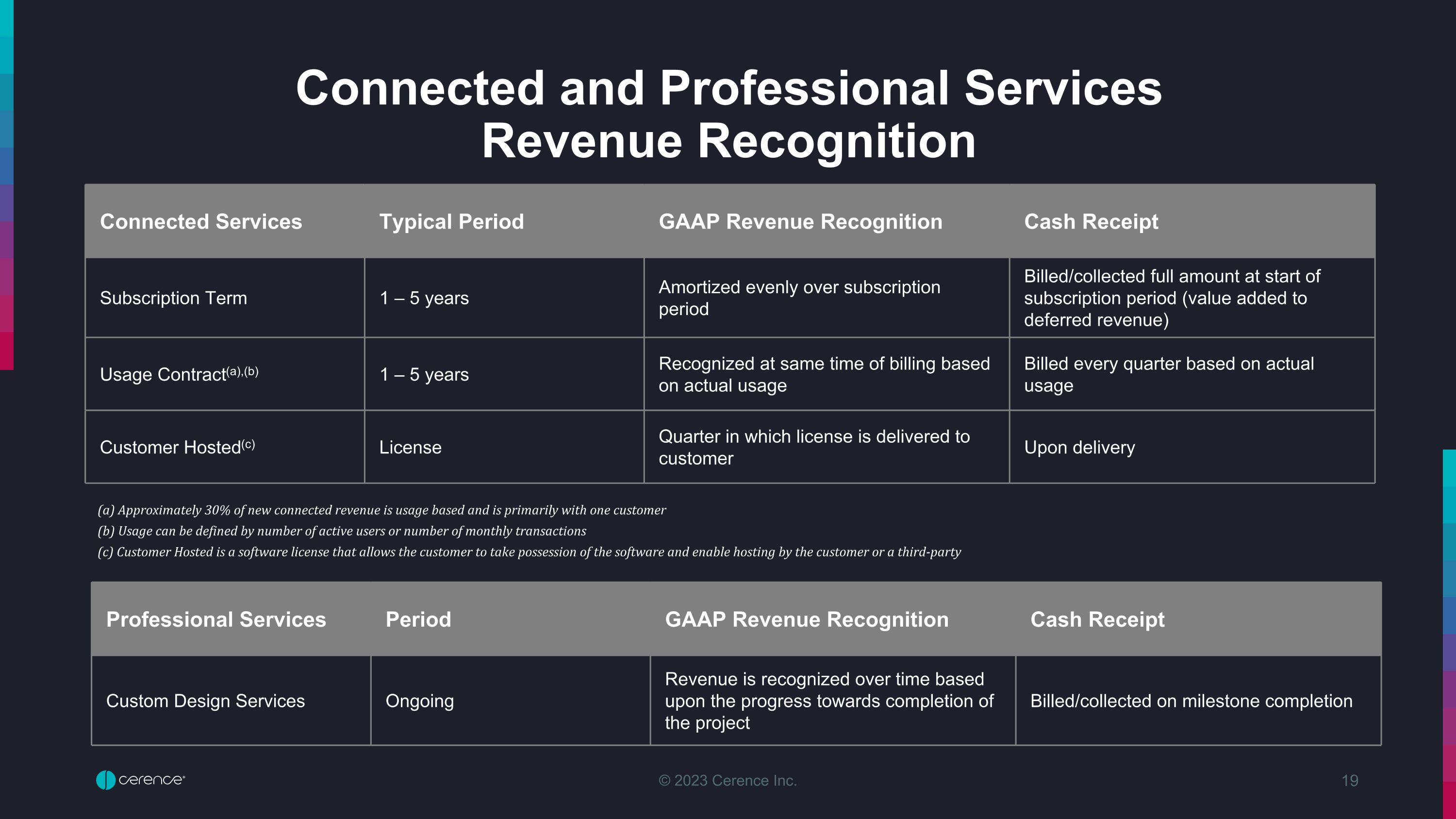

Connected and Professional Services �Revenue Recognition Connected Services Typical Period GAAP Revenue Recognition Cash Receipt Subscription Term 1 – 5 years Amortized evenly over subscription period Billed/collected full amount at start of subscription period (value added to deferred revenue) Usage Contract(a),(b) 1 – 5 years Recognized at same time of billing based on actual usage Billed every quarter based on actual usage Customer Hosted(c) License Quarter in which license is delivered to customer Upon delivery (a) Approximately 30% of new connected revenue is usage based and is primarily with one customer (b) Usage can be defined by number of active users or number of monthly transactions (c) Customer Hosted is a software license that allows the customer to take possession of the software and enable hosting by the customer or a third-party Professional Services Period GAAP Revenue Recognition Cash Receipt Custom Design Services Ongoing Revenue is recognized over time based upon the progress towards completion of the project Billed/collected on milestone completion

KPI Measures – Definitions Key performance indicators We believe that providing key performance indicators (“KPIs”), allows investors to gain insight into the way management views the performance of the business. We further believe that providing KPIs allows investors to better understand information used by management to evaluate and measure such performance. KPIs should not be considered superior to, or a substitute for, operating results prepared in accordance with GAAP. In assessing the performance of the business during the three months ended June 30, 2023, our management has reviewed the following KPIs, each of which is described below: Percent of worldwide auto production with Cerence technology: The number of Cerence enabled cars shipped as compared to IHS Markit car production data. Average contract duration: The weighted average annual period over which we expect to recognize the estimated revenues from new license and connected contracts signed during the quarter, calculated on a trailing twelve months (“TTM”) basis and presented in years. Repeatable software contribution: The percentage of repeatable revenues as compared to total GAAP revenue in the quarter on a TTM basis. Repeatable revenues are defined as the sum of License and Connected Services revenues. Change in number of Cerence connected cars shipped: The year over year change in the number of cars shipped with Cerence connected solutions. Amounts are calculated on a TTM basis. Change in billings per car: The rate of growth calculated from the average billings per car based on a trailing twelve month comparison while excluding, professional services, legacy contract and adjusted for prepay usage.

Non-GAAP Financial Measures – Definitions Discussion of Non-GAAP Financial Measures We believe that providing the non-GAAP information in addition to the GAAP presentation, allows investors to view the financial results in the way management views the operating results. We further believe that providing this information allows investors to not only better understand our financial performance, but more importantly, to evaluate the efficacy of the methodology and information used by management to evaluate and measure such performance. The non-GAAP information should not be considered superior to, or a substitute for, financial statements prepared in accordance with GAAP. We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of the business, for making operating decisions and for forecasting and planning for future periods. While our management uses these non-GAAP financial measures as a tool to enhance their understanding of certain aspects of our financial performance, our management does not consider these measures to be a substitute for, or superior to, the information provided by GAAP financial statements. Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial statements provides such readers with useful supplemental data that, while not a substitute for GAAP financial statements, allows for greater transparency in the review of our financial and operational performance. In assessing the overall health of the business during the three and nine months ending June 30, 2023 and 2022, our management has either included or excluded the following items in general categories, each of which is described below. Cerence is not providing a reconciliation of certain forward-looking, non-GAAP financial targets to the GAAP equivalent because Cerence is unable to provide this reconciliation without unreasonable effort due to information regarding the relevant adjustments not being ascertainable or accessible. Such information could be material to future results.

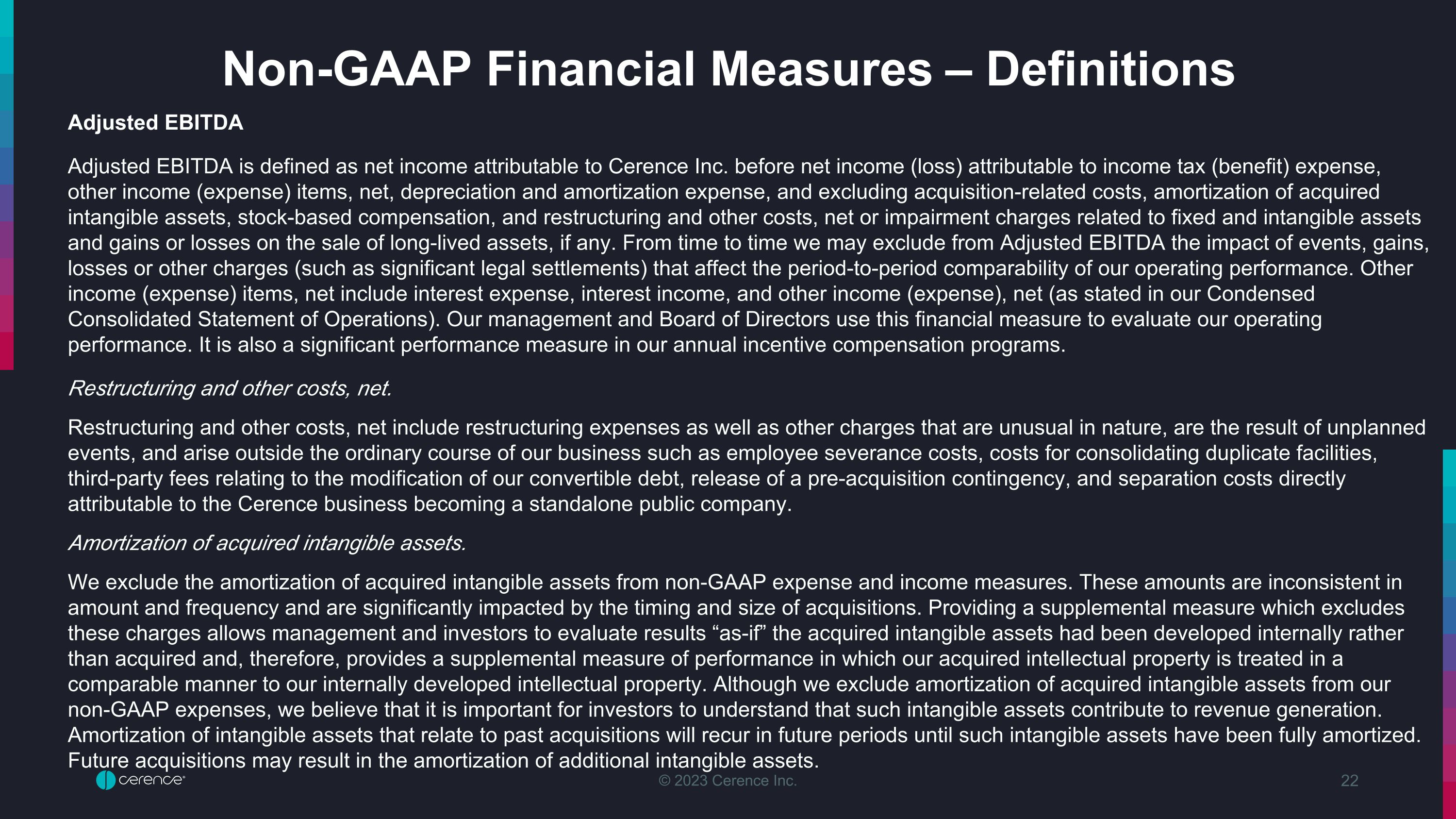

Non-GAAP Financial Measures – Definitions Adjusted EBITDA Adjusted EBITDA is defined as net income attributable to Cerence Inc. before net income (loss) attributable to income tax (benefit) expense, other income (expense) items, net, depreciation and amortization expense, and excluding acquisition-related costs, amortization of acquired intangible assets, stock-based compensation, and restructuring and other costs, net or impairment charges related to fixed and intangible assets and gains or losses on the sale of long-lived assets, if any. From time to time we may exclude from Adjusted EBITDA the impact of events, gains, losses or other charges (such as significant legal settlements) that affect the period-to-period comparability of our operating performance. Other income (expense) items, net include interest expense, interest income, and other income (expense), net (as stated in our Condensed Consolidated Statement of Operations). Our management and Board of Directors use this financial measure to evaluate our operating performance. It is also a significant performance measure in our annual incentive compensation programs. Restructuring and other costs, net. Restructuring and other costs, net include restructuring expenses as well as other charges that are unusual in nature, are the result of unplanned events, and arise outside the ordinary course of our business such as employee severance costs, costs for consolidating duplicate facilities, third-party fees relating to the modification of our convertible debt, release of a pre-acquisition contingency, and separation costs directly attributable to the Cerence business becoming a standalone public company. Amortization of acquired intangible assets. We exclude the amortization of acquired intangible assets from non-GAAP expense and income measures. These amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Providing a supplemental measure which excludes these charges allows management and investors to evaluate results “as-if” the acquired intangible assets had been developed internally rather than acquired and, therefore, provides a supplemental measure of performance in which our acquired intellectual property is treated in a comparable manner to our internally developed intellectual property. Although we exclude amortization of acquired intangible assets from our non-GAAP expenses, we believe that it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Future acquisitions may result in the amortization of additional intangible assets.

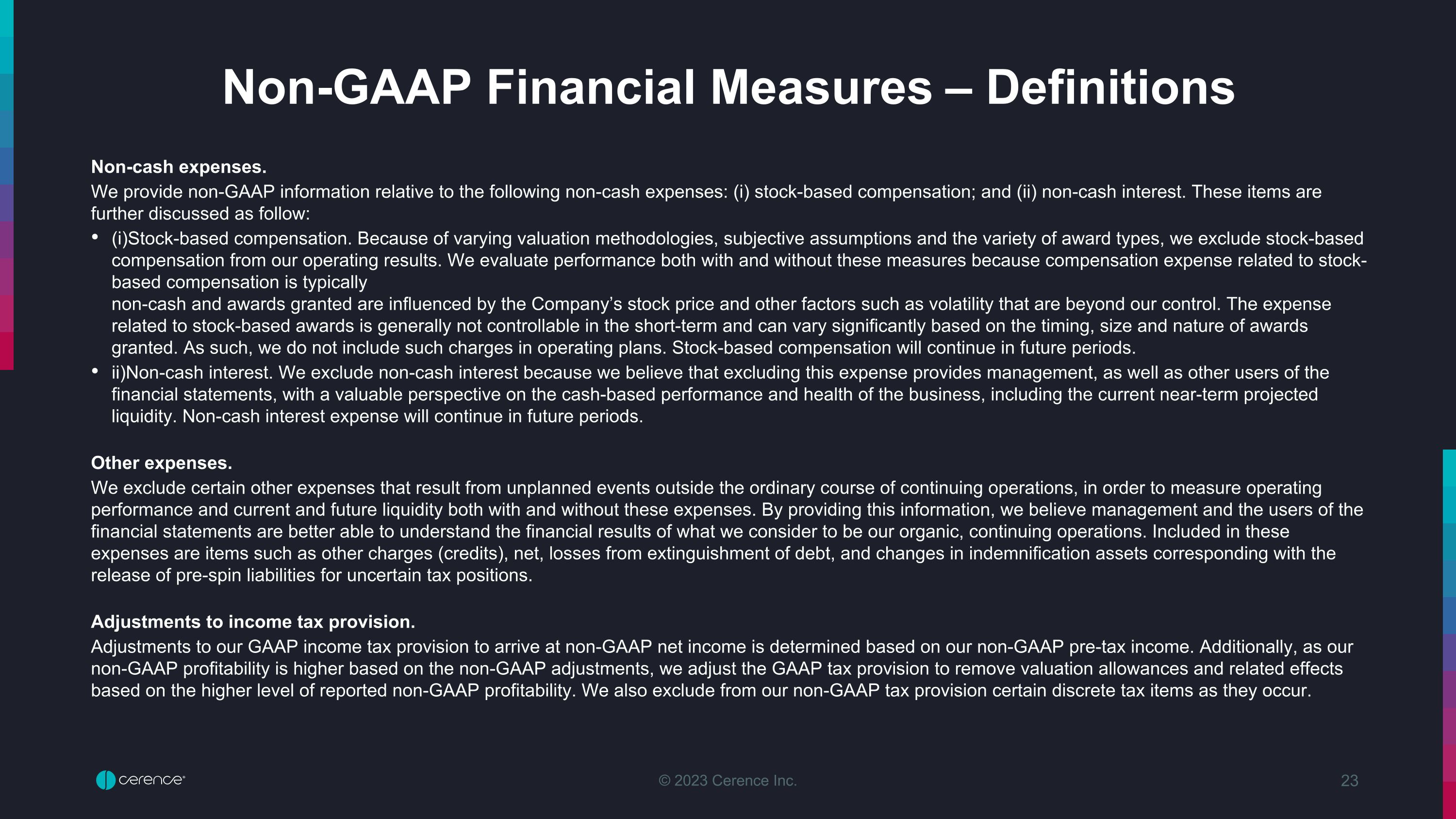

Non-GAAP Financial Measures – Definitions Non-cash expenses. We provide non-GAAP information relative to the following non-cash expenses: (i) stock-based compensation; and (ii) non-cash interest. These items are further discussed as follow: (i)Stock-based compensation. Because of varying valuation methodologies, subjective assumptions and the variety of award types, we exclude stock-based compensation from our operating results. We evaluate performance both with and without these measures because compensation expense related to stock-based compensation is typically �non-cash and awards granted are influenced by the Company’s stock price and other factors such as volatility that are beyond our control. The expense related to stock-based awards is generally not controllable in the short-term and can vary significantly based on the timing, size and nature of awards granted. As such, we do not include such charges in operating plans. Stock-based compensation will continue in future periods. ii)Non-cash interest. We exclude non-cash interest because we believe that excluding this expense provides management, as well as other users of the financial statements, with a valuable perspective on the cash-based performance and health of the business, including the current near-term projected liquidity. Non-cash interest expense will continue in future periods. Other expenses. We exclude certain other expenses that result from unplanned events outside the ordinary course of continuing operations, in order to measure operating performance and current and future liquidity both with and without these expenses. By providing this information, we believe management and the users of the financial statements are better able to understand the financial results of what we consider to be our organic, continuing operations. Included in these expenses are items such as other charges (credits), net, losses from extinguishment of debt, and changes in indemnification assets corresponding with the release of pre-spin liabilities for uncertain tax positions. Adjustments to income tax provision. Adjustments to our GAAP income tax provision to arrive at non-GAAP net income is determined based on our non-GAAP pre-tax income. Additionally, as our non-GAAP profitability is higher based on the non-GAAP adjustments, we adjust the GAAP tax provision to remove valuation allowances and related effects based on the higher level of reported non-GAAP profitability. We also exclude from our non-GAAP tax provision certain discrete tax items as they occur.

Q3 FY23 Reconciliations of GAAP �to Non-GAAP Results Free cash flow is net cash provided by operating activities determined in accordance with GAAP less capital expenditures. Free cash flow is not a measure of cash available for discretionary expenditures. (unaudited - in thousands) (unaudited - in thousands) Three Months Ended Nine Months Ended June 30, June 30, 2023 2022 2023 2022 GAAP revenue $61,660 $89,041 $213,711 $269,747 GAAP gross profit $40,722 $64,789 $141,576 $196,962 Stock-based compensation 163 722 2,699 3,384 Amortization of intangible assets 103 103 310 2,879 Non-GAAP gross profit $40,988 $65,614 $144,585 $203,225 GAAP gross margin 66.0% 72.8% 66.2% 73.0% Non-GAAP gross margin 66.5% 73.7% 67.7% 75.3% GAAP operating (loss) income $(8,501) $15,777 $(31,095) $44,989 Stock-based compensation* 6,974 6,253 31,801 19,020 Amortization of intangible assets 656 2,965 5,607 12,030 Restructuring and other costs, net* 1,172 1,197 11,075 6,586 Non-GAAP operating income $301 $26,192 $17,388 $82,625 GAAP operating margin -13.8% 17.7% -14.6% 16.7% Non-GAAP operating margin 0.5% 29.4% 8.1% 30.6% GAAP net loss $(16,455) $(99,267) $(44,702) $(80,699) Stock-based compensation* 6,974 6,253 31,801 19,020 Amortization of intangible assets 656 2,965 5,607 12,030 Restructuring and other costs, net* 1,172 1,197 11,075 6,586 Depreciation 2,462 2,314 7,544 6,823 Total other expense, net (4,943) (4,050) (5,640) (10,950) Provision for income taxes 3,011 110,994 7,967 114,738 Adjusted EBITDA $2,763 $28,506 $24,932 $89,448 GAAP net loss margin -26.7% -111.5% -20.9% -29.9% Adjusted EBITDA margin 4.5% 32.0% 11.7% 33.2% * - $4.0 million in stock-based compensation is included in Restructuring and other costs, net during Q1'22. Three Months Ended Nine Months Ended June 30, June 30, 2023 2022 2023 2022 GAAP net loss $(16,455) $(99,267) $(44,702) $(80,699) Stock-based compensation* 6,974 6,253 31,801 19,020 Amortization of intangible assets 656 2,965 5,607 12,030 Restructuring and other costs, net* 1,172 1,197 11,075 6,586 Loss on debt extinguishment 1,333 - 1,333 - Non-cash interest expense 540 1,327 1,450 3,922 Indemnification asset release - - - 1,302 Other (25) - (844) - Adjustments to income tax expense 4,144 104,487 5,107 93,768 Non-GAAP net (loss) income $(1,661) $16,962 $10,827 $55,929 Adjusted EPS: GAAP Numerator: Net loss attributed to common shareholders - basic and diluted $(16,455) $(99,267) $(44,702) $(80,699) Non-GAAP Numerator: Net (loss) income attributed to common shareholders - basic $(1,661) $16,962 $10,827 $55,929 Interest on the Notes, net of tax - - 3,024 Net (loss) income attributed to common shareholders - diluted $(1,661) $16,962 $10,827 $58,953 GAAP Denominator: Weighted-average common shares outstanding - basic and diluted 40,324 39,313 40,167 39,113 Non-GAAP Denominator: Weighted-average common shares outstanding- basic 40,324 39,313 40,167 39,113 Adjustment for diluted shares - - 197 5,046 Weighted-average common shares outstanding - diluted 40,324 39,313 40,364 44,159 GAAP net loss per share - diluted $(0.41) $(2.53) $(1.11) $(2.06) Non-GAAP net (loss) income per share - diluted $(0.04) $0.43 $0.27 $1.34 GAAP net cash (used in) provided by operating activities $(8,197) $(3,928) $(3,760) $2,815 Capital expenditures (1,520) (4,433) (3,597) (14,418) Free Cash Flow $(9,717) $(8,361) $(7,357) $(11,603) * - $4.0 million in stock-based compensation is included in Restructuring and other costs, net during Q1'22.

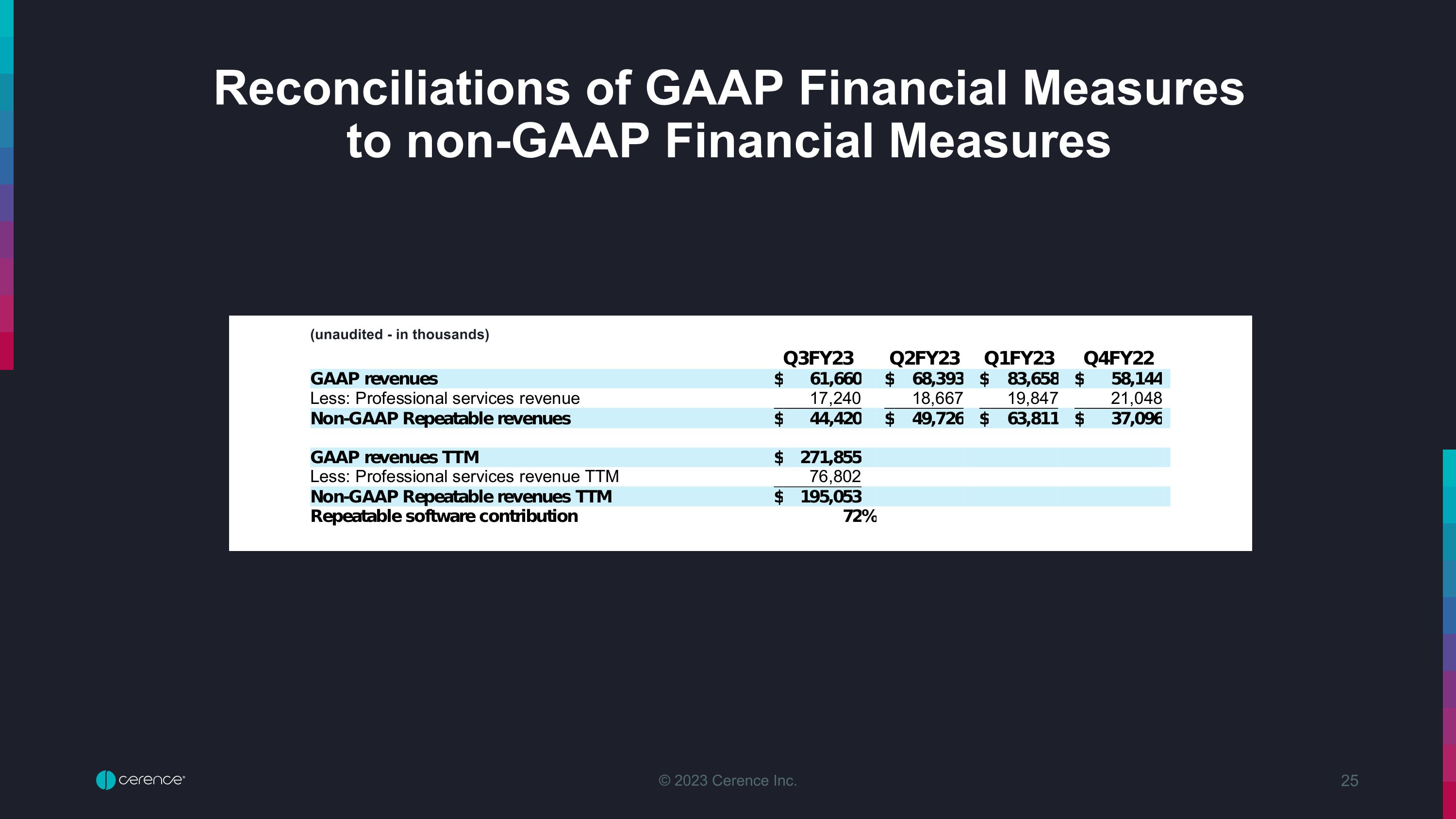

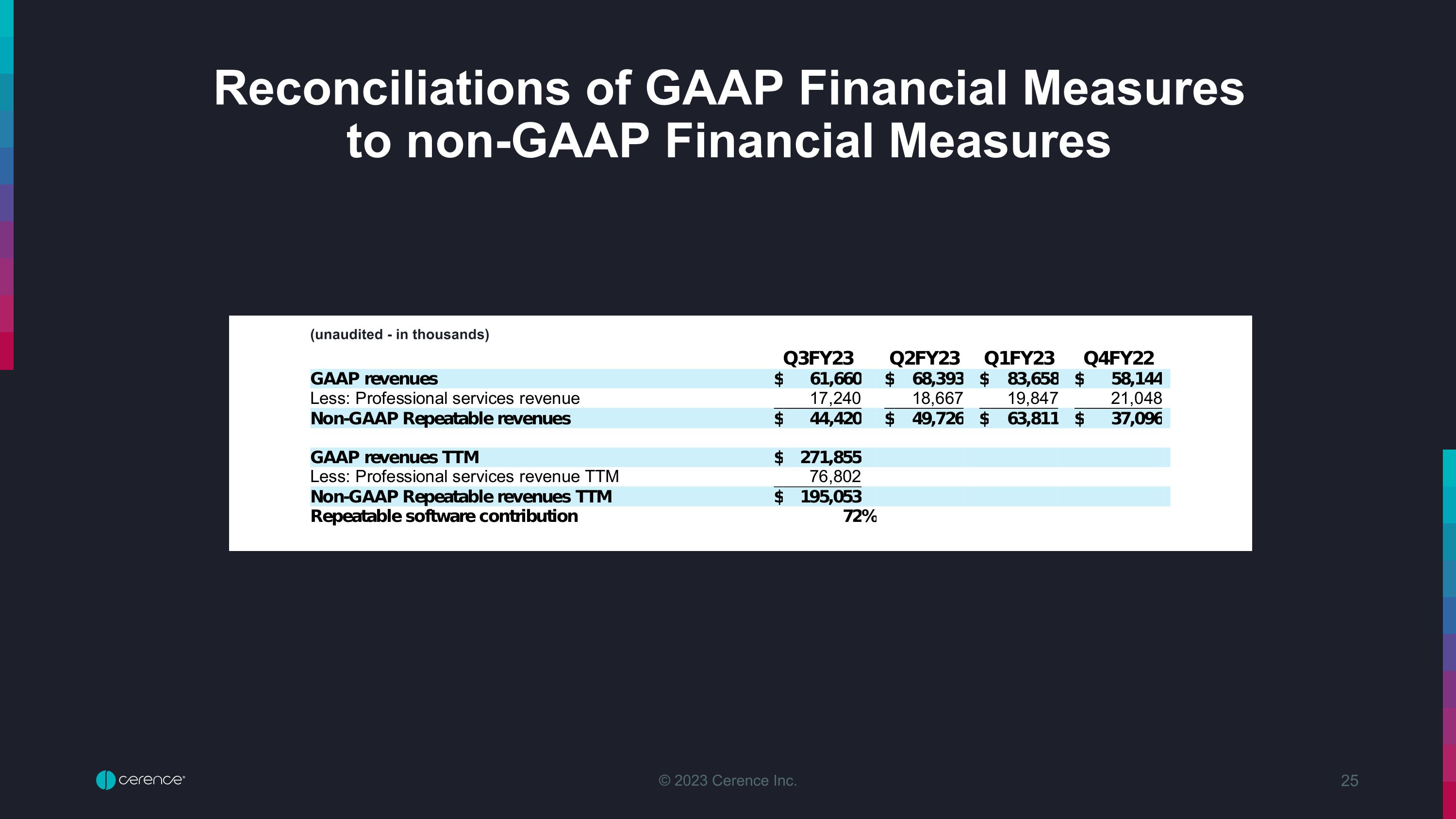

Reconciliations of GAAP Financial Measures �to non-GAAP Financial Measures (unaudited - in thousands) Q3FY23 Q2FY23 Q1FY23 Q4FY22 GAAP revenues $61,660 $68,393 $83,658 $58,144 Less: Professional services revenue 17,240 18,667 19,847 21,048 Non-GAAP Repeatable revenues $44,420 $49,726 $63,811 $37,096 GAAP revenues TTM $271,855 Less: Professional services revenue TTM 76,802 Non-GAAP Repeatable revenues TTM $195,053 Repeatable software contribution 72%

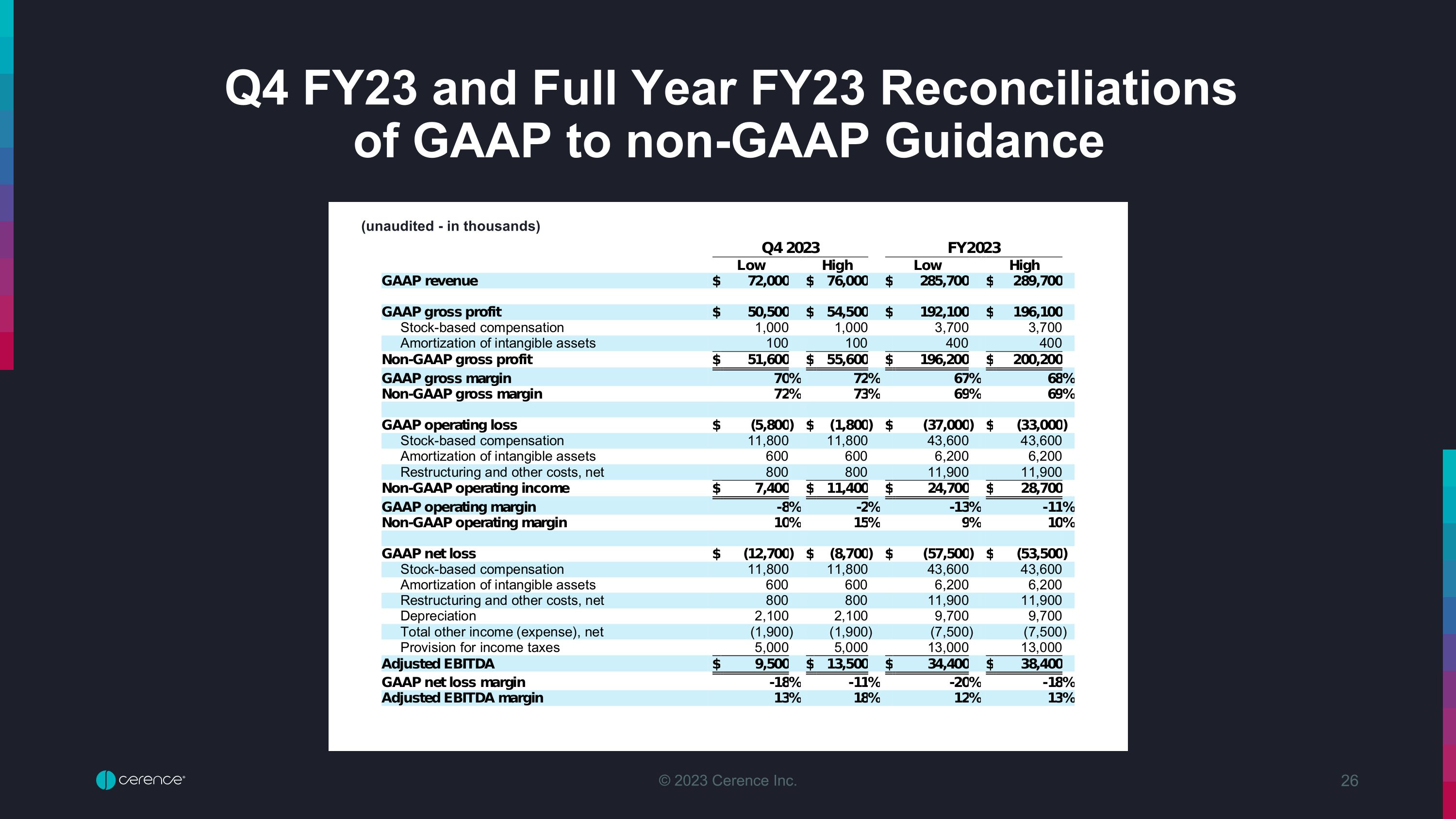

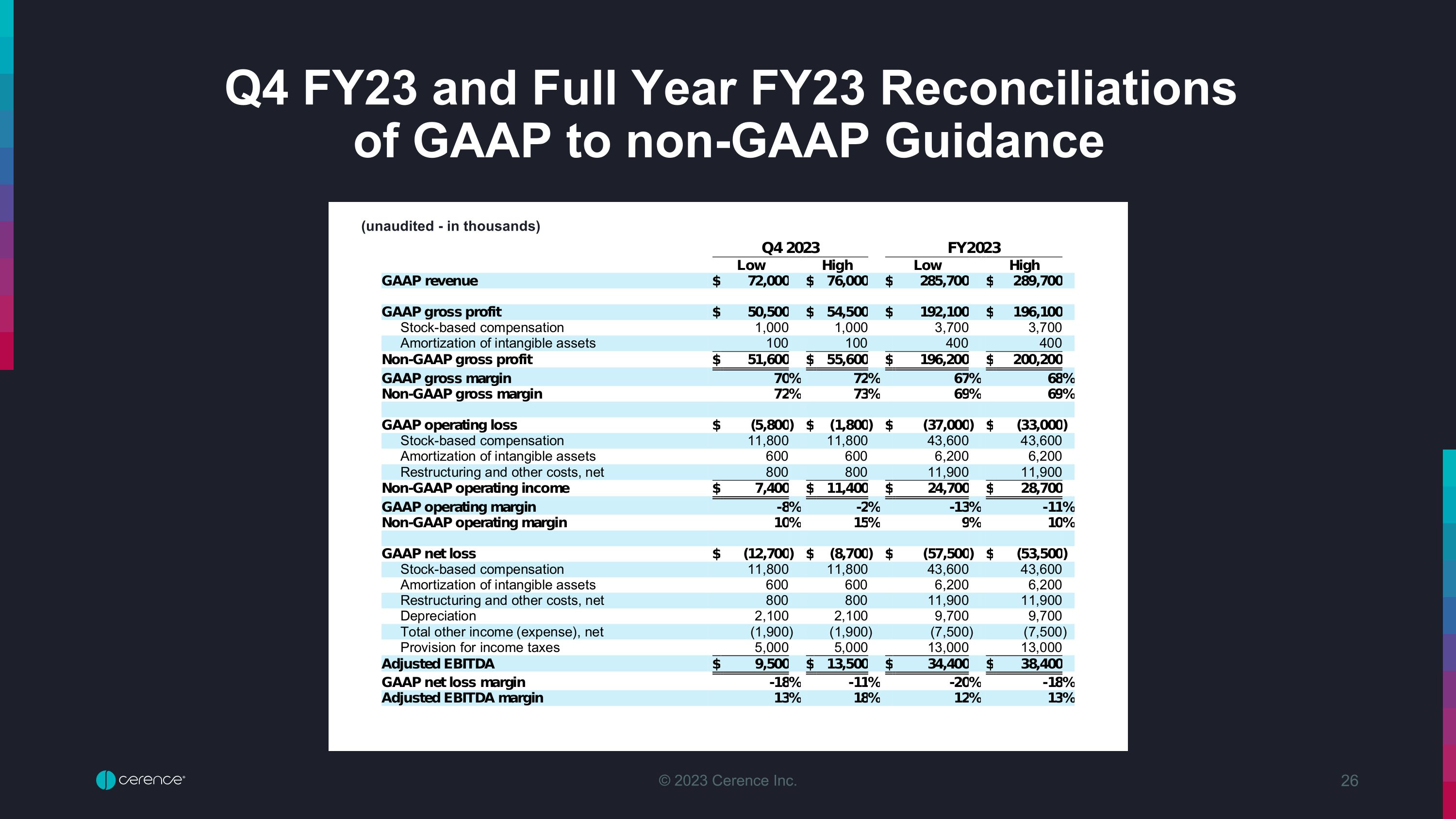

Q4 FY23 and Full Year FY23 Reconciliations �of GAAP to non-GAAP Guidance (unaudited - in thousands) Q4 2023 FY2023 Low High Low High GAAP revenue $72,000 $76,000 $285,700 $289,700 GAAP gross profit $50,500 $54,500 $192,100 $196,100 Stock-based compensation 1,000 1,000 3,700 3,700 Amortization of intangible assets 100 100 400 400 Non-GAAP gross profit $51,600 $55,600 $196,200 $200,200 GAAP gross margin 70% 72% 67% 68% Non-GAAP gross margin 72% 73% 69% 69% GAAP operating loss $(5,800) $(1,800) $(37,000) $(33,000) Stock-based compensation 11,800 11,800 43,600 43,600 Amortization of intangible assets 600 600 6,200 6,200 Restructuring and other costs, net 800 800 11,900 11,900 Non-GAAP operating income $7,400 $11,400 $24,700 $28,700 GAAP operating margin -8% -2% -13% -11% Non-GAAP operating margin 10% 15% 9% 10% GAAP net loss $(12,700) $(8,700) $(57,500) $(53,500) Stock-based compensation 11,800 11,800 43,600 43,600 Amortization of intangible assets 600 600 6,200 6,200 Restructuring and other costs, net 800 800 11,900 11,900 Depreciation 2,100 2,100 9,700 9,700 Total other income (expense), net (1,900) (1,900) (7,500) (7,500) Provision for income taxes 5,000 5,000 13,000 13,000 Adjusted EBITDA $9,500 $13,500 $34,400 $38,400 GAAP net loss margin -18% -11% -20% -18% Adjusted EBITDA margin 13% 18% 12% 13%

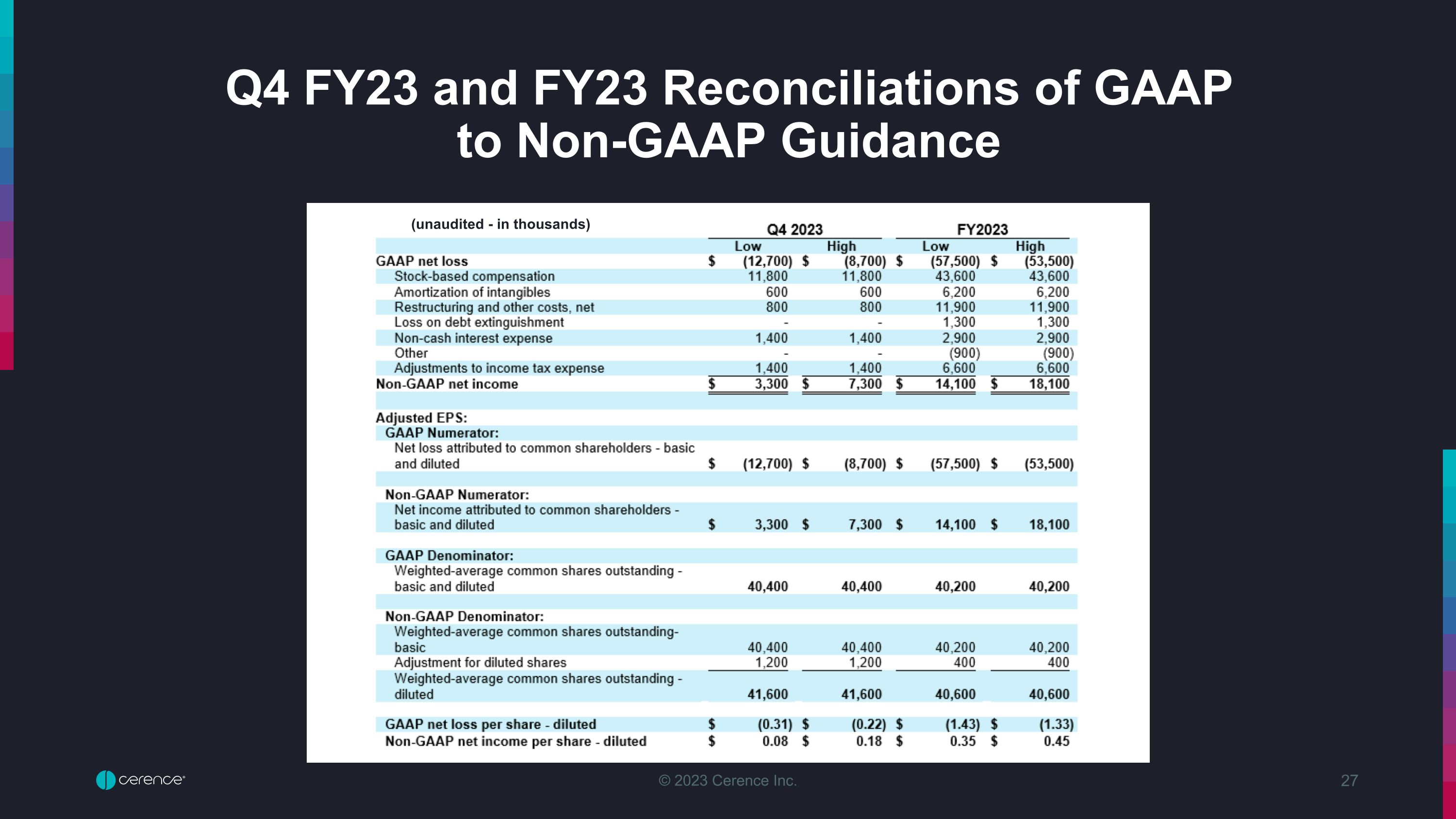

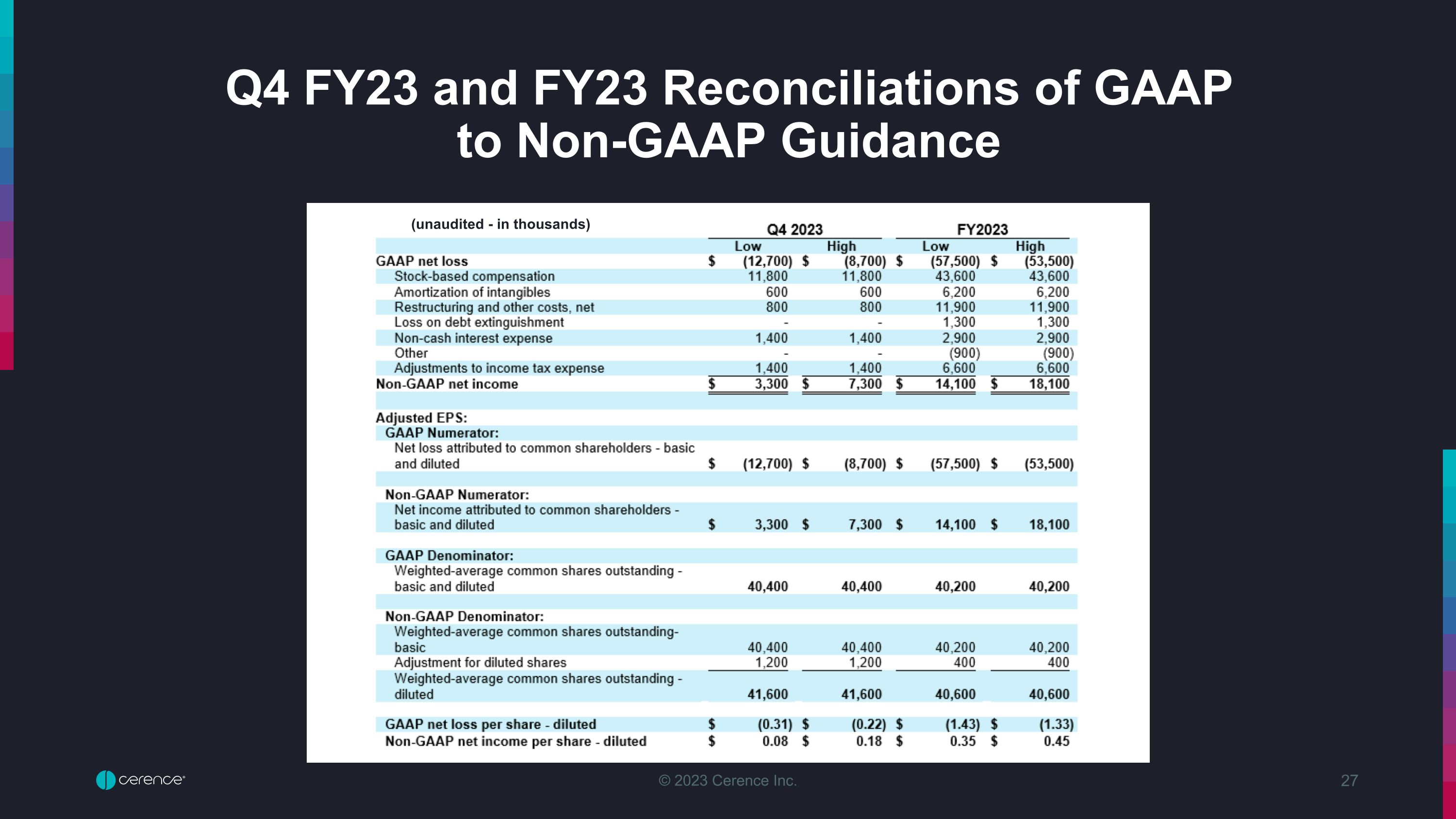

Q4 FY23 and FY23 Reconciliations of GAAP �to Non-GAAP Guidance (unaudited - in thousands) Q4 2023 FY2023 Low High Low High GAAP net loss $(12,700) $(8,700) $(57,500) $(53,500) Stock-based compensation 11,800 11,800 43,600 43,600 Amortization of intangibles 600 600 6,200 6,200 Restructuring and other costs, net 800 800 11,900 11,900 Loss on debt extinguishment - - 1,300 1,300 Non-cash interest expense 1,400 1,400 2,900 2,900 Other - - (900) (900) Adjustments to income tax expense 1,400 1,400 6,600 6,600 Non-GAAP net income $3,300 $7,300 $14,100 $18,100 Adjusted EPS: GAAP Numerator: Net loss attributed to common shareholders - basic and diluted $(12,700) $(8,700) $(57,500) $(53,500) Non-GAAP Numerator: Net income attributed to common shareholders - basic and diluted $3,300 $7,300 $14,100 $18,100 GAAP Denominator: Weighted-average common shares outstanding - basic and diluted 40,400 40,400 40,200 40,200 Non-GAAP Denominator: Weighted-average common shares outstanding- basic 40,400 40,400 40,200 40,200 Adjustment for diluted shares 1,200 1,200 400 400 Weighted-average common shares outstanding - diluted 41,600 41,600 40,600 40,600 GAAP net loss per share - diluted $(0.31) $(0.22) $(1.43) $(1.33) Non-GAAP net income per share - diluted $0.08 $0.18 $0.35 $0.45