Investor Rights Agreement

In October 2020, we entered into an amended and restated investor rights agreement, or IRA, as amended in March 2021, with certain holders of our redeemable convertible preferred stock and common stock, including entities affiliated with our directors. The IRA provides the holders of our redeemable convertible preferred stock with certain registration rights, including the right to demand that we file a registration statement or request that their shares be covered by a registration statement that we are otherwise filing. Simon Tate, Andrew Levin and Liam Ratcliffe are affiliated with Intermediate Capital Group plc, RA Capital Management, L.P. and AI ETI LLC, respectively. The IRA also provides these stockholders with information rights, which will terminate upon the closing of this offering, and a right of first refusal with regard to certain issuances of our capital stock, which will not apply to, and will terminate upon, the closing of this offering. After the closing of this offering, the holders of 18,345,278 shares of common stock issuable on conversion of outstanding redeemable convertible preferred stock, which includes the conversion of the 3,846,150 shares of Series B redeemable convertible preferred stock we issued and sold in May 2021, will be entitled to rights with respect to the registration of their shares of common stock under the Securities Act under this agreement. For a description of these registration rights, see the section titled “Description of Capital Stock—Registration Rights.”

Relationship with Carnot, LLC

In October 2018, we entered into a services agreement with Carnot, LLC (along with its successor agreements, the Carnot Agreement). Under the terms of the Carnot Agreement, Carnot Pharma, LLC provides research and services related to our drug discovery, research and development programs and we compensate Carnot Pharma, LLC for the time its personnel devote to such efforts. The Carnot Agreement is terminable by either party without cause on thirty days’ written notice. Carnot, LLC was subsequently dissolved and the services agreement transitioned to its successor Carnot Pharma, LLC. During 2018, 2019, 2020 and the three months ended March 31, 2021, we made payments to Carnot, LLC and Carnot Pharma, LLC of $0.6 million, $1.5 million, $0.6 million and $0.4 million, respectively, for research and development expenses. RACM is the manager of the members of Carnot Pharma, LLC and Andrew Levin, our former CEO and a member of our board of directors, is the President of Carnot Pharma, LLC. Adam Rosenberg, a member of our board of directors, is a Venture Partner at Carnot Pharma, LLC, dba RA Ventures.

Asset Acquisitions with Related Parties

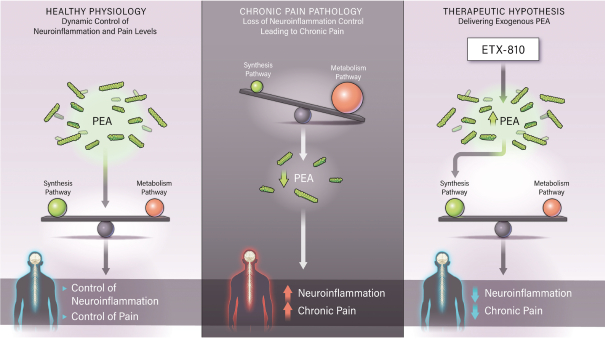

In February 2019, we acquired 100% of the share capital of NeoKera, LLC for 83,333 shares of common stock valued at $1.50 per share. In June 2020, we determined to discontinue further development and dissolve NeoKera, LLC. Concurrent with the acquisition of NeoKera in February 2019, we acquired in process research and development from Carnot, LLC related to ETX-810. We issued 1.75 million shares of common stock, valued at $1.50 per share, to acquire the assets. At the time of these acquisitions, RACM was a manager of the members of NeoKera, LLC and Carnot, LLC, and Andrew Levin, a member of our board or directors, was our Chief Executive Officer and was the President of Carnot, LLC.

In October 2020, we acquired 100% of the share capital of Athenen Therapeutics, Inc. for a one-for-one exchange of outstanding preferred and common stock. As a result, we issued a total of 2.5 million Series A preferred shares and 1.55 million shares of common stock, valued at $5.80 per share and $1.32 per share, respectively. The IPR&D acquired in this transaction will enable us to develop ETX-155. RAH, RACN and BP were greater than 5% stockholders of Athenen prior to the acquisition.

Employment Arrangements

We have entered into employment agreements and offer letters with certain of our executive officers. For more information regarding these agreements with our executive officers, see the section titled “Executive Compensation—Employment Arrangements.”

- 170 -