May 10, 2022 Cerence Q2 FY22 Earnings Stefan Ortmanns, CEO Tom Beaudoin, EVP, CFO Rich Yerganian, SVP of IR Exhibit 99.2 @2022 Cerence Inc.

Forward-Looking Statements This material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements (other than statements of historical fact), including, without limitation, statements regarding the Company’s future performance, results and financial condition, expected growth, opportunities, business and market trends, and innovation, and management’s future expectations, beliefs, goals, plans or prospects, are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company’s web site at http://www.cerence.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement after the date of this document. Cerence @2022 Cerence Inc. 2

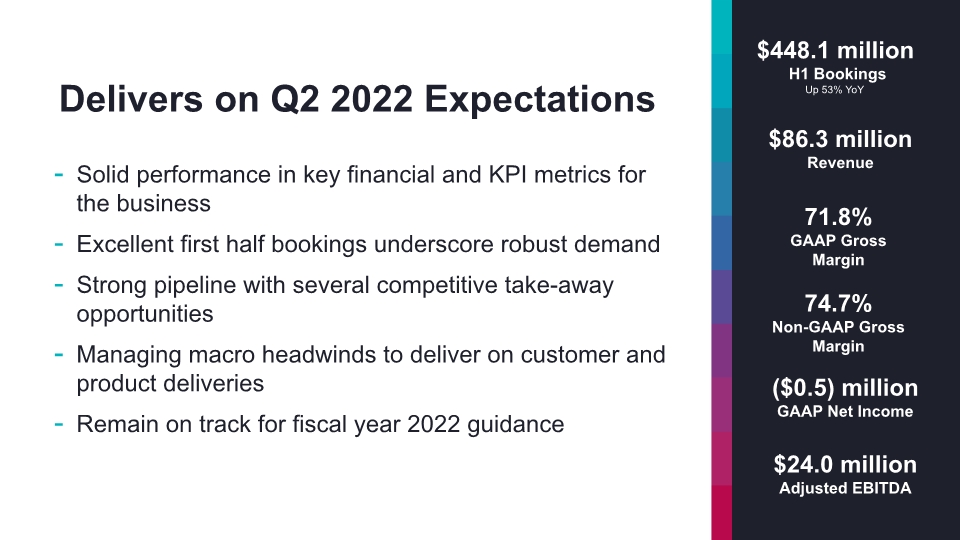

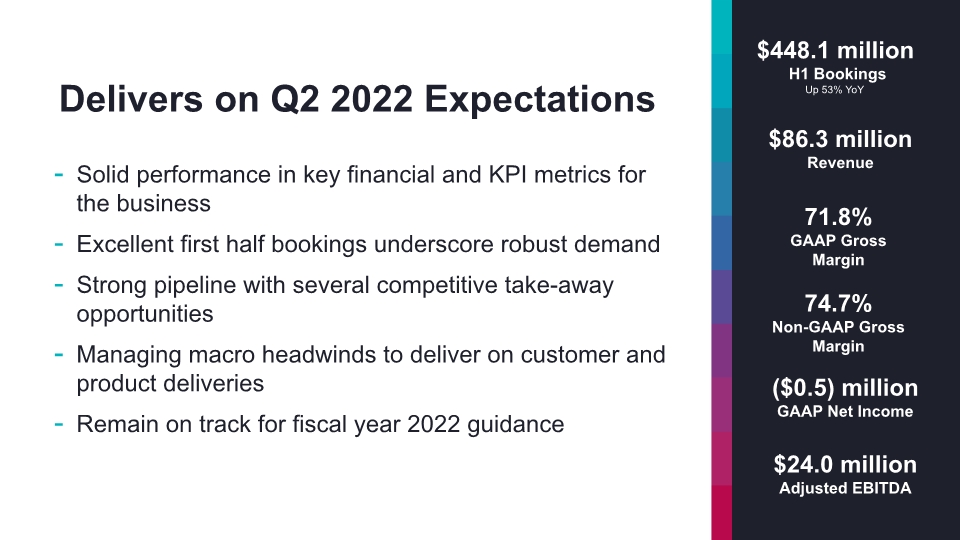

Delivers on Q2 2022 Expectations Solid performance in key financial and KPI metrics for the business Excellent first half bookings underscore robust demand Strong pipeline with several competitive take-away opportunities Managing macro headwinds to deliver on customer and product deliveries Remain on track for fiscal year 2022 guidance $86.3 million Revenue $448.1 million H1 Bookings Up 53% YoY ($0.5) million GAAP Net Income $24.0 million Adjusted EBITDA 71.8% GAAP Gross Margin 74.7% Non-GAAP Gross Margin

Strong H1 FY22 Bookings of $448M 4 53% growth over the same period last year Four new 2-wheeler accounts, bringing total to six @2022 Cerence Inc. 4

The Journey Ahead Focus resources on customer and key product programs Accelerate design win and bookings momentum in all markets Prioritize innovation and investments within areas of highest returns Advance strategic roadmap to deliver long-term sustainable growth 5 @2022 Cerence Inc. 5

Financial Summary @2022 Cerence Inc.

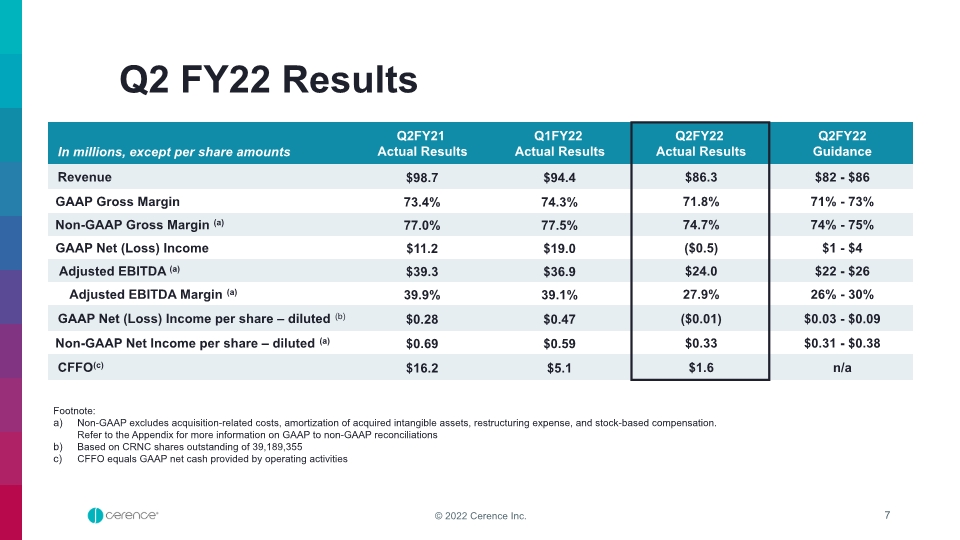

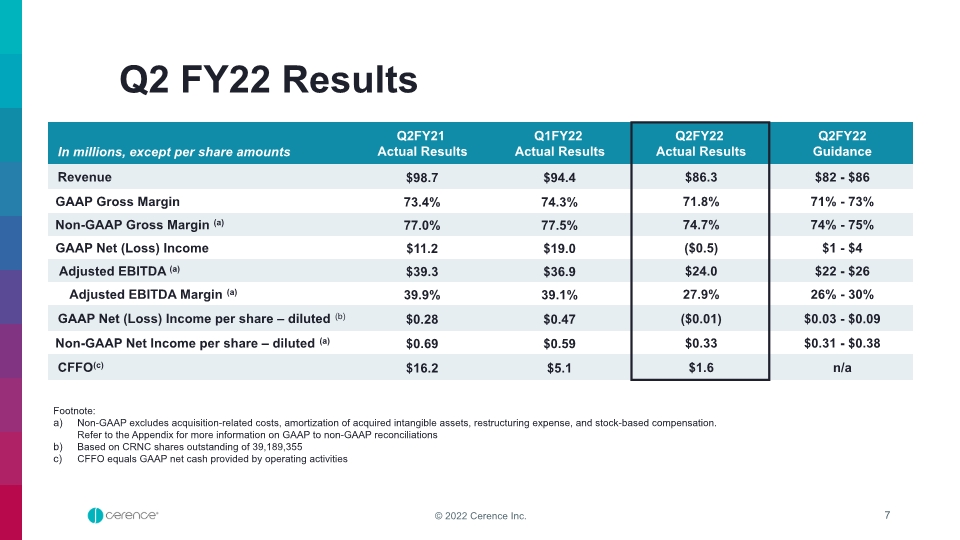

Footnote: Non-GAAP excludes acquisition-related costs, amortization of acquired intangible assets, restructuring expense, and stock-based compensation. Refer to the Appendix for more information on GAAP to non-GAAP reconciliations Based on CRNC shares outstanding of 39,189,355 CFFO equals GAAP net cash provided by operating activities Q2 FY22 Results In millions, except per share amounts Q2FY21 Actual Results Q1FY22 Actual Results Q2FY22 Actual Results Q2FY22 Guidance Revenue $98.7 $94.4 $86.3 $82 - $86 GAAP Gross Margin 73.4% 74.3% 71.8% 71% - 73% Non-GAAP Gross Margin (a) 77.0% 77.5% 74.7% 74% - 75% GAAP Net (Loss) Income $11.2 $19.0 ($0.5) $1 - $4 Adjusted EBITDA (a) $39.3 $36.9 $24.0 $22 - $26 Adjusted EBITDA Margin (a) 39.9% 39.1% 27.9% 26% - 30% GAAP Net (Loss) Income per share – diluted (b) $0.28 $0.47 ($0.01) $0.03 - $0.09 Non-GAAP Net Income per share – diluted (a) $0.69 $0.59 $0.33 $0.31 - $0.38 CFFO(c) $16.2 $5.1 $2.0 n/a @2022 Cerence Inc. 7

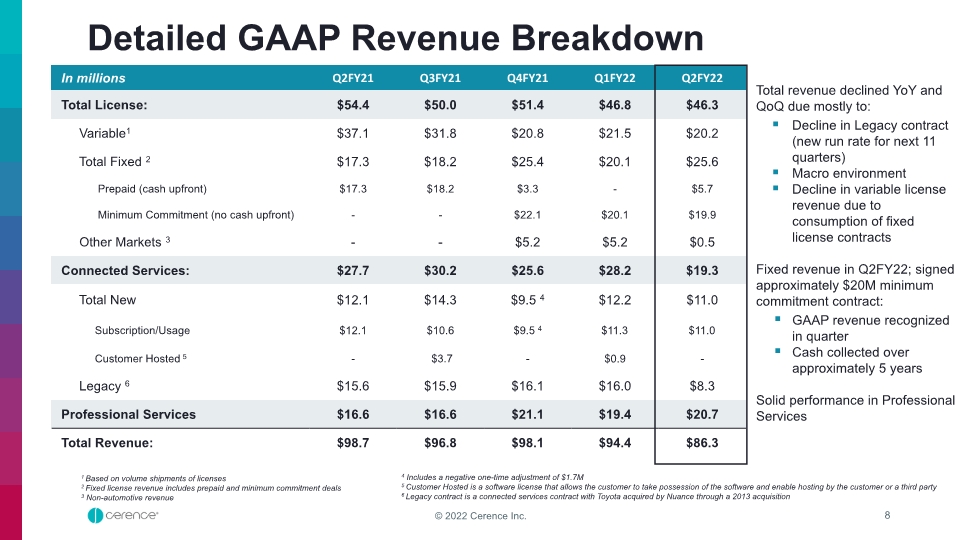

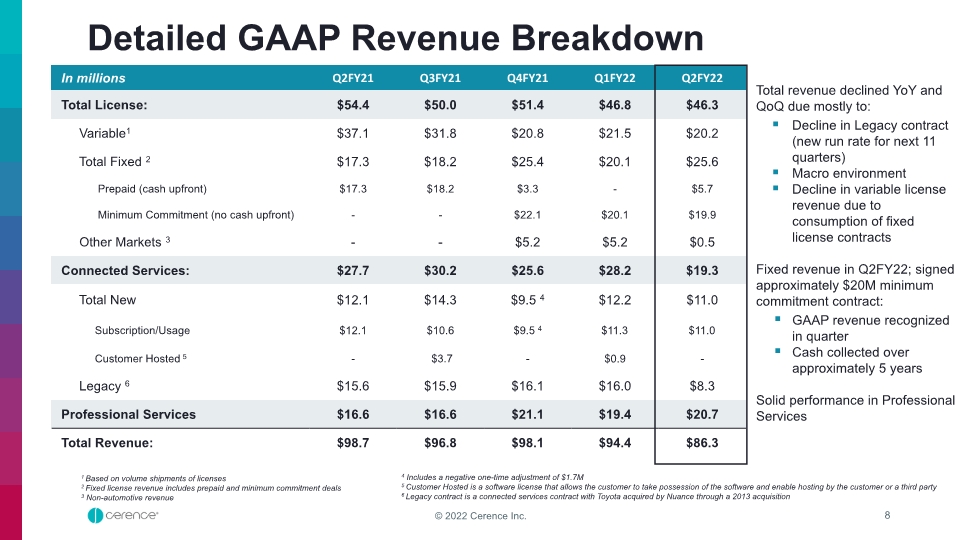

Detailed GAAP Revenue Breakdown 1 Based on volume shipments of licenses 2 Fixed license revenue includes prepaid and minimum commitment deals 3 Non-automotive revenue Total revenue declined YoY and QoQ due mostly to: Decline in Legacy contract (new run rate for next 11 quarters) Macro environment Decline in variable license revenue due to consumption of fixed license contracts Fixed revenue in Q2FY22; signed approximately $20M minimum commitment contract: GAAP revenue recognized in quarter Cash collected over approximately 5 years Solid performance in Professional Services 4 Includes a negative one-time adjustment of $1.7M 5 Customer Hosted is a software license that allows the customer to take possession of the software and enable hosting by the customer or a third party 6 Legacy contract is a connected services contract with Toyota acquired by Nuance through a 2013 acquisition In millions Q2FY21 Q3FY21 Q4FY21 Q1FY22 Q2FY22 Total License: $54.4 $50.0 $51.4 $46.8 $46.3 Variable1 $37.1 $31.8 $20.8 $21.5 $20.2 Total Fixed 2 $17.3 $18.2 $25.4 $20.1 $25.6 Prepaid (cash upfront) $17.3 $18.2 $3.3 - $5.7 Minimum Commitment (no cash upfront) - - $22.1 $20.1 $19.9 Other Markets 3 - - $5.2 $5.2 $0.5 Connected Services: $27.7 $30.2 $25.6 $28.2 $19.3 Total New $12.1 $14.3 $9.5 4 $12.2 $11.0 Subscription/Usage $12.1 $10.6 $9.5 4 $11.3 $11.0 Customer Hosted 5 - $3.7 - $0.9 - Legacy 6 $15.6 $15.9 $16.1 $16.0 $8.3 Professional Services $16.6 $16.6 $21.1 $19.4 $20.7 Total Revenue: $98.7 $96.8 $98.1 $94.4 $86.3 Cerence @2022 Cerence Inc. 8

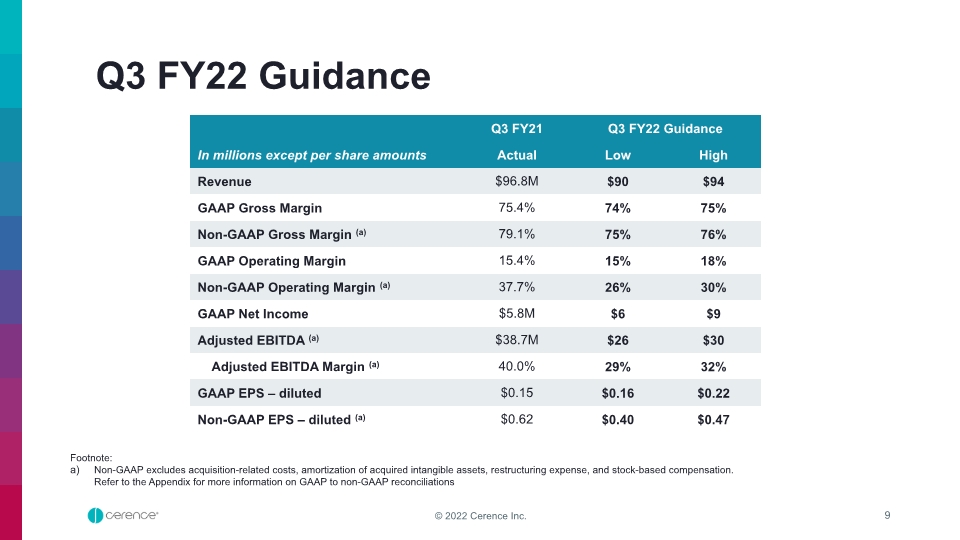

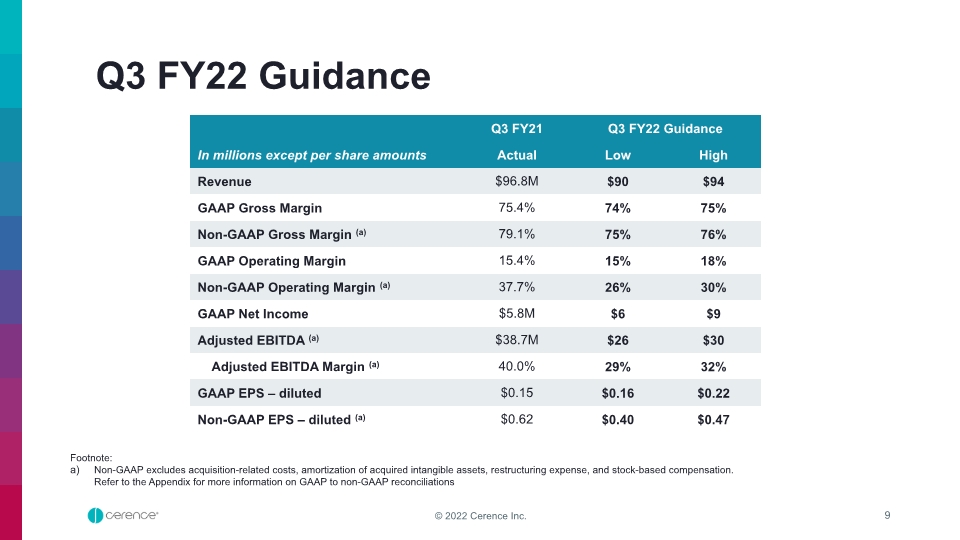

Q3 FY22 Guidance Footnote: Non-GAAP excludes acquisition-related costs, amortization of acquired intangible assets, restructuring expense, and stock-based compensation. Refer to the Appendix for more information on GAAP to non-GAAP reconciliations Q3 FY21 Q3 FY22 Guidance In millions except per share amounts Actual Low High Revenue $96.8M $90 $94 GAAP Gross Margin 75.4% 74% 75% Non-GAAP Gross Margin (a) 79.1% 75% 76% GAAP Operating Margin 15.4% 15% 18% Non-GAAP Operating Margin (a) 37.7% 26% 30% GAAP Net Income $5.8M $6 $9 Adjusted EBITDA (a) $38.7M $26 $30 Adjusted EBITDA Margin (a) 40.0% 29% 32% GAAP EPS – diluted $0.15 $0.16 $0.22 Non-GAAP EPS – diluted (a) $0.62 $0.40 $0.47 Cerence @2022 Cerence Inc. 9

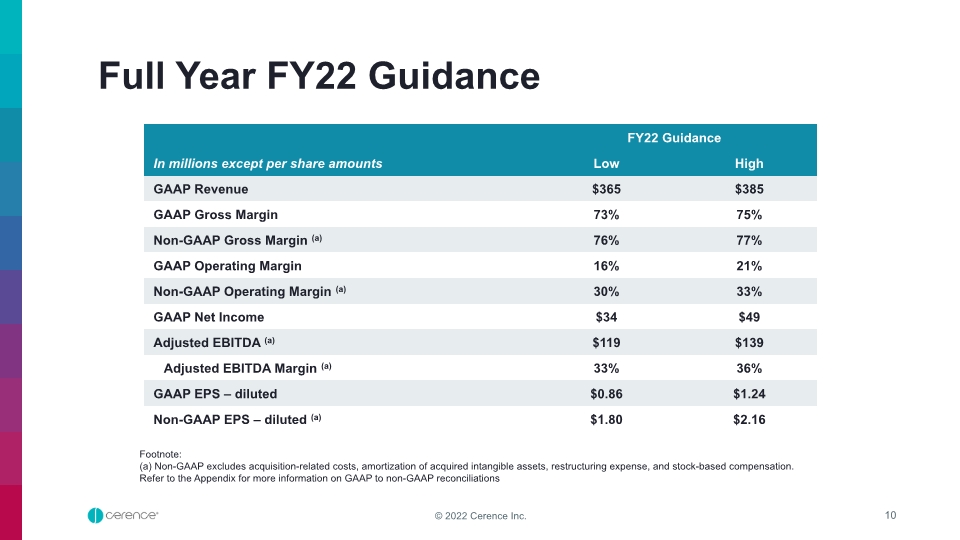

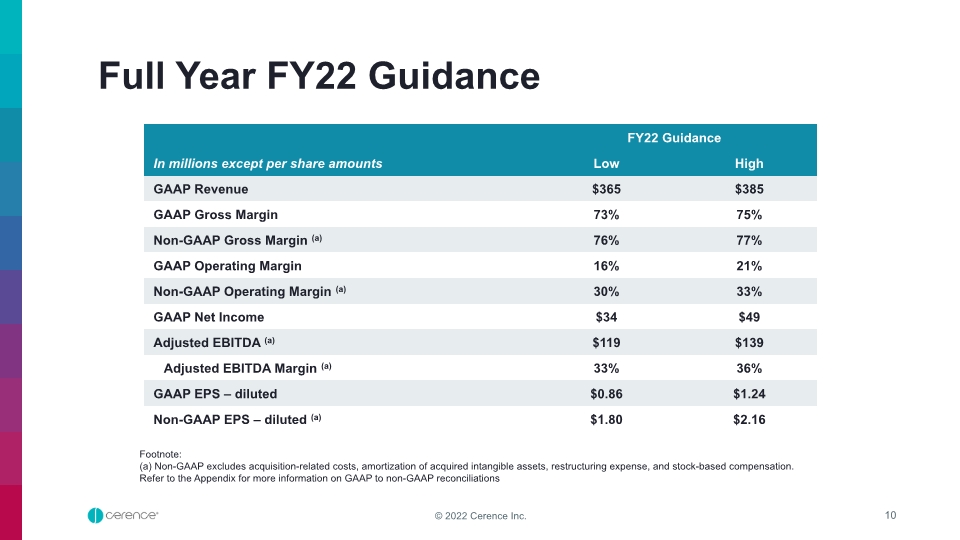

Full Year FY22 Guidance Footnote: (a) Non-GAAP excludes acquisition-related costs, amortization of acquired intangible assets, restructuring expense, and stock-based compensation. Refer to the Appendix for more information on GAAP to non-GAAP reconciliations FY22 Guidance In millions except per share amounts Low High GAAP Revenue $365 $385 GAAP Gross Margin 73% 75% Non-GAAP Gross Margin (a) 76% 77% GAAP Operating Margin 16% 21% Non-GAAP Operating Margin (a) 30% 33% GAAP Net Income $34 $49 Adjusted EBITDA (a) $119 $139 Adjusted EBITDA Margin (a) 33% 36% GAAP EPS – diluted $0.86 $1.24 Non-GAAP EPS – diluted (a) $1.80 $2.16 Cerence @2022 Cerence Inc. 10

Thank you. Cerence @2022 Cerence Inc.

Appendix Cerence @2022 Cerence Inc.

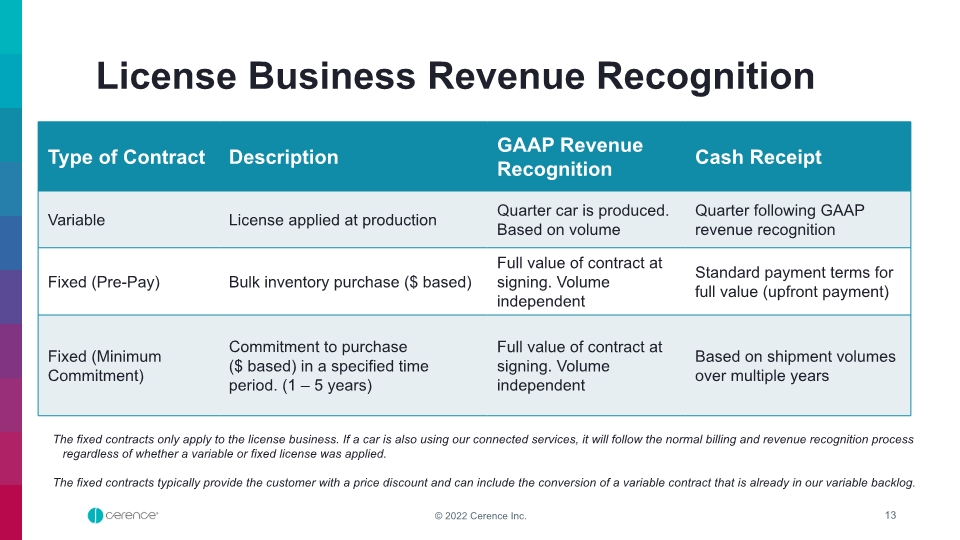

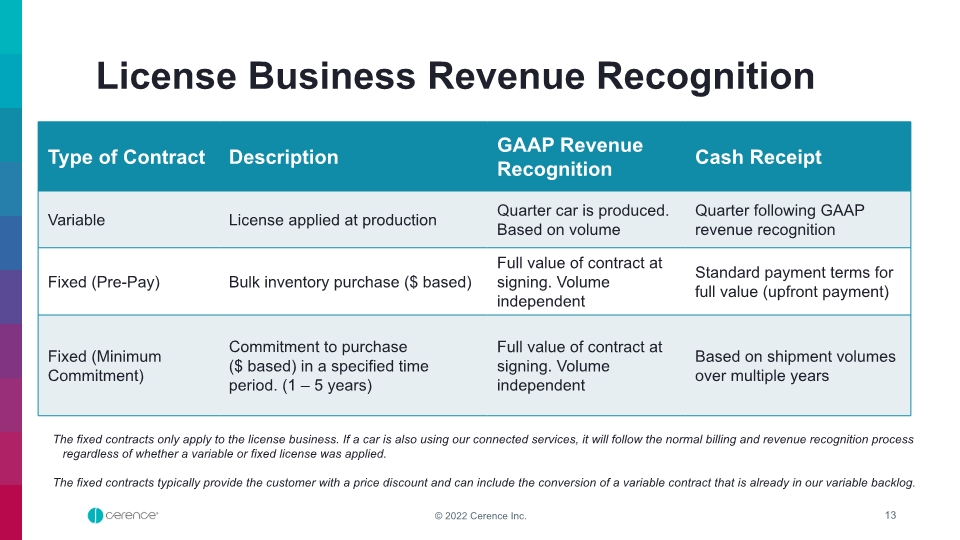

License Business Revenue Recognition The fixed contracts only apply to the license business. If a car is also using our connected services, it will follow the normal billing and revenue recognition process regardless of whether a variable or fixed license was applied. The fixed contracts typically provide the customer with a price discount and can include the conversion of a variable contract that is already in our variable backlog. Type of Contract Description GAAP Revenue Recognition Cash Receipt Variable License applied at production Quarter car is produced. Based on volume Quarter following GAAP revenue recognition Fixed (Pre-Pay) Bulk inventory purchase ($ based) Full value of contract at signing. Volume independent Standard payment terms for full value (upfront payment) Fixed (Minimum Commitment) Commitment to purchase ($ based) in a specified time period. (1 – 5 years) Full value of contract at signing. Volume independent Based on shipment volumes over multiple years Cerence @2022 Cerence Inc. 13

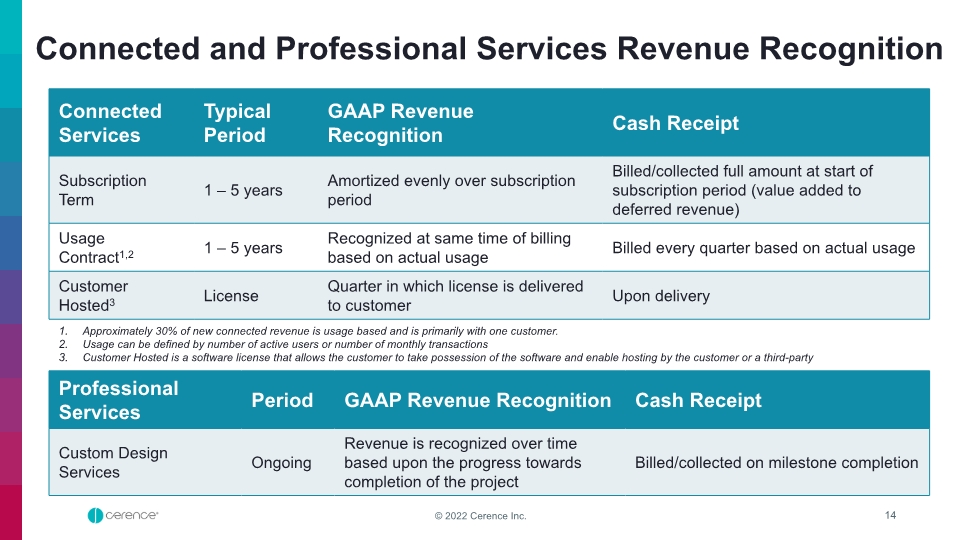

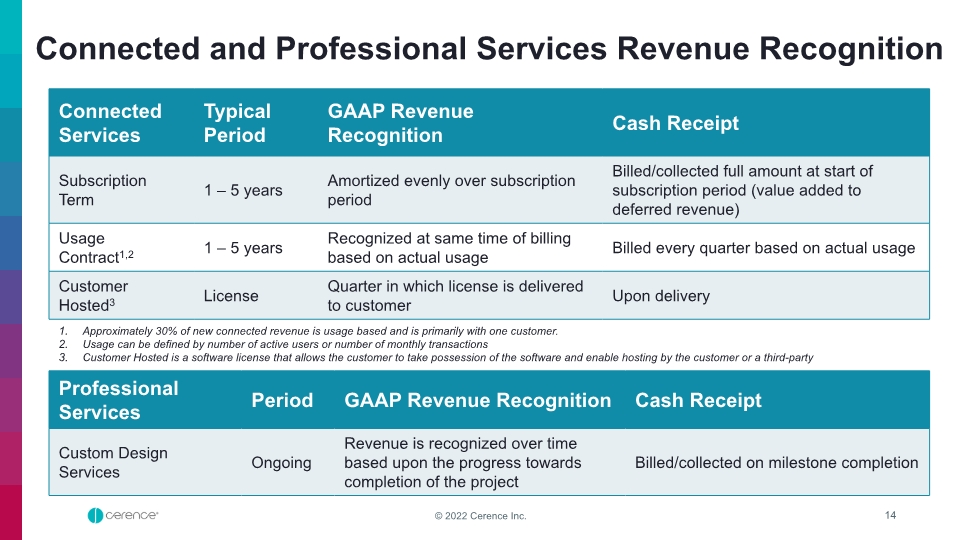

Connected and Professional Services Revenue Recognition Approximately 30% of new connected revenue is usage based and is primarily with one customer. Usage can be defined by number of active users or number of monthly transactions Customer Hosted is a software license that allows the customer to take possession of the software and enable hosting by the customer or a third-party Connected Services Typical Period GAAP Revenue Recognition Cash Receipt Subscription Term 1 – 5 years Amortized evenly over subscription period Billed/collected full amount at start of subscription period (value added to deferred revenue) Usage Contract1,2 1 – 5 years Recognized at same time of billing based on actual usage Billed every quarter based on actual usage Customer Hosted3 License Quarter in which license is delivered to customer Upon delivery Professional Services Period GAAP Revenue Recognition Cash Receipt Custom Design Services Ongoing Revenue is recognized over time based upon the progress towards completion of the project Billed/collected on milestone completion Cerence @2022 Cerence Inc. 14

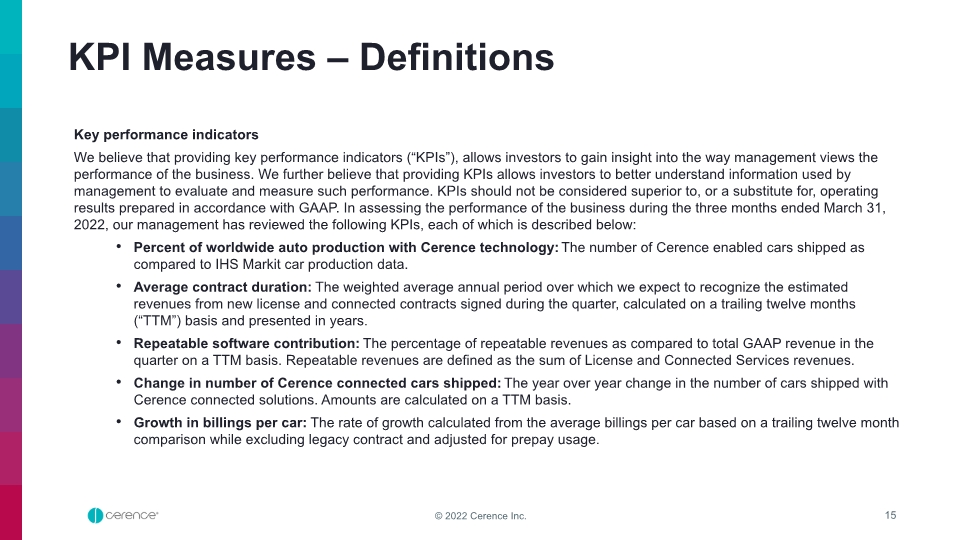

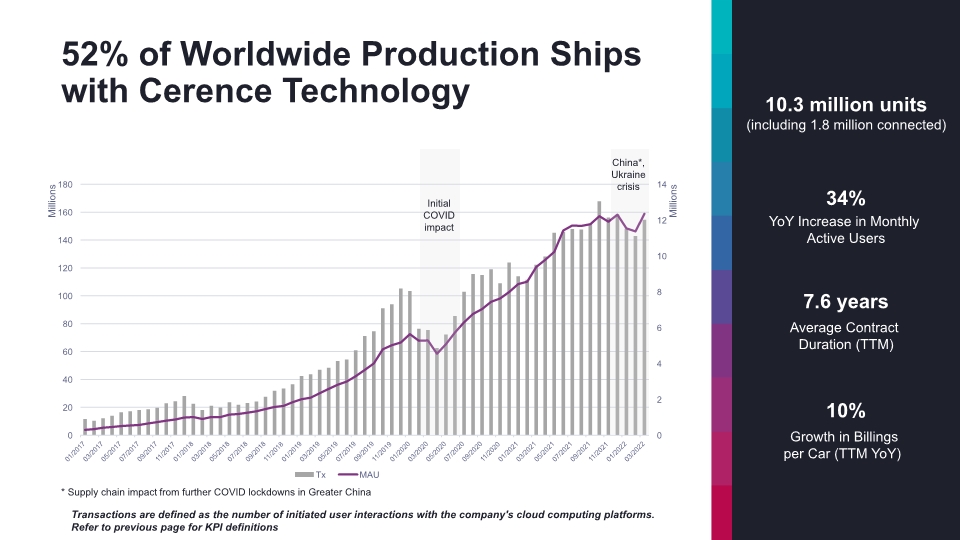

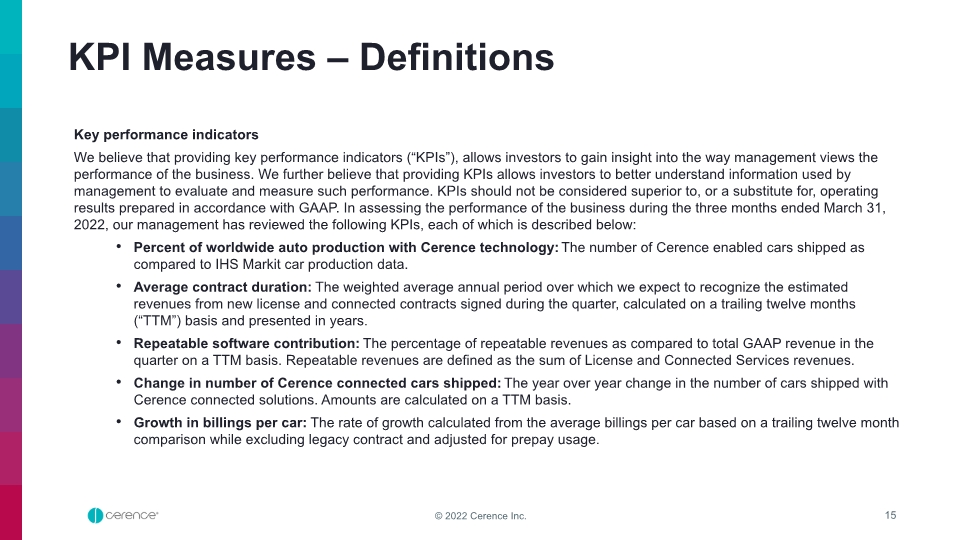

KPI Measures – Definitions Key performance indicators We believe that providing key performance indicators (“KPIs”), allows investors to gain insight into the way management views the performance of the business. We further believe that providing KPIs allows investors to better understand information used by management to evaluate and measure such performance. KPIs should not be considered superior to, or a substitute for, operating results prepared in accordance with GAAP. In assessing the performance of the business during the three months ended March 31, 2022, our management has reviewed the following KPIs, each of which is described below: Percent of worldwide auto production with Cerence technology: The number of Cerence enabled cars shipped as compared to IHS Markit car production data. Average contract duration: The weighted average annual period over which we expect to recognize the estimated revenues from new license and connected contracts signed during the quarter, calculated on a trailing twelve months (“TTM”) basis and presented in years. Repeatable software contribution: The percentage of repeatable revenues as compared to total GAAP revenue in the quarter on a TTM basis. Repeatable revenues are defined as the sum of License and Connected Services revenues. Change in number of Cerence connected cars shipped: The year over year change in the number of cars shipped with Cerence connected solutions. Amounts are calculated on a TTM basis. Growth in billings per car: The rate of growth calculated from the average billings per car based on a trailing twelve month comparison while excluding legacy contract and adjusted for prepay usage. Cerence @2022 Cerence Inc. 15

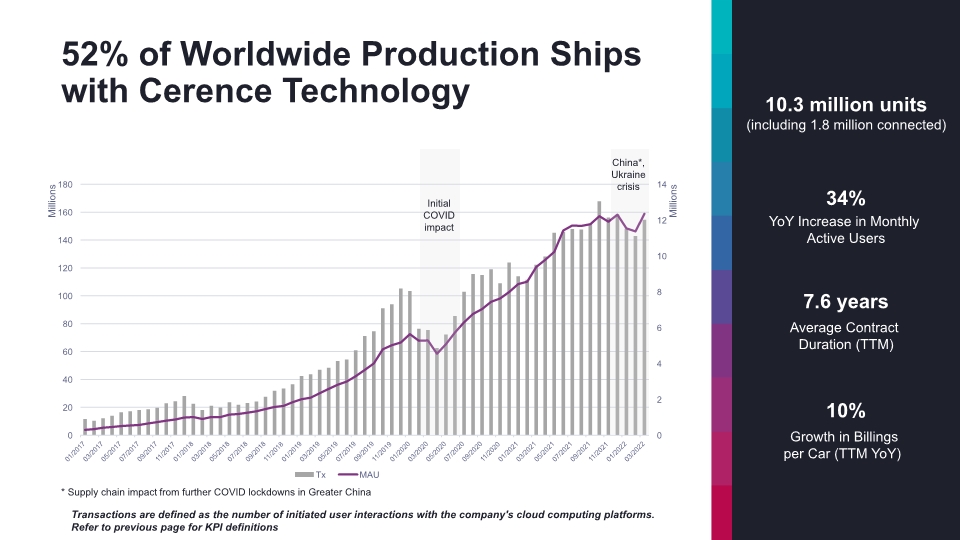

52% of Worldwide Production Ships with Cerence Technology 10.3 million units (including 1.8 million connected) 34% YoY Increase in Monthly Active Users 7.6 years Average Contract Duration (TTM) 10% Growth in Billings per Car (TTM YoY) * Supply chain impact from further COVID lockdowns in Greater China Transactions are defined as the number of initiated user interactions with the company's cloud computing platforms. Refer to previous page for KPI definitions

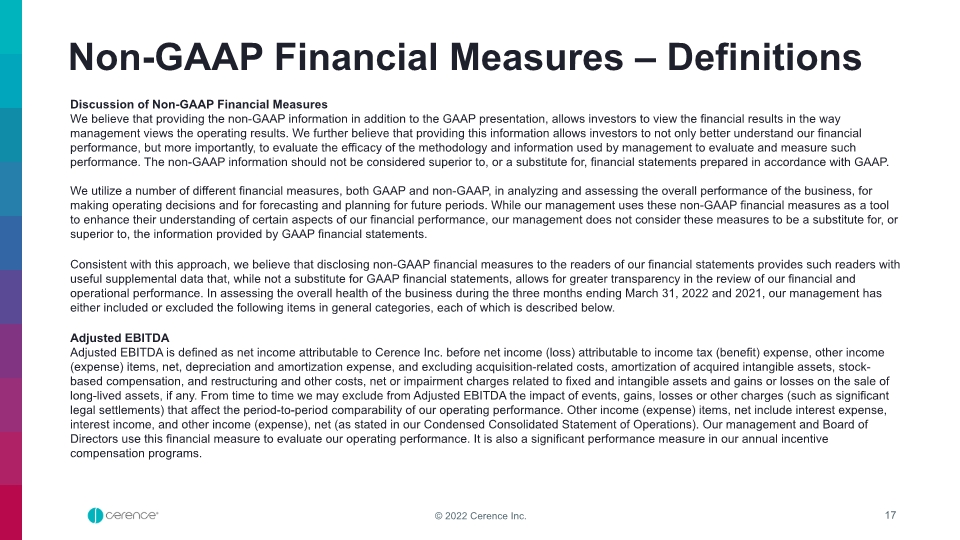

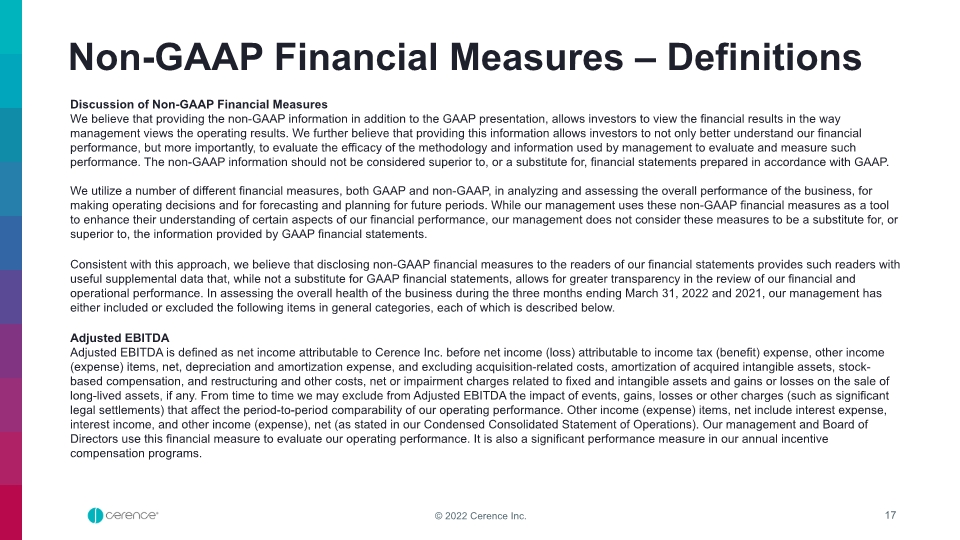

Non-GAAP Financial Measures – Definitions Discussion of Non-GAAP Financial Measures We believe that providing the non-GAAP information in addition to the GAAP presentation, allows investors to view the financial results in the way management views the operating results. We further believe that providing this information allows investors to not only better understand our financial performance, but more importantly, to evaluate the efficacy of the methodology and information used by management to evaluate and measure such performance. The non-GAAP information should not be considered superior to, or a substitute for, financial statements prepared in accordance with GAAP. We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of the business, for making operating decisions and for forecasting and planning for future periods. While our management uses these non-GAAP financial measures as a tool to enhance their understanding of certain aspects of our financial performance, our management does not consider these measures to be a substitute for, or superior to, the information provided by GAAP financial statements. Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial statements provides such readers with useful supplemental data that, while not a substitute for GAAP financial statements, allows for greater transparency in the review of our financial and operational performance. In assessing the overall health of the business during the three months ending March 31, 2022 and 2021, our management has either included or excluded the following items in general categories, each of which is described below. Adjusted EBITDA Adjusted EBITDA is defined as net income attributable to Cerence Inc. before net income (loss) attributable to income tax (benefit) expense, other income (expense) items, net, depreciation and amortization expense, and excluding acquisition-related costs, amortization of acquired intangible assets, stock-based compensation, and restructuring and other costs, net or impairment charges related to fixed and intangible assets and gains or losses on the sale of long-lived assets, if any. From time to time we may exclude from Adjusted EBITDA the impact of events, gains, losses or other charges (such as significant legal settlements) that affect the period-to-period comparability of our operating performance. Other income (expense) items, net include interest expense, interest income, and other income (expense), net (as stated in our Condensed Consolidated Statement of Operations). Our management and Board of Directors use this financial measure to evaluate our operating performance. It is also a significant performance measure in our annual incentive compensation programs. Cerence @2022 Cerence Inc. 17

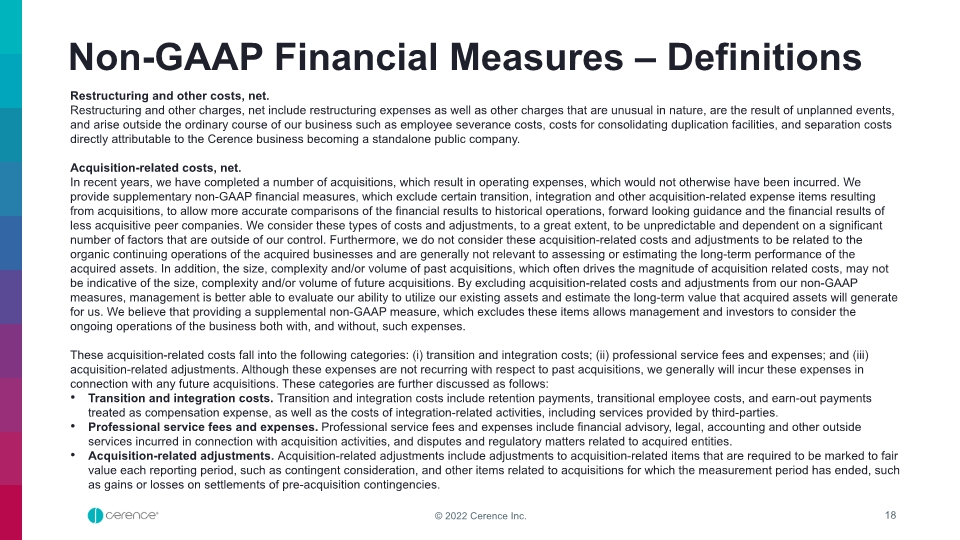

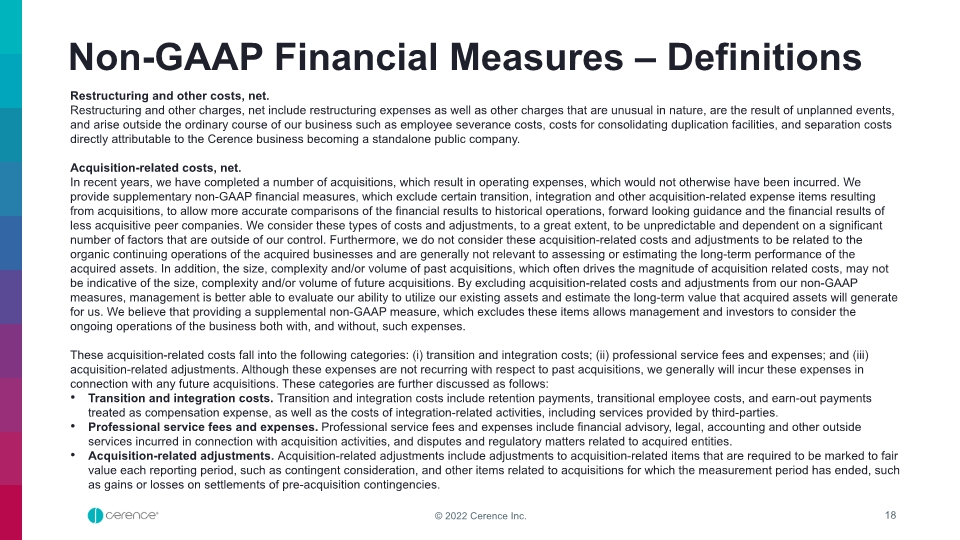

Non-GAAP Financial Measures – Definitions Restructuring and other costs, net. Restructuring and other charges, net include restructuring expenses as well as other charges that are unusual in nature, are the result of unplanned events, and arise outside the ordinary course of our business such as employee severance costs, costs for consolidating duplication facilities, and separation costs directly attributable to the Cerence business becoming a standalone public company. Acquisition-related costs, net. In recent years, we have completed a number of acquisitions, which result in operating expenses, which would not otherwise have been incurred. We provide supplementary non-GAAP financial measures, which exclude certain transition, integration and other acquisition-related expense items resulting from acquisitions, to allow more accurate comparisons of the financial results to historical operations, forward looking guidance and the financial results of less acquisitive peer companies. We consider these types of costs and adjustments, to a great extent, to be unpredictable and dependent on a significant number of factors that are outside of our control. Furthermore, we do not consider these acquisition-related costs and adjustments to be related to the organic continuing operations of the acquired businesses and are generally not relevant to assessing or estimating the long-term performance of the acquired assets. In addition, the size, complexity and/or volume of past acquisitions, which often drives the magnitude of acquisition related costs, may not be indicative of the size, complexity and/or volume of future acquisitions. By excluding acquisition-related costs and adjustments from our non-GAAP measures, management is better able to evaluate our ability to utilize our existing assets and estimate the long-term value that acquired assets will generate for us. We believe that providing a supplemental non-GAAP measure, which excludes these items allows management and investors to consider the ongoing operations of the business both with, and without, such expenses. These acquisition-related costs fall into the following categories: (i) transition and integration costs; (ii) professional service fees and expenses; and (iii) acquisition-related adjustments. Although these expenses are not recurring with respect to past acquisitions, we generally will incur these expenses in connection with any future acquisitions. These categories are further discussed as follows: Transition and integration costs. Transition and integration costs include retention payments, transitional employee costs, and earn-out payments treated as compensation expense, as well as the costs of integration-related activities, including services provided by third-parties. Professional service fees and expenses. Professional service fees and expenses include financial advisory, legal, accounting and other outside services incurred in connection with acquisition activities, and disputes and regulatory matters related to acquired entities. Acquisition-related adjustments. Acquisition-related adjustments include adjustments to acquisition-related items that are required to be marked to fair value each reporting period, such as contingent consideration, and other items related to acquisitions for which the measurement period has ended, such as gains or losses on settlements of pre-acquisition contingencies. Cerence @2022 Cerence Inc. 18

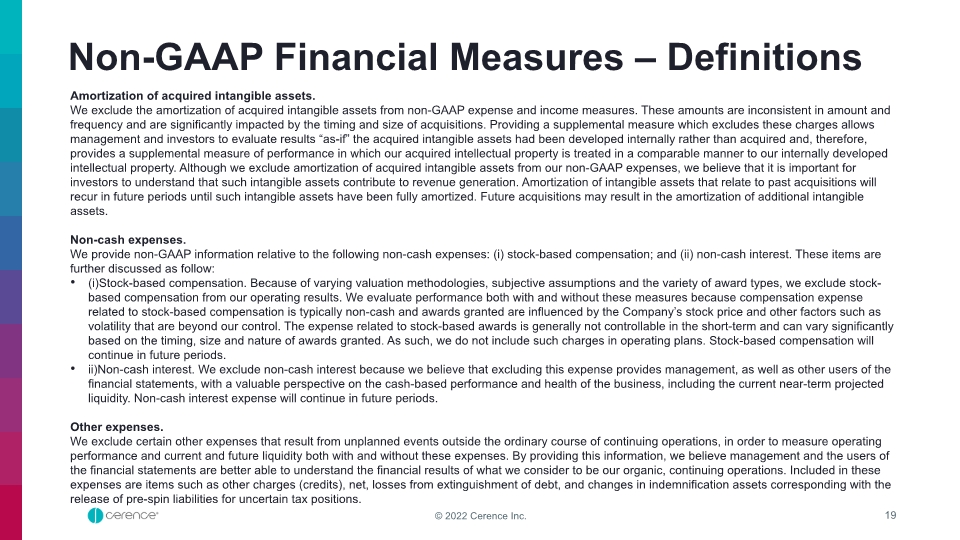

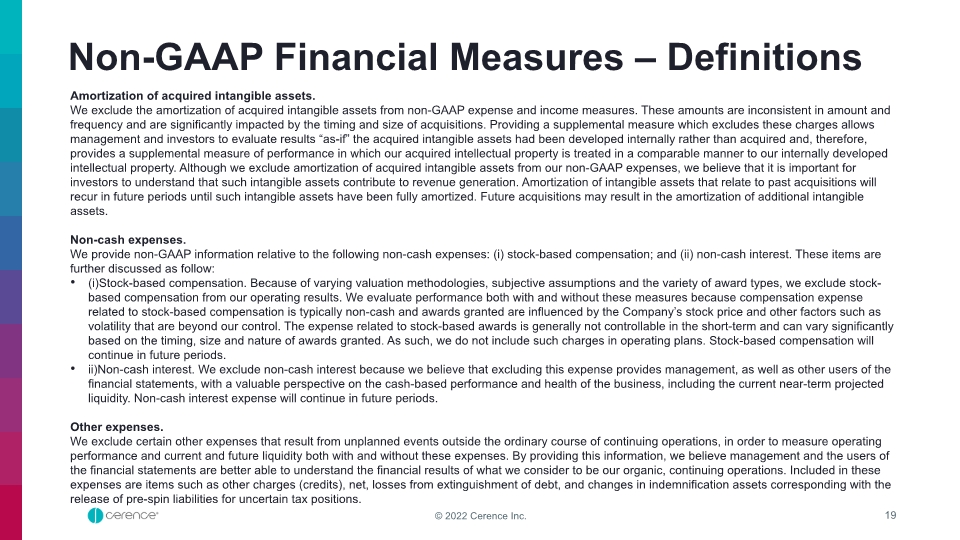

Non-GAAP Financial Measures – Definitions Amortization of acquired intangible assets. We exclude the amortization of acquired intangible assets from non-GAAP expense and income measures. These amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Providing a supplemental measure which excludes these charges allows management and investors to evaluate results “as-if” the acquired intangible assets had been developed internally rather than acquired and, therefore, provides a supplemental measure of performance in which our acquired intellectual property is treated in a comparable manner to our internally developed intellectual property. Although we exclude amortization of acquired intangible assets from our non-GAAP expenses, we believe that it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Future acquisitions may result in the amortization of additional intangible assets. Non-cash expenses. We provide non-GAAP information relative to the following non-cash expenses: (i) stock-based compensation; and (ii) non-cash interest. These items are further discussed as follow: (i)Stock-based compensation. Because of varying valuation methodologies, subjective assumptions and the variety of award types, we exclude stock-based compensation from our operating results. We evaluate performance both with and without these measures because compensation expense related to stock-based compensation is typically non-cash and awards granted are influenced by the Company’s stock price and other factors such as volatility that are beyond our control. The expense related to stock-based awards is generally not controllable in the short-term and can vary significantly based on the timing, size and nature of awards granted. As such, we do not include such charges in operating plans. Stock-based compensation will continue in future periods. ii)Non-cash interest. We exclude non-cash interest because we believe that excluding this expense provides management, as well as other users of the financial statements, with a valuable perspective on the cash-based performance and health of the business, including the current near-term projected liquidity. Non-cash interest expense will continue in future periods. Other expenses. We exclude certain other expenses that result from unplanned events outside the ordinary course of continuing operations, in order to measure operating performance and current and future liquidity both with and without these expenses. By providing this information, we believe management and the users of the financial statements are better able to understand the financial results of what we consider to be our organic, continuing operations. Included in these expenses are items such as other charges (credits), net, losses from extinguishment of debt, and changes in indemnification assets corresponding with the release of pre-spin liabilities for uncertain tax positions. Cerence @2022 Cerence Inc. 19

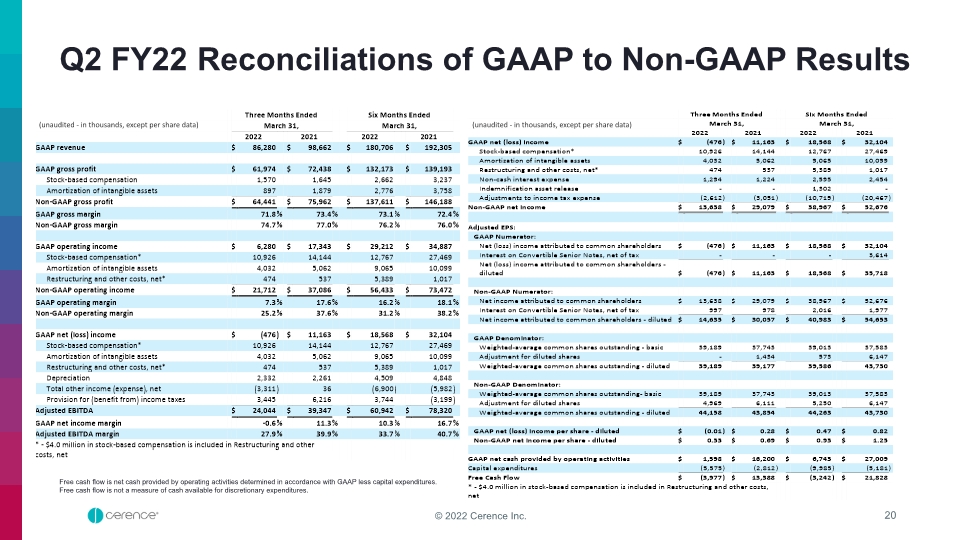

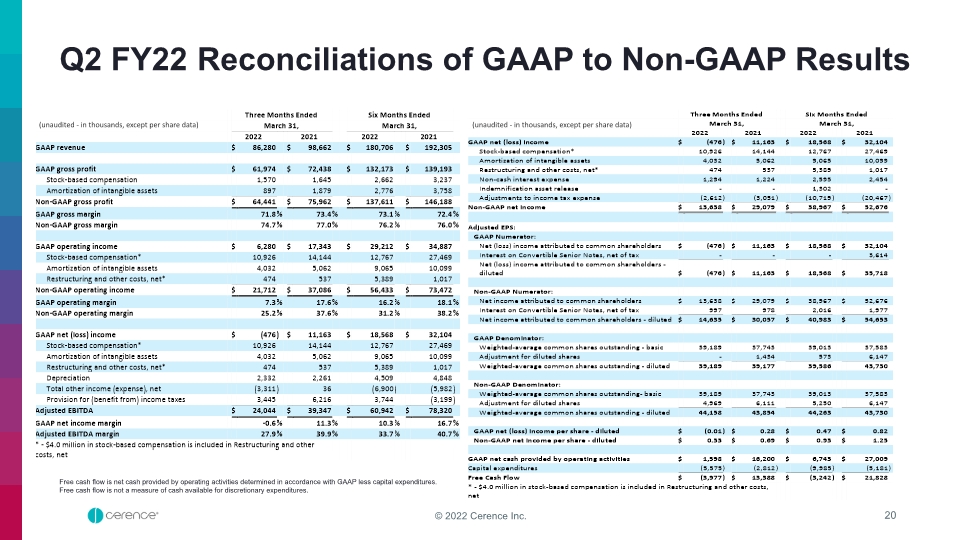

Q2 FY22 Reconciliations of GAAP to Non-GAAP Results (unaudited - in thousands, except per share data) (unaudited - in thousands, except per share data) Free cash flow is net cash provided by operating activities determined in accordance with GAAP less capital expenditures. Free cash flow is not a measure of cash available for discretionary expenditures. Three Months Ended Six Months Ended March 31, March 31, 2022 2021 2022 2021 GAAP revenue $86,280 $98,662 $180,706 $192,305 GAAP gross profit $61,974 $72,438 $132,173 $139,193 Stock-based compensation 1,570 1,645 2,662 3,237 Amortization of intangible assets 897 1,879 2,776 3,758 Non-GAAP gross profit $64,441 $75,962 $137,611 $146,188 GAAP gross margin 71.8% 73.4% 73.1% 72.4% Non-GAAP gross margin 74.7% 77.0% 76.2% 76.0% GAAP operating income $6,280 $17,343 $29,212 $34,887 Stock-based compensation* 10,926 14,144 12,767 27,469 Amortization of intangible assets 4,032 5,062 9,065 10,099 Restructuring and other costs, net* 474 537 5,389 1,017 Non-GAAP operating income $21,712 $37,086 $56,433 $73,472 GAAP operating margin 7.3% 17.6% 16.2% 18.1% Non-GAAP operating margin 25.2% 37.6% 31.2% 38.2% GAAP net (loss) income $(476) $11,163 $18,568 $32,104 Stock-based compensation* 10,926 14,144 12,767 27,469 Amortization of intangible assets 4,032 5,062 9,065 10,099 Restructuring and other costs, net* 474 537 5,389 1,017 Depreciation 2,332 2,261 4,509 4,848 Total other income (expense), net (3,311) 36 (6,900) (5,982) Provision for (benefit from) income taxes 3,445 6,216 3,744 (3,199) Adjusted EBITDA $24,044 $39,347 $60,942 $78,320 GAAP net income margin -0.6% 11.3% 10.3% 16.7% Adjusted EBITDA margin 27.9% 39.9% 33.7% 40.7% * - $4.0 million in stock-based compensation is included in Restructuring and other costs, net Three Months Ended Six Months Ended March 31, March 31, 2022 2021 2022 2021 GAAP net (loss) income $(476) $11,163 $18,568 $32,104 Stock-based compensation* 10,926 14,144 12,767 27,469 Amortization of intangible assets 4,032 5,062 9,065 10,099 Restructuring and other costs, net* 474 537 5,389 1,017 Non-cash interest expense 1,294 1,224 2,595 2,454 Indemnification asset release - - 1,302 - Adjustments to income tax expense (2,612) (3,051) (10,719) (20,467) Non-GAAP net income $13,638 $29,079 $38,967 $52,676 Adjusted EPS: GAAP Numerator: Net (loss) income attributed to common shareholders $(476) $11,163 $18,568 $32,104 Interest on Convertible Senior Notes, net of tax - - - 3,614 Net (loss) income attributed to common shareholders - diluted $(476) $11,163 $18,568 $35,718 Non-GAAP Numerator: Net income attributed to common shareholders $13,638 $29,079 $38,967 $52,676 Interest on Convertible Senior Notes, net of tax 997 978 2,016 1,977 Net income attributed to common shareholders - diluted $14,635 $30,057 $40,983 $54,653 GAAP Denominator: Weighted-average common shares outstanding - basic 39,189 37,743 39,013 37,583 Adjustment for diluted shares - 1,434 573 6,147 Weighted-average common shares outstanding - diluted 39,189 39,177 39,586 43,730 Non-GAAP Denominator: Weighted-average common shares outstanding- basic 39,189 37,743 39,013 37,583 Adjustment for diluted shares 4,969 6,111 5,250 6,147 Weighted-average common shares outstanding - diluted 44,158 43,854 44,263 43,730 GAAP net (loss) income per share - diluted $(0.01) $0.28 $0.47 $0.82 Non-GAAP net income per share - diluted $0.33 $0.69 $0.93 $1.25 GAAP net cash provided by operating activities $1,598 $16,200 $6,743 $27,009 Capital expenditures (5,575) (2,812) (9,985) (5,181) Free Cash Flow $(3,977) $13,388 $(3,242) $21,828 * - $4.0 million in stock-based compensation is included in Restructuring and other costs, net Q2 FY22 Reconciliations of GAAP to Non-GAAP Results Three Months Ended Six Months Ended (unaudited ‐ in thousands, except per share data) March 31, March 31, 2022 2021 2022 2021 GAAP revenue $ 86,280 $ 98,662 $ 180,706 $ 192,305 GAAP gross profit $ 61,974 $ 72,438 $ 132,173 $ 139,193 Stock‐based compensation 1,570 1,645 2,662 3,237 Amortization of intangible assets 897 1,879 2,776 3,758 Non‐GAAP gross profit $ 64,441 $ 75,962 $ 137,611 $ 146,188 GAAP gross margin 71.8% 73.4% 73.1% 72.4% Non‐GAAP gross margin 74.7% 77.0% 76.2% 76.0% GAAP operating income $ 6,280 $ 17,343 $ 29,212 $ 34,887 Stock‐based compensation* 10,926 14,144 12,767 27,469 Amortization of intangible assets 4,032 5,062 9,065 10,099 Restructuring and other costs, net* 474 537 5,389 1,017 Non‐GAAP operating income $ 21,712 $ 37,086 $ 56,433 $ 73,472 GAAP operating margin 7.3% 17.6% 16.2% 18.1% Non‐GAAP operating margin 25.2% 37.6% 31.2% 38.2% GAAP net (loss) income $ (476) $ 11,163 $ 18,568 $ 32,104 Stock‐based compensation* 10,926 14,144 12,767 27,469 Amortization of intangible assets 4,032 5,062 9,065 10,099 Restructuring and other costs, net* 474 537 5,389 1,017 Depreciation 2,332 2,261 4,509 4,848 Total other income (expense), net (3,311) 36 (6,900) (5,982) Provision for (benefit from) income taxes 3,445 6,216 3,744 (3,199) Adjusted EBITDA $ 24,044 $ 39,347 $ 60,942 $ 78,320 GAAP net income margin ‐0.6% 11.3% 10.3% 16.7% Adjusted EBITDA margin 27.9% 39.9% 33.7% 40.7% * ‐ $4.0 million in stock‐based compensation is included in Restructuring and other costs, net Free cash flow is net cash provided by operating activities determined in accordance with GAAP less capital expenditures. Free cash flow is not a measure of cash available for discretionary expenditures. Three Months Ended Six Months Ended (unaudited ‐ in thousands, except per share data) March 31, March 31, 2022 2021 2022 2021 GAAP net (loss) income $ (476) $ 11,163 $ 18,568 $ 32,104 Stock‐based compensation* 10,926 14,144 12,767 27,469 Amortization of intangible assets 4,032 5,062 9,065 10,099 Restructuring and other costs, net* 474 537 5,389 1,017 Non‐cash interest expense 1,294 1,224 2,595 2,454 Indemnification asset release ‐ ‐ 1,302 ‐ Adjustments to income tax expense (2,612) (3,051) (10,719) (20,467) Non‐GAAP net income $ 13,638 $ 29,079 $ 38,967 $ 52,676 Adjusted EPS: GAAP Numerator: Net (loss) income attributed to common shareholders $ (476) $ 11,163 $ 18,568 $ 32,104 Interest on Convertible Senior Notes, net of tax ‐ ‐ ‐ 3,614 Net (loss) income attributed to common shareholders ‐ diluted $ (476) $ 11,163 $ 18,568 $ 35,718 Non‐GAAP Numerator: Net income attributed to common shareholders $ 13,638 $ 29,079 $ 38,967 $ 52,676 Interest on Convertible Senior Notes, net of tax 997 978 2,016 1,977 Net income attributed to common shareholders ‐ diluted $ 14,635 $ 30,057 $ 40,983 $ 54,653 GAAP Denominator: Weighted‐average common shares outstanding ‐ basic 39,189 37,743 39,013 37,583 Adjustment for diluted shares ‐ 1,434 573 6,147 Weighted‐average common shares outstanding ‐ diluted 39,189 39,177 39,586 43,730 Non‐GAAP Denominator: Weighted‐average common shares outstanding‐ basic 39,189 37,743 39,013 37,583 Adjustment for diluted shares 4,969 6,111 5,250 6,147 Weighted‐average common shares outstanding ‐ diluted 44,158 43,854 44,263 43,730 GAAP net (loss) income per share ‐ diluted $ (0.01) $ 0.28 $ 0.47 $ 0.82 Non‐GAAP net income per share ‐ diluted $ 0.33 $ 0.69 $ 0.93 $ 1.25 GAAP net cash provided by operating activities $ 1,598 $ 16,200 $ 6,743 $ 27,009 Capital expenditures (5,575) (2,812) (9,985) (5,181) Free Cash Flow $ (3,977) $ 13,388 $ (3,242) $ 21,828 * ‐ $4.0 million in stock‐based compensation is included in Restructuring and other costs, net © 2022 Cerence Inc. 20

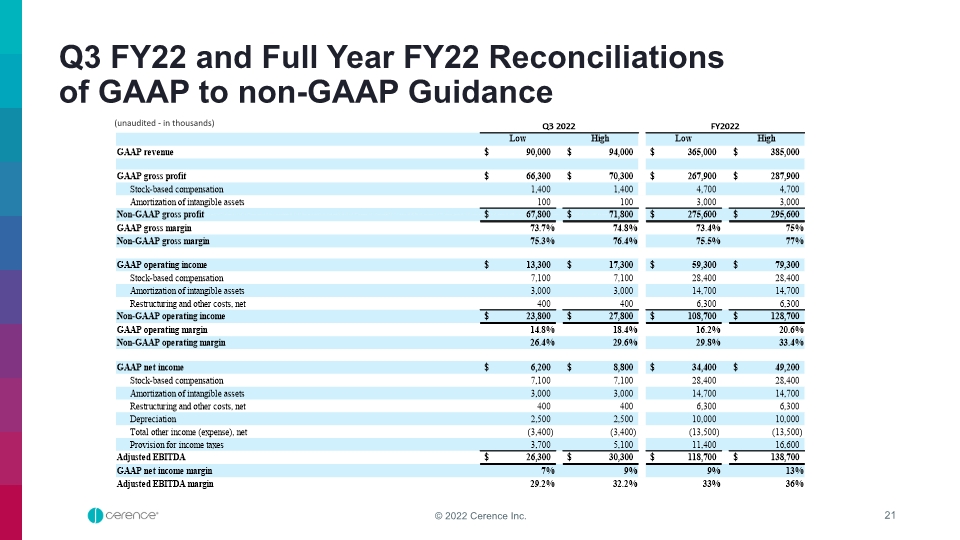

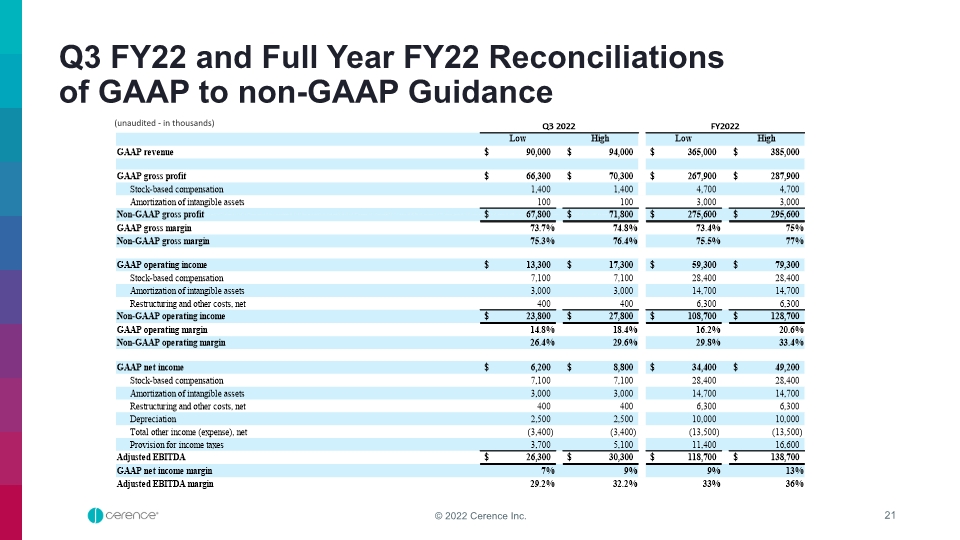

Q3 FY22 and Full Year FY22 Reconciliations of GAAP to non-GAAP Guidance (unaudited - in thousands) Q3 2022 FY2022 Low High Low High GAAP revenue $90,000 $94,000 $365,000 $385,000 GAAP gross profit $66,300 $70,300 $267,900 $287,900 Stock-based compensation 1,400 1,400 4,700 4,700 Amortization of intangible assets 100 100 3,000 3,000 Non-GAAP gross profit $67,800 $71,800 $275,600 $295,600 GAAP gross margin 74% 75% 73% 75% Non-GAAP gross margin 75% 76% 76% 77% GAAP operating income $13,300 $17,300 $59,300 $79,300 Stock-based compensation 7,100 7,100 28,400 28,400 Amortization of intangible assets 3,000 3,000 14,700 14,700 Restructuring and other costs, net 400 400 6,300 6,300 Non-GAAP operating income $23,800 $27,800 $108,700 $128,700 GAAP operating margin 15% 18% 16% 21% Non-GAAP operating margin 26% 30% 30% 33% GAAP net income $6,200 $8,800 $34,400 $49,200 Stock-based compensation 7,100 7,100 28,400 28,400 Amortization of intangible assets 3,000 3,000 14,700 14,700 Restructuring and other costs, net 400 400 6,300 6,300 Depreciation 2,500 2,500 10,000 10,000 Total other income (expense), net (3,400) (3,400) (13,500) (13,500) Provision for income taxes 3,700 5,100 11,400 16,600 Adjusted EBITDA $26,300 $30,300 $118,700 $138,700 GAAP net income margin 7% 9% 9% 13% Adjusted EBITDA margin 29% 32% 33% 36% Q3 FY22 and Full Year FY22 Reconciliations of GAAP to non-GAAP Guidance (unaudited ‐ in thousands) Q3 2022 FY2022 Low High Low High GAAP revenue $ 90,000 $ 94,000 $ 365,000 $ 385,000 GAAP gross profit $ 66,300 $ 70,300 $ 267,900 $ 287,900 Stock-based compensation 1,400 1,400 4,700 4,700 Amortization of intangible assets 100 100 3,000 3,000 Non-GAAP gross profit $ 67,800 $ 71,800 $ 275,600 $ 295,600 GAAP gross margin 73.7% 74.8% 73.4% 75% Non-GAAP gross margin 75.3% 76.4% 75.5% 77% GAAP operating income $ 13,300 $ 17,300 $ 59,300 $ 79,300 Stock-based compensation 7,100 7,100 28,400 28,400 Amortization of intangible assets 3,000 3,000 14,700 14,700 Restructuring and other costs, net 400 400 6,300 6,300 Non-GAAP operating income $ 23,800 $ 27,800 $ 108,700 $ 128,700 GAAP operating margin 14.8% 18.4% 16.2% 20.6% Non-GAAP operating margin 26.4% 29.6% 29.8% 33.4% GAAP net income $ 6,200 $ 8,800 $ 34,400 $ 49,200 Stock-based compensation 7,100 7,100 28,400 28,400 Amortization of intangible assets 3,000 3,000 14,700 14,700 Restructuring and other costs, net 400 400 6,300 6,300 Depreciation 2,500 2,500 10,000 10,000 Total other income (expense), net (3,400) (3,400) (13,500) (13,500) Provision for income taxes 3,700 5,100 11,400 16,600 Adjusted EBITDA $ 26,300 $ 30,300 $ 118,700 $ 138,700 GAAP net income margin 7% 9% 9% 13% Adjusted EBITDA margin 29.2% 32.2% 33% 36% © 2022 Cerence Inc. 21

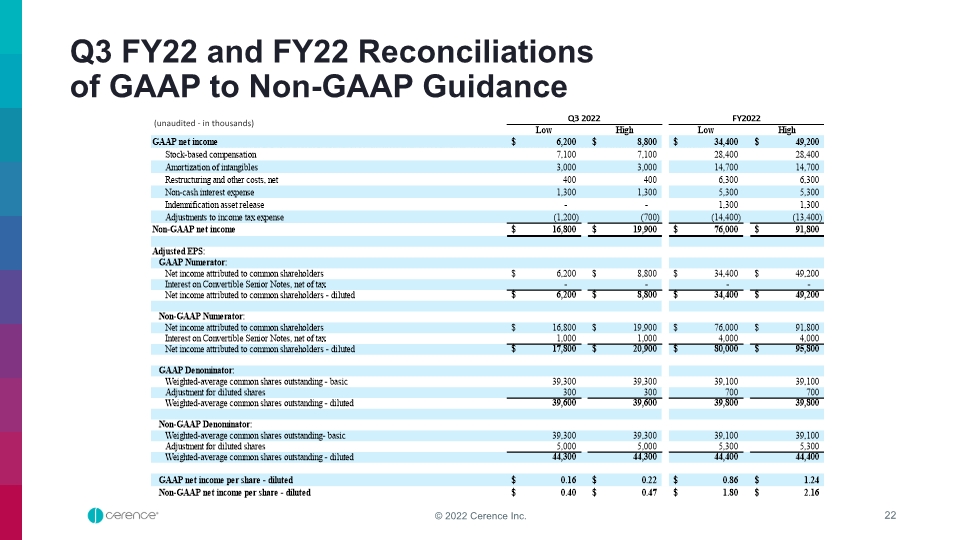

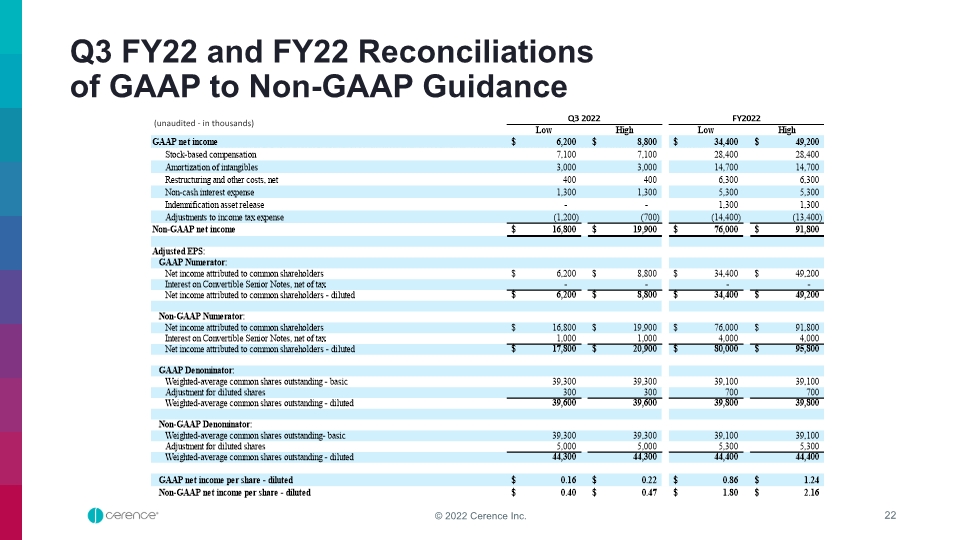

Q3 FY22 and FY22 Reconciliations of GAAP to Non-GAAP Guidance (unaudited - in thousands) Q3 2022 FY2022 Low High Low High GAAP net income $6,200 $8,800 $34,400 $49,200 Stock-based compensation 7,100 7,100 28,400 28,400 Amortization of intangibles 3,000 3,000 14,700 14,700 Restructuring and other costs, net 400 400 6,300 6,300 Non-cash interest expense 1,300 1,300 5,300 5,300 Indemnification asset release - - 1,300 1,300 Adjustments to income tax expense (1,200) (700) (14,400) (13,400) Non-GAAP net income $16,800 $19,900 $76,000 $91,800 Adjusted EPS: GAAP Numerator: Net income attributed to common shareholders $6,200 $8,800 $34,400 $49,200 Non-GAAP Numerator: Net income attributed to common shareholders $16,800 $19,900 $76,000 $91,800 Interest on Convertible Senior Notes, net of tax 1,000 1,000 4,000 4,000 Net income attributed to common shareholders - diluted $17,800 $20,900 $80,000 $95,800 GAAP Denominator: Weighted-average common shares outstanding - basic 39,300 39,300 39,100 39,100 Adjustment for diluted shares 300 300 700 700 Weighted-average common shares outstanding - diluted 39,600 39,600 39,800 39,800 Non-GAAP Denominator: Weighted-average common shares outstanding- basic 39,300 39,300 39,100 39,100 Adjustment for diluted shares 5,000 5,000 5,300 5,300 Weighted-average common shares outstanding - diluted 44,300 44,300 44,400 44,400 GAAP net income per share - diluted $0.16 $0.22 $0.86 $1.24 Non-GAAP net income per share - diluted $0.40 $0.47 $1.80 $2.16 Q3 FY22 and FY22 Reconciliations of GAAP to Non-GAAP Guidance (unaudited ‐ in thousands) Q3 2022 FY2022 Low High Low High GAAP net income $ 6,200 $ 8,800 $ 34,400 $ 49,200 Stock-based compensation 7,100 7,100 28,400 28,400 Amortization of intangibles 3,000 3,000 14,700 14,700 Restructuring and other costs, net 400 400 6,300 6,300 Non-cash interest expense 1,300 1,300 5,300 5,300 Indemnification asset release - - 1,300 1,300 Adjustments to income tax expense (1,200) (700) (14,400) (13,400) Non-GAAP net income $ 16,800 $ 19,900 $ 76,000 $ 91,800 Adjusted EPS: GAAP Numerator: Net income attributed to common shareholders $ 6,200 $ 8,800 $ 34,400 $ 49,200 Interest on Convertible Senior Notes, net of tax - - - - Net income attributed to common shareholders - diluted $ 6,200 $ 8,800 $ 34,400 $ 49,200 Non-GAAP Numerator: Net income attributed to common shareholders $ 16,800 $ 19,900 $ 76,000 $ 91,800 Interest on Convertible Senior Notes, net of tax 1,000 1,000 4,000 4,000 Net income attributed to common shareholders - diluted $ 17,800 $ 20,900 $ 80,000 $ 95,800 GAAP Denominator: Weighted-average common shares outstanding - basic 39,300 39,300 39,100 39,100 Adjustment for diluted shares 300 300 700 700 Weighted-average common shares outstanding - diluted 39,600 39,600 39,800 39,800 Non-GAAP Denominator: Weighted-average common shares outstanding- basic 39,300 39,300 39,100 39,100 Adjustment for diluted shares 5,000 5,000 5,300 5,300 Weighted-average common shares outstanding - diluted 44,300 44,300 44,400 44,400 GAAP net income per share - diluted $ 0.16 $ 0.22 $ 0.86 $ 1.24 Non-GAAP net income per share - diluted $ 0.40 $ 0.47 $ 1.80 $ 2.16 © 2022 Cerence Inc. 22