- CRNC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cerence (CRNC) 8-KCerence Announces First Quarter Fiscal 2025 Results

Filed: 6 Feb 25, 4:14pm

Cerence Q1 FY25 Earnings Presentation Brian Krzanich, Chief Executive Officer Tony Rodriquez, Chief Financial Officer February 6, 2025 Exhibit 99.2

Forward-Looking Statements Statements in this presentation regarding: Cerence’s future performance, results and financial condition; expected growth and profitability; outlook; transformation plans and cost efficiency initiatives, including the estimated net annualized cost savings; strategy; opportunities; business, industry and market trends; strategy regarding fixed contracts and its impact on financial results; backlog; revenue visibility; revenue timing and mix; demand for Cerence products; innovation and new product offerings, including AI technology; expected benefits of technology partnerships; cost efficiency initiatives; and management’s future expectations, estimates, assumptions, beliefs, goals, objectives, targets, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” "projects," "forecasts," “expects,” “intends,” "continues," "will," "may," or “estimates” or similar expressions) should also be considered to be forward-looking statements. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risk, uncertainties and other factors, which may cause actual results or performance of the company to be materially different from any future results or performance expressed or implied by such forward-looking statements, including, but not limited to: the highly competitive and rapidly changing market in which we operate; adverse conditions in the automotive industry, the related supply chain and semiconductor shortage, or the global economy more generally; volatility in the political, legal and regulatory environment in which we operate, including trade, tariffs and other policies implemented by the new administration or actions taken by other countries in response; automotive production delays; changes in customer forecasts; the impacts of the COVID-19 pandemic on our and our customers’ businesses; the ongoing conflicts in Ukraine and the Middle East; our inability to control and successfully manage our expenses and cash position; our inability to deliver improved financial results from process optimization efforts and cost reduction actions; escalating pricing pressures from our customers; the impact on our business of the transition to a lower level of fixed contracts, including the failure to achieve such a transition; our failure to win, renew or implement service contracts; the cancellation or postponement of existing contracts; the loss of business from any of our largest customers; effects of customer defaults; our inability to successfully introduce new products, applications and services; our strategies to increase cloud offerings and deploy generative AI and large language models (LLMs); the inability to expand into adjacent markets; the inability to recruit and retain qualified personnel; disruptions arising from transitions in management personnel, including the transition to our new Chief Executive Officer; cybersecurity and data privacy incidents; failure to protect our intellectual property; defects or interruptions in service with respect to our products; fluctuating currency rates and interest rates; inflation; financial and credit market volatility; restrictions on our current and future operations under the terms of our debt, the use of cash to service or repay our debt; and our inability to generate sufficient cash from our operations; and the other factors discussed in our Annual Report on Form 10-K, quarterly reports on Form 10-Q, and other filings with the Securities and Exchange Commission. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date made. We undertake no obligation to update any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by law.

Q1 FY25 Financial Details

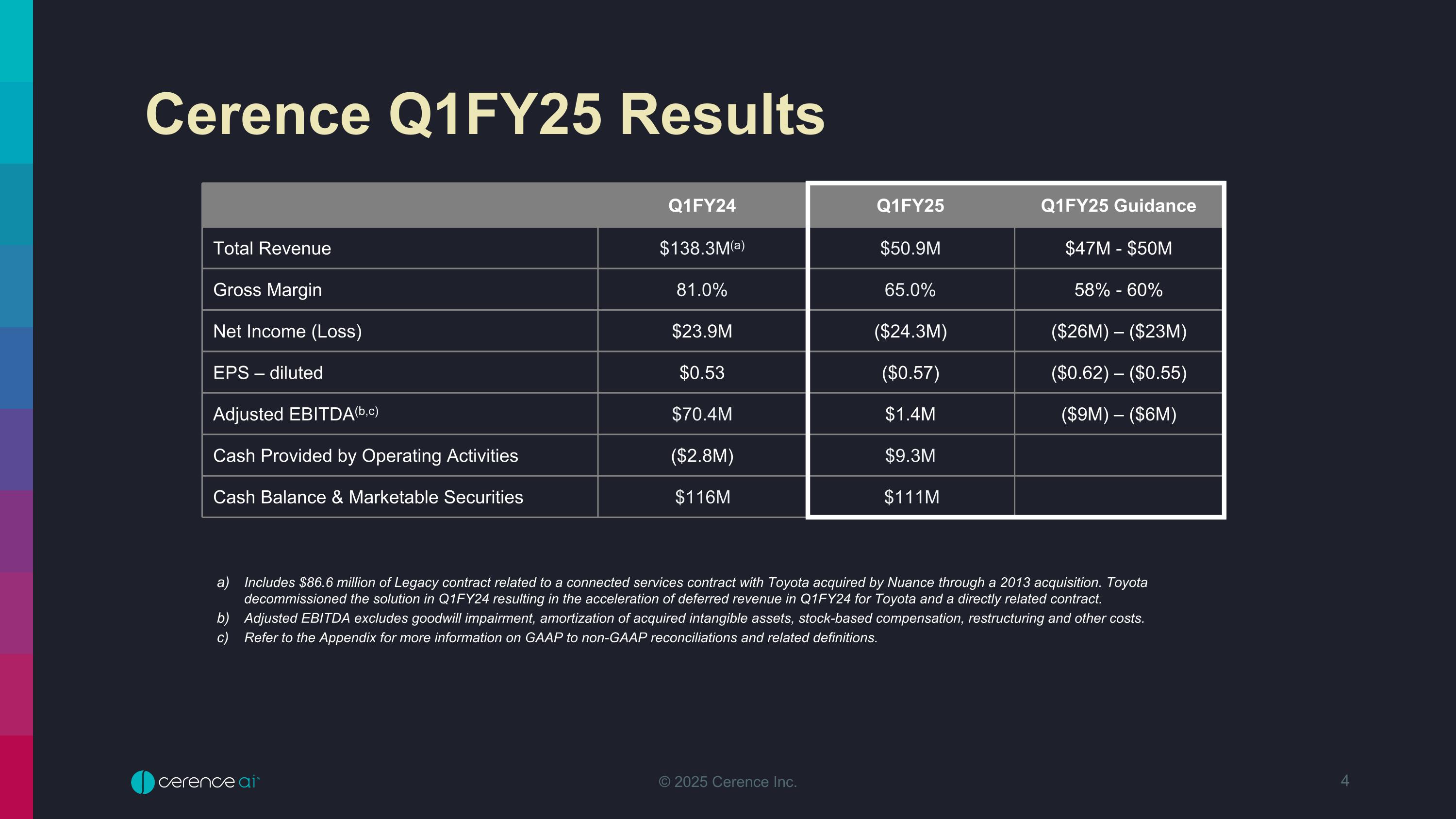

Cerence Q1FY25 Results Q1FY24 Q1FY25 Q1FY25 Guidance Total Revenue $138.3M(a) $50.9M $47M - $50M Gross Margin 81.0% 65.0% 58% - 60% Net Income (Loss) $23.9M ($24.3M) ($26M) – ($23M) EPS – diluted $0.53 ($0.57) ($0.62) – ($0.55) Adjusted EBITDA(b,c) $70.4M $1.4M ($9M) – ($6M) Cash Provided by Operating Activities ($2.8M) $9.3M Cash Balance & Marketable Securities $116M $111M Includes $86.6 million of Legacy contract related to a connected services contract with Toyota acquired by Nuance through a 2013 acquisition. Toyota decommissioned the solution in Q1FY24 resulting in the acceleration of deferred revenue in Q1FY24 for Toyota and a directly related contract. Adjusted EBITDA excludes goodwill impairment, amortization of acquired intangible assets, stock-based compensation, restructuring and other costs. Refer to the Appendix for more information on GAAP to non-GAAP reconciliations and related definitions.

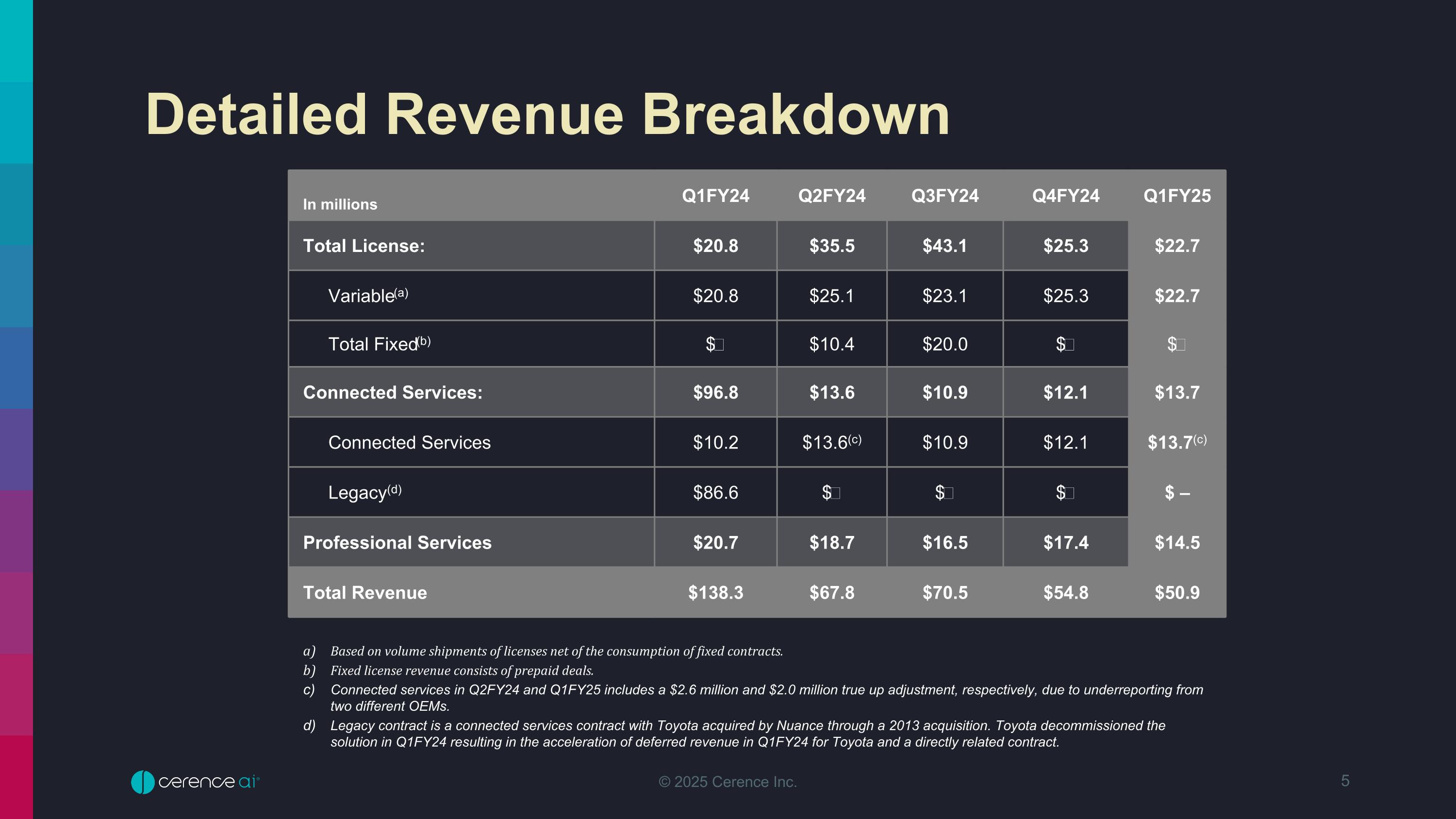

In millions Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Total License: $20.8 $35.5 $43.1 $25.3 $22.7 Variable(a) $20.8 $25.1 $23.1 $25.3 $22.7 Total Fixed(b) $ ̶ $10.4 $20.0 $ ̶ $ ̶ Connected Services: $96.8 $13.6 $10.9 $12.1 $13.7 Connected Services $10.2 $13.6(c) $10.9 $12.1 $13.7(c) Legacy(d) $86.6 $ ̶ $ ̶ $ ̶ $ – Professional Services $20.7 $18.7 $16.5 $17.4 $14.5 Total Revenue $138.3 $67.8 $70.5 $54.8 $50.9 Based on volume shipments of licenses net of the consumption of fixed contracts. Fixed license revenue consists of prepaid deals. Connected services in Q2FY24 and Q1FY25 includes a $2.6 million and $2.0 million true up adjustment, respectively, due to underreporting from two different OEMs. Legacy contract is a connected services contract with Toyota acquired by Nuance through a 2013 acquisition. Toyota decommissioned the solution in Q1FY24 resulting in the acceleration of deferred revenue in Q1FY24 for Toyota and a directly related contract. Detailed Revenue Breakdown

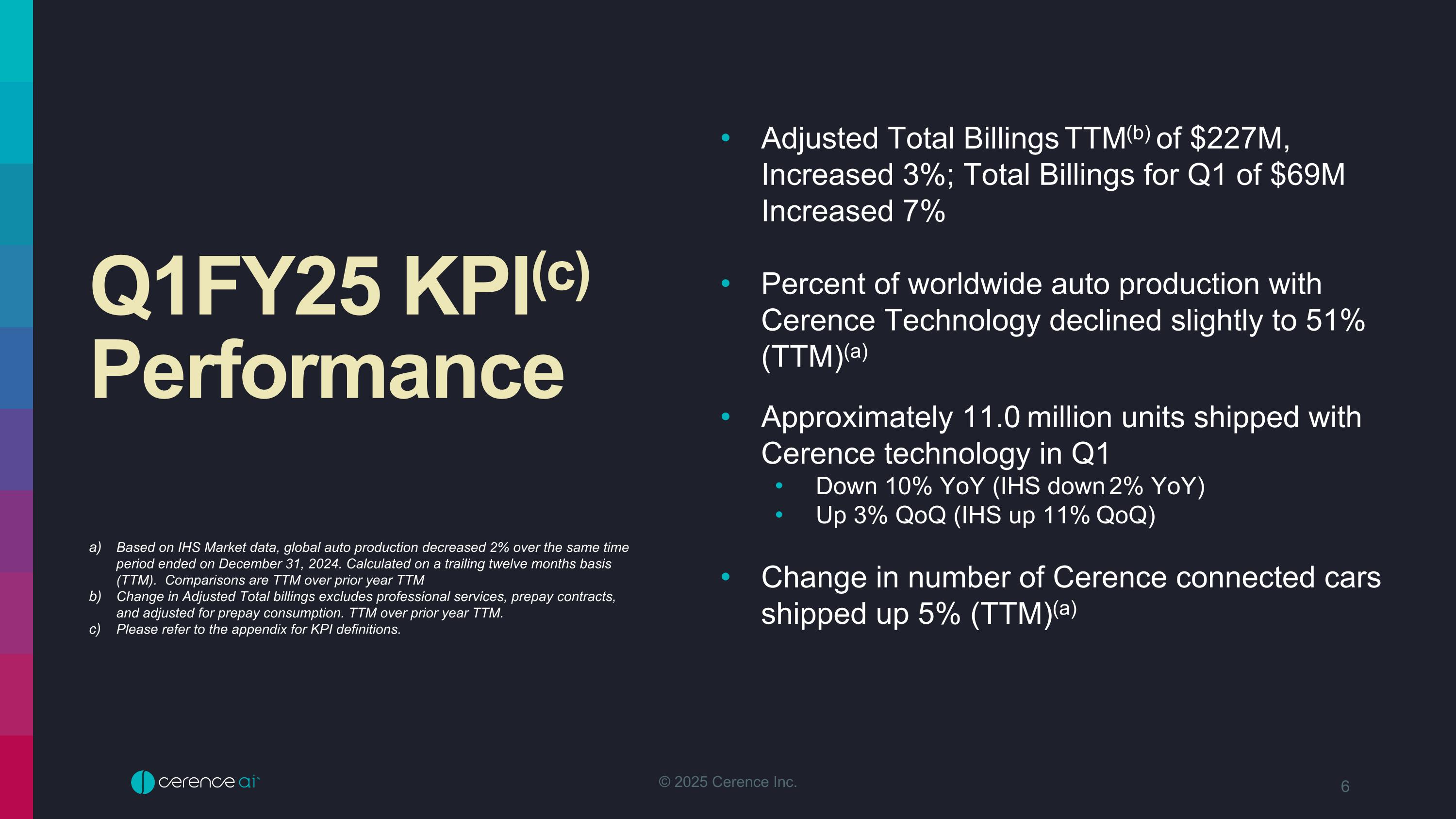

Adjusted Total Billings TTM(b) of $227M, Increased 3%; Total Billings for Q1 of $69M Increased 7% Percent of worldwide auto production with Cerence Technology declined slightly to 51% (TTM)(a) Approximately 11.0 million units shipped with Cerence technology in Q1 Down 10% YoY (IHS down 2% YoY) Up 3% QoQ (IHS up 11% QoQ) Change in number of Cerence connected cars shipped up 5% (TTM)(a) Q1FY25 KPI(c) Performance 6 Based on IHS Market data, global auto production decreased 2% over the same time period ended on December 31, 2024. Calculated on a trailing twelve months basis (TTM). Comparisons are TTM over prior year TTM Change in Adjusted Total billings excludes professional services, prepay contracts, and adjusted for prepay consumption. TTM over prior year TTM. Please refer to the appendix for KPI definitions.

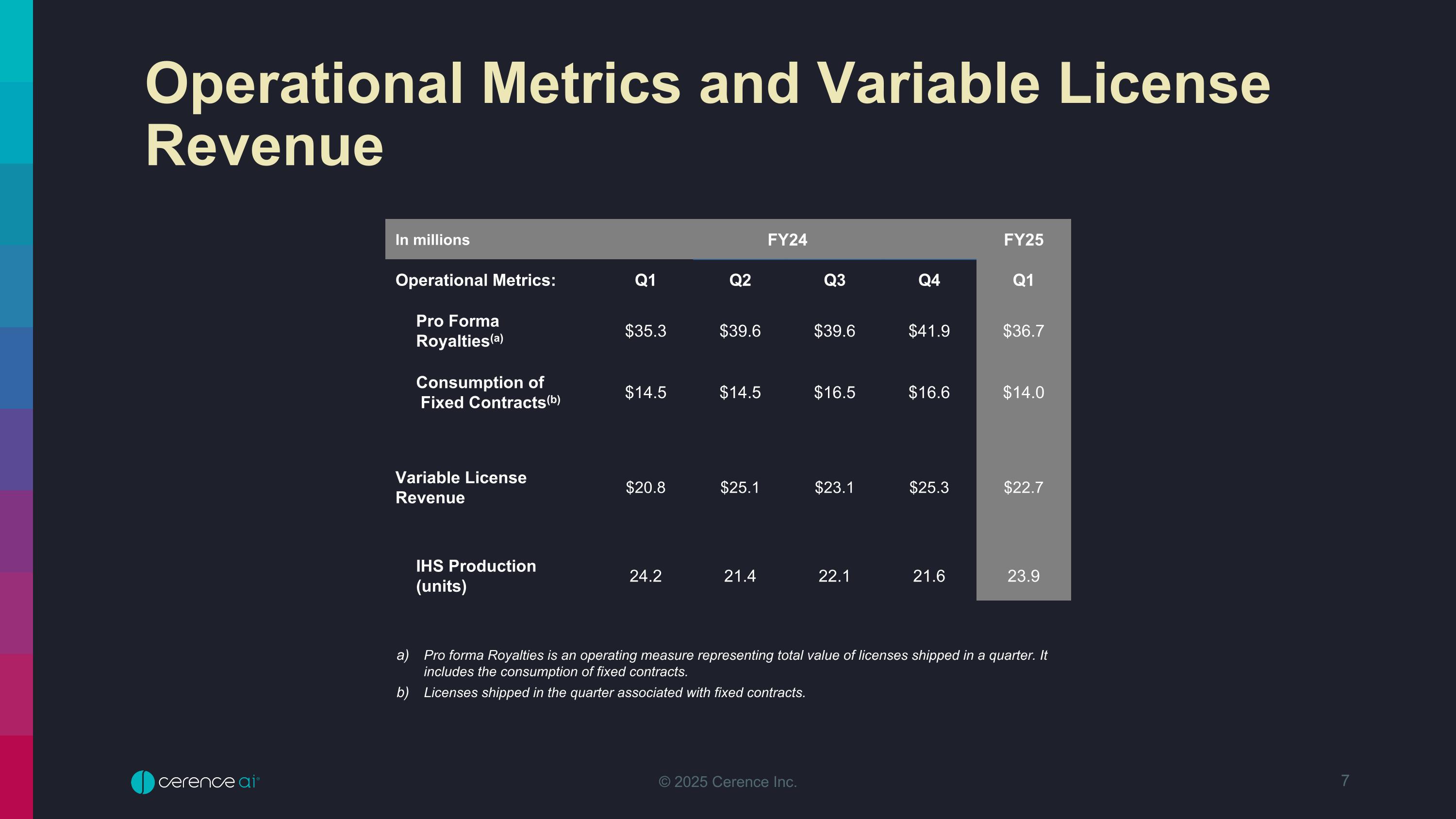

In millions FY24 FY25 Operational Metrics: Q1 Q2 Q3 Q4 Q1 Pro Forma Royalties(a) $35.3 $39.6 $39.6 $41.9 $36.7 Consumption of Fixed Contracts(b) $14.5 $14.5 $16.5 $16.6 $14.0 Variable License Revenue $20.8 $25.1 $23.1 $25.3 $22.7 IHS Production (units) 24.2 21.4 22.1 21.6 23.9 Pro forma Royalties is an operating measure representing total value of licenses shipped in a quarter. It includes the consumption of fixed contracts. Licenses shipped in the quarter associated with fixed contracts. Operational Metrics and Variable License Revenue

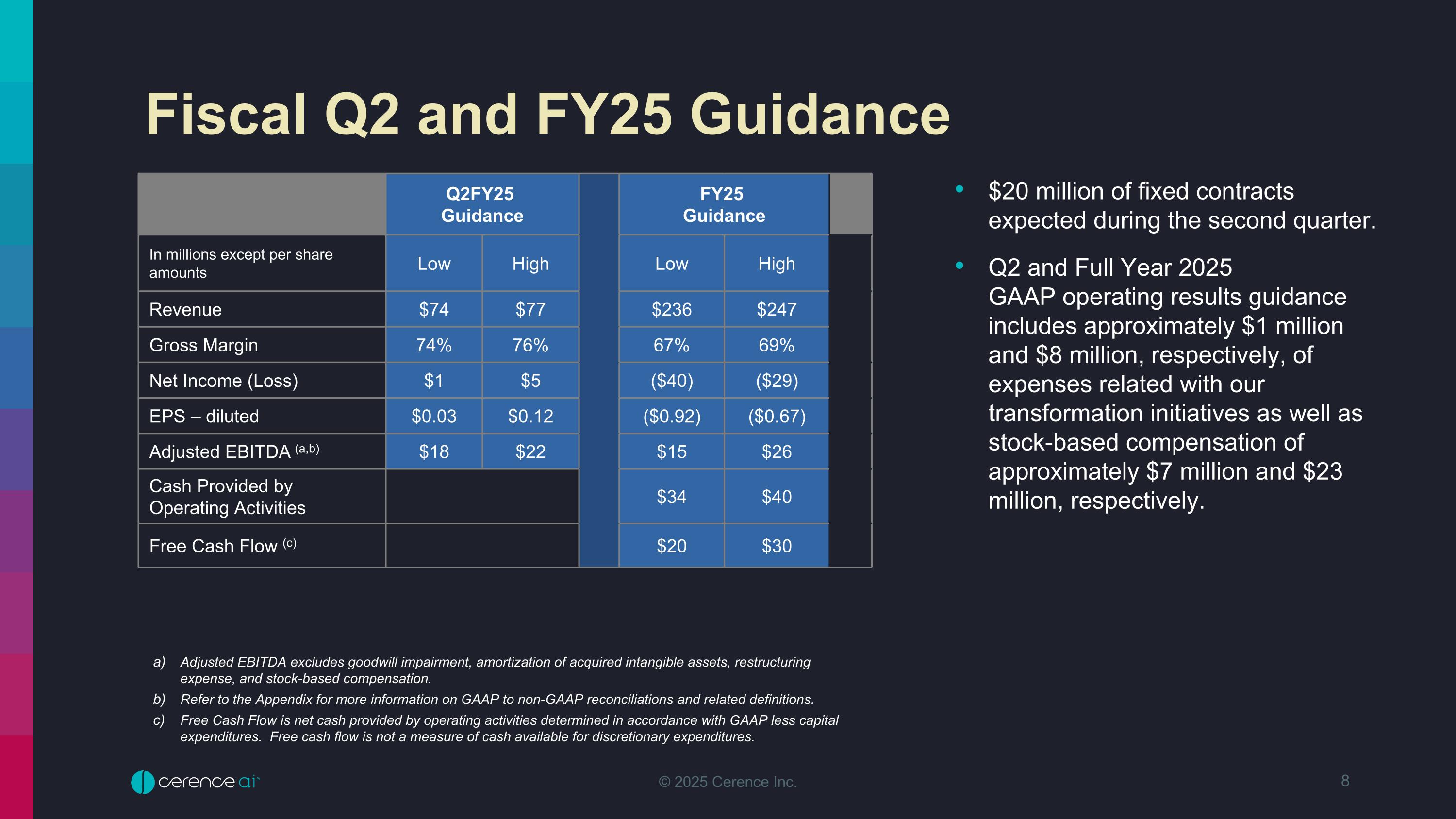

Fiscal Q2 and FY25 Guidance $20 million of fixed contracts expected during the second quarter. Q2 and Full Year 2025 GAAP operating results guidance includes approximately $1 million and $8 million, respectively, of expenses related with our transformation initiatives as well as stock-based compensation of approximately $7 million and $23 million, respectively. Q2FY25 Guidance FY25 Guidance In millions except per share amounts Low High Low High Revenue $74 $77 $236 $247 Gross Margin 74% 76% 67% 69% Net Income (Loss) $1 $5 ($40) ($29) EPS – diluted $0.03 $0.12 ($0.92) ($0.67) Adjusted EBITDA (a,b) $18 $22 $15 $26 Cash Provided by Operating Activities $34 $40 Free Cash Flow (c) $20 $30 Adjusted EBITDA excludes goodwill impairment, amortization of acquired intangible assets, restructuring expense, and stock-based compensation. Refer to the Appendix for more information on GAAP to non-GAAP reconciliations and related definitions. Free Cash Flow is net cash provided by operating activities determined in accordance with GAAP less capital expenditures. Free cash flow is not a measure of cash available for discretionary expenditures.

Appendix

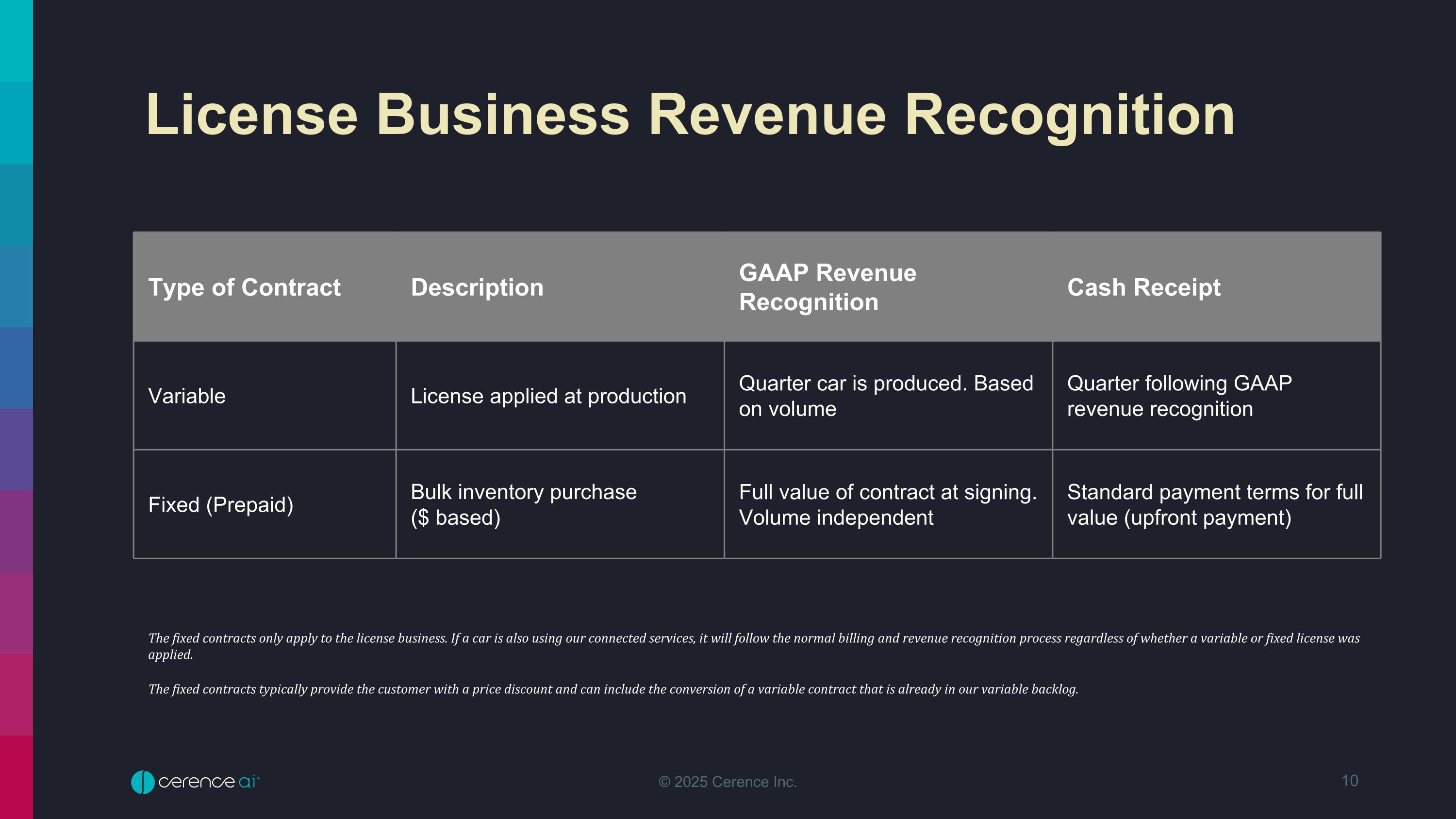

License Business Revenue Recognition Type of Contract Description GAAP Revenue Recognition Cash Receipt Variable License applied at production Quarter car is produced. Based on volume Quarter following GAAP revenue recognition Fixed (Prepaid) Bulk inventory purchase ($ based) Full value of contract at signing. Volume independent Standard payment terms for full value (upfront payment) The fixed contracts only apply to the license business. If a car is also using our connected services, it will follow the normal billing and revenue recognition process regardless of whether a variable or fixed license was applied. The fixed contracts typically provide the customer with a price discount and can include the conversion of a variable contract that is already in our variable backlog.

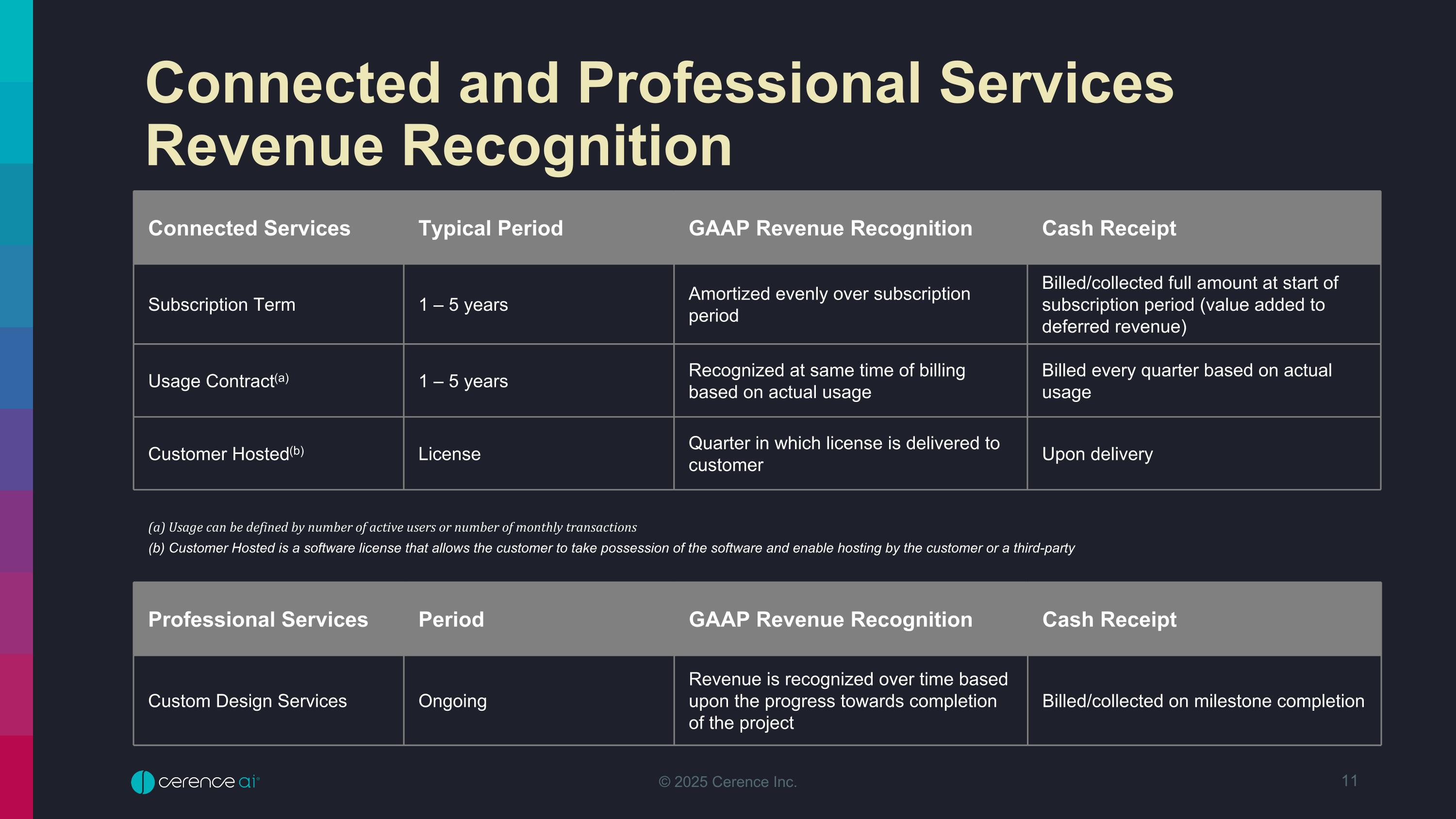

Connected and Professional Services Revenue Recognition Connected Services Typical Period GAAP Revenue Recognition Cash Receipt Subscription Term 1 – 5 years Amortized evenly over subscription period Billed/collected full amount at start of subscription period (value added to deferred revenue) Usage Contract(a) 1 – 5 years Recognized at same time of billing based on actual usage Billed every quarter based on actual usage Customer Hosted(b) License Quarter in which license is delivered to customer Upon delivery (a) Usage can be defined by number of active users or number of monthly transactions (b) Customer Hosted is a software license that allows the customer to take possession of the software and enable hosting by the customer or a third-party Professional Services Period GAAP Revenue Recognition Cash Receipt Custom Design Services Ongoing Revenue is recognized over time based upon the progress towards completion of the project Billed/collected on milestone completion

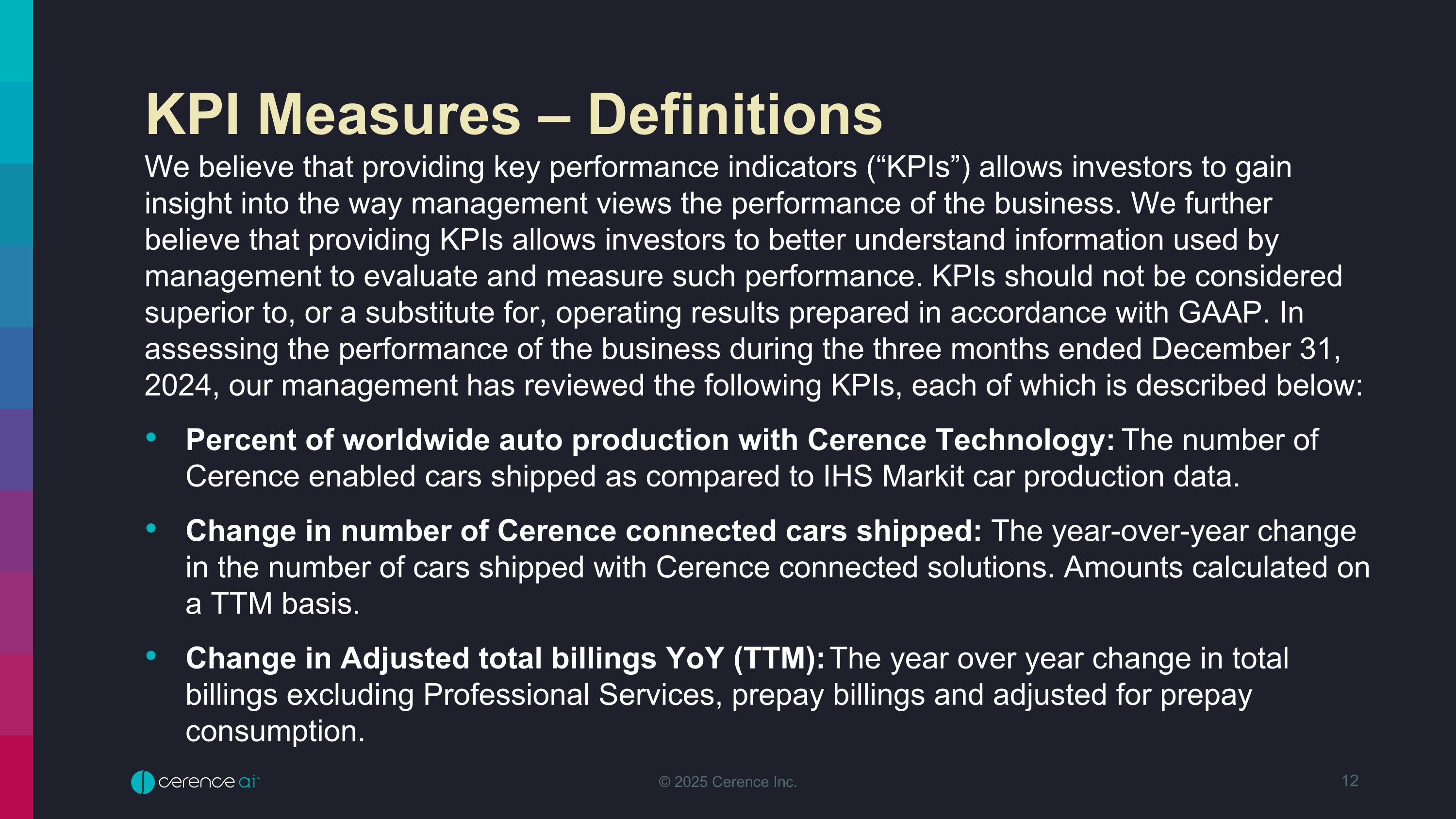

KPI Measures – Definitions We believe that providing key performance indicators (“KPIs”) allows investors to gain insight into the way management views the performance of the business. We further believe that providing KPIs allows investors to better understand information used by management to evaluate and measure such performance. KPIs should not be considered superior to, or a substitute for, operating results prepared in accordance with GAAP. In assessing the performance of the business during the three months ended December 31, 2024, our management has reviewed the following KPIs, each of which is described below: Percent of worldwide auto production with Cerence Technology: The number of Cerence enabled cars shipped as compared to IHS Markit car production data. Change in number of Cerence connected cars shipped: The year-over-year change in the number of cars shipped with Cerence connected solutions. Amounts calculated on a TTM basis. Change in Adjusted total billings YoY (TTM): The year over year change in total billings excluding Professional Services, prepay billings and adjusted for prepay consumption.

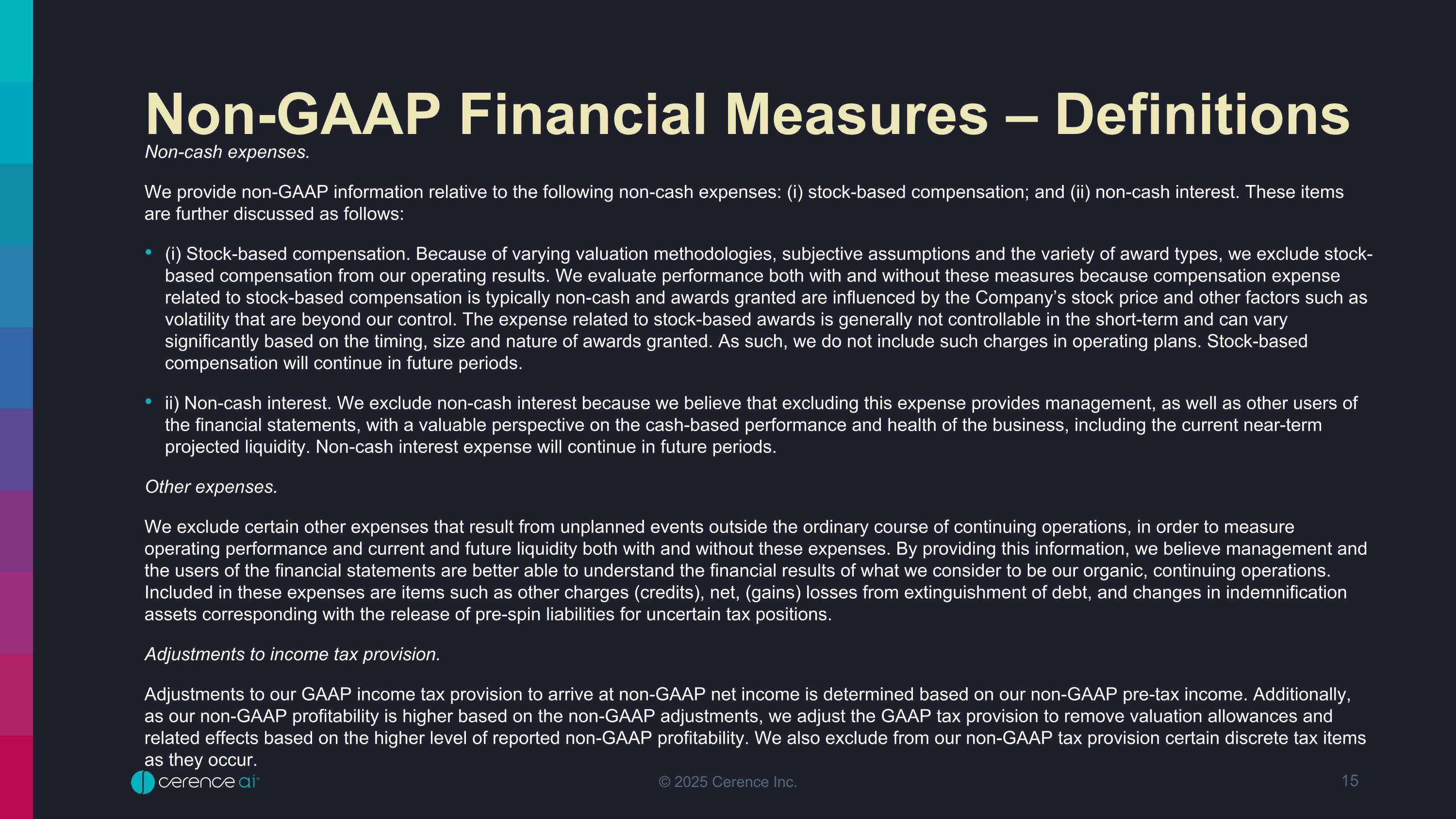

Non-GAAP Financial Measures – Definitions Discussion of Non-GAAP Financial Measures We believe that providing the non-GAAP information in addition to the GAAP presentation, allows investors to view the financial results in the way management views the operating results. We further believe that providing this information allows investors to not only better understand our financial performance, but more importantly, to evaluate the efficacy of the methodology and information used by management to evaluate and measure such performance. The non-GAAP information should not be considered superior to, or a substitute for, financial statements prepared in accordance with GAAP. We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of the business, for making operating decisions and for forecasting and planning for future periods. While our management uses these non-GAAP financial measures as a tool to enhance their understanding of certain aspects of our financial performance, our management does not consider these measures to be a substitute for, or superior to, the information provided by GAAP financial statements. Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial statements provides such readers with useful supplemental data that, while not a substitute for GAAP financial statements, allows for greater transparency in the review of our financial and operational performance. In assessing the overall health of the business during the three months ended December 31, 2024 and 2023, our management has either included or excluded the following items in general categories, each of which is described below.

Non-GAAP Financial Measures – Definitions Adjusted EBITDA. Adjusted EBITDA is defined as net income attributable to Cerence Inc. before net income (loss) attributable to income tax (benefit) expense, other income (expense) items, net, depreciation and amortization expense, and excluding amortization of acquired intangible assets, stock-based compensation, and restructuring and other costs, net or impairment charges related to fixed and intangible assets and gains or losses on the sale of long-lived assets, if any. From time to time we may exclude from Adjusted EBITDA the impact of events, gains, losses or other charges (such as significant legal settlements) that affect the period-to-period comparability of our operating performance. Other income (expense) items, net include interest expense, interest income, and other income (expense), net (as stated in our Condensed Consolidated Statement of Operations). Our management and Board of Directors use this financial measure to evaluate our operating performance. It is also a significant performance measure in our annual incentive compensation programs. Restructuring and other costs, net. Restructuring and other costs, net include restructuring expenses as well as other charges that are unusual in nature, are the result of unplanned events, and arise outside the ordinary course of our business such as employee severance costs, consulting costs relating to our transformation initiatives, and costs for consolidating duplicate facilities. Amortization of acquired intangible assets. We exclude the amortization of acquired intangible assets from non-GAAP expense and income measures. These amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Providing a supplemental measure which excludes these charges allows management and investors to evaluate results “as-if” the acquired intangible assets had been developed internally rather than acquired and, therefore, provides a supplemental measure of performance in which our acquired intellectual property is treated in a comparable manner to our internally developed intellectual property. Although we exclude amortization of acquired intangible assets from our non-GAAP expenses, we believe that it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Future acquisitions may result in the amortization of additional intangible assets.

Non-GAAP Financial Measures – Definitions Non-cash expenses. We provide non-GAAP information relative to the following non-cash expenses: (i) stock-based compensation; and (ii) non-cash interest. These items are further discussed as follows: (i) Stock-based compensation. Because of varying valuation methodologies, subjective assumptions and the variety of award types, we exclude stock-based compensation from our operating results. We evaluate performance both with and without these measures because compensation expense related to stock-based compensation is typically non-cash and awards granted are influenced by the Company’s stock price and other factors such as volatility that are beyond our control. The expense related to stock-based awards is generally not controllable in the short-term and can vary significantly based on the timing, size and nature of awards granted. As such, we do not include such charges in operating plans. Stock-based compensation will continue in future periods. ii) Non-cash interest. We exclude non-cash interest because we believe that excluding this expense provides management, as well as other users of the financial statements, with a valuable perspective on the cash-based performance and health of the business, including the current near-term projected liquidity. Non-cash interest expense will continue in future periods. Other expenses. We exclude certain other expenses that result from unplanned events outside the ordinary course of continuing operations, in order to measure operating performance and current and future liquidity both with and without these expenses. By providing this information, we believe management and the users of the financial statements are better able to understand the financial results of what we consider to be our organic, continuing operations. Included in these expenses are items such as other charges (credits), net, (gains) losses from extinguishment of debt, and changes in indemnification assets corresponding with the release of pre-spin liabilities for uncertain tax positions. Adjustments to income tax provision. Adjustments to our GAAP income tax provision to arrive at non-GAAP net income is determined based on our non-GAAP pre-tax income. Additionally, as our non-GAAP profitability is higher based on the non-GAAP adjustments, we adjust the GAAP tax provision to remove valuation allowances and related effects based on the higher level of reported non-GAAP profitability. We also exclude from our non-GAAP tax provision certain discrete tax items as they occur.

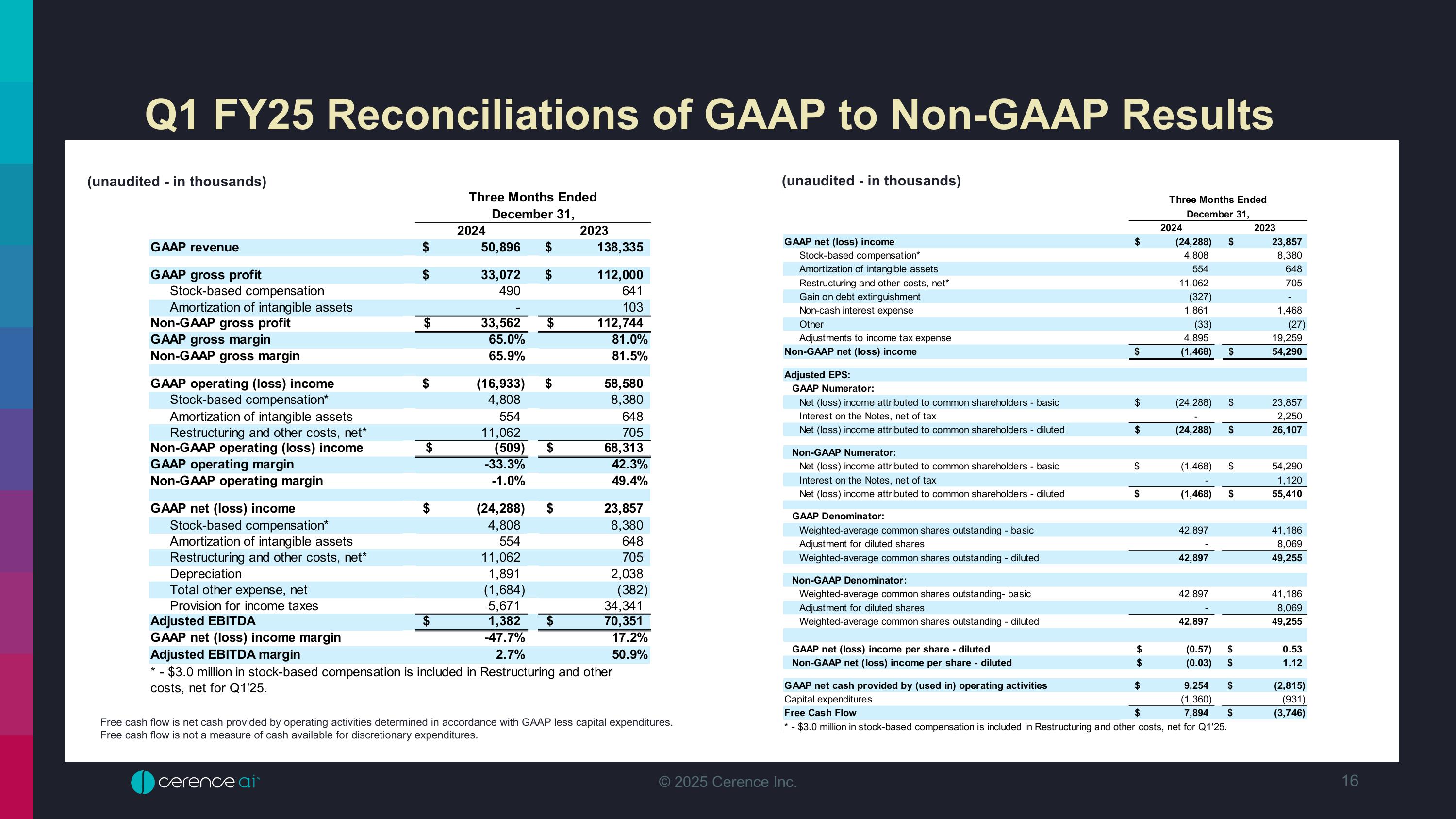

Q1 FY25 Reconciliations of GAAP to Non-GAAP Results Free cash flow is net cash provided by operating activities determined in accordance with GAAP less capital expenditures. Free cash flow is not a measure of cash available for discretionary expenditures. (unaudited - in thousands) (unaudited - in thousands) Three Months Ended December 31, 2024 2023 GAAP revenue $50,896 $138,335 GAAP gross profit $33,072 $112,000 Stock-based compensation 490 641 Amortization of intangible assets - 103 Non-GAAP gross profit $33,562 $112,744 GAAP gross margin 65.0% 81.0% Non-GAAP gross margin 65.9% 81.5% GAAP operating (loss) income $(16,933) $58,580 Stock-based compensation* 4,808 8,380 Amortization of intangible assets 554 648 Restructuring and other costs, net* 11,062 705 Non-GAAP operating (loss) income $(509) $68,313 GAAP operating margin -33.3% 42.3% Non-GAAP operating margin -1.0% 49.4% GAAP net (loss) income $(24,288) $23,857 Stock-based compensation* 4,808 8,380 Amortization of intangible assets 554 648 Restructuring and other costs, net* 11,062 705 Depreciation 1,891 2,038 Total other expense, net (1,684) (382) Provision for income taxes 5,671 34,341 Adjusted EBITDA $1,382 $70,351 GAAP net (loss) income margin -47.7% 17.2% Adjusted EBITDA margin 2.7% 50.9% * - $3.0 million in stock-based compensation is included in Restructuring and other costs, net for Q1'25. Three Months Ended December 31, 2024 2023 GAAP net (loss) income $(24,288) $23,857 Stock-based compensation* 4,808 8,380 Amortization of intangible assets 554 648 Restructuring and other costs, net* 11,062 705 Gain on debt extinguishment (327) - Non-cash interest expense 1,861 1,468 Other (33) (27) Adjustments to income tax expense 4,895 19,259 Non-GAAP net (loss) income $(1,468) $54,290 Adjusted EPS: GAAP Numerator: Net (loss) income attributed to common shareholders - basic $(24,288) $23,857 Interest on the Notes, net of tax - 2,250 Net (loss) income attributed to common shareholders - diluted $(24,288) $26,107 Non-GAAP Numerator: Net (loss) income attributed to common shareholders - basic $(1,468) $54,290 Interest on the Notes, net of tax - 1,120 Net (loss) income attributed to common shareholders - diluted $(1,468) $55,410 GAAP Denominator: Weighted-average common shares outstanding - basic 42,897 41,186 Adjustment for diluted shares - 8,069 Weighted-average common shares outstanding - diluted 42,897 49,255 Non-GAAP Denominator: Weighted-average common shares outstanding- basic 42,897 41,186 Adjustment for diluted shares - 8,069 Weighted-average common shares outstanding - diluted 42,897 49,255 GAAP net (loss) income per share - diluted $(0.57) $0.53 Non-GAAP net (loss) income per share - diluted $(0.03) $1.12 GAAP net cash provided by (used in) operating activities $9,254 $(2,815) Capital expenditures (1,360) (931) Free Cash Flow $7,894 $(3,746) * - $3.0 million in stock-based compensation is included in Restructuring and other costs, net for Q1'25.

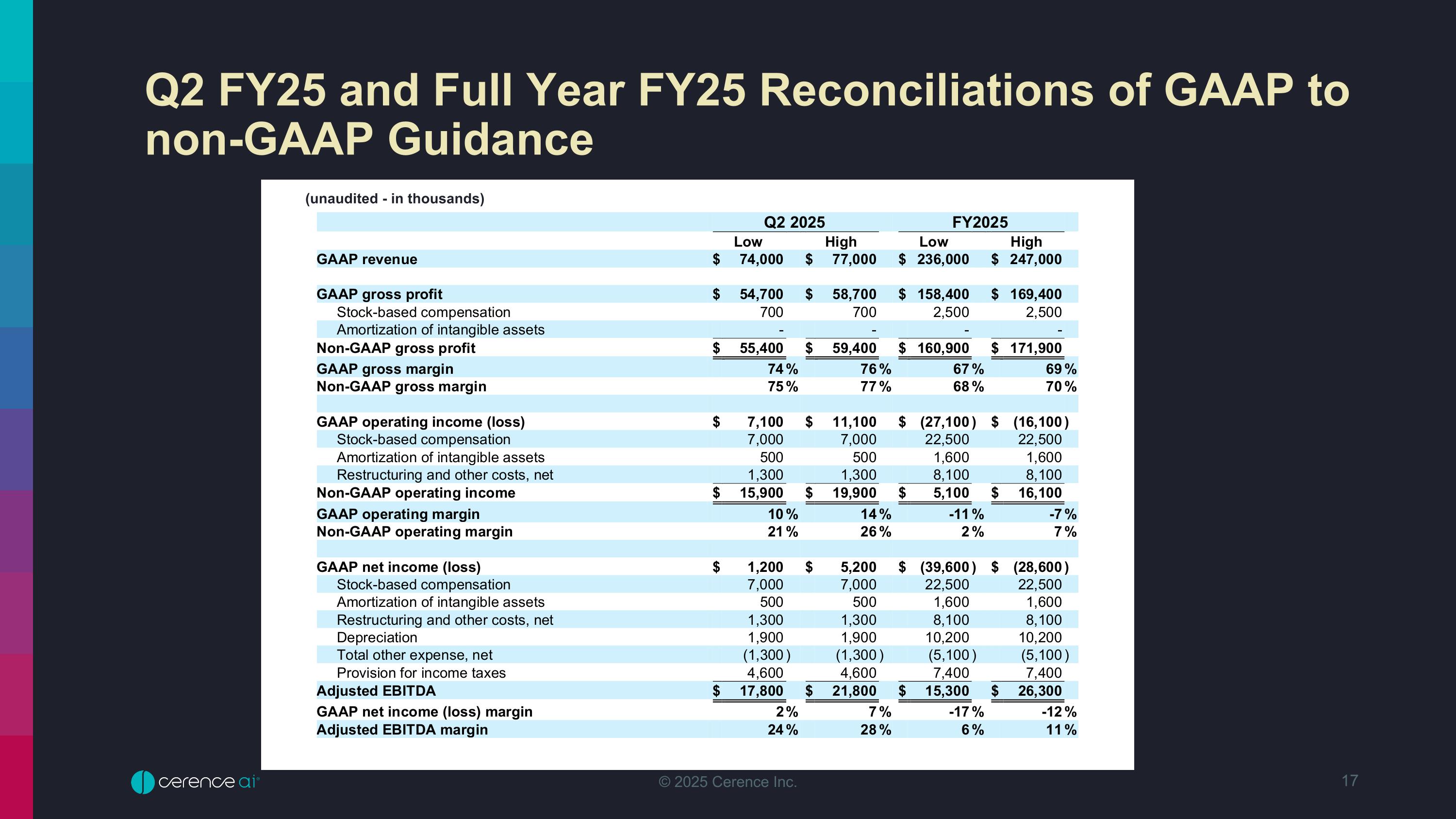

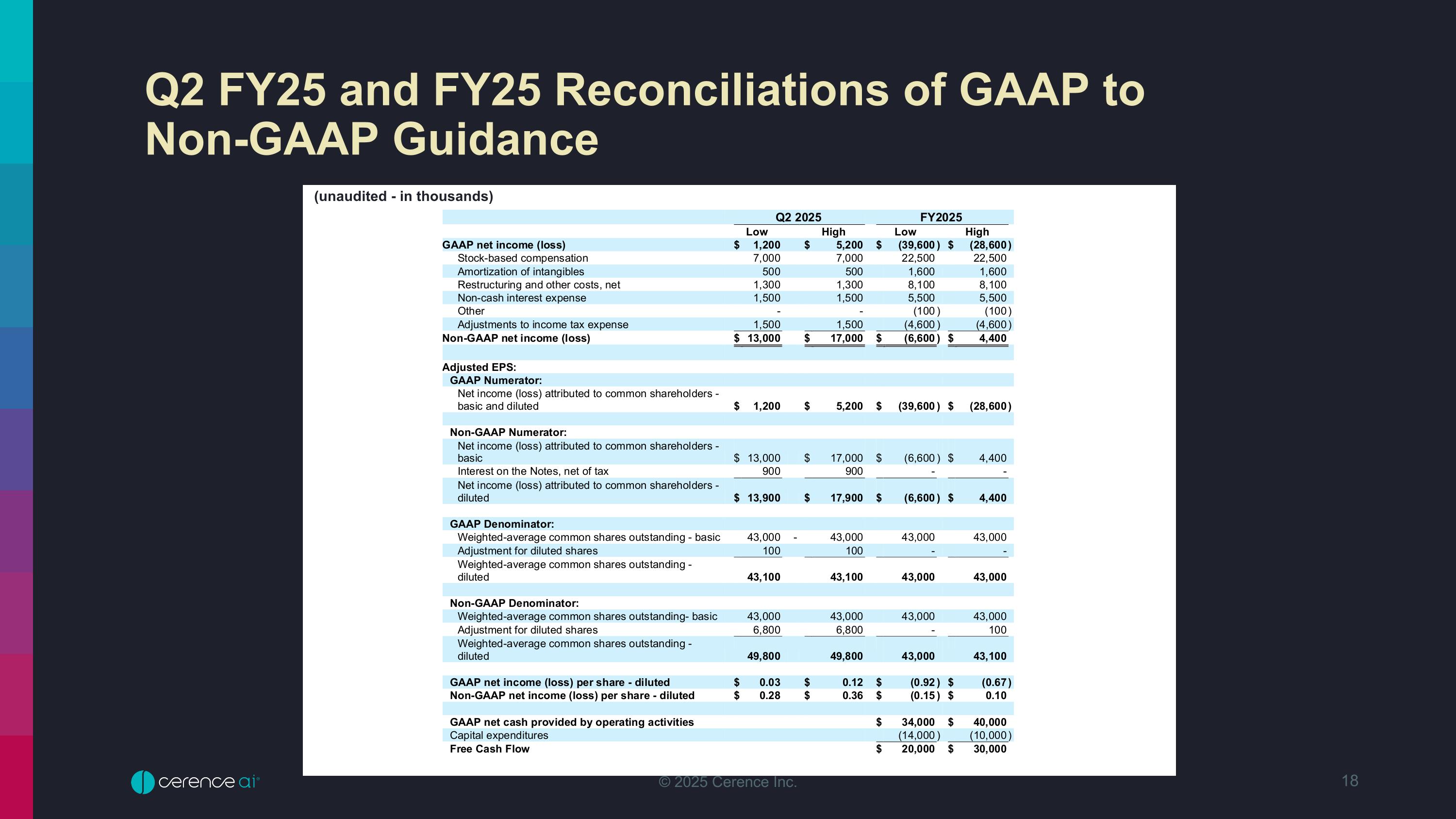

Q2 FY25 and Full Year FY25 Reconciliations of GAAP to non-GAAP Guidance (unaudited - in thousands) Q2 2025 FY2025 Low High Low High GAAP revenue $74,000 $77,000 $236,000 $247,000 GAAP gross profit $54,700 $58,700 $158,400 $169,400 Stock-based compensation 700 700 2,500 2,500 Amortization of intangible assets - - - - Non-GAAP gross profit $55,400 $59,400 $160,900 $171,900 GAAP gross margin 74% 76% 67% 69% Non-GAAP gross margin 75% 77% 68% 70% GAAP operating income (loss) $7,100 $11,100 $(27,100) $(16,100) Stock-based compensation 7,000 7,000 22,500 22,500 Amortization of intangible assets 500 500 1,600 1,600 Restructuring and other costs, net 1,300 1,300 8,100 8,100 Non-GAAP operating income $15,900 $19,900 $5,100 $16,100 GAAP operating margin 10% 14% -11% -7% Non-GAAP operating margin 21% 26% 2% 7% GAAP net income (loss) $1,200 $5,200 $(39,600) $(28,600) Stock-based compensation 7,000 7,000 22,500 22,500 Amortization of intangible assets 500 500 1,600 1,600 Restructuring and other costs, net 1,300 1,300 8,100 8,100 Depreciation 1,900 1,900 10,200 10,200 Total other expense, net (1,300) (1,300) (5,100) (5,100) Provision for income taxes 4,600 4,600 7,400 7,400 Adjusted EBITDA $17,800 $21,800 $15,300 $26,300 GAAP net income (loss) margin 2% 7% -17% -12% Adjusted EBITDA margin 24% 28% 6% 11% Q2 2025 FY2025 Low High Low High GAAP net income (loss) $1,200 $5,200 $(39,600) $(28,600) Stock-based compensation 7,000 7,000 22,500 22,500 Amortization of intangibles 500 500 1,600 1,600 Restructuring and other costs, net 1,300 1,300 8,100 8,100 Non-cash interest expense 1,500 1,500 5,500 5,500 Other - - (100) (100) Adjustments to income tax expense 1,500 1,500 (4,600) (4,600) Non-GAAP net income (loss) $13,000 $17,000 $(6,600) $4,400 Adjusted EPS: GAAP Numerator: Net income (loss) attributed to common shareholders - basic and diluted $1,200 $5,200 $(39,600) $(28,600) Non-GAAP Numerator: Net income (loss) attributed to common shareholders - basic $13,000 $17,000 $(6,600) $4,400 Interest on the Notes, net of tax 900 900 - - Net income (loss) attributed to common shareholders - diluted $13,900 $17,900 $(6,600) $4,400 GAAP Denominator: Weighted-average common shares outstanding - basic 43,000 43,000 43,000 43,000 Adjustment for diluted shares 100 100 - - Weighted-average common shares outstanding - diluted 43,100 43,100 43,000 43,000 Non-GAAP Denominator: Weighted-average common shares outstanding- basic 43,000 43,000 43,000 43,000 Adjustment for diluted shares 6,800 6,800 - 100 Weighted-average common shares outstanding - diluted 49,800 49,800 43,000 43,100 GAAP net income (loss) per share - diluted $0.03 $0.12 $(0.92) $(0.67) Non-GAAP net income (loss) per share - diluted $0.28 $0.36 $(0.15) $0.10 GAAP net cash provided by operating activities $34,000 $40,000 Capital expenditures (14,000) (10,000) Free Cash Flow $20,000 $30,000

Q2 FY25 and FY25 Reconciliations of GAAP to Non-GAAP Guidance (unaudited - in thousands) Q2 2025 FY2025 Low High Low High GAAP revenue $74,000 $77,000 $236,000 $247,000 GAAP gross profit $54,700 $58,700 $158,400 $169,400 Stock-based compensation 700 700 2,500 2,500 Amortization of intangible assets - - - - Non-GAAP gross profit $55,400 $59,400 $160,900 $171,900 GAAP gross margin 74% 76% 67% 69% Non-GAAP gross margin 75% 77% 68% 70% GAAP operating income (loss) $7,100 $11,100 $(27,100) $(16,100) Stock-based compensation 7,000 7,000 22,500 22,500 Amortization of intangible assets 500 500 1,600 1,600 Restructuring and other costs, net 1,300 1,300 8,100 8,100 Non-GAAP operating income $15,900 $19,900 $5,100 $16,100 GAAP operating margin 10% 14% -11% -7% Non-GAAP operating margin 21% 26% 2% 7% GAAP net income (loss) $1,200 $5,200 $(39,600) $(28,600) Stock-based compensation 7,000 7,000 22,500 22,500 Amortization of intangible assets 500 500 1,600 1,600 Restructuring and other costs, net 1,300 1,300 8,100 8,100 Depreciation 1,900 1,900 10,200 10,200 Total other expense, net (1,300) (1,300) (5,100) (5,100) Provision for income taxes 4,600 4,600 7,400 7,400 Adjusted EBITDA $17,800 $21,800 $15,300 $26,300 GAAP net income (loss) margin 2% 7% -17% -12% Adjusted EBITDA margin 24% 28% 6% 11% Q2 2025 FY2025 Low High Low High GAAP net income (loss) $1,200 $5,200 $(39,600) $(28,600) Stock-based compensation 7,000 7,000 22,500 22,500 Amortization of intangibles 500 500 1,600 1,600 Restructuring and other costs, net 1,300 1,300 8,100 8,100 Non-cash interest expense 1,500 1,500 5,500 5,500 Other - - (100) (100) Adjustments to income tax expense 1,500 1,500 (4,600) (4,600) Non-GAAP net income (loss) $13,000 $17,000 $(6,600) $4,400 Adjusted EPS: GAAP Numerator: Net income (loss) attributed to common shareholders - basic and diluted $1,200 $5,200 $(39,600) $(28,600) Non-GAAP Numerator: Net income (loss) attributed to common shareholders - basic $13,000 $17,000 $(6,600) $4,400 Interest on the Notes, net of tax 900 900 - - Net income (loss) attributed to common shareholders - diluted $13,900 $17,900 $(6,600) $4,400 GAAP Denominator: Weighted-average common shares outstanding - basic 43,000 43,000 43,000 43,000 Adjustment for diluted shares 100 100 - - Weighted-average common shares outstanding - diluted 43,100 43,100 43,000 43,000 Non-GAAP Denominator: Weighted-average common shares outstanding- basic 43,000 43,000 43,000 43,000 Adjustment for diluted shares 6,800 6,800 - 100 Weighted-average common shares outstanding - diluted 49,800 49,800 43,000 43,100 GAAP net income (loss) per share - diluted $0.03 $0.12 $(0.92) $(0.67) Non-GAAP net income (loss) per share - diluted $0.28 $0.36 $(0.15) $0.10 GAAP net cash provided by operating activities $34,000 $40,000 Capital expenditures (14,000) (10,000) Free Cash Flow $20,000 $30,000